Application of the Black–Scholes Financial Model to Support Adaptability as a Sustainability Strategy for Buildings: A Case Study of an Adaptable Campus Parking Garage

Abstract

:1. Introduction

| Contribution 1: | Develop a model based on the Black–Scholes financial options model (BSM), to determine the real option value of an adaptable building. The model includes the effects of inflation and is suited to conditions where the building’s value is not directly linked to revenue. |

| Contribution 2: | Demonstrate the model through a hypothetical case study of a college campus parking garage expansion project. |

2. Background

2.1. Design for Adaptability

2.2. Real Options

2.3. Black–Scholes Financial Pricing Model

- Constant short-term risk-free interest rate;

- The distribution of stock prices is log-normal and variance is constant (i.e., the stock price follows a “random walk”);

- No dividends are paid on the stock;

- Only “European” options are considered; “American” options were not used;

- No transaction costs are associated with the selling and buying of the stock;

- Individuals can borrow any amount of the security price to buy or hold it;

- No penalties for short selling a stock.

2.4. Engel, Browning, and Reich (EBR) Model

2.5. Applications of Real Options to Building Design

2.6. Distinction and Relationship to Previous Works

3. Modified BSM

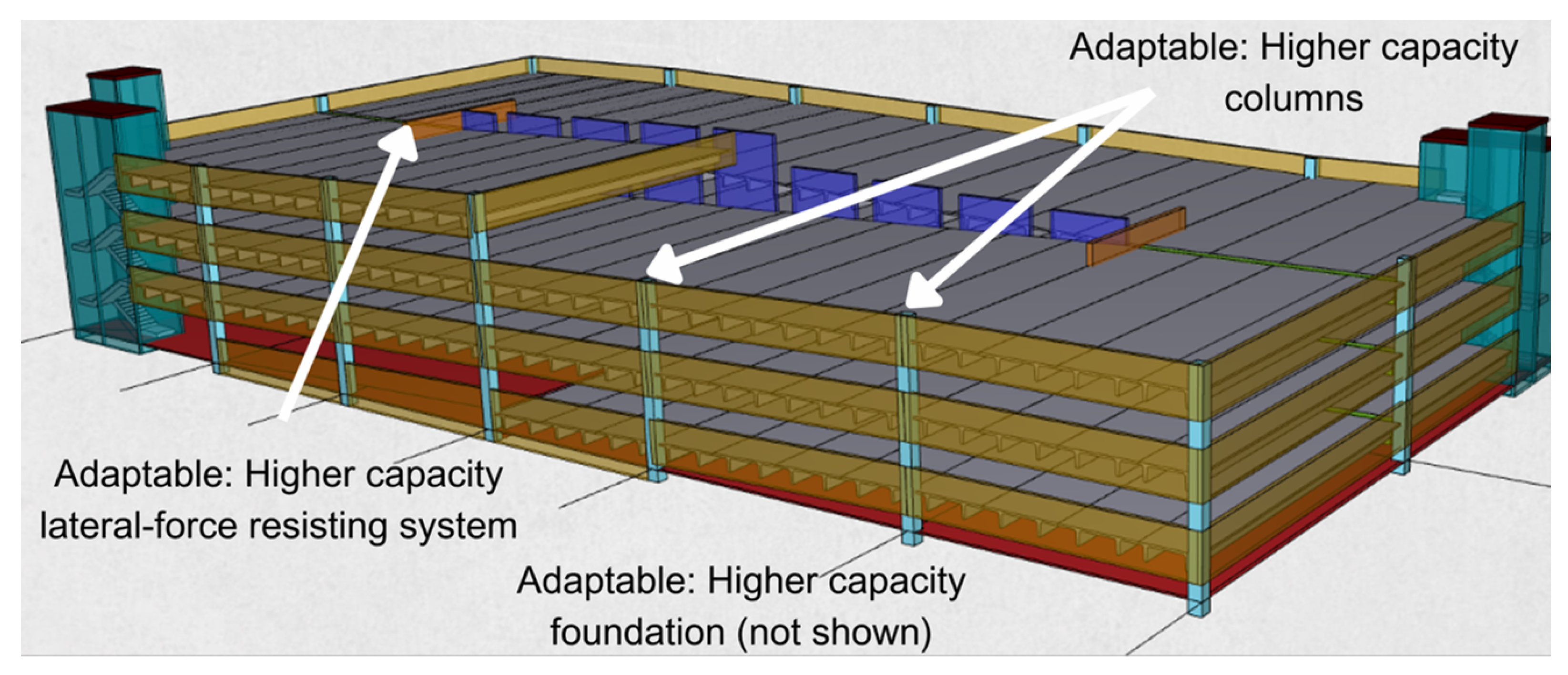

3.1. Garage Designs

3.2. Model Development

3.3. Values for Model Parameters

| Variable | Definition | Notes |

|---|---|---|

| Cost of the 5-story parking garage at t = 0 | Taken as USD 8,700,000 | |

| Cost of the traditional 3-story parking garage at t = 0 | Taken as USD 5,100,000 | |

| Adjusted value added through the addition of parking levels (in this example, the addition of 2 parking levels) | Equation (6) | |

| Cost of the adaptable 3-story parking garage at t = 0 | Taken as USD 6,200,000; calculated as 120% of | |

| Present value of the price to expand the adaptable parking garage from 3 to 5 stories | Equation (9) | |

| Cost of expanding the adaptable garage from 3 to 5 stories at t = 0. Taken as the cost difference between 5- and 3-story garage | Equation (8), taken as USD 3,600,000 | |

| Present value of the price to demolish the traditional 3-story garage and build a replacement 5-story garage | Equation (10) | |

| Cost of demolition of the traditional 3-story parking garage and replacement by a 5-story garage at t = 0 | Taken as USD 9,300,000 | |

| Construction cost inflation rate | Taken as 2.78% | |

| Owner-defined value inflation rate | See discussion in Section 3.2 | |

| r | An interest rate under a “no-risk” assumption | Taken as 2.80%, based on the July 2022 US 10-Year Treasury Bond Rate |

| t | Time at which expansion (or demolition and replacement) is undertaken | Discrete times of 5, 10, 15, 20, 25, and 30 years are used |

| Volatility in parking value | Taken as 11.6% | |

| Option value of being able to expand adaptable garage from 3 to 5 stories | Equation (15) | |

| Option value of being able to demolish traditional 3-story garage and replace it with a 5-story garage | Equation (16) | |

| Adjusted with the lower-bound value of zero | See discussion in Section 4.1 |

3.4. Net Option Values and Net Payoff Ratio

4. Case Study Results and Discussion

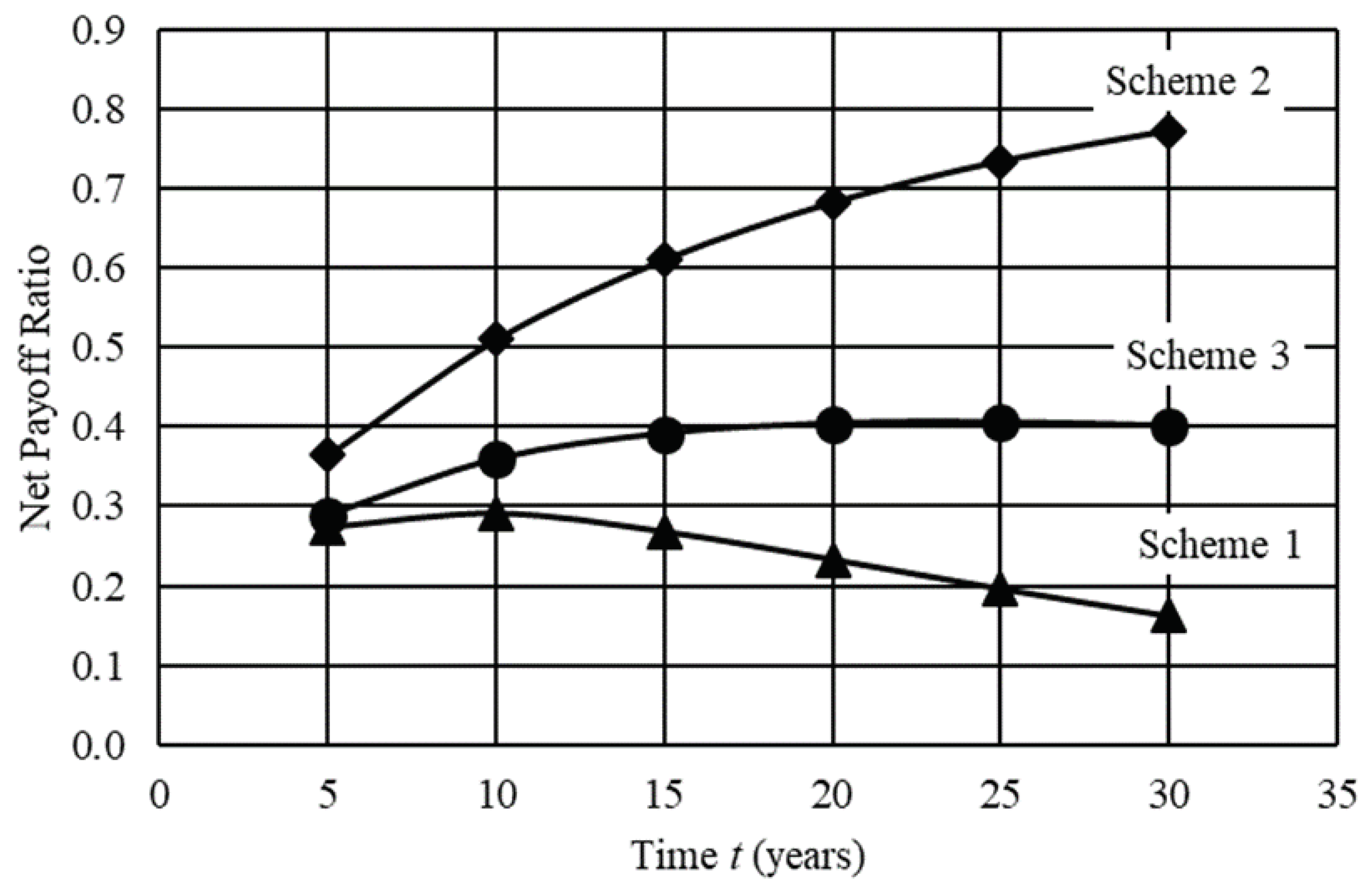

4.1. Scheme 1: No Value Inflation or Construction Cost Inflation ( = = 0)

4.2. Scheme 2: Owner-Defined Value Inflation Equals Construction Cost Inflation ( = = 2.78%)

4.3. Scheme 3: Owner-Defined Value Inflation Does Not Equal Construction Cost Inflation ( = 2.00%, = 2.78%)

4.4. Sensitivity Study

5. Conclusions and Recommendations

- The NPR has the highest sensitivity to the initial cost for an adaptable parking garage. Therefore, if the premium for the adaptable option is relatively low, then it would be preferable to invest in the adaptable option. In the case study, a 10% decrease in the initial cost of the adaptable building affected an increase in NPR of approximately 120%.

- The NPR is highly sensitive to the owner-defined inflation rate for the value of additional parking, especially at more distant expiry dates. A 1% increase in value inflation affected an approximately 60% increase in NPR at year 30. This rate is the most loosely defined variable in the model, and care should be taken when selecting its value. If an owner is willing to pay the market rate to construct parking, then it is suggested that the value inflation rate be set equal to the construction cost inflation rate.

- For baseline parameters that best reflect the real-world conditions of the case study, the premium paid for an adaptable garage would not be justified. This result is sensitive to input values and circumstances that are specific to the case study.

- Alternatives for calculating the value of assets that are only indirectly related to revenue (i.e., parking spaces on many college campuses). The current model implemented a user-defined inflation parameter that was loosely defined but had a critical impact on the model output.

- Methods for modeling trends in asset demand. Analogous to the original assumption of the BSM, demand for parking spaces in the current model is based on a constant mean across time and volatility of demand follows a “random walk”. Future models could account for growth/loss of demand. It is possible that the owner-defined value inflation rate could be used for this purpose.

- The economic value associated with other types of options, such as occupancy change. For example, future work could address the option value of a parking garage that can be adapted into a residential or lab building.

- Considerations in the model for asset depreciation and other potential factors within the model.

- An LCA comparison of traditional and adaptable designs and options. In addition to an LCA of the case study, general explorations of LCA and adaptable designs are also warranted.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Architecture 2030. Available online: https://architecture2030.org/why-the-building-sector/ (accessed on 14 June 2023).

- Sabnis, A.; Mysore, P.; Anant, S. Construction Materials—Embodied Energy Footprint—Global Warming; Interaction. In Proceedings of the Structural Engineers World Congress, Singapore, 19–22 October 2015. [Google Scholar]

- United States Environmental Protection Agency (EPA). Available online: https://www.epa.gov/smm/sustainable-management-construction-and-demolition-materials (accessed on 26 August 2022).

- The American Institute of Architects. Buildings That Last: Design for Adaptability, Deconstruction and Reuse [PDF]. Available online: https://www.aia.org/resource-center/design-adaptability-deconstruction-reuse (accessed on 14 June 2023).

- Construction Industry Institute. Circularity in Capital Projects: Innovations and Opportunities; Final Report 380; 1 July 2022. Available online: https://www.construction-institute.org/circularity-in-capital-projects-innovations-and-opportunities (accessed on 23 September 2022).

- Geissdoerfer, M.; Savaget, P.; Bocken, N.M.P.; Hultink, E.J. The Circular Economy—A new sustainability paradigm? J. Clean. Prod. 2017, 143, 757–768. [Google Scholar] [CrossRef]

- Dams, B.; Maskell, D.; Shea, A.; Allen, S.; Driesser, M.; Kretschmann, T.; Walker, P.; Emmitt, S. A circular construction evaluation framework to promote designing for disassembly and adaptability. J. Clean. Prod. 2021, 316, 128122. [Google Scholar] [CrossRef]

- Salama, W. Design of concrete buildings for disassembly: An explorative review. Int. J. Sustain. Built Environ. 2017, 6, 617–635. [Google Scholar] [CrossRef]

- Arora, S.K.; Foley, R.W.; Youtie, J.; Shapira, P.; Wiek, A. Drivers of technology adoption—The case of nanomaterials in building construction. Technol. Forecast. Soc. Change 2014, 87, 232–244. [Google Scholar] [CrossRef]

- Bourke, K.; Adams, K. The Business Case for Re-Usable Buildings—Business Models, Systems Diagnosis and Case for Action. In Proceedings of the 15th International Conference on Durability of Building Materials and Components, Barcelona, Spain, 20–23 October 2020. [Google Scholar]

- Cruz Rios, F.; Grau, D.; Bilec, M. Barriers and Enablers to Circular Building Design in the US: An Empirical Study. J. Constr. Eng. Manag. 2021, 147, 04021117. [Google Scholar] [CrossRef]

- Heidrich, O.; Kamara, J.; Maltese, S.; Re Cecconi, F.; Dejaco, M.C. A critical review of the developments in building adaptability. Int. J. Build. Pathol. Adapt. 2017, 35, 284–303. [Google Scholar] [CrossRef]

- Arge, K. Adaptable office buildings: Theory and practice. Facilities 2005, 23, 119–127. [Google Scholar] [CrossRef]

- Bitter, C.M.; Ross, B.E.; Parker, S.; Milkovitz, M. Cost Comparison of Typical and Adaptable Precast Parking Structures in the US. In Proceedings of the 2nd International Conference of Circular Systems for the Built Environment, Eindhoven, The Netherlands, 9 December 2021. [Google Scholar]

- Brigante, J.; Ross, B.E.; Bladow, M. Costs of Implementing Design for Adaptability Strategies in Wood-Framed Multifamily Housing. J. Archit. Eng. 2023, 29, 05022013. [Google Scholar] [CrossRef]

- Damodaran, A. The Promise of Real Options. J. Appl. Corp. Financ. 2000, 13, 29–44. [Google Scholar] [CrossRef]

- Sick, G.; Gamba, A. Some Important Issues Involving Real Options: An Overview. Multinatl. Financ. J. 2010, 14, 73–123. [Google Scholar]

- Coppens, T.; Van Acker, M.; Machiels, T.; Compernolle, T. A real options framework for adaptive urban design. J. Urban Des. 2021, 26, 681–698. [Google Scholar] [CrossRef]

- Black, F.; Scholes, M. The Pricing of Options and Corporate Liabilities. J. Political Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Hazelrigg, G. Research 101 for Engineers. Available online: https://hw898.ise.msstate.edu/files/research_101_for_engineers.pdf (accessed on 21 February 2013).

- U.S. General Services Administration. Available online: https://www.gsa.gov/ (accessed on 3 January 2024).

- Allahaim, F.; Leifer, D. Towards Changeability: The Adaptable Buildings Design (ABD) Framework. In Proceedings of the 5th International Conference of Arab Society for Computer Aided Architectural Design, Fes, Morocco, 19–21 October 2010. [Google Scholar]

- Elvarrson, A.B.; Martani, C.; Adey, B.T. Considering automated vehicle deployment uncertainty in the design of optimal parking garages using real options. J. Build. Eng. 2021, 34, 101703. [Google Scholar] [CrossRef]

- Rockow, Z.R.; Ross, B.E.; Becker, A.K. Comparison of Building Adaptation Projects and Design for Adaptability Strategies. J. Archit. Eng. 2021, 27, 04021022. [Google Scholar] [CrossRef]

- O’Connor, J. Survey on actual service lives for North American buildings. In Proceedings of the Woodframe Housing Durability and Disaster Issues Conference, Conference Paper, Las Vegas, NV, USA, 4–6 October 2004. [Google Scholar]

- The Athena Institute. Minnesota Demolition Survey: Phase Two Report [PDF]. 2004. Available online: https://www.athenasmi.org/ (accessed on 27 September 2022).

- Thomsen, A.; van der Flier, K. Understanding obsolescence: A conceptual model for buildings. Build. Res. Inf. 2011, 39, 352–362. [Google Scholar] [CrossRef]

- Kasarda, M.E.; Terpenny, J.P.; Inman, D.; Precoda, K.R.; Jelesko, J.; Sahin, A.; Park, J. Design for adaptability (DFAD)—A new concept for achieving sustainable design. Robot. -Comput.-Integr. Manuf. 2007, 23, 727–734. [Google Scholar] [CrossRef]

- Webster, M.D. Structural design for adaptability and deconstruction: A strategy for closing the materials loop and increasing building value. New Horizons Better Pract. 2007, 1–6. [Google Scholar] [CrossRef]

- Carroon, J. Sustainable Preservation: Greening Existing Buildings; Wiley: Hoboken, NJ, USA, 2010. [Google Scholar]

- Gosling, J.; Sassi, P.; Naim, M.; Lark, R. Adaptable buildings: A systems approach. Sustain. Cities Soc. 2013, 7, 44–51. [Google Scholar] [CrossRef]

- Zhao, T.; Tseng, C.L. Valuing Flexibility in Infrastructure Expansion. J. Infrastruct. Syst. 2003, 9, 89–97. [Google Scholar] [CrossRef]

- Leslie, K.J.; Michaels, M.P. The real power of real options. Mckinsey Q. 1997, 3, 5–22. [Google Scholar]

- Sutherland, A.G.; Williams, J.R. Valuing Real Options: Insights from Competitive Strategy; Research Showcase @ CMU: Pittsburgh, PA, USA, 2008; pp. 1–30. [Google Scholar]

- Wang, T.; de Neufville, R. Real Options “in” Projects. In Proceedings of the 9th Real Options Annual International Conference, Conference Paper, Paris, France, 22–25 June 2005. [Google Scholar]

- Sturm, M.; Goldstein, M.A.; Huntington, H.; Douglas, T.A. Using an option pricing approach to evaluate strategic decisions in a rapidly changing climate: Black-Scholes and climate change. Clim. Change 2017, 140, 437–449. [Google Scholar] [CrossRef]

- Kalfin; Sukono, S.S.; Mamat, M.; Bon, A.T. Model for Determining Natural Disaster Insurance Premiums in Indonesia Using the Black Scholes Method. In Proceedings of the International Conference on Industrial Engineering and Operations Management, Detroit, MI, USA, 10–14 August 2020. [Google Scholar]

- Engels, A.; Browning, T.R. Designing Systems for Adaptability by Means of Architecture Options. Syst. Eng. 2008, 11, 125–146. [Google Scholar] [CrossRef]

- Engels, A.; Reich, Y. Advancing Architecture Options Theory: Six Industrial Case Studies. Syst. Eng. 2015, 18, 396–414. [Google Scholar] [CrossRef]

- Nafia, H.; Agmour, I.; El Foutayeni, Y.; Achtaich, N. Pricing American put options model with application to oil options. Int. J. Comput. Sci. Math. 2023, 17, 67–78. [Google Scholar] [CrossRef]

- Martins, J.; Marques, R.C.; Cruz, C.O. Real Options in Infrastructure: Revisiting the Literature. J. Infrastruct. Syst. 2015, 21, 04014026. [Google Scholar] [CrossRef]

- Zeng, S.; Zhang, S. Real Options Literature Review. iBusiness 2011, 3, 43. [Google Scholar] [CrossRef]

- Martello, M.V.; Whittle, A.J.; Oddo, P.C.; de Neufville, R. Real options analysis for valuation of climate adaptation pathways with application to transit infrastructure. Risk Anal. 2023, 1–21. [Google Scholar] [CrossRef] [PubMed]

- de Neufville, R.; Scholtes, S.; Wang, T. Real Options by Spreadsheet: Parking Garage Case Example. J. Infrastruct. Syst. 2006, 12, 107–111. [Google Scholar] [CrossRef]

- Pudney, S.G.; Mills, D.E.; Mudunuri, S. The End of Megaproject Uncertainty: Post COVID-19 National Infrastructure Management. In 14th World Congress on Engineering Asset Management Proceedings; Springer International Publishing: Cham, Switzerland, 2021. [Google Scholar]

- Fawcett, W. Investing in flexibility: The lifecycle options synthesis. Proj.-Mit J. Plan. 2011, 10, 13–29. [Google Scholar]

- Associated General Contractors of America. Construction Inflation Alert [PDF]. 2022. Available online: https://www.agc.org/learn/construction-data/agc-construction-inflation-alert (accessed on 15 February 2023).

- Aultman, S.; (Metromont Corporation, Greenville, SC, USA). Interview. Personal communication, 2022. [Google Scholar]

- Moreland, K.; (Clemson University Parking and Transportation Services, Clemson, SC, USA). Interview. Personal communication, 2022. [Google Scholar]

- RSMeans Online. 2022. Available online: https://www.rsmeansonline.com/ (accessed on 17 November 2022).

- United States Army Corps of Engineers (USACE). CWCCIS Indices. 2022. Available online: https://www.usace.army.mil/Cost-Engineering/cwccis/ (accessed on 21 November 2022).

- Longstaff, F.A. Are Negative Option Prices Possible? The Callable U.S. Treasury-Bond Puzzle. J. Bus. 1992, 65, 571–592. [Google Scholar] [CrossRef]

- Margrabe, W. The Value of an Option to Exchange One Asset for Another. J. Financ. 1978, 33, 177–186. [Google Scholar] [CrossRef]

- Datar, V.; Mathews, S. European Real Options: An Intuitive Algorithm for the Black-Scholes Formula. J. Appl. Financ. 2004, 14, 45–51. [Google Scholar]

| Symbol | Definitions | |

|---|---|---|

| Black and Scholes, 1973 [19] | Engels and Browning, 2008 [38] | |

| S | Current stock price | Current value of a system’s component |

| S’ | Not used | Estimated value of a system’s component (after upgrade) |

| X | Price paid at time t by an investor to exercise option contract | Estimated cost to upgrade system’s component at time t |

| Statistical measure of stock price fluctuations (volatility) over time | The uncertainty value of the upgraded system’s component, determined by stakeholders and translated to a market value over time | |

| t | Time at which the stock option will expire, and the investor must choose if they will buy the stock option at the strike price | Time at which the upgraded system’s component is deployed |

| r | The interest rate under a “no-risk” assumption | The no-risk interest rate associated with the financial support needed to upgrade the system’s component at time t |

| OV | Value of stock option (option value) | Value of the system’s ability to be upgraded |

| Limitation | Approach for Addressing the Limitation in the Parking Garage Case Study |

|---|---|

| Only applicable to European options | The OVs will be calculated at discrete five-year increments after construction. Thus, the calculations will give the option value if the garage were expanded (i.e., the option is exercised) at the time increment. The OVs will then be compared across different increments. |

| Only works with normal distribution | The volatility of the parking garage value will be taken as the volatility in the number of parking passes issued. The number of passes is normally distributed for the campus parking case study (found through a Jarque–Bera test). The number of parking passes had a constant mean over the 20-year historical period considered. |

| Requires advanced financial knowledge | The case study example was selected as a means of “translating” the financial aspects of the BSM to an engineering example, thus making the approach more accessible to non-finance professionals. |

| Required assumptions limit the use of the model (price, volatility, duration) | The case study uses historical construction cost inflation and parking demand data to inform model assumptions. Sensitivity studies are used to demonstrate how assumed inputs impact calculated option values. |

| Able to deal with only one factor of uncertainty | This limitation is present in the case study. The only source of volatility in the calculations is the volatility of the parking garage value. Other uncertainties, such as volatility in construction costs, are not considered. It is reasoned that increases in uncertainty will increase the OV; omitting them from the model is conservative. |

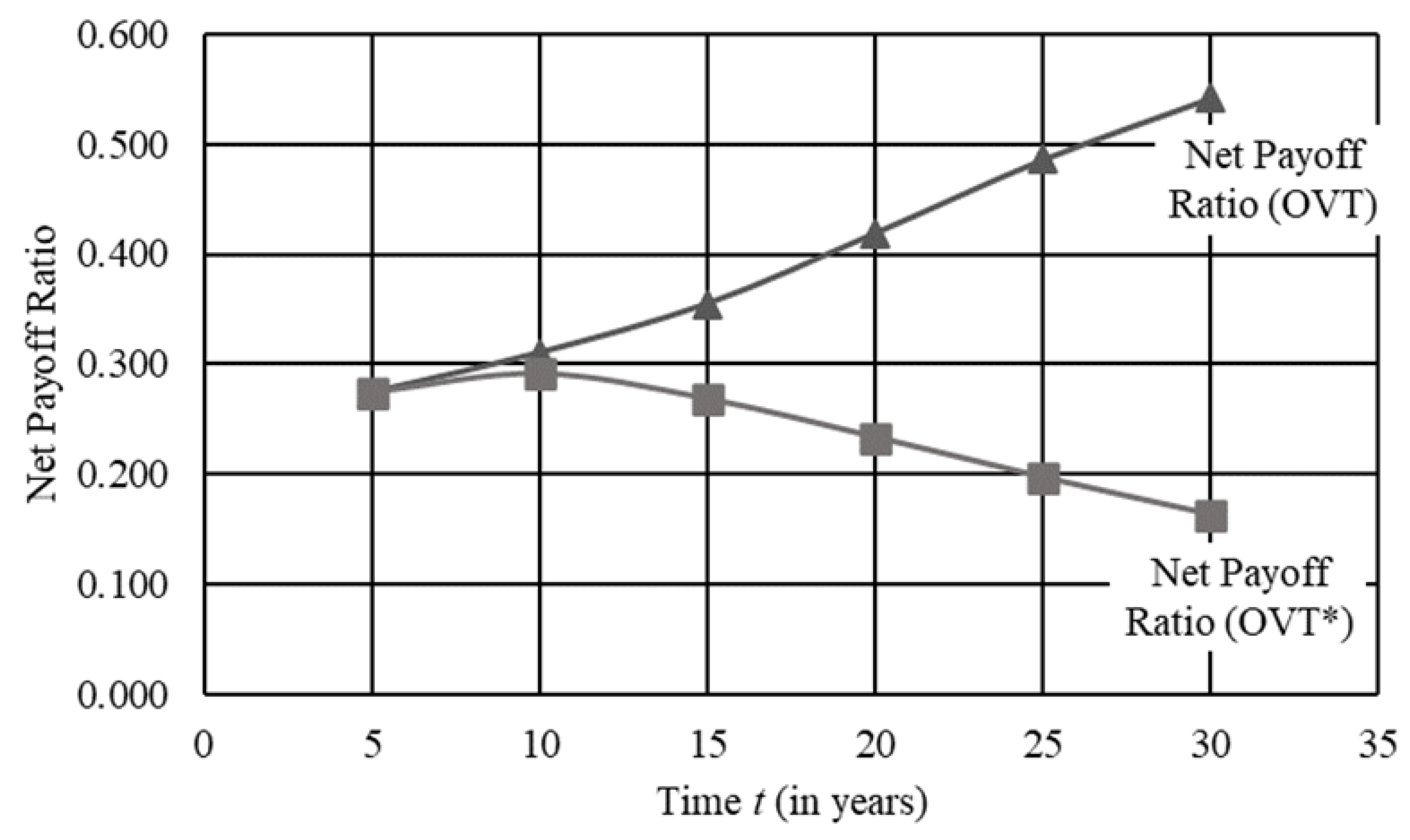

| Year 5 | Year 10 | Year 15 | Year 20 | Year 25 | Year 30 | |

|---|---|---|---|---|---|---|

| USD 279,404 | USD 296,846 | USD 273,565 | USD 238,070 | USD 200,917 | USD 166,394 | |

| −USD 311 | −USD 19,873 | −USD 88,579 | −USD 189,533 | −USD 294,871 | −USD 386,547 | |

| USD 0 | USD 0 | USD 0 | USD 0 | USD 0 | USD 0 | |

| − | USD 279,715 | USD 316,719 | USD 362,144 | USD 427,604 | USD 495,788 | USD 552,941 |

| − | USD 279,404 | USD 296,846 | USD 273,565 | USD 238,070 | USD 200,917 | USD 166,394 |

| Net Payoff Ratio () | 0.27 | 0.31 | 0.36 | 0.42 | 0.49 | 0.54 |

| Net Payoff Ratio () | 0.27 | 0.29 | 0.27 | 0.23 | 0.20 | 0.16 |

| Year 5 | Year 10 | Year 15 | Year 20 | Year 25 | Year 30 | |

|---|---|---|---|---|---|---|

| USD 371,109 | USD 522,837 | USD 637,916 | USD 733,817 | USD 817,335 | USD 891,971 | |

| USD 46 | USD 3184 | USD 15,871 | USD 38,604 | USD 69,013 | USD 104,743 | |

| − | USD 371,064 | USD 519,653 | USD 622,045 | USD 695,212 | USD 748,322 | USD 787,228 |

| Net Payoff Ratio | 0.36 | 0.51 | 0.61 | 0.68 | 0.73 | 0.77 |

| Year 5 | Year 10 | Year 15 | Year 20 | Year 25 | Year 30 | |

|---|---|---|---|---|---|---|

| USD 295,022 | USD 367,850 | USD 403,518 | USD 420,324 | USD 425,533 | USD 422,945 | |

| USD 17 | USD 964 | USD 3991 | USD 7991 | USD 11,573 | USD 13,879 | |

| − | USD 295,006 | USD 366,887 | USD 399,527 | USD 412,334 | USD 413,961 | USD 409,066 |

| Net Payoff Ratio | 0.29 | 0.36 | 0.39 | 0.40 | 0.41 | 0.40 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Reed-Grice, M.; Ross, B.E. Application of the Black–Scholes Financial Model to Support Adaptability as a Sustainability Strategy for Buildings: A Case Study of an Adaptable Campus Parking Garage. Sustainability 2024, 16, 2610. https://doi.org/10.3390/su16072610

Reed-Grice M, Ross BE. Application of the Black–Scholes Financial Model to Support Adaptability as a Sustainability Strategy for Buildings: A Case Study of an Adaptable Campus Parking Garage. Sustainability. 2024; 16(7):2610. https://doi.org/10.3390/su16072610

Chicago/Turabian StyleReed-Grice, Miranda, and Brandon E. Ross. 2024. "Application of the Black–Scholes Financial Model to Support Adaptability as a Sustainability Strategy for Buildings: A Case Study of an Adaptable Campus Parking Garage" Sustainability 16, no. 7: 2610. https://doi.org/10.3390/su16072610