Sustainable Supplier Evaluation: From Current Criteria to Reconstruction Based on ESG Requirements

Abstract

:1. Introduction

2. Literature Review

2.1. Sustainable Supplier Evaluation

2.2. ESG Framework and Regulatory Requirements

2.3. Literature Summary

3. Methods and Data

3.1. Research Design

3.2. Sample

3.3. Coding Procedure

3.4. Data Analysis

4. Results and Discussion

4.1. Discussion about System 1 and System 2

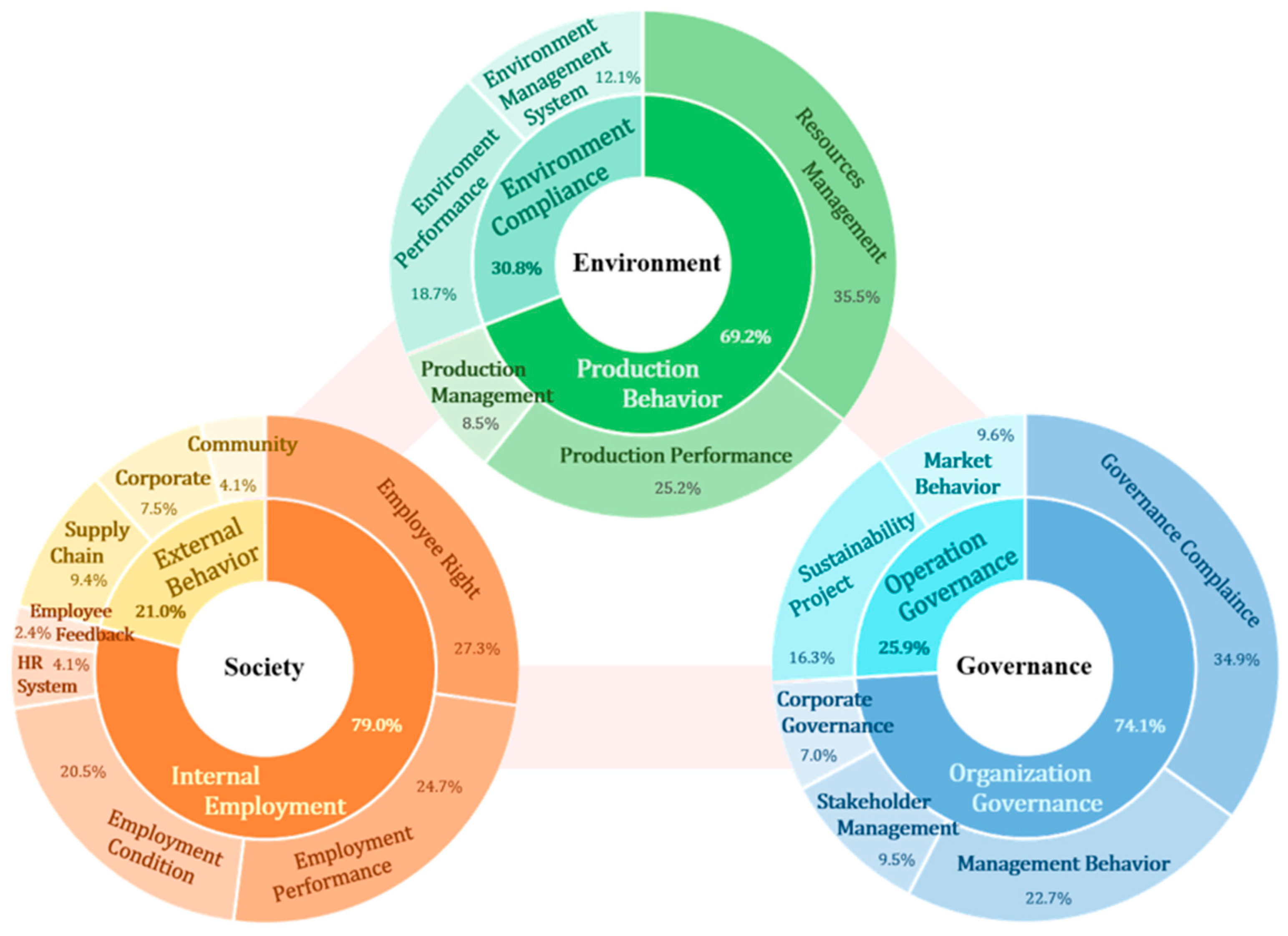

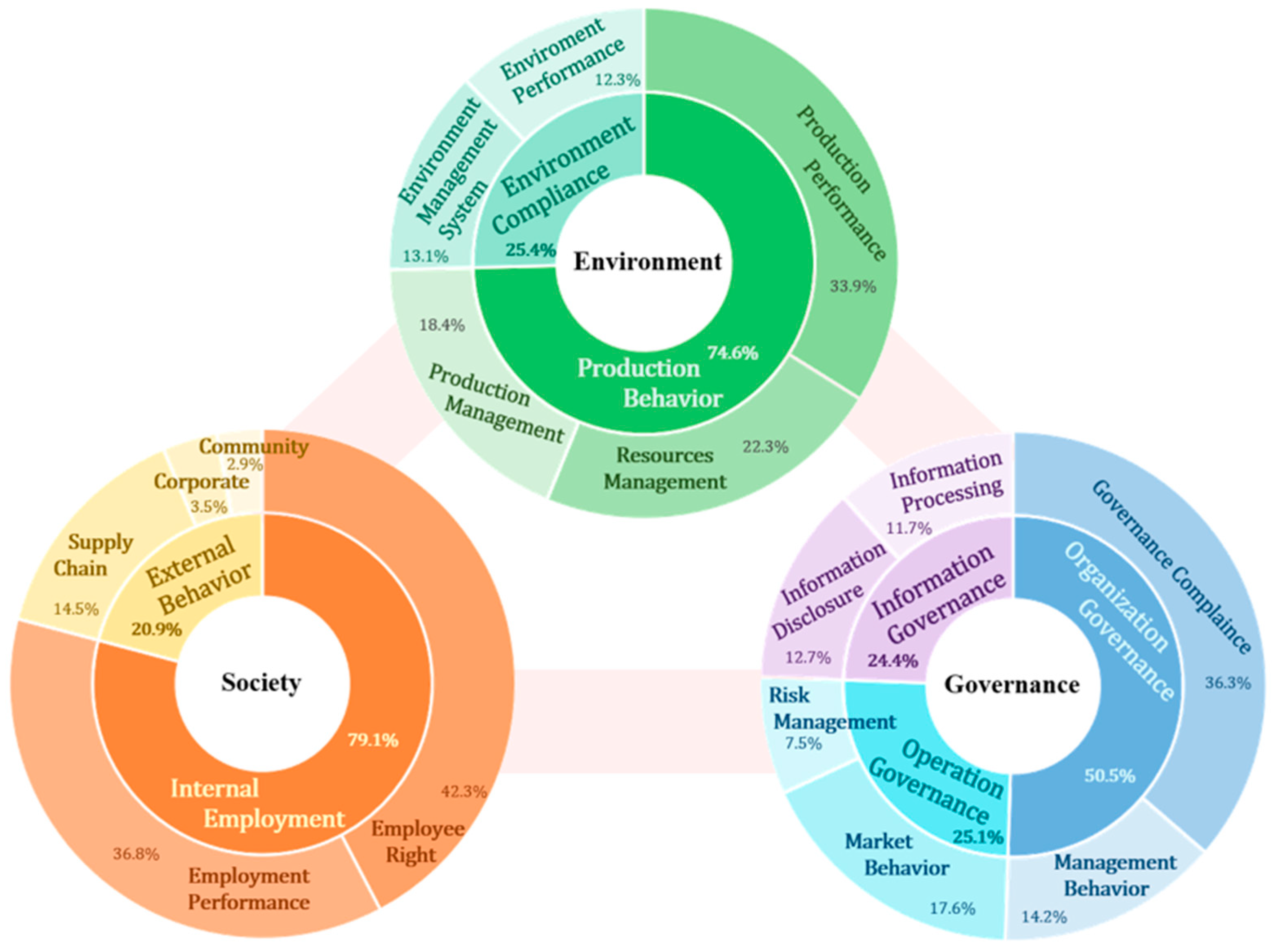

4.1.1. Review of the Current Supplier Sustainability Evaluation System (System 2)

4.1.2. Comparative Analysis of System 1 and System 2

4.2. Reconstruction of Evaluation Criteria

4.2.1. Steps of Reconstruction

4.2.2. The Reconstructed Sustainable Supplier Evaluation Criteria based on ESG Regulatory Requirements

4.3. Discussion of the Reconstructed Evaluation Criteria

4.4. Application of the Reconstructed Evaluation Criteria

5. Conclusions

- (1)

- Research Conclusion

- (2)

- Research Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Evaluation Criteria Details of System 1

| Dimension | Core Category | Main Category | Initial Category |

|---|---|---|---|

| Environmental (E) | Production Behavior (69.2%) | Resource Management (35.5%) | Energy Structure (11.3%) Water (9.3%) Energy Consumption (9.3%) Energy Intensity (5.6%) |

| Production Performance (25.2%) | Greenhouse Gas Emission (9.3%) Gas Emission Intensity (5.6%) Wastewater Discharge (4.7%) Material (1.9%) Product (1.9%) Carbon Footprint (0.9%) Exhaust Gas Emissions (0.9%) | ||

| Production Management (8.5%) | Waste Management (6.7%) Recycling Management (0.9%) Hazardous Materials Management (0.9%) | ||

| Environment Compliance (30.8%) | Environment Performance (18.7%) | Climate Impacts (7.5%) Biodiversity (5.6%) Environmental Incident Records (3.8%) Air Quality Impact (0.9%) Land and Ecological Resources Impact (0.9%) | |

| Environment Management System (12.1%) | Environment Operations (5.6%) Environment Regulation (5.6%) Supply Chain Environment Management (0.9%) |

| Dimension | Core Category | Main Category | Initial Category |

|---|---|---|---|

| Social (S) | Internal Employment (79.0%) | Employee Right (27.3%) | Global Health and Safety (7.7%) Human Rights Policy (5.9%) Human Rights Diligence (5.9%) Career Development and Training (4.3%) Freedom of Association and Collective (3.5%) |

| Employment Performance (24.7%) | Gender Pay Ratio (6.8%) CEO Pay Ratio (5.1%) Child Labor and Forced Labor (5.1%) Non-discrimination and Inclusion (4.2%) Casualty Rate (3.5%) | ||

| Employment Condition (20.5%) | Employee Turnover Rate (8.5%) Gender Ratio (7.7%) Temporary Worker Ratio (3.5%) Employee Nationality (0.8%) | ||

| HR System (4.1%) | Human Resource Management Policies (1.7%) Board Oversight of Human Resources (0.8%) Human Resources Risk Management (0.8%) Human Resources Target Investment (0.8%) | ||

| Employee Feedback (2.4%) | Voluntary Turnover Rate (0.8%) Employee Satisfaction (0.8%) Maternity/Childcare Leave Return Rate (0.8%) | ||

| External Behavior (21.0%) | Supply Chain (9.4%) | Supplier Audit Data (4.3%) Supply Chain Social Management (3.5%) Rights of Local People (0.8%) Local Procurement (0.8%) | |

| Corporate (7.5%) | Violations (1.7%) Product Responsibility (1.7%) Consumer Privacy (1.7%) Lack of Compliance Supervision (0.8%) Involvement in Controversial Weapons (0.8%) Sustainable Economic Activity (0.8%) | ||

| Community (4.1%) | Community Impact (2.5%) Community Investment (0.8%) Initiatives that Benefit the Community (0.8%) |

| Dimension | Core Category | Main Category | Initial Category |

|---|---|---|---|

| Governance (G) | Organization Governance (74.1%) | Governance Compliance (34.9%) | Board Diversity (12.1%) Ethics and Anti-corruption (10.6%) Board Independence (8.1%) Code of Business Ethics (4.1%) |

| Management Behavior (22.7%) | Data and Information Policy (8.1%) Incentive Payments (6.7%) Supplier Code of Conduct (5.3%) Discloser Policy (2.6%) | ||

| Stakeholder Management (9.5%) | Stakeholder Participation Mechanism (4.1%) Stakeholder Risk Management (2.6%) Stakeholder Risk (1.4%) Minority Shareholder Rights (1.4%) | ||

| Corporate Governance (7.0%) | Corporate Governance System (1.4%) Corporate Governance Structure (1.4%) Corporate Executive Body (1.4%) Corporate Organization Chart (1.4%) Subsidiaries and Affiliates (1.4%) | ||

| Operation Governance (25.9%) | Sustainability Project (16.3%) | Sustainability External Audit (5.3%) Sustainability Reporting (4.1%) Sustainability Disclosure (4.1%) Sustainability Governance (1.4%) Sustainable Development Policy (1.4%) | |

| Market Behavior (9.6%) | Inconsistent Behavior (2.6%) Historical Event Reporting (1.4%) Anti-competitive Conduct (1.4%) Internal Control and Audit (1.4%) Dividends (1.4%) Main Transaction Information (1.4%) |

Appendix B. Evaluation Criteria Details of System 2

| Dimension | Core Category | Main Category | Initial Category |

|---|---|---|---|

| Environmental (E) | Production Behavior (74.6%) | Production Performance (33.9%) | Greenhouse Gas Emissions (9.3%) Material Type and Efficiency (9.3%) Carbon Footprint (5.4%) Exhaust Gas Emissions (3.8%) Pollutants (3.8%) Products (1.5%) Noise Outside the Factory (0.8%) |

| Resources Management (22.3%) | Resource Efficiency (5.4%) Energy (8.5%) Water (6.9%) Land (1.5%) | ||

| Production Management (18.4%) | Waste Management (6.9%) Hazardous Materials Management (4.6%) Chemical Substance Management (4.6%) Recycling Management (2.3%) | ||

| Environment Compliance (25.4%) | Environment Management System (13.1%) | Environment Management System (6.9%) Environment Certifications and License (4.6%) Environment Accident Handling Plan (0.8%) Environment Diligence (0.8%) | |

| Environment Performance (12.3%) | Environment Compliance (3.1%) Climate Change and Protection (3.1%) Air Quality Impact (2.3%) Biodiversity (2.3%) Zero Deforestation (1.5%) |

| Dimension | Core Category | Main Category | Initial Category |

|---|---|---|---|

| Social (S) | Internal Employment (79.1%) | Employee Right (42.3%) | Occupation Health and Safety (10.4%) Salary and Benefits (10.4%) Freedom of Association and Collective (8.3%) Human Right (8.3%) Employee Grievance Mechanism (2.8%) Career Development and Training (2.1%) |

| Employment Performance (36.8%) | Child Labor and Forced Labor (10.4%) Non-discrimination and Equality (9.1%) Working Hours (8.3%) Inclusion and Diversity (4.1%) Working Environment (2.8%) Employment Freedom (1.4%) Employee Engagement (0.7%) | ||

| External Behavior (20.9%) | Supply Chain (14.5%) | Conflict Minerals (11.0%) Local Procurement (2.1%) Responsible Sourcing (1.4%) | |

| Corporate (3.5%) | Public and Private Security (1.4%) Social Violations (0.7%) Prohibition of Supporting Armed Forces (0.7%) Slavery and Human Trafficking (0.7%) | ||

| Community (2.9%) | Community Impact (2.1%) Local Community Equity (0.8%) |

| Dimension | Core Category | Main Category | Initial Category |

|---|---|---|---|

| Governance (G) | Organization Governance (50.5%) | Governance Compliance (36.3%) | Intellectual Property Protection (10.9%) Anti-corruption and Bribery (9.3%) Business Ethics (9.3%) Comply with the Law (3.4%) Money Laundering (3.4%) |

| Management Behavior (14.2%) | Discloser Policy (5.9%) Management Systems and Accountability (5.9%) Stakeholder Management (0.8%) Reporting Mechanism (0.8%) Partner Diligence (0.8%) | ||

| Operation Governance (25.1%) | Market Behavior (17.6%) | Fair Competition and Transactions (11.8%) No Unfair Competition (2.5%) External Regulation (1.7%) Fraud (0.8%) Insider Trading (0.8%) | |

| Risk Management (7.5%) | Import and Export Control (5.0%) AI Risk (1.7%) Sanction Risk (0.8%) | ||

| Information Governance (24.4%) | Information Disclosure (12.7%) | Conflict of Interest (7.7%) Information Disclosure (4.2%) Financial Disclosure (0.8%) | |

| Information Processing (11.7%) | Information Security Protection (5.0%) Personal Privacy Protection (3.4%) Information Privacy Protection (2.5%) Accurately Recorded (0.8%) |

Appendix C. The Reconstructed Sustainable Supplier Evaluation Criteria Based on ESG Requirements (Including Interpretation of Primary Indicators)

| Dimension | Major Indicator | Secondary Indicator | Primary Indicator | |

|---|---|---|---|---|

| Indicator | Explain | |||

| E— Environmental | E1 Production Behavior | E1-1 Production Performance | E1-1.1 Greenhouse Gas Emission E1-1.2 Gas Emission Intensity E1-1.3 Material Type and Efficiency E1-1.4 Carbon Footprint E1-1.5 Waste Gas Emission E1-1.6 Waste Water Emission E1-1.7 Pollutant E1-1.8 Product | Reflect emissions and emission intensity. Various gas emissions per unit of output. Include direct and indirect materials. Carbon emissions of finished products in three categories. Reflect waste gas treatment methods and emissions. Reflect wastewater treatment methods and emissions. Reflect the type, treatment, and quantity of pollutants. Reflect the environmental friendliness in product life cycle. |

| E1-2 Resources Management | E1-2.1 Resource Efficiency E1-2.2 Energy E1-2.3 Water E1-2.4 Land | Consumption of each kind of resource per unit of output. Reflect energy structure, category, and consumption. Reflect water resources consumption and management. Reflect the utilization and management of land resources. | ||

| E1-3 Production Management | E1-3.1 Waste Management E1-3.2 Hazardous Substance Management E1-3.3 Chemical Substance Management E1-3.4 Recycling Management | Reflect waste categories and management. Reflect hazardous materials categories and management. Reflect chemical substance categories and management. Reflect the status of material recycling. | ||

| E2 Environment Compliance | E2-1 Environment Management System | E2-1.1 Environment Management System E2-1.2 Environment Certification and License E2-1.3 Environment Due Diligence | Including management policies, organization structure, etc. Reflect environment certification status. Supervision and investigation of environment behavior. | |

| E2-2 Environmental Performance | E2-2.1 Environment Incident Records E2-2.2 Environment Compliance E2-2.3 Climate Change and Protection E2-2.4 Air Quality Impact E2-2.5 Biodiversity | Recording of environmental events. Examine whether there are environmental violations. Reflect positive and negative impacts on climate change. Reflect positive and negative impacts on air quality. Reflect positive and negative impacts on biodiversity. | ||

| S— Social | S1 Internal Employment | S1-1 Employee Right | S1-1.1 Occupation Health and Safety S1-1.2 Wages and Benefits S1-1.3 Freedom of Association and Collective S1-1.4 Human Rights S1-1.5 Employee Grievance Mechanism S1-1.6 Career Development and Training S1-1.7 Human Resources Management Policy | Reflect health and safety policies and behaviors. Reflect employee wages and benefits. Reflect employees’ association and negotiation rights. Examine corporate human rights policies. Reflect employee grievance channels and handling modes. Reflect opportunities for professionalism and promotion. Examine human resources-related policies. |

| S1-2 Employment Performance | S1-2.1 Child Labor and Forced Labor S1-2.2 Non-discrimination and Equality S1-2.3 Working Hours S1-2.4 Gender Pay Ratio S1-2.5 CEO Pay Ratio S1-2.6 Inclusion and Diversity S1-2.7 Working Environment | Examine whether child labor and forced labor exist. Examine whether any discrimination exists. Examine whether working hours comply with regulations. Reflect the difference in pay between genders. Reflect the difference in pay between CEO and employees. Reflect employee diversity. Examine the friendliness of the working environment. | ||

| S1-3 Employment condition | S1-3.1 Employee Turnover Rate S1-3.2 Gender Ratio S1-3.3 Temporary Worker Ratio | Examine the age and turnover of employees. Examine the employee gender ratio. Examine the ratio of temporary workers to regular employees. | ||

| S2 External Behavior | S2-1 Supply Chain | S2-1.1 Conflict Minerals S2-1.2 Supply Chain Audit Data S2-1.3 Supply Chain Social Management S2-1.4 Local Procurement | Examine whether to use minerals that affect human rights. Audit supply chains’ social conduct. Reflect social behavioral management of supply chains. Examine local purchasing practices. | |

| S2-2 Corporate | S2-2.1 Product Responsibility S2-2.2 Consumer Privacy S2-2.3 Social Violations S2-2.4 Prohibition of Supporting Armed Forces | Examine responsible behavior towards products. Reflect the protection and infringement of consumer privacy. Disclose social violations. Do not fund illegal armed forces. | ||

| S2-3 Community | S2-3.1 Community Impact S2-3.2 Local Community Rights | Examine support for community work. Examine whether practices infringe the interests of local communities. | ||

| G— Governance | G1 Organization Governance | G1-1 Governance Compliance | G1-1.1 Board Diversity G1-1.2 Board Independence G1-1.3 Intellectual Property Protection G1-1.4 Anti-corruption and Bribery G1-1.5 Business Ethics G1-1.6 Compliance with Laws G1-1.7 Money Laundering | Examine the gender ratio of the board. Examine the proportion of independent directors of the board. Reflect the status of IP protection and infringement. Examine whether there is corruption. Reflect compliance or violation of business ethics. Examine whether there are illegal cases. Examine whether there is money laundering. |

| G1-2 Management Behavior | G1-2.1 Data Policy G1-2.2 Incentivized Pay G1-2.3 Supplier Code of Conduct G1-2.4 Discloser Policy G1-2.5 Management System and Accountability G1-2.6 Stakeholder Management | Review data and information policies. Reflect incentivized pay for sustainable matters. Examine whether there is a supplier code of conduct. Examine the relevant systems for disclosure behavior. Examine management systems and accountability policies. Examine stakeholder risk-return management. | ||

| G1-3 Information Governance | G1-3.1 Conflict of Interest G1-3.2 Information Disclosure G1-3.3 Information Security Protection G1-3.4 Personal Privacy Protection G1-3.5 Information Privacy Protection | Review the disclosure of conflicts of interest. Determine whether information disclosure is compliant. Reflect information security protection behaviors. Reflect privacy protection practices for insiders. Reflect the protection of business information. | ||

| G2 Operation Governance | G2-1 Market Behavior | G2-1.1 Fair Competition and Transactions G2-1.2 No Unfair Competition G2-1.3 External Supervision G2-1.4 Inconsistent Behavior | Examine the fairness of market transactions and competition. Determine whether there are illegitimate gains. Determine whether there is external regulation. Determine whether there are operations that violate regulations. | |

| G2-2 Sustainability Project | G2-2.1 Sustainability External Assurance G2-2.2 Sustainability Reporting G2-2.3 Sustainability Disclosure | Conduct external audits of sustainability matters. Routine reporting on sustainability matters. Disclosure of information on sustainable matters. | ||

| G2-3 Risk Management | G2-3.1 Import and Export Control G2-3.2 AI Risk | Management of import and export control risks. Management of AI risks. | ||

References

- Zhang, C.; Jin, S.Y. What Drives Sustainable Development of Enterprises? Focusing on ESG Management and Green Technology Innovation. Sustainability 2022, 14, 20. [Google Scholar] [CrossRef]

- Liu, P.D.; Gao, H.; Ma, J.H. Novel green supplier selection method by combining quality function deployment with partitioned Bonferroni mean operator in interval type-2 fuzzy environment. Inf. Sci. 2019, 490, 292–316. [Google Scholar] [CrossRef]

- Zhan, Y.Z.; Chung, L.; Lim, M.K.; Ye, F.; Kumar, A.; Tan, K.H. The impact of sustainability on supplier selection: A behavioural study. Int. J. Prod. Econ. 2021, 236, 12. [Google Scholar] [CrossRef]

- Yu, E.P.Y.; Guo, C.Q.; Luu, B.V. Environmental, social and governance transparency and firm value. Bus. Strategy Environ. 2018, 27, 987–1004. [Google Scholar] [CrossRef]

- Ahmadi, H.B.; Lo, H.W.; Gupta, H.; Kusi-Sarpong, S.; Liou, J.J.H. An integrated model for selecting suppliers on the basis of sustainability innovation. J. Clean. Prod. 2020, 277, 11. [Google Scholar] [CrossRef]

- Shekarian, E.; Ijadi, B.; Zare, A.; Majava, J. Sustainable Supply Chain Management: A Comprehensive Systematic Review of Industrial Practices. Sustainability 2022, 14, 30. [Google Scholar] [CrossRef]

- Bai, C.G.; Kusi-Sarpong, S.; Ahmadi, H.B.; Sarkis, J. Social sustainable supplier evaluation and selection: A group decision-support approach. Int. J. Prod. Res. 2019, 57, 7046–7067. [Google Scholar] [CrossRef]

- Pedroso, C.B.; Tate, W.L.; da Silva, A.L.; Carpinetti, L.C.R. Supplier development adoption: A conceptual model for triple bottom line (TBL) outcomes. J. Clean. Prod. 2021, 314, 18. [Google Scholar]

- Maaloul, A.; Zéghal, D.; Ben Amar, W.; Mansour, S. The Effect of Environmental, Social, and Governance (ESG) Performance and Disclosure on Cost of Debt: The Mediating Effect of Corporate Reputation. Corp. Reput. Rev. 2023, 26, 1–18. [Google Scholar] [CrossRef]

- Puriwat, W.; Tripopsakul, S. From ESG to DESG: The Impact of DESG (Digital Environmental, Social, and Governance) on Customer Attitudes and Brand Equity. Sustainability 2022, 14, 15. [Google Scholar] [CrossRef]

- Chen, Z.F.; Xie, G.X. ESG disclosure and financial performance: Moderating role of ESG investors. Int. Rev. Financ. Anal. 2022, 83, 16. [Google Scholar] [CrossRef]

- Elkington, J. Towards the sustainable corporation—Win-win-win business strategies for sustainable development. Calif. Manag. Rev. 1994, 36, 90–100. [Google Scholar] [CrossRef]

- Noci, G. Designing ‘green’ vendor rating systems for the assessment of a supplier’s environmental performance. Eur. J. Purch. Supply Manag. 1997, 3, 103–114. [Google Scholar] [CrossRef]

- Govindan, K.; Khodaverdi, R.; Jafarian, A. A fuzzy multi criteria approach for measuring sustainability performance of a supplier based on triple bottom line approach. J. Clean. Prod. 2013, 47, 345–354. [Google Scholar] [CrossRef]

- Fallahpour, A.; Olugu, E.U.; Musa, S.N.; Wong, K.Y.; Noori, S. A decision support model for sustainable supplier selection in sustainable supply chain management. Comput. Ind. Eng. 2017, 105, 391–410. [Google Scholar] [CrossRef]

- Yazdani, M.; Chatterjee, P.; Zavadskas, E.K.; Hashemkhani, Z.S. Integrated QFD-MCDM framework for green supplier selection. J. Clean. Prod. 2017, 142, 3728–3740. [Google Scholar] [CrossRef]

- Zimmer, K.; Fröhling, M.; Schultmann, F. Sustainable supplier management—A review of models supporting sustainable supplier selection, monitoring and development. Int. J. Prod. Res. 2016, 54, 1412–1442. [Google Scholar] [CrossRef]

- Ahi, P.; Searcy, C. Measuring social issues in sustainable supply chains. Meas. Bus. Excell. 2015, 19, 33–45. [Google Scholar] [CrossRef]

- Ahmadi, H.B.; Kusi-Sarpong, S.; Rezaei, J. Assessing the social sustainability of supply chains using Best Worst Method. Resour. Conserv. Recycl. 2017, 126, 99–106. [Google Scholar] [CrossRef]

- Ghadimi, P.; Dargi, A.; Heavey, C. Making sustainable sourcing decisions: Practical evidence from the automotive industry. Int. J. Logist. Res. Appl. 2017, 20, 297–321. [Google Scholar] [CrossRef]

- Chai, N.J.; Zhou, W.L.; Jiang, Z.G. Sustainable supplier selection using an intuitionistic and interval-valued fuzzy MCDM approach based on cumulative prospect theory. Inf. Sci. 2023, 626, 710–737. [Google Scholar] [CrossRef]

- Hendiani, S.; Liao, H.C.; Ren, R.X.; Lev, B. A likelihood-based multi-criteria sustainable supplier selection approach with complex preference information. Inf. Sci. 2020, 536, 135–155. [Google Scholar] [CrossRef]

- Mina, H.; Kannan, D.; Gholami-Zanjani, S.M.; Biuki, M. Transition towards circular supplier selection in petrochemical industry: A hybrid approach to achieve sustainable development goals. J. Clean. Prod. 2021, 286, 16. [Google Scholar] [CrossRef]

- Karami, S.; Yaghin, R.G.; Mousazadegan, F. Supplier selection and evaluation in the garment supply chain: An integrated DEA-PCA-VIKOR approach. J. Text. Inst. 2021, 112, 578–595. [Google Scholar] [CrossRef]

- Aditi; Kannan, D.; Darbari, J.D.; Jha, P.C. Sustainable supplier selection model with a trade-off between supplier development and supplier switching. Ann. Oper. Res. 2023, 331, 351–392. [Google Scholar] [CrossRef]

- Awasthi, A.; Govindan, K.; Gold, S. Multi-tier sustainable global supplier selection using a fuzzy AHP-VIKOR based approach. Int. J. Prod. Econ. 2018, 195, 106–117. [Google Scholar] [CrossRef]

- Dai, T.L.; Tang, C. Frontiers in Service Science: Integrating ESG Measures and Supply Chain Management: Research Opportunities in the Postpandemic Era. Serv. Sci. 2022, 14, 1–12. [Google Scholar] [CrossRef]

- Zeng, H.L.; Li, R.Y.M.; Zeng, L.Y. Evaluating green supply chain performance based on ESG and financial indicators. Front. Environ. Sci. 2022, 10, 13. [Google Scholar] [CrossRef]

- UNGC. Who Cares Wins: Connecting Financial Markets to a Changing World. 2004. Available online: https://www.unepfi.org/fileadmin/events/2004/stocks/who_cares_wins_global_compact_2004.pdf (accessed on 15 February 2023).

- Yu, E.P.Y.; Van Luu, B.; Chen, C.H. Greenwashing in environmental, social and governance disclosures. Res. Int. Bus. Financ. 2020, 52, 23. [Google Scholar] [CrossRef]

- Brooks, C.; Oikonomou, I. The effects of environmental, social and governance disclosures and performance on firm value: A review of the literature in accounting and finance. Br. Account. Rev. 2018, 50, 1–15. [Google Scholar] [CrossRef]

- Huang, D.Z.X. Environmental, social and governance (ESG) activity and firm performance: A review and consolidation. Account. Financ. 2021, 61, 335–360. [Google Scholar] [CrossRef]

- Wang, N.; Pan, H.Y.; Feng, Y.Z.; Du, S.X. How do ESG practices create value for businesses? Research review and prospects. Sustain. Account. Manag. Policy J. 2023, 23, 24. [Google Scholar] [CrossRef]

- Cornell, B. ESG preferences, risk and return. Eur. Financ. Manag. 2021, 27, 12–19. [Google Scholar] [CrossRef]

- Drempetic, S.; Klein, C.; Zwergel, B. The Influence of Firm Size on the ESG Score: Corporate Sustainability Ratings under Review. J. Bus. Ethics 2020, 167, 333–360. [Google Scholar] [CrossRef]

- Singhania, M.; Saini, N. Institutional framework of ESG disclosures: Comparative analysis of developed and developing countries. J. Sustain. Financ. Invest. 2023, 13, 516–559. [Google Scholar] [CrossRef]

- Bruno, M.; Lagasio, V. An Overview of the European Policies on ESG in the Banking Sector. Sustainability 2021, 13, 10. [Google Scholar] [CrossRef]

- Alamillos, R.R.; de Mariz, F. How Can European Regulation on ESG Impact Business Globally? J. Risk Financ. Manag. 2022, 15, 19. [Google Scholar]

- Fytilakos, I. Text mining in fisheries scientific literature: A term coding approach. Ecol. Inform. 2021, 61, 8. [Google Scholar] [CrossRef]

- Kobayashi, V.B.; Mol, S.T.; Berkers, H.A.; Kismihók, G.; Den Hartog, D.N. Text Mining in Organizational Research. Organ. Res. Methods 2018, 21, 733–765. [Google Scholar] [CrossRef]

- Dicle, M.F.; Dicle, B. Content analysis: Frequency distribution of words. Stata J. 2018, 18, 379–386. [Google Scholar] [CrossRef]

- Laver, M.; Benoit, K.; Garry, J. Extracting policy positions from political texts using words as data. Am. Political Sci. Rev. 2003, 97, 311–331. [Google Scholar] [CrossRef]

- Roberts, C.W. Other than counting words—A linguistic approach to content-analysis. Soc. Forces 1989, 68, 147–177. [Google Scholar] [CrossRef]

- Kolbe, R.H.; Burnett, M.S. Content-analysis research—An examination of applications with directives for improving research reliability and objectivity. J. Consum. Res. 1991, 18, 243–250. [Google Scholar] [CrossRef]

- Scott, W.A. Citation classic—Reliability of content-analysis—The case of nominal scale coding. Curr. Contents/Soc. Behav. Sci. 1984, 18, 14-14. [Google Scholar]

- Müller-Hansen, F.; Callaghan, M.W.; Minx, J.C. Text as big data: Develop codes of practice for rigorous computational text analysis in energy social science. Energy Res. Soc. Sci. 2020, 70, 9. [Google Scholar] [CrossRef]

| “Regulation Requirements” Sample | “Corporate Practices” Sample | |

|---|---|---|

| Objects number | 69 | 17 |

| Raw data size | 69 | 42 |

| After-filtering data size | 55 | 42 |

| Parameter | Definition |

|---|---|

| The occurrence times of the th initial category indicator in the th dimension | |

| The total occurrence times of all initial category indicators in the th dimension | |

| The number of initial category indicators | |

| The number of dimensions | |

| E | S | G | |

|---|---|---|---|

| Given critical indicator accumulated R value | 90.0% | 90.0% | 80.0% |

| Critical indicator R value | 1.9% | 1.7% | 2.6% |

| Actual critical indicator accumulated R value | 93.7% | 88.9% | 80.4% |

| The number of indicators retained in the 2nd stage | 15 | 20 | 14 |

| Deleted number of indicators | 1 | 11 | 12 |

| E | S | G | |

|---|---|---|---|

| Given critical indicator accumulated R value | 90.0% | 90.0% | 90.0% |

| Critical indicator R value | 2.3% | 2.1% | 1.7% |

| Actual critical indicator accumulated R value | 93.1% | 92.2% | 93.6% |

| The number of indicators retained in the 2nd stage | 18 | 14 | 17 |

| Deleted number of indicators | 3 | 5 | 7 |

| Major Indicator | Secondary Indicator | Primary Indicator |

|---|---|---|

| E—Environmental Dimension | ||

| E1 Production Behavior | E1-1 Production Performance | E1-1.1 Greenhouse Gas Emission, E1-1.2 Gas Emission Intensity, E1-1.3 Material Type and Efficiency, E1-1.4 Carbon Footprint, E1-1.5 Waste Gas Emission, E1-1.6 Waste Water Emission, E1-1.7 Pollutant, E1-1.8 Product |

| E1-2 Resources Management | E1-2.1 Resource Efficiency, E1-2.2 Energy, E1-2.3 Water, E1-2.4 Land | |

| E1-3 Production Management | E1-3.1 Waste Management, E1-3.2 Hazardous Substance Management, E1-3.3 Chemical Substance Management, E1-3.4 Recycling Management | |

| E2 Environment Compliance | E2-1 Environment Management System | E2-1.1 Environment Management System, E2-1.2 Environment Certification and Licensing, E2-1.3 Environment Due Diligence |

| E2-2 Environmental Performance | E2-2.1 Environment Incident Records, E2-2.2 Environment Compliance, E2-2.3 Climate Change and Protection, E2-2.4 Air Quality Impact, E2-2.5 Biodiversity | |

| S—Social Dimension | ||

| S1 Internal Employment | S1-1 Employee Right | S1-1.1 Occupation Health and Safety, S1-1.2 Wages and Benefits, S1-1.3 Freedom of Association and Collective, S1-1.4 Human Rights, S1-1.5 Employee Grievance Mechanism, S1-1.6 Career Development and Training, S1-1.7 Human Resources Management Policy |

| S1-2 Employment Performance | S1-2.1 Child Labor and Forced Labor, S1-2.2 Non-discrimination and Equality, S1-2.3 Working Hours, S1-2.4 Gender Pay Ratio, S1-2.5 CEO Pay Ratio, S1-2.6 Inclusion and Diversity, S1-2.7 Working Environment | |

| S1-3 Employment condition | S1-3.1 Employee Turnover Rate, S1-3.2 Gender Ratio, S1-3.3 Temporary Worker Ratio | |

| S2 External Behavior | S2-1 Supply Chain | S2-1.1 Conflict Minerals, S2-1.2 Supply Chain Audit Data, S2-1.3 Supply Chain Social Management, S2-1.4 Local Procurement |

| S2-2 Corporate | S2-2.1 Product Responsibility, S2-2.2 Consumer Privacy, S2-2.3 Social Violations, S2-2.4 Prohibition of Supporting Armed Forces | |

| S2-3 Community | S2-3.1 Community Impact, S2-3.2 Local Community Rights | |

| G—Governance Dimension | ||

| G1 Organization Governance | G1-1 Governance Compliance | G1-1.1 Board Diversity, G1-1.2 Board Independence, G1-1.3 Intellectual Property Protection, G1-1.4 Anti-corruption and Bribery, G1-1.5 Business Ethics, G1-1.6 Compliance with Laws, G1-1.7 Money Laundering |

| G1-2 Management Behavior | G1-2.1 Data Policy, G1-2.2 Incentivized Pay, G1-2.3 Supplier Code of Conduct, G1-2.4 Discloser Policy, G1-2.5 Management System and Accountability, G1-2.6 Stakeholder Management | |

| G1-3 Information Governance | G1-3.1 Conflict of Interest, G1-3.2 Information Disclosure, G1-3.3 Information Security Protection, G1-3.4 Personal Privacy Protection, G1-3.5 Information Privacy Protection | |

| G2 Operation Governance | G2-1 Market Behavior | G2-1.1 Fair Competition and Transactions, G2-1.2 No Unfair Competition, G2-1.3 External Supervision, G2-1.4 Inconsistent Behavior |

| G2-2 Sustainability Project | G2-2.1 Sustainability External Assurance, G2-2.2 Sustainability Reporting, G2-2.3 Sustainability Disclosure | |

| G2-3 Risk Management | G2-3.1 Import and Export Control, G2-3.2 AI Risk | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lou, S.; You, X.; Xu, T. Sustainable Supplier Evaluation: From Current Criteria to Reconstruction Based on ESG Requirements. Sustainability 2024, 16, 757. https://doi.org/10.3390/su16020757

Lou S, You X, Xu T. Sustainable Supplier Evaluation: From Current Criteria to Reconstruction Based on ESG Requirements. Sustainability. 2024; 16(2):757. https://doi.org/10.3390/su16020757

Chicago/Turabian StyleLou, Shuqi, Xiaoyue You, and Tao Xu. 2024. "Sustainable Supplier Evaluation: From Current Criteria to Reconstruction Based on ESG Requirements" Sustainability 16, no. 2: 757. https://doi.org/10.3390/su16020757

APA StyleLou, S., You, X., & Xu, T. (2024). Sustainable Supplier Evaluation: From Current Criteria to Reconstruction Based on ESG Requirements. Sustainability, 16(2), 757. https://doi.org/10.3390/su16020757