Impact of Low-Carbon City Pilot Policies on Green Construction Industry Innovation

Abstract

:1. Introduction

2. Theoretical Analysis and Research Assumptions

2.1. Low-Carbon Cities Pilot Policies and Green Innovation for Businesses

2.2. Government Resource Allocation and Enterprise Green Innovation

3. Data Description and Model Construction

3.1. Data Description

3.1.1. Explanatory Variables

3.1.2. Control Variables

3.1.3. Scope of Research

3.1.4. Data Descriptive Analysis

3.2. Model Building

4. Empirical Analysis

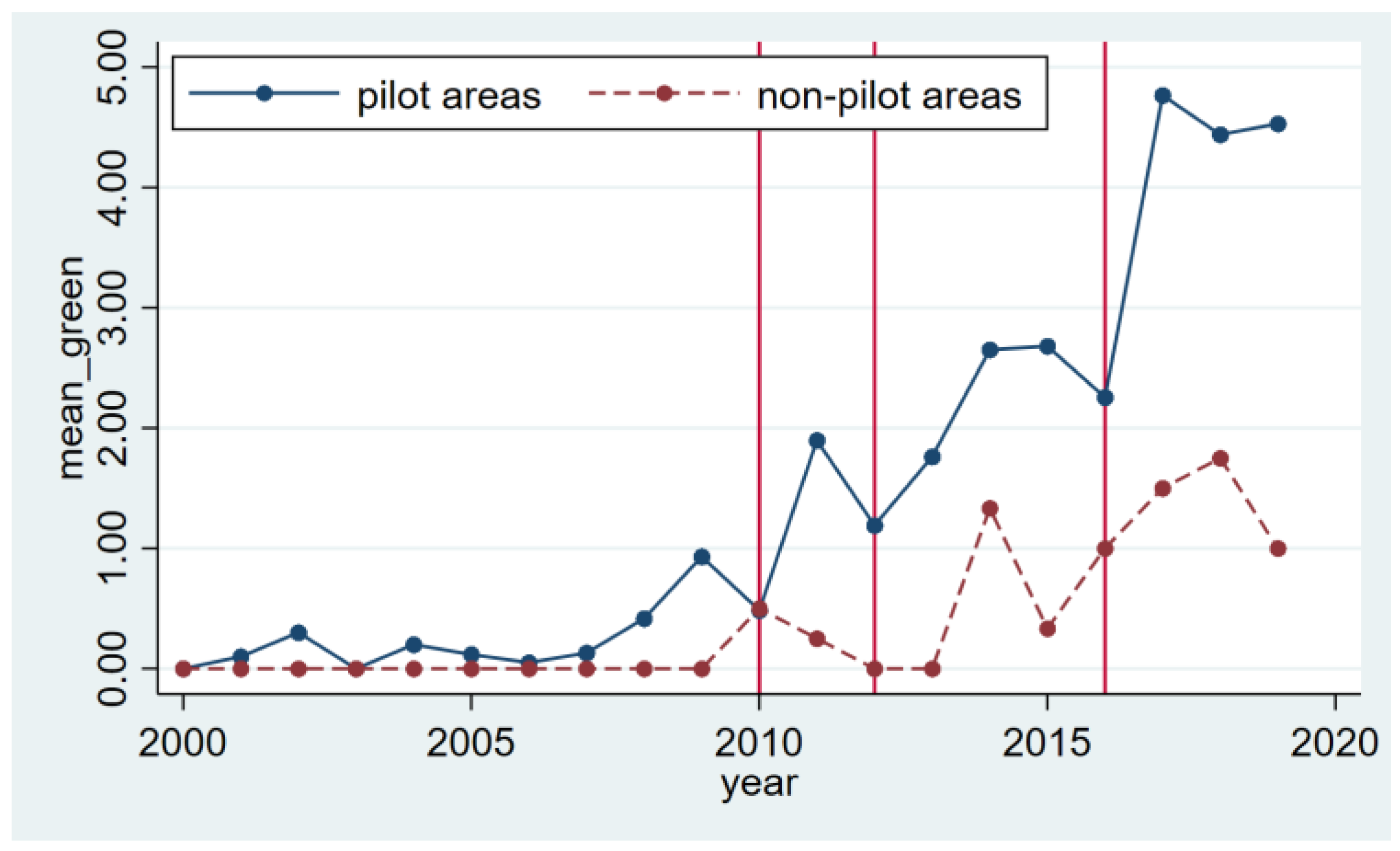

4.1. Parallel Trend Test

4.2. Basic Regression Results

4.3. Robustness Test

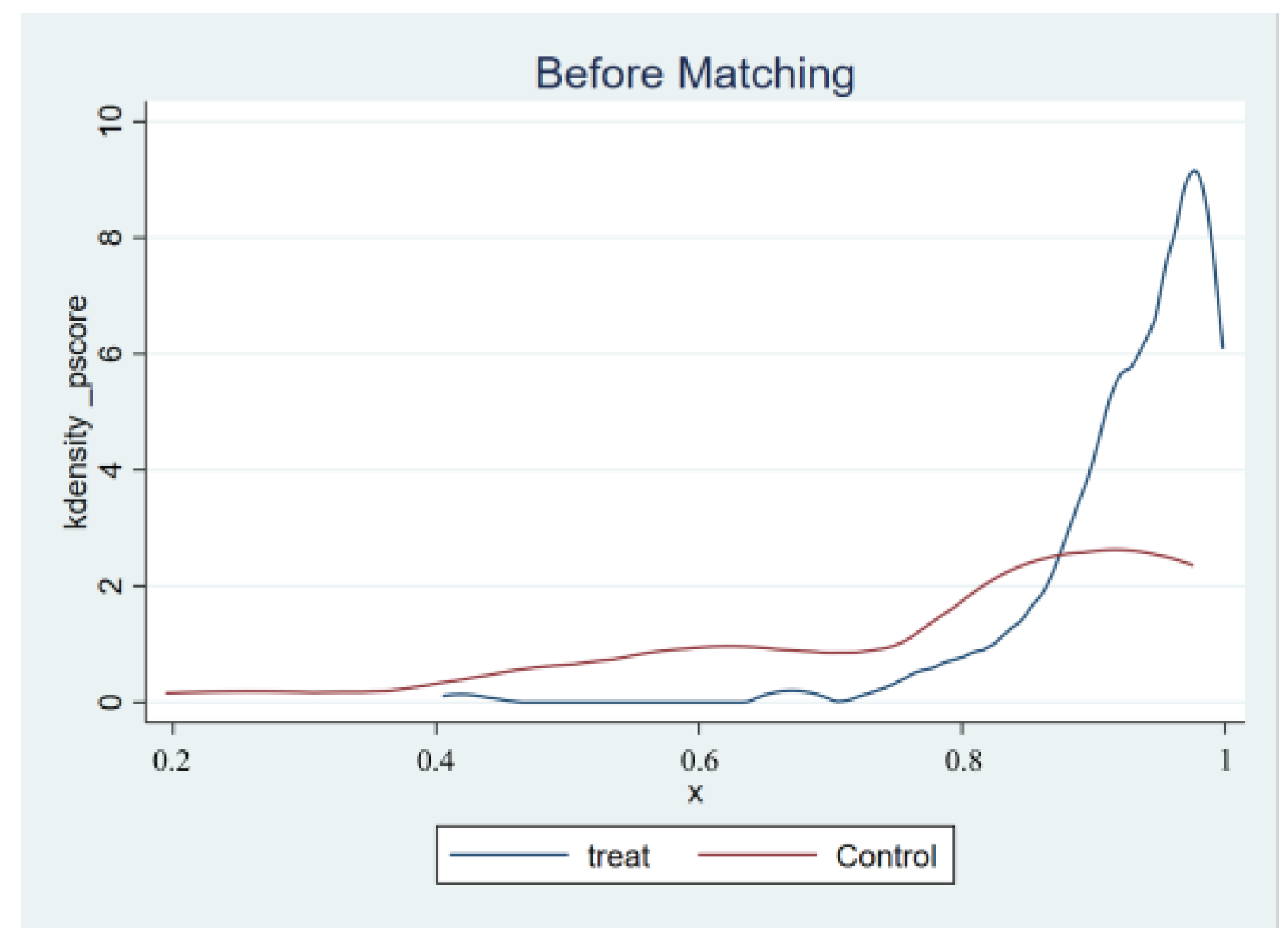

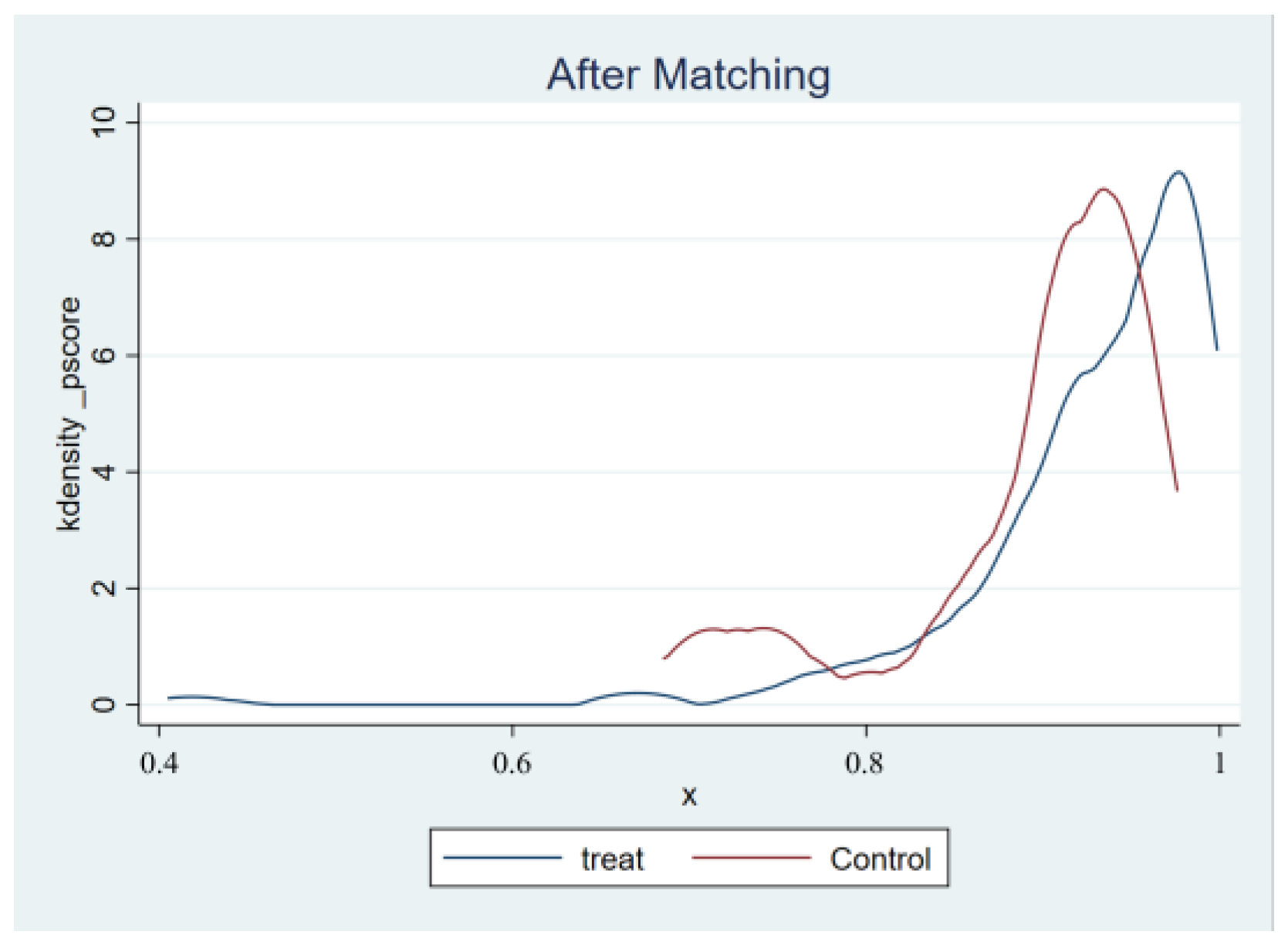

4.3.1. PSM-DID Testing

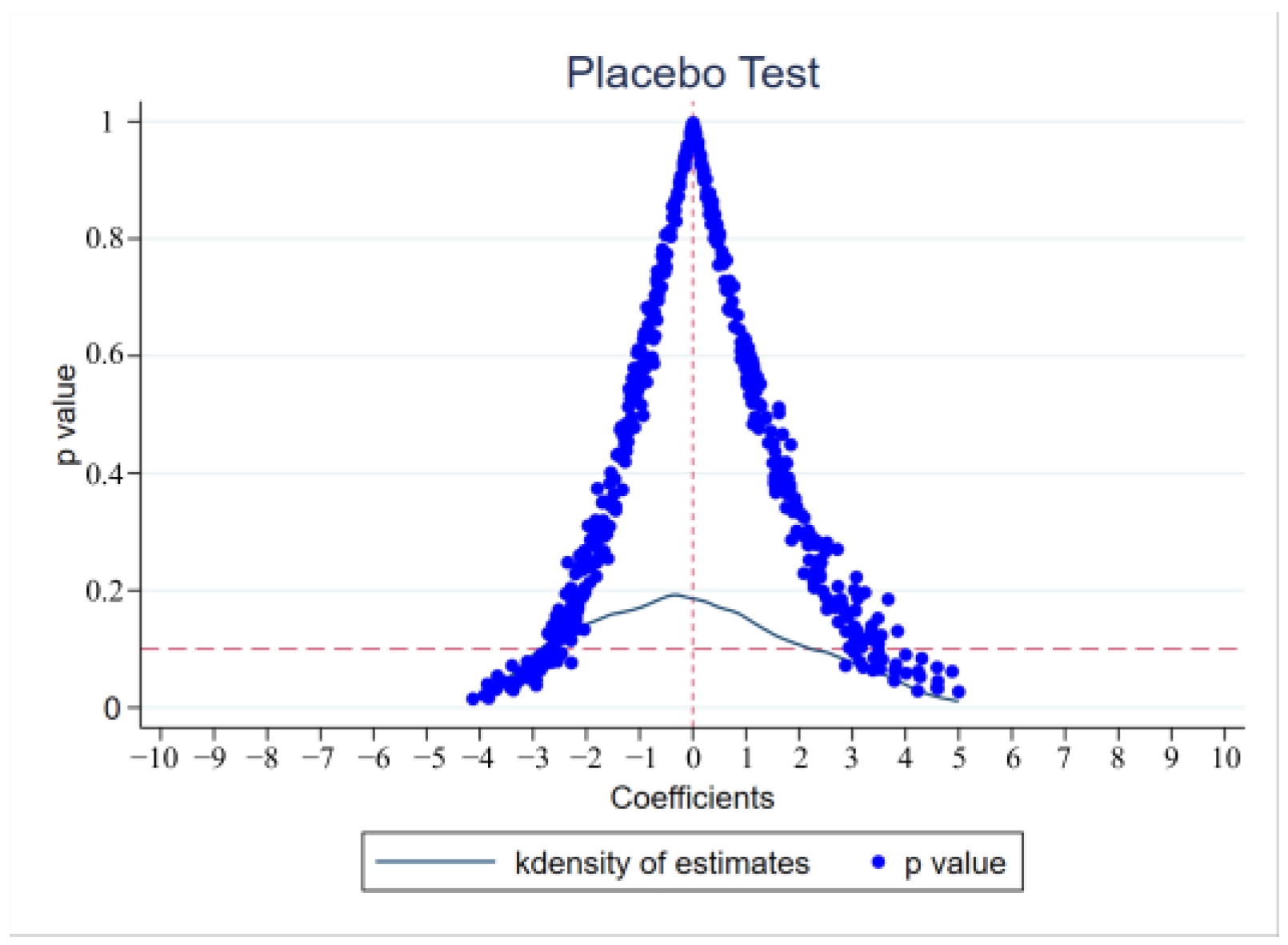

4.3.2. Placebo Testing

4.3.3. Replace the Explanatory Variable

4.4. Heterogeneity Analysis

4.4.1. Heterogeneity Analysis of Enterprise Ownership Types

4.4.2. Analysis of Differences in the Life Cycle of Enterprises

5. Research Conclusions and Policy Suggestions

5.1. Research Conclusion

5.2. Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Liu, H.; Li, J.; Sun, Y.; Wang, Y.; Zhao, H. Estimation Method of Carbon Emissions in the Embodied Phase of Low Carbon Building. Adv. Civ. Eng. 2020, 2020, 8853536. [Google Scholar] [CrossRef]

- Yao, Q.-Z.; Yin, Z.-M.; Wang, J.-M.; Li, J.-L.; Shao, L.-S. Calculation of Life Cycle Carbon Emissions of Residential Buildings. J. Phys. Conf. Ser. 2023, 2534, 012015. Available online: https://iopscience.iop.org/article/10.1088/1742-6596/2534/1/012015 (accessed on 20 April 2023). [CrossRef]

- Guo, X.-M.; Fang, C.-L. Spatio-temporal interaction heterogeneity and driving factors of carbon emissions from the construction industry in China. Environ. Sci. Pollut. Res. Int. 2022, 30, 81966–81983. [Google Scholar] [CrossRef]

- Xu, X.; Mumford, T.; Zou, P. Life-cycle building information modelling (BIM) engaged framework for improving building energy performance. Energy Build. 2021, 231, 110496. [Google Scholar] [CrossRef]

- Wei, Y.-M.; Chen, K.-Y.; Kang, J.-N.; Chen, W.-M.; Wang, X.-Y.; Zhang, X.-Y. Policy and Management of Carbon Peaking and Carbon Neutrality: A Literature Review. Engineering 2022, 14, 52–63. [Google Scholar] [CrossRef]

- Chen, F.; Zhang, W.-Y.; Chen, R.; Jiang, F.-F.; Ma, J.; Zhu, X.-H. Adapting carbon neutrality: Tailoring advanced emission strategies for developing countries. Appl. Energy 2024, 361, 122845. [Google Scholar] [CrossRef]

- Hou, Z.-M.; Xiong, Y.; Luo, J.-S.; Fang, Y.-L.; Haris, M.; Chen, Q.-J.; Yue, Y.; Wu, L.; Wang, Q.-C.; Huang, L.-C.; et al. International experience of carbon neutrality and prospects of key technologies: Lessons for China. Pet. Sci. 2023, 20, 893–909. [Google Scholar] [CrossRef]

- Beiser-McGrath, L.F.; Bernauer, T.; Prakash, A. Command and control or market-based instruments? Public support for policies to address vehicular pollution in Beijing and New Delhi. Environ. Polit. 2022, 32, 586–618. [Google Scholar] [CrossRef]

- Lamperti, F.; Napoletano, M.; Roventini, A. Green Transitions and the Prevention of Environmental Disasters: Market-Based vs. Command-and-Control Policies. Macroecon. Dyn. 2019, 24, 1861–1880. [Google Scholar] [CrossRef]

- Gao, Z.; Liu, H.; Xu, X.; Xiahou, X.; Cui, P.; Mao, P. Research Progress on Carbon Emissions of Public Buildings: A Visual Analysis and Review. Buildings 2023, 13, 677. [Google Scholar] [CrossRef]

- Wang, L.; Long, X.; Wu, K.-J.; Tseng, M.-L.; Cao, Y. Nexus amongst environmental regulations, carbon emission intensity and technological innovation in China’s construction industry. Environ. Sci. Pollut. Res. 2023, 30, 57915–57930. [Google Scholar] [CrossRef]

- Zhang, J.-X.; Ouyang, Y.; Ballesteros-Pérez, P.; Li, H.; Philbin, S.P.; Li, Z.-L.; Skitmore, M. Understanding the impact of environmental regulations on green technology innovation efficiency in the construction industry. Sustain. Cities Soc. 2021, 65, 102647. [Google Scholar] [CrossRef]

- Mollaei, S.; Amidpour, M.; Sharifi, M. Analysis and development of conceptual model of low-carbon city with a sustainable approach. Int. J. Environ. Sci. Technol. 2019, 16, 6019–6028. [Google Scholar] [CrossRef]

- Chen, J.-Y.; Luo, W.-J.; Ren, X.-H.; Liu, T.-Q. The local-neighborhood effects of low-carbon city pilots program on PM2.5 in China: A spatial difference-in-differences analysis. Sci. Total Environ. 2022, 857, 159511. [Google Scholar] [CrossRef]

- Feng, T.; Lin, Z.-G.; Du, H.-B.; Qiu, Y.-M.; Zuo, J. Does low-carbon pilot city program reduce carbon intensity? Evidence from Chinese cities. Res. Int. Bus. Financ. 2021, 58, 101450. [Google Scholar] [CrossRef]

- Li, X.; Huang, Y.; Li, J.; Liu, X.; He, J.; Dai, J. The Mechanism of Influencing Green Technology Innovation Behavior: Evidence from Chinese Construction Enterprises. Buildings 2022, 12, 237. [Google Scholar] [CrossRef]

- Wu, H.; Xia, S.; Long, X.; Chen, J.; Li, C.; Hao, Y. Innovation under environmental constraints: Does corporate environmental responsibility matter in green innovation? J. Inf. Econ. 2023, 1, 21. [Google Scholar] [CrossRef]

- Tang, J.; Li, S. How Do Environmental Regulation and Environmental Decentralization Affect Regional Green Innovation? Empirical Research from China. Int. J. Environ. Res. Public Health 2022, 19, 7074. [Google Scholar] [CrossRef] [PubMed]

- Liang, P.; Xie, S.; Qi, F.; Huang, Y.; Wu, X. Environmental Regulation and Green Technology Innovation under the Carbon Neutrality Goal: Dual Regulation of Human Capital and Industrial Structure. Sustainability 2023, 15, 2001. [Google Scholar] [CrossRef]

- Ren, G.; Chen, Y. Is the impact of environmental regulation on enterprise green technology innovation incentives or inhibitions? A re-examination based on the China meta-analysis. Front. Environ. Sci. 2023, 10, 3389. [Google Scholar] [CrossRef]

- Shen, T.; Li, D.; Jin, Y.; Li, J. Impact of Environmental Regulation on Efficiency of Green Innovation in China. Atmosphere 2022, 13, 767. [Google Scholar] [CrossRef]

- Chen, J.; Wang, X.; Shen, W.; Tan, Y.; Matac, L.M.; Samad, S. Environmental Uncertainty, Environmental Regulation and Enterprises’ Green Technological Innovation. Int. J. Environ. Res. Public Health 2022, 19, 9781. [Google Scholar] [CrossRef] [PubMed]

- Shen, W.-P.; Wang, Y.; Luo, W.-J. Does the Porter hypothesis hold in China? Evidence from the low-carbon city pilot policy. J. Appl. Econ. 2021, 24, 246–269. [Google Scholar] [CrossRef]

- Wu, H.-Q.; Hu, S.-M. The impact of synergy effect between government subsidies and slack resources on green technology innovation. J. Clean. Prod. 2020, 274, 122682. [Google Scholar] [CrossRef]

- Han, F.; Mao, X.; Yu, X.-Y.; Yang, L.-G. Government environmental protection subsidies and corporate green innovation: Evidence from Chinese microenterprises. J. Innov. Knowl. 2024, 9, 100458. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, X. The Impact of the Green Finance Reform and Innovation Pilot Zone on the Green Innovation—Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 7330. [Google Scholar] [CrossRef] [PubMed]

- Yu, F.; Guo, Y.; Le-Nguyen, K.; Barnes, S.J.; Zhang, W. The impact of government subsidies and enterprises’ R&D investment: A panel data study from renewable energy in China. Energy Policy 2016, 89, 106–113. [Google Scholar] [CrossRef]

- Eyva-de la Hiz, D.I.; Ferron-Vilchez, V.; Aragon-Correa, J.A. Do Firms’ Slack Resources Influence the Relationship between Focused Environmental Innovations and Financial Performance? More is Not Always Better. J. Bus. Ethics 2019, 159, 1215–1227. [Google Scholar] [CrossRef]

- Liu, Z.-M.; Li, X.; Peng, X.-R.; Lee, S. Green or nongreen innovation? Different strategic preferences among subsidized enterprises with different ownership types. J. Clean. Prod. 2020, 245, 118786. [Google Scholar] [CrossRef]

- Nie, C.; Li, R.; Feng, Y.; Chen, Z. The impact of China’s energy saving and emission reduction demonstration city policy on urban green technology innovation. Sci. Rep. 2023, 13, 15168. [Google Scholar] [CrossRef]

- Gao, D.; Wong, C.W.Y.; Lai, K.-h. Development of Ecosystem for Corporate Green Innovation: Resource Dependency Theory Perspective. Sustainability 2023, 15, 5450. [Google Scholar] [CrossRef]

- Wang, J.; Liu, Z.; Shi, L.; Tan, J. The Impact of Low-Carbon Pilot City Policy on Corporate Green Technology Innovation in a Sustainable Development Context—Evidence from Chinese Listed Companies. Sustainability 2022, 14, 10953. [Google Scholar] [CrossRef]

- Xu, X.; Yu, H.; Sun, Q.; Tam, V. A critical review of occupant energy consumption behavior in buildings: How we got here, where we are, and where we are headed. Renew. Sustain. Energy Rev. 2023, 182, 113396. [Google Scholar] [CrossRef]

- Rosenbaum, P.R.; Rubin, D.B. Constructing a Control Group Using Multivariate Matched Sampling Methods That Incorporate the Propensity Score. Am. Stat. 1985, 39, 33–38. [Google Scholar] [CrossRef]

- Li, H.; Wang, L. Research on the Impact of China’s National Innovation City Pilot Policy on High-Efficiency Agglomeration—Estimation and Analysis Based on DID Models. In Proceedings of the Fifth International Conference on Economic and Business Management (FEBM 2020), Sanya, China, 17–19 October 2020; pp. 37–41. [Google Scholar] [CrossRef]

- Gao, K.; Wang, L.; Liu, T.-T.; Zhao, H.-Q. Management executive power and corporate green innovation—Empirical evidence from China’s state-owned manufacturing sector. Technol. Soc. 2022, 70, 102043. [Google Scholar] [CrossRef]

- Yu, C.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Yang, X.; Mao, S.; Sun, L.; Feng, C.; Xia, Y. The Effect of Economic Policy Uncertainty on Green Technology Innovation: Evidence from China’s Enterprises. Sustainability 2022, 14, 11522. [Google Scholar] [CrossRef]

- Vladimirov, I.; Vicentiy, A.; Gavrilov, O. Modern cloud technologies for business and industry: Opportunities and trends for Russian & Global markets. J. Inf. Econ. 2023, 1, 18. [Google Scholar] [CrossRef]

- Li, L. Online consumers build trust with online merchants through real-time interaction function. J. Inf. Econ. 2023, 1, 17. [Google Scholar] [CrossRef]

- Ma, J.; Hu, Q.; Shen, W.; Wei, X. Does the Low-Carbon City Pilot Policy Promote Green Technology Innovation? Based on Green Patent Data of Chinese A-Share Listed Companies. Int. J. Environ. Res. Public Health 2021, 18, 3695. [Google Scholar] [CrossRef]

| Variable Name | Calculation Method | Data Source |

|---|---|---|

| Quantities of green patent applications | Number of searches cumulative | SIPO |

| Enterprise size | Logarithm of the total capital at the end of the year for enterprise | CSMAR |

| Enterprise age | The logarithm of the duration of the enterprise‘s listing | CSMAR |

| Tobin Q | The logarithm of enterprise’s Tobin Q | CSMAR |

| Enterprise debt | The amount of loans obtained by the enterprise in the current year/total assets | CSMAR |

| Earnings on total assets | Net profit of the enterprise/total assets | CSMAR |

| Capital intensity | Total assets of the enterprise/operating revenue | CSMAR |

| Shareholding ratio of the top ten shareholders | Shareholdings held by the top ten shareholders/total shares | CSMAR |

| Proportion of independent directors | Number of independent directors/total number of board members | CSMAR |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Number of green patent applications | 737 | 2.119 | 5.422 | 0 | 43 |

| Enterprise size | 737 | 6.29 × 1010 | 2.05 × 1011 | 1.07 × 107 | 2.03 × 1012 |

| Enterprise age | 737 | 8.176 | 6.424 | 0 | 27 |

| Tobin Q | 737 | 1.363 | 0.498 | 0.849 | 4.951 |

| Enterprise debt | 737 | 0.636 | 0.194 | 0.028 | 1.890 |

| Earnings on total assets | 737 | 0.229 | 0.057 | −0.859 | 0.502 |

| Capital intensity | 737 | 0.644 | 0.332 | 0.015 | 1.961 |

| Shareholding ratio of the top ten shareholders | 737 | 56.803 | 18.528 | 0.88 | 95.38 |

| Proportion of independent directors | 737 | 0.367 | 0.110 | 0 | 0.8 |

| Variable | (1) | (2) |

|---|---|---|

| Number of Green Patents | Number of Green Patents | |

| City. post | 2.641 ** | 3.325 *** |

| (2.799) | (3.021) | |

| Enterprise size | 0.696 | |

| (1.577) | ||

| Enterprise age | 1.118 ** | |

| (2.461) | ||

| Tobin Q | 3.837 ** | |

| (2.153) | ||

| Enterprise debt | −0.157 | |

| (−0.049) | ||

| Earnings on total assets | 13.895 * | |

| (1.834) | ||

| Capital intensity | −5.448 | |

| (−1.105) | ||

| Shareholding ratio of the top ten shareholders | −0.029 ** | |

| (−2.461) | ||

| Proportion of independent directors | 0.072 | |

| (0.011) | ||

| Individual fixation effect | Control | Control |

| Year fixed effect | Control | Control |

| N | 737 | 737 |

| R2 | 0.259 | 0.305 |

| Variable | Unmatched | Mean | % reduct | t-test | V(T)/ | |||

|---|---|---|---|---|---|---|---|---|

| Matched | Treated | Control | % bias | |bias| | t | p > |t| | V(C) | |

| Proportion of independent directors | U | 0.0399 | 0.3674 | 37.1 | 65.6 | 4.55 | 0.000 | 1.53 * |

| M | 0.3885 | 0.3777 | 12.8 | 1.63 | 0.104 | 0.98 | ||

| Shareholding ratio of top ten shareholders | U | 59.387 | 52.04 | 40.8 | 69.2 | 5.06 | 0.000 | 0.81 |

| M | 57.202 | 59.461 | −12.5 | −1.75 | 0.081 | 1.15 | ||

| Enterprise size | U | 23.424 | 22.447 | 59.7 | 70.0 | 7.31 | 0.000 | 1.78 * |

| M | 23.003 | 22.71 | 17.9 | 2.35 | 0.019 | 0.74 * | ||

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Number of Green Patents | Number of Green Invention Patents | Number of Green Utility Model Patents | |

| City. post | 3.325 *** | 3.109 *** | 0.216 |

| (3.021) | (5.323) | (0.414) | |

| Enterprise size | 0.696 | 0.319 | 0.378 * |

| (1.577) | (1.181) | (2.025) | |

| Enterprise age | 1.118 ** | 0.567 | 0.552 |

| (2.461) | (1.426) | (1.235) | |

| Tobin Q | 3.837 ** | 1.456 | 2.381 * |

| (2.153) | (1.433) | (2.004) | |

| Enterprise debt | −0.157 | −0.784 | 0.626 |

| (−0.049) | (−0.681) | (0.289) | |

| Earnings on total assets | 13.895 * | 6.065 ** | 7.830 |

| (1.834) | (2.443) | (1.360) | |

| Capital intensity | −5.448 | −3.559 | −1.889 |

| (−1.105) | (−1.342) | (−0.822) | |

| Shareholding ratio of the top ten shareholders | −0.029 ** | −0.007 | −0.022 ** |

| (−2.461) | (−1.626) | (−2.701) | |

| Proportion of independent directors | 0.072 | −1.300 | 1.372 |

| (0.011) | (−0.398) | (0.387) | |

| Individual fixation effect | Control | Control | Control |

| Year fixed effect | Control | Control | Control |

| N | 737 | 737 | 737 |

| R2 | 0.305 | 0.289 | 0.306 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| All Construction Enterprises | State-Owned Enterprises | Non-State-Owned Enterprises | |

| City. post | 3.325 *** | 2.933 ** | 0.014 |

| (3.021) | (2.312) | (0.004) | |

| Enterprise size | 0.696 | 0.627 | −0.271 |

| (1.577) | (0.874) | (−0.082) | |

| Enterprise age | 1.118 ** | 1.055 * | 0.040 |

| (2.461) | (1.952) | (0.017) | |

| Tobin Q | 3.837 ** | 3.136 ** | 3.895 |

| (2.153) | (2.366) | (1.161) | |

| Enterprise debt | −0.157 | −0.782 | 1.728 |

| (−0.049) | (−0.316) | (0.353) | |

| Earnings on total assets | 13.895 * | 14.075 ** | 11.427 |

| (1.834) | (2.177) | (0.466) | |

| Capital intensity | −5.448 | −10.543 ** | 2.237 |

| (−1.105) | (−2.538) | (1.009) | |

| Shareholding ratio of the top ten shareholders | −0.029 ** | −0.008 | −0.075 |

| (−2.461) | (−0.226) | (−1.053) | |

| Proportion of independent directors | 0.072 | −2.876 | −3.376 |

| (0.011) | (−0.482) | (−0.313) | |

| Individual fixation effect | Control | Control | Control |

| Year fixed effect | Control | Control | Control |

| N | 737 | 387 | 228 |

| R2 | 0.305 | 0.421 | 0.384 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Start-Up Enterprise | Growing Enterprise | Mature Enterprise | |

| City. post | −16.265 | 3.174 *** | 5.980 *** |

| (−1.120) | (2.928) | (6.571) | |

| Enterprise size | 1.194 | 0.721 * | 1.617 |

| (0.576) | (1.930) | (1.710) | |

| Enterprise age | 5.993 | 3.974 ** | 0.703 |

| (1.759) | (2.165) | (0.213) | |

| Tobin Q | 1.376 | 0.224 | −4.996 |

| (0.753) | (0.066) | (−0.979) | |

| Enterprise debt | −24.488 | 10.664 | −19.707 |

| (−0.586) | (1.246) | (−0.949) | |

| Earnings on total assets | 3.957 | −5.638 | −17.350 * |

| (1.408) | (−1.159) | (−2.022) | |

| Capital intensity | −0.058 ** | −0.032 *** | −0.045 |

| (−2.162) | (−2.933) | (−0.555) | |

| Shareholding ratio of the top ten shareholders | −18.273 *** | 0.670 | 1.231 |

| (−6.021) | (0.101) | (0.103) | |

| Individual fixation effect | Control | Control | Control |

| Year fixed effect | Control | Control | Control |

| N | 184 | 615 | 245 |

| R2 | 0.489 | 0.302 | 0.493 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ma, X.; Zhu, L. Impact of Low-Carbon City Pilot Policies on Green Construction Industry Innovation. Sustainability 2024, 16, 2964. https://doi.org/10.3390/su16072964

Ma X, Zhu L. Impact of Low-Carbon City Pilot Policies on Green Construction Industry Innovation. Sustainability. 2024; 16(7):2964. https://doi.org/10.3390/su16072964

Chicago/Turabian StyleMa, Xin, and Linjuan Zhu. 2024. "Impact of Low-Carbon City Pilot Policies on Green Construction Industry Innovation" Sustainability 16, no. 7: 2964. https://doi.org/10.3390/su16072964