Abstract

This study presents an innovative financial model that integrates the debt-for-climate swap mechanism with Article 6 of the Paris Agreement, specifically designed to support Africa’s transition to clean energy. The model connects debt-for-climate swaps with the creation of internationally transferred mitigation outcomes (ITMOs), offering mutual benefits for both debtor and creditor nations. This approach aims to improve the debt sustainability of African countries while strengthening their climate resilience by combining Article 6 of the Paris Agreement with Official Development Assistance (ODA). Additionally, this model aligns with key Sustainable Development Goals (SDGs), including SDG 7 (Affordable and Clean Energy), SDG 13 (Climate Action), and SDG 17 (Partnerships for the Goals). Furthermore, the study proposes a restructuring of existing environmental safeguards by incorporating the “Do No Significant Harm” (DNSH) criteria and environmental contribution indicators to ensure alignment with the minimum safeguards mandated by Article 6 and international development standards. Through quantitative analysis, our findings indicate that the proposed debt-for-climate swap model could significantly contribute to Africa’s clean energy transition, address the region’s external debt challenges, and enhance climate resilience.

1. Introduction

The urgent need to tackle Africa’s external debt crisis alongside its climate vulnerability has intensified in recent years. With over USD 1.13 trillion in external debt and an annual requirement of USD 200 billion to transition to clean energy, Africa faces a critical intersection of financial and environmental challenges. While the international community has explored various solutions [1], such as debt-for-nature swaps and, more recently, debt-for-climate swaps, this model stands out.

It aligns with global climate objectives and directly supports the Sustainable Development Goals (SDGs), particularly SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action). By facilitating the reallocation of financial resources towards renewable energy and climate resilience, the model addresses both debt relief and climate action in a cohesive strategy.

The implementation of these mechanisms holds significant promise for bolstering the economic well-being of developing nations in two aspects: debt sustainability (i.e., SDG 17.4 [2]) and environmental sustainability. Developing countries face significant challenges, with total external debt service payments exceeding 20% of their revenue [3], underscoring the need to prioritize debt sustainability, particularly in the long term. Specifically in Africa, the median public debt has reached 65% of gross domestic product (GDP) [4]. To address this challenge, researchers have consistently examined debt-relief programs, such as the debt-for-climate swap model [5,6,7]. Moreover, incentivizing the allocation of fiscal resources towards mitigation and adaptation efforts can be linked to SDG 13 [8]. These mechanisms have the potential to significantly contribute to global efforts in addressing climate change. The specific cases analyzed in Section 2 demonstrate the benefits of responding to climate change. These research articles, based on case analysis, recommend implementing these programs while recognizing their contributions to both addressing climate change and enhancing environmental sustainability. Consequently, it is imperative to advocate for the proposal of a debt-for-climate swap model that aligns seamlessly with the evolving landscape of funding utilization to support climate actions in developing countries.

Furthermore, despite the absence of consensus at the 28th Conference of Parties, market mechanisms, governed by Article 6 of the Paris Agreement [9], continue to hold significant importance in international efforts to mitigate climate change. Unlike the clean development mechanism (CDM) under the Kyoto Protocol, these mechanisms ensure equal footing for all parties to the UNFCCC. This equality potentially steers a shift toward prioritizing the utilization of internationally transferred mitigation outcomes (ITMOs) to fulfill their respective nationally determined contributions (NDCs). Given the successive emergence of new mechanisms addressing international climate change, it becomes increasingly apparent that there is a pressing need to reform existing models of providing climate-related financial resources and development cooperation.

Recognizing the crucial role of research in this area, the authors focus on the primary research question, “How can we maximize the positive impact of new mechanisms on both climate resilience and debt sustainability in Africa?”. Additionally, the study explores supplementary questions, including “How can we develop effective environmental and social safeguards for the proposed models?” and “How can we forecast the financial benefits of these models?”. These inquiries aim to investigate the feasibility and potential of the proposed model in depth.

To address the primary research question, our study proposes a collaborative model that integrates the debt-for-climate swap mechanism with Article 6 of the Paris Agreement, with a specific focus on Article 6.4. Inspired by the debt-for-efficiency swap between Spain and Uruguay in 2005 [10], which was implemented under the clean development mechanism (CDM), our model aims to provide a practical solution for enhancing both climate resilience and debt sustainability.

To answer the supplementary research questions, the authors propose a restructuring of the current environmental safeguards within the Article 6 and Article 6.4 frameworks. This involves categorizing these criteria into two primary groups: DNSH (Do Not Significantly Harm) criteria and environmental contribution criteria. Additionally, the study includes a quantitative analysis of the proposed models, considering the requirements of Article 6, which involves providing internationally transferred mitigation outcomes (ITMOs) for contributing nations while simultaneously meeting their nationally determined contributions (NDCs). By building on scientific literature, such as [11], this study deepens the understanding of how debt swap mechanisms can contribute to sustainable development while considering the interplay between climate change, renewable energy, and investments aimed at advancing the Sustainable Development Goals (SDGs) (see [11]; Figure 2).

Based on these proposals, this study develops an institutional framework that aligns with both international development cooperation and the Paris Agreement’s market mechanisms. This framework aims to ensure coherence and effectiveness in project implementation, facilitating a seamless integration of climate and financial objectives.

Our paper puts forward a unified model for the debt-for-climate swap mechanism, intricately linked to Article 6 of the Paris Agreement. This model considers various facets of bilateral cooperation and the Paris Agreement market mechanisms, ensuring comprehensive coverage and alignment with global climate objectives. Furthermore, the debt-for-climate swap aligned with Article 6 provides a distinct advantage through the generation of internationally transferred mitigation outcomes (ITMOs), which are pivotal in addressing climate change for both debtor and creditor nations.

Significantly, the model presented operates on a debt-for-climate swap mechanism grounded in official development assistance (ODA). This approach aims to stimulate the use of contributing countries’ existing budgets for swiftly initiating relevant projects. Moreover, our design offers the potential for extending and applying the model to climate-related funding beyond development cooperation in the future, thereby broadening its scope and impact.

The Article 6-linked debt-for-climate swap proposed in this paper offers a financial framework to bolster Africa’s transition to clean energy. Simultaneously, it enhances the financial stability of African nations by leveraging diverse resources, including official development assistance (ODA).

The implementation of this innovative policy alternative is expected to yield significant benefits, particularly for Africa, which faces the dual challenge of needing USD 200 billion annually to transition to clean energy (as noted in [12], p. 154) while carrying an external debt burden of approximately USD 1 trillion (referenced in [13]). We believe that this study offers substantial policy implications, as it provides a foundation for improving debt sustainability in the African region and fosters a renewed commitment to climate action by alleviating the continent’s external debt pressures.

This paper is structured as follows. Section 2 presents an extensive review of previous research examining the connections between debt-for-nature swap mechanisms and debt-for-climate swap mechanisms and explores the correlation between debt swap and market mechanisms. Section 3 and Section 4.1 evaluate the necessity and appropriateness of integrating debt-for-climate swap mechanisms with Article 6 to support the clean energy transition in Africa. To determine the model’s suitability for the African context, the study analyzes data from prior clean development mechanism (CDM) projects—the market mechanism used before Article 6—specifically focusing on its application in the energy sector.

In Section 4.2 and Section 4.3, we propose a comprehensive model for the debt-for-climate swap mechanism linked with the Paris Agreement market mechanisms, drawing on the findings from the applicability assessment conducted in Section 3. Building on these insights, Section 5 calculates the potential benefits for both debtor and creditor countries, explores the future trajectory of utilizing the proposed model, and underscores the importance of further research into institutional changes based on classifications of official development assistance (ODA).

2. Literature Review

Research pertaining to debt swap mechanisms can be traced back to the inception of the debt-for-nature swap mechanism in 1988 [14]. This mechanism was broadly classified into two categories: debt/equity swaps and debt buyback (debt rescue) methods. It was observed that the debt-for-nature swap mechanism typically adopts the debt/equity swap approach. Furthermore, in order to expedite the implementation of this mechanism, Hansen proposed the utilization of existing concessional loans within the World Bank instead of entering into new agreements. This type of debt swap, leveraging existing development resources, could facilitate rapid implementation, thereby supporting efficient debt swap operations and ensuring swift stabilization within financial markets.

Building on Hansen’s pioneering research, debt swap mechanisms have garnered significant support from international financial institutions and development finance entities. A prominent illustration is the debt-for-nature swap mechanism established under the U.S. Tropical Forest Conservation Act (TFCA) [15]. An analysis of a debt swap arrangement was conducted between the U.S. Agency for International Development (USAID) and the Indonesian government in 2009. They highlighted that this agreement bolstered Indonesia’s national budgetary flexibility by leveraging interest rate adjustments, thereby presenting a novel form of official development assistance. However, concerns arose regarding the potential diversion of freed-up budget resources to non-climate-related areas. In response, they advocated for an ‘earmarking approach’ within the agreement, stipulating the specific allocation of budgetary funds to mitigate such risks.

Despite notable cases of success, the popularity of debt-for-nature swap mechanisms experienced a decline in the 2010s, coinciding with the emergence of initiatives like the Heavily Indebted Poor Countries (HIPC) support and the Multilateral Debt Relief Initiative (MDRI) from the G8 summit. However, discussions surrounding debt swap mechanisms regained momentum after 2020, particularly within the United Nations Framework Convention on Climate Change (UNFCCC). The creation of a Loss and Damage Fund has led to discussions about integrating debt swap agreements into its utilization strategy, supported by evidence such as [16]. This resurgence has sparked active discussions aimed at establishing a systematic and operational foundation for debt swap mechanisms.

Ref. [16] discussed the Seychelles debt-for-nature swap case, highlighting that the total debt volume remained unchanged, suggesting debt restructuring rather than reduction (debt rescue). While acknowledging the financial flexibility gained through restructuring, they underscored the limited benefit of enhancing the country’s debt sustainability since the actual debt remained unchanged. The study also noted the protracted negotiations and insufficient stakeholder involvement in implementing the mechanism, proposing that future negotiations for concluding debt swap agreements should adhere to timelines similar to those in traditional debt adjustment negotiations. Additionally, this research presented indicators for assessing the feasibility of the mechanism, including national financial status, creditworthiness, debt levels, climate vulnerability, and other pertinent objectives.

According to [17], countries ineligible for the Debt Service Suspension Initiative (DSSI) constitute over 70% of the world’s less-developed countries’ debt. They advocate for a mechanism whereby a debt swap agreement improves a country’s debt sustainability, with budgetary funds transparently channeled into a secured fund for the intended projects’ utilization. The study underscores the importance of nationally led efforts in concluding debt swap agreements and encourages private finance involvement to mitigate potential associated risks.

To summarize, the trajectory of research on debt swap agreements has progressed from the initial introduction of mechanisms to the examination of practical cases, with proposals for a systematic debt swap agreement mechanism at the forefront of the discourse. Concurrently, the convergence of debt swap mechanisms with market mechanisms under the United Nations Framework Convention on Climate Change has emerged as another avenue of research. Ref. [10] conducted a review of a bilateral efficiency-based debt swap mechanism between Spain and Uruguay, highlighting its alignment with the clean development mechanism under the Kyoto Protocol. The project entailed offsetting Uruguay’s debt of approximately USD 10,800,572 to Spain in exchange for investments in sustainable development. This was achieved through providing Certified Emission Reductions (CERs) generated from a debt swap-based project as compensation, with Spain being prioritized.

Nevertheless, the project underscores a notable issue inherent in the clean development mechanism: its perceived bias favoring Annex I countries over non-Annex I countries. This bias is evident in the project’s prioritization of financial contributions required to obtain Certified Emission Reductions (CERs). Consequently, it faces challenges for its recognition as official development assistance. This limitation motivates us to propose a model for official development assistance that aligns with the principles of the Paris Agreement market mechanisms, ensuring equitable treatment for all participating countries.

Moreover, it is crucial to evaluate the suitability of the debt-for-climate swap mechanism in Africa to address the research question, “How can we optimize the benefits of new mechanisms to enhance both climate resilience and debt sustainability in Africa?”. To this end, this paper reviews research related to debt-relief schemes in Africa.

Ref. [18] analyzes the impact of public debt financing on renewable energy development in sub-Saharan Africa (SSA). This study demonstrates the positive effects of public debt financing on renewable energy projects through economic analysis and recommends the debt-for-climate swap as a viable solution for renewable energy development in SSA. The findings of this research underscore the necessity of developing a debt-for-climate swap mechanism in Africa.

Reference [19] discusses the legal framework for debt cancellation in Africa within the context of international law. According to the study, the stringent conditions attached to foreign loans make it challenging for recipient countries to comply, increasing their dependency on further borrowing from donor countries. To address this issue, the “necessity principle” can be invoked to justify the rapid suspension or cancellation of a state’s debt repayment obligations, allowing them to refuse the stringent conditions linked to foreign loans.

For the theoretical foundation of the Article 6-linked debt-for-climate swap mechanism, the “necessity principle” can be applied. This principle uses the urgency of combating climate change to justify the rapid cancellation of national debt, enabling the implementation of Article 6 projects that directly address climate change.

Based on the above analysis, we examine the discourse surrounding key performance indicators (KPIs) used in managing Africa’s debt to aid in selecting projects under the proposed mechanism. Ref. [20] introduced KPIs utilized in debt restructuring in the western Africa region, categorizing them into climate and nature-related outcomes and processes, policy actions, and projects involved in the institutional implementation process. Additionally, it details the measurement of their monetary values. Specifically, in the domain of policy (political) actions, they conducted a comprehensive review of nationally determined contributions (NDCs), national action plans (NAP), and other pertinent factors throughout the project lifecycle. They emphasized that only climate change mitigation actions not mandated for developing countries can be considered under the debt swap mechanism.

Incorporating this research, a comprehensive landscape of research trends emerges regarding Africa’s strategies to confront climate change. Notably, climate litigation cases span a spectrum from the energy sector, central to the proposed in this paper, to human rights, as referenced in [21].

In light of existing research, this study is significant on several fronts. Firstly, it introduces a novel research topic by proposing a model that integrates the debt-for-climate swap mechanism with the Paris Agreement’s market mechanisms, an area not extensively covered in current literature. Secondly, it goes beyond presenting a basic model by incorporating aspects of official development assistance, green taxonomies, and market mechanisms—elements not addressed in existing research. Lastly, it highlights the urgent need for creditor countries within the international community to accelerate the adoption of debt-for-climate swap mechanisms linked to Article 6 of the Paris Agreement.

3. Necessity of the Debt-for-Climate Swap Model

The African continent is currently dealing with two major crises: a climate crisis and a debt crisis. As a result, there is now an urgent requirement for climate finance in Africa. Despite the existence of international climate finance mechanisms like the Green Climate Fund (GCF) and the Global Environment Facility (GEF), they are inadequate in addressing Africa’s climate finance requirements.

The procedures of the Green Climate Fund for commencing funding-based projects are complex, leading to challenges for African countries in obtaining the required financial resources. The World Resources Institute (WRI) identifies various areas where limitations in accessing the Green Climate Fund (GCF) are evident [22]. The readiness support has primarily prioritized National Designated Authorities (NDAs) over Direct Access Entities (DAEs). This implies that even organizations authorized for ‘Direct Access’ encounter challenges in obtaining project funding directly from the Green Climate Fund.

In this particular context, Development Assistance Entities are unable to obtain assistance for the development of project proposals from the Project Preparation Facility. The Project Preparation Facility (PPF) is a financing tool created to aid in the development of project ideas and funding proposals utilizing both monetary and non-monetary approaches. Nevertheless, the topics of discussion within the GCF PPF have centered on entities whose concept notes have received endorsement from the GCF Secretariat. As a result, DAEs lacking approved projects encounter substantial challenges in developing their concept notes autonomously, impacting over two-thirds of the DAEs benefiting from the GCF PPF.

In addition to the challenges concerning access to project funding, the complexity of international climate finance mechanisms often results in delays in the timely allocation of funds to meet demands. In addition, the debt crisis in Africa worsens the situation, posing additional threats and constraints to the continent’s ability to address climate change. African countries are facing significant pressure from creditors to repay debts that exceed USD 1 trillion. In addition to climate finance, there are significant global initiatives designed to tackle the issue of the debt crisis, including the Debt Service Suspension Initiative (DSSI). The Debt Service Suspension Initiative (DSSI), created by the Group of Twenty (G20) in May 2020, has facilitated the suspension of debt for low-income countries.

Nevertheless, the Debt Service Suspension Initiative (DSSI) has shown inefficacy as a result of limited involvement from private lenders and Multilateral Development Banks (MDBs). Eurodad’s data indicate that eligible countries have only achieved a 16.8% debt suspension rate. This suggests a lack of motivation for MDBs or private lenders to engage in the Debt Service Suspension Initiative, diminishing its efficacy [23].

As a result, nations that qualify for the Debt Service Suspension Initiative (DSSI) have only utilized a small proportion of their available debt relief and have explored alternative approaches to restructuring or suspending their debt. For example, Zambia sought to reorganize its USD 750 million national debt with the assistance of private consulting firms, as opposed to utilizing Debt Service Suspension Initiative (DSSI) measures.

Even though Zambia met the criteria to benefit from the Debt Service Suspension Initiative, it chose to work with private lenders and consulting firms for the process of restructuring its debt. This case demonstrates the real-world implications connected to the previously mentioned subjects.

Table 1 presents a summary of the aforementioned analysis based on [22,23], with a focus on the primary mechanisms related to climate finance and debt suspension.

Table 1.

Limitation analysis of major finance mechanisms for crises.

According to the analysis provided, the debt-for-climate swap model linked to Article 6 offers benefits that can assist in addressing access issues and offer incentives for participants in the market. First, the debt-for-climate swap program associated with Article 6 is strictly regulated by bilateral cooperation. This indicates that the bilateral agreement regarding Article 6-linked debt-for-climate swap, along with the negotiation process for the agreement, can enable both countries to execute the debt swap and, in the end, acknowledge the complete access of debtor countries to the financing.

Additionally, the model presented in this paper harmonizes the incentives for a market with Article 6 of the Paris Agreement. Article 6 of the United Nations Framework Convention on Climate Change (UNFCCC) facilitates collaboration among parties to reduce greenhouse gas emissions. Consequently, each party can obtain internationally transferred mitigation outcomes (ITMOs) as a result of this process.

The prevailing attitude toward Article 6 is generally favorable when utilizing this system. The GGGI has identified a prevailing favorable attitude toward initiatives that focus on generating additional value streams to enable countries to achieve their objectives, fostering a vibrant private sector to support the transition to low-carbon practices, and promoting sustainable development with reduced emissions [24].

Hence, the debt-for-climate swap model associated with Article 6 has the potential to motivate countries and private sectors within those countries to engage actively in this initiative. The specifics of the debt-for-climate swap model linked with Article 6 will be proposed in Section 4.

4. Conditions for the Success of Article 6-Linked Debt-for-Climate Swap Model

4.1. The Adaptability of Africa’s Clean Energy Transition and Market Mechanisms

This study delves into the application of the Article 6-linked debt-for-climate swap model within the context of Africa’s clean energy transition. Thus, it is paramount to assess the suitability of the proposed model for Africa to facilitate the subsequent rapid implementation and establishment of related mechanisms. This chapter meticulously evaluates the status of Africa’s clean energy transition and external debt while also scrutinizing the adaptability of both the debt swap and Paris Agreement market mechanisms within the African context.

Despite Africa contributing “the least” to global greenhouse gas emissions [12], the continent remains highly vulnerable to the impacts of climate change, primarily due to its susceptibility to climate variability. Of particular concern is the reliance of African economies on sectors sensitive to climate change, including energy, transportation, and agriculture. Consequently, addressing climate change has emerged as a formidable challenge for African economies.

However, Africa has faced challenges securing funds for climate actions, exacerbated by the escalating debt burden, which reached USD 1.13 trillion in 2023 across various countries in the region. Compounding this issue are the tightening monetary policies of developed countries, placing additional strain on the sixteen countries within the region expected to repay approximately USD 22.3 billion in debt shortly [13]. Meanwhile, the projected additional funding required for Africa’s clean energy transition stands at USD 200 billion annually until 2030, necessitating a minimum financial capacity of over USD 1.2 trillion over the next 6–7 years [12].

In the context of Africa’s clean energy transition and external debt, debt swap mechanisms emerge as innovative financing instruments facilitated by major financial institutions such as the AfDB. Furthermore, given the challenges African nations encounter in securing domestic financial capacity, external funding has the potential to bolster debt sustainability. This, in turn, can initiate a positive feedback loop by utilizing secured financial surpluses for the clean energy transition.

Subsequently, an assessment of the adaptability between Africa’s clean energy transition and the market mechanisms of the Paris Agreement is undertaken. Initially, owing to the incomplete finalization of detailed methodologies, data pertaining to project implementation and management under Article 6 can be insufficient. Therefore, coherence assessment is conducted based on the analysis of clean development mechanism (CDM) projects in Africa, which serve as precursors to Article 6 of the Paris Agreement.

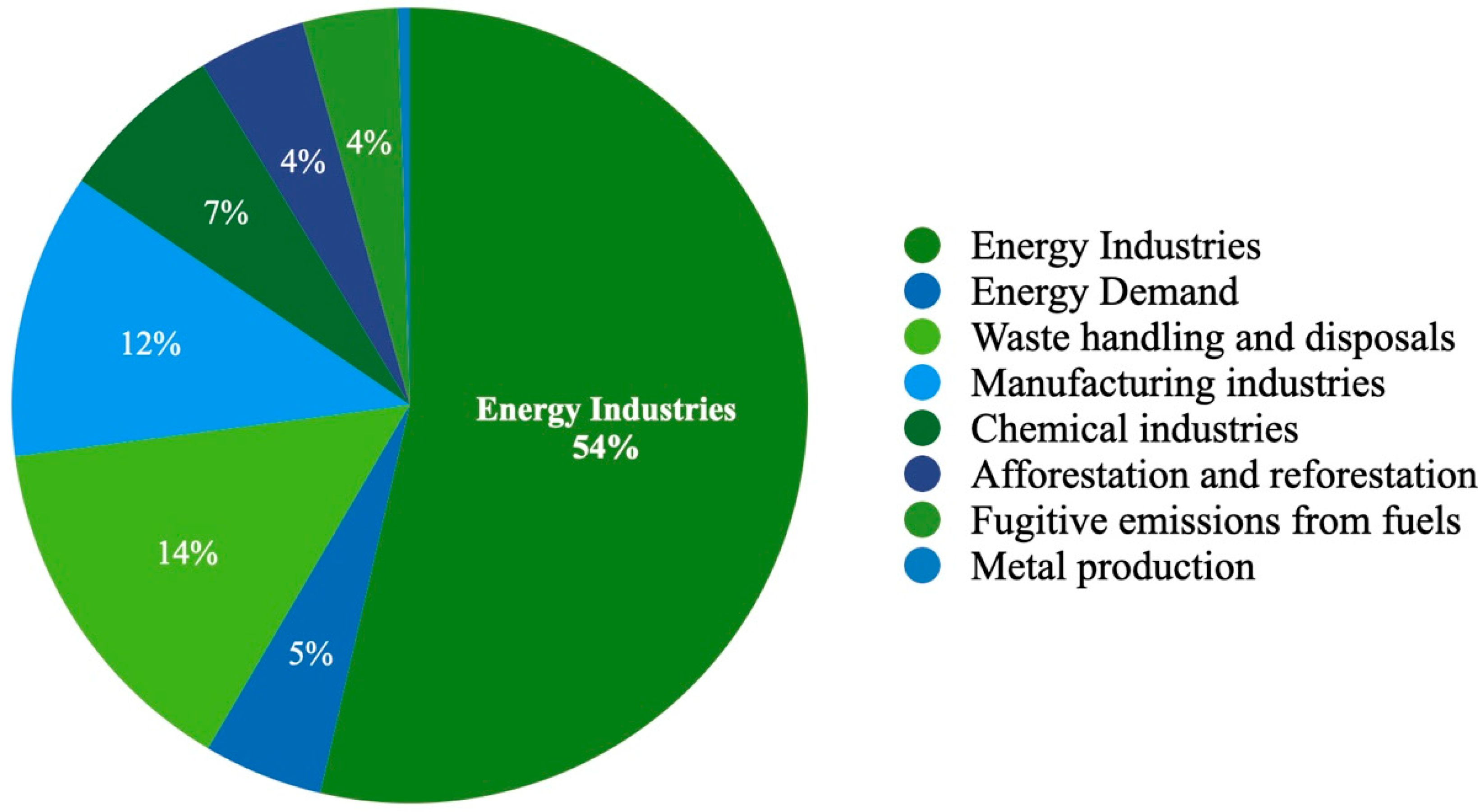

CDM projects in Africa encompass eight sectors, as illustrated in Figure 1. Notably, the sectors directly pertinent to this study are Energy Industries and Energy Demand, jointly constituting 59% of all projects [25]. Moreover, given the relevance of energy-related aspects to industrial classifications such as Manufacturing Industries, Metal Production, and Chemical Industries, the proportion is anticipated to be even higher, as depicted in Figure 1.

Figure 1.

Analysis of CDM activities in Africa.

As depicted in Figure 1, clean development mechanism (CDM) projects in Africa predominantly concentrate on the energy sector. Entities involved in these projects prioritize greenhouse gas reductions, primarily through activities such as energy transition and efficiency enhancement. Given this trend, it is reasonable to expect a similar emphasis on energy-related projects under the Paris Agreement market mechanisms succeeding the CDM. Consequently, the application of the proposed debt-for-climate swap model linked with the Paris Agreement market mechanisms for clean energy transition in Africa appears promising. We can infer that, akin to the clean development mechanism, the proposed system holds potential for successful implementation, particularly considering the notable track record of greenhouse gas reduction achievements facilitated by energy sector projects under the clean development mechanism.

It is essential to acknowledge that, unlike the clean development mechanism, market mechanisms specified under Article 6 of the Paris Agreement entail parties engaging in activities on an equal footing, securing mitigation outcomes known as ITMOs to fulfill their nationally determined contributions. In this context, future projects are anticipated to involve the proportional allocation of ITMOs among participating countries rather than allowing individual countries to secure their mitigation outcomes independently. While projects under the Paris Agreement market mechanisms may not operate identically to those under the clean development mechanism, the demonstrated effectiveness of greenhouse gas reduction achieved through the application of previous market mechanisms in the energy industry justifies the utilization of Article 6-based market mechanisms for clean energy transition.

4.2. Indicative Criteria: DNSH and Environmental Contribution Criteria

The Article 6-linked debt-for-climate swap model outlined in this study is crafted as a collaborative framework that merges debt relief in the guise of official development assistance with project implementation based on market mechanisms. Additionally, the debt-for-climate swap, hinged upon Debtor Countries’ commitments to channel investments toward climate change mitigation within the context of debt swap agreements, highlights the importance of evaluating the environmental integrity of associated projects.

Considering these attributes, it becomes crucial to establish criteria that can effectively be applied within the realms of environmental official development assistance and the Paris Agreement market mechanism simultaneously. In this paper, acknowledging the indispensability of such key performance indicators, our objective is to introduce illustrative criteria, referred to as indicative criteria. These criteria, divided into Do No Significant Harm (DNSH) criteria and environmental contribution criteria, are adept at encompassing the two aforementioned elements.

First, the indicative criteria outlined in this study mirror the attributes of environmental official development assistance and are harmonized with the policies of the United States, the principal contributor to global official development assistance [26]. This alignment optimizes indicators for large-scale development finance [27]. Furthermore, this study has scrutinized green taxonomies to appraise the green economic activities of projects under the Article 6-linked debt-for-climate swap model and to evaluate the minimum criteria that these projects must meet.

In this endeavor, we integrated the Do No Significant Harm (DNSH) criteria outlined in the European Union Green Taxonomy [28], South Korea’s Green Taxonomy [29], and the Republic of South Africa’s Green Taxonomy [30].

The Korean Green Taxonomy is customized to harmonize with the nationally determined contributions (NDCs), placing emphasis on emissions reduction within the transition and industrial sectors [29]. This alignment stems from the acknowledgment that it aligns with the expected demand for greenhouse gas reduction in Africa’s transition and industry sectors, reflecting its future industrial development. On the other hand, the European Union Green Taxonomy has been integrated by considering the traits of Africa’s traditional major trading markets [28]. The objective is to fortify resilience against the recent reinforcement of environmental regulations by the European Union, which includes measures aimed at curbing greenwashing practices.

The Green Taxonomy of the Republic of South Africa [30] stands out as the sole green classification system on the African continent. Its inclusion in this study serves to capture the distinct characteristics of a country possessing such a system. Simultaneously, our aim is to furnish indicators that effectively evaluate green economic activities suited for the African region, the primary focus of the proposed debt swap model. By incorporating the principles of environmental official development assistance and green taxonomies, we advocate for the adoption of the DNSH (Do No Significant Harm) criteria as the minimum environmental and human safeguard. These criteria are detailed in Table 2 below. The following table was restructured by authors based on the European Union Green Taxonomy [28], South Korea’s Green Taxonomy [29], and the Republic of South Africa’s Green Taxonomy [30].

Table 2.

Indicative Criteria: DNSH Criteria.

The indicators listed in Table 2 provide comprehensive coverage of the critical areas concerning existing climate change mitigation and adaptation endeavors. Moreover, they are crafted to integrate values pertinent to biodiversity and natural assets, as mandated by the Convention on Biological Diversity (CBD) and the Task Force on Nature-Related Financial Disclosures (TNFD). Additionally, these indicators encompass specific principles delineated in Guidance on cooperative approach referred to in Article 6, Paragraph 2, of the Paris Agreement [31] and Rules, modalities and procedures of the mechanism established by Article 6, paragraph 4, of the Paris Agreement. [32], including the mitigation of non-permanence risk.

In the proposed model, if a project meets the formulated criteria for all DNSH criteria, a determination regarding the significance and extent of its environmental contributions will be based on these criteria’s values. This determination will ultimately dictate whether the project progresses and qualifies for a debt swap agreement. The objective is to establish a foundation for deploying investments resulting from these debt swap agreements to fund climate actions. This approach mirrors the methodology employed within the framework of the green taxonomy adopted in the three countries examined above. Furthermore, this approach integrates the guidelines associated with the Paris Agreement market mechanisms, particularly Article 6, Paragraph 2, Guidance [31] and Article 6, Paragraph 4, Rules, Modalities, and Procedures [32].

Significantly, the notions of additionality and co-benefits in mitigation are integrated, necessitating the voluntary reduction of harmful emissions and linking greenhouse gas abatement with climate change adaptation. The indicative environmental contribution criteria reflecting these considerations are outlined in Table 3 below (authors, referred to [31,32,33]). If a project meets the criteria established for all these indicators, it qualifies for the Article 6-linked debt-for-climate swap, as it generates substantial environmental contributions and adheres to the core principles of major green taxonomy and environmental official development assistance.

Table 3.

Indicative Criteria: Environmental Contribution Criteria.

4.3. Combined Model of ODA and Article 6-Linked Debt-for-Climate Swap and Considerations

The Article 6-linked debt-for-climate swap model can be delineated into two categories. First, the debt-for-climate swap predicated on development funds, embodying the essence of official development assistance, and second, the implementation of Article 6.4 mechanism projects, which is governed by the UNFCCC A6.4 Supervisory Body, financed by national budgets equivalent to the amount of the debt swap.

Before introducing the model, it is important to explain the rationale for selecting Article 6.4, also known as the “Paris Agreement Crediting Mechanism”. The Article 6.4 mechanism is a centralized approach, distinct from projects based on Article 6.2, allowing for more comprehensive guidelines to ensure transparency and safeguard measures. Therefore, the authors conclude that Article 6.4 is a more suitable choice for this model. Given the above distinctions, it is crucial to devise a mechanism with careful consideration of its alignment with the Paris Agreement market mechanisms and adherence to Article 6-related guidelines to the principles of the clean development mechanism. This includes ensuring that official development assistance budgets are not directly invested in projects aimed solely at obtaining Certified Emission Reductions (CERs).

On 30 April 2004, the High-Level Meeting of the Organization for Economic Cooperation and Development (OECD) Development Assistance Committee (DAC) convened to discuss the appropriateness of utilizing official development assistance funds within the framework of the clean development mechanism.

While recognizing the potential for utilizing official development assistance in implementing projects under the clean development mechanism, it was determined that any Certified Emission Reductions (CERs) generated from projects funded by official development assistance must be fully reimbursed to the creditor countries. Consequently, creditor countries are mandated to deduct the monetary value of these emission reductions from their official development assistance budgets.

However, the guidelines and provisions outlined in 2021 for the Paris Agreement in Article 6.2 and Article 6.4 do not specify the relationship between internationally transferred mitigation outcomes (ITMOs) and official development assistance [31,32]. Nevertheless, given that the Article 6.4 mechanism in the Paris Agreement is anticipated to incorporate aspects of the clean development mechanism, some alignment with the international resolutions concerning the clean development mechanism is expected.

Given the potential scenarios discussed above, where official development assistance finance directly fuels the implementation of market mechanisms, including the Article 6.4 mechanism, it is anticipated that any resulting internationally transferred mitigation outcomes (ITMOs) from such projects would either predominantly benefit the creditor countries or be structured in their favor. This stands in contrast to the former market mechanism, the clean development mechanism, which enabled creditor countries to fully acquire emission reductions. However, within the framework of the Paris Agreement market mechanisms, entirely favoring creditor countries with ITMOs could undermine the emission reduction incentives of host countries.

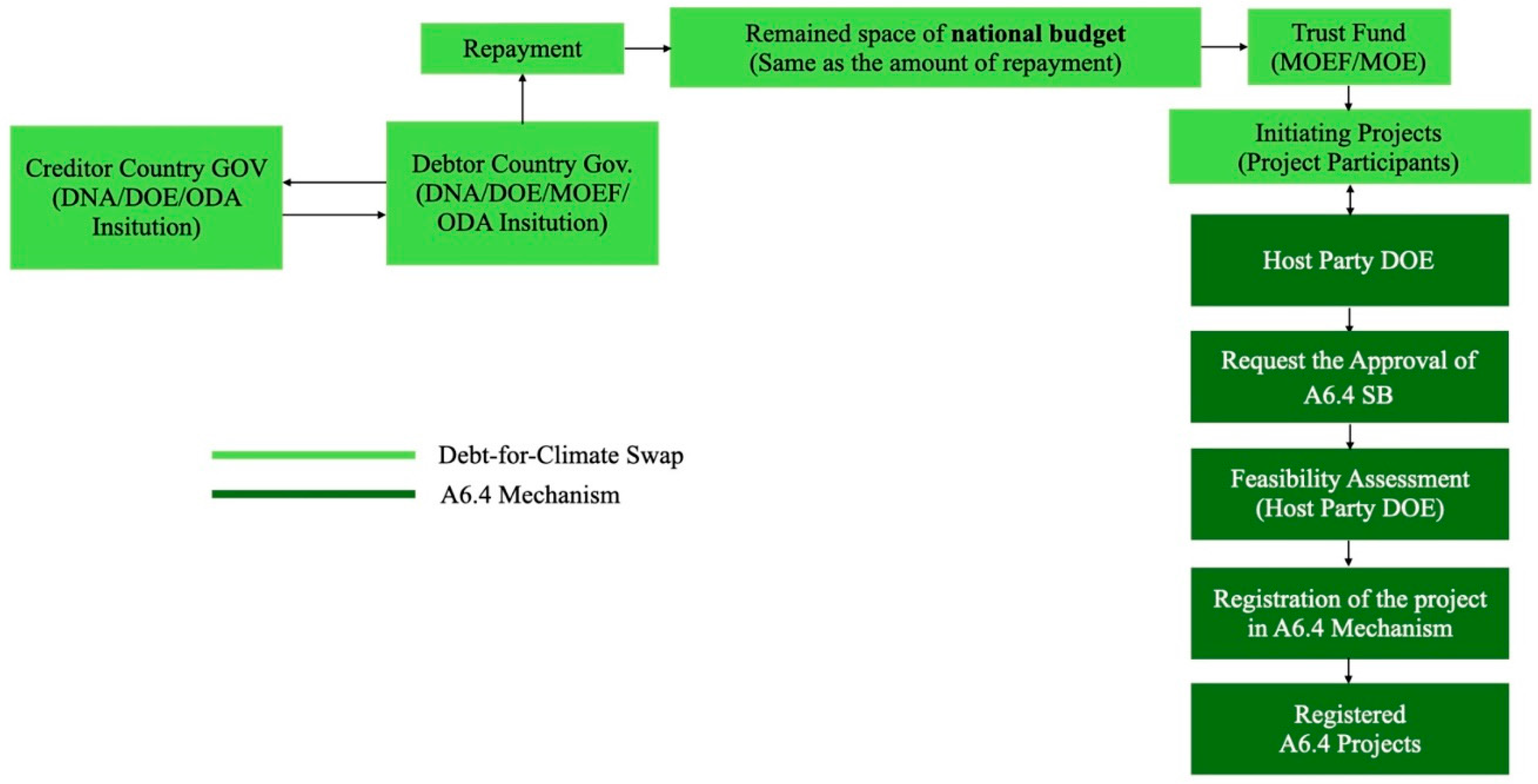

However, diverging from the aforementioned discussion, the proposed Article 6-linked debt-for-climate swap model, depicted in Figure 2 below, enables an indirect allocation of official development assistance funds into the project’s financing. This presents an alternative interpretation to the analysis provided earlier.

Figure 2.

Article 6-Linked Debt-for-Climate Swap Model: Debt Swap and Initiating A6.4 Project.

In Figure 2, the key stakeholders encompass the Creditor Country (Donor Country) and the Debtor Country (Recipient Country), which comprise governmental bodies like the Ministry of Environment and the Ministry of Planning and Finance. Additionally, official development assistance institutions, Designated National Authority (DNA) appointed under the Paris Agreement Article 6.4 mechanism, Designated Operating Entity (DOE), and project participants engaged in Article 6.4 mechanism projects are integral components.

In the initial phase of implementing this system, the Creditor Country initiates the Article 6-linked debt-for-climate swap, paving the way for the Debtor Country’s participation. Here, the Debtor Country formulates projects involving its own project participants for Article 6.4 mechanism-based initiatives. These projects, inclusive of plans for debt offset utilization, are then submitted for approval.

Subsequently, the Creditor Country engages in consultations with the Designated National Authority and Designated Operating Entity (DOE), official development assistance institutions, and pertinent government departments to enlist project participants. Once recruited, the Creditor Country’s project participants conduct their own feasibility assessments and provide support to the project, collaborating closely with the Debtor Country’s project participants to advance detailed project development. Furthermore, discussions between the Creditor Country’s official development assistance institutions and the Debtor Country’s government regarding the form, either concessional or non-concessional, and amount of aid take place.

During these discussions, the Designated National Authority (DNA), Designated Operating Entity (DOE), and project participants from both countries collaborate to negotiate the project duration. This step aligns with the ‘Rules, modalities, and procedures for the mechanism established by Article 6, Paragraph 4, of the Paris Agreement’ [32], which requires the selection of one of the two project types for the crediting period. Furthermore, the Creditor Country must continuously monitor the progress of the Debtor Country’s project and provide risk mitigation by facilitating the phased disbursement of funds. Potential negotiation options incorporating these considerations are outlined in Table 4.

Table 4.

Potential Negotiation Options (project types) of Article 6-related Debt-for-Climate Swap (Source: Authors, referring the V. A. 31. (f) of the Rules, modalities, and procedures for the mechanism established by Article 6, Paragraph 4, of the Paris Agreement, see [32].).

Upon completing the viability assessment of the Debtor Country’s debt swap utilization plan, negotiating funding, and allocating ITMOs among project participants in the Article 6.4 mechanism project, both countries formally initiate the system by signing agreements like the Record of Discussion (R/D). Subsequently, the Creditor Country offsets liabilities according to the agreed terms, while the Debtor Country transparently allocates a portion of the debt offset to a trust fund [34].

According to these negotiations, the Creditor Country and Debtor Country’s project participants begin project implementation. Throughout this phase, project participants maintain ongoing communication with the Debtor Country’s Designated Operating Entity (DOE) to implement the DOE feasibility assessment and to seek approval for the Article 6.4 mechanism project from the Article 6.4 Supervisory Body.

Following these steps, the project initiation phase of the Article 6-linked debt-for-climate swap is completed. This process aligns with the indirect utilization of official development assistance funds. The rationale behind this lies in the fact that the resources funding the Article 6.4-based project primarily come from the budget of the Debtor Country. Therefore, it can be interpreted that collaboration between the Debtor Country and external actors, especially project participants originating from the Creditor Country, applies to the Paris Agreement market mechanism, as it operates within the accounting framework of the Debtor Country’s budget.

In this interpretation, the Creditor Country provides its official development assistance funds not for the purpose of acquiring internationally transferred mitigation outcomes (ITMOs) but rather to enhance the Debtor Country’s debt sustainability and strengthen climate actions. Subsequently, the Debtor Country utilizes these funds to undertake climate actions through the utilization of the Article 6.4 mechanism. The involvement of project participants from the Creditor Country stems from the Creditor Country’s utilization of the Paris Agreement Article 6.4 mechanism, aligning with the purpose of providing technical support within the context of a debt swap agreement.

However, the interpretation of technical support may not be applicable if there is a lack of prior bilateral agreement on climate change cooperation. Therefore, when selecting the Debtor Country, the Creditor Country needs to assess whether a bilateral framework agreement on climate change cooperation has been reached. An exemplary instance of such a bilateral agreement is the ongoing bilateral climate cooperation framework agreement actively promoted by South Korea. South Korea is accelerating the conclusion of bilateral climate cooperation agreements for international mitigation projects currently in progress with eighteen countries, such as Vietnam, Mongolia, Gabon, and Uzbekistan [35,36,37,38,39].

The framework agreement for climate cooperation in the Republic of Korea typically comprehensively outlines collaborative activities between the two nations and sectors specified in Articles 2 (Areas of Cooperation) and 3 (Cooperative Activities). Additionally, Article 4 (Voluntary Cooperation under the Paris Agreement) introduces specific provisions for cooperation in implementing projects within the Paris Agreement market mechanisms. If such an agreement is concluded between the Creditor Country and the Debtor Country, it allows for the involvement of project participants from the Creditor Country as part of collaborative efforts that provide technical support and help in the joint management of projects related to the implementation of Paris Agreement Article 6.4 mechanisms.

Taking the above into account, it becomes evident that Article 6-linked debt-for-climate swap agreements can effectively address issues related to the utilization of official development assistance budgets for acquiring internationally transferred mitigation outcomes (ITMOs). Moreover, it offers the advantage of allowing the mitigation outcomes generated through the participation of project participants from the Creditor Country to be utilized upon receipt, aligning seamlessly with nationally determined contributions (NDCs) and other international mitigation purposes (OIMPs). Furthermore, by leveraging the regulations outlined in Article 6 of the Paris Agreement, this mechanism facilitates monitoring without necessitating the establishment of a separate monitoring system at the official development assistance level, thereby yielding additional benefits.

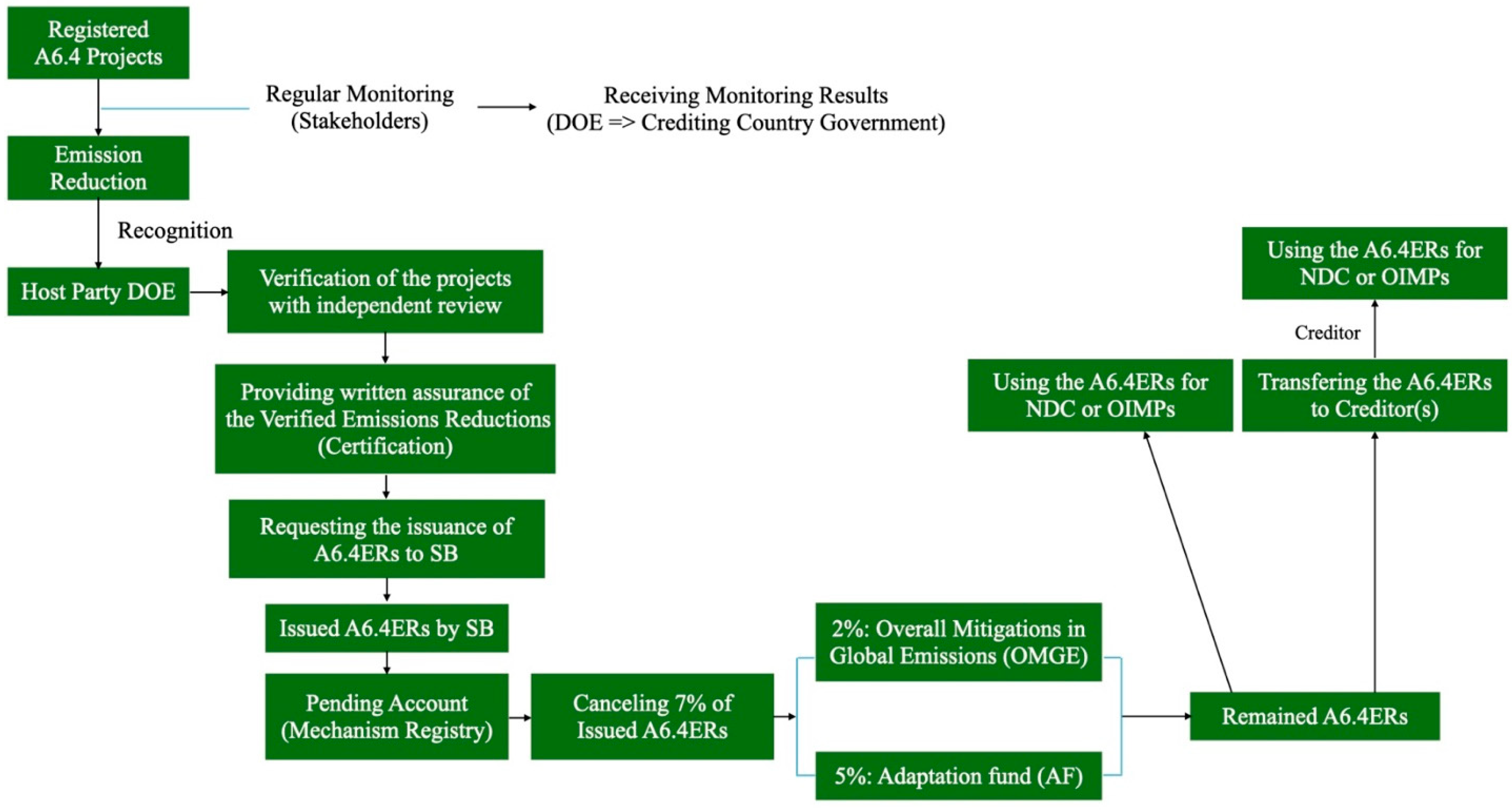

This rationale is depicted in the monitoring and A6.4ERs acquisition stages, as illustrated in Figure 3 below. As per the rules, modalities, and procedures outlined in Article 6, Paragraph 4 of the Paris Agreement, each project participant is mandated to continuously monitor the greenhouse gas reductions produced by the project throughout specified monitoring periods. Furthermore, there is an obligation to monitor potential reversals in greenhouse gas reductions, thus mitigating non-permanence risks linked to these reductions.

Figure 3.

Article 6-Linked Debt-for-Climate Swap Model: Monitoring and A6.4ERs Acquisition.

Projects enrolled in the Article 6.4 mechanism necessitate the provision of extensive information, encompassing technology and equipment specifics, major schedules and incremental progress, greenhouse gas reduction and removal data, and quality assurance protocols. It is worth highlighting that the rigorous oversight of greenhouse gas reduction, mandated through the disclosure obligations, is in harmony with leveraging this system to bolster climate action, as delineated in Table 5 ([32], p.26) below.

Table 5.

The Obligatory Calculations Related to the Greenhouse Gases Reduction or Net Removal.

Moreover, the monitoring process, guided by the aforementioned provisions, is undertaken by project participants and stakeholders. Subsequently, the monitoring data are relayed to the Article 6.4 supervisory body and the designated national authority, enabling the host country government to oversee project status through the designated national authority. As a result, the deployment of the debt-for-climate swap agreement for climate-related projects can be monitored via the obligatory monitoring-based reports stipulated in Article 6, eliminating the necessity for separate monitoring of the utilization of debt swap funds.

Following the monitoring phase, project participants (DOEs) initiate the issuance of A6.4ERs from the Article 6.4 supervisory body by furnishing a verified report detailing the extent of greenhouse gas reduction achieved during the monitoring period. Upon approval of the issuance, seven percent of the issued A6.4ERs are automatically nullified and redirected to the mechanism account. Once this step is completed, the remaining A6.4ERs are allocated to the host country’s account, with the intention of distributing the credits to the Creditor Country’s account based on the predetermined ratio outlined in the Record of Discussion (R/D). This procedural framework enables both countries to leverage the obtained A6.4ERs toward fulfilling their nationally determined contributions (NDCs) or other international mitigation purposes (OIMPs).

5. Article 6-Linked Debt-for-Climate Swap Model: Advantages and Considerations

This study has examined the key factors for success, fundamental models, and additional considerations in implementing the Article 6-linked debt-for-climate swap model. Before delving into the positive impacts of the proposed swap on debt sustainability enhancement and addressing the monitoring challenges of existing debt swap mechanisms, this chapter seeks to assess the necessity for a debt swap mechanism. This is due to the insufficient revenues solely from Article 6.4 Emission Reductions (A6.4ERs) to support Article 6.4 mechanism projects. To accomplish this, it analyzes the average project costs, emission reductions, and the price of Certified Emission Reductions (CERs) within clean development mechanism (CDM) projects in Africa.

The selection process relied on the CDM pipeline from the United Nations Environmental Programme Copenhagen Climate Center [40]. The information in this pipeline, including numeric values, is based on the UNFCCC CDM project data from Project Activity (PA) and Programme of Activities (PoA). It was designed to select only projects aligned with Article 6 of the Paris Agreement and the main nationally determined contributions (NDCs). This ensures that projects are in line with both Article 6 and primary NDCs. It is important because credits from CDM projects can seamlessly transfer to A6.4ERs if the projects undergo Paris Agreement Article 6 conversion.

Six African CDM projects meeting these criteria were identified, with an average project cost of USD 127 million. Considering the 7% cancellation of total A6.4ERs for overall mitigation in global emissions (OMGE) and the Adaptation Fund as outlined in [32], the average potential for Article 6.4 Emission Reductions (A6.4ERs) is 860,250 tCO2e (tons of CO2 equivalent). With an average price of Certified Emission Reductions (CERs) at USD 26.59 per ton, this results in a potential revenue of USD 22,874,047.50 from CDM emission reductions. This revenue is calculated by multiplying the average total emission reductions by the average CER price. A detailed analysis of these calculations, which is based on [40], is provided in Table 6 below.

Table 6.

Analysis of Clean Development Mechanism Projects in Africa.

Upon comparing these figures, it becomes clear that the revenue from anticipated A6.4ERs based on CDM emission reductions is approximately one-fifth of the average project cost. This underscores the need for additional funding beyond what A6.4ERs alone can provide for Paris Agreement Article 6-based projects. This necessity is addressed in this paper through mechanisms such as the Article 6-linked debt-for-climate swap.

Next, this paper outlines four premises to illustrate the enhancement in debt sustainability facilitated by the Article 6-linked debt-for-climate swap. Firstly, achieving total debt relief based on the entire project cost is considered practically unattainable, even when solely relying on the foreign assistance budget of the United States, the primary contributor to Africa [41]. Instead, the swap depends on the revenue expected to be generated through A6.4ERs.

Furthermore, to optimize the benefits of this mechanism, a debt rescue approach based on debt swaps must be implemented. Additionally, considering the nature of the Paris Agreement regime, which mandates all parties to reduce emissions, Donor Countries should provide A6.4ERs to recipient countries in a favorable proportion. In this chapter, a 60:40 ratio is established based on the assumption that the energy sector in Africa contributes to 60% of national greenhouse gas emissions, using Nigeria’s energy sector as a representative example [42]. The refined approach for the quantitative analysis of this model, which will be detailed in future research, will be developed as more data related to ITMOs from Article 6 projects become available.

Consequently, a debt swap is envisioned to be executed according to this ratio, with debt relief set at 60% of the anticipated revenue attainable through A6.4ERs. Lastly, as indicated in Table 4 of this paper, accounting for varying crediting periods, all debt relief is assumed to be allocated proportionally within the respective crediting period.

Based on these premises, 60% of the anticipated revenue from A6.4ERs, which amounts to USD 13,724,428.50, would be allocated to the Creditor Country. According to Table 4, the potential distribution to the Creditor Country over the crediting period is detailed in Table 7 (authors referred to [32]).

Table 7.

Potential Distribution from A6.4ERs to Creditor Country.

Considering these scenarios, executing the Article 6-linked debt-for-climate swap within the budget allocations of the United States foreign assistance-related budget, the primary contributor to Africa, is deemed feasible. Other countries, such as South Korea, may utilize joint funding through international organizations to facilitate the swap.

However, when devising budgets with this approach, each country must contemplate integrating A6.4ERs into their domestic markets before selling them. For example, if A6.4ERs were integrated into the European Union Emissions Trading System (ETS), with the current price at USD 73.11 per ton as of 20 April 2024 [43], the anticipated revenue from A6.4ERs could be projected at USD 62,892,977.5.

Under the assumptions outlined above, if the Article 6-linked debt-for-climate swap were implemented, Debtor Countries could free up financial resources equivalent to the debt repayment of USD 13,724,428.5 by repaying debts. At the same time, they could obtain 40% of A6.4ERs to fulfill their NDC commitments or generate revenue through market sales while implementing climate change adaptation projects.

By providing funding, donor countries would receive 60% of the A6.4ERs generated by the projects, allowing them to earn revenue through NDC utilization or other international mitigation purposes (OIMPs) utilization. Moreover, it is anticipated that the Article 6-linked debt-for-climate swap agreements would address challenges in the implementation of existing debt swap systems, particularly concerning the resolution of monitoring issues. Current debt swap mechanisms utilize various monitoring methods and exhibit different transaction characteristics for each project, posing challenges for financial institutions involved in new debt swap investments.

Therefore, the establishment of a common set of key performance indicators and associated monitoring criteria applicable to the entire debt swap system, in case of its adoption, is anticipated to attract significant funding for debt swap agreements ([20], p. 15). From this perspective, the model proposed in this study, as depicted in Table 1, incorporates common criteria for applied projects, eliminating the need for project-specific performance measurements.

Furthermore, the post-implementation monitoring criteria align with the characteristics of the market mechanisms stipulated under Article 6 of the Paris Agreement, providing overarching standards for the entire system. Derived from the features outlined in Article 6, this model mandates monitoring of the greenhouse gas reduction effects resulting from the implementation of projects envisioned by the proposed mechanism, as detailed in Table 4.

Thus, the integration of the Paris Agreement market mechanisms and debt-for-climate swap agreements not only serves to induce climate action in host countries, as envisioned in this study, but also provides a tool to quantitatively assess climate change responses through greenhouse gas reduction.

Adopting the above model requires equitable distribution and acquisition of internationally transferred mitigation outcomes (ITMOs) generated from collaborative projects between Creditor and Debtor (host) Countries. This aspect is intricately tied to the earlier discourse concerning the delineation of mitigation obligations, given that the market mechanisms outlined in Article 6 of the Paris Agreement presuppose shared obligations for all signatory parties as per Article 2. Consequently, both contributing and host nations bear the responsibility to fulfill their respective greenhouse gas reduction commitments, precluding contributing countries from shouldering the entirety of emissions reduction efforts.

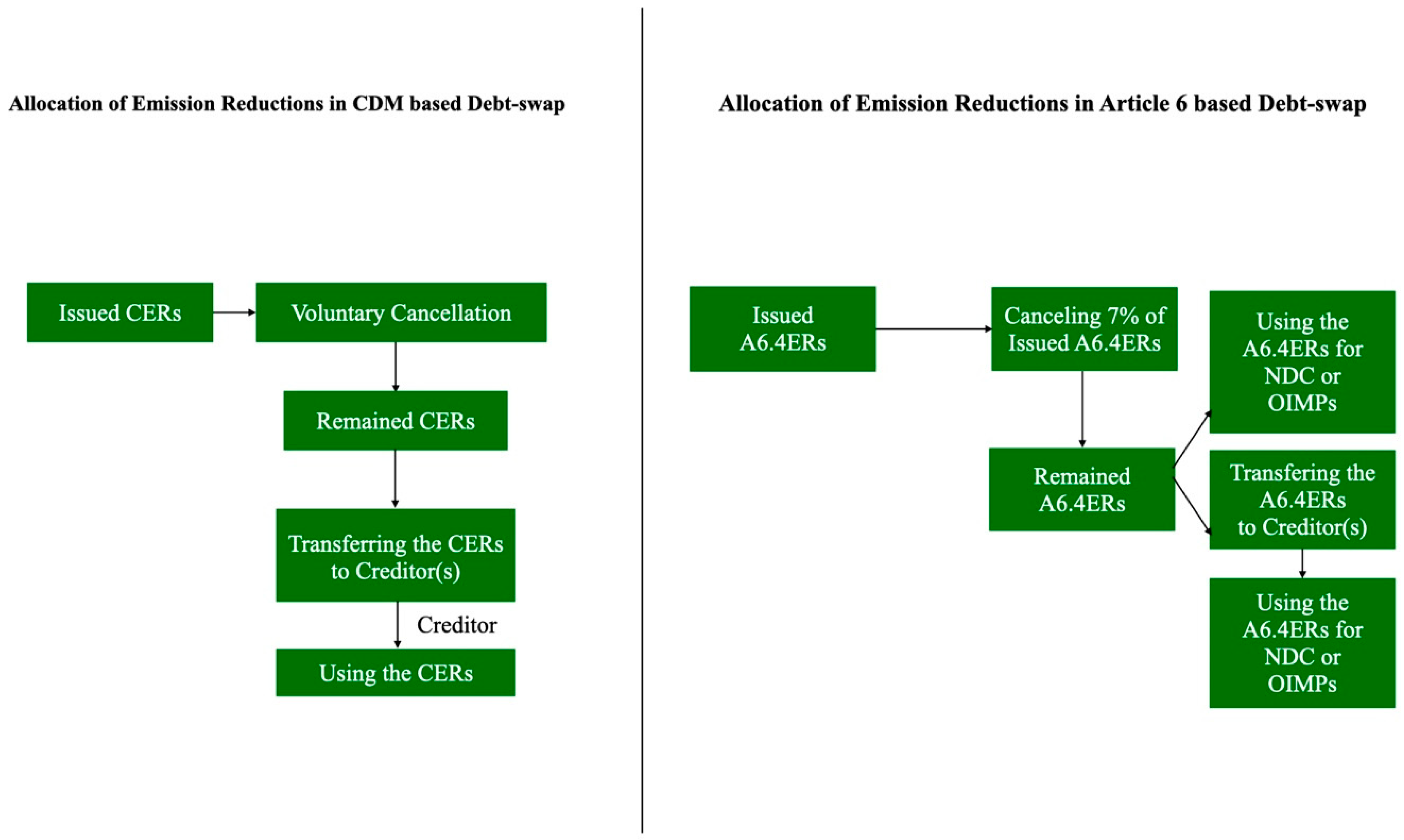

This highlights a notable departure from the debt swap model operationalized within the clean development mechanism. Governed by the Kyoto Protocol, the clean development mechanism assigns mitigation obligations solely to Annex I countries, creating a unilateral framework wherein Annex I nations assist non-Annex I counterparts. Consequently, debt swap agreements under the clean development mechanism predominantly entail projects financed by Annex I nations, with resulting emission reductions (CERs) being wholly credited to contributing countries, see [10]. This contrast is effectively delineated in Figure 4 below.

Figure 4.

Difference of the Allocation Method Between the Clean Development Mechanism (CDM)-based Debt Swap Mechanism and Article 6-based Debt Swap Mechanism.

The model delineated in this paper, depicted in Figure 4 above, mandates negotiations between contributing and debtor nations to establish ITMOs apportionment ratios. As elucidated in Figure 2, this underscores the crucial involvement of both the project management authority (DNA) and project participants, including DOEs, in these negotiations.

6. Conclusions

As previously discussed, the Article 6-linked debt-for-climate swap model presented in this paper harmonizes with the debt-for-climate swap framework by integrating official development assistance with Article 6-based market mechanism projects. Notably, the funding for these market mechanism projects stems from the national budgets of Debtor Countries, mitigating apprehensions that activities influenced by specific interests might be construed as official development assistance.

Hence, the model delineated in this study not only stands ready to serve as a foundational framework for emerging mechanisms in environmental official development assistance but also boasts a substantial advantage: fostering international collaboration on climate change mitigation. This bilateral cooperation not only offers valuable project experiences to both contributing and debtor countries but also facilitates knowledge exchange and mutual support in tackling global challenges.

Within the framework of the Sustainable Development Goals (SDGs), the debt-for-climate swap model connected to Article 6, implemented in Africa’s clean energy sector, has the potential to positively impact SDG 7, SDG 13, and SDG 17. This model is designed to facilitate the provision of external funding for debt repayment in Africa, thereby increasing fiscal capacity to allocate resources toward climate-focused initiatives. By utilizing one of the international climate response schemes, Article 6 of the Paris Agreement, the potential environmental advantage of this model can be managed by UNFCCC and its parties with the rules, including [31,32]. As a result, this model can help overcome the debt crisis, which poses an obstacle to investing in clean energy as part of climate action, and contribute to the achievement of SDG 17.4 [2], SDG 13 [8], and SDG 7 [44].

Furthermore, the system holds a significant advantage by concurrently enhancing the financial stability of debtor countries while catalyzing climate action, thereby fostering both economic and environmental benefits. However, to effectively implement the Article 6-linked debt-for-climate swap model, innovative shifts among stakeholders, policy stability assurance, and the development of specific operational models based on concessional and non-concessional aid are imperative. The model proposed in this study envisions a pivotal role for the development finance institutions of contributing countries. Therefore, the establishment of organizations, such as a task force led by global development finance institutions, is essential for implementing this system. As noted in the Introduction, a task force already exists, formed by multilateral development banks to oversee debt-for-nature swaps, with private financial institutions increasingly engaging in debt swap agreements, offering a blueprint for the decision-making bodies underpinning this system.

Additionally, clear definitions related to the utilization of official development assistance resources for the Paris Agreement market mechanism need to be formulated. These definitions should be in line with resolutions adopted by economic development cooperation organizations like the OECD, which address the use of official development assistance resources for clean development mechanisms.

Certainly, the absence of an internationally agreed-on definition could lead to differences of opinion and potential confusion, especially in the case of the proposed model, where funding from contributing countries indirectly affects national accounting figures. Therefore, it is imperative to formulate relevant definitions, guidelines, regulations, procedures, and even methodologies for the implementation of the Paris Agreement market mechanism. These should be addressed at the 29th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP29).

Initially, the detailed guidelines for the operation of the Paris Agreement market mechanism were expected to be adopted at the 28th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP28). However, due to issues such as the inclusion of guidelines for the definition in Article 6.2 and the rejection of recommendations for the supervisory body in Article 6.4, these guidelines and regulations were not adopted in the end [45].

Certainly, while regulations related to the Paris Agreement market mechanism, including Article 6.4, are currently outlined in the United Nations Framework Convention on Climate Change (UNFCCC) (as of 1 January 2024, a total of 11 standards and procedures are in effect, with tools and guidelines for the implementation of standards and procedures currently under preparation, see [46]), the effectiveness of these regulations and guidelines may be limited without a globally agreed-upon set of procedures. Therefore, countries, including South Korea, must strive to achieve a unanimous consensus for the swift operation of the Paris Agreement market mechanism within this year.

Finally, in conjunction with all the processes, there is a critical need for research and development of a specific model for the Article 6-linked debt-for-climate swap agreements that would reflect the characteristics of concessional and non-concessional aid. This necessity stems from the emergence of countries, such as Canada, expressing their reluctance to recognize internationally transferred mitigation outcomes (ITMOs) generated from projects funded by official development assistance bodies.

While the potential expansion of this trend on an international scale may be expected to be low, a meticulous examination process is still necessary to determine if there are types of expenditure within the institutional model that can be directly categorized as investment. This examination should consider both concessional and non-concessional aid while also considering the approval of official development assistance funds for the creation of a clean development mechanism.

Despite these challenges, this study carries significant implications for international development cooperation and mitigation project policies. First, prioritizing research areas related to the application of the Paris Agreement market mechanism to development cooperation is crucial. Additionally, the model proposed in this study addresses monitoring activities in Debtor Countries, thus overcoming the shortcomings of existing debt swap mechanisms addressing climate change adaptation on a global scale. Looking ahead, future research will build upon the fundamental model of the Article 6-linked debt-for-climate swap presented in this paper to formulate a specific model that deals with concessional and non-concessional aid, focusing on both financial soundness and climate action in debtor countries.

Author Contributions

Conceptualization, Y.C. and H.-C.L.; methodology, Y.C. and H.-C.L.; formal analysis, Y.C. and H.-C.L.; investigation, Y.C.; resources, Y.C.; writing—original draft preparation, Y.C.; writing—review and editing, H.-C.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by Konkuk University in 2023.

Institutional Review Board Statement

Ethical review and approval for this study are not applicable since no human subjects or patients were involved.

Informed Consent Statement

Not applicable. This study did not involve humans.

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- UNFCCC Climate Champions. Joint Declaration and Taskforce on Credit Enhancement for Sustainability-Linked Foreign Financing. Available online: https://climatechampions.unfccc.int/joint-declaration-and-task-force/ (accessed on 20 April 2024).

- United Nations. SDG 17: Strengthen the Means of Implementation and Revitalize the Global Partnership for Sustainable Development. Available online: https://sdgs.un.org/goals/goal17 (accessed on 20 April 2024).

- United Nations. Financing for Sustainable Development Report; United Nations: New York, NY, USA, 2023. [Google Scholar]

- African Development Bank (AfDB). Annual Meetings 2024: Old Debt Resolution for African Countries—The Cornerstone of Reforming the Global Financial Architecture. Available online: https://www.afdb.org/en/news-and-events/annual-meetings-2024-old-debt-resolution-african-countries-cornerstone-reforming-global-financial-architecture-70791 (accessed on 20 April 2024).

- Telesetsky, A. Multilateral Debt Relief for Clean Ocean Energy. Sustainability 2023, 15, 14702. [Google Scholar] [CrossRef]

- Rambarran, J. Debt for Climate Swaps: Lessons for Caribbean SIDS from the Seychelles’ Experience. Soc. Econ. Stud. 2018, 67, 261–291. [Google Scholar]

- The Commonwealth Blue Charter. Innovative Financing—Debt for Conservation Swap, Seychelles’ Conservation and Climate Adaptation Trust and the Blue Bonds Plan, Seychelles; Commonwealth Secretariat: London, UK, 2020. [Google Scholar]

- United Nations. SDG 13: Take Urgent Action to Combat Climate Change and Its Impacts. Available online: https://sdgs.un.org/goals/goal13#targets_and_indicators (accessed on 20 April 2024).

- UNFCCC. Paris Agreement; UNFCCC: Bonn, Germany, 2015. [Google Scholar]

- Cassimon, D.; Prowse, M.; Essers, D. Financing the Clean Development Mechanism through Debt-for-Efficiency Swaps?: Case Study Evidence from a Uruguayan wind Farm Project; Working Paper/2011.06; Institute of Development Policy and Management (IOB) of the University of Antwerp: Antwerpen, Belgium, 2011. [Google Scholar]

- D’Adamo, I.; Di Carlo, C.; Gastaldi, M.; Rossi, E.N.; Uricchio, A.F. Economic Performance, Environmental Protection and Social Progress: A Cluster Analysis Comparison towards Sustainable Development. Sustainability 2024, 16, 5049. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). Financing Clean Energy in Africa; IEA: Paris, France, 2023. [Google Scholar]

- Adesina, A.A. Evolution of Debt Landscape over the past 10 years in Africa. In Proceedings of the African Development Bank Group, Paris Club, Paris, France, 20 June 2023. [Google Scholar]

- Hansen, S. Debt for Nature Swaps: Overview and Discussion of Key Issues, Environment Department Working Paper No. 1 of the World Bank Policy Planning and Research Staff: Environment Department. In World Bank Working Paper; World Bank: Bretton Woods, NH, USA, 1988. [Google Scholar]

- Cassimon, D.; Prowse, M.; Essers, D. The pitfalls and potential of debt-for-nature swaps: A US-Indonesian case study. Glob. Environ. Change 2011, 21, 93–102. [Google Scholar] [CrossRef]

- Pouponneau, A. Applicability of innovative finance for addressing loss and damage: Lessons from the Seychelles. In Proceedings of the First Workshop on Addressing Loss and Damage in the Context of Decisions 2/CP.27 and 2/CMA.4 of the Transitional Committee of United Nations Framework Convention on Climate Change (UNFCCC TC), Bonn, Germany, 29–30 April 2023. [Google Scholar]

- Singh, D.; Widge, V. Debt for Climate Swaps: Supporting a Sustainable Recovery; Climate Policy Initiative: Cape Town, South Africa, 2021. [Google Scholar]

- Onuoha, F.C.; Dimnwobi, S.K.; Okere, K.I.; Ekesiobi, C. Funding the green transition: Governance quality, public debt, and renewable energy consumption in Sub-Saharan Africa. Util. Policy 2023, 82, 101574. [Google Scholar] [CrossRef]

- Ikejiaku, B.-V. International Law and Sustainable Development: Grounds for Cancellation of Africa Debts. Law Dev. Rev. 2023, 16, 385–411. [Google Scholar] [CrossRef]

- Steele, P.; Patel, S.; Beauchamp, E. Key Performance Indicators for climate and nature outcomes for debt management. In Key Performance Indicators: Debt Management for Nature and Climate: Backgrounder; International Institute for Environment and Development (IIED): London, UK, 2021. [Google Scholar]

- Bouwer, K.; Etemire, U.; Field, T.-L.; Jegede, A.O. (Eds.) . Climate Litigation and Justice in Africa; Bristol University Press: Bristol, UK, 2024. [Google Scholar]

- World Resources Institute (WRI). Improving access to the Green Climate Fund: How the fund can better support developing countries. In Working Paper; WRI: Washington, DC, USA, 2021. [Google Scholar]

- Fresnillo, L. The G20 Debt Service Suspension Initiative—Draining out the Titanic with a bucket? Briefing Paper: October 2020; European Network on Debt and Development (Eurodad): Brussels, Belgium, 2020. [Google Scholar]

- Global Green Growth Institute (GGGI). Global Survey on Article 6 Readiness Report; GGGI: Seoul, Republic of Korea, 2022. [Google Scholar]

- UNFCCC. Activity Search of the Clean Development Mechanism (CDM) Website. Available online: https://cdm.unfccc.int/Projects/projsearch.html (accessed on 17 January 2024).

- UNFCCC. Article 6.4 Activity Standard for Projects, Version 01.0; UNFCCC: Bonn, Germany, 2024. [Google Scholar]

- USAID. Climate Risk Management for USAID Projects and Activities. In A Mandatory Reference for ADS Chapter 201; USAID: Washington, DC, USA, 2022. [Google Scholar]

- European Union. Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment and amending Regulation (EU) 2019/2088. Off. J. Eur. Union 2020, 63, L 198. [Google Scholar]

- Ministry of Environment. Guidelines for Korean Green Taxonomy; Ministry of Environment: Sejong-si, Republic of Korea, 2022. [Google Scholar]

- IFC. South African Green Finance Taxonomy, 1st ed.; Department of National Treasury of the Republic of South Africa & International Finance Corporation: Pretoria, South Africa, 2022. [Google Scholar]

- UNFCCC. Guidance on cooperative approaches referred to in Article 6, paragraph 2, of the Paris Agreement. In Annex of Decision 2/CMA.3; UNFCCC: Bonn, Germany, 2021. [Google Scholar]

- UNFCCC. Rules, modalities and procedures of the mechanism established by Article 6, paragraph 4, of the Paris Agreement. In Annex of Decision 3/CMA.3; UNFCCC: Bonn, Germany, 2021. [Google Scholar]

- UNFCCC. Paris Agreement-Article 6: Tool for the Demonstration And Assessment of Additionality: Draft; UNFCCC: Bonn, Germany, 2022. [Google Scholar]

- Choi, B. Linkages and Implications for Paris Agreement-Related ODA Projects and International Mitigation Projects. In Proceedings of the KRIC Carbon Expert Group Seminar Presentation, Korean Research Institute on Climate Change (KRIC), Seoul, Republic of Korea, 8 January 2024. [Google Scholar]

- Ministry of Economy and Finance (with Related Ministries). International Mitigation Project Implementation Strategy; MOEF: Sejong, Republic of Korea, 2022. [Google Scholar]

- Government of Korea. Framework Agreement for Cooperation on Climate Change between the Government of the Republic of Korea and the Government of the Socialist Republic of Vietnam; Government of Korea: Daejeon, Republic of Korea, 2021. [Google Scholar]

- Government of Korea. Framework Agreement for Cooperation on Climate Change between the Government of the Republic of Korea and the government of the Gabonese Republic; Government of Korea: Daejeon, Republic of Korea, 2023. [Google Scholar]

- Government of Korea. Framework Agreement for Cooperation on Climate Change between the Government of the Republic of Korea and the government of the Mongolia; Government of Korea: Daejeon, Republic of Korea, 2023. [Google Scholar]

- Government of Korea. Framework Agreement for Cooperation on Climate Change between the Government of the Republic of Korea and the government of the Republic of Uzbekistan; Government of Korea: Daejeon, Republic of Korea, 2023. [Google Scholar]

- United Nations Environment Programmee (UNEP) Copenhagen Climate Center. CDM Pipeline. Available online: https://unepccc.org/cdm-ji-pipeline/ (accessed on 20 April 2024).

- The Economic Growth Assistance for Africa in FY2022 is $147.1 million. In U.S. Assistance for Sub-Saharan Africa: An Overview; U.S. Congressional Research Service: Washington, DC, USA, 2023; p. 005.

- African Development Bank (AfDB) and African Development Fund. West African Countries ITMO Readiness Scoping Assessment; AfDB: Abidjan, Côte d’Ivoire, 2021. [Google Scholar]

- CarbonCredits.com. Available online: https://carboncredits.com/carbon-prices-today/?gclid=EAIaIQobChMIoqz-zLDahQMVCRF7Bx2dOAslEAAYASAAEgJhBvD_BwE (accessed on 20 April 2024).

- United Nations. SDG 7: Ensure Access to Affordable, Reliable, Sustainable and Modern Energy for All. Available online: https://sdgs.un.org/goals/goal7 (accessed on 20 April 2024).

- Ministry of Foreign Affairs. The Closing of UNFCCC COP28. 2023. Available online: https://www.mofa.go.kr/www/brd/m_4080/view.do?seq=374485&page=1 (accessed on 24 April 2024).

- UNFCCC. Rules and Regulations in the Page of Article 6.4 Supervisory Body. 2024. Available online: https://unfccc.int/process-and-meetings/bodies/constituted-bodies/article-64-supervisory-body/rules-and-regulations#guid (accessed on 24 January 2024).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).