A Study on the Impact of External Shocks on the Resilience of China’s Grain Supply Chain

Abstract

:1. Introduction

2. Literature Review

3. Theoretical Analysis and Hypotheses

3.1. Grain Supply Chain Resilience

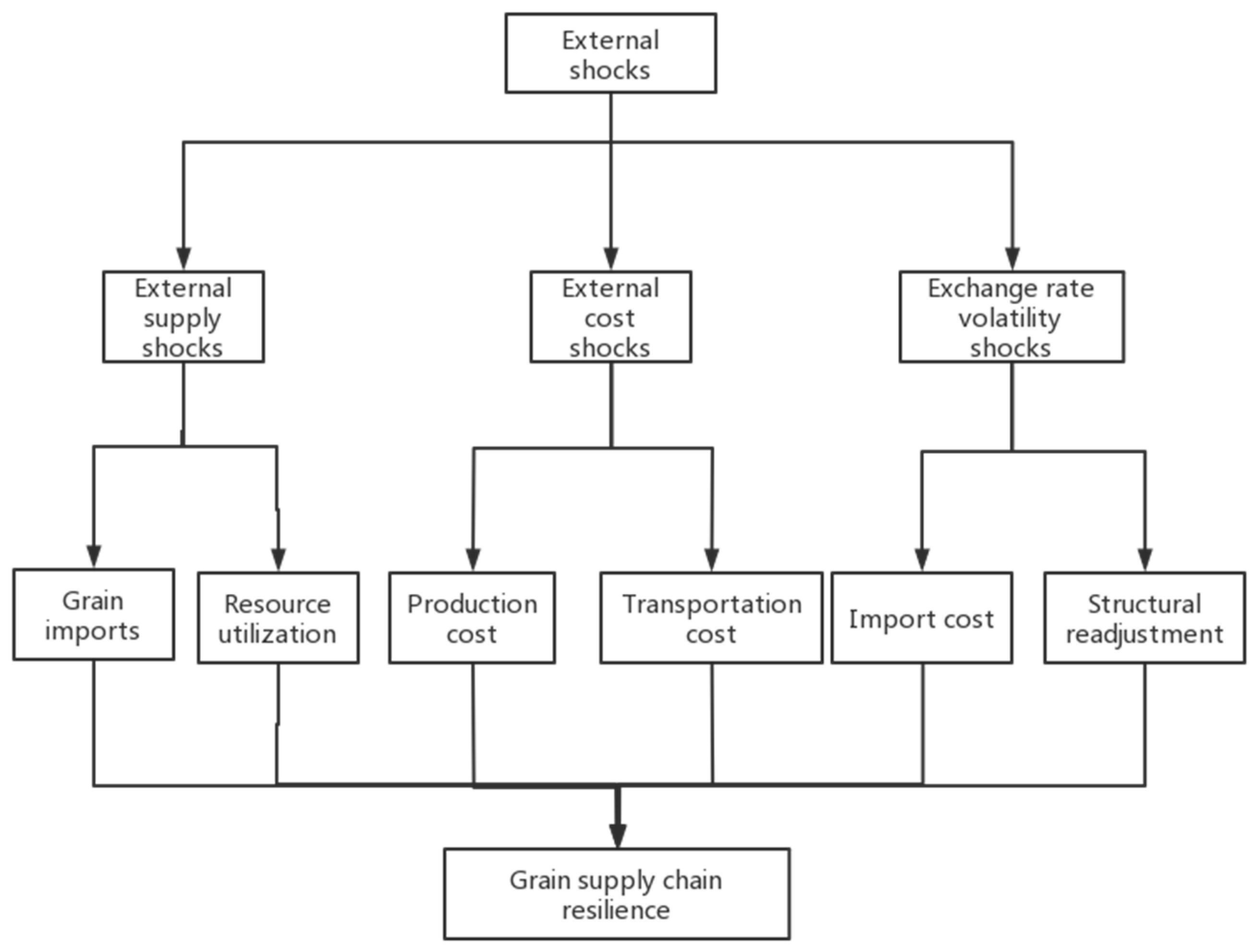

3.2. Mechanisms of External Shocks on the Resilience of China’s Grain Supply Chain

4. Materials and Methods

4.1. The Construction of China’s Grain Supply Chain Resilience Indicator System

4.2. Model Construction

4.3. Selection of Variables

- The dependent variable is grain supply chain resilience, which is represented in this paper using the measured total grain supply chain resilience indicator.

- The core explanatory variables are the volume of world grain exports, international oil prices, and the RMB exchange rate. World grain export volume (exp) is an external supply shock factor. Generally speaking, under open economy conditions, the supply factors that affect the grain supply chain depend on China’s external grain dependence. Therefore, referring to the research of Wang Baihao, this paper uses the world grain export volume as the external supply shock [39]. International oil price (oil) is the cost change shock element. Production cost is usually considered as the main supply factor leading to changes in the resilience of China’s grain supply chain. On the one hand, oil price affects supply chain resilience by pushing up production costs. As China’s agricultural mechanization continues to advance, but when the price of oil continues to rise, the cost of grain production will continue to increase, thus affecting the level of supply chain resilience. On the other hand, it affects supply chain resilience by increasing transportation costs. Therefore, referring to Zhang Liang’s study [40], this paper uses the international oil price as an external cost shock. The RMB exchange rate (ex) reflects the exchange rate fluctuation shock, and this paper selects the United States as the representative of the external economy to measure the RMB exchange rate indicator. This paper adopts the indirect valuation method, i.e., the exchange rate is expressed by the quantity of 1 unit of RMB against the US dollar (the following RMB exchange rates are all indirectly valued). An increase in the value of the exchange rate indicates RMB appreciation, while a decrease in the value indicates RMB depreciation, which is conducive to simplifying the understanding of the empirical results. Therefore, referring to Guo Fengjuan, this study utilizes the RMB exchange rate to reflect exchange rate volatility shocks [41].

- Control variables include urbanization rate (urban), industrial structure rationalization (ind), investment in rural fixed assets (inv), total reservoir capacity (cap), and gas price (gas). According to Hao Aimin, using the ratio of the urban population to the total population to represent the urbanization rate (urban) [42]. The rationalization of industrial structure is used to measure the rational distribution and efficient use of resource factors, with the formula TL = /(Y/L)]. The TL indicates the Taylor indicator, where the smaller the value indicates a more reasonable structure. Yi and Y indicate the output value and output value of each industry, Li and L indicate the labor input and total labor force of each sub-industry. The n indicates the number of industry sectors. In this article, n = 3 represents the three-time industry. Reservoirs play an important role in agricultural irrigation, providing farmers with benefits in terms of drought mitigation and grain security. Therefore, the total reservoir capacity is chosen in this paper to measure the impact on the resilience of the grain supply chain. Natural gas plays an important role in grain production, processing, and transportation. Therefore, this paper chooses the natural gas price to measure the impact on the resilience of the grain supply chain.

4.4. Data Sources

5. Results

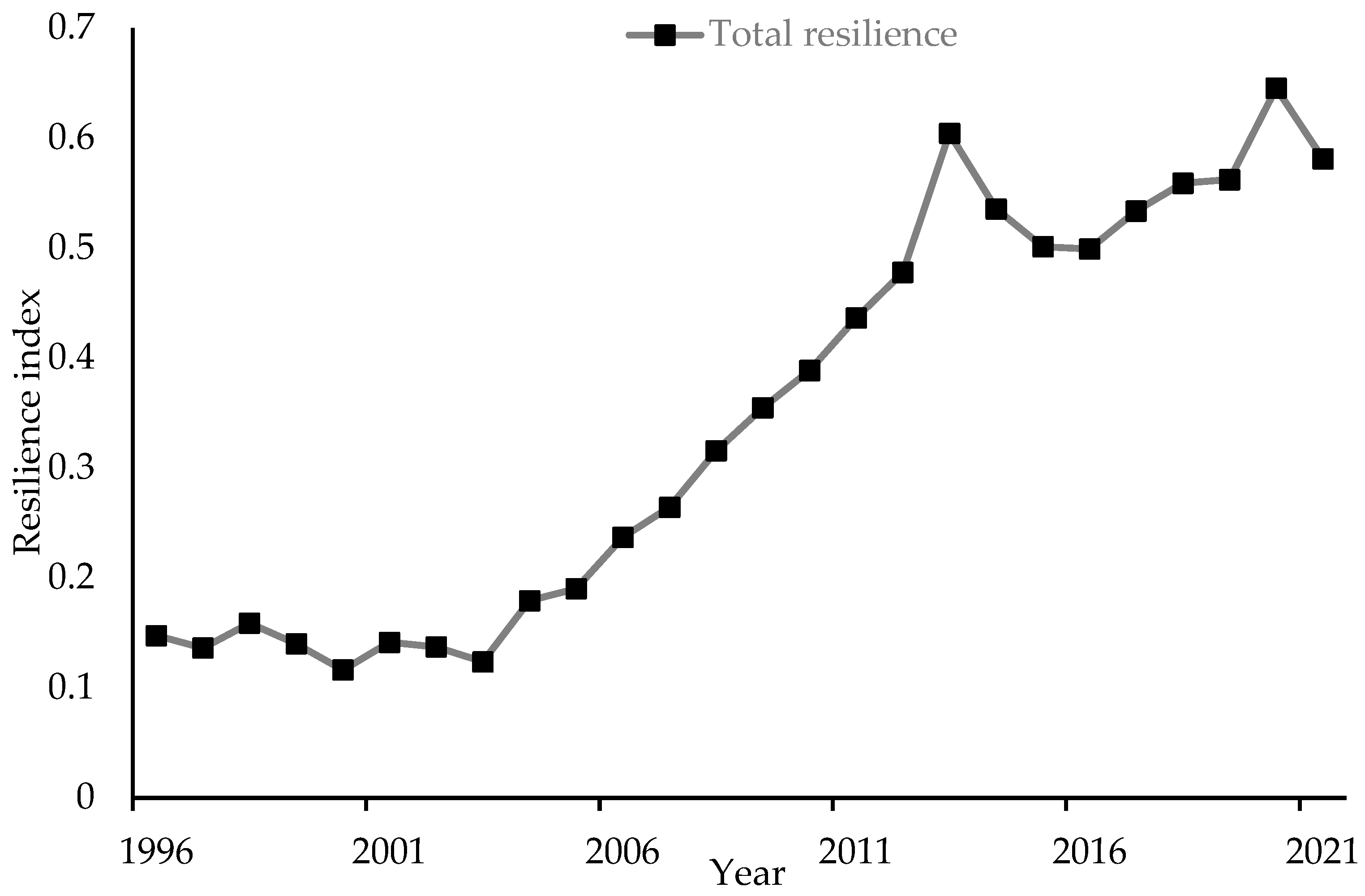

5.1. Results and Trend Analysis of China’s Grain Supply Chain Resilience Measurements

5.2. Stationarity Test

5.3. Results and Trend Analysis of China’s Grain Supply Chain Resilience Measurements

5.4. Robustness Tests

6. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Joshi, S.; Sharma, M.; Ekren, B.Y.; Kazancoglu, Y.; Luthra, S.; Prasad, M. Assessing Supply Chain Innovations for Building Resilient Food Supply Chains: An Emerging Economy Perspective. Sustainability 2023, 15, 4924. [Google Scholar] [CrossRef]

- Chang, J.; Jiang, H. Spatio-Temporal Differentiations and Influence Factors in China’s Grain Supply Chain Resilience. Sustainability 2023, 15, 8074. [Google Scholar] [CrossRef]

- Liao, H.; Hu, X.L.; Liu, S.Q. Analysis of supply chain resilience in China under unfavorable external shocks. Entomol. Econ. 2021, 40, 50–59. [Google Scholar]

- Li, L.G.; Zhang, P.Y.; Tan, J.T.; Guan, H.M. Evolution of the resilience concept and progress of regional economic resilience research. Hum. Geogr. 2019, 34, 1–7. [Google Scholar]

- Fingleton, B.; Garretsen, H.; Martin, R. Recessionary shocks and regional employment: Evidence on the resilience of UK regions. J. Reg. Sci. 2012, 52, 109–133. [Google Scholar] [CrossRef]

- Shaw, K. Managing for local resilience: Towards a strategic approach. Public Adm. Policy 2013, 28, 43–65. [Google Scholar] [CrossRef]

- Martin, R.; Ben, G.; Andy, P.; Peter, S. Economic Shocks and the Differential Resilience of Places. In Regional Studies Policy Impact Books; Taylor & Francis: London, UK, 2013; Volume 28, pp. 43–65. [Google Scholar]

- Chen, M.Y. Progress of international regional economic resilience research: An introduction to the theoretical analysis framework based on evolutionary theory. Progress Geogr. Sci. 2021, 36, 1435–1444. [Google Scholar]

- Su, R.G.; Zhao, X.L. Manufacturing development, entrepreneurial vigor, and urban economic resilience. Flinn. Sci. 2020, 9, 79–92. [Google Scholar]

- Wei, Z.; Xiu, C.L. Exploring the concept and analyzing the framework of urban network resilience. Adv. Geosci. 2020, 39, 488–502. [Google Scholar]

- Larson, P.D. Designing and Managing the Supply Chain: Concepts, Strategies, and Case Studies. J. Bus. Logist. 2001, 22, 259–261. [Google Scholar] [CrossRef]

- Tah, J.; Carr, V. Effectively Managing Vertical Supply Relationships: A Risk Management Model for Outsourcing. Supply Chain. Manag. 2001, 4, 176–183. [Google Scholar]

- Garcia, L.; Steinberger, G.; Rothmund, M. A model and prototype implementation for tracking and tracing agricultural batch products along the grain chain. Food Control 2010, 21, 112–121. [Google Scholar] [CrossRef]

- Mu, W.; Van-Asselt, E.D.; Fels-Klerx, H.J. Towards a resilient food supply chain in the context of food safety. Food Control 2021, 125, 107953. [Google Scholar] [CrossRef]

- Panicker, V.; Akhil, U.S.; Vadlamani, P.S.; Das, A.; Abhishek, T.; Anoop, K.P. Simulation modelling and analysis of warehouse operations in a grain supply chain. Int. J. Logist. Syst. Manag. 2020, 37, 465–487. [Google Scholar]

- Chen, Z. Research on Risk Analysis and Prevention of Grain Supply Chain. Rural. Econ. 2021, 12, 24–28. [Google Scholar]

- Ding, D.; Yang, Y.S. Identification and prevention of key risk points in China’s grain supply chain. Soc. Sci. Front. 2019, 5, 247–250. [Google Scholar]

- Wang, X.Y.; Wang, Z.N.; Kong, J.L. Multidimensional data-driven comprehensive risk evaluation of grain supply chain hazards. J. Grain. Sci. Technol. 2019, 37, 129–138. [Google Scholar]

- Zeng, T. Regional Economic Resilience Connotation Analysis and Indicator System Construction. Reg. Flinn. Res. 2020, 7, 74–78. [Google Scholar]

- Chen, Y.W.; Ding, G.L. Measurement of urban economic resilience of prefecture-level cities in China. Stat. Dec. Mk. 2020, 36, 102–106. [Google Scholar]

- Liu, Z.; Pan, Z.Y.; Yu, G.X. Measurement of urban resilience level and spatial characteristic differentiation in city clusters in the middle reaches of the Yangtze River. Economy 2021, 3, 27–34. [Google Scholar]

- Brakman, S.; Garretsen, H. Regional resilience across Europe: On urbanization and the initial impact of the Great Recession. Camb. J. Reg. Econ. Soc. 2015, 8, 225–240. [Google Scholar] [CrossRef]

- Bergeijk, P.; Brakman, S.; Marrewijk, C. Heterogeneous economic resilience and the great recession’s world trade collapse. Pap. Reg. Sci. 2017, 96, 3–12. [Google Scholar] [CrossRef]

- Martin, R. Rebuilding the economy from the Covid crisis: Time to rethink regional studies? Reg. Stud. Reg. Sci. 2021, 8, 143–161. [Google Scholar] [CrossRef]

- Swanepoel, J.A. The impact of external shocks on South African inflation at different price stages. In Studies in Economics and Econometrics; Taylor & Francis: London, UK, 2006; Volume 30, pp. 1–22. [Google Scholar]

- Gosse, J.B.; Guillaumin, C. Can external shocks explain the Asian side of global imbalances? Lessons from a structural VAR model with block exogeneity. Rev. Int. Econ. 2013, 21, 85–102. [Google Scholar] [CrossRef]

- Anetor, F.O. Foreign capital inflows, financial development, and growth in Nigeria: A structural VAR approach. J. Dev. Areas 2020, 54, 69–86. [Google Scholar] [CrossRef]

- Omoshoro, J.; Oyeyinka, S. Global imbalances, external adjustment, and propagated shocks: An African perspective from a global VAR model. Int. Econ. 2021, 165, 186–203. [Google Scholar] [CrossRef]

- Olamide, E.; Maredza, A.; Ogujiuba, K. Monetary Policy, External Shocks and Economic Growth Dynamics in East Africa: An S-VAR Model. Sustainability 2022, 14, 3490. [Google Scholar] [CrossRef]

- Liu, J.Q. Modern Macroeconomic Shock Theory, 1st ed.; Jilin University Press: Changchun, China, 2000; pp. 26–27. [Google Scholar]

- Liu, S.C. Modern Economic Dictionary, 1st ed.; Jiangsu People’s Publishing House: Nanjing, China, 2005; pp. 113–119. [Google Scholar]

- Li, X.; Zhou, Y. Analysis of the impact of external shocks on domestic agricultural products price fluctuation. Technol. Econ. 2023, 4, 116–119. [Google Scholar]

- Zhang, L.; Zhang, X. Study on the impact of external shock on the price fluctuation of agricultural products in China: Based on the perspective of the agricultural industry chain. J. Manag. World 2021, 1, 71–81. [Google Scholar]

- Luo, F. The impact of external shocks on the price fluctuation of agricultural products in China: Empirical study based on the SVAR model. Agric. Technol. Econ. 2011, 10, 4–11. [Google Scholar]

- Man, K. Study on the instability criterion for dynamic fracture resilience testing of rocks. Sci. Technol. Eng. 2016, 16, 147–152. [Google Scholar]

- Li, S.Q.; Chen, W.; Zha, Y. Study on transverse and longitudinal differences in impact resilience of large forged bars of TC18 alloy. R. Mt. Mats. Eng. 2021, 50, 911–917. [Google Scholar]

- Falkendal, T.; Otto, C.; Schewe, J. Grain export restrictions during COVID-19 risk food insecurity in many low- and middle-income countries. Nat. Food 2021, 2, 11–14. [Google Scholar] [CrossRef] [PubMed]

- Cao, D.; He, Z.; Zhang, J. Resilience-vulnerability study of the whole industry chain of the rail transportation industry. Econ. Math. 2020, 37, 16–26. [Google Scholar]

- Wang, B.H. An Empirical Study on the Impact of International Grain Price Volatility on China’s Grain Security. Master’s Thesis, Jiangxi University of Finance and Economics, Nanchang, China, 2018. [Google Scholar]

- Zhang, L. Analysis of the Impact Mechanism of External Shocks on the Price Volatility of Agricultural Products in China. Master’s Thesis, Northeast University of Finance and Economics, Tianjin, China, 2012. [Google Scholar]

- Guo, F.J.; Ding, J.P. Research on the interaction among RMB internationalization, exchange rate, and cross-border capital flows. Contemp. Econ. Sci. 2023, 45, 1–12. [Google Scholar]

- Hao, A.M.; Tan, J.Y. The impact of digital village construction on the resilience of China’s grain system. J. S. China Agric. Univ. 2022, 21, 10–24. [Google Scholar]

| Primary Indicators | Secondary Indicators | Tertiary Indicators | Interpretation of Indicators | Unit | Indicator Attributes |

|---|---|---|---|---|---|

| Supply chains total resilience | Supply chain fracture resilience | Production capacity | Grain total output/average number of people in the primary industry | T/person | + |

| Warehousing capacity | Grain total output + net grain imports − grain sales volume | WT | + | ||

| Transport capacity | Total agricultural logistics | Trillion RMB | + | ||

| Processing capability | Finished goods/average number of workers | 10,000 RMB/person | + | ||

| Sales ability | Expressed in terms of the number of grain product movements, calculated as: grain sales/average grain stocks | % | + | ||

| Supply chain impact resilience | Financial support | Financial support for agriculture | Billion RMB | + | |

| Financial support | Balance of loans to financial institutions for manufacturing agricultural production materials in local and foreign currencies as a percentage of all loans | % | + | ||

| External Dependence | Grain imports/total grain production | % | - | ||

| R&D capability | Number of valid invention patents | PCS | + | ||

| Innovation capacity | Senior Agricultural Technician | Person | + | ||

| Capacity to translate results into action | Contractual turnover of the State Fund for the Transformation of Agricultural Science and Technology Achievements | Billion RMB | + | ||

| Disaster resistance | The area of the disaster/become the area of the disaster | % | + | ||

| Supply chain synergy resilience | Synergy between production and marketing | Grain production in the year/grain sales in the year | % | + | |

| Synergy between purchase and sale | Grain purchases in the year/grain sales in the year | % | + | ||

| Information synergy | Informatization development indicator | % | + | ||

| Transportation network | Road density | 1000 km | + | ||

| Circulation efficiency | Grain cargo turnover | WT | + |

| Variable | Connotation | Mean | Me | Max | Min | SD |

|---|---|---|---|---|---|---|

| res | Total grain supply chain resilience | 0.3447 | 0.34 | 0.65 | 0.12 | 0.186 |

| lnexp | World grain exports | 1.3806 | 1.33 | 1.86 | 0.88 | 0.308 |

| lnoil | International oil price | 3.8611 | 3.98 | 4.60 | 2.67 | 0.568 |

| ex | RMB exchange rate | 0.1383 | 0.14 | 0.16 | 0.12 | 0.016 |

| urban | Urbanization rate | 0.4756 | 0.48 | 0.65 | 0.30 | 0.102 |

| ind | Rationalization of industrial structure | 5.6329 | 4.51 | 11.04 | 3.10 | 2.377 |

| lninv | Investment in rural fixed assets | 7.7114 | 7.92 | 10.02 | 4.69 | 1.776 |

| lncap | Total reservoir capacity | 8.8180 | 8.85 | 9.20 | 8.43 | 0.249 |

| lngas | Price of natural gas | 3.2787 | 3.24 | 4.27 | 2.64 | 0.480 |

| Variable | t | p | 1% Critical Value | 5% Critical Value | 10% Critical Value | Conclusion |

|---|---|---|---|---|---|---|

| res | −4.329 | 0.3447 | 0.34 | 0.65 | 0.12 | stationary |

| lnexp | −6.492 | 1.3806 | 1.33 | 1.86 | 0.88 | stationary |

| lnoil | −4.647 | 3.8611 | 3.98 | 4.60 | 2.67 | stationary |

| ex | −3.928 | 0.1383 | 0.14 | 0.16 | 0.12 | stationary |

| urban | −6.116 | 0.4756 | 0.48 | 0.65 | 0.30 | stationary |

| ind | −3.705 | 5.6329 | 4.51 | 11.04 | 3.10 | stationary |

| lninv | −3.103 | 7.7114 | 7.92 | 10.02 | 4.69 | stationary |

| lncap | −3.986 | 8.8180 | 8.85 | 9.20 | 8.43 | stationary |

| lngas | −4.331 | 3.2787 | 3.24 | 4.27 | 2.64 | stationary |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| res | res | res | res | res | res | |

| lnexp | 0.3710 *** | 0.2818 *** | 0.1954 *** | 0.1662 *** | 0.2391 *** | 0.2347 *** |

| (0.0474) | (0.0803) | (0.0341) | (0.0311) | (0.0344) | (0.0304) | |

| lnoil | −0.2092 *** | −0.3602 *** | −0.3384 *** | −0.4102 *** | −0.4083 *** | −0.3963 *** |

| (0.0218) | (0.0312) | (0.0341) | (0.0350) | (0.0373) | (0.0397) | |

| ex | 5.2420 *** | 5.4287 *** | 4.0976 *** | 2.4808 ** | 2.5110 ** | 2.6351 ** |

| (1.1068) | (1.1530) | (1.0499) | (1.0014) | (1.2304) | (1.2353) | |

| urban | 0.5999 | −0.1422 | −0.3202 | −0.3112 | 0.1649 | |

| (0.8758) | (0.7677) | (0.7921) | (0.9478) | (0.8562) | ||

| ind | 0.0302 *** | 0.0413 ** | 0.0412 ** | 0.0267 | ||

| (0.0095) | (0.0151) | (0.0164) | (0.0156) | |||

| lninv | 0.0425 | 0.0424 | 0.0229 | |||

| (0.0447) | (0.0463) | (0.0415) | ||||

| lncap | −0.0065 | 0.0028 | ||||

| (0.3526) | (0.3105) | |||||

| lngas | −0.0788 ** | |||||

| (0.0316) | ||||||

| _cons | −0.8118 *** | −0.8035 *** | −0.7247 *** | −0.5668 *** | −0.5193 | −0.3336 |

| (0.0794) | (0.0813) | (0.0722) | (0.1813) | (2.5915) | (2.2831) | |

| N | 26 | 26 | 26 | 26 | 26 | 26 |

| adj. R2 | 0.953 | 0.952 | 0.967 | 0.966 | 0.965 | 0.973 |

| F-statistics | 171.08 | 125.33 | 145.79 | 121.05 | 98.30 | 111.71 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| res | res | res | res | res | res | |

| lnexp | 0.3579 *** | 0.3539 *** | 0.3744 *** | 0.3664 *** | 0.3528 *** | 0.3713 *** |

| (0.0535) | (0.0883) | (0.0415) | (0.0182) | (0.0353) | (0.0312) | |

| lnoil | −0.2893 *** | −0.4593 *** | −0.2574 *** | 0.3431 *** | 0.3414 *** | 0.1005 ** |

| (0.0264) | (0.0356) | (0.0378) | (0.0393) | (0.0418) | (0.0463) | |

| ex | 5.0250 *** | 5.2027 *** | 3.9424 *** | 2.4614 ** | 2.4949 ** | 2.6011 ** |

| (1.1895) | (1.2283) | (1.1067) | (1.0471) | (1.0942) | (1.2135) | |

| urban | 0.6426 | −0.1026 | −0.2784 | −0.2685 | 0.1564 | |

| (0.8920) | (0.7850) | (0.8162) | (0.9766) | (0.8826) | ||

| ind | 0.0299 *** | 0.0404 ** | 0.0403 ** | 0.0268 | ||

| (0.0097) | (0.0156) | (0.0170) | (0.0161) | |||

| lninv | 0.0398 | 0.0397 | 0.0237 | |||

| (0.0462) | (0.0478) | (0.0429) | ||||

| lncap | −0.0072 | 0.0033 | ||||

| (0.3611) | (0.3197) | |||||

| lngas | −0.0806 ** | |||||

| (0.0338) | ||||||

| poil | 0.0238 | 0.0262 | 0.0196 | 0.0152 | 0.0152 | −0.0067 |

| (0.0425) | (0.0432) | (0.0362) | (0.0368) | (0.0379) | (0.0348) | |

| _cons | −0.7476 *** | −0.7321 *** | −0.6721 *** | −0.5359 ** | −0.4831 | −0.3455 |

| (0.1403) | (0.1435) | (0.1217) | (0.1999) | (2.6556) | (2.3514) | |

| N | 26 | 26 | 26 | 26 | 26 | 26 |

| adj. R2 | 0.952 | 0.951 | 0.965 | 0.965 | 0.963 | 0.971 |

| F-statistics | 124.38 | 97.33 | 117.25 | 99.25 | 82.02 | 93.68 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| ri | ri | lngrain | lngrain | lngrainp | lngrainp | |

| lnexp | 0.1191 *** | 0.1121 *** | 0.4679 *** | 0.1721 *** | 0.3320 *** | 0.2112 *** |

| (0.0365) | (0.0297) | (0.0719) | (0.0388) | (0.0739) | (0.0386) | |

| lnoil | −0.0947 *** | −0.0629 *** | −0.0844 ** | −0.0916 * | −0.0992 *** | −0.0924 * |

| (0.0168) | (0.0188) | (0.0331) | (0.0508) | (0.0340) | (0.0506) | |

| ex | 4.0325 *** | 3.5032 ** | 7.3662 *** | 5.2575 *** | 7.6020 *** | 5.0575 ** |

| (0.8522) | (1.3840) | (1.6797) | (1.1182) | (1.7267) | (2.1049) | |

| urban | 0.1398 | −1.3004 | −1.5342 | |||

| (0.8381) | (1.0963) | (1.0916) | ||||

| ind | 0.0081 | 0.0840 *** | 0.0856 *** | |||

| (0.0153) | (0.0200) | (0.0199) | ||||

| lninv | 0.0323 | 0.1538 ** | 0.1452 ** | |||

| (0.0406) | (0.0531) | (0.0529) | ||||

| lncap | 0.0030 | −0.2761 | −0.2759 | |||

| (0.3040) | (0.3976) | (0.3959) | ||||

| lngas | −0.0616 * | −0.0482 | −0.0518 | |||

| (0.0310) | (0.0405) | (0.0403) | ||||

| _cons | −0.5617 *** | −0.1885 | 9.6536 *** | 12.6021 *** | 4.9762 *** | 7.9147 ** |

| (0.0611) | (2.2350) | (0.1204) | (2.9233) | (0.1238) | (2.9108) | |

| N | 26 | 26 | 26 | 26 | 26 | 26 |

| adj. R2 | 0.907 | 0.911 | 0.928 | 0.970 | 0.889 | 0.957 |

| F-statistics | 81.87 | 33.09 | 108.93 | 102.10 | 67.99 | 69.84 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| res | res | res | res | res | res | res | |

| lnexp(−1) | 0.3870 *** | 0.5184 *** | 0.3286 *** | 0.4584 *** | 0.6070 *** | 0.9122 *** | 0.7577 *** |

| (0.0524) | (0.0309) | (0.0584) | (0.0855) | (0.0962) | (0.0990) | (0.0309) | |

| lnoil(−1) | −0.2796 *** | −0.2654 *** | −0.2510 *** | −0.2494 *** | −0.2492 *** | −0.2548 *** | −0.2455 *** |

| (0.0233) | (0.0344) | (0.0331) | (0.0336) | (0.0345) | (0.0351) | (0.0427) | |

| ex(−1) | 3.8494 *** | 4.2726 *** | 3.1443 *** | 2.9396 *** | 2.6410 ** | 2.8052 * | 2.2090 * |

| (1.1848) | (1.2402) | (1.0975) | (1.0643) | (1.2979) | (1.4725) | (1.3261) | |

| urban | 1.0658 | 0.4173 | 0.1390 | −0.0099 | 0.3280 | 0.3845 | |

| (0.9691) | (0.8358) | (0.9378) | (1.0601) | (1.1233) | (1.1620) | ||

| ind | 0.0297 *** | 0.0362 ** | 0.0365 ** | 0.0285 | 0.0272 | ||

| (0.0095) | (0.0135) | (0.0139) | (0.0164) | (0.0171) | |||

| lninv | 0.0322 | 0.0305 | 0.0288 | 0.0217 | |||

| (0.0465) | (0.0480) | (0.0482) | (0.0525) | ||||

| lncap | 0.1065 | 0.1071 | 0.0876 | ||||

| (0.3185) | (0.3197) | (0.3318) | |||||

| lngas | −0.0318 | −0.0298 | |||||

| (0.0339) | (0.0352) | ||||||

| poil | 0.0185 | ||||||

| (0.0454) | |||||||

| _cons | −0.8114 *** | −0.8202 *** | −0.6910 *** | −0.5674 *** | −1.3621 | −1.2320 | −1.0828 |

| (0.0848) | (0.0848) | (0.0821) | (0.1968) | (2.3858) | (2.3984) | (2.4905) | |

| N | 25 | 25 | 25 | 25 | 25 | 25 | 25 |

| adj. R2 | 0.946 | 0.947 | 0.963 | 0.962 | 0.960 | 0.960 | 0.957 |

| F-statistics | 142.19 | 108.01 | 125.81 | 102.05 | 83.17 | 72.37 | 60.99 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zheng, T.; Zhao, G.; Chu, S. A Study on the Impact of External Shocks on the Resilience of China’s Grain Supply Chain. Sustainability 2024, 16, 956. https://doi.org/10.3390/su16030956

Zheng T, Zhao G, Chu S. A Study on the Impact of External Shocks on the Resilience of China’s Grain Supply Chain. Sustainability. 2024; 16(3):956. https://doi.org/10.3390/su16030956

Chicago/Turabian StyleZheng, Tao, Guiqian Zhao, and Siwei Chu. 2024. "A Study on the Impact of External Shocks on the Resilience of China’s Grain Supply Chain" Sustainability 16, no. 3: 956. https://doi.org/10.3390/su16030956