Pathway to a Sustainable Energy Economy: Determinants of Electricity Infrastructure in Nigeria

Abstract

:1. Introduction

2. Literature Review

2.1. Electricity Consumption and Economic Growth

2.2. Electricity Consumption and Ecological Footprint

2.3. Energy Consumption and Economic Growth

2.4. Electricity Generation and Economic Growth

2.5. Electricity Generation, Economic Growth, Socio-Political Factors

Literature on Substitution Effect

3. Materials and Methods

3.1. Methodology

3.2. Estimation Strategies

3.3. The ARDL Bound Testing Model

3.4. Substitutional Effect Model

General-to-Specific Estimation Techniques

4. Results

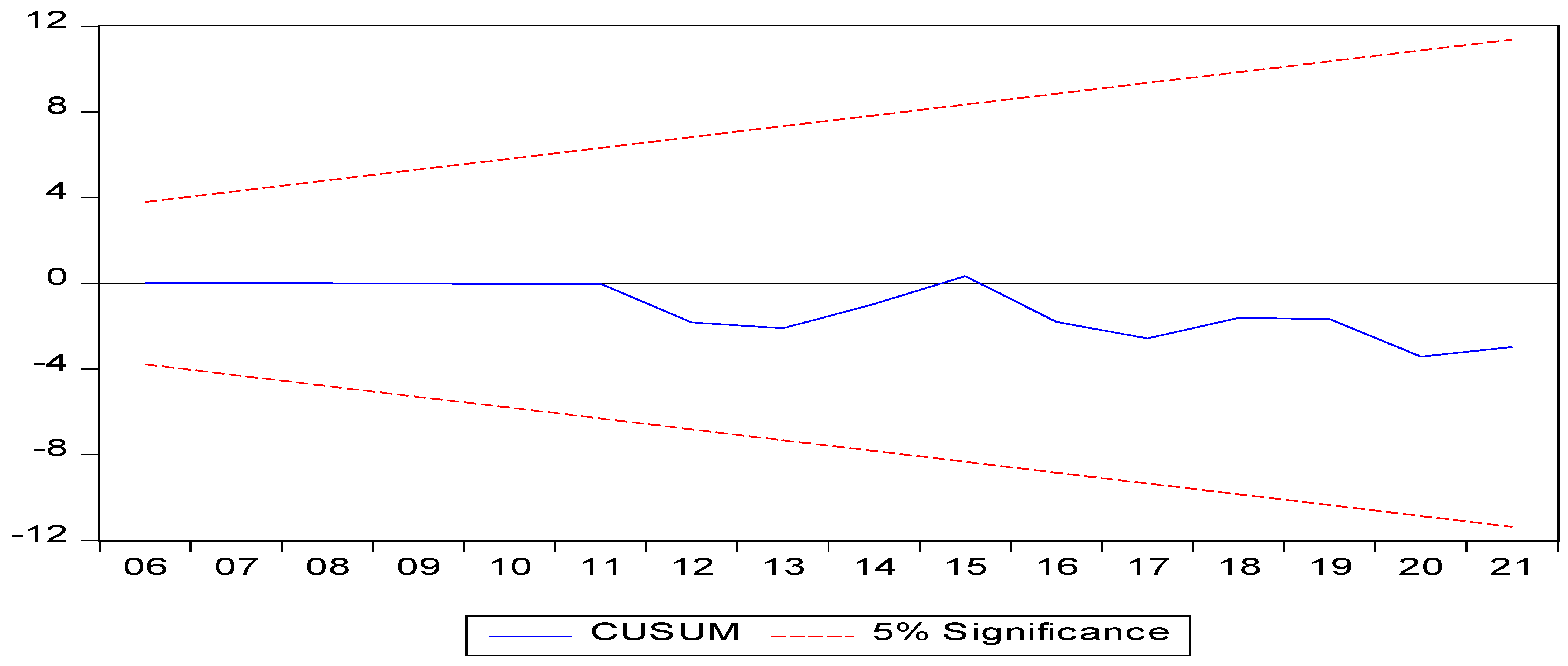

4.1. Stability Test Result

4.2. Bootstrap ARDL Technique Results

4.3. Diagnostic Test

4.4. Robustness Check

4.4.1. Introducing the Control Variables

4.4.2. [26] Causality Test Results

4.4.3. Results Regarding the Mediating Role of Socio-Political Factors

4.5. The Results of the GETs MODEL

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Isola, A.; Ozturk, I.; Olanipekun, I.O.; John, A. Examining the linkages between electricity consumption and economic growth in African economies. Energy 2020, 208, 118363. [Google Scholar] [CrossRef]

- Sarkodie, S.A. Causal effect of environmental factors, economic indicators and domestic material consumption using frequency domain causality test. Sci. Total Environ. 2020, 736, 139602. [Google Scholar] [CrossRef] [PubMed]

- Sarkodie, S.A.; Strezov, V. An empirical study of the Environmental Kuznets curve and Environmental Sustainability curve hypothesis for Australia, China, Ghana and the USA. J. Clean. Prod. 2018, 201, 98–110. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Strezov, V. A review of the Environmental Kuznets Curve hypothesis using bibliometric and meta-analysis. Sci. Total Environ. 2019, 649, 128–145. [Google Scholar] [CrossRef] [PubMed]

- Adebola, S.; Al-mulali, U.; Ozturk, I. Validating the environmental Kuznets curve hypothesis in India and China: The role of hydroelectricity consumption. Renew. Sustain. Energy Rev. 2017, 80, 1578–1587. [Google Scholar] [CrossRef]

- IEA. World Energy Outlook 2014; IEA: Paris, France, 2014; Available online: https://www.iea.org/reports/world-energy-outlook-2014 (accessed on 22 August 2023).

- IEA. World Energy Outlook 2021; IEA: Paris, France, 2021; Available online: https://www.iea.org/reports/world-energy-outlook-2021 (accessed on 22 August 2023).

- Lawal, A.I.; Salisu, A.A.; Asaleye, A.J.; Oseni, E.; Lawal-Adedoyin, B.B.; Dahunsi, S.O.; Omoju, E.O.; DickTonye, A.O.; Ogunwole, E.B.; Babajide, A.A. Economic Growth, Exchange Rate and Remittance Nexus: Evidence from Africa. J. Risk Financ. Manag. 2022, 15, 235. [Google Scholar] [CrossRef]

- Omoju, O.E.; Li, J.; Zhang, J.; Rauf, A.; Sosoo, V.E. Implications of shocks in energy consumption for energy policy in sub-Saharan Africa. Energy Environ. 2019, 31, 1077–1097. [Google Scholar] [CrossRef]

- Aliyu, A.K.; Modu, B.; Tan, C.W. A review of renewable energy development in Africa: A focus in A focus in South Africa, Egypt and Nigeria. Renew. Sustain. Energy Rev. 2018, 81, 2502–2518. [Google Scholar] [CrossRef]

- Aydin, M. Renewable and non-renewable electricity consumption e economic growth nexus: Evidence from OECD countries. Renew. Energy 2019, 136, 599–606. [Google Scholar] [CrossRef]

- Wesseh, P.K., Jr.; Lin, B. Output and substitution elasticities of energy and implications for renewable energy expansion in the ECOWAS region. Energy Policy 2016, 89, 125–137. [Google Scholar] [CrossRef]

- Singh, M.K.; Malek, J.; Sharma, H.K.; Kumar, R. Converting the threats of fossil fuel-based energy generation into opportunities for renewable energy development in India. Renew. Energy 2024, 224, 120153. [Google Scholar] [CrossRef]

- Huang, J.; Luan, B.; He, W.; Chen, X.; Li, M. Energy technology of conservation versus substitution and energy intensity in China. Energy 2022, 244, 122695. [Google Scholar] [CrossRef]

- Raza, M.Y.; Lin, B. Renewable energy substitution and energy technology impact in a transitional economy: A perspective from Pakistan. J. Clean. Prod. 2022, 360, 132163. [Google Scholar] [CrossRef]

- Amigues, J.-P.; Kama AA, L.; Moreaux, M. Equilibrium transitions from non-renewable energy to renewable energy under capacity constraints. J. Econ. Dyn. Control 2015, 55, 89–112. [Google Scholar] [CrossRef]

- Adeleye, B.N.; Id, R.O.; Lawal, A.I.; De Alwis, T. Energy use and the role of per capita income on carbon emissions in African countries. PLoS ONE 2021, 16, e0259488. [Google Scholar] [CrossRef]

- Lawal, A.I.; Asaleye, A.J.; Iseolorunkanmi, J.; Popoola, O.R. Economic growth, agricultural output and tourism development in Nigeria: An application of the ARDL bound testing approach. J. Environ. Manag. Tour. 2018, 9, 786–794. [Google Scholar] [CrossRef]

- Lawal, A.I.; Somoye, R.O.; Babajide, A.A. Are African stock markets efficient? Evidence from wavelet unit root test for a random walk. Econ. Bull. 2017, 37, 2665–2679. [Google Scholar]

- Lawal, A.I.; Nwanji, T.I.; Asaleye, A.; Ahmed, V. Economic growth, financial development and trade openness in Nigeria: An application of the ARDL bound testing approach. Cogent Econ. Financ. 2016, 4, 1258810. [Google Scholar] [CrossRef]

- Fashina, O.A.; Asaleye, A.J.; Ogunjobi, J.O.; Lawal, A.I. Foreign aid, human capital and economic growth nexus: Evidence from Nigeria. J. Int. Stud. 2018, 11, 104–117. [Google Scholar] [CrossRef]

- Lawal, A.I.; Bose Bukola, L.-A.; Olakanmi, O.; Samson, T.K.; Ike, N.T.; Ajayi, A.S.; Adeniran, F.S.; Ezekiel, O.; Oyelude, O.; Adigun, G. Examining the Link between Technical Efficiency, Corporate Governance and Financial Performance of Firms: Evidence from Nigeria. J. Risk Financ. Manag. 2022, 15, 524. [Google Scholar] [CrossRef]

- UNDP. Human Development Indices and Indicators: 2018 Statistical Update, Technical Notes; Human Development Report Office: New York, NY, USA, 2018; Available online: https://hdr.undp.org/system/files/documents/2018summaryhumandevelopmentstatisticalupdateen.pdf (accessed on 22 August 2023).

- World Development Indicator. WDI 2022. 2022. Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 22 August 2023).

- Ayodele, T.R.; Ogunjuyigbe AS, O.; Ajayi, O.D.; Yusuff, A.A.; Mosetlhe, T.C. Willingness to pay for green electricity derived from renewable energy sources in Nigeria. Renew. Sustain. Energy Rev. 2021, 14, 111279. [Google Scholar] [CrossRef]

- Dumitrescu, E.I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Testing structural hypothesis in a multivariate co-integration analysis of the PPP and UIP for UK. J. Econom. 1992, 53, 211–244. [Google Scholar] [CrossRef]

- Meng, G.; Liu, H.; Li, J.; Sun, C. Determination of driving forces for China’s energy consumption and regional disparities using a hybrid structural decomposition analysis. Energy 2022, 239, 122191. [Google Scholar] [CrossRef]

- Shahbaz, M.; Song, M.; Ahmad, S.; Vo, X.V. Does economic growth stimulate energy consumption? The role of human capital and R&D expenditures in China. Energy Econ. 2021, 105, 105662. [Google Scholar] [CrossRef]

- Ameyaw, B.; Li, Y.; Ma, Y.; Korang, J.; Appiah-kubi, J.; Annan, A. Renewable electricity generation proposed pathways for the US and China. Renew. Energy 2021, 170, 212–223. [Google Scholar] [CrossRef]

- Hooi, H.; Smyth, R. Multivariate Granger causality between electricity generation, exports, prices and GDP in Malaysia. Energy 2010, 35, 3640–3648. [Google Scholar] [CrossRef]

- Shaffer, R.B.R. Perspectives and Challenges in the Policing of Terrorism. Terror. Political Violence 2018, 30, 174–180. [Google Scholar] [CrossRef]

- Li, J.; Omoju, O.E.; Zhang, J.; Ikhide, E.E.; Lu, G.; Lawal, A.I.; Ozue, V.A. Does Intellectual Property Rights Protection Constitute a Barrier to Renewable Energy? An Econometric Analysis. Natl. Inst. Econ. Rev. 2020, 251, R37–R46. [Google Scholar] [CrossRef]

- Ben, M.; Ben, S.; Ozturk, I. Testing environmental Kuznets curve hypothesis: The role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol. Indic. 2017, 60, 824–831. [Google Scholar] [CrossRef]

- Lin, B.; Liu, C. Why is electricity consumption inconsistent with economic growth in China? Energy Policy 2016, 88, 310–316. [Google Scholar] [CrossRef]

- Son, H.; Yoon, S. Reducing energy poverty: Characteristics of household electricity use in Vietnam. Energy Sustain. Dev. 2020, 59, 62–70. [Google Scholar] [CrossRef]

- Khan, Z.; Malik, M.Y.; Ph, D.; Latif, K.; Jiao, Z. Heterogeneous effect of eco-innovation and human capital on renewable & non-renewable energy consumption: Disaggregate analysis for G-7 countries. Energy 2020, 209, 118405. [Google Scholar] [CrossRef]

- Al-bajjali, S.K.; Yacoub, A. Estimating the determinants of electricity consumption in Jordan. Energy 2018, 147, 1311–1320. [Google Scholar] [CrossRef]

- Usama, A.; Adebola, S.; Salahuddin, M. The prominence of renewable and non-renewable electricity generation on the environmental Kuznets curve: A case study of Ethiopia. Energy 2020, 211, 118665. [Google Scholar] [CrossRef]

- Fatai, F.; Ozturk, I.; Oluwatoyin, M.; Agboola, P.O.; Victor, F. The implications of renewable and non-renewable energy generating in Sub-Saharan Africa: The role of economic policy uncertainties. Energy Policy 2021, 150, 112115. [Google Scholar] [CrossRef]

- Sadi, H.; Prince, S.; Uzuner, G.; Victor, F.; Asumadu, S. Trivariate modelling of the nexus between electricity consumption, urbanization and economic growth in Nigeria: Fresh insights from Maki Cointegration and causality tests. Heliyon 2020, 6, e03400. [Google Scholar] [CrossRef]

- Nepal, R.; Paija, N. Energy security, electricity, population and economic growth: The case of a developing South Asian resource-rich economy. Energy Policy 2019, 132, 771–781. [Google Scholar] [CrossRef]

- Nepal, R.; Paija, N.; Tyagi, B.; Harvie, C. Energy security, economic growth and environmental sustainability in India: Does FDI and trade openness play a role? J. Environ. Manag. 2021, 281, 111886. [Google Scholar] [CrossRef]

- Guliyev, H.; Tatoğlu, F.Y. The Relationship Between Renewable Energy and Economic Growth in European Countries: Evidence from Panel Data Model with Sharp and Smooth Changes. Renew. Energy Focus 2023, 46, 185–196. [Google Scholar] [CrossRef]

- Geng, L.; Ofori, C.; Ampong, S.A.; Appiah-Twum, F.; Alhassan, E.A. Towards a sustainable environment: Examining the spatial VARIATIONS of renewable energy, environmental pollution, and economic growth in Europe. Energy Strategy Rev. 2023, 50, 101231. [Google Scholar] [CrossRef]

- Nuţă, F.M.; Ali, S.; Abban, O.J.; Khan, I.; Irfan, M.; Nutßa, A.C.; Dankyi, A.; Asghar, M. The relationship among urbanization, economic growth, renewable energy consumption, and environmental degradation: A comparative view of European and Asian emerging economies. Gondwana Res. 2024, 128, 325–339. [Google Scholar] [CrossRef]

- Atems, B.; Hotaling, C. The effect of renewable and nonrenewable electricity generation on economic growth. Energy Policy 2018, 112, 111–118. [Google Scholar] [CrossRef]

- Hdom, A.D. Examining carbon dioxide emissions, fossil & renewable electricity generation and economic growth: Evidence from a panel of South American countries. Renew. Energy 2019, 139, 186–197. [Google Scholar] [CrossRef]

- Marques, A.C.; Fuinhas, J.A.; Nunes, A.R. Electricity generation mix and economic growth: What role is being played by nuclear sources and carbon dioxide emissions in France? Energy Policy 2016, 92, 7–19. [Google Scholar] [CrossRef]

- Mac Domhnaill, C.; Ryan, L. Towards renewable electricity in Europe: Revisiting the determinants of renewable electricity in the European Union. Renew. Energy 2020, 154, 955–965. [Google Scholar] [CrossRef]

- Gregory, J. Governance, scale, scope: A review of six South African electricity generation infrastructure megaprojects. Util. Policy 2020, 66, 101103. [Google Scholar] [CrossRef]

- Sandu, S.; Yang, M.; Shi, X.; Chi, Y. A governance perspective on electricity industry development: The case of Papua New Guinea. Energy Policy 2020, 141, 111464. [Google Scholar] [CrossRef]

- Dagnachew, A.G.; Hof, A.F.; Roelfsema, M.R.; Van Vuuren, D.P. Actors and governance in the transition toward universal electricity access in Sub-Saharan Africa. Energy Policy 2020, 143, 111572. [Google Scholar] [CrossRef]

- Buragohain, B.; Mahanta, P.; Moholkar, V.S. Biomass gasification for decentralized power generation: The Indian perspective. Renew. Sustain. Energy Rev. 2010, 14, 73–92. [Google Scholar] [CrossRef]

- Hiloidhari, M.; Baruah, D.C. Crop residue biomass for decentralized electrical power generation in rural areas (part 1): Investigation of spatial availability. Renew. Sustain. Energy Rev. 2011, 15, 1885–1892. [Google Scholar] [CrossRef]

- König, S.; Bchini, Q.; McKenna, R.; Köppel, W.; Bachseitz, M.; Entress, J.; Ryba, M.; Michaelis, J.; Roser, A.; Schakib-Ekbatan, K. Analysing the regional potential and social acceptance of power-to-gas in the context of decentralized co-generation in Baden-Württemberg. J. Energy Storage 2018, 16, 93–107. [Google Scholar] [CrossRef]

- Lehner, J.; Weißbach, T. Global and local effects of decentralised electric power generation on the grid in the Western Balkan Countries (WBC). Energy 2009, 34, 555–563. [Google Scholar] [CrossRef]

- Moner-Girona, M.; Bender, A.; Becker, W.; Bódis, K.; Szabó, S.; Kararach, A.; Anadon, L. A multidimensional high-resolution assessment approach to boost decentralised energy investments in Sub-Saharan Africa. Renew. Sustain. Energy Rev. 2021, 148, 111282. [Google Scholar] [CrossRef]

- Ha, Y.; Sapkota, S. Investigating decentralized renewable energy systems under different governance approaches in Nepal and Indonesia: How does governance fail? Energy Res. Soc. Sci. 2021, 80, 102214. [Google Scholar] [CrossRef]

- Stritzke, S.; Trotter, P.A.; Twesigye, P. Towards responsive energy governance: Lessons from a holistic analysis of energy access in Uganda and Zambia. Energy Policy 2021, 148 Pt A, 111934. [Google Scholar] [CrossRef]

- Saba, C.S.; Biyase, M. Determinants of renewable electricity development in Europe: Do Governance indicators and institutional quality matter? Energy Rep. 2022, 8, 13914–13938. [Google Scholar] [CrossRef]

- Falchetta, G.; Dagnachew, A.G.; Hof, A.F.; Milne, D.J. The role of regulatory, market and governance risk for electricity access investment in sub-Saharan Africa. Energy Sustain. Dev. 2021, 62, 136–150. [Google Scholar] [CrossRef]

- Brisbois, M.C. Decentralised energy, decentralised accountability? Lessons on how to govern decentralised electricity transitions from multi-level natural resource governance. Glob. Transit. 2020, 2, 16–25. [Google Scholar] [CrossRef]

- Dye, B.J. Unpacking authoritarian governance in electricity policy: Understanding progress, inconsistency and stagnation in Tanzania. Energy Res. Soc. Sci. 2021, 80, 102209. [Google Scholar] [CrossRef]

- Opeyemi, B.M. Path to sustainable energy consumption: The possibility of substituting renewable energy for non-renewable energy. Energy 2021, 228, 120519. [Google Scholar] [CrossRef]

- Husain, S.; Sohag, K.; Wu, Y. Proven reserve oil and renewable energy nexus: Efficacy of policy stringency. Resour. Policy 2024, 90, 104835. [Google Scholar] [CrossRef]

- Mohammad-Bagher, J.; Rasti-Barzoki, M.; Altmann, J. An evolutionary game-theoretic approach for investigating the long-term behavior of the industry sector for purchasing renewable and non-renewable energy: A case study of Iran. Energy 2023, 285, 129245. [Google Scholar] [CrossRef]

- Acheampong, A.O.; Boateng, E.; Annor, C.B. Do corruption, income inequality and redistribution hasten transition towards (non)renewable energy economy? Struct. Chang. Econ. Dyn. 2024, 68, 329–354. [Google Scholar] [CrossRef]

- Saadaoui, H.; Omri, E.; Chtourou, N. The transition to renewable energies in Tunisia: The asymmetric impacts of technological innovation, government stability, and democracy. Energy 2024, 293, 130686. [Google Scholar] [CrossRef]

- Huihui, W.; Alharthi, M.; Ozturk, I.; Sharif, A.; Hanif, I.; Dong, X. A strategy for the promotion of renewable energy for cleaner production in G7 economies: By means of economic and institutional progress. J. Clean. Prod. 2024, 434, 140323. [Google Scholar] [CrossRef]

- Lin, B.; Ankrah, I. On Nigeria’s renewable energy program: Examining the effectiveness, substitution potential, and the impact on national output. Energy 2019, 167, 1181–1193. [Google Scholar] [CrossRef]

- Kumara, S.; Fujiib, H.; Managi, S. Substitute or complement? Assessing renewable and nonrenewable energy in OECD countries. Appl. Econ. 2015, 47, 1438–1459. [Google Scholar] [CrossRef]

- Taheri, A.A. Oil shocks and the dynamics of substitution adjustments of industrial fuels in the US. Appl. Econ. 1994, 26, 751–756. [Google Scholar] [CrossRef]

- Wua, W.; Cheng, Y.; Lin, X.; Yao, X. How does the implementation of the Policy of Electricity Substitution influence green economic growth in China? Energy Policy 2019, 131, 251–261. [Google Scholar] [CrossRef]

- CBN. Central Bank of Nigeria Statistical Bulletin; CBN (Central Bank of Nigeria): Abuja, Nigeria, 2006.

- GFN. Global Footprint Network. 2022. Available online: https://api.footprintnetwork.org/v1/data/5001%26type=BCtot,EFCtot/all/ (accessed on 12 August 2023).

- Joof, F.; Samour, A.; Tursoy, T.; Ali, M. Climate change, insurance market, renewable energy, and biodiversity: Double-materiality concept from BRICS countries. Environ. Sci. Pollut. Res. 2023, 30, 28676–28689. [Google Scholar] [CrossRef] [PubMed]

- McNown, R.; Sam, C.Y.; Goh, S.K. Bootstrapping the autoregressive distributed lag test for cointegration. Appl. Econ. 2018, 50, 1509–1521. [Google Scholar] [CrossRef]

- Li, J.; Dong, X.; Dong, K. Green efficiency of natural gas and driving factors analysis: The role of the natural gas price in China. Energy Effic. 2022, 15, 24. [Google Scholar] [CrossRef]

- Toda, H.Y.; Yamamoto, T. Statistical inference in vector autoregressions with possibly integrated process. J. Econom. 1995, 66, 225–250. [Google Scholar] [CrossRef]

- Ahmed, Z.; Nathaniel, S.P.; Shahbaz, M. The criticality of information and communication technology and human capital in environmental sustainability: Evidence from Latin American and Caribbean countries. J. Clean. Prod. 2021, 286, 125529. [Google Scholar] [CrossRef]

- Yasmeen, R.; Zhang, X.; Sharif, A.; Shah Wu, H.; Dincă, M.S. The role of wind energy towards sustainable development in top-16 wind energy consumer countries: Evidence from STIRPAT model. Gondwana Res. 2023, 121, 56–71. [Google Scholar] [CrossRef]

- Sun, C.; Khan, A.; Ren, Y. Empowering Progress: Education, innovations and financial development in the battle against energy poverty. J. Clean. Prod. 2023, 425, 138941. [Google Scholar] [CrossRef]

- Adebola, S.; Opeyemi, M. The impact of shale gas development on the U.S. economy: Evidence from a quantile autoregressive distributed lag model. Energy 2020, 205, 118004. [Google Scholar] [CrossRef]

- Lin, B.; Ankrah, I. Renewable energy (electricity) development in Ghana: Observations, concerns, substitution possibilities, and implications for the economy. J. Clean. Prod. 2019, 233, 1396–1409. [Google Scholar] [CrossRef]

- Salim, R.A.; Ra, S. Why do some emerging economies proactively accelerate the adoption of renewable energy? Energy Econ. 2012, 34, 1051–1057. [Google Scholar] [CrossRef]

- Galadima, M.D.; Aminu, A.W. Nonlinear Unit Root and Nonlinear Causality in Natural Gas—Economic Growth Nexus: Evidence from Nigeria. Energy 2019, 190, 116415. [Google Scholar] [CrossRef]

- Kruse, R.; Kaufmann, H.; Wegener, C. Bias-corrected estimation for speculative bubbles in stock prices. Econ. Model. 2018, 73, 354–364. [Google Scholar] [CrossRef]

- Mukhtarov, S.; Mikayilov, J.I.; Humbatova, S.; Muradov, V. Do High Oil Prices Obstruct the Transition to Renewable Energy Consumption? Sustainability 2020, 12, 4689. [Google Scholar] [CrossRef]

- Mukhtarov, S.; Mikayilov, J.I.; Maharramov, S.; Aliyev, J. Higher oil prices, are they good or bad for renewable energy consumption: The case of Iran? Renew. Energy 2022, 186, 411–419. [Google Scholar] [CrossRef]

- Omri, A.; Khuong, D. On the determinants of renewable energy consumption: International evidence. Energy 2014, 72, 554–560. [Google Scholar] [CrossRef]

- Castle, J.L.; Hendry, D.F. A low-dimension portmanteau test for non-linearity. J. Econom. 2010, 158, 231–245. [Google Scholar] [CrossRef]

- Wesseh, P.K., Jr.; Lin, B. Can African countries efficiently build their economies on renewable energy? Renew. Sustain. Energy Rev. 2016, 54, 161–173. [Google Scholar] [CrossRef]

- Chakamera, C.; Alagidede, P. Electricity crisis and the effect of CO2 emissions on infrastructure-growth nexus in Sub-Saharan Africa. Renew. Sustain. Energy Rev. 2018, 94, 945–958. [Google Scholar] [CrossRef]

- Malik, I.A.; Siyal, G.-E.; Bin Abdullah, A.; Alam, A.; Zaman, K.; Kyophilavong, P.; Shahbaz, M.; Baloch, S.U.; Shams, T. Turn on the lights: Macroeconomic factors affecting renewable energy in Pakistan. Renew. Sustain. Energy Rev. 2014, 38, 277–284. [Google Scholar] [CrossRef]

| ADF Unit Root Test | PV Unit Root Test | ||||||

|---|---|---|---|---|---|---|---|

| Variables | ‘At Level’ | First Differences | Variables | ‘At Level’ | First Differences | ||

| t-Stat. | t-Stat. | t-Stat. | SBD | t-Stat. | SBD | ||

| −0.801 | −6.218 *** | −2.711 | 2000 | −7.165 *** | 2010 | ||

| −1.522 | −4.109 *** | −2.602 | 2003 | −5.102 *** | 2014 | ||

| −1.106 | −5.855 *** | −3.566 | 2010 | −7.122 *** | 2018 | ||

| −0.929 | −4.077 *** | −2.013 | 2009 | −4.609 *** | 2014 | ||

| −0.811 | −4.804 *** | −2.105 | 1996 | −5.448 *** | 2003 | ||

| −1.114 | −5.032 *** | −3.625 | 2011 | −5.182 *** | 2017 | ||

| −0.498 | −3.004 *** | −1.045 | 2008 | −3.402 *** | 2019 | ||

| −0.7441 | −3.624 *** | −1.182 | 2004 | −5.098 *** | 2008 | ||

| Bootstrap ARDL | Diagnostic Tests | ||||

|---|---|---|---|---|---|

| Test | Value | CV at 5% | Test | Test Statistics | p-Values |

| F-statistics | 3.660 *** | 3.544 | Jarque-Bera | 0.644 | 0.703 |

| T-dependence | −3.554 *** | −3.228 | Ramsey Reset | 1.187 | 0.239 |

| F-dependence | 4.618 *** | 4.23 | BPG | 1.172 | 0.359 |

| BG-LM | 0.245 | 0.769 | |||

| Variables | Coefficients | Std. Error | t-Statistic |

|---|---|---|---|

| 0.033 *** | 0.0844 | 14.4544 | |

| 0.0569 ** | 0.0071 | 8.0988 | |

| 0.1285 *** | 0.0143 | 9.0237 | |

| −0.2988 *** | 0.0283 | 6.8445 | |

| 0.0945 *** | 0.0233 | 3.4982 | |

| 0.0447 | 0.0431 | 2.0665 | |

| 0.0987 *** | 0.1162 | 2.2099 | |

| −0.3228 *** | 0.0451 | 1.7662 | |

| −0.413 | 0.1052 | 2.5669 |

| Variables | Coefficients | Std. Error | t-Statistic |

|---|---|---|---|

| 0.046 *** | 0.0454 | 13.7544 | |

| 0.039 ** | 0.0051 | 14.0584 | |

| 0.034 *** | 0.0264 | 14.5349 | |

| 0.0419 ** | 0.0051 | 8.0128 | |

| 0.1202 ** | 0.0173 | 9.0147 | |

| 0.2078 *** | 0.0403 | 6.2025 | |

| 0.9032 * | 0.0143 | 2.1512 | |

| 0.945 ** | 0.0332 | 2.1062 | |

| 0.816 *** | 0.0417 | 2.1007 | |

| 0.0387 *** | 0.0821 | 2.0815 | |

| 0.0917 * | 0.1032 | 2.2009 | |

| 0.4128 * | 0.0331 | 1.7012 | |

| −0.419 | 0.1014 | 1.7091 |

| Variables | |||||

|---|---|---|---|---|---|

| - | 0.7032 *** | 0.8207 ** | 0.9157 *** | 0.9004 *** | |

| 0.0145 *** | - | 0.6126 | 0.3409 *** | 0.3176 | |

| 0.9033 | 0.7443 | - | 0.1807 | 0.5521 | |

| 0.0672 *** | 0.0633 *** | 0.8221 ** | - | 0.0988 *** | |

| 0.8507 | 0.7842 | 0.2119 | 0.0193 | - |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| 0.329 *** (4.18) | 1.6101 *** (3.05) | 1.154 *** (5.46) | 1.109 ** (0.77) | 0.922 (1.31) | 0.164 *** (4.05) | |

| 0.031 *** (10.29) | ||||||

| 0.041 *** (11.01) | ||||||

| 0.0257 *** (5.19) | ||||||

| −0.0545 *** (5.15) | ||||||

| 0.0134 [0.021] | 0.0138 [0.021] | 0.079 [0.002] | 0.084 [0.004] | −0.1556 * [0.024] | −0.158 [0.014] | |

| 0.027 *** [0.051] | 0.0205 ** [0.052] | 0.0256 *** [0.025] | 0.0904 ** [0.052] | 0.186 * [0.034] | 0.148 * [0.015] | |

| 0.035 *** [0.051] | 0.158 ** [0.032] | 0.741 *** [0.003] | 0.035 * [0.025] | 0.137 ** [0.044] | 0.145 * [0.021] | |

| −0.251 [0.007] | −0.108 [0.005] | −0.343 [0.004] | −0.445 [0.013] | 0.154 * [0.044] | 0.182 * [0.014] | |

| 3603.55 *** | 7.4 × 104 *** | 51203.04 *** | 2.6 × 105 *** | 15224.01 *** | 1544f8.09 *** |

| Panel A: Final Model Specification Results in Dynamic Form | ||

|---|---|---|

| Variables | Coefficients | p-Value |

| InGENCAP | 0.7095 | 0.0005 |

| InRGDP | 0.3351 | 0.0332 |

| InREN | −4.0021 | 0.0433 |

| InNREC | −0.5112 | 0.0044 |

| InECOF | 0.4328 | 0.0065 |

| Structural dates | ||

| I:1986 | −0.3566 | −0.4476 |

| S1:1999 | 0.4223 | 0.0338 |

| S1:2007 | −1.177 | 0.0000 |

| D1:2016 | 1.0432 | 0.0000 |

| R-Square | 0.8743 | |

| Adjusted R-Square | 0.7705 | |

| Panel A: Long-Run Coefficients | |||||

|---|---|---|---|---|---|

| REC | NREC | I:1986 | SI:1999 | SI:2003 | DI:2016 |

| −0.0911 *** | −0.7322 *** | −0.4103 ** | 0.2336 *** | −1.0033 *** | 0.8771 *** |

| Panel B: Diagnostic tests results | |||||

| AR 1–2 test | ARCH 1–1 test | Normality Test | Hetero test | Hetero-X | RESET 23 Test |

| 2.7524 [0.0825] | 0.4033 [0.5113] | 0.4211 [0.7211] | 1.1001 [0.4048] | 0.7433 [0.6022] | 0.3044 [0.7331] |

| Panel C: Cointegration test results | |||||

| −6.3422 ** | |||||

| Panel D: Non-linearity test results | |||||

| Chi-square 14.658 [0.4011] | F-form 0.65448 [0.7443] | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tabash, M.I.; Oseni, E.; Ahmed, A.; Elsantil, Y.; Daniel, L.N.; Lawal, A.I. Pathway to a Sustainable Energy Economy: Determinants of Electricity Infrastructure in Nigeria. Sustainability 2024, 16, 2953. https://doi.org/10.3390/su16072953

Tabash MI, Oseni E, Ahmed A, Elsantil Y, Daniel LN, Lawal AI. Pathway to a Sustainable Energy Economy: Determinants of Electricity Infrastructure in Nigeria. Sustainability. 2024; 16(7):2953. https://doi.org/10.3390/su16072953

Chicago/Turabian StyleTabash, Mosab I., Ezekiel Oseni, Adel Ahmed, Yasmeen Elsantil, Linda Nalini Daniel, and Adedoyin Isola Lawal. 2024. "Pathway to a Sustainable Energy Economy: Determinants of Electricity Infrastructure in Nigeria" Sustainability 16, no. 7: 2953. https://doi.org/10.3390/su16072953