Abstract

Based on 208 city-level data in China, this paper empirically analyzes the impact of ESG rating on carbon emissions through the SDM spatial metrology model, identifies the direct and indirect consequences and spatial spillover effects of ESG rating on carbon emissions, and compares the regional heterogeneity and city-size heterogeneity of such impacts. This paper draws three conclusions: (1) Empirical evidence shows that the ESG rating performance of enterprises has a significant inhibition effect on carbon dioxide emissions. Specifically, when the ESG rating performance increases by 1%, carbon emissions will decrease by 0.076; among other control variables, the effect of FDI on carbon emission reduction is that when ESG score performance increases by 1%, carbon emission decreases by 0.022. (2) In the decomposition of the total effects, indirect effects and direct effects have the same impact on carbon emissions, and the total effect is −0.393. (3) The inhibition effect is more significant in the Eastern Region and in megacities, where the effect of −0.096 in the Eastern Region is more obvious than that of −0.078 at the national level, and the effect of carbon reduction in megacities is significantly greater than 0.013 in big cities. This suggests regional heterogeneity in regards to the role of ESG ratings in reducing CO2 emissions. This paper reveals the specific effects and internal logic of the impact of ESG performance on CO2 emissions, which has certain implications for various regions to further promote the construction of an ESG system, according to local conditions, and to encourage enterprises to focus on emission reduction and high-quality development.

1. Introduction

In recent years, environmental problems have been increasing. Based on China’s national conditions and responsibilities as a major country, it proposed the goal of “carbon neutrality and carbon peaking” (hereinafter referred to as the “double carbon” goal) at the General Debate of the 75th session of the United Nations General Assembly. Carbon emission reduction is an urgent problem for China to solve. At the same time, from the micro perspective of enterprises and investors, the current ESG rating standard has become a new scale for the green development of organizations. So, what is the logical relationship between carbon emissions and ESG ratings? It is of great significance to study this relationship, as by so doing, we can better understand the sustainable development capabilities of enterprises, guide investors to make more comprehensive and responsible investment decisions, and promote more environmentally friendly and socially responsible business practices. At present, the academic research on carbon emissions is mainly divided into the following areas:

(1) Calculation of carbon footprint: this process is very complicated. Some scholars start from the implied emission and footprint, and combine the expenditure data with the life-cycle greenhouse gas emission intensity derived from the environmentally extended input–output model to calculate carbon footprint [1]. Various researchers have estimated the carbon footprint of some cities in the United States, China, the European Union, and Japan, based on the GGMCF model. They believe that consistent actions taken by local governments will exert different proportions of impacts on global carbon emissions, which confirms the effect of local government policies on carbon emissions [2]. Other scholars have estimated the contribution of individuals to the global carbon footprint, based on their geographic location and lifestyle, from the perspective of individual behavior, determining that the carbon footprint of different socioeconomic classes is varies significantly [3]. Some scholars have also built an overall framework for carbon footprint measurement in the field of consumption, systematically identified improvement schemes to promote consumer choice at different stages of the supply chain, and tried to solve the problem of reducing carbon dioxide emissions from the perspective of the consumer [4]. Overall, the calculation of carbon footprint is still the focus of scholars, but the research on the development of carbon footprint from the perspective of investment needs to be further improved.

(2) Technological innovation: this includes research on how to innovate technology, develop low-carbon processes, improve energy efficiency, and reduce carbon emissions. Some scholars believe that carbon neutrality can be simply understood as energy structure adjustment [5]. At present, China is facing challenges to achieve the “dual carbon” goal, such as high pressure, tight time constraints, high overall costs, insufficient technology reserves, unbalanced development, high costs of removing the “carbon lock”, an immature carbon pricing mechanism, and complex benefit adjustments [6,7]. In terms of technological innovation, some scholars have discussed the driving factors of CO2 emission changes in major industries in various regions of China, proving quantitatively that technological progress plays a key role in the process of reducing CO2 emission [8].

(3) Policy and governance: developing appropriate policies and programs to promote the realization of green and low carbon technologies. In the governance of carbon emissions, urban development and carbon emission reduction are contradictory and unified. Under the “dual carbon” goal, there is not a rush to decrease emissions within a short period of time, but rather there is a plant to gradually change the mode of each city [9]. Based on the transformation of the development model of a city or a country, governance policies should start from the structural contradictions in population structure, investment efficiency, and energy supply and demand when facing the challenge of realizing the “dual carbon” goal [10].

(4) Social participation: raising public awareness of environmental protection, promoting social participation and action, and promoting the realization of carbon reduction and carbon neutrality. The green transformation of China’s production and operation mode and lifestyle is being gradually promoted under the “dual-carbon” goal [11], and this transformation process will have a positive effect on the realization of the “dual-carbon” goal. When some scholars studied the impact of environmental assessment and public participation on the effect of environmental pollution control, they also proposed that the role of public participation in the process of environmental control is gradually becoming more and more important over time [12].

(5) Economy and finance: the realization of carbon marketization; the formulation of an appropriate carbon tax, a carbon trading system, and carbon finance policies; and the promotion of the development of a low-carbon economy and the realization of carbon emission reduction. A carbon tax, which exhibits significant effects and low cost, is often advocated as a policy tool to reduce carbon emissions [13]. Some scholars believe that a carbon trading policy can also promote the overall green development and the reduce carbon intensity of pilot areas [14,15]. Carbon finance can play an important role in promoting sustainable development by providing economic incentives, reducing the cost of emission reduction, promoting the development of a low-carbon economy, and promoting international cooperation. However, at present, green technology and climate change investment and financing generally encounter a series of problems, such as a lack of relevant standards, the absence of an incentive innovation mechanism, and financing difficulties [16].

(6) Urban infrastructure development: the improvement of the urban environment, the building of low-carbon cities, and the development of low-carbon transportation and energy systems. From the perspective of urban development, the increase in economic development and resident income level are the main driving factors for the growth of traffic CO2 emissions, and the development level of public transport has a significant negative effect on the growth of traffic CO2 emissions. The main factors affecting the carbon emission efficiency of transportation include population size, income level, transportation intensity, factor endowment, transportation structure, and energy saving technology level [17].

Scholars have conducted a relatively comprehensive study on carbon emissions, mostly starting from urban data to build indicators for research [18,19,20] but lacking the perspective of combining enterprise data and urban data. As one of the main participants in economic and social development, enterprises not only possess economic and legal responsibility, but also social and moral responsibility, and it is natural that they should undertake the green and low-carbon development tasks required by the state. Among them, ESG rating performance is an important standard used to measure the high-quality development of enterprises in the new era, and has been widely considered since the concept of ESG rating was put forward. The doubling of the asset scale drives more listed companies and investment institutions to pay increasing attention to the benefits and costs accompanying the ESG rating. China’s ESG rating for responsible investment from the perspective of the “carbon peak, carbon neutral” goal, put forward after the practice was initiated, has also increased significantly. The development of enterprises founded on the specific practice of the environment, taking social and governance factors into account; the establishment of the “double carbon” goal; and the high-quality development of China’s economy in regards to the green and low-carbon requirements for enterprises once again stressed the importance of the ESG rating for enterprise development.

Domestic and foreign scholars have conducted many studies in ESG-related fields. Scholars pay attention to the correlation between the ESG rating performance [21], financial performance [22], and non-financial performance of enterprises, and deeply discuss the quality and influence of ESG rating data sources and rating methods [23]. At the same time, scholars also study how investors integrate ESG rating factors to make decisions [24] and reveal the impact of ESG rating integration on portfolio risk and return [25]. In studying the relationship between ESG and financial institutions, financial institutions and markets are also committed to promoting sustainable finance, such as green finance, digital finance, and sustainable finance innovation. Green financing and green economic development are positive indicators of ESG rating performance [26]. Digital finance enhances ESG by reducing corporate financial constraints and increasing green innovation and external supervision [27,28]. In addition, particularly in the context of environmental issues and climate change, the role of business in regards to environmental risk and climate transition has received close attention from researchers. It can be found from previous studies that some scholars believe that the development of an ESG rating will promote the realization of the “two-carbon” goal. Theoretically, ESG investment and the realization of carbon neutrality are mutually reinforcing, but some policies, such as carbon control iniatives, will have a negative impact on ESG rating performance, [29]. Investing in ESG ratings will focus on the long-term development of the company, which requires the company to generate profits and contribute to environmental improvement, which is in line with the goal of carbon neutrality. Because the concept of ESG is consistent with the concept of carbon neutrality, some studies start from green transformation and believe that ESG rating can promote the green transformation of enterprises and help market entities to prevent the risks of this process [25,30], among which the important driving force to promote green transformation is green innovation ability [31].

According to the above literature review, the current research regarding corporate ESG rating mainly focuses on the impact of corporate information disclosure [25], financial performance [22], corporate value [32,33,34,35,36], and decision-making participation [24]. Research on “dual-carbon” targets mainly focuses on industrial green development [30], technological innovation [31,37,38], “dual-carbon” policy design [39], implementation, and ESG investment strategy management and practice [40]. However, there are few studies on the impact of ESG and carbon emissions from a spatial perspective, especially concerning the empirical verification and complete theoretical framework at the prefecture level. In order to explore the relationship between ESG and carbon emissions and improve the study on the impact of ESG rating on carbon emissions from a spatial perspective, this paper uses the data of 208 cities in China from 2010 to 2019, first empirically analyzing the impact of the ESG rating on carbon emissions through the spatial metrology SDM model. Secondly, the direct effect, indirect effect, and spatial spillover effect of ESG rating on carbon emissions were determined through total effect decomposition. Thirdly, the regional heterogeneity of the urban size effect is compared with the heterogeneity of urban size through the characteristics of different regions. Finally, combined with the conclusions and the studies of other scholars, this research provides support for the formulation of corresponding carbon emission management policies in different regions.

2. Materials and Methods

2.1. Model Design

The ESG rating can promote the improvement of enterprise performance [41,42], and better environmental performance can alleviate corporate financing constraints [43,44], therefore, in recent years, the ESG rating has received more attention from enterprises. The ESG rating attaches importance to the green development of enterprises, so the importance of carbon emission reduction has been greatly increased. In order to improve the overall ESG rating score of the enterprise itself, the enterprise attempts to improve energy efficiency, reduce unnecessary energy consumption, and develop clean energy, which will reduce the total regional carbon emissions. On the other hand, the enterprise actively advocates the low-carbon development mode and a low-carbon lifestyle, pushing the green development of energy conservation and emission reduction into all areas of the enterprise operation and all links with production and sales. As the main body of regional social practice, the enterprise employees directly participate in the emission reduction to achieve the reduction of regional carbon dioxide emissions. Therefore, the following hypothesis is proposed: The higher the comprehensive ESG rating score of enterprises in the region, the lower the regional CO2 emissions.

In the field of environmental economics, the IPAT model is a widely used research method for exploring the impact of the relationship between population size and economic factors on the environment. The standard STIRPAT model is as follows:

where represent, respectively, the carbon dioxide emission, population size, economic development level, and technological innovation degree of the i city in the t year; , , , and are the parameters and represent the random error terms. By applying the STIRPAT model, researchers have gained a deeper understanding of how human activities affect the environment, providing support for more effective environmental policies. The wide application of this model provides useful guidance for us to explore ways and strategies to achieve high-quality development goals. For the enterprises in the driving position of regional economic development, these become the research highlights for regional high-quality transformation and development, and ESG enterprise rating plays a key role in guiding enterprises to move towards high-quality development. By focusing on the integrated performance of the environment, society, and governance, ESG ratings drive companies towards the goal of sustainability, promoting the harmonious development of the economy, society, and the environment, and achieving long-term sound and high-quality development.

Therefore, this paper intends to use this model to explore the impact of ESG rating on carbon emissions. In order to verify the realistic relationship between carbon emissions and ESG rating level, this paper will use China’s city-level panel data for empirical analysis. Based on the research objectives, the measurement model is set as follows:

where, are the parameters; is the CO2 emission of the th city in the year; is the ESG rating index of the city in the t year; is a group of common control variables for carbon emissions, including industrial structure (IS), urbanization level (URB), and foreign direct investment (FDI); and is a random error term.

Because carbon dioxide is easily dispersed between regions, the effect of diffusion will be more significant because of the development of the transportation industry. In addition, a city’s carbon dioxide emissions depend not only on the level of local economic development, but also on the environmental conditions and economic levels of the neighboring areas. Therefore, the distribution state of carbon dioxide will show a relatively obvious spatial autocorrelation. This paper intends to choose a spatial econometric model for empirical analysis, and the spatial Durbin model to be used is as follows:

Among them, and represent the regional effect and the practical effect, respectively; represents the spatial autoregressive coefficient; and represents control variables such as IS and FDI. To simplify the spatial Durbin model formula, all independent variables are represented by , which is used to add a spatial lag terms. represents the spatial weight matrix.

2.2. Variable Description

(1) Explained variable: Carbon dioxide emissions (I), derived from carbon emission data from city-level inventories published by the China Carbon Accounting Database (CEADs). After matching the ESG rating data of 290 cities published in the database, valid city data of 208 cities were obtained, after cities with serious data missing were excluded.

(2) Core explanatory variable: ESG rating index, using the China Securities Index for all Chinese A-shares in 2010–2019 for ratings processing. AAA, AA, A, BBB, BB, B, CCC, CC, and C correspond to a score of 9 to 1. According to the A-share registration, the A-shares in the same registration location during the same year are added together to obtain the specific score.

(3) Control variables: According to previous literature studies, the main influencing factors on carbon emissions are selected, including population size, economic development level, industrial structure, urbanization level, and foreign direct investment. The details are shown below and are summarized in Table 1:

Table 1.

Regression equation main variable table.

(1) Population size (P): The population size of a region is an important factor affecting carbon dioxide emissions; the larger the population size of the city, the greater the energy consumption, and more human activities will also produce more carbon emissions. This paper selects the total population at the end of the year to measure the population size; the regression coefficient is expected to be positive.

(2) Level of economic development (A): Generally speaking, the higher the level of economic development, the larger the production scale, and the more carbon emissions will be generated in the production process. However, when the economic development reaches a certain high level, the emission reduction effect will occur through industrial structure upgrading and energy structure optimization, which is also the theoretical gist of the environmental Kuznets curve. In this paper, per capita GDP is chosen to measure the level of urban economic development, and the annual nominal GDP is converted to the real GDP based on the results from 2010, so as to eliminate the impact of price changes. Because China is currently an upper-middle-income country, and the economic development across the country is uneven, the regression coefficient of per capita GDP is expected to be positive.

(3) Industrial structure (IS): The secondary industry has the highest carbon emissions among the three industries, especially the development of energy-consuming industries such as power and steam will lead to the increase in carbon emissions, and the low-level industrial structure will undoubtedly cause the high carbon emissions. This paper chooses the proportion of the added value of the secondary industry in GDP to represent the industrial structure, and the regression coefficient is expected to be positive.

(4) Urbanization level (URB): On the one hand, urbanization will drive the development of the steel industry to emit a large amount of carbon dioxide; on the other hand, the lifestyle of urban residents, including the increase in automobile exhaust emissions and the high demand for electricity, leads to more carbon dioxide generation in cities than in rural areas. Theoretically speaking, the higher the level of urbanization, the higher the corresponding carbon dioxide emissions, so the regression coefficient is expected to be positive. The measurement of the urbanization level generally includes two dimensions: population urbanization and land urbanization. Because China’s Urban Statistical Yearbook ceased releasing data regarding non-agricultural population levels in 2019, the population urbanization index cannot be obtained. This paper uses the land urbanization index to measure urbanization, i.e., the proportion of urban construction land in the urban area, and the regression coefficient is expected to be positive.

(5) Foreign direct investment (FDI): Since 2012, China has vigorously promoted the construction of ecological civilization. Under this background, newly established foreign-funded enterprises will face higher environmental protection requirements when entering China. Meanwhile, the knowledge and technology spillover effect brought by foreign investment will improve the energy utilization efficiency of Chinese enterprises, improve the production process, and reduce carbon emissions. In this paper, the actual utilization of FDI in the current year is selected to measure FDI, and the unit of FDI is converted into CNY according, to the CNY/USD exchange rate published by the National Bureau of Statistics in the current year, and the regression coefficient is expected to be negative.

2.3. Data Source and Processing

Explanatory variables were collated according to the ESG ratings from the China Securities Index, the carbon dioxide emissions of the explained variables come mainly from the CEADs database, and the current urban carbon emission data is updated until 2019. Other data were collected from the Chinese Urban Statistical Yearbook of the corresponding year, and some missing data were supplemented using the linear interpolation method in Stata17 software. The specific method of linear interpolation is to use the ipolate command for interpolation, building a linear equation to estimate the value of missing points by calculating the slope between two adjacent data points. After ensuring the integrity of the data, in order to avoid pseudo-regression, the logarithmic value of the data is employed, and the data after taking the natural logarithm value is used for subsequent model fitting.

Due to the availability of carbon emissions data, this paper selects the data of 208 cities at or above the prefecture level in China from 2010 to 2019 as samples to build a panel data model. The specific model construction was fitted in Stata17 software.

3. Results

3.1. Moran’s I Test

In order to prove the spatial correlation of the explained variables, the correlation test of carbon dioxide emissions at the city level is carried out. Common spatial autocorrelation tests include Moran’s I test, Geary’s C test, the local indicators of spatial association (LISA), and the Getis–Ord Gi test; in order to understand the global spatial autocorrelation of the whole and to minimize the influence of outliers, Moran’s I test is selected. When the range of Moran’s I is (0,1), it is assumed that there is a positive spatial autocorrelation, and when the range of Moran’s I is (−1,0), it is assumed that there is a negative spatial correlation. The original hypothesis is that there is no spatial autocorrelation of geographical data, and the alternative hypothesis is that there is a spatial autocorrelation of geographical data. Moran’s I is calculated as follows:

where is the carbon emission of city , is the average carbon emission of all cities, and is the normalized spatial geographical weight matrix, which commonly includes a 0–1 adjacency matrix, a geographical distance weight matrix, an economic distance weight matrix, and an economic geography nested matrix. In order to explore the spillover effect of ESG rating enterprise rating on carbon emissions, this paper selected the inverse distance square matrix, with a better effect after several regressions and tests, and the calculation expression is as follows:

where represents the distance between geographical units and , obtained by the latitude and longitude between them. The weight value is represented by the distance between two places; the closer the distance between two places, the larger the value, and the farther the distance, the smaller the value.

Based on the CO2 emission data of 208 cities in China from 2010 to 2019, Moran’s I index from 2010 to 2019 was obtained using Stata17 software, as shown in Table 2 below.

Table 2.

Global Moran’s I Index of CO2 emissions from Chinese cities, 2010–2019.

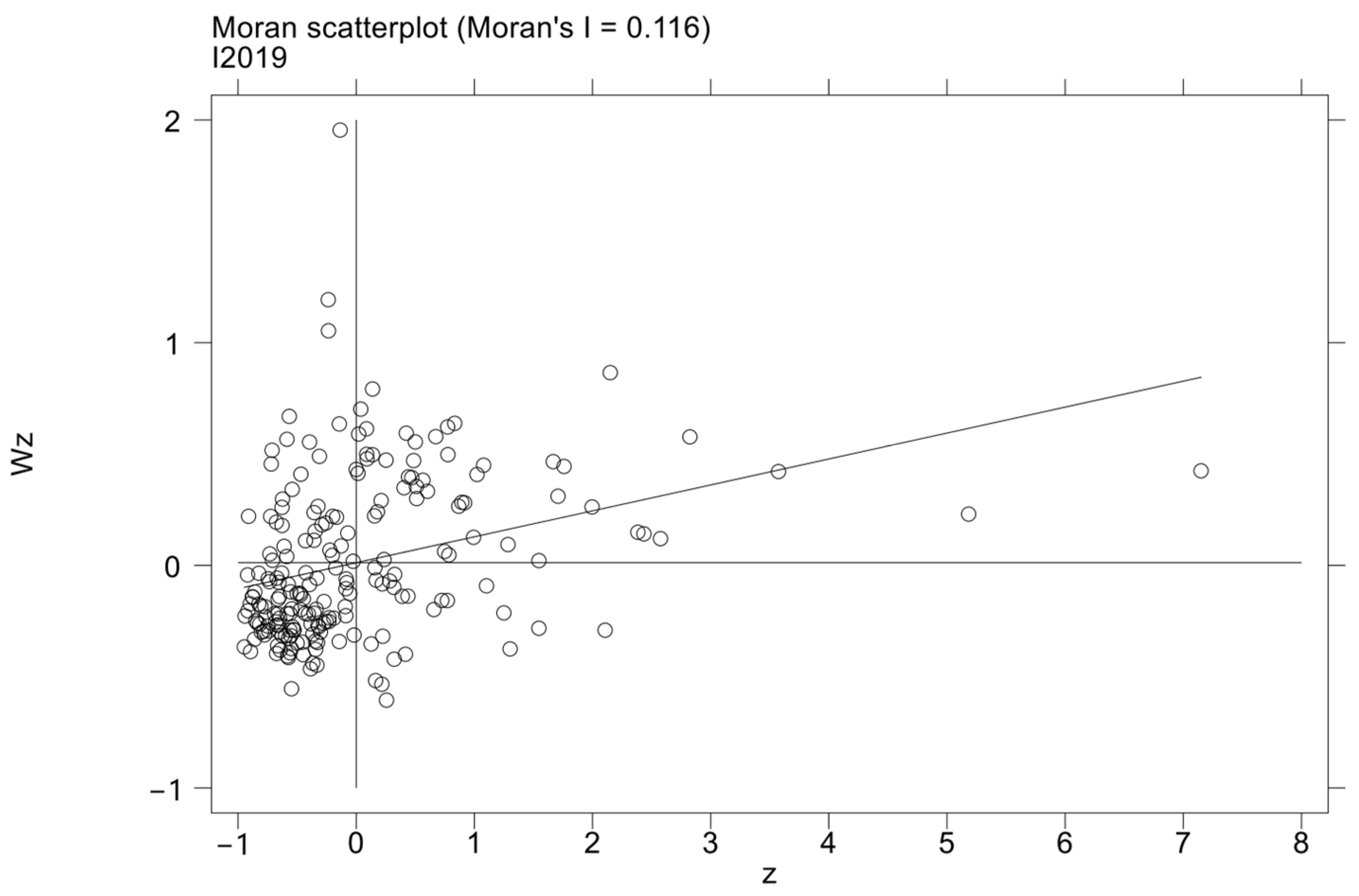

From the results in the Table 2, it can be seen that the carbon emissions of 208 cities in 2010–2019 show significance at the 99% confidence level, and the Moran’s I index is greater than 0, indicating that carbon dioxide presents a positive spatial correlation in different locations. In order to better observe the interregional carbon emission aggregation, this paper draws the local Moran scatter plot of carbon emissions in 2019, as shown in Figure 1. The Moran’s I index is mainly distributed in the first and third quadrants, indicating that China’s current carbon emission exhibits a significant local spatial aggregation feature in geographical space. And it mainly presents high—high agglomeration and low—low agglomeration.

Figure 1.

Moran’s I index scatter plot (2019).

3.2. Selection and Testing of Spatial Metrology Model

As shown in Table 3, VIF test was conducted on the sample data, and the results are shown in the following table. It is determined that the VIF value of each variable is less than 5, the highest value is 2.55, the lowest value is 1.12, and the average value is 1.87, indicating that there is no serious multicollinearity between the variables.

Table 3.

Collinearity test.

As can be seen from the above analysis, the carbon emissions of 208 cities are spatially correlated, so the spatial weight matrix should be added to the model, and the empirical element should be estimated by using a spatial econometric model to make the model fit better. In this paper, OLS regression and LM testing were performed first, and the test results are shown in Table 4 below. The results show that the p values under LM testing and robust LM testing both passed the 1% significance level, indicating the existence of a spatial error effect and a spatial lag effect. Mixed panel regression was rejected, and the spatial Durbin model was initially selected. After that, the Hausman test was used to determine whether a fixed effect model or a random effect model was adopted. According to the test results in Table 4, the null hypothesis, “the difference between coefficients is not systematic”, was rejected, and the fixed effect model was adopted.

Table 4.

Non-spatial panel data estimation and LM test results.

The LR test and the Wald test were used to determine whether the spatial Durbin model could be degenerated into SAR and SEM models. In other words, the applicability of the spatial Durbin model was further verified on the premise of determining the spatial correlation between variables. The results are shown in Table 5, and both LR test and Wald test resulted in 1% significance levels. The SDM model cannot be degraded into an SEM model or an SAR model. Based on the above tests, this paper uses the SDM model for subsequent empirical analysis.

Table 5.

Results of the Hausman test, Wald test, and LR test.

3.3. Estimation Results and Analysis of Spatial Durbin Model

3.3.1. Result Analysis of Spatial Durbin Model

Based on the results of the above correlation tests, it can be seen that this paper should adopt the fixed effect spatial Durbin model for spatial econometric regression. In order to explore the degree of fit between various models, SDM model regression is used to compare the regression results of the static panel model and the dynamic panel, and the regression results of the four models are shown in Table 6 below.

Table 6.

Estimation results of different panel models.

Among them, the spatial autocorrelation coefficient ρ passed the significance test at the 99% confidence level, with a value of 0.254, indicating that there is a positive spatial spillover effect of carbon emissions, i.e., the increase in carbon emissions in the city will lead to the increase in carbon emissions in the surrounding area. The reasons for the positive spatial spillover effect may stem from the following points: First, there are close economic links between cities, especially in terms of the supply chain and the industrial division of labor. When a city’s economic growth leads to increased industrial activity and demand in surrounding areas, those areas may need to increase energy consumption, thereby producing more carbon emissions. Secondly, the different degree of policy adjustment between cities may lead to the difference between local environmental protection policies and those of surrounding cities, causing local enterprises to transfer activities with high carbon emissions to other places.

The significance test value of × lnESG is −0.224, indicating that the ESG rating level of the neighboring region has a reduction effect on the carbon emissions in the region, and there is a corresponding spatial effect. The main reasons for the spatial effect of ESG rating on carbon emissions are as follows:

(1) Role models and benchmarking: A high ESG rating in a neighboring region may inspire local businesses and governments to take actions to improve their ESG performance and thus, to emulate successful mitigation strategies.

(2) Competitive market dynamics: The proximity to high ESG standards may create market pressure for local companies to adopt emission reduction initiatives in order to remain competitive or to enter markets with higher ESG requirements.

(3) Collaboration and information sharing: Through ESG investments, cooperation and information sharing between neighboring regions in regards to emission reduction strategies and best practices can promote environmental awareness and collective action to coordinate broader emission reduction efforts.

(4) Investment preference: Investors and financial institutions may be more inclined to invest in regions with good ESG performance, which will push local businesses and governments to prioritize emission reduction initiatives. At present, the flow of capital factors is more likely in these cases, and the green capital flowing out of neighboring cities will also be used for local green development.

In addition, from the perspective of other variables, industrial structure, foreign direct investment, and urbanization level also have spatial effects on carbon emissions. Specifically, × lnIS and × lnFDI, at −0.735 and −0.085, respectively, are significantly negative values, indicating that the industrial structure and foreign direct investment in neighboring places also have a certain reduction effect on local carbon emissions. For × lnURB, the significant value is 0.286, indicating that the urbanization level of neighboring areas has a certain increasing effect on local carbon emissions.

The estimated results of the ESG rating of the core explanatory variables selected in this paper are −0.099, −0.065, −0.086, and −0.076, respectively, in the four models, all of which are negative. Moreover, the regression coefficients of the panel mixed regression and the SDM model pass the significance test of 1%. This shows that there is a significant negative correlation between green technology innovation and carbon emissions, indicating that the enterprise ESG rating will inhibit carbon emissions.

From the perspective of the control variables, population size, economic development level, industrial structure, and urbanization level passed the significance level of 1%. (1) The regression coefficient of population size is 0.692, indicating a significant positive correlation between population size and carbon emissions; that is, the increase in population size will promote the increase in carbon emissions. This is consistent with the research results of Zhang Huaming et al. [45], which showed that per capita carbon dioxide and urban population size showed an inverted U-shaped relationship at the early stage. (2) The regression coefficient of the economic development level is 1.060, indicating that there is a significant positive correlation between the economic development level and carbon emissions; that is, the increase in per capita GDP will promote the increase in carbon emissions. This indicates that China is in the first half of the environmental Kuznets curve. At present, China is still in the industrialization stage, and the added value of industry and manufacturing is the main source of economic growth. In regions with a larger per capita GDP, the scale of industrial production is also larger, and the energy consumption accompanying it will also increase, which will play a positive role in increasing carbon emissions. (3) The regression coefficient of industrial structure is 0.352, indicating that the increase in the proportion of industrial structure to GDP will promote the increase in carbon emissions. The secondary industry includes mainly high energy consumption, high emission, and low efficiency; this kind of enterprise profits, as the goal of the development model will inevitably lead to the increase in environmental pollution. This also shows the necessity of industrial transformation, as the economic and environmental benefits of the industrial structure simultaneously promote high-quality development. (4) The level of regression coefficient of urbanization is 0.094, indicating a significant positive correlation between urbanization level and carbon emissions; that is, the improvement of the urbanization level will promote the increase in carbon emissions. Rapid urban expansion can lead to changes in land use in surrounding areas, such as the conversion of agricultural land to industrial land, and these changes can lead to increased carbon emissions.

3.3.2. Spatial Durbin Model Decomposition of Direct Effects and Indirect Effects

Through the decomposition of the above model, Table 7 specifically shows the direct effect, indirect effect, and total effect value of the regression result of the model decomposition. For the core explanatory variables, the direct effect of the ESG rating is −0.078, and the indirect effect is −0.315, both of which pass the 1% significance test. The results show that the upgrading of the ESG ratings of both local and foreign enterprises has a significant negative effect on local carbon emissions. However, the indirect effect is significantly larger than the direct effect, indicating that the carbon emission reduction effect resulting from the ESG rating of enterprises mainly comes from other places. This paper suggests that the reason for this may be the mismatch between the registration place and the actual office address of many enterprises, so the indirect effect is greater than the direct effect. The total effect of firm ESG rating is −0.393, which is in the same direction as the results for the decomposed direct effect and the indirect effect, and the effect is larger. The larger the overall effect, the greater the effect of a firm’s ESG rating on local and surrounding carbon emissions. Therefore, enterprises should be encouraged to pay attention to the coordinated development of the environment, society, and governance, increasing the contribution of enterprises to the national emission reduction.

Table 7.

Decomposition of the ESG rating spatial spillover effect.

Among the control variables, the direct effect of population size is 0.696; that is, the expansion of the local population size will significantly increase the regional carbon emissions. The indirect effect of 0.234 only passed the significance test at the 90% confidence level, and was smaller than that of the direct effect. The reason for the decline in the significance of the indirect effect may be that the ecological environmental differences among cities lead to a different capacity for absorbing carbon emissions resulting from the increase in population size.

The direct effect of economic development level is 1.065; that is, the growth of per capita GDP in the region will significantly increase the level of carbon emissions in the region. The indirect effect of economic development level is 0.464; that is, the growth of per capita GDP in the region will significantly increase the carbon emission level of the surrounding region. As economies grow, the expansion of various sectors will lead to more energy consumption and resource use, and the strengthening of regional economic linkages will also lead to an increase in carbon emissions.

The direct and indirect effects of industrial structure are 0.344 and −0.855, respectively, which are significant at 99% and 95% confidence levels. The reason for the difference between the two may be that the high energy-consuming industries of the secondary industry, such as the construction industry and the hydropower and gas supply industry, mostly serve the local residents, and it is difficult to generate these as cross-regional or mobile services. Therefore, the industrial structure of the neighboring region has a negative effect on the local carbon emissions. The final total effect value was −0.512, which did not pass the significance test; that is, the total effect of industrial structure on carbon emissions was unknown.

The direct and indirect effects of urbanization level are 0.099 and 0.409, respectively, which both pass the significance test, indicating that the improvement of the local and foreign urbanization level will increase the level of carbon emissions. On the one hand, the construction of infrastructure and urban housing consumes a large amount of iron and steel raw materials, resulting in high energy consumption, and on the other hand, the electrification and automation of modern cities cause a large demand for electric energy. Under the trend of green development, on the one hand, it is necessary to vigorously develop the green construction industry for the replacement of building materials. On the other hand, it is necessary to guide people to establish a thrifty consumption concept and to form a social atmosphere that is proud of green consumption and ecological environmental protection, while being ashamed of extravagance and waste which aggravate ecological burdens.

Both the direct and indirect effects of FDI are negative; that is, the increase in FDI in the region and neighboring regions will inhibit the carbon emission in the region, and industrial agglomeration, technology spillover, and structural effects may be the possible reasons for emission reduction. At the same time, the total effect is the same as the direct effect and the indirect effect, and the value is greater than both, indicating that foreign investment may promote carbon emission reduction due to the introduction of more advanced environmental protection technology or through green investment influenced by national investment policies.

3.3.3. The Impact of Firm ESG Rating on Carbon Emissions under Regional Heterogeneity

The impact of enterprise ESG ratings on carbon emissions among 208 cities has been analyzed above. China has a vast geographical area, and different regional classifications may have different impacts. Therefore, according to the division of the Eastern, Central, and Western regions, provided by the Bureau of Statistics of China, the Eastern Region includes 102 cities, such as Beijing and Tianjin, the Central Region includes 64 cities, such as Taiyuan and Wuhan, and the Western region includes 42 cities, such as Chengdu and Guiyang. These cities are divided into three inverse distance square weight matrices. The spatial Durbin model with fixed time was selected to analyze the different effects of the ESG rating on carbon emissions in the three regions of Eastern, Central, and Western China.

According to the regression results in Table 8, there are obvious differences in the impact of variables in different regions on carbon emissions. For the core explanatory variable of corporate ESG rating in the Eastern Region, the carbon emission reduction effect of this rating still exists, and the regression coefficient is −0.096, which is greater than the national emission reduction effect of −0.076. For the Central and Western regions, the carbon emission reduction effect of the enterprise ESG rating is not significant. This paper suggests that the possible reasons for these results lie in the following aspects: First, from the data of the Eastern Region, the rating scores of enterprises participating in ESG rating are generally better than those of the Central and Western regions, so the effect of carbon emission reduction will be more significant. Secondly, because the economic development level of the Eastern Region is better than that of the Central and Western regions, the number of enterprises participating in the ESG enterprise rating is also higher than that of the Central and Western regions, and the difference in data volume will result in different effects between regions.

Table 8.

Influence of ESG ratings of enterprises in different regions on carbon emissions.

From the perspective of control variables, population size is significantly positive in both the Eastern and Western regions, and both pass the significance test under 1%. On the whole, population size in the Eastern Region has a greater positive effect on carbon emissions, at 0.777, which is greater than the overall level of the country, which may be related to the trend of labor flow to the Eastern Region. Compared with the national level of 1.060, the economic development level in the Central Region has a greater influence on carbon emissions, indicating that the economic growth problem, combined with environmental pollution, is the most serious in the Central Region, and it is imperative to change the economic growth mode and implement energy conservation and emission reduction projects. The regression coefficients of industrial structure in the three regions are significantly positive, indicating that the influence of industrial structure on carbon emission reduction must be considered, and the promotion of the green transformation and development process of secondary industry offers practical significance for the realization of the “dual carbon” goal.

The level of urbanization is significantly positive in the Western Region, and sustainable urbanization should be actively promoted to ensure that urban planning and construction are in line with environmental protection and low-carbon goals. The regression coefficient of FDI in the eastern and Central Regions is significant, the Eastern Region is significantly positive, and the Central Region is significantly negative, indicating that the effect of FDI utilization in the Eastern and Central regions is different. In the East, foreign enterprises may mainly invest in high-carbon emission industries, or the Eastern Region may relax the carbon emission restrictions in order to attract more foreign investment. The significant negative regression coefficient in the Central Region may be due to the technology spillover effect of foreign capital, which improves the effective utilization efficiency of energy and inhibits carbon emissions.

3.3.4. The Impact of Firm ESG Rating on Carbon Emissions under City-Size Heterogeneity

Theoretically, population size and carbon emissions should be positively correlated, and urban population size will affect the emission reduction effect resulting from the ESG rating of enterprises. In order to explore the impact of enterprise ESG rating on carbon emissions under different city sizes, this paper makes adjustments according to the Notice on Adjusting the Classification Standards of City Sizes issued by The State Council in 2014 and uses the number of permanent residents to classify city sizes. The figures shown in Table 9 are the number of permanent residents of the city, 50, 100, 500 and 1000 respectively represent the number of permanent residents. The specific classification standards are shown in Table 9 below:

Table 9.

City size classification (unit: thousands of people).

After the merger, the number of small and medium-sized cities is 2, the number of large cities is 117, and the number of megacities is 89. Since the number of small and medium-sized cities after the merger is still too small to be authoritative for the data results, this research only analyzes the heterogeneity of big cities and megacities. The results are shown in Table 10. Whether for big cities or megacities, the ESG rating of enterprises, the main explanatory variable, has an inhibitory effect on carbon emissions, but with the increase in population, the effect of carbon emission reduction is more obvious. Among these, the population of megacities is large, and the total GDP value of the cities is relatively high. It is reasonable to speculate that ESG can promote carbon emission reduction better when the GDP of the cities increases. Similarly, other scholars have also found that when the GDP of a city is higher, the impact of ESG rating on sustainable development is more significant [46,47].

Table 10.

Influence of ESG rating performance of enterprises of different city sizes on carbon emissions.

3.4. Robustness Test

In this paper, by adding control and lag variables, we observe whether adding new control variables will lead to changes in the coefficient coincidence and the significance of core explanatory variables. First, as shown in Table 11, when the green coverage rate of built-up areas was added to the baseline regression as a control variable, the positive and negative and significance of the core explanatory variables did not change, and the above results were still valid after the control variables were added. Second, the regression coefficient of the core explanatory variable is −0.075 after all variables are treated with a one-stage lag, indicating that the ESG rating of the previous year will inhibit the carbon emissions of the current year. The coincidence and significance of the coefficients of other control variables are the same as those of the benchmark regression, which verifies the reliability of the conclusions in this paper.

Table 11.

Robustness test.

4. Discussion and Conclusions

4.1. Discussion

Enterprise development provides the source of power for urban economic development, and measuring the impact of changes in the enterprise ESG rating on carbon emissions is an essential part of implementing high-quality development, as well as an inevitable requirement for achieving the “double carbon” goal. Based on the data of listed companies from 2010 to 2019, this paper uses the spatial Durbin model to assess the impact of ESG rating on carbon emissions. The findings are as follows:

(1) The concentration distribution trend of carbon dioxide emissions in China is obvious, mainly showing a “high and low” agglomeration trend in regards to geographical characteristics, and the geographical distribution of enterprise ESG rating performance is also strong in the East and weak in the West. Most cities showed a gradual increase in ESG rating performance during the period from 2010 to 2019, while some cities also showed a slow development in their scores.

(2) ESG rating performance has a significant inhibitory effect on carbon emissions, and there is a spatial spillover effect. The results of the spatial Durbin model show that, controlling for other factors remaining unchanged, carbon emissions decrease by 0.076 for every 1% increase in ESG performance. From the empirical results, the direct effect of ESG rating on carbon emissions is −0.078, the indirect effect is −0.315, and the spatial effect is −0.224, indicating that the improvement of local and neighboring ESG performance will have a inhibiting effect on local carbon emissions. The indirect effect is greater than the direct effect, which may be due to the fact that the ESG performance used in this paper considers the place of company registration. This is consistent with the research of foreign scholars. The degree of city compliance with ESG principles largely depends on the quality and efficiency of urban economic policies, and there is regional heterogeneity [48].

(3) According to the regression results of regional heterogeneity, the carbon emission reduction effect of ESG rating in Eastern China is still significant, while the effect of ESG rating in other regions is not obvious. The inhibitory effect of −0.096 in the Eastern Region is more obvious than that of −0.078 at the national level. According to the heterogeneity regression results for city size, both large cities and megacities exhibit significant inhibition effects, which proves that the agglomeration effect of large cities and megacities is dominant, indicating that a certain urban population size and ESG rating performance will contribute to urban green and low-carbon development.

4.2. Conclusions

As mentioned above, this paper confirms the inhibitory effect of ESG rating on carbon emissions and its spatial spillover effect. However, this study includes some limitations. First, due to the limitations of data and information, the final deadline of the data used in this paper is 2019; secondly, because this paper focuses on the study of the spatial effect at the macro level, the mechanism of study for the ESG rating’s inhibition of carbon emissions is not perfect, and a future study can focus more on the effect of ESG investment and various emissions between different industries. On the basis of previous studies, this paper proposes some future research directions:

(1) The transparency of corporate information disclosure should be continuously monitored and improved in the future. Some scholars in other countries believe that the ESG rating is better at predicting future risks and opportunities, is easier to use in regards to carrying out long-term strategic thinking, and is more concerned about the long-term development of wealth [49,50]. Academics in the Singapore area believe that investment in Singapore start-ups is moving in the direction of ESG ratings, as the country makes sustainability a priority [51]. In the United States, investment in sustainably oriented innovation has increased since 2015 [52], as has the number of patents issued to improve ESG performance [53], which means that companies looking to improve ESG performance need to invest in R&D and innovation programs [54]. Judging from the ESG development of these countries, the future ESG rating will have a significant impact on the sustainable development process. At the same time, scholars are increasingly concerned about the carbon reduction effects of ESG. When considering future investment decisions, good ESG performance generates moral capital, has an insurance effect, and reduces corporate risk [55], which in turn reduces the rate of return demanded by investors and creditors, thereby reducing the cost of equity [56] and the cost of debt. Due to the reduction of enterprise costs, these enterprises will obtain more stable earnings and long-term sustainable growth potential. Consumers are also more likely to support companies that are actively involved in environmental causes, thus tilting market demand toward environmentally friendly products and services.

(2) Considering the conclusion that the indirect effect of enterprise ESG rating on carbon emission reduction is greater than the direct effect, and the impact of one cycle lag is slightly smaller, it is suggested that enterprises should not only pay attention to direct emission reduction measures, but they should also adopt comprehensive carbon emission reduction strategies. In the future, the coordinated development of inter-city policies will become the main development direction, and determining how to break inter-regional barriers will become the research focus. Considering that the lag effect of the first phase is still significant, increasing green infrastructure construction from the perspective of ESG development still has a significant effect [57]. It is recommended that the government develop a comprehensive ESG policy framework to promote not only the ESG rating performance of enterprises, but also the ESG rating performance of society as a whole. Governments can create enticements, such as tax breaks or incentives, to encourage businesses to actively participate in ESG. In addition, cooperation between enterprises is encouraged to jointly develop environmentally friendly technologies, achieve synergies in ESG rating performance, and minimize carbon emissions.

(3) In the future, we should pay attention to the differences between cities and focus on the coordinated development of policies. First of all, due to the significant inhibitory effect of the Eastern Region and large cities and megacities, the future government, enterprises, and all sectors of society should strengthen ESG improvement measures in the Eastern Region and areas with large populations. Secondly, it is crucial to promote technological innovation and knowledge sharing, exploring the role of technological innovation regarding the impact of the ESG rating on carbon emissions. In the future, governments can create incentives to encourage cities with good ESG investments to continue to achieve significant carbon reduction outcomes concerning their local development and to share their experiences to drive a green and low-carbon transition across the country.

Author Contributions

Conceptualization, Y.H. and W.Y.; methodology, W.Y.; software, Y.H.; validation, Y.H. and W.Y.; formal analysis, Y.H.; investigation, W.Y.; resources, Y.H.; data curation, Y.H.; writing—original draft preparation, Y.H.; writing—review and editing, W.Y.; visualization, Y.H.; supervision, W.Y.; project administration, Y.H.; funding acquisition, Y.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Lombardi, M.; Laiola, E.; Tricase, C.; Rana, R. Assessing the urban carbon footprint: An overview. Environ. Impact Assess. Rev. 2017, 66, 43–52. [Google Scholar] [CrossRef]

- Moran, D.; Kanemoto, K.; Jiborn, M.; Wood, R.; Többen, J.; Seto, K.C. Carbon footprints of 13,000 cities. Environ. Res. Lett. 2018, 13, 064041. [Google Scholar] [CrossRef]

- Bhoyar, S.P.; Dusad, S.; Shrivastava, R.; Mishra, S.; Gupta, N.; Rao, A.B. Understanding the impact of lifestyle on individual carbon-footprint. Procedia-Soc. Behav. Sci. 2014, 133, 47–60. [Google Scholar] [CrossRef]

- Schanes, K.; Giljum, S.; Hertwich, E. Low carbon lifestyles: A framework to structure consumption strategies and options to reduce carbon footprints. J. Clean. Prod. 2016, 139, 1033–1043. [Google Scholar] [CrossRef]

- Lin, B. China’s High-quality Economic Growth in the Process of Carbon Neutrality. Econ. Res. J. 2022, 57, 56–71. [Google Scholar]

- Liu, Y.; Li, Y.; Wang, W. Challenges, opportunities and actions for China to achieve the targets of carbon peak and carbon neutrality. China Popul. Resour. Environ. 2021, 31, 1–5. [Google Scholar]

- Liu, H.J.; Shi, Y.; Guo, L.X.; Qiao, L.C. China’s Energy Reform in the New Era: Process, Achievements and Prospects. J. Manag. World 2022, 38, 6–24. [Google Scholar]

- Yang, L.; Zhu, J.; Jia, Z. Influencing Factors and Current Challenges of CO2 Emission Reduction China: A Perspective Based on Technological Progress. Econ. Res. J. 2019, 54, 118–132. [Google Scholar]

- Yuan, X.; Geng, H.; Li, S.; Li, Z. The Status, Challenges and Countermeasures of the “Double Carbon” Goal Realization in Chinese Cities from the Perspective of High-Quality Development. J. Xi’an Jiaotong Univ. 2022, 42, 30–38. [Google Scholar]

- Zhu, X.; Gong, B. Risks, Challenges and Pathways towards Carbon Peaking and Climate Neutrality in the Context of High-quality Development. Gov. Stud. 2022, 38, 13–23. [Google Scholar]

- Zhuang, G.; Zhou, H.; Guo, P.; Zhong, M.; Zhang, Z. “Double carbon” goal and regional economic development. Reg. Econ. Rev. 2022, 1, 16–27. [Google Scholar]

- Wu, J.; Xu, M.; Ma, Y. Environmental Assessment, Public Participation and Governance Effectiveness: Evidence from the Chinese Provinces. Chin. Public Adm. 2016, 9, 75–81. [Google Scholar]

- Baranzini, A.; Goldemberg, J.; Speck, S. A future for carbon taxes. Ecol. Econ. 2000, 32, 395–412. [Google Scholar] [CrossRef]

- Ren, Y.; Fu, J. Research on the effect of carbon emissions trading on emission reduction and green development. China Popul. Resour. Environ. 2019, 29, 11–20. [Google Scholar]

- Tang, K.; Liu, Y.; Zhou, D.; Qiu, Y. Urban carbon emission intensity under emission trading system in a developing economy: Evidence from 273 Chinese cities. Environ. Sci. Pollut. Res. 2021, 28, 5168–5179. [Google Scholar] [CrossRef] [PubMed]

- An, G. Discussion on the Innovation Path of Green Finance under the Goal of Carbon Neutrality. S. China Financ. 2021, 1, 3–12. [Google Scholar]

- Yuan, C.W.; Zhang, S.; Jiao, P.; Wu, D. Temporal and spatial variation and influencing factors research on total factor efficiency for transportation carbon emissions in China. Resour. Sci. 2017, 39, 687–697. [Google Scholar]

- Sun, X.; Liu, X. Spatiotemporal evolution and influencing factors of urban carbon emission efficiency in China: Based on heterogeneous spatial stochastic frontier model. Geogr. Res. 2023, 42, 3182–3201. [Google Scholar]

- Wei, L.; Hou, Y.; Cao, H. Urban Carbon Emission Performance in China: Dynamic Decomposition, Spatial Difference and Influencing Factors. J. Stat. Inf. 2024, 39, 69–83. [Google Scholar]

- Cao, J.; Ren, Z. How Does Low-Carbon City Pilot Policy Affect Urban Carbon Emissions? Res. Financ. Econ. Issues 2024, 1, 57–71. [Google Scholar]

- Zhang, C.; Zhang, Y.; Chen, Y. ESG Implementation, Investor Confidence and Listed Companies’ Performance. J. Environ. Econ. 2021, 6, 22–39. [Google Scholar]

- Cai, W.; Deng, L.; Liu, Y. ESG Performance and Corporate Financial Performance under Double Carbon Goals: Based on the Moderating Effect of External Pressure. Financ. Theory Pract. 2023, 6, 69–81. [Google Scholar]

- Du, Y. Research on ESG Audit under the Constraint of “Double Carbon” Goal. J. Harbin Inst. Technol. 2022, 24, 154–160. [Google Scholar]

- Wang, Y.; Xie, M.; Guo, C. Does Firm ESG Performance Influence Bank Credit Decisions? Empirical Evidence from A-share Listed Firms in China. Financ. Econ. Res. 2023, 38, 97–114. [Google Scholar]

- Jiang, Y.; Yao, S. ESG Disclosure, External Concerns, and Firm Risk. J. Syst. Manag. 2024, 33, 214–229. [Google Scholar]

- Yang, Q.; Du, Q.; Razzaq, A.; Shang, Y. How volatility in green financing, clean energy, and green economic practices derive sustainable performance through ESG indicators? A sectoral study of G7 countries. Resour. Policy 2022, 75, 102526. [Google Scholar] [CrossRef]

- Mu, W.; Liu, K.; Tao, Y.; Ye, Y. Digital finance and corporate ESG. Financ. Res. Lett. 2023, 51, 103426. [Google Scholar] [CrossRef]

- Ren, X.; Zeng, G.; Zhao, Y. Digital finance and corporate ESG performance: Empirical evidence from listed companies in China. Pac.-Basin Financ. J. 2023, 79, 102019. [Google Scholar] [CrossRef]

- Shu, H.; Tan, W. Does carbon control policy risk affect corporate ESG performance? Econ. Model. 2023, 120, 106148. [Google Scholar] [CrossRef]

- Hu, J.; Yu, X.; Han, Y. Can ESG Rating Promote Green Transformation of Enterprises? J. Quant. Technol. Econ. 2023, 40, 90–111. [Google Scholar]

- Meng, M.; Tan, X.; Liu, S.; Lei, J. Research on the Impact of ESG Performance on Green Innovation. J. Technol. Econ. 2023, 42, 13–24. [Google Scholar]

- Xi, L.; Zhao, H. The influence Mechanism and Data Test of Enterprise ESG Performance on Earnings Sustainability. Manag. Rev. 2022, 34, 313–326. [Google Scholar]

- Wang, L.; Lian, Y.; Dong, J. Study on the Impact Mechanism of ESG Performance on Corporate Value. Secur. Mark. Her. 2022, 5, 23–34. [Google Scholar]

- Xue, T.; Guo, Q.; Xiao, W. An Empirical Study on the ESG Impact Mechanism on Enterprise Value under the Context of Carbon Peak and Neutrality Target. Soc. Sci. Front. 2022, 11, 89–99+281. [Google Scholar]

- Wang, B.; Yang, M. A Study on the Mechanism of ESG Performance on Corporate Value-Empirical Evidence from A-share Listed Companies in China. Soft Sci. 2022, 36, 78–84. [Google Scholar]

- Shi, Y.; Wang, H. Corporate Social Responsibility and Company Value: An ESG Risk Premium Perspective. Econ. Res. J. 2023, 58, 67–83. [Google Scholar]

- Fang, X.; Hu, D. Corporate ESG Performance and Innovation: Empirical Evidence from A-share listed Companies. Econ. Res. J. 2023, 58, 91–106. [Google Scholar]

- Chen, Y.; Si, D.; Ni, M. Digital Transformation, ESG Performance and Corporate Innovation Performance. Mod. Financ. Econ.-J. Tianjin Univ. Financ. Econ. 2023, 43, 32–48. [Google Scholar]

- Qian, Y.; Sang, J.; Lu, W.; Li, X.; Tian, J.; Chen, L. Review on the Research Progress of ESG and Its New Opportunities under the National Pledge of Carbon Peaking and Carbon Neutralization. Chin. J. Environ. Manag. 2023, 15, 36–47. [Google Scholar]

- Bai, X.; Zhu, Y.; Han, J. ESG Performance, Institutional Investor Preference and Firm Value of Listed Companies. J. Stat. Inf. 2022, 37, 117–128. [Google Scholar]

- Li, J.; Yang, Z.; Chen, J.; Cui, W. Study on the Mechanism of ESG Promoting Corporate Performance: Based on the Perspective of Corporate Innovation. Sci. Sci. Manag. ST 2021, 42, 71–89. [Google Scholar]

- Li, W.; Hao, C.; Chui, G.; Zheng, M.; Meng, Q. Forty Years of Corporate Governance Research: A Review and Agenda. Foreign Econ. Manag. 2019, 41, 161–185. [Google Scholar]

- Shen, H.; Ma, Z. Local Economic Development Pressure, Firm Environmental Performance and Debt Financing. J. Financ. Res. 2014, 2, 153–166. [Google Scholar]

- Qiu, M.; Yin, H. ESG performance and financing cost of enterprises in the context of ecological civilization construction. J. Quant. Technol. Econ. 2019, 36, 108–123. [Google Scholar]

- Zhang, H.; Yuan, P.; Zhu, Z. City population size, industrial agglomeration and CO2 emission in Chinese prefectures. China Environ. Sci. 2021, 41, 2459–2470. [Google Scholar]

- Guo, Z.; He, Y. ESG and Urban Sustainable Development. Trans. Econ. Bus. Manag. Res. 2024, 5, 250–265. [Google Scholar] [CrossRef]

- Garveya, G.T.; Iyera, M.; Nashb, J. Carbon footprint and productivity: Does the “E” in ESG capture efficiency as well as environment? J. Invest. Manag. 2018, 16, 59–69. [Google Scholar]

- Kyriakopoulos, G.; Kumar, V.; Romanova, O. Realisation of ESG principles in million-plus cities under the sanctions regime: Is there an alternative? In E3S Web of Conferences; EPD Sciences: Birmingham, UK, 2023; Volume 435, p. 01003. [Google Scholar]

- Schmitz, J.; Schrader, J. Corporate social responsibility: A microeconomic review of the literature. J. Econ. Surv. 2015, 29, 27–45. [Google Scholar] [CrossRef]

- Hossain, M.M.; Momin, M.A.; Rowe, A.L.; Quaddus, M. Corporate social and environmental reporting practices: A case of listed companies in Bangladesh. Sustain. Account. Manag. Policy J. 2017, 8, 138–165. [Google Scholar] [CrossRef]

- Pangarkar, N.; Vandenberg, P. Singapore’s Ecosystem for Technology Startups and Lessons for Its Neighbors; Asian Development Bank: Manila, Philippines, 2022. [Google Scholar]

- Chatterji, A.K.; Durand, R.; Levine, D.I.; Touboul, S. Do ratings of firms converge? Implications for managers, investors and strategy researchers. Strateg. Manag. J. 2016, 37, 1597–1614. [Google Scholar] [CrossRef]

- Berg, F.; Koelbel, J.F.; Rigobon, R. Aggregate confusion: The divergence of ESG ratings. Rev. Financ. 2022, 26, 1315–1344. [Google Scholar] [CrossRef]

- LaBella, M.J.; Sullivan, L.; Russell, J.; Novikov, D. The Devil Is in the Details: The Divergence in ESG Data and Implications for Responsible Investing; QS Investors: New York, NY, USA, 2019; Volume 11. [Google Scholar]

- Lins, K.V.; Servaes, H.; Tamayo, A. Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. J. Financ. 2017, 72, 1785–1824. [Google Scholar] [CrossRef]

- Pástor, Ľ.; Stambaugh, R.F.; Taylor, L.A. Sustainable investing in equilibrium. J. Financ. Econ. 2021, 142, 550–571. [Google Scholar] [CrossRef]

- Lee, E.; Kim, G. Analysis of domestic and international green infrastructure research trends from the ESG perspective in South Korea. Int. J. Environ. Res. Public Health 2022, 19, 7099. [Google Scholar] [CrossRef] [PubMed]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).