Revealing the Supply Chain 4.0 Potential within the European Automotive Industry

Abstract

:1. Introduction

2. Literature Review

2.1. Supply Chain Management

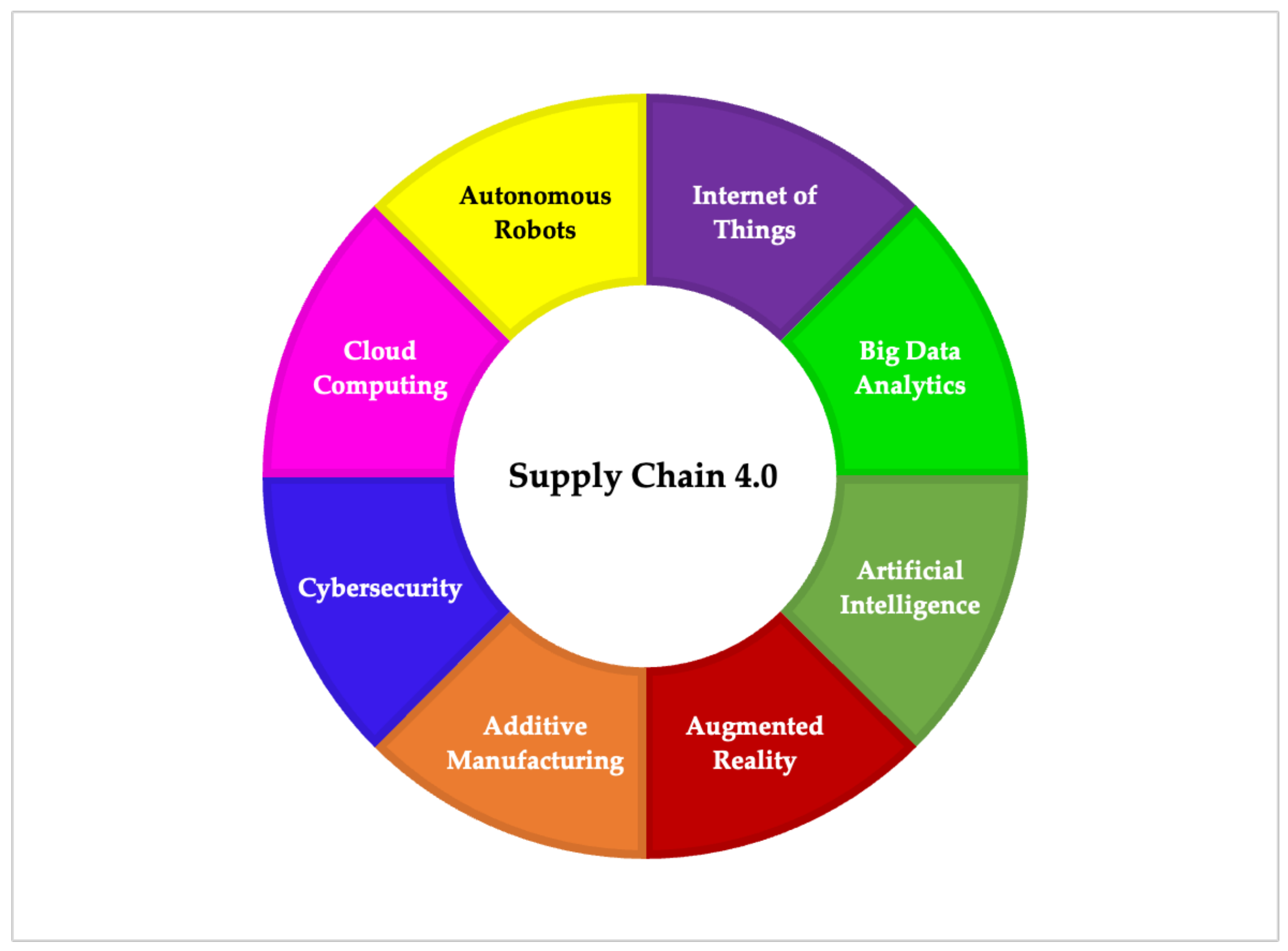

2.2. Industry 4.0

2.3. Industry 4.0 and Opportunities for Automotive Nexus

2.4. Illustration of Research Trends

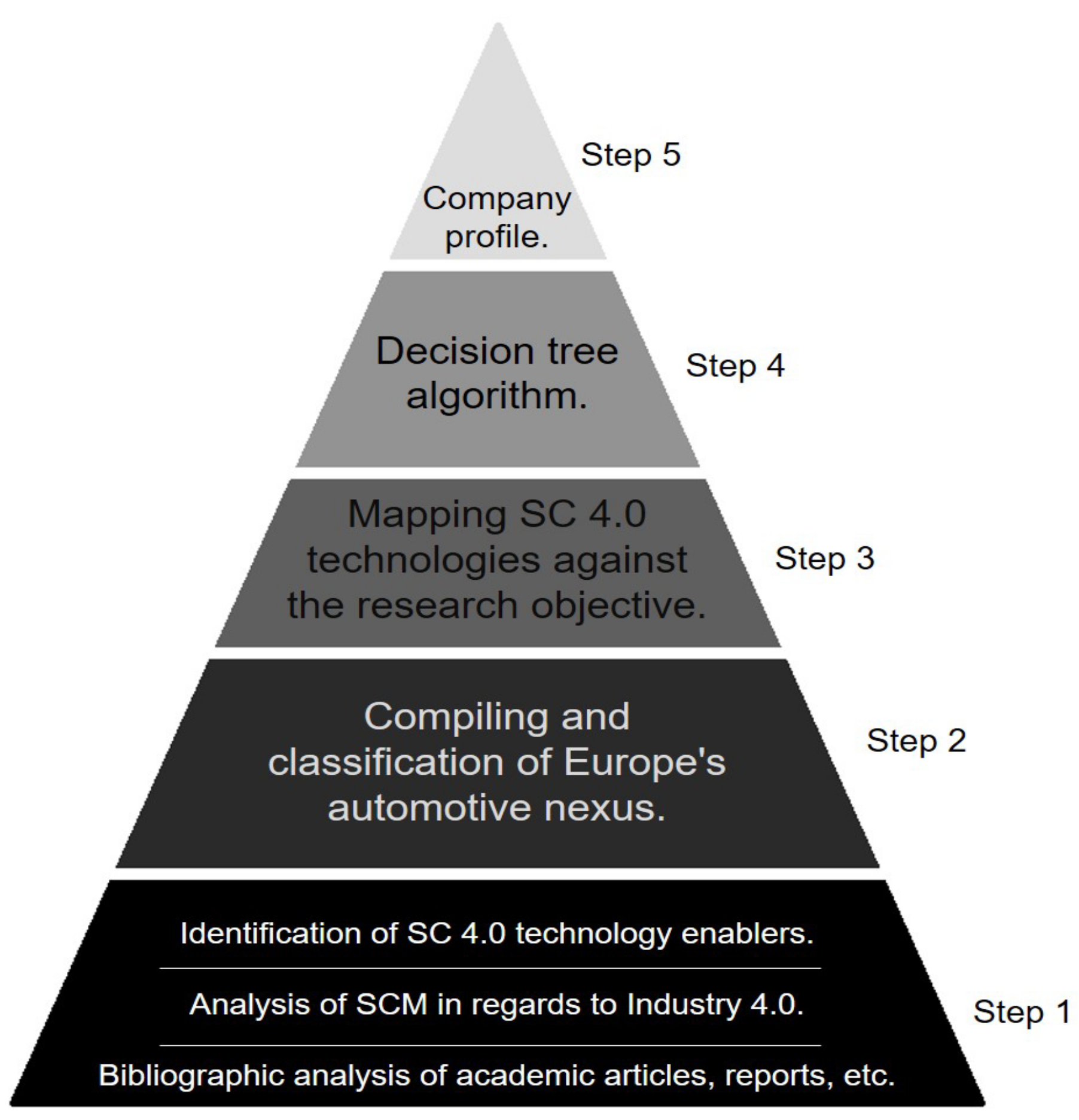

3. Research Method and Implementation

3.1. Data Acquisition and Collection

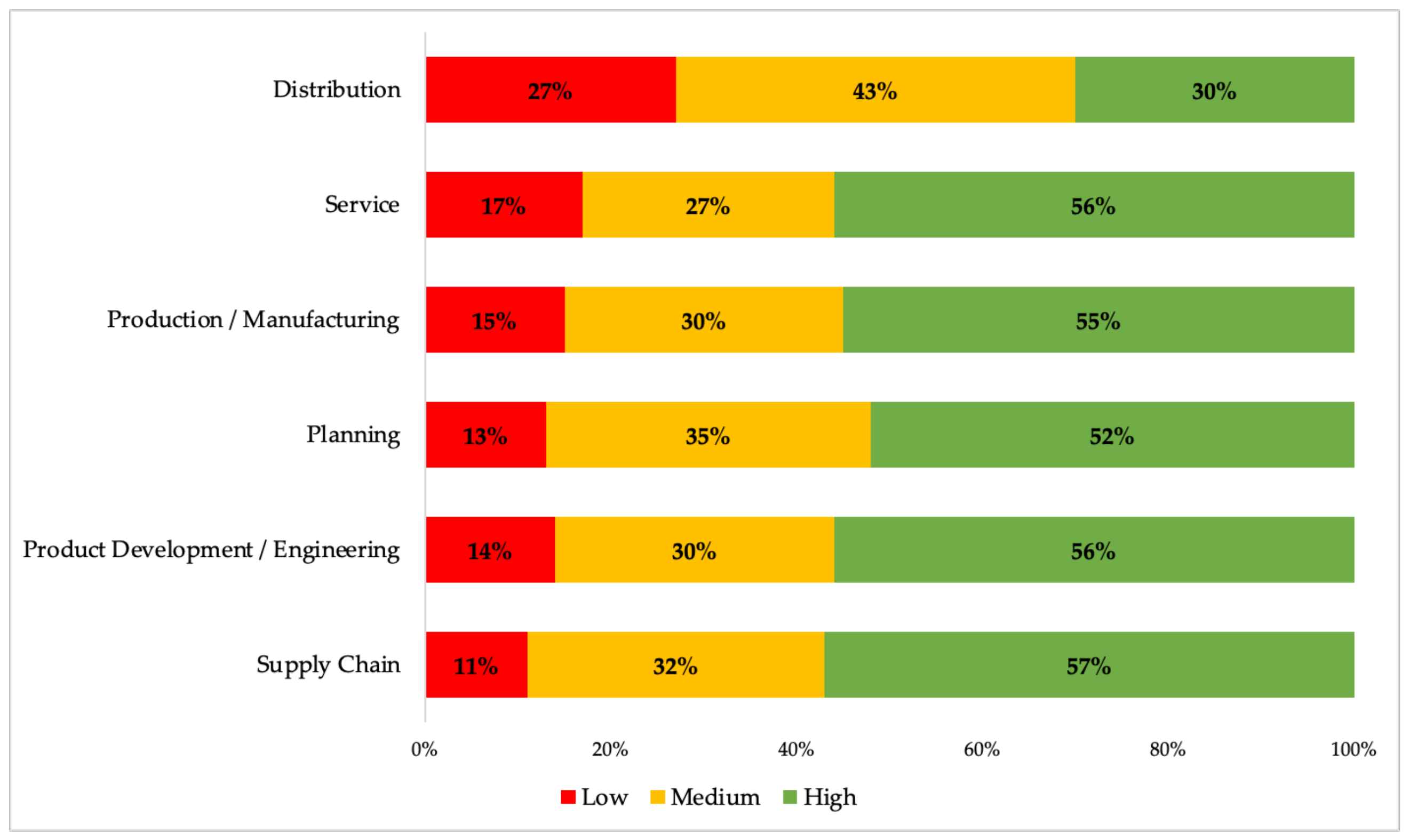

3.2. Sample Data Insights

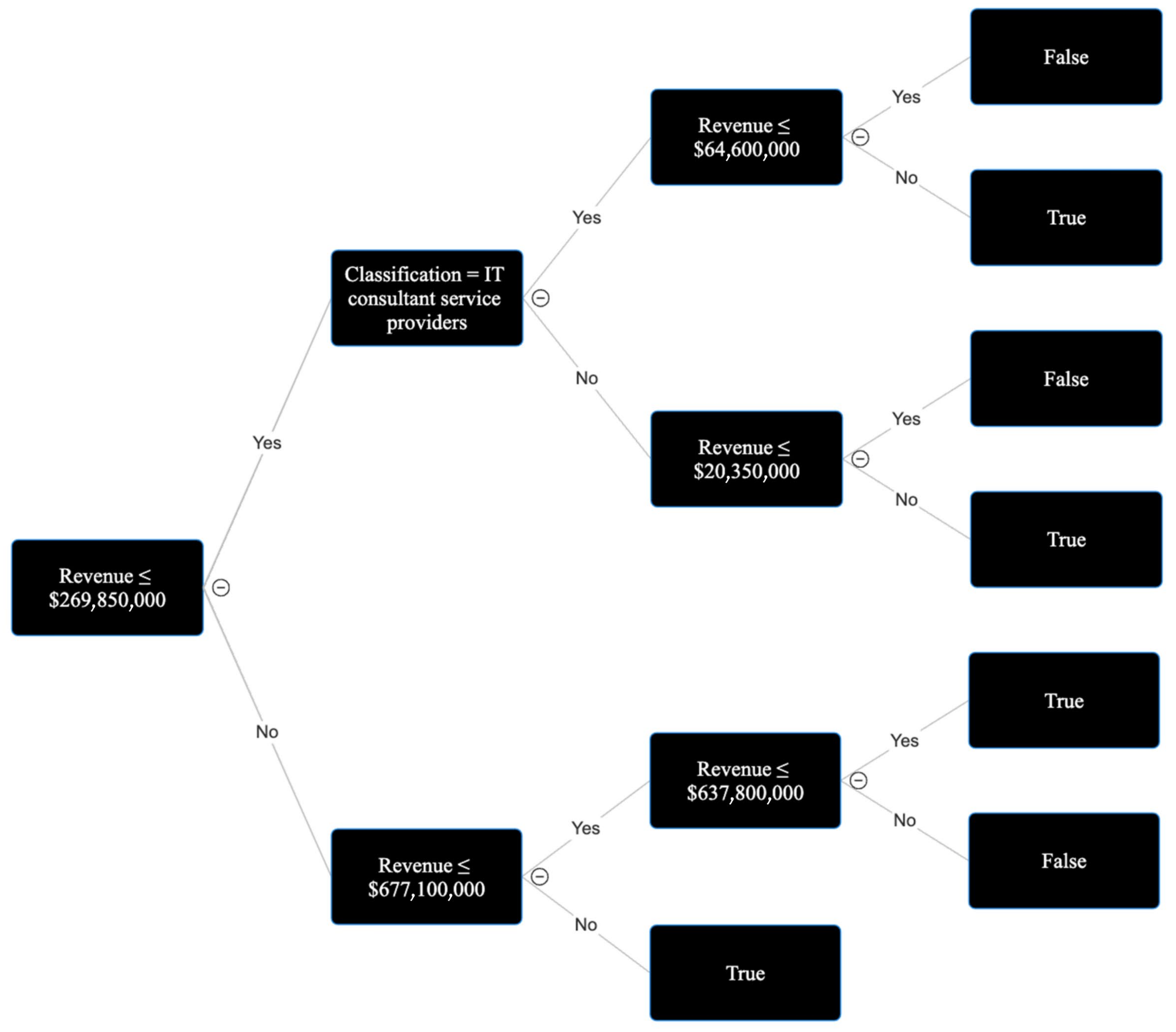

3.3. Decision Tree Algorithm to Streamline Input and Apply Logic and Deduct Output

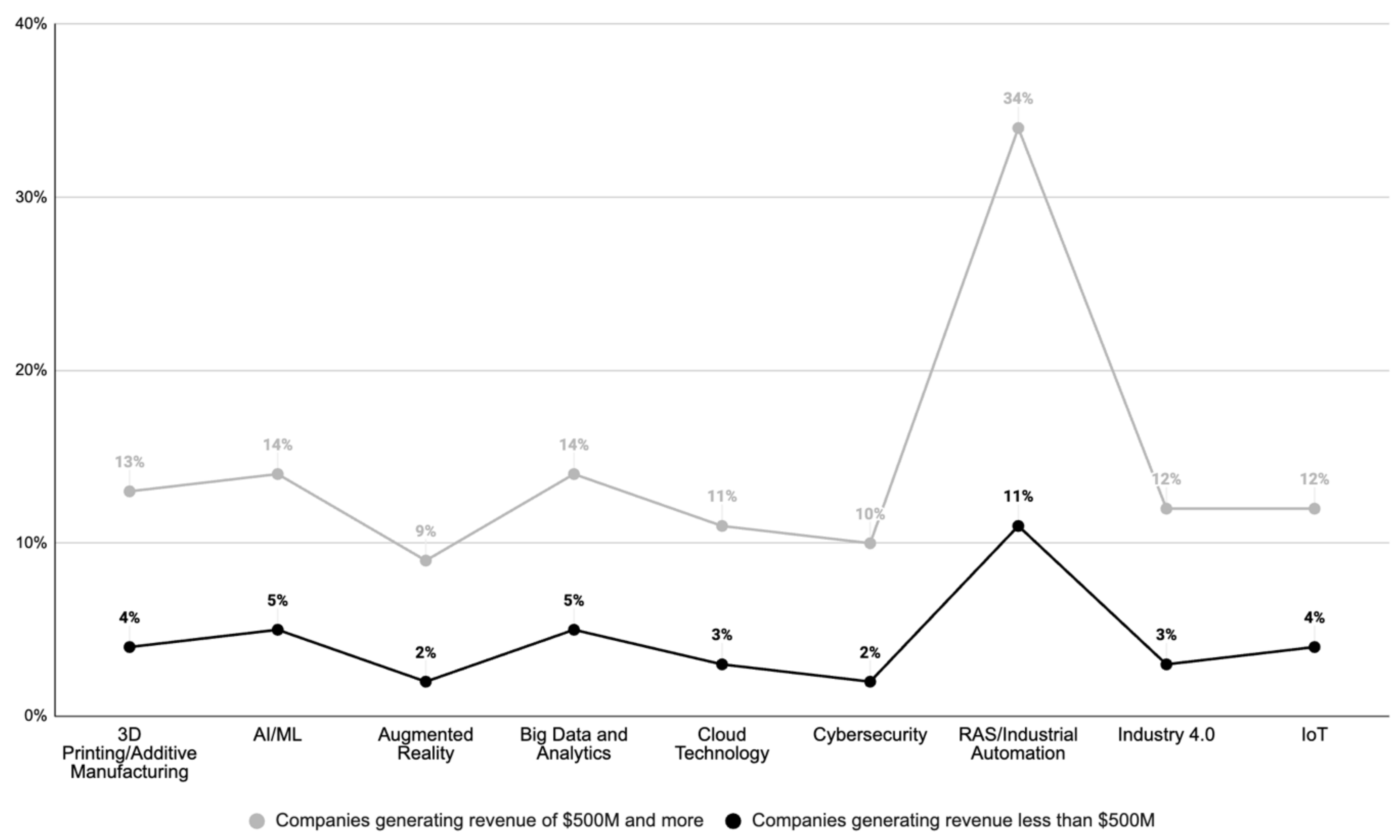

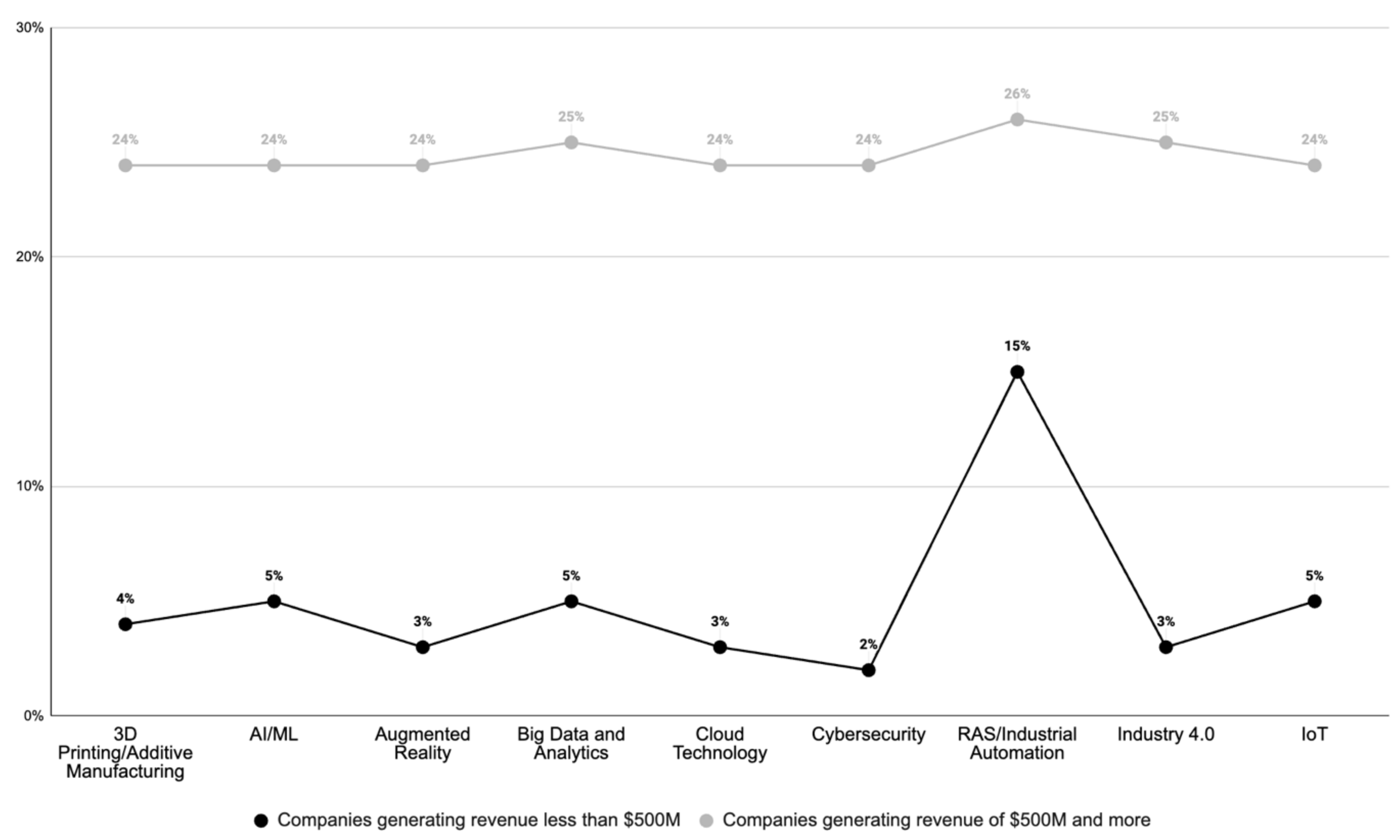

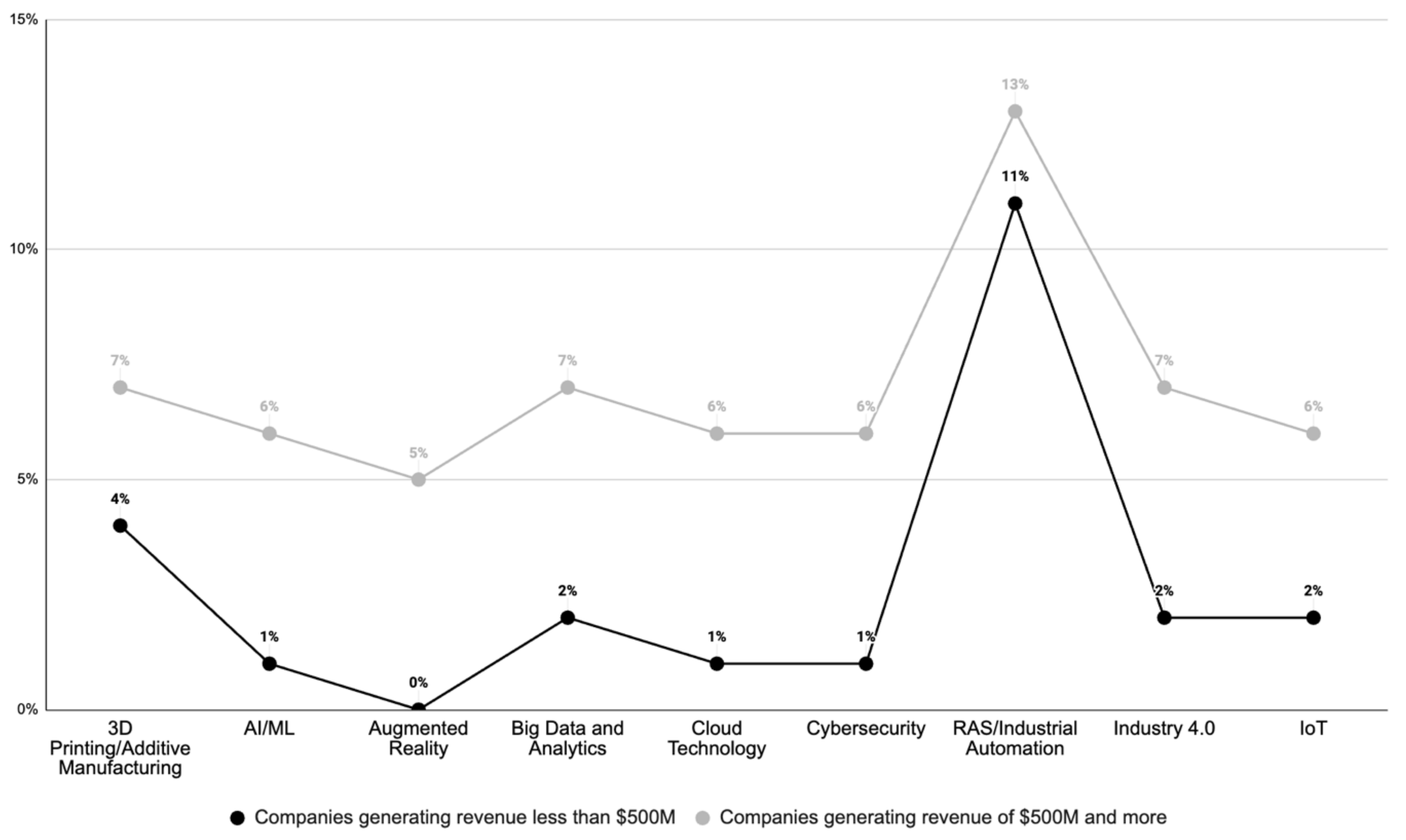

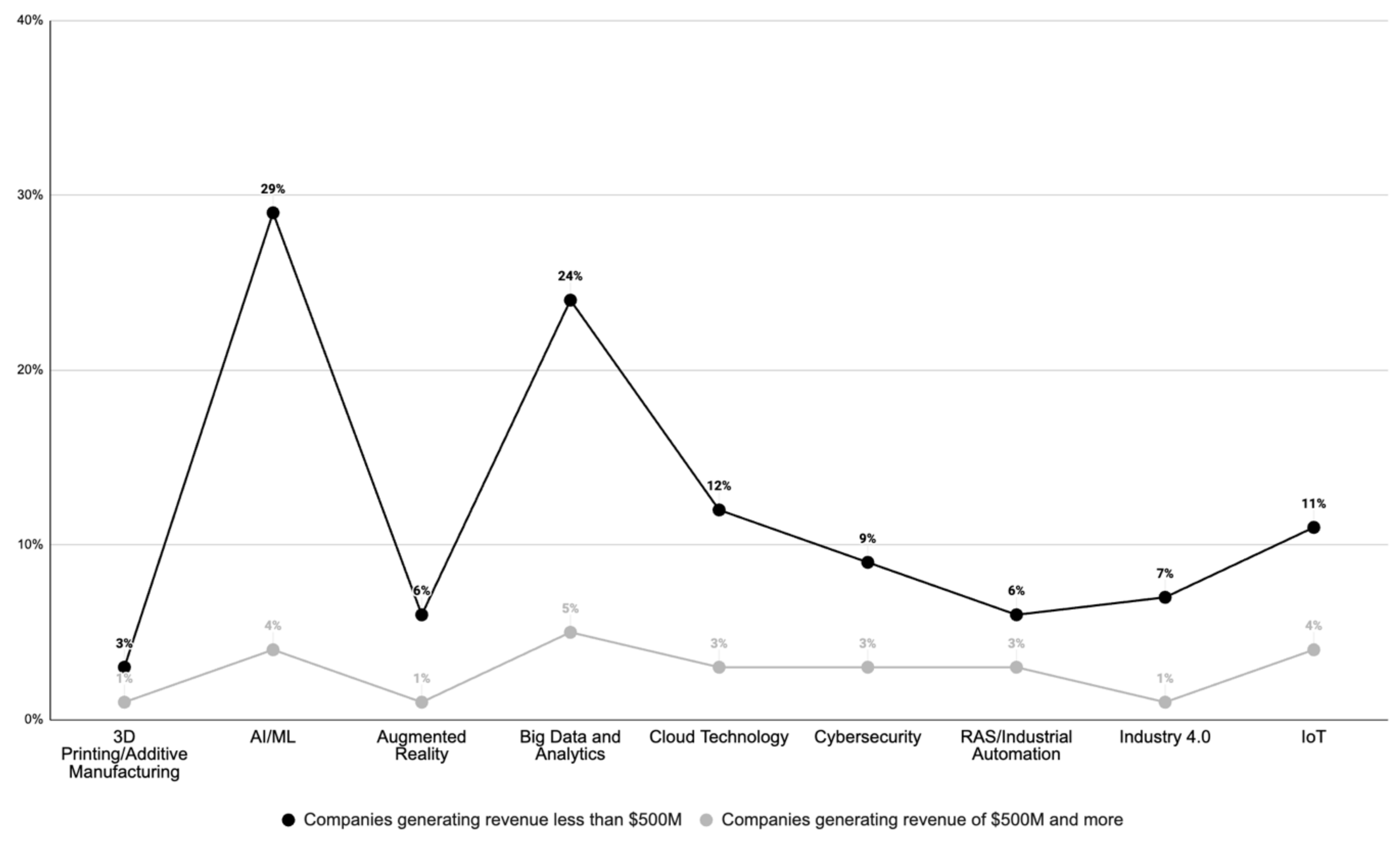

4. Results

5. Discussion

5.1. Practical Contributions

5.2. Theoretical Contributions

5.3. Limitations

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Yan, R. Optimization Approach for Increasing Revenue of Perishable Product Supply Chain with the Internet of Things. Ind. Manag. Data Syst. 2017, 117, 729–741. [Google Scholar] [CrossRef]

- Agrawal, P.; Narain, R.; Ullah, I. Analysis of Barriers in Implementation of Digital Transformation of Supply Chain Using Interpretive Structural Modelling Approach. J. Model. Manag. 2019, 15, 297–317. [Google Scholar] [CrossRef]

- Shamout, M.; Ben-Abdallah, R.; Alshurideh, M.; Alzoubi, H.; Kurdi, B.A.; Hamadneh, S. A Conceptual Model for the Adoption of Autonomous Robots in Supply Chain and Logistics Industry. Uncertain Supply Chain Manag. 2022, 10, 577–592. [Google Scholar] [CrossRef]

- Lin, D.; Lee, C.K.M.; Lau, H.; Yang, Y. Strategic Response to Industry 4.0: An Empirical Investigation on the Chinese Automotive Industry. Ind. Manag. Data Syst. 2018, 118, 589–605. [Google Scholar] [CrossRef]

- Koh, L.; Orzes, G.; Jia, F.J. The Fourth Industrial Revolution (Industry 4.0): Technologies Disruption on Operations and Supply Chain Management. Int. J. Oper. Prod. Manag. 2019, 39, 817–828. [Google Scholar] [CrossRef]

- Global Car & Automobile Manufacturing—Market Size. Available online: https://www.ibisworld.com/global/market-size/global-car-automobile-manufacturing/ (accessed on 10 September 2023).

- Masoumi, S.M.; Kazemi, N.; Abdul-Rashid, S.H. Sustainable Supply Chain Management in the Automotive Industry: A Process-Oriented Review. Sustainability 2019, 11, 3945. [Google Scholar] [CrossRef]

- Mathivathanan, D.; Kannan, D.; Haq, A.N. Sustainable Supply Chain Management Practices in Indian Automotive Industry: A Multi-Stakeholder View. Resour. Conserv. Recycl. 2018, 128, 284–305. [Google Scholar] [CrossRef]

- Kumar Singh, R.; Modgil, S. Assessment of Lean Supply Chain Practices in Indian Automotive Industry. Glob. Bus. Rev. 2023, 24, 68–105. [Google Scholar] [CrossRef]

- Distinctive Traits of Digital Frontrunners in Manufacturing. Available online: https://www2.deloitte.com/content/dam/insights/us/articles/4625_Distinctive-Traits-of-Digital-Frontrunners/4625_Distinctive-Traits-of-Digital-Frontrunners.pdf (accessed on 12 September 2023).

- Belhadi, A.; Kamble, S.; Jabbour, C.J.C.; Gunasekaran, A.; Ndubisi, N.O.; Venkatesh, M. Manufacturing and Service Supply Chain Resilience to the COVID-19 Outbreak: Lessons Learned from the Automobile and Airline Industries. Technol. Forecast. Soc. Chang. 2021, 163, 120447. [Google Scholar] [CrossRef]

- Yazdanparast, R.; Tavakkoli-Moghaddam, R.; Heidari, R.; Aliabadi, L. A Hybrid Z-Number Data Envelopment Analysis and Neural Network for Assessment of Supply Chain Resilience: A Case Study. Cent. Eur. J. Oper. Res. 2021, 29, 611–631. [Google Scholar] [CrossRef]

- Eslami, M.H.; Achtenhagen, L.; Bertsch, C.T.; Lehmann, A. Knowledge-Sharing across Supply Chain Actors in Adopting Industry 4.0 Technologies: An Exploratory Case Study within the Automotive Industry. Technol. Forecast. Soc. Chang. 2023, 186, 122118. [Google Scholar] [CrossRef]

- Ghadge, A.; Mogale, D.G.; Bourlakis, M.M.; Maiyar, L.; Moradlou, H. Link between Industry 4.0 and Green Supply Chain Management: Evidence from the Automotive Industry. Comput. Ind. Eng. 2022, 169, 108303. [Google Scholar] [CrossRef]

- Brettel, M.; Friederichsen, N.; Keller, M.; Rosenberg, M. How Virtualization, Decentralization and Network Building Change the Manufacturing Landscape: An Industry 4.0 Perspective. Int. J. Mech. Aerosp. Ind. Mechatron. Manuf. Eng. 2014, 8, 37–44. [Google Scholar] [CrossRef]

- Erol, S.; Jäger, A.; Hold, P.; Ott, K.; Sihn, W. Tangible Industry 4.0: A Scenario-Based Approach to Learning for the Future of Production. Procedia CIRP 2016, 54, 13–18. [Google Scholar] [CrossRef]

- Matt, D.T.; Rauch, E. SME 4.0: The Role of Small- and Medium-Sized Enterprises in the Digital Transformation. In Industry 4.0 for SMEs; Matt, D.T., Modrák, V., Zsifkovits, H., Eds.; Springer International Publishing: Cham, Switzerland, 2020; pp. 3–36. ISBN 9783030254247. [Google Scholar]

- Spieske, A.; Birkel, H. Improving Supply Chain Resilience through Industry 4.0: A Systematic Literature Review under the Impressions of the COVID-19 Pandemic. Comput. Ind. Eng. 2021, 158, 107452. [Google Scholar] [CrossRef] [PubMed]

- Antony, J.; Sony, M.; McDermott, O. Conceptualizing Industry 4.0 Readiness Model Dimensions: An Exploratory Sequential Mixed-Method Study. TQM 2023, 35, 577–596. [Google Scholar] [CrossRef]

- Ellingsen, O.; Aasland, K.E. Digitalizing the Maritime Industry: A Case Study of Technology Acquisition and Enabling Advanced Manufacturing Technology. J. Eng. Technol. Manag. 2019, 54, 12–27. [Google Scholar] [CrossRef]

- Sony, M.; Aithal, P.S. Developing an Industry 4.0 Readiness Model for Indian Engineering Industries. Int. J. Manag. Technol. Soc. Sci. 2020, 5, 141–153. [Google Scholar] [CrossRef]

- Ghobakhloo, M.; Iranmanesh, M. Digital Transformation Success under Industry 4.0: A Strategic Guideline for Manufacturing SMEs. J. Manuf. Technol. Manag. 2021, 32, 1533–1556. [Google Scholar] [CrossRef]

- Dutta, G.; Kumar, R.; Sindhwani, R.; Singh, R.K. Digitalization Priorities of Quality Control Processes for SMEs: A Conceptual Study in Perspective of Industry 4.0 Adoption. J. Intell. Manuf. 2021, 32, 1679–1698. [Google Scholar] [CrossRef]

- Oliver, R.K.; Webber, M.D. Supply-Chain Management: Logistics Catches up with Strategy. In The Roots of Logistics; Klaus, P., Müller, S., Eds.; Springer: Berlin/Heidelberg, Germany, 2012; pp. 183–194. ISBN 9783642279218. [Google Scholar]

- Cooper, M.C.; Lambert, D.M.; Pagh, J.D. Supply Chain Management: More Than a New Name for Logistics. Int. J. Logist. Manag. 1997, 8, 1–14. [Google Scholar] [CrossRef]

- Mentzer, J.T.; DeWitt, W.; Keebler, J.S.; Min, S.; Nix, N.W.; Smith, C.D.; Zacharia, Z.G. Defining supply chain management. J. Bus. Logist. 2001, 22, 1–25. [Google Scholar] [CrossRef]

- What Is Supply Chain Management? Available online: https://cscmp.org/CSCMP/Certify/Fundamentals/What_is_Supply_Chain_Management.aspx?WebsiteKey=0b3f453d-bd90-4121-83cf-172a90b226a9 (accessed on 21 September 2023).

- The Supply Chain: From Raw Materials to Order Fulfilment. Available online: https://www.investopedia.com/terms/s/supplychain.asp (accessed on 21 September 2023).

- What Is Supply Chain Management? Available online: https://www.ibm.com/topics/supply-chain-management#:~:text=supply%20chain%20management%3F-,Supply%20chain%20management%20is%20the%20handling%20of%20the%20entire%20production,final%20product%20to%20the%20consumer (accessed on 21 September 2023).

- Dubey, R.; Altay, N.; Gunasekaran, A.; Blome, C.; Papadopoulos, T.; Childe, S.J. Supply Chain Agility, Adaptability and Alignment: Empirical Evidence from the Indian Auto Components Industry. Int. J. Oper. Prod. Manag. 2018, 38, 129–148. [Google Scholar] [CrossRef]

- Christopher, M.; Holweg, M. “Supply Chain 2.0”: Managing Supply Chains in the Era of Turbulence. Int. J. Phys. Dist. Log. Manag. 2011, 41, 63–82. [Google Scholar] [CrossRef]

- Bak, O.; Shaw, S.; Colicchia, C.; Kumar, V. A Systematic Literature Review of Supply Chain Resilience in Small–Medium Enterprises (SMEs): A Call for Further Research. IEEE Trans. Eng. Manag. 2023, 70, 328–341. [Google Scholar] [CrossRef]

- Koberg, E.; Longoni, A. A Systematic Review of Sustainable Supply Chain Management in Global Supply Chains. J. Clean. Prod. 2019, 207, 1084–1098. [Google Scholar] [CrossRef]

- Introduction to Processes. Available online: https://scor.ascm.org/processes/introduction (accessed on 1 October 2023).

- Manders, J.H.M.; Caniëls, M.C.J.; Ghijsen, P.W.T. Exploring Supply Chain Flexibility in a FMCG Food Supply Chain. J. Purch. Supply Manag. 2016, 22, 181–195. [Google Scholar] [CrossRef]

- Duong, L.N.K.; Al-Fadhli, M.; Jagtap, S.; Bader, F.; Martindale, W.; Swainson, M.; Paoli, A. A Review of Robotics and Autonomous Systems in the Food Industry: From the Supply Chains Perspective. Trends Food Sci. Technol. 2020, 106, 355–364. [Google Scholar] [CrossRef]

- Swafford, P.M.; Ghosh, S.; Murthy, N. Achieving Supply Chain Agility through IT Integration and Flexibility. Int. J. Prod. Econ. 2008, 116, 288–297. [Google Scholar] [CrossRef]

- Tjahjono, B.; Esplugues, C.; Ares, E.; Pelaez, G. What Does Industry 4.0 Mean to Supply Chain? Procedia Manuf. 2017, 13, 1175–1182. [Google Scholar] [CrossRef]

- Fatorachian, H.; Kazemi, H. Impact of Industry 4.0 on Supply Chain Performance. Prod. Plan. Control 2021, 32, 63–81. [Google Scholar] [CrossRef]

- Vogel-Heuser, B.; Hess, D. Guest Editorial Industry 4.0–Prerequisites and Visions. IEEE Trans. Automat. Sci. Eng. 2016, 13, 411–413. [Google Scholar] [CrossRef]

- Recommendations for Implementing the Strategic Initiative INDUSTRIE 4.0. Available online: https://www.din.de/resource/blob/76902/e8cac883f42bf28536e7e8165993f1fd/recommendations-for-implementing-industry-4-0-data.pdf (accessed on 10 October 2023).

- Opportunities and Challenges of the Industrial Internet. Available online: https://www.pwc.nl/en/assets/documents/pwc-industrie-4-0.pdf (accessed on 10 October 2023).

- Dalenogare, L.S.; Benitez, G.B.; Ayala, N.F.; Frank, A.G. The Expected Contribution of Industry 4.0 Technologies for Industrial Performance. Int. J. Prod. Econ. 2018, 204, 383–394. [Google Scholar] [CrossRef]

- Frank, A.G.; Dalenogare, L.S.; Ayala, N.F. Industry 4.0 Technologies: Implementation Patterns in Manufacturing Companies. Int. J. Prod. Econ. 2019, 210, 15–26. [Google Scholar] [CrossRef]

- Bai, C.; Dallasega, P.; Orzes, G.; Sarkis, J. Industry 4.0 Technologies Assessment: A Sustainability Perspective. Int. J. Prod. Econ. 2020, 229, 107776. [Google Scholar] [CrossRef]

- Oztemel, E.; Gursev, S. Literature Review of Industry 4.0 and Related Technologies. J. Intell. Manuf. 2020, 31, 127–182. [Google Scholar] [CrossRef]

- Aspects of the Research Roadmap in Application Scenarios. Available online: https://www.scribd.com/document/527796092/Aspects-of-the-Research-Roadmap (accessed on 17 October 2023).

- Wagner, T.; Herrmann, C.; Thiede, S. Industry 4.0 Impacts on Lean Production Systems. Procedia CIRP 2017, 63, 125–131. [Google Scholar] [CrossRef]

- Nagy, J.; Oláh, J.; Erdei, E.; Máté, D.; Popp, J. The Role and Impact of Industry 4.0 and the Internet of Things on the Business Strategy of the Value Chain—The Case of Hungary. Sustainability 2018, 10, 3491. [Google Scholar] [CrossRef]

- Pereira, A.C.; Romero, F. A Review of the Meanings and the Implications of the Industry 4.0 Concept. Procedia Manuf. 2017, 13, 1206–1214. [Google Scholar] [CrossRef]

- Xu, L.D.; Xu, E.L.; Li, L. Industry 4.0: State of the Art and Future Trends. Int. J. Prod. Res. 2018, 56, 2941–2962. [Google Scholar] [CrossRef]

- Sharma, A.; Khanna, P. Relevance of Adopting Emerging Technologies in Outbound Supply Chain: New Paradigm for Cement Industry. OSCM Int. J. 2020, 13, 210–221. [Google Scholar] [CrossRef]

- Ekren, B.Y.; Mangla, S.K.; Turhanlar, E.E.; Kazancoglu, Y.; Li, G. Lateral Inventory Share-Based Models for IoT-Enabled E-Commerce Sustainable Food Supply Networks. Comput. Oper. Res. 2021, 130, 105237. [Google Scholar] [CrossRef]

- Lahane, S.; Kant, R.; Shankar, R. Circular Supply Chain Management: A State-of-Art Review and Future Opportunities. J. Clean. Prod. 2020, 258, 120859. [Google Scholar] [CrossRef]

- Xu, X.; Lu, Y.; Vogel-Heuser, B.; Wang, L. Industry 4.0 and Industry 5.0—Inception, Conception and Perception. J. Manuf. Syst. 2021, 61, 530–535. [Google Scholar] [CrossRef]

- Ivanov, D.; Dolgui, A. Viability of Intertwined Supply Networks: Extending the Supply Chain Resilience Angles towards Survivability. A Position Paper Motivated by COVID-19 Outbreak. Int. J. Prod. Res. 2020, 58, 2904–2915. [Google Scholar] [CrossRef]

- Büyüközkan, G.; Göçer, F. Digital Supply Chain: Literature Review and a Proposed Framework for Future Research. Comput. Ind. 2018, 97, 157–177. [Google Scholar] [CrossRef]

- Attaran, M. Digital Technology Enablers and Their Implications for Supply Chain Management. Supply Chain Forum Int. J. 2020, 21, 158–172. [Google Scholar] [CrossRef]

- Ramirez-Peña, M.; Sánchez Sotano, A.J.; Pérez-Fernandez, V.; Abad, F.J.; Batista, M. Achieving a Sustainable Shipbuilding Supply Chain under I4.0 Perspective. J. Clean. Prod. 2020, 244, 118789. [Google Scholar] [CrossRef]

- Stank, T.; Esper, T.; Goldsby, T.J.; Zinn, W.; Autry, C. Toward a Digitally Dominant Paradigm for Twenty-First Century Supply Chain Scholarship. Int. J. Phys. Distrib. Logist. Manag. 2019, 49, 956–971. [Google Scholar] [CrossRef]

- The Economic Potential of Generative AI: The Next Productivity Frontier. Available online: https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-economic-potential-of-generative-AI-the-next-productivity-frontier#introduction (accessed on 29 October 2023).

- Cimini, C.; Pezzotta, G.; Pinto, R.; Cavalieri, S. Industry 4.0 Technologies Impacts in the Manufacturing and Supply Chain Landscape: An Overview. In Service Orientation in Holonic and Multi-Agent Manufacturing; Borangiu, T., Trentesaux, D., Thomas, A., Cavalieri, S., Eds.; Springer International Publishing: Cham, Switzerland, 2019; Volume 803, pp. 109–120. ISBN 9783030030025. [Google Scholar]

- Haleem, A.; Javaid, M. Additive Manufacturing Applications in Industry 4.0: A Review. J. Ind. Intg. Manag. 2019, 4, 1930001. [Google Scholar] [CrossRef]

- Li, Y.; Jia, G.; Cheng, Y.; Hu, Y. Additive Manufacturing Technology in Spare Parts Supply Chain: A Comparative Study. Int. J. Prod. Res. 2017, 55, 1498–1515. [Google Scholar] [CrossRef]

- Haghnegahdar, L.; Joshi, S.S.; Dahotre, N.B. From IoT-Based Cloud Manufacturing Approach to Intelligent Additive Manufacturing: Industrial Internet of Things—An Overview. Int. J. Adv. Manuf. Technol. 2022, 119, 1461–1478. [Google Scholar] [CrossRef]

- Tao, F.; Zhang, L.; Liu, Y.; Cheng, Y.; Wang, L.; Xu, X. Manufacturing Service Management in Cloud Manufacturing: Overview and Future Research Directions. J. Manuf. Sci. Eng. 2015, 137, 040912. [Google Scholar] [CrossRef]

- Vincent Wang, X.; Xu, X.W. An Interoperable Solution for Cloud Manufacturing. Robot. Comput.-Integr. Manuf. 2013, 29, 232–247. [Google Scholar] [CrossRef]

- Wan, J.; Yi, M.; Li, D.; Zhang, C.; Wang, S.; Zhou, K. Mobile Services for Customization Manufacturing Systems: An Example of Industry 4.0. IEEE Access 2016, 4, 8977–8986. [Google Scholar] [CrossRef]

- Rohacz, A.; Strassburger, S. Augmented Reality in Intralogistics Planning of the Automotive Industry: State of the Art and Practical Recommendations for Applications. In Proceedings of the 2019 IEEE 6th International Conference on Industrial Engineering and Applications (ICIEA), Tokyo, Japan, 12–15 April 2019; pp. 203–208. [Google Scholar]

- DHL Supply Chain Deploys Latest Version of Smart Glasses Worldwide. Available online: https://group.dhl.com/en/media-relations/press-releases/2019/dhl-supply-chain-deploys-latest-version-of-smart-glasses-worldwide.html (accessed on 7 November 2023).

- Vaidya, S.; Ambad, P.; Bhosle, S. Industry 4.0—A Glimpse. Procedia Manuf. 2018, 20, 233–238. [Google Scholar] [CrossRef]

- Vieira, A.A.C.; Dias, L.M.S.; Santos, M.Y.; Pereira, G.A.B.; Oliveira, J.A. Simulation of an Automotive Supply Chain Using Big Data. Comput. Ind. Eng. 2019, 137, 106033. [Google Scholar] [CrossRef]

- Aamer, A.; Eka Yani, L.P.; Alan Priyatna, I.M. Data Analytics in the Supply Chain Management: Review of Machine Learning Applications in Demand Forecasting. OSCM Int. J. 2020, 14, 1–13. [Google Scholar] [CrossRef]

- Ali, I.; Arslan, A.; Khan, Z.; Tarba, S.Y. The Role of Industry 4.0 Technologies in Mitigating Supply Chain Disruption: Empirical Evidence from the Australian Food Processing Industry. IEEE Trans. Eng. Manag. 2022, 1–11. [Google Scholar] [CrossRef]

- Mirtsch, M.; Kinne, J.; Blind, K. Exploring the Adoption of the International Information Security Management System Standard ISO/IEC 27001: A Web Mining-Based Analysis. IEEE Trans. Eng. Manag. 2021, 68, 87–100. [Google Scholar] [CrossRef]

- Gupta, N.; Tiwari, A.; Bukkapatnam, S.T.S.; Karri, R. Additive Manufacturing Cyber-Physical System: Supply Chain Cybersecurity and Risks. IEEE Access 2020, 8, 47322–47333. [Google Scholar] [CrossRef]

- Pold87/Academic-Keyword-Occurrence: First Release, Belgium. 2018. Available online: https://zenodo.org/records/1218409#.ZDVFeOxBy3I (accessed on 1 September 2023).

- Golicic, S.L.; Davis, D.F. Implementing Mixed Methods Research in Supply Chain Management. Int. J. Phys. Distrib. Logist. Manag. 2012, 42, 726–741. [Google Scholar] [CrossRef]

- Lind, L.; Pirttilä, M.; Viskari, S.; Schupp, F.; Kärri, T. Working Capital Management in the Automotive Industry: Financial Value Chain Analysis. J. Purch. Supply Manag. 2012, 18, 92–100. [Google Scholar] [CrossRef]

- Shalev-Shwartz, S.; Ben-David, S. Understanding Machine Learning: From Theory to Algorithms, 1st ed.; Cambridge University Press: Cambridge, UK, 2014; ISBN 9781107057135. [Google Scholar]

- Hastie, T.; Tibshirani, R.; Friedman, J. The Elements of Statistical Learning; Springer Series in Statistics; Springer: New York, NY, USA, 2009; ISBN 9780387848570. [Google Scholar]

- Gupta, B.; Rawat, A.; Jain, A.; Arora, A.; Dhami, N. Analysis of Various Decision Tree Algorithms for Classification in Data Mining. IJCA 2017, 163, 15–19. [Google Scholar] [CrossRef]

- Olson, D.L. A Review of Supply Chain Data Mining Publications. J. Supply Chain Manag. Sci. 2020, 1, 15–26. [Google Scholar] [CrossRef]

- Abdirad, M.; Krishnan, K. Industry 4.0 in Logistics and Supply Chain Management: A Systematic Literature Review. Eng. Manag. J. 2021, 33, 187–201. [Google Scholar] [CrossRef]

- Tan, W.C.; Sidhu, M.S. Review of RFID and IoT Integration in Supply Chain Management. Oper. Res. Perspect. 2022, 9, 100229. [Google Scholar] [CrossRef]

| Definition | Source |

|---|---|

| The systemic, strategic coordination of the traditional business functions and the tactics across these business functions within a particular company and across businesses within the supply chain, for the purposes of improving the long-term performance of the individual companies and the supply chain as a whole. | [26] |

| SCM is the active management of supply chain activities to maximize customer value and achieve a sustainable competitive advantage. Supply chain activities cover everything from product development, sourcing, and production to logistics, as well as the information systems needed to coordinate these activities. | [27] |

| A network between a company and its suppliers to produce and distribute a specific product to the final buyer; it includes different activities, people, entities, information, and resources. | [28] |

| Supply chain management is the handling of the entire production flow of a good or service to maximize quality, delivery, customer experience, and profitability. | [29] |

| Region | Co. per Region | Less than USD 1M | USD 1M–10M | USD 10M–50M | USD 50M–100M | USD 100M–500M | USD 500M–1B | USD 1B–10B | USD 10B+ | No Revenue Info. |

|---|---|---|---|---|---|---|---|---|---|---|

| DACH | 351 | 5 | 113 | 59 | 30 | 39 | 21 | 39 | 14 | 31 |

| Benelux | 71 | 1 | 16 | 21 | 8 | 11 | 2 | 3 | 2 | 7 |

| Scandinavia | 76 | 1 | 21 | 23 | 6 | 11 | 1 | 8 | 3 | 2 |

| UK | 181 | 4 | 54 | 67 | 13 | 17 | 3 | 7 | 5 | 11 |

| The Balkans | 30 | 0 | 10 | 4 | 1 | 4 | 1 | 0 | 0 | 10 |

| France | 115 | 1 | 40 | 25 | 9 | 10 | 5 | 7 | 4 | 14 |

| Italy | 166 | 2 | 58 | 57 | 12 | 11 | 7 | 8 | 2 | 9 |

| Spain | 59 | 0 | 19 | 21 | 6 | 4 | 0 | 5 | 0 | 4 |

| Other EU Countries | 91 | 1 | 39 | 23 | 7 | 8 | 4 | 1 | 1 | 7 |

| Total | 1140 | 15 | 370 | 300 | 92 | 115 | 44 | 78 | 31 | 95 |

| Region | Co. per Region | 11–50 | 51–100 | 101–250 | 251–500 | 501–1000 | 1001–5000 | 5001–10,000 | 10,000+ |

|---|---|---|---|---|---|---|---|---|---|

| DACH | 351 | 87 | 43 | 64 | 45 | 21 | 58 | 17 | 16 |

| Benelux | 71 | 14 | 10 | 20 | 9 | 9 | 7 | 1 | 1 |

| Scandinavia | 76 | 18 | 12 | 18 | 8 | 5 | 9 | 0 | 6 |

| UK | 181 | 51 | 39 | 45 | 20 | 7 | 11 | 1 | 7 |

| The Balkans | 30 | 9 | 3 | 5 | 6 | 3 | 4 | 0 | 0 |

| France | 115 | 37 | 10 | 28 | 11 | 8 | 9 | 5 | 7 |

| Italy | 166 | 52 | 28 | 43 | 16 | 8 | 14 | 2 | 3 |

| Spain | 59 | 17 | 16 | 12 | 6 | 2 | 3 | 2 | 1 |

| Other EU Countries | 91 | 26 | 16 | 21 | 11 | 6 | 8 | 3 | 0 |

| Total | 1140 | 311 | 177 | 256 | 132 | 69 | 123 | 31 | 41 |

| Category | Amount |

|---|---|

| Number of funded companies | 174 |

| Avg. amount of raised capital | USD 152,234,680 |

| Max. amount of raised capital | USD 2,800,000,000 |

| Min. amount of raised capital | USD 15,000 |

| Avg. number of funding rounds | 3 |

| Avg. last funding year | 2018 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Milosavljevic, M.; Mousavi, A.; Moraca, S.; Fajsi, A.; Rostohar, D. Revealing the Supply Chain 4.0 Potential within the European Automotive Industry. Sustainability 2024, 16, 1421. https://doi.org/10.3390/su16041421

Milosavljevic M, Mousavi A, Moraca S, Fajsi A, Rostohar D. Revealing the Supply Chain 4.0 Potential within the European Automotive Industry. Sustainability. 2024; 16(4):1421. https://doi.org/10.3390/su16041421

Chicago/Turabian StyleMilosavljevic, Marko, Alireza Mousavi, Slobodan Moraca, Angela Fajsi, and Danijela Rostohar. 2024. "Revealing the Supply Chain 4.0 Potential within the European Automotive Industry" Sustainability 16, no. 4: 1421. https://doi.org/10.3390/su16041421