Optimal Operation and Market Integration of a Hybrid Farm with Green Hydrogen and Energy Storage: A Stochastic Approach Considering Wind and Electricity Price Uncertainties

Abstract

:1. Introduction

- A simple but accurate linear AEL model is proposed, including degradation mechanisms and partial load effects for power system simulations and optimization, which tend to be neglected in the literature.

- A stochastic optimization algorithm is presented for day-ahead electricity market scheduling to deal with price and renewable production uncertainties, which outperforms existing stochastic and deterministic approaches while using the same input data.

- The presented model is used in a simulation framework for studying future hydrogen market and supply chain scenarios and their effect on hybrid plant configurations. This analysis highlights the practical applications of the proposed model.

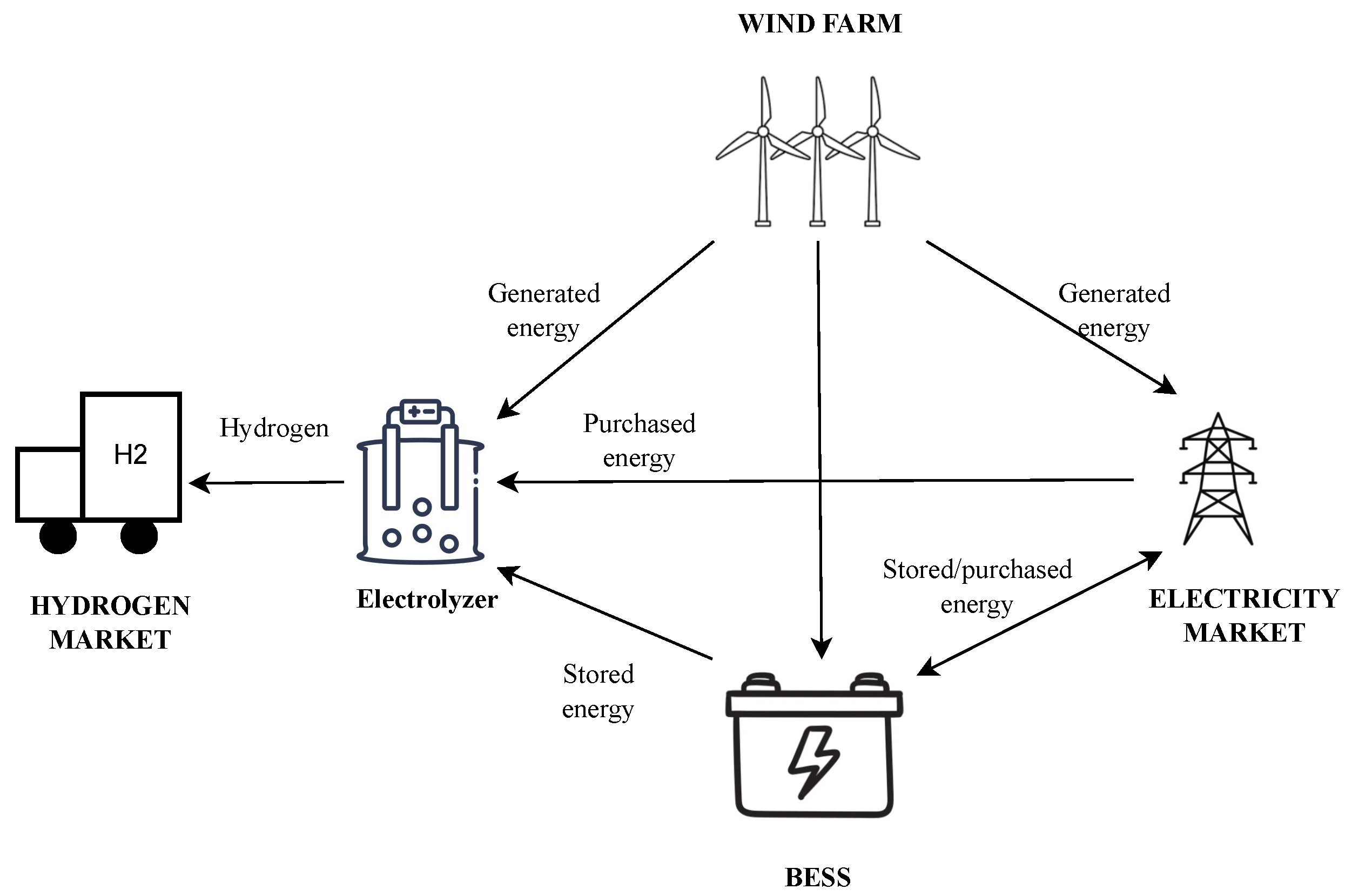

2. Plant Components Modeling

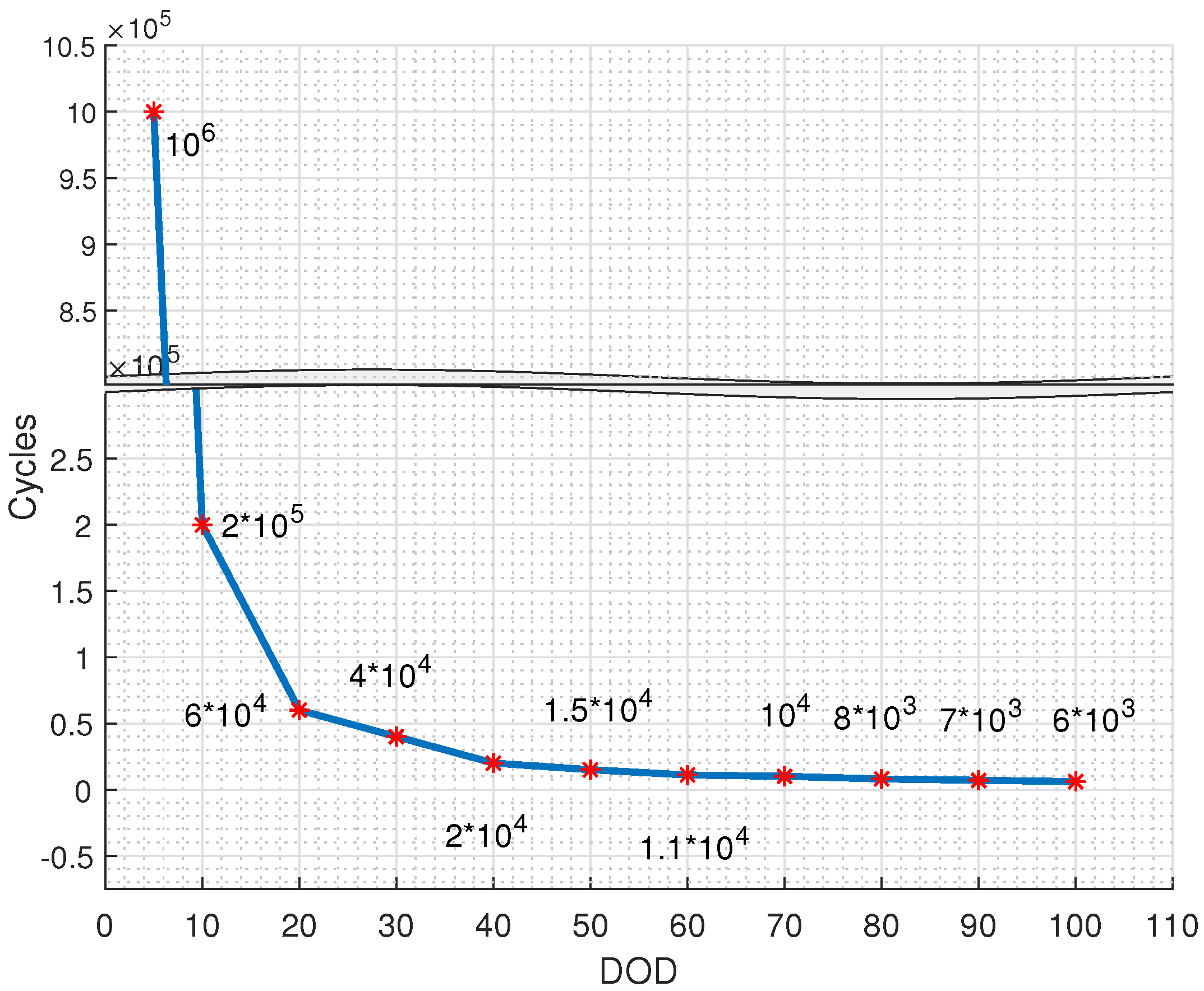

2.1. Battery Energy Storage System

- The BESS cannot be charged above its nominal power, as represented by the equationwhere is the charging power during hour t in MW, is the nominal power in MW, and ND(t) is a boolean variable that is equal to 1 when the BESS is not discharging at time t.

- The BESS cannot discharge above its nominal power, as represented by the equationwhere is the discharging power during hour t in MW, is the nominal power in MW, and NC(t) is a boolean variable that is equal to 1 when the BESS is not charging at time t.

- Charging power is always positive, as represented by the equation

- Discharging power is also always positive, as represented by the equation

- The BESS cannot be charged and discharged simultaneously, as represented by the equation

- The resulting BESS power at period t is computed for convenience as

- The energy stored at the end of the period equals the amount stored at the end of the previous hour and the charged/discharged energy considering efficiencies, as represented by the equationwhere E(t) is the stored energy at the end of hour t in MWh, is the charging efficiency as a percentage, and is the discharging efficiency as a percentage.

- The SOC at any given time must be between the boundaries and .

- The SOC at , , is set by the user for the first day of simulation, but it inherits its value from the final value of the previous day for multiple-day simulations.

- The BESS daily degradation cost is computed as follows:where is the daily BESS degradation cost in EUR, and is the BESS replacement cost in EUR. The use of for computing a cost from battery degradation creates an optimization problem for amortizing a future BESS replacement.

2.2. Alkaline Electrolyzer

- : AEL remaining useful lifetime t (pu);

- Hours(t): Hours of operation during time period t;

- : Lifetime hours;

- Cycles(t): Start/stop cycles performed during time period t;

- : Start/stop lifetime cycles.

- : Hydrogen contamination growth during hour h (pu);

- P: AEL input power during hour h (pu).

- On mode: The AEL is producing hydrogen and operating at nominal conditions.

- Idle mode: Nominal conditions are maintained, but the AEL is not producing hydrogen.

- Off mode: The AEL is not generating hydrogen, and no energy is being applied to maintain nominal conditions, resulting in a gradual cooling until reaching a fully cold state.

- The total electrolyzer power output for each time period is derived from the sum of the various operating modes:where is the power employed in producing hydrogen during hour t in MW, is the power consumed in the Idle mode during hour t in MW, is the cold starting power consumed during time period t in MW, and is the total power consumption during hour t in MW.

- Binary variables are used to determine the AEL operation mode at each hour, and only one mode is allowed at a time:where is the binary variable for On mode, is the binary variable for Off mode, and is the binary variable for Idle mode. Each binary variable takes value 1 when its respective mode is enabled.

- An additional mode is used to define the cooling process, which appears only when the AEL is off:where is a binary variable that defines Cool mode, in which AEL temperature and pressure slowly decrease since it is shut down. It equals 1 when its temperature and pressure state has become colder.

- The pressure and temperature state of the electrolyzer is updated at each hour as follows:where is the state at the end of hour t; this variable is limited between 0 and . The variable is the number of hours it takes to get fully cold when off, and is the fraction of the starting power required for a cold start.

- Whenever the electrolyzer is off, its temperature and pressure decrease until they reach the fully cold state:where the value 1 in the first term prevents the binary variable from reaching a value of 0 until is 0.

- Idle mode’s hourly power consumption is defined as:where is the hourly power consumption during Idle mode in MW.

- On mode’s hourly power consumption is limited as:where and are the minimum and maximum AEL On mode’s active powers, respectively, in MW.

- The cold start power factor is defined as:This factor, bounded between 0 and 1, represents how far the AEL is from reaching an operational state. If 1, it needs the full cold start power.

- The cold start power consumption is defined as:where is the AEL starting power in MW, is the cold start time in hours, and is the maximum electrolyzer power in MW. This equation models the starting power consumption and considers that less power is required if the AEL is not completely cold when a cold start takes place.

- The hydrogen generation process is defined as:where is the hydrogen flow during hour t in kg, is the AEL efficiency in pu, and is the hydrogen high heating value in kg/MWh.

- The operation cost of the AEL, defined by the degradation models described above, is formulated as:where is the degradation cost during hour t in EUR, and K is the electrolyzer replacement cost in EUR. The first term of the sum represents the degradation caused by operational hours of usage, and the second term is the degradation caused by on/off operational cycles.

- The oxygen contamination process is formulated as:where is the oxygen impurity level at the end of hour t in %, is the oxygen contamination during hour t in %, and is a binary variable that defines the AEL purging.

- The Purging mode is enabled when no is being produced:An inequality constraint is applied to allow for the possibility of Off and Idle modes to be non-zero when no purge is in progress. This scenario occurs, for instance, when the AEL is in a clean state and does not intend to generate hydrogen, enabling the Off or Idle binary variables to have a value of 1.

- When oxygen contamination reaches 2%, the AEL is shut down:

- Purging mode is disabled when the contamination value reaches 0:

- A piecewise constraint is used to regulate the contamination process, derived from (12):

2.3. Plant Model

- The power generated by the wind farm is defined as:where is the generated power during hour t in MW, is the generated power used by the BESS during hour t in MW, is the generated power sent to the grid during hour t, is the generated power sent to the AEL during hour t in MW, and is the curtailed power during hour t in MW.

- The BESS discharging power is divided as follows:where is the BESS power sent to the grid during hour t in MW, and is the BESS power sent to the AEL during hour t.

- The AEL power flow is defined as follows:

3. Mathematical Programming Models for Day-Ahead Market Bidding and Real-Time Control

3.1. Day-Ahead Market Bidding

3.2. Real-Time Operation

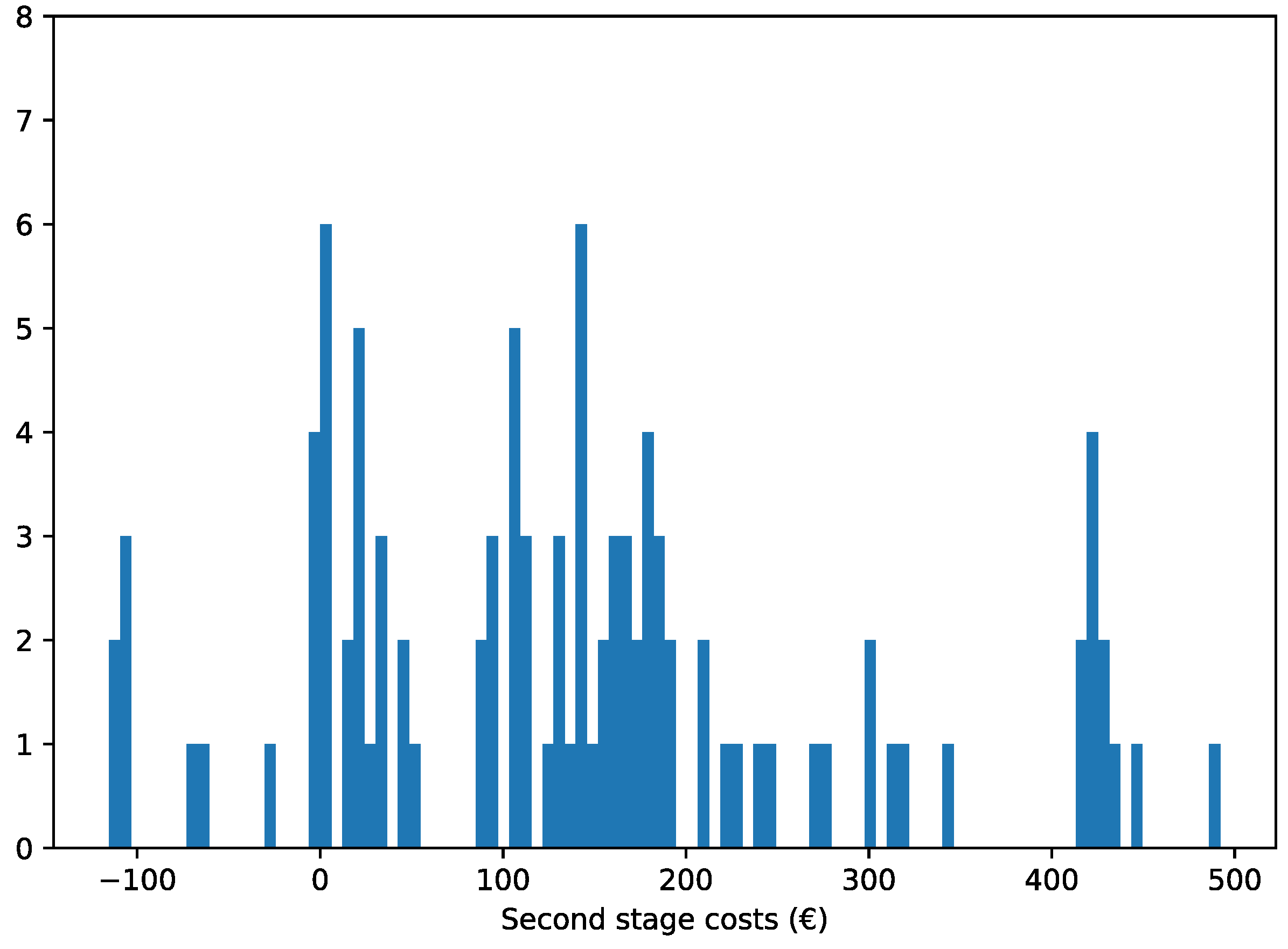

4. Two-Stage Stochastic Optimization Algorithm

4.1. Two-Stage Stochastic Optimization Overview

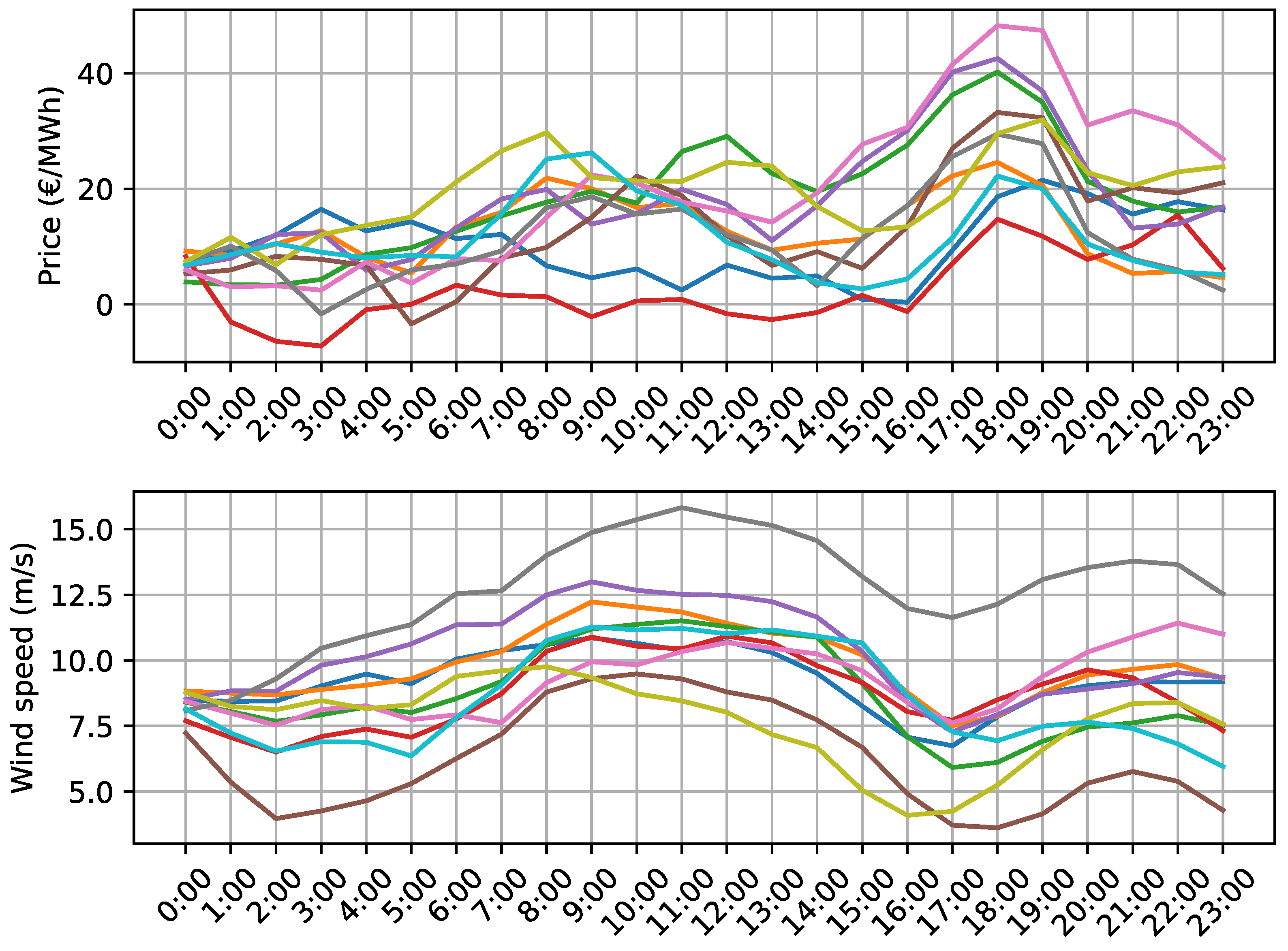

4.2. Monte Carlo Approach

4.3. Bootstrapping Approach

5. Simulation Framework and Results

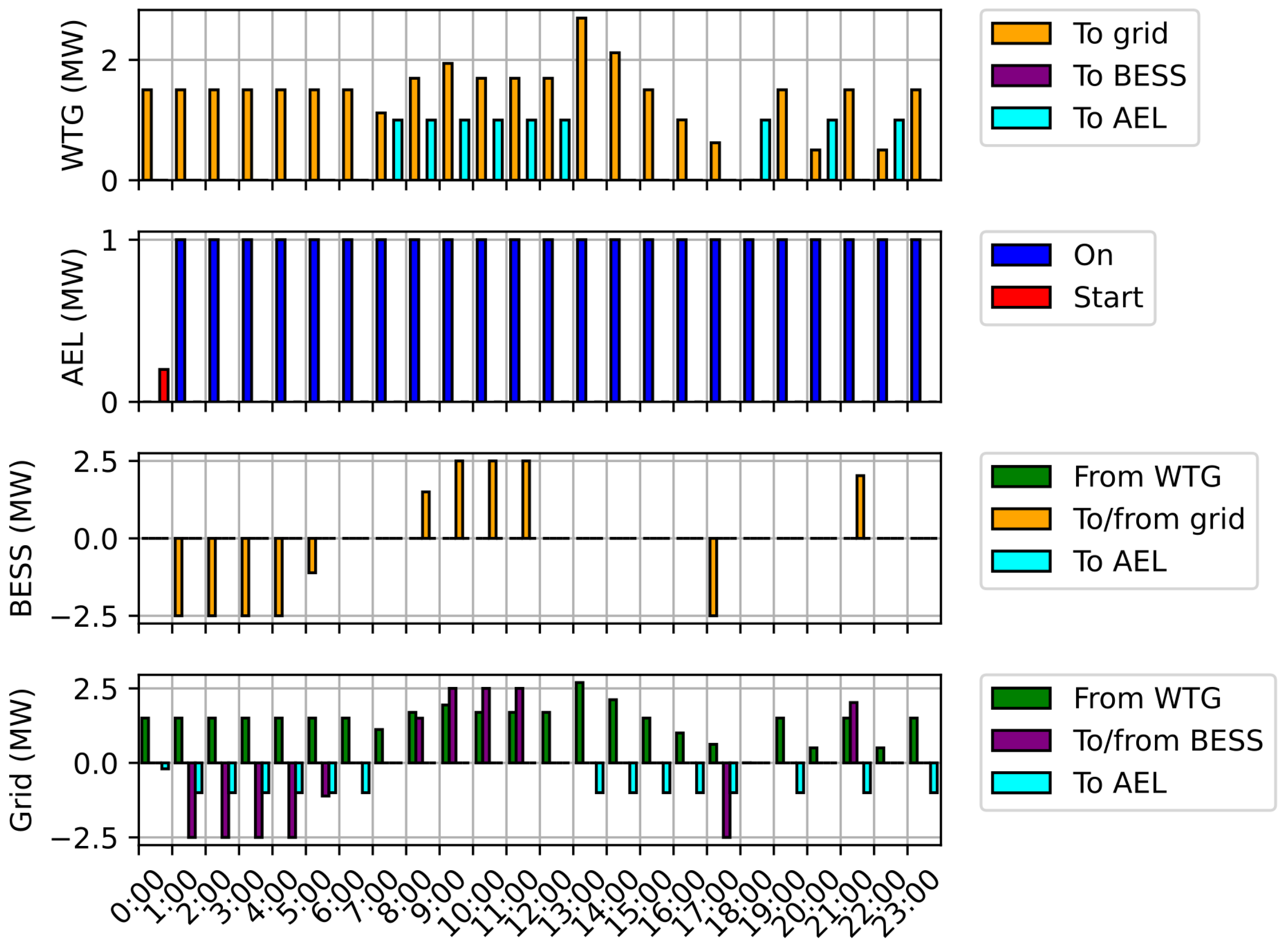

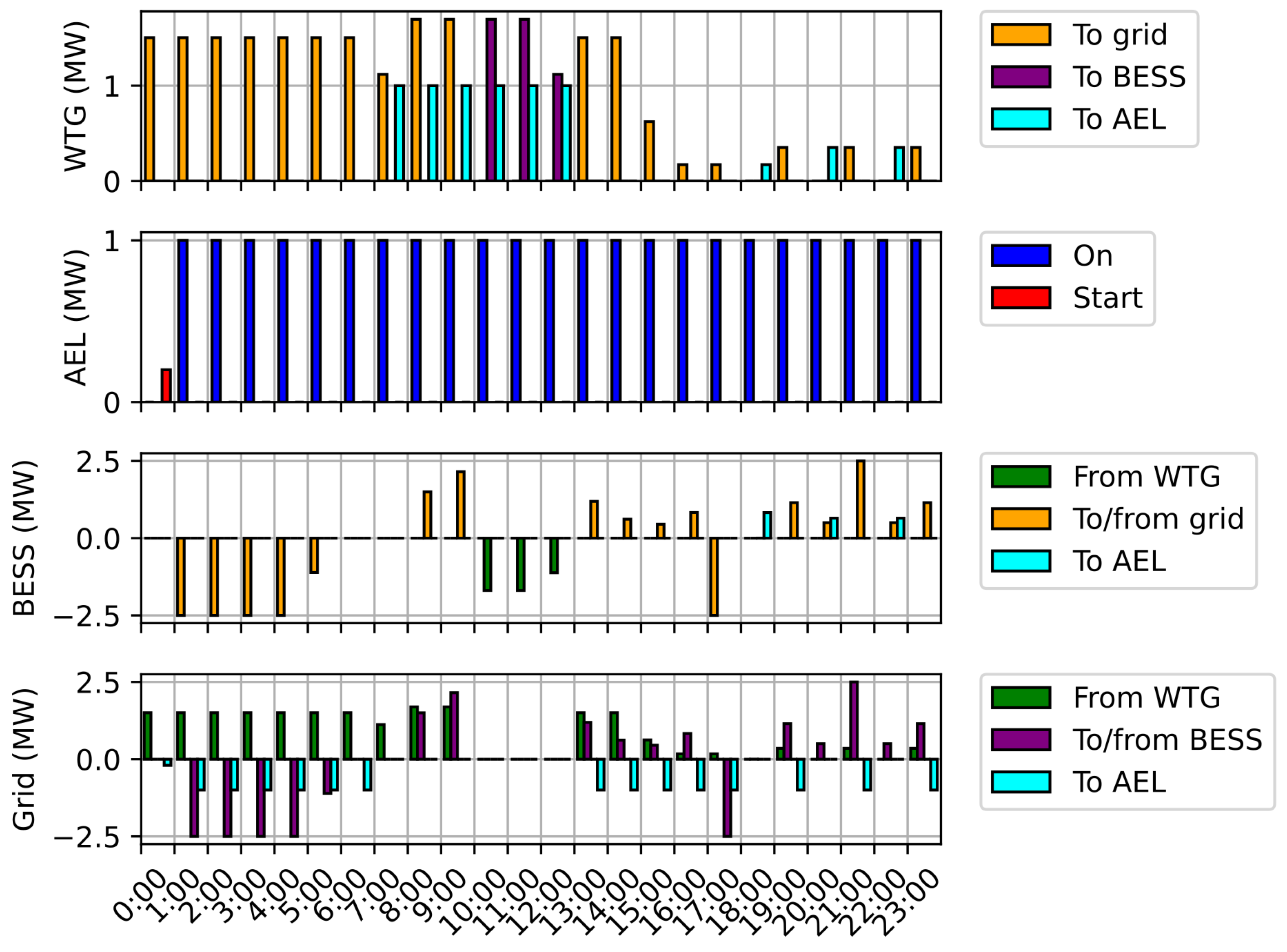

5.1. Single-Day Demonstration

5.2. Case Studies

5.2.1. Hydrogen Price Effects on Market Participation

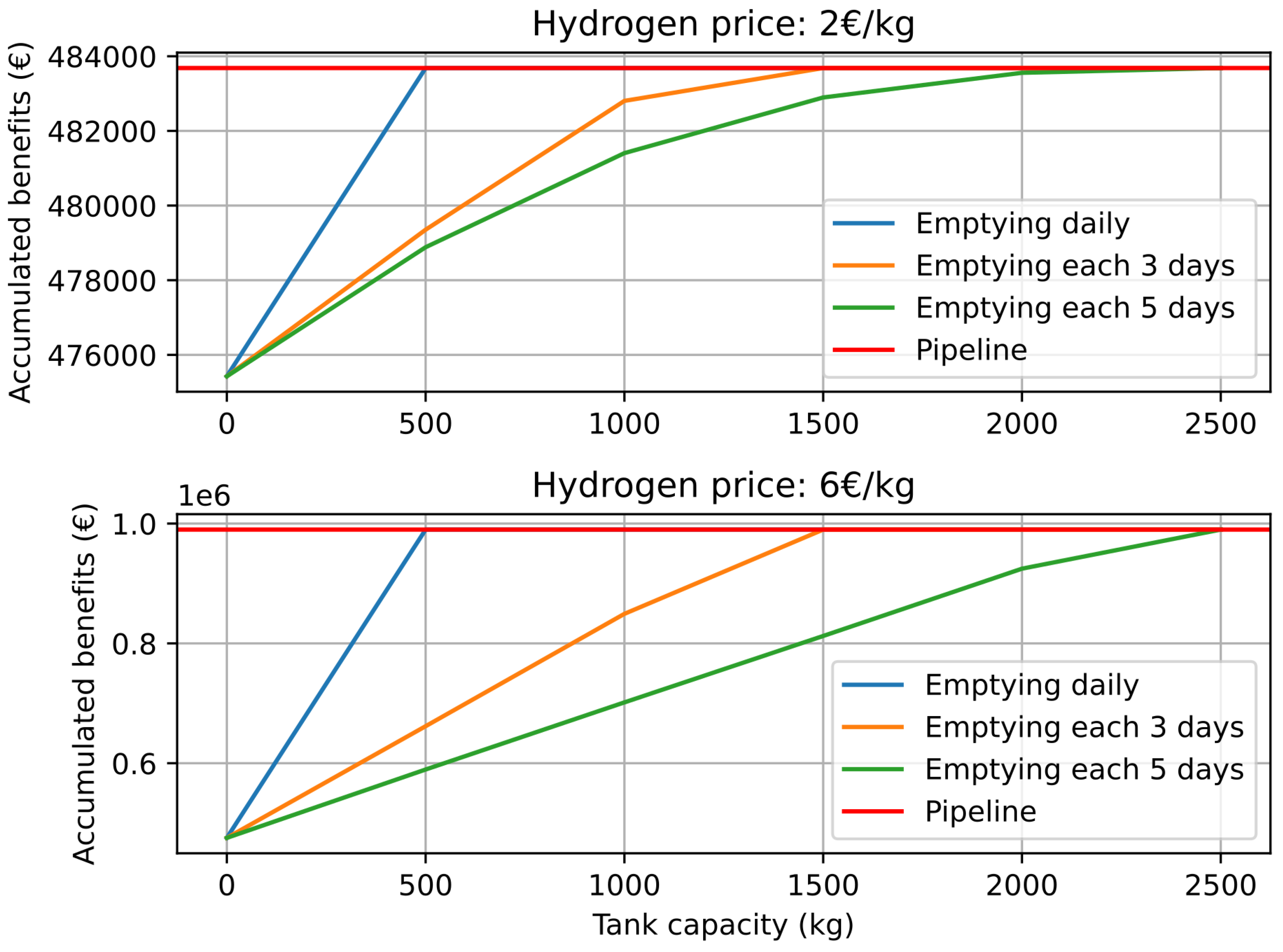

5.2.2. Hydrogen Price Effects on Different Hydrogen Off-Taker Scenarios

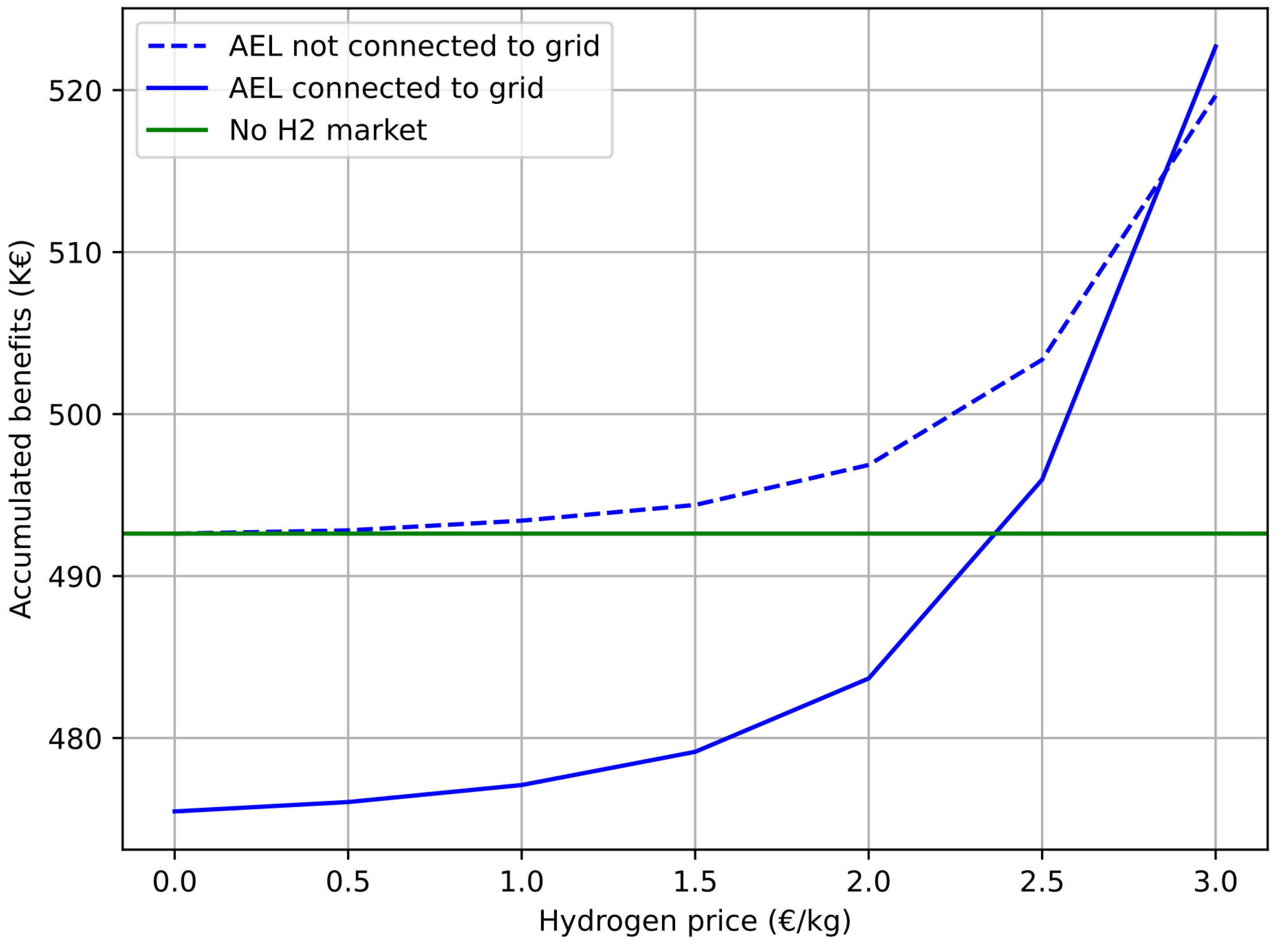

5.2.3. Hydrogen Price Effects Depending on AEL Grid Connections

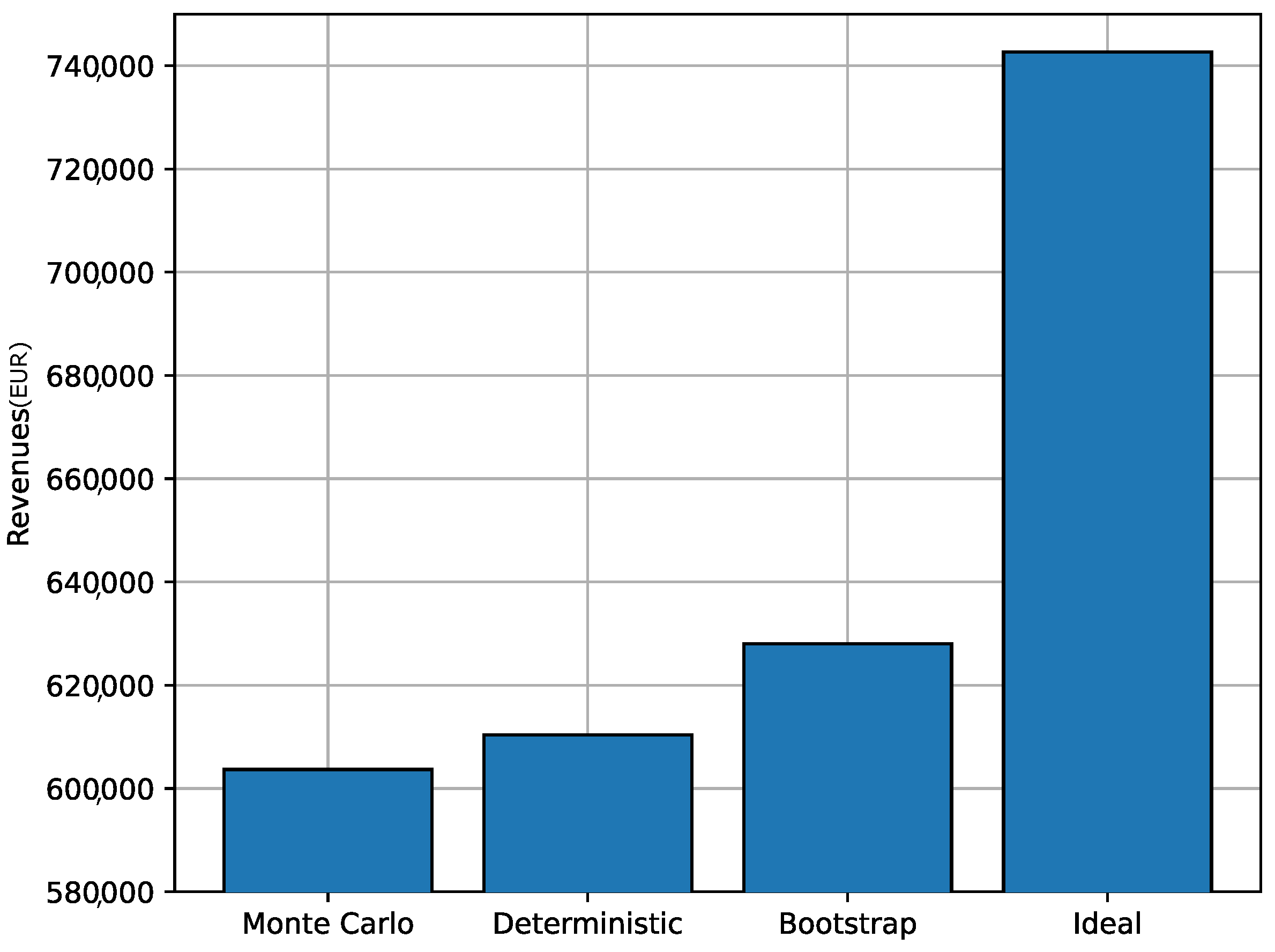

5.3. Stochastic Algorithm Comparison

- Ideal scenario: The plant receives perfect wind speed and electricity price forecasts.

- Stochastic Monte Carlo scenario: The Monte Carlo algorithm is used for day-ahead commitment generation.

- Stochastic Bootstrap scenario: The proposed bootstrap algorithm is used for day-ahead commitment generation.

- Deterministic scenario: A direct approach that considers deterministic forecasts.

6. Conclusions and Future Work

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| ESS | energy storage system |

| BESS | battery energy storage system |

| EMS | energy management system |

| AEL | alkaline electrolyzer |

| DOD | depth of discharge |

| SOC | state of charge |

| SOH | state of health |

| NPV | net present value |

| EOL | end of life |

| MILP | mixed-integer linear program |

References

- Renewable Capacity Statistics 2023. 2023. Available online: https://www.irena.org/Publications/2023/Mar/Renewable-capacity-statistics-2023 (accessed on 21 January 2024).

- Kalair, A.; Abas, N.; Saleem, M.S.; Kalair, A.R.; Khan, N. Role of energy storage systems in energy transition from fossil fuels to renewables. Energy Storage 2021, 3, e135. [Google Scholar] [CrossRef]

- Dogger, J.D.; Roossien, B.; Nieuwenhout, F.D.J. Characterization of Li-Ion Batteries for Intelligent Management of Distributed Grid-Connected Storage. IEEE Trans. Energy Convers. 2011, 26, 256–263. [Google Scholar] [CrossRef]

- Abbasi, T.; Abbasi, S. ‘Renewable’ hydrogen: Prospects and challenges. Renew. Sustain. Energy Rev. 2011, 15, 3034–3040. [Google Scholar] [CrossRef]

- Bodner, M.; Hofer, A.; Hacker, V. H2 generation from alkaline electrolyzer. WIREs Energy Environ. 2015, 4, 365–381. [Google Scholar] [CrossRef]

- Reniers, J.M.; Mulder, G.; Ober-Blöbaum, S.; Howey, D.A. Improving optimal control of grid-connected lithium-ion batteries through more accurate battery and degradation modelling. J. Power Sources 2018, 379, 91–102. [Google Scholar] [CrossRef]

- Ulleberg, Ø. Modeling of advanced alkaline electrolyzers: A system simulation approach. Int. J. Hydrogen Energy 2003, 28, 21–33. [Google Scholar] [CrossRef]

- Varela, C.; Mostafa, M.; Zondervan, E. Modeling alkaline water electrolysis for power-to-x applications: A scheduling approach. Int. J. Hydrogen Energy 2021, 46, 9303–9313. [Google Scholar] [CrossRef]

- Roald, L.A.; Pozo, D.; Papavasiliou, A.; Molzahn, D.K.; Kazempour, J.; Conejo, A. Power systems optimization under uncertainty: A review of methods and applications. Electr. Power Syst. Res. 2023, 214, 108725. [Google Scholar] [CrossRef]

- Eghbali, N.; Hakimi, S.M.; Hasankhani, A.; Derakhshan, G.; Abdi, B. Stochastic energy management for a renewable energy based microgrid considering battery, hydrogen storage, and demand response. Sustain. Energy Grids Netw. 2022, 30, 100652. [Google Scholar] [CrossRef]

- Yu, D.; Wang, J.; Li, D.; Jermsittiparsert, K.; Nojavan, S. Risk-averse stochastic operation of a power system integrated with hydrogen storage system and wind generation in the presence of demand response program. Int. J. Hydrogen Energy 2019, 44, 31204–31215. [Google Scholar] [CrossRef]

- Abdelghany, M.B.; Al-Durra, A.; Zeineldin, H.; Hu, J. Integration of cascaded coordinated rolling horizon control for output power smoothing in islanded wind–solar microgrid with multiple hydrogen storage tanks. Energy 2024, 291, 130442. [Google Scholar] [CrossRef]

- Abdelghany, M.B.; Al-Durra, A.; Daming, Z.; Gao, F. Optimal multi-layer economical schedule for coordinated multiple mode operation of wind–solar microgrids with hybrid energy storage systems. J. Power Sources 2024, 591, 233844. [Google Scholar] [CrossRef]

- McMurry, J.; Fay, R.C.; Robinson, J.K. Chemistry; Pearson: London, UK, 2015. [Google Scholar]

- Rosewater, D.M.; Copp, D.A.; Nguyen, T.A.; Byrne, R.H.; Santoso, S. Battery Energy Storage Models for Optimal Control. IEEE Access 2019, 7, 178357–178391. [Google Scholar] [CrossRef]

- Barré, A.; Deguilhem, B.; Grolleau, S.; Gérard, M.; Suard, F.; Riu, D. A review on lithium-ion battery ageing mechanisms and estimations for automotive applications. J. Power Sources 2013, 241, 680–689. [Google Scholar] [CrossRef]

- Maheshwari, A.; Paterakis, N.G.; Santarelli, M.; Gibescu, M. Optimizing the operation of energy storage using a non-linear lithium-ion battery degradation model. Appl. Energy 2020, 261, 114360. [Google Scholar] [CrossRef]

- Cao, J.; Harrold, D.; Fan, Z.; Morstyn, T.; Healey, D.; Li, K. Deep Reinforcement Learning-Based Energy Storage Arbitrage With Accurate Lithium-Ion Battery Degradation Model. IEEE Trans. Smart Grid 2020, 11, 4513–4521. [Google Scholar] [CrossRef]

- Ouyang, D.; Weng, J.; Chen, M.; Liu, J.; Wang, J. Experimental analysis on the degradation behavior of overdischarged lithium-ion battery combined with the effect of high-temperature environment. Int. J. Energy Res. 2020, 44, 229–241. [Google Scholar] [CrossRef]

- Doerffel, D.; Sharkh, S.A. A critical review of using the Peukert equation for determining the remaining capacity of lead-acid and lithium-ion batteries. J. Power Sources 2006, 155, 395–400. [Google Scholar] [CrossRef]

- Cheng, S.; Liu, Y.H.; Hesse, H.; Naumann, M.; Truong, C.; Jossen, A. A PSO-Optimized Fuzzy Logic Control-Based Charging Method for Individual Household Battery Storage Systems within a Community. Energies 2018, 11, 469. [Google Scholar] [CrossRef]

- Wang, Y.; Zhou, Z.; Botterud, A.; Zhang, K.; Ding, Q. Stochastic coordinated operation of wind and battery energy storage system considering battery degradation. J. Mod. Power Syst. Clean Energy 2016, 4, 581–592. [Google Scholar] [CrossRef]

- Oliveira, A.M.; Beswick, R.R.; Yan, Y. A green hydrogen economy for a renewable energy society. Curr. Opin. Chem. Eng. 2021, 33, 100701. [Google Scholar] [CrossRef]

- Niaz, H.; Liu, J. A Mixed Integer Dynamic Optimization Approach for a Hybrid-Stand Alone Solar and Wind Powered Alkaline Water Electrolyser for Renewable Hydrogen. In 31st European Symposium on Computer Aided Process Engineering; Türkay, M., Gani, R., Eds.; Elsevier: Amsterdam, The Netherlands, 2021; Volume 50, pp. 1285–1291. [Google Scholar]

- Huang, C.; Zong, Y.; You, S.; Træholt, C. Economic model predictive control for multi-energy system considering hydrogen-thermal-electric dynamics and waste heat recovery of MW-level alkaline electrolyzer. Energy Convers. Manag. 2022, 265, 115697. [Google Scholar] [CrossRef]

- Lafforgue, C.; Zadick, A.; Dubau, L.; Maillard, F.; Chatenet, M. Selected Review of the Degradation of Pt and Pd-based Carbon-supported Electrocatalysts for Alkaline Fuel Cells: Towards Mechanisms of Degradation. Fuel Cells 2018, 18, 229–238. [Google Scholar] [CrossRef]

- David, M.; Ocampo-Martínez, C.; Sánchez-Peña, R. Advances in alkaline water electrolyzers: A review. J. Energy Storage 2019, 23, 392–403. [Google Scholar] [CrossRef]

- Ali Khan, M.H.; Daiyan, R.; Han, Z.; Hablutzel, M.; Haque, N.; Amal, R.; MacGill, I. Designing optimal integrated electricity supply configurations for renewable hydrogen generation in Australia. iScience 2021, 24, 102539. [Google Scholar] [CrossRef] [PubMed]

- Brauns, J.; Turek, T. Alkaline Water Electrolysis Powered by Renewable Energy: A Review. Processes 2020, 8, 208. [Google Scholar] [CrossRef]

- Schmidt, O.; Gambhir, A.; Staffell, I.; Hawkes, A.; Nelson, J.; Few, S. Future cost and performance of water electrolysis: An expert elicitation study. Int. J. Hydrogen Energy 2017, 42, 30470–30492. [Google Scholar] [CrossRef]

- Fang, R.; Liang, Y. Control strategy of electrolyzer in a wind-hydrogen system considering the constraints of switching times. Int. J. Hydrog. Energy 2019, 44, 25104–25111, Special Issue on International Conference on Novel Functional Materials 2018. [Google Scholar] [CrossRef]

- Shehzad, M.F.; Abdelghany, M.B.; Liuzza, D.; Glielmo, L. Modeling of a Hydrogen Storage Wind Plant for Model Predictive Control Management Strategies. In Proceedings of the 2019 18th European Control Conference (ECC), Naples, Italy, 25–28 June 2019; pp. 1896–1901. [Google Scholar]

- Abdelghany, M.B.; Al-Durra, A. A coordinated model predictive control of grid-connected energy storage systems. In Proceedings of the 2023 American Control Conference (ACC), San Diego, CA, USA, 31 May–2 June 2023; pp. 1862–1867. [Google Scholar]

- Matute, G.; Yusta, J.; Beyza, J.; Correas, L. Multi-state techno-economic model for optimal dispatch of grid connected hydrogen electrolysis systems operating under dynamic conditions. Int. J. Hydrogen Energy 2021, 46, 1449–1460. [Google Scholar] [CrossRef]

- Ruszczynski, A.; Shapiro, A. Handbooks in OR & MS, Vol. 10; Elsevier Science B.V.: Amsterdam, The Netherlands, 2003. [Google Scholar]

- Qiu, H.; Gu, W.; Liu, P.; Sun, Q.; Wu, Z.; Lu, X. Application of two-stage robust optimization theory in power system scheduling under uncertainties: A review and perspective. Energy 2022, 251, 123942. [Google Scholar] [CrossRef]

- Harrison, R.L. Introduction to Monte Carlo Simulation. AIP Conf. Proc. 2010, 1204, 17–21. [Google Scholar] [PubMed]

- Lan, P.; Han, D.; Zhang, R.; Xu, X.; Yan, Z. Optimal portfolio design of energy storage devices with financial and physical right market. Front. Energy 2021, 16, 95–104. [Google Scholar] [CrossRef]

- Efron, B.; Tibshirani, R. An Introduction to the Bootstrap; Chapman & Hall/CRC: Boca Raton, FL, USA, 1993. [Google Scholar]

- Rosenfeld, J.P.; Donchin, E. Resampling (bootstrapping) the mean: A definite do. Psychophysiology 2015, 52, 969–972. [Google Scholar] [CrossRef] [PubMed]

- Hasni, M.; Aguir, M.; Babai, M.; Jemai, Z. Spare parts demand forecasting: A review on bootstrapping methods. Int. J. Prod. Res. 2019, 57, 4791–4804. [Google Scholar] [CrossRef]

- McHugh, C.; Coleman, S.; Kerr, D.; McGlynn, D. Forecasting Day-ahead Electricity Prices with A SARIMAX Model. In Proceedings of the 2019 IEEE Symposium Series on Computational Intelligence (SSCI), Xiamen, China, 6–9 December 2019; pp. 1523–1529. [Google Scholar] [CrossRef]

- Global Modeling and Assimilation Office. inst3_3d_asm_Cp: MERRA-2 3D IAU State, Meteorology Instantaneous 3-Hourly (p-coord, 0.625x0.5L42), Version 5.12.4. 2015. Available online: https://gmao.gsfc.nasa.gov/reanalysis/MERRA-2/data_access/ (accessed on 21 November 2022).

- Ball, M.; Wietschel, M. The future of hydrogen—Opportunities and challenges. Int. J. Hydrogen Energy 2009, 34, 615–627. [Google Scholar] [CrossRef]

- Seo, Y.; Park, H.; Lee, S.; Kim, J.; Han, S. Design concepts of hydrogen supply chain to bring consumers offshore green hydrogen. Int. J. Hydrogen Energy 2023, 48, 15126–15142. [Google Scholar] [CrossRef]

| Parameter | Value | Parameter | Value |

|---|---|---|---|

| AEL Nominal Power | 1 MW | AEL Cooling Time | 5 h |

| AEL Minimum Power | 0.3 MW | Hydrogen HHV | 0.0394 kg·MW |

| AEL Efficiency | 75% | AEL Idle Mode Power | 0.04 MW |

| AEL Replacement Cost | 500 EUR/kW | BESS Capacity | 10 MWh |

| AEL Lifetime | 100,000 h | BESS Nominal Power | 2.5 MW |

| AEL Lifetime Cycles | 50,000 | BESS Efficiency | 90% |

| AEL Cold Start Time | 12 min | BESS Replacement Cost | 50 EUR/KWh |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

García-Miguel, P.L.C.; Zarilli, D.; Alonso-Martinez, J.; Plaza, M.G.; Gómez, S.A. Optimal Operation and Market Integration of a Hybrid Farm with Green Hydrogen and Energy Storage: A Stochastic Approach Considering Wind and Electricity Price Uncertainties. Sustainability 2024, 16, 2856. https://doi.org/10.3390/su16072856

García-Miguel PLC, Zarilli D, Alonso-Martinez J, Plaza MG, Gómez SA. Optimal Operation and Market Integration of a Hybrid Farm with Green Hydrogen and Energy Storage: A Stochastic Approach Considering Wind and Electricity Price Uncertainties. Sustainability. 2024; 16(7):2856. https://doi.org/10.3390/su16072856

Chicago/Turabian StyleGarcía-Miguel, Pedro Luis Camuñas, Donato Zarilli, Jaime Alonso-Martinez, Manuel García Plaza, and Santiago Arnaltes Gómez. 2024. "Optimal Operation and Market Integration of a Hybrid Farm with Green Hydrogen and Energy Storage: A Stochastic Approach Considering Wind and Electricity Price Uncertainties" Sustainability 16, no. 7: 2856. https://doi.org/10.3390/su16072856

APA StyleGarcía-Miguel, P. L. C., Zarilli, D., Alonso-Martinez, J., Plaza, M. G., & Gómez, S. A. (2024). Optimal Operation and Market Integration of a Hybrid Farm with Green Hydrogen and Energy Storage: A Stochastic Approach Considering Wind and Electricity Price Uncertainties. Sustainability, 16(7), 2856. https://doi.org/10.3390/su16072856