Abstract

Sustainability in business is a subject of growing interest to investors, stakeholders, and companies for overcoming uncertainty. However, it is also questioned with “is this business approach is finance worthy”, how does a firm’s commitment to ESG translate into tangible outcomes that benefit investors? In this paper, textual analysis is applied to the 10-year sustainability report from 2012 to 2021 released by Hang Lung Properties (HLP) to empirically explore its ESG (environmental, social, and governance)-related strategy, initiatives, actions, and outcomes. Employed with a “commitment-action-outcomes” framework, this firm-based longitudinal case study on ESG investigates how HLP deploys and implements corporate sustainability activities, in order to increase its profits as well as stock returns. Our empirical evidence indicates that the firm’s ESG commitment leads to its green and low-carbon transition. Further, it identifies three key enablers of ESG commitment—ESG integration and evolvement, high-intensity ESG effort, and technological innovation—that can spur low-carbon transition and achieve long-term value. This paper contributes to the literature in the following ways. Firstly, it sheds light on the effectiveness of ESG commitments in promoting sustainable business practices. Secondly, it enriches the understanding to build an enterprise’s resilience and self-reliance via ESG initiatives in the face of uncertainty. Lastly, it makes an important methodological contribution by constructing a new employed textual analysis for the ESG research domain.

1. Introduction

Sustainable development is a global aspiration issue. Declared in 2015, the United Nations’ 2030 Agenda builds on the Sustainable Development Goals (SDGs) under the title “transforming our world” [1]. Indeed, sustainability has become a pressing issue for businesses worldwide as concerns over climate change, environmental degradation, and social inequality continue to escalate. As a result, investors are increasingly demanding that firms demonstrate a commitment to environmental, social, and governance (ESG) principles to mitigate risks associated with these challenges [2]. Companies, in turn, have been adopting ESG strategies to build resilience and maintain long-term competitiveness.

While the importance of ESG is widely recognized, there are varying degrees of implementation among firms [3]. Although China has the largest number of existing buildings and new buildings every year in the world and the total urban building provision exceeds 60 billion square meters [4], some companies may view ESG as a mere compliance exercise, while others commit to it more deeply to drive sustainable business practices. Further, in terms of carbon emission intensity, commercial real estate is about 2.09 times more than the average Chinese building, mainly resulting from its heating ventilation air-conditioning system, lighting, and electricity system during the building operation phase (office of the National Energy Leading Group, 2007, Beijing, China) and the trend is continuously inclining. How a firm’s commitment to ESG translates into tangible outcomes, such as reduced carbon emissions and improved environmental performance, thus its overall performance, however, remains an open question.

To address this gap in knowledge, this paper examines how a firm’s commitment to ESG drives the green and low-carbon transition through a longitudinal case study of Hang Lung Properties (HLP). Referring to the sustainability report in the years from 2012 to 2021 released by HLP, it applies natural language processing to the texts in the sustainability report and conducts a firm-based longitudinal case study on ESG, to identify its ESG-related topics and activities and diminish the gap between the myth and the reality for ESG. The research objectives of this paper are threefold. Firstly, it aims to analyze the ESG-related topics and activities of HLP over the ten-year period to understand the evolution of its sustainability strategy. Secondly, it investigates which factors determine a firm’s ESG commitment that lead to its green and low-carbon transition. Thirdly, it probes how a firm maintains sustainable development ingrained in corporate strategies and practices, eventually improving the ESG corporate performance.

This paper is structured as follows: Section 1 provides an overview of the importance of ESG in business and introduces HLP as the subject of our study. Section 2 reviews the literature on ESG and sustainable development, focusing on the key concepts of CSR, ESG, and green low-carbon development. Section 3 outlines the methodology used in this paper, including the selection of HLP sustainability reports and the process of textual analysis in three chronological stages towards Hang Lung’s green low-carbon transition. Section 4 presents our findings regarding HLP’s commitment to and deployment and implementation of ESG, specific actions taken, and outcomes achieved in terms of green low-carbon transition. Section 5 makes several propositions for firms to urge a commitment to ESG and achieve ESG’s goal of green low-carbon development, and also discusses the implications of our findings for future research and practice.

2. Literature Review and Hypotheses Development

Sustainability has become a subject of growing interest to investors, stakeholders, and companies as businesses seek to mitigate risk and navigate uncertainty in a rapidly changing world. In particular, environmental, social, and governance (ESG) practices have emerged as a key aspect of corporate sustainability, with companies looking to integrate sustainability into their business strategy to achieve long-term value and competitiveness. However, questions still remain about the financial worthiness of corporate sustainability programs and how to achieve the benefit from these programs. The review focuses on three key themes: (1) the evolution from corporate social responsibility (CSR) to ESG; (2) the intersection of ESG and the green and low-carbon transition; and (3) the role of technological innovation in empowering ESG practices.

2.1. Evolution from CSR to ESG

Corporate social responsibility (CSR) has long been recognized as a crucial aspect of sustainable business practices around philanthropic activities and abiding by legal obligations. However, in recent years, there has been a notable shift towards environmental, social, and governance (ESG) considerations. The evolution from CSR to ESG reflects a growing recognition of the need for businesses to address both social and environmental challenges [5,6]. Carroll et al. [7] underline the shift in CSR towards a comprehensive environmental, social, and governance (ESG) framework that considers a company’s impact on the environment, its social contributions, and its governance practices. Increasing stakeholder expectations have played a significant role in this transition [8]. Regulatory changes and the recognition of climate change as a critical global challenge have also motivated companies to embrace ESG [9,10].

The evolution of CSR has been driven by several factors [11,12]. Firstly, there is a growing recognition of the interdependence between businesses and society. Companies are increasingly aware that their long-term success is closely tied to the wellbeing of the communities and environments in which they operate. As a result, they are adopting more proactive approaches to addressing societal and environmental challenges. Secondly, stakeholders, including customers, employees, investors, and regulators, are demanding greater accountability and transparency from corporations. They expect companies to go beyond mere compliance with laws and regulations and actively contribute to sustainable development. ESG initiatives provide firms with an opportunity to build trust, enhance their reputation, and also help firms identify new business opportunities and manage risks effectively [13]. Furthermore, the business landscape itself has evolved, with sustainability becoming a crucial aspect of competitiveness [14]. Organizations recognize that integrating sustainable practices into their operations can lead to cost savings, operational efficiencies, and improved risk management. By embracing ESG, companies can foster innovation, attract talent, and enhance their reputation [13], finally creating value not only for their shareholders but also for other stakeholders.

In light of these developments, the concept of ESG has gained prominence. It encompasses three key dimensions: environmental, social, and governance. The environmental aspect focuses on reducing a firm’s ecological footprint by conserving resources, mitigating climate change, and promoting environmentally friendly practices. The social dimension emphasizes fostering positive relationships with employees, customers, communities, and other stakeholders through fair labor practices, diversity and inclusion initiatives, and community engagement. Lastly, governance refers to establishing transparent and accountable decision-making processes, ensuring ethical behavior, and minimizing corruption. Noteworthy authors like Eccles et al. [15] and Tsalis et al. [16] discuss the emergence of various ESG reporting standards, such as the Global Reporting Initiative (GRI) [17,18], Sustainability Accounting Standards Board (SASB) [19], and the Task Force on Climate-related Financial Disclosures (TCFD) [20]. These frameworks enable companies to measure, report, and integrate ESG factors into their decision-making processes.

Such an approach helps create shared value, where societal and environmental benefits are not seen as conflicting with financial performance but rather as integral to long-term success. Companies that prioritize sustainability in these areas are viewed more favorably by investors who seek to make positive social and environmental impacts with their investments. ESG investing has been found to have a positive impact on firms’ financial performance. A meta-analysis conducted by Friede et al. [21] found that companies with high ESG scores tend to have lower costs of capital and higher stock prices. Similarly, research by Eccles et al. [15] found that firms with strong sustainability practices had better financial performance over the long-term. Therefore, it is hypothesized that:

Hypothesis 1.

ESG evolvement and long-term benefits rely on a firm’s capacity to integrate ESG initiatives that streamline the steps from initial ESG deployment to tangible ESG implementation.

2.2. Intersection between ESG and Green Low-Carbon Transition

The intersection between environmental, social, and governance (ESG) factors and the green low-carbon transition has garnered significant attention among scholars and practitioners alike. Scholars, including Bartlett et al. [22] and Grewal et al. [23], highlight the importance of ESG integration in driving the green and low-carbon transition. They argue that a firm’s commitment to ESG principles leads to improved environmental performance, reduced carbon emissions, and increased resource efficiency [24]. Recent studies by Amel-Zadeh et al. [25] emphasize the financial benefits associated with ESG integration. They find that firms with strong ESG practices are more likely to attract green investments, access favorable financing conditions, and achieve long-term sustainability goals.

Moreover, Grewal et al. [23] argue that ESG integration helps drive the reduction in carbon emissions. Firms that embrace ESG principles are more likely to adopt clean technologies and practices that mitigate greenhouse gas emissions. By transitioning to low-carbon energy sources, optimizing energy consumption, and promoting carbon-neutral operations, companies can significantly contribute to global efforts in combating climate change [26]. Elkington [20] suggests that regulatory frameworks and policies should incentivize and support ESG integration to accelerate the transition towards a low-carbon economy. They also emphasize the importance of engaging stakeholders and fostering collaborations to address the complex challenges associated with reducing carbon emissions. Through effective ESG integration [27], firms can play an active role in decarbonizing various sectors and supporting the transition towards a greener economy.

Additionally, the implementation of ESG principles positively influences resource efficiency [3]. Grewal et al. [23] argue that considering social and environmental aspects alongside traditional governance factors leads to more sustainable and efficient resource utilization. By adopting sustainable procurement practices, optimizing operational processes, and minimizing waste generation, companies can achieve higher levels of resource productivity. Enhanced resource efficiency not only benefits the environment but also improves a firm’s economic performance by reducing costs and enhancing overall competitiveness. Liu et al. [28] highlight the need for businesses to integrate ESG considerations into their decision-making processes and supply chain management to maximize resource efficiency.

Koller et al. [29] argue that a strong ESG proposition can create value in five essential ways: top-line growth, cost reductions, regulatory and legal interventions, productivity uplift, and investment and asset optimization. El-Kassar and Singh [24] argue that a firm’s commitment to ESG principles leads to improved environmental performance. By integrating ESG factors into their business strategies, companies can better align their operations with sustainability goals. This includes implementing practices for energy efficiency [30], waste reduction, and pollution prevention [31]. For instance, companies may invest in renewable energy sources, adopt eco-friendly production techniques, or develop sustainable supply chains [32]. Such initiatives enable firms to reduce their overall ecological footprint and contribute to the green low-carbon transition [33]. Therefore, it is hypothesized that:

Hypothesis 2.

Strong ESG proposition for achieving a green and low-carbon transition requires high-intensity effort, to drive a firm’s execution towards shifting from ESG deployment to ESG implementation.

2.3. Role of Technological Innovation in Empowering ESG Practices

Technological innovation plays a crucial role in empowering ESG practices within organizations. The integration of technology enables businesses to efficiently and effectively address sustainability challenges, improve social impact, and enhance corporate governance. In a study conducted by Smith et al. [34], the authors emphasize the significant influence of technological innovation on environmental sustainability. They argue that advancements in technology have enabled organizations to reduce their ecological footprint through the adoption of renewable energy sources, sustainable resource management systems, and waste reduction strategies. By implementing these technologies, companies can mitigate their negative environmental impacts while also improving operational efficiency and cost-effectiveness.

Furthermore, technological innovation plays a crucial role in enhancing social impact within organizations [35,36]. Brown and DeVries [37] highlight how technology facilitates improved labor practices, employee wellbeing, and community engagement. Schaltegger and Burritt [38] discuss how advanced technologies, such as big data analytics, artificial intelligence, and blockchain, enable companies to collect, analyze, and report ESG-related data accurately and transparently. McGreevy et al. [39] explore specific technological innovations that support the green and low-carbon transition. Examples include renewable energy technologies, smart grids, energy-efficient processes, and digital platforms for sustainable supply chain management. These innovations contribute to reducing carbon emissions and promoting environmental sustainability. By leveraging digital platforms and communication tools, businesses can promote inclusive and diverse work environments, monitor supply chain conditions, and foster meaningful relationships with local communities [40]. This not only contributes to the overall social wellbeing but also enhances the reputation and stakeholder trust.

The relationship between technological innovation and corporate governance is also emphasized by Jones and Phillips [18]. They argue that technology-driven solutions, such as data analytics and artificial intelligence, help organizations improve transparency, accountability, and risk management. These tools enable companies to track and report on ESG performance more accurately, identify potential risks and opportunities, and align business strategies with long-term sustainability goals. By enhancing corporate governance practices, organizations can gain a competitive edge and attract socially responsible investors. Through the adoption of advanced technologies, businesses can address environmental challenges, improve social impact, and enhance corporate governance. By understanding these perspectives, organizations can better leverage technological advancements to drive sustainable and responsible business practices. Therefore, it is hypothesized that:

Hypothesis 3.

Technological innovation catalyzes new technologies and emerging methods that are applied during ESG implementation, thus enabling a firm’s green low-carbon transition.

2.4. Research Gap on ESG Strategy and Practice at Firm Level

Research on ESG strategies and practices has gained significant attention in recent years, mainly on financial performance and market valuation. While there has been a growing emphasis on integrating ESG factors into business operations, a research gap exists in understanding the specific challenges and opportunities faced by firms in implementing these strategies and turning them into actionable initiatives at the firm level. Further, limited attention has been given to exploring the mechanisms through which ESG strategies create value for firms. Moreover, there is a lack of research on the institutional and organizational factors that shape firms’ decision-making processes in terms of the motivators for adopting ESG strategies. Additionally, the literature tends to overlook the heterogeneity of ESG strategies across industries (e.g., commercial real estate) and regions (e.g., mainland of China), making it challenging to draw comprehensive conclusions about their effectiveness. Addressing these research gaps will provide a more nuanced understanding of the dynamics and implications of ESG strategy and practice at the firm level, contributing to the development of effective frameworks and guidelines for firms to adopt and implement ESG strategies successfully. It will also enhance policymakers’ ability to design regulations and incentives that promote sustainable practices at the firm level.

3. Research Design

3.1. Research Methodology

This paper aims to provide a comprehensive understanding of the specific mechanisms by which ESG integration and evolvement from commitment to strategy and practices can drive value creation in the real estate sector. Selecting real estate due to it being a significant contributor to global carbon emissions, accounting for approximately 40% of energy consumption and 30% of greenhouse gas emissions. Additionally, real estate developers hold an influential position in driving the adoption of green building practices, making them ideal subjects for studying the impact of ESG commitments on environmental sustainability. For this purpose, a longitudinal case study design is employed within the “commitment-action-outcomes” framework, which allows for a pivot investigation into the relationships between ESG commitment, ESG strategy, and ESG practice within the firm, and the resulting outcomes.

3.2. Sampling Selection

HLP, as the operating arm of Hang Lung Group Limited (stock code: 00010, HK, China), is a leading Hong Kong company boasting an extensive real estate portfolio in Hong Kong, as well as building, owning, and managing world-class commercial complexes in key cities on the mainland since the 1990s and enjoying the golden opportunities presented by the mainland’s dynamic economic growth. As of now, Hang Lung owns and has been operating 24 properties in Hong Kong and 10 in mainland China, with another 1 in Hangzhou under construction. With its adherence to the highest level of corporate governance, HLP is regarded as one of the best property owners in Hong Kong, consistently achieving high and sustainable returns for its shareholders.

HLP offers an interesting case for studying the impact of ESG commitment on financial and environmental performance. It holds the business philosophy of ‘We Do It Well’ and has gained international recognition as a leading worldwide industry player in commercial real estate; sophisticated investors recognize HLP as Hong Kong’s most resilient company, with the far-sighted leadership of its Board of Directors, strong financial standing, and highest standard of corporate governance practices, as well as its superb and highly professional management in a fast-changing and globalized economic environment. It is worthy and valuable to understand the specific mechanisms regarding how HLP has made a significant commitment to sustainability, with a range of ESG-related initiatives and programs in place.

3.3. Data Collection

In this longitudinal case study, data will be collected over an extended period (10 years, from 2012 to 2021) to capture changes and developments within the firm. When HLP is identified as the research subject, the key variables such as ESG commitment, ESG strategy, ESG practices, organizational factors, and organizational outcomes will be examined throughout the study period.

To gather data, multiple methods are utilized, including document analysis, surveys, interviews, and observations. The collected data are analyzed mainly using qualitative methods, e.g., text analysis and thematic coding that provide insights into the underlying reasons and motivations behind the management board and employees’ “commitment-action-outcomes”.

3.4. Data Analysis

For the data analysis, a powerful text analysis tool—AntConc 3.4.4—is used that provides a comprehensive set of features for analyzing textual data and delving into the structure and patterns of written texts. AntConc allows users to explore various aspects of the corpus, such as word frequency, collocations, and keyword analysis. The tool generates detailed statistics and visualizations, enabling users to identify significant terms and patterns within the corpus. Another essential feature is the concordance tool, which assists in studying how words are used in HLP’s annual sustainability reports. Concordance lines display snippets of text containing the search term, helping users understand its usage, collocates, and collocation strength. The ESG frequency indicators are reported in Table 1.

Table 1.

The frequency indicator of ESG elements in the yearly ESG report.

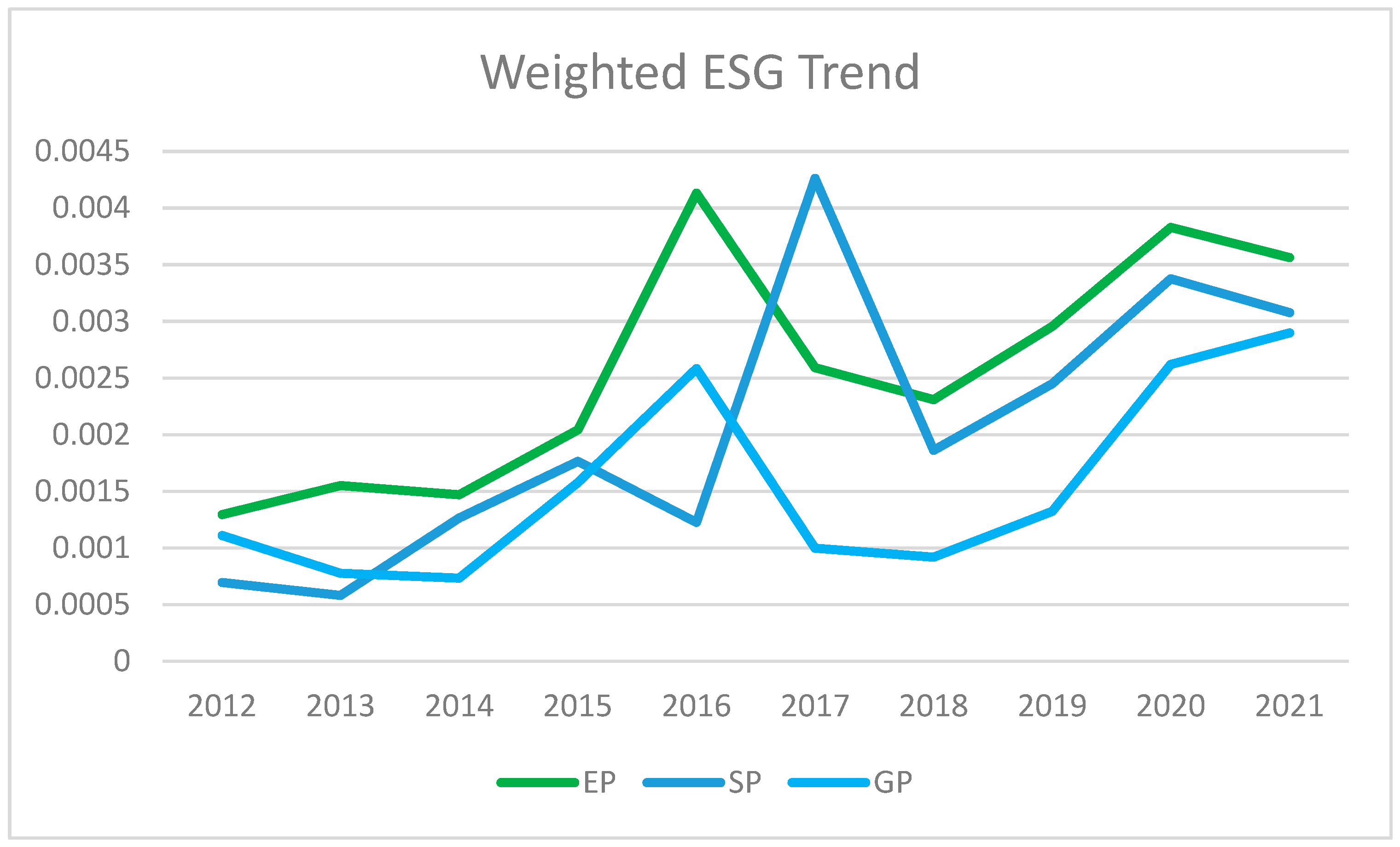

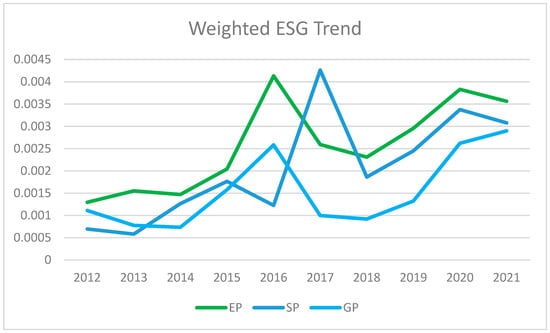

Meanwhile, the E,S,G emphasis in the yearly ESG report is sorted out by using its weighting that its frequency divides by the total words, as reported in Figure 1.

Figure 1.

The weighted ESG trend in the yearly ESG report.

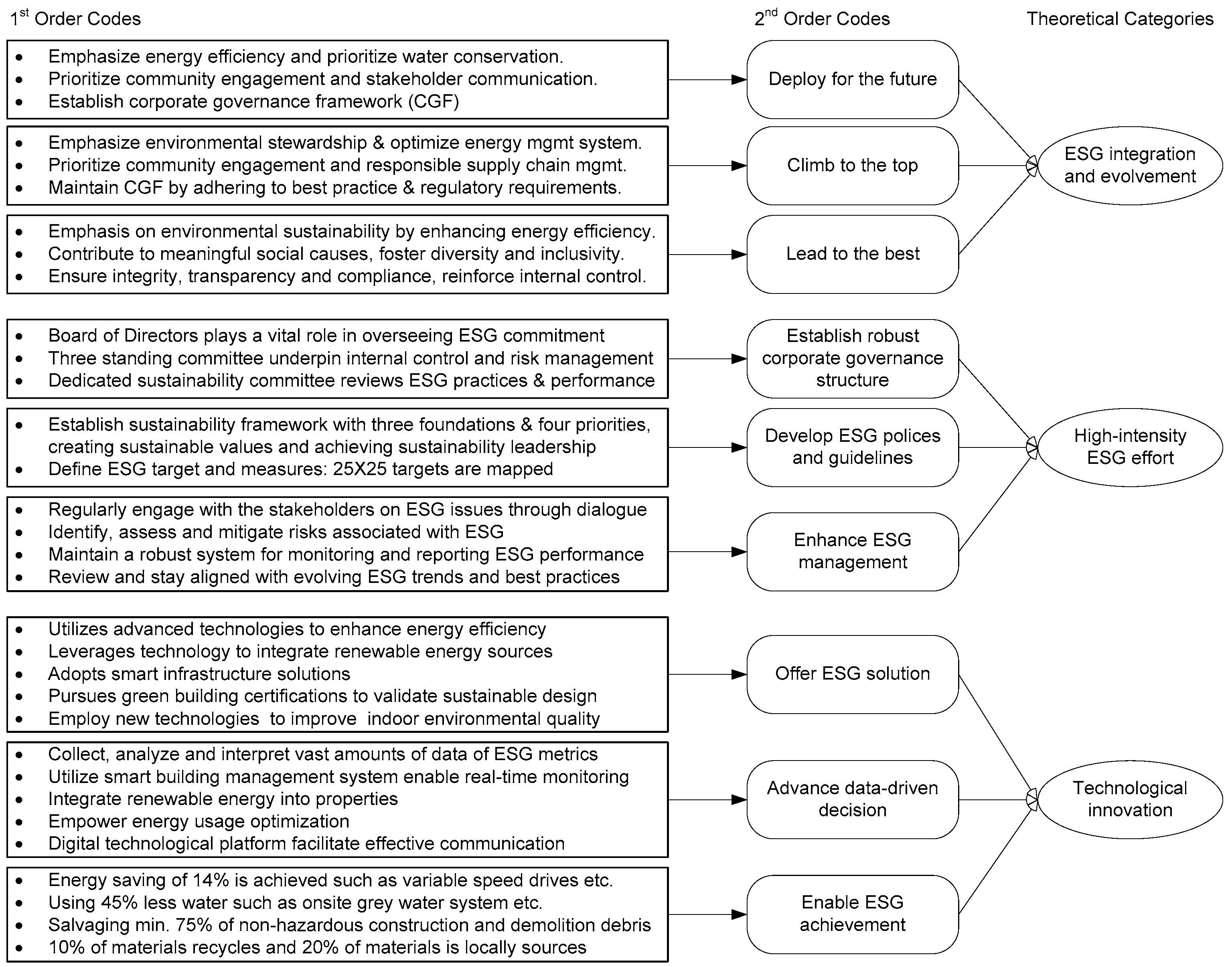

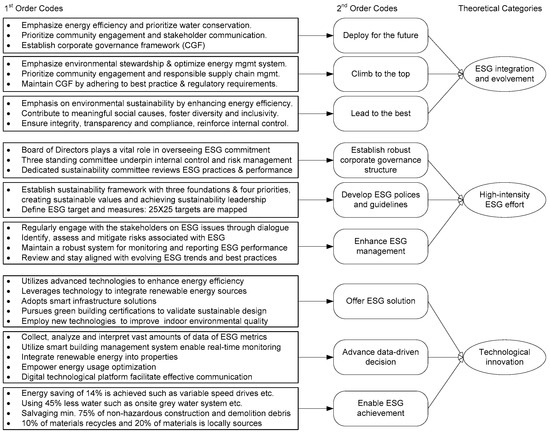

Further, in this longitudinal case study, the inductive nature of this study demands a suspension of the a priori expectations of the findings [41] and maximizes the richness of the secondary data so as to create more sense. Firstly, by reading all the annual sustainability report and generating a detailed list of all the perceived characteristics mentioned by the respondents on the ESG deployment and implementation process and the interactions of strategies, initiatives, and actions, the authorship creates two groups of coding teams and defines inductive code categories. Then, the authorship clusters these characteristics into segmented themes in which characteristics are considered themes. In addition, two coding experts analyze the texts for the existence of these themes. In the end, the good agreement of 95% between the two coding groups is achieved. The data structure is illustrated in Figure 2.

Figure 2.

Overview of data structure.

4. Findings

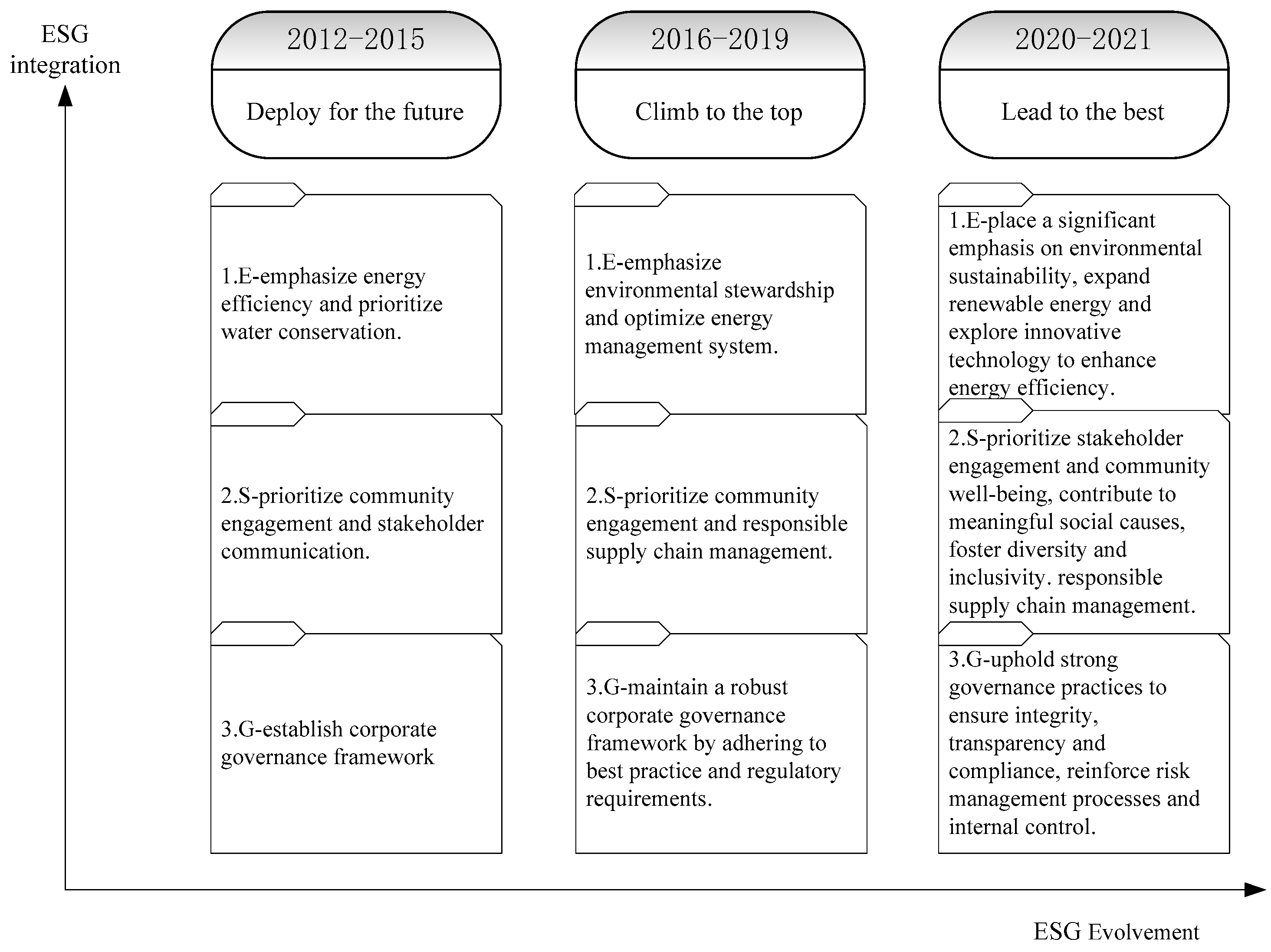

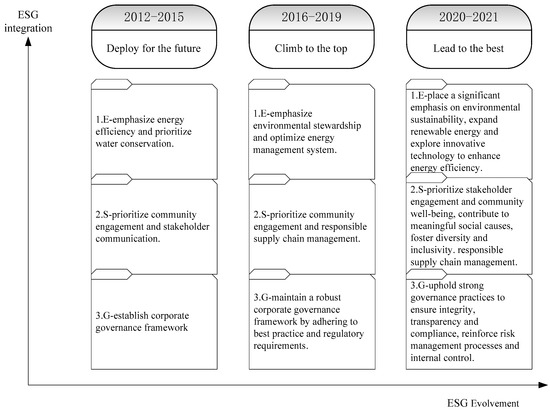

4.1. ESG Integration and Evolvement

HLP is continuously pursuing ESG integration and evolvement, to drive the green low-carbon transition. It can indeed be divided into three phases based on the sustainability reports released in the period from 2012 to 2021. These phases can help outline the company’s progress and initiatives over time, providing a clearer understanding of its ESG integration and evolvement journey. However, it is important to note that the division into three phases is a conceptual approach to analyze the progress rather than an official categorization by HLP itself. The division helps to highlight the company’s efforts and achievements in different periods, showcasing its ongoing commitment to ESG integration and sustainability practices. Please see Figure 3 for the details.

Figure 3.

ESG integration and evolvement in HLP.

4.1.1. Deploy for the Future (Years from 2012–2015)

HLP is committed to integrating environmental, social, and governance (ESG) principles into its operations, as evidenced by its sustainability reports from 2012 to 2015. During this period, HLP focused on various aspects of ESG integration to contribute to sustainable development.

In terms of environmental considerations, HLP implemented a range of initiatives to minimize its ecological footprint. It emphasized energy efficiency and conservation by adopting green building standards for its new projects, such as the LEED certification system. The firm also prioritized water conservation, implementing measures like rainwater harvesting and greywater recycling systems in its buildings. Additionally, HLP took steps to manage waste responsibly through recycling programs and initiatives to reduce construction waste during project development.

Regarding social aspects, HLP prioritized community engagement and stakeholder communication. The firm actively sought feedback from stakeholders through regular meetings and consultations to ensure that their concerns and expectations were addressed. HLP also supported various community initiatives and collaborated with local organizations on projects promoting education, cultural heritage, and healthcare. Furthermore, the firm encouraged employee volunteerism and provided opportunities for staff to contribute to social causes.

HLP demonstrated a strong commitment to good governance practices during this period. It established a comprehensive corporate governance framework to ensure transparency, accountability, and ethical behavior across its operations. The firm adhered to relevant laws and regulations and enhanced internal controls to mitigate risks effectively. HLP also maintained robust reporting mechanisms to address any potential issues promptly.

Overall, HLP’s sustainability reports from 2012 to 2015 exemplify its dedication to ESG integration. By focusing on environmental sustainability, social responsibility, and good governance, the firm aimed to deploy for the future by creating long-term value for its stakeholders while minimizing its impact on the environment and contributing positively to the communities in which it operates.

4.1.2. Climb to the Top (Years from 2016–2019)

HLP continued its commitment to ESG integration during the years 2016 to 2019, as evident in its sustainability reports.

The firm placed a strong emphasis on environmental stewardship by implementing various strategies to reduce its carbon footprint and enhance its energy efficiency. HLP focused on optimizing energy management systems, retrofitting existing buildings with energy-saving technologies, and promoting renewable energy sources. The firm also actively sought green building certifications, such as LEED and BEAM Plus, for its projects, demonstrating its dedication to sustainable construction practices.

In terms of social initiatives, HLP prioritized community engagement and responsible supply chain management. The firm engaged in extensive stakeholder consultations, soliciting feedback to address concerns effectively. It also implemented comprehensive sustainability training programs for its employees, emphasizing responsible business practices. HLP actively supported local communities through partnerships with nonprofit organizations, contributing to education, health, and cultural preservation. Additionally, the firm made efforts to ensure ethical sourcing and supplier diversity, establishing clear guidelines for its supply chain management to promote social responsibility.

With regard to governance, HLP maintained a robust corporate governance framework, adhering to best practices and regulatory requirements. The firm reinforced transparency and accountability through regular reporting and disclosed key financial and non-financial information to stakeholders. By maintaining strong internal controls and risk management systems, HLP aimed to safeguard the interests of shareholders and maintain its reputation as a trusted business entity.

Overall, HLP’s sustainability reports from 2016 to 2019 exemplify its ongoing commitment to ESG integration, showcasing its dedication to environmental sustainability, social responsibility, and sound governance practices, to prove its ambition to climb to the top level in ESG-related deployment and ESG implementation, and, finally, overall ESG performance.

4.1.3. Lead to the Best (Years from 2020–2021)

HLP continued to prioritize ESG integration during the years 2020 to 2021, as outlined in its sustainability reports.

HLP placed a significant emphasis on environmental sustainability, focusing on reducing carbon emissions and mitigating climate change. HLP implemented energy-saving measures across its properties, including the adoption of energy-efficient lighting systems and HVAC equipment. The firm also expanded its renewable energy usage and explored innovative technologies to enhance energy efficiency further. In line with its commitment to sustainable construction, HLP obtained green building certifications for its projects, such as LEED and BEAM Plus, integrating eco-friendly design and materials. Moreover, the firm actively monitored and reported its progress towards achieving environmental targets, demonstrating transparency and accountability.

In terms of social initiatives, HLP prioritized stakeholder engagement and community wellbeing. The firm engaged in regular dialogue with stakeholders, seeking feedback to address concerns effectively. It organized various community programs and activities aimed at promoting education, health, and cultural preservation. HLP also encouraged employee volunteerism, providing opportunities for staff to contribute to meaningful social causes. Additionally, the firm fostered diversity and inclusivity within its workforce, ensuring equal opportunities and fair treatment for all parties.

HLP upheld strong governance practices throughout this period, ensuring integrity, transparency, and compliance. The firm maintained a robust corporate governance framework, regularly reviewing and updating its policies and procedures to reflect best practices. HLP adhered to relevant laws and regulations and promoted ethical behavior across its operations. The firm also reinforced risk management processes and internal controls to mitigate potential risks effectively. Furthermore, HLP consistently reported its governance practices and performance, enabling stakeholders to make informed assessments about its operations.

In conclusion, HLP’s sustainability reports from 2020 to 2021 demonstrate its unwavering commitment to ESG integration. By prioritizing environmental sustainability, social responsibility, and sound governance, the firm strives to create long-term value for stakeholders while minimizing its impact on the environment and positively contributing to society.

4.2. High-Intensity ESG Effort

HLP is committed to integrating environmental, social, and governance (ESG) strategy into the daily operations. To this end, it has established a sustainability governance structure and formulated related policies and guidelines to facilitate decision-making. By abstracting key information from its sustainability reports from the years 2012 to 2021, HLP’s commitment to environmental protection, social responsibility, and sound governance practices is explored in order to analyze the intensity of the ESG efforts undertaken by HLP.

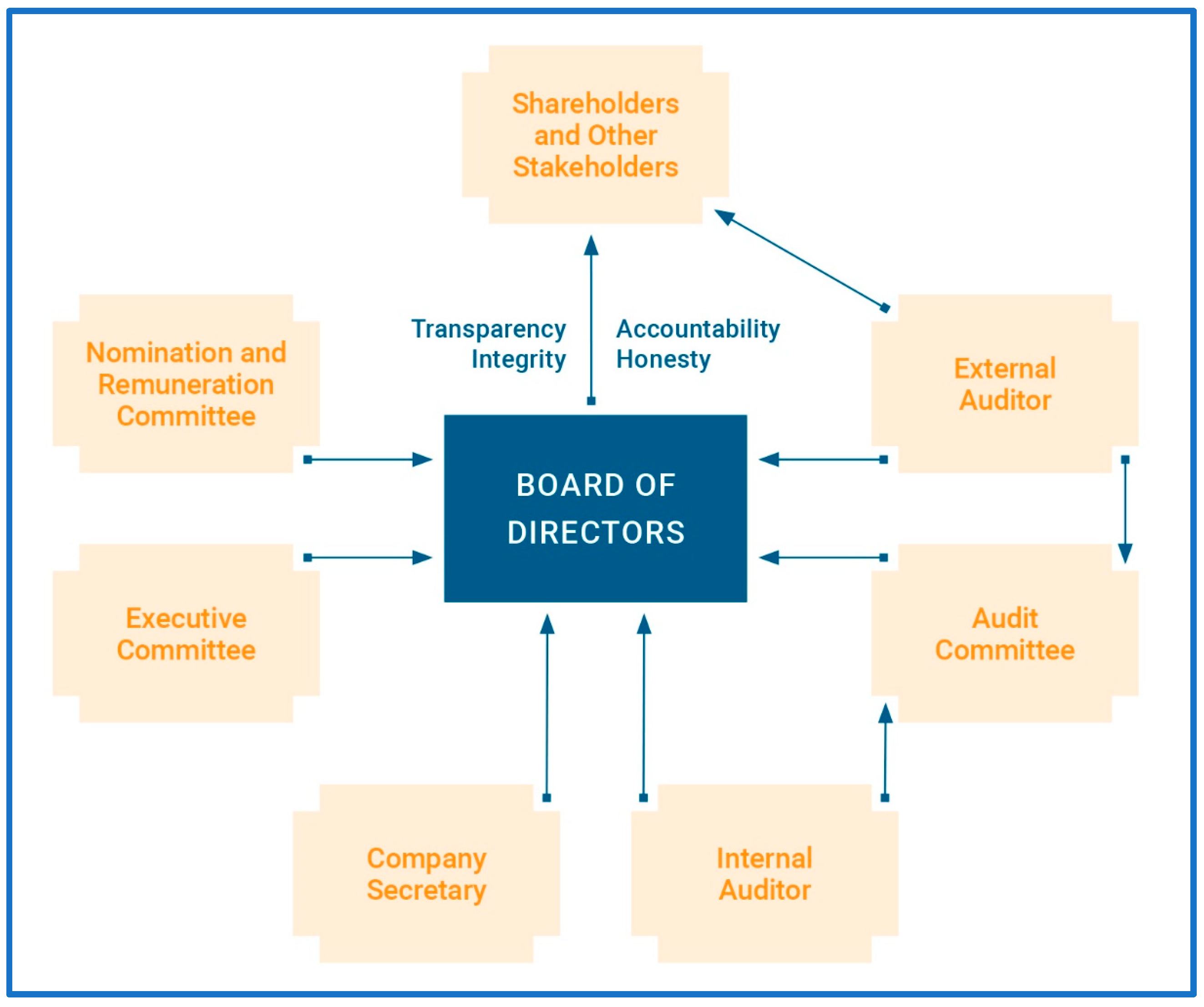

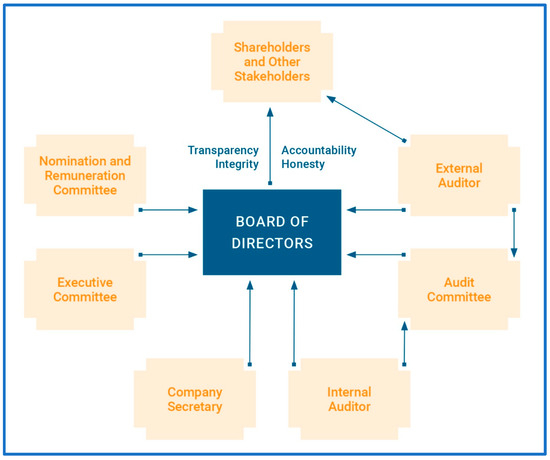

4.2.1. Corporate Governance Structure

Good corporate governance has been the vital foundation of the firm’s wellbeing. HLP demonstrates a strong commitment to corporate governance and environmental, social, and governance (ESG) principles. Further, in the core principles of good corporate governance, it emphasizes transparency and accountability to all stakeholders, maintaining high standards of integrity and establishing trust through sound governance practices. It has established and maintains a robust corporate governance structure that aligns with its ESG commitment. This structure enables HLP to integrate sustainability into its operations and decision-making processes effectively. Refer to Figure 4 for details.

Figure 4.

Corporate governance structure in HLP.

Board of Directors: The Board of Directors plays a vital role in overseeing the company’s ESG commitments. It consists of both executive and independent non-executive directors who bring diverse expertise to the table. The board ensures that HLP adheres to the highest standards of business ethics, transparency, and accountability. It sets strategic objectives, approves ESG-related policies and initiatives, and monitors their implementation.

Standing committees: In order to provide benefit to the stakeholders, HLP strives to meet the highest standard of corporate governance with a highly qualified Board of Directors underpinned by sound internal control and effective risk management systems. There are three committees: the executive committee (EC), nomination and remuneration committee (NRC), and audit committee (AC). The EC meets regularly to establish the strategic direction of the company and to monitor the performance of the management including ESG. The NRC is responsible for setting policy on and determining remuneration packages for executive board members and the top talents. The duties of the AC include maintaining an appropriate relationship with the company’s external auditor, reviewing financial information, and overseeing the financial reporting system, risk management, and internal control systems.

Dedicated sustainability committee: HLP has a dedicated sustainability committee that focuses on ESG matters. The committee comprises board members, senior management, and external experts; see Figure 4 for details. Its primary responsibility is to review and assess the company’s sustainability performance, set targets, and develop strategies to enhance ESG practices. The committee also oversees the integration of sustainability considerations into business operations and identifies risks and opportunities related to ESG factors.

4.2.2. Policies and Guidelines

To facilitate its ESG commitment, HLP has developed comprehensive policies and guidelines. These documents provide clear instructions and expectations for employees, contractors, suppliers, and other stakeholders. For example, the company has an Environmental Policy that outlines its commitment to resource conservation, waste reduction, and pollution prevention. It also has guidelines for responsible investment, community engagement, and employee wellbeing.

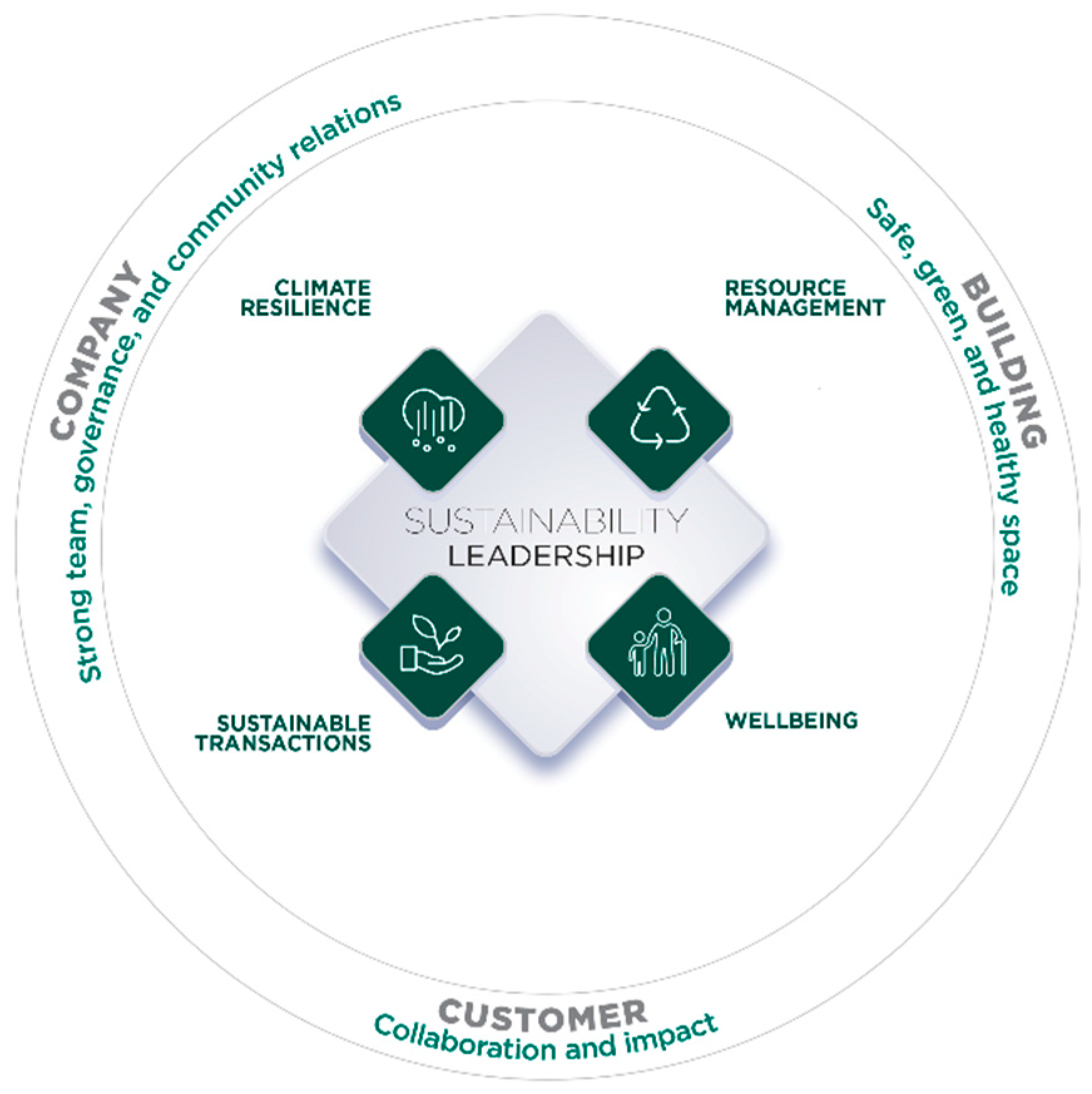

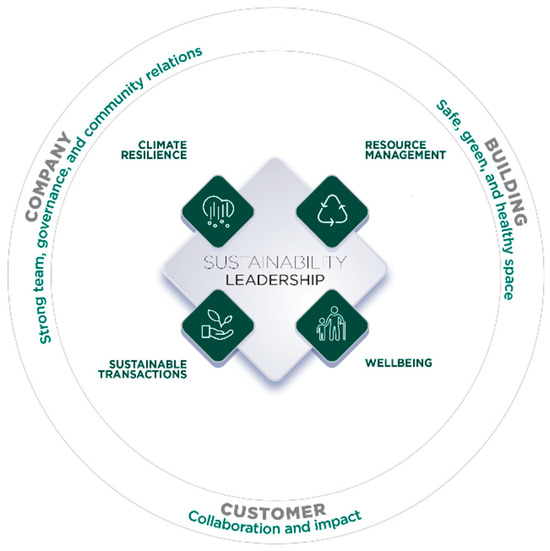

- Establishing sustainability framework: The sustainability framework is established and maintained, which comprises three foundations and four priorities and aims to provide a well-defined direction for HLP to create sustainable values for the stakeholders and in the long run, to achieve sustainability leadership. The three foundations (customer, company, and building) describe the core organizational contexts and indispensable principles underlying all the sustainability efforts. Refer to Figure 5 for details.

Figure 5. Sustainability framework in HLP.

Figure 5. Sustainability framework in HLP. - The four priorities: They reflect the top-four material sustainability issues of HLP, where the firm aims to make significant progress and support the leadership ambitions in the next decade. It includes climate resilience, resource management, wellbeing, and sustainable transactions. Climate resilience refers to adapting to climate change and decarbonizing the business, resource management focuses on optimizing the use and management of natural resources (energy, water, and materials), wellbeing implies sustaining a healthy, inclusive, and safe environment and promoting social wellbeing, and sustainable transactions request the promotion of sustainability practices in all types of business transactions.

- Defining ESG targets and measures: Following the announcement of the 2030 Sustainability Goals and Targets in 2020, HLP established 25 targets to be achieved by the end of 2025 (25 × 25 Sustainability Targets) in 2021. The 25 × 25 Sustainability Targets address the four priorities outlined in HLP’s sustainability. These targets define concrete and quantifiable measures to address significant sustainability challenges and provide the employees with a clear agenda over the next four years, see the details in Table 2.

Table 2. The ESG targets and measures in 2025.

Table 2. The ESG targets and measures in 2025.

4.2.3. ESG Management

The key to ESG’s continuing success is about how the ESG strategy and belief will be supported and practiced by all levels of employees. At HLP, the We Do It Well business philosophy extends from the Board to all of the employees of different positions and at all levels, all of whom strive to uphold the highest standard of integrity and honesty in every aspect of the business around ESG.

- Stakeholder engagement: HLP recognizes the importance of engaging with stakeholders to understand their expectations and concerns regarding ESG issues. The company regularly engages with the stakeholders (shareholders, investors, customers, employees, government agencies, and local communities) through regular dialogue to understand their concerns. By addressing the stakeholders’ concerns on sustainability, HLP discloses the sustainability performance and green low-carbon transition through the annual sustainability reporting exercise, as well as evaluates the performance regularly through participating in different sustainability-themed benchmarks and indices.

- Risk management: ESG risks are integrated into HLP’s broader risk management framework. The company identifies, assesses, and mitigates risks associated with environmental, social, and governance factors. By proactively managing these risks, the company aims to protect its long-term value and ensure sustainable growth. Risk assessments are conducted and monitored regularly; appropriate measures are taken to minimize potential negative impacts.

- Performance measurement and reporting: HLP maintains a robust system for measuring, monitoring, and reporting its ESG performance. The company sets key performance indicators (KPIs) aligned with industry best practices and international standards. Regular audits and assessments evaluate the effectiveness of ESG initiatives and identify areas for improvement. HLP also publishes annual sustainability reports that provide transparent information about its ESG performance and progress towards its goals.

- Continuous improvement: HLP recognizes that its ESG commitment is an ongoing journey. The company continually reviews and enhances its policies, practices, and frameworks to stay aligned with evolving ESG trends and best practices. It actively engages in industry collaborations, benchmarking exercises, and knowledge-sharing platforms to learn from peers and contributes to the development of sustainable real estate practices.

As shown above, HLP has established a comprehensive corporate governance structure and management system to pursue its ESG commitment effectively. Through strong leadership and dedicated committees, clear policies and guidelines, stakeholder engagement, risk management, performance measurement, and integration of ESG into business practices, the company demonstrates its commitment to sustainable development and responsible business operations. HLP’s corporate governance structure and ESG management enable it to navigate ESG challenges, seize opportunities, and create long-term value for its stakeholders while contributing to a more sustainable future.

4.3. Technological Innovation Empowering ESG

In a rapidly changing world, good corporate governance demands constant innovation and adaptation to address new challenges and grasp fresh opportunities in order to maintain a competitive advantage.

4.3.1. Technological Innovation Offering ESG Solution

HLP is committed to promoting environmental, social, and governance (ESG) initiatives through technological innovation. As a generic solution, HLP facilitates stakeholder engagement through digital platforms and technologies. It utilizes online channels to communicate ESG initiatives, share sustainability reports, and gather feedback from tenants, investors, and the wider community. This transparent approach promotes accountability and fosters collaboration in achieving shared sustainability goals. Through these technological innovations, HLP aims to drive sustainable development, minimize environmental impact, and contribute to the wellbeing of the communities in which it operates.

4.3.2. Technological Innovation Advancing Data-Driven Decisions

Technological innovation plays a crucial role in empowering HLP’s ESG initiatives in several ways. Through the empowerment of technological innovation, HLP can measure, monitor, and optimize its ESG performance more effectively. This, in turn, enables it to make data-driven decisions, implement targeted sustainability initiatives, and contribute to a greener and more resilient built environment.

4.3.3. Technological Innovation Enabling ESG Achievements

Technological innovation creates opportunities for collaboration with external partners, including technology providers, research institutions, and industry experts. HLP actively seeks innovative solutions and partnerships to continuously improve its ESG performance. This collaborative approach fuels innovation and helps drive the adoption of sustainable technologies across the commercial real estate industry. Exampled by “Olympia 66 in Dalian”, it elaborates how the ESG goals and targets are achieved. The specific solutions for the above-mentioned dimensions have been listed in Table 3.

Table 3.

The dimensions of technological innovations empowering ESG.

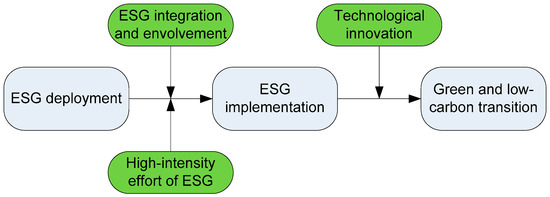

5. Discussion

Upholding the new development concept that “Lucid waters and lush mountains are invaluable assets”, China’s all-level governments spur the firms taking practical measures to advance the 2030 agenda. As HLP is a leading company, environmental, social, and governance (ESG) factors have gained significant attention in the past 10+ years, due to its recognition of the need to transition towards a green and low-carbon economy and the co-integration relationship between corporate financial performance metrics and corporate sustainability performance scores [31]. For this purpose, this paper has underlined the logical steps involved in its journey from ESG deployment to ESG implementation, ultimately achieving green and low-carbon transition. During this journey, three enablers of its ESG commitment are identified, i.e., ESG integration and evolvement, high-intensity ESG effort, and technological innovation.

5.1. The Impact of ESG Integration

ESG integration and evolvement have a significant impact on firms’ ability to achieve green and low-carbon transition. In this research study, HLP has been systematically incorporating ESG factors into its strategy, operations, and decision-making processes, to keep its strategy comparably stable and continuously renewed in pursuing its ESG journey, which can be divided into three stages, namely deploy for the future (2012–2015), climb to the top (2016–2019), and lead to the best (2020–now). As presented, HLP develops a comprehensive ESG strategy tailored to its industry, market, and stakeholder expectations. This involves setting ambitious ESG targets and measures in 2025, framing the corporate governance and four foundations, and establishing key performance indicators (KPIs) for monitoring progress. The ESG integration also helps to dynamically identify material risks and opportunities, enhances stakeholder engagement, improves risk management, and strengthens long-term financial performance, to generate several ESG considerations for ESG deployment.

Most favorably, ESG integration at HLP refers to “integrate ESG into business practices”. HLP integrates ESG considerations into its core business practices. The top-level leadership not only sets the tone for ESG integration, but also conducts due diligence on potential investments to assess their environmental and social impacts, aligning them with the overall corporate strategy. The working-level management team also evaluates supply chain partners based on their ESG performance and encourages them to adopt sustainable practices. Moreover, HLP integrates ESG considerations into every aspect of operations. This includes incorporating eco-friendly technologies, deploying LEED AP and WELL AP into commercial projects, establishing sustainability fitting-out guidelines to tenants, promoting resource efficiency, reducing waste, and implementing responsible supply chain management practices. All these lead to energy-efficient design, green building materials, and renewable energy sources in its construction projects to reduce environmental footprints. At the end, by integrating ESG considerations into every aspect of its business, HLP can drive meaningful change and contribute to sustainable development for ESG implementation.

5.2. The Role of High-Intensity ESG Effort

High-intensity effort is crucial for successful ESG implementation that embeds ESG deployment into daily operations. Achieving successful ESG implementation requires a high-intensity effort from all levels within an organization. This effort includes a strong leadership commitment, clear goal-setting, dedicated resources, and ongoing monitoring and evaluation; these have been reflected in HLP’s governance structure, policies, and guidelines that instruct the employees, contractors, suppliers, and other stakeholders on how to behave towards sustainability. Furthermore, the elaborated sustainability framework indeed secures the three foundations (customer, company, and building) and four priorities (climate resilience, resource management, wellbeing, and sustainable transactions), which provide the direction to create values for the stakeholders and in the long run, to achieve sustainability leadership. However, promoting sustainability practices in all types of business transactions involves aligning incentives, establishing accountability mechanisms, and overcoming resistance to change.

High-intensity effort also drives cultural transformation so that sustainability becomes embedded in the organization’s DNA. By forming the appropriate organizational structure, establishing clear responsibilities, defining the suitable procedure, and allocating dedicated resources, a high-intensity effort ensures that ESG goals are prioritized [42], progress is monitored, and challenges are addressed effectively. However, it requires the company to foster a culture of sustainability throughout the organization. It involves training employees, promoting knowledge sharing, and rewarding sustainable behaviors. For instance, the 25 × 25 Sustainability Targets not only provide the employees with a clear agenda by 2025, but also define concrete and quantifiable measures to address significant sustainability challenges. For instance, challenges related to resource allocation and stakeholder engagement may arise. To some, such sustainability challenges are far away from a firm’s responsibility and capability; therefore, there is a need for collaboration with external stakeholders, such as partners, suppliers, and local communities, to align the collective action and synergize the joint effort towards sustainable outcomes [43].

5.3. The Catalyst of Technological Innovation

Technological innovation acts as a catalyst for achieving a green and low-carbon transition. Firstly, it offers solutions to mitigate environmental impacts, increase energy efficiency, and reduce carbon emissions by advancing renewable energy technologies, energy storage systems, and smart grid infrastructure, to enable firms to reduce their reliance on fossil fuels, decrease carbon emissions, and operate more sustainably. Indeed, technological advancements have the potential to revolutionize industries and pave the way for a sustainable future. For example, HLP wants to demonstrate best efforts to achieve a 70% reduction in greenhouse gas emission intensity; the development of renewable energy technologies such as solar panels and wind turbines has transformed the energy sector by offering clean and sustainable alternatives to traditional fossil fuel-based power generation. HLP also builds a nearly net-zero carbon building. These innovations not only contribute to reducing greenhouse gas emissions but also promote energy independence and resilience.

Secondly, technological innovation in digitalization and data analytics empower data-driven decision-making, enabling businesses to identify areas of improvement and implement targeted strategies, such as monitoring and optimizing energy consumption, reducing waste, and enhancing supply chain transparency. Moreover, with the advent of the Internet of Things (IoT) and connected devices, companies now have access to vast amounts of real-time data that can be analyzed to optimize operations. For instance, HLP has installed so many sensors in infrastructure systems that can monitor energy usage, water consumption, and air quality, allowing businesses to make informed decisions regarding resource allocation and sustainability initiatives.

Thirdly, technological innovation also enables the development of new business models, such as sharing economies and circular economies, which promote resource efficiency and sustainability. For instance, smart grids enable efficient power distribution by monitoring and regulating electricity consumption in real time, thereby reducing wastage and improving overall energy efficiency. Similarly, advanced materials and improved manufacturing processes at suppliers allow for the production of energy-efficient appliances. In conclusion, technological innovation acts as a catalyst for a firm’s green and low-carbon transition by providing solutions to mitigate environmental impacts, increasing energy efficiency, enabling data-driven decision-making, and fostering the development of new business models.

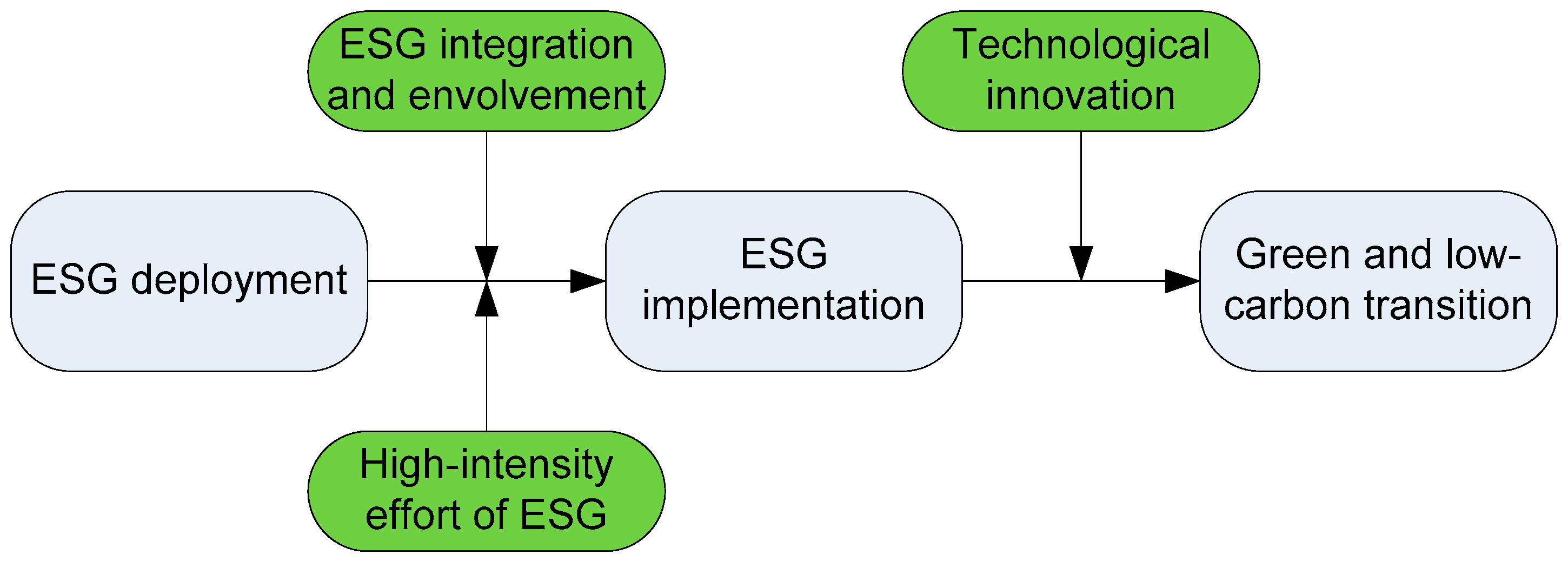

Based on the above discussion, this paper proposes the following research model (Figure 6) for future study.

Figure 6.

Research conceptual model of ESG commitment’s three enablers.

6. Conclusions

HLP has exemplified its dedication to a genuine commitment in the studied 10 years, by consistently prioritizing environmental sustainability, social responsibility, and sound governance practices. HLP also demonstrates its engagement with local communities, upholding ethical standards through its various initiatives. In conclusion, it figures out that in the Hang Lung case, ESG integration and evolvement, high-intensity ESG effort, and the leverage of technological innovation are three enablers to spur low-carbon transition and achieve long-term value.

6.1. Theoretical Contributions

This paper explores the specific mechanisms of the ESG commitment driving a firm’s green and low-carbon transition by borrowing the “commitment-action-outcomes” research framework. It identifies three key enablers of ESG commitment—ESG integration and evolvement, high-intensity ESG effort, and technological innovation—that can spur low-carbon transition and achieve long-term value. It further examines the moderating role of three enablers of ESG commitment, to achieve green and low-carbon transition. ESG integration and evolvement and high-intensity ESG effort facilitate the journey from ESG deployment to ESG implementation, while technological innovation spurs firms’ green low-carbon transition.

In detail, ESG integration and evolvement have increased firms’ capacity to streamline the steps from initial ESG deployment to tangible ESG implementation for achieving a green and low-carbon transition. High-intensity effort drives firms’ execution to shift from ESG deployment to ESG implementation; therefore, high-intensity effort expedites the progression from initial ESG deployment to tangible ESG implementation for achieving a green and low-carbon transition. Technological innovation acts as a catalyst in accelerating a firm’s green low-carbon transition through embedding ESG implementation for achieving lower emissions and a smaller carbon footprint.

By identifying three enablers of ESG commitment and examining the aforesaid specific mechanisms, this paper contributes to the literature in the following ways. Firstly, it sheds light on the effectiveness of ESG commitments in promoting sustainable business practices. Secondly, it enriches the understanding to build an enterprise’s resilience and self-reliance via ESG initiatives in the face of uncertainty. The company’s investment in several ESG-related practices reflects its holistic approach to sustainability. Thirdly, it makes an important methodological contribution by constructing a new employed textual analysis for the ESG research domain.

6.2. Managerial Implications

Written ESG policies are becoming ubiquitous. However, as investment managers’ ESG policies can attest, the existence of a written document is not a reliable indicator of a firm’s commitment to or performance on sustainable long-term goals. Meanwhile, affirming a business’s commitment to a broad range of stakeholders, including customers, employees, suppliers, communities, and, of course, shareholders paying attention to ESG concerns, does not compromise returns, rather, the opposite. However, there are also challenges associated with the adoption of ESG practices, and the final performance very much depends on if the right deliverology is installed and activated. HLP serves as a role model for real estate developers and other associated players, showcasing the positive impacts that can be achieved through an integrated ESG strategy, concerted high-intensity ESG efforts, and continuous technological innovation.

The findings have important implications for firms, investors, and regulators. Firstly, firms should consider integrating sustainability practices into their business strategy to drive long-term sustainability, improve financial performance, and positively impact stakeholders and society. Firms could focus on energy efficiency, waste management, and greenhouse gas emissions reduction for the environmental initiatives. Green roofs, LED lighting, and advanced HVAC systems will be helpful to enhance energy efficiency and reduce carbon emissions in their properties. Secondly, investors can prioritize those firms that implement comprehensive ESG frameworks with continuous social responsibility efforts. In those circumstances, firms engage with the local community for education, health, and cultural preservation, and it is also necessary to cooperate with the supplier to enhance transparency, traceability, and sustainability throughout the entire supply chain, to build long-term relationships with stakeholders and preserve shareholder value. Finally, regulators should address and leverage ESG issues in both the short-term and long-term when figuring out the differentiated policy, which will lead to a positive operating environment and responsible decision-making for firms.

6.3. Limitations and Future Scope of Research

By presenting HLP’s case and examining the specific mechanism of how the ESG commitment drives a firm’s green and low-carbon transition, this paper is regarded as one of the first wave to investigate a firm’s continuously evolving ESG strategies and ESG commitment through a longitudinal case study. Meanwhile, by applying the textual analysis, this paper is able to determine the emerging ESG trends and examine the specific mechanism of how an ESG commitment drives the green and low-carbon transition. However, it is just a single case study and it definitely needs more cases for verification to see if a similar deployment and commitment would generate comparable results, to avoid the bias of organizational contexts.

Although this paper has certain limitations, it offers prospects and directions for future research. Firstly, this study is qualitative in nature, which could have benefited from a quantitative examination that reinforces the development of the proposed model. Moreover, cross-examination of the sustainability reports and obtaining a firsthand survey would have enriched the implications. For future research, a combination of a qualitative and quantitative study is proposed to further investigate the proposed model. Also, a cross-organizational and or cultural comparative analysis of the model can be conducted to examine differences in the relationships by selecting a sample of firms in countries with diverse cultures. Finally, the proposed model can be extended to change management and human resource management practices, as well as the social aspects of innovation and performance.

Author Contributions

All the authors jointly contributed to the research. Their specific roles are stipulated as follows: conceptualization, methodology, and review, J.L.; validation and original draft preparation, S.L.; formal analysis, literature review, and investigation, S.S.L.; data curation, Y.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Giller, K.E.; Drupady, I.M.; Fontana, L.B.; Oldekop, J.A. Editorial overview: The SDGs—Aspirations or inspirations for global sustainability. Curr. Opin. Environ. Sustain. 2018, 34, A1–A2. [Google Scholar] [CrossRef]

- Clark, G.L.; Dixon, A.D. Legitimacy and the extraordinary growth of ESG measures and metrics in the global investment management industry. Environ. Plan. A: Econ. Space 2023, 0308518X231155484. [Google Scholar] [CrossRef]

- Dhar, B.K.; Sarkar, S.M.; Ayittey, F.K. Impact of social responsibility disclosure between implementation of green accounting and sustainable development: A study on heavily polluting companies in Bangladesh. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 71–78. [Google Scholar] [CrossRef]

- China Association of Building Energy Efficiency (CABEE, 2020), Committee of Building Energy Data. China Building Energy Consumption Research Report, Xiamen. Available online: www.cabee.org/site/content/24020.html (accessed on 4 January 2021).

- Ashrafi, M.; Magnan, G.M.; Adams, M.; Walker, T.R. Understanding the Conceptual Evolutionary Path and Theoretical Underpinnings of Corporate Social Responsibility and Corporate Sustainability. Sustainability 2020, 12, 760. [Google Scholar] [CrossRef]

- Mori, M. AI as a Catalyst for ESG Investing. In Advances in Artificial Systems for Medicine and Education VI; Hu, Z., Ye, Z., He, M., Eds.; AIMEE 2022; Lecture Notes on Data Engineering and Communications Technologies; Springer: Cham, Germany, 2023; Volume 159. [Google Scholar] [CrossRef]

- Carroll, A.B. Corporate social responsibility: Evolution of a definitional construct. Bus. Soc. 2016, 55, 322–358. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Creating Shared Value; FSG: Boston, MA, USA, 2011. [Google Scholar]

- Datsii, O.; Levchenko, N.; Shyshkanova, G.; Platonov, O.; Abuselidze, G. Creating a Regulatory Framework for the ESG-investment in the Multimodal Transportation Development. Rural. Sustain. Res. 2021, 46, 39–52. [Google Scholar] [CrossRef]

- Wang, J.; Liu, T. Spatiotemporal evolution and suitability of apple production in China from climate change and land use transfer perspectives. Food Energy Secur. 2022, 11, e386. [Google Scholar] [CrossRef]

- ElAlfy, A.; Palaschuk, N.; El-Bassiouny, D.; Wilson, J.; Weber, O. Scoping the Evolution of Corporate Social Responsibility (CSR) Research in the Sustainable Development Goals (SDGs) Era. Sustainability 2020, 12, 5544. [Google Scholar] [CrossRef]

- Chouaibi, Y.; Zouari, G. The effect of corporate social responsibility practices on real earnings management: Evidence from a European ESG data. Int. J. Discl. Gov. 2021, 19, 11–30. [Google Scholar] [CrossRef]

- López-Concepción, A.; Gil-Lacruz, A.I.; Saz-Gil, I. Stakeholder engagement, Csr development and Sdgs compliance: A systematic review from 2015 to 2021. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 19–31. [Google Scholar] [CrossRef]

- Guo, H.; Yang, C.; Liu, X.; Li, Y.; Meng, Q. Simulation evaluation of urban low-carbon competitiveness of cities within Wuhan city circle in China. Sustain. Cities Soc. 2018, 42, 688–701. [Google Scholar] [CrossRef]

- Eccles, R.G.; Serafeim, G.; Krzus, M.P. Market interest in nonfinancial information. J. Appl. Corp. Financ. 2019, 31, 32–42. [Google Scholar] [CrossRef]

- Tsalis, T.A.; Malamateniou, K.E.; Koulouriotis, D.; Nikolaou, I.E. New challenges for corporate sustainability reporting: United Nations’ 2030 Agenda for sustainable development and the sustainable development goals. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1617–1629. [Google Scholar] [CrossRef]

- Landi, G.; Sciarelli, M. Towards a more ethical market: The impact of ESG rating on corporate financial performance. Soc. Responsib. J. 2019, 15, 11–27. [Google Scholar] [CrossRef]

- Jones, P.; Phillips, E. The impact of technological innovation on corporate governance practices: A systematic review. Corp. Gov. Int. Rev. 2020, 28, 354–370. [Google Scholar]

- Ning, X.; Yim, D.; Khuntia, J. Online Sustainability Reporting and Firm Performance: Lessons Learned from Text Mining. Sustainability 2021, 13, 1069. [Google Scholar] [CrossRef]

- Elkington, J. Partnerships from cannibals with forks: The triple bottom line of 21st-century business. Environ. Qual. Manag. 1998, 8, 37–51. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Finance Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Bartlett, N.; Whittington, E.; Reuvers, S.; Thoday, K. Driving Low-Carbon Growth through Business and Investor Action. In Seizing the Global Opportunity: Partnerships for Better Growth and a Better Climate; New Climate Economy: Washington, DC, USA, 2016. [Google Scholar]

- Grewal, J.; Pati, S.P.; Pathak, A.; Rahman, Z. Exploring the link between ESG practices and green supply chain management: Evidence from Indian industries. Resour. Conserv. Recycl. 2020, 164, 105–154. [Google Scholar]

- El-Kassar, A.N.; Singh, S.K. Green innovation and organizational performance: The influence of big data and the moderating role of management commitment and HR practices. Technol. Forecast. Soc. Chang. 2019, 144, 483–498. [Google Scholar] [CrossRef]

- Amel-Zadeh, A.; Mayer, D.; Müller, K. The value of ESG reporting and the role of technological innovation. Eur. Account. Rev. 2021, 30, 707–744. [Google Scholar]

- Hou, J.; Cao, M.; Liu, P. Development and utilization of geothermal energy in China: Current practices and future strategies. Renew. Energy 2018, 125, 401–412. [Google Scholar] [CrossRef]

- Cappucci, M. The ESG integration paradox. J. Appl. Corp. Financ. 2018, 30, 22–28. [Google Scholar] [CrossRef]

- Liu, A.Z.; Liu, A.X.; Moon, S.; Siegel, D. Does Corporate Social Responsibility Always Result in More Ethical Decision-Making? Evidence from Product Recall Remediation. J. Bus. Ethics 2023, 1–21. [Google Scholar] [CrossRef]

- Koller, T.; Nuttall, R.; Henisz, W. Five Ways that ESG Creates Value; The McKinsey Quarterly: Chicago, IL, USA, 2019. [Google Scholar]

- Lv, S.; Wu, Y. Target-oriented obstacle analysis by PESTEL modeling of energy efficiency retrofit for existing residential buildings in China’s northern heating region. Energy Policy 2009, 37, 2098–2101. [Google Scholar]

- Ivascu, L.; Domil, A.; Sarfraz, M.; Bogdan, O.; Burca, V.; Pavel, C. New insights into corporate sustainability, environmental management and corporate financial performance in European Union: An application of VAR and Granger causality approach. Environ. Sci. Pollut. Res. 2022, 29, 82827–82843. [Google Scholar] [CrossRef] [PubMed]

- Safari, A.; Das, N.; Langhelle, O.; Roy, J.; Assadi, M. Natural gas: A transition fuel for sustainable energy system transformation? Energy Sci. Eng. 2019, 7, 1075–1094. [Google Scholar] [CrossRef]

- Cochran, I.; Hubert, R.; Marchal, V.; Youngman, R.; Rus, K.; Baker, J.; Kynaston, J. Public Financial Institutions and the Low Carbon Transition: Five Case Studies on Low-Carbon Infrastructure and Project Investment. 2014. Available online: https://www.oecd-ilibrary.org/environment-and-sustainable-development/public-financial-institutions-and-the-low-carbon-transition_5jxt3rhpgn9t-en (accessed on 4 January 2021).

- Smith, J.; Johnson, L.; Wilson, M. Technological innovation and environmental sustainability: A review and synthesis of the literature. J. Environ. Manag. 2017, 183 Pt 3, 616–624. [Google Scholar]

- Anser, M.K.; Zhang, Z.; Kanwal, L. Moderating effect of innovation on corporate social responsibility and firm performance in realm of sustainable development. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 799806. [Google Scholar] [CrossRef]

- Hu, Y.; Bai, W.; Farrukh, M.; Koo, C.K. How does environmental policy uncertainty influence enterprise green investments? Technol. Forecast. Soc. Chang. 2023, 189, 122330. [Google Scholar] [CrossRef]

- Brown, C.; DeVries, K. The role of technology in promoting sustainable employment practices. J. Bus. Ethics 2019, 156, 759–772. [Google Scholar]

- Schaltegger, S.; Burritt, R. Contemporary Environmental Accounting: Issues, Concepts and Practice; Routledge: London, UK, 2017. [Google Scholar]

- McGreevy, S.R.; Rupprecht, C.D.D.; Niles, D.; Wiek, A.; Carolan, M.; Kallis, G.; Kantamaturapoj, K.; Mangnus, A.; Jehlička, P.; Taherzadeh, O.; et al. Sustainable agrifood systems for a post-growth world. Nat. Sustain. 2022, 5, 1011–1017. [Google Scholar] [CrossRef]

- Rusch, M.; Schöggl, J.; Baumgartner, R.J. Application of digital technologies for sustainable product management in a circular economy: A review. Bus. Strat. Environ. 2023, 32, 1159–1174. [Google Scholar] [CrossRef]

- Dutton, J.E.; Ashford, S.J.; O’neill, R.M.; Hayes, E.; Wierba, E.E. Reading the wind: How middle managers assess the context for selling issues to top managers. Strateg. Manag. J. 1997, 18, 407–423. [Google Scholar] [CrossRef]

- Fisher, A.; Fukuda-Parr, S. Introduction—Data, knowledge, politics and localizing the SDGs. J. Hum. Dev. Capab. 2019, 20, 375–385. [Google Scholar] [CrossRef]

- Arvidsson, S.; Dumay, J. Corporate ESG reporting quantity, quality and performance: Where to now for environmental policy and practice? Bus. Strat. Environ. 2022, 31, 1091–1110. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).