Green Firms, Environmental Hazards, and Investment

Abstract

:1. Introduction

2. Environmental Risk and Greenness

2.1. Research Hypotheses

2.2. Local Environmental Risks

2.3. Sectoral Grenness

3. Empirical Strategy

3.1. Data

3.2. Model and Econometric Methodology

4. Results

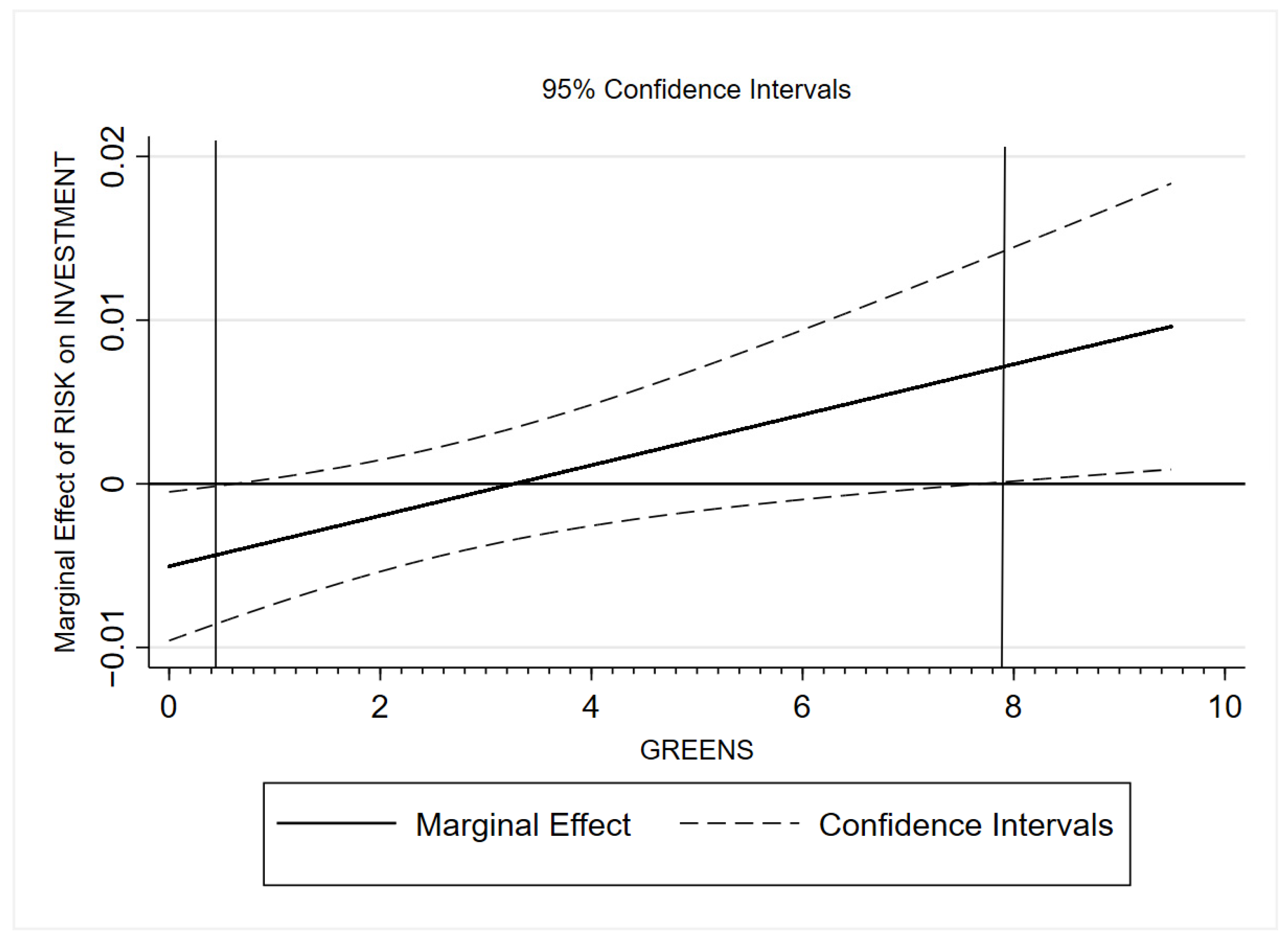

4.1. Baseline Results

4.2. Decomposing the Environmental Risk

4.3. Results Considering the Introduction of the Paris Agreement

5. Concluding Remarks

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| GREENS | GREENS2 | RISK | ΔSALES | DIFFKAPS. | ΔEMP | AGE | LEVER. | CASHFL. | DEBTS. | WORKC. | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GREENS | 1 | ||||||||||

| GREENS2 | 0.4296 *** | 1 | |||||||||

| RISK | −0.0426 *** | −0.0939 *** | 1 | ||||||||

| ΔSALES | 0.0052 *** | −0.0023 ** | 0.0122 *** | 1 | |||||||

| DIFFKAPSALES | −0.0154 *** | −0.0599 *** | −0.0072 *** | −0.1241 *** | 1 | ||||||

| ΔEMP | 0.0037 *** | 0.0046 *** | 0.0152 *** | 0.5534 *** | −0.0878 *** | 1 | |||||

| AGE | 0.0112 *** | −0.0037 *** | −0.0929 *** | −0.1402 *** | 0.1885 *** | −0.1517 *** | 1 | ||||

| LEVERAGE | −0.0274 *** | −0.0094 *** | 0.0395 *** | 0.0686 *** | −0.1550 *** | 0.0646 *** | −0.2773 *** | 1 | |||

| CASHFLOW | 0.0257 *** | 0.0485 *** | 0.0028 *** | 0.1103 *** | −0.3121 *** | 0.0592 *** | −0.0698 *** | −0.1252 *** | 1 | ||

| DEBTSUST | −0.0115 *** | −0.0335 *** | 0.0264 *** | −0.0993 *** | 0.3404 *** | −0.1493 *** | 0.0227 *** | 0.1622 *** | −0.1255 *** | 1 | |

| WORKCAP | 0.0274 *** | 0.0560 *** | −0.0349 *** | −0.0590 *** | −0.3679 *** | −0.0506 *** | 0.1680 *** | −0.5491 *** | 0.2037 *** | −0.2216 *** | 1 |

References

- IPCC. AR6 Climate Change 2022: Impacts, Adaptation and Vulnerability—Summary for Policy Makers; (AR6); IPCC: Geneva, Switzerland, 2022; Available online: https://www.ipcc.ch/report/ar6/wg2/downloads/report/IPCC_AR6_WGII_SummaryForPolicymakers.pdf?fbclid=IwAR2ObESfzPpubjH3dmiI4y9SA65MQMPNvFIUlDQoJSuccmtRU7pWfvnEAWo (accessed on 7 June 2022).

- Albala-Bertrand, J.M. Natural disaster situations and growth: A macroeconomic model for sudden disaster impacts. World Dev. 1993, 21, 1417–1434. [Google Scholar] [CrossRef]

- Anbarci, N.; Escaleras, M.; Register, C.A. Earthquake fatalities: The interaction of nature and political economy. J. Public Econ. 2005, 89, 1907–1933. [Google Scholar] [CrossRef]

- Kahn, M.E. The death toll from natural disasters: The role of income, geography, and institutions. Rev. Econ. Stat. 2005, 87, 271–284. [Google Scholar] [CrossRef]

- Halliday, T. Migration, risk, and liquidity constraints in El Salvador. Econ. Dev. Cult. Change 2006, 54, 893–925. [Google Scholar] [CrossRef]

- Skidmore, M.; Toya, H. Do natural disasters promote long-run growth? Econ. Inq. 2002, 40, 664–687. [Google Scholar] [CrossRef]

- Hallegatte, S.; Dumas, P. Can natural disasters have positive consequences? Investigating the role of embodied technical change. Ecol. Econ. 2009, 68, 777–786. [Google Scholar] [CrossRef]

- Hochrainer, S. Assessing the Macroeconomic Impacts of Natural Disasters: Are There Any? World Bank Policy Research Working Paper. 2009. Available online: https://openknowledge.worldbank.org/entities/publication/deb177e2-35f1-5cb5-8657-7b33ec8137d0 (accessed on 18 November 2023).

- Leiter, A.M.; Oberhofer, H.; Raschky, P.A. Creative disasters? Flooding effects on capital, labour and productivity within European firms. Environ. Resour. Econ. 2009, 43, 333–350. [Google Scholar] [CrossRef]

- De Mel, S.; McKenzie, D.; Woodruff, C. Enterprise recovery following natural disasters. Econ. J. 2012, 122, 64–91. [Google Scholar] [CrossRef]

- Miao, Q.; Popp, D. Necessity as the mother of invention: Innovative responses to natural disasters. J. Environ. Econ. Manag. 2014, 68, 280–295. [Google Scholar] [CrossRef]

- Yamamoto, H.; Naka, T. Quantitative analysis of the impact of floods on firms’ financial conditions. Bank Jpn. 2021. Available online: https://www.boj.or.jp/en/research/wps_rev/wps_2021/data/wp21e10.pdf (accessed on 18 November 2023).

- Reggiani, A.; De Graaff, T.; Nijkamp, P. Resilience: An evolutionary approach to spatial economic systems. Netw. Spat. Econ. 2002, 2, 211–229. [Google Scholar] [CrossRef]

- Duval, R.; Elmeskov, J.; Vogel, L. Structural policies and economic resilience to shocks. Struct. Policies Econ. Resil. Shock. 2007. Available online: https://www.oecd-ilibrary.org/docserver/140152385131.pdf?expires=1704719146&id=id&accname=guest&checksum=AEC5D8AC1ABBEE94A1CFD92FA49AF432 (accessed on 18 November 2023). [CrossRef]

- Rose, A. Economic principles, issues, and research priorities in hazard loss estimation. In Modeling Spatial and Economic Impacts of Disasters; Okuyama, Y., Chang, S.E., Eds.; Springer: Berlin/Heidelberg, Germany, 2004; pp. 13–36. [Google Scholar]

- Martin, R. Regional economic resilience, hysteresis and recessionary shocks. J. Econ. Geogr. 2012, 12, 1–32. [Google Scholar] [CrossRef]

- Li, S. Natural extreme events, government subsidies and corporate environment responsibility: Evidence from China’s energy sector. Energy Econ. 2022, 114, 106278. [Google Scholar] [CrossRef]

- Antonioli, D.; Marzucchi, A.; Modica, M. Resilience, performance and strategies in firms’ reactions to the direct and indirect effects of a natural disaster. Netw. Spat. Econ. 2022, 22, 1–25. [Google Scholar] [CrossRef]

- Tol, R.S.; Leek, F.P. Economic analysis of natural disasters. In Climate, Change and Risk; Downing, T.E., Olshtoorn, A.J., Tol, R.S.J., Eds.; Routledge: London, UK, 1998; pp. 332–351. [Google Scholar]

- Liu, D.; Sun, W.; Zhang, X. Is the Chinese economy well positioned to fight the COVID-19 pandemic? The financial cycle perspective. Emerg. Mark. Financ. Trade 2020, 56, 2259–2276. [Google Scholar] [CrossRef]

- Vidya, C.T.; Prabheesh, K.P. Implications of COVID-19 pandemic on the global trade networks. Emerg. Mark. Financ. Trade 2020, 56, 2408–2421. [Google Scholar] [CrossRef]

- Uchida, H.; Miyakawa, D.; Hosono, K.; Ono, A.; Uchino, T.; Uesugi, I. Natural Disaster and Natural Selection. RIETI Discussion Paper Series. 2013. Available online: https://www.rieti.go.jp/jp/publications/dp/14e055.pdf (accessed on 18 November 2023). [CrossRef]

- Sobel, R.S.; Leeson, P.T. Government’s response to Hurricane Katrina: A public choice analysis. Public Choice 2006, 127, 55–73. [Google Scholar] [CrossRef]

- Crespo Cuaresma, J.; Hlouskova, J.; Obersteiner, M. Natural disasters as creative destruction? Evidence from developing countries. Econ. Inq. 2008, 46, 214–226. [Google Scholar] [CrossRef]

- Chen, Y.E.; Li, C.; Chang, C.P.; Zheng, M. Identifying the influence of natural disasters on technological innovation. Econ. Anal. Policy 2021, 70, 22–36. [Google Scholar] [CrossRef]

- Gries, T.; Naudé, W. Extreme events, entrepreneurial start-ups, and innovation: Theoretical conjectures. Econ. Disasters Clim. Change 2021, 5, 329–353. [Google Scholar] [CrossRef]

- O’Connor, R.E.; Bard, R.J.; Fisher, A. Risk perceptions, general environmental beliefs, and willingness to address climate change. Risk Anal. 1999, 19, 461–471. [Google Scholar] [CrossRef]

- Degryse, H.; Goncharenko, R.; Theunisz, C.; Vadasz, T. When green meets green. J. Corp. Financ. 2023, 78, 102355. [Google Scholar] [CrossRef]

- IPCC; Mach, K.J.; Planton, S.; von Stechow, C. Annex II: Glossary. In Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Climate Change 2014: Synthesis Report; Core Writing Team, Pachauri, R.K., Meyer, L.A., Eds.; IPCC: Geneva, Switzerland, 2014; pp. 117–130. [Google Scholar]

- Boschma, R. Towards an evolutionary perspective on regional resilience. Reg. Stud. 2015, 49, 733–751. [Google Scholar] [CrossRef]

- Okuyama, Y. Economics of natural disasters: A critical review. Reg. Res. Inst. Work. Pap. 2003. Available online: https://researchrepository.wvu.edu/cgi/viewcontent.cgi?article=1123&context=rri_pubs (accessed on 18 November 2023).

- Hallegatte, S.; Hourcade, J.C.; Dumas, P. Why economic dynamics matter in assessing climate change damages: Illustration on extreme events. Ecol. Econ. 2007, 62, 330–340. [Google Scholar] [CrossRef]

- Pan, X.; Qiu, B. The impact of flooding on firm performance and economic growth. PLoS ONE 2022, 17, e0271309. [Google Scholar] [CrossRef]

- Hu, H.; Lei, T.; Hu, J.; Zhang, S.; Kavan, P. Disaster-mitigating and general innovative responses to climate disasters: Evidence from modern and historical China. Int. J. Disaster Risk Reduct. 2018, 28, 664–673. [Google Scholar] [CrossRef]

- Botzen, W.W.; Deschenes, O.; Sanders, M. The economic impacts of natural disasters: A review of models and empirical studies. Rev. Environ. Econ. Policy 2019, 13, 167–188. [Google Scholar] [CrossRef]

- Auci, S.; Barbieri, N.; Coromaldi, M.; Michetti, M. Climate variability, innovation and firm performance: Evidence from the European agricultural sector. Eur. Rev. Agric. Econ. 2021, 48, 1074–1108. [Google Scholar] [CrossRef]

- Noy, I.; Strobl, E. Creatively destructive hurricanes: Do disasters spark innovation? Environ. Resour. Econ. 2023, 84, 1–17. [Google Scholar] [CrossRef]

- Koppel, B.M. Induced innovation theory, agricultural research, and Asia’s green revolution: A Reappraisal. In Induced Innovation Theory and International Agricultural Development: A Reassessment; Koppel, B.M., Ed.; Routledge: London, UK; John Hopkins University Press: Baltimore, MD, USA, 1994. [Google Scholar]

- Smithers, J.; Blay-Palmer, A. Technology innovation as a strategy for climate adaptation in agriculture. Appl. Geogr. 2001, 21, 175–197. [Google Scholar] [CrossRef]

- Wurlod, J.D.; Noailly, J. The impact of green innovation on energy intensity: An empirical analysis for 14 industrial sectors in OECD countries. Energy Econ. 2018, 71, 47–61. [Google Scholar] [CrossRef]

- Gagliardi, L.; Marin, G.; Miriello, C. The greener the better? Job creation effects of environmentally-friendly technological change. Ind. Corp. Change 2016, 25, 779–807. [Google Scholar] [CrossRef]

- Ghisetti, C.; Quatraro, F. Green technologies and environmental productivity: A cross-sectoral analysis of direct and indirect effects in Italian regions. Ecol. Econ. 2017, 132, 1–13. [Google Scholar] [CrossRef]

- Lybbert, T.J.; Zolas, N.J. Getting patents and economic data to speak to each other: An ‘algorithmic links with probabilities’ approach for joint analyses of patenting and economic activity. Res. Policy 2014, 43, 530–542. [Google Scholar] [CrossRef]

- Marin, G.; Lotti, F. Productivity effects of eco-innovations using data on eco-patents. Ind. Corp. Chang. 2017, 26, 125–148. [Google Scholar] [CrossRef]

- Mulier, K.; Schoors, K.; Merlevede, B. Investment-cash flow sensitivity and financial constraints: Evidence from unquoted European SMEs. J. Bank. Financ. 2016, 73, 182–197. [Google Scholar] [CrossRef]

- Blundell, R.; Bond, S.; Devereux, M.; Schiantarelli, F. Investment and Tobin’s Q: Evidence from company panel data. J. Econom. 1992, 51, 233–257. [Google Scholar] [CrossRef]

- Bond, S.; Harhoff, D.; Van Reenen, J. Investment, R&D and financial constraints in Britain and Germany. Ann. D’econ. Stat. 2005, 433–460. [Google Scholar] [CrossRef]

- Mizen, P.; Vermeulen, P. Corporate Investment and Cash Flow Sensitivity: What Drives the Relationship? European Central Bank Working Paper Series. 2005. Available online: https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp485.pdf (accessed on 18 November 2023). [CrossRef]

- Bloom, N.; Bond, S.; Van Reenen, J. Uncertainty and investment dynamics. Rev. Econ. Stud. 2007, 74, 391–415. [Google Scholar] [CrossRef]

- Guariglia, A. Internal financial constraints, external financial constraints, and investment choice: Evidence from a panel of UK firms. J. Bank. Financ. 2008, 32, 1795–1809. [Google Scholar] [CrossRef]

| Mean | Std. Dev. | Min | Max | Obs | ||

|---|---|---|---|---|---|---|

| INVESTMENT | Sum of depreciation in year t and the change in fixed assets from year t − 1 to year t diveded by replacement value of the firm’s capital stock. | 0.51 | 1.20 | −0.78 | 16.41 | 525,957 |

| GREENS (a) | Number of green patent at sectoral level (4-digit), following Wurload and Noailly methodology. See Section 2 for details. | 2.60 | 2.41 | 0.00 | 9.49 | 525,957 |

| GREENS2 (a) | Number of green patent at sectoral level (4-digit). See Section 2 for details. | 4.30 | 1.87 | 0.00 | 8.39 | 525,957 |

| RISK | Firm’s municipality enviromental risk (see notes for a detailed description). | 1.40 | 1.02 | 0.00 | 4.00 | 525,957 |

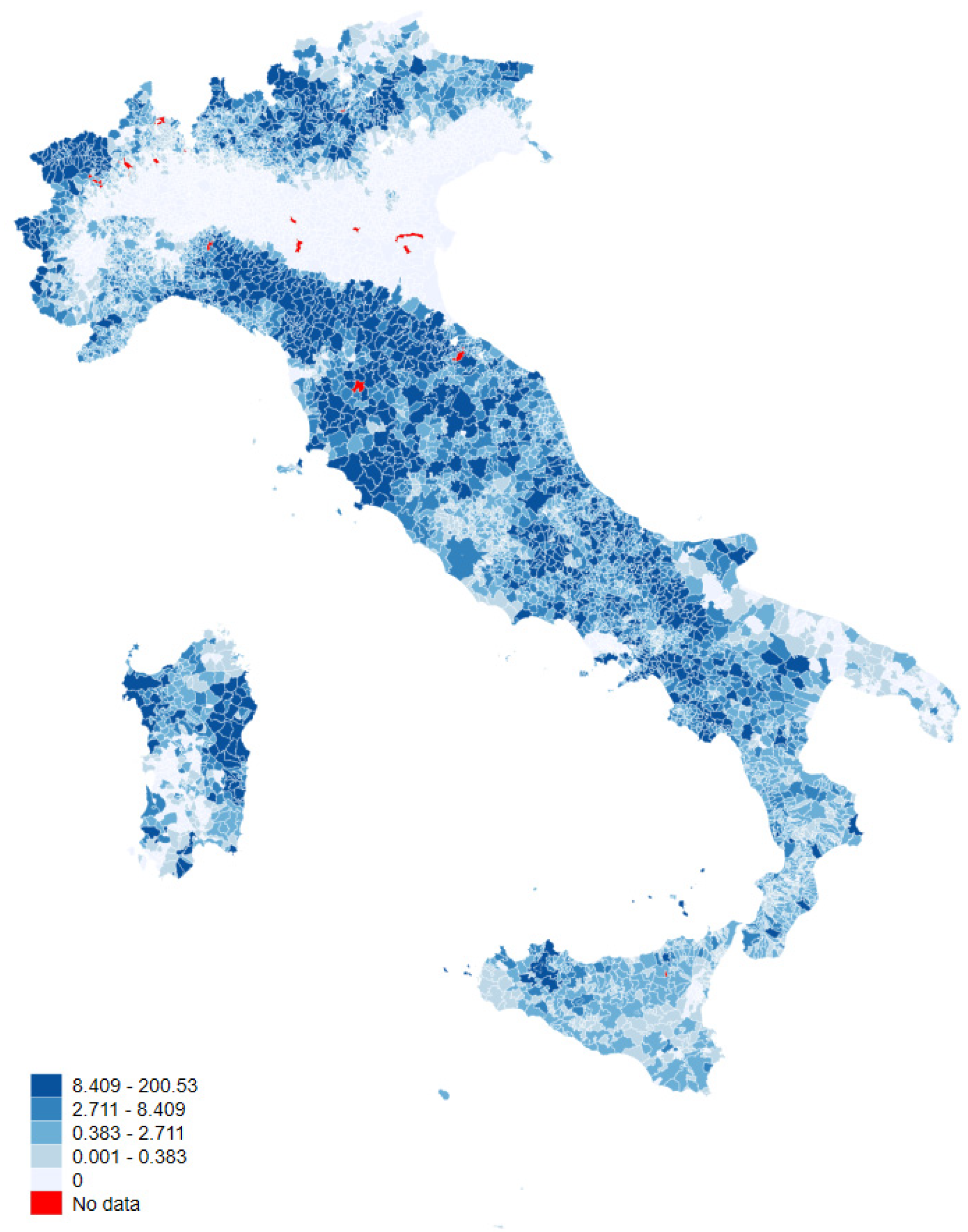

| LANDSLIDE | Firm’s municipality surface (km2) at higher landslide hazard | 3.08 | 8.68 | 0.00 | 200.54 | 525,957 |

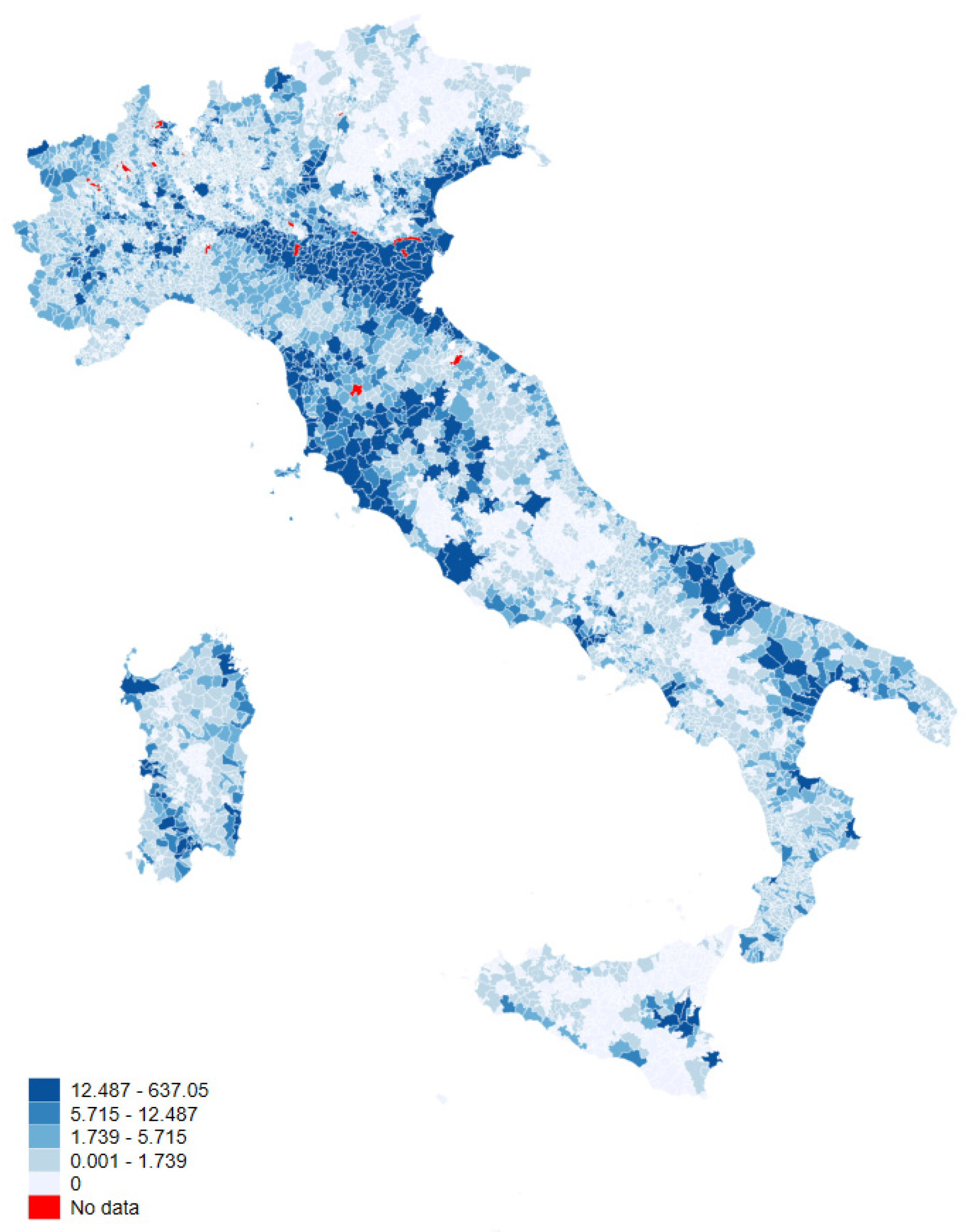

| HYDRAULIC | Firm’s municipality surface (km2) at higher hydraulic hazard | 15.59 | 44.61 | 0.00 | 653.62 | 525,957 |

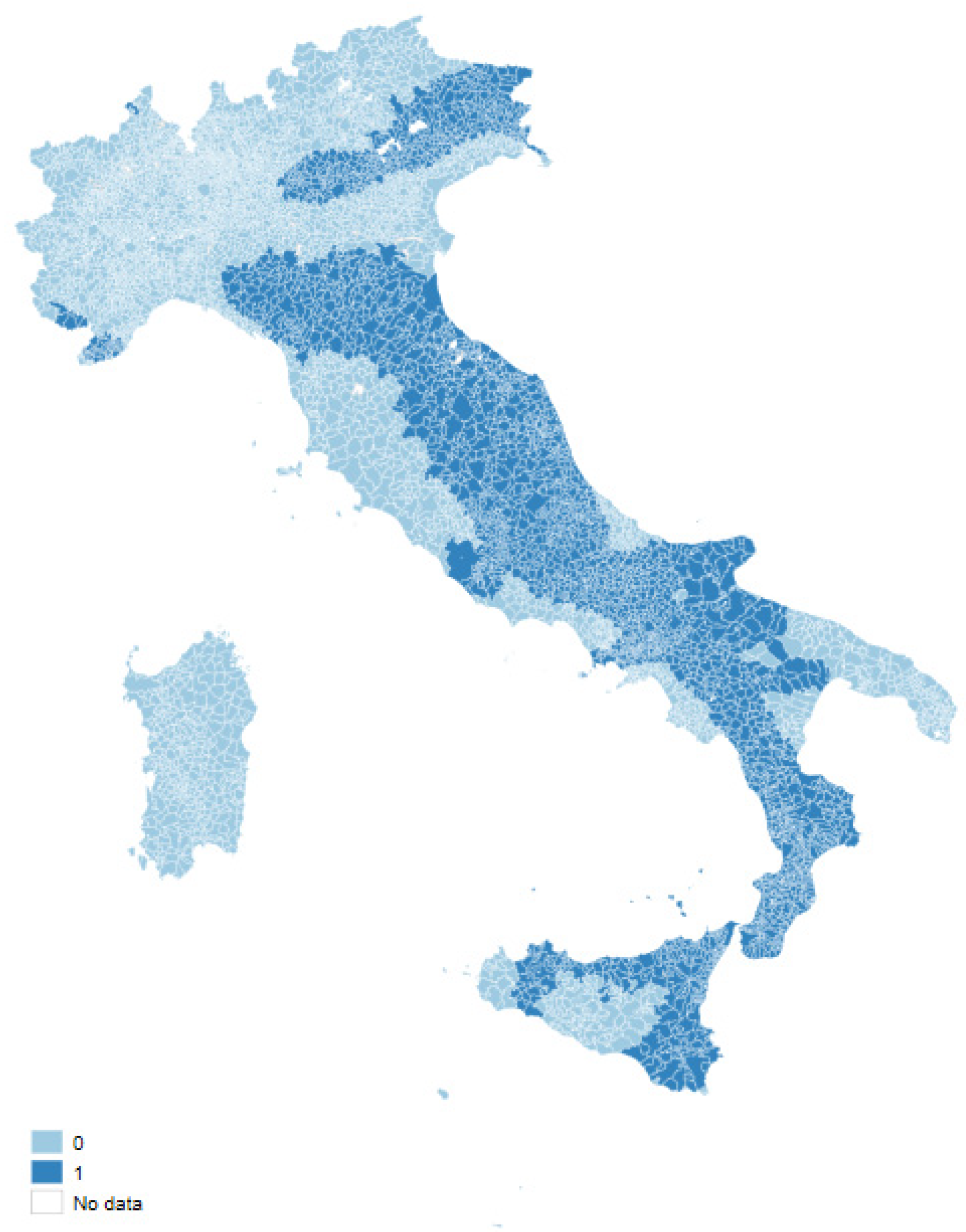

| EARTHQUAKE | Dummy = 1 for firm’s municipality at higher earthquake hazard | 0.43 | 0.50 | 0 | 1 | 525,957 |

| VOLCANIC | Dummy = 1 for firm’s municipality in a volcanic area | 0.02 | 0.15 | 0 | 1 | 525,957 |

| ΔSALES | Change in the log of real total sales. | 0.03 | 0.29 | −4.93 | 9.35 | 525,957 |

| DIFFKAPSALES | Difference between the log of capital and the log of real total sales. | 2.56 | 1.52 | −7.13 | 10.34 | 525,952 |

| ΔEMP | Change in the log of real total costs of employees | 0.04 | 0.35 | −7.41 | 6.68 | 525,957 |

| AGE | Current year minus firm’s year of establishment | 20.2 | 12.87 | 3.00 | 65.0 | 525,957 |

| LEVERAGE | (Current plus non-current liabilities) to total assets | 0.72 | 0.21 | 0.08 | 1.13 | 525,957 |

| CASHFLOW | Cash flow scaled by its beginning of period capital. | 0.80 | 2.39 | −23.63 | 33.55 | 525,957 |

| DEBTSUST | Interest paid to total sales | 0.02 | 0.02 | 0.00 | 0.50 | 525,957 |

| WORKCAP | (Currents assets minus current liabilities) to total assets | 0.20 | 0.25 | −1.00 | 0.95 | 525,957 |

| 1 | 2 | |

|---|---|---|

| GREENS | 0.0041 *** | |

| 0.0010 | ||

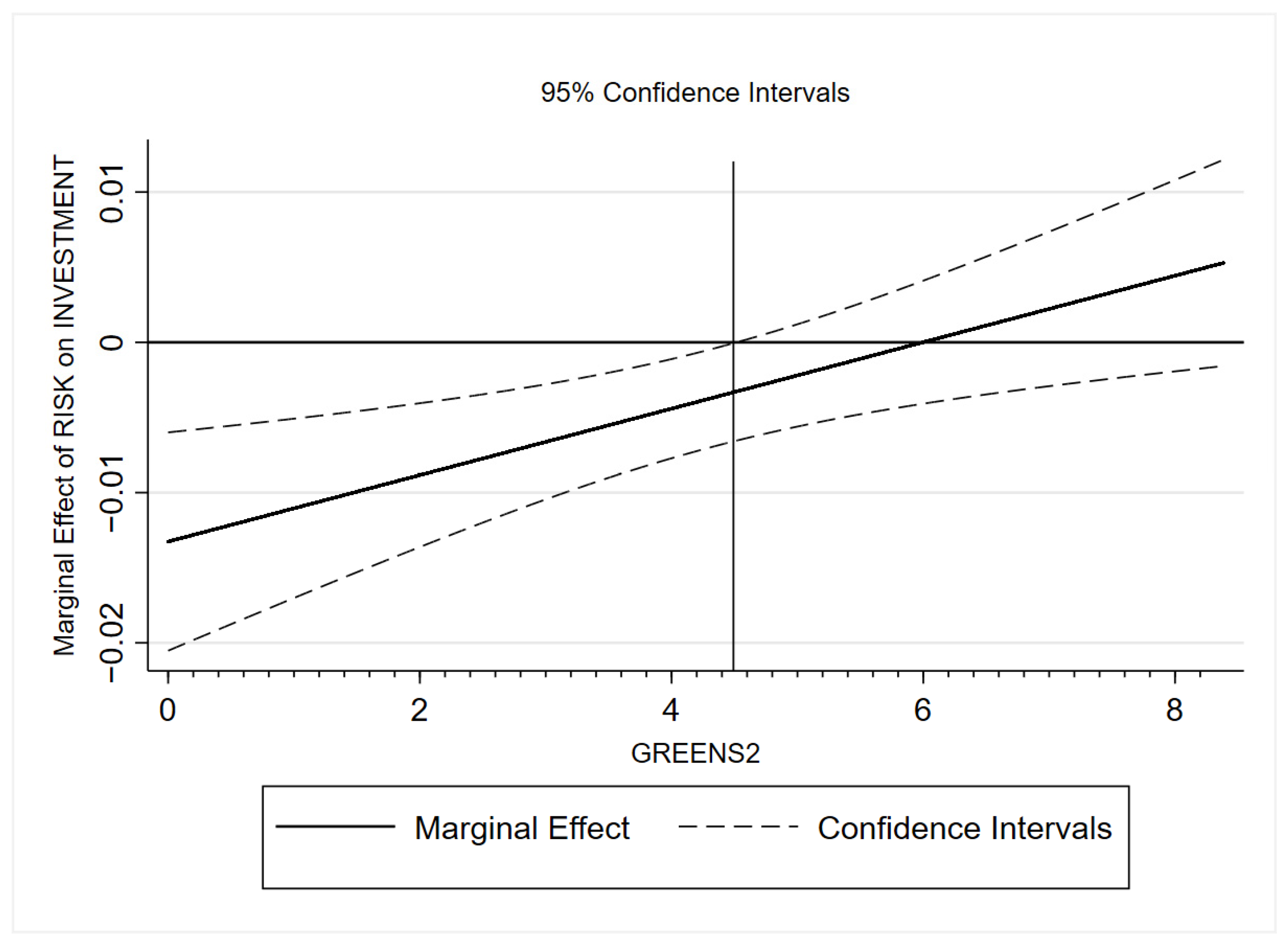

| GREENS2 | 0.0085 *** | |

| 0.0014 | ||

| RISK | −0.0050 ** | −0.0133 *** |

| 0.0023 | 0.0037 | |

| GREENS × RISK | 0.0015 ** | |

| 0.0006 | ||

| GREENS2 × RISK | 0.0022 *** | |

| 0.0008 | ||

| INVESTMENT_1 | 0.0613 *** | 0.1294 *** |

| 0.0013 | 0.0012 | |

| ΔSALES | 0.2306 *** | 0.2996 *** |

| 0.0060 | 0.0058 | |

| ΔSALES_1 | 0.2596 *** | −0.0201 *** |

| 0.0050 | 0.0047 | |

| DIFFKAPSALES_2 | −0.2985 *** | −0.3559 *** |

| 0.0016 | 0.0014 | |

| CASHFLOW | 0.1141 *** | 0.0956 *** |

| 0.0007 | 0.0007 | |

| ΔEMP | 0.1057 *** | 0.1091 *** |

| 0.0047 | 0.0046 | |

| AGE | −0.0001 | 0.0010 *** |

| 0.0001 | 0.0001 | |

| LEVERAGE | −0.4841 *** | −0.7779 *** |

| 0.0104 | 0.0102 | |

| DEBTSUST | 4.1051 *** | 5.0442 *** |

| 0.0784 | 0.0763 | |

| WORKCAP | −0.8636 *** | −1.1294 *** |

| 0.0089 | 0.0087 | |

| Observations | 525,957 | 525,957 |

| Joint significance test (RISK,GREENS) | 20.7590 | |

| P (RISK,GREENS) | 0.0000 | |

| Joint significance test (RISK,GREENS2) | 80.4147 | |

| P (RISK,GREENS2) | 0.0000 |

| 1 | 2 | 3 | 4 | |

|---|---|---|---|---|

| GREENS | 0.0041 *** | 0.0053 *** | 0.0020 ** | 0.0037 *** |

| 0.0007 | 0.0007 | 0.0008 | 0.0006 | |

| LANDSLIDE | 0.0000 | |||

| 0.0003 | ||||

| GREENS × LANDSLIDE | 0.0000 | |||

| 0.0001 | ||||

| HYDRAULIC | −0.0002 *** | |||

| 0.0000 | ||||

| GREENS × HYDRAULIC | 0.0000 * | |||

| 0.0000 | ||||

| EARTHQUAKE | −0.0153 *** | |||

| 0.0044 | ||||

| GREENS × EARTHQUAKE | 0.0025 ** | |||

| 0.0012 | ||||

| VOLCANIC | −0.0732 *** | |||

| 0.0136 | ||||

| GREENS × VOLCANIC | 0.0114 *** | |||

| 0.0041 | ||||

| INVESTMENT_1 | 0.1625 *** | 0.1296 *** | 0.1293 *** | 0.1290 *** |

| 0.0013 | 0.0012 | 0.0012 | 0.0012 | |

| ΔSALES | 0.0127 ** | 0.2997 *** | 0.2996 *** | 0.2984 *** |

| 0.0061 | 0.0059 | 0.0058 | 0.0058 | |

| ΔSALES_1 | 0.0191 *** | −0.0206 *** | −0.0200 *** | −0.0212 *** |

| 0.0050 | 0.0047 | 0.0047 | 0.0047 | |

| DIFFKAPSALES_2 | −0.0535 *** | −0.3566 *** | −0.3538 *** | −0.3545 *** |

| 0.0015 | 0.0014 | 0.0014 | 0.0014 | |

| CASHFLOW | 0.1473 *** | 0.0956 *** | 0.0958 *** | 0.0956 *** |

| 0.0007 | 0.0007 | 0.0007 | 0.0007 | |

| ΔEMP | 0.1318 *** | 0.1090 *** | 0.1095 *** | 0.1091 *** |

| 0.0049 | 0.0046 | 0.0046 | 0.0046 | |

| AGE | −0.0029 *** | 0.0010 *** | 0.0009 *** | 0.0009 *** |

| 0.0001 | 0.0001 | 0.0001 | 0.0001 | |

| LEVERAGE | 0.3607 *** | −0.7812 *** | −0.7719 *** | −0.7720 *** |

| 0.0108 | 0.0102 | 0.0102 | 0.0102 | |

| DEBTSUST | 0.0871 | 5.0470 *** | 5.0467 *** | 5.0413 *** |

| 0.0806 | 0.0767 | 0.0763 | 0.0763 | |

| WORKCAP | −0.1407 *** | −1.1335 *** | −1.1230 *** | −1.1242 *** |

| 0.0094 | 0.0088 | 0.0087 | 0.0087 | |

| Observations | 524,194 | 524,199 | 525,957 | 525,957 |

| Joint significance test (LANDSLIDE, GREENS) | 17.2185 | |||

| P (LANDSLIDE, GREENS) | 0.0000 | |||

| Joint significance test (HYDRAULIC, GREENS) | 41.2984 | |||

| P (HYDRAULIC, GREENS) | 0.0000 | |||

| Joint significance test (EARTHQUAKE, GREENS) | 16.0851 | |||

| P (EARTHQUAKE, GREENS) | 0.0000 | |||

| Joint significance test (VOLCANIC, GREENS) | 33.4271 | |||

| P (VOLCANIC, GREENS) | 0.0000 | |||

| 1 | 2 | 3 | 4 | |

|---|---|---|---|---|

| GREENS2 | 0.0038 *** | 0.0030 *** | 0.0062 *** | 0.0063 *** |

| 0.0014 | 0.0010 | 0.0012 | 0.0009 | |

| LANDSLIDE | 0.0009 ** | |||

| 0.0004 | ||||

| GREENS2 × LANDSLIDE | −0.0002 ** | |||

| 0.0001 | ||||

| HYDRAULIC | −0.0003 *** | |||

| 0.0001 | ||||

| GREENS2 × HYDRAULIC | 0.0000 ** | |||

| 0.0000 | ||||

| EARTHQUAKE | −0.0227 *** | |||

| 0.0074 | ||||

| GREENS2 × EARTHQUAKE | 0.0032 ** | |||

| 0.0016 | ||||

| VOLCANIC | −0.0738 *** | |||

| 0.0225 | ||||

| GREENS2 × VOLCANIC | 0.0076 | |||

| 0.0054 | ||||

| INVESTMENT_1 | 0.0603 *** | 0.1295 *** | 0.1289 *** | 0.1298 *** |

| 0.0013 | 0.0012 | 0.0012 | 0.0012 | |

| ΔSALES | 0.2307 *** | 0.2976 *** | 0.2987 *** | 0.2982 *** |

| 0.0060 | 0.0058 | 0.0058 | 0.0059 | |

| ΔSALES_1 | 0.2609 *** | −0.0212 *** | −0.0202 *** | −0.0218 *** |

| 0.0050 | 0.0047 | 0.0047 | 0.0047 | |

| DIFFKAPSALES_2 | −0.2994 *** | −0.3561 *** | −0.3546 *** | −0.3566 *** |

| 0.0016 | 0.0014 | 0.0014 | 0.0014 | |

| CASHFLOW | 0.1137 *** | 0.0956 *** | 0.0954 *** | 0.0957 *** |

| 0.0007 | 0.0007 | 0.0007 | 0.0007 | |

| ΔEMP | 0.1061 *** | 0.1088 *** | 0.1094 *** | 0.1087 *** |

| 0.0047 | 0.0046 | 0.0046 | 0.0046 | |

| AGE | 0.0000 | 0.0010 *** | 0.0009 *** | 0.0010 *** |

| 0.0001 | 0.0001 | 0.0001 | 0.0001 | |

| LEVERAGE | −0.4885 *** | −0.7800 *** | −0.7734 *** | −0.7797 *** |

| 0.0104 | 0.0102 | 0.0102 | 0.0102 | |

| DEBTSUST | 4.0653 *** | 5.0653 *** | 5.0496 *** | 5.0714 *** |

| 0.0786 | 0.0764 | 0.0764 | 0.0767 | |

| WORKCAP | −0.8744 *** | −1.1327 *** | −1.1285 *** | −1.1285 *** |

| 0.0089 | 0.0088 | 0.0088 | 0.0088 | |

| Observations | 525,957 | 525,957 | 525,957 | 524,199 |

| Joint significance test (LANDSLIDE, GREENS2) | 5.2866 | |||

| P (LANDSLIDE, GREENS2) | 0.0051 | |||

| Joint significance test (HYDRAULIC, GREENS2) | 13.7480 | |||

| P (HYDRAULIC, GREENS2) | 0.0000 | |||

| Joint significance test (EARTHQUAKE, GREENS2) | 31.7469 | |||

| P (EARTHQUAKE, GREENS2) | 0.0000 | |||

| Joint significance test (VOLCANIC, GREENS2) | 36.2113 | |||

| P (VOLCANIC, GREENS2) | 0.0000 | |||

| 1 | 2 | 3 | 4 | |

|---|---|---|---|---|

| GREENS | 0.0042 *** | 0.0037 ** | ||

| 0.0013 | 0.0018 | |||

| GREENS2 | 0.0085 *** | 0.0087 *** | ||

| 0.0017 | 0.0024 | |||

| RISK | −0.0025 | −0.0089 ** | −0.0108 ** | −0.0168 *** |

| 0.0028 | 0.0040 | 0.0045 | 0.0064 | |

| GREENS × RISK | 0.0012 * | 0.0021 ** | ||

| 0.0007 | 0.0010 | |||

| GREENS2 × RISK | 0.0019 ** | 0.0026 * | ||

| 0.0009 | 0.0013 | |||

| INVESTMENT_1 | 0.0817 *** | 0.0363 *** | 0.1462 *** | 0.1091 *** |

| 0.0017 | 0.0022 | 0.0016 | 0.0019 | |

| ΔSALES | 0.2275 *** | 0.2386 *** | 0.2934 *** | 0.3157 *** |

| 0.0070 | 0.0109 | 0.0068 | 0.0107 | |

| ΔSALES_1 | 0.2417 *** | 0.2960 *** | −0.0327 *** | 0.0108 |

| 0.0057 | 0.0096 | 0.0054 | 0.0092 | |

| DIFFKAPSALES_2 | −0.2909 *** | −0.3104 *** | −0.3472 *** | −0.3705 *** |

| 0.0019 | 0.0027 | 0.0017 | 0.0025 | |

| CASHFLOW | 0.1120 *** | 0.1165 *** | 0.0940 *** | 0.0968 *** |

| 0.0009 | 0.0011 | 0.0009 | 0.0011 | |

| ΔEMP | 0.0991 *** | 0.1153 *** | 0.1013 *** | 0.1208 *** |

| 0.0056 | 0.0084 | 0.0055 | 0.0083 | |

| AGE | 0.0002 | −0.0004 ** | 0.0012 *** | 0.0006 *** |

| 0.0002 | 0.0002 | 0.0001 | 0.0002 | |

| LEVERAGE | −0.4832 *** | −0.4952 *** | −0.7748 *** | −0.7906 *** |

| 0.0126 | 0.0181 | 0.0123 | 0.0178 | |

| DEBTSUST | 3.8681 *** | 4.9110 *** | 4.7418 *** | 5.9973 *** |

| 0.0863 | 0.1715 | 0.0839 | 0.1673 | |

| WORKCAP | −0.8136 *** | −0.9444 *** | −1.0798 *** | −1.2083 *** |

| 0.0107 | 0.0156 | 0.0105 | 0.0154 | |

| Observations | 326,037 | 199,920 | 326,037 | 199,920 |

| Joint significance test (RISK, GREENS) | 10.7695 | 9.6814 | ||

| P (RISK, GREENS) | 0.0000 | 0.0001 | ||

| Joint significance test (RISK, GREENS2) | 47.7097 | 32.6813 | ||

| P (RISK, GREENS2) | 0.0000 | 0.0000 | ||

| Period | before 2015 | after 2015 | before 2015 | after 2015 |

| 1 | 2 | 3 | 4 | |

|---|---|---|---|---|

| GREENS | 0.0046 *** | 0.0034 ** | ||

| 0.0014 | 0.0016 | |||

| GREENS2 | 0.0087 *** | 0.0084 *** | ||

| 0.0018 | 0.0021 | |||

| RISK | −0.0034 | −0.0066 * | −0.0112 ** | −0.0151 *** |

| 0.0030 | 0.0035 | 0.0048 | 0.0057 | |

| GREENS × RISK | 0.0010 | 0.0021 ** | ||

| 0.0008 | 0.0009 | |||

| GREENS2 × RISK | 0.0017 * | 0.0027 ** | ||

| 0.0010 | 0.0012 | |||

| INVESTMENT_1 | 0.0761 *** | 0.0489 *** | 0.1415 *** | 0.1193 *** |

| 0.0019 | 0.0019 | 0.0017 | 0.0017 | |

| ΔSALES | 0.2280 *** | 0.2359 *** | 0.2919 *** | 0.3125 *** |

| 0.0075 | 0.0095 | 0.0073 | 0.0094 | |

| ΔSALES_1 | 0.2399 *** | 0.2888 *** | −0.0364 *** | 0.0075 |

| 0.0060 | 0.0084 | 0.0057 | 0.0080 | |

| DIFFKAPSALES_2 | −0.2923 *** | −0.3052 *** | −0.3464 *** | −0.3667 *** |

| 0.0020 | 0.0024 | 0.0019 | 0.0022 | |

| CASHFLOW | 0.1128 *** | 0.1153 *** | 0.0953 *** | 0.0954 *** |

| 0.0010 | 0.0010 | 0.0010 | 0.0010 | |

| ΔEMP | 0.0958 *** | 0.1157 *** | 0.0982 *** | 0.1203 *** |

| 0.0061 | 0.0073 | 0.0059 | 0.0072 | |

| AGE | 0.0001 | −0.0002 | 0.0011 *** | 0.0008 *** |

| 0.0002 | 0.0002 | 0.0002 | 0.0002 | |

| LEVERAGE | −0.5018 *** | −0.4734 *** | −0.7859 *** | −0.7760 *** |

| 0.0136 | 0.0159 | 0.0133 | 0.0156 | |

| DEBTSUST | 3.9099 *** | 4.5673 *** | 4.7450 *** | 5.6523 *** |

| 0.0913 | 0.1422 | 0.0886 | 0.1386 | |

| WORKCAP | −0.8077 *** | −0.9236 *** | −1.0678 *** | −1.1944 *** |

| 0.0115 | 0.0137 | 0.0113 | 0.0135 | |

| Observations | 270,828 | 255,129 | 270,828 | 255,129 |

| Joint significance test (RISK, GREENS) | 11.7389 | 8.7204 | ||

| P (RISK, GREENS) | 0.0000 | 0.0002 | ||

| Joint significance test (RISK, GREENS2) | 43.4902 | 37.0981 | ||

| P (RISK, GREENS2) | 0.0000 | 0.0000 | ||

| Period | before 2014 | after 2014 | before 2014 | after 2014 |

| 1 | 2 | 3 | 4 | |

|---|---|---|---|---|

| GREENS | 0.0050 *** | 0.0037 ** | ||

| 0.0015 | 0.0018 | |||

| GREENS2 | 0.0090 *** | 0.0061 *** | ||

| 0.0020 | 0.0024 | |||

| GREENF | ||||

| RISK | −0.0027 | −0.0089 ** | −0.0106 ** | −0.0170 *** |

| 0.0034 | 0.0040 | 0.0054 | 0.0064 | |

| GREENS × RISK | 0.0007 | 0.0021 ** | ||

| 0.0009 | 0.0010 | |||

| GREENS2 × RISK | 0.0016 | 0.0027 ** | ||

| 0.0011 | 0.0013 | |||

| INVESTMENT_1 | 0.0682 *** | 0.0363 *** | 0.1354 *** | 0.1092 *** |

| 0.0021 | 0.0022 | 0.0019 | 0.0019 | |

| ΔSALES | 0.2219 *** | 0.2386 *** | 0.2847 *** | 0.3139 *** |

| 0.0082 | 0.0109 | 0.0080 | 0.0107 | |

| ΔSALES_1 | 0.2395 *** | 0.2960 *** | −0.0395 *** | 0.0099 |

| 0.0066 | 0.0096 | 0.0062 | 0.0092 | |

| DIFFKAPSALES_2 | −0.2942 *** | −0.3104 *** | −0.3477 *** | −0.3697 *** |

| 0.0023 | 0.0027 | 0.0021 | 0.0025 | |

| CASHFLOW | 0.1146 *** | 0.1165 *** | 0.0968 *** | 0.0969 *** |

| 0.0011 | 0.0011 | 0.0011 | 0.0011 | |

| ΔEMP | 0.1050 *** | 0.1153 *** | 0.1076 *** | 0.1207 *** |

| 0.0067 | 0.0084 | 0.0065 | 0.0083 | |

| AGE | 0.0002 | −0.0004 ** | 0.0012 *** | 0.0006 *** |

| 0.0002 | 0.0002 | 0.0002 | 0.0002 | |

| LEVERAGE | −0.5044 *** | −0.4952 *** | −0.7883 *** | −0.7857 *** |

| 0.0151 | 0.0181 | 0.0148 | 0.0178 | |

| DEBTSUST | 3.9291 *** | 4.9110 *** | 4.7568 *** | 5.9982 *** |

| 0.1012 | 0.1715 | 0.0983 | 0.1673 | |

| WORKCAP | −0.8076 *** | −0.9444 *** | −1.0663 *** | −1.2052 *** |

| 0.0128 | 0.0156 | 0.0126 | 0.0153 | |

| Observations | 216,097 | 199,920 | 216,097 | 199,920 |

| Joint significance test (RISK, GREENS) | 10.4955 | 9.6814 | ||

| P (RISK, GREENS) | 0.0000 | 0.0001 | ||

| Joint significance test (RISK, GREENS2) | 35.8654 | 23.7677 | ||

| P (RISK, GREENS2) | 0.0000 | 0.0000 | ||

| Period | before 2013 | after 2016 | before 2013 | after 2016 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Oliviero, T.; Rondinella, S.; Zazzaro, A. Green Firms, Environmental Hazards, and Investment. Sustainability 2024, 16, 542. https://doi.org/10.3390/su16020542

Oliviero T, Rondinella S, Zazzaro A. Green Firms, Environmental Hazards, and Investment. Sustainability. 2024; 16(2):542. https://doi.org/10.3390/su16020542

Chicago/Turabian StyleOliviero, Tommaso, Sandro Rondinella, and Alberto Zazzaro. 2024. "Green Firms, Environmental Hazards, and Investment" Sustainability 16, no. 2: 542. https://doi.org/10.3390/su16020542

APA StyleOliviero, T., Rondinella, S., & Zazzaro, A. (2024). Green Firms, Environmental Hazards, and Investment. Sustainability, 16(2), 542. https://doi.org/10.3390/su16020542