Can the Reform of the Commercial System Enhance the Resilience of Enterprises? Evidence Based on Quasi Natural Experiments

Abstract

1. Introduction

2. Theoretical Analysis and Research Hypotheses

2.1. The Impact of Commercial System Reform on Enterprise Resilience

2.2. The Mechanism of the Impact of Commercial System Reform on Enterprise Resilience

3. Model Construction, Variables and Data

3.1. Model Construction

3.2. Variable Selection

3.2.1. Dependent Variable

3.2.2. Core Explanatory Variables

3.2.3. Control Variables

3.3. Data Description

- Manually collect commercial system reform data from 286 prefecture level and above cities in China from 2011 to 2022 on the industrial and commercial bureaus and government official websites of various cities, and organise data on the implementation of reforming the commercial system in the cities where listed companies are located.

- We drew on the methods of [54] to process the data of Chinese A-share listed companies from 2011 to 2022, removing samples of incomplete core variables and financial companies. We also excluded samples of financial outliers (including samples with total assets less than 0, net assets less than 0, asset–liability ratio greater than 1, and abnormal operations).

- The rest of the digital comes from CSMAR database and cnrds database.

- To acquire empirical data for this study, we will compare the pertinent data on the reform of the commercial system in cities at or above the prefecture level with the data of A-share listed companies based on their respective addresses. Ultimately, 18,483 study samples were examined.

4. Empirical Analysis

4.1. Benchmark Regression Results

4.2. Robustness Testing

4.2.1. Replacing Variables in Commercial System Reform

4.2.2. Replacing Enterprise Resilience Variables

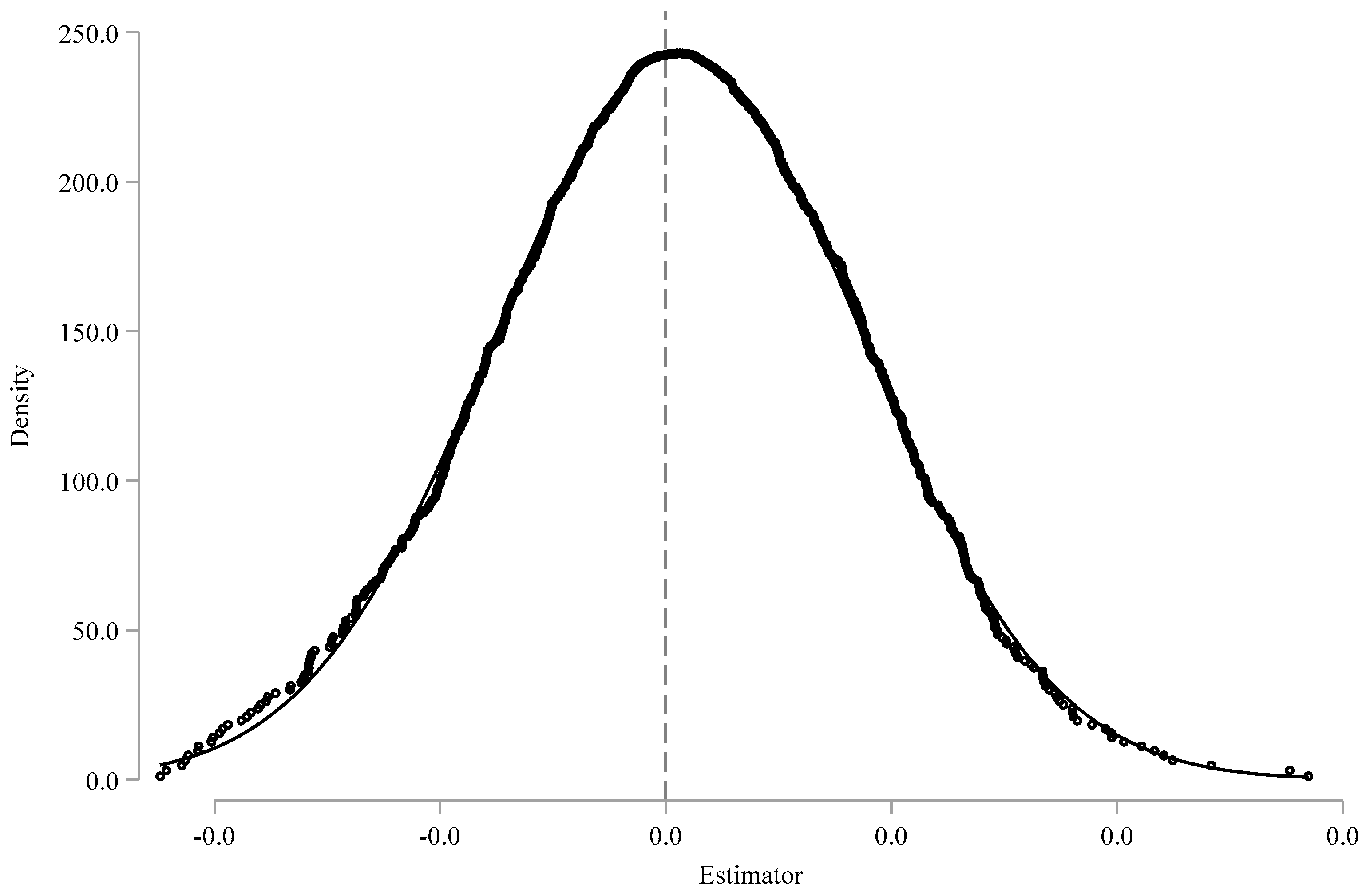

4.2.3. Placebo Test

4.2.4. PSM-DID

4.2.5. Excluding Interference from Other Policies

4.3. Endogenous Processing

4.4. Inspection of Intermediary Mechanisms

4.5. Heterogeneity Analysis

4.5.1. Distinguishing the Nature of Property Rights

4.5.2. Differentiate Enterprise Size

4.5.3. Differentiate Industry Competitiveness Differences

4.5.4. Distinguishing Industry Technical Differences

5. Conclusions and Policy Implications

5.1. Conclusions

5.2. Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Foris, T.; Tecău, A.S.; Dragomir, C.C.; Foris, D. The Start-Up Manager in Times of Crisis: Challenges and Solutions for Increasing the Resilience of Companies and Sustainable Reconstruction. Sustainability 2022, 14, 9140. [Google Scholar] [CrossRef]

- Wang, Y.; Gao, J. Shocks of 2019-nCoV, Economic Resilience and China’s High Quality Development. Bus. Manag. J. 2020, 42, 5–17. [Google Scholar] [CrossRef]

- Hillmann, J.; Guenther, E. Organizational resilience: A valuable construct for management research. Int. J. Manag. Rev. 2020, 23, 7–44. [Google Scholar] [CrossRef]

- Lengnick-Hall, C.A.; Beck, T.E.; Lengnick-Hall, M.L. Developing a capacity for organizational resilience through strategic human resource Management. Hum. Resour. Manag. Rev. 2011, 21, 243–255. [Google Scholar] [CrossRef]

- Zhang, Q.; Ge, F.; Zhang, L.; Qi, L.; Hao, B. Review and Outlook on the Resilience of Domestic and Foreign Enterprises. Sci. Technol. Prog. Countermeas. 2024, 1–12. [Google Scholar]

- Li, P.; Zhu, J. Organizational Resilience: Latest Literature Review. Foreign Econ. Manag. 2021, 43, 25–41. [Google Scholar]

- Tian, Y.; Fan, X. Adversity quotients, environmental variables and career adaptability in student nurses. J. Vocat. Behav. 2014, 85, 251–257. [Google Scholar] [CrossRef]

- Liu, S.; Xin, H. Mindfulness research in the field of organizational management: Based on a multi-level perspective. China Hum. Resour. Dev. 2019, 36, 37–53+93. [Google Scholar]

- Donaldson-Feilder, E.; Lewis, R.; Yarker, J.; Whiley, L.A. Interpersonal Mindfulness in Leadership Development: A Delphi Study. J. Manag. Educ. 2022, 46, 816–852. [Google Scholar] [CrossRef]

- Zhang, J.; Long, J.; Von Schaewen, A.M.E. How Does Digital Transformation Improve Organizational Resilience?—Findings from PLS-SEM and fsQCA. Sustainability 2021, 13, 11487. [Google Scholar] [CrossRef]

- Kahn, W.A.; Barton, M.A.; Fisher, C.M.; Heaphy, E.D.; Reid, E.M.; Rouse, E.D. The geography of strain: Organizational resilience as a function of intergroup relations. Acad. Manag. Rev. 2018, 43, 509–529. [Google Scholar] [CrossRef]

- Keum, D. Cog in the wheel:resource release and the scope of interdependencies in corporate adjustment activities. Strateg. Manag. J. 2019, 41, 175–197. [Google Scholar] [CrossRef]

- Greenwood, R. The Professional Partnership: Relic or Exemplary Form of Governance? Organ. Stud. 2003, 24, 909–933. [Google Scholar] [CrossRef]

- Lu, R.; Xu, L.; Ye, Q.; Hai, T. Study on Resilience of Chinese Private Enterprises and Influencing Factors. Econ. Manag. 2021, 43, 56–73. [Google Scholar]

- Feng, W.; Chen, H. The impact of binary innovation on the organizational resilience of high-tech enterprises: The moderating effect of knowledge scope and knowledge balance. Sci. Technol. Manag. 2022, 43, 117–135. [Google Scholar]

- Chattopadhyay, S.; Bercovitz, J. When one door closes, another door opens for some: Evidence from the post-TRIPS Indian pharmaceutical industry. Strateg. Manag. J. 2020, 41, 988–1022. [Google Scholar] [CrossRef]

- Jia, Y.; Fu, Q.; Wang, L.; Li, D. Technological Innovation and Enterprise Resilience: Based on the COVID-19 Scenario. Manag. Sci. 2023, 36, 17–34. [Google Scholar]

- Hess, T.; Matt, C.; Benlian, A. Options for formula ting a digital transformation strategy. Publ. Darmstadt Tech. Univ. Inst. Bus. Stud. 2016, 15, 123–139. [Google Scholar]

- Liu, J.; Xu, Y. ESG Performance and Corporate Resilience. Audit Econ. Res. 2024, 39, 54–64. [Google Scholar]

- Li, E.; Zhang, C.; Wan, X. Innovative decision-making under economic policy uncertainty: A perspective on corporate resilience. Contemp. Financ. Econ. 2022, 102–114. [Google Scholar] [CrossRef]

- Song, Y.; Zhang, X. Can innovation driven policies enhance the resilience of enterprises in the global value chain? World Econ. Res. 2023, 89–104+134. [Google Scholar] [CrossRef]

- Li, H.; Yu, D.; Yu, J. Commercial System Reform and Total Factor Productivity of Enterprises: Evidence from Quasi Natural Experiments. Sci. Res. Manag. 2023, 44, 151–157. [Google Scholar]

- Fu, L.; Shi, Y.; Yang, X.; Zhang, W. Enterprise resilience to the COVID-19 pandemic: The role of business environment. PLoS ONE 2023, 18, e0288722. [Google Scholar] [CrossRef] [PubMed]

- Li, H.; Yu, D.; Ke, Z. Commercial System Reform, Enterprise Green Innovation and Enterprise ESG Performance. Sustainability 2023, 15, 14469. [Google Scholar] [CrossRef]

- Li, X.; Yu, D. The Effect of Commercial System Reform on Enterprise Innovation. Econ. Dyn. 2021, 49, 116–131. [Google Scholar]

- Yujuan, W.; Jacquline, T. The impact of environmental regulation, Environment, Social and Government Performance, and technological innovation on enterprise resilience under a green recovery. Heliyon 2023, 9, e20278. [Google Scholar]

- Velic, P.A.; Jahic, H.; Krndzija, L. Firm resilience as a moderating force for SMEs’ innovation performance: Evidence from an emerging economy perspective. Reg. Sci. Policy Pract. 2024, 16, 100033. [Google Scholar] [CrossRef]

- Xu, X.; Ma, J. Commercial System Reform and Market Entity Entry Rate—Quantity Competition or Quality Competition. J. Sun Yat Sen Univ. 2019, 59, 191–202. [Google Scholar]

- Zhang, L.; Chen, Q.; Bi, Q. Commercial System Reform and Institutional Costs of Enterprises. J. Sun Yat Sen Univ. 2019, 59, 167–177. [Google Scholar]

- Huang, L.; Sun, X.; Wang, X. Commercial System Reform and Foreign Direct Investment. J. Sun Yat Sen Univ. 2019, 59, 178–190. [Google Scholar]

- Xia, J.; Liu, C. Contract Spirit, Commercial Reform and Innovation Level. Manag. World 2020, 36, 26–36+48+242. [Google Scholar]

- Liu, C.; Yang, J. Commercial System Reform and Industrial Specialization. China Ind. Econ. 2020, 385, 135–153. [Google Scholar]

- Chen, Y.; Li, C.; Tan, H.; Wang, Y. Research on the Impact of Enterprise ESG Performance on Enterprise Resilience. Financ. Theory Pract. 2024, 45, 128–135. [Google Scholar]

- Zhang, W.; Xia, L. The Impact of Business Environment on Mass Entrepreneurship: Evidence from Commercial System Reform. Reform 2020, 36, 94–103. [Google Scholar]

- Zhang, S.; Xu, M.; Zhu, Y.; Wang, Z. Technological Innovation, Organizational Resilience and High-quality Development of Manufacturing Enterprises. Sci. Technol. Prog. Countermeas. 2023, 40, 81–92. [Google Scholar]

- Lian, J.; Yu, B. Research on the Impact of Enterprise Business Environment on Financing Constraints. Price Theory Pract. 2019, 422, 88–91. [Google Scholar]

- Li, B. Correlation Analysis between Financial Ecological Environment and Innovation Capability of Commercial Circulation Enterprises: Based on the Perspective of Financing Constraints. Bus. Econ. Res. 2021, 834, 9–12. [Google Scholar]

- Li, B.; Gong, S.; Zeng, Y.T. Digital Financial Inclusion, Financial Constraints and Financial Sustainability of SMEs. Reform 2022, 38, 126–142. [Google Scholar]

- Si, D.; Li, X.; Kong, D.; Jiang, C. Does Interest Rate Liberalization Lower the Operational Risks of Enterprises? Dual Perspectives of Financing Constraints and Financialization. Financ. Res. 2023, 46, 113–130. [Google Scholar]

- Huang, L.; Sun, X.; Wang, X. Has the reform of the commercial system effectively stimulated entrepreneurship—Evidence from prefecture level cities. Financ. Res. 2020, 46, 142–155. [Google Scholar]

- Fisman, R.; Wang, Y. The mortality cost of political connections. Rev. Econ. Stud. 2015, 82, 1346–1382. [Google Scholar] [CrossRef]

- Liu, X.; Li, X. Pyramid Structure, Tax Burden, and Enterprise Value: Evidence Based on Local State Owned Enterprises. Manag. World 2012, 8, 91–105. [Google Scholar]

- Zhang, M.; Lijun, M.; Zhang, B.; Yi, Z. Pyramidal Structure, Political Intervention and Firms’tax Burden: Evidence from China’s Local SOEs. J. Corp. Financ. 2016, 36, 15–25. [Google Scholar] [CrossRef]

- Zhang, S.; Zhang, M.; Meng, S. Corporate transaction costs and corporate green total factor productivity. Financ. Res. Lett. 2024, 61, 105041. [Google Scholar] [CrossRef]

- Cardillo, G.; Bendinelli, E.; Torluccio, G. COVID-19, ESG investing, and the resilience of more sustainable stocks: Evidence from European firms. Bus. Strategy Environ. 2022, 32, 602–623. [Google Scholar] [CrossRef]

- Qiliang, M.; Xianzhuang, M. The shaping of inter-regional industrial linkages by institutional and cultural division in China: Characteristics and differences. Econ. Anal. Policy 2024, 81, 1113–1132. [Google Scholar] [CrossRef]

- Zhang, Z.; Yao, C.; Yu, C. The “double-edged sword” effect of management innovation implementation on the growth of small and medium-sized enterprises. Sci. Res. 2018, 36, 1325–1333. [Google Scholar]

- Dubey, R.; Gunasekaran, A.; Childe, S.J.; Fosso Wamba, S.; Roubaud, D.; Foropon, C. Empirical investigation of data analytics capability and organizational flexibility as complements to supply chain resilience. Int. J. Prod. Res. 2019, 59, 110–128. [Google Scholar] [CrossRef]

- Restrepo-Morales, J.A.; Valencia-Cárdenas, M.; García-Pérez-de-Lema, D. The role of technological innovation in the mitigation of the crisis generated by COVID-19: An empirical study of small and medium-sized businesses (SMEs) in Latin America. Int. Stud. Manag. Organ. 2024, 54, 120–136. [Google Scholar] [CrossRef]

- Ghomi, V.; Nooraei, S.V.R.; Shekarian, N.; Shokoohyar, S.; Parast, M. Improving supply chain resilience through investment in flexibility and innovation. Int. J. Syst. Sci. Oper. Logist. 2023, 10, 2221068. [Google Scholar] [CrossRef]

- Piprani, A.Z.; Khan, S.A.R.; Salim, R.; Khalilur Rahman, M. Unlocking sustainable supply chain performance through dynamic data analytics: A multiple mediation model of sustainable innovation and supply chain resilience. Environ. Sci. Pollut. Res. Int. 2023, 30, 90615–90638. [Google Scholar] [CrossRef] [PubMed]

- Ortiz-de-Mandojana, N.; Bansal, P. The long term benefits oforganizational resilience through sustainable business practices. Strateg. Manag. J. 2016, 37, 1615–1631. [Google Scholar] [CrossRef]

- Xiao, X.; Lin, Y. ESG Performance and Corporate Resilience: Effects and Mechanisms. Ind. Econ. Rev. 2024, 1–19. [Google Scholar] [CrossRef]

- Wang, G.J.; Lu, X.X. The the Belt and Road Initiative and the Upgrading of Chinese Enterprises. China Ind. Econ. 2019, 372, 43–61. [Google Scholar]

- Bi, Q.; Chen, X.; Xu, X.; Li, S. Administrative Approval Reform and Enterprise Entry. Econ. Res. 2018, 53, 140–155. [Google Scholar]

- Heino, N.; Alimov, N.; Tuominen, P. Family firm employment behavior during a financial crisis: Does generational stage matter? J. Fam. Bus. Strategy 2024, 15, 100624. [Google Scholar] [CrossRef]

- Wang, S.; Yang, Z.; Zhang, W.; Zhang, S. Research on the impact of heterogeneous environmental regulations on the economic resilience of carbon neutral enterprises. J. Manag. 2023, 20, 1771–1780. [Google Scholar]

- Tian, D.; Ding, B. Measurement and Mechanism of High Quality Development of Enterprises: From the Perspective of Organizational Resilience. China Soft Sci. 2023, 37, 154–170. [Google Scholar]

- Guo, C.; Luo, J. “Dual role” suppliers for major clients and enterprise supply chain resilience. Contemp. Financ. 2024, 139–152. [Google Scholar] [CrossRef]

- Alhajjeah, D.; Besim, M. Firms’ Capital Structure during Crises: Evidence from the United Kingdom. Sustainability 2024, 16, 5469. [Google Scholar] [CrossRef]

- Possebon, E.A.G.; Cippiciani, F.A.; Savoia, J.R.F.; de Mariz, F. ESG Scores and Performance in Brazilian Public Companies. Sustainability 2024, 16, 5650. [Google Scholar] [CrossRef]

- Zhang, K.; Lei, Z.; Li, H. Market Access Control and Total Factor Productivity of Enterprises: Evidence from Negative Lists. World Econ. 2023, 46, 152–176. [Google Scholar]

- Zhou, M.; Lu, Y.; Du, Y.; Yao, X. Establishment of Development Zones and Upgrading of Regional Manufacturing Industry. China Ind. Econ. 2018, 33, 62–79. [Google Scholar]

- Liu, C.; Xia, J. Business System Reform, Human Capital, and Entrepreneurial Choices. Financ. Trade Econ. 2021, 42, 113–129. [Google Scholar] [CrossRef]

- Wang, Y.; Feng, X. Administrative Approval System Reform and Enterprise Innovation. China Ind. Econ. 2018, 24–42. [Google Scholar] [CrossRef]

- Charles, J.H.; Joshua, R.P. New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar]

- Xia, J.; Liu, C. Administrative Approval Reform, Transaction Costs, and China’s Economic Growth. Manag. World 2017, 47–59. [Google Scholar]

- Bishop, P. Knowledge Diversity and Entrepreneurship Following an Economic Crisis: An Empirical Study of Regional Resilience in Great Britain. Entrep. Reg. Dev. 2019, 31, 496–515. [Google Scholar] [CrossRef]

- Lin, Z.; Liu, L. Exploratory Study on the Competency Characteristics of Chinese Entrepreneurs during the Transformation Period. Manag. World 2007, 98–104. [Google Scholar] [CrossRef]

- Gong, X.; Yu, J. How does digital transformation of enterprises affect the share of labor income? Mod. Econ. Explor. 2023, 24–35. [Google Scholar] [CrossRef]

- Hu, J.; Han, Y.; Zhong, Y. How Digital Transformation of Enterprises Affects ESG Performance: Evidence from Chinese Listed Companies. Ind. Econ. Rev. 2023, 54, 105–123. [Google Scholar]

| Variable | Variable Symbol | Variable Definition | N | Mean | Sd | Min | Max |

|---|---|---|---|---|---|---|---|

| Enterprise resilience | Resil | Synthesise enterprise resilience indicators using the entropy method based on the standard deviation of cumulative sales revenue growth within three years and monthly stock returns within one year | 18,483 | 0.902 | 0.0686 | 0.0242 | 0.998 |

| Reform of the commercial system | Policy | The reform of the commercial system was introduced as 1 by the city where the enterprise is located in a certain year, and otherwise 0 | 18,483 | 0.204 | 0.403 | 0 | 1 |

| Enterprise size | Size | Take the logarithm of the total assets of the company at the end of the period | 18,483 | 23.18 | 1.272 | 20.36 | 26.4 |

| The asset–liability ratio | Lev | Total liabilities/total assets at the end of the period | 18,483 | 0.476 | 0.197 | 0.0589 | 0.895 |

| The cash flow of a company | Cashflow | Net cash flow/total assets | 18,483 | 0.0599 | 0.0677 | −0.149 | 0.246 |

| Profitability | ROA | Enterprise net profit/average total assets | 18,483 | 0.0507 | 0.0603 | −0.176 | 0.23 |

| The listing age | ListAge | Subtract the year of establishment of the enterprise from the statistical year and add 1 | 18,483 | 2.481 | 0.673 | 0 | 3.367 |

| Institutional investor shareholding ratio | INST | The number of shares owned by institutional investors/total number of shares | 18,483 | 0.506 | 0.216 | 0.0121 | 0.882 |

| Book-to-market ratio | BM | Book value of the company/market value of the company | 18,483 | 1.43 | 1.582 | 0.0876 | 10.12 |

| Tobin Q | TobinQ | Market value/asset replacement cost of the enterprise | 18,483 | 1.984 | 1.398 | 0.825 | 9.598 |

| Return on equity | ROE | Enterprise net profit/average net assets | 18,483 | 0.0885 | 0.117 | −0.58 | 0.383 |

| The largest shareholder’s shareholding ratio | TOP1 | Shareholding percentage of the largest shareholder in the enterprise | 18,483 | 0.37 | 0.159 | 0.0873 | 0.751 |

| Foreign direct investment | fdi | The foreign direct investment’s actual utilisation logarithm | 18,483 | 12.44 | 1.357 | 7.948 | 14.66 |

| Economic development | pgdp | Logarithmic calculation of per capita GDP in cities | 18,483 | 11.18 | 0.476 | 10.01 | 12.12 |

| Industrial structure | stru | proportion of the secondary industry | 18,483 | 0.4597 | 0.112 | 0.0885 | 0.8934 |

| Marketization degree | mark | The proportion of urban private and individual employees in the total number of employees in each city | 18,483 | 0.902 | 0.0686 | 0.0242 | 0.998 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Resil | Resil | Resil | Resil | Resil | Resil | |

| Policy | 0.0119 ** | 0.0347 *** | 0.0347 *** | 0.0053 *** | 0.0383 *** | 0.0383 *** |

| (0.005) | (0.013) | (0.012) | (0.002) | (0.011) | (0.011) | |

| Size | 0.0142 *** | 0.0229 ** | 0.0229 ** | |||

| (0.002) | (0.010) | (0.010) | ||||

| Lev | −0.1372 *** | −0.1526 *** | −0.1526 *** | |||

| (0.016) | (0.037) | (0.037) | ||||

| Cashflow | 0.0460 | −0.0383 | −0.0383 | |||

| (0.042) | (0.049) | (0.049) | ||||

| Roa | 0.4460 *** | 0.2511 | 0.2511 | |||

| (0.124) | (0.185) | (0.185) | ||||

| BM | 0.0152 *** | 0.0204 *** | 0.0204 *** | |||

| (0.002) | (0.003) | (0.003) | ||||

| ListAge | 0.0175 *** | 0.0611 *** | 0.0611 *** | |||

| (0.005) | (0.020) | (0.020) | ||||

| Inst | 0.0641 *** | 0.0483 ** | 0.0483 ** | |||

| (0.013) | (0.023) | (0.023) | ||||

| TobinQ | −0.0237 *** | −0.0278 *** | −0.0278 *** | |||

| (0.002) | (0.004) | (0.004) | ||||

| Roe | −0.1697 *** | −0.1653 * | −0.1653 * | |||

| (0.059) | (0.098) | (0.098) | ||||

| Top1 | 0.0106 | −0.0350 | −0.0350 | |||

| (0.017) | (0.047) | (0.047) | ||||

| Constant | 4.5116 *** | 4.5024 *** | 4.5024 *** | 4.0777 *** | 3.9632 *** | 3.9632 *** |

| (0.002) | (0.006) | (0.006) | (0.073) | (0.397) | (0.397) | |

| city control variables | no | no | no | yes | yes | yes |

| Time fixed effect | yes | yes | yes | yes | yes | yes |

| city fixed effects | no | no | yes | no | no | yes |

| Corporate fixed effects | no | yes | yes | no | yes | yes |

| R-squared | 0.687 | 0.759 | 0.759 | 0.711 | 0.768 | 0.768 |

| Observations | 18,483 | 18,367 | 18,367 | 18,483 | 18,367 | 18,367 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Resil | Resil | Resil | Resil | Resil | Resil | |

| Policy | 0.0101 ** | 0.0193 ** | 0.0193 ** | 0.0110 ** | 0.0142 *** | 0.0142 *** |

| (0.005) | (0.009) | (0.009) | (0.005) | (0.004) | (0.004) | |

| Size | 0.0142 *** | 0.0224 ** | 0.0224 ** | |||

| (0.002) | (0.010) | (0.010) | ||||

| Lev | −0.1373 *** | −0.1514 *** | −0.1514 *** | |||

| (0.016) | (0.037) | (0.037) | ||||

| Cashflow | 0.0472 | −0.0350 | −0.0350 | |||

| (0.042) | (0.049) | (0.049) | ||||

| Roa | 0.4458 *** | 0.2509 | 0.2509 | |||

| (0.124) | (0.186) | (0.186) | ||||

| BM | 0.0152 *** | 0.0205 *** | 0.0205 *** | |||

| (0.002) | (0.003) | (0.003) | ||||

| ListAge | 0.0175 *** | 0.0601 *** | 0.0601 *** | |||

| (0.005) | (0.020) | (0.020) | ||||

| Inst | 0.0648 *** | 0.0477 ** | 0.0477 ** | |||

| (0.013) | (0.023) | (0.023) | ||||

| TobinQ | −0.0238 *** | −0.0277 *** | −0.0277 *** | |||

| (0.002) | (0.004) | (0.004) | ||||

| Roe | −0.1694 *** | −0.1634 * | −0.1634 * | |||

| (0.059) | (0.098) | (0.098) | ||||

| Top1 | 0.0097 | −0.0406 | −0.0406 | |||

| (0.017) | (0.048) | (0.048) | ||||

| Constant | 4.5099 *** | 4.5110 *** | 4.5110 *** | 4.0711 *** | 4.0505 *** | 4.0505 *** |

| (0.002) | (0.002) | (0.002) | (0.073) | (0.392) | (0.392) | |

| city control variables | no | no | no | yes | yes | yes |

| Time fixed effect | yes | yes | yes | yes | yes | yes |

| city fixed effects | no | no | yes | no | no | yes |

| Corporate fixed effects | no | yes | yes | no | yes | yes |

| R-squared | 0.655 | 0.783 | 0.783 | 0.709 | 0.775 | 0.775 |

| Observations | 18,483 | 18,367 | 18,367 | 18,483 | 18,367 | 18,367 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Growth | Growth | Growth | Growth | Growth | Growth | |

| Policy | 0.0249 | 0.3193 *** | 0.2742 *** | 0.0508 * | 0.0373 | 0.0848 |

| (0.046) | (0.102) | (0.077) | (0.030) | (0.077) | (0.067) | |

| Size | 1.0268 *** | 1.0356 *** | 1.1988 *** | |||

| (0.015) | (0.017) | (0.037) | ||||

| Lev | −1.6110 *** | −1.4511 *** | −1.5276 *** | |||

| (0.132) | (0.141) | (0.177) | ||||

| Cashflow | 0.0942 | 0.2788 | 0.6707 *** | |||

| (0.219) | (0.224) | (0.240) | ||||

| Roa | 4.8666 *** | 4.0143 *** | 5.2858 *** | |||

| (0.891) | (0.941) | (0.977) | ||||

| BM | −0.0563 *** | −0.0569 *** | 0.0392 *** | |||

| (0.012) | (0.013) | (0.014) | ||||

| ListAge | 0.2865 *** | 0.2988 *** | 0.3482 *** | |||

| (0.020) | (0.023) | (0.069) | ||||

| Inst | 0.3459 *** | 0.3880 *** | 0.1848 ** | |||

| (0.068) | (0.071) | (0.092) | ||||

| TobinQ | 0.0035 | 0.0044 | −0.0162 | |||

| (0.009) | (0.010) | (0.013) | ||||

| Roe | −0.8771 * | −1.2108 ** | −0.8138 * | |||

| (0.472) | (0.498) | (0.486) | ||||

| Top1 | 0.1427 | 0.1113 | 0.0340 | |||

| (0.092) | (0.100) | (0.203) | ||||

| Constant | 3.0891 *** | 3.0279 *** | 3.0417 *** | 20.1447 *** | 18.8904 *** | 19.5650 *** |

| (0.023) | (0.028) | (0.020) | (0.444) | (0.811) | (0.998) | |

| city control variables | no | no | no | yes | yes | yes |

| Time fixed effect | yes | yes | yes | yes | yes | yes |

| city fixed effects | no | no | yes | no | no | yes |

| Corporate fixed effects | no | yes | yes | no | yes | yes |

| R-squared | 0.655 | 0.783 | 0.783 | 0.709 | 0.775 | 0.775 |

| Observations | 18,483 | 18,367 | 18,367 | 18,483 | 18,367 | 18,367 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Resil | Resil | Resil | Resil | Resil | Resil | |

| Policy | 0.0159 *** | 0.1213 *** | 0.0070 *** | 0.0129 *** | 0.0665 *** | 0.0076 *** |

| (0.002) | (0.006) | (0.002) | (0.002) | (0.006) | (0.002) | |

| Size | 0.0172 *** | 0.0231 *** | 0.0044 ** | |||

| (0.001) | (0.003) | (0.002) | ||||

| Lev | 0.0090 | −0.0022 | 0.0407 | |||

| (0.034) | (0.045) | (0.031) | ||||

| Cashflow | −0.0653 *** | −0.0695 *** | −0.0288 * | |||

| (0.015) | (0.021) | (0.017) | ||||

| Roa | −0.0441 *** | −0.0599 *** | −0.0306 *** | |||

| (0.005) | (0.010) | (0.007) | ||||

| BM | 0.0401 *** | −0.0335 ** | −0.0078 | |||

| (0.013) | (0.015) | (0.010) | ||||

| ListAge | −0.0036 *** | −0.0104 *** | 0.0042 *** | |||

| (0.001) | (0.001) | (0.001) | ||||

| Inst | −0.0008 | 0.0044 | −0.0076 | |||

| (0.005) | (0.014) | (0.009) | ||||

| TobinQ | 0.0033 *** | 0.0039 *** | −0.0051 *** | |||

| (0.001) | (0.001) | (0.001) | ||||

| Roe | −0.0148 *** | −0.0263 *** | 0.0089 * | |||

| (0.004) | (0.007) | (0.005) | ||||

| Top1 | 0.0161 *** | 0.0372 *** | 0.0120 *** | |||

| (0.001) | (0.005) | (0.004) | ||||

| Constant | 0.8986 *** | 0.8770 *** | 0.9005 *** | 0.1596 *** | −0.5141 *** | 0.8020 *** |

| (0.001) | (0.002) | (0.001) | (0.023) | (0.070) | (0.080) | |

| city control variables | no | no | no | yes | yes | yes |

| Time fixed effect | yes | yes | yes | yes | yes | yes |

| city fixed effects | no | no | yes | no | no | yes |

| Corporate fixed effects | no | yes | yes | no | yes | yes |

| R-squared | 0.109 | 0.187 | 0.760 | 0.165 | 0.380 | 0.768 |

| Observations | 18,432 | 18,316 | 18,316 | 18,432 | 18,316 | 18,316 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Resil | Resil | Resil | Resil | Resil | Resil | |

| Policy | 0.0146 *** | 0.0200 *** | 0.0200 *** | 0.0032 *** | 0.0249 *** | 0.0249 *** |

| (0.006) | (0.005) | (0.005) | (0.001) | (0.006) | (0.006) | |

| Size | 0.0132 *** | 0.0199 * | 0.0199 * | |||

| (0.002) | (0.011) | (0.011) | ||||

| Lev | −0.1372 *** | −0.1382 *** | −0.1382 *** | |||

| (0.018) | (0.036) | (0.036) | ||||

| Cashflow | 0.0648 | −0.0374 | −0.0374 | |||

| (0.043) | (0.053) | (0.053) | ||||

| Roa | 0.4091 *** | 0.2270 | 0.2270 | |||

| (0.132) | (0.198) | (0.198) | ||||

| BM | 0.0165 *** | 0.0216 *** | 0.0216 *** | |||

| (0.002) | (0.003) | (0.003) | ||||

| ListAge | 0.0211 *** | 0.0552 *** | 0.0552 *** | |||

| (0.006) | (0.021) | (0.021) | ||||

| Inst | 0.0527 *** | 0.0452 ** | 0.0452 ** | |||

| (0.013) | (0.022) | (0.022) | ||||

| TobinQ | −0.0234 *** | −0.0270 *** | −0.0270 *** | |||

| (0.002) | (0.004) | (0.004) | ||||

| Roe | −0.1514 ** | −0.1523 | −0.1523 | |||

| (0.062) | (0.106) | (0.106) | ||||

| Top1 | 0.0242 | −0.0496 | −0.0496 | |||

| (0.018) | (0.053) | (0.053) | ||||

| Constant | 4.5122 *** | 4.5058 *** | 4.5058 *** | 4.0982 *** | 4.0625 *** | 4.0625 *** |

| (0.002) | (0.005) | (0.005) | (0.076) | (0.432) | (0.432) | |

| city control variables | no | no | no | yes | yes | yes |

| Time fixed effect | yes | yes | yes | yes | yes | yes |

| city fixed effects | no | no | yes | no | no | yes |

| Corporate fixed effects | no | yes | yes | no | yes | yes |

| R-squared | 0.681 | 0.756 | 0.756 | 0.706 | 0.764 | 0.764 |

| Observations | 9579 | 9518 | 9518 | 9579 | 9518 | 9518 |

| First-Stage Regression | Second-Stage Regression | |

|---|---|---|

| (1) | (2) | |

| Variables | Policy | Resil |

| IV | 0.0687 *** | |

| (0.012) | ||

| Policy | 0.0342 *** | |

| (0.007) | ||

| control variables | yes | yes |

| R-squared | 0.665 | 0.744 |

| Number | 18,483 | 18,483 |

| Kleibbergen-Paap Wald | 689.18 *** | |

| [0.000] | ||

| Kleibbergen-Paap LM | 320.46 *** | |

| [0.000] | ||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| Resil | KZ | Resil | Cost | Resil | R&D | Resil | |

| Policy | 0.0383 *** | −0.0384 *** | 0.0448 *** | −0.0505 ** | 0.0453 * | 0.0266 *** | 0.0131 |

| (0.011) | (0.013) | (0.013) | (0.024) | (0.027) | (0.007) | (0.006) | |

| KZ | −0.0044 ** | ||||||

| (0.002) | |||||||

| Cost | −0.0104 ** | ||||||

| (0.005) | |||||||

| R&D | 0.0116 *** | ||||||

| (0.003) | |||||||

| Size | 0.0229 ** | −0.5903*** | 0.0220 * | −0.2387 *** | 0.0206 * | 0.8060 *** | 0.0133 |

| (0.010) | (0.047) | (0.011) | (0.022) | (0.011) | (0.042) | (0.013) | |

| Lev | −0.1526 *** | 6.6054 *** | −0.0535 | 2.5980 *** | −0.0628 | −0.3432 ** | −0.0724 |

| (0.037) | (0.229) | (0.051) | (0.116) | (0.051) | (0.166) | (0.059) | |

| Cashflow | −0.0383 | −13.7288 *** | −0.0677 | 0.4772 *** | −0.0039 | 0.0975 | −0.0166 |

| (0.049) | (0.233) | (0.070) | (0.133) | (0.052) | (0.222) | (0.061) | |

| Roa | 0.2511 | −15.3502 *** | 0.7371 * | −2.3910 *** | 0.8027 * | 1.6131 | 0.9650 * |

| (0.185) | (1.346) | (0.430) | (0.700) | (0.412) | (1.265) | (0.535) | |

| BM | 0.0204 *** | 0.0156 | 0.0192 *** | 0.0534 *** | 0.0197 *** | 0.0436 ** | 0.0223 *** |

| (0.003) | (0.013) | (0.003) | (0.008) | (0.003) | (0.021) | (0.004) | |

| ListAge | 0.0611 *** | 0.9745 *** | 0.0317 | 0.1108 *** | 0.0603 *** | −0.0717 | 0.0910 *** |

| (0.020) | (0.085) | (0.020) | (0.041) | (0.020) | (0.060) | (0.021) | |

| Inst | 0.0483 ** | 0.0022 | 0.0305 | −0.0426 | 0.0385 | −0.0226 | 0.0274 |

| (0.023) | (0.104) | (0.024) | (0.052) | (0.024) | (0.089) | (0.026) | |

| TobinQ | −0.0278 *** | 0.4706 *** | −0.0220 *** | 0.0323 *** | −0.0240 *** | −0.0025 | −0.0226 *** |

| (0.004) | (0.021) | (0.003) | (0.007) | (0.004) | (0.014) | (0.004) | |

| Roe | −0.1653 * | 2.2103 *** | −0.5981 ** | −8.2874 *** | −0.7084 *** | 0.2820 | −0.7516 ** |

| (0.098) | (0.632) | (0.260) | (0.377) | (0.259) | (0.717) | (0.346) | |

| Top1 | −0.0350 | −0.0592 | −0.0398 | −0.2891 ** | −0.0326 | 0.0099 | −0.0433 |

| (0.047) | (0.227) | (0.048) | (0.129) | (0.048) | (0.261) | (0.048) | |

| Constant | 3.9632 *** | 7.0584 *** | 3.8719 *** | 5.3390 *** | 3.9130 *** | 0.1018 | 4.3171 *** |

| (0.397) | (2.006) | (0.427) | (1.154) | (0.427) | (1.992) | (0.461) | |

| city control variables | yes | yes | yes | yes | yes | yes | yes |

| Time fixed effect | yes | yes | yes | yes | yes | yes | yes |

| city fixed effects | yes | yes | yes | yes | yes | yes | yes |

| Corporate fixed effects | yes | yes | yes | yes | yes | yes | yes |

| R-squared | 0.768 | 0.872 | 0.780 | 0.848 | 0.772 | 0.873 | 0.778 |

| Observations | 18,367 | 18,367 | 18,367 | 18,367 | 18,367 | 18,367 | 18,367 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| State-Owned | State-Owned | Private | Private | |

| Resil | Resil | Resil | Resil | |

| Policy | 0.0171 | 0.0229 | 0.0403 *** | 0.0415 *** |

| (0.021) | (0.021) | (0.014) | (0.013) | |

| Size | 0.0345 *** | −0.0041 | ||

| (0.012) | (0.012) | |||

| Lev | −0.1570 *** | −0.0661 | ||

| (0.040) | (0.042) | |||

| Cashflow | 0.0630 | −0.0873 | ||

| (0.051) | (0.074) | |||

| Roa | −0.1142 | 0.6767 * | ||

| (0.215) | (0.368) | |||

| BM | 0.0207 *** | 0.0189 *** | ||

| (0.003) | (0.006) | |||

| ListAge | 0.0438 | 0.0840 *** | ||

| (0.037) | (0.021) | |||

| Inst | 0.0432 | 0.0343 | ||

| (0.026) | (0.029) | |||

| TobinQ | −0.0378 *** | −0.0251 *** | ||

| (0.008) | (0.004) | |||

| Roe | −0.0488 | −0.3268 | ||

| (0.071) | (0.216) | |||

| Top1 | −0.0317 | −0.0105 | ||

| (0.054) | (0.074) | |||

| Constant | 4.5103 *** | 3.8103 *** | 4.5084 *** | 4.2505 *** |

| (0.004) | (0.567) | (0.008) | (0.598) | |

| city control variables | no | yes | no | yes |

| Time fixed effect | yes | yes | yes | yes |

| city fixed effects | yes | yes | yes | yes |

| Corporate fixed effects | yes | yes | yes | yes |

| R-squared | 0.798 | 0.809 | 0.747 | 0.754 |

| Observations | 9301 | 9301 | 9136 | 9136 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Large-Scale | Large-Scale | Small & Medium | Small & Medium | |

| Resil | Resil | Resil | Resil | |

| Policy | 0.0373 * | 0.0422 * | 0.0108 | 0.0047 |

| (0.023) | (0.022) | (0.030) | (0.030) | |

| Size | 0.0209 * | −0.0083 | ||

| (0.012) | (0.034) | |||

| Lev | −0.1350 *** | −0.1064 | ||

| (0.032) | (0.097) | |||

| Cashflow | 0.0329 | −0.0767 | ||

| (0.053) | (0.113) | |||

| Roa | 0.2607 | 0.0139 | ||

| (0.214) | (0.330) | |||

| BM | 0.0199 *** | 0.0971 *** | ||

| (0.003) | (0.033) | |||

| ListAge | 0.0630 *** | 0.0461 | ||

| (0.023) | (0.050) | |||

| Inst | 0.0347 | −0.0277 | ||

| (0.022) | (0.044) | |||

| TobinQ | −0.0308 *** | −0.0233 *** | ||

| (0.006) | (0.005) | |||

| Roe | −0.1886 * | 0.0826 | ||

| (0.114) | (0.187) | |||

| Top1 | 0.0269 | −0.2418 | ||

| (0.048) | (0.183) | |||

| Constant | 4.5330 *** | 3.9388 *** | 4.3642 *** | 5.1223 *** |

| (0.005) | (0.460) | (0.007) | (1.603) | |

| city control variables | no | yes | no | yes |

| Time fixed effect | yes | yes | yes | yes |

| city fixed effects | yes | yes | yes | yes |

| Corporate fixed effects | yes | yes | yes | yes |

| R-squared | 0.755 | 0.764 | 0.823 | 0.830 |

| Observations | 15,285 | 15,285 | 3082 | 3082 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| High | High | Low | Low | |

| Resil | Resil | Resil | Resil | |

| Policy | 0.0397 ** | 0.0478 *** | 0.0084 | 0.0104 |

| (0.019) | (0.012) | (0.030) | (0.030) | |

| Size | 0.0284 ** | 0.0345 | ||

| (0.014) | (0.035) | |||

| Lev | −0.1541 *** | −0.1018 | ||

| (0.046) | (0.097) | |||

| Cashflow | −0.0316 | 0.0427 | ||

| (0.055) | (0.120) | |||

| Roa | 0.2544 | 0.4767 | ||

| (0.222) | (0.545) | |||

| BM | 0.0236 *** | 0.0198 ** | ||

| (0.004) | (0.009) | |||

| ListAge | 0.0854 *** | 0.0255 | ||

| (0.027) | (0.050) | |||

| Inst | 0.0682 ** | −0.0196 | ||

| (0.031) | (0.038) | |||

| TobinQ | −0.0282 *** | −0.0121 | ||

| (0.004) | (0.014) | |||

| Roe | −0.1935 | −0.2847 | ||

| (0.122) | (0.196) | |||

| Top1 | −0.0142 | −0.0568 | ||

| (0.065) | (0.119) | |||

| Constant | 4.5776 *** | 4.1991 *** | 4.1747 *** | −1.8924 |

| (0.011) | (0.497) | (0.006) | (3.847) | |

| city control variables | no | yes | no | yes |

| Time fixed effect | yes | yes | yes | yes |

| city fixed effects | yes | yes | yes | yes |

| Corporate fixed effects | yes | yes | yes | yes |

| R-squared | 0.699 | 0.712 | 0.781 | 0.787 |

| Observations | 14,899 | 14,899 | 3468 | 3468 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| High-Tech | High-Tech | Low-Tech | Low-Tech | |

| Resil | Resil | Resil | Resil | |

| Policy | 0.0852 ** | 0.0818 ** | 0.0307 | 0.0321 |

| (0.041) | (0.039) | (0.019) | (0.020) | |

| Size | −0.0138 | 0.0364 ** | ||

| (0.011) | (0.017) | |||

| Lev | −0.0237 | −0.1893 *** | ||

| (0.043) | (0.053) | |||

| Cashflow | −0.1325 ** | 0.0032 | ||

| (0.060) | (0.056) | |||

| Roa | 0.1701 | 0.0852 | ||

| (0.222) | (0.205) | |||

| BM | 0.0308 *** | 0.0184 *** | ||

| (0.008) | (0.003) | |||

| ListAge | 0.0657 *** | 0.0444 | ||

| (0.023) | (0.031) | |||

| Inst | 0.0126 | 0.0655 * | ||

| (0.026) | (0.035) | |||

| TobinQ | −0.0167 *** | −0.0403 *** | ||

| (0.003) | (0.007) | |||

| Roe | −0.0167 | −0.1098 | ||

| (0.096) | (0.078) | |||

| Top1 | −0.0211 | −0.0612 | ||

| (0.057) | (0.068) | |||

| Constant | 4.5055 *** | 5.2302 *** | 4.5024 *** | 3.3408 *** |

| (0.005) | (0.572) | (0.009) | (0.589) | |

| city control variables | no | yes | no | yes |

| Time fixed effect | yes | yes | yes | yes |

| city fixed effects | yes | yes | yes | yes |

| Corporate fixed effects | yes | yes | yes | yes |

| R-squared | 0.861 | 0.865 | 0.736 | 0.748 |

| Observations | 6985 | 6985 | 11,382 | 11,382 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, H.; Ke, Z.; Yan, J. Can the Reform of the Commercial System Enhance the Resilience of Enterprises? Evidence Based on Quasi Natural Experiments. Sustainability 2024, 16, 7616. https://doi.org/10.3390/su16177616

Li H, Ke Z, Yan J. Can the Reform of the Commercial System Enhance the Resilience of Enterprises? Evidence Based on Quasi Natural Experiments. Sustainability. 2024; 16(17):7616. https://doi.org/10.3390/su16177616

Chicago/Turabian StyleLi, Hui, Zhixuan Ke, and Jinghua Yan. 2024. "Can the Reform of the Commercial System Enhance the Resilience of Enterprises? Evidence Based on Quasi Natural Experiments" Sustainability 16, no. 17: 7616. https://doi.org/10.3390/su16177616

APA StyleLi, H., Ke, Z., & Yan, J. (2024). Can the Reform of the Commercial System Enhance the Resilience of Enterprises? Evidence Based on Quasi Natural Experiments. Sustainability, 16(17), 7616. https://doi.org/10.3390/su16177616