How Does Green Credit Affect Corporate Green Investment Efficiency? A Test Based on Listed Corporations in China’s Heavy Pollution Industry

Abstract

1. Introduction

2. Literature Review

2.1. Impact of GC

2.2. Green Investment Efficiency

2.3. The Impact of GC on Corporate Investment and Financing Behavior

3. Methodology

3.1. Hypotheses

3.2. The Super-SBM DEA

3.3. Fixed Effects Model

3.4. Threshold Effect Model

3.5. Variable Descriptions and Data Sources

4. Empirical Analysis and Results

4.1. Changing Patterns of Green Investment Efficiency

4.2. Basic Results Analysis

4.3. Robustness Tests

4.4. Heterogeneity Analysis

4.4.1. Internal Control Perspectives

4.4.2. External Regulatory Perspectives

4.5. Further Analysis

5. Conclusion and Policy Implications

5.1. Conslusions

5.2. Policy Implications

5.3. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhang, B.; Yang, Y.; Bi, J. Tracking the implementation of green credit policy in China: Top-down perspective and bottom-up reform. J. Environ. Manag. 2011, 92, 1321–1327. [Google Scholar] [CrossRef] [PubMed]

- Su, X.; Pan, C.; Zhou, S.; Zhong, X. Threshold effect of green credit on firms’ green technology innovation: Is environmental information disclosure important? J. Clean. Prod. 2022, 380, 134945. [Google Scholar] [CrossRef]

- Lin, B.; Pan, T. Financing decision of heavy pollution enterprises under green credit policy: Based on the perspective of signal transmission and supply chain transmission. J. Clean. Prod. 2023, 412, 137454. [Google Scholar] [CrossRef]

- Liu, H.; Liu, Z.; Zhang, C.; Li, T. Transformational insurance and green credit incentive policies as financial mechanisms for green energy transitions and low-carbon economic development. Energy Econ. 2023, 126, 107016. [Google Scholar] [CrossRef]

- Su, D.; Lian, L. Does Green Credit Policy Affect Corporate Financing and Investment? Evidence from Publicly Listed Firms in Pollution-Intensive Industries. J. Financ. Res. 2018, 462, 123–137. [Google Scholar]

- Cutillas Gomariz, M.F.; Sánchez Ballesta, J.P. Financial reporting quality, debt maturity and investment efficiency. J. Bank. Financ. 2014, 40, 494–506. [Google Scholar] [CrossRef]

- Hao, F.; Xie, Y.; Liu, X.; Sarkar, B. The impact of green credit guidelines on the technological innovation of heavily polluting enterprises: A Quasi-Natural experiment from China. Math. Probl. Eng. 2020, 2020, 8670368. [Google Scholar] [CrossRef]

- Su, T.; Meng, L.; Wang, K.; Wu, J. The role of green credit in carbon neutrality: Evidence from the breakthrough technological innovation of renewable energy firms. Environ. Impact Assess. Rev. 2023, 101, 107135. [Google Scholar] [CrossRef]

- Li, G.; Wang, P.; Pal, R. Measuring sustainable technology R&D innovation in China: A unified approach using DEA-SBM and projection analysis. Expert Syst. Appl. 2022, 209, 118393. [Google Scholar]

- Zhang, J.; Luo, Y.; Ding, X. Can green credit policy improve the overseas investment efficiency of enterprises in China? J. Clean. Prod. 2022, 340, 130785. [Google Scholar] [CrossRef]

- Li, L.; Qiu, L.; Xu, F.; Zheng, X. The impact of green credit on firms’ green investment efficiency: Evidence from China. Pac.-Basin Financ. J. 2023, 79, 101995. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Shi, W. Has China’s carbon emissions trading (CET) policy improved green investment in carbon-intensive enterprises? Comput. Ind. Eng. 2023, 180, 109240. [Google Scholar] [CrossRef]

- Hassan, S.T.; Batool, B.; Sadiq, M.; Zhu, B. How do green energy investment, economic policy uncertainty, and natural resources affect greenhouse gas emissions? A Markov-switching equilibrium approach. Environ. Impact Assess. Rev. 2022, 97, 106887. [Google Scholar] [CrossRef]

- Wang, Q.; Fan, Z. Green finance and investment behavior of renewable energy enterprises: A case study of China. Int. Rev. Financ. Anal. 2023, 87, 102564. [Google Scholar] [CrossRef]

- Wang, B.; Zhao, W. Interplay of renewable energy investment efficiency, shareholder control and green financial development in China. Renew. Energy 2022, 199, 192–203. [Google Scholar] [CrossRef]

- Guo, K.; Cao, Y.; He, S.; Li, Z. Evaluating the efficiency of green economic production and environmental pollution control in China. Environ. Impact Assess. Rev. 2024, 104, 107294. [Google Scholar] [CrossRef]

- Lian, Y.; Gao, J.; Ye, T. How does green credit affect the financial performance of commercial banks? —Evidence from China. J. Clean. Prod. 2022, 344, 131069. [Google Scholar] [CrossRef]

- Luo, S.; Yu, S.; Zhou, G. Does green credit improve the core competence of commercial banks? Based on quasi-natural experiments in China. Energy Econ. 2021, 100, 105335. [Google Scholar] [CrossRef]

- Zhang, A.; Deng, R.; Wu, Y. Does the green credit policy reduce the carbon emission intensity of heavily polluting industries? -Evidence from China’s industrial sectors. J. Environ. Manag. 2022, 311, 114815. [Google Scholar] [CrossRef]

- Zhou, D.; Qiu, Y.; Wang, M. Does environmental regulation promote enterprise profitability? Evidence from the implementation of China’s newly revised Environmental Protection Law. Econ. Model. 2021, 102, 105585. [Google Scholar] [CrossRef]

- Yin, W.; Zhu, Z.; Kirkulak-Uludag, B.; Zhu, Y. The determinants of green credit and its impact on the performance of Chinese banks. J. Clean. Prod. 2021, 286, 124991. [Google Scholar] [CrossRef]

- Cilliers, E.J.; Diemont, E.; Stobbelaar, D.J.; Timmermans, W. Sustainable green urban planning: The green credit tool. J. Place Manag. Dev. 2010, 3, 57–66. [Google Scholar] [CrossRef]

- Guo, P. Financial policy innovation for social change: A case study of China’s green credit policy. Int. Rev. Sociol. 2014, 24, 69–76. [Google Scholar] [CrossRef]

- Wu, S.; Zhou, X.; Zhu, Q. Green credit and enterprise environmental and economic performance: The mediating role of eco-innovation. J. Clean. Prod. 2023, 382, 135248. [Google Scholar] [CrossRef]

- Zhou, C.; Sun, Z.; Qi, S.; Li, Y.; Gao, H. Green credit guideline and enterprise export green-sophistication. J. Environ. Manag. 2023, 336, 117648. [Google Scholar] [CrossRef] [PubMed]

- Zhang, D.; Kong, Q. Renewable energy policy, green investment, and sustainability of energy firms. Renew. Energy 2022, 192, 118–133. [Google Scholar] [CrossRef]

- Zhang, M.; Zhang, X.; Song, Y.; Zhu, J. Exploring the impact of green credit policies on corporate financing costs based on the data of Chinese A-share listed companies from 2008 to 2019. J. Clean. Prod. 2022, 375, 134012. [Google Scholar] [CrossRef]

- Lu, Y.; Gao, Y.; Zhang, Y.; Wang, J. Can the green finance policy force the green transformation of high-polluting enterprises? A quasi-natural experiment based on “Green Credit Guidelines”. Energy Econ. 2022, 114, 106265. [Google Scholar] [CrossRef]

- Wen, H.; Lee, C.-C.; Zhou, F. Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ. 2021, 94, 105099. [Google Scholar] [CrossRef]

- Wu, S.; Wu, L.; Zhao, X. Impact of the green credit policy on external financing, economic growth and energy consumption of the manufacturing industry. Chin. J. Popul. Resour. Environ. 2022, 20, 59–68. [Google Scholar] [CrossRef]

- Xu, X.; Li, J. Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J. Clean. Prod. 2020, 264, 121574. [Google Scholar] [CrossRef]

- Zhao, J.; Huang, J.; Liu, F. Green credit policy and investment-cash flow sensitivity: Evidence from a quasi-natural experiment. Financ. Res. Lett. 2023, 52, 103502. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, X.; Xing, C. How does China’s green credit policy affect the green innovation of high polluting enterprises? The perspective of radical and incremental innovations. J. Clean. Prod. 2022, 336, 130387. [Google Scholar] [CrossRef]

- Lin, B.Q.; Pan, T. The impact of green credit on green transformation of heavily polluting enterprises: Reverse forcing or forward pushing? Energy Policy 2024, 184, 113901. [Google Scholar] [CrossRef]

- Huang, X.B.; Xie, J.W. Impact of green credit policies on the global value chain position of heavy polluting enterprises. Energy Policy 2024, 192, 114269. [Google Scholar] [CrossRef]

- Eyraud, L.; Clements, B.; Wane, A. Green investment: Trends and determinants. Energy Policy 2013, 60, 852–865. [Google Scholar] [CrossRef]

- Mielke, J.; Steudle, G.A. Green Investment and Coordination Failure: An Investors’ Perspective. Ecol. Econ. 2018, 150, 88–95. [Google Scholar] [CrossRef]

- Wang, W.; Wang, X. Does provincial green governance promote enterprise green investment? Based on the perspective of government vertical management. J. Clean. Prod. 2023, 396, 136519. [Google Scholar] [CrossRef]

- Chang, Y.-T.; Zhang, N.; Danao, D.; Zhang, N. Environmental efficiency analysis of transportation system in China: A non-radial DEA approach. Energy Policy 2013, 58, 277–283. [Google Scholar] [CrossRef]

- Burnett, R.D.; Hansen, D.R. Ecoefficiency: Defining a role for environmental cost management. Account. Organ. Soc. 2008, 33, 551–581. [Google Scholar] [CrossRef]

- Pan, K.; He, F. Does Public Environmental Attention Improve Green Investment Efficiency?—Based on the Perspective of Environmental Regulation and Environmental Responsibility. Sustainability 2022, 14, 12861. [Google Scholar] [CrossRef]

- Chang, K.; Wan, Q.; Lou, Q.; Chen, Y.; Wang, W. Green fiscal policy and firms’ investment efficiency: New insights into firm-level panel data from the renewable energy industry in China. Renew. Energy 2020, 151, 589–597. [Google Scholar] [CrossRef]

- Hu, S.; Wang, A.; Du, K.; Si, L. Can China railway express improve environmental efficiency? Evidence from China’s cities. Environ. Impact Assess. Rev. 2023, 99, 107005. [Google Scholar] [CrossRef]

- Fan, Q.; Liu, J.; Zhang, T.; Liu, H. An evaluation of the efficiency of China’s green investment in the “Belt and Road” countries. Struct. Change Econ. Dyn. 2022, 60, 496–511. [Google Scholar] [CrossRef]

- Huang, L.; Lei, Z. How environmental regulation affect corporate green investment: Evidence from China. J. Clean. Prod. 2021, 279, 123560. [Google Scholar] [CrossRef]

- Hu, Y.; Bai, W.; Farrukh, M.; Koo, C.K. How does environmental policy uncertainty influence corporate green investments? Technol. Forecast. Soc. Change 2023, 189, 122330. [Google Scholar] [CrossRef]

- Anagnostopoulou, S.C.; Avgoustaki, A. The impact of human resource practices on corporate investment efficiency. Int. Rev. Financ. Anal. 2023, 87, 102609. [Google Scholar] [CrossRef]

- Yan, C.; Mao, Z.; Ho, K.-C. Effect of green financial reform and innovation pilot zones on corporate investment efficiency. Energy Econ. 2022, 113, 106185. [Google Scholar] [CrossRef]

- Tian, J.F.; Sun, S.Y.; Cao, W.; Bu, D.; Xue, R. Make every dollar count: The impact of green credit regulation on corporate green investment efficiency. Energy Econ. 2024, 130, 107307. [Google Scholar] [CrossRef]

- Chai, S.; Zhang, K.; Wei, W.; Ma, W.; Abedin, M.Z. The impact of green credit policy on enterprises’ financing behavior: Evidence from Chinese heavily-polluting listed companies. J. Clean. Prod. 2022, 363, 132458. [Google Scholar] [CrossRef]

- Liu, X.; Wang, E.; Cai, D. Green credit policy, property rights and debt financing: Quasi-natural experimental evidence from China. Financ. Res. Lett. 2019, 29, 129–135. [Google Scholar] [CrossRef]

- Li, W.; Cui, G.; Zheng, M. Does green credit policy affect corporate debt financing? Evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 5162–5171. [Google Scholar] [CrossRef]

- Khan, M.K.; He, Y.; Akram, U.; Sarwar, S. Financing and monitoring in an emerging economy: Can investment efficiency be increased? China Econ. Rev. 2017, 45, 62–77. [Google Scholar] [CrossRef]

- Naeem, K.; Li, M.C. Corporate investment efficiency: The role of financial development in firms with financing constraints and agency issues in OECD non-financial firms. Int. Rev. Financ. Anal. 2019, 62, 53–68. [Google Scholar] [CrossRef]

- Feng, X.; Li, Y.; Huang, B. Research on manufacturer’s investment strategy and green credit policy for new energy vehicles based on consumers’ preferences and technology adoption. Technol. Forecast. Soc. Change 2023, 191, 122476. [Google Scholar] [CrossRef]

- Li, Z.; Liao, G.; Wang, Z.; Huang, Z. Green loan and subsidy for promoting clean production innovation. J. Clean. Prod. 2018, 187, 421–431. [Google Scholar] [CrossRef]

- He, L.; Zhang, L.; Zhong, Z.; Wang, D.; Wang, F. Green credit, renewable energy investment and green economy development: Empirical analysis based on 150 listed companies of China. J. Clean. Prod. 2019, 208, 363–372. [Google Scholar] [CrossRef]

- Zhao, X.; Ramzi, B.; Mohammad, Z.A.; Zhou, S.L. The charm of green finance: Can green finance reduce corporate carbon emissions? Energy Econ. 2024, 134, 107574. [Google Scholar] [CrossRef]

- Peng, B.; Yan, W.; Elahi, E.; Wan, A. Does the green credit policy affect the scale of corporate debt financing? Evidence from listed companies in heavy pollution industries in China. Environ. Sci. Pollut. Res. 2022, 29, 755–767. [Google Scholar] [CrossRef]

- Zhang, K.; Li, Y.; Qi, Y.; Shao, S. Can green credit policy improve environmental quality? Evidence from China. J. Environ. Manag. 2021, 298, 113445. [Google Scholar] [CrossRef]

- Hu, G.; Wang, X.; Wang, Y. Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ. 2021, 98, 105134. [Google Scholar] [CrossRef]

- Lv, C.; Fan, J.; Lee, C.-C. Can green credit policies improve corporate green production efficiency? J. Clean. Prod. 2023, 397, 136573. [Google Scholar] [CrossRef]

- Gebauer, S.; Setzer, R.; Westphal, A. Corporate debt and investment: A firm-level analysis for stressed euro area countries. J. Int. Money Financ. 2018, 86, 112–130. [Google Scholar] [CrossRef]

- Grossman, S.J.; Hart, O.D. Corporate Financial Structure and Managerial Incentives. In The Economics of Information and Uncertainty; National Bureau of Economic Research: Cambridge, MA, USA, 1983; pp. 107–140. [Google Scholar]

- Myers, S.C. Determinants of corporate borrowing. J. Financ. Econ. 1977, 5, 147–175. [Google Scholar] [CrossRef]

- Wiredu, G.O.; Boateng, K.A.; Effah, J.K. The platform executive: Technology shaping of executive cognition during digital service innovation. Inf. Manag. 2021, 58, 103469. [Google Scholar] [CrossRef]

- Jiang, Y.; Hu, Y.; Asante, D.; Mintah Ampaw, E.; Asante, B. The Effects of Executives’ low-carbon cognition on corporate low-carbon performance: A study of managerial discretion in China. J. Clean. Prod. 2022, 357, 132015. [Google Scholar] [CrossRef]

- Zhou, Z.; Nie, L.; Ji, H.; Zeng, H.; Chen, X. Does a firm’s low-carbon awareness promote low-carbon behaviors? Empirical evidence from China. J. Clean. Prod. 2020, 244, 118903. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Lv, Y.; Xie, Y.X.; Lou, X.J. Spatial-temporal transition and convergence trend of regional green innovation efficiency in China. J. Quant. Tech. Econ. 2020, 5, 78–97. [Google Scholar]

- Hsu, P.-H.; Tian, X.; Xu, Y. Financial development and innovation: Cross-country evidence. J. Financ. Econ. 2014, 112, 116–135. [Google Scholar] [CrossRef]

- Li, S.; Wang, Q. Green finance policy and digital transformation of heavily polluting firms: Evidence from China. Financ. Res. Lett. 2023, 55, 103876. [Google Scholar] [CrossRef]

- Zhou, G.; Sun, Y.; Luo, S.; Liao, J. Corporate social responsibility and bank financial performance in China: The moderating role of green credit. Energy Econ. 2021, 97, 105190. [Google Scholar] [CrossRef]

- Su, C.-W.; Li, W.; Umar, M.; Lobonţ, O.-R. Can green credit reduce the emissions of pollutants? Econ. Anal. Policy 2022, 74, 205–219. [Google Scholar] [CrossRef]

- Niu, H.; Zhao, X.; Luo, Z.; Gong, Y.; Zhang, X. Green credit and enterprise green operation: Based on the perspective of enterprise green transformation. Front. Psychol. 2022, 13, 1041798. [Google Scholar] [CrossRef]

| Variables | Acronym | Operationalization | Sources |

|---|---|---|---|

| Green investment | GI | Environmental, green-related investments | Annual report and corporate social responsibility reports |

| Labor input | LI | Number of employees in the company | CSMAR database, Resset database |

| Capital investment | GI | Enterprise fixed assets value | CSMAR database, Resset database |

| Net profit | NP | Net profit | CSMAR database, Resset database |

| Particulate matter | PM | Particulate matter emissions of corporations | Annual report and corporate social responsibility reports |

| Sulfur dioxide | SO2 | Sulfur dioxide emissions of corporations | Annual report and corporate social responsibility reports |

| Nitrogen oxide | NO | Nitric oxide emissions of corporations | Annual report and corporate social responsibility reports |

| Green investment efficiency | GIE | Efficiency calculated from the measurement model on the super-SBM model | |

| Green credit | GC | Ln(GC Balance/Total loans at the end of the period) | CSMAR database, Bank Annual Reports and corporate social esponsibility reports |

| Corporation size | Size | log(total assets) | CSMAR database, Resset database |

| Return on net assets | ROE | Net Profit/Average balance of shareholders’ equity | CSMAR database, Resset database |

| Cash flow | Cashflow | Net cash flows from operating activities/total assets | CSMAR database, Resset database |

| Fixed assets as a percentage | Fixed | Net fixed assets/total assets | CSMAR database, Resset database |

| Percentage of independent directors | Indep | Independent Directors/Number of Directors | CSMAR database, Resset database |

| Overhead rate | Mfee | Overhead/Operating income | CSMAR database, Resset database |

| TobinQ | TobinQ | (Market value of shares outstanding + Number of non-marketable shares × Net assets per share + Carrying value of liabilities)/total assets | CSMAR database, Resset database |

| Political connection | SOE | Dummy variable: 1 if it is a state-owned enterprise, 0 if otherwise | CSMAR database, Resset database |

| Financial supervision | FS | Dummy variable: 1 if it is a Strong financial supervision, 0 if otherwise | National Bureau of Statistics of China |

| Executive shareholding | ES | Dummy variable: 1 if it is a High Executive Shareholding, 0 if otherwise | CSMAR database, Resset database |

| Environmental regulation | ER | Dummy variable: 1 if it is a Strong environmental regulation, 0 if otherwise | National Bureau of Statistics of China |

| Asset–liability ratio | Lev | Total liabilities at year-end/Total assets at year-end | CSMAR database, Resset database |

| Executive green thinking | EGT | Environment-related word frequency statistics | Annual report |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| GI | 468 | 2.709 × 10⁸ | 1.241 × 10⁹ | 18,406 | 2.276 × 10¹⁰ |

| LI | 468 | 7932 | 8240 | 352 | 70,829 |

| NP | 468 | 1.879 × 10⁹ | 5.468 × 10⁹ | −3.418 × 10⁹ | 5.572 × 10¹⁰ |

| PM | 468 | 654.9 | 1947 | 0.00400 | 15,004 |

| SO2 | 468 | 1191 | 2931 | 0.174 | 21,500 |

| NO | 468 | 2256 | 5703 | 5.830 | 68,803 |

| GIE | 468 | 0.314 | 0.259 | 0.00176 | 1.869 |

| GC | 468 | −2.687389 | 0.1179233 | −2.797537 | −2.445186 |

| Size | 468 | 23.34 | 1.294 | 20.39 | 26.43 |

| ROE | 468 | 0.0878 | 0.129 | −0.819 | 0.406 |

| Cashflow | 468 | 0.0761 | 0.0608 | −0.152 | 0.257 |

| Fixed | 468 | 0.393 | 0.144 | 0.0414 | 0.711 |

| Indep | 468 | 0.362 | 0.0474 | 0.300 | 0.571 |

| Mfee | 468 | 0.0530 | 0.0328 | 0.00695 | 0.195 |

| SOE | 468 | 0.530 | 0.500 | 0 | 1 |

| FR | 468 | 0.487 | 0.500 | 0 | 1 |

| ES | 468 | 0.502 | 0.501 | 0 | 1 |

| ER | 468 | 0.526 | 0.500 | 0 | 1 |

| Lev | 468 | 0.465 | 0.176 | 0.0790 | 0.906 |

| EGT | 468 | 7.194 | 7.156 | 0 | 48 |

| GIE | GC | Size | ROE | Cashflow | FIXED | Indep | Mfee | TobinQ | |

|---|---|---|---|---|---|---|---|---|---|

| GIE | 1 | ||||||||

| GC | 0.207 *** | 1 | |||||||

| Size | 0.0300 | 0.128 *** | 1 | ||||||

| ROE | 0.102 ** | 0.0510 | 0.184 *** | 1 | |||||

| Cashflow | 0.256 *** | 0.081 * | 0.152 *** | 0.478 *** | 1 | ||||

| Fixed | −0.304 *** | −0.093 ** | 0.089 * | −0.163 *** | −0.0340 | 1 | |||

| Indep | 0.113 ** | 0.0560 | −0.00500 | 0.0440 | 0.163 *** | −0.0450 | 1 | ||

| Mfee | 0.0210 | −0.176 *** | −0.463 *** | −0.101 ** | −0.083 * | −0.166 *** | 0.0610 | 1 | |

| TobinQ | 0.349 *** | 0.00100 | −0.082 * | 0.246 *** | 0.316 *** | −0.339 *** | 0.264 *** | 0.238 *** | 1 |

| VIF | 1.06 | 1.32 | 1.38 | 1.43 | 1.19 | 1.09 | 1.39 | 1.42 |

| Variable | GIE | GIE | GIE | GIE |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| GC | 0.454 *** | 0.613 *** | 0.346 *** | 0.577 *** |

| (6.232) | (6.779) | (3.995) | (5.032) | |

| Size | −0.041 | −0.053 * | ||

| (−1.402) | (−1.797) | |||

| ROE | −0.303 *** | −0.311 *** | ||

| (−3.383) | (−3.452) | |||

| Cashflow | 0.552 *** | 0.539 *** | ||

| (2.890) | (2.827) | |||

| Fixed | −0.709 *** | −0.633 *** | ||

| (−5.037) | (−4.469) | |||

| Indep | 0.797 *** | 0.661 ** | ||

| (2.646) | (2.171) | |||

| Mfee | −1.208 ** | −0.635 | ||

| (−2.100) | (−1.013) | |||

| TobinQ | 0.036 ** | 0.045 *** | ||

| (2.315) | (2.762) | |||

| Constant | 1.535 *** | 1.924 *** | 2.174 *** | 3.020 *** |

| (7.828) | (8.138) | (2.608) | (3.423) | |

| Year | NO | YES | NO | YES |

| Corporation | YES | YES | YES | YES |

| N | 468 | 468 | 468 | 468 |

| R2 | 0.091 | 0.120 | 0.189 | 0.214 |

| Variable | GIE | GIE |

|---|---|---|

| First (1) | Second (2) | |

| IV (L.GC) | 1.260 *** | |

| (20.94) | ||

| GC | 0.551 *** | |

| (4.30) | ||

| Size | 0.002 | 0.004 |

| (0.47) | (0.38) | |

| ROE | −0.011 | −0.207 * |

| (−0.30) | (−1.91) | |

| Cashflow | 0.0779 | 0.834 *** |

| (1.12) | (3.87) | |

| Fixed | −0.024 | −0.379 *** |

| (−0.89) | (−4.64) | |

| Indep | −0.012 | −0.019 |

| (−0.15) | (−0.07) | |

| Mfee | −0.114 | −0.099 |

| (−0.92) | (−0.25) | |

| TobinQ | 0.002 | 0.061 *** |

| (0.43) | (4.98) | |

| Constant | 0.764 *** | 1.721 *** |

| (3.99) | (3.96) | |

| Observations | 468 | 468 |

| R-squared | 0.572 | 0.222 |

| Variable | GIE | GIE |

|---|---|---|

| (1) | (2) | |

| GC | 0.585 *** | 0.215 *** |

| (5.070) | (5.032) | |

| Size | −0.062 ** | −0.053 * |

| (−2.093) | (−1.797) | |

| ROE | −0.298 *** | −0.311 *** |

| (−3.287) | (−3.452) | |

| Cashflow | 0.505 *** | 0.539 *** |

| (2.635) | (2.827) | |

| Fixed | −0.672 *** | −0.633 *** |

| (−4.714) | (−4.469) | |

| Indep | 0.599 * | 0.661 ** |

| (1.956) | (2.171) | |

| Mfee | −0.596 | −0.635 |

| (−0.944) | (−1.013) | |

| TobinQ | 0.044 *** | 0.045 *** |

| (2.674) | (2.762) | |

| Constant | 3.303 *** | −0.885 |

| (3.720) | (−1.270) | |

| Year | YES | YES |

| Corporation | YES | YES |

| N | 468 | 468 |

| R2 | 0.213 | 0.214 |

| Variable | GIE | GIE | GIE | GIE |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| GC | 0.213 * | 0.256 ** | 0.342 *** | 0.435 *** |

| (1.684) | (2.549) | (4.050) | (3.320) | |

| Size | 0.008 | −0.008 | −0.039 | −0.074 |

| (0.168) | (−0.196) | (−1.200) | (−1.448) | |

| ROE | −0.189 | −0.226 | −0.300 ** | −0.380 ** |

| (−1.025) | (−1.547) | (−2.452) | (−2.000) | |

| Cashflow | 0.527 * | 0.535 ** | 0.551 *** | 0.568 ** |

| (1.884) | (2.414) | (2.974) | (1.971) | |

| FIXED | −0.620 *** | −0.649 *** | −0.707 *** | −0.769 *** |

| (−2.655) | (−3.508) | (−4.570) | (−3.199) | |

| Indep | 0.623 | 0.680 | 0.792 ** | 0.914 |

| (1.135) | (1.562) | (2.178) | (1.615) | |

| Mfee | −1.675 | −1.523 * | −1.220 * | −0.892 |

| (−1.583) | (−1.816) | (−1.739) | (−0.818) | |

| TobinQ | 0.029 | 0.031 | 0.036 ** | 0.041 |

| (1.161) | (1.578) | (2.159) | (1.576) | |

| Quantile | 0.1 | 0.25 | 0.5 | 0.75 |

| N | 468 | 468 | 468 | 468 |

| Variable | GIE | |||

|---|---|---|---|---|

| SOE | Non-SOE | High Executive Shareholding | Low Executive Shareholding | |

| (1) | (2) | (3) | (4) | |

| GC | 0.579 *** | 0.449 *** | 0.551 *** | 0.723 *** |

| (3.466) | (2.623) | (3.015) | (4.520) | |

| Size | −0.037 | −0.024 | −0.019 | −0.066 * |

| (−0.867) | (−0.473) | (−0.301) | (−1.869) | |

| ROE | −0.327 ** | −0.303 ** | −0.422 *** | −0.008 |

| (−2.439) | (−2.405) | (−3.730) | (−0.040) | |

| Cashflow | 0.510 * | 0.601 ** | 0.538 * | 0.769 ** |

| (1.858) | (2.158) | (1.931) | (2.590) | |

| Fixed | −0.688 *** | −0.476 ** | −0.671 ** | −0.632 *** |

| (−2.792) | (−2.484) | (−2.575) | (−3.406) | |

| Indep | 0.987 ** | 0.154 | 0.526 | 1.328 ** |

| (2.393) | (0.327) | (1.044) | (2.605) | |

| Mfee | −1.576 * | −0.280 | 0.084 | −0.731 |

| (−1.666) | (−0.296) | (0.090) | (−0.764) | |

| TobinQ | 0.043 ** | 0.026 | 0.071 ** | 0.010 |

| (2.282) | (0.763) | (2.052) | (0.397) | |

| Constant | 2.614 ** | 2.127 | 2.106 | 3.523 *** |

| (2.001) | (1.491) | (1.178) | (3.118) | |

| Year | YES | YES | YES | YES |

| Corporation | YES | YES | YES | YES |

| N | 248 | 220 | 235 | 233 |

| R2 | 0.281 | 0.146 | 0.176 | 0.347 |

| Variable | GIE | |||

|---|---|---|---|---|

| Strong Financial Supervision | Weak Financial Regulation | Strong Environmental Regulation | Weak Environmental Regulation | |

| (1) | (2) | (3) | (4) | |

| GC | 0.574 *** | 0.586 *** | 0.519 *** | 0.574 *** |

| (3.570) | (3.415) | (3.071) | (3.387) | |

| Size | −0.055 | −0.050 | 0.002 | −0.087 ** |

| (−1.012) | (−1.325) | (0.040) | (−2.208) | |

| ROE | −0.289 *** | −0.321 * | −0.341 ** | −0.299 ** |

| (−2.713) | (−1.901) | (−2.169) | (−2.563) | |

| Cashflow | 0.683 *** | 0.411 | 0.583 ** | 0.475 |

| (2.775) | (1.336) | (2.165) | (1.633) | |

| Fixed | −0.688 *** | −0.533 ** | −0.590 *** | −0.623 *** |

| (−3.887) | (−2.274) | (−2.616) | (−3.186) | |

| Indep | 1.396 ** | 0.445 | 1.091 ** | 0.386 |

| (2.349) | (1.129) | (2.303) | (0.915) | |

| Mfee | −0.782 | −0.373 | −0.710 | −0.919 |

| (−0.880) | (−0.403) | (−0.815) | (−0.954) | |

| TobinQ | 0.037 * | 0.047 * | 0.063 ** | 0.035 |

| (1.830) | (1.743) | (2.402) | (1.582) | |

| Constant | 2.814 * | 3.004 ** | 1.386 | 3.916 *** |

| (1.847) | (2.571) | (0.929) | (3.347) | |

| Year | YES | YES | YES | YES |

| Corporation | YES | YES | YES | YES |

| N | 228 | 240 | 246 | 222 |

| R2 | 0.299 | 0.159 | 0.226 | 0.224 |

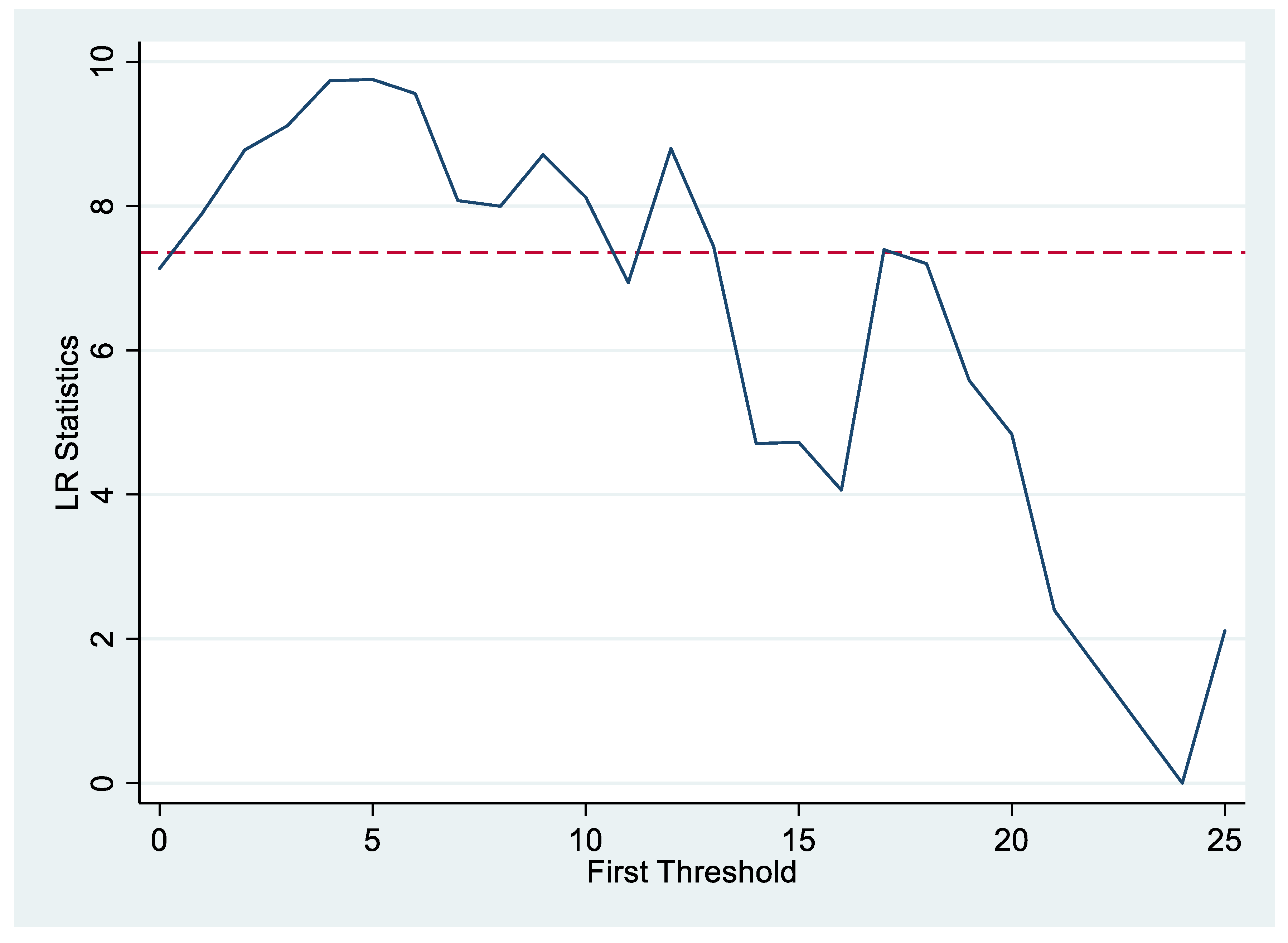

| Variable | Threshold Number | p-Value | p-Value | Crit10 | Crit5 | Crit1 |

|---|---|---|---|---|---|---|

| Lev | Single | 13.34 | 0.0400 | 11.5374 | 12.8469 | 20.4280 |

| Double | 7.41 | 0.2933 | 10.6939 | 12.5674 | 16.8130 | |

| EGT | Single | 10.16 | 0.0900 | 9.5493 | 12.0726 | 17.1045 |

| Double | 3.24 | 0.4967 | 8.6420 | 10.4968 | 17.1059 |

| Variable | THRESHOLD VALUE | 95% Confidence Interval |

|---|---|---|

| Lev | 0.2948 | (0.2801, 0.3032) |

| EGT | 24.0000 | (19.0000, 25.0000) |

| Variable | GIE | GIE |

|---|---|---|

| (1) | (2) | |

| GC∙I (Lev ≤ 0.2948) | 0.308 *** | |

| (3.48) | ||

| GC∙I (Lev > 0.2948) | 0.355 *** | |

| (3.87) | ||

| GC∙I (EGT ≤ 24.0000) | 0.371 *** | |

| (4.36) | ||

| GC∙I (EGT > 24.0000) | 0.299 *** | |

| (2.95) | ||

| Size | −0.025 | −0.048 |

| (−0.92) | (−1.61) | |

| ROE | −0.324 ** | −0.272 ** |

| (−2.60) | (−2.33) | |

| Cashflow | 0.549 *** | 0.517 *** |

| (3.37) | (2.86) | |

| Fixed | −0.650 *** | −0.767 *** |

| (−3.40) | (−3.35) | |

| Indep | 0.728 * | 0.816 ** |

| (1.89) | (2.07) | |

| Mfee | −1.366 * | −1.178 |

| (−1.84) | (−1.47) | |

| TobinQ | 0.031 *** | 0.039 *** |

| (2.98) | (4.12) | |

| Constant | 1.819 ** | 2.427 *** |

| (2.30) | (2.78) | |

| Observations | 468 | 468 |

| Number of area | 78 | 78 |

| R-squared | 0.215 | 0.207 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, L.; Liu, Y.; Zhang, M.; Zhou, X.; Huang, J. How Does Green Credit Affect Corporate Green Investment Efficiency? A Test Based on Listed Corporations in China’s Heavy Pollution Industry. Sustainability 2025, 17, 3712. https://doi.org/10.3390/su17083712

Liu L, Liu Y, Zhang M, Zhou X, Huang J. How Does Green Credit Affect Corporate Green Investment Efficiency? A Test Based on Listed Corporations in China’s Heavy Pollution Industry. Sustainability. 2025; 17(8):3712. https://doi.org/10.3390/su17083712

Chicago/Turabian StyleLiu, Liyun, Yefan Liu, Mingming Zhang, Xinyu Zhou, and Jia Huang. 2025. "How Does Green Credit Affect Corporate Green Investment Efficiency? A Test Based on Listed Corporations in China’s Heavy Pollution Industry" Sustainability 17, no. 8: 3712. https://doi.org/10.3390/su17083712

APA StyleLiu, L., Liu, Y., Zhang, M., Zhou, X., & Huang, J. (2025). How Does Green Credit Affect Corporate Green Investment Efficiency? A Test Based on Listed Corporations in China’s Heavy Pollution Industry. Sustainability, 17(8), 3712. https://doi.org/10.3390/su17083712