The Impact of Green Business Ethics and Green Financing on Sustainable Business Performance of Industries in Türkiye: The Mediating Role of Corporate Social Responsibility

Abstract

1. Introduction

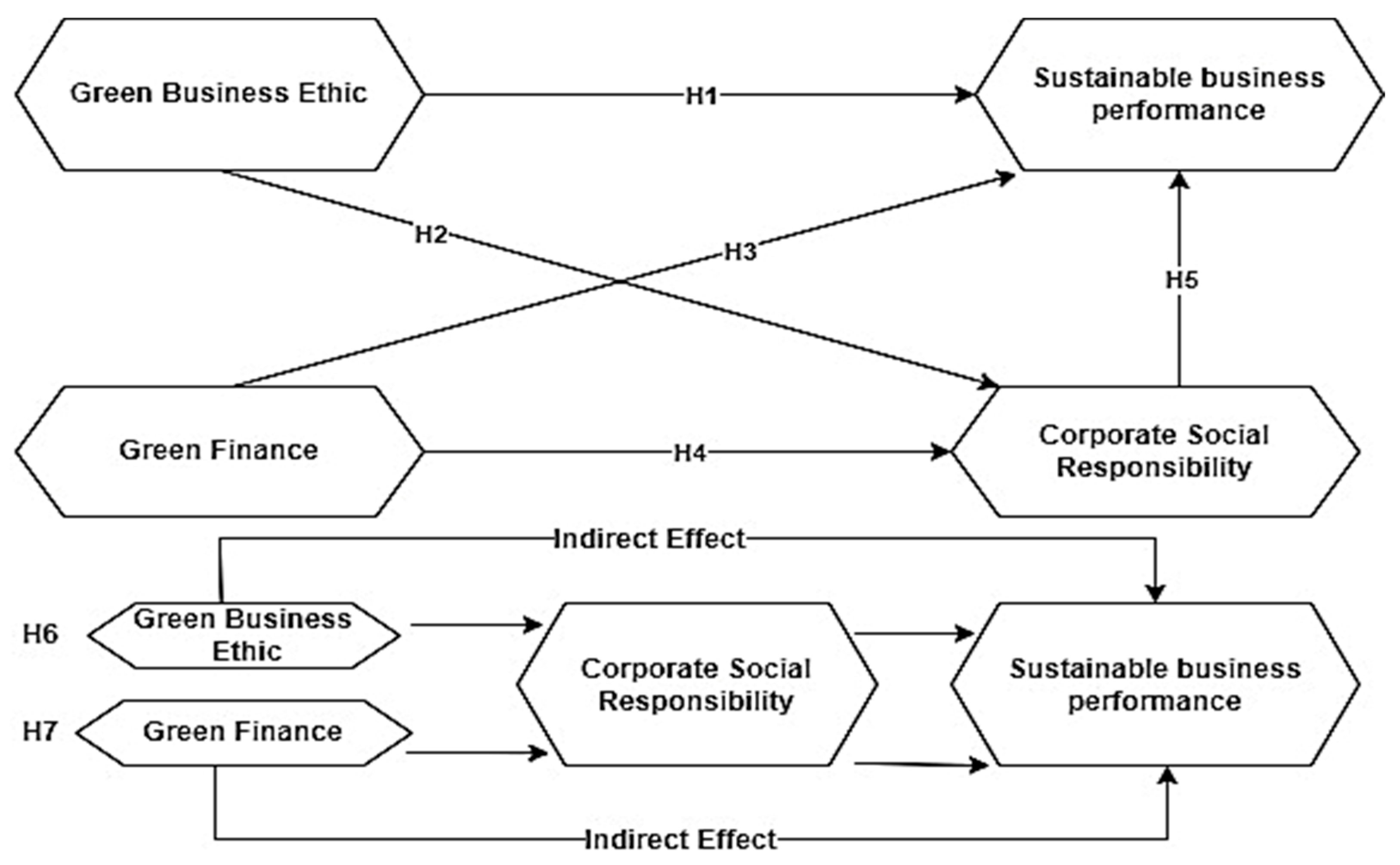

- To examine the role of green business ethics on sustainable business performance.

- Examining the role of green financing on sustainable business performance.

- To examine the role of corporate social responsibility on sustainable business performance.

- To examine the role of green business ethics on corporate social responsibility.

- To examine the role of green financing on corporate social responsibility.

- Examining the mediating effect of corporate social responsibility on sustainable business performance in the context of green business ethics and green finance

2. Theoretical Background and Hypothesis Development

2.1. Relationship between Green Business Ethics and Sustainable Business Performance and CSR

2.2. Relationship between Green Finance and Sustainable Business Performance and CSR

2.3. Relationship between CSR and Sustainable Business Performance

2.4. Relationship between CSR and Green Business Ethics and Sustainable Performance

2.5. Relationship between CSR, Green Financing and Sustainable Performance

3. Research Methodology

3.1. Population and Data Collection

3.2. Measurement Instruments

3.3. Statistical Analysis

4. Results

Hypothesis Tests

5. Discussion and Implications for Policy

5.1. Theoretical and Practical Implications

5.1.1. Theoretical Implications

5.1.2. Practical Implications

6. Conclusions

7. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Factor Item

| Factors | Items | (λ) |

| Corporate Social Responsibility | ||

| Our business participates in initiatives and campaigns that advance societal safety. | 0.899 | |

| Our business wants to grow sustainably while considering future generations’ requirements. | 0.598 | |

| Our corporation supports non-governmental organizations that operate in troubled regions. | 0.891 | |

| Our business goes above and beyond what the law requires to protect customer rights. | 0.890 | |

| Our company fully and promptly complies with all legal regulations. | 0.827 | |

| Green Business Ethic | ||

| Operates by human rights. | 0.860 | |

| Fulfills its social and environmental responsibilities. | 0.759 | |

| Provides a fair working environment for employees. | 0.545 | |

| Respects the rights of employees. | 0.820 | |

| Addresses complaints of human rights violations and makes necessary arrangements. | 0.568 | |

| Does not force its employees to work. | 0.835 | |

| Does not employ child labor. | 0.616 | |

| No discrimination is made in hiring. | 0.794 | |

| Fair compensation is applied. | 0.711 | |

| The daily working hours do not exceed 8 h. | 0.593 | |

| Provides a working environment that complies with occupational health and safety standards. | 0.566 | |

| Water usage is minimized. | 0.709 | |

| Prioritizes energy efficiency. | 0.585 | |

| Waste generation is minimized. | 0.546 | |

| Paper usage is reduced. | 0.773 | |

| No harm is caused to the environment in activities. | 0.760 | |

| Opposes all forms of corruption, such as bribery and fraud. | 0.857 | |

| Activities are transparent. | 0.753 | |

| Unethical behaviors are easily reported to management. | 0.607 | |

| All activities are conducted by the principle of accountability. | 0.779 | |

| Sustainable Business Performance | ||

| Our organization’s net profit margin has increased. | 0.937 | |

| Our organization’s return on investment has increased. | 0.942 | |

| The growth of our profitability has been exceptional. | 0.665 | |

| Our profitability has surpassed that of our competitors. | 0.847 | |

| Our overall financial performance has outperformed our competitors | 0.900 | |

| Green Finance | ||

| Our company has established policies to ensure that financing is directed towards environmentally sustainable projects. | 0.712 | |

| Our company has allocated a specific budget for green projects and initiatives. | 0.960 | |

| Our company has invested in green bonds or other similar financial instruments. | 0.897 | |

| Our company has received financing from banks or other financial institutions for green projects. | 0.736 | |

| Our company has engaged in advocacy or lobbying efforts to promote green financing at the national or international level. | 0.807 |

References

- Crosbie, L.; Knight, K. Strategy for Sustainable Business: Environmental Opportunity and Strategic Choice; McGraw-Hill: London, UK, 1995. [Google Scholar]

- Fauzi, N.S.; Zainuddin, A.; Nawawi, A.H.; Johari, N. A Pilot Framework of Corporate Real Estate Sustainable Performance Measurement (CRESPM). Int. J. Acad. Res. Bus. Soc. Sci. 2018, 8, 725–739. [Google Scholar]

- Chou, S.F.; Horng, J.S.; Liu, C.H.; Gan, B. Explicating Restaurant Performance: The Nature and Foundations of Sustainable Service and Organizational Environment. Int. J. Hosp. Manag. 2018, 72, 56–66. [Google Scholar] [CrossRef]

- Haseeb, M.; Hussain, H.I.; Kot, S.; Androniceanu, A.; Jermsittiparsert, K. Role of Social and Technological Challenges in Achieving a Sustainable Competitive Advantage and Sustainable Business Performance. Sustainability 2019, 11, 3811. [Google Scholar] [CrossRef]

- Székely, F.; Knirsch, M. Responsible Leadership and Corporate Social Responsibility: Metrics for Sustainable Performance. Eur. Manag. J. 2005, 23, 628–647. [Google Scholar] [CrossRef]

- Agrawal, R.; Wankhede, V.A.; Kumar, A.; Upadhyay, A.; Garza-Reyes, J.A. Nexus of Circular Economy and Sustainable Business Performance in the Era of Digitalization. Int. J. Product. Perform. Manag. 2022, 71, 748–774. [Google Scholar] [CrossRef]

- Goni, F.A.; Gholamzadeh Chofre, A.; Estaki Orakani, Z.; Klemeš, J.J.; Davoudi, M.; Mardani, A. Sustainable Business Model: A Review and Framework Development. Clean Technol. Environ. Policy 2021, 23, 889–897. [Google Scholar] [CrossRef]

- Lee, J.W. Green Finance and Sustainable Development Goals: The Case of China. J. Asian Financ. Econ. Bus. 2020, 7, 577–586. [Google Scholar] [CrossRef]

- Wang, Y.; Zhi, Q. The Role of Green Finance in Environmental Protection: Two Aspects of Market Mechanism and Policies. Energy Procedia 2016, 104, 311–316. [Google Scholar] [CrossRef]

- Ng, A.W. From Sustainability Accounting to a Green Financing System: Institutional Legitimacy and Market Heterogeneity in a Global Financial Center. J. Clean. Prod. 2018, 195, 585–592. [Google Scholar] [CrossRef]

- Wang, K.H.; Zhao, Y.X.; Jiang, C.F.; Li, Z.Z. Does Green Finance Inspire Sustainable Development? Evidence From a Global Perspective. Econ. Anal. Policy 2022, 75, 412–426. [Google Scholar] [CrossRef]

- Tüyen, A. The Concept of Sustainability and Factors Affecting Sustainability in Businesses. Istanb. Commer. Univ. J. Soc. Sci. 2020, 19, 91–117. [Google Scholar]

- Krishna, A.; Dangayach, G.S.; Jainabc, R. Business Ethics: A Sustainability Approach. Procedia-Soc. Behav. Sci. 2011, 25, 281–286. [Google Scholar] [CrossRef]

- Rushton, K. Business Ethics: A Sustainable Approach. Bus. Ethics A Eur. Rev. 2002, 11, 137–139. [Google Scholar] [CrossRef]

- Pervez, S. Defining Green Business Ethics and Exploring Its Adoption within the Textile Industry of Pakistan. Abasyn Univ. J. Soc. Sci. 2020, 13, 90–105. [Google Scholar] [CrossRef]

- Bayram, V.; Öztırak, M. Green Business Ethics: A Scale Development Study. JOEEP J. Emerg. Econ. Policy 2023, 8, 124–135. [Google Scholar]

- Yalçın, B. Success Dynamics of Businesses: Sustainability, Ethics and Corporate Social Responsibility. In Sustainability-Focused Business Models: Environmental and Economic Strategies for Businesses; Akpınar, E., Şenol, E., Eds.; Eğtim: Ankara, Türkiye, 2024; Volume 41, Chapter 3; pp. 41–61. [Google Scholar]

- Sammy, M.; Odemilin, G.; Bampton, R. Corporate Social Responsibility: A Strategy for Sustainable Business Success. An analysis of 20 Selected British Companies. Corp. Gov. Int. J. Bus. Soc. 2010, 10, 203–217. [Google Scholar] [CrossRef]

- Hys, K.; Hawrysz, L. Corporate Social Responsibility Reporting. China-USA Bus. Rev. 2012, 11, 1515–1524. [Google Scholar]

- Boran, T.A. Conceptual Review of Global Standards in Corporate Social Responsibility and Sustainability Reporting. Krit. İletişim Çalışmaları J. 2023, 5, 56–77. [Google Scholar] [CrossRef]

- Bebbington, J.; Larrinaga, C. Accounting and Sustainable Development: An Exploration. Account. Organ. Soc. 2014, 39, 395–413. [Google Scholar] [CrossRef]

- Nyachanchu, T.O.; Cheruiyot, T.K. Role of Leadership Behaviour in Sustainability: Financial Services Sector Players. J. Econ. Sustain. Dev. 2017, 8, 167–173. [Google Scholar]

- Herold, D.M. Has Carbon Disclosure Become More Transparent in the Global Logistics Industry? An Investigation of Corporate Carbon Disclosure Strategies between 2010 and 2015. Logistics 2018, 2, 13. [Google Scholar] [CrossRef]

- Babu, S.; Mony, S. CSR in India: Evolution, Models, and Impact; Rethinking Business Responsibility in a Global Context: Challenges to Corporate Social Responsibility, Sustainability and Ethics; Springer: Cham, Switzerland, 2020; pp. 147–178. [Google Scholar]

- Javeed, S.A.; Teh, B.H.; Ong, T.S.; Chong, L.L.; Abd Rahim, M.F.B.; Latief, R. How Does Green Innovation Strategy Influence Corporate Financing? Corporate Social Responsibility and Gender Diversity Play a Moderating Role. Int. J. Environ. Res. Public Health 2022, 19, 8724. [Google Scholar] [CrossRef] [PubMed]

- Secinaro, S.; Calandra, D.; Petricean, D.; Chmet, F. Social Finance and Banking Research as a Driver for Sustainable Development: A Bibliometric Analysis. Sustainability 2020, 13, 330. [Google Scholar] [CrossRef]

- Ay, Ü. Ethics and Social Responsibility in Business; Nobel Publications: Istanbul, Türkiye, 2023. [Google Scholar]

- Falcone, P.M. Environmental Regulation and Green Investments: The Role of Green Finance. Int. J. Green Econ. 2020, 14, 159–173. [Google Scholar] [CrossRef]

- Rizzello, A. The Green Financing Framework Combining Innovation and Resilience: A Growing Toolbox of Green Finance Instruments. In Green Investing: Changing Paradigms and Future Directions; Springer International Publishing: Heidelberg Germany, 2022; pp. 55–83. [Google Scholar] [CrossRef]

- Gangi, F.; Daniele, L.M.; Varrone, N. How Do Corporate Environmental Policy and Corporate Reputation Affect Risk-Adjusted Financial Performance? Bus. Strategy Environ. 2020, 29, 1975–1991. [Google Scholar] [CrossRef]

- Carroll, A.B. Corporate Social Responsibility. Organ. Dyn. 2015, 44, 87–96. [Google Scholar] [CrossRef]

- Bacinello, E.; Tontini, G.; Alberton, A. Influence of Corporate Social Responsibility on Sustainable Practices of Small and Medium-sized Enterprises: Implications on Business Performance. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 776–785. [Google Scholar] [CrossRef]

- Li, X.; Yang, Y. Does Green Finance Contribute to Corporate Technological Innovation? The Moderating Role of Corporate Social Responsibility. Sustainability 2022, 14, 5648. [Google Scholar] [CrossRef]

- Tan, X.; Sirichand, K.; Vivian, A.; Wang, X. How Connected is the Carbon Market to Energy and Financial Markets? A Systematic Analysis of Spillovers and Dynamics. Energy Econ. 2020, 90, 104870. [Google Scholar] [CrossRef]

- Steffen, B. A Comparative Analysis of Green Financial Policy Output in OECD Countries. Environ. Res. Lett. 2021, 16, 074031. [Google Scholar] [CrossRef]

- Feng, W.; Bilivogui, P.; Wu, J.; Mu, X. Green Finance: Current Status, Development, and Future Course of Actions in China. Environ. Res. Commun. 2023, 5, 035005. [Google Scholar] [CrossRef]

- Zhou, X.; Cui, Y. Green Bonds, Corporate Performance, and Corporate Social Responsibility. Sustainability 2019, 11, 6881. [Google Scholar] [CrossRef]

- Lyu, B.; Da, J.; Ostic, D.; Yu, H. How Does Green Credit Promote Carbon Reduction? A Mediated Model Frontiers in Environmental Science. Environ. Econ. Manag. 2022, 10, 878060. [Google Scholar]

- Belozyorov, S.A.; Xie, X. China’s Green Insurance System and Functions. In E3S Web of Conferences; EDP Sciences: Les Ulis, France, 2021; Volume 311, p. 03001. [Google Scholar]

- Nayak, P.; Taher, Z.; Maria, A.V. G20 and Sustainable Finance: A Case for GSS+ Bonds. In NDIEAS-2024 International Symposium on New Dimensions and Ideas in Environmental Anthropology; Atlantis Press: Amsterdam, The Netherlands, 2024; pp. 182–196. [Google Scholar]

- Szwajca, D. Different Faces of CSR: Greenwashing in the Context of its Impact on Corporate Reputation; Scientific Papers of Silesian University of Technology, Organization and Management Series; Silesian University of Technology Press: Gliwice, Poland, 2022; p. 161. [Google Scholar] [CrossRef]

- Bahadur, W.; Waqqas, O. Corporate Social Responsibility for a Sustainable Business. J. Sustain. Soc. 2013, 2, 92–97. [Google Scholar]

- Li, Y.; Al-Sulaiti, K.; Dongling, W.; Abbas, J.; Al-Sulaiti, I. Tax Avoidance Culture and Employees’ Behavior Affect Sustainable Business Performance: The Moderating Role of Corporate Social Responsibility. Front. Environ. Sci. 2022, 10, 964410. [Google Scholar] [CrossRef]

- Carroll, A.B.; Shabana, K.M. The Business Case for Corporate Social Responsibility: A Review of Concepts, Research and Practice. Int. J. Manag. Rev. 2010, 12, 85–105. [Google Scholar] [CrossRef]

- Waddock, S.A.; Bodwell, C. Total Responsibility Management: The Manual; Routledge: London, UK, 2011. [Google Scholar]

- Reinig, C.J.; Tilt, C.A. Corporate Social Responsibility Issues in Media Releases: A Stakeholder Analysis of Australian Banks. Issues Soc. Environ. Account. 2009, 2, 176–197. [Google Scholar] [CrossRef]

- Smith, S.S. Accounting, Governance and Stakeholder Reporting, And Economic. J. Appl. Bus. Econ. 2015, 17, 76–80. [Google Scholar]

- Bonnafous-Boucher, M.; Rendtorff, J.D. Stakeholder Theory in Strategic Management. In Stakeholder Theory: A Model for Strategic Management; Springer: Cham, Switzerland, 2016; pp. 21–39. [Google Scholar]

- Yazicioglu, Y.; Erdogan, S. SPSS Applied Scientific Research Methods; Detay Publishing: Ankara, Türkiye, 2004; pp. 49–50. [Google Scholar]

- Afzal, A.; Rasoulinezhad, E.; Malik, Z. Green Finance and Sustainable Development in Europe. Econ. Res. Ekon. Istraživanja 2022, 35, 5150–5163. [Google Scholar] [CrossRef]

- Costa, A.J.; Curi, D.; Bandeira, A.M.; Ferreira, A.; Tomé, B.; Joaquim, C.; Santos, C.; Góis, C.; Meira, D.; Azevedo, G.; et al. Literature Review and Theoretical Framework of the Evolution and Interconnectedness of Corporate Sustainability Constructs. Sustainability 2022, 14, 4413. [Google Scholar] [CrossRef]

- Fernando, Y.; Jabbour, C.J.C.; Wah, W.X. Pursuing Green Growth in Technology Firms Through the Connections Between Environmental Innovation and Sustainable Business Performance: Does Service Capability Matter? Resour. Conserv. Recycl. 2019, 141, 8–20. [Google Scholar] [CrossRef]

- Hox, J.J.; Bechger, T.M. An introduction to structural equation modeling. Family Science Review. 1998, 11, 354–373. [Google Scholar]

- Bagozzi, R.P.; Yi, Y. Specification, Evaluation, and Interpretation of Structural Equation Models. J. Acad. Mark. Sci. 2012, 40, 8–34. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 7th ed.; Pearson Education International: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- Gürbüz, S. Structural Equation Model with AMOS; Seçkin Publishing: Ankara, Türkiye, 2019. [Google Scholar]

- Kock, N. Common Method Bias in PLS-SEM: A Full Collinearity Assessment Approach. Int. J. e-Collab. (IJEC) 2015, 11, 1–10. [Google Scholar] [CrossRef]

- Jordan, P.J.; Troth, A.C. Common Method Bias in Applied Settings: The Dilemma of Researching in Organizations. Aust. J. Manag. 2020, 45, 3–14. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Organ, D.W. Self-Reports in Organizational Research: Problems and Prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Rodríguez-Ardura, I.; Meseguer-Artola, A. How to Prevent, Detect and Control Common Method Variance in Electronic Commerce Research. J. Theor. Appl. Electron. Commer. Res. 2020, 15, 1–5. [Google Scholar] [CrossRef]

- Ünal, U.; Bağcı, R.B.; Taşçıoğlu, M. The Perfect Combination to Win the Competition: Bringing Sustainability and Customer Experience Together. Bus. Strategy Environ. 2024, 33, 4806–4824. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The Moderator-Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Hayes, A.F. Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach, 2nd ed.; The Guilford Press: New York, NY, USA, 2018. [Google Scholar]

- Adams, C.; Petrella, L. Collaboration, Connections and Change: The UN Global Compact, The Global Reporting Initiative, Principles for Responsible Management Education and the Globally Responsible Leadership Initiative. Sustain. Account. Manag. Policy J. 2010, 1, 292–296. [Google Scholar]

- Ozturk, U.C.; Cevher, E. Are Green Businesses Real? Examining Ethical Codes in the Scope of Environmental Awareness and Ethics. J. Soc. Sci. Res. 2015, 10, 145–162. [Google Scholar]

- Süklüm, N.A. Conceptual View of the Relationship Between Corporate Social Responsibility, Green Accounting, and Green Auditing. Bilecik Şeyh Edebali Univ. J. Soc. Sci. 2015, 5, 151–163. [Google Scholar]

- Özkaya, B. Green Advertisements in the Context of Green Marketing as an Extension of the Social Responsibility Understanding of Companies. Öneri J. 2010, 9, 247–258. [Google Scholar]

- Şimşek, O.; Tunalı, H. The Role of Green Financing Practices on Sustainable Development: Turkey Projection. J. Econ. Financ. Res. 2022, 4, 16–45. [Google Scholar]

- Orado, D. What You Need to Know about IFC’s Green Bonds (The World Bank Climate Explainer Series). 2021. Available online: https://www.worldbank.org/en/news/feature/2021/12/08/whatyou-need-to-know-about-ifc-s-green-bonds (accessed on 15 May 2024).

- Morioka, S.N.; de Carvalho, M.M. A Systematic Literature Review Towards a Conceptual Framework for Integrating Sustainability Performance into Business. J. Clean. Prod. 2016, 136, 134–146. [Google Scholar] [CrossRef]

- Aksu, B.Ç.; Doğan, A. Evaluation of Environmental Sustainability and Human Resources Management Functions in the Context of Green HRM. J. Aksaray Univ. Fac. Econ. Adm. Sci. 2021, 13, 137–148. [Google Scholar]

- Uslu, Y.D.; Kedikli, E. An Overview of Green Human Resources Management Within the Scope of Sustainability. Third Sect. Soc. Econ. 2017, 52, 66–81. [Google Scholar]

- Yalçın, A.Z. The Idea of Green Economy for Sustainable Development and Fiscal Policies. Çankırı Karatekin Univ. J. Fac. Econ. Adm. Sci. 2016, 6, 749–775. [Google Scholar]

- Zengin, B.; Aksoy, G. Evaluation of Sustainable Development Understanding in Terms of Green Marketing and Green Finance. J. Bus. Econ. Manag. Res. 2021, 4, 362–379. [Google Scholar]

- Kuzgun, Ş.; Gözükara, E. Relationships Between Organizational Resilience Capacity, Green Innovation, Perceived Green Organizational Behavior and Sustainability Performance: Application of ISO 500. J. Manag. Sci. 2023, 21, 399–432. [Google Scholar]

- Ye, J.; Dela, E. The Effect of Green Investment and Green Financing on Sustainable Business Performance of Foreign Chemical Industries Operating in Indonesia: The Mediating Role of Corporate Social Responsibility. Sustainability 2023, 15, 11218. [Google Scholar] [CrossRef]

- Saether, E.A.; Eide, A.E.; Bjørgum, Ø. Sustainability Among Norwegian Maritime Firms: Green Strategy and Innovation as Mediators of Long-term Orientation and Emission Reduction. J. Bus. Strategy Environ. 2021, 30, 2382–2395. [Google Scholar] [CrossRef]

- Gökgöz, F.; Güvercin, M.T. Energy Security and Renewable Energy Efficiency in EU. Renew. Sustain. Energy Rev. 2018, 96, 226–239. [Google Scholar] [CrossRef]

- Papież, M.; Śmiech, S.; Frodyma, K. Determinants of Renewable Energy Development in the EU Countries. A 20-year Perspective. Renew. Sustain. Energy Rev. 2018, 91, 918–934. [Google Scholar] [CrossRef]

- Zheng, G.W.; Siddik, A.B.; Masukujjaman, M.; Fatema, N. Factors affecting the sustainability performance of financial institutions in Bangladesh: The role of green finance. Sustainability 2021, 13, 10165. [Google Scholar] [CrossRef]

| Demographics | N | Percentage |

|---|---|---|

| Gender | ||

| Male | 204 | 47.80% |

| Female | 223 | 52.20% |

| Age (years) | ||

| 25–35 | 405 | 94.80% |

| 45–55 | 16 | 3.70% |

| 55+ | 6 | 1.40% |

| Marital Status | ||

| Single | 267 | 62.50% |

| Married | 160 | 37.50% |

| Level of education | ||

| High school | 15 | 3.50% |

| Associate degree | 21 | 4.90% |

| Bachelor’s degree | 258 | 60.40% |

| Graduate degree | 133 | 31.10% |

| Institution | ||

| Public | 69 | 16.20% |

| Private | 358 | 83.80% |

| CR | AVE | MSV | ASV | (I) | (II) | (III) | (IV) | |

|---|---|---|---|---|---|---|---|---|

| (I) Corporate Social Responsibility | 0.915 | 0.687 | 0.585 | 0.328 | (0.829) | |||

| (II) Green Business Ethic | 0.919 | 0.504 | 0.136 | 0.074 | 0.785 | (0.710) | ||

| (III) Sustainable Business Performance | 0.934 | 0.740 | 0.262 | 0.156 | 0.618 | 0.595 | (0.860) | |

| (IV) Green Finance | 0.916 | 0.690 | 0.585 | 0.811 | 0.616 | 0.565 | 0.693 | (0.831) |

| Hypotheses | Path | B | Result | ||||

|---|---|---|---|---|---|---|---|

| H1 | Green Business Ethics |  | Sustainable business performance | 0.02 | Supported | ||

| H2 | Green Business Ethics |  | Corporate Social Responsibility | 0.25 | Supported | ||

| H3 | Green Finance |  | Sustainable business performance | 0.05 | Supported | ||

| H4 | Green Finance |  | Corporate Social Responsibility | 0.71 | Supported | ||

| H5 | Corporate Social Responsibility |  | Sustainable business performance | 0.46 | Supported | ||

| H6 | Green Business Ethics |  | Corporate Social Responsibility |  | Sustainable business performance | 0.27 | Supported |

| H7 | Green Finance |  | Corporate Social Responsibility |  | Sustainable business performance | 0.38 | Supported |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alay, H.K.; Keskin, A.; Deveciyan, M.T.; Şen, G.; Kayalıdereden, D.; Berber, Ş. The Impact of Green Business Ethics and Green Financing on Sustainable Business Performance of Industries in Türkiye: The Mediating Role of Corporate Social Responsibility. Sustainability 2024, 16, 7868. https://doi.org/10.3390/su16177868

Alay HK, Keskin A, Deveciyan MT, Şen G, Kayalıdereden D, Berber Ş. The Impact of Green Business Ethics and Green Financing on Sustainable Business Performance of Industries in Türkiye: The Mediating Role of Corporate Social Responsibility. Sustainability. 2024; 16(17):7868. https://doi.org/10.3390/su16177868

Chicago/Turabian StyleAlay, Hazal Koray, Abdulkadir Keskin, Meri Taksi Deveciyan, Gülaçtı Şen, Didem Kayalıdereden, and Şayan Berber. 2024. "The Impact of Green Business Ethics and Green Financing on Sustainable Business Performance of Industries in Türkiye: The Mediating Role of Corporate Social Responsibility" Sustainability 16, no. 17: 7868. https://doi.org/10.3390/su16177868

APA StyleAlay, H. K., Keskin, A., Deveciyan, M. T., Şen, G., Kayalıdereden, D., & Berber, Ş. (2024). The Impact of Green Business Ethics and Green Financing on Sustainable Business Performance of Industries in Türkiye: The Mediating Role of Corporate Social Responsibility. Sustainability, 16(17), 7868. https://doi.org/10.3390/su16177868