Unraveling Korea’s Energy Challenge: The Consequences of Carbon Dioxide Emissions and Energy Use on Economic Sustainability

Abstract

1. Introduction

2. Literature Review

3. Variable and Model

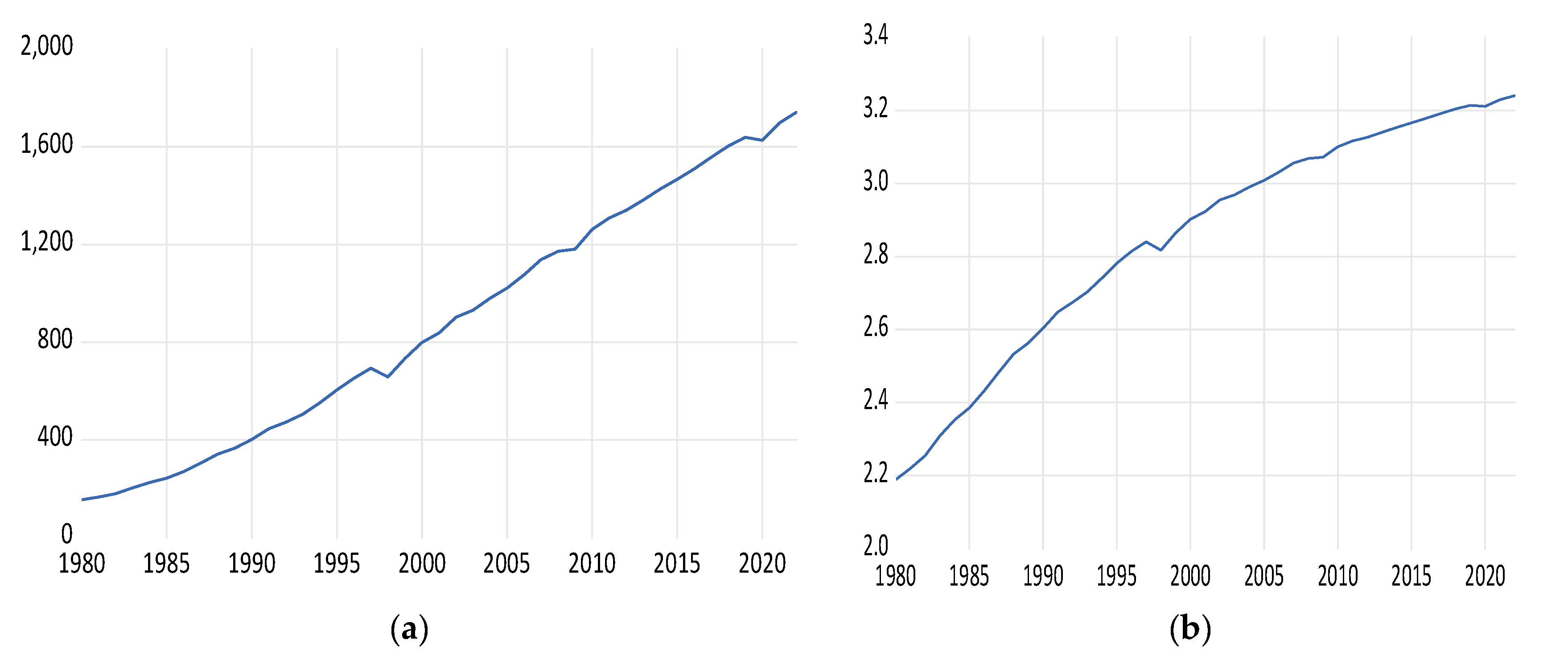

3.1. Variable

3.2. Theoretical Model

3.3. Econometric Model

4. Results and Discussion

4.1. Fundamental Analyses

4.2. Long-Run Effects

4.3. Short-Run Effects

4.4. Causality Test

4.5. Robustness Test

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Saboori, B.; Rasoulinezhad, E.; Sung, J. The Nexus of Oil Consumption, CO2 Emissions and Economic Growth in China, Japan and South Korea. Environ. Sci. Pollut. Res. 2017, 24, 7436–7455. [Google Scholar] [CrossRef]

- Nam, K.; Hwangbo, S.; Yoo, C. A Deep Learning-Based Forecasting Model for Renewable Energy Scenarios to Guide Sustainable Energy Policy: A Case Study of Korea. Renew. Sustain. Energy Rev. 2020, 122, 109725. [Google Scholar] [CrossRef]

- Jo, B.-K.; Jang, G. An Evaluation of the Effect on the Expansion of Photovoltaic Power Generation According to Renewable Energy Certificates on Energy Storage Systems: A Case Study of the Korean Renewable Energy Market. Sustainability 2019, 11, 4337. [Google Scholar] [CrossRef]

- Ha, Y.; Byrne, J. The Rise and Fall of Green Growth: Korea’s Energy Sector Experiment and Its Lessons for Sustainable Energy Policy. WIREs Energy Environ. 2019, 8, e335. [Google Scholar] [CrossRef]

- Ifaei, P.; Charmchi, A.S.T.; Loy-Benitez, J.; Yang, R.J.; Yoo, C. A Data-Driven Analytical Roadmap to a Sustainable 2030 in South Korea Based on Optimal Renewable Microgrids. Renew. Sustain. Energy Rev. 2022, 167, 112752. [Google Scholar] [CrossRef]

- Hong, J.H.; Kim, J.; Son, W.; Shin, H.; Kim, N.; Lee, W.K.; Kim, J. Long-Term Energy Strategy Scenarios for South Korea: Transition to a Sustainable Energy System. Energy Policy 2019, 127, 425–437. [Google Scholar] [CrossRef]

- Ghezelbash, A.; Seyedzadeh, M.; Khaligh, V.; Liu, J. Impacts of Green Energy Expansion and Gas Import Reduction on South Korea’s Economic Growth: A System Dynamics Approach. Sustainability 2023, 15, 9281. [Google Scholar] [CrossRef]

- Yeo, Y.; Oh, I. Evaluating the Impacts of Renewable Energy Promotion Policies on Sustainable Development: A Computable General Equilibrium Model Approach. J. Clean. Prod. 2023, 421, 138360. [Google Scholar] [CrossRef]

- Sonnenschein, J.; Mundaca, L. Decarbonization under Green Growth Strategies? The Case of South Korea. J. Clean. Prod. 2016, 123, 180–193. [Google Scholar] [CrossRef]

- Kim, S.-Y.; Thurbon, E. Developmental Environmentalism: Explaining South Korea’s Ambitious Pursuit of Green Growth. Politics Soc. 2015, 43, 213–240. [Google Scholar] [CrossRef]

- Bayarsaikhan, T.; Kim, M.-H.; Oh, H.J.; Gim, T.-H.T. Toward Sustainable Development? Trend Analysis of Environmental Policy in Korea from 1987 to 2040. J. Environ. Plan. Manag. 2023, 66, 1640–1654. [Google Scholar] [CrossRef]

- Jahanger, A.; Usman, M.; Murshed, M.; Mahmood, H.; Balsalobre-Lorente, D. The Linkages between Natural Resources, Human Capital, Globalization, Economic Growth, Financial Development, and Ecological Footprint: The Moderating Role of Technological Innovations. Resour. Policy 2022, 76, 102569. [Google Scholar] [CrossRef]

- Adedoyin, F.F.; Gumede, M.I.; Bekun, F.V.; Etokakpan, M.U.; Balsalobre-Lorente, D. Modelling Coal Rent, Economic Growth and CO2 Emissions: Does Regulatory Quality Matter in BRICS Economies? Sci. Total Environ. 2020, 710, 136284. [Google Scholar] [CrossRef] [PubMed]

- Amin, N.; Song, H. The Role of Renewable, Non-Renewable Energy Consumption, Trade, Economic Growth, and Urbanization in Achieving Carbon Neutrality: A Comparative Study for South and East Asian Countries. Environ. Sci. Pollut. Res. 2022, 30, 12798–12812. [Google Scholar] [CrossRef]

- Shahzad, U.; Elheddad, M.; Swart, J.; Ghosh, S.; Dogan, B. The Role of Biomass Energy Consumption and Economic Complexity on Environmental Sustainability in G7 Economies. Bus. Strat. Environ. 2023, 32, 781–801. [Google Scholar] [CrossRef]

- Ba, H.; Winecoff, W.K. American Financial Hegemony, Global Capital Cycles, and the Macroeconomic Growth Environment. Econ. Politics 2023, 36, 334–372. [Google Scholar] [CrossRef]

- Tsomb, E.I.B.T.; Atangana, H.O. Multilateral Environmental Agreements and the Growth of Total Factor Productivity in Developing Countries: Evidence from the Foreign Direct Investment Channel. Environ. Dev. Sustain. 2023, 25, 12965–12997. [Google Scholar] [CrossRef]

- Li, J.; Irfan, M.; Samad, S.; Ali, B.; Zhang, Y.; Badulescu, D.; Badulescu, A. The Relationship between Energy Consumption, CO2 Emissions, Economic Growth, and Health Indicators. Int. J. Environ. Res. Public Health 2023, 20, 2325. [Google Scholar] [CrossRef]

- Bildirici, M.; Genç, S.Y.; Ersin, Ö.Ö. Effects of Fiscal and Monetary Policies, Energy Consumption and Economic Growth on CO2 Emissions in the Turkish Economy: Nonlinear Bootstrapping NARDL and Nonlinear Causality Methods. Sustainability 2023, 15, 10463. [Google Scholar] [CrossRef]

- Khan, M. CO2 Emissions and Sustainable Economic Development: New Evidence on the Role of Human Capital. Sustain. Dev. 2020, 28, 1279–1288. [Google Scholar] [CrossRef]

- Adedoyin, F.F.; Nwulu, N.; Bekun, F.V. Environmental Degradation, Energy Consumption and Sustainable Development: Accounting for the Role of Economic Complexities with Evidence from World Bank Income Clusters. Bus. Strat. Environ. 2021, 30, 2727–2740. [Google Scholar] [CrossRef]

- Ahmad, M.; Muslija, A.; Satrovic, E. Does Economic Prosperity Lead to Environmental Sustainability in Developing Economies? Environmental Kuznets Curve Theory. Environ. Sci. Pollut. Res. 2021, 28, 22588–22601. [Google Scholar] [CrossRef]

- Magazzino, C.; Toma, P.; Fusco, G.; Valente, D.; Petrosillo, I. Renewable Energy Consumption, Environmental Degradation and Economic Growth: The Greener the Richer? Ecol. Indic. 2022, 139, 108912. [Google Scholar] [CrossRef]

- Rehman, A.; Ma, H.; Ozturk, I.; Ulucak, R. Sustainable Development and Pollution: The Effects of CO2 Emission on Population Growth, Food Production, Economic Development, and Energy Consumption in Pakistan. Environ. Sci. Pollut. Res. 2022, 29, 17319–17330. [Google Scholar] [CrossRef] [PubMed]

- Omri, A.; Belaïd, F. Does Renewable Energy Modulate the Negative Effect of Environmental Issues on the Socio-Economic Welfare? J. Environ. Manag. 2021, 278, 111483. [Google Scholar] [CrossRef] [PubMed]

- Wen, J.; Mughal, N.; Zhao, J.; Shabbir, M.S.; Niedba\la, G.; Jain, V.; Anwar, A. Does Globalization Matter for Environmental Degradation? Nexus among Energy Consumption, Economic Growth, and Carbon Dioxide Emission. Energy Policy 2021, 153, 112230. [Google Scholar] [CrossRef]

- Fan, K.; Zheng, M.; Shen, Y.; Zhang, F. Nexus between Economic Recovery, Energy Consumption, CO2 Emission, and Total Natural Resources Rent. Resour. Policy 2023, 87, 104157. [Google Scholar] [CrossRef]

- Hatipoglu, E.; Soytas, M.A.; Belaïd, F. Environmental Consequences of Geopolitical Crises: The Case of Economic Sanctions and Emissions. Resour. Policy 2023, 85, 104011. [Google Scholar] [CrossRef]

- Adedoyin, F.; Abubakar, I.; Bekun, F.V.; Sarkodie, S.A. Generation of Energy and Environmental-Economic Growth Consequences: Is There Any Difference across Transition Economies? Energy Rep. 2020, 6, 1418–1427. [Google Scholar] [CrossRef]

- Dong, K.; Hochman, G.; Timilsina, G.R. Do Drivers of CO2 Emission Growth Alter Overtime and by the Stage of Economic Development? Energy Policy 2020, 140, 111420. [Google Scholar] [CrossRef]

- Ozcan, B.; Tzeremes, P.G.; Tzeremes, N.G. Energy Consumption, Economic Growth and Environmental Degradation in OECD Countries. Econ. Model. 2020, 84, 203–213. [Google Scholar] [CrossRef]

- Namahoro, J.P.; Wu, Q.; Zhou, N.; Xue, S. Impact of Energy Intensity, Renewable Energy, and Economic Growth on CO2 Emissions: Evidence from Africa across Regions and Income Levels. Renew. Sustain. Energy Rev. 2021, 147, 111233. [Google Scholar] [CrossRef]

- Rahman, M.M.; Nepal, R.; Alam, K. Impacts of Human Capital, Exports, Economic Growth and Energy Consumption on CO2 Emissions of a Cross-Sectionally Dependent Panel: Evidence from the Newly Industrialized Countries (NICs). Environ. Sci. Policy 2021, 121, 24–36. [Google Scholar] [CrossRef]

- Wang, Q.; Su, M. Drivers of Decoupling Economic Growth from Carbon Emission–an Empirical Analysis of 192 Countries Using Decoupling Model and Decomposition Method. Environ. Impact Assess. Rev. 2020, 81, 106356. [Google Scholar] [CrossRef]

- Alam, M.M.; Murad, M.W. The Impacts of Economic Growth, Trade Openness and Technological Progress on Renewable Energy Use in Organization for Economic Co-Operation and Development Countries. Renew. Energy 2020, 145, 382–390. [Google Scholar] [CrossRef]

- Chien, F.; Ajaz, T.; Andlib, Z.; Chau, K.Y.; Ahmad, P.; Sharif, A. The Role of Technology Innovation, Renewable Energy and Globalization in Reducing Environmental Degradation in Pakistan: A Step towards Sustainable Environment. Renew. Energy 2021, 177, 308–317. [Google Scholar] [CrossRef]

- Saidi, K.; Omri, A. The Impact of Renewable Energy on Carbon Emissions and Economic Growth in 15 Major Renewable Energy-Consuming Countries. Environ. Res. 2020, 186, 109567. [Google Scholar] [CrossRef]

- Djellouli, N.; Abdelli, L.; Elheddad, M.; Ahmed, R.; Mahmood, H. The Effects of Non-Renewable Energy, Renewable Energy, Economic Growth, and Foreign Direct Investment on the Sustainability of African Countries. Renew. Energy 2022, 183, 676–686. [Google Scholar] [CrossRef]

- Khan, I.; Hou, F.; Zakari, A.; Tawiah, V.K. The Dynamic Links among Energy Transitions, Energy Consumption, and Sustainable Economic Growth: A Novel Framework for IEA Countries. Energy 2021, 222, 119935. [Google Scholar] [CrossRef]

- Habiba, U.; Xinbang, C.; Anwar, A. Do Green Technology Innovations, Financial Development, and Renewable Energy Use Help to Curb Carbon Emissions? Renew. Energy 2022, 193, 1082–1093. [Google Scholar] [CrossRef]

- Rahman, Z.U.; Khattak, S.I.; Ahmad, M.; Khan, A. A Disaggregated-Level Analysis of the Relationship among Energy Production, Energy Consumption and Economic Growth: Evidence from China. Energy 2020, 194, 116836. [Google Scholar] [CrossRef]

- Topcu, E.; Altinoz, B.; Aslan, A. Global Evidence from the Link between Economic Growth, Natural Resources, Energy Consumption, and Gross Capital Formation. Resour. Policy 2020, 66, 101622. [Google Scholar] [CrossRef]

- Khan, I.; Hou, F.; Irfan, M.; Zakari, A.; Le, H.P. Does Energy Trilemma a Driver of Economic Growth? The Roles of Energy Use, Population Growth, and Financial Development. Renew. Sustain. Energy Rev. 2021, 146, 111157. [Google Scholar] [CrossRef]

- Chen, S.; Zhang, H.; Wang, S. Trade Openness, Economic Growth, and Energy Intensity in China. Technol. Forecast. Soc. Chang. 2022, 179, 121608. [Google Scholar] [CrossRef]

- Xie, F.; Liu, Y.; Guan, F.; Wang, N. How to Coordinate the Relationship between Renewable Energy Consumption and Green Economic Development: From the Perspective of Technological Advancement. Environ. Sci. Eur. 2020, 32, 71. [Google Scholar] [CrossRef]

- Usman, A.; Ozturk, I.; Hassan, A.; Zafar, S.M.; Ullah, S. The Effect of ICT on Energy Consumption and Economic Growth in South Asian Economies: An Empirical Analysis. Telemat. Inform. 2021, 58, 101537. [Google Scholar] [CrossRef]

- Bithas, K.; Kalimeris, P.; Koilakou, E. Re-estimating the Energy Intensity of Growth with Implications for Sustainable Development. The Myth of the Decoupling Effect. Sustain. Dev. 2021, 29, 441–452. [Google Scholar] [CrossRef]

- Wang, Q.; Jiang, R. Is Carbon Emission Growth Decoupled from Economic Growth in Emerging Countries? New Insights from Labor and Investment Effects. J. Clean. Prod. 2020, 248, 119188. [Google Scholar] [CrossRef]

- Nasreen, S.; Mbarek, M.B.; Atiq-ur-Rehman, M. Long-Run Causal Relationship between Economic Growth, Transport Energy Consumption and Environmental Quality in Asian Countries: Evidence from Heterogeneous Panel Methods. Energy 2020, 192, 116628. [Google Scholar] [CrossRef]

- Baz, K.; Cheng, J.; Xu, D.; Abbas, K.; Ali, I.; Ali, H.; Fang, C. Asymmetric Impact of Fossil Fuel and Renewable Energy Consumption on Economic Growth: A Nonlinear Technique. Energy 2021, 226, 120357. [Google Scholar] [CrossRef]

- Shahbaz, M.; Raghutla, C.; Chittedi, K.R.; Jiao, Z.; Vo, X.V. The Effect of Renewable Energy Consumption on Economic Growth: Evidence from the Renewable Energy Country Attractive Index. Energy 2020, 207, 118162. [Google Scholar] [CrossRef]

- Destek, M.A.; Sinha, A. Renewable, Non-Renewable Energy Consumption, Economic Growth, Trade Openness and Ecological Footprint: Evidence from Organisation for Economic Co-Operation and Development Countries. J. Clean. Prod. 2020, 242, 118537. [Google Scholar] [CrossRef]

- Zafar, M.W.; Shahbaz, M.; Sinha, A.; Sengupta, T.; Qin, Q. How Renewable Energy Consumption Contribute to Environmental Quality? The Role of Education in OECD Countries. J. Clean. Prod. 2020, 268, 122149. [Google Scholar] [CrossRef]

- Zhao, J.; Patwary, A.K.; Qayyum, A.; Alharthi, M.; Bashir, F.; Mohsin, M.; Hanif, I.; Abbas, Q. The Determinants of Renewable Energy Sources for the Fueling of Green and Sustainable Economy. Energy 2022, 238, 122029. [Google Scholar] [CrossRef]

- Le, T.-H.; Chang, Y.; Park, D. Renewable and Nonrenewable Energy Consumption, Economic Growth, and Emissions: International Evidence. Energy J. 2020, 41, 73–92. [Google Scholar] [CrossRef]

- Chen, C.; Pinar, M.; Stengos, T. Renewable Energy Consumption and Economic Growth Nexus: Evidence from a Threshold Model. Energy Policy 2020, 139, 111295. [Google Scholar] [CrossRef]

- Malik, M.A. Economic Growth, Energy Consumption, and Environmental Quality Nexus in Turkey: Evidence from Simultaneous Equation Models. Environ. Sci. Pollut. Res. 2021, 28, 41988–41999. [Google Scholar] [CrossRef] [PubMed]

- Dogan, E.; Altinoz, B.; Madaleno, M.; Taskin, D. The Impact of Renewable Energy Consumption to Economic Growth: A Replication and Extension of Inglesi-Lotz (2016). Energy Econ. 2020, 90, 104866. [Google Scholar] [CrossRef]

- Gao, C.; Ge, H.; Lu, Y.; Wang, W.; Zhang, Y. Decoupling of Provincial Energy-Related CO2 Emissions from Economic Growth in China and Its Convergence from 1995 to 2017. J. Clean. Prod. 2021, 297, 126627. [Google Scholar] [CrossRef]

- Zhou, X.; Song, M.; Cui, L. Driving Force for China’s Economic Development under Industry 4.0 and Circular Economy: Technological Innovation or Structural Change? J. Clean. Prod. 2020, 271, 122680. [Google Scholar] [CrossRef]

- Bustos, P.; Garber, G.; Ponticelli, J. Capital Accumulation and Structural Transformation. Q. J. Econ. 2020, 135, 1037–1094. [Google Scholar] [CrossRef]

- Yang, Z.; Abbas, Q.; Hanif, I.; Alharthi, M.; Taghizadeh-Hesary, F.; Aziz, B.; Mohsin, M. Short-and Long-Run Influence of Energy Utilization and Economic Growth on Carbon Discharge in Emerging SREB Economies. Renew. Energy 2021, 165, 43–51. [Google Scholar] [CrossRef]

- Ahmed, Z.; Asghar, M.M.; Malik, M.N.; Nawaz, K. Moving towards a Sustainable Environment: The Dynamic Linkage between Natural Resources, Human Capital, Urbanization, Economic Growth, and Ecological Footprint in China. Resour. Policy 2020, 67, 101677. [Google Scholar] [CrossRef]

- Zia, S.; Rahman, M.U.; Noor, M.H.; Khan, M.K.; Bibi, M.; Godil, D.I.; Quddoos, M.U.; Anser, M.K. Striving towards Environmental Sustainability: How Natural Resources, Human Capital, Financial Development, and Economic Growth Interact with Ecological Footprint in China. Environ. Sci. Pollut. Res. 2021, 28, 52499–52513. [Google Scholar] [CrossRef] [PubMed]

- Xu, Y.; Li, A. The Relationship between Innovative Human Capital and Interprovincial Economic Growth Based on Panel Data Model and Spatial Econometrics. J. Comput. Appl. Math. 2020, 365, 112381. [Google Scholar] [CrossRef]

- Goenka, A.; Liu, L. Infectious Diseases, Human Capital and Economic Growth. Econ. Theory 2020, 70, 1–47. [Google Scholar] [CrossRef]

- Gruzina, Y.; Firsova, I.; Strielkowski, W. Dynamics of Human Capital Development in Economic Development Cycles. Economies 2021, 9, 67. [Google Scholar] [CrossRef]

- Zhou, J.; Raza, A.; Sui, H. Infrastructure Investment and Economic Growth Quality: Empirical Analysis of China’s Regional Development. Appl. Econ. 2021, 53, 2615–2630. [Google Scholar] [CrossRef]

- Das, G.G.; Drine, I. Distance from the Technology Frontier: How Could Africa Catch-up via Socio-Institutional Factors and Human Capital? Technol. Forecast. Soc. Chang. 2020, 150, 119755. [Google Scholar] [CrossRef]

- Zhang, S.; Liu, Y.; Huang, D.-H. Contribution of Factor Structure Change to China’s Economic Growth: Evidence from the Time-Varying Elastic Production Function Model. Econ. Res.-Ekon. Istraživanja 2020, 33, 2919–2942. [Google Scholar] [CrossRef]

- Yasmeen, H.; Tan, Q.; Zameer, H.; Vo, X.V.; Shahbaz, M. Discovering the Relationship between Natural Resources, Energy Consumption, Gross Capital Formation with Economic Growth: Can Lower Financial Openness Change the Curse into Blessing. Resour. Policy 2021, 71, 102013. [Google Scholar] [CrossRef]

- Mohamed Sghaier, I. Foreign Capital Inflows and Economic Growth in North African Countries: The Role of Human Capital. J. Knowl. Econ. 2022, 13, 2804–2821. [Google Scholar] [CrossRef]

- Henok, W.; Kaulihowa, T. The Impact of FDI on Human Capital Development in SACU Countries. Int. J. Soc. Econ. 2022, 49, 268–279. [Google Scholar] [CrossRef]

- Konstandina, M.S.; Gachino, G.G. International Technology Transfer: Evidence on Foreign Direct Investment in Albania. J. Econ. Stud. 2020, 47, 286–306. [Google Scholar] [CrossRef]

- Han, W.; Wang, J.; Wang, X. FDI and Firm Productivity in Host Countries: The Role of Financial Constraints. J. Int. Money Financ. 2022, 124, 102623. [Google Scholar] [CrossRef]

- Hanousek, J.; Shamshur, A.; Svejnar, J.; Tresl, J. Corruption Level and Uncertainty, FDI and Domestic Investment. J. Int. Bus. Stud. 2021, 52, 1750–1774. [Google Scholar] [CrossRef]

- Contractor, F.J.; Dangol, R.; Nuruzzaman, N.; Raghunath, S. How Do Country Regulations and Business Environment Impact Foreign Direct Investment (FDI) Inflows? Int. Bus. Rev. 2020, 29, 101640. [Google Scholar] [CrossRef]

- Huang, Y.; Chen, F.; Wei, H.; Xiang, J.; Xu, Z.; Akram, R. The Impacts of FDI Inflows on Carbon Emissions: Economic Development and Regulatory Quality as Moderators. Front. Energy Res. 2022, 9, 820596. [Google Scholar] [CrossRef]

- Azam, A.; Ateeq, M.; Shafique, M.; Rafiq, M.; Yuan, J. Primary Energy Consumption-Growth Nexus: The Role of Natural Resources, Quality of Government, and Fixed Capital Formation. Energy 2023, 263, 125570. [Google Scholar] [CrossRef]

- Minh, T.B.; Van, H.B. Evaluating the Relationship between Renewable Energy Consumption and Economic Growth in Vietnam, 1995–2019. Energy Rep. 2023, 9, 609–617. [Google Scholar] [CrossRef]

- Iqbal, A.; Tang, X.; Rasool, S.F. Investigating the Nexus between CO2 Emissions, Renewable Energy Consumption, FDI, Exports and Economic Growth: Evidence from BRICS Countries. Environ. Dev. Sustain. 2023, 25, 2234–2263. [Google Scholar] [CrossRef]

- Appiah-Otoo, I.; Chen, X.; Ampah, J.D. Exploring the Moderating Role of Foreign Direct Investment in the Renewable Energy and Economic Growth Nexus: Evidence from West Africa. Energy 2023, 281, 128346. [Google Scholar] [CrossRef]

- Tariq, G.; Sun, H.; Fernandez-Gamiz, U.; Mansoor, S.; Pasha, A.A.; Ali, S.; Khan, M.S. Effects of Globalization, Foreign Direct Investment and Economic Growth on Renewable Electricity Consumption. Heliyon 2023, 9, e14635. [Google Scholar] [CrossRef] [PubMed]

- Wu, D.; Geng, Y.; Pan, H. Whether Natural Gas Consumption Bring Double Dividends of Economic Growth and Carbon Dioxide Emissions Reduction in China? Renew. Sustain. Energy Rev. 2021, 137, 110635. [Google Scholar] [CrossRef]

- Fu, Q.; Álvarez-Otero, S.; Sial, M.S.; Comite, U.; Zheng, P.; Samad, S.; Oláh, J. Impact of Renewable Energy on Economic Growth and CO2 Emissions—Evidence from BRICS Countries. Processes 2021, 9, 1281. [Google Scholar] [CrossRef]

- Wang, T.; Henderson, D.J. Estimation of a Varying Coefficient, Fixed-Effects Cobb–Douglas Production Function in Levels. Econ. Lett. 2022, 213, 110354. [Google Scholar] [CrossRef]

- Smirnov, R.G.; Wang, K.; Wang, Z. The Cobb-Douglas Production Function for an Exponential Model. In Advances in Econometrics, Operational Research, Data Science and Actuarial Studies; Terzioğlu, M.K., Ed.; Contributions to Economics; Springer International Publishing: Cham, Switzerland, 2022; pp. 1–12. ISBN 978-3-030-85253-5. [Google Scholar]

- Ishikawa, A. Why Does Production Function Take the Cobb–Douglas Form? In Statistical Properties in Firms’ Large-Scale Data; Evolutionary Economics and Social Complexity Science; Springer: Singapore, 2021; Volume 26, pp. 113–135. ISBN 9789811622960. [Google Scholar]

- Zhou, K.; Gao, X. Production Function with Single Factor for Intelligent Manufacturing by Workshop Agent. J. Knowl. Econ. 2023. [Google Scholar] [CrossRef]

- Ketokivi, M.; Mahoney, J.T. Transaction Cost Economics As a Theory of Supply Chain Efficiency. Prod. Oper. Manag. 2020, 29, 1011–1031. [Google Scholar] [CrossRef]

- Sass, W.; Boeve-de Pauw, J.; Olsson, D.; Gericke, N.; De Maeyer, S.; Van Petegem, P. Redefining Action Competence: The Case of Sustainable Development. J. Environ. Educ. 2020, 51, 292–305. [Google Scholar] [CrossRef]

- Foss, N.J.; Klein, P.G.; Lien, L.B.; Zellweger, T.; Zenger, T. Ownership Competence. Strateg. Manag. J. 2021, 42, 302–328. [Google Scholar] [CrossRef]

- Wang, J.; Song, H.; Tian, Z.; Bei, J.; Zhang, H.; Ye, B.; Ni, J. A Method for Estimating Output Elasticity of Input Factors in Cobb-Douglas Production Function and Measuring Agricultural Technological Progress. IEEE Access 2021, 9, 26234–26250. [Google Scholar] [CrossRef]

- Zhang, Q.; Pan, J.; Jiang, Y.; Feng, T. The Impact of Green Supplier Integration on Firm Performance: The Mediating Role of Social Capital Accumulation. J. Purch. Supply Manag. 2020, 26, 100579. [Google Scholar] [CrossRef]

- Somjai, S.; Chankoson, T.; Jermsittiparsert, K. An Economic Analysis of Agricultural Production Function on the Paddy Fields of Thailand. Entrep. Sustain. Issues 2020, 7, 2012. [Google Scholar] [CrossRef] [PubMed]

- Xie, Z.; Wu, R.; Wang, S. How Technological Progress Affects the Carbon Emission Efficiency? Evidence from National Panel Quantile Regression. J. Clean. Prod. 2021, 307, 127133. [Google Scholar] [CrossRef]

- Cheng, C.; Ren, X.; Dong, K.; Dong, X.; Wang, Z. How Does Technological Innovation Mitigate CO2 Emissions in OECD Countries? Heterogeneous Analysis Using Panel Quantile Regression. J. Environ. Manag. 2021, 280, 111818. [Google Scholar] [CrossRef]

- Anser, M.K.; Ahmad, M.; Khan, M.A.; Zaman, K.; Nassani, A.A.; Askar, S.E.; Abro, M.M.Q.; Kabbani, A. The Role of Information and Communication Technologies in Mitigating Carbon Emissions: Evidence from Panel Quantile Regression. Environ. Sci. Pollut. Res. 2021, 28, 21065–21084. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Pesaran, B. Working with Microfit 4.0; Camfit Data Ltd.: Cambridge, UK, 1997. [Google Scholar]

- Mohammed, B.U.; Wiysahnyuy, Y.S.; Ashraf, N.; Mempouo, B.; Mengata, G.M. Pathways for Efficient Transition into Net Zero Energy Buildings (nZEB) in Sub-Sahara Africa. Case Study: Cameroon, Senegal, and Côte d’Ivoire. Energy Build. 2023, 296, 113422. [Google Scholar] [CrossRef]

- Yeo, D.; Dongo, K.; Mertenat, A.; Lüssenhop, P.; Körner, I.; Zurbrügg, C. Material Flows and Greenhouse Gas Emissions Reduction Potential of Decentralized Composting in Sub-Saharan Africa: A Case Study in Tiassalé, Côte D’Ivoire. Int. J. Environ. Res. Public Health 2020, 17, 7229. [Google Scholar] [CrossRef]

- Ali, A.; Radulescu, M.; Balsalobre-Lorente, D. A Dynamic Relationship between Renewable Energy Consumption, Nonrenewable Energy Consumption, Economic Growth, and Carbon Dioxide Emissions: Evidence from Asian Emerging Economies. Energy Environ. 2023, 34, 3529–3552. [Google Scholar] [CrossRef]

- Khan, A.; Chenggang, Y.; Hussain, J.; Kui, Z. Impact of Technological Innovation, Financial Development and Foreign Direct Investment on Renewable Energy, Non-Renewable Energy and the Environment in Belt & Road Initiative Countries. Renew. Energy 2021, 171, 479–491. [Google Scholar]

- Çağlayan Akay, E.; Oskonbaeva, Z.; Bülbül, H. What Do Unit Root Tests Tell Us about Unemployment Hysteresis in Transition Economies? Appl. Econ. Anal. 2020, 28, 221–238. [Google Scholar] [CrossRef]

- Webb, C.; Linn, S.; Lebo, M.J. Beyond the Unit Root Question: Uncertainty and Inference. Am. J. Political Sci. 2020, 64, 275–292. [Google Scholar] [CrossRef]

- Pretis, F. Econometric Modelling of Climate Systems: The Equivalence of Energy Balance Models and Cointegrated Vector Autoregressions. J. Econom. 2020, 214, 256–273. [Google Scholar] [CrossRef]

- Grabowski, W.; Welfe, A. The Tobit Cointegrated Vector Autoregressive Model: An Application to the Currency Market. Econ. Model. 2020, 89, 88–100. [Google Scholar] [CrossRef]

- Yang, K.; Lee, L. Estimation of Dynamic Panel Spatial Vector Autoregression: Stability and Spatial Multivariate Cointegration. J. Econom. 2021, 221, 337–367. [Google Scholar] [CrossRef]

- Shin, Y.; Yu, B.; Greenwood-Nimmo, M. Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework. In Festschrift in Honor of Peter Schmidt; Sickles, R.C., Horrace, W.C., Eds.; Springer: New York, NY, USA, 2014; pp. 281–314. ISBN 978-1-4899-8007-6. [Google Scholar]

- Cho, J.S.; Greenwood-Nimmo, M.; Shin, Y. Recent Developments of the Autoregressive Distributed Lag Modelling Framework. J. Econ. Surv. 2023, 37, 7–32. [Google Scholar] [CrossRef]

- Sam, C.Y.; McNown, R.; Goh, S.K. An Augmented Autoregressive Distributed Lag Bounds Test for Cointegration. Econ. Model. 2019, 80, 130–141. [Google Scholar] [CrossRef]

- Jordan, S.; Philips, A.Q. Cointegration Testing and Dynamic Simulations of Autoregressive Distributed Lag Models. Stata J. 2018, 18, 902–923. [Google Scholar] [CrossRef]

- Jiang, W.; Liu, Y. The Asymmetric Effect of Crude Oil Prices on Stock Prices in Major International Financial Markets. N. Am. J. Econ. Financ. 2021, 56, 101357. [Google Scholar] [CrossRef]

- Long, S.; Zhang, M.; Li, K.; Wu, S. Do the RMB Exchange Rate and Global Commodity Prices Have Asymmetric or Symmetric Effects on China’s Stock Prices? Financ. Innov. 2021, 7, 48. [Google Scholar] [CrossRef]

- Merlin, M.L.; Chen, Y. Analysis of the Factors Affecting Electricity Consumption in DR Congo Using Fully Modified Ordinary Least Square (FMOLS), Dynamic Ordinary Least Square (DOLS) and Canonical Cointegrating Regression (CCR) Estimation Approach. Energy 2021, 232, 121025. [Google Scholar] [CrossRef]

- Barnett, W.A.; Ghosh, T.; Adil, M.H. Is Money Demand Really Unstable? Evidence from Divisia Monetary Aggregates. Econ. Anal. Policy 2022, 74, 606–622. [Google Scholar] [CrossRef]

- Kaur, J.; Singh, K.; Chaudhary, R.; Vashishtha, S. How Economic Growth, Sustainable Energy and Carbon Emission Impact Each Other? New Insights from India Using ARDL Approach. OPEC Energy Rev. 2023, 47, 216–238. [Google Scholar] [CrossRef]

- Ayad, H.; Mishra, P.; Kumari, B.; Ray, S.; Nuţă, F.M.; Gautam, R.; Balsalobre-Lorente, D.; Nuţă, A.C.; Zamfir, C.G. The Spillover Effects of Uncertainty and Globalization on Environmental Quality in India: Evidence from Combined Cointegration Test and Augmented ARDL Model. Front. Environ. Sci. 2023, 11, 1144201. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Odugbesan, J.A. Modeling CO2 Emissions in South Africa: Empirical Evidence from ARDL Based Bounds and Wavelet Coherence Techniques. Environ. Sci. Pollut. Res. 2021, 28, 9377–9389. [Google Scholar] [CrossRef] [PubMed]

- Musa, M.; Gao, Y.; Rahman, P.; Albattat, A.; Ali, M.A.S.; Saha, S.K. Sustainable Development Challenges in Bangladesh: An Empirical Study of Economic Growth, Industrialization, Energy Consumption, Foreign Investment, and Carbon Emissions—Using Dynamic ARDL Model and Frequency Domain Causality Approach. Clean Technol. Environ. Policy 2023. [Google Scholar] [CrossRef]

- Aftab, S.; Ahmed, A.; Chandio, A.A.; Korankye, B.A.; Ali, A.; Fang, W. Modeling the Nexus between Carbon Emissions, Energy Consumption, and Economic Progress in Pakistan: Evidence from Cointegration and Causality Analysis. Energy Rep. 2021, 7, 4642–4658. [Google Scholar] [CrossRef]

- Nur Mozahid, M.; Akter, S.; Hafiz Iqbal, M. Causality Analysis of CO2 Emissions, Foreign Direct Investment, Gross Domestic Product, and Energy Consumption: Empirical Evidence from South Asian Association for Regional Cooperation (SAARC) Countries. Environ. Sci. Pollut. Res. 2022, 29, 65684–65698. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds Testing Approaches to the Analysis of Level Relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Kaur, H.; Sarin, V. The Saving–Investment Cointegration Across East Asian Countries: Evidence from the ARDL Bound Approach. Glob. Bus. Rev. 2021, 22, 1010–1018. [Google Scholar] [CrossRef]

- Ullah, S.; Hussain, S.; Rustandi Kartawinata, B.; Muhammad, Z.; Fitriana, R. Empirical Nexus between Chinese Investment under China–Pakistan Economic Corridor and Economic Growth: An ARDL Approach. Cogent Bus. Manag. 2022, 9, 2032911. [Google Scholar] [CrossRef]

- Udemba, E.N.; Magazzino, C.; Bekun, F.V. Modeling the Nexus between Pollutant Emission, Energy Consumption, Foreign Direct Investment, and Economic Growth: New Insights from China. Environ. Sci. Pollut. Res. 2020, 27, 17831–17842. [Google Scholar] [CrossRef] [PubMed]

- Smeekes, S.; Wijler, E. An Automated Approach towards Sparse Single-Equation Cointegration Modelling. J. Econom. 2021, 221, 247–276. [Google Scholar] [CrossRef]

- Kraft, P.W.; Key, E.M.; Lebo, M.J. Hypothesis Testing with Error Correction Models. Political Sci. Res. Methods 2022, 10, 870–878. [Google Scholar] [CrossRef]

- Atil, L.; Fellag, H.; Sipols, A.E.; Santos-Martín, M.T.; De Blas, C.S. Non-Linear Cointegration Test, Based on Record Counting Statistic. Comput. Econ. 2023. [Google Scholar] [CrossRef]

- Contreras-Reyes, J.E.; Hernández-Santoro, C. Assessing Granger-Causality in the Southern Humboldt Current Ecosystem Using Cross-Spectral Methods. Entropy 2020, 22, 1071. [Google Scholar] [CrossRef] [PubMed]

- Sun, X.; Fang, W.; Gao, X.; An, S.; Liu, S.; Wu, T. Time-Varying Causality Inference of Different Nickel Markets Based on the Convergent Cross Mapping Method. Resour. Policy 2021, 74, 102385. [Google Scholar] [CrossRef]

- Zhu, K.; Liu, H. Confidence Intervals for Parameters in High-Dimensional Sparse Vector Autoregression. Comput. Stat. Data Anal. 2022, 168, 107383. [Google Scholar] [CrossRef]

- Adolf, J.K.; Loossens, T.; Tuerlinckx, F.; Ceulemans, E. Optimal Sampling Rates for Reliable Continuous-Time First-Order Autoregressive and Vector Autoregressive Modeling. Psychol. Methods 2021, 26, 701. [Google Scholar] [CrossRef]

- Adeleye, B.N.; Akam, D.; Inuwa, N.; James, H.T.; Basila, D. Does Globalization and Energy Usage Influence Carbon Emissions in South Asia? An Empirical Revisit of the Debate. Environ. Sci. Pollut. Res. 2022, 30, 36190–36207. [Google Scholar] [CrossRef]

- Azam, M.; Uddin, I.; Khan, S.; Tariq, M. Are Globalization, Urbanization, and Energy Consumption Cause Carbon Emissions in SAARC Region? New Evidence from CS-ARDL Approach. Environ. Sci. Pollut. Res. 2022, 29, 87746–87763. [Google Scholar] [CrossRef] [PubMed]

- Clarke, J.A.; Mirza, S. A Comparison of Some Common Methods for Detecting Granger Noncausality. J. Stat. Comput. Simul. 2006, 76, 207–231. [Google Scholar] [CrossRef]

- Shahzad, U.; Asl, M.G.; Khalfaoui, R.; Tedeschi, M. Extreme Contributions of Conventional Investments Vis-à-Vis Islamic Ones to Renewables. Renew. Sustain. Energy Rev. 2024, 189, 113932. [Google Scholar] [CrossRef]

- Toda, H.Y.; Yamamoto, T. Statistical Inference in Vector Autoregressions with Possibly Integrated Processes. J. Econom. 1995, 66, 225–250. [Google Scholar] [CrossRef]

- Gold, D.; Lederer, J.; Tao, J. Inference for High-Dimensional Instrumental Variables Regression. J. Econom. 2020, 217, 79–111. [Google Scholar] [CrossRef]

- Young, A. Consistency without Inference: Instrumental Variables in Practical Application. Eur. Econ. Rev. 2022, 147, 104112. [Google Scholar] [CrossRef]

- Maydeu-Olivares, A.; Shi, D.; Fairchild, A.J. Estimating Causal Effects in Linear Regression Models with Observational Data: The Instrumental Variables Regression Model. Psychol. Methods 2020, 25, 243. [Google Scholar] [CrossRef] [PubMed]

- González Olivares, D.; Guizar, I. Estimation of Continuous and Discrete Time Co-Integrated Systems with Stock and Flow Variables. J. Time Ser. Econom. 2021, 13, 145–186. [Google Scholar] [CrossRef]

- Neto, D. Adaptive LASSO for Selecting Fourier Coefficients in a Functional Smooth Time-Varying Cointegrating Regression: An Application to the Feldstein–Horioka Puzzle. Math. Comput. Simul. 2021, 179, 253–264. [Google Scholar] [CrossRef]

- Ozmec-Ban, M.; Babić, R.Š. A Literature Review of Recent Causality Analyses between Air Transport Demand and Socio-Economic Factors. Transp. Res. Procedia 2023, 73, 85–93. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, D.; Driha, O.M.; Bekun, F.V.; Adedoyin, F.F. The Asymmetric Impact of Air Transport on Economic Growth in Spain: Fresh Evidence from the Tourism-Led Growth Hypothesis. Curr. Issues Tour. 2021, 24, 503–519. [Google Scholar] [CrossRef]

- Demetrescu, M.; Kusin, V.; Salish, N. Testing for No Cointegration in Vector Autoregressions with Estimated Degree of Fractional Integration. Econ. Model. 2022, 108, 105694. [Google Scholar] [CrossRef]

- Kheifets, I.L.; Phillips, P.C. Fully Modified Least Squares Cointegrating Parameter Estimation in Multicointegrated Systems. J. Econom. 2023, 232, 300–319. [Google Scholar] [CrossRef]

- Karimi, M.S.; Ahmad, S.; Karamelikli, H.; Dinç, D.T.; Khan, Y.A.; Sabzehei, M.T.; Abbas, S.Z. Dynamic Linkages between Renewable Energy, Carbon Emissions and Economic Growth through Nonlinear ARDL Approach: Evidence from Iran. PLoS ONE 2021, 16, e0253464. [Google Scholar] [CrossRef]

- Maroufi, N.; Hajilary, N. The Impacts of Economic Growth, Foreign Direct Investments, and Gas Consumption on the Environmental Kuznets Curve Hypothesis CO2 Emission in Iran. Environ. Sci. Pollut. Res. 2022, 29, 85350–85363. [Google Scholar] [CrossRef]

- Salman, M.; Long, X.; Dauda, L.; Mensah, C.N. The Impact of Institutional Quality on Economic Growth and Carbon Emissions: Evidence from Indonesia, South Korea and Thailand. J. Clean. Prod. 2019, 241, 118331. [Google Scholar] [CrossRef]

- Koc, S.; Bulus, G.C. Testing Validity of the EKC Hypothesis in South Korea: Role of Renewable Energy and Trade Openness. Environ. Sci. Pollut. Res. 2020, 27, 29043–29054. [Google Scholar] [CrossRef]

- Fouquet, R. Path Dependence in Energy Systems and Economic Development. Nat. Energy 2016, 1, 16098. [Google Scholar] [CrossRef]

- Wang, Q.; Ali, A.; Chen, Y.; Xu, X. An Empirical Analysis of the Impact of Renewable and Non-Renewable Energy Consumption on Economic Growth and Carbon Dioxide Emissions: Evidence from Seven Northeast Asian Countries. Environ. Sci. Pollut. Res. 2023, 30, 75041–75057. [Google Scholar] [CrossRef]

- Rehman, E.; Rehman, S. Modeling the Nexus between Carbon Emissions, Urbanization, Population Growth, Energy Consumption, and Economic Development in Asia: Evidence from Grey Relational Analysis. Energy Rep. 2022, 8, 5430–5442. [Google Scholar] [CrossRef]

- Ali, M.; Seraj, M. Nexus between Energy Consumption and Carbon Dioxide Emission: Evidence from 10 Highest Fossil Fuel and 10 Highest Renewable Energy-Using Economies. Environ. Sci. Pollut. Res. 2022, 29, 87901–87922. [Google Scholar] [CrossRef]

- Moon, H.; Min, D. Assessing Energy Efficiency and the Related Policy Implications for Energy-Intensive Firms in Korea: DEA Approach. Energy 2017, 133, 23–34. [Google Scholar] [CrossRef]

- Nejat, P.; Jomehzadeh, F.; Taheri, M.M.; Gohari, M.; Majid, M.Z.A. A Global Review of Energy Consumption, CO2 Emissions and Policy in the Residential Sector (with an Overview of the Top Ten CO2 Emitting Countries). Renew. Sustain. Energy Rev. 2015, 43, 843–862. [Google Scholar] [CrossRef]

- Hille, E.; Lambernd, B. The Role of Innovation in Reducing South Korea’s Energy Intensity: Regional-Data Evidence on Various Energy Carriers. J. Environ. Manag. 2020, 262, 110293. [Google Scholar] [CrossRef]

- Ozcan, B.; Ozturk, I. Renewable Energy Consumption-Economic Growth Nexus in Emerging Countries: A Bootstrap Panel Causality Test. Renew. Sustain. Energy Rev. 2019, 104, 30–37. [Google Scholar] [CrossRef]

- Bhat, J.A. Renewable and Non-Renewable Energy Consumption—Impact on Economic Growth and CO2 Emissions in Five Emerging Market Economies. Environ. Sci. Pollut. Res. 2018, 25, 35515–35530. [Google Scholar] [CrossRef] [PubMed]

- Wei, Z.; Huang, L. Does Renewable Energy Matter to Achieve Sustainable Development? Fresh Evidence from Ten Asian Economies. Renew. Energy 2022, 199, 759–767. [Google Scholar] [CrossRef]

- Liu, H.; Kim, H.; Liang, S.; Kwon, O.-S. Export Diversification and Ecological Footprint: A Comparative Study on EKC Theory among Korea, Japan, and China. Sustainability 2018, 10, 3657. [Google Scholar] [CrossRef]

- Prasetyo, P.E.; Kistanti, N.R. Human Capital, Institutional Economics and Entrepreneurship as a Driver for Quality & Sustainable Economic Growth. Entrep. Sustain. Issues 2020, 7, 2575. [Google Scholar]

- Jahanger, A.; Yang, B.; Huang, W.-C.; Murshed, M.; Usman, M.; Radulescu, M. Dynamic Linkages between Globalization, Human Capital, and Carbon Dioxide Emissions: Empirical Evidence from Developing Economies. Environ. Dev. Sustain. 2023, 25, 9307–9335. [Google Scholar] [CrossRef]

- Sawng, Y.; Kim, P.; Park, J. ICT Investment and GDP Growth: Causality Analysis for the Case of Korea. Telecommun. Policy 2021, 45, 102157. [Google Scholar] [CrossRef]

- Sarangi, A.K.; Pradhan, R.P. ICT Infrastructure and Economic Growth: A Critical Assessment and Some Policy Implications. Decision 2020, 47, 363–383. [Google Scholar] [CrossRef]

- Yu, H.; Zhang, J.; Zhang, M.; Fan, F. Cross-National Knowledge Transfer, Absorptive Capacity, and Total Factor Productivity: The Intermediary Effect Test of International Technology Spillover. Technol. Anal. Strateg. Manag. 2022, 34, 625–640. [Google Scholar] [CrossRef]

- Buckley, P.J.; Driffield, N.; Kim, J.-Y. The Role of Outward FDI in Creating Korean Global Factories. Manag. Int. Rev. 2022, 62, 27–52. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Awosusi, A.A.; Kirikkaleli, D.; Akinsola, G.D.; Mwamba, M.N. Can CO2 Emissions and Energy Consumption Determine the Economic Performance of South Korea? A Time Series Analysis. Environ. Sci. Pollut. Res. 2021, 28, 38969–38984. [Google Scholar] [CrossRef]

- Baek, J.; Kim, H.S. Is Economic Growth Good or Bad for the Environment? Empirical Evidence from Korea. Energy Econ. 2013, 36, 744–749. [Google Scholar] [CrossRef]

- Kim, S. The Effects of Foreign Direct Investment, Economic Growth, Industrial Structure, Renewable and Nuclear Energy, and Urbanization on Korean Greenhouse Gas Emissions. Sustainability 2020, 12, 1625. [Google Scholar] [CrossRef]

- Lee, S.-H.; Jung, Y. Causal Dynamics between Renewable Energy Consumption and Economic Growth in South Korea: Empirical Analysis and Policy Implications. Energy Environ. 2018, 29, 1298–1315. [Google Scholar] [CrossRef]

- Rong, G.; Qamruzzaman, M. Symmetric and Asymmetric Nexus between Economic Policy Uncertainty, Oil Price, and Renewable Energy Consumption in the United States, China, India, Japan, and South Korea: Does Technological Innovation Influence? Front. Energy Res. 2022, 10, 973557. [Google Scholar] [CrossRef]

- Oryani, B.; Moridian, A.; Rezania, S.; Vasseghian, Y.; Bagheri, M.; Shahzad, K. Asymmetric Impacts of Economic Uncertainties and Energy Consumption on the Ecological Footprint: Implications apropos Structural Transformation in South Korea. Fuel 2022, 322, 124180. [Google Scholar] [CrossRef]

- Dinh, T.T.-H.; Vo, D.H.; The Vo, A.; Nguyen, T.C. Foreign Direct Investment and Economic Growth in the Short Run and Long Run: Empirical Evidence from Developing Countries. J. Risk Financ. Manag. 2019, 12, 176. [Google Scholar] [CrossRef]

- Tehseen Jawaid, S.; Raza, S.A. Workers’ Remittances and Economic Growth in China and Korea: An Empirical Analysis. J. Chin. Econ. Foreign Trade Stud. 2012, 5, 185–193. [Google Scholar] [CrossRef]

- Kim, S.; Lim, H.; Park, D. Does Productivity Growth Lower Inflation in Korea? Appl. Econ. 2013, 45, 2183–2190. [Google Scholar] [CrossRef]

- Chen, X.; Wang, Y.; Li, T. Examining the Resource Curse Phenomenon, Digital Finance Integration, and Their Impacts on Economic Growth: Empirical Insights from South Korea. Resour. Policy 2024, 88, 104508. [Google Scholar] [CrossRef]

- Ghosh, S. Foreign Direct Investment, Female Education, Capital Formation, and Economic Growth in Japan and South Korea. Int. Econ. J. 2019, 33, 509–536. [Google Scholar] [CrossRef]

- Kim, S.; Lee, K.; Nam, K. The Relationship between CO2 Emissions and Economic Growth: The Case of Korea with Nonlinear Evidence. Energy Policy 2010, 38, 5938–5946. [Google Scholar] [CrossRef]

- Kang, S.; Li, Z.; Jeong, D. An Effect of Carbon Dioxide and Energy Reduction on Production Efficiency and Economic Growth: Application of Carbon Neutrality in Korea. Sustainability 2022, 14, 17054. [Google Scholar] [CrossRef]

- Shahbaz, M.; Zakaria, M.; Shahzad, S.J.H.; Mahalik, M.K. The Energy Consumption and Economic Growth Nexus in Top Ten Energy-Consuming Countries: Fresh Evidence from Using the Quantile-on-Quantile Approach. Energy Econ. 2018, 71, 282–301. [Google Scholar] [CrossRef]

- Balcilar, M.; Ozdemir, Z.A.; Arslanturk, Y. Economic Growth and Energy Consumption Causal Nexus Viewed through a Bootstrap Rolling Window. Energy Econ. 2010, 32, 1398–1410. [Google Scholar] [CrossRef]

- Yang, Y.; Greaney, T.M. Economic Growth and Income Inequality in the Asia-Pacific Region: A Comparative Study of China, Japan, South Korea, and the United States. J. Asian Econ. 2017, 48, 6–22. [Google Scholar] [CrossRef]

- Zang, W.; Baimbridge, M. Exports, Imports and Economic Growth in South Korea and Japan: A Tale of Two Economies. Appl. Econ. 2012, 44, 361–372. [Google Scholar] [CrossRef]

- Lee, J.C.; Won, Y.J.; Jei, S.Y. Study of the Relationship between Government Expenditures and Economic Growth for China and Korea. Sustainability 2019, 11, 6344. [Google Scholar] [CrossRef]

- Akkermans, D.H. Net Profit Flow per Country from 1980 to 2009: The Long-Term Effects of Foreign Direct Investment. PLoS ONE 2017, 12, e0179244. [Google Scholar] [CrossRef] [PubMed]

- Stojanovic, V.; He, S.; Zhang, B. State and Parameter Joint Estimation of Linear Stochastic Systems in Presence of Faults and non-Gaussian Noises. Int. J. Robust Nonlinear Control 2020, 30, 6683–6700. [Google Scholar] [CrossRef]

- Winkler, A.M.; Ridgway, G.R.; Webster, M.A.; Smith, S.M.; Nichols, T.E. Permutation Inference for the General Linear Model. Neuroimage 2014, 92, 381–397. [Google Scholar] [CrossRef]

- Zhang, C.-H.; Zhang, S.S. Confidence Intervals for Low Dimensional Parameters in High Dimensional Linear Models. J. R. Stat. Soc. Ser. B Stat. Methodol. 2014, 76, 217–242. [Google Scholar] [CrossRef]

| Panel A: Kwiatkowski–Phillips–Schmidt–Shin Unit Root Test | |||

|---|---|---|---|

| Variable | Level | 1st level | result |

| 0.168 ** | 0.156 ** | ; | |

| 0.093 | 0.178 ** | ||

| 0.082 | 0.224 *** | ||

| 0.110 | 0.163 ** | ||

| 0.140 * | 0.166 ** | ; | |

| 0.108 | 0.377 *** | ; | |

| Panel B: Bounds test | |||

| Method | Model | Optimal lag | Critical value |

| ARDL | 1, 1, 1, 1, 1, 2 | 6.787 *** | |

| NARDL | 1, 1, 1, 1, 1, 2,1 | 5.889 *** | |

| Panel C: Diagnostic tests | |||

| Test | ARDL | NARDL | |

| Normality | 1.604 | 1.478 | |

| -serial | 1.761 | 1.039 | |

| -white | 0.089 | 0.097 | |

| -Ramsey | 1.546 | 1.339 | |

| CUSUM | Stable | Stable | |

| CUSUM squares | Stable | Stable | |

| Variable | ARDL | NARDL |

|---|---|---|

| 0.508 ** (3.364) | 0.569 ** (3.604) | |

| 0.793 *** (8.804) | ||

| 0.795 *** (9.222) | ||

| 0.772 *** (9.016) | ||

| 0.411 * (1.823) | 0.418 ** (2.087) | |

| 0.647 ** (2.135) | 0.671 * (1.777) | |

| 0.158 * (1.706) | 0.141 ** (2.221) | |

| Long-run asymmetric test | 7.462 *** | |

| Variable | ARDL | NARDL |

|---|---|---|

| 0.239 *** (4.969) | 0.219 *** (4.551) | |

| 0.417 *** (5.514) | ||

| 0.398 *** (6.529) | ||

| 0.363 *** (6.655) | ||

| 0.194 ** (2.048) | 0.198 ** (2.354) | |

| 0.373 *** (2.865) | 0.386 *** (2.981) | |

| 0.122 * (1.651) | 0.154 * (1.737) | |

| 0.085 * (1.757) | 0.073 (1.478) | |

| −0.022 *** (−9.025) | −0.026 *** (−9.168) | |

| −1.755 * (−1.705) | −2.181 (−1.298) | |

| Short-run asymmetric test | 16.394 *** | |

| Variable | ||||||

|---|---|---|---|---|---|---|

| - | 6.564 *** | 3.177 *** | 1.134 | 1.786 | 1.077 | |

| 6.625 *** | - | 3.256 *** | 0.564 | 1.287 | 1.349 | |

| 3.162 *** | 2.087 ** | - | 1.297 | 1.065 | 0.938 | |

| 2.084 ** | 0.497 | 1.255 | - | 0.786 | 1.216 | |

| 1.997 ** | 0.746 | 1.765 * | 1.066 | - | 0.972 | |

| 2.108 ** | 1.016 | 1.707 * | 0.961 | - |

| V and M | Fully Modified Ordinary Least Squares | Dynamic Ordinary Least Squares |

|---|---|---|

| 0.633 *** (3.723) | 0.615 *** (3.493) | |

| 0.680 *** (4.858) | 0.660 *** (4.906) | |

| 0.465 * (1.821) | 0.468 * (1.833) | |

| 0.771 ** (2.043) | 0.772 *** (2.853) | |

| 0.197 ** (2.311) | 0.185 * (1.645) | |

| 0.067 *** | 0.085 *** | |

| 4.499 *** | 4.743 *** | |

| −1.604 ** (−1.991) | −1.722 * (−1.659) | |

| 0.835 | 0.849 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Y.; He, Y. Unraveling Korea’s Energy Challenge: The Consequences of Carbon Dioxide Emissions and Energy Use on Economic Sustainability. Sustainability 2024, 16, 2074. https://doi.org/10.3390/su16052074

Li Y, He Y. Unraveling Korea’s Energy Challenge: The Consequences of Carbon Dioxide Emissions and Energy Use on Economic Sustainability. Sustainability. 2024; 16(5):2074. https://doi.org/10.3390/su16052074

Chicago/Turabian StyleLi, Yao, and Yugang He. 2024. "Unraveling Korea’s Energy Challenge: The Consequences of Carbon Dioxide Emissions and Energy Use on Economic Sustainability" Sustainability 16, no. 5: 2074. https://doi.org/10.3390/su16052074

APA StyleLi, Y., & He, Y. (2024). Unraveling Korea’s Energy Challenge: The Consequences of Carbon Dioxide Emissions and Energy Use on Economic Sustainability. Sustainability, 16(5), 2074. https://doi.org/10.3390/su16052074