Abstract

With the continuous deterioration of the global ecological environment, energy saving, emission reduction, low carbon, and green industry have become new trends in global economic development. Green transformation (GT) and environmental, social, and corporate governance (ESG) elements have become the internal driving forces of corporate modernization. However, there is a lack of systematic theoretical and empirical research on the consequences of green transformation and ESG management on sustainable competitive advantage. Based on the core competence theory of enterprises, this research has discussed the effects of green transformation and ESG management on sustainable competitive advantages of enterprises, as well as the mediating role of ESG management between green transformation and sustainable competitive advantage of enterprises. The study took high-tech enterprises in the Pearl River Delta and Yangtze River Delta as samples and used correlation analysis, factor analysis, and multiple regression analysis to test the research hypotheses. The obtained empirical results showed that GT had a significant effect on ESG management and enduring competitive edge (encompassing both financial and strategic outcomes). There are obvious differences in the relationship between ESG management and sustainable competitive advantage in the Pearl River Delta and Yangtze River Delta enterprises. ESG management acts as a partial intermediary factor between GT and sustained competitive advantage. This study enriches the view of core competence theory and provides a reference for enterprises to achieve sustainable competitive advantage.

1. Introduction

In the era of global carbon emission peak and maintaining carbon neutral equilibrium, industries with high carbon dioxide emissions face the risk of elimination, and green transformation (GT) caused by low-carbon technologies and products is becoming a new growth point of global economic development [1]. With the rise of emerging industries such as new energy technologies, clean energy, and environmental protection strategies, an efficient combination of the real economy and green technology has become more extensive, and GT has attracted significant attention among academia, enterprise management teams, and employment groups [2]. GT can help enterprises achieve sustainable development by developing green production methods and lifestyles [3].

Based on the internal perspective of enterprise transformation, GT comes from twin carbon objectives for mitigation, requiring businesses to realize green technology innovations and complete green transformations of old and new driving forces of the industry by developing green innovation technologies, optimizing traditional energy structures, and enhancing resource utilization efficiencies [4]. To promote the construction of modern industrial systems, green financial policies play critical roles in the transformation and upgrading of manufacturing enterprises. Due to their green standards and financial attributes, such measures can better meet the requirements of enterprises in implementing green innovation activities [5]. Currently, China’s economy is progressing toward a state of superior development, and the key to achieving energy conservation and emission reduction development goals in the manufacturing industry is the close combination of digital technologies and traditional industries [6]. Whether enterprises can successfully perform green transformation is a profound indicator of the effectiveness of regional coordinated control policies for air pollution and is also the main beginning point for improving relevant policies [7].

Considering the increasingly severe global climate and environmental problems, the concept of sustainable development constitutes a vital motivating factor for promoting sustainable economic progress with enhanced quality standards, and the public is paying significant attention to information related to environment, society, and corporate governance (ESG), which has attained the status of a crucial benchmark to measure the harmonious corporate growth and expansion [8]. The disclosure rate of ESG information by Chinese listed companies from 2009 to 2022 increased from 89.17% to 96.37%. In this context, prioritization is critically essential for analyzing the potential motivations of enterprises through ESG information disclosure. In addition, ESG reporting quality plays a key role in accelerating sustainable and quality-focused economic progress and realizing dual-carbon goals [9]. ESG presents a positive organizational identity. As enterprises invest more in ESG, it will help them build solid social relationships and equip their employees with a stronger sense of identity with the enterprise, thus enhancing enterprises’ resilience to crisis events [10].

Currently, the uncertainty of environmental consequences in the business activities of enterprises is deepening, and the ESG performance of enterprises is attracting increasing attention [11]. Regarding the needs of enterprises to achieve sustainable development goals, GT can help them improve resource utilization efficiency, decrease pollution and emissions, reduce negative environmental impacts, and enhance the endogenous development momentum of enterprises [12]. The essence of GT is strategic change, which cannot be separated from the management and control functions of the senior management team. The advanced cognitive concepts and value differences of the senior management team provide continuous innovation vitality for enterprise GT development [13]. Active ESG functions can help enterprises grasp key strategic resources, generate unique competitive advantages, decrease business risks, and prevent falling into debt [14]. An increase in the investment of enterprises in environmental protection will urge them to carry out green technology innovations, adjust the traditional inherent patterns of enterprises, optimize enterprise strategies, and, thus, improve enterprise ESG management level [15]. GT and ESG management have emerged as inevitable options for enterprises to perform reform and innovation, and an efficient combination of the two will become the main driving force for enterprise development. Using core competence theory, this research revealed the effects of GT and ESG management on the long-term competitive superiority of enterprises.

With the continuous progress of human society, people are no longer simply chasing the functional satisfaction of commercial products but are increasingly concerned about environmental protection and sustainable societal advancement. In this regard, enterprises begin to form sustainable competitive advantages by shaping innovative thinking of meaning management [16]. Internal strategic resources and dynamic external environments are critical sources of sustainable competitive advantage [17]. Due to uneven resource distribution among enterprises, the inertia of organizational procedures, and differences in organizational systems, balanced development brought by enterprises through progressive and disruptive innovation will become critical for strengthening enduring competitive edges [18]. Based on enterprise core competence theory, the comprehensive capability system consisting of materialized and capability resources is the key to maintaining the sustainable competitive advantages of enterprises [19].

Therefore, according to enterprise core competence theory, this research investigated the relationships among GT, ESG management, and enterprise sustainable competitive advantages based on previous research and theoretical analyses. It introduced a new angle for evaluating the impacts of GT and ESG management on sustainable competitive advantages of enterprises. This research also compared differences among GT, ESG management, and sustainable competitive advantages of high-tech enterprises within the Yangtze and Pearl River Deltas and provided guidelines for the high-quality development of Chinese enterprises.

2. Literature Review and Research Hypothesis

2.1. Green Transformation and ESG Management

GT means that an enterprise takes resource conservation and environmental protection as its development orientations and green innovation as its core to achieve harmonious unity among economic, ecological, and social benefits [20]. The aim of GT is to change the traditional extensive development model and lead sustainable development with the green concepts of low consumption and low emission [21]. GT is a green development strategy to achieve energy efficiency and emission mitigation, which can enhance the quality and efficiency of the economy and environment [22]. These conclusions have some similarities: they believed that green technology-based innovation was a process for enterprises to add value, and new development forms would promote corporate restructuring and enhancement. The main function of GT is to help enterprises address the shortcomings of traditional development models and realize the leapfrog development of enterprises under the impetus of the new technological revolution.

Considering the relationship between the economic industry and the environment, the industrial green transformation path is a breakthrough in traditional industrial transformation research [23]. Currently, there are situations such as excessive resource consumption and increased pollution emission in the production processes of retail enterprises, and the GT of the retail industrial structure has gradually been transformed into an important guarantee for retail industrial agglomeration [24]. In terms of social cognition, some consumers still maintain a traditional understanding of the green consumption concept and value pursuit, and GT concept can improve the demand of people for a green lifestyle [25]. Previous research has highlighted two GT motivations: one is out of the goal of realizing enterprise value transformation, and the other is the choice of the enterprise under opportunist motive [2].

Di Ang showed that GT promoted social recognition of ESG management and could make up for ESG management deficiencies to a certain extent. GT pays attention to green technology innovations, improves green financial systems, and builds green transformation mechanisms so as to more effectively achieve pollution prevention and control of enterprises, thus improving the ESG management level of enterprises [26]. Guo Kesha and Tian Xiaoxiao concluded that GT could foster green market demand, coordinate the relationship between development and emission reduction, create a favorable environment for ESG management activities, and continuously enhance green industry development policies [27]. Considering the aforementioned analyses, the subsequent hypothesis was suggested:

Hypothesis 1a.

Green Transformation (GT) has a positive impact on ESG management.

2.2. ESG Management and Sustainable Competitive Advantage

ESG management refers to the process of investment decision-making. It not only considers the economic and non-economic performance metrics of businesses but also pays special attention to the long-term value of investment activities and constantly enhances the comprehensive management ability and sustainable development level of enterprises [28]. In the era of green-leading economic development, an increasing number of enterprises have taken ESG management consciousness as their strategic thinking ability. Enterprises that adopt ESG management concepts can effectively decrease financial risks and debt costs and activate corporate financing environments, thus helping enterprises maintain competitive advantages in the capital market and cultivate sustainable business concepts [29]. The main functions of ESG management are promoting environmental improvement with green products, actively taking social responsibilities to improve corporate image, and realizing corporate governance standardization and modernization. As a novel management model, ESG management guarantees corporate sustainability and growth and realizes the value objectives of enterprises by adjusting innovation financing levels and optimizing the innovation investment structure [30].

Active ESG management can improve enterprise internal control, maintain close cooperative relations with stakeholders, and help enterprises obtain the required resources, thus improving their market position and sustainable competitive strength [31]. Rabaya and Saleh [32] showed that ESG activities had positive impacts on the lasting competitive strength of enterprises. A sustainable development agenda has been embedded in the business model, and a significant relationship has been found between ESG activities and sustainable competitive advantages. Enterprises with good ESG management performance can decrease financing costs, increase corporate sales revenue through long-term stable value, and continuously improve corporate financial performance [33]. Truant et al. proved that ESG activities had major impacts on the supply chain [34]. To achieve strategic performance development goals, enterprises need to adhere to sustainable development principles in supply chains.

Zhang Xianhua and Qin Dongsheng reported that ESG activities of enterprises could improve shareholder return rates and decrease financial risks, significantly optimizing the financial well-being of enterprises [35]. Su Ling and He Yuxing [36] showed that the impact efficiencies of ESG activities on the financial performance of enterprises can be improved by strengthening the green cognition of executives in ESG activities, developing green products and services, and meeting consumer demands for ecological protection. Su Yanli et al. suggested that enterprises with good ESG activities had better innovation performance, financial performance, and social value; their corporate social reputation was recognized by consumers, and they could continue to attract more investors, resulting in the improvement of corporate strategic performance [37]. Given the aforementioned analyses, the following hypotheses were put forward:

Hypothesis 2a.

ESG management has a positive impact on the sustainable competitive advantage of enterprises.

Hypothesis 2b.

ESG management has a positive impact on financial performance.

Hypothesis 2c.

ESG management has a positive impact on strategic performance.

2.3. Green Transformation and Sustainable Competitive Advantage

Sustainable competitive advantages are the core competitive abilities of an enterprise, which could continuously create higher value for customers than its market rivals and was the foundation of long-term enterprise development [38]. The analysis of sustainable competitive advantages determines whether the enterprise can achieve its strategic goals and enhance its management performance. Although many factors affect the sustainable competitive advantages of enterprises, the reliability of data statistics is more important in the empirical analysis of enterprises. In previous literature, most studies took the long-term value-added ability of enterprises as a measure of sustainable competitive advantage. Adaptation to differentiated market demand and realization of the growth of enterprise assets and sales could be considered as indicators of the value-added ability of enterprises [39]. In order to achieve more stable operations, enterprises should evaluate asset operation, repayment ability, profitability, and other indicators through financial performance to make enterprise management and decision-making processes more scientific [40]. For performance improvement, enterprises pay more attention to improving their strategic performance through internal operations, learning and growth, finance, customers, etc. [41]. Enterprises with better operating conditions use financial and strategic performance indicators to measure their sustainable competitive advantages [42].

As a higher-level value orientation, GT aims to achieve a green, high-quality, sustainable growth model as the core competitive advantage of enterprises [43]. Today, the contradiction between economic growth and environmental conservation has become increasingly severe, and it is urgent to modify the existing economic development models. GT is the fundamental approach to address this crisis for traditional manufacturing enterprises [44]. Arseculeratne and Yazdanifard [45] considered GT a green marketing business strategy. To accommodate constantly evolving market demand, enterprises need to rely on green marketing strategies to achieve sustainable competitive advantages. Chen et al. concluded that the improvement of environmental rules stimulates green finance processes, thus promoting the industry to achieve GT and ultimately helping enterprises to achieve sustainable profits [46].

GT is an effective green governance model that can guide enterprises to develop in a greener and more inclusive direction [47]. Zhu Dongbo showed that GT could help break the path dependence of traditional industries, drive industrial transformation and upgrading, scientifically guide enterprise investment direction, improve enterprise green economic value, and promote the steady growth of corporate financial performance [48]. Li Xiaoyang et al. evaluated the GT requirements of manufacturing enterprises to attract customers with their own products and qualities, integrate high-quality and high-value-added products into their manufacturing industry chains, and satisfy the diversified needs of manufacturing enterprises, so as to realize their long-term goals and mission values [49]. Through GT, the overall strategic performance of enterprises could be improved to enhance their core competitiveness [50]. In accordance with the above findings, the following hypotheses were suggested:

Hypothesis 3a.

Green transformation has a positive impact on the sustainable competitive advantage of enterprises.

Hypothesis 3b.

Green transformation has a positive impact on financial performance.

Hypothesis 3c.

Green transformation has a positive impact on strategic performance.

2.4. Mediating Impact of ESG Management

An Ran and Chen Yimao [51] proved that ESG management of enterprises was a typical long-term behavior. According to GT goals, ESG management can effectively improve environmental conditions, respond to green consumption demand, improve the relationships among enterprises and environmental protection departments, and obtain a good market reputation, thus exerting positive impacts on the sustainable competitive advantages of enterprises. Strengthening enterprise ESG management could improve the quality of export products, effectively adjust their structures, improve enterprise market value, and provide notable effects on the financial prosperity of businesses [52]. As a sustainable development model, GT needs an enterprise to have a good ESG management level. Higher modernization degrees of an enterprise results in more effective restraining of improper behaviors of the management team, reduction of opportunism, improvement of investor confidence, and promotion of the realization of enterprise strategic performance objectives [53].

The development of the GT concept will accelerate the transformation of the energy industry, improve environmental, social, and governance management levels, and improve the management structure of energy enterprises so as to more effectively cooperate with enterprises in ESG management [54]. Alkaraan et al. showed that enterprises with better ESG performance tended to participate more actively in economic activities, and through GT, they could quickly achieve their strategic investment objectives and better financial performance [55]. Alsayegh et al. found that the disclosure of basic information such as ESG in an effective corporate governance system can enhance the level of the strategic objectives of the enterprise [56]. The economic and social values of the enterprise can be better reflected in the process of implementing GT so as to efficiently achieve the strategic performance of the enterprise. According to the above analyses, the following hypotheses were proposed:

Hypothesis 4a.

ESG management has an intermediary effect between green transformation and sustainable competitive advantage.

Hypothesis 4b.

ESG management has an intermediary effect between green transformation and financial performance.

Hypothesis 4c.

ESG management has an intermediary effect between green transformation and strategic performance.

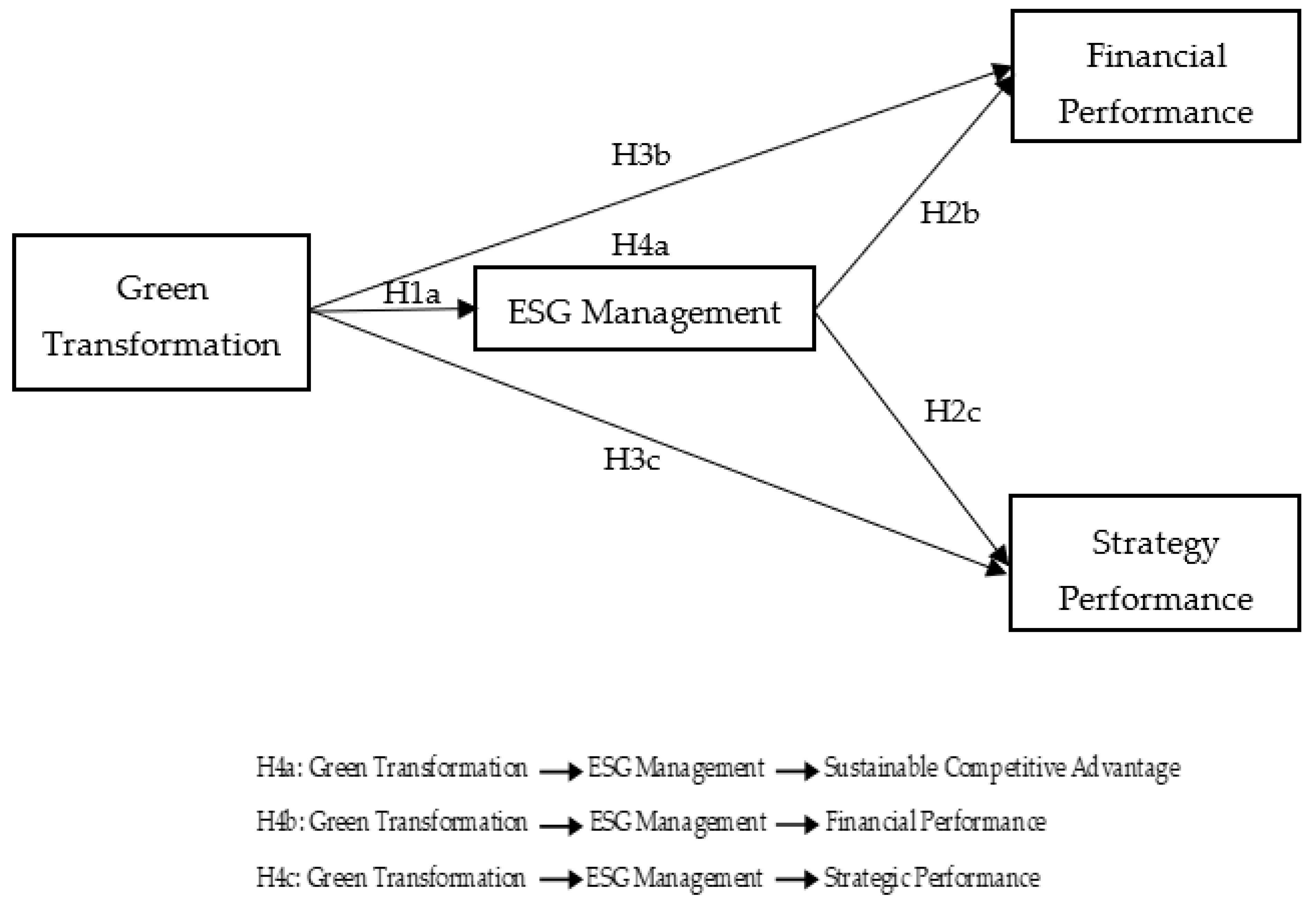

Based on the previous literature review and research hypothesis, we built a model diagram of the relationship between green transformation, ESG management, and sustainable competitive advantage, as shown in Figure 1.

Figure 1.

The relationship model between green transformation, ESG management, and sustainable competitive advantage.

3. Research Methods

3.1. Research Sample and Data Collection

This research adopted high-tech enterprises in the Pearl River Delta and Yangtze River Delta as research samples, mainly due to three reasons: first, compared with traditional manufacturing enterprises, high-tech enterprises in these two regions are larger in scale, grow more rapidly, and play significant roles in promoting the transformation of regional industrial structures to ecology and green [57]; second, high-tech enterprises in these two regions have outstanding regional coordination and innovation capabilities, and have made remarkable contributions to international commodity trade development through active participation in international economic cooperations [58]; and third, high-tech enterprises in the Pearl River Delta and Yangtze River Delta enjoy from similar geographical advantages. Despite differences in policies and measures as well as scientific research levels and industrial resources, enterprises strongly rely on forming sustainable competitive advantages [59]. It is of great significance in both theoretical and practical aspects to compare high-tech enterprises in the two regions. Considering that middle and senior technical personnel and senior management team members of high-tech enterprises are familiar with GT, ESG management, sustainable competitive advantages, and other variables, the current research adopted these individuals as research objects. The formal survey lasted for about 4 months from early March 2024 to late June 2024. Questionnaires were distributed on the internet through webchat, Email, etc., and on the spot through actual investigation and research. In the Pearl River Delta region, 350 questionnaires were distributed, of which 202 questionnaires were recovered, and 24 incomplete responses were excluded, resulting in a total of 178 questionnaires. In the Yangtze River Delta region, however, 300 questionnaires were issued, 196 questionnaires were recovered, 33 invalid questionnaires with errors and incomplete filling were excluded, and 163 questionnaires were finally considered valid. Assuming that the un-returned questionnaires might affect the conclusions of this research, the t-test method was applied to ensure that there were no significant differences among returned questionnaires (202 in the Pearl River Delta region and 196 in the Yangtze River Delta region) and un-returned questionnaires (148 in the Pearl River Delta region and 104 in the Yangtze River Delta region) under the effects of the size and age of enterprise. The t-test showed no unreacted bias. The attributes of the sample are summarized in Table 1.

Table 1.

Distinctive enterprise traits in the Pearl River Delta and Yangtze River Delta.

3.2. Variable Selection and Questionnaire Development

In addition to control variables to collect data on the establishment years and employee number of enterprises, the questionnaires of this research (GT, ESG management, financial performance, and strategic performance) were all filled out using a 5-level Likert scale, where 1 to 5 correspond to strongly disagree to strongly agree. The items of the questionnaire referred to the mature scale at home and abroad, which ensured the feasibility and scientificity of the questionnaire collection. In order to ensure the effectiveness and quality of questionnaire results, a presurvey test was performed before the formal questionnaire survey, and presurvey data were not included in the formal questionnaire survey results. The selection of specific variables and literature support were performed as follows. Measurement items are presented in Table 2.

Independent variable: green transformation. GT means that under the guidance of the green development concept, enterprises take the pursuit of economic development and environmental protection as the common goal, assume intensive use of resources and environmentally friendliness as the guidance, and take extensive to intensive as the new growth mode of enterprises [60]. The most striking manifestation of enterprise green transformation is the shift from high carbon pollution to green emission reduction [6]. Green transformation is a dynamic development process. Based on Zhao et al. [61] and Xu et al. [62], the green management concept of corporate executives and the green innovation ability of enterprises were adopted to measure the development potential of the green transformation of enterprises, and six questions including green development concept, green development technology, and green strategic objectives were introduced.

Intermediary variable: ESG management. According to Rahman and Post [63], three ecological development goals of enterprises were adopted as questionnaire items for environmental factors, and the findings of Chen Honghui et al. [64] and Mai et al. [65] were applied for social factors and corporate governance. Social factors adopted three items: promoting regional industrial progress, effectively combining enterprise value with employee value, and improving employee treatment. Corporate governance adopted three items: efficient enterprise management process governance, internal organization system improvement, and corporate culture environment construction.

Dependent variable: enterprise sustained competitive advantage. Sustainable competitive advantages referred to the ability of an enterprise to surpass its competitors in production, management, research and development, marketing, and other aspects in fierce market competition. In terms of enterprise business conditions, enterprises with sustainable competitive advantages surpass similar enterprises in financial ability, growth, long-term strategic value, etc., presenting excellent development momentum [66]. Therefore, financial and strategic performance were applied for measurements. In the financial performance dimension, the conclusions of Hu Peifeng et al. [67] and Li et al. [68] were adopted, and three items of return on assets, sales profit, and product market share were considered for measurements. Referring to the items suggested by Zhou Ran et al. [41] and Bansal [69], strategic performance was measured by three items: long-term competitiveness, transformation and upgrading, and development achievements.

Control variables: to ensure results stability, the age and size of the enterprise were included as control variables in the research. The reasons for the selection of control variables were as follows: First, older enterprises were more fully prepared and experienced in enterprise transformation, including experience in pollution reduction, equipment upgrading, and environmental governance. Therefore, they could better achieve their strategic goals. Enterprise size was closely related to employee number and management cost, which had an important effect on enterprise strategic transformation [70,71]. Second, due to organizational inertia within enterprises, the innovation consciousness of older enterprises was much lower than that of new enterprises. Differences in enterprise size showed the degree of enterprise resource wealth, which will have an important effect on enterprise innovation value [72]. In order to decrease value deviations, a natural logarithm was used to convert the values of the age and size of the enterprise.

Table 2.

Specific questions in the questionnaire of sample enterprises.

Table 2.

Specific questions in the questionnaire of sample enterprises.

| Major | Code | Subfactor | Reference |

|---|---|---|---|

| GT1 | The management of the company can promote the concept of green development | ||

| GT2 | The company is committed to the development of green technology | ||

| GT | GT3 | The company is able to replace energy-intensive equipment in a timely manner | Zhao et al. [61]; |

| GT4 | The company opens up new markets with green products | Xu et al. [62] | |

| GT5 | The company attaches great importance to the training of green technical personnel | ||

| GT6 | Company management can establish green strategic goals | ||

| ESG1 | The company is actively building an eco-friendly product market | ||

| ESG2 | The company advocates pursuing corporate profits in a low-carbon way | ||

| ESG3 | The daily office of the company opposes extravagance and waste | Rahman and Post [63] | |

| ESG4 | The company promotes the progress of regional industry with its own development | ||

| ESG | ESG5 | The company adheres to the effective combination of enterprise value and employee value | |

| ESG6 | The company focuses on improving the treatment of employees while pursuing economic value | Chen Honghui and Liu Mengdie [64]; | |

| ESG7 | The company attaches great importance to the efficient governance of enterprises | Mai et al. [65] | |

| ESG8 | The company will continue to improve the flow of internal organizational systems | ||

| ESG9 | The company actively builds a harmonious corporate culture environment | ||

| FP1 | The company’s return on assets continues to improve | ||

| FP | FP2 | The company’s sales profit is increasing year by year | Hu Peifeng et al. [67]; |

| FP3 | The company’s product market share is higher than the industry average | Li and Atuahene-Gima [68] | |

| SP1 | Compared with the past, the long-term competitiveness of enterprises has improved | ||

| SP | SP2 | Great progress has been made in the transformation and upgrading of enterprises | Zhou Ran et al. [41]; |

| SP3 | The development achievements of the enterprise are gradually recognized by the same industry | Bansal [69] |

3.3. Model Construction

To test the research hypotheses proposed above, the following three regression equation models were constructed:

Equation (1): Model of the total effect of independent variable X (GT) on dependent variable Y (sustained competitive advantage):

where c is the total effect of independent variable X (GT) on dependent variable Y (sustained competitive advantage), and e1 is the error term.

Y = cX + e1

Equation (2): Effect model of independent variable X (GT) on intermediate variable M (ESG):

where a is the effect of independent variable X (GT) on intermediate variable M (ESG), and e2 is the error term.

M = aX + e2

Equation (3): Model of the effect of independent variable X (GT) on intermediate variable M (ESG) on dependent variable Y (continuous competitive advantage):

where c’ is the direct effect of independent variable X (GT) on dependent variable Y (sustained competitive advantage) after controlling intermediary variable M (ESG), b is the effect of intermediary variable M (ESG) on dependent variable Y (sustained competitive advantage) after controlling independent variable X (GT), and e3 is the error term.

Y = c’X + bM + e3

Test steps: First, verifying if the total effect c of independent variable X (GT) on dependent variable Y (continuous competitive advantage) was significant using Equation (1). Second, using Equation (2) to check whether the effect a of independent variable X (GT) on intermediary variable M (ESG) was significant. Third, the influence of independent variable X (GT) and intermediary variable M (ESG) on dependent variable Y (continuous competitive advantage) was considered in Equation (3) to test whether c’ and b were significant.

3.4. Reliability and Validity Test

To ensure the reliability and validity of the questionnaires, we conducted a thorough evaluation and performed factor analysis for each measurement variable. SPSS27.0 was applied in this research, and the data processing results are presented in Table 3 and Table 4. According to Nunnally [73], the KMO (kaiser meyer olkin) value of each variable ranged from 0.703 to 0.941, Cronbach’s α coefficient of the variables ranged from 0.791 to 0.925, and combined reliability (CR) of the variables ranged from 0.881 to 0.937, all of which were higher than 0.7. This showed that the research scale had high consistency and reliability. According to Fornell and Larcker [74], the factor load of each item of the scale variable ranged from 0.711 to 0.903, reaching an index value higher than 0.5, which proved that the aggregate validity of research variables was good. The AVE (average variance extracted) of the variables ranged from 0.588 to 0.764, meeting the requirement that the critical value should be higher than 0.5, which indicated that the discrimination validity of each variable was good. On the basis of the guiding principles of Podsakoff et al. [75], single-factor tests were performed by Harman, and test results showed that homology bias basically did not affect research conclusions. Therefore, the scale in this research had good reliability and validity conditions and could be further analyzed.

Table 3.

Verification outcomes for the reliability and validity of corporate variable measures in the Pearl River Delta sample.

Table 4.

Assessment findings on the dependability and effectiveness of enterprise variable evaluations of the Yangtze River Delta sample enterprises.

4. Empirical Results

4.1. Descriptive Statistics

To ensure the validity of research conclusions, this study used multiple linear regression tests and SPSS27.0 to process the data. The data presented in Table 5 and Table 6 clearly indicated that the mean value of each research variable ranged from 2.28 to 3.06; that is, the mean values of GT, ESG, financial performance, strategic performance, and other variables were at relatively high levels, which could meet empirical research requirements in this research. The correlation coefficients presented in Table 5 and Table 6 showed that there were significant positive correlations among GT, ESG, financial performance, strategic performance, and other variables, and research hypotheses in this research were preliminarily verified.

Table 5.

Correlation coefficients of sample enterprise variables in the Pearl River Delta.

Table 6.

Correlation coefficients of sample enterprise variables in the Yangtze River Delta.

4.2. Hypothesis Testing and Analysis

As shown in Table 7 and Table 8, Models 1, 3, 5, and 7 represented the influences of control variables on dependent variables, that is, the regression analysis of the effects of the age and size of enterprises on ESG management, sustainable competitive advantage, financial performance, and strategic performance. Models 2, 4, 6, and 8 represented the influences of independent variables on dependent variables, and GT conducted regression analysis on ESG management, sustainable competitive advantage, and economic and strategic outcomes. The data in the tables prove, that the influences of control variables on dependent variables were not significant, indicating that the age and size of enterprises did not affect the findings of this research. In Table 7, GT had significant influences on ESG management (β = 0.477, p < 0.001), sustainable competitive advantage (β = 0.510, p < 0.001), financial performance (β = 0.435, p < 0.001) and strategic performance (β = 0.414, p < 0.001). In Table 8, GT had remarkable effects on ESG management (β = 0.442, p < 0.001), sustainable competitive advantage (β = 0.560, p < 0.001), economic efficacy (β = 0.486, p < 0.001), and strategic competency (β = 0.443, p < 0.001). Therefore, Hypotheses 1a, 3a, 3b, and 3c were verified.

Table 7.

Regression analysis of Pearl River Delta GT on ESG management, enduring market superiority, financial performance, and strategic performance.

Table 8.

Regression analysis of Yangtze River Delta GT on ESG management, prolonged competitive edge, financial performance, and strategic performance.

As presented in Table 9 and Table 10, regression analyses of ESG management on sustainable competitive advantage, financial performance, and strategic performance were performed. In Table 9, ESG management significantly affected sustainable competitive advantage (β = 0.491, p < 0.001), financial performance (β = 0.423, p < 0.001), and strategic performance (β = 0.394, p < 0.001). In Table 10, ESG management had remarkable impacts on sustainable competitive advantage (β = 0.498, p < 0.001), financial performance (β = 0.382, p < 0.001), and strategic performance (β = 0.437, p < 0.001). Therefore, Hypotheses 2a, 2b, and 2c were verified.

Table 9.

Regression analysis of enduring superiority in competition, financial performance, and strategic performance by ESG management in the Pearl River Delta.

Table 10.

Regression analysis of sustainable market dominance, financial performance, and strategic performance of ESG management in Yangtze River Delta.

By referring to the four-step tests of the mediating effect proposed by Baron and Kenny [76], the first step was to test the effects of the independent variable (GT) on dependent variables (sustainable competitive advantage, financial performance, and strategic performance), the second step was to evaluate the influences of the independent variable (GT) on the mediating variable (ESG management), the third step was to explore the effects of mediating variables (ESG management) on dependent variables (sustainable competitive advantage, financial performance, and strategic performance), and the fourth step was to incorporate independent (GT) and mediating (ESG management) variables into the research model to investigate differences in their influences on dependent variables. Combined with previous analyses, GT significantly contributed to enhancing sustainable competitive advantage, financial performance, and strategic performance; that is, it met the requirement that the independent variable should have a significant impact on the dependent variable in mediation effect tests. Research results confirmed that the D-W (durbin-watson) values of the variables in the Pearl River Delta and Yangtze River Delta models were close to 2, and VIF (variance inflation factor) values were lower than 3. Test results showed that there was no autocorrelation and multicollinearity among the variables. As presented in Table 11, GT had a significant positive effect on ESG management (β = 0.469, p < 0.001) and (β = 0.441, p < 0.001); that is, GT had a significant positive effect on ESG management, which met the condition of the influence of independent variables on intermediary variables in mediation effect tests.

Table 11.

Regression analysis of GT’s impact on ESG management.

According to the data given in Table 12 and Table 13, the regression weight of GT on sustainable competitive advantage in model 16 was lower than that of model 4 (β was decreased from 0.510 and 0.560 to 0.357 and 0.421, respectively); that is, ESG management partially intermediated the relationship between green transformation and sustainable competitive advantage of enterprises. Therefore, Hypothesis 4a was verified. In model 18, the regression coefficient of GT on financial performance was lower than that of model 6 (β was decreased from 0.435 and 0.486 to 0.302 and 0.394, respectively), indicating that ESG management had a partial mediating effect between green transformation and financial performance, and Hypothesis 4b was verified. Regression coefficients of GT on strategic performance in model 20 were lower than that of model 8 (β was decreased from 0.414 and 0.443 to 0.292 and 0.310, respectively), indicating that ESG management played a partial intermediary role between green transformation and strategic performance, and Hypothesis 4c was verified.

Table 12.

Tests the mediational pathway of ESG factors in sample enterprises in the Pearl River Delta.

Table 13.

Tests the intermediary role played by ESG management in sample enterprises in the Yangtze River Delta.

5. Conclusions

5.1. Discussion

This research explored the influences of GT on the sustainable competitive advantage of enterprises under the intermediary role of ESG management and analyzed differences among enterprises within the boundaries of the Pearl River Delta and Yangtze River Delta.

First, GT had a significant impact on ESG management, and GT and ESG management had good research results in the empirical analysis of enterprises in the Pearl River Delta and Yangtze River Delta. This was consistent with the findings of Alkaraan et al. [55], who found that GT achieved better financial performance under ESG management activities by eliminating backward production capacity, adjusting the enterprise organization system, and innovating enterprise technology products. In summary, GT could help enterprises realize a growth mode process from extensive to intensive, from high carbon pollution to green emission reduction, and promote high-quality development of the economy and environmental protection of enterprise [60]. Therefore, enterprise executives should recognize the positive role of GT and improve the level of enterprise ESG management.

Second, enterprises in the Pearl River Delta and Yangtze River Delta had obvious differences in terms of the relationship between ESG management and sustainable competitive advantage. In the Yangtze River Delta, ESG management had positive impacts on the sustainable competitive advantage and strategic performance of enterprises. However, compared with the Yangtze River Delta, ESG management in the Pearl River Delta had a certain lag in sustainable competitive advantage and strategic performance of enterprises, which might be due to three aspects. (1) Although many enterprises began to release ESG reports, the accuracy, scientificity, and transparency of these reports needed to be improved, and there were market behaviors that misled investors and consumers, which were not conducive to the construction of sustainable competitive advantages for enterprises. (2) Many enterprises in Pearl River Delta have paid more attention to ESG management, but they lack systematic ESG management strategic planning and execution plans in actual operations and fail to fully integrate internal and external resources of enterprises, making it difficult to improve the overall strategic performance of enterprises. (3) For many enterprises in the Pearl River Delta region, ESG management was a complex and systematic project, enterprises lacked experience in ESG management, and ESG management talent reserve was insufficient. Therefore, it was difficult to form an effective management mode, which affected the realization of corporate strategic performance. The impact of ESG management on enterprise financial performance in the Pearl River Delta was much stronger than that in the Yangtze River Delta, which might be due to two reasons. (1) The Pearl River Delta region was at the forefront of reform and opening up. It relied on the special economic zone and the Guangdong–Hong Kong–Macao greater bay area. The ESG investment concept had been previously accepted by the capital market, expanded financing channels for enterprises, made full use of the advantages of the capital market to provide more financial support for enterprises, decreased production risks of enterprises, and significantly improved the financial performance of enterprises. (2) As a critical growth part of China’s economic development, the Pearl River Delta region has introduced more policies to encourage and help enterprises to strengthen ESG management ESG development, including tax incentives, financial support, and talent introduction. These policies provided a clear direction for enterprise development, thus improving the financial performance of enterprises.

Third, enterprises in the Pearl River Delta and Yangtze River Delta have made remarkable achievements in research on the relationship between GT and sustainable competitive advantage. This conclusion was consistent with Zhou et al. [21], who suggested that green transformation needed to be combined with sustainable development goals of enterprises to improve the transition rate of enterprises toward green transformation. Based on the enterprise core value theory, GT is the key to maintaining the sustainable competitive advantage of enterprises. Therefore, the implementation of GT positively contributes to scientifically adjusting the industrial layout of companies and optimizing the production layout of enterprises. In market competition, enterprises that take the lead in implementing GT can be favored by the market, gain the support of consumers, accelerate enterprise ecological transformation, and form the ability of sustainable development [20]. Higher levels of enterprise GT improve the social image and corporate reputation, the enterprise obtains greater legitimacy, and the impact on the sustainable competitive advantage of the enterprise is more long-term [77]. Thus, these findings were added to previous research.

Fourth, this research examined the intermediary function of ESG stewardship between GT and sustained competitive advantage. In the Pearl River Delta and Yangtze River Delta, ESG management played a partial mediating role between green transformation and sustainable competitive advantage of enterprises, and ESG management played a partial mediating role between green transformation and financial performance, as well as green transformation and strategic performance. Therefore, ESG management could effectively regulate enterprise business activities. By fully considering all factors in the market, enterprises could maximize the competitive advantage of ESG management activities, which formed the driving force for the sustainable development of enterprises.

5.2. Impact

The research presented has vital academic implications. This study explored the impacts of GT on the sustainable competitive advantage of enterprises and enriched GT research results through empirical investigations. Enterprises strengthen green transformation, reduce energy consumption, and develop green ecological technologies, which can reduce the time and production cost of enterprises, change their traditional operation mode, and improve their sustainable competitive advantage. However, there are still some deficiencies in research on the relationship between GT and sustainable competitive advantage. To explore the practicability of research results, this study considered ESG management as an intermediary variable in its scope and empirically analyzed the mediating role of ESG management in the relationship between GT and continuous competition of enterprises to enhance the intellectual richness and insights of enterprise GT studies.

This research was of the following practical significance. GT is an enterprise modernization development trend. Based on the findings of this research, GT and ESG management are important guarantees for future-oriented enterprise development, and enterprises should give full play to the positive roles of GT and ESG management in the development of an ecological economy. ESG management is a key factor in the sustainable competitive advantage of enterprises, and business executives need to deeply understand its significance. In transformation and upgrading strategies, enterprises need to fully consider the effective coordination of GT and ESG management to achieve the long-term goal of GT’s impact on the enterprise sustainable competitive advantage. Considering the green transformation background, the environmental protection department pays great attention to enterprise ESG management activities. In order to encourage enterprises to cooperate with environmental protection departments to develop a green and low-carbon economy, environmental protection departments should further improve the evaluation system of the GT and ESG management activities of enterprises to better help enterprises achieve industrial restructuring and technological innovation.

Business leaders should fully recognize the positive impact of GT on ESG management and the continued competitive advantage of the company. First, GT has encouraged business leaders to incorporate ESG management into their operational strategies, shifting from a traditional profit-centered business model to one that focuses more on ecological protection and social responsibility. Hence, business leaders should take the lead in establishing environmental awareness, taking the sustainable development concept as the source of enterprise long-term development, guiding corporate teams and employees to realize the importance of GT to corporate value, and forming a significant environmental culture. Second, GT requires business leaders to have a higher strategic perspective and innovation ability, and actively respond to the adjustment of environmental protection regulations and changes in green consumption concepts to finally adjust the product structures and service models of enterprises. Simultaneously, business leaders are required to have cross-disciplinary management capabilities and innovative awareness. Hence, business leaders should consider green technology development as an enterprise’s core competitiveness, actively promote and apply clean energy technologies, and provide consumers with more environmentally friendly and high-quality products and services. Finally, GT brings new market development opportunities for business leaders to increase new growth points by investing in clean energy projects and improving the overall utilization of renewable resources. Therefore, business leaders need to develop sustainable green development strategies, optimize supply chain management methods, use environmentally friendly materials, decrease carbon emissions, and achieve harmonious unity of business development and environmental protection.

Policymakers should strengthen GT promotion and regulation. Firstly, GT encourages policymakers to incorporate ecological civilization construction into national strategic planning, promote economic restructuring, promote the transformation and upgrading of traditional industries, and build a green development economic system. Therefore, policymakers should strengthen the top-level design and long-term planning of GT, clarify transformation direction, path, and time point, improve cross-departmental coordination mechanisms, and ensure the scientific implementation of policies. Secondly, GT needs great amounts of financial support, and policymakers need to provide financial support for in-depth GT development through fiscal subsidies, tax incentives, and financial policies. Hence, policymakers should actively explore and improve fiscal and financial policies, establish green funds, issue green bonds, and provide preferential green credits and other ways to decrease financing costs in the process of enterprise transformation and stimulate market vitality. Finally, GT is the trend of global economic development, and policymakers need to actively participate in international cooperations and exchanges, strengthen policy coordination with other countries, and provide scientific solutions to improve global climate and environmental changes. Therefore, we will actively participate in international dialogue on green development and strengthen cooperation and exchanges with other countries regarding green standards, green systems, and green governance.

Differentiation comparison and empirical analysis of enterprises in two economically developed regions of China can effectively analyze the focus of economic development in the two regions. The Pearl River Delta and Yangtze River Delta regions paid more attention to the realization of GT goals during the economic development, but ESG management application degrees in the two regions were different to some extent. Pearl River Delta enterprises were close to Hong Kong and Macao, had extensive contact with the international market, and had high levels of ESG management practice and application, while Yangtze River Delta enterprises paid more attention to regional ESG management assessment. Therefore, differences were observed among enterprises in the Pearl River Delta and Yangtze River Delta in assigning more economic values to ESG management. This research added depth and nuance to the existing literature on the impacts of GT and ESG management on sustained competitive advantage. Currently, green development mode has become a new growth point of global economic development. The empirical analysis of ESG management activities in the Pearl River Delta and Yangtze River Delta has laid a foundation for further development of ecological and circular economy in the two regions.

5.3. Shortcomings of the Research and Future Research Opportunities

Although this research made some progress, there were some limitations. First, sample selection had limitations. This research only investigated high-tech enterprises in the Pearl River Delta and Yangtze River Delta, and the research scope can be extended to other regions or cities in the future. Second, the enterprises involved in the survey were from a variety of industries, and the sustainable competitive advantage of GT was clearly different from those of other enterprises, which might have a certain limiting effect on GT evaluation. Third, the present research only considered the effects of GT on sustainable competitive advantage, and the impacts stemming from environmental volatility and environmental competition on sustainable edge in the marketplace can be further evaluated in the future. Fourth, the research method had the following three limitations: (1) When designing the questionnaire, the academic level and the understanding depth and language expression ability of the researcher might have influenced the interviewees, resulting in a subjective bias in questionnaire results. (2) In terms of respondents’ bias, due to the limitations of time, cost, and resources in the research process, researchers could only adopt a part of the research objectives. Respondents from different positions, departments, and cultural backgrounds have different understandings of the same question, which will increase the bias of research samples. (3) In the data analysis process, statistical methods might not be able to perform a comprehensive analysis of the potential information and complex relationships of the data. At the same time, there will be problems such as wrong interpretation and over-interpretation in data processing, which can affect the accuracy of research conclusions. However, our findings provided valuable experience for future academic research and practical activities.

Author Contributions

Conceptualization, L.X. and H.W.; methodology and analysis, L.X. and H.W. Writing—original draft preparation, H.W.; writing—review and editing, L.X. All authors have read and agreed to the published version of the manuscript.

Funding

Focused Research Grant from Anhui Province Social Science Planning General Project “Research on the Dynamic Mechanism of High Quality Development of Anhui Province’s’ Specialized, Refined, Unique and New’ Enterprises under the Background of Digital Economy” (Grant No. AHSKY2023D033).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Duan, X.; Zhang, X.; Zhang, Y.; Gong, Y.; Shen, Y. Challenges and countermeasures of green transformation of school uniform industry under the background of “dual carbon”. Wool Spinn. Technol. 2022, 50, 99–105. [Google Scholar]

- Wu, J.; Wei, X.; Ren, X. Enterprise green transition and labor income share: To promote or extrusion. Ind. Econ. Res. 2023, 6, 100–113+127. [Google Scholar]

- Wang, R.; Dai, X. Value chain upgrading effect of enterprises’ green transformation: Based on text analysis of Chinese listed companies’ Annual Reports. J. Shanxi Univ. Financ. Econ. 2024, 46, 82–95. [Google Scholar]

- He, J.; Xia, W. Can from can assign to make: “double carbon” under the goal of building enterprise green transition. J. Build. Econ. 2024, 45, 5–13. [Google Scholar]

- Liu, S.; Ma, L. The impact of green finance on the green transformation of manufacturing enterprises. Resour. Sci. 2023, 45, 1992–2008. [Google Scholar] [CrossRef]

- Dai, X.; Yang, S. Digital empowerment, sources of digital input and green transformation of manufacturing industry. China Ind. Econ. 2022, 9, 83–101. [Google Scholar]

- Zhang, T.; Lu, H. The impact of regional government air pollution management on enterprises’ green transformation: An empirical study based on difference-difference model. Soc. Sci. Shandong 2024, 7, 167–175. [Google Scholar]

- Wang, Y.; Hu, Z. Empirical test of the impact toughness of supply chain enterprise ESG performance. J. Stat. Decis. 2024, 40, 179–183. [Google Scholar]

- Lai, Y.; Liu, W. Study on Peer effects of corporate ESG information Disclosure: Active imitation or Passive Response? Financ. Theory Pract. 2024, 3, 82–95. [Google Scholar]

- Wu, Y.; Zhang, X.; Guo, J. Research on the impact of corporate ESG responsibility Fulfillment on high quality development. Financ. Theory Pract. 2024, 6, 87–98. [Google Scholar]

- Chai, B.; Zhang, R.; Wan, D. Environmental Uncertainty and Corporate ESG Performance. Syst. Eng. Theory Pract. 2024, 44, 1780–1794. [Google Scholar]

- Li, J.; Lian, G.; Xu, A. A game-breaking approach to enterprise green transformation under the “dual carbon” vision: An empirical study on digitalization driving greening. Econ. Technol. Econ. Stud. 2023, 40, 27–49. [Google Scholar]

- Ren, X.; Sun, L. How to Activate the Multi-Green Transformation Path of Manufacturing Enterprises: A Study Based on Qualitative Comparative Analysis of Fuzzy Sets. Prog. Sci. Technol. Countermeas. pp. 1–9. Available online: https://link.cnki.net/urlid/42.1224.G3.20240425.1330.002 (accessed on 28 April 2024).

- Liu, D.; Liu, G. The impact of ESG responsibility Fulfillment on corporate debt default risk. Stat. Decis. 2024, 40, 177–182. [Google Scholar]

- Liao, G.; Huang, S.; Yang, S. Environmental protection investment and ESG performance of enterprises under two wheel drive: An analysis based on regulation effect and threshold effect. Friends Account. 2024, 16, 75–84. [Google Scholar]

- Qu, G.; Chen, J.; Wang, L.; Mei, L.; Zhu, Z. Innovative assets: Theoretical basis, strategic value and the enterprise practice. Sci. Res. 2021, 39, 1111–1119. [Google Scholar]

- Zhong, T. Supply chain stability, market environment and enterprise sustainable competitive advantage. J. Account. 2022, 13, 53–57. [Google Scholar]

- Lan, S.; Hu, H. The influence of dynamic equilibrium of dual Innovation on sustainable competitive advantage of enterprises. Stat. Decis. 2024, 40, 166–171. [Google Scholar]

- Yang, Q.; Ren, J. The composition and mechanism of Enterprise Core Competence in the era of intelligent Industry: Based on the grounded theoretical analysis of 223 public speeches of enterprise leaders. Chin. BBS Sci. Technol. 2020, 12, 86–97. [Google Scholar]

- Cao, Y.; Li, X.; Hu, H.; Wan, G.; Wang, S. How can digitalization drive green transformation of manufacturing enterprises? under the perspective of resource scheduling theory exploratory case study. Manag. World 2023, 39, 96–113+126. [Google Scholar]

- Zhou, S.; Li, W.; Lu, Z.; Lu, Z. A technical framework for integrating carbon emission peaking factors into the industrial green transformation planning of a city cluster in China. J. Clean. Prod. 2022, 344, 131091. [Google Scholar] [CrossRef]

- Xie, X.; Han, Y. How can local manufacturing enterprises achieve “gorgeous transformation” in green innovation? based on the basic concept of attention of many case studies. Manag. World 2022, 38, 76–106. [Google Scholar]

- Ma, L. Research on the path of industrial green transformation in coastal areas based on the coupling type of industrial environment. Geogr. Res. 2018, 37, 1587–1598. [Google Scholar]

- He, Y. Mechanism of retail industry agglomeration and Internet development affecting green transformation of industrial structure: Based on the “dual carbon” goal driven perspective. Bus. Econ. Res. 2023, 9, 165–168. [Google Scholar]

- Wang, X.; Jiang, C. Green transformation development mode and policy suggestion. Key Probl. Price Theory Pract. 2023, 4, 86–91+208. [Google Scholar]

- Di, A. Path optimization for green transformation of heavy polluting enterprises: Based on transaction cost economics. Inn. Mong. Soc. Sci. 2023, 44, 134–141. [Google Scholar]

- Guo, K.; Tian, X. Way to speed up the industrial development of our country green transformation, achievements, challenges and path. J. Econ. Asp. 2023, 1, 8–16. [Google Scholar]

- Qin, Y.; Li, S. Research on the relationship between inclusive green development, environmental protection and financial performance: An empirical analysis based on ESG. Price Theory Pract. 2024, 2, 164–168+223. [Google Scholar]

- Li, K.; Qiu, S.; Lin, Z. Can ESG performance inhibit earnings management? based on the perspective of external audit. J. Account. 2024, 9, 48–52. [Google Scholar]

- Wang, N.; Pan, H.; Wu, Y.; Li, R. ESG Performance, Innovation and Enterprise Investment Decision Value. Res. Dev. Manag. 2024, 36, 88–100. [Google Scholar] [CrossRef]

- Wang, D.; Zhang, D. ESG performance, high-quality development of manufacturing industry and digital transformation. Stat. Decis. 2023, 39, 172–176. [Google Scholar]

- Rabaya, A.J.; Saleh, N.M. The moderating effect of IR framework adoption on the relationship between environmental, social, and governance (ESG) disclosure and a firm’s competitive advantage. Environ. Dev. Sustain. 2022, 24, 2037–2055. [Google Scholar] [CrossRef]

- Yan, W.; Zhao, Y.; Meng, D. Research on the impact of ESG Rating on Financial Performance of Listed Companies. J. Nanjing Audit. Univ. 2023, 20, 71–80. [Google Scholar]

- Truant, E.; Borlatto, E.; Crocco, E.; Bhatia, M. ESG performance and technological change: Current state-of-the-art, development and future directions. J. Clean. Prod. 2023, 429, 139493. [Google Scholar] [CrossRef]

- Zhang, X.; Qin, D. Fulfillment of ESG responsibilities performance and financial performance of the synergistic effect of test. J. Account. Mon. 2024, 45, 43–49. [Google Scholar]

- Su, L.; He, Y. ESG Performance, Executive Green Cognition and Corporate Financial Performance. Account. Commun. pp. 1–5. Available online: https://link.cnki.net/urlid/42.1103.F.20240516.1025.002 (accessed on 18 May 2024).

- Su, Y.; Zhang, J.; Liu, S. Digital transformation, ESG performance and enterprise performance research review. J. Account. Mon. 2023, 44, 53–57. [Google Scholar]

- Song, L. Serial Product Innovation and Sustainable Competitive Advantage. Contemp. Film. 2023, 10, 70–75. [Google Scholar]

- Chang, Q.; Wang, Z.; Ji, G.; Zhang, L.; Zhang, Q. Look far and take advantage of the situation: An adaptive management approach to the construction of Yili’s sustainable competitive advantage. J. Manag. 2023, 20, 631–642. [Google Scholar]

- Wang, M. Biotechnology breeding enterprise financial performance of the key factors affecting. J. Mol. Plant Breed. 2024, 22, 3785–3790. [Google Scholar]

- Zhou, R.; Tang, F.; Cao, J.; Li, X. Market orientation, dynamic capability and firm strategic performance: A comparative study of two cases. Manag. Case Stud. Rev. 2024, 17, 56–71. [Google Scholar]

- Peng, C.; Xi, L.; Zhang, X. Research on the impact of breakthrough innovation on sustainable competitive advantage in highly dynamic and competitive environment. Sci. Technol. Manag. Res. 2018, 38, 10–17. [Google Scholar]

- Li, J.; Li, X. Antecedents, paths and strategies of manufacturing enterprises’ green transformation: An analysis from the perspective of carbon neutrality. Mod. Manag. Sci. 2023, 5, 124–132. [Google Scholar]

- Kuang, C.; Liu, J.; Li, W. Several intelligence fusion can assign and manufacturing enterprise green transition. J. Contemp. Financ. Econ. 2024, 5, 114–127. [Google Scholar]

- Arseculeratne, D.; Yazdanifard, R. How green marketing can create a sustainable competitive advantage for a business. Int. Bus. Res. 2014, 7, 130. [Google Scholar] [CrossRef]

- Chen, D.; Hu, H.; Chang, C.P. Green finance, environment regulation, and industrial green transformation for corporate social responsibility. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 2166–2181. [Google Scholar] [CrossRef]

- Hu, J.; Yu, L.; Liu, Y. Research on the incentive effect of Fintech on enterprises’ green transformation: Based on the dual empowerment perspective of digitalization and green governance. Mod. Financ. Econ. J. Tianjin Univ. Financ. Econ. 2024, 44, 93–109. [Google Scholar]

- Zhu, D. Environmental regulation, technological innovation and green transformation of China’s industrial structure. Ind. Tech. Econ. 2020, 39, 57–64. [Google Scholar]

- Li, X.; Dai, L.; Mou, S.; Yan, X. Agglomeration of producer services and green transformation and upgrading of manufacturing industry: The moderating role of information and communication technology. J. Southwest Univ. Soc. Sci. Ed. 2022, 48, 83–96. [Google Scholar]

- Miao, Z.; Zhao, G. Impacts of digital information management systems on green transformation of manufacturing enterprises. Int. J. Environ. Res. Public Health 2023, 20, 1840. [Google Scholar] [CrossRef]

- An, R.; Chen, Y. Improvement of ESG Performance, R&D Investment and Export Performance. Econ. Asp. 2023, 8, 98–106. [Google Scholar]

- Zhu, S.; Li, J.; Zhang, Q.; Zhong, T. Environmental information disclosure, cost impact with the enterprise product quality adjustment. China Ind. Econ. 2022, 3, 76–94. [Google Scholar]

- Fan, Y.; Meng, Y.; Hu, B. Corporate ESG performance and debt financing costs—The theoretical mechanism and empirical evidence. J. Econ. Manag. 2023, 45, 123–144. [Google Scholar]

- Baran, M.; Kuźniarska, A.; Makieła, Z.J.; Sławik, A.; Stuss, M.M. Does ESG reporting relate to corporate financial performance in the context of the energy sector transformation? Evidence from Poland. Energies 2022, 15, 477. [Google Scholar] [CrossRef]

- Alkaraan, F.; Albitar, K.; Hussainey, K.; Venkatesh, V. corporate transformation toward Industry 4.0 and financial performance: The influence of environmental, social, and governance (ESG). Technol. Forecast. Soc. Chang. 2022, 175, 121423. [Google Scholar] [CrossRef]

- Alsayegh, M.F.; Abdul Rahman, R.; Homayoun, S. Corporate economic, environmental, and social sustainability performance transformation through ESG disclosure. Sustainability 2020, 12, 3910. [Google Scholar] [CrossRef]

- Zhang, B.; Hu, M. Spatial and temporal evolution and convergence of eco-economic efficiency in three major urban agglomerations in China. Ecol. Econ. 2024, 40, 83–91. [Google Scholar]

- Liu, Y.; Qian, M.; Wang, Y. Spillover effect of incubation network innovation synergy on regional innovation efficiency: An empirical study based on three major urban agglomerations in China. China Soft Sci. 2023, 3, 32–41. [Google Scholar]

- Tian, F.; Qin, J.; Yang, K. Research on Regional differences and convergence of economic development of three major urban agglomerations in China. Syst. Eng. Theory Pract. 2021, 41, 1709–1721. [Google Scholar]

- Chen, F.; Jiang, G.; Dong, K. Digital economy to the transformation of manufacturing green space spillover effect. China Popul. Resour. Environ. 2024, 5, 114–125. [Google Scholar]

- Zhao, Y.; Peng, B.; Elahi, E.; Wan, A. Does the extended producer responsibility system promote the green technological innovation of enterprises? An empirical study based on the difference-in-differences model. J. Clean. Prod. 2021, 319, 128631. [Google Scholar]

- Xu, R.; Yao, D.; Zhou, M. Does the development of digital inclusive finance improve the enthusiasm and quality of corporate green technology innovation? J. Innov. Knowl. 2023, 8, 100382. [Google Scholar] [CrossRef]

- Rahman, N.; Post, C. Measurement issues in environmental corporate social responsibility (ECSR): Toward a transparent, reliable, and construct valid instrument. J. Bus. Ethics 2012, 105, 307–319. [Google Scholar] [CrossRef]

- Chen, H.; Liu, M. ESG Overview of the Research, Development and Future. Contemp. Econ. Manag. pp. 1–21. Available online: https://link.cnki.net/urlid/13.1356.F.20240522.1116.002 (accessed on 23 May 2024).

- Mai, N.K.; Nguyen, A.K.T.; Nguyen, T.T. Implementation of corporate social responsibility strategy to enhance firm reputation and competitive advantage. J. Compet. 2021, 13, 96–114. [Google Scholar] [CrossRef]

- Zhu, D.; Zhou, C.; Luo, Z. Sustainable competitive advantage, dividend distribution and financing liability adjustment. J. Suzhou Univ. (Philos. Soc. Sci.) 2017, 38, 100–108+191. [Google Scholar]

- Hu, P.; Wu, Y.; Zhu, L.; Zhai, J. Carbon emissions trading under the financial performance of the performance of the carbon impact study. J. Manag. Mod. 2024, 44, 168–179. [Google Scholar]

- Li, H.; Atuahene-Gima, K. Product innovation strategy and the performance of new technology ventures in China. Acad. Manag. J. 2001, 44, 1123–1134. [Google Scholar] [CrossRef]

- Bansal, P. Evolving sustainably: A longitudinal study of corporate sustainable development. Strateg. Manag. J. 2005, 26, 197–218. [Google Scholar] [CrossRef]

- Hou, Y.; Li, S.; Hao, M.; Rao, W. The impact of market green pressure on green innovation behavior of knowledge-based enterprises. China Popul. Resour. Environ. 2021, 31, 100–110. [Google Scholar]

- Wei, L.; Dang, X. Convention replication, network closure and innovation catalysis: An interactive effect model. Nankai Manag. Rev. 2018, 21, 165–175+190. [Google Scholar]

- Cao, D.; Peng, C.; Ma, H. The impact of firm dual innovation on business model innovation: A study based on different organizational practice update levels. Sci. Technol. Manag. Res. 2021, 41, 16–25. [Google Scholar]

- Nunnally, J.C. An overview of psychological measurement. In Clinical Diagnosis of Mental Disorders: A Handbook; Springer: New York, NY, USA, 1978; pp. 97–146. [Google Scholar]

- Fornell, C.; Larcker, D.F. Structural equation models with unobservable variables and measurement error: Algebra and statistics. J. Mark. Res. 1981, 18, 382–388. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

- Lin, C.; Wu, Q. Does digital transformation Promote green transformation of enterprises? West. BBS 2024, 34, 94–110. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).