Abstract

Although corporate social responsibility (CSR) can be examined from the point of view of the fundamental philosophy of business and society, many companies focus solely on profit. The main goal of this research is the investigation of the relationship between CSR and organizational financial performance, and the role of customer satisfaction in the proposed relationship. To investigate the proposed relationships, PLS–SEM analysis was performed using the statistical software Smart PLS. The sample used for this study consists of 165 large companies that operate in the Republic of Serbia, each with more than 250 employees (large organizations). The obtained results showed that in companies in Serbia, there is a positive and statistically significant relationship between CSR and customer satisfaction and a positive but statistically insignificant relationship between CSR and financial performance. Regarding the mediating role of customer satisfaction in explaining the relationship between CSR and financial performance, a positive full mediation relationship was found. Theoretical and managerial implications are also provided.

1. Introduction

Increased globalization and the emergence of a knowledge-based economy have highlighted the meaning of corporate social responsibility (CSR) through the fundamental philosophy of business and society [1]. Business activities are usually motivated by profit-seeking [2]. However, companies should be responsible for the environment, not only for profits, to reach sustainable corporate development [3]. One of the possible approaches to implementing wider business responsibilities is the concept of CSR. The analysis of CSR has moved from estimating the effect of CSR in terms of its financial importance to considering its impact on the wider society [4]. To implement CSR, companies need to make decisions that affect their financial performance [5]. By analyzing 114 empirical studies related to the relationship between CSR and organizational performance, Saha et al. [6] pointed out that financial determinants are the main barriers affecting the implementation of CSR. Likewise, their results found that the internal and external environments are important determinants of success in the adoption of CSR. It implies that managers should adopt a strategic CSR on the level of equilibrium of the total costs and benefits [7]. Therefore, companies must estimate all financial aspects that may affect CSR implementation [8].

When it comes to the effects of CSR on financial performance, there are two theoretical models: the trade-off hypothesis and the social-impact hypothesis. The first model implies that CSR negatively affects financial performance, where companies use additional resources that raise operational costs and the price of goods and services. The second model is based on the theory of stakeholders and suggests a positive relationship between these variables, where companies require social performance to consolidate their legitimacy and upgrade financial performance in the long run [9]. The implementation of CSR helps companies improve their connections with stakeholders and obtain resources to enhance their financial performance [10,11].

In addition, the relationship between CSR and customer satisfaction is also an important topic. Although sometimes CSR includes the concept of customer satisfaction, we distinguish between these two concepts. CSR is a broader business approach, while customer satisfaction can be seen as an evaluation of the customers’ purchase and consumption experiences with a company. Generally, research has shown a positive relationship between them. Previous studies have gathered data through surveys of firm representatives, typically top managers [12,13,14,15], while others have focused on surveying customers directly [16,17,18]. Furthermore, in some of the research, customer satisfaction has a mediation effect on the relationship between CSR and financial performance.

Based on the above-mentioned points, the main goal of this research is the investigation of the relationship between CSR and organizational financial performance, and the examination of the role of customer satisfaction in the proposed relationship. The motivation for the research came from the fact that there is not enough evidence related to the mediation effect of customer satisfaction in the proposed relationship, especially in Serbia, a developing country. Most of the previous research was based in Western developed and South-East developing countries [19]. The methodology obtained a theoretical review accompanied by empirical research and data analysis using PLS–SEM analysis. The research was conducted in the Republic of Serbia from September to December 2021 in 165 large private business organizations, each with more than 250 employees.

The article consists of three parts. The first part presents the theoretical background on the relationships between main concepts, CSR, financial performance, and customer satisfaction. The second part obtains the methodology and the presentation of the results of the research. The final part of the paper presents the conclusions, including theoretical and managerial implications and limitations of the presented research. Some future ideas are given at the end of the paper.

2. Theoretical Background

2.1. Stakeholders’ Theory and CSR

CSR as a concept is usually explained in the context of several theories in the areas of economics, management, and ethics. The most important and widely investigated theories that explain the CSR concept are instrumental theories, institutional theory, political economy theory, legitimacy theory, and stakeholder theory [20]. Among many previously mentioned approaches, the stakeholder approach is one of the most important when it comes to the theoretical explanation of the effects and relationships between social responsibility and business performance. According to the stakeholders’ theory, a business entity should be responsible for a wide range of stakeholders, i.e., individuals and legal entities, as well as organizations and other groups affected by the entity’s activities. The business of an organization can be affected by different interested parties or stakeholders (internal, i.e., shareholders, management, and employees, and external, i.e., financial institutions, suppliers, government, local community, consumers, etc.). CSR is composed of multiple stakeholder-related activities, including employee relationships, diversity management, corporate governance, environmental protection, community development, and consumer relations [19] (p. 3). If managed properly, CSR will not only improve the satisfaction of all stakeholders but also financial performance. For example, satisfied employees will be more motivated to perform effectively, and satisfied customers will be more willing to make repeat purchases and recommend the products to others, satisfied suppliers will provide discounts, etc. [21] (p. 679). Stakeholder theory affects business decision-making by encouraging managers to consider a broader range of outcomes and impacts when making business decisions. This approach can lead to more sustainable and socially responsible practices.

2.2. Relations between CSR and Financial Performance

Corporate financial performance is often measured by Tobin’s Q ratio [22] or profitability ratios retrieved from financial statements of companies, banks, or other organizations [21]. The most commonly used measures of assessing the financial performance of companies are ROA, ROE, ROCE, ROS, ROI, company market value, EPS, P/E, Tobin’s Q, and MVA [23]. Return on assets (ROA) is a widely applied measure in evaluating financial performance [24] and the proxy for profitability [25]. The impact of CSR on corporate financial performance can be analyzed from three aspects.

First, socially responsible operations raise profitability, where the positive influence of CSR has been identified in previous studies [26,27,28,29,30,31,32,33,34,35]. Looking at the empirical research, Ang et al. [26] analyzed the relationship between CSR and financial performance measured by ROA, as well as the moderating effect of ownership structure for 6306 heavily polluting listed companies in China for the period 2012–2019. Their results confirmed that CSR positively affects corporate financial performance, where CSR promotes this performance better in non-state-owned companies compared with state-owned companies. Zhu et al. [27] identified that CSR practices have a significant and positive effect on the financial and social performance of firms in China, while Matei et al. [30] confirmed a positive influence of CSR on the financial performance of companies in Romania. The empirical study of Yang et al. [28] examined the impact of CSR performance on the 125 Chinese pharmaceutical companies for the period 2010–2016. Their study has investigated the impact of five aspects of CSR, such as shareholders, employees, customers, suppliers, and environmental practices, on financial indicators such as return on assets, return on equity, earnings per share and Tobin’s Q return. Empirical results of applied regression models have identified a positive and significant effect of the overall CSR score on the financial indicators of the analyzed companies in China. It is interesting that the environmental aspect of CSR mostly affects the financial performance as opposed to customers, suppliers, and employees. Okafor et al. [31] examined the link between corporate social responsibility and the financial performance of 100 U.S. technology companies from the period 2017–2019 and found a positive correlation. Specifically, tech companies that spend more on corporate social responsibility experience greater revenue and profitability levels. Bag and Omrane [29] investigated the effect of CSR on the financial performance of 100 listed Indian companies and found positive implications of CSR to profitability and market share as a proxy for financial performance. Using DID regression, Ben Saad and Belkacem [32] found that CSR has a significant positive impact on financial performance measured by ROA and ROE on the sample of French companies in the period 2006–2017. Nguyen et al. [33] identified a positive correlation between corporate social responsibility and financial performance measured by ROA for Australian publicly listed companies over the period 2009–2015. Similarly, Nguyen et al. [33] found a positive relationship between ROA as a proxy for CFP and corporate social responsibility in Vietnamese listed companies for the period 2012–2017. Coelho et al. [34] analyzed 53 articles related to corporate social responsibility and financial performance and concluded that CSR directly affects a company’s financial performance. Kabir and Chowdhury [35] analyzed the causality between corporate social responsibility and the financial performance of 30 listed banks in Bangladesh for the period 2006–2018. Using the panel VAR method, this study confirmed that better corporate financial performance leads to higher CSR expenditure. However, CSR expenditure does not necessarily affect corporate financial performance.

Second, CSR could lead to higher costs and a decline in profitability, where the negative influence of CSR was confirmed in studies [36,37,38]. Based on the analysis of Fu et al. [39], a negative relationship between CSR and financial performance was identified in the sample of Chinese companies for the period 2005–2006, as well as 2009–2010. Similar results were found in the research of Yousoff and Adamu [40], who registered a negative relationship between these variables for 100 companies listed on the Malaysian stock exchange for the period 2009–2013. Cavaco and Crifo [36] researched the CSR and financial performance of 300 companies from 15 countries in the period 2002–2007. This study found that corporate social responsibility harmed financial performance measured by ROA and Tobin’s Q. Elouidani and Zoubir [37] analyzed and confirmed a negative impact of CSR on the financial performance of 20 companies listed on the stock exchange of Casablanca for the period 2007–2010. Nollet et al. [38] investigated the relationship between corporate social performance and corporate financial performance covering S&P500 companies in the period 2007–2011. The empirical findings of the linear model indicated a significant negative relationship between corporate social performance and return on capital for the observed period. Likewise, the authors of [41] (2021) confirmed that companies that implemented more CSR measures experienced a higher negative influence on profitability.

Third, there are studies [42,43,44] that have confirmed a neutral link or no relationship between CSR and corporate financial performance. In the analysis of 245 UK companies, Sun et al. [42] found no statistically significant correlation among these variables. Han et al. [44] estimated the relationship between CSR and profitability by testing the ESG performance score on the listed companies in Korea in the period 2008–2014. Their findings indicated that the environmental responsibility performance score was negatively correlated with financial performance, while the governance responsibility performance score had a positive sign on financial performance. Furthermore, the empirical findings of this study did not find significant evidence of a relationship between CSR and financial performance. Likewise, the relationship between these variables can be U-shaped, where the impact of CSR is negative, the company’s revenues decrease for a certain period, and where, later, CSR starts to positively affect financial performance. By contrast, CSR could have a positive impact on financial performance at the start, but after a certain period, greater revenues will decline, affected by the negative impact of CSR [5].

Bearing in mind that most of the research supports the existence of a relationship between SCR and financial performance and that CSR practices can enhance the overall performances of companies (higher income, higher employee productivity, etc.), the first hypothesis is formulated as follows:

H1.

CSR positively and directly affects financial performance.

2.3. Relationship between CSR, Customer Satisfaction, and Financial Performance

As already suggested, when considering the relationship between CSR and customer satisfaction, many studies have pointed to a positive association between these two variables. Some of them were based on surveys conducted among firm representatives (usually top managers), while in others, the focus was on customers.

Gimeno-Arias et al. [12] found a positive effect of CSR practices on customer satisfaction using a sample of 166 managers from small and medium-sized Spanish food and beverage manufacturing companies. The direct positive impact of CSR on customer satisfaction was also found by El-Garaihy et al. [13], whose research included 205 marketing managers from companies operating in different industries in Saudi Arabia (such as automotive, computer, chemical, petroleum, electronics, food, etc.). Another study from Saudi Arabia confirmed the positive relationship between CSR and customer satisfaction. It was carried out by Salam et al. [14], who analyzed 326 responses from top managers from companies in various sectors (industrial manufacturing, consumer product manufacturing, export–import, distribution and logistics, and service). A similar result regarding the effect of CSR on customer satisfaction was obtained in the research of Saeidi et al. [15], whose sample consisted of 205 top managers from Iranian industrial manufacturing and consumer product manufacturing companies. As mentioned in the previous study, the focus was primarily on these two sectors, bearing in mind their large impact on the environment and society.

When it comes to studies investigating the topic from the point of view of customers, Nareeman and Hassan [16] researched 152 respondents from Malaysia and found that the economic, ethical, and philanthropic dimensions of CSR have a significant and positive impact on both customer satisfaction and loyalty; by contrast, there is a negative relationship between the legal dimension of CSR and customer satisfaction and loyalty. Additionally, the research found a strong and significant positive relationship between improved customer satisfaction and loyalty. In addition, Bello et al. [18] researched more than 600 customers from Nigeria regarding telecommunications services. They found out that perceived CSR directly and positively affects service quality, satisfaction, and repurchase intention. Additionally, service quality and satisfaction mediate the effect of perceived CSR on repurchase intention, both individually and sequentially. Furthermore, Corporate Reputation and Accountability (CRA) moderates the impact of perceived CSR on service quality perceptions and repurchase intention. Finally, when researching more than 250 participants from China, Chung et al. [17] found out that CSR positively influences customer satisfaction and loyalty, and customer satisfaction, in turn, positively influences customer loyalty. Additionally, corporate image moderates the relationship between CSR and customer satisfaction.

According to Luo and Bhattacharya, customers can have better perceived value and higher satisfaction “from a product that is made by a socially responsible company (i.e., added value through good social causes). Engaging in CSR may allow firms to understand their generalized customers better and thus improve their customer-specific knowledge because improving customer knowledge represents another antecedent that has been found to enhance customer satisfaction” [45] (p. 4).

Bearing in mind everything previously stated, the following hypothesis can be formulated:

H2.

CSR positively and directly affects customer satisfaction.

The relationship between CSR and financial performance (FP) was studied through the aspect of mediation in previous research. For example, results from a sample of 280 Australian firms suggest that CSR is linked to financial performance (FP), but the effect is indirect. While CSR influences both reputation and customer satisfaction, only reputation mediates the CSR–FP relationship [46]. However, in some of the research, a mediating effect of customer satisfaction can be found in the CSR–financial performance (FP) relationship. Xie et al. [47] researched a sample of 238 firms located in China and Vietnam, and it was found that the relationship between CSR efforts and financial performance is fully mediated by customer satisfaction. When researching a bank’s customers in Jordan, Alafi and Alsufi [48] also suggested that customer satisfaction mediated the relationship between CSR services and FP.

Drawing on the previous research and from stakeholder theory, it can be stated that strong CSR practices often report higher levels of customer satisfaction, which then correlates with improved financial metrics. Companies with satisfied customers will have greater customer loyalty, positive word of mouth, and customer’s willingness to pay premium prices, and repeated purchases, which can increase a firm’s market value, cash flows, and firm financial performance [45]. We propose that companies with high levels of CSR practices will have higher financial performance when they have a high level of customer satisfaction. Therefore, the following hypothesis is defined:

H3.

Customer satisfaction has a mediation effect on the relationship between CSR and financial performance.

3. Methodology

The research was based on a single-respondent methodology. Only one questionnaire per organization was collected as a representative of the company. “It is expected that the level of professionalism and internal regulations of the analyzed organizations will not allow respondents (who stated that they have managerial responsibilities) to give false answers” [49] (p. 993). Also, a previous pilot study with a different sample was conducted at the beginning of 2021 in Serbia [19] and used to test the questionnaire in a specific business environment. In this research, we introduced a new mediation variable—customer satisfaction.

3.1. CSR in Serbia—The Context

Before 1990, CSR practices in companies in Serbia (formerly Yugoslavia) were mostly related to employee well-being and some local community issues. During the 1990s, CSR was neglected due to the economic depression, high inflation, wars, and changes in the economy and political system. At the very beginning of the 21st century, from 2000, most of the newly privatized companies did not perform CSR activities, and if they were, those were mostly ad hoc philanthropic or environmental short-term actions. The goal of business was profit. After several years of changes and the entrance of foreign direct investments and MNCs on the market, the European Union’s influence and development of a legal framework, the introduction of ESG reporting natives, and the development of civil society and NGOs, Serbian companies started to implement more strategic and innovative CSR practices. Those CSR initiatives go beyond philanthropy and are related to employees and labor conditions, environmental protection, fair business practices towards clients and suppliers, and responsible behavior related to the local community and government (tax payment, investment in local infrastructure). CSR is still in the developing phase in Serbia, and therefore, scientific research is needed.

3.2. Questionnaire and Variables

The questionnaire used in this research was created based on various prior studies [15,50,51], and it was adjusted to stakeholder theory since it explored the main areas (stakeholders). The questionnaire had four parts. The first part was related to the organizational details and demographic variables, the second part contained questions on CSR, the third part was related to customer satisfaction, and in the fourth part, financial outcomes were presented [19,20,52].

CSR was measured through 26 questions. A CSR variable was developed as a formative construct from 6 factors (dimensions) of CSR, according to the stakeholder theory [53,54]: responsibility to the environment (four questions), employees (five questions), community (four questions), investors (four questions), suppliers (five questions), and customers (four questions) [19,20]. This part of the questionnaire was created based on previous research made in the developing countries of Dubai [51] and Turkey [50].

Financial performance (Fin Perf) was measured through market share, profit rate, return on investment, return on assets, return on equity, and growth in sales volume [15,51]. These measures were based on the research of Saeidi et al. [15]. The respondents compared their business performances with their main competitors on a scale from 1 to 5, with 1 being weak, or the least within this branch, and 5 being superior [19]. Subjective questions to assess firm performance were used instead of accounting measures because, according to Santos and Brito [55], subjective measures allow “the control of different economic activities in the sample when comparing the firm to the industry’s average, and it minimizes the sector influence on the datasets”, and because it is helpful in research where it is “very difficult to access the actual data of organizations owing to the rejection from managers to share sensitive financial data or because of poor reporting” [56] (p. 612).

Customer satisfaction was measured on a scale of 7 items (questions). Several authors [15,46,57] proposed that the customer satisfaction indicator could be the construct that would present an overall evaluation of the consumption experiences of a firm. Galbreath and Shum [46] and Galbreath developed 7 items for measuring customer expectations and the relationship between customers and the firm [58]. The scale was designed to investigate managerial perceptions of the satisfaction of their customers. These seven items cover three main dimensions of customer satisfaction: customer satisfaction with product or service quality, customer satisfaction with value for price, and meeting customer expectations [46] (p. 219).

Each item of the questionnaire was rated on a Likert scale, where 1 was strongly disagree and 5 was strongly agree [15].

3.3. Sample and Data Collection

The sample used for this study consists of 165 large companies that operate in the Republic of Serbia, with more than 250 employees (this is considered to be a large organization), mostly from the processing industry (50.9% of the sample), privately owned, with 65% national companies and 35% foreign subsidiaries. For this study, the authors explained the idea of the research and the need for this research at the country level, accompanied by assuring anonymity and confidentiality during data collection. Also, we asked all participants to participate voluntarily. Regarding the sample, we used publicly available information about the companies, and only large companies with more than 250 employees that are active and showed business results in the Serbian Business Register were chosen as the population from which we drew our sample.

Regarding the representativeness of the sample, according to the data of the Statistical Office of the Republic of Serbia, the number of companies employing 250 or more employees in 2021 was 584 in the domicile economy. The sample in this paper is 165 companies (valid questionnaires), which makes the sample 28.25% of the basic set (all companies with more than 250 employees). The size of the sample is adequate, bearing in mind “the ten times more” rule, which means that the sample size for PLS–SEM analysis should be at least ten times larger than the largest number of formative indicators for a particular construct in the model to be satisfied [19].

Data collection was performed using a Google online questionnaire. The respondents were managers in senior positions who had access to the necessary data. Most of the respondents belonged to either the top management board (49.7%) or the middle management level (44.8%), while only 5.5% of respondents were from the line managerial level. The managers were asked to rate their organizations regarding the questions on CSR, customer satisfaction, and financial performance. Responses were collected from September 2021 to December 2021.

As for the sampling method, the research used the convenient sampling method, which is based on the inclusion in the research of those subjects of the basic set who are available.

3.4. Data Analysis

PLS–SEM analysis was used for the investigation of the relationship, using Smart PLS 3.2.9 software to estimate the measurement and structural model parameters and to generate the accompanying bootstrap estimates.

The first part of the analysis was the measurement of the formative second-order construct in the model, CSR. For constructs of customer satisfaction and financial performance that were reflective, Hair et al. [59] suggested measures for analyzing reflective constructs: individual indicator reliability, internal consistency reliability, convergent validity, and discriminant validity. The bootstrap method based on 5000 subsamples was applied to estimate the structural model significance.

4. Results

The formative construct in the model (CSR) was tested by calculating outer weights and significance through standard deviation, t-statistics, and p-values. Table 1 presents data on formative construct analysis.

Table 1.

Assessment of the formative construct of Corporate Social Responsibility.

Based on data in Table 1, coefficients of the path showed positive significant results (p-values < 0.05) for the second-order construct, i.e., CSR and six variables.

The multicollinearity analysis (common method bias) was assessed through the variance inflation factor (VIF) and Harman’s single score. Kock [60] argued that values of VIF need to be lower than 3.3. In that case, there is no multicollinearity issue. Based on the obtained results, there was no multicollinearity inside formative constructs because the values of VIFs were less than 3.3 [60]. Moreover, Harman’s single factor score of 46.09% showed that the total variance for a single factor was less than the maximum allowed of 50%.

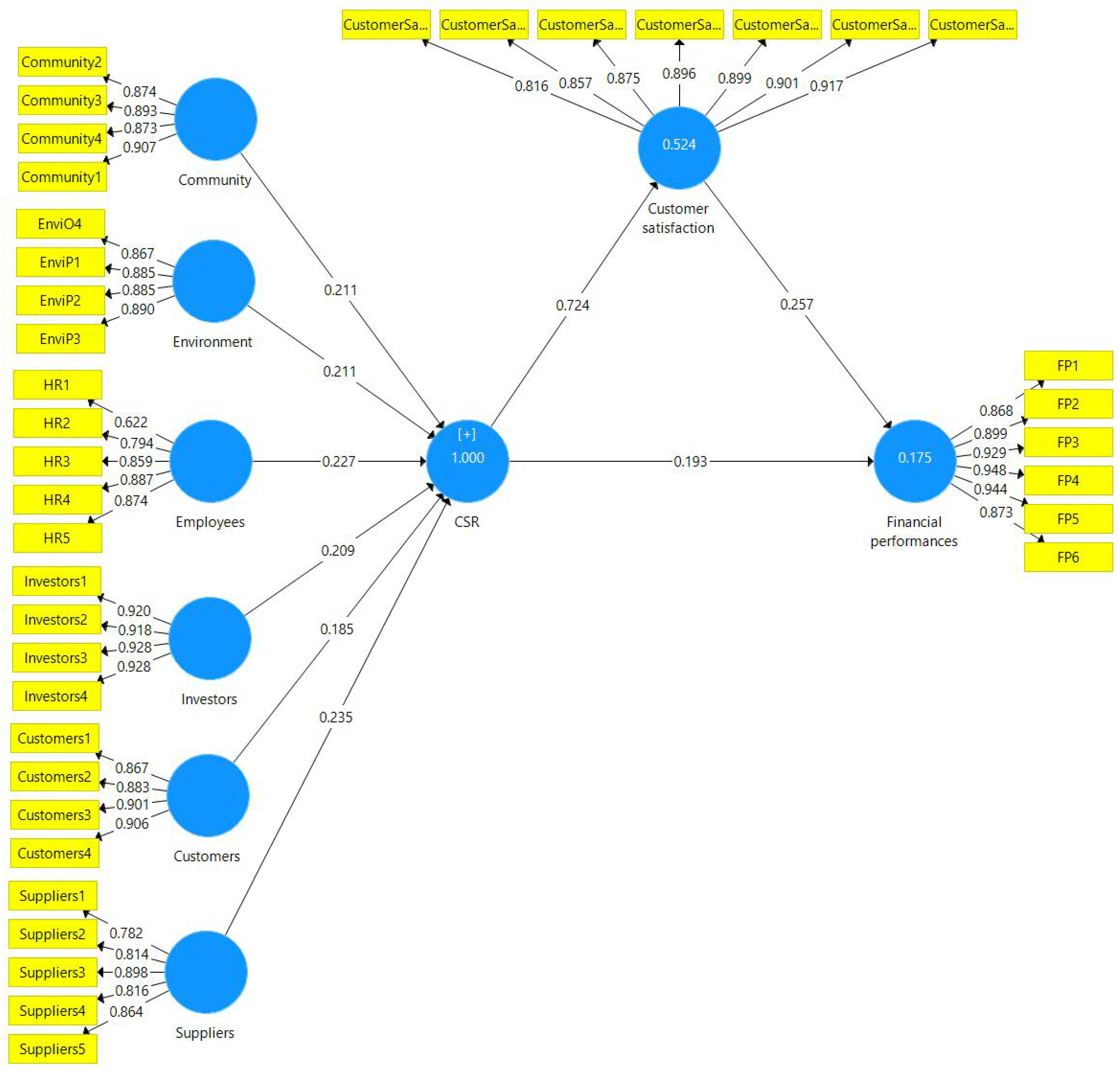

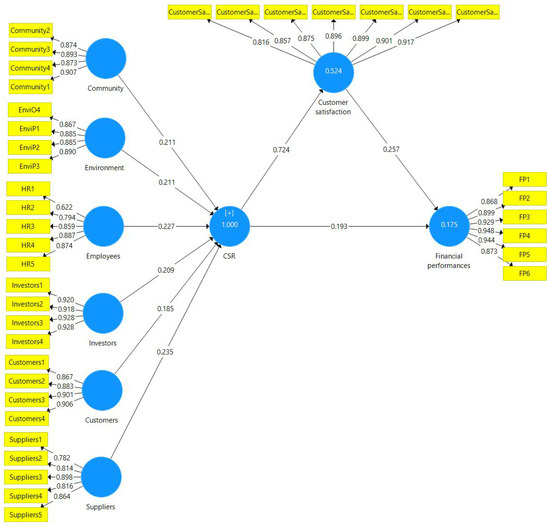

The second part of the analysis analyzed reflective constructs of the outer model. First, reflective indicator loadings, internal consistency reliability, convergent validity, and discriminant validity were tested. This type of measurement was proposed for reflective constructions in the model [20,59]. The lowest eligibility limit for factor load is 0.708. The indicators’ loadings between 0.4 and 0.7 should be retained only if their removal did not have an impact on the average variance extracted and composite reliability [59]. Item HR1 had to be removed from further analysis because its load level was lower than acceptable. The retained items with the allowed degree of load are presented in Figure 1.

Figure 1.

Path analysis with factor loadings.

Figure 1 presents path analysis with factor loadings.

Table 2 below outlines the reliability tests. The values of Cronbach’s Alpha ranged from 0.867 (employees) to 0.959 for financial performance. Bearing in mind that the lowest acceptable limit of Cronbach’s Alpha should be 0.6, we can conclude that this condition is satisfied. The value of composite reliability of constructs ranged from 0.906 (variable employees) to the highest value, 0.967 (for financial performance). Some authors recommended that the lowest limit of acceptability of Composite Reliability should be 0.7 [59]. Convergent validity was assessed by average variance extracted (AVE). The lowest acceptable limit of AVE is 0.5 [61]. Based on the data in Table 2, convergent validity was satisfied.

Table 2.

Assessment of the formative construct CSR.

The authors also investigated the discriminant validity using the heterotrait–monotrait (HTMT) ratio. Since the HTMT ratio is one of the most rigorous criteria for discriminant validity, the authors chose to present this one. HTMT ratio values below 0.9 indicate that the defined components are sufficiently different from each other; it means that they describe different phenomena [59]. Table 3 shows that all HTMT values were below 0.9, which means that the discriminant validity criterion was met.

Table 3.

Heterotrait–monotrait (HTMT) ratio.

Also, the multicollinearity analysis indicates that all VIF values are below the threshold of 3.3 [60], and therefore, the model was found to be reliable and valid.

The final step was to analyze the relationship between CSR and financial performance, as well as the mediating role of customer satisfaction in the proposed relationship. R-squared, representing the variance of the dependent variable explained by the independent variable, shows a value of 17.5% for financial performance, while in the case of customer satisfaction, R2 is 52.4% in the model. Table 4 shows the result of the bootstrapping procedure.

Table 4.

Results of the bootstrapping.

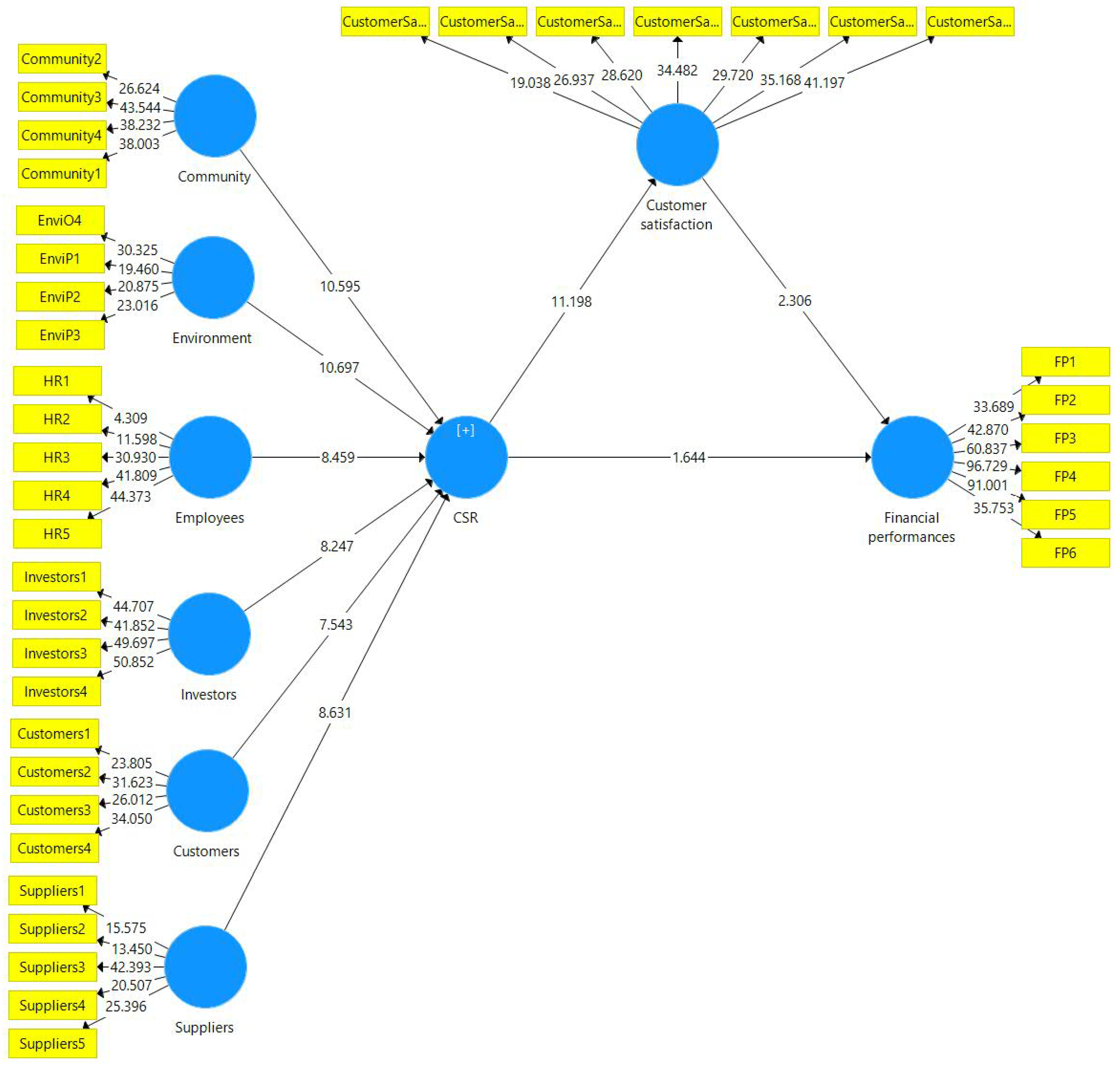

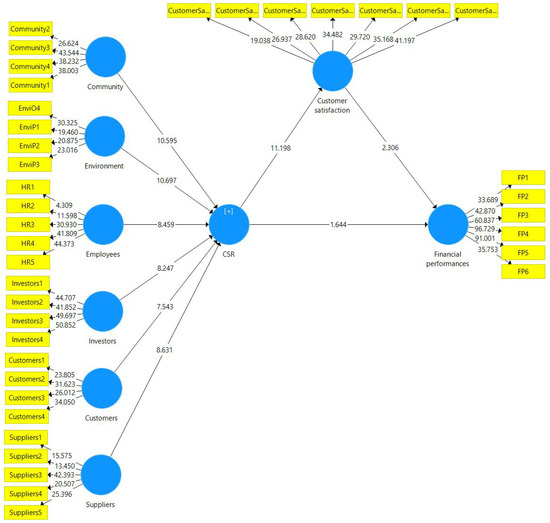

The results shown in Table 4 indicate a positive and statistically significant relationship between CSR and customer satisfaction (β = 0.724; t = 11.198; p = 0.000) and a positive but statistically insignificant relationship between CSR and financial performance (β = 0.193; t = 1.644; p = 0.100). This means that there is no direct relationship between the mentioned constructs. Regarding the mediating role of customer satisfaction in explaining the relationship between CSR and financial performance, a positive mediation relationship was found since the indirect effect of CSR on financial performance through customer satisfaction was significant (β = 0.186; t = 2.248; p = 0.025). Full mediation was determined (see Figure 2).

Figure 2.

Bootstrapping analysis with T-values.

5. Discussion

The presented results show that in companies in Serbia, there is a positive and statistically significant relationship between CSR and customer satisfaction and a positive but statistically insignificant relationship between CSR and financial performance. Regarding the mediating role of customer satisfaction in explaining the relationship between CSR and financial performance, a positive full mediation relationship was found since the indirect effect of CSR on financial performance through customer satisfaction was significant. The first hypothesis is not proven, while the second and third are.

The authors aimed to present how CSR is related to financial performance in companies in Serbia, and to customer satisfaction, too. Regarding the CSR–financial performance link, this relationship has been investigated in previous research all around the world, and the present results are in line with those from other authors, namely Sun et al. [42], Han et al. [44], Marić et al. [19] and even Adamkaite et al. [5], who found no statically significant relationships among these variables. The reasons for this kind of result could be found in a theoretical model that implies that CSR negatively affects financial performance because companies use additional resources (for responsible and sustainable operations) that raise operational costs and price of goods and, in turn, gain lower economic and financial results [9,62]. One more possible explanation of the results is also the institutional environment in developing economies that were usually promoting high economic growth and international competitiveness, that, if not properly managed, may lead to social inequality, poor labor practices, and enormous environmental damage” [51] (p. 374).

Besides financial performance, one of the main findings of this research was that there is a direct positive statistically significant relationship between CSR and customer satisfaction. This means that companies that are socially responsible to their stakeholders can use these practices and enhance the satisfaction of their customers, who can be aware of CSR initiatives and the responsible behavior of their providers. Similar results are also found in previous research [12,13,14,15]. Companies could use CSR as an important instrument in gaining a higher level of customer satisfaction and fostering their corporate reputation, which is seen as an overall image of the companies seen by a wide range of stakeholders [20].

Finally, we found that customer satisfaction is a significant mediator in the relationship between CSR and the financial performance of a company. This means that achieving a higher level of customer satisfaction through CSR creates superior financial performance for a company. The result is in line with previous research [15,47,63]. Customer satisfaction measures the loyalty and quality of customers for a firm [47]. The CSR of a company could “enable customers to perceive that they gain value from those firms with strong CSR records, such as feeling that they are better understood and more respected. Accordingly, CSR efforts can help firms improve customer satisfaction by attracting and retaining customers, enhancing brand image, and increasing customer loyalty. Furthermore, CSR can improve customer satisfaction by increasing firms’ perceived utility and value” [47] (pp. 27–28).

6. Conclusions

This research investigated the relationship between CSR and the financial performance of large companies in Serbia, with the mediation effect of customer satisfaction. Previous literature suggested that CSR has a positive impact on customer satisfaction and that there is still no clear evidence of a CSR–financial performance link. We developed our hypotheses and explored relationships between the mentioned constructs. The obtained results showed that in companies in Serbia there is a positive and statistically significant relationship between CSR and customer satisfaction, and a positive but statistically insignificant relationship between CSR and financial performance. Regarding the mediating role of customer satisfaction in explaining the relationship between CSR and financial performance, a positive full mediation relationship was found. Based on the results of the theoretical and empirical research, we derived theoretical and managerial implications.

Theoretical implications are mostly related to increasing the literature base and proving the questionnaire and the model. First, we increased our understanding of the effects of organizations’ CSR on financial performance and customer satisfaction. Although this relationship has been previously investigated regarding the CSR–financial performance link, it is important to emphasize that positive relationships between CSR and customer satisfaction were detected. In the case of financial performance, we proved that in the developing country of Serbia, there are no statistically significant effects of CSR on performance, but the link is significant and positive through customer satisfaction as a mediator. Second, our study demonstrates the efficacy of using a questionnaire grounded in the stakeholder theory of CSR [51]. An additional theoretical implication pertains to the validation of the questionnaire, which is derived from earlier versions applied in other developed and developing countries [15,51] and previously applied in Serbia for processing companies only [20,64]. All applied reliability tests confirmed the high validity and reliability of the data. This validation supports the potential for cross-national or regional comparisons using the same or similar questionnaires, enabling cross-national research to explore similarities and differences in CSR and its impact on proposed variables. This is significant for both theoretical and practical reasons: for theory, it facilitates the testing of established hypotheses and theories in diverse contexts; for practitioners, it underscores the importance of CSR practices for the company and identifies which CSR practices have the most substantial impact on market and financial performance.

To create a responsible business environment, it is essential to examine how corporate social responsibility (CSR) is practiced in the business world [65], as this is a concept that is related to both business and society [66]. Therefore, managerial implications are even more important. Those could be seen in the evidence of the positive influence of CSR initiatives on customer satisfaction and financial performance, through customer satisfaction. This means that achieving a higher level of customer satisfaction through CSR creates superior financial performance for a company. “Companies should practice CSR activities because it has been proven that responsible and ethical business practices which take into account a large group of stakeholders, and a wider business, social and natural environment, will bring greater benefits for the companies that would be perceived as more valuable for the society” [20], and it could be used for enhancing customer satisfaction. Contemporary customers are more and more aware of CSR and sustainability, and therefore, companies need to invest in such practices and business operations to gain attention, attract customers, and satisfy their wider needs and attitudes.

Regarding research limitations, the first is related to the sample, which does not possess responses from small and medium-sized organizations, which make up more than 90% of the economy in the Republic of Serbia. Also, public sector companies were not taken into account. The second limitation is related to the single-respondent methodology. Although most of the previous research used customers as respondents, we decided to investigate the perception of managers. The reasons for this lie in the fact that those are accountable and responsible persons in organizations, and they could provide more valid data, following business ethics and their positions in the company [20]. The third limitation is the usage of subjective measures of financial performance instead of objective ones. However, Santos and Brito [55] stated that subjective measures like managerial estimation are acceptable because they allow the control of different economic activities in the sample when comparing the firm to the industry’s average, and they minimize the sector influence on the data sets, while Vij and Bedi [56] suggested that this is an acceptable solution when it is difficult to access objective data from companies. The fourth limitation is related to the positive approach to CSR, which sometimes is not in question. For example, Li et al. found that firms in China in the period 2009–2019 that make long-term donations (as a part of their CSR behavior) tend to report timely goodwill impairment, while firms making excessive short-term donations are more likely to delay goodwill impairment. Short-term donations are motivated not only by covering up the goodwill impairment delay but also by providing insurance-like protection when delayed impairment is announced. Moral licensing plays a role in inducing such opportunistic behaviors and misuse of the CSR approach to cover up corporate fraud [67].

Future research could be focused on more detailed analysis of the presented relationships in SMEs, and in public sector organizations. These two sectors, according to size and ownership, are very significant in the context of the Serbian economy, and therefore, it will be important to investigate the proposed relations. Also, making a longitudinal analysis would be valuable for the theory and practice of CSR, because it will comprise estimated relations over a longer period. Besides the above-mentioned points, investigating specific aspects of CSR that could be used as opportunistic behavior, as in the case of Li et al.’s research, is also a direction for future research.

Author Contributions

Conceptualization, B.K., and N.Đ.; methodology, N.B.; validation, N.M. and M.A.; data analysis, N.M.; writing—original draft preparation, M.A.; writing—review and editing, B.K. and N.Đ. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Provincial Secretariat for Higher Education and Scientific Research of the Autonomous Province of Vojvodina, the Republic of Serbia, during the project “Financial, marketing and management aspects of energy efficiency in the function of sustainable development of AP Vojvodina”, grant number: 142-451-3381/2023.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors upon request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Shahzad, F.; Baig, M.H.; Rehman, I.U.; Saeed, A.; Asim, G.A. Does intellectual capital efficiency explain corporate social responsibility engagement-firm performance relationship? Evidence from environmental, social and governance performance of US listed firms. Borsa Istanb. Rev. 2022, 22, 295–305. [Google Scholar] [CrossRef]

- Sang, M.; Zhang, Y.; Ye, K.; Jiang, W. Moderating Effects of Internalization between Corporate Social Responsibility and Financial Performance: The Case of Construction Firms. Buildings 2022, 12, 185. [Google Scholar] [CrossRef]

- Simmou, W.; Govindan, K.; Sameer, I.; Hussainey, K.; Simmou, S. Linking corporate social responsibility strategy, green innovation, and environmental performance: Evidence from Maldivian and Moroccan small and medium-sized enterprises. J. Clean. Prod. 2023, 384, 135265. [Google Scholar] [CrossRef]

- Kong, Y.; Antwi-Adjei, A.; Bawuah, J. A Systematic Review of the Business Case for Corporate Social Responsibility and Firm Performance. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 444–454. [Google Scholar] [CrossRef]

- Adamkaite, J.; Streimikiene, D.; Rudzioniene, K. The Impact of Social Responsibility on Corporate Financial Performance in the Energy Sector: Evidence from Lithuania. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 91–104. [Google Scholar] [CrossRef]

- Saha, R.; Shashi Cerchione, R.; Singh, R.; Dahiya, R. Effect of ethical leadership and corporate social responsibility on firm performance: A systematic review. Corp. Soc. Responsib. Environ. Manag. 2019, 27, 409–429. [Google Scholar]

- Lin, W.L.; Ho, J.A.; Sambasivan, M. Impact of corporate political activity on the relationship between corporate social responsibility and financial performance: A dynamic panel data approach. Sustainability 2019, 11, 60. [Google Scholar] [CrossRef]

- Ma, C.; Chisti, M.F.; Durrani, M.K.; Bashir, R.; Safdar, S.; Hussain, R.T. The Corporate Social Responsibility and Its Impact on Financial Performance: A Case of Developing Countries. Sustainability 2023, 15, 3724. [Google Scholar] [CrossRef]

- Hamdoun, M.; Achabou, M.A.; Dekhili, S. Could CSR Improve the Financial Performance of Developing Countries’ Firms? Analyses of Mediating Effect of Intangible Resources. Eur. Bus. Rev. 2022, 34, 41–61. [Google Scholar]

- Barnet, M.L.; Salomon, R.M. Does It Pay to Be Really Good? Addressing the Shape of the Relationship between Social and Financial Performance. Strateg. Manag. J. 2012, 33, 1304–1320. [Google Scholar] [CrossRef]

- Shirasu, Y.; Kawakita, H. Long-term financial performance of corporate social responsibility. Global Financ. J. 2020, 50, 100532. [Google Scholar] [CrossRef]

- Gimeno-Arias, F.; Santos-Jaén, J.M.; Palacios-Manzano, M.; Garza-Sánchez, H.H. Using PLS-SEM to Analyze the Effect of CSR on Corporate Performance: The Mediating Role of Human Resources Management and Customer Satisfaction. An Empirical Study in the Spanish Food and Beverage Manufacturing Sector. Mathematics 2021, 9, 2973. [Google Scholar] [CrossRef]

- El-Garaihy, W.H.; Mobarak, A.-K.M.; Albahussain, S.A. Measuring the Impact of Corporate Social Responsibility Practices on Competitive Advantage: A Mediation Role of Reputation and Customer Satisfaction. Int. J. Bus. Manag. 2014, 9, 109–124. [Google Scholar] [CrossRef]

- Salam, M.A.; Jahed, M.A.; Palmer, T. CSR Orientation and Firm Performance in the Middle Eastern and African B2B Markets: The Role of Customer Satisfaction and Customer Loyalty. Ind. Mark. Manag. 2022, 107, 1–13. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How Does Corporate Social Responsibility Contribute to Firm Financial Performance? The Mediating Role of Competitive Advantage, Reputation, and Customer Satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Nareeman, A.; Hassan, Z. Customer Perceived Practices of CSR on Improving Customer Satisfaction and Loyalty. Int. J. Account. Bus. Manag. 2013, 1, 30–49. [Google Scholar]

- Chung, K.-H.; Yu, J.-F.; Choi, M.-G.; Shin, J.-J. The Effects of CSR on Customer Satisfaction and Loyalty in China: The Moderating Role of Corporate Image. J. Econ. Bus. Manag. 2015, 3, 542–547. [Google Scholar] [CrossRef]

- Bello, K.B.; Jusoh, A.; Md Nor, K. Relationships and Impacts of Perceived CSR, Service Quality, Customer Satisfaction and Consumer Rights Awareness. Soc. Responsib. J. 2021, 17, 1116–1130. [Google Scholar] [CrossRef]

- Marić, S.; Berber, N.; Slavić, A.; Aleksić, M. The Mediating Role of Employee Commitment in the Relationship between Corporate Social Responsibility and Firm Performance in Serbia. Sage Open 2021, 11, 21582440211037668. [Google Scholar] [CrossRef]

- Berber, N.; Aleksić, M.; Slavić, A.; Jelača, M.S. The Relationship between Corporate Social Responsibility and Corporate Reputation in Serbia. Eng. Econ. 2022, 33, 232–245. [Google Scholar] [CrossRef]

- Galant, A.; Cadez, S. Corporate Social Responsibility and Financial Performance Relationship: A Review of Measurement Approaches. Econ. Res. 2017, 30, 676–693. [Google Scholar] [CrossRef]

- Tobin, J. A General Equilibrium Approach to Monetary Theory. J. Money Credit. Bank. 1969, 1, 15–29. [Google Scholar] [CrossRef]

- Barauskaite, G.; Streimikiene, D. Corporate Social Responsibility and Financial Performance of Companies: The Puzzle of Concepts, Definitions and Assessment Method. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 278–287. [Google Scholar] [CrossRef]

- Brooks, C.; Oikonomou, I. The Effects of Environmental, Social and Governance Disclosures and Performance on Firm Value: A Review of the Literature in Accounting and Finance. Br. Account. Rev. 2018, 50, 1–15. [Google Scholar] [CrossRef]

- Cho, S.J.; Chung, C.Y.; Young, J. Study on the Relationship between CSR and Financial Performance. Sustainability 2019, 11, 343. [Google Scholar] [CrossRef]

- Ang, R.; Shao, Z.; Liu, C.; Yang, C.; Zheng, Q. The Relationship between CSR and Financial Performance and the Moderating Effect of Ownership Structure: Evidence for Chinese Heavily Polluting Listed Enterprises. Sustain. Prod. Consum. 2021, 30, 117–129. [Google Scholar] [CrossRef]

- Zhu, Q.; Liu, J.; Lai, K. Corporate social responsibility practices and performance improvement among Chinese national state-owned enterprises. J. Prod. Econ. 2016, 171, 417–426. [Google Scholar] [CrossRef]

- Yang, M.; Bento, P.; Akbar, A. Does CSR Influence Firm Performance Indicators? Evidence from Chinese Pharmaceutical Enterprises. Sustainability 2019, 11, 5656. [Google Scholar] [CrossRef]

- Bag, S.; Omrane, A. Corporate Social Responsibility and Its Overall Effects on Financial Performance: Empirical Evidence from Indian Companies. J. Afr. Bus. 2020, 23, 264–280. [Google Scholar] [CrossRef]

- Matei, F.B.; Boboc, C.; Ghita, S. The relationship between corporate social responsibility and financial performance in Romanian companies. Econ. Comput. Econ. Cybern. Stud. Res. 2021, 55, 297–314. [Google Scholar] [CrossRef]

- Okafor, A.; Adeleye, B.N.; Adusei, M. Corporate social responsibility and financial performance: Evidence from US tech firms. J. Clean. Prod. 2021, 292, 126078. [Google Scholar] [CrossRef]

- Ben Saad, S.; Belkacem, L. How Does Corporate Social Responsibility Influence Firm Financial Performance? Corp. Gov. 2022, 22, 1–22. [Google Scholar] [CrossRef]

- Nguyen, C.T.; Nguyen, L.T.; Nguyen, N.Q. Corporate social responsibility and financial performance: The case in Vietnam. Cogent Econ. Financ. 2022, 10, 2075600. [Google Scholar] [CrossRef]

- Coelho, R.; Jayantilal, S.; Ferreira, J.J. The Impact of Social Responsibility on Corporate Financial Performance: A Systematic Literature Review. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1535–1560. [Google Scholar] [CrossRef]

- Kabir, M.A.; Chowdhury, S.S. Empirical Analysis of the Corporate Social Responsibility and Financial Performance Causal Nexus: Evidence from the Banking Sector of Bangladesh. Asia Pac. Manag. Rev. 2023, 28, 1–12. [Google Scholar] [CrossRef]

- Cavaco, S.; Crifo, P. CSR and Financial Performance: Complementarity between Environmental, Social and Business Behaviours. Appl. Econ. 2014, 46, 3323–3338. [Google Scholar] [CrossRef]

- Elouidani, A.; Zoubir, F. Corporate Social Responsibility and Financial Performance. Afr. J. Account. Audit. Financ. 2015, 4, 74–85. [Google Scholar] [CrossRef]

- Nollet, J.; Filis, G.; Mitrokostas, E. Corporate social responsibility and financial performance: A non-linear and disaggregated approach. Econ. Model. 2016, 52, 400–407. [Google Scholar] [CrossRef]

- Fu, G.; Wang, J.; Jia, M. The Relationship between Corporate Social Performance and Financial Performance: Modified Models and Their Application—Evidence from Listed Companies in China. J. Contemp. Manag. 2012, 9, 17–37. [Google Scholar]

- Yousoff, W.F.W.; Adamu, M.S. The Relationship between Corporate Social Responsibility and Financial Performance: Evidence from Malaysia. Int. Bus. Manag. 2016, 10, 345–351. [Google Scholar]

- Lee, Y.-H.; Yang, L.T.-Y. Corporate Social Responsibility and Financial Performance: A Case Study Based in Taiwan. Appl. Econ. 2021, 53, 2661–2670. [Google Scholar] [CrossRef]

- Sun, N.; Salama, A.; Hussainey, K.; Habbash, M. Corporate environmental disclosure, corporate governance and earning management. Manag. Audit. J. 2010, 25, 679–700. [Google Scholar] [CrossRef]

- Soana, M.G. The relationship between corporate social performance and corporate financial performance in the banking sector. J. Bus. Ethics 2011, 104, 133–148. [Google Scholar] [CrossRef]

- Han, J.-J.; Kim, H.J.; Yu, J. Empirical Study on Relationship between Social Responsibility and Financial Performance in Korea. Asian J. Sustain. Soc. Responsib. 2016, 1, 61–76. [Google Scholar] [CrossRef]

- Luo, X.; Bhattacharya, C.B. Corporate social responsibility, customer satisfaction, and market value. J. Mark. 2006, 70, 1–18. [Google Scholar] [CrossRef]

- Galbreath, J.; Shum, P. Do customer satisfaction and reputation mediate the CSR–FP link? Evidence from Australia. Aust. J. Manag. 2012, 37, 211–229. [Google Scholar]

- Xie, X.; Jia, Y.; Meng, X.; Li, C. Corporate Social Responsibility, Customer Satisfaction, and Financial Performance: The Moderating Effect of the Institutional Environment in Two Transition Economies. J. Clean. Prod. 2017, 150, 26–39. [Google Scholar] [CrossRef]

- Alafi, K.; Alsufy, F.J.H. Corporate Social Responsibility Associated with Customer Satisfaction and Financial Performance: A Case Study with Housing Banks in Jordan. Int. J. Humanit. Soc. Sci. 2012, 2, 102–115. [Google Scholar]

- Berber, N.; Slavić, A.; Strugar Jelača, M.; Bjekić, R. The effects of market economy type on the training practice differences in the Central Eastern European region. Employ. Relat. 2020, 42, 971–998. [Google Scholar] [CrossRef]

- Turker, D. Measuring corporate social responsibility: A scale development study. J. Bus. Ethics 2009, 85, 411–427. [Google Scholar] [CrossRef]

- Rettab, B.; Brik, A.B.; Mellahi, K. A Study of Management Perceptions of the Impact of Corporate Social Responsibility on Organisational Performance in Emerging Economies: The Case of Dubai. J. Bus. Ethics 2009, 89, 371–390. [Google Scholar] [CrossRef]

- Grubor, A.; Berber, N.; Aleksić, M.; Bjekić, R. The Influence of Corporate Social Responsibility on Organizational Performance: A Research in AP Vojvodina. An. Ekon. Fak. Subi. 2020, 43, 3–13. [Google Scholar] [CrossRef]

- Farmaki, A. Corporate social responsibility in hotels: A stakeholder approach. Int. J. Contemp. Hosp. Manag. 2019, 31, 2297–2320. [Google Scholar] [CrossRef]

- Yoon, B.; Chung, Y. The effects of corporate social responsibility on firm performance: A stakeholder approach. J. Hosp. Tour. Manag. 2018, 37, 89–96. [Google Scholar] [CrossRef]

- Santos, J.B.; Brito, L.A.L. Toward a Subjective Measurement Model for Firm Performance. BAR-Braz. Adm. Rev. 2012, 9, 95–117. [Google Scholar] [CrossRef]

- Vij, S.; Bedi, H.S. Are subjective business performance measures justified? Int. J. Product. Perform. Manag. 2016, 65, 603–621. [Google Scholar] [CrossRef]

- Andreassen, T.W.; Lindestad, B. Customer Loyalty and Complex Services: The Impact of Corporate Image on Quality, Customer Satisfaction and Loyalty for Customers with Varying Degrees of Service Expertise. Int. J. Serv. Ind. Manag. 1998, 9, 7–23. [Google Scholar] [CrossRef]

- Galbreath, J. How Does Corporate Social Responsibility Benefit Firms? Evidence from Australia. Eur. Bus. Rev. 2010, 22, 411–431. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Kock, N. Common Method Bias in PLS-SEM: A Full Collinearity Assessment Approach. Int. J. e-Collab. 2015, 11, 1–10. [Google Scholar] [CrossRef]

- Dash, G.; Paul, J. CB-SEM vs PLS-SEM Methods for Research in Social Sciences and Technology Forecasting. Technol. Forecast. Soc. Chang. 2021, 173, 121092. [Google Scholar] [CrossRef]

- Tang, Z.; Hull, C.E.; Rothenberg, S. How Corporate Social Responsibility Engagement Strategy Moderates the CSR–Financial Performance Relationship. J. Manag. Stud. 2012, 49, 1274–1303. [Google Scholar] [CrossRef]

- Ali, R.; Sial, M.S.; Brugni, T.V.; Hwang, J.; Khuong, N.V.; Khanh, T.H.T. Does CSR Moderate the Relationship between Corporate Governance and Chinese Firm’s Financial Performance? Evidence from the Shanghai Stock Exchange (SSE) Firms. Sustainability 2020, 12, 149. [Google Scholar] [CrossRef]

- Aleksić, M.; Berber, N.; Strugar, J.M.; Bjekić, R. The Impact of Corporate Social Responsibility on the Environmental Performance of Large Organizations in Serbia. Strateg. Manag. 2022. [Google Scholar] [CrossRef]

- Modreanu, A.; Toma, S.-G.; Burcea, M.; Grădinaru, C. Perceptions and Attitudes of SMEs and MNCs Managers Regarding CSR Implementation: Insights from Companies Operating in the Retail Sector. Sustainability 2024, 16, 3963. [Google Scholar] [CrossRef]

- Dieguez, T.; Loureiro, P.; Ferreira, I. Portuguese Corporate Social Responsibility: Features and Stakeholder Views. Int. J. Innov. Econ. Dev. 2023, 9, 7–15. [Google Scholar]

- Li, F.; Lu, W.; Wang, J. Corporate Social Responsibility and Goodwill Impairment: Charitable Donations of Chinese Listed Companies. Available online: https://ssrn.com/abstract=4337571 (accessed on 7 February 2024).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).