Study on the Selection of Recycling Strategies for the Echelon Utilization of Electric Vehicle Batteries under the Carbon Trading Policy

Abstract

:1. Introduction

- (1)

- What channel models does the recycling system of EVBs encompass? In different recycling channel models, what specific roles do the various members play, and what functions do these members fulfill in the recycling process?

- (2)

- How does the government implement relevant policies, particularly by limiting carbon emissions during production and establishing carbon trading prices, and what are the subsequent impacts on the economic interests of members within the CLSC?

- (3)

- How are the equilibrium strategies of BS and electric vehicle manufacturers (EVMs) within a CLSC affected under different recycling channel models? In particular, how do multiple factors related to the exchange and recycling service intertwine to influence the formulation of these strategies: the reuse rate of recycled batteries, the compensation derived from tiered utilization, and the effect of unit exchange and recycling costs on corporate pricing, recycling efforts, and the choice of recycling channels?

- (4)

- How do the profits of each member change under a joint recycling model with the introduction of blockchain technology versus a joint recycling model without the introduction of blockchain, and is the introduction of blockchain a superior recycling channel model?

2. Literature Review

3. Methodology

- (1)

- It is the responsibility of the BS to provide EVM with the batteries needed to produce EVs, either from new manufacturing materials or recycling.

- (2)

- EVM manufactures new EVs by sourcing batteries from BS. In addition, EVM can obtain batteries for manufacturing that can be directly recycled by participating in the recovery process.

- (3)

- For the carbon emissions of BS and EVM in the production process, the government controls the carbon emissions of the manufacturers through carbon quotas, and at the same time opens a carbon trading market, where BS and EVM can trade their carbon emission rights.

4. The Model

4.1. Model S—BS Invests Separately

4.2. Model M—EVM Invests Separately

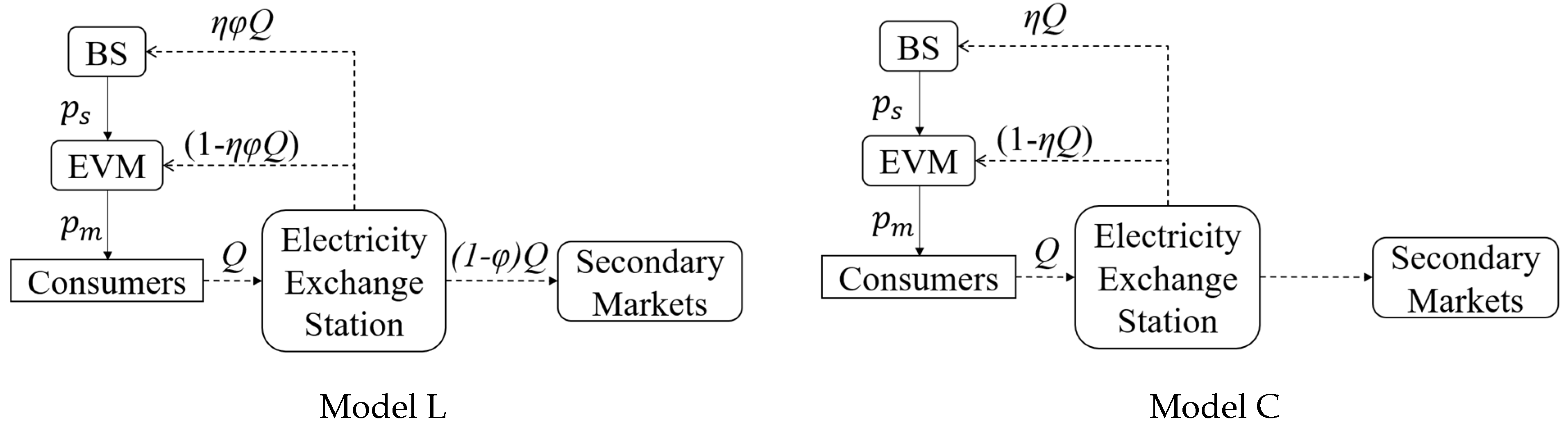

4.3. Model L—Joint Investment Model

4.4. Model C—Introduction of Blockchain under the Co-Investment Model

4.5. Comparative Analysis of EVB Recycling Channel Models

5. Numerical Experiments

5.1. Impact of Recycling Environment on Profits

5.1.1. Impact of Unit Recovery Costs and Remanufacturability Rates on BS Margins

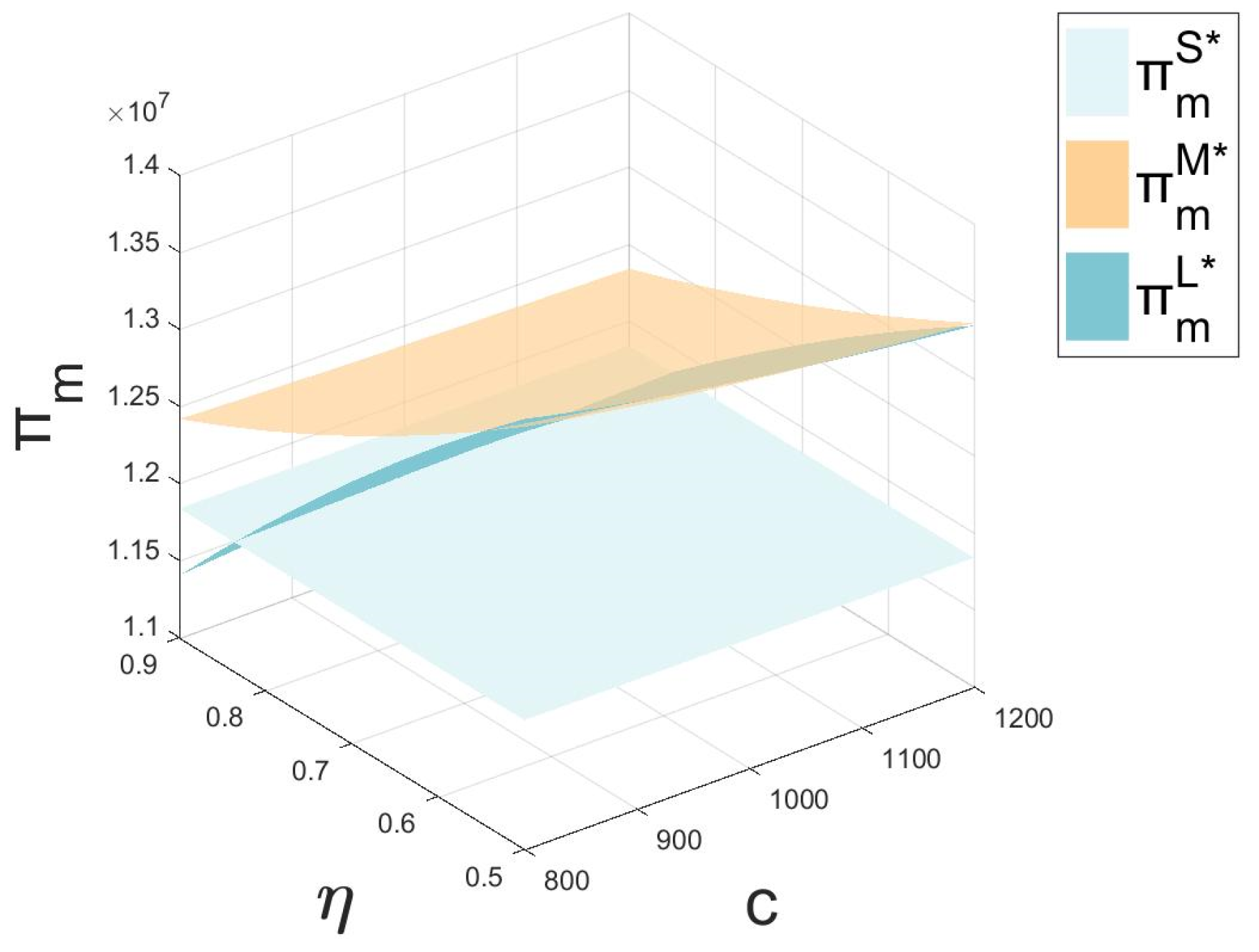

5.1.2. Impact of Unit Recovery Costs and Remanufacturability Rates on EVM Margins

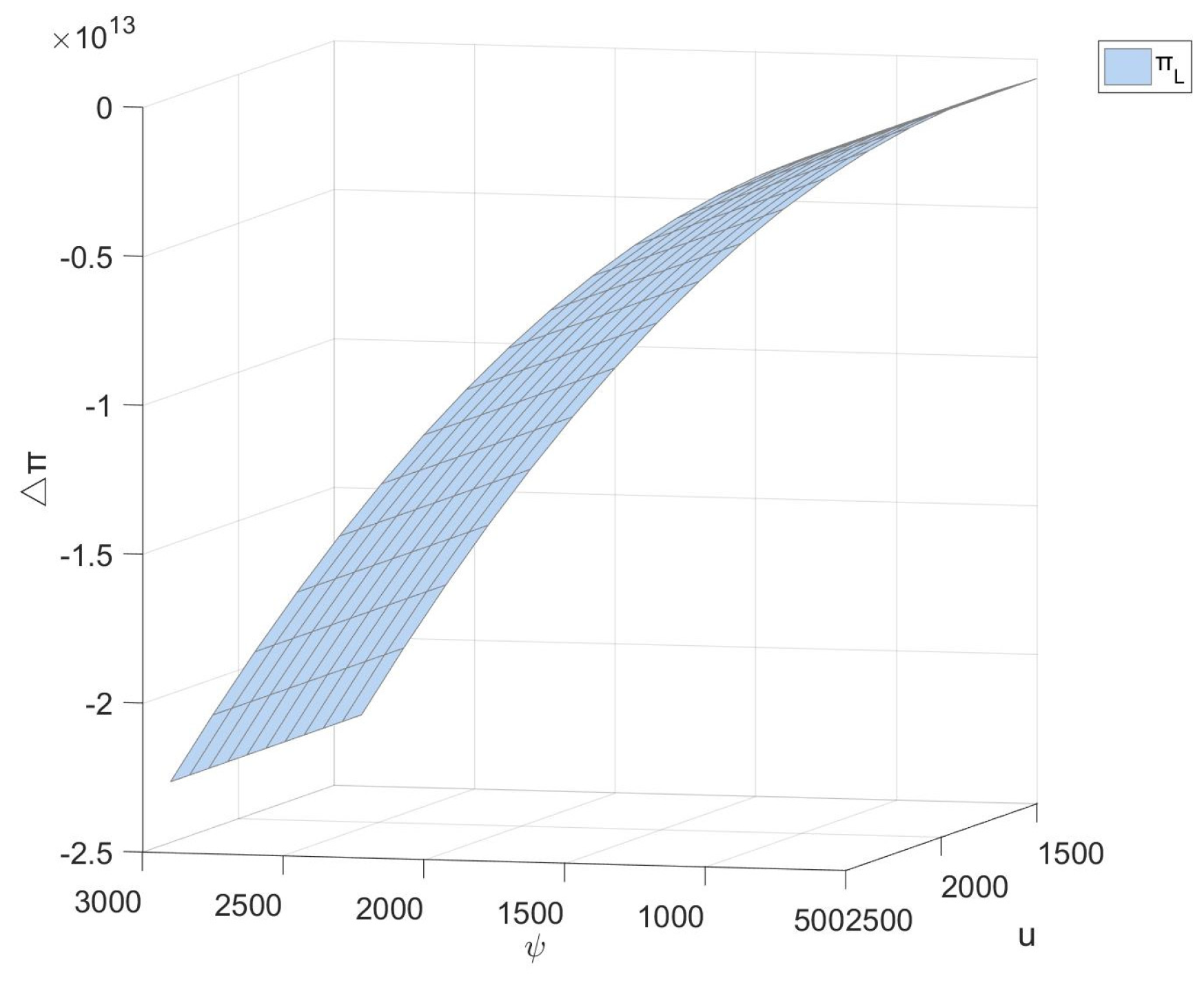

5.1.3. Impact of Cost-Sharing Ratios and Remanufacturability Rates on BS and EVM’s Profits

5.1.4. Summary of the Impact of Variables Related to the Recycling Process

5.2. Impact of Carbon Emission-Related Variables on Profits

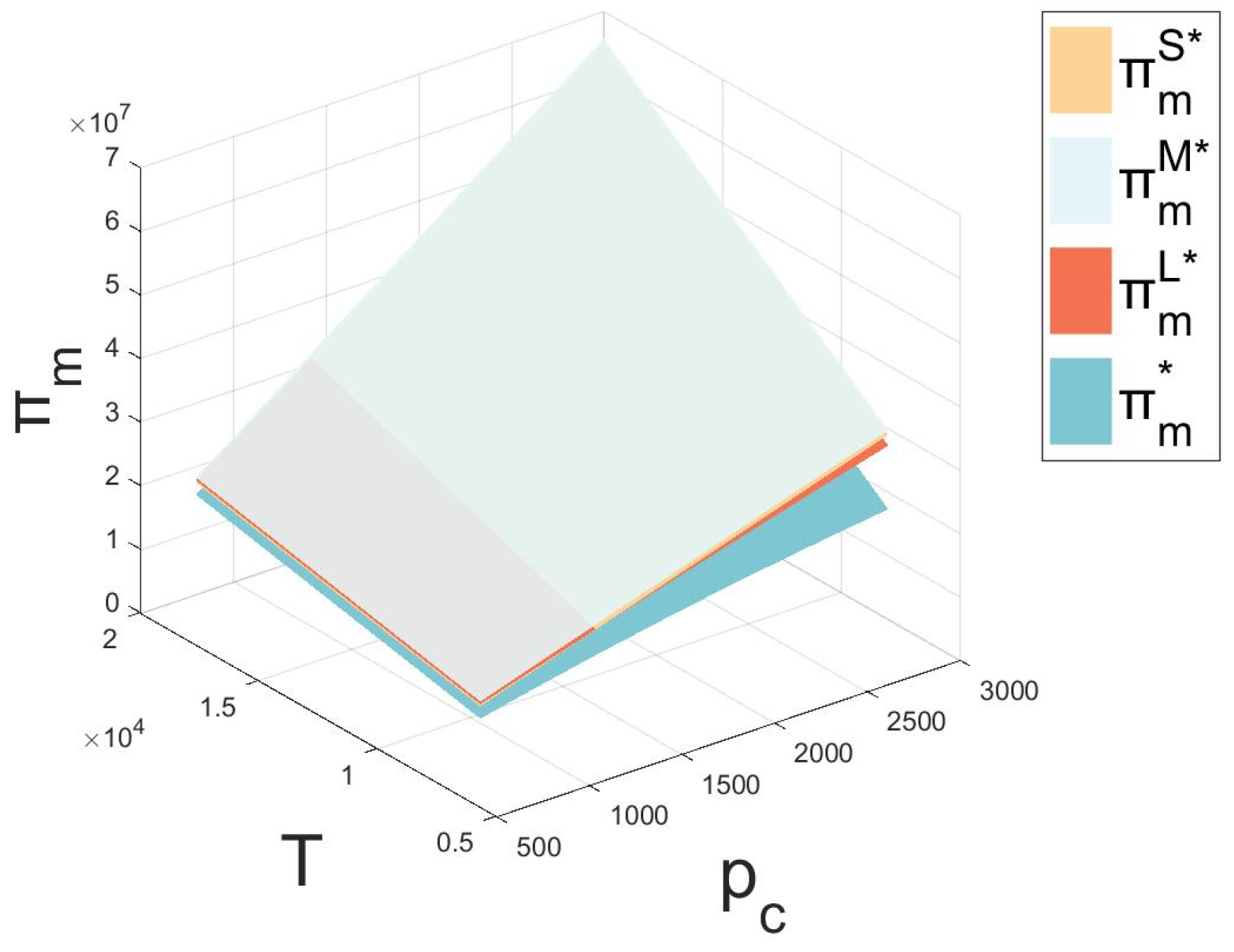

5.2.1. Impact of Carbon Trading Prices and Carbon Emission Allowances on BS’ and EVM’ Profits

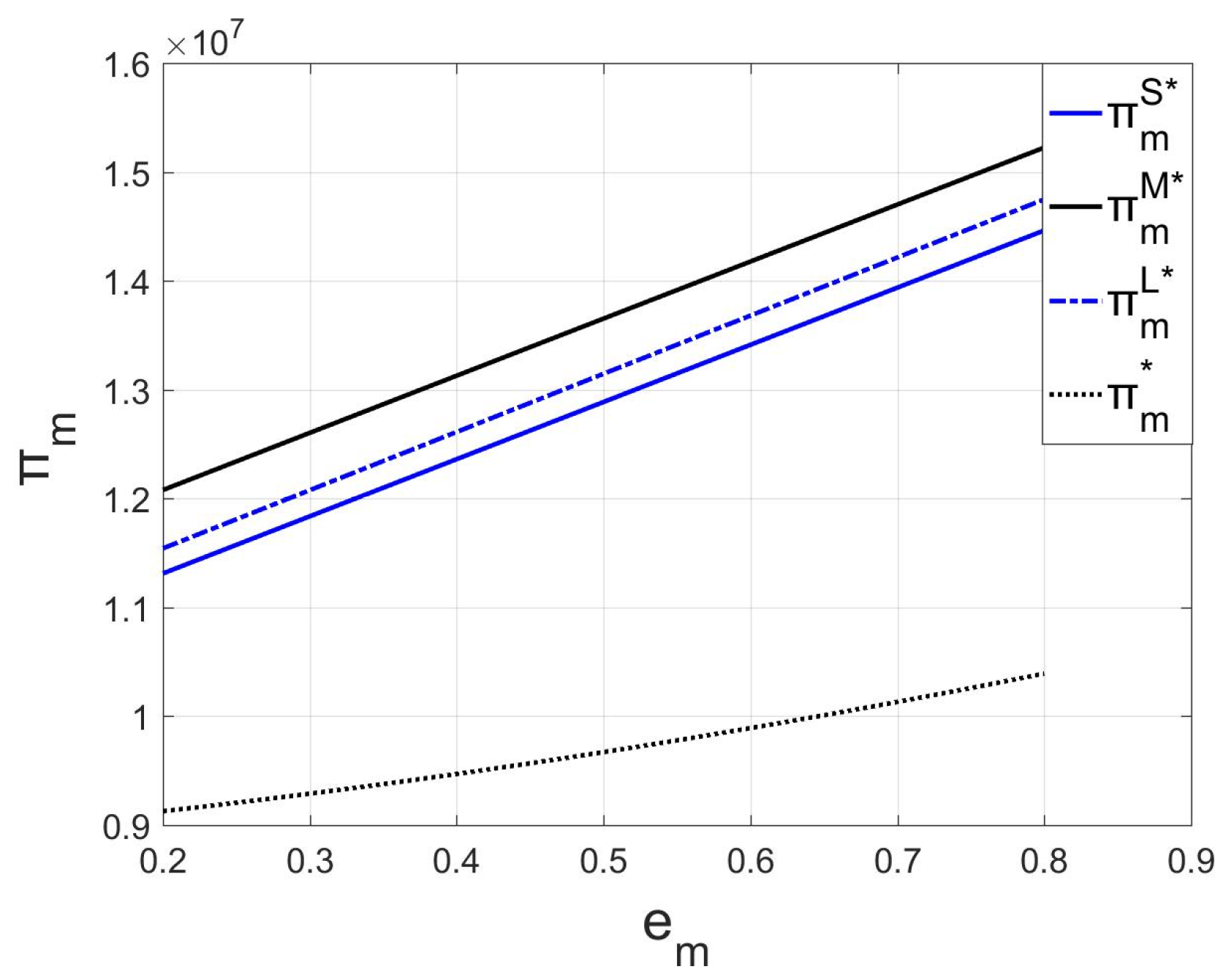

5.2.2. Impact of Carbon Intensity on BS’ and EVM’ Profits

5.2.3. Impact of Carbon Trading Prices and Carbon Allowances on Total Supply Chain Profits

5.2.4. Summary of the Impact of Variables Related to Carbon Emissions

5.3. The Problem of Choosing a Strategy for Introducing Blockchain Technology

5.3.1. Impact of Unit Blockchain Costs and Battery Availability on Total Supply Chain Profitability

5.3.2. Impact of Unit Blockchain Costs and Consumer Sensitivity to Blockchain on Strategy

5.3.3. Summary of the Impact of Blockchain Technology-Related Variables

6. Conclusions and Management Insights

6.1. Conclusions

- (1)

- From a pricing perspective, whether BS adopts an independent recycling model, EVM pursues an independent recycling approach, or both parties collaborate in a joint recycling model, the differences in recycling channels do not fundamentally alter the optimal pricing strategies of BS and EVM. In this context, the optimal pricing for enterprises is solely influenced by the recycling market environment and carbon emission restrictions. However, upon the introduction of blockchain technology, the optimal pricing for BS and EVM rises compared to when blockchain technology is absent. At this juncture, the optimal pricing is subject to a triple influence: the recycling market environment, carbon emission restrictions, and the correlation coefficients associated with blockchain technology.

- (2)

- From the perspective of recycling efforts, enterprises under different recycling models have varying degrees of effort. Specifically, when the carbon trading price is low, joint investment models can stimulate greater efforts than BS recycling alone. On the contrary, when carbon trading prices are high, joint investment models outperform EVM recycling alone and show higher enthusiasm for recycling. It is worth noting that the introduction of blockchain technology does not always directly improve recycling efforts, and its effect is influenced by the price of materials for echelon use in the recycling market. When the price is low, the introduction of blockchain technology will bring about higher recycling efforts.

- (3)

- From the perspective of enterprises’ choice of recycling models, BS and EVM have different equilibrium returns under different recycling models. Therefore, based on their own interests, enterprises tend to choose various recycling models. In general, both BS and EVM obtain more benefits from participating in the recycling process than from not participating. Under the joint recycling model, BS can achieve more significant gains than EVM. The increase in battery utilization rate, the enhancement of consumers’ sensitivity to blockchain, and the higher carbon trading prices are all key factors that drive enterprises to adopt blockchain technology. Likewise, blockchain technology has a greater impact on the gains of BS in CLSC.

6.2. Management Insights

- (1)

- From the perspective of BS, faced with carbon emission restrictions and trading policies, the battery recycling and remanufacturing strategy not only significantly reduces production costs, but also effectively curbs carbon emissions generated from the use of raw materials to produce new batteries. Compared to the non-recycling model, participation in the recycling model demonstrates notable profit advantages, making it a favorable strategic business choice for BS. Specifically, the echelon utilization of batteries is intimately linked to the economic benefits of recycling models, meaning that the higher the reusability rate, the more substantial the economic returns from the recycling process. In the CLSC recycling model, the integration of the recycling stage with blockchain technology yields particularly significant gains for BS; therefore, BS should actively engage in related practices. Additionally, given the pivotal position of EVM in the supply chain, BS can explore collaborative models to attract their participation in joint recycling initiatives. Since the gains accruing to BS under joint recycling models typically exceed those of EVM, BS might consider incentivizing EVM’s involvement through reasonable cost-sharing and benefit distribution mechanisms, thereby fostering a mutually beneficial relationship. In summary, when formulating recycling strategies, BS should comprehensively evaluate the current state of echelon utilization of batteries in the market along with the cost-effectiveness of blockchain technology, flexibly selecting the most suitable recycling model. This approach not only aligns with policy directives to achieve sustainable development, but also enables BS to gain a competitive edge in the fierce market competition, thereby enhancing their overall business competitiveness.

- (2)

- From the perspective of EVM, despite the limited role of battery recycling in directly reducing carbon emissions during vehicle manufacturing in the face of carbon emission restrictions and trading policies, EVM-exclusive recycling remains the most profitable strategy among all recycling models. This is because EVM manufacturers retain pricing power over recycled batteries and reap the benefits of battery echelon utilization. Compared to independent recycling models, the direct benefits of joint recycling models may slightly decrease; yet, when BS undertakes solo recycling, the profits accruing to EVM manufacturers are even more limited. Actively engaging in recycling activities is not only a manifestation of EVM’s environmental responsibility, but also a prudent move to enhance economic efficiency. Notably, when BS shoulders a higher proportion of investments or offers subsidies during collaborative recycling, the joint recycling model transforms into a mutually beneficial solution, deserving serious consideration and adoption by EVM. Furthermore, to further bolster market competitiveness and ensure product compliance with policy directives, EVM should actively explore the potential of integrating blockchain technology into the EV supply chain. The introduction of blockchain technology will forge a highly transparent and traceable information platform, providing manufacturers with robust data support that enables them to excel in the fiercely competitive market. In conclusion, EVM must not only demonstrate flexibility in their recycling strategies, but also fully embrace blockchain technology, applying it to the construction of CLSC networks. By harnessing innovation as a driving force for development, they can lead the industry into the future.

- (3)

- From the government’s point of view, battery recycling activities not only effectively curb the phenomenon of indiscriminate battery disposal, thereby preventing the potential risk of toxic substance leakage, but also significantly reduce the consumption of natural resources and energy through the strategy of battery echelon utilization, effectively mitigating environmental pollution, which is closely aligned with the government’s environmental protection policy orientation. Therefore, the government should actively promote corporate recycling behavior, advocate for the concept of battery echelon utilization, and incentivize upstream and downstream enterprises in the supply chain to actively participate in battery recycling and reuse. The government can implement recycling subsidy policies to provide economic incentives for recycling enterprises and promote recycling and reuse activities. Addressing the imbalance of interests between BS and EVM in the joint recycling model, government subsidy mechanisms have become crucial in enhancing recycling momentum and balancing the enthusiasm of all parties. Furthermore, promoting the deep integration of digitalization and manufacturing can not only enhance the universality of battery recycling, reducing the complexity of recycling operations for enterprises, but also make production carbon emissions more transparent, helping enterprises establish mutual recognition mechanisms with the European Union, thereby enhancing the international competitiveness of the battery industry. The government can precisely formulate supportive policies such as financial funding support and tax incentives to encourage enterprises to accelerate their integration into the digitalization process. At the same time, given that consumers’ sensitivity to corporate recycling efforts directly impacts the recycling rate, the government needs to strengthen supervision of the recycling market and enhance the attractiveness of recycling services. On the other hand, the implementation of carbon emission regulation policies has also prompted enterprises to participate in recycling and remanufacturing, effectively reducing carbon emissions and fully demonstrating the positive role of government intervention. However, while rising carbon trading prices can incentivize higher recycling rates and reduced carbon emissions, they may also induce a blind pursuit of high carbon prices. Therefore, it is particularly important to reasonably set carbon emission quotas and guide enterprises to participate in carbon trading rationally by regulating their profits. Consequently, regulatory agencies should strive to build a sustainable carbon trading environment, including detailed carbon trading guidelines and setting reasonable price ranges, to promote the stable development of the carbon market and the simultaneous achievement of environmental protection goals.

6.3. Research Contributions and Future Prospects

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

| 0.4 | 17,228,117 | 381,219.8 | 11,346,341 | −1,023,357 |

| 0.6 | 16,890,382 | 43,484.16 | 11,684,077 | −685,621 |

| 0.8 | 16,552,646 | −294,252 | 12,021,812 | −347,885 |

| 0.4 | 17,228,117 | 381,219.8 | 11,346,341 | −1,023,357 |

| 0.4 | 16,177,102 | −964,593 | 1,2461,216 | −411,575 |

| 0.6 | 15,899,823 | −1,241,871 | 12,738,495 | −134,296 |

| 0.8 | 15,622,544 | −1,519,150 | 13,015,773 | 142,982.9 |

| 0.4 | 16,177,102 | −964,593 | 12,461,216 | −411,575 |

| 0.4 | 15,247,000 | −2,160,000 | 13,410,940 | −101,340 |

| 0.6 | 15,024,280 | −2,382,720 | 13,633,660 | 121,380 |

| 0.8 | 14,801,560 | −2,605,440 | 13,856,380 | 344,100 |

| 0.4 | 15,247,000 | −2,160,000 | 13,410,940 | −101,340 |

References

- Foumani, M.; Smith-Miles, K. The impact of various carbon reduction policies on green flow shop scheduling. Appl. Energy 2019, 249, 300–315. [Google Scholar] [CrossRef]

- Halat, K.; Hafezalkotob, A. Modeling carbon regulation policies in inventory decisions of a multi-stage green supply chain: A game theory approach. Comput. Ind. Eng. 2019, 128, 807–830. [Google Scholar] [CrossRef]

- Liu, J.; Qiu, F.; Zhang, T.; Liu, H. Dynamics of green economic development in countries joining the belt and road initiative: Is it driven by green investment transformation? J. Environ. Manag. 2023, 347, 118969. [Google Scholar] [CrossRef] [PubMed]

- Zahoor, A.; Yu, Y.; Zhang, H.; Nihed, B.; Afrane, S.; Peng, S.; S’api, A.; Lin, C.J.; Mao, G. Can the new energy vehicles (NEVs) and power battery industry help China to meet the carbon neutrality goal before 2060? J. Environ. Manag. 2023, 336, 117663. [Google Scholar] [CrossRef] [PubMed]

- Eichner, T.; Pethig, R. EU-type carbon regulation and the waterbed effect of green energy promotion. Energy Econ. 2019, 80, 656–679. [Google Scholar] [CrossRef]

- Vaughan, A. The looming electric car battery waste mountain. New Sci. 2023, 244, 12. [Google Scholar] [CrossRef]

- Bobba, S.; Mathieux, F.; Blengini, G.A. How will second-use of batteries affect stocks and flows in the EU? A model for traction Li-ion batteries. Resour. Conserv. Recycl. 2019, 145, 279–291. [Google Scholar] [CrossRef]

- Malinauskaite, J.; Anguilano, L.; Rivera, X.S. Circular waste management of electric vehicle batteries: Legal and technical perspectives from the EU and the UK post Brexit. Int. J. Thermofluids 2021, 10, 100078. [Google Scholar] [CrossRef]

- Schultmann, F.; Engels, B.; Rentz, O. Closed-Loop Supply Chains for Spent Batteries. Interfaces 2003, 33, 57–71. [Google Scholar] [CrossRef]

- Virmani, N.; Agarwal, V.; Karuppiah, K.; Agarwal, S.; Raut, R.D.; Paul, S.K. Mitigating barriers to adopting electric vehicles in an emerging economy context. J. Clean. Prod. 2023, 414, 137557. [Google Scholar] [CrossRef]

- Vallera, A.M.; Nunes, P.M.; Brito, M.C. Why we need battery swapping technology. Energy Policy 2021, 157, 112481. [Google Scholar] [CrossRef]

- Majeed, U.; Khan, L.U.; Yaqoob, I.; Kazmi, S.M.A.; Salah, K.; Hong, C.S. Blockchain for IoT-based smart cities: Recent advances, requirements, and future challenges. J. Netw. Comput. 2021, 181, 103007. [Google Scholar] [CrossRef]

- Fleischmann, M.; Bloemhof-Ruwaard, J.M.; Dekker, R. Quantitative Models for Reverse Logistics: A Review. Eur. J. Oper. Res. 1997, 103, 1–17. [Google Scholar] [CrossRef]

- Guide, J.V.; Jayaraman, V.; Srivastava, R.; Benton, W.C. Supply-chain management for recoverable manufacturing systems. Interfaces 2000, 30, 125–142. [Google Scholar] [CrossRef]

- Karuppiah, K.; Sankaranarayanan, B. An integrated multi-criteria decision-making approach for evaluating e-waste mitigation strategies. Appl. Soft Comput. 2023, 144, 110420. [Google Scholar] [CrossRef]

- De, A.; Ray, A.; Kundu, T.; Sheu, J.B. Is it wise to compete or to collaborate? Remanufacturing business models under collective extended producer responsibility legislation. Transp. Res. Part E Logist. Transp. Rev. 2023, 179, 103294. [Google Scholar] [CrossRef]

- Lin, J.; Naim, M.; Tang, O. In-house or outsourcing? The impact of remanufacturing strategies on the dynamics of component remanufacturing systems under lifecycle demand and returns. Eur. J. Oper. Res. 2024, 315, 965–979. [Google Scholar] [CrossRef]

- Feng, Z.; Li, F.; Tan, C. Supplier development or supplier integration? Equilibrium analysis in competing electric vehicle supply chains with power battery recycling. Expert Syst. Appl. 2024, 238, 121519. [Google Scholar] [CrossRef]

- Chen, J.; Tian, Y.; Chan, F.T.S.; Tang, H.; Che, P.H. Pricing, greening, and recycling decisions of capital-constrained closed-loop supply chain with Pricing, greening, and recycling decisions of capital-constrained closed-loop supply chain with government subsidies under financing strategies. J. Clean. 2024, 438, 140797. [Google Scholar] [CrossRef]

- Jena, S.K.; Meena, P. Competitive sustainable processes and pricing decisions in omnichannel closed-up supply chains under different channel power structures. J. Retail. Consum. Serv. 2022, 69, 103114. [Google Scholar] [CrossRef]

- Hosseini-Motlagh, S.M.; Ebrahimi, S.; Zirakpourdehkordi, R. Coordination of dual-function acquisition price and corporate social responsibility in a sustainable closed-loop supply chain. J. Clean. Prod. 2020, 251, 119629. [Google Scholar] [CrossRef]

- Zhou, Y.; Zhang, Y.; Wahab, M.I.M.; Goh, M. Channel leadership and performance for a closed-loop supply chain considering competition. Transp. Res. Part E Logist. Transp. Rev. 2023, 175, 103151. [Google Scholar] [CrossRef]

- Esenduran, G.; Lin, Y.T.; Xiao, W.L.; Jin, M.Y. Choice of electronic waste recycling standard under recovery channel competition. Manuf. Serv. Oper. Manag. 2020, 22, 495–512. [Google Scholar] [CrossRef]

- Yang, Y.; Lin, J.; Hedenstierna, C.P.T.; Zhou, L. The more the better? The impact of the number and location of product recovery options on the system dynamics in a closed-loop supply chain. Transp. Res. Part E Logist. Transp. Rev. 2023, 175, 109863. [Google Scholar] [CrossRef]

- Huang, Q.L.; Hou, J.; Shen, H.C. Remanufacturing and pricing strategies under modular architecture. Comput. Ind. Eng. 2024, 188, 109863. [Google Scholar] [CrossRef]

- Ma, P.; Meng, Y. Optimal financing strategies of a dual-channel closed-loop supply chain. Electron. Commer. Res. 2022, 53, 101140. [Google Scholar] [CrossRef]

- Wu, J.; Zhang, L.; Shen, X. Outsourcing or Authorizing? Optimal Options for Third-Party Remanufacturing Modes with Green Consumerism. Sustainability 2024, 16, 1914. [Google Scholar] [CrossRef]

- Shekarian, E.; Marandi, A.; Majava, J. Dual-channel remanufacturing closed-loop supply chains under carbon footprint and collection competition. Sustain. Prod. Consum. 2021, 28, 1050–1075. [Google Scholar] [CrossRef]

- Ghadge, A.; Mogale, D.G.; Bourlakis, M.; Maiyar, L.M.; Moradlou, H. Link between Industry 4.0 and green supply chain management: Evidence from the automotive industry. Comput. Ind. Eng. 2022, 169, 108303. [Google Scholar] [CrossRef]

- Shahparvari, S.; Soleimani, H.; Govindan, K.; Bodaghi, B.; Fard, M.T.; Jafari, H. Closing the loop: Redesigning sustainable reverse logistics network in uncertain supply chains. Comput. Ind. Eng. 2021, 157, 107093. [Google Scholar] [CrossRef]

- Liu, X.; Sun, X.; Zheng, H.; Huang, D. Do policy incentives drive electric vehicle adoption? Evidence from China. Transp. Res. Part A Policy Pract. 2021, 150, 49–62. [Google Scholar] [CrossRef]

- Littlejohn, C.; Proost, S. What role for electric vehicles in the decarbonization of the car transport sector in Europe? Econ. Transp. 2022, 32, 100283. [Google Scholar] [CrossRef]

- Li, S.; Bin, Z.; Jia, D. Optimal decisions for hybrid manufacturing and remanufacturing with trade-in program and carbon tax. Omega 2024, 124, 103012. [Google Scholar] [CrossRef]

- Jauhari, W.A.; Pujawan, I.N.; Suef, M. A closed-loop supply chain inventory model with stochastic demand, hybrid production, carbon emissions, and take-back incentives. J. Clean. Prod. 2021, 320, 128835. [Google Scholar] [CrossRef]

- Guo, Y.; Wang, M.; Yang, F. Joint emission reduction strategy considering channel inconvenience under different recycling structures. Comput. Ind. Eng. 2022, 169, 108159. [Google Scholar] [CrossRef]

- Yang, L.; Lan, L.; Wan, Y. Recycling and differential pricing strategies in closed-loop supply chains considering blockchain. Electron. Commer. Res. 2024. [Google Scholar] [CrossRef]

- Zhang, X.G.; Zhu, S.L.; Dai, S.Q.; Jiang, Z.G.; Gong, Q.S.; Wang, Y. Optimization of third party take-back enterprise collection strategy based on blockchain and remanufacturing reverse logistics. Comput. Ind. Eng. 2024, 187, 109846. [Google Scholar] [CrossRef]

- Silva, E.R.D.S.; Lohmer, J.; Rohla, M.; Angelis, J. Unleashing the circular economy in the electric vehicle battery supply chain: A case study on data sharing and blockchain potential, Resources. Conserv. Recycl. 2023, 193, 106969. [Google Scholar] [CrossRef]

- Meyer, D.; Schaupensteiner, N.; Riquel, J. Business Models and Ecosystems in the Circular Economy Using the Example of Battery Second Use Storage Systems. Sustainability 2024, 16, 1906. [Google Scholar] [CrossRef]

- Bera, S.; Giri, B.C. Evolutionary game analysis for non-cooperative behavior of entities in a closed-loop green supply chain under government intervention. Soft Comput. 2023, 27, 17785–17808. [Google Scholar] [CrossRef]

- Zhang, Z.; Liang, H. Research on coordination of the NEV battery closed-loop supply chain considering CSR and fairness concerns in third-party recycling models. Sci. Rep. 2023, 13, 22172. [Google Scholar] [CrossRef]

- Wei, J.; Govindan, K.; Li, Y.; Zhao, J. Pricing and collecting decisions in a closed-loop supply chain with symmetric and asymmetric information. Comput. Oper. Res. 2015, 54, 257–265. [Google Scholar] [CrossRef]

- Jena, S.K.; Sarmah, S.P.; Padhi, S.S. Impact of government incentive on price competition of closed-loop supply chain systems. INFOR Inf. Syst. Oper. Res. 2018, 56, 192–224. [Google Scholar] [CrossRef]

- Liu, H.; Ye, L.L.; Sun, J.N. Automotive parts remanufacturing models: Consequences for ELV take-back under government regulations. J. Clean. Prod. 2023, 416, 137760. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Bhattacharya, S.; Wassenhove, L.N.V. Closed-loop supply chain models with product remanufacturing. Manag. Sci. 2004, 50, 239–252. [Google Scholar] [CrossRef]

- Turki, S.; Sauvey, C.; Rezg, N. Modeling and optimization of a manufacturing/remanufacturing system with storage facility under carbon cap and trade policy. J. Clean. Prod. 2018, 193, 441–458. [Google Scholar] [CrossRef]

- Wei, Y.; Zhu, R.; Tan, L. Emission trading scheme, technological innovation, and competitiveness: Evidence from China’s thermal power enterprises. J. Environ. Manag. 2022, 320, 115874. [Google Scholar] [CrossRef]

| Parameters | Definition |

|---|---|

| Carbon allowance market prices | |

| Unit price of metal elements sold under recycled battery echelon | |

| Unit cost of raw materials/remanufacturing used by BS | |

| Unit cost of manufacturing carried out by EVM | |

| Market demand under the i-model | |

| T | Free carbon allowances allocated to businesses by the government |

| Carbon emissions from BS and EVM under model i | |

| Selling price of batteries in S, M, L, and C modes by BS | |

| Selling prices of EVs by EVM in S, M, L, and C modes | |

| Level of the recycling effort | |

| Profitability of BS in S, M, L, and C models | |

| EVB profits in S, M, L, and C models |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qi, Y.; Yao, W.; Zhu, J. Study on the Selection of Recycling Strategies for the Echelon Utilization of Electric Vehicle Batteries under the Carbon Trading Policy. Sustainability 2024, 16, 7737. https://doi.org/10.3390/su16177737

Qi Y, Yao W, Zhu J. Study on the Selection of Recycling Strategies for the Echelon Utilization of Electric Vehicle Batteries under the Carbon Trading Policy. Sustainability. 2024; 16(17):7737. https://doi.org/10.3390/su16177737

Chicago/Turabian StyleQi, Yue, Weixin Yao, and Jiagui Zhu. 2024. "Study on the Selection of Recycling Strategies for the Echelon Utilization of Electric Vehicle Batteries under the Carbon Trading Policy" Sustainability 16, no. 17: 7737. https://doi.org/10.3390/su16177737