Abstract

This research explores the importance of environmental management accounting practices in businesses. It examines how market competition, environmental unpredictability, organizational size, and corporate governance influence the adoption of environmental management accounting tools and environmental performance. Data were collected from a survey of 397 individuals across various industries in Vietnam. The study found that greater environmental unpredictability, more intense market competition, larger organizational scale, and more effective corporate governance promote the use of environmental management accounting, leading to improved environmental performance. Additionally, environmental management accounting methods mediate the relationships among market competition, environmental uncertainty, organizational size, corporate governance, and environmental performance. This study contributes to the literature by highlighting the significance of environmental management accounting practices in Vietnam and offers practical insights for corporate leaders in developing countries. Overall, the findings suggest that businesses in competitive and unpredictable environments should prioritize the implementation of environmental management accounting practices to improve their environmental performance. This has practical implications for corporate leaders in developing countries like Vietnam, emphasizing the need for robust accounting practices to navigate environmental challenges.

1. Introduction

Environmental factors in accounting are reflected through the identification of the environmental costs connected with products, processes, and services. However, numerous current conventional accounting practices are unable to deal sufficiently with environmental costs. Accordingly, environmental managerial accounting is obtaining more impetus for sustainable businesses, as stakeholders have stressed executives to concentrate more on environmental matters [1]. To attain better environmental management for business, the implementation of environmental managerial accounting for business has been deemed to bring important competitive advantages for business [2].

Environmental managerial accounting is an important management method that provides executives with critical environmental information. This information helps them make better business decisions and maintain effective control over environmental pollu-tion. Allen (1988) [3] contended that corporations need environmental managerial accounting practices to deliver appropriate and exact environmental information to facilitate efforts to oversee environmental costs, which can increase environmental performance. Numerous investigators have requested new practices such as environmental managerial accounting implements and have turned their attention from a humble role of environmental determination to a multifaceted function of making worthwhile the reduction of environmental costs. Environmental managerial accounting techniques may help firms meet national sustainability targets, which interests government stakeholders. Local communities, directly affected by company environmental effects, have different environmental responsibility views [4]. They worry most about air and water pollution caused by business activity. Therefore, understanding how environmental managerial accounting might reduce these issues is vital. For local communities, environmental reporting openness and company involvement in ecologically responsible practices demonstrate corporate commitment to community well-being. Their viewpoints illuminate environmental managerial accounting’s social aspects, demonstrating their ability to build community trust and collaboration [5]. Ecologically motivated environmental groups concentrate on sustainability and conservation. Their views emphasize the necessity for corporations to go beyond compliance and actively protect the environment. Environmental managerial accounting helps quantify ecological damages and promote responsibility, according to environmental groups [6], which say that integrating such methods shows a commitment to sustainable corporate operations. Understanding these views makes it possible to see how corporations and environmental activists interact and how environmental managerial accounting may bridge the gap between profit-driven and environmentally conscientious activities [7]. Furthermore, environmental managerial accounting activities in Vietnam affect society via these stakeholder views. As companies traverse the complex web of expectations, they must balance regulatory compliance, community well-being, and environmental preservation. Recognizing and combining these various ideas into environmental managerial accounting practices offers a more holistic approach that meets stakeholder interests. Synergistic integration of company aims with social and environmental expectations is key to sustainable and ethical business practices in Vietnam.

Vietnam’s environmental contamination was addressed by Quyen et al. (1995) [8], highlighting major issues where numerous local and international papers have highlighted Vietnam’s grave environmental challenges. Water and air pollution are the biggest difficulties, with Vietnam having some of the worst environmental conditions. Vietnam has complicated environmental issues due to natural and manmade factors. Chu (2018) [9] depicted a world where environmental contamination is a major issue. Climate-induced variables and human-driven activities like industrialization and urbanization threaten Vietnam’s ecology.

Vietnam’s environmental pollution currently exists in the air, water, and soil, exceeding the acceptable limits of national standards [9]; one of the most vital causes is that the legal powers of environmental management are not strong enough because there have not been enough environmental managerial tools such as environmental managerial accounting. Moreover, environmental managerial accounting is a strategic solution tied to environmental responsibility in this setting [10]. Businesses must implement environmental managerial accounting processes to address and reduce the nation’s environmental issues. Businesses must embrace environmental sustainability for moral and ethical reasons, not just financial ones. As firms acknowledge their position in Vietnam’s natural context, environmental responsibility and environmental managerial accounting become interdependent. The acceptance of environmental managerial accounting will help firms analyze, evaluate, and reduce their environmental effect. Thus, this supports environmental responsibility, when companies actively protect and improve their surroundings. Indeed, Vietnam’s environmental issues and the need for enterprises to adopt environmental managerial accounting are interconnected, since they represent a paradigm shift where environmentally responsible firms go beyond profit-making to improve Vietnam’s environment.

In fact, businesses should explore small-scale environmental managerial accounting projects to make these proposals more practicable and successful [11]. Definitely, this facilitates iterative learning, strategy adjustments based on real-world feedback, and organization-wide best practices, and using specialized departments or projects to phase implementation helps reduce large-scale implementation issues. Overall, environmental managerial accounting adoption in Vietnam demands a diversified strategy; therefore, businesses can overcome obstacles and become leaders in environmental responsibility by adopting a culturally sensitive organizational mindset, investing in workforce training, leveraging government support, encouraging internal collaboration, and using a phased implementation strategy. Thus, these tips will help businesses operate sustainably and become more resilient and competitive in the shifting Vietnamese business scene. Thus far, only a few studies have analyzed environmental managerial accounting practices in Vietnam.

Furthermore, environmental managerial accounting practices for business are considered as an interceding factor in the linkages among environmental performance and market competition, environmental uncertainty, organization size, as well as corporate governance. To the best of the authors’ knowledge, only a research project by Appiah et al. (2020) [12] investigated the linkage between environmental uncertainty and environmental performance by considering the mediation of environmental managerial accounting. Therefore, the purpose of the existing research is to study the factors determining the approval of environmental managerial accounting practices in Vietnam’s economic and environmental settings. Then, we try to study the mediating role of environmental managerial accounting practices in the research model. The current research is anticipated to contribute to the body of accounting knowledge by delivering a Vietnamese viewpoint to environmental managerial accounting.

2. Theoretical Background and Hypotheses Development

2.1. Theoretical Background

The contingency theory of managerial accounting in general, as well as of environmental managerial accounting, is applied as the theoretic framework for the current research. Managerial accounting and environmental managerial accounting practices have the most vital functions of businesses, and could be determined by contingent variables such as market competition, environmental uncertainty, organizational size, as well as corporate governance [13,14].

Institutional theory, a cornerstone of organizational sociology, shows how organizations react to social norms, values, and expectations. Peters (2022) [15] suggested that organizations are firmly ingrained in society, since, institutions, reflecting social norms and structures, shape organizational behavior. Institutional influences including legal legislation, cultural norms, and industry practices strongly impact companies’ decisions; therefore, institutional theory has a tremendous influence on managerial accounting, as internal organization processes are fluidly connected to external forces and institutional norms [16], because institutional theory meaningfully affects organizational behavior and decision making by shaping the frameworks within which managers work, often beyond their direct consciousness. Managerial accountants must balance internal management demands with institutional expectations, because institutional context shapes accounting practices, defining both the form and content of managerial accounting systems.

Integrating theoretical frameworks in managerial accounting is a major step beyond contingency theory because this combination with institutional theory provides a deep knowledge of managerial accounting procedures. Notably, it is clear that these ideas complement each other, in that contingency theory resonates with institutional theory to examine how external forces and internal expectations affect accounting processes. Ultimately, understanding these theoretical frameworks and their effects on organizational decision making is essential to navigating this complication; hence, scholars may investigate more connections between these ideas in the future. Definitely, exploring management accountants’ changing position in organizational settings is promising since it involves studying how management accountants may use these ideas to make decisions to solve current issues and promote sustainable company practices. Indeed, managerial accounting theory goes beyond contingency theory to include institutional theory; thus, this comprehensive integration improves our knowledge of accounting methods, benefiting academics and managers in managerial accounting.

2.2. Influence of Environmental Managerial Accounting on Environmental Performance

Effects of environmental managerial systems on environmental performance have been widely recognized [17], while environmental managerial accounting allows managers to utilize their resources effectively to enhance environmental performance [18]. Likewise, Burritt et al. (2002) [19] and Gibson and Martin (2004) [20] argued that environmental managerial accounting can help decrease environmental expenditures, acquire better product pricing, develop production processes, sustain skilled workers, as well as enhance firm image. Businesses with sound techniques of environmental managerial accounting can enjoy lower expenditures linked to environmental actions, resulting in advanced environmental performance. Albelda Pérez et al. (2007) [21] designated two main intangible assets in the setting of uninterrupted environmental enhancement analysis. First is the incorporation of environmental matters in making strategies. Second is the usage of managerial accounting in business. In addition, De Beer and Friend (2006) [22] underlined the role of environmental accounting in assessing two different aspects, firstly “existing environmental project options”, and secondly “environmental performance”. Furthermore, environmental managerial accounting is deemed to help businesses achieve environmental profits and understand environmental responsibility [23]; this focuses on global attention in part, as firm performance is presently evaluated in terms of not only economic but also environmental effectiveness [24].

To achieve this goal, numerous firms have considered employing environmental managerial accounting to enhance environmental performance. Additionally, Solovida and Latan (2017) [24] indicated the effect of adopting environmental managerial accounting on environmental performance. Latan et al. (2018) [1] explored the influence of environmental managerial accounting on environmental efficiency and the role of other factors in improving environmental effectiveness. Susanto and Meiryani (2019) [25] indicated internal and external items affecting the acceptance of environmental managerial accounting, which can lead to environmental effectiveness. Other scholars affirmed that environmental managerial accounting might make businesses achieve environmental responsibility, resulting in environmental efficiency [26].

Environmental managerial accounting is supportive for executives to obtain environmental information. Therefore, executives can cultivate indicators to assess environmental performance [27]. According to Burritt and Schaltegger (2014) [28], managers have focused on environmental performance and also on environmental managerial accounting; by applying environmental managerial accounting, environmental performance is likely improved. All of them that decide sound environmental management policies are better for solving environmental matters enhancing environmental performance due to the usage of better environmental managerial accounting. In addition, numerous other studies also suggest the impacts of environmental managerial accounting on environmental effectiveness [29,30,31]. The empirical findings show that the acceptance of environmental managerial accounting positively affects environmental performance. Moreover, Zandi and Lee (2019) [32] confirmed environmental managerial accounting has an important role in enhancing environmental performance. Generally, we suggest the following hypothesis:

H1.

The implementation of environmental managerial accounting practices leads to improved environmental performance: This is because environmental managerial accounting provides firms with the necessary tools and information to manage and reduce their environmental impact.

2.3. Influence of Factors on Environmental Managerial Accounting and Environmental Performance

Given a lack of earlier contingency-based studies on environmental accounting, it is necessary to rely on environmental managerial research and the larger body of literature on managerial accounting in shaping a set of factors to be reflected [33]. According to Zandi and Lee (2019) [32], there is need for research into the acceptance of environmental managerial accounting in the ever-changing business environment. Businesses have no clear physical borders for delivering, selling, and buying products or services. Nevertheless, there have been a lot of threats to environmental sustainability; current companies are constrained to accept various environmental managerial tools to survive the current ecosphere. Therefore, Zandi and Lee (2019) [32] investigated the effects of internal and external items on environmental managerial accounting. External factors have been measured with market competition and environmental uncertainty [32,34,35], whereas, internal factors have been proxied with organizational size and corporate governance [35,36].

Based on the existing literature assuming businesses have been pursuing strong environmental effectiveness, Duanmu et al. (2018) [37] analyzed the association between competitive strategies and their feedback to market competition. The results indicate market competition positively affects environmental effectiveness. Muttaqin (2022) [38] explored the role of managerial accounting tools in the impact of market competition on managerial effectiveness, indicating market competition could provide a positive and substantial impact on managerial accounting tools and on managerial performance.

Ghasemi et al. (2016) [39] examined the interplay between market competition and managerial accounting systems on managerial effectiveness. Their research indicates the existence of direct interactions between market competition and managerial accounting systems, and between managerial accounting systems and managerial effectiveness. Ismail et al. (2018) [40] claimed traditional managerial accounting techniques are not capable of offering sound information to efficiently run in such a dynamic business environment. The study examined the effect of managerial accounting information in the tie between market competition and organizational effectiveness, demonstrating a positive relationship between managerial accounting systems and performance.

Mia and Clarke (1999) [41] asserted that increasing market competition allows managers to use more imperative managerial accounting systems. Their research offers an explanation for the association between intensity of market competition and managerial effectiveness by combining into the research model managerial accounting systems. The findings demonstrate the intensity of market competition is a cause of adopting information systems, which will lead to organizational effectiveness. Leong and Yang (2020) [42] investigated if market competition makes businesses be more socially responsible. Businesses are more reactive in decreasing social concerns than proactive in enhancing their social strengths. Among those concerns, businesses seem to be more active in decreasing environmental concerns, leading businesses to attain social performance.

Other studies, like Ibadin and Imoisilli (2010) [43], have shown that environmental unpredictability strongly influences managerial accounting procedures; therefore, these empirical findings support the idea that sophisticated managerial accounting practices can improve organizational efficiency if they are carefully tailored to environmental uncertainty. Notably, these studies show the strategic necessity of integrating environmental managerial accounting metrics with the unpredictable and dynamic external environment. Ruzita (2010) [44] emphasizes the strong association between environmental uncertainty and organizational internal effectiveness assessments, because this highlights environmental uncertainty’s dual role in affecting enterprises’ internal effectiveness measurements and strategic choices. Evidently, the acceptance of environmental uncertainty as an external component is crucial to understanding the adoption and efficacy of internal performance assessments in organizations. These studies provide practical advice for organizations looking to improve their environmental managerial accounting practices, and firms may improve environmental managerial accounting by identifying and resolving environmental uncertainty. Indeed, this strategic alignment helps the company handle unanticipated external events and promotes proactive and adaptable environmental responsibility.

Appiah et al. (2020) [12] checked the impact of environmental uncertainty on environmental managerial accounting and environmental performance. With a rise in economic activities, environmental matters have risen. Businesses are currently more aware of environmental protection, and have consequently been working on it. Environmental managerial accounting is a technique via which businesses can control environmental matters. The findings indicate environmental uncertainty has impacts both on environmental managerial accounting and on environmental performance. Latan et al. (2018) studied the impact of business environment uncertainty on environmental effectiveness, considering the role of environmental managerial accounting; a positive influence of business environment uncertainty was indicated on the usage of environmental managerial accounting, which then increases environmental performance. Environmental managerial accounting is an imperative and suitable means for offering environmental information to attain greater environmental performance.

Although Miller (1987) [45] stated that the bond between organizational size and environmental managerial accounting practice design is hazy and unclear, Robbins (2001) [46] showed that there is a link between firm size and environmental managerial accounting practices. Moreover, Ibadin and Imoisilli (2010) [43] indicated that company size has an impact on environmental managerial accounting practices. Environmental managerial accounting practices are referred to as information characteristics (scope, timeliness, aggregation, and integration). Therefore, it can suggest an association between organizational size and environmental managerial accounting practices. Ruzita (2010) [44] found a positive significant link between firm size and the use of novelty managerial tools, which shows that more innovative managerial tools in business are related to larger firm sizes. Additionally, Nguyen (2020) [47] asserted firm size imposes an influence on the application of environmental managerial accounting in businesses. Moreover, numerous researchers verified organizational size significantly affects environmental statements [33,48]. Since big corporations are subjected to more public supervision, it is necessary for them to accept environmental managerial accounting to make good social images to cope with public pressure. Furthermore, big corporations have greater resources to accept more sophisticated accounting practices [49].

Christ and Burritt (2013) [33] extended existing knowledge by exploring if business environments can be utilized to improve understanding of adopting environmental managerial accounting for business. Grounded on the theory of contingency, a conceptual framework was established to ascertain a business environment where businesses more likely engage with the practices of environmental managerial accounting. The findings demonstrate that the use of environmental managerial accounting is related to organizational size. Drawing on the theory of contingency, Mokhtar et al. (2016) [35] investigated the extent to which businesses adopt environmental managerial accounting as well as whether the adoption depends on firm characteristics, including organizational size. Likewise, Nguyen et al. (2020) [50] also indicated a relationship between firm size and the implementation of environmental managerial accounting in business. Uche et al. (2019) [51] determined the effect of firm characteristics on environmental performance, revealing firm characteristics (including organizational size) affect environmental performance. Fianko et al. (2021) [52] studied the effect of internal and external management systems on environmental performance. The results show organizational size moderates the effect of internal and external management systems on environmental performance. Ha (2022) [53] focused on the factors affecting the application of environmental accounting within organizations, from the perspective of stakeholders. The results show that enterprise size is one of the factors that has a significant influence on the implementation of environmental accounting for business.

The implementation of managerial accounting as well as environmental managerial accounting in business is related to corporate governance. For example, Salvato and Melin (2008) [54] emphasized that the authorization of organizational supervision to independent executives with their good training, proficiency, and knowledge could result in higher validation. The independent executives have to report the work to the owners; thus, formal managerial practices are necessary to efficiently run businesses [55]. Similarly, Christine et al. (2011) [56] highlighted that it is indispensable to start an isolated unit in charge of managerial accounting, where formal accounting tools should be applied for formalized managerial practices. Professionalization of independent executives is connected to the implementation of more sophisticated managerial practices. Lu and Wang (2021) [57] investigated the relation between corporate governance and environmental effectiveness, indicating common internal corporate governance is best associated with better environmental performance.

Based on Jaffar et al. (2018) [58], environmental management and environmental effectiveness have recently become progressively important for businesses, as they are better in line with social values. Top management play a vital role in addressing environmental matters that include compliance with environmental rules and guidelines. However, in spite of an increasing number of environmental problems, there is fairly little research that reflects on the role of corporate governance in impacting environmental effectiveness. Ali et al. (2022) [59] explored the role of corporate governance to improve environmental effectiveness. The findings demonstrate some elements of corporate governance have effects on environmental effectiveness. In addition, Bosun-Fakunle et al. (2023) [60] considered the linkage between corporate governance and environmental efficiency. The findings indicate that corporate governance is imperative in attaining environmental effectiveness. Likewise, Abedin et al. (2023) [61] suggested that the elements of corporate governance are related to environmental effectiveness.

Furthermore, Irshad et al. (2023) [62] examined how corporate governance determines sustainability and environmental effectiveness and indicated corporate governance is only operative in extremely environmentally sustainable situations. There is an increasing agreement where traditional accounting systems do not satisfactorily offer needed information for environmental management. Environmental managerial accounting was introduced in 2001, and a guidance document on environmental managerial accounting was issued in 2005. Although environmental managerial accounting is a fairly new technique, it has been used for all of the managerial accounting objectives. Environmental managerial accounting systems are continuously evolving in the same direction as conventional managerial accounting to resource productivity and the activities of value creation. In theory, environmental managerial accounting would be an integral part of managerial accounting. It is obvious that both managerial accounting and environmental managerial accounting share numerous conjoint objectives. Overall, we can suggest the following hypotheses:

H2a.

Higher levels of market competition drive firms to adopt environmental managerial accounting practices: Competitive pressures necessitate better management of environmental costs and risks, which EMA facilitates.

H2b.

Increased market competition leads to better environmental performance: Firms in highly competitive markets are more likely to engage in sustainable practices to gain a competitive edge.

H3a.

Greater environmental uncertainty encourages the adoption of environmental managerial accounting practices: Firms facing unpredictable environmental conditions need robust accounting practices to navigate these uncertainties.

H3b.

Higher environmental uncertainty leads to improved environmental performance. Firms that can effectively manage environmental risks are likely to perform better environmentally.

H4a.

Larger organizations are more likely to adopt environmental managerial accounting practices. Larger firms have more resources and greater public scrutiny, prompting them to implement comprehensive accounting systems.

H4b.

Larger organizations achieve better environmental performance. Their greater resources and more structured management practices enable them to address environmental issues more effectively.

H5a.

Firms with stronger corporate governance structures are more likely to adopt environmental managerial accounting practices: Good governance promotes transparency and accountability, which are facilitated by environmental managerial accounting.

H5b.

Effective corporate governance leads to better environmental performance. Firms with strong governance are more likely to engage in sustainable practices and comply with environmental regulations.

2.4. Mediation of Environmental Managerial Accounting

The mediation of environmental managerial accounting in the research model has been investigated. Saputra et al. (2023) [63] emphasized a need to realize the application of environmental managerial accounting for supporting competitive advantage strategies that can be implemented within the organization, and environmental managerial accounting can mediate the association between green competitive advantage and sustainability effectiveness. Mondal et al. (2023) [64] investigated the effect of financial disclosures on sustainable growth via the mediation of environmental managerial accounting. The results show that financial disclosures have indirect effects on sustainable growth via environmental managerial accounting. Environmental managerial accounting exerts a statistical impact on sustainable growth.

Solovida and Latan (2017) [24] asserted that the use of environmental managerial accounting as an intangible asset brings benefits to businesses by offering environmental information, resulting in better environmental effectiveness. Environmental strategies may affect environmental effectiveness via the mediation of environmental managerial accounting. Study should extend to considering the role of organizational capabilities such as environmental managerial accounting in mediating the research model. Amir and Chaudhry (2019) [65] assessed the linkage between environmental strategy and firm performance that is mediated by environmental managerial accounting. The results show there exists a positive association within the research model between the mediation of environmental managerial accounting in environmental strategy and firm effectiveness. The study tried to find the focus of environmental strategy to augment organizational effectiveness and to improve the usage of environmental managerial accounting.

Amir et al. (2020) [27] assessed the bond between management commitment and organizational effectiveness, based on the legitimacy theory with the mediation of environmental managerial accounting. The results demonstrate a positive and direct influence of management commitment on environmental effectiveness. Additionally, environmental managerial accounting intervenes between top management commitment and environmental effectiveness. Agustia et al. (2019) [66] determined the impact of green innovation on organizational value with environmental managerial accounting as a mediating factor. The findings reveal green innovation affects environmental managerial accounting, whereas environmental managerial accounting is deemed as one of the determinants of organizational value. In addition, green innovation also influences organizational value. Environmental managerial accounting plays a mediating role between green innovation and firm value.

Werimon et al. (2023) [31] indicated that environmental managerial accounting significantly mediates the effect of transformation leadership on environmental performance. Environmental managerial accounting has a positive influence in mediating leadership transformation with environmental performance. The results reveal that hospital management can enhance hospital environmental performance by implementing policies and can also utilize environmental managerial accounting for evaluating the overall efficiency of environmental costs. Environmental managerial accounting significantly mediates the effect of transformational leadership on hospital environmental performance. This finding supports the idea that environmental managerial accounting serves as a mediator in transformational leadership and hospital environmental effectiveness. According to Mia and Clarke (1999) [41], executives’ usage of managerial information plays an arbitrating role in the association between the intensity of market competition and organizational effectiveness. The findings show that businesses that utilize managerial information could successfully cope with market competition, thus increase in effectiveness. Muttaqin (2022) [38] investigated the intrusion of managerial accounting systems in the linkage between market competition and managerial effectiveness, showing a positive relationship between market competition and managerial effectiveness via managerial accounting systems. Ghasemi et al. (2016) [39] studied the mediation of managerial accounting systems between market competition and managerial effectiveness. The results reveal the tie between market competition and managerial effectiveness is arbitrated by managerial accounting systems.

As mentioned above, various research has already highlighted the mediating role of managerial accounting as well as environmental managerial accounting in the research model. However, only a few studies have scrutinized the mediation of environmental managerial accounting in the relationships among environmental performance and market competition, environmental uncertainty, organization size, as well as corporate governance. The authors only found a study by Appiah et al. (2020) [12] that scrutinized the linkage between environmental uncertainty and environmental performance by considering the mediation of environmental managerial accounting. The mediating mechanisms of environmental managerial accounting in the research model are important for researchers as well as business managers [63], because they can help better understand the complicated linkages among external variables, internal variables, and environmental performance. Furthermore, the abovementioned arguments asserted that the use of environmental managerial accounting for business can enhance environmental performance. Nevertheless, they are both determined by market competition, environmental uncertainty, organization size, and corporate governance. Anchored in Baron and Kenny (1986) [67], we can reach the mediation hypotheses of environmental managerial accounting in business. Generally, we can make the following hypotheses:

H6.

Environmental managerial accounting can mediate the relationship between market competition and environmental performance.

H7.

Environmental managerial accounting can mediate the relationship between environmental uncertainty and environmental performance.

H8.

Environmental managerial accounting can mediate the relationship between organizational size and environmental performance.

H9.

Environmental managerial accounting can mediate the relationship between corporate governance and environmental performance.

3. Methodology

3.1. Research Model

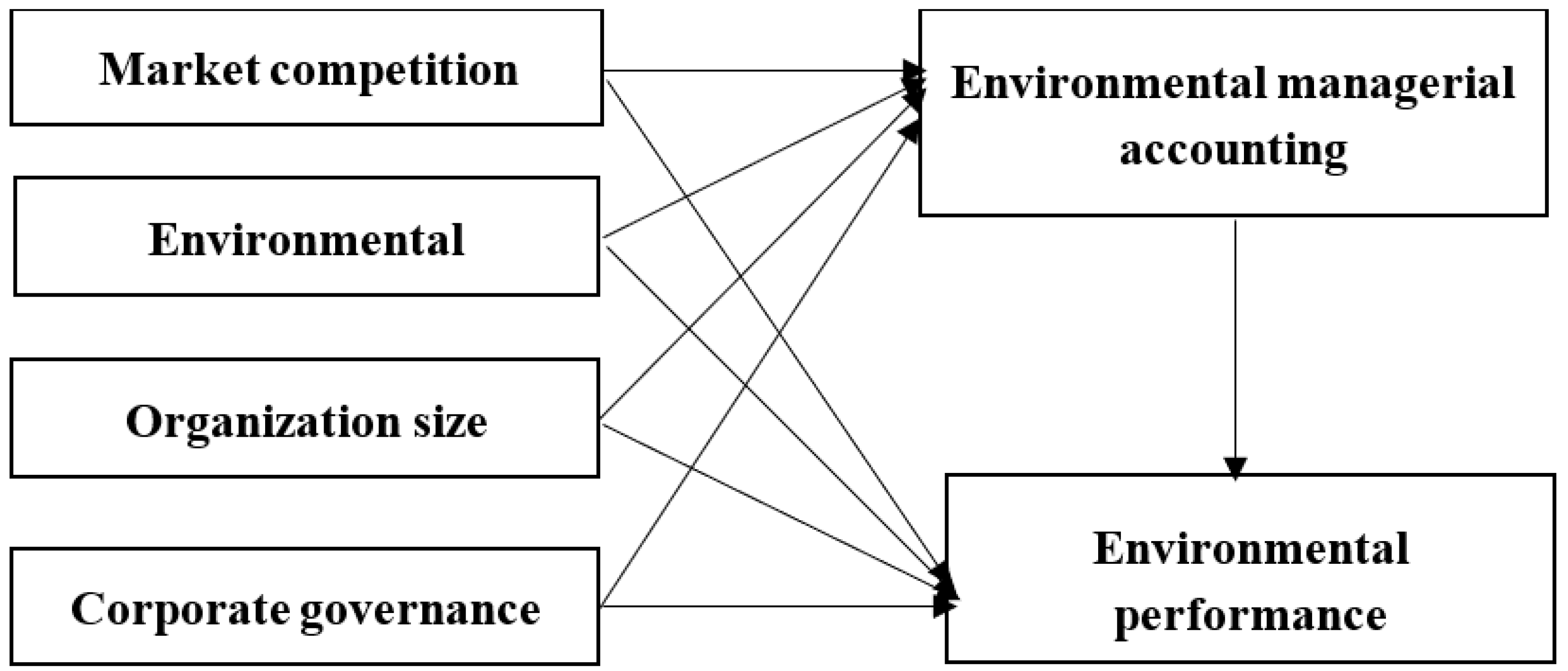

The above hypotheses were used as foundational knowledge to yield a projected research model. Having clarified the hypotheses derived from the reviewed literature, the following research model can be arrived at, as shown in Figure 1.

Figure 1.

Research model.

3.2. Measurements

Environmental managerial accounting: Grounded on Christ and Burritt (2013) [33] and Latan et al. (2018) [1], we measured environmental managerial accounting (ENG) with 13 items (ENG1 to ENG13), which were designed with a five-point scale, as shown in Appendix A. Environmental performance: Drawing on Chuang and Huang (2018) [68], in the current research, environmental performance (ENE) was measured with 8 items (ENE1 to ENE8), as shown in Appendix A. Those items concentrate on compliance with the current set of environmental protection laws, environment-related effects, and advantages relating to environmentally friendly activities. The items were estimated with a five-point scale.

Market competition: Modified from prior projects [69,70], we evaluated market competition (MAN) with 8 items for rating the intensity and importance of competition in price, product range, quality, new product introduction, advertising and promotion, marketing distribution, number of major competitors, and package deals for customers (MAN1 to MAN8), as shown in Appendix A. The items were measured using a five-point scale. Environmental uncertainty: Based on previous research [44,71], we evaluated environmental uncertainty (ENY) with five items (ENY1 to ENY5), which were calculated using a five-point scale, as shown in Appendix A.

Organization size: According to Nguyen (2009) [72], the current research evaluated organization size (ORE) with a three-point scale, which consists of “small”, “medium”, and “large”. Corporate governance: Anchored in previous studies [73,74], the current research measured corporate governance (COE) based on board-related aspects consisting of two items (COE1 to COE2), which are board independence and audit committee independence. COE1 is the percentage of independent directors on the board; whereas COE2 is the percentage of independent directors in the audit committee.

3.3. Data Collection

A thorough pilot test of measurements was undertaken before the study’s data gathering phase. In the first round, ten business leaders with direct environmental managerial accounting experience were asked to give useful suggestions. This strategic pilot test rigorously validated the metrics for future studies. The researchers strengthened their analysis by including practitioners and experts, ensuring that the criteria used were relevant and robust in capturing environmental managerial accounting methods. The study survey then focused on Vietnam’s dynamic economy and changing regulations. The targeted informants were executives involved in environmental managerial accounting in 1654 publicly listed enterprises in Vietnam. From these 1654 publicly listed enterprises, 675 enterprises were randomly selected, of which there were 500 publicly listed enterprises that were involved in environmental pollution chosen for the research. Only one executive in every enterprise was asked to offer relevant information. Of the 500 questionnaires that were delivered to enterprises, only 397 questionnaires were suitably completed with sufficient information for analyses, accounting for 79.4%. The obtained data were richer, since these Vietnamese businesspeople from a variety of sectors replied diligently and relevantly. The large respondent pool strengthens the research, revealing environmental managerial accounting trends, issues, and possibilities in Vietnam. This rigorous strategy, including a comprehensive pilot test, focused participant selection, and a large survey respondent pool, emphasizes the study’s methodological rigor. The study’s smooth transition from pilot testing to statewide surveys shows a purposeful and educated approach, positioning it to contribute to environmental managerial accounting practices in Vietnamese businesses.

The figures of the final research sample are revealed in Table 1. The biggest number of the selected observations fell into the industry of construction and construction materials category, making up 17.38% with 69 observations. The second rank fell into the industry of food, accounting for 16.12% with 64 observations, followed by the sector of natural rubber, fertilizer, and chemicals (11.84% with 47 observations). The smallest number belonged to the 4 industries of hotels and building management, fisheries, and garment with 9 observations per sector, accounting for 2.27% per observation. The other sectors make up from 3.02% with 12 observations to 9.07% with 36 observations.

Table 1.

Profile of the final research sample.

4. Results

4.1. Valuation of Instrumental Reliability

To analyze the stability of items within the scales, the procedures of Cronbach’s α analyses were undertaken, which generated the results in Table 2. Based on Murtagh and Heck (2012), the estimates of α should yield values higher than the 0.6 level to be satisfactory, and more than 0.7 to be appropriate. The total correlations had to obtain values over the 0.5 limit to be acceptable. Additionally, the estimates of α if the item is removed should be smaller than their own total of α to be considered acceptable. As shown in Table 2, the estimates of α all attain the values of above 0.7 (the smallest is 0.874), and all of the total correlations exceed the 0.5 level (the smallest is 0.657). Furthermore, all the estimations of α if the item is removed (ranging from 0.861 to 0.957) are under their own total of α (ranging from 0.874 to 0.961).

Table 2.

Reliability analyses of scales.

The aforementioned findings demonstrate all the dimensions are internally constant with their own scales. In order to organize the dimensions to their own latent factors, an exploratory analysis of factors for the variables formed from multiple items was performed, the results of which are shown in Table 3. The explanatory factor analysis is a statistical technique used to categorize the links among the factors in the research model, offering a group of items based on the strength of relationships by employing the sample data. The validity analyses of convergence and discriminant were performed to determine the validity of scales.

Table 3.

Exploratory factor analyses.

As Murtagh and Heck (2012) [75] revealed, the validity of convergence is the extent to which various dimensions are consistent with one another. If the loadings and communalities all surpass the 0.5 limit, the data are convergent. The validity of the discriminant is the extent to which items in different groups are divergent from one another. If the cross-loadings surpass the 0.3 threshold, the data are divergent. Based on Table 3, the loadings and communalities all exceed the 0.5 value. These figures demonstrate the convergence in the research model. The cross-loadings all surpass the lowest limit of 0.3, indicating the divergence of the research model.

Additionally, the estimates of KMO exceed the lowest edge of 0.7 (0.946) and the chi-square reaches a value of 10,006.246 at the 1% significance level, indicating the exploratory factor analysis achieves a good fit. Generally, the research model reaches adequate validity for convergence and divergence.

4.2. Assessment of Causal Links

To estimate the causal impacts in the research model, the current study used various analyses of regression to evaluate models from 1 to 3, creating the results in Table 4. This research is anchored in the indicators postulated by Murtagh and Heck (2012) [75] to evaluate the research model. Furthermore, Table 4 indicates that all three of the models achieve a goodness of fit. The values of F reach 75.847 (Model 1), 272.240 (Model 2), and 66.496 (Model 3), all at the 1% significance level. Furthermore, the estimates of the explained variance (R2) achieve values of 0.436 (Model 1), 0.735 (Model 2), and 0.460 (Model 3), indicating the amounts of variance explained by explanatory variables are 43.6% (Model 1), 73.5% (Model 2), and 46% (Model 3). The Durbin–Watson estimates take the values of 1.904 (Model 1), 1.873 (Model 2), and 1.920 (Model 3), falling into their interval between du and (4–du), which disclose no autocorrelation. Furthermore, the coefficients of χ2 from the Breusch–Pagan test gain the values of 0.937 (Model 1), 0.611 (Model 2), and 0.525 (Model 3) with the estimates of Pχ2 equal to 0.295 (Model 1), 0.399 (Model 2), and 0.784 (Model 3), which all surpass the 5% significance level, thus representing no heteroskedasticity.

Table 4.

Multiple regression analyses to test causal hypotheses.

Furthermore, the estimators of VIF all obtain values less than the 2 level, showing no multicollinearity. In Model 1, the regression of environmental performance on market competition, environmental uncertainty, organization size, and corporate governance was undertaken; whereas, in Model 3, the regression of environmental performance on market competition, environmental uncertainty, organization size, corporate governance, and environmental managerial accounting was estimated. The findings show that market competition, environmental uncertainty, and organization size are positively related to environmental performance at the 1% significance level, whereas corporate governance positively affects environmental performance at the 5% significance level. The influence of environmental managerial accounting on environmental performance is statistically positive at the 1% significance level. The empirical results are in support of H1 “The usage of environmental managerial accounting can enhance environmental performance”, H2b “Market competition influences environmental performance”, H3b “Environmental uncertainty influences environmental performance”, and H4b “Organization size influences environmental performance” at the 1% significance level, as well as in support of H5b “Corporate governance influences environmental performance” at the 5% significance level.

In Model 2, the regression of environmental managerial accounting on market competition, environmental uncertainty, organization size, and corporate governance was performed. The findings show that market competition, environmental uncertainty, and organization size are positively related to environmental managerial accounting at the 1% significance level, whereas corporate governance positively affects environmental managerial accounting at the 5% significance level.

The empirical results are in support of H2a “Market competition affects the use of environmental managerial accounting for business”, H3a “Environmental uncertainty affects the use of environmental managerial accounting for business”, and H4a “Organization size affects the use of environmental managerial accounting for business” at the 1% significance level, as well as in support of H5a “Corporate governance affects the usage of environmental managerial accounting for business” at the 5% significance level.

4.3. Assessment of Mediation

When entered into the research model in Model 3 from Model 1, the influential estimates of MAN, ENY, ORE, and COE on environmental performance decline to 0.124, 0.156, 0.163, and 0.632, respectively, from 0.144, 0.200, 0.348, and 0.777, respectively. These findings advocate a mediating role of environmental managerial accounting on the causal effects of MAN, ENY, ORE, and COE on environmental performance. Next, the current study applied procedures projected by Aroian (1947) [76] and Goodman (1960) [77] to investigate the statistical significance for the interceding influences. The mediating procedures generated the results in Table 5. As the figures disclose, the interceding effects of environmental managerial accounting on the causal associates from MAN, ENY, ORE, and COE to environmental performance are all statistically significant.

Table 5.

Mediation analyses.

The mediating effects on the associations of MAN and COE with environmental performance are significant at the 5% level (tindirect = 4.255, 3.486, 4.035, 3.389, 2.972, and 3.279; pt = 0.000, 0.000, 0.000, 0.000, 0.003, and 0.001, respectively). However, those of ENY and ORE with environmental performance are at the 1% significance level (tindirect = 1.905 and 1.826; pt = 0.057 and 0.068, respectively). Overall, we can conclude that environmental managerial accounting partially mediates the causal relations of MAN, ENY, ORE, and COE to environmental performance. These abovementioned findings indicate that environmental managerial accounting transmits a part of the impacts of MAN, ENY, ORE, and COE to environmental performance indirectly via itself. Thus, the findings are in support of H6 “Environmental managerial accounting can intervene between market competition and environmental performance”, H7 “Environmental managerial accounting can intervene between environmental uncertainty and environmental performance”, H8 “Environmental managerial accounting can intervene between organization size and environmental performance”, and H9 “Environmental managerial accounting can intervene between corporate governance and environmental performance”.

5. Discussion

There has been a lot of research investigating the links among environmental managerial accounting, external variables, internal variables, and environmental performance. Nevertheless, none or little research has studied intervention mechanisms in the related research models. To the best of our knowledge, only a study by Appiah et al. (2020) [12] scrutinized the linkage between environmental uncertainty and environmental performance by considering the mediation of environmental managerial accounting. Others also examined the mediating role of environmental managerial accounting in improving environmental performance. However, no studies explored the mediating role of environmental managerial accounting in the relationships among market competition, environmental uncertainty, organization size, corporate governance, and environmental performance. Solovida and Latan (2017) [24] asserted that environmental strategies can impact environmental performance via the intervention of environmental managerial accounting. Amir et al. (2020) [27] evaluated the tie between management commitment and organizational performance, highlighting the intervention of environmental managerial accounting. Werimon et al. (2023) [31] showed that environmental managerial accounting is a mediator in the impact of transformation leadership on environmental performance.

Therefore, Saputra et al. (2023) [63] underlined a need to realize the adoption of environmental managerial accounting for supporting competitive advantage strategies that could be applied within the firm, and environmental managerial accounting can mediate the link between green competitive advantage and sustainability performance. Based on the suggestions by Baron and Kenny (1986) [67], the current research tried to analyze the mediating role of environmental managerial accounting in the effects of market competition, environmental uncertainty, organization size, and corporate governance on environmental performance. The empirical results are in support of the mediation of environmental managerial accounting in the effects of market competition, environmental uncertainty, organization size, and corporate governance on environmental performance, which are consistent with those of previous research.

Based on the abovementioned empirical findings, some implications are evident for those in charge of environmental managerial accounting. The results show that when a firm operates in a higher uncertain business environment and a higher intensity of market competition, its executives are more likely to accept environmental managerial accounting practices, which concurs with the results of prior research [32,34,38,43,44,71,78,79], which discovered the uncertain business environment and the intensity of market competition can lead executives to require the more suitable and precise environmental information offered by environmental managerial accounting practices. Therefore, executives could more effectively run their businesses.

The findings also provide evidence of a linkage between corporate governance and environmental managerial accounting practices, which concurs with the results of prior research [54,60,62]. The majority of firms with independent executives are likely to accept environmental managerial accounting to run businesses because independent executives have to report the work to the owners, so they require formal managerial implements such as environmental managerial accounting practices for those reports. These findings are in agreement with earlier research findings [54,55,56]. Furthermore, when organizational size is larger, environmental managerial accounting practices are thought to be compulsory to the organization, which likely augments the implementation of environmental managerial accounting tools in businesses.

More importantly, this research provides statistical evidence on the mediating role of environmental managerial accounting practices among environmental performance and market competition, environmental uncertainty, organization size, as well as corporate governance. Nevertheless, these findings on the mediating role of environmental managerial accounting practices in the research model of environmental performance and market competition, environmental uncertainty, organization size, as well as corporate governance have not been discovered before [12,24,27,31,63,65,66]. Hence, the current research synthesized the existing literature on environmental managerial accounting practices among environmental performance and market competition, environmental uncertainty, organization size, as well as corporate governance, and then established the mediating hypothesis. The results infer that, when included in the research model, environmental managerial accounting practices will decrease the effects of market competition, environmental uncertainty, organization size, and corporate governance on environmental performance.

There are some limitations in the current research. Firstly, the cross-sectional data were based on single respondents from firms; as a result, bias may occur. Secondly, this research was implemented in Vietnam as a developing economy, and our findings are expected to be applied in other developing countries. However, business conditions among developing countries may be different, so one should generalize our findings with care. Future research should explore the longitudinal effects of environmental management accounting adoption, particularly how these practices influence financial performance over time. Additionally, further studies could examine the impact of environmental management accounting practices in other developing countries, allowing for a comparative analysis of their effectiveness across different economic and regulatory contexts. Investigating the specific mechanisms through which environmental management accounting practices improve environmental performance could also provide deeper insights into their operational benefits.

6. Conclusions

This study demonstrates the significant impact of environmental management accounting practices on environmental performance in Vietnamese industries. The results indicate that higher environmental unpredictability, increased market competition, larger organizational scale, and effective corporate governance significantly promote the adoption of environmental management accounting practices. These practices, in turn, lead to enhanced environmental performance.

These findings have important practical implications for corporate leaders in developing countries. Businesses operating in competitive and unpredictable environments should prioritize the implementation of environmental management accounting practices to improve their environmental performance. Theoretically, the study contributes to the literature by highlighting the mediating role of environmental management accounting practices in the relationship between environmental and organizational factors and environmental performance.

Author Contributions

Conceptualization, Q.L.H. and V.K.N.; methodology, Q.L.H.; data collection, V.K.N.; formal analysis, Q.L.H.; writing—original draft preparation, Q.L.H. and V.K.N.; writing—review and editing, Q.L.H.; visualization, Q.L.H.; supervision, Q.L.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and the protocol was approved by the Ethics Committee of Training & Scientific Council of Business Administration Faculty of Ho Chi Minh City University of Industry and Trade (HUIT) (No. 23/HĐKHĐT) on 16 May 2024.

Informed Consent Statement

Informed consent for participation was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A. Questionnaire Design

Table A1.

Study factors and their related items.

Table A1.

Study factors and their related items.

| Factor | Item | Statement |

|---|---|---|

| ENG | ENG1 | Identification of environment-related costs |

| ENG2 | Estimation of environment-related contingent liabilities | |

| ENG3 | Classification of environment-related costs | |

| ENG4 | Allocation of environment-related costs to production processes | |

| ENG5 | Allocation of environment-related costs to products | |

| ENG6 | Introduction or improvement to environment-related cost management | |

| ENG7 | Creation and use of environment-related cost accounts | |

| ENG8 | Development and use of environment-related key performance indicators | |

| ENG9 | Product life-cycle cost assessments | |

| ENG10 | Product inventory analyses | |

| ENG11 | Product impact analyses | |

| ENG12 | Product improvement analysis | |

| ENG13 | Assessment of potential environmental impacts associated with capital investment decisions | |

| ENE | ENE1 | Business satisfaction with current performance in reducing pollution and production costs |

| ENE2 | Business satisfaction with current performance in reducing environmental fines | |

| ENE3 | Business satisfaction with current performance in improving relations with the community | |

| ENE4 | Business satisfaction with reduction in workplace accidents | |

| ENE5 | Business satisfaction with current performance increasing image in environmental protection | |

| ENE6 | Business satisfaction regarding current increases in products with environmentally friendly design | |

| ENE7 | Business satisfaction with current performance-strengthening internal environmental management and communication | |

| ENE8 | Business satisfaction with performance in awareness and understanding of current trends in environmental regulations | |

| MAN | MAN1 | Intensity of competition in price |

| MAN2 | Intensity of competition in product range | |

| MAN3 | Intensity of competition in quality | |

| MAN4 | Intensity of competition in new product introduction | |

| MAN5 | Intensity of competition in advertising and promotion | |

| MAN6 | Intensity of competition in marketing distribution | |

| MAN7 | Intensity of competition in number of major competitors | |

| MAN8 | Intensity of competition in package deals for customers | |

| ENY | ENY1 | Change in technology |

| ENY2 | Change in economy | |

| ENY3 | Change in resources and services used by the company | |

| ENY4 | Change in product market and demand | |

| ENY5 | Change in government policy |

Source: Authors’ systematization.

References

- Latan, H.; Chiappetta Jabbour, C.J.; Lopes de Sousa Jabbour, A.B.; Wamba, S.F.; Shahbaz, M. Effects of environmental strategy, environmental uncertainty and top management’s commitment on corporate environmental performance: The role of environmental management accounting. J. Clean. Prod. 2018, 180, 297–306. [Google Scholar] [CrossRef]

- Gunarathne, N.; Lee, K.H. Environmental Management Accounting (EMA) for environmental management and organizational change: An eco-control approach. J. Account. Organ. Chang. 2015, 11, 362–383. [Google Scholar] [CrossRef]

- Allen, D.G. Relevance Lost: The Rise and Fall of Management Accounting. By H. Thomas Johnson and Robert S. Kaplan. Boston: Harvard Business School Press, 1987; pp. xv + 269. Notes and index. $24.95. In Business History Review; Cambridge University Press: Cambridge, UK, 1988; Volume 62, pp. 176–178. [Google Scholar]

- Bruun, O. Environmental protection in the hands of the state: Authoritarian environmentalism and popular perceptions in Vietnam. J. Environ. Dev. 2020, 29, 171–195. [Google Scholar] [CrossRef]

- Clarke, B.D.; Vu, C.C. EIA effectiveness in Vietnam: Key stakeholder perceptions. Heliyon 2021, 7, e06157. [Google Scholar] [CrossRef]

- Nguyen, B. Does local environmental governance improve tourism companies’ performance? Evidence from Vietnam. J. Travel Res. 2022, 61, 747–761. [Google Scholar] [CrossRef]

- Covert, H.H.; Sherman, M.; Le, D.; Lichtveld, M.Y. Environmental health risk relationships, responsibility, and sources of information among Vietnamese Americans in coastal Mississippi. Health Risk Soc. 2020, 22, 362–376. [Google Scholar] [CrossRef] [PubMed]

- Quyen, P.B.; Nhan, D.D.; Van San, N. Environmental pollution in Vietnam: Analytical estimation and environmental priorities. TrAC Trends Anal. Chem. 1995, 14, 383–388. [Google Scholar] [CrossRef]

- Chu, T.T.H. Environmental pollution in Vietnam: Challenges in management and protection. J. Vietnam. Environ. 2018, 9, 1–3. [Google Scholar] [CrossRef]

- Huynh, Q.L.; Lan, T.T.N. Importance of Environmentally Managerial Accounting to Environmental and Economic Performance. Int. J. Energy Econ. Policy 2021, 11, 381–388. [Google Scholar] [CrossRef]

- Bui, N.; Le, O.; Dao, H. Roadmap for the implementation of IFRS in Vietnam: Benefits and challenges. Accounting 2020, 6, 533–552. [Google Scholar] [CrossRef]

- Appiah, B.K.; Zhang, D.; Majumder, S.C.; Monaheng, M.P. Effects of environmental strategy, uncertainty and top management commitment on the environmental performance: Role of environmental management accounting and environmental management control system. Int. J. Energy Econ. Policy 2020, 10, 360–370. [Google Scholar] [CrossRef]

- Gordon, L.A.; Miller, D. A contingency framework for the design of accounting information systems. Account. Organ. Soc. 1976, 1, 59–69. [Google Scholar] [CrossRef]

- Otley, D. The contingency theory of management accounting and control: 1980–2014. Manag. Account. Res. 2016, 31, 45–62. [Google Scholar] [CrossRef]

- Peters, B.G. Institutional theory. In Handbook on Theories of Governance; Edward Elgar Publishing: Cheltenham, UK, 2022; pp. 323–335. [Google Scholar]

- Risi, D.; Vigneau, L.; Bohn, S.; Wickert, C. Institutional theory-based research on corporate social responsibility: Bringing values back in. Int. J. Manag. Rev. 2023, 25, 3–23. [Google Scholar] [CrossRef]

- Spencer, S.Y.; Adams, C.; Yapa, P.W. The mediating effects of the adoption of an environmental information system on top management’s commitment and environmental performance. Sustain. Account. Manag. Policy J. 2013, 4, 75–102. [Google Scholar] [CrossRef]

- Pondeville, S.; Swaen, V.; De Rongé, Y. Environmental management control systems: The role of contextual and strategic factors. Manag. Account. Res. 2013, 24, 317–332. [Google Scholar] [CrossRef]

- Burritt, R.L.; Hahn, T.; Schaltegger, S. Towards a comprehensive framework for environmental management accounting—Links between business actors and environmental management accounting tools. Aust. Account. Rev. 2002, 12, 39–50. [Google Scholar] [CrossRef]

- Gibson, K.C.; Martin, B.A. Demonstrating value through the use of environmental management accounting. Environ. Qual. Manag. 2004, 13, 45–52. [Google Scholar] [CrossRef]

- Albelda Pérez, E.; Correa Ruiz, C.; Carrasco Fenech, F. Environmental management systems as an embedding mechanism: A research note. Account. Audit. Account. J. 2007, 20, 403–422. [Google Scholar] [CrossRef]

- De Beer, P.; Friend, F. Environmental accounting: A management tool for enhancing corporate environmental and economic performance. Ecol. Econ. 2006, 58, 548–560. [Google Scholar] [CrossRef]

- Derchi, G.B.; Burkert, M.; Oyon, D. Environmental management accounting systems: A review of the evidence and propositions for future research. Account. Control. Sustain. 2013, 26, 197–229. [Google Scholar]

- Solovida, G.T.; Latan, H. Linking environmental strategy to environmental performance: Mediation role of environmental management accounting. Sustain. Account. Manag. Policy J. 2017, 8, 595–619. [Google Scholar] [CrossRef]

- Susanto, A.; Meiryani, M. Antecedents of Environmental Management Accounting and Environmental Performance: Evidence from Indonesian Small and Medium Enterprises. Int. J. Energy Econ. Policy 2019, 9, 401–407. [Google Scholar] [CrossRef]

- Ferreira, A.; Moulang, C.; Hendro, B. Environmental management accounting and innovation: An exploratory analysis. Accounting. Audit. Account. J. 2010, 23, 920–948. [Google Scholar] [CrossRef]

- Amir, M.; Rehman, S.A.; Khan, M.I. Mediating role of environmental management accounting and control system between top management commitment and environmental performance: A legitimacy theory. J. Manag. Res. 2020, 7, 132–160. [Google Scholar] [CrossRef]

- Burritt, R.; Schaltegger, S. Accounting towards sustainability in production and supply chains. Br. Account. Rev. 2014, 46, 327–343. [Google Scholar] [CrossRef]

- Christine, D.; Yadiati, W.; Afiah, N.N.; Fitrijanti, T. The relationship of environmental management accounting, environmental strategy and managerial commitment with environmental performance and economic performance. Int. J. Energy Econ. Policy 2019, 9, 458–464. [Google Scholar] [CrossRef]

- Sidik, M.H.J.; Yadiati, W.; Lee, H.; Khalid, N. The dynamic association of energy, environmental management accounting and green intellectual capital with corporate environmental performance and competitive. Int. J. Energy Econ. Policy 2019, 9, 379–386. [Google Scholar] [CrossRef]

- Werimon, S.; Supriyantono, A.; Wurarah, R.N.; Nugroho, B. The mediating effect of environmental management accounting on hospital environmental performance: Analyzing hazardous waste processing in public hospitals of Manokwari Regency. World J. Adv. Res. Rev. 2023, 19, 86–96. [Google Scholar] [CrossRef]

- Zandi, G.; Lee, H. Factors affecting environmental management accounting and environmental performance: An empirical assessment. Int. J. Energy Econ. Policy 2019, 9, 342–348. [Google Scholar] [CrossRef]

- Christ, K.L.; Burritt, R.L. Environmental management accounting: The significance of contingent variables for adoption. J. Clean. Prod. 2013, 41, 163–173. [Google Scholar] [CrossRef]

- Shahzadi, S.; Khan, R.; Toor, M.; ul Haq, A. Impact of external and internal factors on management accounting practices: A study of Pakistan. Asian J. Account. Res. 2018, 3, 211–223. [Google Scholar] [CrossRef]

- Mokhtar, N.; Jusoh, R.; Zulkifli, N. Corporate characteristics and environmental management accounting (EMA) implementation: Evidence from Malaysian public listed companies (PLCs). J. Clean. Prod. 2016, 136, 111–122. [Google Scholar] [CrossRef]

- Handoyo, S.; Mulyani, S.; Ghani, E.K.; Soedarsono, S. Firm characteristics, business environment, strategic orientation, and performance. Adm. Sci. 2023, 13, 74. [Google Scholar] [CrossRef]

- Duanmu, J.L.; Bu, M.; Pittman, R. Does market competition dampen environmental performance? Evidence from China. Strateg. Manag. J. 2018, 39, 3006–3030. [Google Scholar] [CrossRef]

- Muttaqin, G.F. Mediating Effect of Management Accounting System on The Relationship Between Competition and Performance. Rev. Account. Tax. 2022, 1, 15–32. [Google Scholar] [CrossRef]

- Ghasemi, R.; Azmi Mohamad, N.; Karami, M.; Hafiz Bajuri, N.; Asgharizade, E. The mediating effect of management accounting system on the relationship between competition and managerial performance. Int. J. Account. Inf. Manag. 2016, 24, 272–295. [Google Scholar] [CrossRef]

- Ismail, K.; Isa, C.R.; Mia, L. Market competition, lean manufacturing practices and the role of Management Accounting Systems (MAS) information. J. Pengur. 2018, 52, 47–61. [Google Scholar] [CrossRef]

- Mia, L.; Clarke, B. Market competition, management accounting systems and business unit performance. Manag. Account. Res. 1999, 10, 137–158. [Google Scholar] [CrossRef]

- Leong, C.K.; Yang, Y.C. Market competition and firms’ social performance. Econ. Model. 2020, 91, 601–612. [Google Scholar] [CrossRef]

- Ibadin, P.O.; Imoisili, O. Organization contexts and management accounting system design: Empirical evidence from Nigeria. Int. J. Curr. Res. 2010, 10, 64–73. [Google Scholar]

- Ruzita, J. The influence of perceived environmental uncertainty, firm size, and strategy on multiple performance measuresusage. Afr. J. Bus. Manag. 2010, 4, 1972–1984. [Google Scholar]

- Miller, G.A. Meta-analysis and the culture-free hypothesis. Organ. Stud. 1987, 8, 309–326. [Google Scholar] [CrossRef]

- Robbins, S.P. Organisational Behaviour: Global and Southern African Perspectives; Pearson South Africa: Cape Town, South Africa, 2001. [Google Scholar]

- Nguyen, T.K.T. Studying factors affecting environmental accounting implementation in mining enterprises in Vietnam. J. Asian Financ. Econ. Bus. 2020, 7, 131–144. [Google Scholar] [CrossRef]

- Pahuja, S. Relationship between environmental disclosures and corporate characteristics: A study of large manufacturing companies in India. Soc. Responsib. J. 2009, 5, 227–244. [Google Scholar] [CrossRef]

- Chenhall, R.H. Management control systems design within its organizational context: Findings from contingency-based research and directions for the future. Account. Organ. Soc. 2003, 28, 127–168. [Google Scholar] [CrossRef]

- Nguyen, T.M.H.; Nguyen, T.K.T.; Nguyen, T.T.V. Factors affecting the implementation of environmental accounting by construction companies listed on the Ho Chi Minh Stock Exchange. J. Asian Financ. Econ. Bus. 2020, 7, 269–280. [Google Scholar] [CrossRef]

- Uche, E.P.; Ndubuisi, A.N.; Chinyere, O.J. Effect of firm characteristics on environmental performance of quoted industrial goods firms in Nigeria. Int. J. Res. Bus. Econ. Manag. 2019, 3, 1–13. [Google Scholar]

- Fianko, S.K.; Amoah, N.; Jnr, S.A.; Dzogbewu, T.C. Green supply chain management and environmental performance: The moderating role of firm size. Int. J. Ind. Eng. Manag. 2021, 12, 163–173. [Google Scholar] [CrossRef]

- Ha, V.T. Factors Affecting the Implementation of Environmental Management Accounting in Manufacturing Enterprises: Evidence from Vietnam. J. Posit. Sch. Psychol. 2022, 6, 3289–3305. [Google Scholar]

- Salvato, C.; Melin, L. Creating Value across Generations in Family-Controlled Businesses: The Role of Family Social Capital. Fam. Bus. Rev. 2008, 21, 259–275. [Google Scholar] [CrossRef]

- Cromie, S.; Stephenson, B.; Monteith, D. The Management of Family Firms: An Empirical Investigation. Int. Small Bus. J. 1995, 13, 11–34. [Google Scholar] [CrossRef]

- Christine, D.; Birgit, F.D.; Christine, M. Corporate governance and management accounting in family firms: Does generation matter. Int. J. Bus. Res. 2011, 11, 29–39. [Google Scholar]

- Lu, J.; Wang, J. Corporate governance, law, culture, environmental performance and CSR disclosure: A global perspective. J. Int. Financ. Mark. Inst. Money 2021, 70, 101264. [Google Scholar] [CrossRef]

- Jaffar, R.; Aziendeh, R.R.; Shukor, Z.A.; Rahman, M.R.C.A. Environmental performance: Does corporate governance matter. J. Pengur. 2018, 52, 133–143. [Google Scholar] [CrossRef][Green Version]

- Ali, H.R.; Mohammad, A.J.; Al-Kake FR, A.; Nawaz, M.A.; Hussain, S. The Impact of Corporate Governance on Environmental Performance of Public Listed Companies in Malaysia: A Robust Standard Error Approach. Acad. Strateg. Manag. J. 2022, 21, 1–14. [Google Scholar]

- Bosun-Fakunle, Y.F.; Mary, J.; Gbenga, E. Effect of Corporate Governance and Environmental Performance Empirical Evidence from Zimbabwe. Am. J. Ind. Bus. Manag. 2023, 13, 163–181. [Google Scholar] [CrossRef]

- Abedin, S.H.; Subha, S.; Anwar, M.; Kabir, M.N.; Tahat, Y.A.; Hossain, M. Environmental performance and corporate governance: Evidence from Japan. Sustainability 2023, 15, 3273. [Google Scholar] [CrossRef]

- Irshad, A.U.R.; Safdar, N.; Younas, Z.I.; Manzoor, W. Impact of Corporate Governance on Firms’ Environmental Performance: Case Study of Environmental Sustainability-Based Business Scenarios. Sustainability 2023, 15, 7775. [Google Scholar] [CrossRef]

- Saputra, K.A.K.; Subroto, B.; Rahman, A.F.; Saraswati, E. Mediation role of environmental management accounting on the effect of green competitive advantage on sustainable performance. J. Sustain. Sci. Manag. 2023, 18, 103–115. [Google Scholar] [CrossRef]

- Mondal, M.S.A.; Akter, N.; Moni, S.J.; Polas, M.R.H. Financial and non-financial disclosures on sustainable development: The mediating role of environmental accounting disclosure practices. Int. J. Financ. Account. Manag. 2023, 5, 387–406. [Google Scholar] [CrossRef]

- Amir, M.; Chaudhry, N.I. Linking environmental strategy to firm performance: A sequential mediation model via environmental management accounting and top management commitment. Pak. J. Commer. Soc. Sci. (PJCSS) 2019, 13, 849–867. [Google Scholar]

- Agustia, D.; Sawarjuwono, T.; Dianawati, W. The mediating effect of environmental management accounting on green innovation: Firm value relationship. Int. J. Energy Econ. Policy 2019, 9, 299–306. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The Moderator-Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Chuang, S.P.; Huang, S.J. The effect of environmental corporate social responsibility on environmental performance and business competitiveness: The mediation of green information technology capital. J. Bus. Ethics 2018, 150, 991–1009. [Google Scholar] [CrossRef]

- Khandwalla, P.N. Effect of Different Types of Competition on Use of Management Controls. J. Account. Res. 1972, 10, 275–285. [Google Scholar] [CrossRef]

- Isa, C.R. A Note on Market Competition, Advanced Manufacturing Technology and Management Accounting and Control Systems Change. Malays. Account. Rev. 2007, 6, 43–62. [Google Scholar]

- Chenhall, R.H.; Morris, D. The impact of structure, environment, and interdependence on the perceived usefulness of management accounting systems. Account. Rev. 1986, 61, 16–35. [Google Scholar]

- Nguyen, T.D. Decree No. 56/2009/ND-CP of 30 June 2009 on Assistance to the Development of Small- and Medium-Sized Enterprises; Vietnamese Government: Hanoi, Vietnam, 2009. [Google Scholar]

- Singla, M.; Singh, S. Board monitoring, product market competition and firm performance. Int. J. Organ. Anal. 2019, 27, 1036–1052. [Google Scholar] [CrossRef]

- Bhagat, S.; Bolton, B. Corporate governance and firm performance. J. Corp. Financ. 2008, 14, 257–273. [Google Scholar] [CrossRef]

- Murtagh, F.; Heck, A. Multivariate Data Analysis; Springer Science & Business Media: New York, NY, USA, 2012; Volume 131. [Google Scholar]

- Aroian, L.A. The probability function of the product of two normally distributed variables. Ann. Math. Stat. 1947, 18, 265–271. [Google Scholar] [CrossRef]

- Goodman, L.A. On the exact variance of products. J. Am. Stat. Assoc. 1960, 55, 708–713. [Google Scholar] [CrossRef]

- Baumler, J.V. Defined criteria of perfoance in organizational control. Adm. Sci. Q. 1971, 16, 340–350. [Google Scholar] [CrossRef]

- Summers, L. Organizing for the Future: The New Logic for Managing Complex Organizations. Pers. Psychol. 1994, 47, 380. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).