A Study on the Impact of Digital Transformation on Enterprise Performance: The Mediating Role of Dual Innovation and the Moderating Role of Management Power

Abstract

1. Introduction

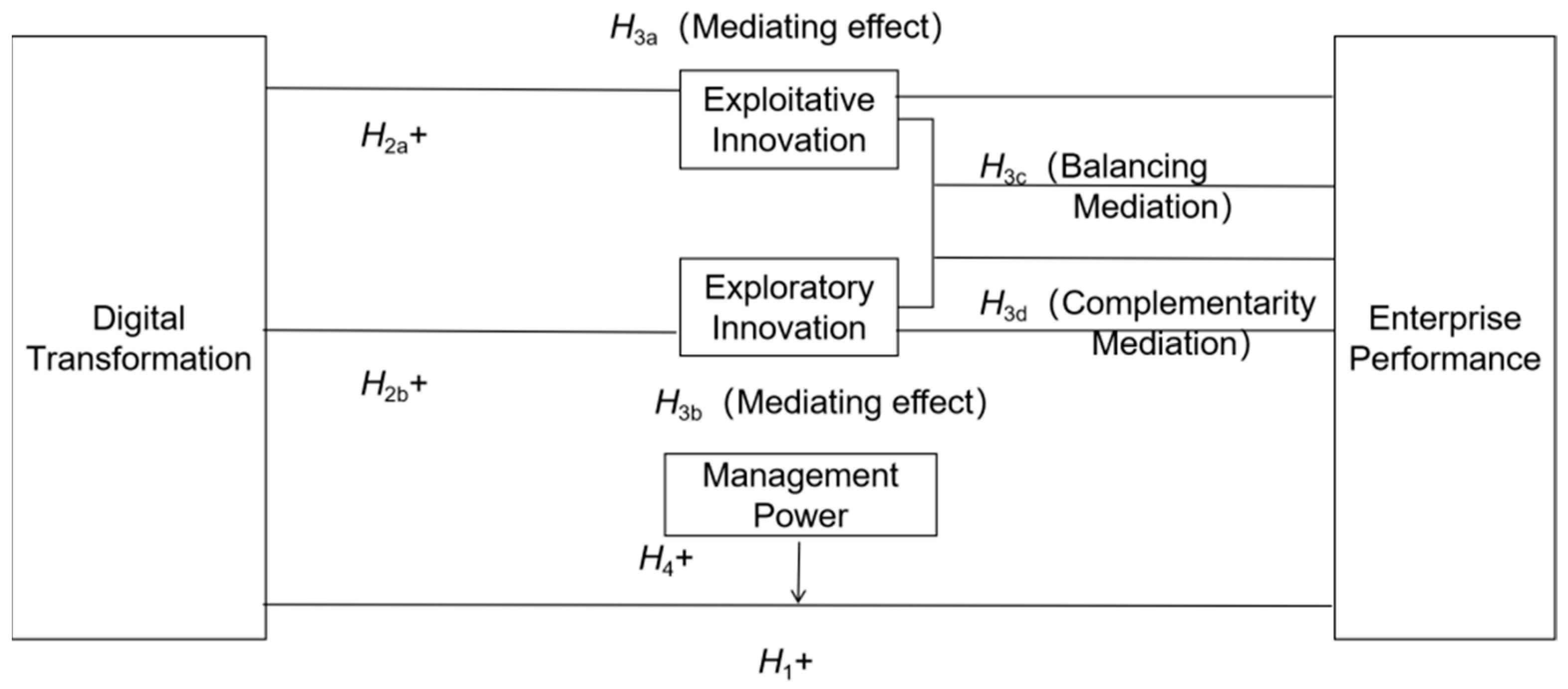

2. Theoretical Analysis and Research Hypotheses

2.1. Digital Transformation and Enterprise Performance

2.2. Impact of Digital Transformation on Dual Innovation

2.3. The Mediating Role of Dual Innovation Between Digital Transformation and Enterprise Performance

2.4. The Moderating Role of Management Power Between Digital Transformation and Enterprise Performance

3. Study Design

3.1. Sample Selection and Data Sources

3.2. Variable Measurement and Description

- (1)

- Enterprise performance (EP). Most of the existing studies choose indicators such as net interest rate on total assets, return on net assets, and Tobin’s Q value to measure enterprise performance, in which net interest rate on total assets can reflect the ability of enterprises to utilize their assets to obtain profits, and can more accurately reflect the profitability of enterprises and the efficiency of asset operation in a certain period. Therefore, this paper refers to Sun C. et al.’s [44] approach to measuring corporate performance using the net interest rate on total assets.

- (2)

- Digital transformation (DT). Referring to the research of scholars such as Zhen H.L. [45], 139 digitization-related word frequencies under the categories of technology classification, organizational empowerment, and digital application are counted. By crawling the annual reports of listed companies from 1999–2023, the original report text is organized into panel data, the text length of the full text of the annual report is further counted, the text length of the full text in the Chinese and English parts is counted, and then the dictionary of digitization terms is constructed. The number of exact words is counted after removing the stop words, and the computed word frequency of digitization transformation and the word frequency of the level of each dimension is used as the digital transformation degree index. The higher the digitization index, the higher the level of enterprise digital transformation.

- (3)

- Mediating variables. The number of patents obtained more directly reflects the enterprise’s achievements and strength in technological innovation; therefore, referring to the research of Zhong C.B. et al. [46], this is the total number of utility model patents and design patents obtained in the year plus 1 to take the logarithm to measure exploitative innovation (I), and the number of invention patents obtained in the year plus 1 to take the logarithm to measure exploratory innovation (R). Also, concerning existing studies [35,47], the balanced metric is used to measure binary innovation balance (BA), and the product term of binary innovations is used to measure binary innovation complementarity (CP), which is given in the following formulas:

- (4)

- Managerial power (MP). To comprehensively reflect the size and distribution of the power of corporate management, it is necessary to consider the position and influence of the management within the company, as well as the management’s economic interests and other factors, so concerning the study of Liu J.M. et al. [48], the general manager’s years of service, the two positions in the board of directors, the size of the board of directors, the proportion of internal directors, and the proportion of management shareholding is included in the management power measurement system, and principal component analysis is used to obtain a composite score to measure it.

- (5)

3.3. Model Construction

4. Empirical Analysis

4.1. Correlation Analysis and Descriptive Statistics

4.2. Base Return

4.3. Mediating Effect Test

4.4. Moderating Effect Test

4.5. Heterogeneity Analysis

4.5.1. Heterogeneity Test Based on Region

4.5.2. Heterogeneity Test Based on High-Tech Industries

4.5.3. Heterogeneity Test Based on Firms’ Profitability Status

4.6. Robustness Check

4.6.1. Endogeneity Test

4.6.2. Exclusion of Interference from Special Economic Regions

4.6.3. Deletion of Sample Data During Stock Market Crashes and Epidemics

4.6.4. Replacement of Core Explanatory Variable Measures

- (1)

- Replacing the measurement of explanatory variables. Total return on assets (ROA) takes into account all of the assets of the enterprise, including net assets and liabilities, which can comprehensively reflect the ability of the enterprise to obtain corporate benefits through the use of total assets, including net assets and liabilities, and adopt ROA to re-measure the performance of the enterprise, and the regression data are shown in column (5) of Table 6.

- (2)

- The replacement of explanatory variables measurement referred to the study of Wu F. et al. [17] to replace the object of digitized word frequency statistics. Focusing on specific digital business scenarios application, the level of digital transformation was re-measured, with regression data as shown in column (6) of Table 6.

- (3)

- Replacing the measurement of mediating variables. The number of patent applications can reflect the activity and investment of enterprises in technological innovation, so the number of invention patents applied for by enterprises in the same year is used to re-measure the dual innovation for the mediation effect test, and the regression data are shown in columns (1)–(8) of Table 7.

- (4)

- The replacement of moderating variable measurement. Replacing the management power composite indicator system to re-measure the moderating variables in order to avoid chance results [50], the regressions are shown in columns (9) and (10) of Table 7. The regression results are consistent with the previous findings, indicating that the analysis obtained in the previous section is robust.

5. Discussion

6. Conclusions and Recommendations

6.1. Policy Suggestions

- (1)

- Build an environment for digital transformation and extend the value of digital technology applications. The government can introduce a series of incentives, including tax breaks, capital subsidies, and other preferential policies, to reduce the economic burden of enterprises at the initial stage of digital transformation and increase their enthusiasm for participating in the transformation. Enterprises can consider increasing their R&D investment in cutting-edge digital technologies such as 5G Internet and artificial intelligence, deeply integrating digital technologies into their daily business processes, management modes, and operation strategies, realizing the reshaping and optimization of business processes, enhancing production efficiency and product quality, improving enterprise competitiveness and market adaptability, and giving full play to the prying effect of digital transformation on enterprise performance.

- (2)

- In a relatively dynamic environment, focus on the formation of the synergistic interaction of dual innovation. Enterprises should reasonably distinguish and utilize dual innovation according to their innovation level, market demand, and technological development trend, realize the balance of dual innovation, and actively utilize the complementarity of the two to promote each other. Enterprises with strong innovation ability can focus on the research and development of new technologies and new products to obtain long-term competitive advantages. Enterprises with weak innovation ability can focus on the optimization and upgrading of existing technologies and products to quickly respond to market changes while giving full play to the rapid response and cost-effectiveness advantages of exploitative innovation in the short term and also focusing on the leading role of exploratory innovation in long-term development, and, through the reasonable allocation of resources and organizational arrangements, realize the balance and complementarity of the two modes of innovation.

- (3)

- Strengthen management’s knowledge of digital transformation and optimize management’s power allocation and decision-making mechanism. Enterprises can conduct digital transformation training for management to enhance their knowledge of digital technology, data-driven decision-making, and innovative management models, ensure that management can deeply understand the strategic significance of digital transformation, and at the same time, rationally allocate management power to ensure that they have sufficient power in key decision-making areas, to be able to quickly and effectively respond to the challenges of the digital transformation process.

- (4)

- Based on enterprises’ characteristics, implement dynamic and differentiated digital transformation strategies.

6.2. Points for Improvement

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Buccieri, D.; Javalgi, R.G.; Cavusgil, E. International new venture performance: Role of international entrepreneurial culture, ambidextrous innovation, and dynamic marketing capabilities. Int. Bus. Rev. 2020, 29, 101639. [Google Scholar] [CrossRef]

- Tiberius, V.; Schwarzer, H.; Roig-Dobón, S. Radical innovations: Between established knowledge and future research opportunities. J. Innov. Knowl. 2021, 6, 145–153. [Google Scholar] [CrossRef]

- Li, J.; Hu, J.L.; Wang, X. Carbon emission reduction effects and mechanisms of digital economy development from a global perspective. China Popul. Resour. Environ. 2024, 8, 3–12. [Google Scholar]

- Wang, Q.; Zhang, F.; Li, R. Revisiting the environmental kuznets curve hypothesis in 208 counties: The roles of trade openness, human capital, renewable energy and natural resource rent. Environ. Res. 2023, 216, 114637. [Google Scholar] [CrossRef] [PubMed]

- Li, J.; Zhao, J. Digital empowerment and regulatory efficiency improvement in environmental governance: From the perspective of labor substitution. China Popul. Resour. Environ. 2023, 33, 130–137. [Google Scholar]

- He, D.X.; Zhang, H.; Liu, Y.T. New Substantive Enterprises Promote the Digital-Substantive Integration and Improve the Quality of Development. China Ind. Econ. 2024, 2, 5–21. [Google Scholar]

- Liu, P.F.; Zhang, W. The effect of collaborative R&D on absorption speed of external technology: An empirical research in Chinese High-tech industry. Stud. Sci. Sci. 2021, 39, 1396–1406. [Google Scholar]

- Guo, K.M. Artificial Intelligence, Structural Transformation and Labor Shar. J. Manag. World 2019, 35, 60–77. [Google Scholar]

- Zhou, X.; Guo, S.H. How does digital transformation affect corporate margins-Research on mechanism and experience from the perspective of digital economy. J. Guizhou Univ. Financ. Econ. 2023, 41, 32–40. [Google Scholar]

- Wang, W.N.; Yang, Z.; Mei, L.; Chen, J. Can Digitize Value Chain Enable Innovation?: Evidence from Chinese Manufacturing Enterprises. Sci. Sci. Manag. Sci. Technol. 2023, 44, 33–55. [Google Scholar]

- Fang, X.; Dong, J.; Peng, X.Y. Influence of Dimension and Combination of the Sharedness of Top Management Team Competence on Enterprise Performance—Based on the Mediating Role of Exploratory Innovation. RD Manag. 2023, 35, 94–107. [Google Scholar]

- Heavin, C.; Power, D.J. Challenges for digital transformation–towards a conceptual decision support guide for managers. J. Decis. Syst. 2018, 27 (Suppl. 1), 38–45. [Google Scholar] [CrossRef]

- Li, J.; Cao, Y.H. Digital Transformation Driving Model of Manufacturing Enterprises Based on Configuration Perspective. RD Manag. 2022, 34, 106–122. [Google Scholar]

- Goldfarb, A.; Tucker, C. Digital economics. J. Econ. Lit. 2019, 57, 3–43. [Google Scholar] [CrossRef]

- Zhou, Y.; Xu, J.; Liu, Z. The impact of digital transformation on corporate innovation: Roles of analyst coverage and internal control. Manag. Decis. Econ. 2024, 45, 373–393. [Google Scholar] [CrossRef]

- Xiao, T.S.; Sun, R.Q.; Yuan, C.; Sun, J. Digital Transformation, Human Capital Structure Adjustment and Labor Income Share. J. Manag. World 2022, 38, 220–237. [Google Scholar]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise Digital Transformation and Capital Market Performance: Empirical Evidence from Stock Liquidity. J. Manag. World 2021, 37, 130–144. [Google Scholar]

- Yu, J.; Bai, Y.T.; Meng, Q.S.; Chen, F. Research on the impact of digital transformation strategy on the digital innovation performance of enterprises. Sci. Res. Manag. 2024, 45, 1–11. [Google Scholar]

- Shi, L.; Peng, Z.C. The Impact of Digital Transformation on Innovation Efficiency of Enterprises: An Analytical Framework Based on Schumpeterian Innovation Paradigm. Chin. Rural Econ. 2024, 4, 99–119. [Google Scholar]

- Xu, H.; Ma, L.J. Digital Economy, Resource Dependence and Green Economy Development. Financ. Econ. 2022, 1, 45–54. [Google Scholar]

- Chi, M.M.; Wang, J.J.; Wang, W.J. Research on the influencing mechanism of firms’ innovation performance in the context of digital transformation: A mixed method study. Stud. Sci. Sci. 2022, 40, 319–331. [Google Scholar]

- Vial, G. Understanding digital transformation: A review and a research agenda. In Managing Digital Transformation; Routledge: Oxfordshire, UK, 2021; pp. 13–66. [Google Scholar]

- Aghion, P.; Bergeaud, A.; Lequien, M.; Melitz, M.J. The heterogeneous impact of market size on innovation: Evidence from French firm-level exports. Rev. Econ. Stat. 2024, 106, 608–626. [Google Scholar] [CrossRef]

- Romer, P.M. Increasing returns and long-run growth. J. Political Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Bai, P.W.; Yu, L. Digital Economy Development and Firms’ Markup: Theoretical Mechanisms and Empirical Facts. China Ind. Econ. 2021, 11, 59–77. [Google Scholar]

- Liu, S.C.; Yan, J.C.; Zhang, S.X.; Lin, H. Can Corporate Digital Transformation Promote Input-Output Efficiency? J. Manag. World 2021, 37, 170–190. [Google Scholar]

- March, J.G. Exploration and exploitation in organizational learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- Raisch, S.; Birkinshaw, J. Organizational ambidexterity: Antecedents, outcomes, and moderators. J. Manag. 2008, 34, 375–409. [Google Scholar] [CrossRef]

- Peng, C.; Li, R.X.; Yang, H.; Yu, P. Research on the Relationship between Dual Innovation and sustainable Development of Enterprises under Dynamic and Competitive Environment. Sci. Technol. Prog. Policy 2020, 37, 70–79. [Google Scholar]

- Su, X.; Zhou, S.S. Ambidextrous Innovation and Firm Competitive Position: Empirical Evidence from Listed Companies in China. South China J. Econ. 2019, 5, 52–77. [Google Scholar]

- Chen, Q.J.; Wan, M.F.; Wang, Y.M. The Influence of Digital Technology Application on Ambidextrous Innovation of Enterprises—Empirical Test Based on Organizational Life Cycle. Soft Sci. 2021, 35, 92–98. [Google Scholar]

- Qi, Y.D.; Xiao, X. Transformation of Enterprise Management in the Era of Digital Economy. J. Manag. World 2020, 36, 135–152+250. [Google Scholar]

- Jian, Z.; Xu, Y.; Li, Y.H.; Huang, Y. Formation and Governance Mechanism of Productivity Dilemma: An Integrated Theoretical Framework. J. Manag. World 2020, 36, 187–205+242. [Google Scholar]

- Yu, F.F.; Cao, J.Y.; Du, H.Y. Digitalization Paradox: Double-Edged Sword Effect of Enterprise Digitalization on Innovation Performance. RD Manag. 2022, 34, 1–12. [Google Scholar]

- Cao, Q.; Gedajlovic, E.; Zhang, H. Unpacking organizational ambidexterity: Dimensions, contingencies, and synergistic effects. Organ. Sci. 2009, 20, 781–796. [Google Scholar] [CrossRef]

- Floyd, S.W.; Lane, P.J. Strategizing throughout the organization: Managing role conflict in strategic renewal. Acad. Manag. Rev. 2000, 25, 154–177. [Google Scholar] [CrossRef]

- Li, R.X.; Peng, C.; Lv, C.L. Dual innovation synergy and sustainable development of enterprises: The mediating effect of competitive advantages. Sci. Res. Manag. 2022, 43, 139–148. [Google Scholar]

- Yang, D.; Chen, Z.; Yang, P. Digitalization Degree, Ambidextrous Innovation and Enterprise Performance. Stat. Decis. 2023, 39, 167–172. [Google Scholar]

- Li DQ, X.; Peng, C.; Xi, L. The Effect of Dynamic Capabilities on the Synergy of Ambidextrous Innovation: The Moderating Effect of Environmental-competitiveness. Oper. Res. Manag. Sci. 2017, 26, 183–192. [Google Scholar]

- Finkelstein, S. Power in top management teams: Dimensions, measurement, and validation. Acad. Manag. J. 1992, 35, 505–538. [Google Scholar] [CrossRef]

- Hambrick, D.C. Upper echelons theory: An update. Acad. Manag. Rev. 2007, 32, 334–343. [Google Scholar] [CrossRef]

- Yun, J.; Ning, X. “Young and Promsing Young” or “Old but Vigorous”: CEO Career Concerns and Strategic Change. Bus. Manag. J. 2020, 42, 135–152. [Google Scholar]

- Chen, G.; Zeng, D.; Wei, Q.; Zhang, M.; Guo, X. Transitions of Decision-Making Paradigms and Enabled Innovations in the Context of Big Data. J. Manag. World 2020, 36, 95–105+220. [Google Scholar]

- Sun, C.W.; Wei, X.N. Market-Incentive Environmental Regulations, Government Subsidies, and Firm Performance. Public Financ. Res. 2022, 7, 97–112. [Google Scholar]

- Zhen, H.X.; Wang, X.; Fang, H.X. Administrative Protection of Intellectual Property Rights and Corporate Digital Transformation. Econ. Res. J. 2023, 58, 62–79. [Google Scholar]

- Zhong, C.B.; Huang, Y.Z.; Liu, W. Study on the Impact of Emerging Economies Overseas R&D to the Innovation of the Parent Company: Based on Incremental Innovation and Subversive Innovation Perspective. Nankai Econ. Stud. 2014, 180, 91–104. [Google Scholar]

- Wang, F.B.; Chen, J.X.; Yang, Y. An Analysis of the Effect of the Explorative and Exploitative Innovations and their Balance. J. Manag. World 2012, 3, 96–112+188. [Google Scholar]

- Liu, J.M.; Zhang, L.; Yang, X.X. Government Subsidy, Management Power and State-owned Executives’ Excess Remuneration. Account. Res. 2019, 8, 64–70. [Google Scholar]

- Kong, L.; Liu, T.Z.; Peng, Y.T. Will the Digital Transformation of “More Words, Less Actions” Affect the Company’s Carbon Emissions? J. Nanjing Audit Univ. 2024, 21, 32–43. [Google Scholar]

- Zheng, S.S. Managerial Power Intensity, Internal and External Monitoring and Stock Price Crash Risk. J. Guangdong Univ. Financ. Econ. 2019, 34, 72–86. [Google Scholar]

- Pigola, A.; Fischer, B.; Moraes GH, S.M. Impacts of Digital Entrepreneurial Ecosystems on Sustainable Development: Insights from Latin America. Sustainability 2024, 16, 7928. [Google Scholar] [CrossRef]

- Soomro, R.B.; Memon, S.G.; Dahri, N.A.; Al-Rahmi, W.M.; Aldriwish, K.; ASalameh, A.; Al-Adwan, A.S.; Saleem, A. The Adoption of Digital Technologies by Small and Medium-Sized Enterprises for Sustainability and Value Creation in Pakistan: The Application of a Two-Staged Hybrid SEM-ANN Approach. Sustainability 2024, 16, 7351. [Google Scholar] [CrossRef]

- Jibril, H.; Kesidou, E.; Roper, S. Do digital technologies enable firms that prioritize sustainability goals to innovate? Empirical evidence from established UK micro-businesses. Br. J. Manag. 2024, 35, 2155–2173. [Google Scholar] [CrossRef]

- Qin, T.; Wang, L.; Zhou, Y.; Guo, L.; Jiang, G.; Zhang, L. Digital technology-and-services-driven sustainable transformation of agriculture: Cases of China and the EU. Agriculture 2022, 12, 297. [Google Scholar] [CrossRef]

- Lin, J.; Mao, M. How does digital transformation affect sustainable innovation performance? The pivotal roles of digital technology-business alignment and environmental uncertainty. Sustain. Dev. 2024, 32, 3163–3181. [Google Scholar] [CrossRef]

- Yao, Y.; Li, J. Digital transformation and technological innovation state-owned enterprises: A new perspective based on environmental uncertainty and relational embeddedness. China Soft Sci. 2024, 7, 122–136. [Google Scholar]

- Song, J.; Li, X.Q. The “Belt and Road ”Initiative and Innovation Ambidexterity of China’s BRI-participating Enterprises: Insights from the Strategy Tripod Perspective. Manag. Rev. 2024, 36, 73–85. [Google Scholar]

| Variable Types | Symbols | Method of Measurement | Sample Size/One | Average | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|---|---|

| Independent variables | DT | Combining text analytics to calculate the Enterprise Digital Transformation Index | 20,630 | 2.065 | 1.506 | 0.000 | 7.444 |

| Dependent variable | EP | Net interest rate on total assets | 20,630 | 0.038 | 0.125 | −14.302 | 0.493 |

| Mediating variables | I | The sum of the number of utility models and designs obtained plus one takes the natural logarithm | 20,630 | 1.189 | 1.438 | 0.000 | 7.799 |

| R | Number of patents for inventions granted in the year plus one in natural logarithms | 20,630 | 0.721 | 1.018 | 0.000 | 7.195 | |

| BA | 1 − |I − R|(I + R) | 12,069 | 0.391 | 0.378 | 0.000 | 1.000 | |

| CP | I × R | 20,630 | 1.597 | 3.668 | 0.000 | 45.352 | |

| Moderating variables | MP | Principal component analysis | 20,630 | −0.176 | 0.988 | −2.514 | 1.984 |

| Control variables | DAR | Total enterprise liabilities/total assets | 20,630 | 0.417 | 0.232 | 0.008 | 10.495 |

| CI | Net fixed assets at end of year/total assets at end of year | 20,630 | 2.841 | 3.035 | 0.424 | 22.937 | |

| RE | Percentage of assets with retained earnings | 20,630 | 0.136 | 0.725 | −53.417 | 1.046 | |

| CR | Sum of money funds and trading financial assets/current liabilities | 20,630 | 0.999 | 1.946 | 1 × 10 | 70.449 | |

| TQ | Tobin’s Q value | 20,630 | 2.138 | 1.975 | −4.192 | 92.299 | |

| HHI | Herfindahl–Hirschman Index | 20,630 | 0.142 | 0.143 | −0.412 | 2.817 |

| Variables of Interest | Base Regression | Introducing Interaction Terms | Base Regression | |

|---|---|---|---|---|

| (1) | (2) | (3) | (1) | |

| EP | EP | EP | EP | |

| DT | 0.006 * | |||

| (1.740) | ||||

| DT × I | 0.001 *** | |||

| (3.386) | ||||

| DT × R | 0.001 *** | |||

| (3.614) | ||||

| Controls | Yes | Yes | Yes | |

| Constants | 0.103 *** | 0.107 *** | 0.107 *** | |

| (4.169) | (4.663) | (4.680) | ||

| Year | Yes | Yes | Yes | |

| Firm | Yes | Yes | Yes | |

| N | 20,630 | 20,630 | 20,630 | |

| R2 | 0.243 | 0.265 | 0.263 | |

| Variables | Base Regression | Exploitative Innovation Mediation Regression Test | Exploratory Innovation Mediating Regression Test | Mediation Regression Tests for Dual Innovation Equilibrium | Dual Innovation Complementarity Mediation Regression Test | ||||

|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

| EP | I | EP | R | EP | BA | EP | CP | EP | |

| DT | 0.006 * | 0.023 ** | 0.006 * | 0.016 ** | 0.006 * | 0.011 ** | 0.001 ** | 0.072 *** | 0.006 * |

| (1.740) | (2.075) | (1.734) | (2.057) | (1.730) | (2.082) | (2.022) | (2.648) | (1.729) | |

| I | 0.001 * | ||||||||

| (1.778) | |||||||||

| R | 0.002 *** | ||||||||

| (2.607) | |||||||||

| BA | 0.002 * | ||||||||

| (1.848) | |||||||||

| CP | 4.4 × 10−4 ** | ||||||||

| (2.332) | |||||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constants | 0.103 *** | 1.009 *** | 0.102 *** | 0.613 *** | 0.102 *** | 0.310 *** | 0.070 *** | 1.013 *** | 0.103 *** |

| (4.169) | (20.765) | (4.141) | (19.028) | (4.155) | (10.689) | (9.483) | (9.287) | (4.163) | |

| N | 20,630 | 20,630 | 20,630 | 20,630 | 20,630 | 12,069 | 12,069 | 20,630 | 20,630 |

| R2 | 0.243 | 0.061 | 0.247 | 0.032 | 0.247 | 0.017 | 0.305 | 0.031 | 0.246 |

| Variables | (1) | (2) |

|---|---|---|

| EP | EP | |

| DT | 6.21 × 10−3 *** | 6.08 × 10−3 *** |

| (4.761) | (4.657) | |

| MP | 0.003 * | −0.003 |

| (−1.704) | (−1.632) | |

| DT × MP | 0.00169 * | |

| (1.881) | ||

| Controls | Yes | Yes |

| Constants | 0.103 *** | 0.104 *** |

| (18.341) | (18.438) | |

| N | 20,630 | 20,630 |

| R2 | 0.243 | 0.243 |

| Variables | EP | ||||||

|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| Eastern | Central | Western | High-Tech Industry | Non-High-Tech Industries | High-Loss Enterprises | Low-Loss Enterprise | |

| DT | 0.002 *** | 0.020 *** | 0.002 | 0.002 *** | 0.009 | −0.001 ** | 0.004 * |

| (3.450) | (3.073) | (1.065) | (2.812) | (1.352) | (−2.512) | (1.792) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constants | 0.123 *** | −0.003 | 0.113 *** | 0.115 *** | 0.016 | 0.104 *** | 0.104 *** |

| (40.725) | (−0.104) | (11.106) | (14.622) | (0.162) | (13.351) | (5.168) | |

| N | 14,889 | 3497 | 2244 | 12,291 | 8339 | 10,363 | 10,267 |

| R2 | 0.343 | 0.046 | 0.375 | 0.419 | 0.124 | 0.452 | 0.112 |

| Variable | Test for Endogeneity | Exclusion of Special Economic Zones | Exclude Special Event Shocks | Replace the Core Variable Measure | ||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (4) | |

| Stage 1 | Stage 2 | EP | EP | Replacing the Measurement of Explanatory Variables | Replacement of Explanatory Variables Measurement | |

| DT | EP | EP1 | EP | |||

| IV | 0.912 *** | |||||

| (36.4771) | ||||||

| DT | 0.050 *** | 0.007 *** | 0.002 *** | 0.001 * | ||

| (9.963) | (4.036) | (3.770) | (1.899) | |||

| DT1 | 0.005 * | |||||

| (1.712) | ||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Constants | −0.077 ** | −0.036 *** | 0.094 *** | 0.124 *** | 0.123 *** | 0.105 *** |

| (−2.035) | (−2.680) | (13.117) | (44.583) | (13.695) | (4.301) | |

| N | 20,630 | 20,630 | 15,575 | 18,156 | 20,630 | 20,630 |

| R2 | 0.501 | 0.062 | 0.233 | 0.356 | 0.243 | 0.246 |

| Variables | Using Innovative Intermediary Role Robust Regression Test | Exploratory Innovation Intermediary Role Robust Regression Test | Equilibrium Robustness Tests | Complementarity Robustness Test | Management Power Moderation Test | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | |

| I | EP | R | EP | BA | EP | CP | EP | EP | EP | |

| DT | 0.020 * | 0.006 * | 0.033 *** | 0.006 * | 0.009 * | 0.001 * | 0.087 ** | 0.006 * | 6.17 × 10−3 *** | 6.07 × 10−3 *** |

| (1.819) | (1.734) | (3.141) | (1.727) | (1.772) | (1.950) | (2.159) | (1.729) | (4.733) | (4.653) | |

| I | 0.001 ** | |||||||||

| (2.203) | ||||||||||

| R | 0.001 ** | |||||||||

| (2.365) | ||||||||||

| BA | 0.003 ** | |||||||||

| (2.192) | ||||||||||

| CP | 4.89 × 10−4 *** | |||||||||

| (3.188) | ||||||||||

| MP2 | −0.002 | −0.002 | ||||||||

| (−0.923) | (−0.831) | |||||||||

| DT × MP2 | 1.62 × 10−3 * | |||||||||

| (1.730) | ||||||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constants | 1.140 *** | 0.102 *** | 1.008 *** | 0.102 *** | 0.452 *** | 0.063 *** | 2.031 *** | 0.103 *** | 2.031 *** | 0.103 *** |

| (24.016) | (4.098) | (25.259) | (4.125) | (14.382) | (9.567) | (13.876) | (4.130) | (13.876) | (4.130) | |

| N | 20,630 | 20,630 | 20,630 | 20,630 | 12,293 | 12,293 | 20,630 | 20,630 | 20,630 | 20,630 |

| R2 | 0.048 | 0.248 | 0.099 | 0.248 | 0.008 | 0.299 | 0.049 | 0.249 | 0.243 | 0.243 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, X.; Yan, Y. A Study on the Impact of Digital Transformation on Enterprise Performance: The Mediating Role of Dual Innovation and the Moderating Role of Management Power. Sustainability 2024, 16, 9298. https://doi.org/10.3390/su16219298

Wang X, Yan Y. A Study on the Impact of Digital Transformation on Enterprise Performance: The Mediating Role of Dual Innovation and the Moderating Role of Management Power. Sustainability. 2024; 16(21):9298. https://doi.org/10.3390/su16219298

Chicago/Turabian StyleWang, Xiyu, and Ying Yan. 2024. "A Study on the Impact of Digital Transformation on Enterprise Performance: The Mediating Role of Dual Innovation and the Moderating Role of Management Power" Sustainability 16, no. 21: 9298. https://doi.org/10.3390/su16219298

APA StyleWang, X., & Yan, Y. (2024). A Study on the Impact of Digital Transformation on Enterprise Performance: The Mediating Role of Dual Innovation and the Moderating Role of Management Power. Sustainability, 16(21), 9298. https://doi.org/10.3390/su16219298