Abstract

This study empirically analyzed the effect of digital transformation capability on the financial performance of foreign subsidiaries of Korean listed firms, focusing on the moderating effect of the ESG level. The results of an empirical analysis on data from 483 foreign subsidiaries of Korean listed firms collected through surveys from February to May 2021 are as follows. First, it was found that digital transformation capability had a positive effect on financial performance. Second, as a result of analyzing the moderating effect of the ESG level, it was found that the environmental (E) level and the social (S) level in ESG strengthened the positive relationship between digital transformation capability and financial performance. However, it was found that the level of governance (G) in ESG rather weakens the positive relationship between digital transformation capability and financial performance. The results of this study suggest that foreign subsidiaries need to actively build digital transformation capability in order to improve their financial performance. Since the results of this study suggest different moderating effects of ESG, practical implications can be suggested that foreign subsidiaries should consider the fact that different effects may occur for each ESG activity if they want to improve their financial performance through digital transformation capability.

1. Introduction

Digital transformation means “strategies that embrace the implications of digital transformation and drive better operational performance” (p. 253, [1]) or it refers to increasing productivity by introducing disruptive technologies into a firm’s business model, and pursuing efficiency of value-chain and resource reconfiguration [2,3,4]. DX is emerging as an important issue in the “new normal” due to the changing business environment, including advances in ICT technology and convergence between industries due to the Fourth Industrial Revolution [4,5]. Many firms are pursuing digital transformation to effectively respond to environmental changes and are making efforts to establish and implement strategies to create better performance [1], but unfortunately, research to empirically analyze digital transformation is still insufficient [3]. Although some previous studies have identified the impact of digital transformation on a firm’s performance, such studies focus on parts of digital transformation such as IoT and blockchain technologies possessed by firms. Attempts to focus on digital transformation capability (hereafter, DX capability) as a firm’s capability and to determine the causality between DX capability and financial performance remain insufficient. In this study, we defined DX capability as a capability to “use new digital technologies, such as mobile, artificial intelligence, cloud, blockchain, and the Internet of things (IoT) technologies, to enable major business improvements to augment customer experience, streamline operations, or create new business models” (p. 326, [3]). Some previous studies have argued that it is necessary to pay attention to the DX capability of foreign subsidiaries [6,7]. Such studies emphasize that digital capabilities held by foreign subsidiaries can more easily acquire international resources through digital systems and contribute to improving the performance of multinational corporations by increasing the efficiency of global production bases [6]. However, some previous studies have shown that DX capabilities do not always have a positive impact on firm performance [8,9]. Some researchers believe that DX capabilities are the result of creativity and constant research and development activities that firms have put in place to create DX capabilities [9]. Similarly, recent studies have sought to identify the relationship between DX capabilities and firm performance as firms change their activities, strategies, and behaviors to adapt to the new normal [10]. However, previous studies focusing on the DX capability of foreign subsidiaries have not yet looked at their interactions with ESG. This study aims to examine the effect of DX capabilities of foreign subsidiaries on financial performance, focusing on the moderating effect of the ESG level.

Recently, ESG (environmental, social, and governance), non-financial elements that measure the sustainability of firms, is attracting academic and practical attention along with DX capability [8]. Among S&P 500 companies, only 20% of them published sustainability or corporate responsibility reports in 2011, but this increased to 86% in 2018, indicating that the ESG of firms is becoming more important [11,12]. Recently, digital transformation and ESG have been at the center of change in the business environment, but unfortunately, attempts to simultaneously consider DX capability and ESG as determinants of firm’s financial performance are not active. This study attempts to fill a gap in the literature by examining the impact of the interaction between DX capabilities and ESG levels on financial performance.

2. Theoretical Background and Hypothesis Development

2.1. Theoretical Background

According to the resource-based view, the DX capability possessed by a firm can be seen as a valuable resource that enables the creation of a sustainable competitive advantage. Because DX capability helps firms manage their resources effectively [13], they can help create economically and environmentally sustainable outcomes [14]. In particular, since firms can change employees’ work patterns or business strategies through digital transformation [15,16], many previous studies argue that DX capability built through digitalization such as IoT, blockchain, and the cloud have a positive effect on financial performance [17,18,19,20,21]. For example, Zhou et al. [22] explained that a firm’s digitalization is built on the basis of the firm’s digital technologies. The authors investigated the impact of digitalization on firms’ performance in China’s financial service industry. As a result of the analysis, it was argued that the smaller the firm, the more digitalization has a positive effect on the firm’s performance by integrating resources across different departments to increase operational efficiency and lowering production costs. Jeong et al. [6] emphasizes that digital innovation of multinational corporations should not be limited to their headquarters but should be expanded to foreign subsidiaries. The authors argue that if a foreign subsidiary has DX capability, it can more easily acquire international resources through digital systems and contribute to increase the financial performance of multinational corporations by enhancing the efficiency of global production bases [6]. Meanwhile, some previous studies have looked at digital capabilities as an aspect of dynamic capabilities and identified its relationship with financial performance. Dynamic capabilities refer to the ability to create, extend, and modify a company’s resources based on innovation in response to rapid market and technological changes [23,24,25,26]. Firms need to build strong dynamic capabilities to quickly generate and implement accelerating digital transformation [27,28,29]. The strong dynamic capabilities that firms possess can be a DX capability that can optimize and improve its business process efficiency [30,31]. In accordance with the above discussion, this study considers the DX capability possessed by foreign subsidiaries as a major antecedent of financial performance.

Meanwhile, the rise of ESG can be cited as one of the major environmental changes that have recently affected corporate management activities. ESG, which includes environmental, social, and governance, refers to non-financial factors that evaluate the sustainability of a firm [32]. In this study, the ESG level is defined as the level of ESG management in terms of environment, society, and governance performed by foreign subsidiaries in the host country’s market [33]. Previous studies related to ESG mainly focus on topics such as ESG investment [11,34,35], the importance of ESG indicators for SRI [36], ESG information [37], ESG ratings or scores [38,39,40], and ESG disclosure [41]. Many of these previous studies argue that ESG has a positive effect on firms’ financial performance [12,34,42]. Tan and Zhu [43] argued that ESG ratings not only provide a positive corporate image of a firm, but also promote green innovation by contributing to the development of sustainable green innovation strategies. In addition, He et al. [44] argued that ESG not only pursues social welfare and builds a sound public reputation, but also reduces a firm’s idiosyncratic risk by increasing the information efficiency of the stock market. However, as mentioned above, previous research on ESG has focused on quantitative indicators, such as ESG ratings, scores, and disclosures, but not on qualitative indicators, such as interest in or contribution to ESG performance. The level of attention and commitment to ESG, i.e., the level of ESG management, can determine a company’s strategy and behavior. As such, ESG can promote corporate green innovation and increase information efficiency, so the level of ESG is expected to improve corporate financial performance through interaction with the company’s DX capability. In addition, in a rapidly changing global business environment, it is necessary to look at ESG levels and DX capabilities simultaneously. Therefore, in this study, the ESG level is considered as a moderator that can moderate the relationship between DX capability and the financial performance of foreign subsidiaries.

2.2. DX Capability and Financial Performance of Foreign Subsidiary

DX capability can have a positive impact on a firm’s financial performance because it creates new market opportunities and increases technological efficiency and organizational agility. Heredia et al. [16] argued that digital capabilities allow organizations to create opportunities to build an organization’s competitive advantage. Quickly capturing new technological opportunities in a rapidly changing business environment can improve a firm’s financial performance. Similarly, Karimi and Walter [45] regarded a firm’s DX capability as a digital disruption, because digitalization of firms disrupts a firm’s traditional operating models, which can be seen as disruptive innovation. Karimi and Walter [45] argued that digital disruption reduces unnecessary intermediation costs and incorporates technology more efficiently, which has a positive impact on firms’ financial performance. In today’s business environment, which needs to respond quickly to uncertain business conditions, the authors stressed that if firms can reduce unnecessary costs through digitalization, this can soon lead to improved financial performance. Troise et al. [46] also argued that a firm’s DX capability can improve its market intelligence capabilities and increase its organizational agility, which can eventually increase the firm’s financial performance as the firm can respond quickly to an uncertain business environment. Foreign subsidiaries with DX capability can acquire big data-based local market information by using DX capability to detect changes in consumers’ consumption patterns or collect social media search terms [47]. Therefore, the authors argued that the DX capability of a foreign subsidiary helps collect customized information for host-country consumers and that based on this, the foreign subsidiary can establish and utilize the structure of a company, the goals set, growth strategy, create new data and processing systems, and improve their financial performance. As such, the DX capability owned by a foreign subsidiary will eventually have a positive effect on the financial performance of the subsidiary in the host country because it captures new market opportunities to build a competitive advantage, reduces unnecessary intermediation costs, and increases organizational agility. Therefore, this study established the following hypothesis.

Hypothesis 1 (H1).

The DX capability of a foreign subsidiary will have a positive effect on the financial performance of the subsidiary.

2.3. Moderating Effect of ESG Level

The ESG level of foreign subsidiaries can further strengthen the positive impact of DX capability on financial performance. First, looking at the environmental aspect of ESG, foreign subsidiaries that pursue a high level of environmental management can promote green process innovation through pro-environmental initiatives [48]. This can strengthen the positive relationship between DX capability and financial performance as a foreign subsidiary is more likely to seize new market opportunities and actively introduce green technologies [49]. In other words, the higher the environmental management level of a foreign subsidiary, the more likely it is to seize new opportunities by innovating and introducing green technologies, so the positive impact of DX capability on financial performance will be further strengthened. Based on the above discussion, the following hypothesis was derived.

Hypothesis 2a (H2a).

In ESG, the environmental (E) level of a subsidiary will moderate the relationship between DX capability and the financial performance of the foreign subsidiary in the positive direction.

Next, looking at the social aspect of ESG, a foreign subsidiary that actively implements social management not only treats external stakeholders such as suppliers and consumers fairly, with a sense of responsibility, but also actively invests in employees, who are internal stakeholders [50]. These social management activities can improve relationships with internal and external stakeholders and have a positive impact on increasing the market value of the foreign subsidiary, such as improving its corporate reputation [50,51]. Foreign subsidiaries will try to show stakeholders that they are actively responding to environmental changes such as DX because they are trying to secure legitimacy in their relationships with stakeholders and maintain their reputation and market value. In addition, active investment in education and training for internal employees can strengthen the capabilities of employees [52,53] who lack digital knowledge or know-how, which can further strengthen the positive impact of DX capability on financial performance. Based on the above discussion, the following hypothesis was derived.

Hypothesis 2b (H2b).

In ESG, the social (S) level of a subsidiary will moderate the relationship between DX capability and the financial performance of the foreign subsidiary in the positive direction.

Lastly, looking at the governance aspect of ESG, foreign subsidiaries with a high level of governance actively carry out transparent decision-making and ethical management activities, thereby reducing unnecessary costs and conflicts in the decision-making process and increasing efficiency in organizational operation. This can reinforce the positive impact of DX capability on financial performance. For example, ElMassah and Mohieldin [14] emphasize that if a firm has a transparent governance structure, it enables efficient organizational management away from the traditional bureaucracy paradigm [54,55]. In addition, a foreign subsidiary that actively pursues ethical management can transparently disclose disclosure data such as corporate annual reports, and external stakeholders who have encountered the transparent disclosure data released by the firm can analyze the risks that companies may face and demand re-correction [56]. Time and resources invested for a strategy that does not fit the environment set by the firm can become an unnecessary cost. Therefore, if the firm can correct the wrongly set strategy in advance at the request of external stakeholders, it can reduce trial and error and unnecessary costs, thereby increasing organizational efficiency [14]. In other words, as discussed above, transparent governance and ethical management can reduce unnecessary costs for a firm or increase the efficiency of organizational operations, so the positive impact of DX capability on financial performance will be strengthened. Based on this, the following hypothesis was derived.

Hypothesis 2c (H2c).

In ESG, the governance (G) level of a subsidiary will moderate the relationship between DX capability and the financial performance of the foreign subsidiary in the positive direction.

3. Research Method

3.1. Sample and Data

In this study, an empirical analysis was conducted by considering foreign subsidiaries of Korean listed firms as research subjects. The list of foreign subsidiaries of Korean listed firms was obtained through the ‘2018–2019 Directory of Korean companies entering overseas markets’ published by KOTRA (Korea Trade-Investment Promotion Agency). The survey was conducted for about three months from 21 February to 8 May 2021. A total of 5443 questionnaires was distributed, 521 questionnaires were collected, and the response rate was 9.57%. Among the collected questionnaires, an empirical analysis was finally conducted based on 483 questionnaires, excluding questionnaires in which the parent firm lost their status as a listed firm or responded unfaithfully. This study conducted multiple regression analysis using SPSS Statistics 24.0 to examine the impact of DX capabilities on financial performance, focusing on the moderating effect of ESG levels.

3.2. Measurement of Variables

3.2.1. Dependent Variable

Financial performance (FP): Financial performance (FP), a dependent variable of this study, was measured on a 7-point Likert scale by referring to the studies of Cochran and Wood [57] and Zou and Stan [58]. More specifically, in this study, the degree to which foreign subsidiaries had been satisfied with the following four areas in the overseas market over the past three years was measured as financial performance (FP): the ratio of operating earnings to assets, the ratio of operating earnings to sales, excess market valuation and growth, and overall satisfaction for financial performance (FP) (1 = very unsatisfied, 7 = very satisfied).

3.2.2. Independent Variable

Digital transformation capability (DX capability): DX capability, an independent variable, was measured on a 5-point Likert scale based on how much capability a foreign subsidiary has with regards to the following 5 areas: efficiency technologies (e.g., cloud technologies), connectivity technologies (e.g., 5G technologies and IoT), trust disintermediation technologies (e.g., blockchain), automation technologies (e.g., big data and artificial intelligence), and digital transformation technology required to respond to the Fourth Industrial Revolution (1 = very weak capability, 7 = very strong capability).

3.2.3. Moderating Variable

ESG level: In this study, the ESG level is considered as a moderating variable that moderates the relationship between DX capability and financial performance (FP). The ESG level of a foreign subsidiary was measured as follows by referring to the ESG index provided by the Korea Institute of Corporate Governance and Sustainability and research by Min and Kim [59].

Using a 7-point Likert scale (1 = strongly disagree, 7 = strongly agree), the environmental (E) level was measured to the extent of agreeing with the following eight questions: (1) establishment of strategies and plans to achieve environmental goals, (2) awareness of environmental management, (3) responsibility and authority for the environment, (4) establishment of a management system to respond to climate change, (5) conduct regular inspections to identify factors that have a negative impact on the environment, (6) supply and purchase of eco-friendly products, (7) voluntary participation in environment-related programs for environmental protection, and (8) establishment of an environment-friendly supply chain management system.

In the same way, using a 7-point Likert scale (1 = strongly disagree, 7 = strongly agree) the social (S) level was measured to the extent of agreeing with the following six questions: (1) have policies for workers’ health and safety, (2) provide excellent welfare benefits for workers, (3) provide education and training to develop human resources, (4) establish fair trade principles for consumers, (5) establish management policies to protect consumer privacy, and (6) implement work ethics training.

Lastly, using a 7-point Likert scale (1 = strongly disagree, 7 = strongly agree) the governance (G) level was measured to the extent of agreeing with the following six questions: (1) regular meeting of the board of directors, (2) establishing internal audit bodies, (3) ensuring the independence of external audit bodies or external auditors, (4) protecting the rights of various stakeholders, (5) disclosing important matters that affect decision-making, and (6) conducting transparent and fair management supervision for consumers (market).

3.2.4. Control Variables

Size of the HQs and foreign subsidiary: The sizes of the HQs and foreign subsidiaries were considered as control variables because they could affect the overall management activities of the headquarters and foreign subsidiaries, and were measured by the log value of the total number of employees of the headquarters and subsidiaries [60,61].

Age of the HQs and foreign subsidiary: Since the ages of the HQs and foreign subsidiaries can affect digital knowledge acquisition and capability building, the age of the HQs and foreign subsidiaries, as of 2021, were calculated and used as control variables [21].

GDP dummy: This study included a GDP dummy variable to control the economic level of the host country in the analysis. The GDP dummy was measured as 1 for countries with a higher GDP per capita than Korea in 2021 and 0 for countries with a lower GDP than Korea [62].

Capability of foreign subsidiary: In this study, the capability of the subsidiary was used as a control variable. Referring to the study of Frost et al. [63], the capability of a subsidiary was measured using a 7-point Likert scale (1 = very weak, 7 = very strong) to determine the level of capability possessed by the foreign subsidiary in the following three areas: (1) R&D, (2) production of products and services, and (3) marketing and sales.

Technological orientation: Referring to the study of Gatignon and Xuereb [64], technology orientation was measured by a 7-point Likert scale to determine the extent to which active activities were performed in the following 4 areas: (1) the use of sophisticated technologies in new products development, (2) the rapidity of integration of new technologies, (3) a pro-activity in developing new technologies, (4) in generating new product ideas.

Cultural distance: The cultural distance between home and the host country was used as a control variable. The cultural distance between home and the host country was calculated using the formula proposed by Kogut and Singh [65], and the cultural distance was calculated using the six cultural dimensions suggested by Hofstede [66]. The specific calculation formula is as follows.

: the cultural distance between Korea and country (j);

the score of country (j) on the (i)th cultural dimension;

: the score of Korea on the (i)th cultural dimension.

3.3. Results

Table 1 presents the distribution of research samples of this study by country. As can be seen in this table, the distribution of foreign subsidiaries by country showed the highest response rate in the order of China (100 firms, 21.7%), America (65 firms, 13.5%), Vietnam (41 firms, 8.5%), and Indonesia (41 firms, 8.5%).

Table 1.

Distribution of research sample by country.

Table 2 shows the validity and reliability analysis results. As a result of exploratory factor analysis for a validity check, each factor’s loading value was over 0.56, confirming that there was no major problem with validity. Based on the results of the validity analysis, means values were derived for each factor, and correlation and regression analyses were conducted using the derived mean values. The Cronbach’s alpha value was used to analyze the reliability of the measurement variable, and the Cronbach’s alphas were all over 0.7, confirming that there was no major problem with the reliability of the measurement variable [67].

Table 2.

Results of validity and reliability test.

Table 3 shows the descriptive statistics and correlation analysis results of the variables used in this study. In addition, as a result of checking the VIF value to verify the possibility of multicollinearity, the maximum value was less than 2, confirming that the problem of multicollinearity is not a cause for concern [68].

Table 3.

Descriptive statistics and correlations.

The results of regression analysis for the verification of the research hypotheses are presented in Table 4. Since this study examined the relationship between DX capability and financial performance (FP), focusing on the moderating effect of the ESG level, the average centering technique was used for analysis [69].

Table 4.

Results of regression analysis.

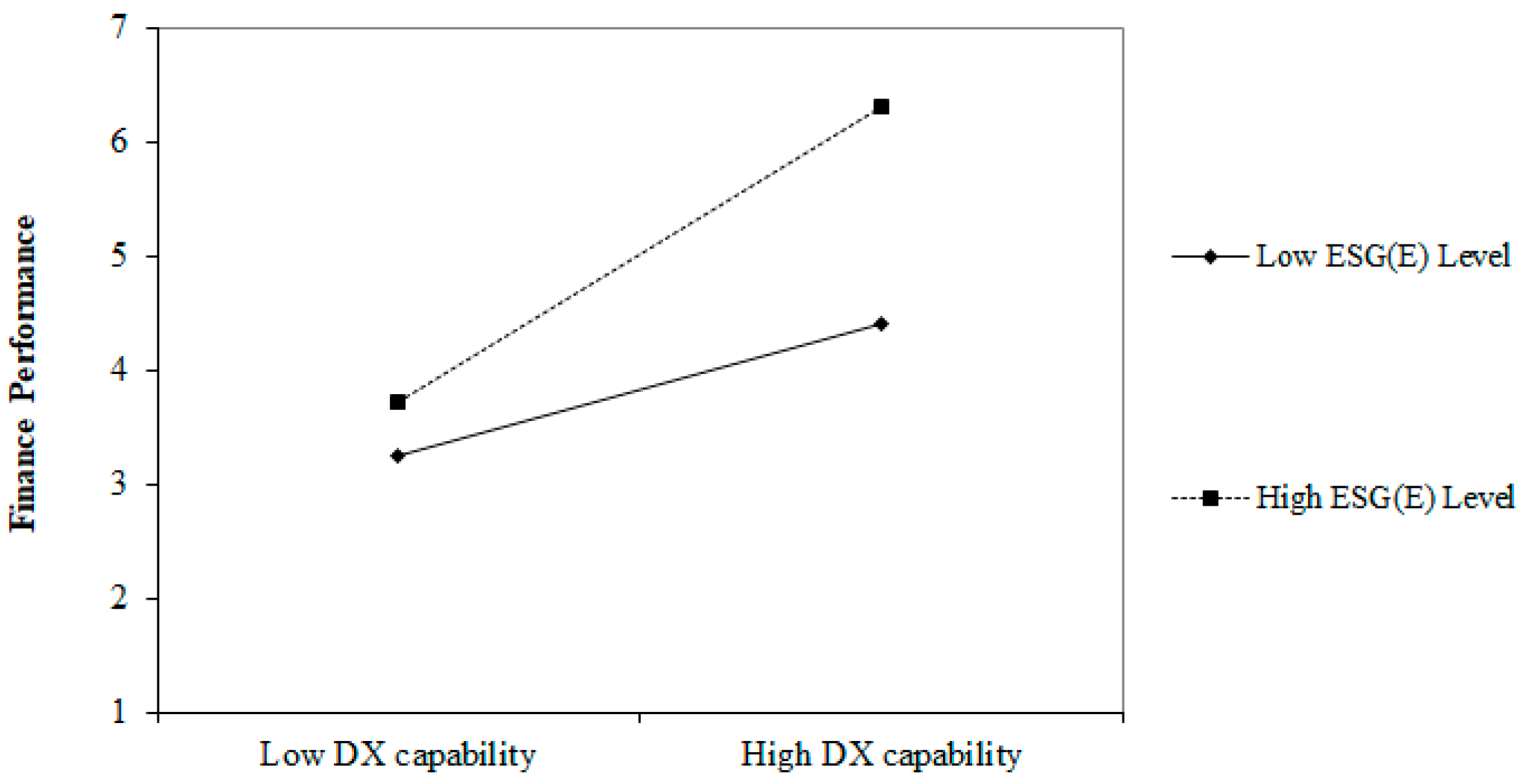

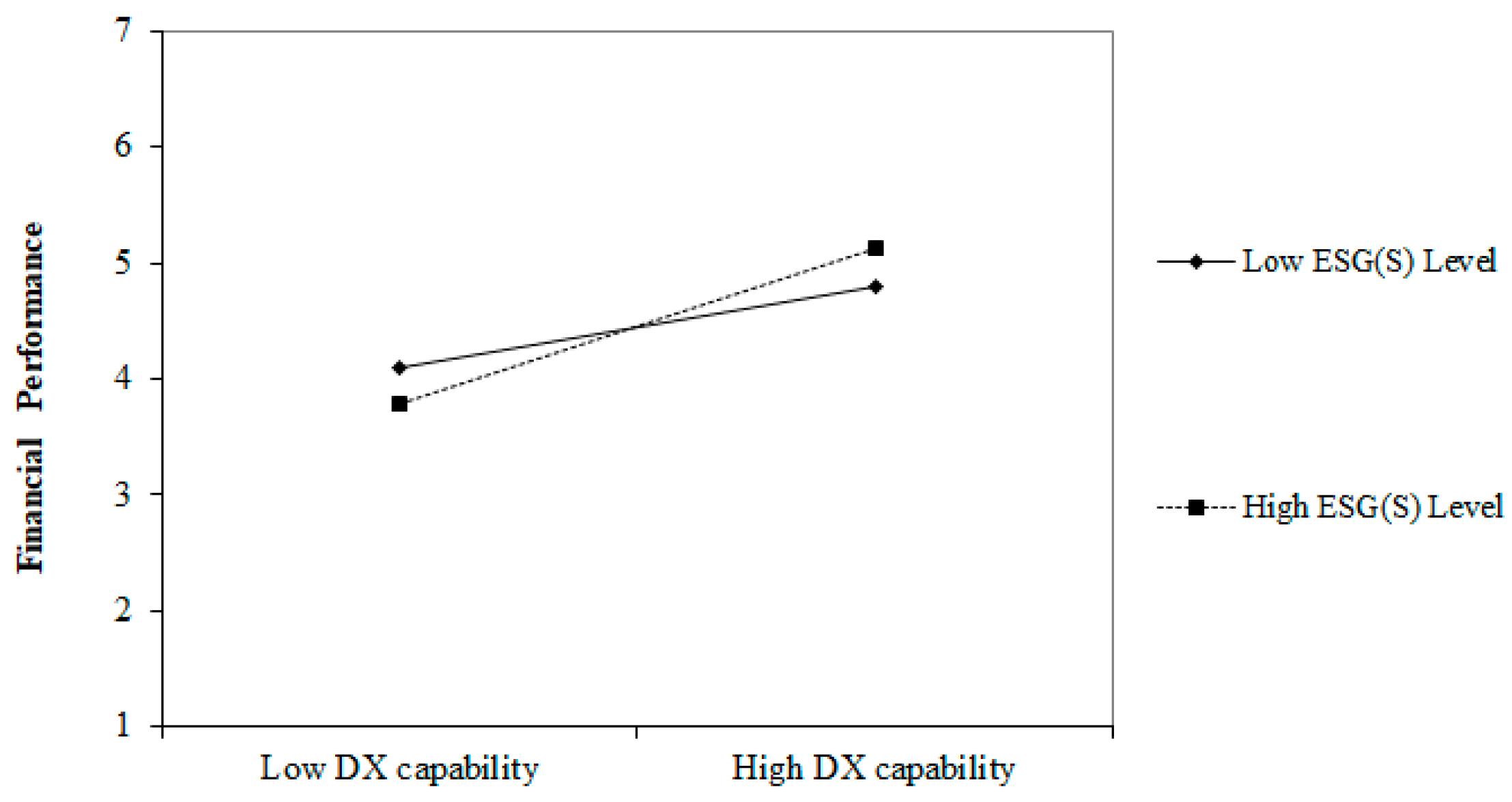

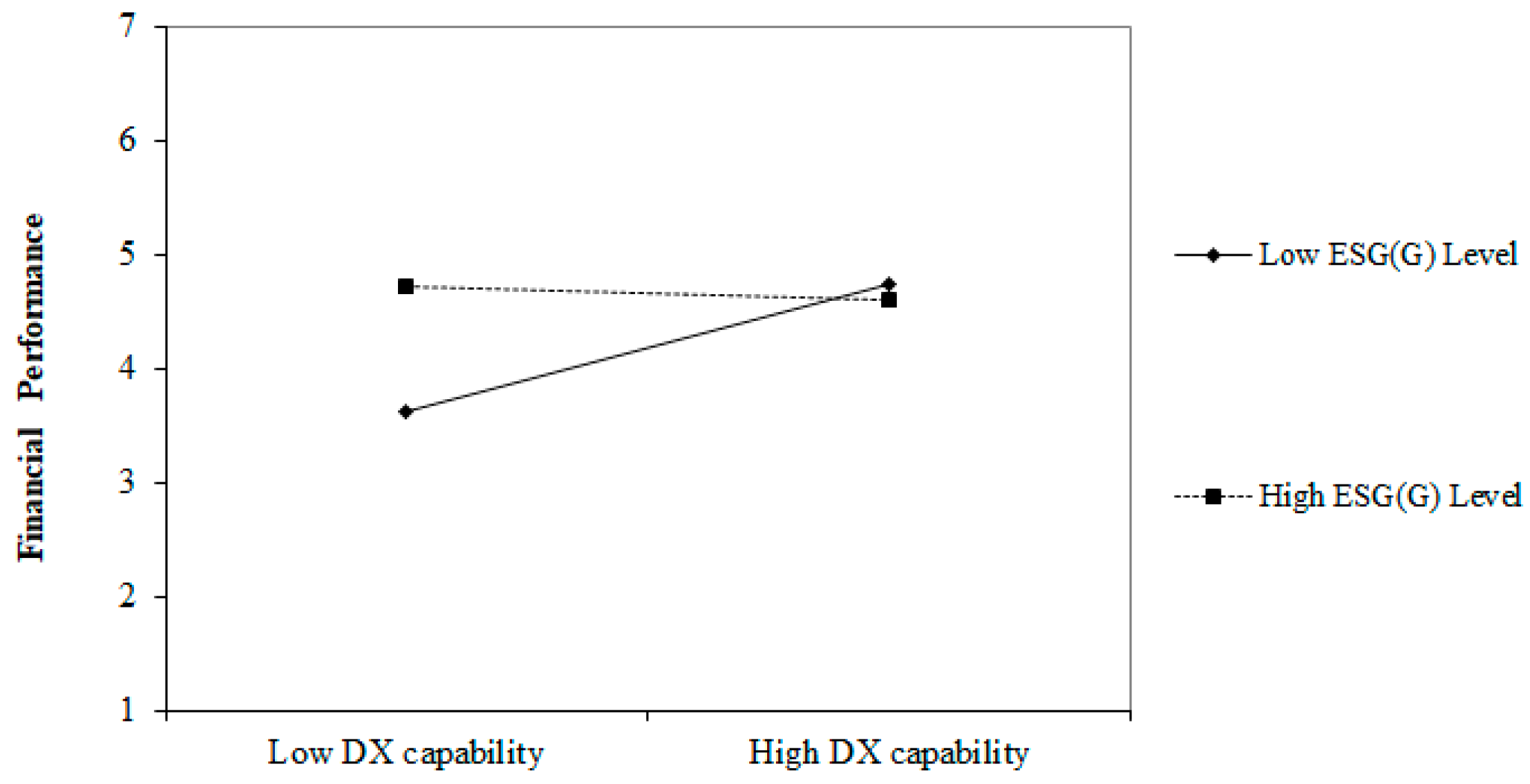

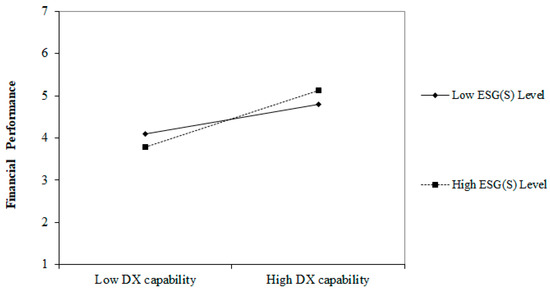

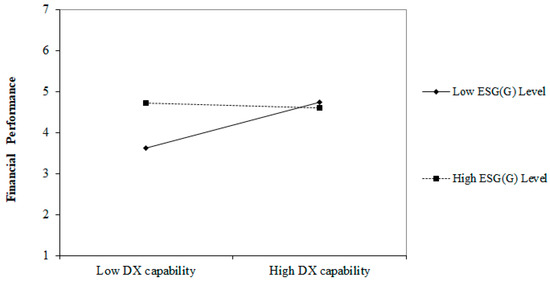

First, model 1 in Table 4 presents the effect of the control variables on the dependent variable, financial performance (FP). As can be seen from model 1, regression analysis showed that AHS (p < 0.05), CFS (p < 0.001), and TO (p < 0.01) had a significant positive effect on financial performance (FP). Next, model 2 presents the results of a regression analysis including control variables and independent variable in the research model. As can be seen in model 2, the independent variable DX capability (p < 0.05) was found to have a significant positive effect on financial performance (FP), so Hypothesis 1 was accepted. Next, model 3 presents the results of a regression analysis including control variables, independent variable, and moderating variables. As shown in model 3, the control variables AHS (p < 0.01), CFS (p < 0.001), TO (p < 0.01), and independent variable DX capability (p < 0.05), were found to have a significant positive effect on financial performance (FP). In addition, the regulatory variables ESG(E) level (p < 0.001), ESG(S) level (p < 0.01), and ESG(G) level (p < 0.01) were all found to have a significant positive effect on financial performance (FP). The following models, 4 to 6, present the results of a regression analysis including control variables, independent variable, moderating variables, and interaction terms. As can be seen in model 4, the control variables CFS (p < 0.001) and TO (p < 0.01), the independent variable DX capability (p < 0.05), the moderating variables ESG(E) level (p < 0.001), ESG(S) level (p < 0.01), and ESG(G) level (p < 0.01) had a significant positive effect on financial performance (FP). As a result of confirming the influence of the interaction term (DX capability × ESG(E) level, p < 0.05) between DX capability and ESG(E) level to verify the moderating effect, ESG(E) level moderates the positive relationship between DX capability and financial performance (FP) in the positive direction. Hypothesis 2a was therefore accepted. Similarly, as seen in model 5, the interaction term (DX capability × ESG(S) level, p < 0.01) between DX capability and ESG(S) level was also found to moderate the positive relationship between DX capability and financial performance (FP) in the positive direction. Therefore, Hypothesis 2b was also accepted. On the other hand, as seen in model 6, the interaction term (DX capability × ESG(G) level, p < 0.05) between DX capability and ESG(G) level was found to moderate the positive relationship between DX capability and financial performance (FP) in the negative direction. Hypothesis 2c was rejected because these results are opposite to the direction expected by hypothesis 2c. Figure 1, Figure 2 and Figure 3 are diagrams illustrating the moderating effects of the ESG level.

Figure 1.

Moderating effect of ESG(E) level.

Figure 2.

Moderating effect of ESG(S) level.

Figure 3.

Moderating effect of ESG(G) level.

Figure 1 shows the moderating effect of the ESG(E) level on DX capability and financial performance.

Figure 2 shows the moderating effect of the ESG(S) level on DX capability and financial performance.

Figure 3 shows the moderating effect of the ESG(G) level on DX capability and financial performance.

4. Discussion and Conclusions

4.1. Discussion

As the global business environment is changing rapidly and competition among companies in the global market is intensifying, DX capabilities and ESG levels, which have emerged as a new paradigm, have become a necessity for corporate management. However, despite the fact that they have become a necessity for corporate management, previous studies aiming to identify the relationship between DX capability and financial performance have not considered ESG activities performed by the firm at the same time. To overcome the limitations of such previous studies, this study empirically analyzed the impact of DX capability on the financial performance of foreign subsidiaries in 483 Korean listed firms, focusing on the moderating effect of the ESG level, and the results are as follows. First, DX capability was found to have a significant positive effect on the financial performance of foreign subsidiaries. This is judged to be because DX capability creates new market opportunities and enhances technological efficiency and organizational agility, as emphasized in previous studies [16,45]. Second, the ESG level was found to partially strengthen the positive impact between DX capability and the financial performance of foreign subsidiaries. More specifically, looking at the moderating effect of the environmental (E) level among ESG, it was found that the environmental (E) level strengthens the positive relationship between DX capability and financial performance because foreign subsidiaries that require a high level of environmental management pursue pro-environmental initiatives and try to introduce green technologies through green process innovation [48,49]. Looking at the moderating effect of the social (S) level, it was found that the social (S) level strengthens the positive relationship between DX capability and FP. This is believed to be because the social (S) level maintains the subsidiary’s corporate reputation and market value [50], securing the legitimacy of external stakeholders by actively responding to the latest environmental changes such as DX, and increasing investment, helping to build DX capability for internal stakeholders [52,53]. Finally, looking at the moderating effect of the governance (G) level, it was found that the governance (G) level rather weakens the positive relationship between DX capability and FP. These findings are contrary to previous studies that have emphasized that having transparent corporate governance will have a positive impact on firm performance by making it easier to manage the organization and prevent corporate risks [54,55,56]. These results show that the higher the level of governance the foreign subsidiary has, the more likely it is that the internal and external supervisory body or board of directors will operate independently, and the foreign subsidiary will try to collect the opinions of both internal and external stakeholders, so decisions on DX capability are not made in a timely manner and will be delayed more than necessary. In other words, the governance (G) level can be assumed to weaken the positive impact of DX capability on FP because decision-making is likely to be carried out inefficiently because foreign subsidiaries spend more time and money collecting the opinions of all stakeholders and making decisions more slowly than necessary [70]. In other words, if the governance (G) level is high, a foreign subsidiary is more likely to make decisions inefficiently because it spends more time and money than necessary collecting the opinions of all stakeholders and making decisions. For this reason, the governance (G) level can be interpreted as weakening the positive relationship between DX capability and financial performance.

4.2. Implication

This study can provide the following academic and practical implications. First, this study has useful academic implications in that it considered DX capability and ESG level, which are major environmental changes surrounding firms recently, as major antecedents in the financial performance of foreign subsidiaries. Prior studies so far only identified the impact on the financial performance of foreign subsidiaries by considering DX capability and ESG level separately, but did not examine the impact on financial performance by simultaneously considering the DX capability and ESG level possessed by foreign subsidiaries. Therefore, this study can present meaningful academic implications in that it simultaneously examined the impact of the DX capability and ESG level held by foreign subsidiaries, which has not been the case in previous studies. Second, previous studies have used quantitative indicators such as ratings, scores, and disclosures. However, this study is significant in that it is the first attempt to examine the level of ESG from a qualitative perspective: the level of ESG management by foreign subsidiaries. Third, since this study suggests that DX capability of foreign subsidiaries has a positive impact on financial performance, it can present practical implications that foreign subsidiaries need to build DX capability as a way to improve financial performance in overseas markets. Fourth, as a result of analyzing the moderating effect of ESG in this study, it was found that the level of governance (G) level weakens the positive relationship between DX capability and financial performance. Therefore, this study can present practical implications that it is necessary to consider that each ESG activity can have a different effect when foreign subsidiaries want to improve financial performance through DX capability. Lastly, the government and public institutions should consider that the financial performance of foreign subsidiaries of Korean firms may vary depending on their DX capabilities and ESG level; they should establish and support policies such as private funds that can freely support and subsidize them in overseas markets.

4.3. Limitations

The limitations of this study are as follows. First, since all variables used in this study were used for empirical analysis based on surveys, there is a possibility that the subjective thoughts of the survey respondents were involved. Therefore, in future research, it is necessary to make efforts to reduce the possibility that the respondent’s subjective opinion may be reflected in the response. Second, many preceding factors suggest various variables in terms of subsidiaries such as technology capability, marketing capability, and R&D capability as major preceding factors in foreign subsidiaries’ financial performance, but this study has limitations in that only DX capability is considered as an independent variable. Although this study considered the subsidiaries’ DX capability as a control variable, since other capabilities except the subsidiaries’ DX capability were not sufficiently controlled, future studies need to use various capabilities emphasized by previous studies as control variables. Finally, given that foreign subsidiaries build DX capabilities and conduct business activities in overseas markets, the role of the CEO and the CEO’s knowledge may be important factors in this study. Therefore, it would be beneficial to consider the CEO’s characteristics and nationality. In addition, given that foreign subsidiaries conduct business activities in a different business environment from their home country, it is necessary to conduct research on the knowledge and cultural differences of foreign subsidiaries.

Author Contributions

Methodology, G.-R.H.; Writing—original draft, G.-R.H.; Writing—review & editing, J.-E.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Hess, T.; Matt, C.; Benlian, A.; Wiesböck, F. Options for formulating a digital transformation strategy. MIS Q. Exec. 2016, 15, 123–139. [Google Scholar]

- Ritter, T.; Pedersen, C.L. Digitization capability and the digitalization of business models in business-to-business firms: Past, present, and future. Ind. Mark. Manag. 2020, 86, 180–190. [Google Scholar] [CrossRef]

- Warner, K.S.; Wäger, M. Building dynamic capabilities for digital transformation: An ongoing process of strategic renewal. Long Range Plan. 2019, 52, 326–349. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. J. Stategic Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Majchrzak, A.; Markus, M.L.; Wareham, J. Designing for digital transformation. MIS Q. 2016, 40, 267–278. [Google Scholar] [CrossRef]

- Jeong, J.; Choi, D.; Kim, J. When digital capabilities of MNC subsidiaries matters: The moderating effect of subsidiary autonomy in Korea. Sustainability 2022, 14, 15176. [Google Scholar] [CrossRef]

- Liang, Y.; Lee, M.J.; Jung, J.S. Dynamic capabilities and an ESG strategy for sustainable management performance. Front. Psychol. 2022, 13, 887776. [Google Scholar] [CrossRef] [PubMed]

- Guo, X.; Li, M.; Wang, Y.; Mardani, A. Does digital transformation improve the firm’s performance? From the perspective of digitalization paradox and managerial myopia. J. Bus. Res. 2023, 163, 113868. [Google Scholar] [CrossRef]

- Usai, A.; Fiano, F.; Petruzzelli, A.M.; Paoloni, P.; Briamonte, M.F.; Orlando, B. Unveiling the impact of the adoption of digital technologies on firms’ innovation performance. J. Bus. Res. 2021, 133, 327–336. [Google Scholar] [CrossRef]

- Tan, B.C.; Pan, S.L.; Hackney, R. The strategic implications of web technologies: A process model of how web technologies enhance organizational performance. IEEE Trans. Eng. Manag. 2009, 57, 181–197. [Google Scholar] [CrossRef]

- Daugaard, D. Emerging new themes in environmental, social and governance investing: A systematic literature review. Account. Financ. 2020, 60, 1501–1530. [Google Scholar] [CrossRef]

- Gillan, S.L.; Koch, A.; Starks, L.T. Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corp. Financ. 2021, 66, 101889. [Google Scholar] [CrossRef]

- Pagani, M.; Pardo, C. The impact of digital technology on relationships in a business network. Ind. Mark. Manag. 2017, 67, 185–192. [Google Scholar] [CrossRef]

- ElMassah, S.; Mohieldin, M. Digital transformation and localizing the sustainable development goals (SDGs). Ecol. Econ. 2020, 169, 106490. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J.; Khan, Z.; Wood, G.; Knight, G. COVID-19 and digitalization: The great acceleration. J. Bus. Res. 2021, 136, 602–611. [Google Scholar] [CrossRef] [PubMed]

- Heredia, J.; Castillo-Vergara, M.; Geldes, C.; Gamarra, F.M.C.; Flores, A.; Heredia, W. How do digital capabilities affect firm performance? The mediating role of technological capabilities in the “new normal”. J. Innov. Knowl. 2022, 7, 100171. [Google Scholar] [CrossRef]

- Di Vaio, A.; Varriale, L. Blockchain technology in supply chain management for sustainable performance: Evidence from the airport industry. Int. J. Inf. Manag. 2020, 52, 102014. [Google Scholar] [CrossRef]

- Dubey, R.; Gunasekaran, A.; Childe, S.J.; Blome, C.; Papadopoulos, T. Big data and predictive analytics and manufacturing performance: Integrating institutional theory, resource-based view and big data culture. Britich J. Manag. 2019, 30, 341–361. [Google Scholar] [CrossRef]

- Kamble, S.; Gunasekaran, A.; Dhone, N.C. Industry 4.0 and lean manufacturing practices for sustainable organisational performance in Indian manufacturing companies. Int. J. Prod. Res. 2020, 58, 1319–1337. [Google Scholar] [CrossRef]

- Wamba, S.F.; Gunasekaran, A.; Akter, S.; Ren, S.J.F.; Dubey, R.; Childe, S.J. Big data analytics and firm performance: Effects of dynamic capabilities. J. Bus. Res. 2017, 70, 356–365. [Google Scholar] [CrossRef]

- Wilden, R.; Gudergan, S.P. The impact of dynamic capabilities on operational marketing and technological capabilities: Investigating the role of environmental turbulence. J. Acad. Mark. Sci. 2015, 43, 181–199. [Google Scholar] [CrossRef]

- Zhou, D.; Kautonen, M.; Dai, W.; Zhang, H. Exploring how digitalization influences incumbents in financial services: The role of entrepreneurial orientation, firm assets, and organizational legitimacy. Technol. Forecast. Soc. Change 2021, 173, 121120. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Helfat, C.E.; Peteraf, M.A. Understanding dynamic capabilities: Progress along a developmental path. Strateg. Organ. 2009, 7, 91–102. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Achtenhagen, L.; Melin, L.; Naldi, L. Dynamics of business models–strategizing, critical capabilities and activities for sustained value creation. Long Range Plann 2013, 46, 427–442. [Google Scholar] [CrossRef]

- Teece, D.J. Profiting from innovation in the digital economy: Enabling technologies, standards, and licensing models in the wireless world. Res. Policy 2018, 47, 1367–1387. [Google Scholar] [CrossRef]

- Inigo, E.A.; Albareda, L.; Ritala, P. Business model innovation for sustainability: Exploring evolutionary and radical approaches through dynamic capabilities. Ind. Innov. 2017, 24, 515–542. [Google Scholar] [CrossRef]

- Loureiro, S.M.C.; Guerreiro, J.; Tussyadiah, I. Artificial intelligence in business: State of the art and future research agenda. J. Bus. Res. 2021, 129, 911–926. [Google Scholar] [CrossRef]

- Zhen, Z.; Yousaf, Z.; Radulescu, M.; Yasir, M. Nexus of digital organizational culture, capabilities, organizational readiness, and innovation: Investigation of SMEs operating in the digital economy. Sustainability 2021, 13, 720. [Google Scholar] [CrossRef]

- Van Duuren, E.; Plantinga, A.; Scholtens, B. ESG integration and the investment management process: Fundamental investing reinvented. J. Bus. Ethics 2016, 138, 525–533. [Google Scholar] [CrossRef]

- Dorfleitner, G.; Halbritter, G.; Nguyen, M. Measuring the level and risk of corporate responsibility–An empirical comparison of different ESG rating approaches. J. Asset Manag. 2015, 16, 450–466. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Pedersen, L.H.; Fitzgibbons, S.; Pomorski, L. Responsible investing: The ESG-efficient frontier. J. Financ. Econ. 2021, 142, 572–597. [Google Scholar] [CrossRef]

- Widyawati, L. A systematic literature review of socially responsible investment and environmental social governance metrics. Bus. Strategy Environ. 2020, 29, 619–637. [Google Scholar] [CrossRef]

- Amel-Zadeh, A.; Serafeim, G. Why and how investors use ESG information: Evidence from a global survey. Financ. Anal. J. 2018, 74, 87–103. [Google Scholar] [CrossRef]

- Dimson, E.; Marsh, P.; Staunton, M. Divergent ESG ratings. J. Portf. Manag. 2020, 47, 75–87. [Google Scholar] [CrossRef]

- Drempetic, S.; Klein, C.; Zwergel, B. The influence of firm size on the ESG score: Corporate sustainability ratings under review. J. Bus. Ethics 2020, 167, 333–360. [Google Scholar] [CrossRef]

- Escrig-Olmedo, E.; Fernández-Izquierdo, M.Á.; Ferrero-Ferrero, I.; Rivera-Lirio, J.M.; Muñoz-Torres, M.J. Rating the raters: Evaluating how ESG rating agencies integrate sustainability principles. Sustainability 2019, 11, 915. [Google Scholar] [CrossRef]

- Khan, M.A. ESG disclosure and firm performance: A bibliometric and meta analysis. Res. Int. Bus. Financ. 2022, 61, 101668. [Google Scholar] [CrossRef]

- Alareeni, B.A.; Hamdan, A. ESG impact on performance of US S&P 500-listed firms. Corp. Gov. Int. J. Bus. Soc. 2020, 20, 1409–1428. [Google Scholar]

- Tan, Y.; Zhu, Z. The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers’ environmental awareness. Technol. Soc. 2022, 68, 101906. [Google Scholar] [CrossRef]

- He, F.; Qin, S.; Liu, Y.; Wu, J.G. CSR and idiosyncratic risk: Evidence from ESG information disclosure. Financ. Res. Lett. 2022, 49, 102936. [Google Scholar] [CrossRef]

- Karimi, J.; Walter, Z. The role of dynamic capabilities in responding to digital disruption: A factor-based study of the newspaper industry. J. Manag. Inf. Syst. 2015, 32, 39–81. [Google Scholar] [CrossRef]

- Troise, C.; Corvello, V.; Ghobadian, A.; O’Regan, N. How can SMEs successfully navigate VUCA environment: The role of agility in the digital transformation era. Technol. Forecast. Soc. Change 2022, 174, 121227. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Broekhuizen, T.; Bart, Y.; Bhattacharya, A.; Dong, J.Q.; Fabian, N.; Haenlein, M. Digital transformation: A multidisciplinary reflection and research agenda. J. Bus. Res. 2021, 122, 889–901. [Google Scholar] [CrossRef]

- Xie, X.; Hoang, T.T.; Zhu, Q. Green process innovation and financial performance: The role of green social capital and customers’ tacit green needs. J. Innov. Knowl. 2022, 7, 100165. [Google Scholar] [CrossRef]

- Tao, H.; Zhuang, S.; Xue, R.; Cao, W.; Tian, J.; Shan, Y. Environmental finance: An interdisciplinary review. Technol. Forecast. Soc. Change 2022, 179, 121639. [Google Scholar] [CrossRef]

- Cavaco, S.; Crifo, P. CSR and financial performance: Complementarity between environmental, social and business behaviours. Appl. Econ. 2014, 46, 3323–3338. [Google Scholar] [CrossRef]

- Cho, S.J.; Chung, C.Y.; Young, J. Study on the Relationship between CSR and Financial Performance. Sustainability 2019, 11, 343. [Google Scholar] [CrossRef]

- Nasiri, M.; Saunila, M.; Ukko, J.; Rantala, T.; Rantanen, H. Shaping digital innovation via digital-related capabilities. Inf. Syst. Front. 2020, 12, 1–18. [Google Scholar] [CrossRef]

- Nirino, N.; Ferraris, A.; Miglietta, N.; Invernizzi, A.C. Intellectual capital: The missing link in the corporate social responsibility–financial performance relationship. J. Intellect. Cap. 2022, 23, 420–438. [Google Scholar] [CrossRef]

- Alkaraan, F. Strategic investment decision-making practices in large manufacturing companies: A role for emergent analysis techniques? Meditari Account. Res. 2020, 28, 633–653. [Google Scholar] [CrossRef]

- Ho, J.; Huang, C.J.; Karuna, C. Large shareholder ownership types and board governance. J. Corp. Financ. 2020, 65, 101715. [Google Scholar] [CrossRef]

- Schwenk, C.R. The cognitive perspective on strategic decision making. J. Manag. Stud. 1988, 25, 41–55. [Google Scholar] [CrossRef]

- Cochran, P.L.; Wood, R.A. Corporate social responsibility and financial performance. Acad. Manag. J. 1984, 27, 42–56. [Google Scholar] [CrossRef]

- Zou, S.; Stan, S. The determinants of export performance: A review of the empirical literature between 1987 and 1997. Int. Mark. Rev. 1998, 15, 333–356. [Google Scholar] [CrossRef]

- Min, J.H.; Kim, B.S. Is ESG effort a normative proposition for sustainability? An analysis of different effects of firms’ ESG efforts by their respective financial status. Korean Manag. Sci. Rev. 2019, 36, 17–35. [Google Scholar] [CrossRef]

- Simonin, B.L. The importance of collaborative know-how: An empirical test of the learning organization. Acad. Manag. J. 1997, 40, 1150–1174. [Google Scholar] [CrossRef]

- Rugman, A.M. The comparative performance of US and European multinational enterprises, 1970–1979. Manag. Int. Rev. 1983, 23, 4–14. [Google Scholar]

- Li, L. Digital transformation and sustainable performance: The moderating role of market turbulence. Ind. Mark. Manag. 2022, 104, 28–37. [Google Scholar] [CrossRef]

- Frost, T.S.; Birkinshaw, J.M.; Ensign, P.C. Centers of excellence in multinational corporations. Strateg. Manag. J. 2002, 23, 997–1018. [Google Scholar] [CrossRef]

- Gatignon, H.; Xuereb, J.M. Strategic orientation of the firm and new product performance. J. Mark. Res. 1997, 34, 77–90. [Google Scholar] [CrossRef]

- Kogut, B.; Singh, H. The effect of national culture on the choice of entry mode. J. Int. Bus. Stud. 1988, 19, 411–432. [Google Scholar] [CrossRef]

- Hofstede, G. Culture and organizations. Int. Stud. Manag. Organ. 1980, 10, 15–41. [Google Scholar] [CrossRef]

- Nunnally, J.C. An overview of Psychological Measurement. In Clinical Diagnosis of Mental Disorders: A Handbook; Springer: Boston, MA, USA, 1978; pp. 97–146. [Google Scholar]

- Chatterjee, S.; Simonoff, J.S. Handbook of Regression Analysis; John Wiley & Sons: Hoboken, NJ, USA, 2013. [Google Scholar]

- Aiken, L.S.; West, S.G. Multiple Regression: Testing and Interpreting Interactions; Sage: Thousand Oaks, CA, USA, 1991. [Google Scholar]

- Khan, M. Corporate governance, ESG, and stock returns around the world. Financ. Anal. J. 2019, 75, 103–123. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).