Research on the Effect of Marketization Reform on the Price of Aviation Kerosene in China

Abstract

1. Introduction

2. The Status of China’s Aviation Kerosene Market and Analysis of Price Influencing Factors

2.1. Analysis of the Status of the Supply and Demand of China’s Aviation Kerosene

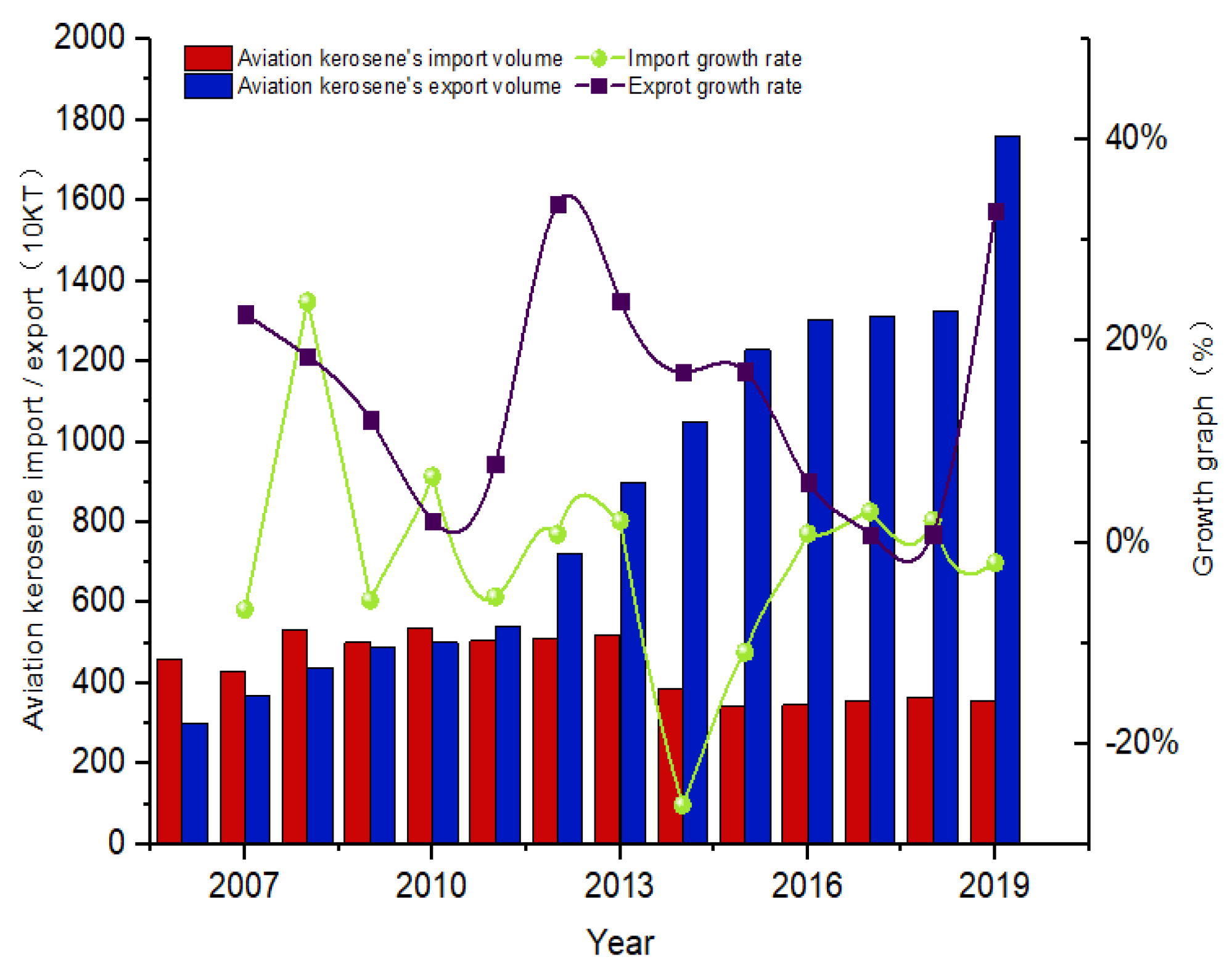

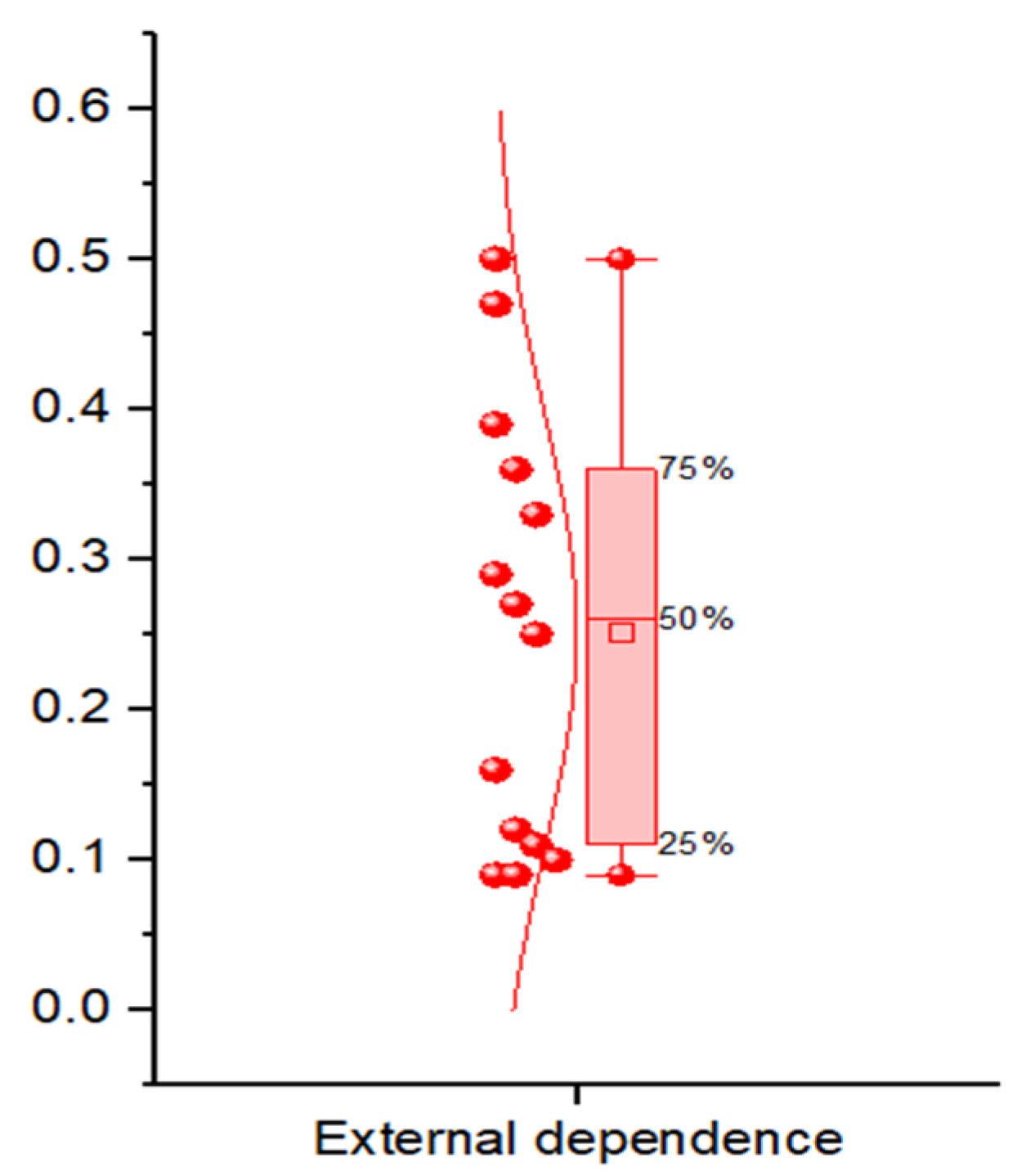

2.2. Analysis of the Current Situation of China’s Aviation Kerosene Import and Export Markets

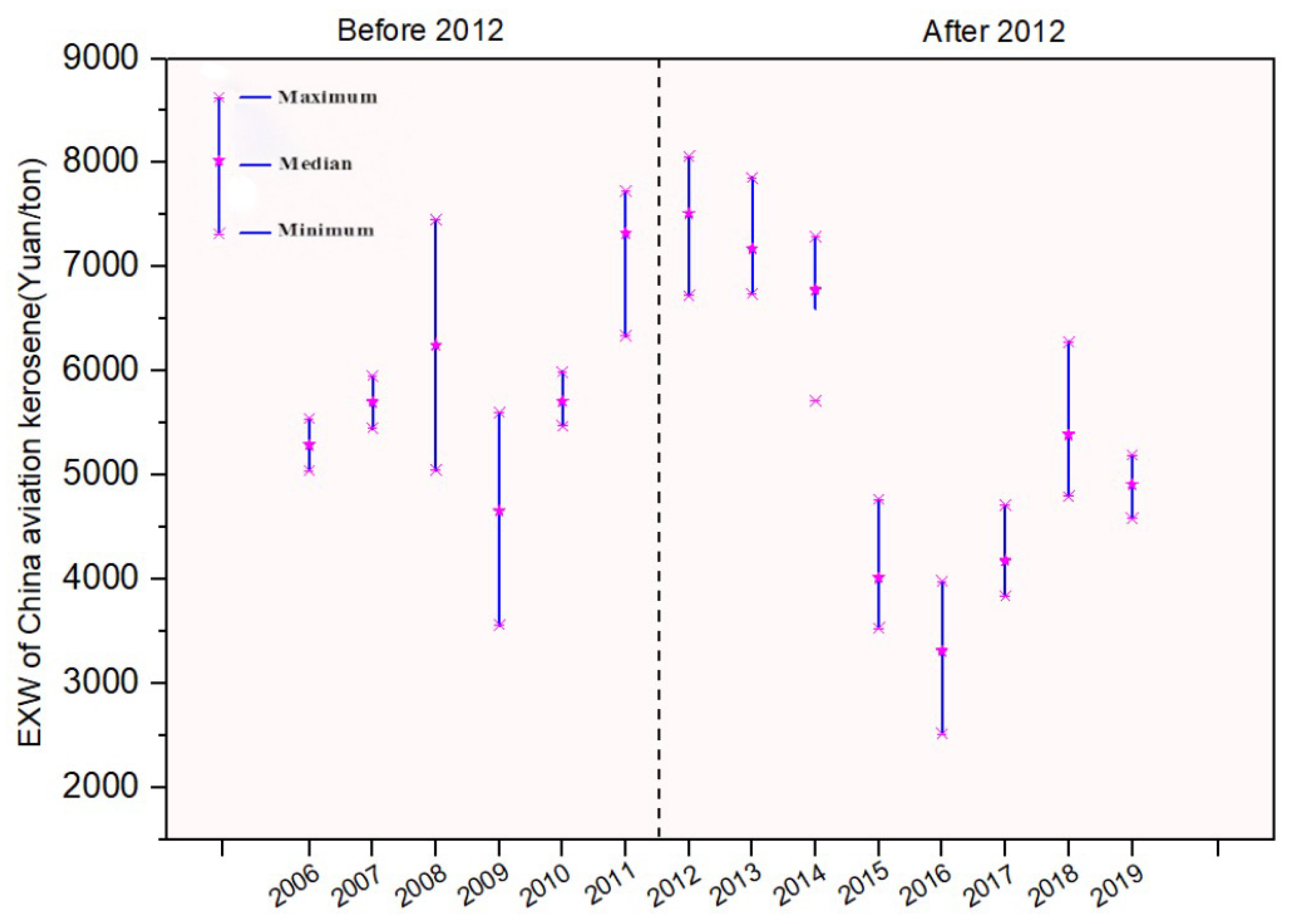

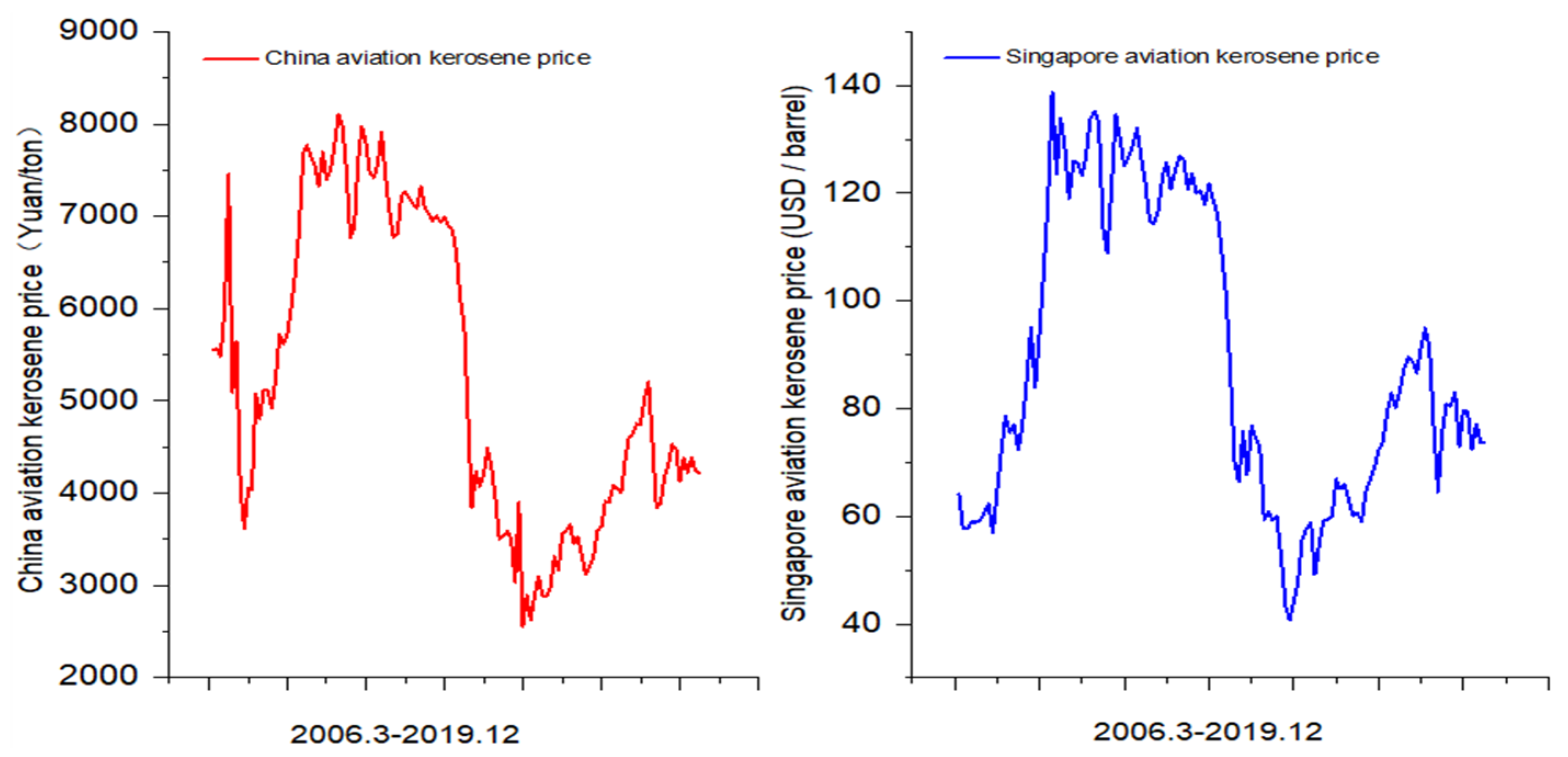

2.3. Analysis of the Current Situation of China’s Aviation Kerosene Prices

3. Materials and Methods

3.1. Equation Specification

3.2. Estimation Methods

3.2.1. Structural Break Unit Roots Test

3.2.2. Johansen Co-Integration Test

3.2.3. Regression Analysis

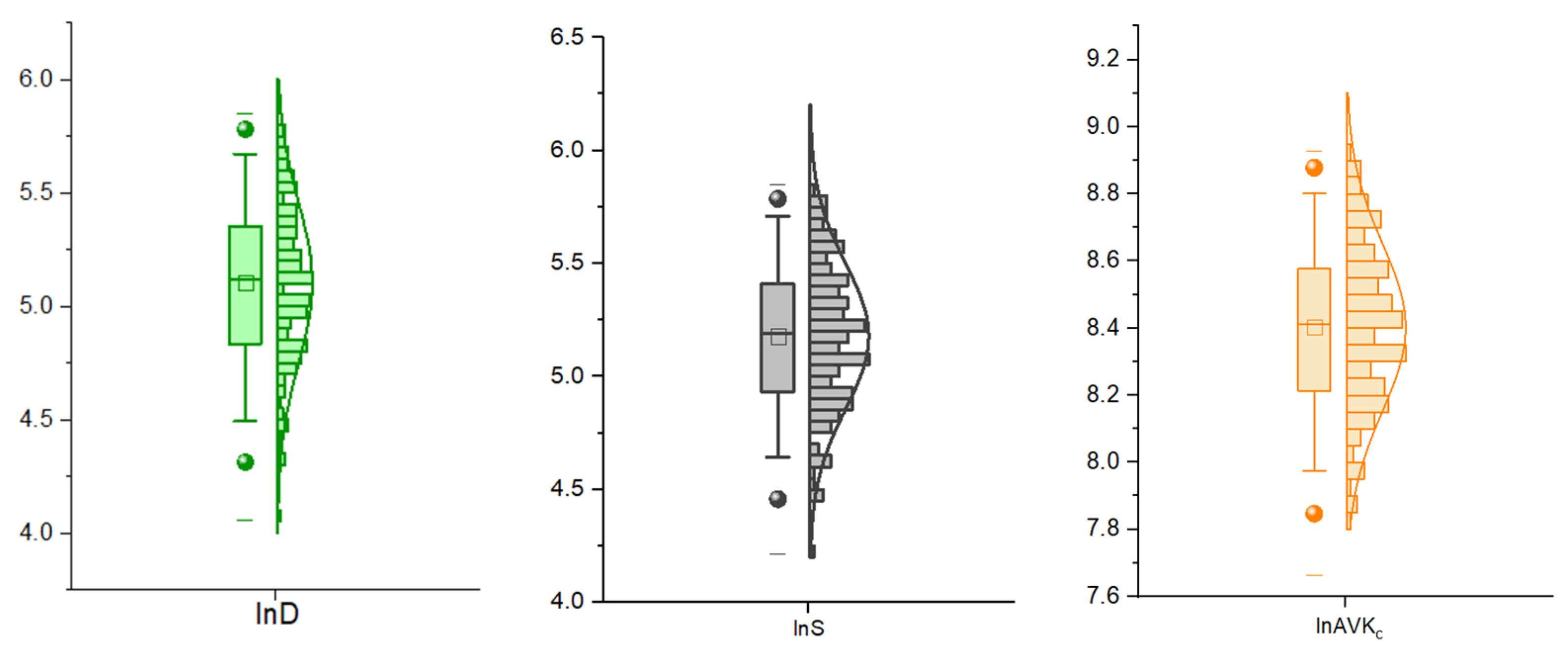

3.2.4. Robustness Analysis

3.2.5. Vector Granger Causality Test

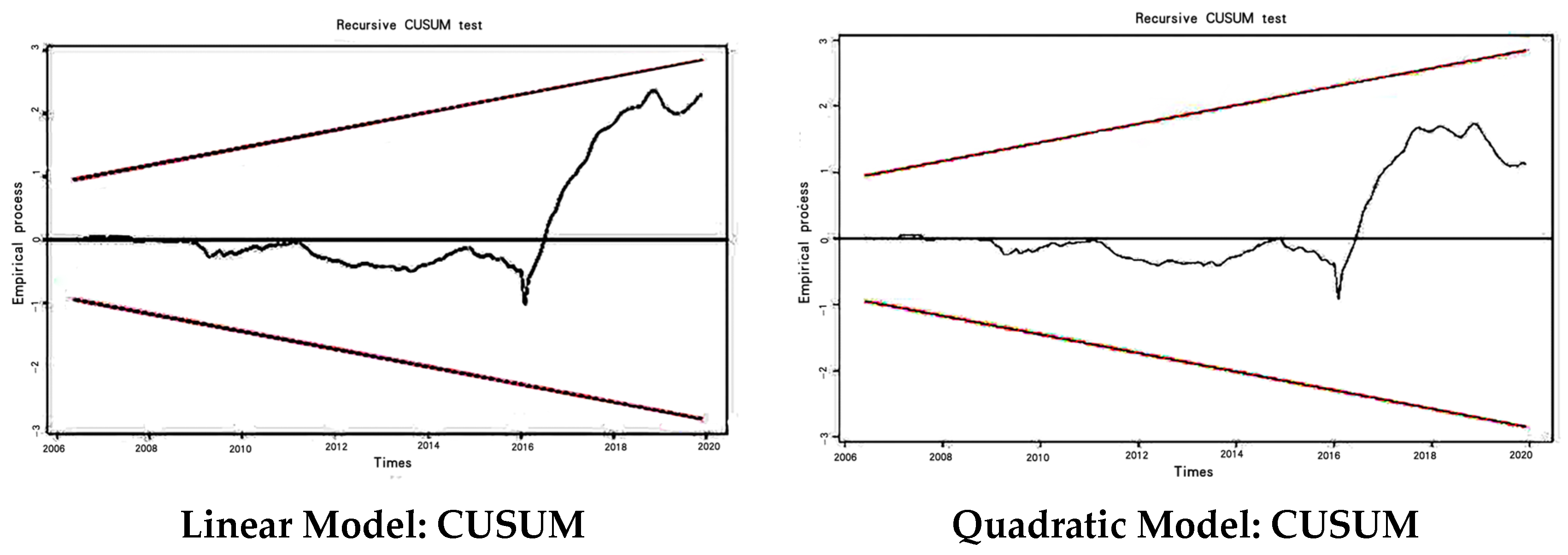

3.3. Data

4. Results

4.1. Unit Root Test Result

4.2. J-J Co-Integration

4.3. Regression Analysis

4.4. Robustness Test

4.5. Granger Causality Test

5. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wang, T.; Wu, F.; Zhang, D.; Ji, Q. Energy market reforms in China and the time-varying connectedness of domestic and international markets. Energy Econ. 2023, 117, 106495. [Google Scholar] [CrossRef]

- Phillip, J.A. Review of sustainable energy carriers for aviation: Benefits, challenges, and future viability. Prog. Aerosp. Sci. 2023, 141, 100919. [Google Scholar] [CrossRef]

- Leonardo, C.; Valentina, S.; Claudia, B.; Giorgio, V. E-fuels, technical and economic analysis of the production of synthetic kerosene precursor as sustainable aviation fuel. Energy Convers. Manag. 2023, 288, 117165. [Google Scholar] [CrossRef]

- Pradeep, S. Impact of diesel price reforms on asymmetricity of oil price pass-through to inflation: Indian perspective. J. Econ. Asymmetries 2022, 26, e00249. [Google Scholar] [CrossRef]

- Kristiana, S.; Laurence, D. Soaring sustainably: Promoting the uptake of sustainable aviation fuels during and post-pandemic. Energy Res. Soc. Sci. 2021, 77, 102074. [Google Scholar] [CrossRef]

- Lea, R.; Eleonore, P.; Karen, S. Environmental impacts in the civil aviation sector: Current state and guidance. Transp. Res. Part D Transp. Environ. 2023, 119, 103717. [Google Scholar] [CrossRef]

- Lin, B.; Liu, X. Reform of refined oil product pricing mechanism and energy rebound effect for passenger transportation in China. Energu Policy 2013, 57, 329–337. [Google Scholar] [CrossRef]

- Seo, J. Diversification of Crude Oil Import Sources as Determinant Factors in the Pricing of Petroleum Products. Energy Sources 2013, 8, 320–327. [Google Scholar] [CrossRef]

- Lin, B.; Ooyang, X.A. Revisit of fossil-fuel subsidies in China: Challenges and opportunities for energy price reform. Energy Convers. Manag. 2014, 82, 124–134. [Google Scholar] [CrossRef]

- Evan, M. Global Kerosene Subsidies: An Obstacle to Energy Efficiency and Development. World Dev. 2017, 99, 463–480. [Google Scholar] [CrossRef]

- Liu, X.; Ye, H.; Wang, Q.; Zhou, D. Flying into the future: A scenario-based analysis of carbon emissions from China’s civil aviation. J. Air Transp. Manag. 2020, 85, 101793. [Google Scholar] [CrossRef]

- Sha, R.; Ge, T.; Li, J. How Energy Price Distortions Affect China’s Economic Growth and Carbon Emissions. Sustainability 2022, 14, 7312. [Google Scholar] [CrossRef]

- Wang, T.; Qu, W.Y.; Zhang, D.; Ji, Q.; Wu, F. Time-varying determinants of China’s liquefied natural gas import price: A dynamic model averaging approach. Energy 2022, 259, 125013. [Google Scholar] [CrossRef]

- Borenstein, S.; Cameron, A.C.; Gilbert, R. Do Gasoline Prices Respond Asymmetrically to Crude Oil Price Changes? Q. J. Econ. 1997, 112, 305–339. [Google Scholar] [CrossRef]

- Asche, F.; Gjølberg, O.; Völker, T. Price relationships in the petroleum market: An analysis of crude oil and refined product prices. Energy Econ. 2003, 25, 289–301. [Google Scholar] [CrossRef]

- Bettendorf, L.; Stéphanie, A.G.; Marco, V. Price asymmetry in the Dutch retail gasoline market. J. Energy Econ. 2003, 25, 669–689. [Google Scholar] [CrossRef]

- Kaufmann, R.K.; Laskowski, C. Causes for an asymmetric relation between the price of crude oil and refined petroleum products. J. Energy Policy 2004, 33, 1587–1596. [Google Scholar] [CrossRef]

- Bumpass, D.; Douglas, C.; Ginn, V. Testing for short and long-run asymmetric responses and structural breaks in the retail gasoline supply chain. J. Energy Econ. 2019, 83, 311–318. [Google Scholar] [CrossRef]

- Kpodar, K.; Abdallah, C. Dynamic fuel price pass-through: Evidence from a new global retail fuel price database. Energy Econ. 2015, 66, 303–312. [Google Scholar] [CrossRef]

- Esteban, M.; Ma, X.; Wang, L.; Lu, Y.; Dai, J.; Li, X. Spillover of international crude oil prices on China’s refined oil wholesale prices and price forecasting: Daily-frequency data of private enterprises and local refineries. J. Pet. Sci. 2022, 19, 1433–1442. [Google Scholar] [CrossRef]

- He, Y.; Lin, B. Is market power the cause of asymmetric pricing in China’s refined oil market? Energy Econ. 2023, 124, 106778. [Google Scholar] [CrossRef]

- Michael, K.; Walls, W.D. Oil industry consolidation and refined product prices: Evidence from US wholesale gasoline terminals. Energy Policy 2010, 38, 3498–3507. [Google Scholar] [CrossRef]

- Hussein, M.; Franz, W. Determinants of oil price subsidies in oil and gas exporting countries. Energy Policy 2018, 122, 409–420. [Google Scholar] [CrossRef]

- Luo, Y.; Ding, S.H. The status quo and development trend forecast of domestic aviation oil market. China Pet. Chem. Ind. Econ. Anal. 2018, 9, 47–50. (In Chinese) [Google Scholar]

- Chen, H.; Sun, Z. International crude oil price, regulation and asymmetric response of China’s gasoline price. Energy Econ. 2021, 94, 105049. [Google Scholar] [CrossRef]

- Zhang, Q.; Hu, Y.; Jiao, J.; Wang, S. Is refined oil price regulation a “shock absorber” for crude oil price shocks? Energy Policy 2023, 173, 113369. [Google Scholar] [CrossRef]

- Tian, X.; Chen, B.; Geng, Y. Energy footprint pathways of China. Energy 2019, 180, 330–340. [Google Scholar] [CrossRef]

- Wang, R.; Chen, Z.; Zhang, W.; Zhu, Q. Proceedings of the 11th International Conference on Modelling, Identification and Control (ICMIC2019); Springer: Singapore, 2020. [Google Scholar]

- Yuan, C.; Yang, Y.; Liu, S.; Fang, Z. Relation between China’s gasoline prices and international crude oil prices. Energy Sources Part B Econ. Plan. Policy 2016, 11, 953–959. [Google Scholar] [CrossRef][Green Version]

- Gong, C.Z.; Wu, D.S.; Gong, H.J.; Qi, R. Multi-agent mixed complementary simulation of natural gas upstream market liberalization in China. Energy 2020, 200, 117535. [Google Scholar] [CrossRef]

- Dong, K.Y.; Sun, R.J.; Jiang, H.D.; Zeng, X.G. CO2 emissions, economic growth, and the environmental Kuznets curve in China: What roles can nuclear energy and renewable energy play? J. Clean. Prod. 2018, 196, 51–63. [Google Scholar] [CrossRef]

- Mrabet, Z.; Alsamara, M. Testing the Kuznets Curve hypothesis for Qatar: A comparison between carbon dioxide and ecological footprint. Renew. Sustain. Energy Rev. 2016, 70, 1366–1375. [Google Scholar] [CrossRef]

- Rafindadi, A.A.; Ozturk, I. Effects of financial development, economic growth and trade on electricity consumption: Evidence from post-Fukushima Japan. Renew. Sustain. Energy Rev. 2016, 54, 1073–1084. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S.W. A Comparative Study of Unit Root Tests with Panel Data and a New Simple Test. Oxf. Bull. Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Zivot, E.; Andrews, D.W. Further Evidence on the Great Crash, the Oil-Price Shock, and the Unit-Root Hypothesis. J. Bus. Econ. Stat. 2002, 20, 25–44. [Google Scholar] [CrossRef]

- Robert, F.; Engle, C.W.J. Granger. Co-Integration and Error Correction: Representation, Estimation, and Testing. Econometrics 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Dyn. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Nicoleta, M.F.; Roxana, M.B.; Silvia, P. Linking Public Finances’ Performance to Renewable-Energy Consumption in Emerging Economies of the European Union. Sustainability 2021, 13, 6344. [Google Scholar] [CrossRef]

- Phillips, C.B.; Hansen, B.E. Statistical Inference in Instrumental Variables Regression with I (1) Processes. Rev. Econ. Stud. 1990, 57, 99–125. [Google Scholar] [CrossRef]

- Pedroni, P. Fully Modified OLS for Heterogeneous Cointegrated Panels; Emerald Group Publishing Limited: Bradford, UK, 2001; pp. 93–130. [Google Scholar] [CrossRef]

- Chen, B.; Suzanne, K.; Chinwe, K. Estimation and Inference of a Cointegrated Regression in Panel Data: A Monte Carlo Study. Am. J. Math. Manag. Sci. 1999, 19, 75–114. [Google Scholar] [CrossRef]

- Cha, K.; Lee, C. Rocket and Feathers in the Gasoline Market: Evidence from South Korea. Sustainability 2023, 15, 3815. [Google Scholar] [CrossRef]

- Liu, Y. Exploring the relationship between urbanization and energy consumption in China using ARDL (autoregressive distributed leg) and FDM (factor decomposition model). Energy 2009, 34, 1846–1864. [Google Scholar] [CrossRef]

| Part A: Research on the Price Correlation between Aviation Kerosene and Other Refined Oil and Oil Products | ||||

| Author | Research Region | Data (Year) | Variable | Research Method |

| Borenstein, 1997 [14] | United States | 1986–1990 | Gasoline price and crude oil spot price | Cumulative adjustment functions |

| Asche et al., 2003 [15] | Europe | 1992–2000 | Crude oil, natural gas, kerosene and naphtha price | Multivariate Johansen tests |

| Bettendorf et al., 2003 [16] | Netherlands | 1996–2011 | Weekly change data on gasoline and refined oil prices | Asymmetric error correction model |

| Kaufmann et al., 2005 [17] | United States | 1986–2002 | Gasoline utilization rate, gasoline inventory, original price, gasoline price | Error correction model |

| Bumpass et al., 2015 [18] | United States | 1991–2006 | International crude oil price and retail price of refined oil | ECM model based on structural fracture inspection |

| Kpodar et al., 2017 [19] | 162 countries | 2000–2014 | Monthly data on gasoline and crude oil prices | Local projection approach of Jordà |

| Esteban et al., 2022 [20] | China | 2003–2020 | Daily frequency data on private enterprises and local refineries | VAR-BEKK-GARCH; PCA-BP neural network |

| He et al., 2022 [21] | China | 2000–2021 | Refined oil prices and the crude oil price | EGARCH model; two-stage regression process |

| Part B: Research on Factors Influencing Aviation Kerosene Prices | ||||

| Author | Research Region | Research Areas | Influencing Factors | Research Method |

| Asche et al., 2003 [15] | Europe | Factors affecting refined oil price | Trends in crude oil, natural gas and international oil price | Qualitative analysis and quantitative methods |

| Michael et al., 2010 [22] | United States | Factors affecting refined oil price | Oil industry integration | Quantitative research: time series regression |

| Hussein et al., 2018 [23] | Mainly developing countries | The price of refined oil and the factors influencing its subsidy | Policy factors such as demand for refined oil, subsidy amount, policy cost, etc. | Qualitative research |

| Luo et al., 2018 [24] | China | Factors affecting the price of aviation fuel | Consumption and distribution, output and distribution, import and export, etc. | Qualitative research |

| Chen et al., 2021 [25] | China | The dynamics of gasoline price response to international oil market price fluctuations and domestic price regulation | Import quota policy and price control | Qualitative research |

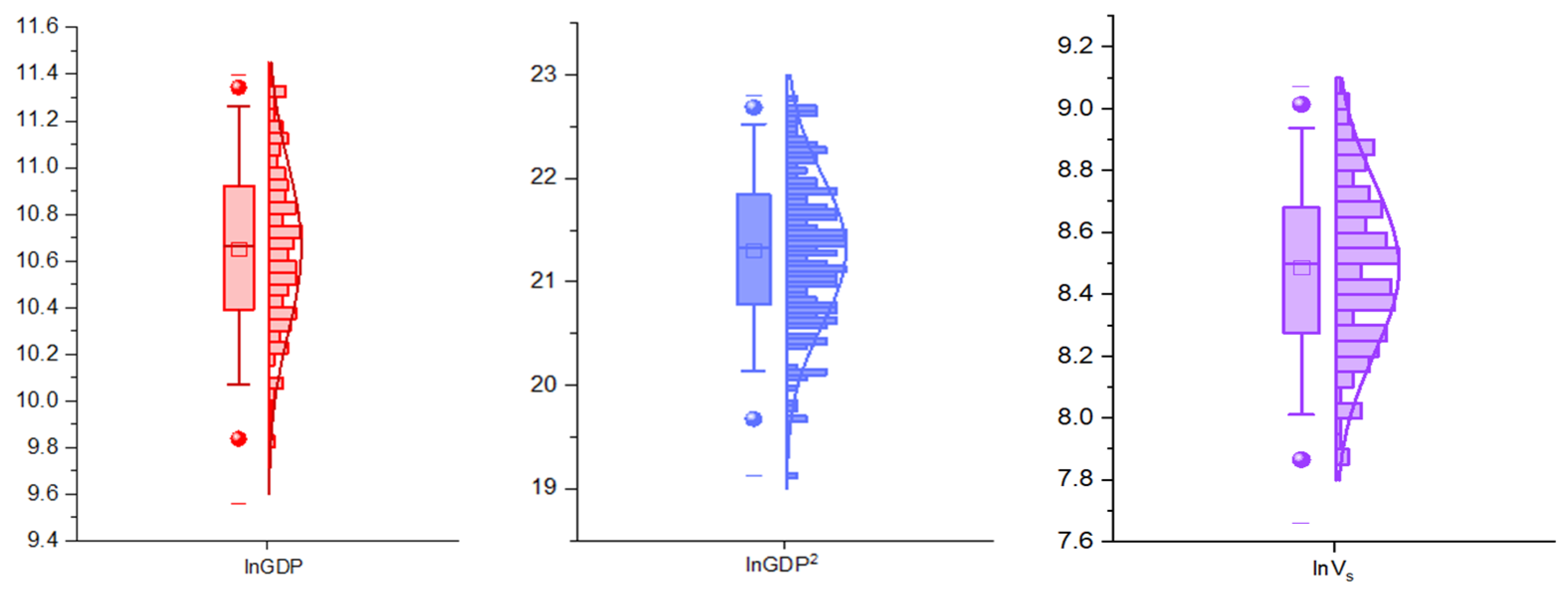

| ln (AVKc) | ln (GDP) | (lnGDP)2 | ln (Vs) | ln (S) | Ln (D) | |

|---|---|---|---|---|---|---|

| Mean | 8.4022 | 10.6529 | 113.6141 | 8.4874 | 5.1031 | 5.1777 |

| Maximum | 8.9284 | 11.3974 | 129.9013 | 9.0729 | 5.8519 | 5.8485 |

| Minimum | 7.6643 | 9.5602 | 913.9793 | 7.6615 | 4.0531 | 4.2128 |

| Std.Dev | 0.2503 | 0.3608 | 766.9641 | 0.2790 | 0.3562 | 0.3221 |

| Skewness | −0.1556 | −0.1423 | −0.0057 | −0.1543 | −0.1557 | −0.1491 |

| Kurtosis | 2.6128 | 2.7074 | 2.6312 | 2.6246 | 2.6128 | 2.6650 |

| Jarque–Bera | 1.7279 (0.3215) | 1.1659 (0.5582) | 1.3648 (0.5382) | 3.6532 (0.4375) | 1.4083 (0.4945) | 2.7279 (0.3214) |

| Sum | 1411.5698 | 1789.6904 | 1908.7161 | 1425.8883 | 857.3262 | 869.8549 |

| Sum Sq.Dev | 10.4615 | 21.7344 | 982.3506 | 13.0028 | 21.1862 | 17.3268 |

| Variable | Result | Result of 1st Difference | Difference Order | ||

|---|---|---|---|---|---|

| T-Statistic | Break Year | T-Statistic | Break Year | ||

| ln (Vs) | −1.6564 (27) | 2008.3 | −9.0866(0) *** | 2012.4 | I(1) |

| ln (AVKc) | −2.0652 (75) | 2012.4 | −9.5451(74) *** | 2012.3 | I(1) |

| ln(S) | −0.5797 (60) | 2010.12 | −7.7494 (0) *** | 2006.1 | I(1) |

| ln(D) | −1.9193 (60) * | 2010.12 | −5.8296 (0) *** | 2006.1 | I(1) |

| ln (GDP) | −0.5378 (28) | 2008.4 | −6.9851(28) *** | 2008.4 | I(1) |

| (lnGDP)2 | −0.109 (28) | 2008.4 | −6.9861(28) *** | 2008.4 | I(1) |

| Estimated Models | Johansen | Result |

|---|---|---|

| 93.20 *** | Cointegration |

| Variable | Dependent Variable: lnAVK | |||||||

|---|---|---|---|---|---|---|---|---|

| Result of Linear Model | Result of Quadratic Model | |||||||

| OLS | FMOLS | DOLS | IMOLS | OLS | FMOLS | DOLS | IMOLS | |

| ln (Vs) | 0.8963 *** (<0.0001) | 0.9128 *** (<0.0001) | 0.9307 *** (<0.0001) | 0.8967 *** (<0.0001) | 0.9166 *** (<0.0001) | 0.9174 *** (<0.0001) | 0.9391 *** (<0.0001) | 0.9155 *** (<0.0001) |

| ln(D) | 0.2229 * (0.058) | 0.2107 (0.1735) | 0.1985 (0.3439) | 0.8042 ** (0.0306) | 0.2892 ** (0.0134) | 0.1692 (0.2384) | 0.1204 (0.5908) | 0.0887 (0.6133) |

| ln(S) | −0.2482 (0.237) | −0.1335 (0.3250) | −0.0784 (0.6760) | −0.6490 * (0.0553) | −0.2524 (0.2165) | −0.4650 * (0.0635) | −0.4215 (0.1774) | −0.5547 (0.2836) |

| ln (GDP) | 0.1057 (0.596) | 0.0225 (0.6729) | −0.0127 (0.8403) | −0.0070 (0.9126) | −1.9394 (0.3249) | 0.0120 (0.8183) | −0.0179 (0.7816) | −0.0212 (0.7229) |

| (ln(GDP))2 | - | - | - | - | 0.0940 (0.1020) | 0.01748 (0.1242) | 0.0193 (0.1908) | 0.0249 (0.2295) |

| Dependent Variable | Short Run | Long Run (ARDL) | |||||

|---|---|---|---|---|---|---|---|

| lnAVKt−1 | lnGDPi−1 | (lnGDPi−1)2 | ln (Vs)t−1 | lnSt−1 | lnDt−1 | ECTt−1 1 | |

| F-Stat [p Value] | T-Stat [p Value] | ||||||

| ΔlnAVKt | - | 0.3118 (0.7325) | 0.3177 (0.7283) | 2.81 * (0.0632) | 0.1745 (0.84) | 0.0381 (0.9626) | −4.750 ** (0.0120) |

| ΔlnGPDi | 0.0144 (0.9857) | - | 1.4511 (0.2374) | 1.5345 (0.2187) | 0.2765 (0.7588) | 0.0506 (0.9507) | −2.2382 (0.6791) |

| (ΔlnGDPi)2 | 0.0138 (0.9863) | 1.1112 (0.3317) | - | 1.6118 (0.2028) | 0.3498 (0.7054) | 0.0212 (0.979) | −0.7073 (0.9741) |

| Δln (Vs)t | 14.245 *** (<0.0001) | 0.2405 (0.7865) | 0.2585 (0.7725) | - | 0.0285 (0.9719) | 0.4432 (0.6428) | −6.1583 *** (0.0002) |

| ΔlnSt | 0.363 (0.6962) | 6.8377 *** (0.0014) | 6.527 *** (0.0019) | 0.1132 (0.893) | - | 0.0365 (0.9642) | −2.982 (0.3741) |

| ΔlnDt | 0.2952 (0.7448) | 2.9452 * (0.0555) | 3.141 * (0.059) | 0.3592 (0.6988) | 2.3976 * (0.0942) | - | −0.6407 (0.9776) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cao, X.; Li, W.; Meng, S.; Zhao, X.; Yang, M. Research on the Effect of Marketization Reform on the Price of Aviation Kerosene in China. Sustainability 2024, 16, 2104. https://doi.org/10.3390/su16052104

Cao X, Li W, Meng S, Zhao X, Yang M. Research on the Effect of Marketization Reform on the Price of Aviation Kerosene in China. Sustainability. 2024; 16(5):2104. https://doi.org/10.3390/su16052104

Chicago/Turabian StyleCao, Xun, Wenxin Li, Siqi Meng, Xin Zhao, and Mianzhi Yang. 2024. "Research on the Effect of Marketization Reform on the Price of Aviation Kerosene in China" Sustainability 16, no. 5: 2104. https://doi.org/10.3390/su16052104

APA StyleCao, X., Li, W., Meng, S., Zhao, X., & Yang, M. (2024). Research on the Effect of Marketization Reform on the Price of Aviation Kerosene in China. Sustainability, 16(5), 2104. https://doi.org/10.3390/su16052104