How Realistic Are Coal Phase-Out Timeline Targets for Turkey?

Abstract

:1. Introduction

2. Literature Review

2.1. Coal-Fired Power Generation

2.1.1. Coal Power from a Historical Perspective (Globally and in Türkiye)

2.1.2. Coal-Fired Power Generation and Energy Security Interaction

2.2. The Challenges Facing the Coal-Fired Power Generation Phase-Out

2.2.1. Technical Challenges

2.2.2. Nontechnical Challenges

2.2.3. Energy Storage as an Option

3. Projecting the Future of Coal Power Generation for Türkiye (Phase-Out or Business-as-Usual?)

3.1. Materials and Methods

3.1.1. APlus Report, 2021

- Reaching a 101 GW solar and wind capacity (20% higher than official targets);

- The elimination of incentives for coal plants and the introduction of a carbon price;

- A 136 GWh battery capacity.

3.1.2. Türkiye National Energy Plan

3.1.3. Approach of Our Study and Analysis

Coal-Fired Capacity in Türkiye: A Slow but Imminent Phase-Out?

Supply–Demand Model with Scenarios

- The target year is 2035.

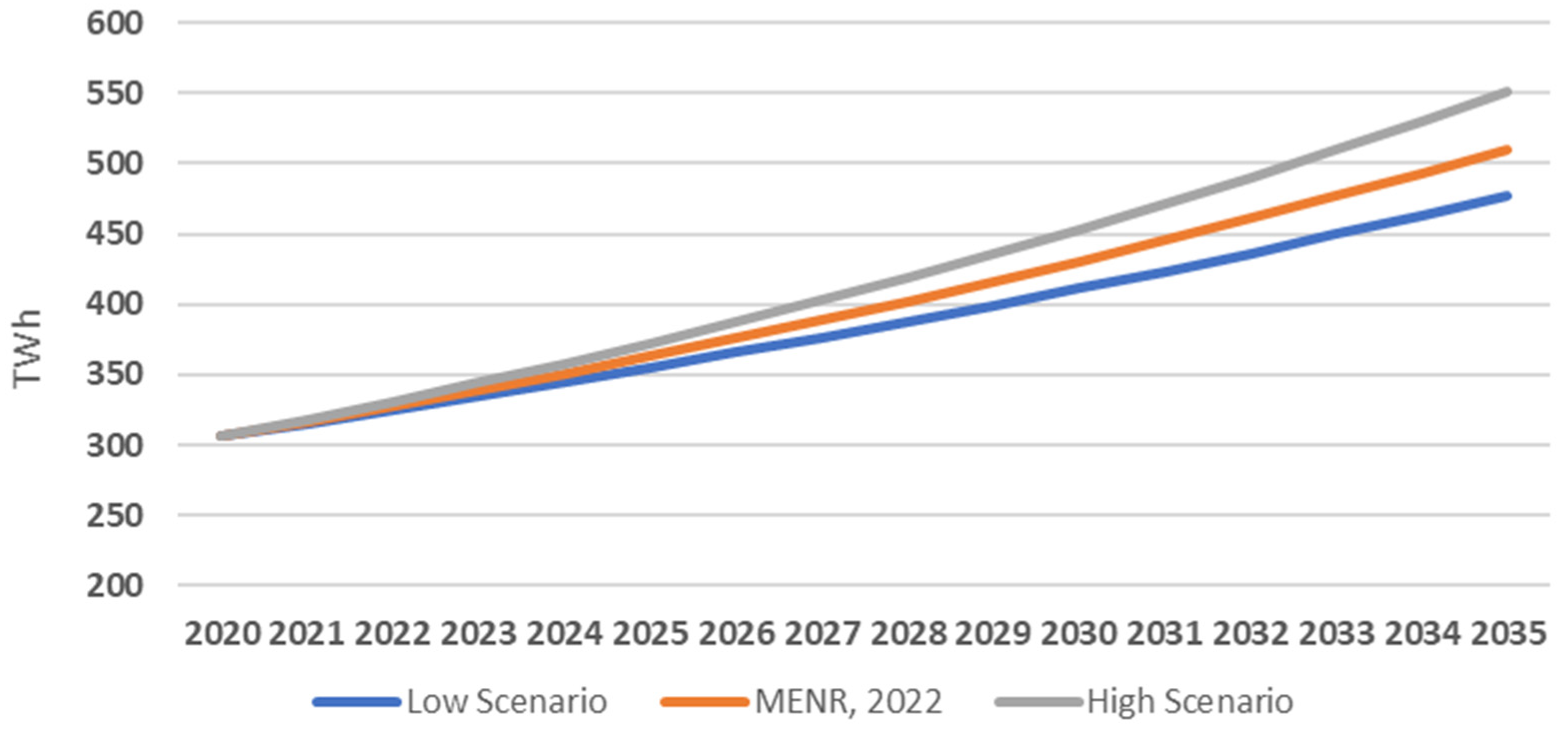

- Hourly Consumption Profile: the rate of increase in the demand of electricity is taken from official MENR plan (as main scenario, 3.5% increase per annum), but we show low and high scenarios, too (see Figure 5).

- 3.

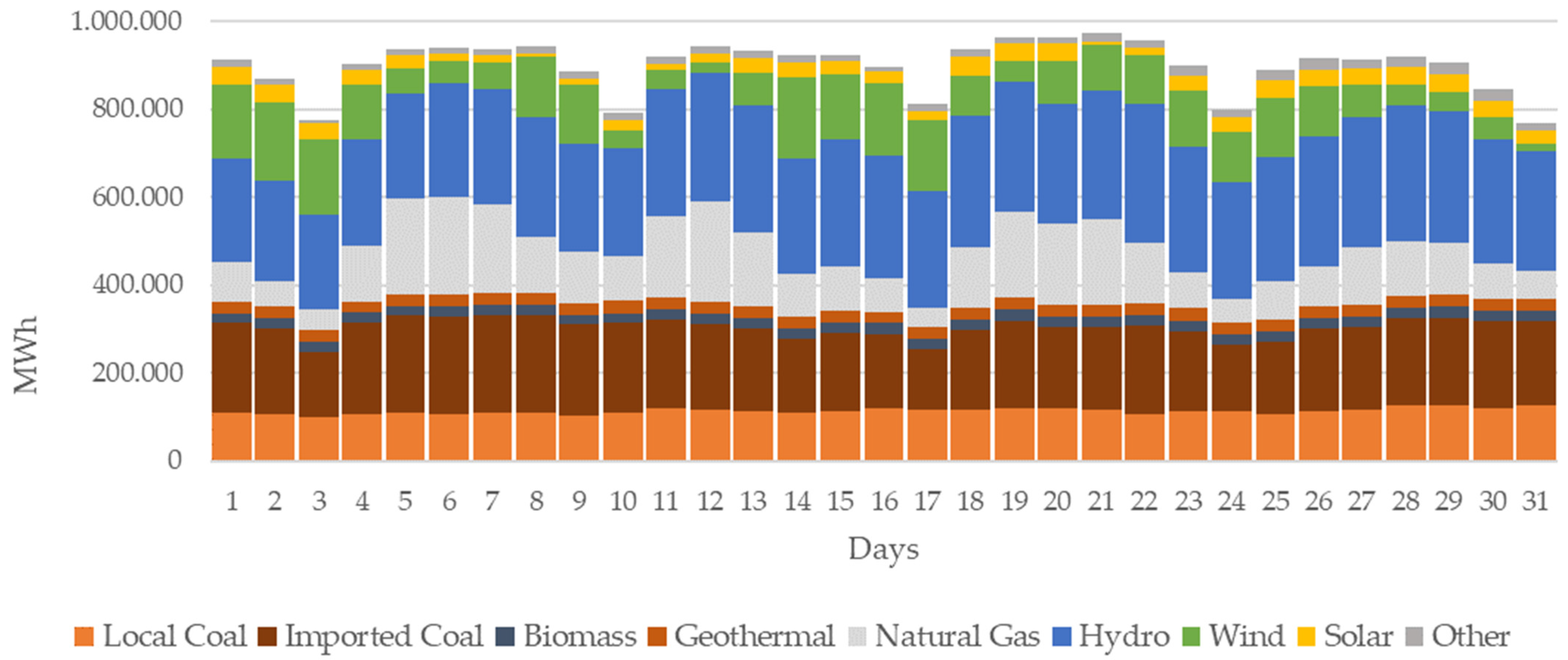

- Hourly demand and generation data from the past 5 years (2018–2022) have been taken and used for profiling the future demand and generation characteristics.

- 4.

- The “Hourly Dispatch” model applies the merit–order principle by taking marginal costs and the flexibilities of different generation sources into account. VRE generate their full potential with no curtailment. Nuclear capacity generates independent of its marginal cost. Other RE, CCGT, and coal share the rest of the demand. It is assumed that the increases in the other RE will be negligible due to near-complete utilization of these resources.

- 5.

- On the way to a decarbonized (and/or net-zero) economy, it is assumed that solar and wind capacity, VRE, would be massively deployed, especially to replace coal (and eventually gas, too). But, as they are intermittent, such an increase would require a sizable energy storage capacity. That is determined as the highest energy deficit across consecutive hours. The depth of discharge (DoD) is accepted as 80%.

- 6.

- Excess wind and solar generation beyond meeting the actual demand and beyond the storable capacity needs to be curtailed at a cost. For the ease of analysis, however, the need for additional battery capacity for the curtailment and the cost associated with it is omitted.

- 7.

- A balance of the Turkish power grid is highly sensitive to the generation of hydropower plants. Minor fluctuations in hydropower generation may have very impactful effects on the calculated battery storage capacities. This study does not consider the scenario of a dry year and assumes all hydro capacity (including run-of-river) dispatchable and has grid priority.

- 8.

- The carbon dioxide emission for a standard coal-fired power plant is assumed to be 0.85 tons/MWh, while a CCGT power plant is assumed to emit 0.45 tons/MWh.

- 9.

- In line with latest market expectations, we assume the cost of installing solar PV to be 480 USD/kW, wind to be 1450 USD/kW, and battery storage to be 400 (including installation and integration to grid costs) USD/KWh.

4. Results and Discussion

- The difficulties and challenges to be overcome. These include reviewing all the existing energy transition technologies and their deployment, procuring permits, and clearing land allocation hurdles. Other concerns are with the grid connection queues and the availability of critical minerals and supply-chain crunches [70]. For example, investments in new wind farms slumped to the lowest in more than a decade in Europe in 2022 [71]. Thus, the possibility of realizing the assumed rate of VRE deployment in Türkiye seems really low.

- Even if the assumption looks achievable, the absence of an official commitment to a coal-exit policy, as well as a high possibility of new geopolitical tensions triggering energy security concerns, may necessitate a coal capacity retention approach by the government.

- Involved costs: The latest observed trends and facts indicate that, after decades of declining technology prices, solar and wind project costs have now begun to increase [72]. Nevertheless, if a decrease should occur (at least for solar), the total estimated renewable transition CAPEX cost for the coal exit 1 scenario would amount to around USD 135 Bio (and for coal exit 2 to around USD 140 Bio). We must also emphasize that these sums do not include the relevant transmission and grid connection costs, as well as the VRE curtailment costs. Furthermore, no consideration is given to just transition issues and related costs. Thus, even if the technology is deployable and the challenges overcome (and policy approach changes towards coal, which looks unlikely), these costs are considerable and would increase the unit price of consumed electricity. That might be the last thing a country already under economic stress might want.

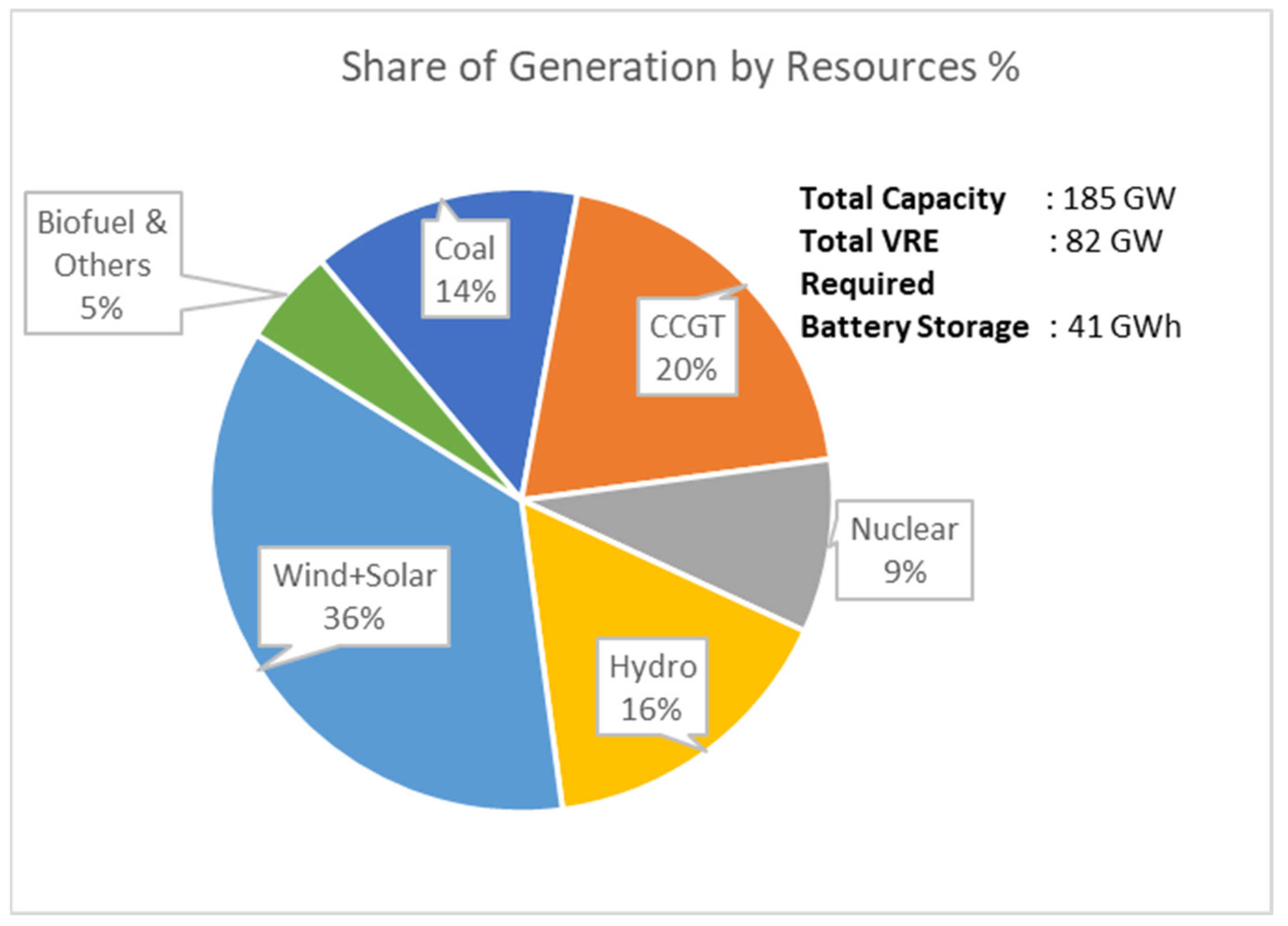

- Coal will, anyway, undergo a slow natural phase-out process (even without policy force), and the speed and scope of this process will depend on the level of deployment of VRE together with battery back-ups, as well as the existence of the carbon price and other economic indicators. Phase-out may accelerate after 2035, probably aimed at a completion by 2053, which is the official net-zero target year of the Turkish government. This is a gradual and cautious transition away from coal (from a good one-third of generation today to around 14% in 2035), whereby coal will also function mostly in a back-up or reserve capacity, fulfilling energy security goals.

- One reason that coal plants are needed in the system is that, even if a high storage capacity (calculated as 4% of global total target) is available and deployable at scale, the cost (as of today’s calculations) of installing such a capacity involves enormous amounts. Until 2035, more than USD 11 billion CAPEX per annum for energy system decarbonization and transition is needed. This may indeed be beyond the means of the country, considering the last 20 years’ trends and actual costs, which is about USD 5 billion per annum, including not only the VRE but all generation facility installment costs.

- As the main aim of decarbonization and energy transition is reducing carbon emissions, we also analyzed the results regarding this issue. In terms of coal generation-related emissions, there will be a ~45% reduction in the BaU scenario; that is, from ~118 million/t today to 62 million/t in 2035. This would be achieved through less utilization and the gradual retirement of coal plants. Total power emissions would amount to around 109 million/t, a reduction of 30% from today’ figure. With the BaU scenario, the stranded-asset trap and associated costs, as well as employment and social issues (just energy transition concerns) in coal regions, can be avoided. In the coal-exit scenario, the reductions are higher than BaU by 63%, reduced to 40 G/tons, as there are only gas emissions left (see Table 4).

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| BAU | Business-as-Usual | LDES | Long-Duration Energy Storage |

| BESS | Battery Energy Storage System | MENR | Ministry of Energy and Natural Resources |

| CAPEX | Capital Expenditure | NDC | Nationally Determined Contribution |

| CCGP | Combined Cycle Gas Power Plant | OECD | Organization for Economic Co-operation and Development |

| CCGT | Combined Cycle Gas Turbine | PP | Power Plant |

| COP | Conference of the Parties | RE | Renewable Energy |

| DoD | Depth of Discharge | REAC | National Renewable Energy Action Plan |

| EMRA | Energy Market Regulatory Authority | SDGs | Sustainable Development Goals |

| EPIAS | Energy Market Operator | SDS | Sustainable Development Scenario |

| ESS | Energy Storage System | TEIAS | Turkish Electricity Transmission Corporation |

| EUAS | National Electricity Generation Corporation | TKI | Turkish Coal Enterprises |

| GHG | Greenhouse Gas | UNFCCC | United Nations Framework Convention on Climate Change |

| IEA | International Energy Agency | VRE | Variable Renewable Energy |

References

- BP. Statistical Review of World Energy. British Petroleum, BP P.L.C., London. 2022. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2022-full-report.pdf (accessed on 20 June 2023).

- Farnoosh, A. Power Generation from Coal, Oil, Gas, and Biofuels. In The Palgrave Handbook of International Energy Economics; Hafner, M., Luciani, G., Eds.; Palgrave Macmillan: Cham, Switzerland, 2022; pp. 109–136. [Google Scholar] [CrossRef]

- IEA. Coal-Fired Electricity. 2023. Available online: https://www.iea.org/reports/coal-fired-electricity (accessed on 18 June 2023).

- IEA. World Energy Outlook 2021. 2021. Available online: https://iea.blob.core.windows.net/assets/ed3b983c-e2c9-401c-8633-749c3fefb375/WorldEnergyOutlook2021.pdf (accessed on 18 June 2023).

- Bixel, E. Coal Phase-Out Status 22 March 2021. 2021. Available online: https://beyondfossilfuels.org/wp-content/uploads/2021/03/Overview-of-national-coal-phase-out-announcements-Europe-Beyond-Coal-22-March-2021.pdf (accessed on 18 June 2023).

- Friedrich-Ebert-Stiftung. The Future of Coal in Europe: Is This the Exit from the Exit? 2022. Available online: https://justclimate.fes.de/e/the-future-of-coal-in-europe (accessed on 18 June 2023).

- RT-MENR. Türkiye National Energy Plan. 2022. Available online: https://enerji.gov.tr/Media/Dizin/EIGM/tr/Raporlar/TUEP/T%C3%BCrkiye_National_Energy_Plan.pdf (accessed on 18 June 2023).

- IEA. World Energy Outlook 2016. 2016. Available online: https://iea.blob.core.windows.net/assets/680c05c8-1d6e-42ae-b953-68e0420d46d5/WEO2016.pdf (accessed on 18 June 2023).

- Yergin, D. The Quest: Energy, Security, and the Remaking of the Modern World; Penguin Publishing Group: New York, NY, USA, 2011. [Google Scholar]

- Biresselioğlu, M.E.; Yıldırım, C.; Demir, M.H.; Tokcaer, S. Establishing and energy security framework for a fast-growing economy: Industry perspectives from Turkey. Energy Res. Soc. Sci. 2017, 27, 151–162. [Google Scholar] [CrossRef]

- Bulmer, R.E.; Kevwe, P.; Eberhard-Ruiz, A.; Jimena, M. Global Perspective on Coal Jobs and Managing Labor Transition out of Coal: Key Issues and Policy Responses; World Bank: Washington, DC, USA, 2021; Available online: https://openknowledge.worldbank.org/entities/publication/fed57ec7-e4ef-5895-82f7-c2028e62b6f1 (accessed on 18 June 2023).

- APlus Report. First Step in the Pathway to a Carbon Neutral Turkey: Coal Phase Out 2030. Prepared for Europe Beyond Coal, Climate Action Network (CAN) Europe, Sustainable Economics and Finance Research Association (SEFiA), WWF-Turkey (World Wildlife Fund), Greenpeace Mediterranean, 350.org and Climate Change Policy and Re-Search Association. 2021. Available online: https://sefia.org/wp-content/uploads/2021/12/Coal-Phaset-Out-2030.pdf (accessed on 20 June 2023).

- Shura Energy Transition Centre. Net Zero 2053: A Roadmap for the Turkish Electricity Sector. 2023. Available online: https://shura.org.tr/wp-content/uploads/2023/05/SHURA-2023-02-Rapor-Net-Zero-2053_Executive_-Summary_03052023-EN.pdf (accessed on 18 June 2023).

- Smil, V. Energy and Civilization. A History; MIT Press: Cambridge, MA, USA, 2017. [Google Scholar]

- Termuehlen, H.; Emsperger, W. Evolutionary Development of Coal-Fired Pow-er Plants. In Clean and Efficient Coal-Fired Power Plants: Development Toward Advanced Technologies; Termuehlen, H., Emsper-ger, W., Eds.; ASME Press: New York, NY, USA, 2003; pp. 3–27. [Google Scholar] [CrossRef]

- Breeze, P. Coal-Fired Generation; Academic Press: Cambridge, MA, USA, 2015. [Google Scholar]

- Speight, J.G. Coal-Fired Power Generation Handbook, 2nd ed.; John Wiley & Sons: Hoboken, NJ, USA, 2021. [Google Scholar]

- Rosenbaum, W. American Energy; SAGE Publications: Thousand Oaks, CA, USA, 2014; Available online: https://www.perlego.com/book/2800898/american-energy-pdf (accessed on 18 June 2023).

- EIA. Electricity Explained. U.S. Energy Information Administration. 2022. Available online: https://www.eia.gov/energyexplained/electricity/electricity-in-the-us.php (accessed on 18 June 2023).

- MENR. Ulusal Enerji Denge Tabloları. Ministry of Energy and Natural Resources. 2023. Available online: https://enerji.gov.tr/eigm-raporlari (accessed on 22 January 2024).

- TEIAS. Electricity Generation and Transmission Statistics. Load Dispatch Department. 2024. Available online: https://www.teias.gov.tr/turkiye-elektrik-uretim-iletim-istatistikleri (accessed on 23 January 2024).

- Ediger, V.S.; Karslioglu, M.O.; Akar, S.; Aras, H.; Tanriverdi, M. Lignite resources of Turkey: Geology, reserves, and exploration history. Int. J. Coal Geol. 2014, 132, 13–22. [Google Scholar] [CrossRef]

- TKI. Lignite and Hard Coal Sector Report; Turkish Coal Institute: Ankara, Turkey, 2022. Available online: https://www.tki.gov.tr/yayinlar (accessed on 22 January 2024).

- Oskay, R.G.; Özgür, N.; Yılmaz, İ.; Kılıç, A. Petrography and geochemistry of the Miocene coals from the Yatağan basin, southwestern Turkey. Bull. Geol. Soc. Greece 2013, 47, 2111–2120. Available online: https://ejournals.epublishing.ekt.gr/index.php/geosociety/article/view/11106/11149ne (accessed on 18 January 2024). [CrossRef]

- Türkyılmaz, O. Yerli Kömür kaynakları Elektrik Üretiminde Kullanılmalı mı, Neden? In Türkiye’de Termik Santraller; TMMOB Report; Ankara, Turkey, 2017; pp. 159–168. Available online: https://www.mmo.org.tr/sites/default/files/Sayfa%20159%20sonras%C4%B1.pdf (accessed on 19 January 2024).

- TMMOB, Maden Mühendisleri Odası. Kömür ve Enerji Raporu 2020. 2020. Available online: https://enerji.mmo.org.tr/wp-content/uploads/2020/09/MADEN-M.O-K%C3%96M%C3%9CR-VR-ENERJ%C4%B0-RAPORU-2020.pdf (accessed on 18 June 2023).

- Uyanik, S. The Role of Domestic Coal in Turkey’s Power Generation: Energy Supply Security versus Climate Commitments? In Proceedings of the 23rd World Energy Congress, Istanbul, Turkey, 9–13 October 2016. [Google Scholar]

- EMRA. License Status Reports; Energy Market Regulatory Authority: Ankara, Turkey, 2024. Available online: https://www.epdk.gov.tr/Detay/Icerik/3-0-86/elektriklisans-islemleri (accessed on 23 January 2024).

- IEA. Coal 2022 Analysis and Forecast to 2025. 2022. Available online: https://iea.blob.core.windows.net/assets/91982b4e-26dc-41d5-88b1-4c47ea436882/Coal2022.pdf (accessed on 18 June 2023).

- ETKB. Bilgi Merkezi. 2022. Available online: https://enerji.gov.tr/bilgimerkezi-tabiikaynaklar-komur (accessed on 18 June 2023).

- IEA. Turkey 2021, Energy Policy Review. 2021. Available online: https://iea.blob.core.windows.net/assets/cc499a7b-b72a-466c-88de-d792a9daff44/Turkey_2021_Energy_Policy_Review.pdf (accessed on 18 June 2023).

- Ember. Türkiye Electricity Review. 2023. Available online: https://ember-climate.org/insights/research/turkiye-electricity-review-2023/#supporting-material (accessed on 18 June 2023).

- IEA. World Energy Outlook. 2022. Available online: https://www.iea.org/reports/world-energy-outlook-2022 (accessed on 18 June 2023).

- Ember. European Electricity Review. 2023. Available online: https://ember-climate.org/insights/research/european-electricity-review-2023/#supporting-material (accessed on 18 June 2023).

- IEA. Electricity Market Report 2023. 2023. Available online: https://www.iea.org/reports/electricity-market-report-2023 (accessed on 18 June 2023).

- IEA. Coal 2023 Analysis and forecast to 2026. 2023. Available online: https://iea.blob.core.windows.net/assets/a72a7ffa-c5f2-4ed8-a2bf-eb035931d95c/Coal_2023.pdf (accessed on 18 June 2023).

- Ferris, N. Energy Monitor. 2022. Available online: https://www.energymonitor.ai/sectors/power/should-we-be-worried-about-coals-resurgence/ (accessed on 18 June 2023).

- Hook, L. Global Coal Use Set to Reach Fresh Record. Financial Times. 2022. Available online: https://www.ft.com/content/017c9e1e-3069-4bf3-8335-f1404abd6eb0 (accessed on 18 June 2023).

- Ediger, V.Ş. An integrated review and analysis of multi-energy transition from fossil fuels to renewables. Energy Procedia 2019, 156, 2–6. [Google Scholar] [CrossRef]

- Uyanık, S. The Future Role of Renewables in Turkey’s Electricity Supply Security. Int. J. Energy Econ. Policy 2018, 8, 89–96. Available online: https://www.researchgate.net/publication/327688950_The_Future_Role_of_Renewables_in_Turkey%27s_Electricity_Supply_Security (accessed on 18 June 2023).

- Flora, R.M.C. Intermittency, Backup and Overcapacity in Wind Energy: Evidence from Europe Countries. Master’s Thesis, Universidade da Beira Interior, Covilhã, Spain, 2012. Available online: http://hdl.handle.net/10400.6/2936 (accessed on 18 June 2023).

- The Economist. Wind and Solar Are Disrupting Electricity Systems. 25 February 2017. Available online: https://www.economist.com/leaders/2017/02/25/wind-and-solar-power-are-disrupting-electricity-systems (accessed on 18 June 2023).

- APS Panels on Public Affairs (POPA). Integrating Renewable Electricity on the Grid; American Physical Society: Washington, DC, USA, 2011; Available online: https://www.aps.org/policy/reports/popa-reports/upload/integratingelec-exsum.pdf (accessed on 20 June 2023).

- Biserčić, A.Z.; Bugarić, U.S. Reliability of Baseload Electricity Generation from Fossil and Renewable Energy Sources. Energy Power Eng. 2021, 13, 190–206. [Google Scholar] [CrossRef]

- Hodgson, C.; Bernard, S. Solar Power Expected to Surpass Coal in 5 Years, Financial Times. 2022. Available online: https://www.ft.com/content/98cec49f-6682-4495-b7be-793bf2589c6d (accessed on 18 June 2023).

- Vos, R.; Sawin, J. Drivers and Barriers. In READy: Renewable Energy Action on Deployment; IEA-RETD, Vos, R., Sawin, J., Eds.; Academic Press: Cambridge, MA, USA, 2012; pp. 49–62. [Google Scholar]

- IEA. Renewables 2022. 2022. Available online: https://www.iea.org/reports/renewables-2022 (accessed on 18 June 2023).

- FT-Big Read. Solar Power: Europe Attempts to Get out of China’s Shadow”. 23 March 2023. Available online: https://www.ft.com/content/009d8434-9c12-48fd-8c93-d06d0b86779e (accessed on 18 June 2023).

- Overland, I. The geopolitics of renewable energy: Debunking four emerging myths. Energy Res. Soc. Sci. 2019, 49, 36–40. [Google Scholar] [CrossRef]

- Fraune, C.; Knodt, M. Sustainable energy transformations in an age of populism, post-truth politics, and local resistance. Energy Res. Soc. Sci. 2018, 43, 1–7. [Google Scholar] [CrossRef]

- Robins, N.; Brunsting, V.; Wood, D. Climate Change and Just Transition: A Guide for Investor Action; Grantham Research Institute on Climate Change and the Environment: London, UK, 2018; Available online: https://sustainabledevelopment.un.org/content/documents/22101ijtguidanceforinvestors23november1118_541095.pdf (accessed on 18 June 2023).

- Smith, S. Just Transition: A Report for the OECD; Just Transition Centre: Washington, DC, USA, 2017; Available online: https://www.oecd.org/environment/cc/g20-climate/collapsecontents/Just-Transition-Centre-report-just-transition.pdf (accessed on 18 June 2023).

- Krawchenko, T.A.; Gordon, M. How Do We Manage a Just Transition? A Comparative Review of National and Regional Just Transition Initiatives. Sustainability 2021, 13, 6070. [Google Scholar] [CrossRef]

- Kumar, S.; Americo, A.; Billingham, C. The New Social Contract: A Just Transition. Brussels. Available online: https://www.changepartnership.org/wp-content/uploads/2016/09/New-social-contract-FINAL-WEB.pdf (accessed on 18 June 2023).

- IEA. Net Zero by 2050, A Roadmap for the Global Energy Sector, Report. 2021. Available online: https://iea.blob.core.windows.net/assets/deebef5d-0c34-4539-9d0c-10b13d840027/NetZeroby2050-ARoadmapfortheGlobalEnergySector_CORR.pdf (accessed on 18 June 2023).

- Ree, K. Promoting Green Jobs: Decent Work in the Transition to Low-Carbon, Green Economies; Brill Nijhoff: Leiden, The Netherlands, 2019; pp. 248–272. [Google Scholar] [CrossRef]

- Bhat, S. Five Ways to Finance Early Coal Phase-Out. RMI. 2023. Available online: https://rmi.org/five-ways-to-finance-early-coal-phaseout/ (accessed on 22 January 2024).

- TOBB. Türkiye Madencilik Sektörü Gelişim Raporu 2020. 2020. Available online: https://mobil.tobb.org.tr/MansetResimleri/27085-22.pdf (accessed on 18 June 2023).

- Apaydın, A. A Study on the Coal Related History and the Fate of ZonguldakJournal of Underground Resources 2020. Available online: https://dergipark.org.tr/tr/download/article-file/1196945 (accessed on 22 January 2024).

- Türkiye İş Kurumu. Zonguldak İli İşgücü Piyasası Araştırması Raporu. 2022. Available online: https://media.iskur.gov.tr/66937/zonguldak.pdf (accessed on 22 January 2024).

- Anadolu Ajansı. “Kömürün Ekmek Olduğu Ilçe: Soma”. 2016. Available online: https://www.aa.com.tr/tr/turkiye/komurun-ekmek-oldugu-ilce-soma/571059 (accessed on 22 January 2024).

- Mitali, J.; Dhinakaran, S.; Mohamad, A.A. Energy storage systems: A review. Energy Storage Sav. 2022, 1, 166–216. [Google Scholar] [CrossRef]

- EU Commission. Batteries for Energy Storage in the European Union. 2022. Available online: https://publications.jrc.ec.europa.eu/repository/bitstream/JRC130724/jrc130724_ceto-a1-batteries-energy-report_20221028_-_pubsy_submission.pdf (accessed on 18 June 2023).

- The Economist. The Electric Grid Is about to Be Transformed. Technology Quarterly. 5 April 2023. Available online: https://www.economist.com/technology-quarterly/2023/04/05/the-electric-grid-is-about-to-be-transformed (accessed on 18 June 2023).

- Wood Mackenzie. Opinion: The Need for Long Duration Energy Storage (LDES) Technologies. 2022. Available online: https://www.woodmac.com/news/opinion/the-need-for-long-duration-energy-storage-ldes-technologies/ (accessed on 18 June 2023).

- IEA. Innovation in Batteries and Electricity Storage. 2020. Available online: https://www.iea.org/reports/innovation-in-batteries-and-electricity-storage (accessed on 18 June 2023).

- Coester, A.; Hofkes, M.W.; Papyrakis, E. An optimal mix of conventional power systems in the presence of renewable energy: A new design for the German electricity market. Energy Policy 2018, 116, 312–322. [Google Scholar] [CrossRef]

- DPT. Elektrik Enerjisi Piyasası ve Arz Güvenliği Strateji Belgesi. 2009. Available online: https://ww4.ticaret.edu.tr/enerji/wp-content/uploads/sites/79/2015/11/Elektrik-Enerjisi-Piyasas%C4%B1-Ve-Arz-G%C3%BCvenli%C4%9Fi-Strateji-Belgesi.pdf (accessed on 18 June 2023).

- RT-MENR. National Renewable Energy Action Plan for Turkey. 2015. Available online: https://climatepolicydatabase.org/policies/national-renewable-energy-action-plan (accessed on 18 June 2023).

- Hodgson, C. Wind Sector Faces Supply Chain Crunch This Decade. Financial Times. 27 March 2023. Available online: https://www.ft.com/content/f324be0d-191e-4943-97fd-51a8d46e286c (accessed on 18 June 2023).

- Reierson, A.; Ainger, J. Wind Investment in Europe Is Plummeting When It Is Most Needed. Bloomberg. 30 March 2023. Available online: https://www.bloomberg.com/news/articles/2023-03-30/wind-investment-in-europe-is-plummeting-when-it-s-most-needed#xj4y7vzkg (accessed on 18 June 2023).

- Fickling, D. Wind’s Future is Looking More Turbulent than Ever. BloombergNEF. 2 April 2023. Available online: https://www.bloomberg.com/opinion/articles/2023-04-02/wind-s-future-is-looking-more-turbulent-despite-strong-demand#xj4y7vzkg (accessed on 20 June 2023).

| Basin Name | Total Reserve Thousand Tons | Owner and Operator | Used in Electricity Generation |

|---|---|---|---|

| Afşin-Elbistan | 4,807,500 | EUAS–TKI | √ |

| Konya-Karapınar | 1,832,816 | EUAS | - |

| Eskişehir-Alpu | 1,453,000 | EUAS–TKI | - |

| Çayırhan | 410,300 | EUAS | √ |

| Afyon-Dinar | 941,440 | EUAS | - |

| Tekirdağ-Merkez | 211,520 | EUAS | - |

| Manisa-Soma | 800,000 | TKI–Private | √ |

| Adana-Tufanbeyli | 323,329 | TKI | √ |

| Kırklareli-Vize | 271,186 | TKI | - |

| Tekirdağ-Saray | 143,729 | TKI | - |

| Kütahya-Tunçbilek | 117,000 | TKI | √ |

| Bingöl-Karlıova | 103,662 | TKI | - |

| Konya-Ilgın | 143,000 | Private | - |

| Edirne | 99,000 | Private | - |

| Çankırı-Orta | 94,390 | Private | √ |

| Tekirdağ-Hayrabolu | 73,000 | Private | - |

| Kırklareli-Pınarhisar | 67,700 | Private | - |

| Amasya-Suluova | 64,000 | Private | - |

| Adıyaman-Gölbaşı | 32,000 | Private | - |

| Total | 11,988,572 |

| License Status | Project Status | Projects | Capacity (MW) |

|---|---|---|---|

| Prelicense | Under evaluation | 3 | 38 |

| Canceled | 16 | 3426 | |

| License | Operational | 37 | 10,743 |

| Canceled | 19 | 8275 | |

| Total Capacity of Local Coal Projects | 22,532 | ||

| Project Realization Ratio Operational Project Capacity/Total Project Capacity | 48% | ||

| BaU (Business-as-Usual) | Coal Exit 1 | Coal Exit 2 | |

|---|---|---|---|

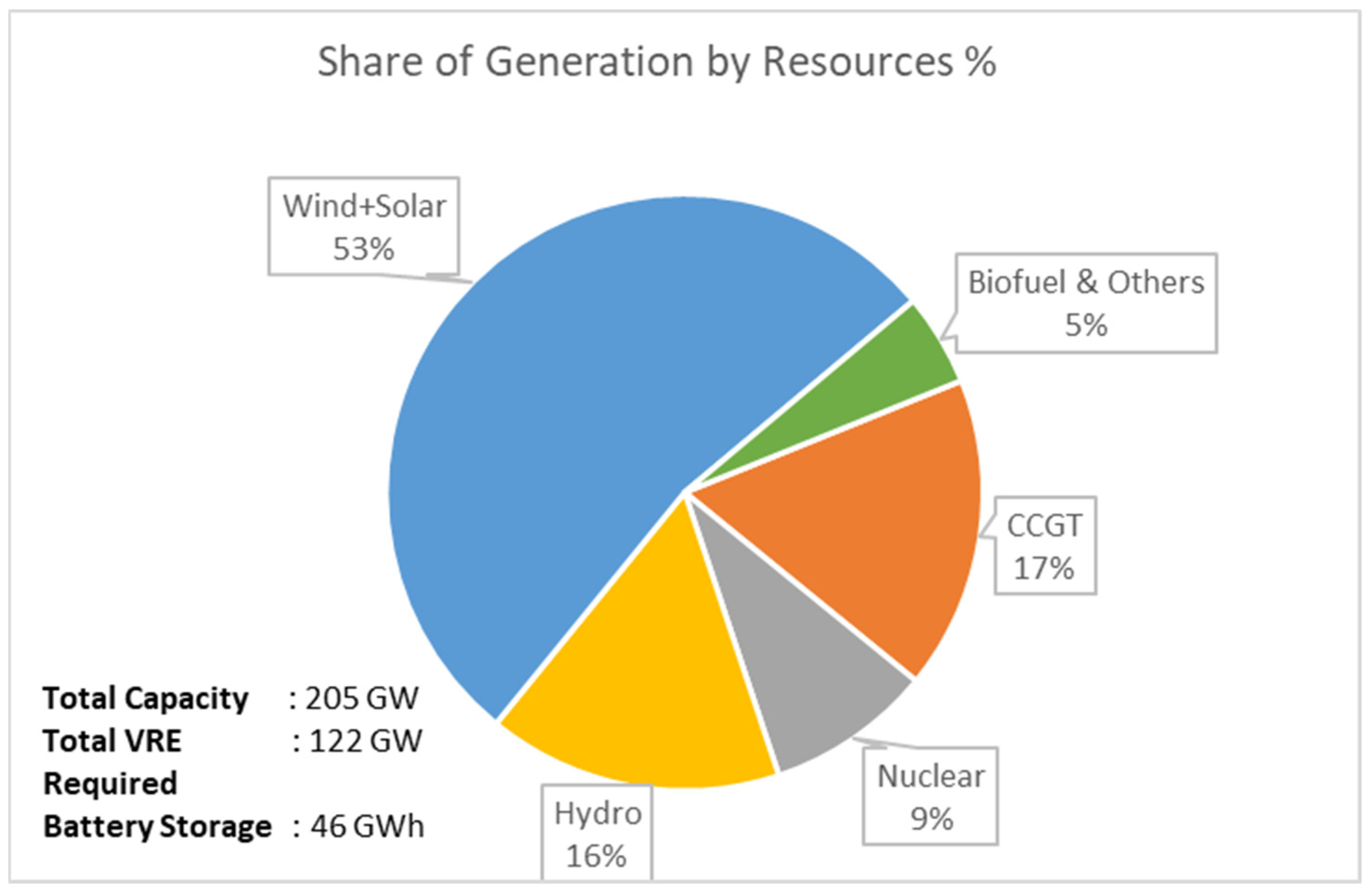

| Wind + solar installed capacity–VRE (GW) | 82 | 122 | 122 |

| Hydro + other RE installed capacity (GW) | 40 | 40 | 40 |

| Coal + CCGT installed capacity (GW) | 56 | 36 | 30 |

| Nuclear installed capacity (GW) | 7 | 7 | 7 |

| Total installed capacity (GW) | 185 | 205 | 200 |

| Battery capacity (GWh) | 41 | 46 | 113 |

| Share of sun + wind (VRE) in power generation (%) | 36 | 53 | 53 |

| Share of renewable energy in power generation (%) | 55 | 74 | 74 |

| Share of coal + CCGT in power generation (%) | 35 | 17 | 17 |

| CO2 emissions from power generation (million tons) | 108 | 40 | 40 |

| Investment requirements (billion USD) excluding curtailment + transmission–grid | 98 | 135 | 140 |

| Generation in 2035 (TWh) | Equivalent CO2 Emissions (Gton) | |||

|---|---|---|---|---|

| BaU | Coal Exit 1 | BaU | Coal Exit 2 | |

| Coal | 73 | 0 | 62,240 | 0 |

| CCGT | 103 | 89 | 46,402 | 40,225 |

| Total | 176 | 89 | 108,642 | 40,225 |

| Delta | −63% | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Uyanik, S.; Dogerlioglu Isiksungur, O. How Realistic Are Coal Phase-Out Timeline Targets for Turkey? Sustainability 2024, 16, 1649. https://doi.org/10.3390/su16041649

Uyanik S, Dogerlioglu Isiksungur O. How Realistic Are Coal Phase-Out Timeline Targets for Turkey? Sustainability. 2024; 16(4):1649. https://doi.org/10.3390/su16041649

Chicago/Turabian StyleUyanik, Sirri, and Ozlem Dogerlioglu Isiksungur. 2024. "How Realistic Are Coal Phase-Out Timeline Targets for Turkey?" Sustainability 16, no. 4: 1649. https://doi.org/10.3390/su16041649