Abstract

Companies engaged in ESG practices to enhance financial performance and demonstrate a commitment to sustainable development. However, the relationship between ESG and financial performance remained unclear, as prior studies were replete with contradictory paradoxes. This study aimed to comprehensively analyze the evolution of ESG practices and their impact on financial performance by comparing English, Chinese, and Korean papers. This study employed a mixed-methods approach and conducted a bibliometric analysis on 2659 ESG-related papers to unveil temporal trends and conduct a meta-analysis. Stratifying by language, linguistic and cultural nuances influencing the relationship were identified. The bibliometric analysis revealed a significant turning point in ESG research around 2019, marked by a surge in publications across languages. Keyword co-occurrence networks highlighted distinct focal points, with financial performance appearing in all the research themes. The meta-analysis indicated a low overall positive correlation between ESG and financial performance. However, Chinese and Korean papers demonstrated a moderate correlation, while English papers showed no significant correlation. This study informed scholarly, managerial, and policy discourse on sustainable business practices, contributing to the evolving ESG landscape.

1. Introduction

In his New York Times column titled “Friedman doctrine”, Milton Friedman, a Nobel laureate in Economics in 1970 and a prominent figure of the Chicago School of Economics, associated the term “doctrine,” laden with doctrinal and principled connotations, with his name, advocating that “the social responsibility of business is to increase profits” [1]. In contrast, stakeholder theory opposed this view, arguing that corporations had to not only satisfy traditional shareholder interests but also consider multiple stakeholders [2,3]. The evolution from the Friedman doctrine to stakeholder theory reflects a broader shift in societal attitudes toward corporate ethics [4]. This shift is further driven by global demands for sustainable business practices, particularly in light of growing environmental challenges such as climate change and the advancement of “dual-carbon” goals aimed at reducing carbon emissions. As these demands grow, it has become imperative to synthesize ESG considerations into corporate strategy.

ESG is widely recognized as crucial non-financial information and is currently an essential indicator for measuring corporate sustainability on the international stage [5]. However, the impact of ESG practices on financial performance transcended binary correlations, sometimes even presenting statistically insignificant, multidimensional relationships. For instance, Atan found no clear correlation between ESG practices and financial performance [6]. In contrast, several studies, including those by Ben Ali and Chouaibi [7], Cek and Eyupoglu [8], Chen [9], Makhdalena [10], and Sandberg. [11], reported a positive correlation, suggesting that companies engaged in ESG practices often demonstrate better financial performance, particularly in countries with less developed capital markets. Zhang proposed and validated hypotheses based on stakeholder theory in the context of sustainable development, finding that ESG enhanced corporate performance [12]. Wong, using Malaysia as a research background and drawing on stakeholder theory and agency theory, found that ESG certification reduced firms’ capital costs, significantly increased Tobin’s Q, and consequently enhanced financial performance and market value [13]. Das-Gupta, through empirical testing of data from 27 countries between 2010 and 2019, discovered that lower financial performance had a positive impact on improving a company’s ESG performance [14]. However, some scholars argued for a negative correlation between ESG and corporate performance, supporting the neoclassical perspective that external investors must bear implementation costs, potentially leading to the misallocation of resources [15,16,17,18]. Duque and Aguilera studied data from 100 multinational enterprises and concluded that there was a negative correlation between corporate ESG and financial performance [19].

Given the growing volume and complexity of studies on ESG and financial performance, it has become increasingly difficult to draw objective conclusions through traditional literature reviews or periodic summaries alone. The existing literature has examined the relationship between ESG and financial performance from various dimensions, but often focuses on a single analytical method [20,21] or is limited to studies in one language [22,23]. Few studies analyze this relationship from the perspective of language differences and the integration of macro and micro approaches. Investigating the impact of ESG on financial performance requires both a macro perspective based on cross-cultural and bibliometric analysis and a micro perspective incorporating meta-analysis. This study seeks to address this gap by employing a rigorous research approach combining bibliometric analysis and meta-analysis to unravel the contradictions and paradoxes of the ESG financial performance nexus. The bibliometric analysis, taking a macro perspective, employs visualization techniques to precisely analyze a vast body of research papers, enabling a panoramic exploration of hotspots, transitions, and developmental trends within a specific field. On the other hand, meta-analysis, approaching from a micro perspective, synthesizes and analyzes the results of multiple independent studies to derive more comprehensive and accurate conclusions.

The primary objective of this study is to analyze the evolution of ESG research and its impact on financial performance across English, Chinese, and Korean papers. Through a meticulous examination of publication trends, keyword co-occurrence patterns, and empirical findings, this paper aims to identify key thematic clusters and language-specific nuances in ESG discourse. By synthesizing diverse empirical evidence, this paper seeks to quantify the relationship between ESG practices and financial performance, thereby elucidating the business case for sustainability in the global marketplace. By uncovering region-specific patterns, the findings aim to inform strategic decision-making, foster sustainable business practices, and contribute to the ongoing discourse on corporate responsibility and financial performance.

2. Methodology

This study adopted two distinct methodologies. The first phase entailed a comprehensive bibliometric analysis of 2659 ESG-related papers in English, Chinese, and Korean. The inclusion of Chinese and Korean papers alongside English papers was motivated by the global relevance and diverse scholarly contributions to ESG research. This approach aimed to provide a comprehensive understanding of ESG trends across different linguistic and cultural contexts, enriching the comparative analysis of key research trends and keyword distributions. In the subsequent phase, a meta-analysis was conducted to assess the impact of ESG practices on financial performance quantitatively. The investigation was stratified by language to capture linguistic and cultural influences on the relationship. Robust validation methods were applied, including publication bias tests, heterogeneity analyses, and robustness tests.

2.1. Study 1 Bibliometric Analysis

2.1.1. Definition and Scope

The implementation of ESG practices varied across countries due to diverse cultural, regulatory, and economic contexts. Bibliometric analysis serves as a quantitative method to assess the scholarly landscape by analyzing patterns, trends, and relationships within a collection of bibliographic sources. In the context of this study, bibliometric analysis was employed to systematically review and evaluate existing papers on the impact of ESG practices on financial performance. The analysis extended to English, Chinese, and Korean papers.

2.1.2. Data Collection and Selection Criteria

This study conducted a comprehensive search across the Web of Science, CNKI, and RISS databases using all fields, with a cutoff date of 18 December 2023, with reference to the multiplayer research methodology [20,23,24,25]. The key string included “ESG” OR “Environment, Social and Governance” AND “Performance”; “ESG” OR “环境 社会 公司治理” AND “绩效”; “ESG” OR “환경 사회 지배구조” AND “성과”. This combination of terms is widely used in English, Chinese, and Korean ESG papers, covering research that addresses sustainability issues from a business and financial perspective [26,27]. A total of 6264 papers were identified, with 1661 English papers, 4117 Chinese papers, and 486 Korean papers. To ensure the quality of the collected papers, Korean papers were limited to KCI and KCI candidate papers, Chinese papers were limited to CSSCI and PKU, and English papers were limited to SCI(E), SSCI, and ESCI. Non-research papers such as conference proceedings and newspapers were excluded during paper processing to further ensure the validity of the paper data sample. Additionally, non-Korean, Chinese, and English papers and papers without authorship were eliminated. The “deduplication” function in CiteSpace was applied, resulting in a final set of 2659 papers (1530 in English, 768 in Chinese, and 361 in Korean).

2.1.3. Analysis Tools

This study primarily employed CiteSpace and R Studio (Bibliometrix) as a visualization analysis tool. It aids scholars in gaining insights into the hotspots, frontiers, and trends within their research fields [28]. Using a literature visualization approach, this study conducted in-depth data mining on relevant papers in the ESG domain. The analysis involved exploring data through aspects such as keyword occurrence, co-occurrence of keywords, keyword clustering, and other analyses. This enabled the assessment of node sizes and quantities, the number and thickness of connecting lines, the timeline of keyword emergence and disappearance, and the relevance of different thematic clusters. Such analyses provided a thorough examination of the key issues, frontiers, and developmental trends within this research domain.

2.2. Study 2 Meta-Analysis

2.2.1. Conceptual Framework and Analysis Methods

The meta-analysis employed a systematic and quantitative approach to synthesize findings from individual studies. The sample of this meta-analysis was limited to SEM papers, marking a novel advancement in research methodology that enhances the statistical validity of findings while reducing measurement and sampling errors. Therefore, in this study, existing research data were used as the object, and comprehensive meta-analysis was used to validate ESG-related hypotheses and derive results. The conceptual framework encompassed key variables such as ESG and financial performance metrics.

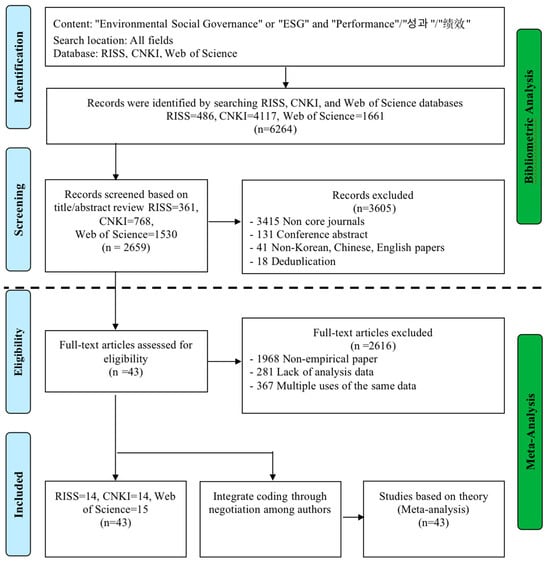

2.2.2. Inclusion and Exclusion Criteria

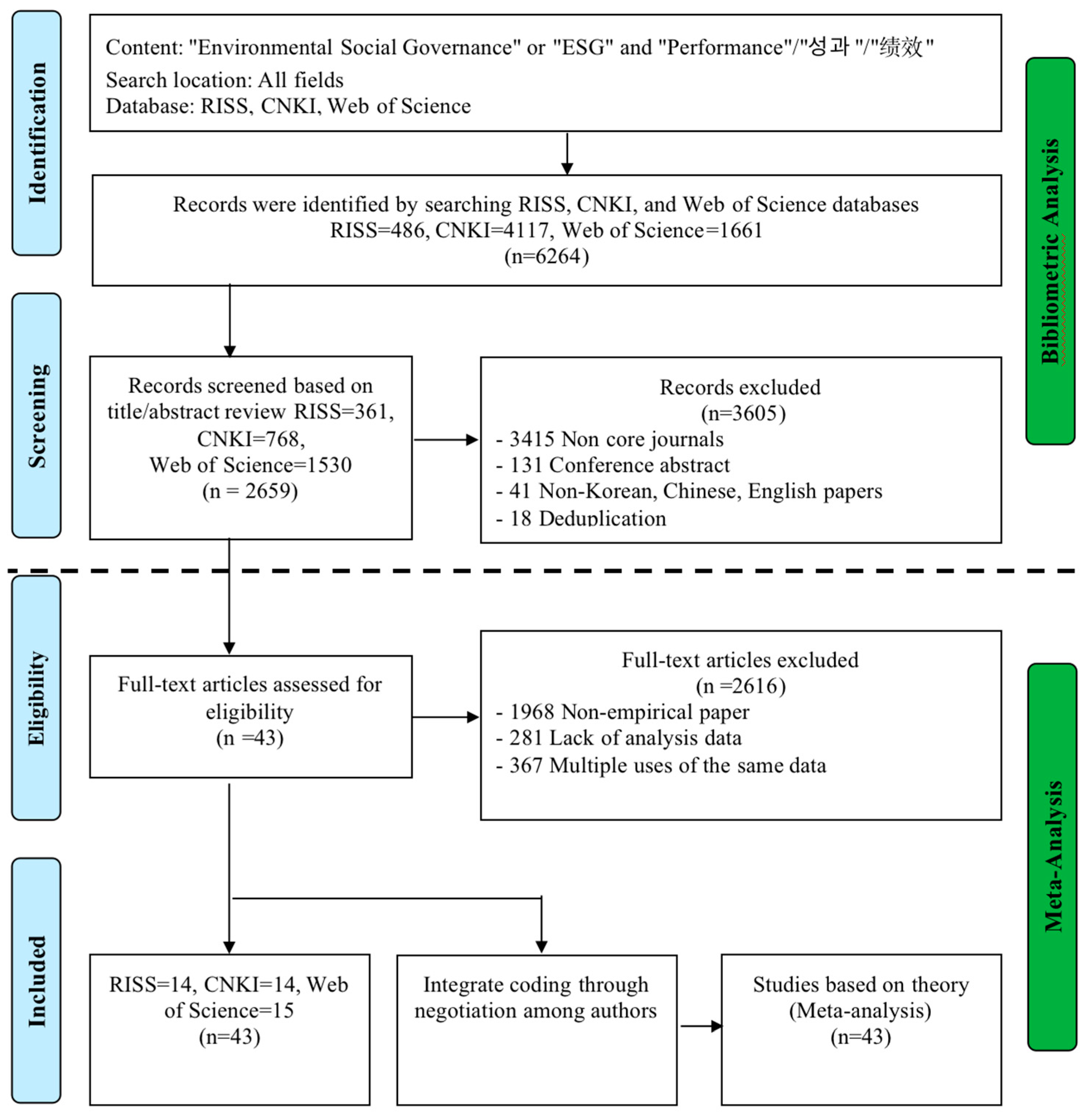

Based on bibliometric analysis, to confirm the absence of overlooked papers, a manual search of references in reviews and relevant papers was conducted, excluding duplicated or low-relevance papers. The selection process required (1) quantitative empirical studies, excluding qualitative and theoretical papers; (2) availability of key data such as sample size and correlation coefficients; and (3) exclusion of duplicate publications from the same study to ensure independence. For studies with multiple independent samples, each sample was coded separately. If multiple papers used the same dataset, the one with the highest impact factor or most comprehensive data was chosen. Ultimately, 43 relevant empirical research papers (14 in Korean, 14 in Chinese, and 15 in English) were selected from an initial pool of 2659 papers (Figure 1).

Figure 1.

PRISMA flowchart.

2.2.3. Data Extraction and Coding

This study employed CMA V3 software for conducting a meta-analysis. In the selection of effect sizes, coded data were based on publication year, correlation coefficients, sample sizes, and other relevant information. Specifically, the coding process involved categorizing variables such as ESG dimensions (environment, social, governance) and financial performance indicators (ROA, ROE, Tobin’s Q). For the entry of correlation coefficients, if a study did not provide the correlation coefficient but offered values like t, F, or β, the corresponding formulas were utilized to convert them into r values before coding. During the coding process, each r value needed to be transformed into the corresponding Fisher’s Z score and then back to a correlation coefficient to present the final results. Ultimately, 43 papers [7,8,9,10,11,12,15,16,18,19,29,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61] were successfully coded, ensuring a thorough investigation into the relationship between ESG and financial performance (Table 1). Among them, a total of 29 papers specifically analyzed ESG, and, in addition, 24 papers independently analyzed each dimension of ESG.

Table 1.

Analysis object paper [7,8,9,10,11,12,15,16,18,19,29,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61].

3. Results

3.1. Study 1 Bibliometric Results

3.1.1. Research Trends

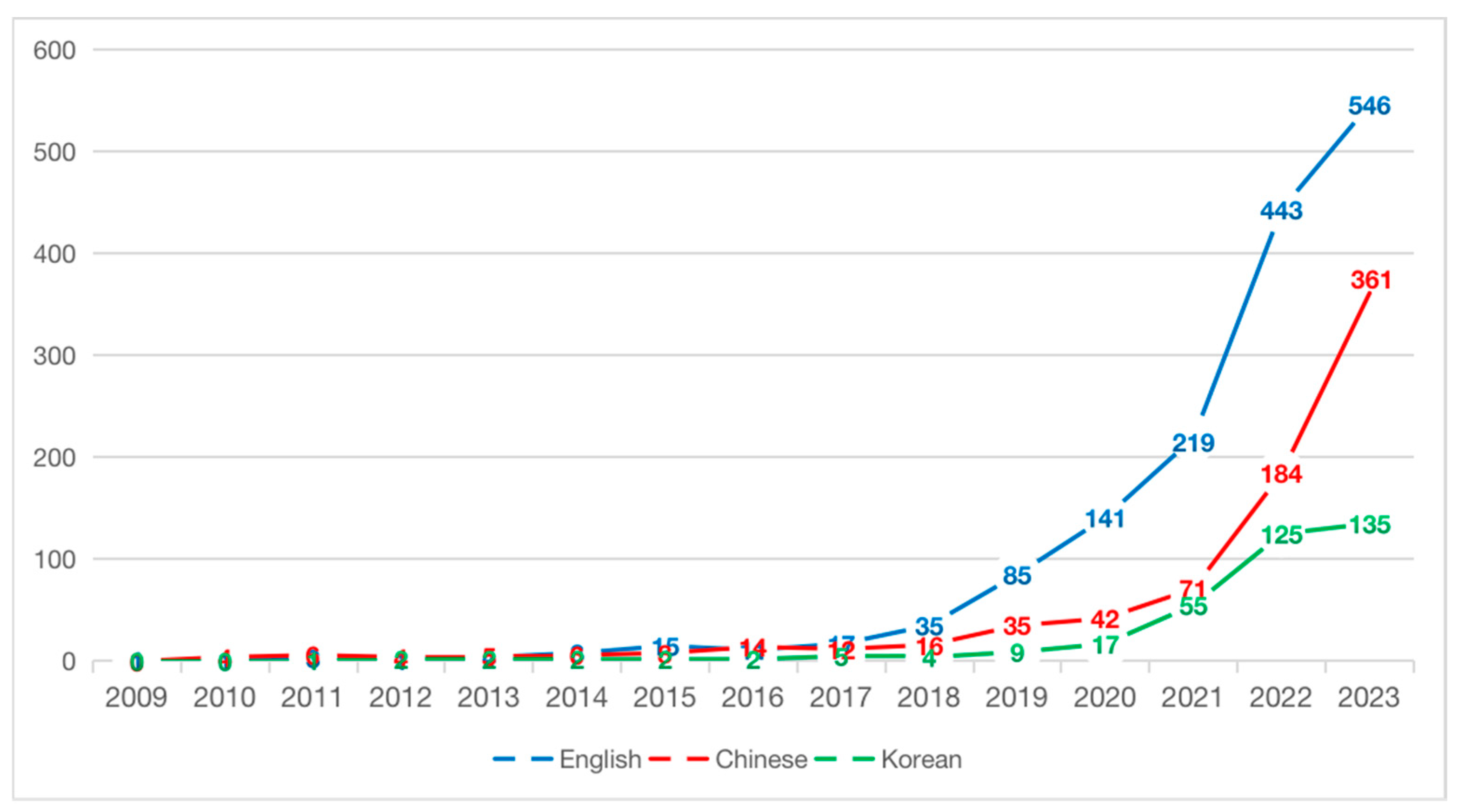

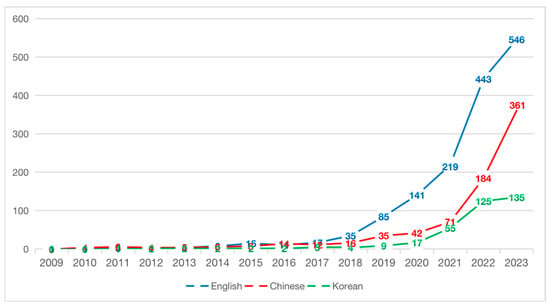

To comprehensively understand the temporal changes and patterns of ESG research papers domestically and internationally, this study conducted a temporal quantitative comparison of 2659 relevant papers in English, Chinese, and Korean. The significant increase in ESG-related research across all three languages especially after 2019 also aligns with the growing urgency of global climate change mitigation and heightened public and investor awareness of sustainability issues, amplified by the COVID-19 pandemic. During this period, ESG issues have gained prominence, not just as a moral imperative but also as a critical factor influencing risk management, resilience, and long-term profitability.

In English research, ESG studies surged dramatically in 2019, reaching over 546 publications in 2023. This sharp uptick mirrors global corporate and regulatory movements, particularly in Western economies, where ESG integration has become a priority due to the growing investor demand for sustainable investments and stricter regulatory frameworks. For instance, frameworks like the European Union’s Corporate Sustainability Reporting Directive and the U.S. Securities and Exchange Commission’s focus on climate-related disclosures has driven companies and investors to prioritize ESG metrics.

Similarly, the rapid increase in Chinese ESG research, growing from 35 papers in 2019 to 361 in 2023, demonstrates the influence of China’s policy direction, particularly its “dual carbon” goals and heightened emphasis on green finance and sustainable development. In response to government mandates for carbon neutrality by 2060, Chinese companies are increasingly integrating environmental considerations into their corporate strategies.

Korean research, while comparatively smaller in volume, also shows a notable rise, with a steady increase from nine publications in 2019 to one hundred and thirty-five in 2023. The rise in Korean publications can be linked to the increasing focus on corporate governance and environmental initiatives within Korea, driven by governmental policy and corporate responsibility standards set by leading Korean conglomerates such as Samsung and LG. (See Figure 2).

Figure 2.

Number of papers and trend chart.

3.1.2. Keyword Co-Occurrence Analysis

Keywords are concise expressions of the core points and themes in academic research. This study utilized CiteSpace, setting the Node Type as Keyword, with a time range from 2009 to 2023. Minimum Spanning Tree, Pruning Sliced Networks, and Pruning the Merged Network were utilized as network pruning methods. Simultaneously, research data from the databases were imported. Additionally, synonymous keywords were processed by merging and deleting them. Ultimately, a frequency and centrality list of ESG research keywords (Table 2) and a keyword co-occurrence network (Figure 3) were obtained.

Table 2.

Top 10 keywords.

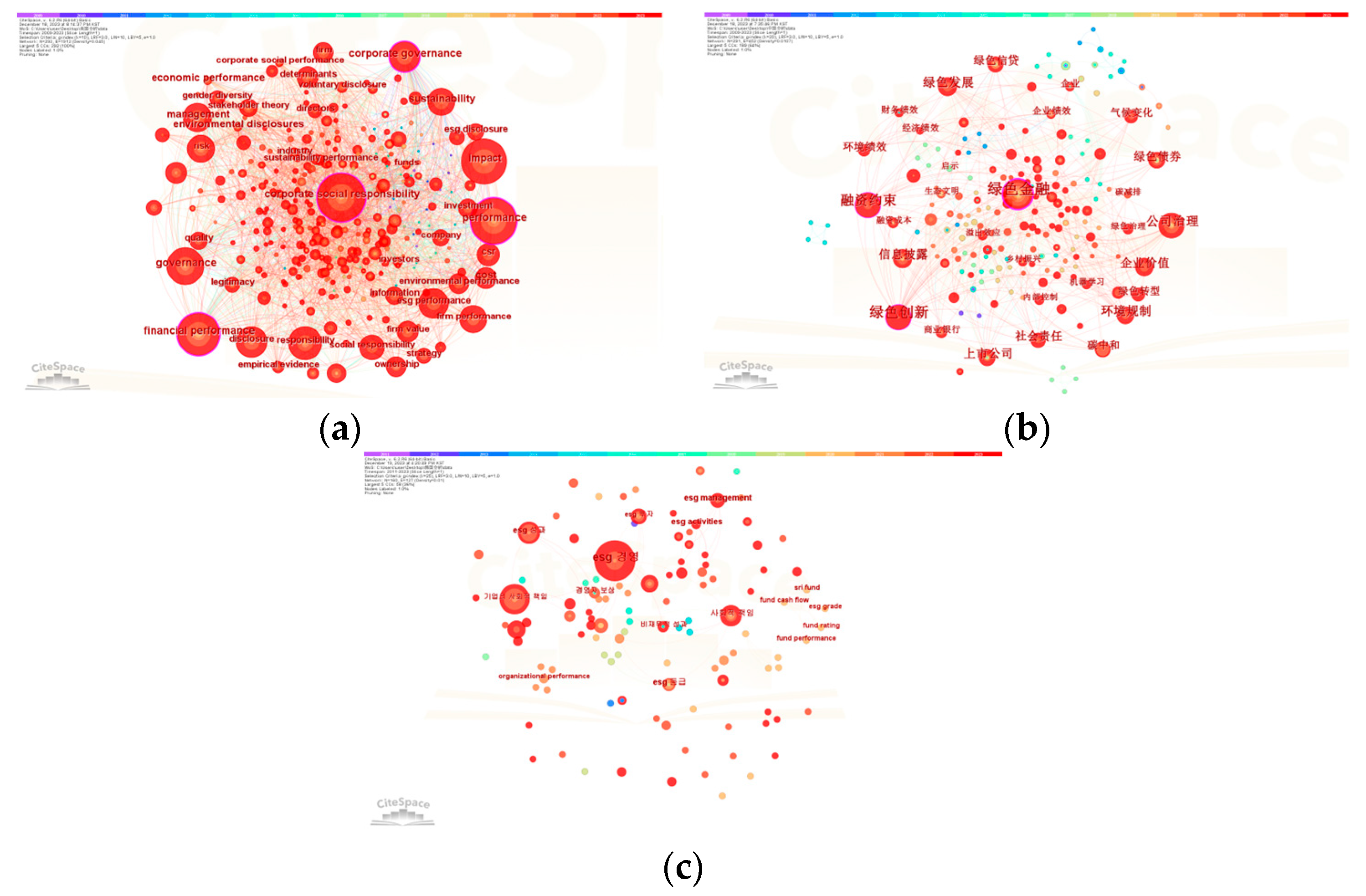

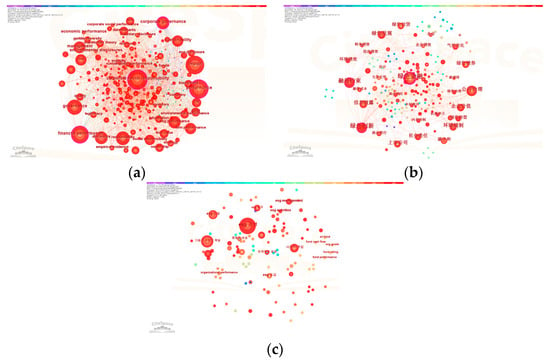

Figure 3.

Keyword co-occurrence networks: (a) English; (b) Chinese; (c) Korean.

Specifically, in English papers, the network included 292 nodes and 1912 connections, with “CSR” as the dominant keyword. In Chinese papers, the network comprised 291 nodes and 452 connections, highlighting “Green Finance” as the top keyword. For Korean papers, the network had 160 nodes and 127 connections, with “ESG Management” as the primary focus. These graphs and data illustrated the distribution of keywords in ESG research across different language domains, providing powerful tools for a deeper understanding of the focal points and trends in academic research.

The frequency of keyword occurrence reflects its importance in the keyword co-occurrence network. To gain a clearer understanding of the focus of ESG research in different languages, this study compiled the top 10 keywords ranked by frequency. In English papers, prominent terms included CSR (550), Impact (438), Performance (436), Financial Performance (390), and Governance (326), etc. In Chinese papers, key terms were Green Finance (57), Corporate Governance (34), Financing Constraints (33), Green Innovation (31), and Information Disclosure (21), etc. Korean papers highlighted ESG Management (39), CSR (21), ESG Performance (12), Social Responsibility (11), and ESG Activities (8) etc.

In keyword co-occurrence analysis, centrality is a crucial metric, where intermediary centrality represents a node’s ability to act as a mediator. A higher value indicates a stronger key and intermediary node role in the co-occurrence network. According to the graph statistics, keywords with centrality greater than 0.1 have a crucial and significant role in the co-occurrence network, providing valuable insights. Currently, in English papers, four keywords had centrality greater than 0.1, including CSR, Performance, Financial Performance, and Corporate Governance. Similarly, in Chinese papers, four keywords had centrality greater than 0.1, namely Green Finance, Financing Constraints, Green Innovation, and Corporate Governance. However, there were no keywords with a centrality greater than 0.1 in Korean ESG performance research.

3.1.3. Keyword Cluster Analysis

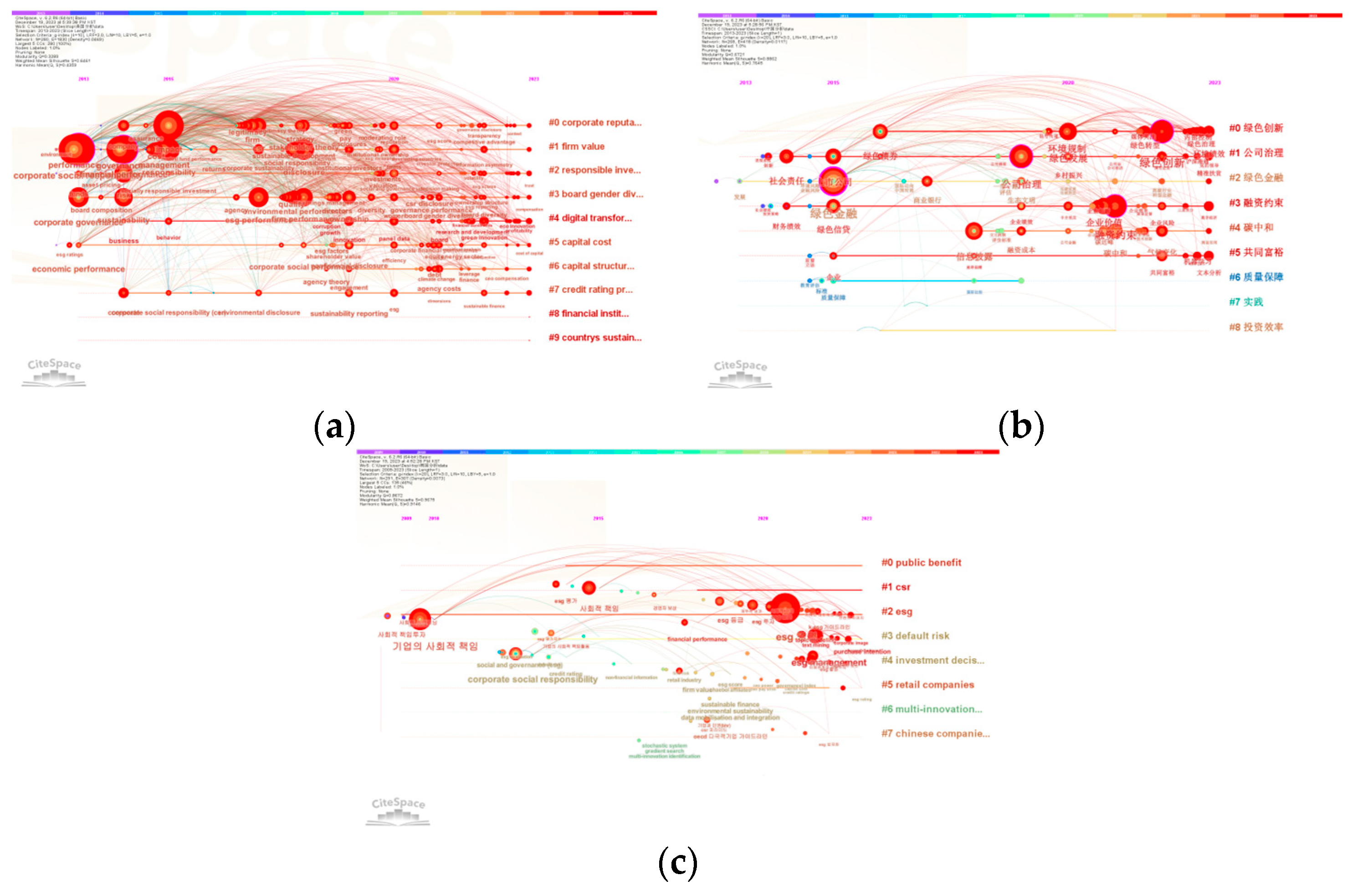

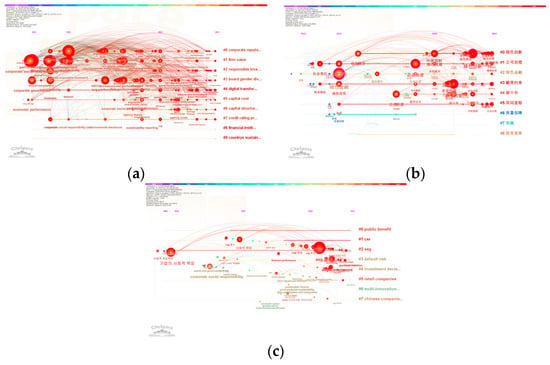

To gain a deeper understanding of the distribution of hot topics in the ESG performance domain and to enhance comprehension of the relationships among these topics, this study conducted a clustering analysis based on keyword co-occurrence maps, utilizing keyword similarity. Employing the LLR algorithm, the study extracted noun terms from keywords and assigned meaningful names to the clusters, resulting in thematic clusters regarding the impact of ESG on performance (Figure 4).

Figure 4.

Keyword clusters: (a) English; (b) Chinese; (c) Korean.

For English papers, 10 major clusters were identified, involving keywords such as corporate reputation, firm value, responsible investor, etc. In Chinese papers, nine major clusters were identified, covering keywords related to green innovation, corporate governance, green finance, etc. In Korean papers, a total of eight major clusters were identified, with their significance and size increasing as the ranking advanced. The keywords for these major clusters included public benefit, CSR, ESG, etc. These clusters provided a clear understanding of the diverse research topics in the ESG performance domain, contributing to a more comprehensive and systematic understanding of the impact of ESG on performance.

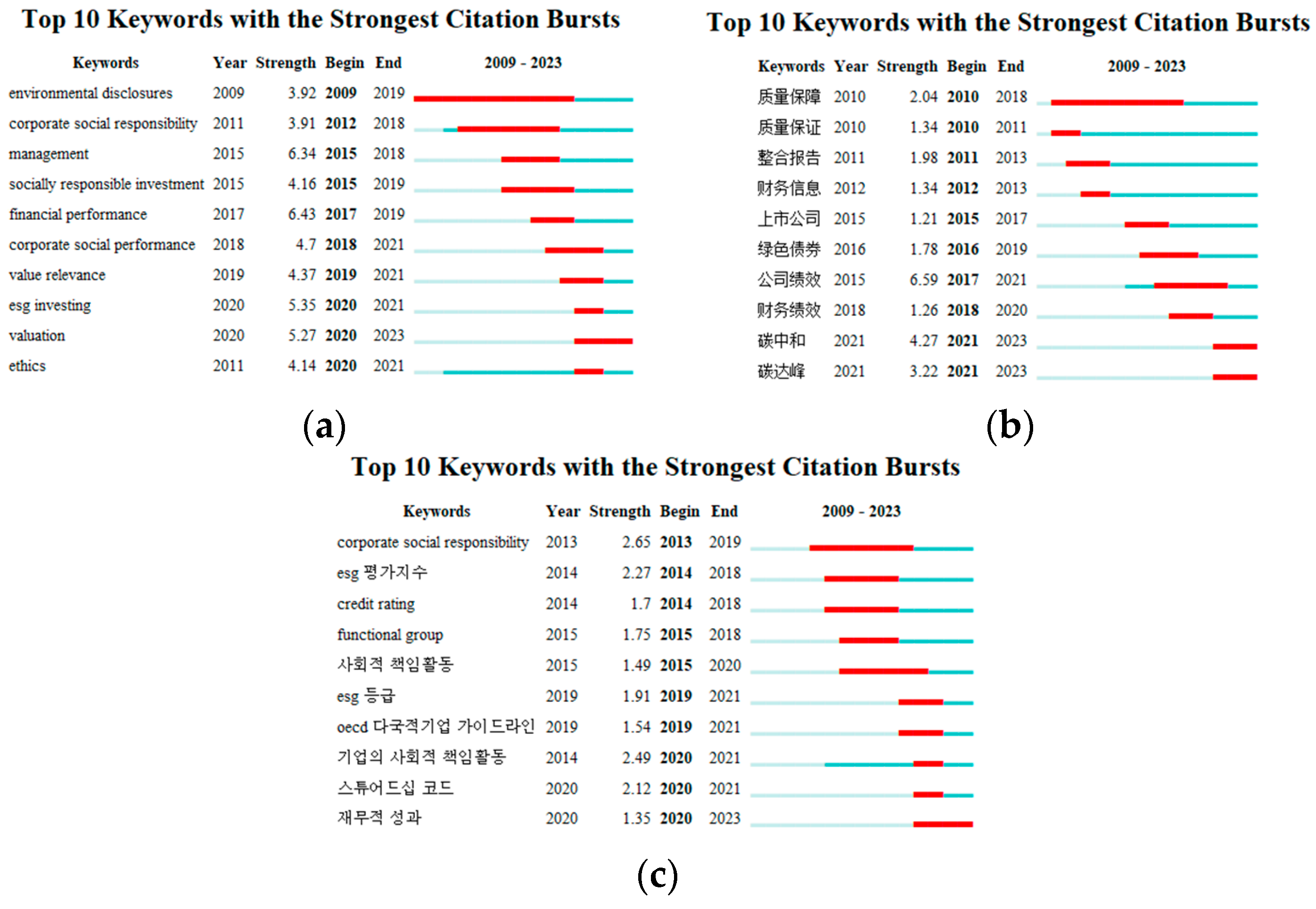

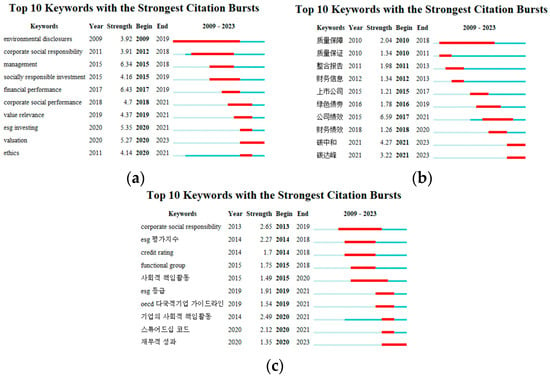

3.1.4. Keyword Burstiness Analysis

The development trends of keywords highlight the most promising themes in a research field, offering insights into future directions. This study used CiteSpace and co-citation analysis to track the “burstiness” of ESG-related keywords, revealing shifts in research focus. By analyzing frequency changes in co-cited papers, the study identified trends in English, Chinese, and Korean ESG research. Keywords with high burstiness often reflect the impact of technological innovations, economic policies, and global changes, indicating research hotspots and their sustained influence.

In English papers, keywords like “ethics,” “financial performance,” and “CSR” reflect a focus on global environmental issues and corporate practices. “Ethics” became a hotspot from 2020 to 2021, while “financial performance” showed strong burstiness from 2017 to 2019, remaining under investigation. Chinese research emphasizes “carbon neutrality,” “carbon peak,” and “financial performance,” reflecting a policy-driven approach. “Carbon neutrality” gained attention in 2021, and “financial performance” was a key focus from 2018 to 2020. Korean research highlights “CSR,” “credit rating,” and “financial performance,” indicating a balanced interest in governance and investment. Overall, while the core ESG themes are consistent across English, Chinese, and Korean research papers, the emphasis on particular aspects such as finance, policy, investment, and specific corporate practices varies, reflecting regional priorities and the influence of local contexts on ESG research. It is noteworthy that regardless of linguistic and cultural differences, all three languages showed attention to financial performance, indicating the significant importance of exploring the relationship between ESG and financial performance from a micro perspective using meta-analysis. (See Figure 5).

Figure 5.

Citation burst keywords: (a) English; (b) Chinese; (c) Korean.

3.1.5. Author Analysis

Through CiteSpace, an analysis of authors was conducted. The network of English papers comprises 241 nodes and 126 links, with the most prolific author being “Buallay, Amina.” The network of Chinese papers consists of 221 nodes and 130 links, with “Junhai Liu” being the most prolific author. In the case of Korean papers, the network comprises 198 nodes and 107 links, with “Jungmin Nam” leading in publication volume. Although there are many scholars in the field of ESG research, the collaboration among nodes is relatively limited, displaying a pattern of overall dispersion with local concentrations. Compared to the results of Khan in 2022, who analyzed collaboration networks in ESG research, this study found a similarly fragmented structure, with nodes demonstrating high dispersion [23]. This pattern suggests that ESG research, much like CSR, tends to develop in localized or thematic silos, rather than through broad, interdisciplinary collaboration. In both this study and previous work by Huang in 2021, collaborative networks were more concentrated around regional clusters, with few global connections [22].

To gain deeper insights into the distribution of authors in the ESG field, the core group of authors in the English papers was identified using Price’s law, based on the number of publications by the first authors. Authors who published more than four papers during the study period are considered core authors in the ESG field, amounting to a total of fifty-five individuals (seventeen from English papers, nine from Chinese papers, and twenty-nine from Korean papers). This indicates that a stable core group of researchers has emerged in the ESG field, while also reflecting the growing attention and influence of ESG research among a broader academic community. (See Table 3).

Table 3.

Top 10 authors.

3.1.6. Institution Analysis

The analysis of institutional collaboration using CiteSpace revealed multiple institutional networks. In the network of English papers, there are 245 nodes and 166 links, with “Univ. Sfax (21)” emerging as the largest research institution by node size, having a centrality of 0.07. The Chinese papers’ network consists of 201 nodes and 103 links, where “Capital University of Economics and Business (14)” serves as the core institution, with a centrality of 0.22. Similarly, the Korean papers generated a network with 156 nodes and 73 links, in which “Pusan National University (28)” holds the largest node, with a centrality of 0.12.

In contrast, Galletta identified different leading institutions in their bibliometric analysis of banking ESG research, with University of Zaragoza and University of Extremadura playing a more prominent role [26]. This could be attributed to different key industries in the broader ESG field and differences in publishing time and specific databases used. While Western institutions have traditionally been leaders in ESG research, the more localized focus of ESG in China, particularly in environmental governance and corporate compliance, has allowed regional institutions to dominate the publication landscape.

This study shows that ESG research remains largely confined to national or regional networks. The presence of Capital University of Economics and Business as a leading institution in the Chinese network aligns with China’s increasing focus on ESG, driven by both government regulations and corporate environmental strategies. Similarly, the lack of cross-border institutional linkages, also observed by Galletta in 2022, suggests that global institutional collaboration in ESG research is still underdeveloped [26]. (See Table 4).

Table 4.

Top 10 institutions.

3.1.7. Country Analysis

The country collaboration network was analyzed using CiteSpace. Since Chinese and Korean papers are predominantly submitted by domestic authors with little distinction between countries, this analysis focuses solely on English papers. The network comprises 87 nodes and 434 links, with a network density of 0.116, indicating a relatively low density and sparse connections between nodes. In the field of ESG research, 45 countries have published more than 10 papers, with China (325), the USA (198), and Italy (154) leading in terms of publication volume. This reflects the contributions of various countries in the field of ESG research and underscores the global nature of this domain. Notably, China out-paced the United States, with 325 publications compared to 198. This is consistent with trends observed by Zeng in 2024, who also highlighted China’s growing dominance in ESG research due to its aggressive national sustainability goals and its leadership in corporate environmental practices [27].

Further analysis reveals that eight countries, including England, China, and the USA, showed high centrality scores (above 0.1), highlighting their roles as key hubs of international collaboration. The finding that England exhibited the highest centrality score (0.36) is consistent with Chytis, who noted that the UK plays a pivotal role in linking ESG research networks, especially within Europe [62]. The relatively lower centrality of the USA in this study (0.25) compared to earlier works suggests a slight reduction in its global collaboration role, potentially due to the rise in Asian institutions as leading contributors to the field. (See Table 5).

Table 5.

Top 10 countries.

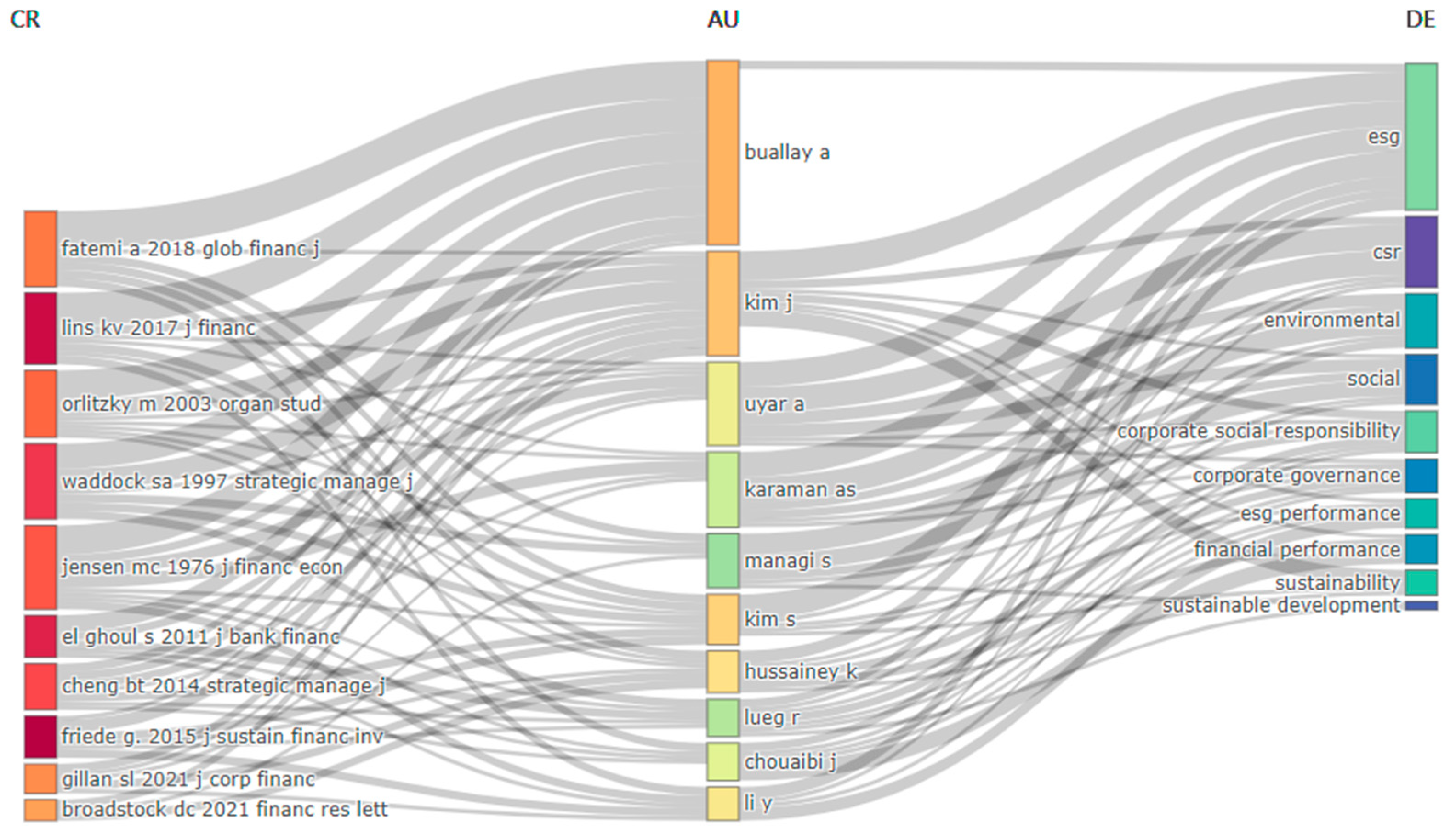

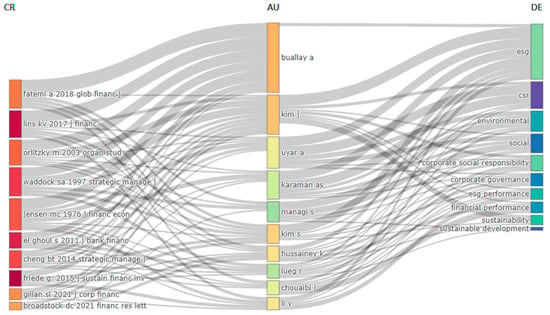

3.1.8. Reference Co-Citation Analysis

Since the Chinese and Korean data collected from the CNKI and RISS platforms did not include references, it was not possible to conduct a reference co-citation analysis for these sources. Therefore, the co-citation analysis in this study focused exclusively on papers from the Web of Science platform. Using R Studio (Bibliometrix), this three-field plot illustrates the key relationships between cited references, influential authors, and prominent themes in the research areas of ESG, and financial performance. The CR (Cited References) field on the left highlights the most frequently cited works, which serve as foundational studies guiding much of the ongoing research in the field. For example, Fatemi in Global Finance Journal explores the intersection of firm value and ESG issues [63], while Orlitzky in Organizational Studies is a seminal work examining the relationship between corporate social/environmental performance (CSP) and financial performance [64]. Waddock in Strategic Management Journal contributes to the strategic management aspects of corporate responsibility and governance [65]. Meanwhile, Jensen and Gillan, published in the Journal of Finance and Journal of Corporate Finance, respectively, provide foundational insights into corporate governance, financial theory, and stakeholder theory [66,67]. These references are pivotal in shaping current discourse on ESG topics and serve as the intellectual backbone for ongoing research, with frequent co-citations demonstrating their continued relevance. The AU (Author) field in the center and the DE (Domain of Study) field on the right align with previous analyses, further confirming the robustness and consistency of the results.

3.2. Study 2 Meta-Analysis Results

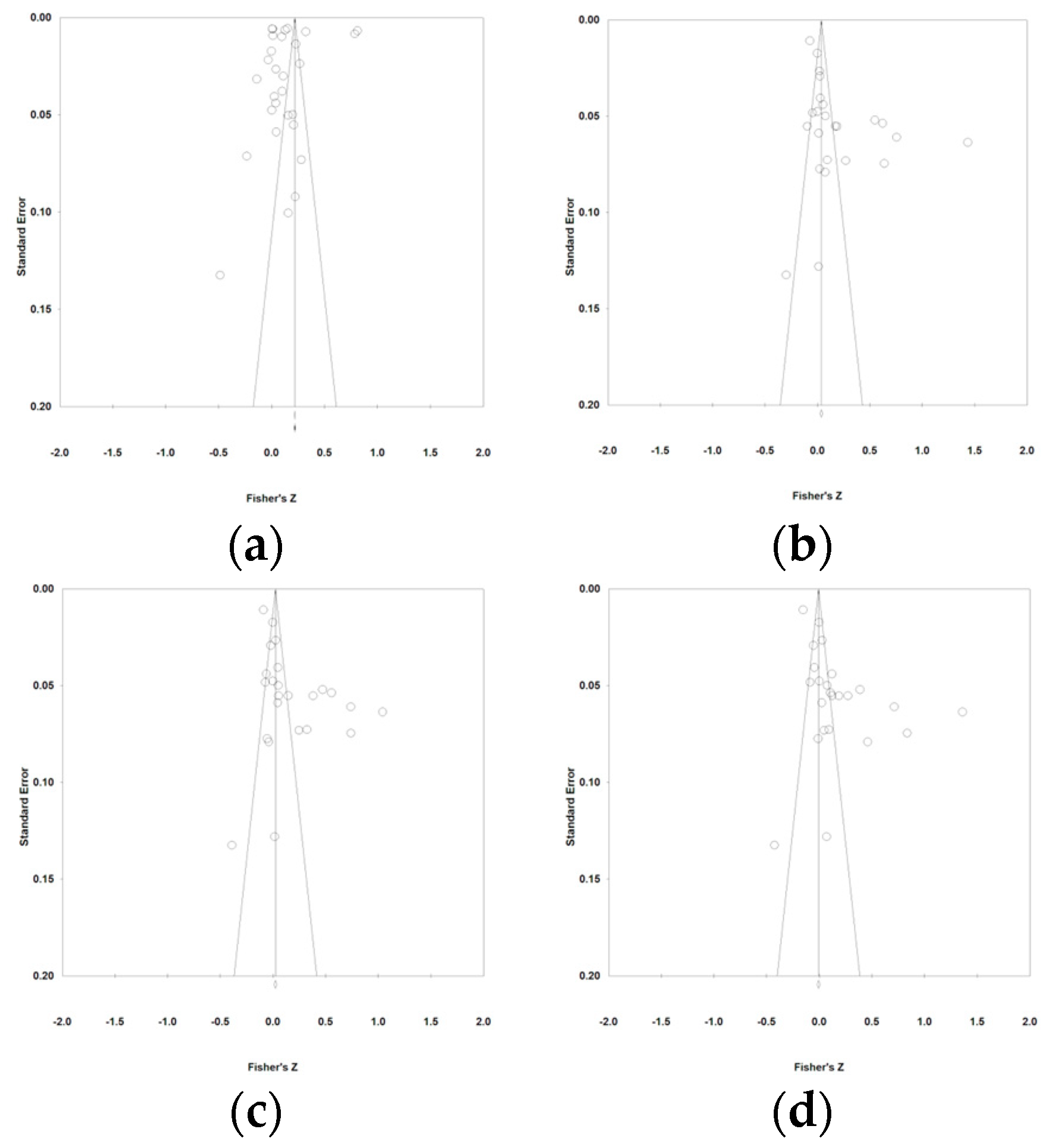

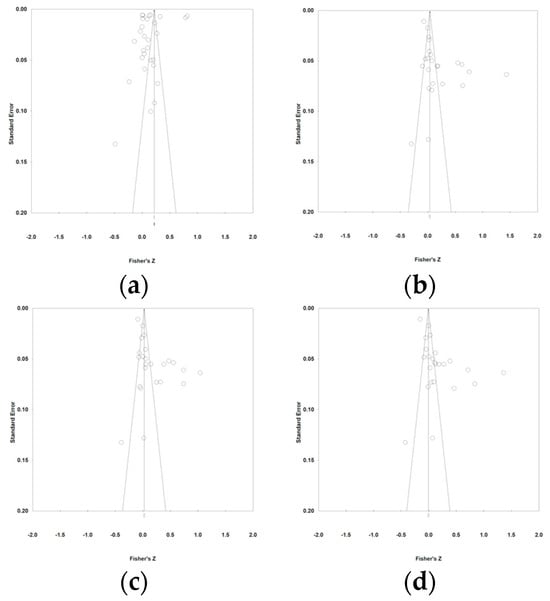

3.2.1. Publication Bias Analysis

This study assessed publication bias using a funnel plot, which examines the distribution of effect sizes to detect bias. Publication bias primarily refers to the tendency of researchers, journals, and readers to publish articles with significant research findings preferentially. Consequently, articles with non-significant results are relatively underrepresented in publications, leading to a certain discrepancy between published research outcomes and the actual situation. The funnel plot aimed to examine the distribution of effect sizes, with the horizontal axis representing the transformed Fisher’s Z effect values and the vertical axis representing the standard error of Fisher’s Z effect values. The results showed that most studies clustered near the top of the funnel plot, centered around the average effect size, indicating minimal publication bias (Figure 6). This suggested a minimal likelihood of publication bias in this meta-analysis, allowing for a reliable assessment of the studies’ overall validity and ensuring the research results’ robustness and reliability. (See Figure 7).

Figure 6.

Three-field plot.

Figure 7.

Funnel plot: (a) ESG and financial performance; (b) E and financial performance; (c) S and financial performance; (d) G and financial performance.

3.2.2. Heterogeneity Test

To enhance the precision of calculating the initial average effect size, this study initially identified the heterogeneity of effect sizes through the Q-test to determine the appropriate estimation model. The purpose of the Q-test was to assess whether the effect values reported in individual studies were homogeneous [68]. Under the premise of subgroup analysis, the Q statistic indicated heterogeneity among the effect values, suggesting that the fixed-effects model analysis method was not appropriate. Specifically, the I2 values were 99.83% (ESG), 97.408% I2, 96.631% (S), and 97.097% (G). This implied that 99.83% (ESG), 97.408% I2, 96.631% (S), and 97.097% (G) of the observed variation originates from true differences in effect values (Table 6). According to Higgins, I2 values of 25%, 50%, and 75% represented low heterogeneity, moderate heterogeneity, and high heterogeneity, respectively [69]. In cases of heterogeneous effect values, there are generally two approaches, one is to remove extreme effect values until homogeneity is achieved, followed by fixed-effects model analysis. However, this approach may not accurately reflect the actual research context. The other approach is to adopt a random effects model analysis that considers variability within and between studies. Therefore, in the overall effect test, this study opted for the random effects model analysis. This choice considered two main factors. Firstly, by reviewing empirical studies on the relationship between ESG and financial performance, it was found that different studies were challenging to sample from entirely homogeneous populations. Secondly, this study believed that measurement indicators of ESG, financial performance, and other factors might have influenced their relationship, and the differences in indicator selection in research design were also one of the reasons for the relatively high heterogeneity.

Table 6.

Heterogeneity test results.

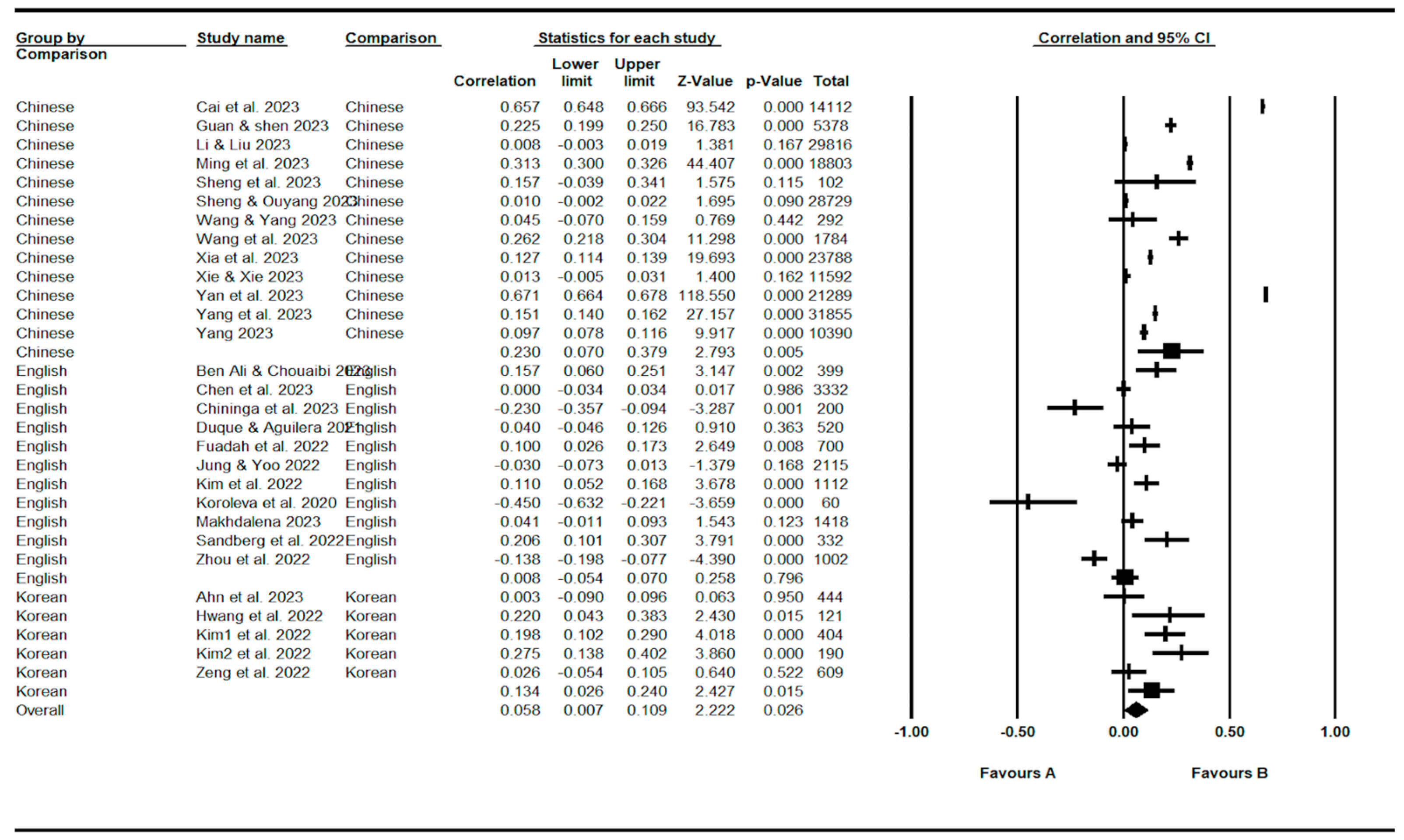

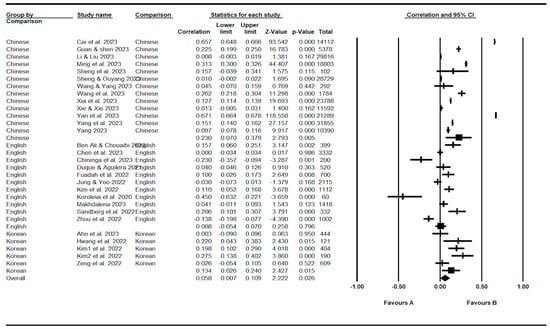

3.2.3. Effect Size Analysis

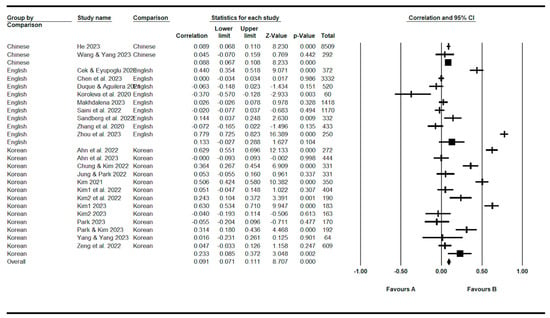

The impact of ESG on financial performance was elucidated through the presentation of main effect sizes. From a subgroup perspective, the overall main effect size of ESG on financial performance was 0.058, with a 95% CI of (0.007–0.109), a Z value of 2.222, and a p value of 0.026. Further analysis revealed that in English papers, the main effect size of ESG on financial performance was 0.008, with a 95% CI of (−0.054–0.070), a Z value of 0.258, and a p value of 0.796. In Chinese papers, the main effect size of ESG on financial performance was 0.230, with a 95% CI of (0.070–0.379), a Z value of 2.793, and a p value of 0.005. In Korean papers, the main effect size of ESG on financial performance was 0.134, with a 95% CI of (0.026–0.240), a Z value of 2.427, and a p value of 0.015 (Figure 8).

Figure 8.

Forest plot (ESG and financial performance) [7,9,10,11,15,16,18,19,29,30,31,34,35,37,38,39,40,41,42,43,44,45,46,47,48,51,54,55,61].

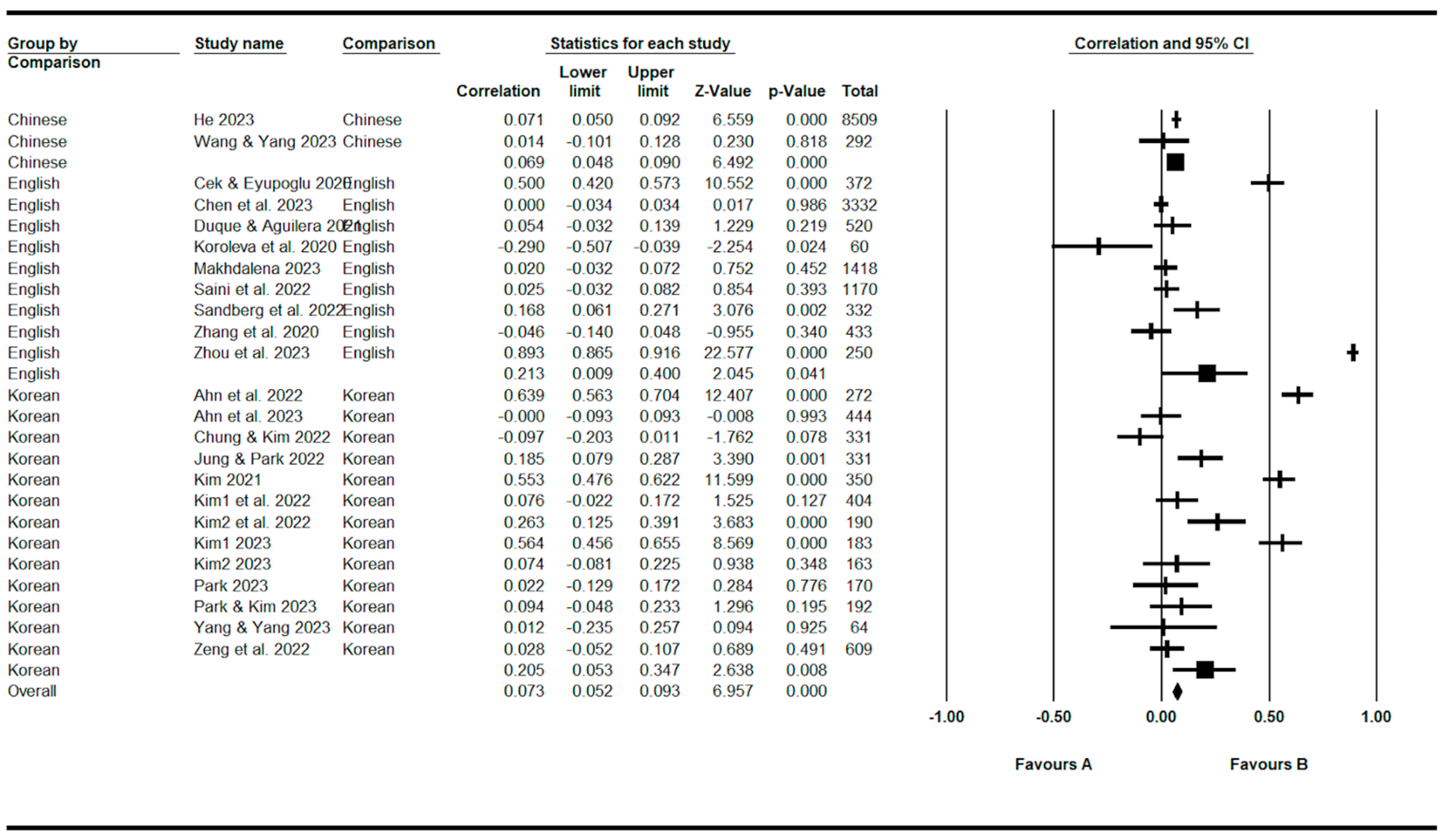

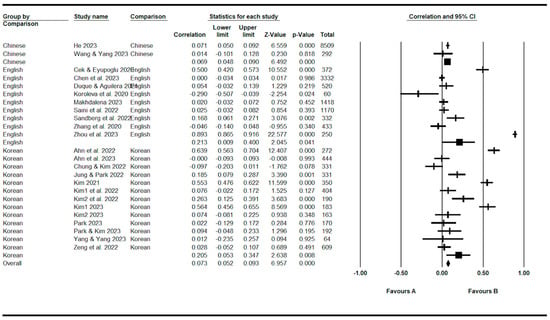

For the E dimension, the main effect size of E on financial performance was 0.073, with a 95% CI of (0.052–0.093), a Z value of 6.957, and a p value of 0.000. Specifically, in English papers, the main effect size of E on financial performance was 0.213, with a 95% CI of (0.009–0.400), a Z value of 2.045, and a p value of 0.041. In Chinese papers, the main effect size of E on financial performance was 0.069, with a 95% CI of (0.0048–0.090), a Z value of 6.492, and a p value of 0.000. In Korean papers, the main effect size of E on financial performance was 0.205, with a 95% CI of (0.053–0.347), a Z value of 2.638, and a p value of 0.008 (Figure 9).

Figure 9.

Forest plot (E and financial performance) [8,9,10,11,17,18,19,31,32,36,41,48,49,50,52,53,54,55,56,57,58,59,60,61].

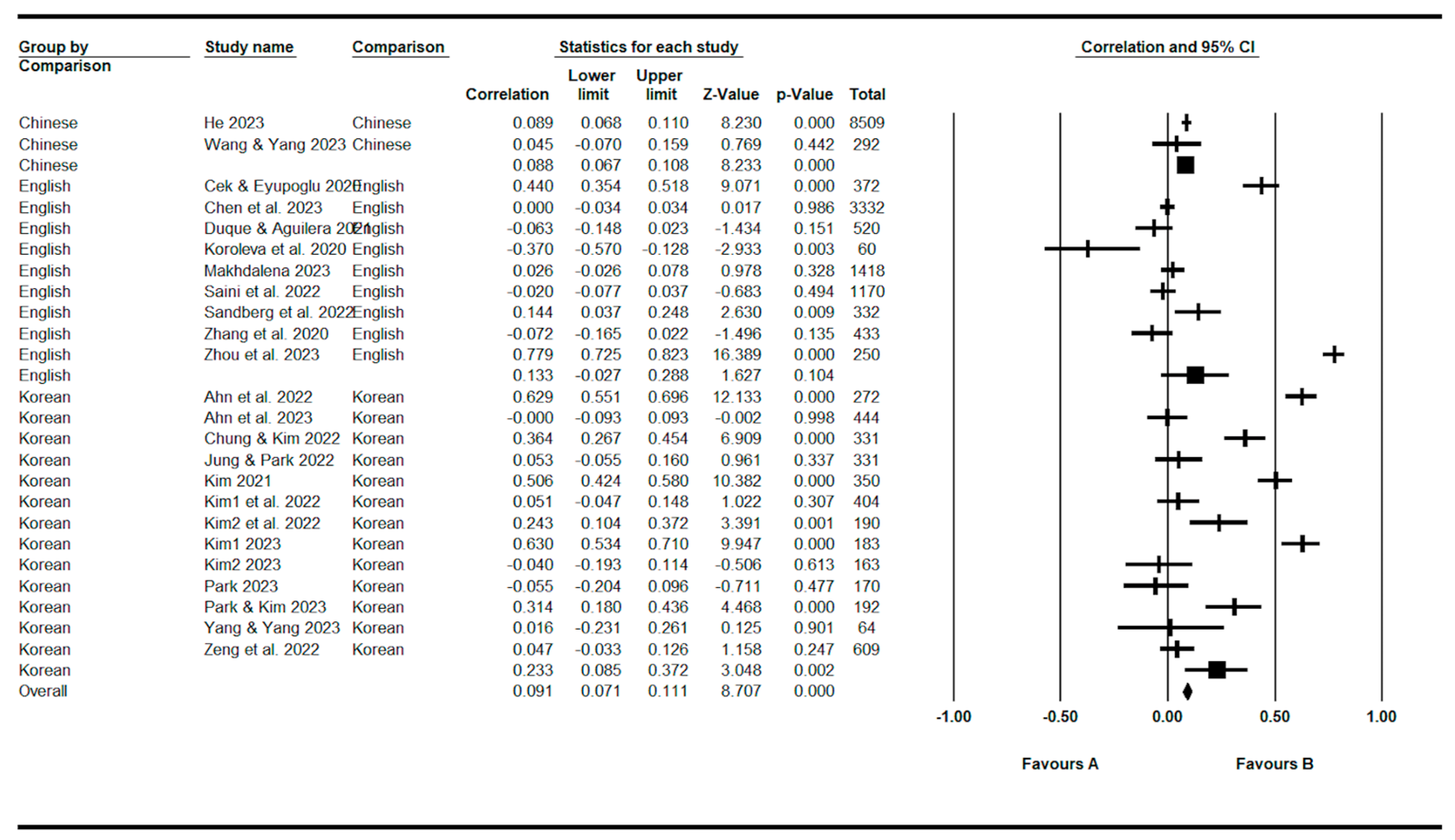

For the S dimension, the main effect size of S on financial performance is 0.091, with a 95% CI of (0.071–0.111), a Z value of 8.707, and a p value of 0.000. Specifically, in English papers, the main effect size of S on financial performance is 0.133, with a 95% CI of (−0.027–0.288), a Z value of 1.627, and a p value of 0.104. In Chinese papers, the main effect size of S on financial performance is 0.088, with a 95% CI of (0.067–0.108), a Z value of 8.233, and a p value of 0.000. In Korean papers, the main effect size of S on financial performance is 0.233, with a 95% CI of (0.085–0.372), a Z value of 3.048, and a p value of 0.002 (Figure 10).

Figure 10.

Forest plot (S and financial performance) [8,9,10,11,17,18,19,31,32,36,41,48,49,50,52,53,54,55,56,57,58,59,60,61].

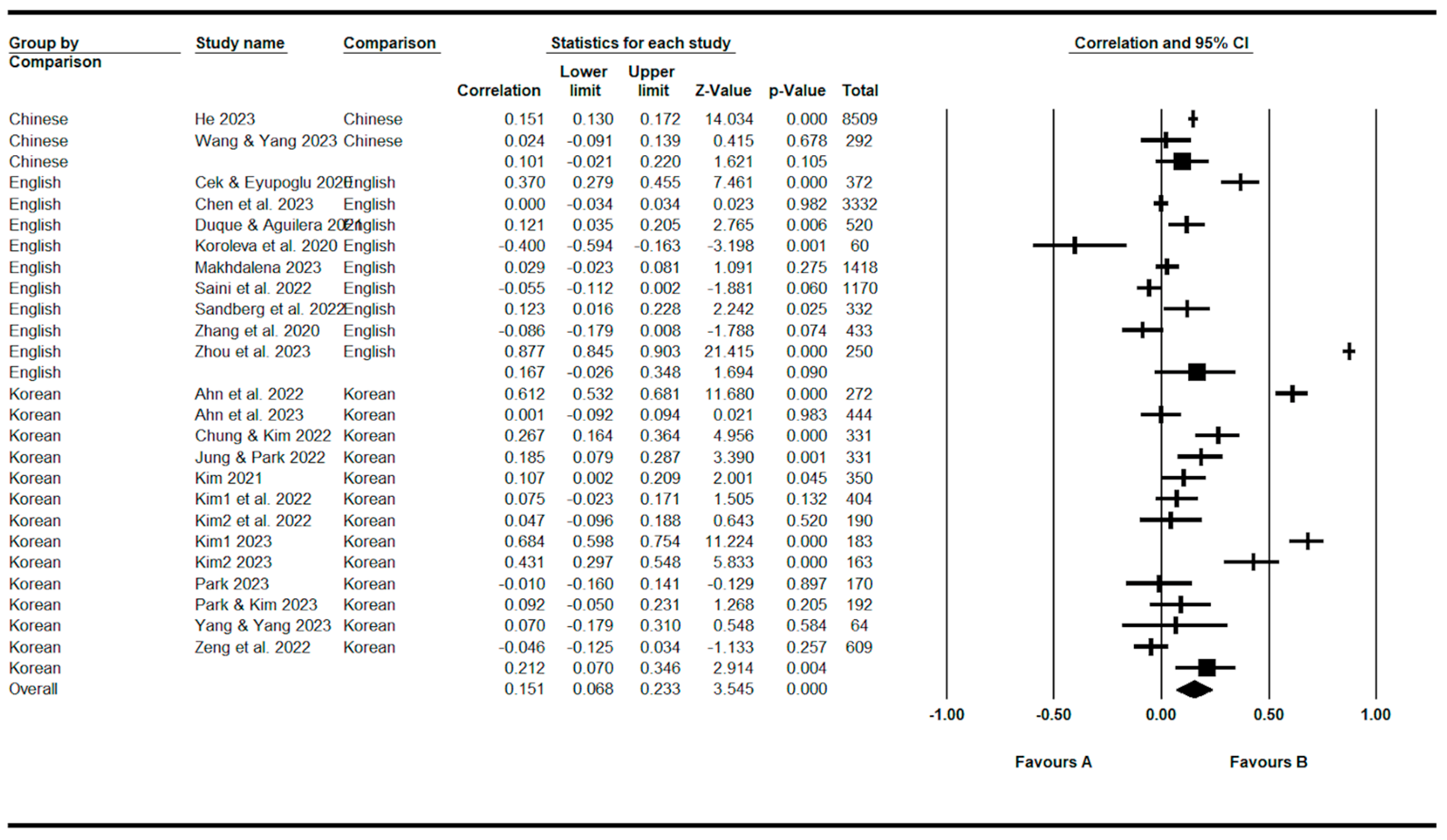

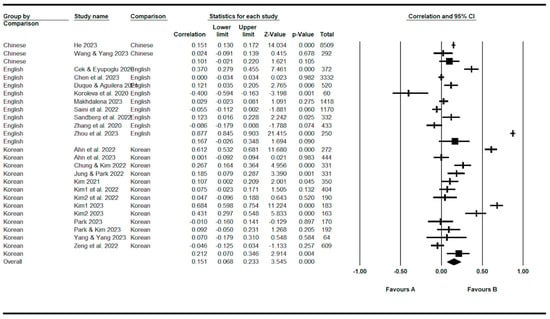

As for the G dimension, the main effect size of G on financial performance was 0.151, with a 95% CI of (0.068–0.233), a Z value of 3.545, and a p value of 0.000. Specifically, in English papers, the main effect size of ESG on financial performance was 0.167, with a 95% CI of (−0.026–0.348), a Z value of 1.694, and a p value of 0.090. In Chinese papers, the main effect size of ESG on financial performance was 0.101, with a 95% CI of (−0.021–0.220), a Z value of 1.621, and a p value of 0.105. In Korean papers, the main effect size of ESG on financial performance was 0.212, with a 95% CI of (0.070–0.346), a Z value of 2.914, and a p value of 0.004 (Figure 11).

Figure 11.

Forest plot (G and financial performance) [8,9,10,11,17,18,19,31,32,36,41,48,49,50,52,53,54,55,56,57,58,59,60,61].

According to Lipsey and Wilson, the division criteria for the correlation degree were as follows: when the correlation coefficient is less than or equal to 0.1, it is considered a low degree of correlation; when the correlation coefficient is between 0.1 and 0.4, it is a moderate degree of correlation; and when the correlation coefficient is greater than 0.4, it is a high degree of correlation [70]. Therefore, the results of this study revealed a low degree of positive correlation between ESG and financial performance. Specifically, in Chinese and Korean papers, there was a moderate degree of positive correlation between ESG and financial performance, while in English papers, ESG was not correlated with financial performance. This indicates an average increase of 0.058 units in financial performance through ESG practices.

For the E dimension, there was a low degree of positive correlation between E and financial performance. Specifically, in Chinese papers, there was a low degree of positive correlation between E and financial performance, and in English and Korean papers, there was a moderate degree of positive correlation between E and financial performance. This indicates an average increase of 0.073 units in financial performance through E practices. In Western economies, environmental practices may still be perceived as a cost or a reputational safeguard rather than a value-creating strategy, which limits their direct financial impact. However, in Korea, with its increasing governmental push for renewable energy and green initiatives, environmental sustainability has become more directly tied to corporate success. China, under its aggressive push toward carbon neutrality and green finance, also shows a positive link, though not as strong as in Korea, due to the relatively recent implementation of these policies.

For the S dimension, there was a low degree of positive correlation between S and financial performance. Specifically, in Chinese papers, there was a low degree of positive correlation between S and financial performance; in Korean papers, there was a moderate degree of positive correlation between S and financial performance; and in English papers, S was not correlated with financial performance. This indicates an average increase of 0.091 units in financial performance through S practices. In Western economies, social aspects of ESG, such as diversity, human rights, and community engagement, are often pursued for ethical reasons rather than financial gain. Therefore, their impact on financial performance is less pronounced. In contrast, Korean companies, which operate in a culture that places a high value on social cohesion and public trust, may experience more direct financial benefits from engaging in social sustainability initiatives. The relatively low correlation in China could reflect the fact that social practices, while growing in importance, have not yet been fully integrated into the financial frameworks of Chinese firms.

Regarding the G dimension, there was a moderate degree of positive correlation between G and financial performance. Specifically, in Korean papers, there was a moderate degree of positive correlation between G and financial performance, and in English and Chinese papers, G was not correlated with financial performance. This indicates an average increase of 0.151 units in financial performance through G practices. In Korea, governance reforms have become crucial following several corporate scandals, leading to stricter regulations and a focus on corporate transparency. This cultural and regulatory shift has strengthened the link between governance and financial performance, as companies that prioritize strong governance are rewarded with higher levels of trust and financial stability. In Western economies, the lack of correlation may be due to governance being perceived as a compliance issue rather than a performance enhancer, while in China, governance reforms are still in the process of being fully integrated into business practices.

In the analysis of the subdivision dimensions, it was explained once again from a different perspective that there is no correlation between ESG and financial performance in English papers. This was attributed to the lack of correlation between S, G, and financial performance in English papers.

3.2.4. Robustness Analysis

To test the robustness of the research findings on the relationship between ESG and financial performance, this study conducted a robustness test by excluding a relatively high proportion of sample papers. After excluding the three largest-sample papers [37,39,45], the remaining samples underwent a primary effects analysis. The results indicated a main effect value of 0.054 for ESG on financial performance, with a 95% CI of (0.002–0.106) and a p value of 0.042. Therefore, there is a low degree of positive correlation between ESG and financial performance, consistent with the previous research conclusions (Table 7).

Table 7.

Sensitivity analysis results.

To verify the robustness of the research results regarding the relationship between ESG’s dimensions and financial performance, this study also adopted the method of excluding a relatively high proportion of sample papers for a robustness test. After excluding the three largest-sample papers [9,10,36], the remaining samples underwent a primary effects analysis. The results showed that the main effect value for E on financial performance was 0.096, with a 95% CI of (0.007–0.183) and a p value of 0.035. The main effect value for S on financial performance was 0.12, with a 95% CI of (0.033–0.204) and a p value of 0.007. The main effect value for G on financial performance was 0.106, with a 95% CI of (0.019–0.191) and a p value of 0.017 (Table 7). The earlier research conclusions indicated a low degree of positive correlation between E and financial performance, a low degree of positive correlation between S and financial performance, and a moderate degree of positive correlation between G and financial performance. The findings of this robustness study largely align with the previous research, except for S’s impact on financial performance, which changed from a low degree of positive correlation to a further moderate degree of positive correlation.

4. Discussion and Conclusions

4.1. Discussion

This study investigated the impact of ESG practices on financial performance in the context of the Friedman Doctrine and stakeholder theory debate through a comprehensive research approach, combining bibliometric analysis and meta-analysis.

The bibliometric analysis revealed patterns in the evolution of ESG research across English, Chinese, and Korean papers. From the perspective of the publication volume of ESG research papers, after 2019, the number of studies has rapidly increased, indicating a significant strengthening of research efforts and marking the formal entry of ESG research into a new stage of systematic construction. Through the analysis of keyword co-occurrence graphs and high-frequency keywords, this paper identified unique features in the studies conducted in the three languages. In Korean papers, the top-ranking keyword is “ESG Management”, and the prevalence of “Green Finance” in Chinese papers suggests a strong emphasis on financial mechanisms within ESG discussions. In contrast, the emphasis on “CSR” in English papers may reflect a broader societal and ethical perspective. The keyword clustering graphs reveal that English papers showcase 10 clusters, encompassing aspects like corporate reputation and company value. Chinese papers exhibit nine clusters, covering topics such as green innovation and corporate governance. Korean papers have eight emerging keyword clusters, including public interest and CSR. Analyzing the keyword burstiness graph, English papers, during the period from 2020 to 2021, emphasized “ethics.” Chinese papers began emphasizing the study of “carbon neutrality” as a popular topic in 2021. Since 2020, Korean papers have mainly focused on the financial performance aspect of ESG research. It is noteworthy that financial performance is a focal point in papers across all three languages.

The meta-analysis synthesized diverse empirical findings across English, Chinese, and Korean papers, and the examination of publication bias through funnel plots revealed a minimal likelihood of biased outcomes, reinforcing the credibility of the meta-analysis. Heterogeneity tests guided the adoption of a random effects model, acknowledging the inherent variability across diverse studies. The effect size analysis suggested a low degree of positive correlation between ESG and financial performance, affirming the burgeoning body of papers supporting the business case for sustainability. However, intriguing variations emerged in sub-variable analyses across different language domains, with Korean and Chinese papers exhibiting a moderate positive correlation, while English papers did not demonstrate a significant association. There is a low degree of positive correlation between E and financial performance, a low degree of positive correlation between S and financial performance, and a moderate degree of positive correlation between G and financial performance.

4.2. Theoretical Implications

Firstly, the temporal analysis of ESG papers revealed distinct phases and an inflection point in 2019, reflecting a paradigm shift in scholarly interest. The identification of language-specific keyword co-occurrence and their centrality in Korean, Chinese, and English papers unveils the diverse conceptual foundations underlying ESG discourse. Notably, the prominence of “Green Finance” in Chinese papers and “CSR” in English papers underscores the contextual nuances and varied emphasis within different linguistic spheres.

Secondly, moving beyond the bibliometric insights, the meta-analysis results contribute significantly to the theoretical landscape by quantifying the relationship between ESG and financial performance. The identified low degree of positive correlation aligns with stakeholder theory, substantiating the proposition that sustainable business practices can yield favorable financial outcomes [2,4]. However, the nuanced variations across language domains highlight the importance of considering cultural factors that may moderate this relationship. The distinct positive correlation observed in Korean and Chinese papers, juxtaposed with the lack of significance in English papers, prompts theoretical reflections on the cultural, institutional, and regulatory contexts that shape the ESG financial performance nexus.

Thirdly, the incorporation of sub-variable analyses for ESG dimensions amplifies the theoretical discourse. The divergent correlations in these dimensions across language domains suggest that the impact of specific ESG facets on financial performance may vary. The identification of a moderate positive correlation between social factors and financial performance in Korean and Chinese papers, coupled with the lack of significance in English papers, is attributed to the lack of correlation between S and financial performance, and G and financial performance in English papers.

Fourthly, the bibliometric and meta-analytic findings underscore the temporality, globality, and social relevance of ESG research. This reinforces the theoretical perspective that ESG is a dynamic and multifaceted construct, shaped by evolving global trends and societal expectations. The observed shifts in keyword emphasis over time suggest that theoretical models of ESG must remain adaptable, integrating emerging themes and trends to remain relevant.

4.3. Managerial Implications

Firstly, managers must recognize the linguistic nuances reflected in the bibliometric analysis, tailoring their ESG strategies to language-specific markets. The observed cultural and linguistic variations in the correlation between ESG dimensions and financial performance underline the importance of tailoring sustainability strategies to specific regional contexts. Management teams should recognize that one-size-fits-all ESG integration may not yield uniform financial benefits globally. Customizing sustainability initiatives based on the predominant cultural values and linguistic nuances in each market can enhance their effectiveness. The prominence of “Green Finance” in Chinese papers suggests an emphasis on financial mechanisms, urging Chinese firms to align their ESG practices with sustainable financial initiatives. Similarly, the prevalence of “CSR” in English papers implies a broader societal focus. Managers should thus craft ESG strategies that resonate with local linguistic priorities, ensuring alignment with regional expectations and regulatory frameworks.

Secondly, understanding the contextualized relationship between ESG and financial performance is imperative for managerial decision-making. In regions like Korea and China, where a positive correlation is evident, integrating robust ESG practices becomes a strategic imperative. In contrast, the lack of correlation between ESG and financial performance in English papers suggests a potential gap in how ESG practices are communicated and measured in English-speaking regions. Management should be cognizant of linguistic nuances and ensure that sustainability reporting aligns with the linguistic and conceptual frameworks prevalent in their operating environments. Managers in English-speaking contexts need to adopt a differentiated approach, recognizing that the impact of ESG on financial performance may vary. The varying degrees of correlation among the E, S, and G dimensions highlight the need for strategic prioritization. In contexts where the E dimension demonstrates a stronger correlation with financial performance, organizations should place a strategic emphasis on environmental sustainability initiatives.

Thirdly, the varying degrees of correlation among the ESG dimensions highlight the need for strategic prioritization. For example, in contexts where the environmental dimension demonstrates a stronger correlation with financial performance, organizations should place a strategic emphasis on environmental sustainability initiatives. This targeted approach ensures that the most impactful aspects of ESG are prioritized, enhancing overall corporate performance.

Fourthly, managers should remain aware of the evolving trends and emerging topics within ESG research. The dynamic nature of ESG themes, as reflected in the bibliometric analysis, suggests that managers need to stay informed about the latest developments and adjust their strategies accordingly. This proactive approach will enable companies to remain competitive and responsive to changes in stakeholder expectations and regulatory landscapes.

4.4. Research Limitations and Future Directions

While this study provides insights, there are avenues for future research to extend and refine this understanding of the relationship between ESG practices and financial performance.

Firstly, exploring sector-specific impacts of ESG practices could provide more granular insights, considering the diverse nature of industries and their unique challenges. Future research may also delve deeper into the cultural and contextual factors that influence the effectiveness of ESG practices.

Secondly, bibliometric analysis is not without its limitations, as it may inadvertently exclude non-peer-reviewed sources and heavily rely on pre-existing papers, potentially introducing publication bias. To address these constraints, future investigations should consider diversifying data sources and encompassing a broader spectrum of publication types.

Thirdly, while meta-analysis yields valuable insights into ESG’s impact on performance, it encounters challenges associated with the inherent heterogeneity in study designs and methodologies. Although sensitivity analyses have been conducted to mitigate heterogeneity, residual variability may persist. Prospects for future research lie in the exploration of additional moderators that might influence the ESG and financial performance relationship, such as industry-specific factors or temporal trends.

Fourth, although this study has encompassed the three major databases to collect data as comprehensively as possible, only the Web of Science supports the direct retrieval of citation data. The CNKI and RISS databases face technical limitations in the automatic extraction and standardization of citation data, which constrains the depth and breadth of this study’s reference co-citation analysis, particularly for Chinese and Korean papers. Once these databases enable the collection of citation data, future research can delve deeper into reference co-citation analyses of Chinese and Korean papers, revealing core papers, knowledge flow pathways, and variations in academic influence across different linguistic contexts.

Author Contributions

H.B.: Conceptualization, Methodology, Investigation, Writing—Original Draft. J.K.: Writing—Review and Editing, Supervision. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the China Scholarship Council, Project No. 202208260056.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The datasets generated and analyzed during the current study are available from the corresponding author upon reasonable request.

Acknowledgments

The authors would like to thank anonymous reviewers for their invaluable suggestions that helped highlight the best in this paper.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Friedman, M. The social responsibility of business is to increase its profits. In Corporate Ethics and Corporate Governance; Springer: Berlin/Heidelberg, Germany, 2007; pp. 173–178. [Google Scholar]

- Clarke, T. The contest on corporate purpose: Why Lynn Stout was right and Milton Friedman was wrong. Account. Econ. Law A Conviv. 2020, 10, 20200145. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Ferrero, I.; Michael Hoffman, W.; McNulty, R.E. Must Milton Friedman embrace stakeholder theory? Bus. Soc. Rev. 2014, 119, 37–59. [Google Scholar] [CrossRef]

- Burke, J.J. Do boards take environmental, social, and governance issues seriously? Evidence from Media Coverage and CEO Dismissals. J. Bus. Ethics 2021, 176, 647–671. [Google Scholar] [CrossRef]

- Atan, R.; Alam, M.M.; Said, J.; Zamri, M. The impacts of environmental, social, and governance factors on firm performance: Panel study of Malaysian companies. Manag. Environ. Qual. Int. J. 2018, 29, 182–194. [Google Scholar] [CrossRef]

- Ben Ali, A.; Chouaibi, J. Mediating effect of ESG performance on executive incentive compensation-financial performance relationship: Evidence from MENA banking sector. Corp. Gov. Int. J. Bus. Soc. 2023, 24, 439–461. [Google Scholar] [CrossRef]

- Cek, K.; Eyupoglu, S. Does environmental, social and governance performance influence economic performance? J. Bus. Econ. Manag. 2020, 21, 1165–1184. [Google Scholar] [CrossRef]

- Chen, S.; Song, Y.; Gao, P. Environmental, social, and governance (ESG) performance and financial outcomes: Analyzing the impact of ESG on financial performance. J. Environ. Manag. 2023, 345, 118829. [Google Scholar] [CrossRef]

- Makhdalena, Z.D.; Zulvina, Y.; Amelia, R.W.; Wicaksono, A.P. Environmental, Social, Governance and Firm Performance in Developing Countries: Evidence from Southeast Asian. Etikonomi 2023, 22, 65–78. [Google Scholar] [CrossRef]

- Sandberg, H.; Alnoor, A.; Tiberius, V. Environmental, social, and governance ratings and financial performance: Evidence from the European food industry. Bus. Strategy Environ. 2023, 32, 2471–2489. [Google Scholar] [CrossRef]

- Zhang, Q.; Loh, L.; Wu, W. How do environmental, social and governance initiatives affect innovative performance for corporate sustainability? Sustainability 2020, 12, 3380. [Google Scholar] [CrossRef]

- Wong, W.C.; Batten, J.A.; Mohamed-Arshad, S.B.; Nordin, S.; Adzis, A.A. Does ESG certification add firm value? Financ. Res. Lett. 2021, 39, 101593. [Google Scholar] [CrossRef]

- DasGupta, R. Financial performance shortfall, ESG controversies, and ESG performance: Evidence from firms around the world. Financ. Res. Lett. 2022, 46, 102487. [Google Scholar] [CrossRef]

- Chininga, E.; Alhassan, A.L.; Zeka, B. ESG ratings and corporate financial performance in South Africa. J. Account. Emerg. Econ. 2024, 14, 692–713. [Google Scholar] [CrossRef]

- Jung, Y.L.; Yoo, H.S. Environmental, social, and governance activities and firm performance: Global evidence and the moderating effect of market competition. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 2830–2839. [Google Scholar] [CrossRef]

- Zhang, C.; Jin, S. What Drives Sustainable Development of Enterprises? Focusing on ESG Management and Green Technology Innovation. Sustainability 2022, 14, 11695. [Google Scholar] [CrossRef]

- Zhou, G.; Liu, L.; Luo, S. Sustainable development, ESG performance and company market value: Mediating effect of financial performance. Bus. Strategy Environ. 2022, 31, 3371–3387. [Google Scholar] [CrossRef]

- Duque-Grisales, E.; Aguilera-Caracuel, J. Environmental, social and governance (ESG) scores and financial performance of multilatinas: Moderating effects of geographic international diversification and financial slack. J. Bus. Ethics 2021, 168, 315–334. [Google Scholar] [CrossRef]

- Ahmad, H.; Yaqub, M.; Lee, S.H. Environmental-, social-, and governance-related factors for business investment and sustainability: A scientometric review of global trends. Environ. Dev. Sustain. 2024, 26, 2965–2987. [Google Scholar] [CrossRef]

- Hornuf, L.; Yüksel, G. The performance of socially responsible investments: A meta-analysis. Eur. Financ. Manag. 2024, 30, 1012–1061. [Google Scholar] [CrossRef]

- Huang, D.Z. Environmental, social and governance (ESG) activity and firm performance: A review and consolidation. Account. Financ. 2021, 61, 335–360. [Google Scholar] [CrossRef]

- Khan, M.A. ESG disclosure and firm performance: A bibliometric and meta-analysis. Res. Int. Bus. Financ. 2022, 61, 101668. [Google Scholar] [CrossRef]

- Hasan, M.; Hoque, A.; Abedin, M.Z.; Gasbarro, D. FinTech and sustainable development: A systematic thematic analysis using human- and machine-generated processing. Int. Rev. Financ. Anal. 2024, 95, 103473. [Google Scholar] [CrossRef]

- Saini, N.; Singhania, M.; Hasan, M.; Yadav, M.P.; Abedin, M.Z. Non-financial disclosures and sustainable development: A scientometric analysis. J. Clean. Prod. 2022, 381, 135173. [Google Scholar] [CrossRef]

- Galletta, S.; Mazzù, S.; Naciti, V. A bibliometric analysis of ESG performance in the banking industry: From the current status to future directions. Res. Int. Bus. Financ. 2022, 62, 101684. [Google Scholar] [CrossRef]

- Zeng, L.; Li, H.; Lin, L.; Hu, D.J.J.; Liu, H. ESG Standards in China: Bibliometric Analysis, Development Status Research, and Future Research Directions. Sustainability 2024, 16, 7134. [Google Scholar] [CrossRef]

- Chen, C.; Ibekwe-SanJuan, F.; Hou, J. The structure and dynamics of cocitation clusters: A multiple-perspective cocitation analysis. J. Am. Soc. Inf. Sci. Technol. 2010, 61, 1386–1409. [Google Scholar] [CrossRef]

- Fuadah, L.L.; Mukhtaruddin, M.; Andriana, I.; Arisman, A. The ownership structure, and the environmental, social, and governance (ESG) disclosure, firm value and firm performance: The audit committee as moderating variable. Economies 2022, 10, 314. [Google Scholar] [CrossRef]

- Kim, J.; Son, S.; Jin, I. The Effects of Shareholding of the National Pension Fund on Environmental, Social, Governance, and Financial Performance: Evidence from the Korean Manufacturing Industry. Sustainability 2022, 14, 11788. [Google Scholar] [CrossRef]

- Koroleva, E.; Baggieri, M.; Nalwanga, S. Company performance: Are environmental, social, and governance factors important. Int. J. Technol. 2020, 11, 1468–1477. [Google Scholar] [CrossRef]

- Saini, N.; Antil, A.; Gunasekaran, A.; Malik, K.; Balakumar, S. Environment-social-governance disclosures nexus between financial performance: A sustainable value chain approach. Resour. Conserv. Recycl. 2022, 186, 106571. [Google Scholar] [CrossRef]

- Zhou, S.; Rashid, M.H.U.; Mohd. Zobair, S.A.; Sobhani, F.A.; Siddik, A.B. Does ESG impact firms’ sustainability performance? The mediating effect of innovation performance. Sustainability 2023, 15, 5586. [Google Scholar] [CrossRef]

- Cai, W.X.; Deng, L.L.; Liu, Y. ESG Performance and Corporate Financial Performance under the Dual Carbon Goal—Based on the Moderating Role of External Pressures. Financ. Theory Pract. 2023, 06, 69–81. [Google Scholar] [CrossRef]

- Guan, X.M.; Shen, M. A Study on the Impact of Government Subsidies and ESG Performance on Firms’ Innovation Performance. Account. Financ. 2023, 04, 72–80. [Google Scholar] [CrossRef]

- He, Y. Research on the Impact of ESG Performance on Financial Performance of Listed Companies. Account. Financ. 2023, 03, 14–22. [Google Scholar] [CrossRef]

- Li, R.J.; Liu, J.L. A Study on the Impact of ESG Performance and Firms’ Financial Performance—Based on the Perspective of Government Subsidies. Manag. Adm. 2023, 12, 1–12. [Google Scholar] [CrossRef]

- Ming, J.R.; Bong, Y.X.; Xu, Z.Y.; Wang, Z.R.; Zhang, D.; Wang, Z.L. ESG performance and corporate green innovation performance: Influence mechanisms and empirical evidence. Commun. Financ. Account. 2023, 24, 28–32. [Google Scholar] [CrossRef]

- Sheng, Y.M.; Liu, C.N.; Liu, T. A study on the relationship between ESG and financial performance of pharmaceutical manufacturing companies. Friends Account. 2023, 12, 1–8. [Google Scholar]

- Sheng, M.Q.; Ouyang, W.H. ESG performance, green technology innovation and short-term financial performance. Technol. Innov. Manag. 2023, 44, 446–455. [Google Scholar] [CrossRef]

- Wang, W.D.; Yang, Y. How does ESG investment affect commercial bank performance? The Moderating Role of External Pressure. Financ. Econ. 2023, 12, 1–14. [Google Scholar] [CrossRef]

- Wang, X.L.; Zhang, X.J.; Wang, N. ESG Disclosure, Debt Financing Cost and Firm Performance: Empirical Evidence Based on Listed Companies in Pharmaceutical Manufacturing Industry. Friends Account. 2023, 13, 82–91. [Google Scholar] [CrossRef]

- Xia, X.; Ren, J.H.; Chen, Z.; Yuan, X.F. Research on ESG Performance, Financing Constraints and Financial Performance of Enterprises. J. Shandong Technol. Bus. Univ. 2023, 37, 1–11. [Google Scholar] [CrossRef]

- Xie, X.Y.; Xie, Y. The impact of ESG ratings on the financial performance of technology-based enterprises. Co-Oper. Econ. Sci. 2023, 13, 150–152. [Google Scholar] [CrossRef]

- Yan, W.X.; Zhao, Y.; Meng, D.F. Study on the Influence of ESG on the Financial Performance of Listed Companies. J. Nanjing Audit Univ. 2023, 20, 71–80. [Google Scholar]

- Yang, Y. A study on the impact of ESG disclosure on firm value—mediating effect based on financial performance and innovation capability. Sci-Tech Dev. Enterp. 2023, 09, 96–100. [Google Scholar] [CrossRef]

- Yang, R.B.; Deng, C.T.; Hou, X.Z. The Impact of ESG Performance on Firm Performance. J. Technol. Econ. 2023, 42, 124–134. [Google Scholar]

- Ahn, J.S.; Chung, S.H.; Lee, S.R.; Park, J.W. The Effect of ESG Activities on the Business Performance. J. Korean Soc. Aviat. Aeronaut. 2022, 30, 92–108. [Google Scholar] [CrossRef]

- Ahn, S.H.; Ahn, J.H.; Han, I.G. The Impact of ESG Activities on the Financial Performances of Korean Firms: Moderating Effect of B2C and B2B Company Types. Korean Manag. Sci. Rev. 2023, 40, 59–75. [Google Scholar] [CrossRef]

- Chung, B.C.; Kim, C.S. The Effect of Creating Shared Value Activities from the ESG Perspective on Sense of Community and Performance of the Experiential Fishing Village. J. Mar. Tour. Res. 2022, 15, 29–52. [Google Scholar] [CrossRef]

- Hwang, E.J.; Cho, S.M.; Ahn, J.Y. ESG Management and Organizational Performance of Public Institutions: The moderating effect of CEO leadership and commitment-based human resource management system. J. Soc. Value Enterp. 2022, 15, 133–163. [Google Scholar] [CrossRef]

- Jung, J.H.; Park, H.S. A Study on the Effect of Corporate ESG Activities on Business Performance: Focusing on the Moderating Effect of Corporate Values Perception. Ind. Promot. Res. 2022, 7, 15–29. [Google Scholar] [CrossRef]

- Kim, M.J. A Study on the Effects of ESG’s Shared Value Creation Activity on Social Capital and Organizational Performance: Focusing on Korean Global Network Marketing Company A. Korean Rev. Corp. Manag. 2021, 12, 17–40. [Google Scholar] [CrossRef]

- Kim, R.A.; Kim, T.M.; Huh, J.H. Analysis of the Structural Relationship Between ESG Management, Job Satisfaction, and Financial Performance. Korean J. Bus. Ethics 2022, 22, 27–47. [Google Scholar] [CrossRef]

- Kim, T.M.; Kim, R.A.; Huh, J.H. The Influence of ESG Management on Financial Performance: The Mediation Effect of Customer Satisfaction. J. CEO Manag. Stud. 2022, 25, 159–176. [Google Scholar] [CrossRef]

- Kim, Y.S. The impact of ESG management on the Corporate Performance of Shipping and Logistics Companies: The mediating effect of Organizational Culture. J. Korea Port Econ. Assoc. 2023, 39, 75–90. [Google Scholar] [CrossRef]

- Kim, Y. S, The mediating effect of organizational commitment on the impact of ESG activities on business performance in logistics companies. J. Korea Res. Assoc. Int. Commer. 2023, 23, 203–224. [Google Scholar] [CrossRef]

- Park, H.H. The Effect of ESG Management on the Financial Performance and Firm Value of Logistics Provider. Local Ind. Res. 2023, 46, 277–296. [Google Scholar] [CrossRef]

- Park, T.; Kim, J.D. A Study on the Effect of Internal and External Pressures on ESG Activities and Business Performance. J. Korean Soc. Ind. Syst. Eng. 2023, 46, 1–14. [Google Scholar] [CrossRef]

- Yang, B.M.; Yang, O.S. A Study on the Effect of ESG on Corporate Performance: Focusing on the Moderating Effect of Balanced ESG Management Strategy. Int. Bus. Rev. 2023, 27, 115–128. [Google Scholar]

- Zeng, Z.; Oh, M.; Choi, S. An Empirical Study on the Relationship between Corporate ESG Activities, Green Innovation and Corporate Performance: Focused on the Chinese Manufacturing Companies. J. Korean Soc. Ind. Syst. Eng. 2022, 45, 186–196. [Google Scholar] [CrossRef]

- Chytis, E.; Eriotis, N.; Mitroulia, M. ESG in Business Research: A Bibliometric Analysis. J. Risk Financ. Manag. 2024, 17, 460. [Google Scholar] [CrossRef]

- Fatemi, A.; Glaum, M.; Kaiser, S. ESG performance and firm value: The moderating role of disclosure. Glob. Financ. J. 2018, 38, 45–64. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate Social and Financial Performance: A Meta-Analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B. The Corporate Social Performance-Financial Performance Link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Gillan, S.L.; Koch, A.; Starks, L.T. Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corp. Financ. 2021, 66, 101889. [Google Scholar] [CrossRef]

- Augusteijn, H.E.; van Aert, R.; van Assen, M.A. The effect of publication bias on the Q test and assessment of heterogeneity. Psychol. Methods 2019, 24, 116. [Google Scholar] [CrossRef]

- Higgins, J.P.; Thompson, S.G.; Deeks, J.J.; Altman, D.G. Measuring inconsistency in meta-analyses. BMJ 2003, 327, 557–560. [Google Scholar] [CrossRef]

- Lipsey, M.W.; Wilson, D.B. Practical Meta-Analysis; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2001. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).