Abstract

This study explores the nexus between digital financial inclusion and household participation in commercial insurance, utilizing data from the Peking University Digital Financial Inclusion Index and the 2018 CFPS database. Using Probit and Logit models, our research uncovers significant regional and risk -preference variations, emphasizing the influence of governance mechanisms. The study underscores the pivotal role of digital participation in a sustainable governance mechanism in shaping financial behavior, as well as the importance of advocating for regulatory interventions, enhanced financial literacy, and infrastructure development to foster equitable insurance access. Moreover, positive determinants, such as education level and social insurance participation, are identified, while discretionary spending emerges as a barrier. This study advocates for expedited digital financial inclusion initiatives to increase financial literacy with strengthened regulatory oversight and governance mechanisms which would ensure sustainable regional development and insurance market resilience.

1. Introduction

Since 2017, the Chinese insurance industry has entered a stage of saturated governance enhancement, leading to questions regarding whether the sustainable performance of the insurance industry can be guaranteed. In this research, governance is defined as the workable mechanism for sustainable performance. In this governance perspective, the Chinese insurance market has also been profoundly influenced by the transformation of digital participation and the digital inclusion of the insurance industry. According to data from the China Banking and Insurance Regulatory Commission (CBIRC), in 2022, Chinese original insurance premium income reached 4.7 trillion yuan, marking a year-on-year increase of 4.58%. Property insurance generated original premiums amounting to 1.27 trillion yuan, showing a growth rate of 8.92% compared to the previous year, whereas life insurance contributed original premiums totaling 3.42 trillion yuan, growing at a rate of 3.1%. As for institutional demographics within the insurance system, there were 237 insurance institutions recorded in 2022, maintaining the same number as in 2021. With respect to sustainable governance in the insurance industry in 2022, China’s insurance penetration stood at 3.88%, while the insurance density was 3326 yuan per capita, indicating a substantial disparity compared to the global average during the same period. Collectively, these data suggest that, over recent years, the Chinese insurance sector has experienced steady growth in terms of its original premium volume, yet it continues to lag significantly behind international benchmarks in terms of both penetration and density levels, implying that insurance has reached a saturation point. In light of this, the question of whether it could take off again, for the purpose of enhancing sustainable growth to support regional development, could be crucial for China to be able to steer its economic structure toward a more advanced stage.

The low participation rate in household commercial insurance is one of the main reasons for the unsustainable development of China’s insurance industry, and the slow growth rate of original premiums is another reason [1]. Thus, in order to promote the sustainable development of China’s insurance industry, it is necessary to first increase the participation rates of household commercial insurance. Analyzing the factors affecting household commercial insurance participation has led most scholars to focus on micro factors, such as individuals, families, and social relationships, and neglect the impact of macro factors, such as digital financial inclusion, on household commercial insurance participation and/or regional differences. Digital financial inclusion is an innovative platform for traditional financial services, through the integration of modern digital technology into financial services. It can effectively reduce financial transaction costs and improve the efficiency of financial services, as well as greatly enhance the convenience of the participants and sharing of the premium. The development of digital financial inclusion has enabled more and more people to enjoy the fruits of financial development, but the impact of digital financial inclusion on the participation in commercial insurance is not yet clear in China. Therefore, the purpose of this paper is to clarify the governance mechanism of digital inclusion in the insurance industry for the sustainable development of lagged regions.

The rest of the paper is structured as follows. Section 2 describes the factors affecting commercial insurance participation and the current state of digital financial inclusion. It also organizes the relevant literature for our model setting. Section 3 provides a logical structure for the articulation on our governance mechanism. Section 4 presents the probit model estimation methodology with a data collection process. Section 5 presents the empirical test result with its implications. Section 6 concludes the research with some policy suggestions.

2. Literature Review

With the development of the national economy, as well as the improvement of residents’ living standards and wealth management consciousness, the role of insurance is gradually recognized by the public, and the use of insurance is more and more extensive [2]. Insurance is an important means of risk management, which can reduce the uncertainty of future economic losses to a certain extent, in addition to the economic compensation on these losses. Insurance also plays a role in capital financing and social management for sustainable development [3]. According to the nature of insurance, it can be divided into two categories: social insurance and commercial insurance. Social insurance can provide basic protection for survival, while the protection function of commercial insurance is more comprehensive, can effectively play a complementary role, and, thus, strongly supports the development of commercial insurance to reduce the financial burden of the state, improve the quality of risk protection, and improve the multi-level social insurance system [4]. There are many factors affecting participation in commercial insurance, and, based on these factors, they can be categorized into the following three groups, according to the existing research.

The first category of factors affecting commercial insurance participation is mainly made up of the basic factors pertaining to individual and family characteristics. Factors such as age, education level, family economic status, and demographic structure are relevant for commercial insurance participants [5,6]. In addition, families who predict that their future health is not optimistic are more likely to make the decision to purchase commercial insurance; so, the level of individual health perception is also one of the factors affecting the purchase of insurance products [7]. Individual and family financial knowledge also affects commercial insurance purchasing decisions, and rich financial knowledge is conducive to increasing the participation rate and degree of participation in commercial insurance [8]. Guven employed Dutch data to analyze the relationship between residents’ subjective well-being and their participation in insurance schemes. The research revealed a statistically significant positive correlation between levels of happiness and involvement in insurance coverage [9]. Higher individual incomes and increased assets also increase the probability of purchasing commercial insurance, but this effect only becomes apparent after wealth reaches a level sufficient to meet the basic standard of living [10]. In addition, a household’s participation in social health insurance affects its decision to purchase medical commercial insurance [11].

The second category of factors affecting commercial insurance participation is mainly made up of social factors, such as social relations and social behavior. Social class can promote residents’ participation in commercial insurance through the mechanisms of comparison and the herd mechanism, and social capital can motivate residents to participate in commercial insurance through the mechanisms of norm regulation, information access, and perceived value [12,13]. Social interaction can promote the exchange of financial knowledge and enhance trust in commercial insurance, which in turn enhances the level of household commercial insurance participation. But, the positive impact of social interaction on household commercial insurance participation varies depending on factors such as educational level and income level [14]. With the development of Internet technology, online social interaction has also become a favorable way to promote household participation in commercial insurance [4].

The third category of factors affecting commercial insurance participation is mainly made up of macro-environmental factors. Although there is less literature exploring the factors affecting commercial insurance participation in the macro context, several researchers found certain macro-environmental factors to have a certain impact on commercial insurance participation. Increasing air pollution, coupled with rising concern among residents, can stimulate commercial health insurance participation [15,16]. The aging situation has an inverted U-shaped effect on household commercial health insurance participation, and the influence trend is more obvious in urban households [17,18]. Population mobility can promote commercial insurance participation, and population mobility promotes commercial health insurance participation more than it promotes commercial pension insurance participation [19].

Digital financial inclusion has had an ineradicable impact on the economic life of residents, especially in developing countries, such as those with emerging economies. Scholars have examined research on emerging markets, such as India, with findings indicating that national policies regarding the digital economy sphere can bridge the digital divide and foster participation in commercial insurance among residents [20]. Studies in the Baltic region have shown that digital platforms and similar methods optimize consumer behavior in purchasing insurance [21]. In terms of ubiquitous characters, digital inclusive financial systems can also increase the performance of both employment and entrepreneurship rates of residents [22], especially regarding the employment and entrepreneurial behavior of disadvantaged groups, thus contributing to the inclusive growth of China’s residents’ income [23]. In terms of behavior, the development of digital inclusive financial systems in the insurance industry has created a substitute for traditional private lending behavior, inhibiting the demand and supply of the private lending market and leading to increased difficulty in private lending among civilians [24]. However, it assists and encourages residents’ access to formal credit through digital payment channels, and the promotion of formal credit by means of digital inclusive finance is most significant in less-developed regions and among disadvantaged groups [25,26]. Researchers have also concluded that the development of digital inclusive finance has, to some extent, had a stimulating effect on the increase in the consumers’ demand for formal credit in rural areas, but has had the opposite effect on producers’ demand for formal credit [23]. In terms of income and wealth, digital inclusive finance can improve the standard of living of residents, increase household income, and improve the quality of life of residents through the protection effect, smoothing effect, and value-added effect, in which the third-party payment business has a particularly obvious effect on the improvement of the quality of life of the residents [27]. Although digital inclusive finance is conducive to the growth of household wealth, we should always pay attention to impact of the digital divide on this effect. Although digital inclusive finance is beneficial to the growth of household wealth overall, it is also important to pay attention to the weakening effect created by the digital divide [28]. In terms of consumption, digital inclusive finance can enhance residents’ consumption level by providing convenient payment methods and alleviating liquidity constraints [29,30]; it can also upgrade residents’ consumption by driving the development of the tertiary industry [31].

However, the roles played by digital credit business, digital payment business, and digital investment business in stimulating rural consumption vary, and the impact of digital inclusive finance on rural consumption in different regions varies as well. Businesses in the region play different roles in boosting rural consumption in different regions [32]. In terms of anti-poverty, digital inclusive finance can alleviate the financial vulnerability of rural households [33]. Digital inclusive finance can also alleviate residential poverty by increasing credit availability [34], and the investment and financing function of digital inclusive finance plays a key role in reducing the vulnerability of rural households to poverty [35]. In addition, digital inclusive finance can promote and enhance the active participation of rural households in the financial market, thus effectively alleviating rural financial exclusion [36]. Furthermore, the purchase of commercial insurance is an important embodiment of participation in the financial market, so, in light of this, what impact will the development of digital inclusive finance have on the participation of residents in commercial insurance? This is the research question we will attempt to answer in this paper.

By combing the above research results, it can be seen that, firstly, there is a rich collection of literature on the influencing factors of commercial insurance participation, but it mainly focuses on analyzing the influence of micro-factors, such as individual and household characteristics, on commercial insurance participation. The research on the influence of factors such as social capital and social interaction on commercial insurance participation is also emerging, but such social factors are still essentially the characteristics embodied by the individual or the family, and there is little literature on the influence of macro-environmental factors on commercial insurance participation. Second, the impact of digital financial inclusion on residents’ economic life involves many aspects, but there are still few studies analyzing the impact of digital financial inclusion on households’ commercial insurance participation. Therefore, based on this comparison of the previous literature, this paper will try to explore the impact of digital financial inclusion on household commercial insurance participation from the perspective of macro-environmental factors and, on this basis, put forward suggestions to promote the sustainable performance of commercial insurance.

3. Theory and Mechanism Analysis

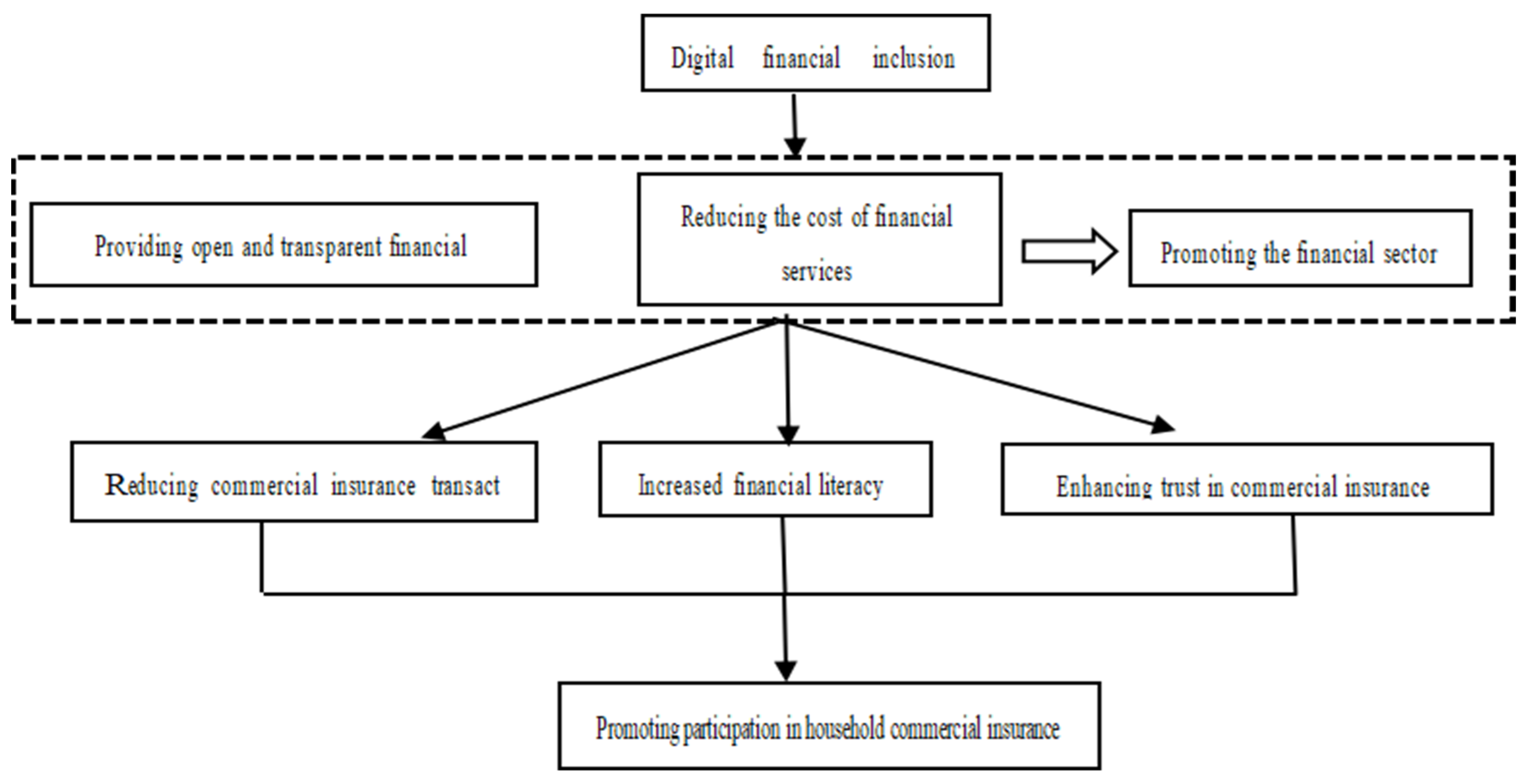

According to transaction cost theory, when residents consider purchasing commercial insurance, households weigh these costs against the benefits of transferring health risks through insurance [37]. Additionally, smoother and more convenient transaction channels can enhance the insurance transaction process. In this process, household governance aims to achieve optimal resource allocation, including risk transfer through insurance and other means. Additionally, digital inclusive finance provides smoother, more convenient transaction channels, thus enhancing the insurance transaction process. Currently, the main manifestation of digital inclusive finance is mobile payment, Internet insurance, Internet credit, etc., which relies on perfect infrastructure, open national policies, and rapidly advancing digital technology, and is able to provide fair, open, and transparent financial services so that different groups with varying demands for purchasing insurance can more conveniently learn about commercial insurance and enhance the commercial insurance trust level. Digital financial inclusion can also serve to increase household financial knowledge [38], and the growth of financial knowledge can help individuals effectively allocate financial assets.

The governance mechanism in this research can be explained as follows: First, individuals with more financial knowledge represent families with higher financial literacy, and higher financial literacy causes families to optimize wealth management in a more rational way; thus, commercial insurance is their best choice for transferring unavoidable risks. Second, when families with higher financial knowledge choose commercial insurance, they have an in-depth and comprehensive understanding of the terms and conditions of commercial insurance, which reduces the information asymmetry and lowers the transaction cost. In addition, based on the support of big data, Internet insurance organizations can locate potential customers more quickly, conveniently, and accurately, according to their consumption ability and their consumption habits in relation to the subject of the information. This makes it possible to provide customized marketing of high-quality services, which stimulates the loyalty of customers to participate in commercial insurance and enhances their trust in insurance organizations. Finally, digital financial inclusion provides a more convenient way to purchase commercial insurance, thus reducing the cost of insurance services. It is also able to expand the scope of insurance services, which in turn allows more residents to enjoy insurance products or services with accurate demand and transparent prices, and, to a certain extent, it alleviates the most common reasons that people reject commercial insurance [39]. In summary, the theoretical mechanism of digital inclusive finance to promote household commercial insurance participation is shown in Figure 1.

Figure 1.

Mechanism of digital financial inclusion on the commercial insurance participation.

There are many factors affecting commercial insurance participation, and this paper introduces variables at the individual, household, and regional levels to comprehensively examine the impact of digital financial inclusion on household commercial insurance participation. Based on the arguments found in Figure 1, this paper proposes the first research hypotheses:

H1

: The development of digital inclusive finance can increase household commercial insurance participation.

China is vast in territory and population, with significant disparities between urban and rural development. Both the extent of digital financial development and participation in household commercial insurance exhibit substantial variations. Therefore, this paper posits the second research hypothesis:

H2:

There is an urban–rural difference in the impact of digital financial inclusion on household commercial insurance participation, and the impact on rural areas is greater than that on urban areas.

The eastern region of China is economically developed, followed by the central region, while the western region experiences slower development, resulting in significant regional disparities. There are regional variations in the development of digital finance across different areas, which may lead to distinct impacts on household commercial insurance. Hence, this paper presents the third research hypothesis:

H3:

There is a regional effect caused by digital financial inclusion, and the effect on household commercial insurance participation is greater in the western region than in the east-central region.

Residents have varying attitudes towards risk. Risk-averse individuals exhibit a strong tendency to avoid uncertainty risks. Residents in this group place greater emphasis on stability and security and are more inclined to protect themselves through risk transfer. Therefore, this paper proposes the fourth research hypothesis:

H4:

There is a risk preference effect caused by digital financial inclusion, and the impact on the participation of risk-averse groups in household commercial insurance is greater than that of risk-preferring groups.

4. Model Construction and Data Sources

Data Sources

The “Digital Inclusive Finance Index” used in this paper comes from the huge amount of data provided by Ant Group Research Institute, and the Digital Finance Research Center of Peking University constructs the index system from multiple dimensions and compiles it together. This process can better reflect the breadth and depth of financial inclusion and map out the degree of financial inclusion development in each province (region and city) in China.

The Chinese Family Panel Survey (CHFS) is conducted every two years. The latest data is updated to 2020. However, due to the severe COVID-19 pandemic at that time, the survey did not take the form of on-site follow-up visits but instead was conducted using remote methods, such as telephone interviews. The data quality suffered significantly as a result. Therefore, this paper uses data from 2018 for analysis. Moreover, 2018 was also a year of rapid development in China’s digital economy, making research on the impact of the digital economy on insurance more convincing. Meanwhile, we also use the China Family Tracking Survey (CFPS) 2018 database, which has the advantages of wide coverage, comprehensive information, and large sample size, etc. The CFPS data are distributed within 25 different provinces across the country, and the level of digital financial inclusion development is diverse in different provinces, which can be matched by provinces to examine the impact of digital financial inclusion on commercial insurance. In order to effectively attenuate potential reverse causality and eliminate endogeneity, we divide the core explanatory variables by 100 and treat them with a one-year lag, i.e., the CFPS2018 data matches the 2017 digital financial inclusion index (Table 1), remove missing values and outliers in the samples, and ultimately obtain data for a sample of 2644 households. The district-level variables are derived from the per capital net income of regions and districts published by the National Bureau of Statistics (NBS).

Table 1.

Digital Financial Inclusion Index (DFIIC) 2017.

- (1)

- Core explained or outcome variables: the research objective of this paper is to examine the impact of the development of digital financial inclusion on commercial insurance; so, whether households participate in commercial insurance (Cin) is used as an explained variable. In the CFPS 2018 questionnaire, when the household’s commercial insurance expenditure in the past 12 months is greater than 0, it is regarded as participating in commercial insurance and assigned a value of 1. When the household’s commercial insurance expenditure in the past 12 months is equal to 0, it is regarded as not participating in commercial insurance and assigned a value of 0.

- (2)

- Core explanatory or independent variables: the research object of this paper is digital inclusive finance; the Peking University Digital Financial Inclusion Index provides a good measure, and the data are authoritative and reliable and can accurately reflect the recent development of China’s inclusive finance. In order to attenuate the endogeneity problem caused by reverse causality, this study divides China’s 2017 Digital Financial Inclusion Index (DFIIC) by 100 and lags it by one year to obtain the Digital Financial Inclusion Development variable (DFIIC), which is used as the core independent variable (the 2018 Chinese Family Panel Studies data correspond to the financial inclusion development variable as the 2017 Digital Financial Inclusion Index divided by 100).

- (3)

- Control variables: observable individual-, household-, and region-level characteristics all have an impact on commercial insurance participation. Individual-level control variables include age, gender, years of education, marital status, health, risk perception, party membership, relationship, social security, and private lending. The control variables at the household level include household size, log value of total household expenditure, log value of total household income, log value of the current year’s asset value of the house, and the proportion of favor spending in total expenditure; the control variables at the regional level include the per capita net income of the district and county in which the household is located (Ln pci), as well as the province, area, etc. The specific variables and assigned values are shown in Table 2.

Table 2. Descriptive statistics of variables.

Table 2. Descriptive statistics of variables.

5. Empirical Results and Their Implications

5.1. Methodology

Based on the structural characteristics of the data and the characteristic limits of binary variables, the probit model is used to explore the impact of digital inclusion on insurance participation. When is the cumulative distribution function of insurance participation, then there is:

Thus, the probit model can be used as follows:

where , is the explained variable, i.e., whether or not to participate in commercial insurance, with 1 indicating that the sample currently has commercial insurance and 0 indicating that the sample is not currently participating in commercial insurance; represents the core explanatory variable coming from the Digital Financial Inclusion 2017 Index; and represents all the other explanatory variables except the core explanatory variable, including the control variables at the individual, household, and regional levels.

In order to test the robustness of the empirical results, this paper uses the Logit model for the robustness test, and, to further exclude the endogeneity problem, the core explanatory variables will be divided by 100 and lagged by 1 year, i.e., CFPS2018 data matches the 2017 Digital Financial Inclusion Index, so the following model is considered:

Equation (3), in which = 1 indicates participation in commercial insurance, = 0 indicates no participation, (i = 1, 2, 3, …, n) indicates the relevant variables affecting participation in commercial insurance, and is the coefficient of each relevant variable. The probability ratio of the selection can be obtained from Equation (3):

Equation (4) is the ratio of the probability that the head of household is willing to participate in commercial insurance to the probability that he or she is not willing to participate in commercial insurance, and the Logit regression model is obtained by taking logarithms on both sides of Equation (4) at the same time:

5.2. Benchmark Regression

Before conducting the regression model of the impact of digital financial inclusion on commercial insurance participation, we first performed a multicollinearity test. The results of the variance inflation factor (VIF) showed that the VIF values of all variables were less than 3, indicating the absence of multicollinearity issues. The regression estimates from the probit model can be found in Table 3. First, only the digital financial inclusion variable is added to the model (1), and it is found that digital financial inclusion significantly increases commercial insurance participation; then, the individual-level control variables are added in the model (2), and it is found that the impact of digital financial inclusion on commercial insurance participation is still significantly positive at the 1% level. Further analysis reveals that both education level and participation in social insurance can increase the participation rate of commercial insurance by 0.062 and 0.145%, respectively, indicating that the participation rate in commercial insurance relies, to a certain extent, on a higher level of knowledge and a more comprehensive understanding of insurance, and, at the same time, those who have social insurance are more inclined to participate in commercial insurance as well; these two are complementary to each other, and together they enhance the role of risk aversion.

Table 3.

Results of the impact of digital financial inclusion on business insurance participation.

It is worth noting that, by increasing the control variables at the household level, the positive effect of digital financial inclusion is still significant, and total household income and total household expenditure also play a positive role, but the expenditure on favors (EXP) significantly inhibits the participation in commercial insurance, statistical significance was negative at a 5% level in model (3), because the expenditure on favors has the function of risk-sharing and the nature of mutual assistance, which is regarded as a kind of informal risk-sharing mechanism, similar to the role played by commercial insurance. Finally, adding the control variables at the regional level in model (4), the positive effect of the explanatory variables is still significant. Per capita net income of the districts and counties also promotes the participation in commercial insurance. Overall, the comprehensive study based on models (1) and (4) shows that digital financial inclusion effectively promotes participation in commercial insurance, which confirms our hypotheses.

5.3. Endogeneity Test

The use of the lag term of the independent variable can effectively carry out the endogeneity test, and, in the benchmark regression test, the first-order lag term is used and the endogeneity problem caused by reverse causality is weakened. In order to test whether the endogeneity problem can be solved, this research chooses to also use the second-order lag term and carry out regression tests, and the results of the endogeneity test are shown in Table 4. Without adding control variables, digital financial inclusion has a positive impact on commercial insurance participation in model (1), and, after adding control variables, its statistical significance became much higher at a 1% level. This shows that digital financial inclusion does play a proactive role in promoting the possibility of choosing commercial insurance participation.

Table 4.

Results of endogeneity test.

5.4. Heterogeneity Test

Because of the existence of urban–rural differences, regional differences, and individual differences in risk perceptions, this paper further investigates the heterogeneity of urban–rural, regional, and risk perceptions to explore the impact of digital financial inclusion on commercial insurance participation in different types of subgroups. This heterogeneity among the insurance participants could be important for customizing digital inclusive finance for sustainable governance.

First, taking the nationally published 2018 urban–rural division code as the standard, the entire CFPS 2018 household sample is divided into urban samples as well as rural samples, of which the number of urban samples is 1123 and the number of rural samples is 1507. After controlling for individual-, household-, and region-level control variables, the results of the probit regression model in Table 5 show that the positive digital financial inclusion’s impact on commercial insurance participation still exists in both rural and urban households, but the positive impact of digital financial inclusion on commercial insurance participation in rural households is much larger than that in urban households, confirming that hypothesis H2 is accepted. Secondly, according to the quasi-criteria published by the National Bureau of Statistics for the division of China, the whole sample is divided into three sub-samples of eastern, central, and western regions, and its empirical results are shown in Table 5 as well. The impact of digital financial inclusion on commercial insurance participation in the western region is significantly positive at the 1% level, while the significance level of the eastern region is slightly lower than that of the western one. The impact of digital financial inclusion in the central region is the weakest, more strongly supporting the idea that rural areas in the western region are best suited for digital inclusive financing in terms of feasibility or governance. Since rural and western regions are all less-developed regions, it follows that digital financial inclusion in less-developed regions has a more significant positive effect on participation in commercial insurance, thus confirming hypothesis H3.

Table 5.

Results of heterogeneity test.

The results in Table 5 imply that the digital inclusive financial system in less-developed regions may not currently seem to be sound, and the development of commercial insurance is relatively weak there, but the development potential is larger compared to the east-central region and the urban areas. Therefore, the effect of digital inclusive finance on participation in commercial insurance in the western region shows an extremely significant positive impact. Finally, based on the risk preference of the head of the household, the entire sample of CFPS2018 is divided into risk-averse and risk-preferring groups. As shown by the results of the heterogeneity test in Table 5, the positive effect of digital financial inclusion on participation in commercial insurance is most significant in risk-preferring households, reaching a significance level of 1%, with a much higher impact than that of the risk-adverse group, which is probably caused by the fact that risk-adverse households are more conservative and pay more attention to the shortcomings of commercial insurance in family risk protection; this is because commercial insurance is not 100% guaranteed to pay out, and paying insurance premiums does not mean that they will definitely receive insurance benefits. But risk-averse families focus on the convenience brought by digital financial inclusion and, at the same time, pay more attention to methods of wealth management brought by financial literacy and prefer to participate in commercial insurance to mitigate risks. In summary, hypothesis H4 is accepted, implying that there is a risk preference effect created by digital inclusive finance that has a greater impact on participation in commercial insurance by the risk-preferring group than the risk-averse group.

5.5. Robustness Test

In order to ensure the robustness of the explanatory power of the indicators, and to maintain a more stable interpretation of the measurement results, this paper uses the Logit model to conduct a robustness test based on the measurement model in Equation (5), Table 6 showing that, both with and without the control variables, digital financial inclusion has a strong positive impact on participation in commercial insurance, all of which are significantly positive at the level of 1%, which further suggests that digital financial inclusion greatly contributes to participation in commercial insurance, and that such a role is not only significant but also robust.

Table 6.

Robustness test results.

6. Conclusions

This study revealed how governance structures supported by digital inclusive finance can enhance their impact on insurance participation. Empirical results, after adding control variables at the individual, household, and regional levels, indicate that digital financial inclusion has a higher facilitating effect on participation in commercial insurance by those in rural areas, those in less-developed regions, and those with risk-aversion perceptions. These research conclusions are similar to those of Li Xiao et al. [40], indicating that digital inclusive finance indeed promotes the development of commercial insurance. Our research implies that developing countries should take a more proactive role on behalf of the public in order to mitigate the digital divide for sustainable development not only in the insurance industry but also in its sustainable governance of the policies.

The impact of digital financial inclusion on participation in commercial insurance exhibits heterogeneous structural differences due to urban–rural divides, regional disparities, and risk preferences. Based on analyses from the perspective of urban–rural divides, the impact of digital financial inclusion on participation in commercial insurance is significantly higher in rural areas than in urban areas. Regional analysis reveals that the influence of digital financial inclusion in the western regions surpasses that in the eastern and central regions, indicating a more pronounced positive effect of digital financial inclusion in underdeveloped areas on participation in commercial insurance. From the standpoint of risk preferences, the impact of digital financial inclusion on participation in commercial insurance is higher among risk-seeking individuals compared to risk-averse groups. This paper also examines other factors influencing participation in commercial insurance, including individual-level education levels, degree of participation in social insurance, household-level total income and expenditure, and regional-level per capita net income in counties. Notably, interpersonal expenditures exert inhibiting effects on participation in commercial insurance.

The digital economy of emerging economies is in a rapid development stage, and the potential of the insurance market still needs further exploration, while the financial system requires regulated development. Therefore, this paper proposes the following policy recommendations. Firstly, the government should expedite the development of digital financial inclusion, with particular emphasis on underserved areas, in order to enrich the feasibility and diversity of insurance services offered by insurance institutions, thereby promoting sustainable governance that will lead to the successful performance of the insurance industry. In general, based on the digital divide theory, it can be argued that a more developed area with highly perceived digital inclusion could create more successful economic development. However, this paper showed that the less-developed areas, which are rarely covered by digital perception, can be encouraged to participate in insurance by receiving access to digital inclusive finance, implying that a more proactive role for governments in developing countries to mitigate the gap of digital access could result, at the very least, in better governance mechanisms regarding the insurance industry.

Secondly, it is necessary to improve the financial market system and restructure the insurance trust market. Relevant authorities should strengthen regulatory oversight of insurance products while intensifying efforts to protect consumer privacy and cracking down on false information and online fraud, thereby fostering a conducive online environment for consumers. Lastly, efforts should be made to continually increase residents’ income, enhance the dissemination of financial knowledge, mitigate information asymmetry, and improve the resource allocation efficiency of financial markets. It is crucial to steadily intensify innovation and development of digital financial inclusion in a prudent manner, as this represents the inevitable path towards enhancing the quality and quantity of development in financial markets in developing countries such as China.

Author Contributions

Conceptualization, Z.H.; methodology, Z.H. and J.X.; validation, Y.M.; investigation, Y.M.; data curation, Z.H.; writing—original draft preparation, Z.H. and J.X.; visualization, Z.H.; funding acquisition, Y.C. and Y.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Acknowledgments

This research was supported by an Inha University Research Grant.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Xie, Y.; Zhang, B.; Yao, Y.; Chen, X.; Wang, X. Mechanism of Human Capital Influence on Household Commercial Insurance Holding Behavior—An Empirical Analysis Based on China Household Finance Survey (CHFS) Data. Front. Environ. Sci. 2022, 10, 961184. [Google Scholar] [CrossRef]

- Yan, X.; Chen, H.; Yang, L.; Rao, K. Commercial Health Insurance under the New Healthcare Reform: Status, Problems and Strategies. Chin. J. Health Policy 2013, 6, 50–54. [Google Scholar]

- Zhang, T.; Li, W.; Li, K.; Liu, Z. Only Words Matter? The Effects of Cognitive Abilities on Commercial Insurance Participation. N. Am. J. Econ. Financ. 2022, 61, 101691. [Google Scholar] [CrossRef]

- Xu, B.-C.; Xu, X.-N.; Zhao, J.-C.; Zhang, M. Influence of Internet Use on Commercial Health Insurance of Chinese Residents. Front. Public Health 2022, 10, 907124. [Google Scholar] [CrossRef] [PubMed]

- Praveenkumar, S. An Empirical Analysis in the Critical Factors Influencing the Health Insurance Business in Achieving Sustainable Development Using Structural Equation Model. Int. Dev. Plan. Rev. 2023, 22, 95–109. [Google Scholar]

- Sun, D.; Chen, W.; Dou, X. Formation Mechanism of Residents’ Intention to Purchase Commercial Health Insurance: The Moderating Effect of Environmental Pollution Perception. J. Public Health 2023, 1–14. [Google Scholar] [CrossRef]

- Yogo, M. Portfolio Choice in Retirement: Health Risk and the Demand for Annuities, Housing, and Risky Assets. J. Monet. Econ. 2016, 80, 17–34. [Google Scholar] [CrossRef] [PubMed]

- Xu, N.; Zhao, R.; Li, Y. Credit Cards and Commercial Insurance Participation: Evidence from Urban Households in China. Account. Financ. 2024, 64, 1159–1182. [Google Scholar] [CrossRef]

- Guven, C.; Hoxha, I. Rain or Shine: Happiness and Risk-Taking. Q. Rev. Econ. Financ. 2015, 57, 1–10. [Google Scholar] [CrossRef]

- Showers, V.E.; Shotick, J.A. The Effects of Household Characteristics on Demand for Insurance: A Tobit Analysis. J. Risk Insur. 1994, 61, 492–502. [Google Scholar] [CrossRef]

- Choi, W.I.; Shi, H.; Bian, Y.; Hu, H. Development of Commercial Health Insurance in China: A Systematic Literature Review. BioMed Res. Int. 2018, 2018, 3163746. [Google Scholar] [CrossRef] [PubMed]

- Roussou, I.; Stiakakis, E.; Sifaleras, A. An Empirical Study on the Commercial Adoption of Digital Currencies. Inf. Syst. E-Bus. Manag. 2019, 17, 223–259. [Google Scholar] [CrossRef]

- Trivedi, S. Blockchain Framework for Insurance Industry. Int. J. Innov. Technol. Manag. 2023, 20, 2350034. [Google Scholar] [CrossRef]

- The Influence of Income Growth on the Premium Income of Commercial Endowment Insurance under the Aging Background. Available online: https://webofscience.clarivate.cn/wos/alldb/full-record/WOS:000519108000053 (accessed on 11 March 2024).

- Ren, T.; Zhao, Q.; Wang, W.; Ding, X. Air Pollution, Residents’ Concern and Commercial Health Insurance’s Sustainable Development. Front. Environ. Sci. 2023, 11, 1136274. [Google Scholar] [CrossRef]

- Chang, T.Y.; Huang, W.; Wang, Y. Something in the Air: Pollution and the Demand for Health Insurance. Rev. Econ. Stud. 2018, 85, 1609–1634. [Google Scholar] [CrossRef]

- Hu, X.; Wang, Z.; Liu, J. The Impact of Digital Finance on Household Insurance Purchases: Evidence from Micro Data in China. Geneva Pap. Risk Insur. Issues Pract. 2022, 47, 538–568. [Google Scholar] [CrossRef]

- Li, G.; Li, Z.; Lv, X. The Ageing Population, Dependency Burdens and Household Commercial Insurance Purchase: Evidence from China. Appl. Econ. Lett. 2021, 28, 294–298. [Google Scholar] [CrossRef]

- Si, W. P Ublic Health Insurance and the Labor Market: Evidence from China’s Urban Resident Basic Medical Insurance. Health Econ. 2021, 30, 403–431. [Google Scholar] [CrossRef] [PubMed]

- Jagani, K.; Patra, S. Digital Participation through Mobile Internet Banking and Its Impact on Financial Inclusion: A Study of Jan Dhan Yojana. Int. J. Public Adm. Digit. Age 2017, 4, 51–61. [Google Scholar] [CrossRef]

- Baranauskas, G. Digital and Customizable Insurance: Empirical Findings and Validation of Behavioral Patterns, Influential Factors, and Decision-Making Framework of Baltic Insurance Consumers in Digital Platforms. In Intelligent Systems in Digital Transformation: Theory and Applications; Springer: Berlin/Heidelberg, Germany, 2022; pp. 397–426. [Google Scholar]

- Ayimah, J.C.; Kuada, J.; Ayimey, E.K. Digital Financial Service Adoption Decisions of Semi-Urban Ghanaian University Students—Implications for Enterprise Development and Job Creation. Afr. J. Econ. Manag. Stud. 2023. ahead-of-print. [Google Scholar] [CrossRef]

- Study on the Impact of Digital Inclusive Finance on Rural Land Transfer and Its Mechanism: Empirical Evidence from CFPS and PKU-DFIIC. Available online: https://webofscience.clarivate.cn/wos/alldb/full-record/WOS:000905024100058 (accessed on 11 March 2024).

- Dai, M.; Cao, H. The Impact of Digital Finance on the Operating Performance of Commercial Banks: Promotion or Inhibition? In E-Business. Digital Empowerment for an Intelligent Future; Tu, Y., Chi, M., Eds.; Lecture Notes in Business Information Processing; Springer Nature: Cham, Switzerland, 2023; Volume 481, pp. 1–11. ISBN 978-3-031-32301-0. [Google Scholar]

- Johnen, C.; Mußhoff, O. Digital Credit and the Gender Gap in Financial Inclusion: Empirical Evidence from Kenya. J. Int. Dev. 2023, 35, 272–295. [Google Scholar] [CrossRef]

- Yue, P.; Korkmaz, A.G.; Yin, Z.; Zhou, H. The Rise of Digital Finance: Financial Inclusion or Debt Trap? Financ. Res. Lett. 2022, 47, 102604. [Google Scholar] [CrossRef]

- Han, H.; Hai, C.; Wu, T.; Zhou, N. How Does Digital Infrastructure Affect Residents’ Healthcare Expenditures? Evidence from Chinese Microdata. Front. Public Health 2023, 11, 1122718. [Google Scholar] [CrossRef] [PubMed]

- Kefeng, Y.; Xiaoxia, Z.; Nedospasova, O.P. The Impact of Digital Divide on Household Participation in Risky Financial Investments: Evidence From China. Chang. Soc. Pers. 2023, 7, 113. [Google Scholar] [CrossRef]

- Li, Y.; Long, H.; Ouyang, J. Digital Financial Inclusion, Spatial Spillover, and Household Consumption: Evidence from China. Complexity 2022, 2022, 8240806. [Google Scholar] [CrossRef]

- Jiang, W.; Hu, Y.; Cao, H. Does Digital Financial Inclusion Increase the Household Consumption? Evidence from China. J. Knowl. Econ. 2024, 125, 106377. [Google Scholar] [CrossRef]

- Hu, D.; Zhai, C.; Zhao, S. Does Digital Finance Promote Household Consumption Upgrading? An Analysis Based on Data from the China Family Panel Studies. Econ. Model. 2023, 125, 106377. [Google Scholar] [CrossRef]

- Shi, Y.; Cheng, Q.; Wu, Y.; Lin, Q.; Xu, A.; Zheng, Q. Promoting or Inhibiting? Digital Inclusive Finance and Cultural Consumption of Rural Residents. Sustainability 2023, 15, 2719. [Google Scholar] [CrossRef]

- Wang, X.; Mao, Z. Research on the Impact of Digital Inclusive Finance on the Financial Vulnerability of Aging Families. Risks 2023, 11, 209. [Google Scholar] [CrossRef]

- Xie, X. Analyzing the Impact of Digital Inclusive Finance on Poverty Reduction: A Study Based on System GMM in China. Sustainability 2023, 15, 13331. [Google Scholar] [CrossRef]

- Liu, L.; Guo, L. Digital Financial Inclusion, Income Inequality, and Vulnerability to Relative Poverty. Soc. Indic. Res. 2023, 170, 1155–1181. [Google Scholar] [CrossRef]

- Mushtaq, R.; Bruneau, C. Microfinance, Financial Inclusion and ICT: Implications for Poverty and Inequality. Technol. Soc. 2019, 59, 101154. [Google Scholar] [CrossRef]

- Skogh, G. The Transactions Cost Theory of Insurance—Contracting Impediments and Costs. J. Risk Insur. 1989, 56, 726. [Google Scholar] [CrossRef]

- Liu, Z.; Zhang, Y.; Li, H. Digital Inclusive Finance, Multidimensional Education, and Farmers’ Entrepreneurial Behavior. Math. Probl. Eng. 2021, 2021, 6541437. [Google Scholar] [CrossRef]

- Abhijith, P.S.; Joseph K., A. Reverse FinTech Socialisation: A Remedy for Financial Exclusion in the Digital Era. Int. J. E-Bus. Res. 2023, 18, 1–17. [Google Scholar] [CrossRef]

- Li, X.; Wu, Y.; Li, J. Digital Financial Development and Household Participation in Commercial Insurance. Stat. Res. 2021, 38, 29–41. (In Chinese) [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).