The Electric Vehicle Supply Chain Ecosystem: Changing Roles of Automotive Suppliers

Abstract

1. Introduction

2. The EV Supply Chain Ecosystem

2.1. Scope of the EV Supply Chain Ecosystem

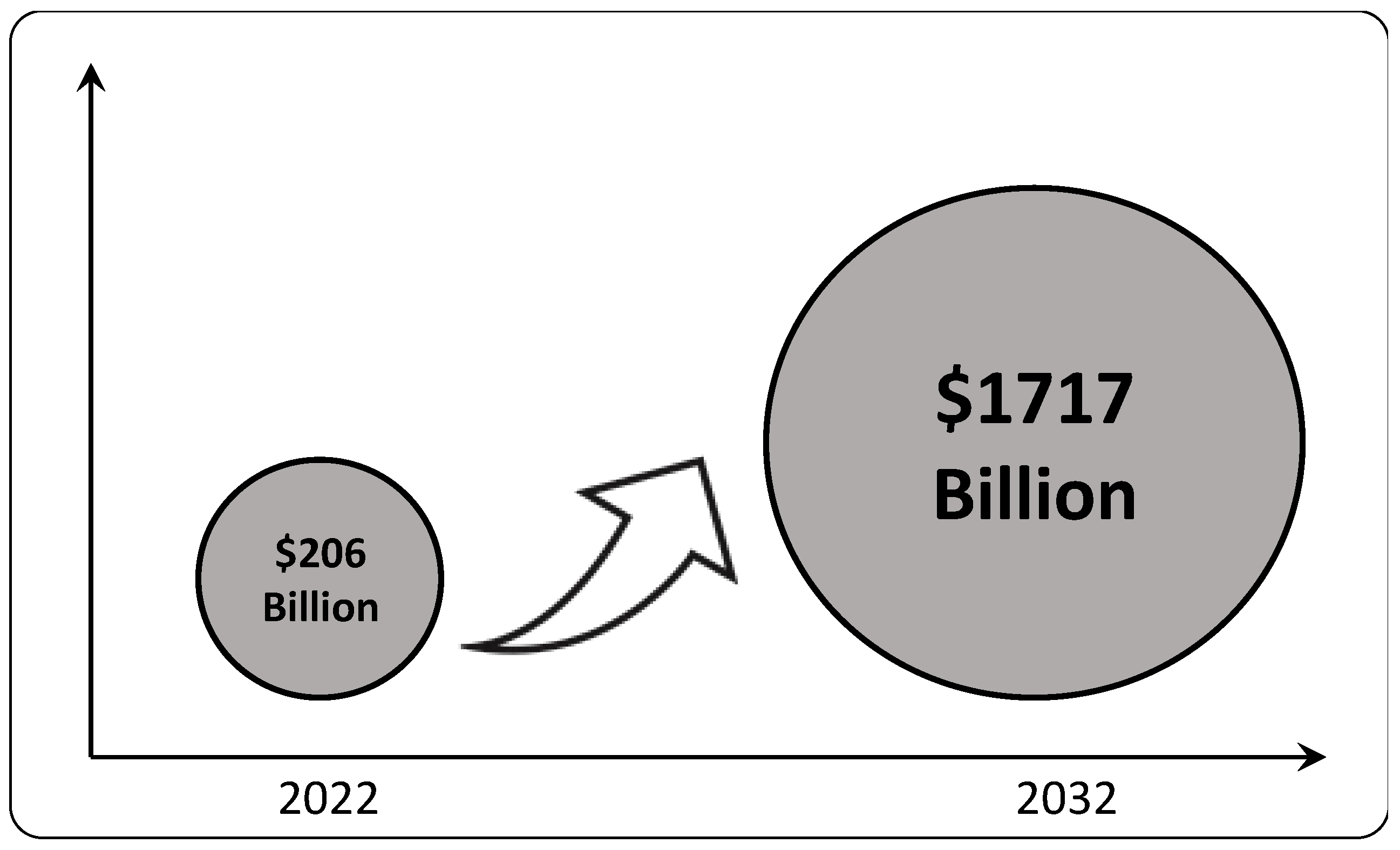

2.2. Scale of the EV Supply Chain Ecosystem

3. Transitioning to the EV Supply Chain Ecosystem

4. Comparing ICE and EV Supply Chains

4.1. Factors from the External Macro-Environment and Supply Chain Advancement

4.2. Comparative Aspects of Automotive Supply Chains

5. EV Supply Chain Ecosystem Transformation

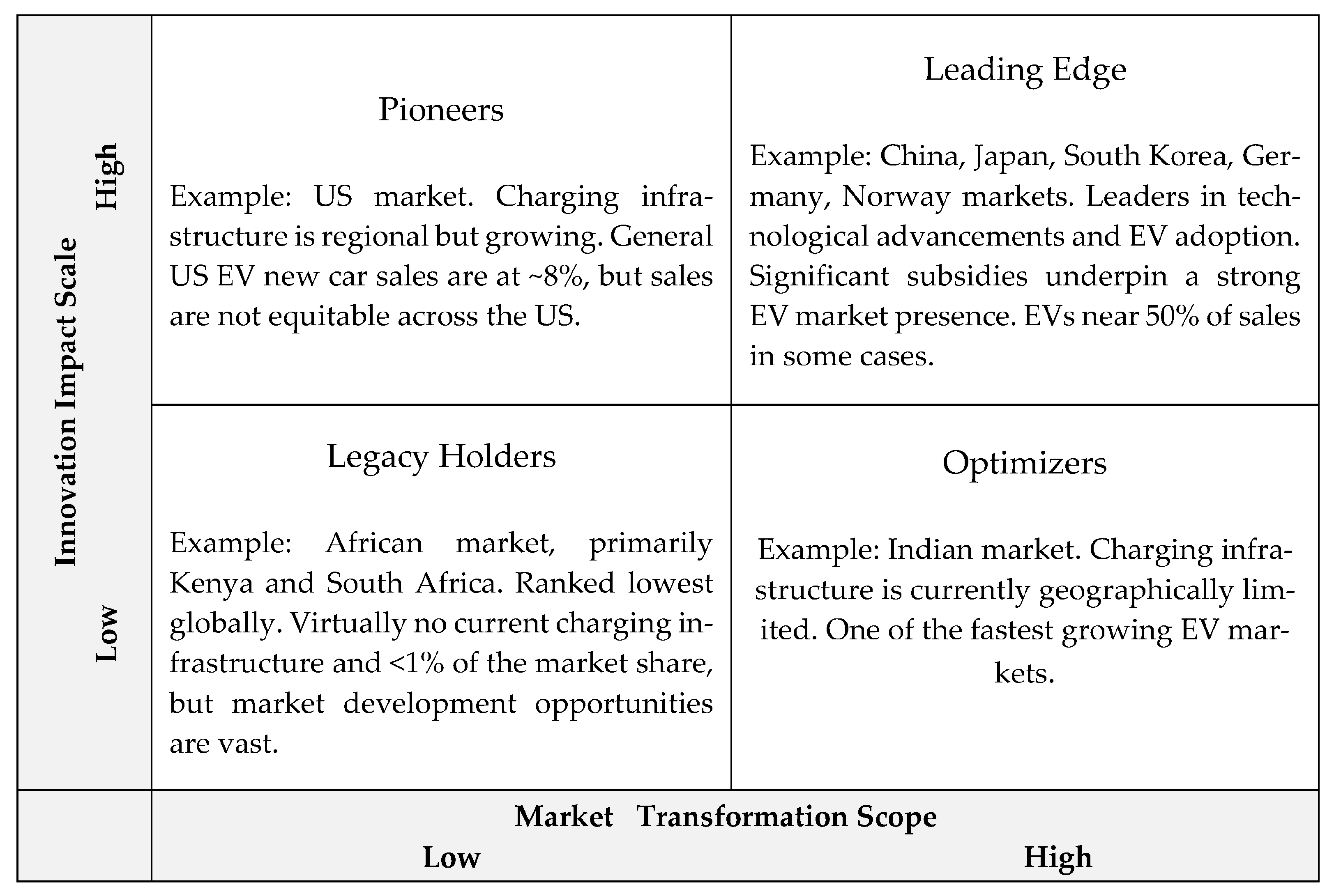

5.1. A Typology of the EV Market

- ▪

- Consumer Demand: Varies based on environmental awareness, economic factors, and government incentives. High demand often correlates with higher sales and more rapid market growth.

- ▪

- Government Policies: Strong incentives, such as subsidies, tax breaks, and emissions regulations, can accelerate the adoption of EVs [11]. Conversely, a lack of support can stifle market growth.

- ▪

- Charging Infrastructure: The availability of charging stations is crucial. Well-established networks encourage EV adoption, whereas poor infrastructure can be a barrier.

- ▪

- Technological Advancements: Breakthroughs in battery technology, such as increased energy density or faster charging capabilities, can make EVs more attractive to consumers.

- ▪

- Economic Factors: The cost of ownership, which includes the purchase price, maintenance, and operating costs, influences market characteristics. As battery costs decrease, EVs become more competitive with ICE vehicles.

- ▪

- Energy Prices: Fluctuations in the price of electricity versus fossil fuels can make EVs more or less appealing to consumers.

- ▪

- Cultural and Social Factors: Social norms and values, such as environmental consciousness, can drive market growth [47].

- ▪

- ▪

- Power Electronics: Advances in power electronics, which control the flow of electricity within the vehicle, can improve efficiency and performance.

- ▪

- Electric Motor Technology: The efficiency and power of electric motors influence vehicle performance, impacting consumer adoption rates [22].

- ▪

- Software and Connectivity: Integration of EVs with smart grids and the Internet of Things (IoT) for better energy management and user experience [25].

- ▪

- Materials Science: Developing lightweight materials and rare-earth elements for motors can impact vehicle efficiency and production costs [20].

- ▪

- Recycling and Sustainability: Technologies for recycling batteries and sustainable sourcing of materials can affect EVs’ long-term viability and environmental impact [50].

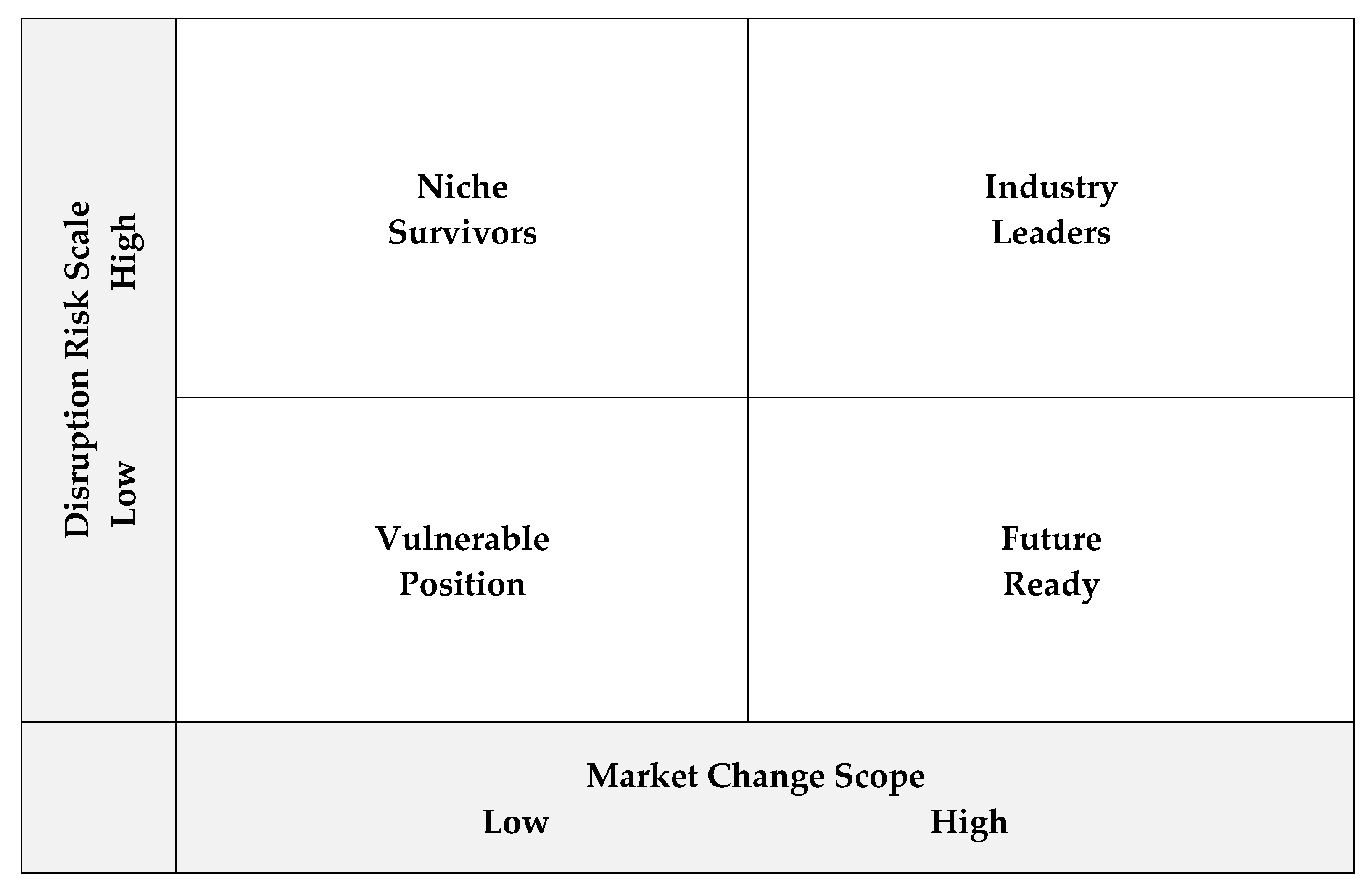

5.2. A Typology of EV Automotive Suppliers

- ▪

- Adaptability: The ability to respond to new market demands, technology shifts, and evolving consumer preferences.

- ▪

- Innovation: Developing new products, services, or processes that meet emerging market trends.

- ▪

- Agility: Quickly adjusting business strategies and operations to capitalize on market opportunities.

- ▪

- Diversification: Offering a range of products or services that cater to various market segments to mitigate the risk associated with market volatility.

- ▪

- ▪

- Dependency on Specific Technologies or Materials: Relying heavily on certain inputs that could be subject to shortages or price volatility.

- ▪

- Regulatory Compliance: The capacity to meet changing regulatory requirements without significant difficulty or delay.

- ▪

- Operational Robustness: The overall stability of operational processes to handle disruptions without major losses.

- ▪

- Financial Stability: Sufficient capital reserves or access to credit to survive periods of disruption without catastrophic consequences.

6. Emerging Research Issues: Challenges and Opportunities

6.1. Challenges for Research in EV Supply Chain Ecosystem

6.2. Opportunities for Research in the EV Supply Chain Ecosystem

7. Discussion

8. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Chaudhuri, A.; Boer, H.; Taran, Y. Supply Chain Integration, Risk Management and Manufacturing Flexibility. Int. J. Oper. Prod. Manag. 2018, 38, 690–712. [Google Scholar] [CrossRef]

- Gunasekaran, A.; Lai, K.h.; Edwin Cheng, T.C. Responsive Supply Chain: A Competitive Strategy in a Networked Economy. Omega 2008, 36, 549–564. [Google Scholar] [CrossRef]

- Fawcett, S.E.; Fawcett, A.M.; Watson, B.J.; Magnan, G.M. Peeking inside the black box: Toward an understanding of supply chain collaboration dynamics. J. Supply Chain. Manag. 2012, 48, 44–72. [Google Scholar] [CrossRef]

- Schroeder, P.; Anggraeni, K.; Weber, U. The Relevance of Circular Economy Practices to the Sustainable Development Goals. J. Ind. Ecol. 2019, 23, 77–95. [Google Scholar] [CrossRef]

- Nieuwenhuis, P.; Wells, P.E. The Global Automotive Industry, 2015th ed.; John Wiley & Sons: West Sussex, UK, 2015; ISBN 9781118802359. [Google Scholar]

- Nunes, B.; Bennett, D. Green Operations Initiatives in the Automotive Industry: An Environmental Reports Analysis and Benchmarking Study. Benchmarking 2010, 17, 396–420. [Google Scholar] [CrossRef]

- Gohoungodji, P.; N’Dri, A.B.; Latulippe, J.M.; Matos, A.L.B. What Is Stopping the Automotive Industry from Going Green? A Systematic Review of Barriers to Green Innovation in the Automotive Industry. J. Clean. Prod. 2020, 277, 123524. [Google Scholar] [CrossRef]

- Vieira, L.C.; Longo, M.; Mura, M. From Carbon Dependence to Renewables: The European Oil Majors’ Strategies to Face Climate Change. Bus. Strategy Environ. 2023, 32, 1248–1259. [Google Scholar] [CrossRef]

- Osman, A.I.; Chen, L.; Yang, M.; Msigwa, G.; Farghali, M.; Fawzy, S.; Rooney, D.W.; Yap, P.S. Cost, Environmental Impact, and Resilience of Renewable Energy under a Changing Climate: A Review. Environ. Chem. Lett. 2023, 21, 741–764. [Google Scholar] [CrossRef]

- IEA. World Energy Outlook 2022—Analysis; IEA: Paris, France, 2022. [Google Scholar]

- IRA. Inflation Reduction Act of 2022. Department of Energy, IRA; 2022. Available online: https://www.energy.gov/gdo/inflation-reduction-act (accessed on 30 December 2023).

- Tibrewal, K.; Venkataraman, C. COVID-19 Lockdown Closures of Emissions Sources in India: Lessons for Air Quality and Climate Policy. J. Environ. Manag. 2022, 302, 114079. [Google Scholar] [CrossRef] [PubMed]

- Nguyen, X.P.; Hoang, A.T.; Ölçer, A.I.; Huynh, T.T. Record Decline in Global CO2 Emissions Prompted by COVID-19 Pandemic and Its Implications on Future Climate Change Policies. Energy Sources Part. A Recovery Util. Environ. Eff. 2021, 1–4. [Google Scholar] [CrossRef]

- Carey, N.; White, J. Industry Pain Abounds as Electric Car Demand Hits Slowdown; Reuters: 2024. Available online: https://www.reuters.com/business/autos-transportation/industry-pain-abounds-electric-car-demand-hits-slowdown-2024-01-30/ (accessed on 30 December 2023).

- Whalen, J. EV Transition Cools as Demand Slows and Automakers Trim Production. The Washington Post. 2023. Available online: https://www.washingtonpost.com/business/2023/12/26/ev-demand-slows/ (accessed on 30 December 2023).

- Anderson, E.G.; Bhargava, H.K.; Boehm, J.; Parker, G. Electric Vehicles Are a Platform Business: What Firms Need to Know. Calif. Manag. Rev. 2022, 64, 135–154. [Google Scholar] [CrossRef]

- Gupta, R.; Mejia, C.; Gianchandani, Y.; Kajikawa, Y. Analysis on Formation of Emerging Business Ecosystems from Deals Activities of Global Electric Vehicles Hub Firms. Energy Policy 2020, 145, 111532. [Google Scholar] [CrossRef]

- Bhatti, G.; Mohan, H.; Raja Singh, R. Towards the Future of Smart Electric Vehicles: Digital Twin Technology. Renew. Sustain. Energy Rev. 2021, 141, 110801. [Google Scholar] [CrossRef]

- Kosai, S.; Takata, U.; Yamasue, E. Natural Resource Use of a Traction Lithium-Ion Battery Production Based on Land Disturbances through Mining Activities. J. Clean. Prod. 2021, 280, 124871. [Google Scholar] [CrossRef]

- Dunn, J.; Slattery, M.; Kendall, A.; Ambrose, H.; Shen, S. Circularity of Lithium-Ion Battery Materials in Electric Vehicles. Environ. Sci. Technol. 2021, 55, 5189–5198. [Google Scholar] [CrossRef] [PubMed]

- Baars, J.; Domenech, T.; Bleischwitz, R.; Melin, H.E.; Heidrich, O. Circular Economy Strategies for Electric Vehicle Batteries Reduce Reliance on Raw Materials. Nat. Sustain. 2020, 4, 71–79. [Google Scholar] [CrossRef]

- Husain, I.; Ozpineci, B.; Islam, M.S.; Gurpinar, E.; Su, G.J.; Yu, W.; Chowdhury, S.; Xue, L.; Rahman, D.; Sahu, R. Electric Drive Technology Trends, Challenges, and Opportunities for Future Electric Vehicles. Proc. IEEE 2021, 109, 1039–1059. [Google Scholar] [CrossRef]

- Perera, P.; Hewage, K.; Sadiq, R. Electric Vehicle Recharging Infrastructure Planning and Management in Urban Communities. J. Clean. Prod. 2020, 250, 119559. [Google Scholar] [CrossRef]

- Vdovic, H.; Babic, J.; Podobnik, V. Automotive Software in Connected and Autonomous Electric Vehicles: A Review. IEEE Access 2019, 7, 166365–166379. [Google Scholar] [CrossRef]

- Sun, X.; Li, Z.; Wang, X.; Li, C. Technology Development of Electric Vehicles: A Review. Energies 2019, 13, 90. [Google Scholar] [CrossRef]

- Rapson, D.S.; Muehlegger, E. The Economics of Electric Vehicles. Rev. Environ. Econ. Policy 2023, 17, 274–294. [Google Scholar] [CrossRef]

- Electric Vehicle Market Size to Hit USD 1716.83 Bn By 2032. Available online: https://www.precedenceresearch.com/electric-vehicle-market (accessed on 29 December 2023).

- Morgan, J. Electric Vehicles: The Future We Made and the Problem of Unmaking It. Camb. J. Econ. 2020, 44, 953–977. [Google Scholar] [CrossRef]

- Electric Vehicles and Supply Chain: PwC. Available online: https://www.pwc.com/us/en/industries/industrial-products/library/electric-vehicles-supply-chain.html (accessed on 28 December 2023).

- Das, H.S.; Rahman, M.M.; Li, S.; Tan, C.W. Electric Vehicles Standards, Charging Infrastructure, and Impact on Grid Integration: A Technological Review. Renew. Sustain. Energy Rev. 2020, 120, 109618. [Google Scholar] [CrossRef]

- Rajaeifar, M.A.; Ghadimi, P.; Raugei, M.; Wu, Y.; Heidrich, O. Challenges and Recent Developments in Supply and Value Chains of Electric Vehicle Batteries: A Sustainability Perspective. Resour. Conserv. Recycl. 2022, 180, 106144. [Google Scholar] [CrossRef]

- Sierzchula, W.; Bakker, S.; Maat, K.; Van Wee, B. The Influence of Financial Incentives and Other Socio-Economic Factors on Electric Vehicle Adoption. Energy Policy 2014, 68, 183–194. [Google Scholar] [CrossRef]

- Ziegler, D.; Abdelkafi, N. Business Models for Electric Vehicles: Literature Review and Key Insights. J. Clean. Prod. 2022, 330, 129803. [Google Scholar] [CrossRef]

- Wu, Y.; Jia, W.; Li, L.; Song, Z.; Xu, C.; Liu, F. Risk Assessment of Electric Vehicle Supply Chain Based on Fuzzy Synthetic Evaluation. Energy 2019, 182, 397–411. [Google Scholar] [CrossRef]

- Perryman, A. A Growing Appetite for EVs Tasks the Supply Chain to Scale | Supply Chain Dive. Available online: https://www.supplychaindive.com/news/electric-vehicle-battery-sourcing-material-manufacturing/596148/ (accessed on 27 January 2024).

- Lai, S.; Qiu, J.; Tao, Y.; Zhao, J. Pricing for Electric Vehicle Charging Stations Based on the Responsiveness of Demand. IEEE Trans. Smart Grid 2023, 14, 530–544. [Google Scholar] [CrossRef]

- Li, K.; Shao, C.; Zhang, H.; Wang, X. Strategic Pricing of Electric Vehicle Charging Service Providers in Coupled Power-Transportation Networks. IEEE Trans. Smart Grid 2023, 14, 2189–2201. [Google Scholar] [CrossRef]

- Arribas-Ibar, M.; Nylund, P.A.; Brem, A. The Risk of Dissolution of Sustainable Innovation Ecosystems in Times of Crisis: The Electric Vehicle during the COVID-19 Pandemic. Sustainability 2021, 13, 1319. [Google Scholar] [CrossRef]

- Bohnsack, R.; Pinkse, J. Value Propositions for Disruptive Technologies: Reconfiguration Tactics in the Case of Electric Vehicles. Calif. Manag. Rev. 2017, 59, 79–96. [Google Scholar] [CrossRef]

- Hussain, A.; Musilek, P. Resilience Enhancement Strategies for and Through Electric Vehicles. Sustain. Cities Soc. 2022, 80, 103788. [Google Scholar] [CrossRef]

- Zhao, J.; Xi, X.; Na, Q.; Wang, S.; Kadry, S.N.; Kumar, P.M. The Technological Innovation of Hybrid and Plug-in Electric Vehicles for Environment Carbon Pollution Control. Environ. Impact Assess. Rev. 2021, 86, 106506. [Google Scholar] [CrossRef]

- Eckstein, D.; Goellner, M.; Blome, C.; Henke, M. The Performance Impact of Supply Chain Agility and Supply Chain Adaptability: The Moderating Effect of Product Complexity. Int. J. Prod. Res. 2015, 53, 3028–3046. [Google Scholar] [CrossRef]

- Blome, D.; Schoenherr, T.; Rexhausen, C. Antecedents and Enablers of Supply Chain Agility and Its Effect on Performance: A Dynamic Capabilities Perspective. Int. J. Prod. Res. 2013, 51, 1295–1318. [Google Scholar] [CrossRef]

- Rong, K.; Shi, Y.; Shang, T.; Chen, Y.; Hao, H. Organizing Business Ecosystems in Emerging Electric Vehicle Industry: Structure, Mechanism, and Integrated Configuration. Energy Policy 2017, 107, 234–247. [Google Scholar] [CrossRef]

- Lu, C.; Rong, K.; You, J.; Shi, Y. Business Ecosystem and Stakeholders’ Role Transformation: Evidence from Chinese Emerging Electric Vehicle Industry. Expert. Syst. Appl. 2014, 41, 4579–4595. [Google Scholar] [CrossRef]

- Al-Alawi, B.M.; Bradley, T.H. Review of Hybrid, Plug-in Hybrid, and Electric Vehicle Market Modeling Studies. Renew. Sustain. Energy Rev. 2013, 21, 190–203. [Google Scholar] [CrossRef]

- Debnath, R.; Bardhan, R.; Reiner, D.M.; Miller, J.R. Political, Economic, Social, Technological, Legal and Environmental Dimensions of Electric Vehicle Adoption in the United States: A Social-Media Interaction Analysis. Renew. Sustain. Energy Rev. 2021, 152, 111707. [Google Scholar] [CrossRef]

- Hannan, M.A.; Hoque, M.M.; Mohamed, A.; Ayob, A. Review of Energy Storage Systems for Electric Vehicle Applications: Issues and Challenges. Renew. Sustain. Energy Rev. 2017, 69, 771–789. [Google Scholar] [CrossRef]

- Mahmoudzadeh Andwari, A.; Pesiridis, A.; Rajoo, S.; Martinez-Botas, R.; Esfahanian, V. A Review of Battery Electric Vehicle Technology and Readiness Levels. Renew. Sustain. Energy Rev. 2017, 78, 414–430. [Google Scholar] [CrossRef]

- Skeete, J.P.; Wells, P.; Dong, X.; Heidrich, O.; Harper, G. Beyond the EVent Horizon: Battery Waste, Recycling, and Sustainability in the United Kingdom Electric Vehicle Transition. Energy Res. Soc. Sci. 2020, 69, 101581. [Google Scholar] [CrossRef]

- Krishnan, R.; Butt, B. “The Gasoline of the Future:” Points of Continuity, Energy Materiality, and Corporate Marketing of Electric Vehicles among Automakers and Utilities. Energy Res. Soc. Sci. 2022, 83, 102349. [Google Scholar] [CrossRef]

- Prasadh, S.H.; Gopalakrishnan, R.; Sathish, S.; Ravichandran, M. Charging Infrastructure for EVs. In The Future of Road Transportation: Electrification and Automation; CRC Press: Boca Raton, FL, USA, 2023; pp. 196–213. ISBN 9781003354901. [Google Scholar]

- Train, K.E.; Winston, C. Vehicle choice behavior and the declining market share of U.S. automakers*. Int. Econ. Rev. 2007, 48, 1469–1496. [Google Scholar] [CrossRef]

- Campbell, J.R.; Hopenhayn, H.A. Market size matters. J. Ind. Econ. 2005, 53, 1–25. [Google Scholar] [CrossRef]

- Sanci, E.; Daskin, M.S.; Hong, Y.C.; Roesch, S.; Zhang, D. Mitigation Strategies against Supply Disruption Risk: A Case Study at the Ford Motor Company. Int. J. Prod. Res. 2022, 60, 5956–5976. [Google Scholar] [CrossRef]

- Thun, J.H.; Hoenig, D. An Empirical Analysis of Supply Chain Risk Management in the German Automotive Industry. Int. J. Prod. Econ. 2011, 131, 242–249. [Google Scholar] [CrossRef]

- Zulkarnain, Z.; Leviäkangas, P.; Kinnunen, T.; Kess, P. The Electric Vehicles Ecosystem Model—Construct, Analysis and Identification of Key Challenges. Manag. Glob. Transit. 2014, 12, 253–277. [Google Scholar]

- Soares, L.O.; Reis, A.d.C.; Vieira, P.S.; Hernández-Callejo, L.; Boloy, R.A.M. Electric Vehicle Supply Chain Management: A Bibliometric and Systematic Review. Energies 2023, 16, 1563. [Google Scholar] [CrossRef]

- Marcos, J.T.; Scheller, C.; Godina, R.; Spengler, T.S.; Carvalho, H. Sources of Uncertainty in the Closed-Loop Supply Chain of Lithium-Ion Batteries for Electric Vehicles. Clean. Logist. Supply Chain. 2021, 1, 100006. [Google Scholar] [CrossRef]

- Yang, Z.; Huang, H.; Lin, F.; Yang, Z.; Lin, F.; Huang, H. Sustainable Electric Vehicle Batteries for a Sustainable World: Perspectives on Battery Cathodes, Environment, Supply Chain, Manufacturing, Life Cycle, and Policy. Adv. Energy Mater. 2022, 12, 2200383. [Google Scholar] [CrossRef]

- Yang, Z.; Chen, H.; Peng, C.; Liu, X. Exploring the Role of Environmental Regulations in the Production and Diffusion of Electric Vehicles. Comput. Ind. Eng. 2022, 173, 108675. [Google Scholar] [CrossRef]

- Kumar, R.R.; Chakraborty, A.; Mandal, P. Promoting Electric Vehicle Adoption: Who Should Invest in Charging Infrastructure? Transp. Res. E Logist. Transp. Rev. 2021, 149, 102295. [Google Scholar] [CrossRef]

- Chirumalla, K.; Reyes, L.G.; Toorajipour, R. Mapping a Circular Business Opportunity in Electric Vehicle Battery Value Chain: A Multi-Stakeholder Framework to Create a Win–Win–Win Situation. J. Bus. Res. 2022, 145, 569–582. [Google Scholar] [CrossRef]

- Kotter, R.; Shaw, S. A Micro to Macro Investigation on Electric Vehicle Policy in the UK: Work Package 3 Activity 6 Report. Work Package 3 Activity 6 Report. 2013. Available online: https://nrl.northumbria.ac.uk/id/eprint/12893/ (accessed on 5 December 2023).

- Gebhardt, M.; Beck, J.; Kopyto, M.; Spieske, A. Determining Requirements and Challenges for a Sustainable and Circular Electric Vehicle Battery Supply Chain: A Mixed-Methods Approach. Sustain. Prod. Consum. 2022, 33, 203–217. [Google Scholar] [CrossRef]

- Lefeng, S.; Shengnan, L.; Chunxiu, L.; Yue, Z.; Cipcigan, L.; Acker, T.L. A Framework for Electric Vehicle Power Supply Chain Development. Util. Policy 2020, 64, 101042. [Google Scholar] [CrossRef]

- Ribeiro da Silva, E.; Lohmer, J.; Rohla, M.; Angelis, J. Unleashing the Circular Economy in the Electric Vehicle Battery Supply Chain: A Case Study on Data Sharing and Blockchain Potential. Resour. Conserv. Recycl. 2023, 193, 106969. [Google Scholar] [CrossRef]

- Jacobides, M.G.; Cennamo, C.; Gawer, A. Towards a Theory of Ecosystems. Strateg. Manag. J. 2018, 39, 2255–2276. [Google Scholar] [CrossRef]

- Bajaj, D.K.; Siddharth, P. Artificial Intelligence (AI) in Electrical Vehicles. In Recent Advances in Energy Harvesting Technologies; River Publishers: Aalborg, Denmark, 2023; pp. 57–76. ISBN 9788770228800. [Google Scholar]

- Lee, M. An Analysis of the Effects of Artificial Intelligence on Electric Vehicle Technology Innovation Using Patent Data. World Pat. Inf. 2020, 63, 102002. [Google Scholar] [CrossRef]

- Hu, J.; Lin, Y.; Li, J.; Hou, Z.; Chu, L.; Zhao, D.; Zhou, Q.; Jiang, J.; Zhang, Y. Performance Analysis of AI-Based Energy Management in Electric Vehicles: A Case Study on Classic Reinforcement Learning. Energy Convers. Manag. 2024, 300, 117964. [Google Scholar] [CrossRef]

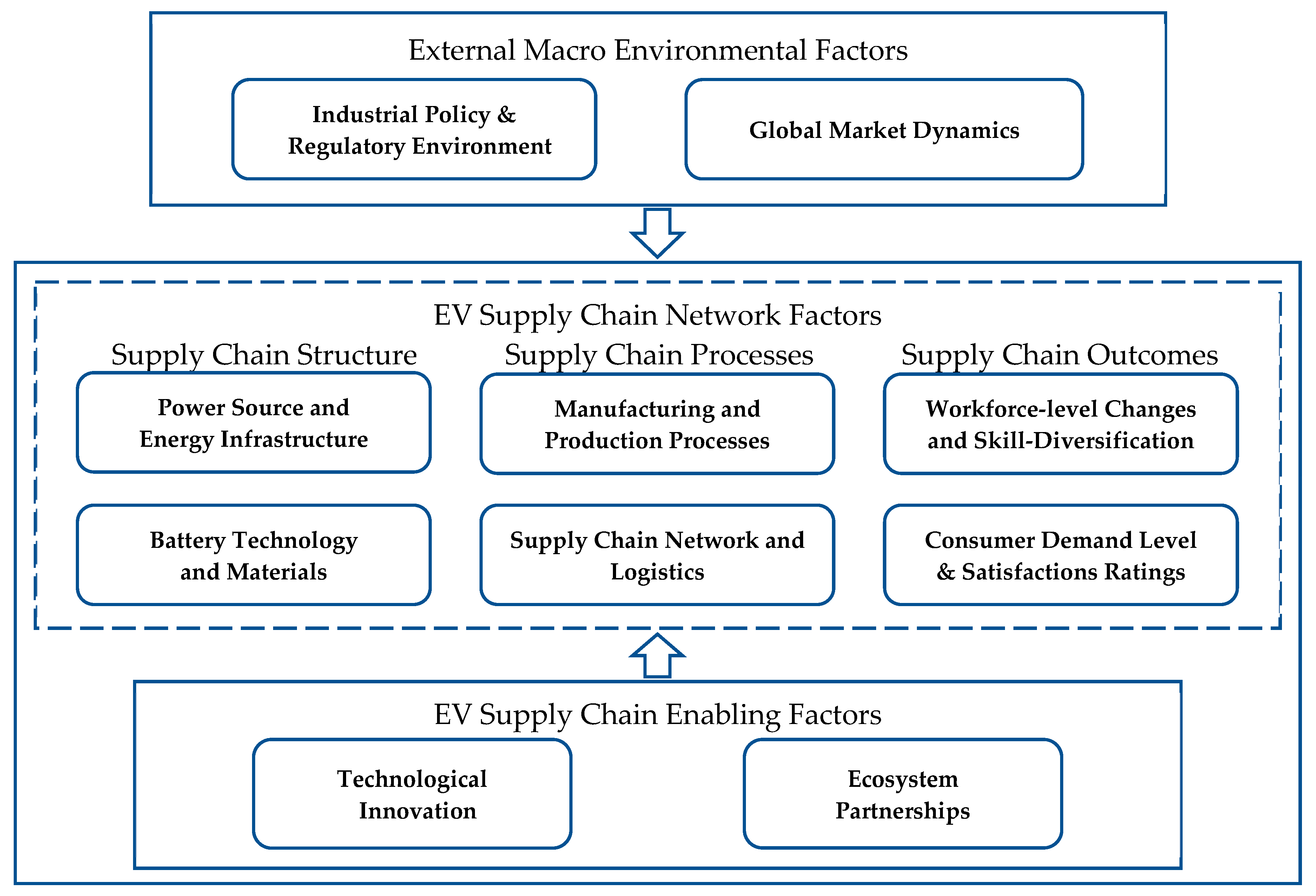

| (1) Macro-Environmental Factors in the broader external environment can significantly impact the EV supply chain. They include macroeconomic, political, regulatory, and environmental influences. For example, government policies on emissions, fuel prices, and trade agreements can all affect the demand for EVs and the availability of key resources like batteries and rare earth metals. Environmental concerns and sustainability initiatives can also influence consumer preferences and drive changes in EV production and supply chain practices. | ||

| Key Variable | Definition | Examples/Indicators |

| Industrial Policy and Regulatory Environment | The set of government policies, rules, regulations, and initiatives that impact industries, including the EV industry. | Tax incentives, subsidies, tax credits, and regulations related to emissions, safety, and manufacturing standards. They also encompass trade policies, tariffs, and international agreements that influence the import and export of EV components and vehicles. |

| Global Market Dynamics | Global market dynamics refer to the factors and forces shaping the global EV marketplace. | Consumer preferences, economic conditions, and competitive forces on a global scale. Market dynamics also encompass competition among automakers, technological advancements, and shifts in supply and demand that impact the global EV market’s growth and profitability. |

| (2) EV supply chain Network Factors pertain to the structure and efficiency of the EV supply chain network itself. They encompass considerations such as the geographical distribution of suppliers, manufacturing facilities, distribution centers, and retail outlets. The design and optimization of the supply chain network impact cost efficiency, lead times, and the ability to meet customer demand. Factors like the location of charging infrastructure and the availability of recycling facilities for batteries are also part of this dimension. | ||

| Key Variable/Element | Definition | Examples/Indicators |

| Power Source and Energy Infrastructure: | The extent of the energy sources used to power EVs and the infrastructure needed to support them. | The generation, distribution, and availability of electric power, as well as the development of charging stations, battery swapping stations, and renewable energy sources (such as solar and wind) integrated into the grid to support sustainable energy for EVs. |

| Battery Technology and Materials: | The specialized chemistries, structural components, and cutting-edge materials integral to the development of high-efficiency, high-density, and durable energy storage solutions for EVs. | It includes sourcing materials like lithium, cobalt, and nickel, as well as advancements in battery chemistry and manufacturing processes. Battery technology influences the performance, range, and cost-effectiveness of EVs. |

| Manufacturing and Production Processes: | The sequence of operations and techniques employed in creating EVs and their components through a systematic assembly and integration of materials into finished products. | It encompasses the assembly of EVs, battery production, and the sourcing of various parts. Efficiency and innovation in manufacturing processes can impact production costs and the speed at which EVs can be brought to market. |

| Supply Chain Network and Logistics: | The planning, coordinating, and managing of the physical flow of goods, including components, finished vehicles, and batteries, throughout the supply chain. | This includes decisions related to warehousing, transportation, inventory management, and distribution networks. Effective logistics and supply chain network design ensure timely delivery to customers and minimize costs. |

| Supply Chain Outcomes: | Consumer Demand Level and Satisfaction Rating are related to consumer behavior and preferences. | Consumer demand for EVs can significantly impact the supply chain, influencing production volumes and distribution strategies. Satisfaction ratings reflect how well the supply chain and EV products meet consumer expectations, affecting brand reputation and future market growth. |

| Workforce Level-Changes and Skill Diversification: | Workforce-level changes involve shifts in employment within the EV supply chain. | As the industry evolves, there may be increased demand for skilled workers in areas such as battery technology, EV manufacturing, and supply chain management. Skill diversification refers to the development of specialized skills needed to support the growing EV ecosystem. |

| (3) EV supply chain Enabling Factors encompass the technologies, processes, and strategies that enable a smooth and efficient EV supply chain. They include advancements in battery technology, supply chain automation, digitalization, and data analytics. For example, innovations in battery chemistry and manufacturing techniques can lead to longer-range EVs with improved performance. Supply chain enabling factors also involve practices like demand forecasting, inventory management, and sustainability initiatives that enhance the overall effectiveness and sustainability of the supply chain. | ||

| Key Variable | Definition | Examples/Indicators |

| Technological Innovation: | The continuous development, improvement, and application of new technologies and solutions that enhance the efficiency, performance, and sustainability of EVs and their related supply chains. | This includes innovations in battery technology, electric drivetrains, charging infrastructure, materials, software systems, and automation. Technological innovation drives advancements in EVs, making them more accessible, affordable, and environmentally friendly. |

| Ecosystem Partnerships: | Collaboration and strategic alliances between various stakeholders, including automakers, suppliers, charging infrastructure providers, energy companies, government entities, and other relevant organizations. | These partnerships aim to create a supportive ecosystem that facilitates the development, production, and adoption of EVs. They may involve joint ventures, research and development agreements, shared infrastructure investments, and initiatives to promote policy and regulatory changes that benefit the EV industry. Ecosystem partnerships help build a cohesive network of organizations working together to overcome challenges and accelerate the growth of the EV market. |

| Feature | ICE Supply Chain | EV Supply Chain |

|---|---|---|

| Innovation scope | Limited | Broad |

| Market dynamics | Mature | Growing |

| Raw materials | Steel, Aluminum, Plastic | Lithium, cobalt, nickel |

| Role of suppliers | Straightforward | Complex |

| Infrastructure | Well-established | Not as well-established |

| Technology use | Mature | Still in development |

| Risk of disruption and resilience | Resilient | Vulnerable |

| Regulations | Established | Evolving |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jagani, S.; Marsillac, E.; Hong, P. The Electric Vehicle Supply Chain Ecosystem: Changing Roles of Automotive Suppliers. Sustainability 2024, 16, 1570. https://doi.org/10.3390/su16041570

Jagani S, Marsillac E, Hong P. The Electric Vehicle Supply Chain Ecosystem: Changing Roles of Automotive Suppliers. Sustainability. 2024; 16(4):1570. https://doi.org/10.3390/su16041570

Chicago/Turabian StyleJagani, Sandeep, Erika Marsillac, and Paul Hong. 2024. "The Electric Vehicle Supply Chain Ecosystem: Changing Roles of Automotive Suppliers" Sustainability 16, no. 4: 1570. https://doi.org/10.3390/su16041570

APA StyleJagani, S., Marsillac, E., & Hong, P. (2024). The Electric Vehicle Supply Chain Ecosystem: Changing Roles of Automotive Suppliers. Sustainability, 16(4), 1570. https://doi.org/10.3390/su16041570