Sustainable Finance and ESG Importance: A Systematic Literature Review and Research Agenda

Abstract

1. Introduction

2. Theoretical Background

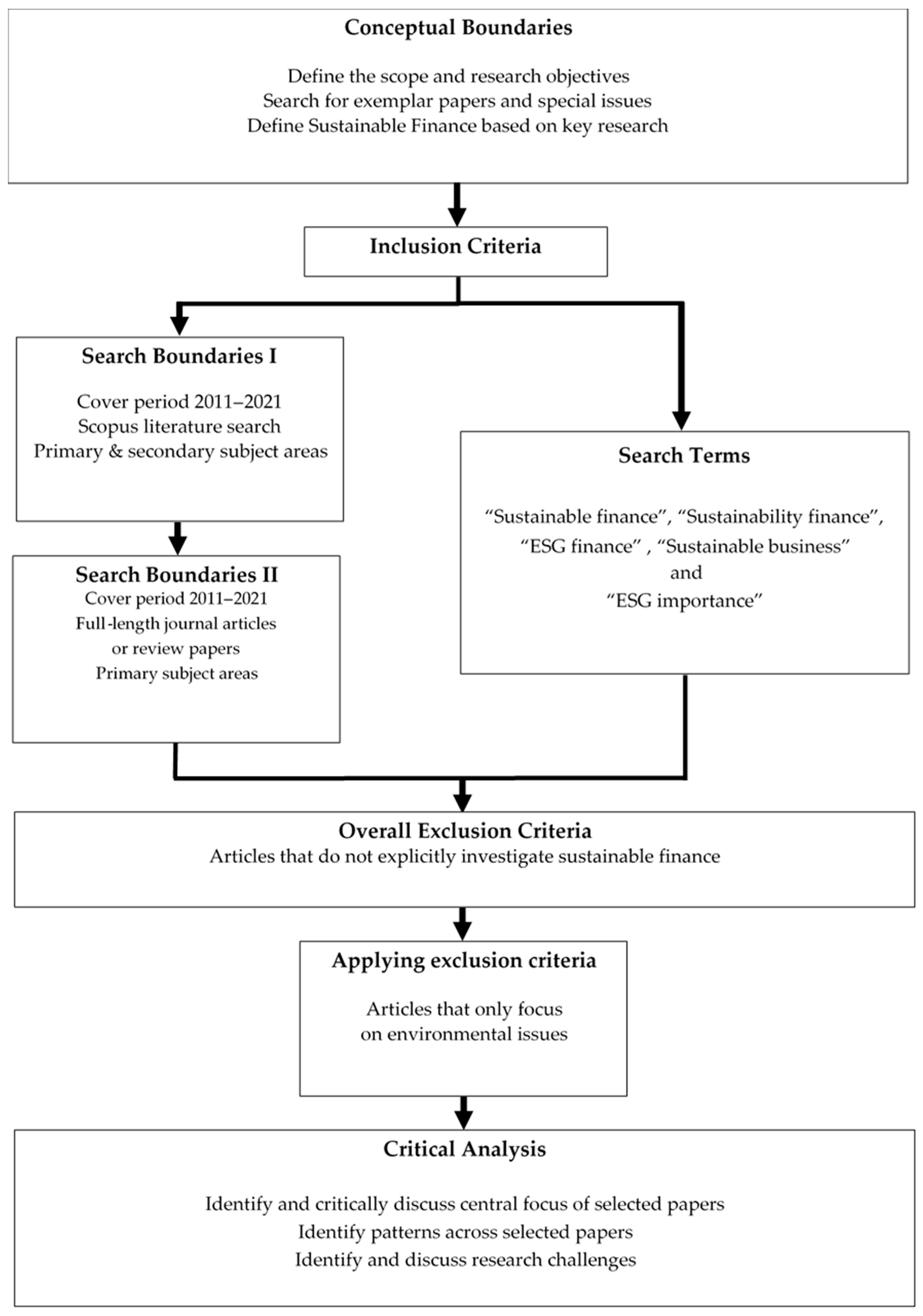

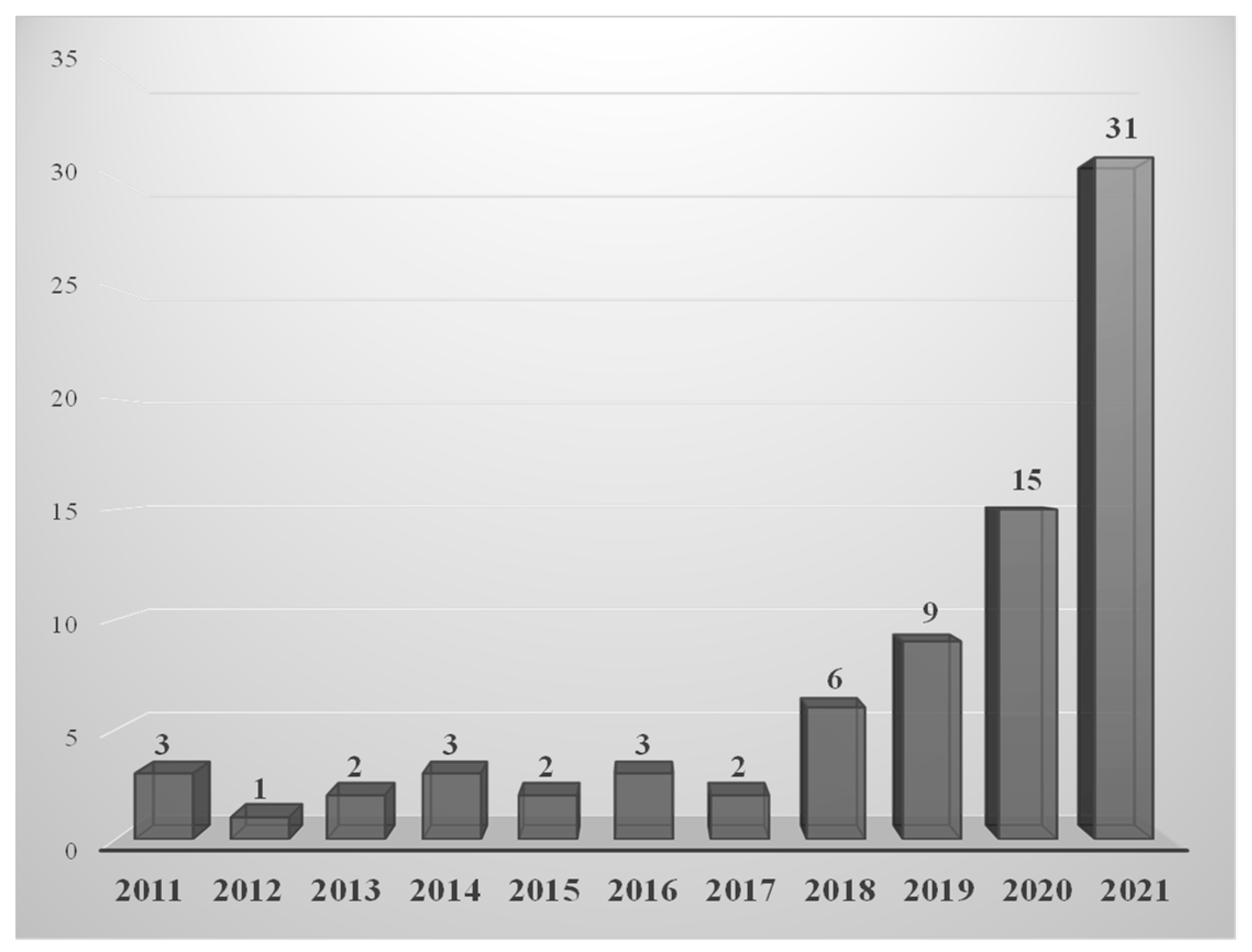

3. Methodological Approach and Results

4. Discussion

4.1. A Shift in Value Creation

4.2. Green Bonds

4.3. ESG: Ratings and Performance

4.4. Sustainable Finance, Banking, and Financial Risks

5. Conclusions

6. Future Research Avenues

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Schoenmaker, D.; Schramade, W. Principles of Sustainable Finance; Oxford University Press: Oxford, UK, 2019; Available online: https://ssrn.com/abstract=3282699 (accessed on 30 December 2023).

- Cunha, F.A.F.d.S.; Meira, E.; Orsato, R.J. Sustainable Finance and Investment: Review and Research Agenda. Bus. Strat. Environ. 2021, 30, 3821–3838. [Google Scholar] [CrossRef]

- Migliorelli, M. What Do We Mean by Sustainable Finance? Assessing Existing Frameworks and Policy Risks. Sustainability 2021, 13, 975. [Google Scholar] [CrossRef]

- UNEP. Definitions and Concepts: Background Note. 2016. Available online: https://wedocs.unep.org/bitstream/handle/20.500.11822/10603/definitions_concept.pdf?sequence=1&%3BisAllowed= (accessed on 30 December 2023).

- OECD. Developing Sustainable Finance Definitions and Taxonomies. 2020. Available online: https://www.oecd.org/env/developing-sustainable-finance-definitions-and-taxonomies-134a2dbe-en.htm (accessed on 30 December 2023).

- Miralles-Quirós, M.M.; Miralles-Quirós, J.L. Sustainable Finance and the 2030 Agenda: Investing to Transform the World. Sustainability 2021, 13, 10505. [Google Scholar] [CrossRef]

- Haigh, M. The Journal of Sustainable Finance & Investment. J. Sustain. Financ. Invest. 2011, 1, 3–4. [Google Scholar] [CrossRef]

- ICMA. Sustainable Finance High-Level Definitions. 2020. Available online: https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/Sustainable-Finance-High-Level-Definitions-May-2020-051020.pdf (accessed on 30 December 2023).

- Nicholls, A. A Primer and Recent Developments. Available online: https://www.adb.org/sites/default/files/institutional-document/691951/ado2021bp-sustainable-finance.pdf (accessed on 1 February 2024).

- Roncalli, T. Green and Sustainable Finance, ESG Investing and Climate Risk. 2021. Available online: https://ssrn.com/abstract=3769378 (accessed on 24 February 2024).

- Bloxham, E. Corporate Governance and Sustainability: New and Old Models of Thinking. J. Sustain. Financ. Invest. 2011, 1, 77–80. [Google Scholar] [CrossRef]

- Bloxham, E. The Knowledge Gap between Investors and Companies. J. Sustain. Financ. Invest. 2011, 1, 156–158. [Google Scholar] [CrossRef]

- Salzmann, A.J. The Integration of Sustainability into the Theory and Practice of Finance: An Overview of the State of the Art and Outline of Future Developments. J. Bus. Econ. 2013, 83, 555–576. [Google Scholar] [CrossRef]

- Hafenstein, A.; Bassen, A. Influences for Using Sustainability Information in the Investment Decision-Making of Non-Professional Investors. J. Sustain. Financ. Invest. 2016, 6, 186–210. [Google Scholar] [CrossRef]

- In, S.Y.; Rook, D.; Monk, A. Integrating Alternative Data (Also Known as ESG Data) in Investment Decision Making. Glob. Econ. Rev. 2019, 48, 237–260. [Google Scholar] [CrossRef]

- Martini, A. Socially Responsible Investing: From the Ethical Origins to the Sustainable Development Framework of the European Union. Environ. Dev. Sustain. 2021, 23, 16874–16890. [Google Scholar] [CrossRef] [PubMed]

- Baer, M.; Campiglio, E.; Deyris, J. It Takes Two to Dance: Institutional Dynamics and Climate-Related Financial Policies. Ecol. Econ. 2021, 190, 107210. [Google Scholar] [CrossRef]

- Flammer, C. Corporate Green Bonds. J. Financ. Econ. 2021, 142, 499–516. [Google Scholar] [CrossRef]

- Mocanu, M.; Constantin, L.-G.; Cernat-Gruici, B. Sustainability Bonds. An International Event Study. J. Bus. Econ. Manag. 2021, 22, 1551–1576. [Google Scholar] [CrossRef]

- Pham, L.; Luu Duc Huynh, T. How Does Investor Attention Influence the Green Bond Market? Fin. Res. Lett. 2020, 35, 101533. [Google Scholar] [CrossRef]

- Agliardi, E.; Agliardi, R. Pricing Climate-Related Risks in the Bond Market. J. Fin. Stab. 2021, 54, 100868. [Google Scholar] [CrossRef]

- Nerlinger, M. Will the DAX 50 ESG Establish the Standard for German Sustainable Investments? A Sustainability and Financial Performance Analysis. Credit Cap. Mark. Kredit Kap. 2020, 53, 461–491. [Google Scholar] [CrossRef]

- Billio, M.; Costola, M.; Hristova, I.; Latino, C.; Pelizzon, L. Inside the ESG Ratings: (Dis)Agreement and Performance. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1426–1445. [Google Scholar] [CrossRef]

- Tanjung, M. Can We Expect Contribution from Environmental, Social, Governance Performance to Sustainable Development? Bus. Strategy Dev. 2021, 4, 386–398. [Google Scholar] [CrossRef]

- Yip, A.W.H.; Bocken, N.M.P. Sustainable Business Model Archetypes for the Banking Industry. J. Clean. Prod. 2018, 174, 150–169. [Google Scholar] [CrossRef]

- Esposito, L.; Mastromatteo, G.; Molocchi, A. Extending ‘Environment-Risk Weighted Assets’: EU Taxonomy and Banking Supervision. J. Sustain. Financ. Invest. 2021, 11, 214–232. [Google Scholar] [CrossRef]

- Sommer, S. Sustainable Finance: An Overview. 2020. Available online: https://www.giz.de/en/downloads/Sustainable%20Finance_English_version.pdf (accessed on 30 December 2023).

- KPMG. Delivering Sustainable Finance. 2020. Available online: https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2020/09/delivering-sustainable-finance.pdf (accessed on 30 December 2023).

- Strandberg, C. Best Practices in Sustainable Finance. Strandberg Consulting. 2005. Available online: https://www.cbd.int/financial/privatesector/several-privatebestpractices.pdf (accessed on 30 December 2023).

- Muñoz, P.; Cohen, B. Sustainable Entrepreneurship Research: Taking Stock and Looking Ahead. Bus. Strat. Environ. 2018, 27, 300–322. [Google Scholar] [CrossRef]

- Doherty, B.; Haugh, H.; Lyon, F. Social Enterprises as Hybrid Organizations: A Review and Research Agenda. Int. J. Manag. Rev. 2014, 16, 417–436. [Google Scholar] [CrossRef]

- Ansari, Z.N.; Kant, R. Exploring the Framework Development Status for Sustainability in Supply Chain Management: A Systematic Literature Synthesis and Future Research Directions. Bus. Strat. Environ. 2017, 26, 873–892. [Google Scholar] [CrossRef]

- Webster, J.; Watson, R.T. Analyzing the Past to Prepare for the Future: Writing a Literature Review. MIS Q. 2002, 26, xiii–xxiii. [Google Scholar]

- Aggarwal, D.; Elembilassery, V. Sustainable Finance in Emerging Markets: A Venture Capital Investment Decision Dilemma. S. Asian J. Bus. Manag. Cases 2018, 7, 131–143. [Google Scholar] [CrossRef]

- Lee, J.W.; School of International Economics and Trade, Anhui University of Finance and Economics (AUFE). Green Finance and Sustainable Development Goals: The Case of China. J. Asian Finance Econ. Bus. 2020, 7, 577–586. [Google Scholar] [CrossRef]

- Setyowati, A.B. Governing Sustainable Finance: Insights from Indonesia. Clim. Policy 2023, 23, 108–121. [Google Scholar] [CrossRef]

- Bidabad, B.; Sherafati, M. Sustainable Financing and Anti-Squandering Measures in Rastin Banking. Int. J. Law Manag. 2017, 59, 939–949. [Google Scholar] [CrossRef]

- Nugroho, L.; Badawi, A.; Hidayah, N. Discourses of Sustainable Finance Implementation in Islamic Bank (Cases Studies in Bank Mandiri Syariah). Int. J. Financ. Res. 2018, 10, 108–117. [Google Scholar] [CrossRef]

- Cheng, C.; Hua, Y.; Tan, D. Spatial Dynamics and Determinants of Sustainable Finance: Evidence from Venture Capital Investment in China. J. Clean. Prod. 2019, 232, 1148–1157. [Google Scholar] [CrossRef]

- Lee, K.-H.; Cin, B.C.; Lee, E.Y. Environmental Responsibility and Firm Performance: The Application of an Environmental, Social and Governance Model: Environmental Responsibility and Firm Performance. Bus. Strat. Environ. 2014, 25, 40–53. [Google Scholar] [CrossRef]

- Thomas, C.J.; Tuyon, J.; Matahir, H.; Dixit, S. The Impact of Sustainability Practices on Firm Financial Performance: Evidence from Malaysia. Manag. Account. Rev. 2021, 20, 211–243. [Google Scholar]

- Mengze, H.; Wei, L. A Comparative Study on Environment Credit Risk Management of Commercial Banks in the Asia-Pacific Region: Environmental Credit Risk Management of Banks in the Asia-Pacific. Bus. Strat. Environ. 2015, 24, 159–174. [Google Scholar] [CrossRef]

- Durrani, A.; Rosmin, M.; Volz, U. The Role of Central Banks in Scaling up Sustainable Finance-What Do Monetary Authorities in the Asia-Pacific Region Think. J. Sustain. Financ. Invest. 2020, 10, 92–112. [Google Scholar] [CrossRef]

- Azhgaliyeva, D.; Kapoor, A.; Liu, Y. Green Bonds for Financing Renewable Energy and Energy Efficiency in South-East Asia: A Review of Policies. J. Sustain. Financ. Invest. 2020, 10, 113–140. [Google Scholar] [CrossRef]

- Schumacher, K.; Chenet, H.; Volz, U. Sustainable Finance in Japan. J. Sustain. Financ. Invest. 2020, 10, 213–246. [Google Scholar] [CrossRef]

- Zhan, C.; de Jong, M. Financing Eco Cities and Low Carbon Cities: The Case of Shenzhen International Low Carbon City. J. Clean. Prod. 2018, 180, 116–125. [Google Scholar] [CrossRef]

- Hoasiuhu, F. Developing a Self-Sustaining Protected Area System: A Feasibility Study of National Tourism Fee and Green Infrastructure in the Solomon Islands. J. Sustain. Financ. Invest. 2012, 2, 287–302. [Google Scholar]

- Liyanage, S.I.H.; Netswera, F.G.; Motsumi, A. Insights from EU Policy Framework in Aligning Sustainable Finance for Sustainable Development in Africa and Asia. Int. J. Energy Econ. Policy 2021, 11, 459–470. [Google Scholar] [CrossRef]

- Cormack, C.; Donovan, C.; Köberle, A.; Ostrovnaya, A. Estimating Financial Risks from the Energy Transition: Potential Impacts from Decarbonization in the European Power Sector. J. Energy Mark. 2021, 13, 1–49. [Google Scholar] [CrossRef]

- Leitao, J.; Ferreira, J.; Santibanez-Gonzalez, E. Green Bonds, Sustainable Development and Environmental Policy in the European Union Carbon Market. Bus. Strat. Environ. 2021, 30, 2077–2090. [Google Scholar] [CrossRef]

- Meibner, N.; Winter, E. Design Principles for Protected Area Certificates: A Case Study on Strategic Investor Groups. Environ. Dev. Sustain. 2019, 21, 303–329. [Google Scholar] [CrossRef]

- Dmuchowski, P.; Dmuchowski, W.; Baczewska-Dąbrowska, A.H.; Gworek, B. Green Economy—Growth and Maintenance of the Conditions of Green Growth at the Level of Polish Local Authorities. J. Clean. Prod. 2021, 301, 126975. [Google Scholar] [CrossRef]

- Pauliukeviciene, G.; Stankeviciene, J. Assessing Statistical Link between FinTech PEST Environment and Achievement of SDGs. Public Munic. Financ. 2021, 10, 47–66. [Google Scholar] [CrossRef] [PubMed]

- Rose, K.J. De-Risking or Recontracting—The Risk Dilemma of EU Money Laundering Regulation. J. Risk Financ. 2020, 21, 445–458. [Google Scholar] [CrossRef]

- Harper Ho, V. Non-Financial Reporting & Corporate Governance: Explaining American Divergence & Its Implications for Disclosure Reform. Account. Econ. Law Conviv. 2020, 10, 20180043. [Google Scholar] [CrossRef]

- Nathwani, J.; Ng, A.W. Investing in the next Generation of Infrastructure for Sustainable Energy in Canada. J. Sustain. Financ. Invest. 2014, 4, 272–279. [Google Scholar] [CrossRef]

- Fatoki, O. Sustainable Finance and Small, Medium and Micro Entreprises in South Africa. Acad. Account. Financ. Stud. J. 2021, 25, 1–7. [Google Scholar]

- Saidane, D.; Abdallah, S.B. African Firm Default Risk and CSR. Fin. Res. Lett. 2021, 43, 101964. [Google Scholar] [CrossRef]

- Saviano, M.; Nenci, L.; Caputo, F. The Financial Gap for Women in the MENA Region: A Systemic Perspective. Gend. Manag. Int. J. 2017, 32, 203–217. [Google Scholar] [CrossRef]

- Gomez, J.F.; Basterra, M.L. Fostering green financing at the subnational level. the case of the basque country. Ekonomiaz 2021, 99, 150–181. [Google Scholar]

- Waygood, S. How Do the Capital Markets Undermine Sustainable Development? What Can Be Done to Correct This? J. Sustain. Financ. Invest. 2011, 1, 81–87. [Google Scholar] [CrossRef]

- Fatemi, A.M.; Fooladi, I.J. Sustainable Finance: A New Paradigm. Glob. Fin. J. 2013, 24, 101–113. [Google Scholar] [CrossRef]

- Manelli, A. New Paradigms for a Sustainable Well-Being. Riv. Studi Sulla Sostenibilita 2014, 2, 11–30. [Google Scholar] [CrossRef]

- Cort, T. Incentivizing the Direction of Multi-Capital toward Inclusive Capitalism. J. Sustain. Financ. Invest. 2018, 8, 203–212. [Google Scholar] [CrossRef]

- Cerrato, D.; Ferrando, T. The Financialization of Civil Society Activism: Sustainable Finance, Non-Financial Disclosure and the Shrinking Space for Engagement. Account. Econ. Law Conviv. 2020, 10, 20190006. [Google Scholar] [CrossRef]

- Cato, S.; Fletcher, M. Introducing Sell-by Dates for Stranded Assets: Ensuring an Orderly Transition to a Sustainable Economy. J. Sustain. Financ. Invest. 2020, 10, 335–348. [Google Scholar] [CrossRef]

- Rizzello, A.; Kabli, A. Social Finance and Sustainable Development Goals: A Literature Synthesis, Current Approaches and Research Agenda. ACRN J. Financ. Risk Perspect. 2020, 9, 120–136. [Google Scholar] [CrossRef]

- Popescu, I.-S.; Hitaj, C.; Benetto, E. Measuring the Sustainability of Investment Funds: A Critical Review of Methods and Frameworks in Sustainable Finance. J. Clean. Prod. 2021, 314, 128016. [Google Scholar] [CrossRef]

- van Zanten, J.A.; Sharma, B.; Christensen, M. Sustainability Integration for Sovereign Debt Investors: Engaging with Countries on the SDGs. J. Sustain. Financ. Invest. 2023, 13, 1300–1317. [Google Scholar] [CrossRef]

- Ionescu, L. Corporate Environmental Performance, Climate Change Mitigation, and Green Innovation Behavior in Sustainable Finance. Econ. Manag. Financ. Mark. 2021, 16, 94–106. [Google Scholar] [CrossRef]

- Park, S.K. Social Bonds for Sustainable Development: A Human Rights Perspective on Impact Investing. Bus. Hum. Rights J. 2018, 3, 233–255. [Google Scholar] [CrossRef]

- Brandstetter, L.; Lehner, O.M. Opening the Market for Impact Investments: The Need for Adapted Portfolio Tools. Entrep. Res. J. 2015, 5, 2. [Google Scholar] [CrossRef]

- Benijts, T. Socially Responsible Investment and Financial Institution’s Response to Secondary Stakeholder Requests. J. Sustain. Financ. Invest. 2014, 4, 321–336. [Google Scholar] [CrossRef][Green Version]

- Bento, N.; Gianfrate, G.; Thoni, M.H. Crowdfunding for Sustainability Ventures. J. Clean. Prod. 2019, 237, 117751. [Google Scholar] [CrossRef]

- Chiu, I.H.Y.; Greene, E.F. The Marriage of Technology, Markets and Sustainable (and) Social Finance: Insights from ICO Markets for a New Regulatory Framework. Eur. Bus. Organ. Law Rev. 2019, 20, 139–169. [Google Scholar] [CrossRef]

- Schoenmaker, D.; Schramade, W. Investing for Long-Term Value Creation. J. Sustain. Financ. Invest. 2019, 9, 356–377. [Google Scholar] [CrossRef]

- Kurznack, L.; Schoenmaker, D.; Schramade, W. A Model of Long-Term Value Creation. J. Sustain. Financ. Invest. 2021, 1–19. [Google Scholar] [CrossRef]

- Schütze, F.; Stede, J. The EU Sustainable Finance Taxonomy and Its Contribution to Climate Neutrality. J. Sustain. Financ. Invest. 2021, 14, 128–160. [Google Scholar] [CrossRef]

- Straub, N. Framing Sustainable Finance: A Critical Analysis of Op-Eds in the Financial Times. Int. J. Bus. Commun. 2021, 60, 1427–1440. [Google Scholar] [CrossRef]

- Weston, P.; Nnadi, M. Evaluation of Strategic and Financial Variables of Corporate Sustainability and ESG Policies on Corporate Finance Performance. J. Sustain. Financ. Invest. 2023, 13, 1058–1074. [Google Scholar] [CrossRef]

- ICMA. Green Bond Principles. 2018. Available online: https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/Green-Bonds-Principles-June-2018-270520.pdf (accessed on 30 December 2023).

- Maltais, A.; Nykvist, B. Understanding the Role of Green Bonds in Advancing Sustainability. J. Sustain. Financ. Invest. 2020, 11, 1–20. [Google Scholar] [CrossRef]

- Agliardi, E.; Agliardi, R. Financing Environmentally-Sustainable Projects with Green Bonds. Environ. Dev. Econ. 2019, 24, 608–623. [Google Scholar] [CrossRef]

- Tuhkanen, H.; Vulturius, G. Are Green Bonds Funding the Transition? Investigating the Link between Companies’ Climate Targets and Green Debt Financing. J. Sustain. Financ. Invest. 2022, 12, 1194–1216. [Google Scholar] [CrossRef]

- Cash, D. Sustainable Finance Ratings as the Latest Symptom of ‘Rating Addiction’. J. Sustain. Financ. Invest. 2018, 8, 242–258. [Google Scholar] [CrossRef]

- Gyönyörová, L.; Stachoň, M.; Stašek, D. ESG Ratings: Relevant Information or Misleading Clue? Evidence from the S&P Global 1200. J. Sustain. Financ. Invest. 2023, 13, 1075–1109. [Google Scholar] [CrossRef]

- Husse, T.; Pippo, F. Responsible Minus Irresponsible—A Determinant of Equity Risk Premia? J. Sustain. Financ. Invest. 2021, 1–23. [Google Scholar] [CrossRef]

- Galletta, S.; Mazzù, S.; Naciti, V.; Vermiglio, C. Sustainable Development and Financial Institutions: Do Banks’ Environmental Policies Influence Customer Deposits? Bus. Strat. Environ. 2021, 30, 643–656. [Google Scholar] [CrossRef]

- Caldecott, B. Climate Risk Management (CRM) and How It Relates to Achieving Alignment with Climate Outcomes (ACO). J. Sustain. Financ. Invest. 2022, 12, 1167–1170. [Google Scholar] [CrossRef]

- Wiklund, S. Evaluating Physical Climate Risk for Equity Funds with Quantitative Modelling-How Exposed Are Sustainable Funds. J. Sustain. Financ. Invest. 2021, 13, 893–918. [Google Scholar] [CrossRef]

- Chenet, H.; Ryan-Collins, J.; van Lerven, F. Finance, Climate-Change and Radical Uncertainty: Towards a Precautionary Approach to Financial Policy. Ecol. Econ. 2021, 183, 106957. [Google Scholar] [CrossRef]

- Coeslier, M.; Louche, C.; Hétet, J.-F. On the Relevance of Low-Carbon Stock Indices to Tackle Climate Change. J. Sustain. Financ. Invest. 2016, 6, 247–262. [Google Scholar] [CrossRef]

- Roncoroni, A.; Battiston, S.; Escobar-Farfán, L.O.L.; Martinez-Jaramillo, S. Climate Risk and Financial Stability in the Network of Banks and Investment Funds. J. Fin. Stab. 2021, 54, 100870. [Google Scholar] [CrossRef]

| Journal | Number of Studies (N) |

|---|---|

| Academy of Accounting and Financial Studies Journal | 1 |

| Accounting, Economics and Law: A Convivium | 2 |

| ACRN Journal of Finance and Risk Perspectives | 1 |

| Business and Human Rights Journal | 1 |

| Business Strategy and Development | 1 |

| Business Strategy and the Environment | 5 |

| Climate Policy | 1 |

| Corporate Social Responsibility and Environmental Management | 1 |

| Credit and Capital Markets | 1 |

| Ecological Economics | 2 |

| Economics, Management, and Financial Markets | 1 |

| Ekonomiaz | 1 |

| Entrepreneurship Research Journal | 1 |

| Environment and Development Economics | 1 |

| Environment, Development and Sustainability | 2 |

| European Business Organization Law Review | 1 |

| Finance Research Letters | 2 |

| Gender in Management | 1 |

| Global Economic Review | 1 |

| Global Finance Journal | 1 |

| International Journal of Business Communication | 1 |

| International Journal of Energy Economics and Policy | 1 |

| International Journal of Financial Research | 1 |

| International Journal of Law and Management | 1 |

| Journal of Asian Finance, Economics and Business | 1 |

| Journal of Business Economics | 1 |

| Journal of Business Economics and Management | 1 |

| Journal of Cleaner Production | 6 |

| Journal of Energy Markets | 1 |

| Journal of Financial Economics | 1 |

| Journal of Financial Stability | 2 |

| Journal of Risk Finance | 1 |

| Journal of Sustainable Finance and Investment | 27 |

| Management and Accounting Review | 1 |

| Public and Municipal Finance | 1 |

| Rivista di Studi sulla Sostenibilita | 1 |

| South Asian Journal of Business and Management Cases | 1 |

| Total | 77 |

| Number of Studies (N) | Qualitative (%) | Quantitative (%) | Theory/Conceptual (%) | Mixed Methods (%) |

|---|---|---|---|---|

| 77 | 35.1 | 35.1 | 16.9 | 13.0 |

| Subject Areas | % |

|---|---|

| Business, management, and accounting | 41.6 |

| Economics, econometrics, and finance | 35.1 |

| Social sciences | 10.4 |

| Environmental science | 5.2 |

| Energy | 3.9 |

| Engineering | 2.6 |

| Decision sciences | 1.3 |

| Subject Area | % |

|---|---|

| Sustainable development | 21 |

| Climate change | 16 |

| Green bonds | 13 |

| Sustainability | 12 |

| Sustainable Development Goals | 7 |

| Investments | 5 |

| Financial performance | 5 |

| Finance | 5 |

| Sustainable investment | 4 |

| Social finance | 4 |

| Number of Studies (N) | Europe (%) | North America (%) | Asia–Pacific (%) | Rest of the World (%) |

|---|---|---|---|---|

| 77 | 59.7 | 13.0 | 20.8 | 6.5 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zairis, G.; Liargovas, P.; Apostolopoulos, N. Sustainable Finance and ESG Importance: A Systematic Literature Review and Research Agenda. Sustainability 2024, 16, 2878. https://doi.org/10.3390/su16072878

Zairis G, Liargovas P, Apostolopoulos N. Sustainable Finance and ESG Importance: A Systematic Literature Review and Research Agenda. Sustainability. 2024; 16(7):2878. https://doi.org/10.3390/su16072878

Chicago/Turabian StyleZairis, Georgios, Panagiotis Liargovas, and Nikolaos Apostolopoulos. 2024. "Sustainable Finance and ESG Importance: A Systematic Literature Review and Research Agenda" Sustainability 16, no. 7: 2878. https://doi.org/10.3390/su16072878

APA StyleZairis, G., Liargovas, P., & Apostolopoulos, N. (2024). Sustainable Finance and ESG Importance: A Systematic Literature Review and Research Agenda. Sustainability, 16(7), 2878. https://doi.org/10.3390/su16072878