Environmental Decentralization, Digital Financial Inclusion, and the Green Transformation of Industries in Resource-Based Cities in China

Abstract

1. Introduction

2. Literature Review and Comments

2.1. The Effect of Environmental Decentralization on the Green Transformation of Industries

2.2. The Effect of Digital Financial Inclusion on the Green Transformation of Industries

2.3. Measurement and Evaluation of the Green Transformation of Industries in Resource-Based Cities

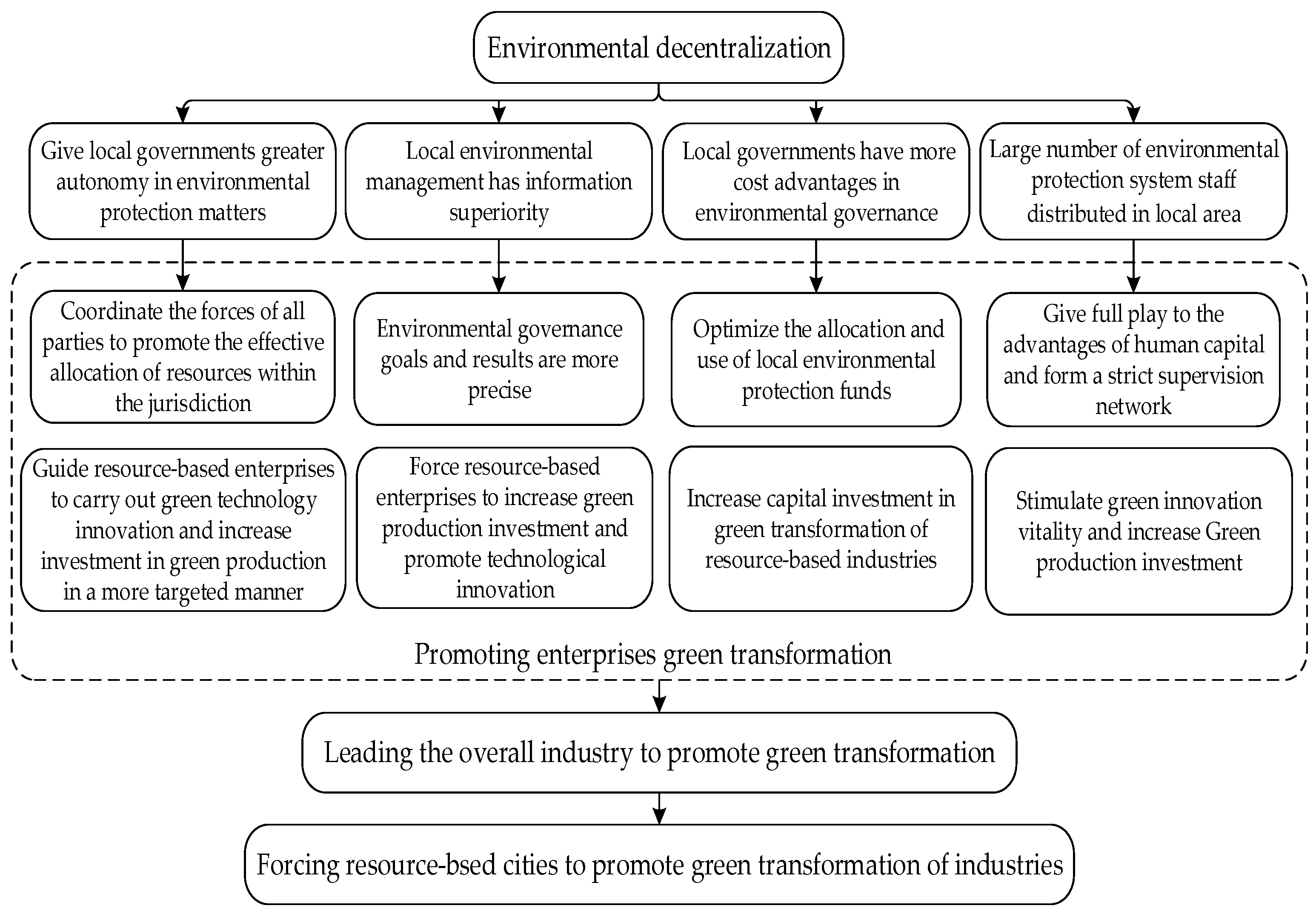

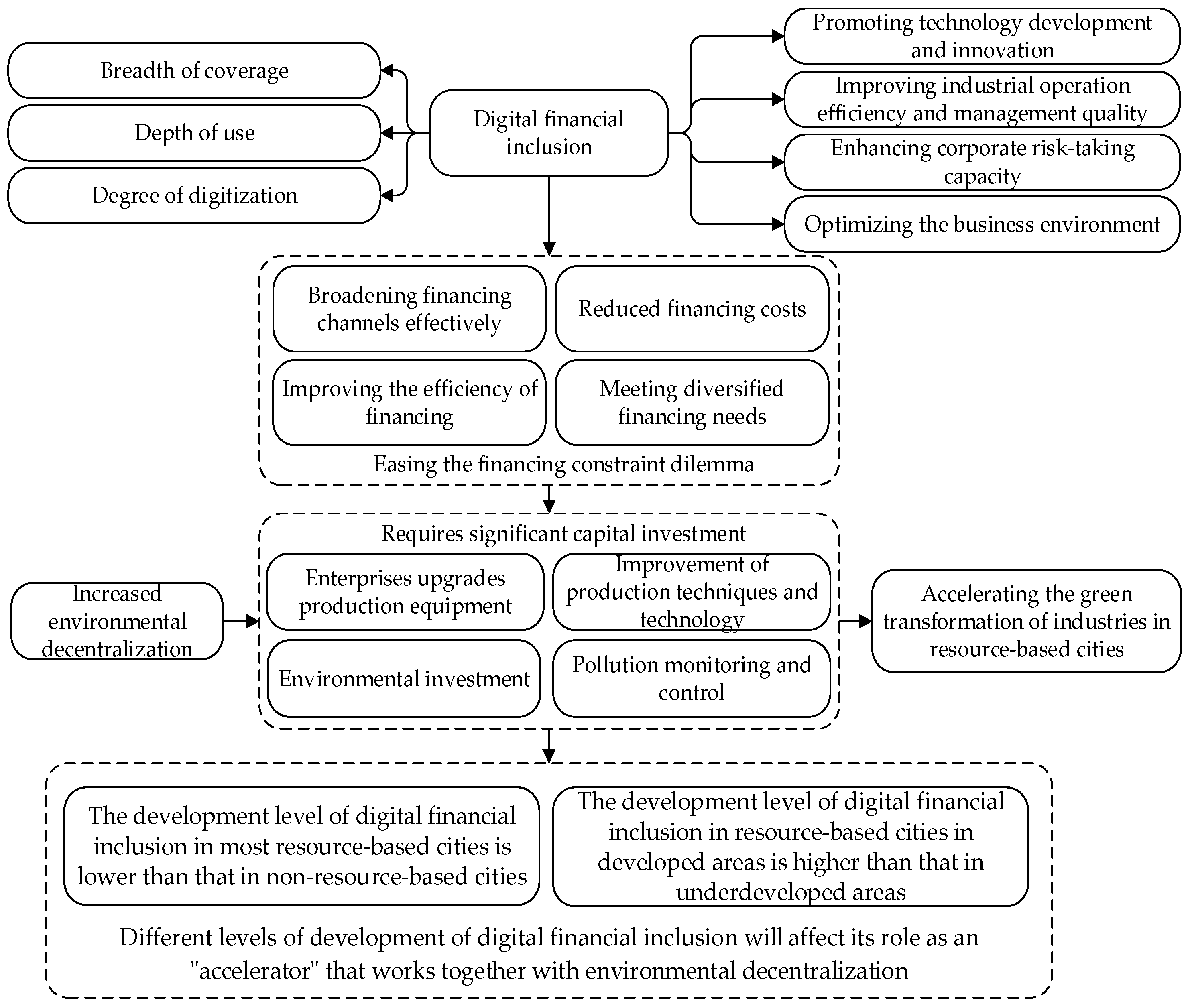

3. Analysis of Mechanisms of Influence and Proposed Research Hypothesis

4. Development of Econometric Model and Selection of Indicators

4.1. Construction of Econometric Model

4.2. Selection of Indicators

4.2.1. Dependent Variables

4.2.2. Independent Variables

4.2.3. Control Variables

4.3. Data Resources

5. Regression Analysis

5.1. Baseline Regression Analysis

5.2. Robustness Test

5.2.1. Instrumental Variable Approach

5.2.2. Replacement of the Dependent Variable

5.2.3. Endogeneity Test Using SYS-GMM Model

6. Further Study

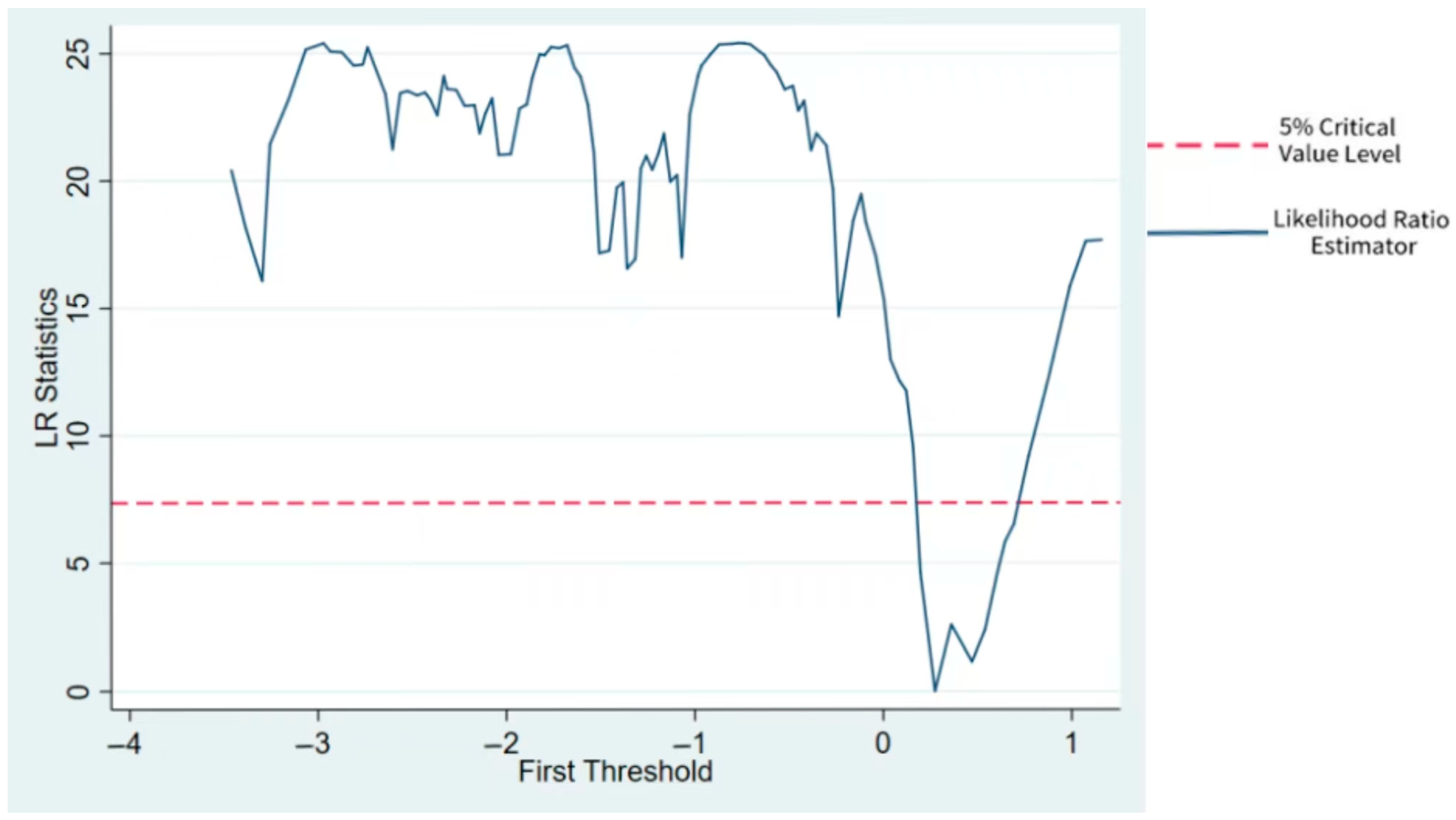

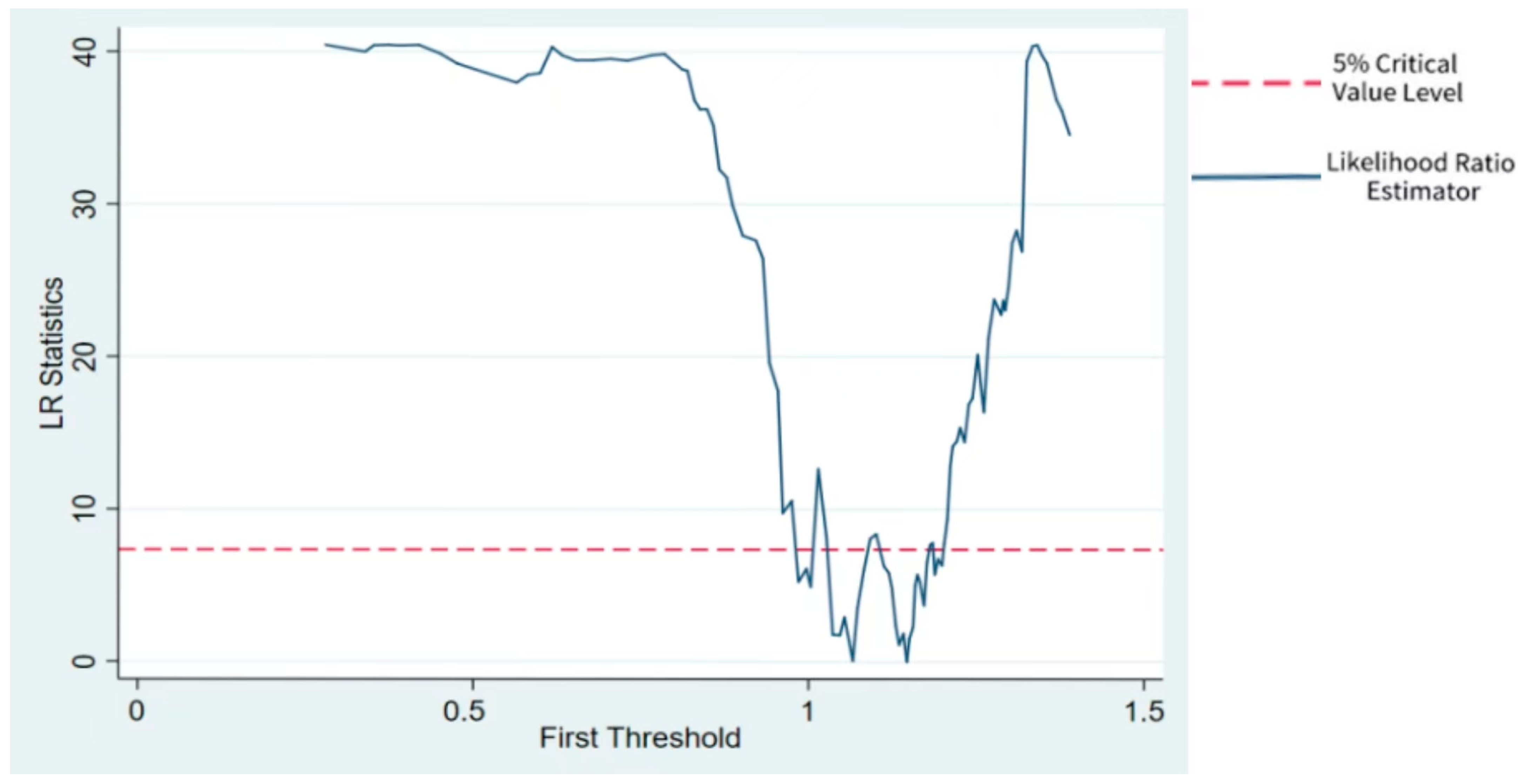

6.1. Analysis of the Threshold Effect

6.1.1. Analysis of the Effect of Environmental Decentralization as a Threshold Variable

6.1.2. Analysis of the Effect of Digital Financial Inclusion as a Threshold Variable

6.2. Heterogeneity Analysis of Different Types of Resource-Based Cities

7. Research Findings and Countermeasures

8. Limitations and Directions for Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Resource-Based Cities | Non-Resource-Based Cities |

|---|---|

| Tangshan, Handan, Xingtai, Zhangjiakou, Chengde, Datong, Yangquan, Changzhi, Jincheng, Shuozhou, Jinzhong, Yuncheng, Xinzhou, Linfen, Lvliang, Baotou, Wuhai, Chifeng, Ordos, Hulunbeier, Fuxin, Fushun, Benxi, Anshan, Panjin, Huludao, Songyuan, Jilin, Liaoyuan, Tonghua, Baishan, Heihe, Daqing, Yichun, Hegang, Shuangyashan, Qitaihe, Jixi, Mudanjiang, Xuzhou, Suqian, Huzhou, Suzhou, Huaibei, Bozhou, Chizhou, Chuzhou, Huainan, Maanshan, Tongling, Xuanchengy, Sanming, Nanping, Longyan, Jingdezhen, Pingxiang, Xinyu, Ganzhou, Yichun, Dongying, Zibo, Linyi, Zaozhuang, Jining, Tai’an, Sanmenxia, Puyang, Luoyang, Pingdingshan, Hebi, Nanyang, Jiaozuo, Ezhou, Huangshi, Hengyang, Shaoyang, Loudi, Chenzhou, Shaoguan, Yunfu, Baise, Hechi, Hezhou, Guangyuan, Nanchong, Guang’an, Zigong, Luzhou, Panzhihua, Dazhou, Ya’an, Liupanshui, Anshun, Bijie, Qujing, Baoshan, Zhaotong, Lijiang, Pu’er, Lincang, Yan’an, Tongchuan, Yulin, Baoji, Weinan, Xianyang, Jinchang, Baiyin, Wuwei, Zhangye, Qingyang, Pingliang, Longnan, Shizuishan, and Karamay. | Shijiazhuang, Qinhuangdao, Baoding, Cangzhou, Langfang, Hengshui, Taiyuan, Hohhot, Bayannur, Ulanqab, Tongliao, Shenyang, Dalian, Dandong, Jinzhou, Yingkou, Liaoyang, Tieling, Chaoyang, Changchun, Siping, Baicheng, Harbin, Qiqihar, Jiamusi, Suihua, Nanjing, Wuxi, Changzhou, Suzhou, Nantong, Lianyungang, Huaian, Yancheng, Yangzhou, Zhenjiang, Taizhou, Hangzhou, Ningbo, Wenzhou, Jiaxing, Shaoxing, Jinhua, Quzhou, Zhoushan, Taizhou, Lishui, Hefei, Wuhu, Bengbu, Anqing, Huangshan, Fuyang, Lu’an, Fuzhou, Xiamen, Putian, Quanzhou, Zhangzhou, Ningde, Nanchang, Jiujiang, Yingtan, Ji’an, Fuzhou, Shangrao, Jinan, Qingdao, Yantai, Weifang, Weihai, Rizhao, Dezhou, Liaocheng, Binzhou, Heze, Zhengzhou, Kaifeng, Anyang, Xinxiang, Xuchang, Luohe, Shangqiu, Xinyang, Zhoukou, Zhumadian, Wuhan, Shiyan, Yichang, Xiangyang, Jingmen, Xiaogan, Jingzhou, Huanggang, Xianning, Suizhou, Changsha, Zhuzhou, Xiangtan, Yueyang, Changde, Zhangjiajie, Yiyang, Yongzhou, Huaihua, Guangzhou, Shenzhen, Zhuhai, Shantou, Foshan, Jiangmen, Zhanjiang, Maoming, Zhaoqing, Huizhou, Meizhou, Shanwei, Heyuan, Yangjiang, Qingyuan, Dongguan, Zhongshan, Chaozhou, Jieyang, Nanning, Liuzhou City, Guilin City, Wuzhou City, Beihai City, Fangchenggang, Qinzhou, Guigang, Yulin, Laibin, Chongzuo, Haikou, Sanya, Sansha, Danzhou, Chengdu, Deyang, Mianyang, Suining, Neijiang, Leshan, Meishan, Yibin, Bazhong, Ziyang, Guiyang, Zunyi, Tongren, Kunming, Yuxi, Lhasa, Rikaze, Chamdo, Linzhi, Shannan, Nagchu, Xi’an, Hanzhong, Ankang, Shangluo, Lanzhou, Jiayuguan, Tianshui, Jiuquan, Dingxi, Xining, Haidong, Yinchuan, Wuzhong, Guyuan, Zhongwei, Urumqi, Turpan and Hami. |

| Region | Number of Samples | Sample Proportion | Resource-BasedCity Types | Number of Samples | Sample Proportion |

|---|---|---|---|---|---|

| Eastern | 19 | 16.96% | Growing resource-based cities | 14 | 12.50% |

| Central | 37 | 33.04% | Mature resource-based cities | 60 | 53.57% |

| Western | 37 | 33.04% | Declining resource-based cities | 23 | 20.54% |

| Northeast | 19 | 16.96% | Regenerative resource-based cities | 15 | 13.39% |

References

- Wu, H.; Deng, K.; Dong, Z.; Meng, X.; Zhang, L.; Jiang, S.; Yang, L.; Xu, Y. Comprehensive assessment of land use carbon emissions of a coal resource-based city, China. J. Clean. Prod. 2022, 379, 134706. [Google Scholar] [CrossRef]

- Batterbury, S.P.J.; Fernando, J.L. Rescaling governance and the impacts of political and environmental decentralization: An introduction. World Dev. 2006, 34, 1851–1863. [Google Scholar] [CrossRef]

- Sarpong, F.A.; Sappor, P.; Nyantakyi, G.; Agyeiwaa, O.E.; Ahakwa, I.; Cobbinah, B.B.; Kir, K.F. Green financial development efficiency: A catalyst for driving China’s green transformation agenda towards sustainable development. Environ. Sci. Pollut. Res. 2023, 30, 60717–60745. [Google Scholar] [CrossRef]

- Gao, D.; Li, Y.; Li, G. Boosting the green total factor energy efficiency in urban China: Does low-carbon city policy matter? Environ. Sci. Pollut. Res. 2022, 29, 56341–56356. [Google Scholar] [CrossRef] [PubMed]

- Fang, Y.; Cao, H. Environmental decentralization, heterogeneous environmental regulation, and green total factor productivity-evidence from China. Sustainability 2022, 14, 11245. [Google Scholar] [CrossRef]

- Xiao, Y. Do financial inclusion and environmental regulations affect the green economy? An empirical study with a generalized linear model. Environ. Sci. Pollut. Res. 2023, 30, 91324–91343. [Google Scholar] [CrossRef]

- Fredriksson, P.G.; Wollscheid, J.R. Environmental decentralization and political centralization. Ecol. Econ. 2014, 107, 402–410. [Google Scholar] [CrossRef]

- Zhao, B.; Wang, K.-L.; Xu, R.-Y. Fiscal decentralization, industrial structure upgrading, and carbon emissions: Evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 39210–39222. [Google Scholar] [CrossRef]

- Opoku, E.E.O.; Acheampong, A.O.; Dzator, J.; Kufuor, N.K. Does environmental sustainability attract foreign investment? Evidence from developing countries. Bus. Strategy Environ. 2022, 31, 3542–3573. [Google Scholar] [CrossRef]

- Fu, Z.; Zhou, Y.; Li, W.; Zhong, K. Impact of digital finance on energy efficiency: Empirical findings from China. Environ. Sci. Pollut. Res. 2023, 30, 2813–2835. [Google Scholar] [CrossRef]

- Shah, N.; Soomro, B.A. Effects of green human resource management practices on green innovation and behavior. Manag. Decis. 2023, 61, 290–312. [Google Scholar] [CrossRef]

- Song, M.; Du, J.; Tan, K.H. Impact of fiscal decentralization on green total factor productivity. Int. J. Prod. Econ. 2018, 205, 359–367. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, H.; Long, R.; Sun, Q.; Jiang, S.; Liu, B. Has the sustainable development planning policy promoted the green transformation in China’s resource-based cities. Resour. Conserv. Recycl. 2022, 180, 106181. [Google Scholar] [CrossRef]

- Zhao, X.; Nakonieczny, J.; Jabeen, F.; Shahzad, U.; Jia, W. Does green innovation induce green total factor productivity? Novel findings from Chinese city level data. Technol. Forecast. Soc. Change 2022, 185, 122021. [Google Scholar] [CrossRef]

- Chen, Y.; Chen, Y.; Yin, G.; Liu, Y. Industrial eco-efficiency of resource-based cities in China: Spatial-temporal dynamics and associated factors. Environ. Sci. Pollut. Res. 2023, 30, 94436–94454. [Google Scholar] [CrossRef]

- Zheng, F.; Niu, Y. Environmental decentralization, resource endowment and urban industrial transformation and upgrading: A comparison of resource-based and non-resource-based cities in China. Sustainability 2023, 15, 10475. [Google Scholar] [CrossRef]

- Yang, J.; Wang, Y.; Mao, J.; Wang, D. Exploring the dilemma and influencing factors of ecological transformation of resource-based cities in China: Perspective on a tripartite evolutionary game. Environ. Sci. Pollut. Res. 2022, 29, 41386–41408. [Google Scholar] [CrossRef]

- Lovo, S. Effect of environmental decentralization on polluting firms in India. Econ. Dev. Cult. Change 2018, 67, 55–94. [Google Scholar] [CrossRef]

- Rexhaeuser, S.; Rammer, C. Environmental innovations and firm profitability: Unmasking the Porter hypothesis. Environ. Resour. Econ. 2014, 57, 145–167. [Google Scholar] [CrossRef]

- Godil, D.I.; Yu, Z.; Sharif, A.; Usman, R.; Khan, S.A.R. Investigate the role of technology innovation and renewable energy in reducing transport sector CO2 emission in China: A path toward sustainable development. Sustain. Dev. 2021, 29, 694–707. [Google Scholar] [CrossRef]

- Udeagha, M.C.; Ngepah, N. Striving towards environmental sustainability in the BRICS economies: The combined influence of fiscal decentralization and environmental innovation. Int. J. Sustain. Dev. World Ecol. 2023, 30, 111–125. [Google Scholar] [CrossRef]

- Li, D.; Lv, H. Investment in environmental innovation with environmental regulation and consumers’ environmental awareness: A dynamic analysis. Sustain. Prod. Consump. 2021, 28, 1366–1380. [Google Scholar] [CrossRef]

- Van Leeuwen, G.; Mohnen, P. Revisiting the Porter hypothesis: An empirical analysis of green innovation for the Netherlands. Econ. Innov. New Technol. 2017, 26, 63–77. [Google Scholar] [CrossRef]

- Turner, E.H.; Thompson, M.A. Further evidence on the financial impact of environmental regulations on the trucking industry. Transp. Policy 2023, 133, 134–143. [Google Scholar] [CrossRef]

- Wang, Y.; Sun, X.; Guo, X. Environmental regulation and green productivity growth: Empirical evidence on the Porter Hypothesis from OECD industrial sectors. Energy Policy 2019, 132, 611–619. [Google Scholar] [CrossRef]

- Liu, X.; Yang, X. Impact of China’s environmental decentralization on carbon emissions from energy consumption: An empirical study based on the dynamic spatial econometric model. Environ. Sci. Pollut. Res. 2022, 29, 72140–72158. [Google Scholar] [CrossRef] [PubMed]

- Shi, F.; Ding, R.; Li, H.; Hao, S. Environmental regulation, digital financial inclusion, and environmental pollution: An empirical study based on the spatial spillover effect and panel threshold effect. Sustainability 2022, 14, 6869. [Google Scholar] [CrossRef]

- Yang, S.; Chen, Z.; Umar, M.; Khursheed, A. Environmental regulation and high-quality sustainable development of China’s economy—An empirical study based on a spatial durbin model and threshold model. Ekon. Istraz. 2022, 35, 5699–5718. [Google Scholar] [CrossRef]

- Akalin, G.; Erdogan, S. Does democracy help reduce environmental degradation? Environ. Sci. Pollut. Res. 2021, 28, 7226–7235. [Google Scholar] [CrossRef]

- Chen, Y.; Kumara, E.K.; Sivakumar, V. Investigation of finance industry on risk awareness model and digital economic growth. Ann. Oper. Res. 2023, 326, 15. [Google Scholar] [CrossRef]

- Lee, C.C.; Tang, M.; Lee, C.C. Reaping digital dividends: Digital inclusive finance and high-quality development of enterprises in China. Telecommun. Policy 2023, 47, 102484. [Google Scholar] [CrossRef]

- Mukalayi, N.M.; Inglesi-Lotz, R. Digital financial inclusion and energy and environment: Global positioning of Sub-Saharan African countries. Renew. Sust. Energ. Rev. 2023, 173, 113069. [Google Scholar] [CrossRef]

- Khan, D.; Nouman, M.; Ullah, A. Assessing the impact of technological innovation on technically derived energy efficiency: A multivariate co-integration analysis of the agricultural sector in South Asia. Environ. Dev. Sustain. 2023, 25, 3723–3745. [Google Scholar] [CrossRef]

- Kim, T. Financing technological innovation: Evidence from patent-intensive firms. Glob. Econ. Rev. 2019, 48, 350–362. [Google Scholar] [CrossRef]

- Syed, A.A.; Ahmed, F.; Kamal, M.A.; Trinidad Segovia, J.E. Assessing the role of digital finance on shadow economy and financial instability: An empirical analysis of selected South Asian countries. Mathematics 2021, 9, 3018. [Google Scholar] [CrossRef]

- Xuan, S.; Ge, W.; Yang, P.; Zhang, Y. Exploring digital finance, financial regulations and carbon emission nexus: New insight from resources efficiency, industrial structure and green innovation in China. Resour. Policy 2024, 88, 104452. [Google Scholar] [CrossRef]

- Li, Y.; Yang, X.; Ran, Q.; Wu, H.; Irfan, M.; Ahmad, M. Energy structure, digital economy, and carbon emissions: Evidence from China. Environ. Sci. Pollut. Res. 2021, 28, 64606–64629. [Google Scholar] [CrossRef]

- Guo, B.; Wang, Y.; Zhou, H.; Hu, F. Can environmental tax reform promote carbon abatement of resource-based cities? Evidence from a quasi-natural experiment in China. Environ. Sci. Pollut. Res. 2022, 30, 117037–117049. [Google Scholar] [CrossRef]

- Zhao, F.; Sun, Y.; Zhang, J. Does industrial agglomeration and environmental pollution have a spatial spillover effect?: Taking panel data of resource-based cities in China as an example. Environ. Sci. Pollut. Res. 2023, 30, 76829–76841. [Google Scholar] [CrossRef]

- Tang, Y.; Wang, Y. Impact of digital economy on ecological resilience of resource-based cities: Spatial spillover and mechanism. Environ. Sci. Pollut. Res. 2023, 30, 41299–41318. [Google Scholar] [CrossRef]

- Deng, Y.; Jiang, W.; Wang, Z. Economic resilience assessment and policy interaction of coal resource oriented cities for the low carbon economy based on AI. Resour. Policy 2023, 82, 103522. [Google Scholar] [CrossRef]

- Anser, M.K.; Yousaf, Z.; Nassani, A.A.; Xuan Vinh, V.; Zaman, K. Evaluating ‘natural resource curse’ hypothesis under sustainable information technologies: A case study of Saudi Arabia. Resour. Policy 2020, 68, 101699. [Google Scholar] [CrossRef]

- Ouyang, X.; Li, Q.; Du, K. How does environmental regulation promote technological innovations in the industrial sector? Evidence from Chinese provincial panel data. Energy Policy 2020, 139, 111310. [Google Scholar] [CrossRef]

- Li, G.; Guo, F.; Di, D. Regional competition, environmental decentralization, and target selection of local governments. Sci. Total Environ. 2021, 755, 142536. [Google Scholar] [CrossRef]

- Calvino, F. Technological innovation and the distribution of employment growth: A firm-level analysis. Ind. Corp. Change 2019, 28, 177–202. [Google Scholar] [CrossRef]

- Latif, Z.; Yang, M.; Danish; Latif, S.; Liu, X.; Pathan, Z.H.; Salam, S.; Zeng, J. The dynamics of ICT, foreign direct investment, globalization and economic growth: Panel estimation robust to heterogeneity and cross-sectional dependence. Telemat. Inform. 2018, 35, 318–328. [Google Scholar] [CrossRef]

- Shimizu, M. The relationship between pollution abatement costs and environmental regulation: Evidence from the Chinese industrial sector. Rev. Dev. Econ. 2020, 24, 668–690. [Google Scholar] [CrossRef]

- Thu, N.T.P.; Huong, L.M.; Xuan, V.N. Factors affecting environmental pollution for sustainable development goals-evidence from Asian countries. Sustainability 2022, 14, 16775. [Google Scholar] [CrossRef]

- Gong, Q.; Wang, X.; Tang, X. How can the development of digital economy empower green transformation and upgrading of the manufacturing industry?—A quasi-natural experiment based on the national big data comprehensive pilot zone in China. Sustainability 2023, 15, 8577. [Google Scholar] [CrossRef]

- Du, K.; Cheng, Y.; Yao, X. Environmental regulation, green technology innovation, and industrial structure upgrading: The road to the green transformation of Chinese cities. Energy Econ. 2021, 98, 105247. [Google Scholar] [CrossRef]

- Herman, K.S.; Xiang, J. How collaboration with G7 countries drives environmental technology innovation in ten Newly Industrializing Countries. Energy Sustain Dev. 2022, 71, 176–185. [Google Scholar] [CrossRef]

- Fan, W.; Yan, L.; Chen, B.; Ding, W.; Wang, P. Environmental governance effects of local environmental protection expenditure in China. Resour. Policy 2022, 77, 102760. [Google Scholar] [CrossRef]

- Jurgelevicius, A.; Tvaronaviciene, M. Assessing the impact of human capital’s structure on high value-added economic sectors in European countries: Illustration of mining industry. Acta Montan. Slovaca 2021, 26, 106–116. [Google Scholar]

- Li, C.J.; Razzaq, A.; Irfan, M.; Luqman, A. Green innovation, environmental governance and green investment in China: Exploring the intrinsic mechanisms under the framework of COP26. Technol. Forecast. Soc. Change 2023, 194, 122708. [Google Scholar] [CrossRef]

- Ozturk, I.; Ullah, S. Does digital financial inclusion matter for economic growth and environmental sustainability in OBRI economies? An empirical analysis. Resour. Conserv. Recycl. 2022, 185, 106489. [Google Scholar] [CrossRef]

- Daud, S.N.M.; Ahmad, A.H. Financial inclusion, economic growth and the role of digital technology. Financ. Res. Lett. 2023, 53, 103602. [Google Scholar] [CrossRef]

- Usman, M.; Balsalobre-Lorente, D.; Jahanger, A.; Ahmad, P. Are Mercosur economies going green or going away? An empirical investigation of the association between technological innovations, energy use, natural resources and GHG emissions. Gondwana Res. 2023, 113, 53–70. [Google Scholar] [CrossRef]

- Li, Z.; Zhu, J.; He, J. The effects of digital financial inclusion on innovation and entrepreneurship: A network perspective. Electron. Res. Arch. 2022, 30, 4697–4715. [Google Scholar] [CrossRef]

- Chen, Y.; Yang, S.; Li, Q. How does the development of digital financial inclusion affect the total factor productivity of listed companies? Evidence from China. Financ. Res. Lett. 2022, 47, 102956. [Google Scholar] [CrossRef]

- Feng, S.; Sui, B.; Liu, H.; Li, G. Environmental decentralization and innovation in China. Econ. Model 2020, 93, 660–674. [Google Scholar] [CrossRef]

- Zhang, Y.; Ma, X.; Pang, J.; Xing, H.; Wang, J. The impact of digital transformation of manufacturing on corporate performance-The mediating effect of business model innovation and the moderating effect of innovation capability. Res. Int. Bus. Financ. 2023, 64, 101890. [Google Scholar] [CrossRef]

- Zhang, J.; Wang, J.; Yang, X.; Ren, S.; Ran, Q.; Hao, Y. Does local government competition aggravate haze pollution? A new perspective of factor market distortion. Socioecon. Plann. Sci. 2021, 76, 100959. [Google Scholar]

- Ran, Q.; Zhang, J.; Hao, Y. Does environmental decentralization exacerbate China’s carbon emissions? Evidence based on dynamic threshold effect analysis. Sci. Total Environ. 2020, 721, 137656. [Google Scholar] [CrossRef] [PubMed]

- Yang, L.; Zhang, Y. Digital financial inclusion and sustainable growth of small and micro enterprises-evidence based on China’s new third board market listed companies. Sustainability 2020, 12, 3733. [Google Scholar] [CrossRef]

- Wang, J.; Feng, L.; Li, B. The heterogeneity impact of factor market distortions on GTFP: From the view of resource-based cities. Environ. Sci. Pollut. Res. 2023, 30, 78108–78126. [Google Scholar] [CrossRef]

- Wang, Y.; Yin, S.; Fang, X.; Chen, W. Interaction of economic agglomeration, energy conservation and emission reduction: Evidence from three major urban agglomerations in China. Energy 2022, 241, 122519. [Google Scholar] [CrossRef]

- Borsatto, J.M.L.S.; Amui, L.B.L. Green innovation: Unfolding the relation with environmental regulations and competitiveness. Resour. Conserv. Recycl. 2019, 149, 445–454. [Google Scholar] [CrossRef]

- Wang, M.; Xu, M.; Ma, S. The effect of the spatial heterogeneity of human capital structure on regional green total factor productivity. Struct. Change Econ. Dyn. 2021, 59, 427–441. [Google Scholar] [CrossRef]

- Wang, W.; Xiao, W.; Bai, C. Can renewable energy technology innovation alleviate energy poverty? Perspective from the marketization level. Technol. Soc. 2022, 68, 101933. [Google Scholar] [CrossRef]

- Xie, Q.; Fan, X. Carbon emission reduction effects of green finance reform and innovation pilot zones policy: Evidence from the prefecture-level city in China. Environ. Sci. Pollut. Res. 2023, 30, 102624–102640. [Google Scholar] [CrossRef]

- Ahmad, M.; Satrovic, E. Role of economic complexity and government intervention in environmental sustainability: Is decentralization critical? J. Clean. Prod. 2023, 418, 138000. [Google Scholar] [CrossRef]

- Wang, X.; Wang, Q. Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resour. Policy 2021, 74, 102436. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold effects in non-dynamic panels, estimation, testing, and inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef]

- Che, C.M. Panel threshold analysis of Taiwan’s outbound visitors. Econ. Model. 2013, 33, 787–793. [Google Scholar] [CrossRef]

- Si, R.; Wang, Y.; Cao, M.; Wen, H. Does green technology innovation promote green economic growth? -Examining regional heterogeneity between resource-based and non-resource-based cities. Int. Rev. Econ. Financ. 2024, 94, 103406. [Google Scholar] [CrossRef]

| Index Type | Secondary Index | Index Description |

|---|---|---|

| input index | capital input | fixed capital stock |

| R&D expenditure | ||

| labor input | number of employees in mining industry | |

| R&D personnel | ||

| energy resource input | total tons of standard coal as a share of GDP | |

| output index | expected output | main business sales income |

| number of patents | ||

| unexpected output | industrial SO2 emissions | |

| industrial wastewater emissions | ||

| industrial soot emissions |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| GTI | 1344 | −2.230 | 1.292 | −8.969 | 1.066 |

| ED | 1344 | −1.053 | 1.736 | −9.006 | 6.115 |

| DFI | 1344 | 1.011 | 0.289 | 0.193 | 1.456 |

| GOV | 1344 | −0.809 | 0.898 | −10.170 | 1.776 |

| EA | 1344 | 0.151 | 0.150 | 0.004 | 0.850 |

| UR | 1344 | 0.542 | 0.140 | 0.181 | 1.077 |

| HC | 1344 | 0.012 | 0.011 | −0.001 | 0.091 |

| ML | 1344 | 1.621 | 4.788 | 0.000 | 17.141 |

| Variable | (1) Mixed | (2) Mixed | (3) Mixed | (4) Random | (5) Random | (6) Random | (7) Fixed | (8) Fixed | (9) Fixed |

|---|---|---|---|---|---|---|---|---|---|

| ED | 0.020 | −0.004 | −0.014 | 0.097 *** | 0.073 ** | 0.055 * | 0.112 *** | 0.102 *** | 0.081 ** |

| (0.020) | (0.020) | (0.021) | (0.028) | (0.029) | (0.030) | (0.034) | (0.035) | (0.037) | |

| DFI | 0.697 *** | 0.716 *** | 0.402 *** | 0.435 *** | 0.226 * | 0.267 ** | |||

| (0.124) | (0.124) | (0.115) | (0.116) | (0.131) | (0.133) | ||||

| ED×DFI | 0.045 * | 0.043 ** | 0.039 * | ||||||

| (0.026) | (0.022) | (0.022) | |||||||

| GOV | −0.098 ** | −0.076 ** | −0.089 ** | −0.198 *** | −0.177 *** | −0.192 *** | −0.216 *** | −0.211 *** | −0.222 *** |

| (0.039) | (0.038) | (0.039) | (0.046) | (0.046) | (0.047) | (0.053) | (0.053) | (0.054) | |

| EA | 2.679 *** | 2.634 *** | 2.640 *** | 2.451 *** | 2.180 *** | 2.137 *** | 2.199 *** | 1.845 *** | 1.740 *** |

| (0.238) | (0.235) | (0.235) | (0.417) | (0.423) | (0.424) | (0.594) | (0.628) | (0.631) | |

| UR | 0.713 *** | 0.249 | 0.244 | 2.351 *** | 1.634 *** | 1.590 *** | 3.118 *** | 2.606 *** | 2.545 *** |

| (0.257) | (0.268) | (0.267) | (0.357) | (0.411) | (0.412) | (0.430) | (0.523) | (0.524) | |

| HC | 2.218 | 0.761 | 0.926 | 7.602 * | 5.873 | 6.554 | 10.078 ** | 8.886 * | 9.747 * |

| (3.182) | (3.157) | (3.156) | (4.388) | (4.400) | (4.412) | (5.115) | (5.158) | (5.176) | |

| ML | 0.020 *** | 0.017 ** | 0.016 ** | 0.034 *** | 0.033 *** | 0.032 *** | 0.034 *** | 0.034 *** | 0.033 *** |

| (0.007) | (0.007) | (0.007) | (0.006) | (0.006) | (0.006) | (0.006) | (0.006) | (0.006) | |

| _cons | −3.137 *** | −3.568 *** | −3.615 *** | −4.074 *** | −4.037 *** | −4.085 *** | −4.480 *** | −4.368 *** | −4.409 *** |

| (0.134) | (0.153) | (0.156) | (0.195) | (0.194) | (0.196) | (0.216) | (0.226) | (0.227) | |

| F | 33.238 | 33.656 | 29.863 | 44.491 | 38.618 | 34.239 | |||

| R-squared | 0.130 | 0.150 | 0.152 | 0.179 | 0.181 | 0.183 |

| Variable | (1) Instrumental Variable Approach | (2) Replacement of Dependent Variable | (3) SYS-GMM |

|---|---|---|---|

| L.ED | 0.504 *** | ||

| (0.116) | |||

| ED | 3.317 *** | 0.006 *** | 0.203 *** |

| (1.263) | (0.002) | (0.076) | |

| DFI | −3.426 ** | 0.190 *** | 1.054 *** |

| (1.614) | (0.007) | (0.288) | |

| ED × DFI | −0.917 ** | 0.003 ** | 0.135 ** |

| (0.378) | (0.001) | (0.055) | |

| _cons | −4.387 *** | 2.088 *** | 0.504 *** |

| (0.230) | (0.012) | (0.116) | |

| F | 328.950 | 252.789 | 286.870 |

| R-squared | 0.222 | 0.623 | |

| Add control variables | Yes | Yes | Yes |

| AR (1) | 0.000 | ||

| AR (2) | 0.424 |

| Variable | F-Value | p-Value | BS Times | Crit10 | Crit5 | Crit1 | Threshold |

|---|---|---|---|---|---|---|---|

| 1st Threshold | 25.490 * | 0.073 | 300 | 23.059 | 27.907 | 36.425 | 0.274 |

| Variable | ED(ED ≤ 0.274) | ED(ED > 0.274) | Control | N | R2 |

|---|---|---|---|---|---|

| GTI | 0.354 * (0.193) | 0.743 *** (0.210) | YES | 1344 | 0.175 |

| Variable | F-Value | p-Value | BS Times | Crit10 | Crit5 | Crit1 | Threshold |

|---|---|---|---|---|---|---|---|

| 1st Threshold | 21.610 *** | 0.043 | 300 | 29.353 | 38.490 | 59.138 | 1.146 |

| Variable | ED (DFI ≤ 1.147) | ED (DFI > 1.147) | Control | N | R2 |

|---|---|---|---|---|---|

| GTI | 0.317 *** (0.065) | 0.145 ** (0.057) | YES | 1344 | 0.125 |

| Variable | (1) Growing Resource-Based Cities | (2) Mature Resource-Based Cities | (3) Declining Resource-Based Cities | (4) Regenerative Resource-Based Cities |

|---|---|---|---|---|

| ED | −0.205 *** | 0.134 *** | 0.006 | −0.193 ** |

| (0.076) | (0.049) | (0.091) | (0.097) | |

| DFI | 0.647 ** | 1.523 *** | 1.424 *** | −0.908 *** |

| (0.285) | (0.154) | (0.254) | (0.344) | |

| ED × DFI | 0.258 *** | 0.090 *** | −0.117 * | 0.093 * |

| (0.070) | (0.032) | (0.062) | (0.056) | |

| Add control variables | YES | YES | YES | YES |

| _cons | −3.390 *** | −3.934 *** | −4.025 *** | −4.615 *** |

| (0.349) | (0.172) | (0.339) | (0.699) | |

| R-squared | 0.087 | 0.257 | 0.259 | 0.267 |

| F-value | 4.804 | 51.553 | 21.793 | 5.888 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zheng, F.; Diao, R.; Che, H. Environmental Decentralization, Digital Financial Inclusion, and the Green Transformation of Industries in Resource-Based Cities in China. Sustainability 2024, 16, 7564. https://doi.org/10.3390/su16177564

Zheng F, Diao R, Che H. Environmental Decentralization, Digital Financial Inclusion, and the Green Transformation of Industries in Resource-Based Cities in China. Sustainability. 2024; 16(17):7564. https://doi.org/10.3390/su16177564

Chicago/Turabian StyleZheng, Feihong, Rongxin Diao, and Hongsheng Che. 2024. "Environmental Decentralization, Digital Financial Inclusion, and the Green Transformation of Industries in Resource-Based Cities in China" Sustainability 16, no. 17: 7564. https://doi.org/10.3390/su16177564

APA StyleZheng, F., Diao, R., & Che, H. (2024). Environmental Decentralization, Digital Financial Inclusion, and the Green Transformation of Industries in Resource-Based Cities in China. Sustainability, 16(17), 7564. https://doi.org/10.3390/su16177564