1. Introduction

Entrepreneurship has the potential to be a catalyst for positive change in both the economic and environmental spheres [

1,

2]. Classical economic literature asserts that entrepreneurs can bring about “creative destruction”, completely transforming the accepted modes of business operation [

3,

4]. Similarly, the view that entrepreneurs are not and cannot be sensitive to environmental causes is swiftly becoming obsolete [

2,

5]. An emerging paradigm of “green entrepreneurship” is fusing an enthusiastic business sense with an increased cognizance of sustainability and other tenets of the environmental movement [

6].

Evidence suggests that economic growth is inversely correlated with environmental sustainability, as many sectors, especially manufacturing, processing, and transportation, rarely account for environmental impacts in their business models [

1]. Due to increased environmental awareness over the past decades, many economic sectors are recognizing the desperate need for more sustainable business practices [

6]. The new generation of environmental entrepreneurs, however, will require innovation in order to overturn prevailing economic institutions. This is particularly true of the natural resources sector, where resource-dependent communities traditionally struggle with persistent poverty [

7,

8]. Examining strategies for starting small-scale enterprises can reveal how such communities can harness the initiative of local entrepreneurs to create businesses that are at the same time environmentally sustainable and economically profitable.

Efforts to address persistent poverty at the rural community level, particularly in the developing world, gave rise to the concept of

microcredit. This non-governmental organization (NGO)-assisted financing mechanism enables poor entrepreneurs to access capital loans with which to establish small enterprises. In recent decades, microcredit-led enterprise development has become one of the widely used tools for development intervention. Such efforts, however, have focused mainly on economic results, largely ignoring the environmental impacts of microenterprises [

9].

The purpose of this research is to examine strategies for establishing and maintaining environmentally friendly (i.e., “green”) microcredit-supported enterprises that simultaneously combine sustainability and economic viability. The specific objectives of this study are threefold: first, to provide a brief overview of the various categories of small socially and environmentally oriented enterprises; second, to empirically assess “green” microenterprises established in rural Bangladesh using green-microcredit strategies; and finally, to explore the potential application of these findings to the establishment of green microenterprises in other parts of the developing world.

2. Environment and Community-Oriented Small Enterprises

Literature on the environmental impacts of microenterprises is sparse. Analysis of their environmental contributions stretches from micro and small enterprises (MSEs) to small and medium enterprises (SMEs). Due to their greater proximity to the natural environment and limited access to resources compared to larger corporations, MSEs tend to be more reactive and focus on general environmental protection in their approach to sustainability [

10]. Though there are countless categories of small, environmentally oriented enterprises, the literature defines three basic types: green enterprises, sustainability enterprises and community-based enterprises as they gained more credence and familiarity in relevant literature. These categories are not mutually exclusive, and careful scrutiny is required to distinguish between them.

2.1. Green Enterprises

In the literature, a host of terms are used interchangeably when describing “green” enterprises (e.g., “environmental enterprise”, “eco-enterprise”, “conservation enterprise”, “organic enterprise”, and “nature enterprise” [

11]), making the notion difficult to precisely define. To clarify them, Hendrickson and Tuttle [

12] succinctly explained that “green entrepreneurship” denotes entrepreneurial activity that benefits the environment, and that “green enterprises” are those that place particular emphasis on environmental impacts in their business practices and resource usage (e.g., using alternative energy sources, recycled products, or more environmental-friendly manufacturing processes).

Linnanen [

13] further argues that green entrepreneurship may entail any combination of four major attributes: nature-oriented modes of business; production and diffusion of environmental technology; provision of environmental management services; and production of environmentally friendly products. Furthermore, the ecological footprint of green enterprises is minimal or zero, as their production processes prioritize resource efficiency and waste reduction/management.

2.2. Sustainability Enterprises

As defined by Tilley and Parrish [

14], sustainability enterprises are those which attempt to integrate environmental, economic, and social considerations in a holistic manner. Such enterprises are built on a different organizing logic than conventional businesses, focusing their resources and “whole enterprise design” on sustainable development [

15] and shifting business philosophy to new form of capitalist ideology that can directly address issues of climate change and other environmental impacts [

16]. According to Parrish and Tilley [

17], sustainability enterprises simply link our knowledge of entrepreneurship to our knowledge of sustainable development. Rather than handling socioeconomics and sustainably as separate systems as in traditional business, sustainability enterprises subscribe to the holistic notion of “humans-in-ecosystems” [

18]. This notion recognizes both the commodity and co-evolutionary aspects of business simultaneously, thereby putting the emphasis on integrated social-ecological systems within which economy is embodied [

19].

2.3. Community-Based and Social Enterprises

The concept of community-based enterprise (CBE) emerged in the literature in the early 1990s. Selsky and Smith [

20] first used the term “community entrepreneurship” to describe entrepreneurial leadership that arises within non-profit organizations. Diamond [

21] explains that community enterprise has its roots in civil society organizations (CSOs), which act in the public interest but independently of the state or the private sector. Pearce [

22] places community enterprise within the wider social movement of “trading with a social purpose”, which encompasses social firms, co-operatives, and mutuals.

Berkes and Davidson-Hunt [

23] regard CBE as being synonymous with social enterprise—or at least a subset of it. Peredo and Chrisman [

24] offer a comprehensive model for CBE, which they define as the practice of “local communities” creating collective business ventures with the aim of contributing to both local economic and social development. In this model, the community acts corporately as both entrepreneur and enterprise in pursuit of the common good. However, although this conception defines cooperatives as equivalent to CBE, Peredo and Chrisman’s model also suggests that they are in fact a subset of CBE. Therefore, no clear conceptualization exists as to how CBE are actually organized [

25].

FAO [

26,

27] presents CBE development as a tool for managing common pool resources or solving poverty issues in rural communities in Uganda and Gambia, but did not lay out its structure. Similarly, Subedi and Bhattarai [

28] presented community-managed enterprises as a means of conserving biodiversity in Nepal. Taking these and other practical examples into account, in a developing country context, CBEs can be broadly defined as: (i) an organization that involves local community members in the management of the venture; (ii) as a mechanism of grassroots socio–economic development; and (iii) a model for local economic development. These usually refer to smaller individual village level enterprises owned and managed by families or smaller groups of people. Such enterprises generate profit to support the livelihoods of their owners and managers—and thus, by extension, the community as a whole.

In developed countries, CBEs take the form of businesses with primarily social or environmental objectives whose surpluses are reinvested in the community. For example, the UK Government Coalition for Social Enterprise defines community enterprise as “Social enterprises that are committed to bringing about change in a specific community”. A comprehensive definition of social enterprise by Shortall and Alter [

29] includes community-based stand-alone businesses, or programs within NGOs or similar organizations. Shortall and Alter also recognize enterprises organized by NGOs for the purpose of helping disadvantaged communities as examples of social enterprises. The microenterprises in discussion of this paper indeed entail much of the characteristics of the community-based and social enterprises (SE); we therefore consider the position of NGO-microfinance institutions (MFI)-assisted micro-entrepreneurship within the domain of CBE and social entrepreneurships or in between these, as shown below in

Figure 1.

Figure 1.

Schematic diagram of NGO-MFI assisted microenterprise.

Figure 1.

Schematic diagram of NGO-MFI assisted microenterprise.

Microenterprise

Small-scale entrepreneurial ventures are one of the main sources of livelihood in poor communities, second only to subsistence agriculture [

30]. The Asian Development Bank [

31] finds that in Asia, microenterprises (both within and outside microcredit programs) account for more than 60% of all enterprises and up to 50% of paid employment. Not surprisingly, since the 1990s, the term “microenterprise” has received significant attention within the development community.

As defined by Midgley [

32], microenterprises are small businesses owned and operated by poor people with the support of sponsoring organizations. They may be owned and/or operated by individuals or small groups, though family members are often involved in day-to-day operations and the number of participants is usually small. Jurik [

33] believes that, to qualify as a microenterprise, the business should employ no more than five people.

Some scholars view microenterprise development as a community-level response to poverty and social crises; for example, Banerjee [

34] argues that microenterprises provide an empowering alternative for many individuals whose only other options are unemployment or low-wage, dead-end jobs. They also hold the potential for revitalizing local economies by providing locally needed services and products. Thus, microenterprises are a powerful weapon in the fight against seemingly intractable poverty and disintegrating communities. Throughout the world, social workers endeavoring to mitigate poverty are adopting microenterprise development in order to build more self-sufficient communities. Bornstein [

35] reports that microcredit loans have had positive effects upon rural communities around the world by providing the poor with the capital they require to start and expand their businesses and take control of their own development and well-being.

Unlike other types of businesses, microcredit-assisted microenterprises cannot forego profit-prioritization over other objectives, since such businesses must be viable economically in order to repay micro-loans obtained from microfinance institutions (MFI). Though there are compelling arguments for defining these microenterprises as “community-based”, many factors such as dependence on surrounding natural resources, pollution and emissions, and lack of technical support and awareness limit the ability of many such enterprises to commit themselves to environmental and social causes [

36]. Wenner

et al. [

37] compiled a categorization of micro-enterprises, listing those activities which tend to do environmental harm, while Rouf [

38] listed those that did little or no harm (

Table 1).

Table 1.

Types of pollution-intensive versus environmental friendly microenterprises.

Table 1.

Types of pollution-intensive versus environmental friendly microenterprises.

| Pollution-Intensive Microenterprises (Wenner et al. 2006) | Environment-Friendly Microenterprises (Adapted from Rouf 2012) |

|---|

| Leather tanning | Organic vegetable cultivation |

| Brick and tile manufacturing | Poultry |

| Chemical intensive agriculture and aquaculture | Paddy-based ventures (cultivation, husking, rice-trading) |

| Metal-working and electroplating | Fish farming (organic feed-intensive) |

| Small-scale mining | Crop cultivation (manure based) |

| Painting and printing | Shops (grocery, stationery) |

| Automobile and motor repair | Vegetable trading |

| Wood processing and metal finishing | Bamboo and cane based handicrafts |

| Charcoal making | Cattle-based (milking, fattening) |

| Textile dyeing | Tailoring |

| Food processing | Nursery raising |

3. Research Methodology

This study applied qualitative case study and participatory methods for field investigation [

39,

40]. The main focus of the study was on a place-based case study in Bangladesh, dealing with a Green Microenterprise development program. The program was launched under Building Environmental Governance Capacity in Bangladesh (BEGCB) project—an international partnership development action research scheme. The BEGCB partnership project conceived the idea of binding microcredit operations to “greening principles”. The essence of these principles was that the operational cycles of a microenterprise should have no negative environmental impacts, and that their operations would enhance provisioning, regulating, and supporting ecosystem services and would not affect cultural ecosystem services.

The case study comprised two components: (i) a green microcredit operation by the Center for Natural Resources Studies (CNRS)—a nationally reputed NGO in Bangladesh—who worked as an implementing partner for the “green” microcredit component of the BEGCB project; and (ii) nine local communities who joined the project as local partners and directly participated in the project implementation. Within the framework of this case the principal areas of analysis for this study consisted of: (i) “green” microenterprises that have been developed under the BEGCB project; and (ii) the “green” microcredit program per se.

In order to establish community-based green microenterprises, CNRS has implemented a “green” microcredit program in two distinct ecosystem-specific sites in Bangladesh: (i) a riparian floodplain ecosystem; and (ii) a wetlands ecosystem. In this study, we concentrated on the riparian site located in Salikha

upazila (sub-district) of the Magura district of Bangladesh and examined the performance of six enterprises located in four separate villages: Bhatoal, Chukinagar, Dakshin Darilaksmipur and Kuatpur (see

Figure 2).

Figure 2.

Map of green microenterprises locations in Magura District, Bangladesh.

Figure 2.

Map of green microenterprises locations in Magura District, Bangladesh.

Four main tools were used to collect the required data and information: (i) direct interviews with semi-structured questionnaires; (ii) focus group discussions (FGD); (iii) direct field observations; and (iv) a literature review of published and unpublished documents and reports. In order to obtain data on entrepreneurial and operational mechanisms pertaining to a specific microenterprise (e.g., input, production processes, waste management, and marketing), direct interviews were conducted with all the six micro-entrepreneurs. To determine the nature and magnitude of ecological contributions and to map community members’ perspectives on such entrepreneurial ventures, four focus group discussion (FGD) meetings were organized with participation by members of the Community-Based Organizations (CBOs) and local community leaders. CBOs in the study area were village-based, saving groups with 20–30 members. Usually, NGOs facilitate formation of CBOs and also guide their operations.

Field investigations were carried out during both summer and winter months of 2012 and 2013, with the whole spectrum of entrepreneurial activities and their implications for their respective ecosystems being directly observed and recorded. An in-depth case study was carried out with two enterprises located in the Kuatpur and Chukinagar villages; their entire business processes—including procurement, production methods, harvesting techniques, waste management, and marketing—were inspected. In addition, careful review of both published and unpublished documents and field reports obtained from the CNRS-BEGCB project allowed data on each enterprise’s projected development plans, capital, loans, savings, production costs, sales turnover, and profits.

Though review of organizational and project documents was instrumental in analyzing the modality of the BEGCB project’s green microcredit program, gaining a full understanding of the project’s effectiveness required the organization of six Key Informant Interviews (KII), in which the following individuals were interviewed: the program director of the green-microcredit component of BEGCB project, the microcredit manager for the project site, two community organizers, and one microcredit and environmental sustainability expert, respectively. Human ethics protocol of the University of Manitoba, Canada was maintained during these field investigations by obtaining prior consent of community members and interviewees. Language and cultural norms were not barriers, as the authors shared the same mother-tongue and were familiar with the culture of the communities under study.

4. Results: Greening Microcredit and the Ecological Mission of Microenterprises

Since 2009, under the BEGCB community program, microfinancing has been provided to the study area by means of lending, granting, and the provision of technical assistance (an “aid bundle”) to CBO members and groups for microenterprise development. The implementation of “greening microcredit” involved not only the “aid bundle” for environmentally supportive or ecologically compliant entrepreneurial ventures but also required understanding of key stakeholders on “greenness” and assurance of many support provisions by the guiding NGO during the operational phase. The BEGCB project, under the guidance of the University of Manitoba’s Natural Resources Institute (NRI), provided the necessary information and background to stakeholders through workshops and technical backstopping. The greening approach of the project is based on the following understanding and assumptions:

Economic activities must take place within the constraint of natural environment [

41].

If the ecosystem goods and services upon which economic activity is dependent are damaged due to causes such as severe soil or river bank erosion, over-fishing, unsustainable harvesting of raw materials, and pollution [

42], the resultant damage undermines the existing enterprise and potential for economic development in future.

“Green” and organic products potentially enjoy high market demand and offer incremental price benefits for the producers.

“Greening” ventures at the community level should be promoted by development thinkers and implementers, especially with respect to climate change issues.

In order to implement the green microcredit modality, the BEGCB project partnered with the Center for Natural Resource Studies (CNRS), an NGO-MFI. Building on its experience in microcredit operation (the classic Grameen Model), CNRS played a vital role in implementing the green microcredit mechanism at the local community level. The main strategic implementation goals of CNRS were:

To increase environmental awareness among local community members.

To develop and diffuse environmentally friendly technology and pertinent skills and knowledge.

To strengthen management capacity to adopt and manage a “green” approach towards entrepreneurship.

Within the “green” microcredit modality that initially takes the form of an “aid bundle”, loans are given to individual entrepreneurs or groups of up to five people, but technical assistance and grants are extended to the associated CBO. However, part of the technical grant necessary for start-up of the green venture is directly given to the enterprises by CBO. The NGO-MFI makes the contract with individual or group borrowers, while a separate contract is made with the CBO for grants and technical assistance. The major contractual terms and conditions emphasize compliance with greening principles set out by the MFI. Unlike the weekly instalments typical of traditional MFIs, this lending scheme follows a monthly loan repayment schedule beginning two or three months after the project’s inception (grace-period), with a flat interest rate of 12% (one of the lowest among the lending MFIs in Bangladesh), which is charged on the principal credit amount.

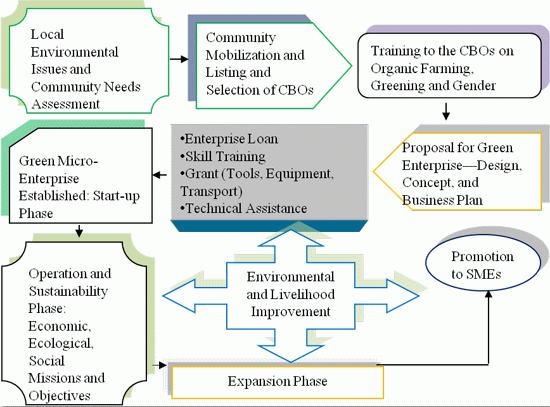

As shown in

Figure 3, before establishing green micro-ventures, CNRS assisted local communities in forming saving groups and CBOs, then provided training to those CBOs on raising awareness of local environmental issues, the application of organic production methods, gender equality issues, and the merits and pitfalls of “green” microcredit programs. It also aided the CBOs in forming self-help groups, usually comprising of four to five members. After group formation, CNRS then put out a call for business or enterprise development plans from interested CBOs.

Proposal development was a process of consultative meetings among the CBO members and facilitation by CNRS site managers and community organizers. A capacity-building workshop on greening microcredit, with participation by the targeted CBO representatives and BEGCB experts, was instrumental in enterprise proposal development. CNRS scrutinized all submitted proposed ventures based on their financial and technical feasibility studies and environmental considerations. Proposals meeting the criteria for environmental and economic goals as set out by CNRS—based on the BEGCB project’s greening principles—were sanctioned for loan and grant allotment.

The loan delivery mechanism of “green” microcredit followed an atypical scheme. Project assessments defined “adequacy” with regard to the investment fund for the micro-ventures, as the initial loan amount is comparatively higher than typical microcredit loans. Loan size for the BEGCB enterprises is in the range of US$200 to $1500, while a typical microcredit loan size is usually US$100–$200, as reported by Elahi and Danopoulos [

43]. Such a microcredit scheme is termed an “enterprise loan” by the Microcredit Regulatory Authority (MRA) of Bangladesh. CNRS adopted this MRA-defined loan size [

44] approach for its intervention operations.

Once the micro-ventures were launched, the BEGCB project extended its cooperation by providing borrowers with training for skill development for specific ventures. Apart from hiring experts for the skill development training, the BEGCB project enabled the CBOs to build networks and obtain technical cooperation from their respective local government departments (the

upazila)

, including horticulture, fishery, livestock, agriculture, and cooperatives. Thus, the micro-entrepreneurs and CBOs received regular guidance and advice from local experts. The BEGCB project also assisted the community enterprises by providing CBOs with the necessary tools, semi-automated accessories, and equipment and transportation for use by all CBO members cooperatively. A micro-venture was eventually established with credit from the MFI, and grant and technical assistance from the project.

Figure 3 illustrates the procedural cycle of BEGCB-CNRS’s green microenterprise development initiative.

In Salikha

upazila of Magura district, nine microenterprises were launched in 2011 (see

Figure 1), of which six were evaluated for the purpose of this study. Of the studied enterprises, two are engaged in handicraft business, three in agriculture, and one in organic aquaculture. In order to measure performance, we analyzed the financial portfolios of these enterprises for the years 2011–2012. In measuring their economic viability, we calculated their operating profit by deducting the cost of goods sold (CoGS), labor and other day-to-day expenses from overall revenue. Operating profit ratio (OPR) (operating profit/sales revenue × 100) was then calculated to measure the ability of these enterprises to sustain their operations. At the same time, key ecological contributions and compliance were recorded as per

Table 2.

Figure 3.

BEGCB green microenterprise development, operation and sustainability path.

Figure 3.

BEGCB green microenterprise development, operation and sustainability path.

At the time of this investigation, the six enterprises examined were in the start-up phase, having only been in operation for two years. They had received enterprise loans ranging from US$300 to US$1200. It is evident from the data presented in

Table 2 that all these enterprises are in a commercially viable position, as their operating profit ratio ranges from 14%–83%. For nursery raising, cow rearing and fish culture (enterprises 3–6), optimal productivity has not yet been achieved, but the entrepreneurs believe benefits will outweigh costs by an acceptable margin within a few years. All four enterprises anticipate greater returns on their investments as their productivity increases, which would soon push them out of the loan bracket. Two of the enterprises had already emerged from the loan cycle (1 and 2) at the time of our investigation, while two others (3 and 6) were close to doing so within a year. In order to further expand and consolidate their businesses, the entrepreneurs are entitled to borrow from the guiding NGO-MFI (in this case, CNRS).

Table 2.

Ecological and economic contributions of six green-microenterprises in Salikha, Magura.

Table 2.

Ecological and economic contributions of six green-microenterprises in Salikha, Magura.

| CGME | Description of the Venture | Key Ecological Contributions and Features | Economic Result (2011–2012); Goal |

|---|

| 1 | Maila Cultivation.

Maila is an aquatic plant used as main raw materials for making locally marketed ordinary bed mats called pati or hugla. These are cultivated in the barren river banks, and homesteads (situated adjacent to the riverbank). | Increased vegetation in the riparian zone, erosion control, fish habitat creation.

No use of fertilizer or chemicals; zero-waste. | Operating Profit Ratio (OPR): 76%;

Goal is to expand cultivation along the barren shoreline of the river and increase production. |

| 2 | Pati making and Maila Cultivation.

Pati is a traditional bed mat made from Maila. It is an eco-friendly substitute to other artificial bed-mats | Eco-friendly materials; zero-waste and zero pollution; patis are biodegradable; increased vegetation in riparian zone, erosion control, and fish habitat creation. | OPR: 83%;

Goal is value addition and market expansion. |

| 3 | Nursery raising, organic vegetables, cultivation, composting (composite agro-based venture). | Afforestation—sapling supply to locality; expansion of organic agriculture; supply of manure to locals. | OPR: 43%;

Goal is to expand plantation and production. |

| 4 | Cow rearing, organic agriculture, biogas plant | Reduced deforestation and emissions; improved soil quality; no use of chemicals and fertilizers; waste is converted to energy for cooking and household use. | OPR: 14%;

Goals are to consolidate present operation and expand in future. |

| 5 | Cow rearing, biogas plant | Reduced deforestation and emissions; supply of manure to the locality; waste (mainly animal excreta) is converted to energy for cooking and household use. | OPR: 17%;

Goals are to consolidate present operation and expand in future |

| 6 | Organic fish fry and fish culture | Water quality protection; local species conservation; no use of artificial fish feeds or nutrients. | OPR: 47%;

Goals are to consolidate present operation and expand organic fish culture |

In order to procure further insights, we selected two enterprises: (i) Enterprise-2:

Maila cultivation and mat making; and (ii) Enterprise-3: Nursery raising, composting manure and organic materials, and organic vegetable cultivation (composite agro-venture). Enterprise-2 is located at Kuatpur village while Enterprise-3 is located at Chukinagar (see

Figure 2).

4.1. Case 1: Maila Cultivation and Mat Making (Agro-Based “Green” Microenterprise and Handicrafts)

This venture (CGME2) encompasses the cultivation of

maila on fallow areas in the riparian zone of the

Chitra River and the use of these

mailas as the raw material for weaving

pati or traditional bed mats (see

Figure 4). The objective of this venture is to become self-reliant through environmentally friendly and livelihood-generating activities. The expected outcomes are: (a) to ensure the availability of mats in the locality and beyond; (b) alternative income-generation; (c) enhancement of skills in “green” activities; and (d) setting an example to encourage other community people to take up eco-friendly ventures.

The owner of the enterprise is Ms. Bishakha Rani Roy, who is primarily a housewife and was not involved with any wage-earning or income-generating activities prior to her involvement with the BEGCB project. After becoming a member of the CBO, namely

Kuatpur Dhaskhin-para Mahila Samity (South Kuatpur Women Cooperative), she expressed keen interest in taking part in a “green” microenterprise development initiative. As a CBO member, she participated in the awareness-building and training programs facilitated by CNRS. Along with another member of their CBO, Ms. Rani then decided to undertake a

maila cultivation and mat-making venture. Having examined her business plan and studying its environmental and financial feasibility, CNRS offered a BEGCB “aid bundle” to her and her CBO. Details of her investment portfolio are presented in

Table 3.

Table 3.

Example of Rekha Rani Roy’s investment portfolio.

Table 3.

Example of Rekha Rani Roy’s investment portfolio.

| Investment | Aid Bundle | Self-Investment |

|---|

| Aid Category | Loan (Microcredit) | Direct Technical Grant to the Enterprise | Technical Grant Facility through CBO | Self |

| Purpose | Land lease for maila cultivation;

Labor cost (for sewing, weeding, and harvesting of maila plants);

Purchase of raw materials, agricultural tools, and accessories for mat making | Seedlings;

Equipment (spade, scissors, tub, weeder, cutter, sprayer for irrigation) | A transportation van was provided to the CBO by BEGCB project for transporting her mat products to local markets | Processing labor costs (i.e., sun drying of maila plants and dyeing of mats) are to be borne by the entrepreneur |

| Amount (BDT) | BDT 19,000 | BDT 6500 | BDT 8500 | BDT 1700 |

| Percentage | 53% | 18% | 24% | 5% |

The investment size was Bangladesh Taka (BDT) 35,700 or US$447 (Bangladesh currency BDT 80 equals 1 USD), allowing Ms. Rani to embark on this venture with only 5% self- investment and a commitment to full-time labor. The loan from MFI was used to lease 40 decimal (approximately 1600 square meters) of riparian land (privately owned) adjacent to her homestead. Other expenditures involved hiring labor for cultivation of maila plants and mat production. Direct technical grants from the project for partial raw materials and tool costs constituted about 18% of the investment amount. The loan amount was 53% of the total investment, which was to be repaid over a one-year period in ten equal instalments, which she accomplished successfully.

Maila seeds are available for collection during the November–December period and seedlings are planted in January. These are harvested in March through April and dried under the sun for a week. When dried, green

maila becomes a golden fiber, rendering it suitable for making mats. For her 2011 season, Rekha Rani projected a production run of 600 mats by the end of August, but was only able to produce 480 pieces due to a lower-than-expected yield of her

maila crop. However, in 2012, her production increased to 530 pieces. Her average operating profit ratio is 83% (see

Table 2) for both the years, which enabled her to pay off her loan instalments. About her venture and future plans Ms. Rani said:

“Though we had some inter-generationally transmitted skill to weave mat, but we were not confident to be able to be an entrepreneur, fellow CBO members and NGO people gave us this hope that we can cultivate maila-plants in the fallow areas of river-bank adjacent to our home and start mat production business commercially. We, the community people, now find that this kind of venture benefits us by two primary ways: i) providing income generation opportunity, and ii) stabilizing river-bank soil thereby making our homes more flood-protective. Now, I plan to lease-in new land for further expansion of maila cultivation.”

Figure 4.

Production work at CGME-2 (making of mat with maila plants).

Figure 4.

Production work at CGME-2 (making of mat with maila plants).

4.2. Case 2: Nursery, Vegetable Cultivation, and Composting (Composite Community-Based Green Microenterprise) (CGME-3)

Another “green” venture assessed through in-depth case study incorporated multiple environmentally friendly economic activities, including raising a plant nursery, organic vegetable cultivation, and composting manure and organic materials. Ms. Bulu Rani Biswas started this venture in December 2009 (with planned credit payback until December 2012). Ms. Biswas is a member of the

Chukinagar Gorapara Mahila Samity (Chukinagar Gorapara Women Cooperative) CBO in Chukinagar village. The investment size of Ms. Biswas’s enterprise was Tk. 63,700 (US$796), which followed the same BEGCB project enterprise development model as Case Study 1. The details of Ms. Biswas’s portfolio are presented in

Table 4.

Table 4.

Bulurani Biswas’s investment portfolio for green microenterprise establishment.

Table 4.

Bulurani Biswas’s investment portfolio for green microenterprise establishment.

| Investment | Aid Bundle | Self-investment |

|---|

| Aid Category | Loan (Microcredit) | Direct Technical Grant to the Enterprise | Technical Grant Facility through CBO | Self |

| Purpose | Land lease for nursery and cultivation; labor cost;

raw materials, agricultural tools, and accessories for nursery raising; fence for the nursery | Seedlings;

equipment (spade, scissors, tub, weeder, cutter, sprayer for irrigation) | An irrigation pump was provided to the CBO by BEGCB project | Agricultural land lease, manure, seed and raw materials purchase |

| Amount BDT | BDT 20,000 | BDT 3800 | BDT 25,200 | BDT 14,700 |

| Percentage | 31% | 6% | 39% | 24% |

The CBO, of which Ms. Biswas is a member, received a grant from BEGCB to purchase agricultural tools and an irrigation pump. Ms. Biswas had full access to the pump, constituting a facility equivalent to 39% of the investment capital for her enterprise. The direct technical grant to her enterprise was 6% and investment from her own fund was 24%.

Ms. Biswas now produces composted manure with dung from her own cows, water hyacinths and other waste from her homestead. She prepares her land for cultivation with manure and uses composts instead of chemical fertilizer for vegetable production and nursery raising. Surplus compost is sold at market, or converted to cooking-fuel stick (cow-dung stick) for sale or personal use. She irrigates her land and nursery with the CBO-managed water pump.

In 2010, she sowed four varieties of vegetable seeds. From January to April 2010, Ms. Biswas’s production cost was Tk. 22,430 (US$280) for both vegetable cultivation and nursery raising. The production cost included labor costs for weeding, irrigation, fertilization and other manual jobs. In her nursery she sowed 4000 mahogany (Swietenia macrophylla) plants (of which 3500 germinated), 50 coconut seedlings (12 have grown), and 500 papaya seedlings (almost all have grown). She also sowed 100 mango seeds, of which 60 plants have grown well. She plans to graft these plants with superior quality mango genes, upon which they will be sold at the market. Potential buyers for mango plants have already made lucrative offers to her.

Ms. Biswas began selling her vegetables at the local market in March 2010. However, until August 2010, she was unable sell any saplings from her nursery as these had not grown enough for sale. Ms. Biswas thus had difficulty paying her loan instalments in 2010 and 2011 as she had to survive only on vegetable sales. In late 2011, however, she began selling saplings from her nursery and has been experiencing good cash flow. By December 2012, she paid back her loan in full.

We observed that Ms. Biswas’s vegetables enjoyed a substantially higher market price due to their organic quality and superior taste. In 2011 and 2012, she produced five varieties of vegetables: okra, green amaranth, red amaranth, basil leaf, and tomato, and sold them in the local market. Though she did not reach her projected production targets, this was compensated for by the higher prices her produce commanded; as indicated in the

Table 5 below:

Table 5.

Comparative local market prices for organic and chemically grown vegetables.

Table 5.

Comparative local market prices for organic and chemically grown vegetables.

| Vegetable | Projected Production | Actual Harvest | Market price for (her) Organic Variety | Price for Chemically Grown Variety |

|---|

| Okra | 200 kg | 160 kg | Tk. 54.00/kg | Tk. 32.00/kg |

| Green amaranth | 950 kg | 860 kg | Tk. 10.00/kg | Tk. 7.00/kg |

| Red amaranth | 260 kg | 230 kg | Tk. 20.00/kg | Tk. 15.00/kg |

| Basil leaf | 50 kg | 40 kg | Tk. 10.00/kg | Tk. 8.00/kg |

| Tomato | 400 kg | 340 kg | Tk. 25.00/kg | Tk. 15.00/kg |

Ms. Biswas’s two-year (2011 and 2012) average operating profit ratio is 43%. Her loan repayment is completed and she is out of the initial investment loan cycle. She now plans to lease further lands for nursery raising and cultivation. One of the CBO leaders in the community stated that “this lady is very enterprising and has a very good sense on agro-production. Her venture is helping us to find saplings for plantation at our arms’ length. Earlier, it was not convenient for us to buy sapling from market because we plant these during rainy season, and the roads are muddy most of the times in that period, so we find it difficult to carry from market. Now, we take sapling from her at a better rate and at a convenient time.”

5. Discussions

Community-based “green” microenterprises (CGME) established under the auspices of the BEGCB project binds ecological benefits, economic profit, and community orientation. Other types of enterprises, whose taxonomies were examined earlier in this paper, do not capture all these goals as coherently as CGMEs. Green enterprises as described in the literature in detail by Schaper [

11], have their core focus on the process of “greening” in their ongoing operations. Sustainability enterprises ideally seek to integrate social, ecological, and economic objectives [

14], but such concepts still remain abstract and theoretical.

Community-based enterprises (CBE), as defined by Peredo and Chrisman [

24], prioritize community goals over profit making—meaning enterprises must meet social objectives first, and economic goals second. Microenterprises, on the other hand, place profit alongside social goals. Such enterprises emerged as a product of the microcredit mechanism pioneered in the 1980s by the Grameen Bank of Bangladesh, and are a promising tool for emancipating and empowering the poor in developing countries. However, as Vergas [

9] and Hall

et al. [

36] point out, even microenterprises lack a vital third bottom line: environmental.

The six entrepreneurial micro-schemes studied in southwestern Bangladesh demonstrate that microcredit clients can be successful in carrying out environmentally friendly and livelihood-generating activities. Community-interest in embarking on “green” micro-ventures is also evident from the BEGCB project experience as CBO members had shown keen interest in environmental protection and also undergone environmental awareness training programs as a prerequisite to applying for a “green” micro-enterprise loan. The CBO members also believed that the development of “green” microenterprises could not only benefit the environment, but also increase their profits. They also believed that, as the environment and natural resource base around them are being degraded rapidly by growth-oriented economic activities, engaging in “green” ventures would bring about their conservation and protection, as well as help ensure the sustainable production of environmental goods and services in the long term.

All ventures described in this paper are still operating successfully and show promise of long-term viability and even expansion. All are also yielding better economic returns due to their organic nature. In-depth case studies of two of these enterprises clearly demonstrated that “green” microenterprises can achieve a considerable profit-making status within a short span (two to three years) of operation. It is not only the operating profit of these enterprises that are considerably high but also the ecosystem benefits that are quite significant as they are rendering multiple environmental ameliorative services. None of their production cycles is found to be harming the environment through pollution, waste generation, resource depletion, and other such agents of environmental degradation.

Theoretically, environmental re-orientation of entrepreneurial ventures occurs through “ecological switchover” as explained by Huber [

45] and Janicke [

46] via their concept of ecological modernization. However, their argument was focused on large-scale enterprises of industrialized societies. At the micro-economic level, the practical implications of ecological modernization are still not yet clearly defined. However, some scholars [

47,

48] assert that strategic intervention, development, and diffusion of new techniques can be instrumental in the ecological modernization of many economic sectors, which is precisely what the BEGCB project accomplished through its microcredit program.

The conditional microcredit for greening purposes with grant and technical assistance (“aid bundles”) have been extremely effective in promoting “ecological switchover” of micro-entrepreneurial ventures. This switchover let entrepreneurs shift away from reactive (control or clean-up) approaches to environmental management to proactive methods such as green raw material selection, organic fertilization, clean production and distribution methods, and afforestation and riparian zone protection.

Though the scope of our research did not allow us to examine compliance of these enterprises with ecological modernization tenets, the modality of these green microenterprises does offer a unique model for bottom-up ecological modernization.

The BEGCB partnership project provides a useful practical example of how “green” microcredit strategies can serve as a useful tool for addressing climate change issues from the bottom up. There are currently millions of such microenterprises worldwide, and if all were to “go green,” the cumulative impact upon the environment would be substantial. Furthermore, these enterprises are largely owned and operated by women, who are the primary local users of natural resources and major victims of pollution and environmental degradation.

There are numerous barriers to successful wide-scale implementation of green microenterprises that need to be addressed, including natural disasters such as floods and pest infestations, as well as market fluctuations and distortions that can seriously set back small-scale entrepreneurs. Furthermore, the success of such enterprises depends largely on marketing and the ability to get one’s goods to market. Currently, most microenterprises are dependent on their supporting NGOs to connect them to downstream buyers, and this dependency constitutes a vital weakness in the micro loans model. It is therefore vital to develop strategies to allow entrepreneurs to independently find markets and promote their goods.

6. Conclusions

Our case study findings reveal that it is tenable to reorient the micro-entrepreneurial operations at the rural community level by adding environmental goals to their business missions. Though these enterprises mostly operate in the informal sector and are therefore beyond the purview of regulatory mechanisms, their association with NGOs (especially development NGO-MFIs) can be instrumental in strategically aligning their operations towards sustainability principles. In addition to generating profit and supporting livelihoods, the studied enterprises demonstrated numerous environmental benefits including carbon sequestration, health preservation, damage control, and conservation of natural resources. If these benefits are counted in monetary terms (valuation for non-marketed direct and indirect benefits), the aggregate return on investment by such enterprises would figure much higher. These findings, however, should be treated carefully as the case study approach deals with unique situations that may not necessarily be reflective of all implementations.

We conclude that microcredit-assisted microenterprises can simultaneously be “green” and make substantial profits. The MFI’s initial role in development support is crucial for the inception of such ventures. Incorporation of greening principles in microcredit delivery mechanisms by MFIs facilitates compliance of ecological principles by community-based microenterprises. Within a span of two to three years, these enterprises can run their operations in a sustainable fashion and, in most cases, emerge from the loan cycle and become self-reliant. A shifted microcredit delivery mechanism incorporating environmental objectives in the MFI-CBO discourse thus paves the way for green microenterprise development. Awareness, knowledge, skill, and technical aid are the core elements in realizing this developmental goal.

Introduction of “green” micro entrepreneurship would initially require multiple stakeholders, especially lenders, borrowers, local authorities, specialists and promoters, and other concerned authorities to work jointly toward the greening goal. The major operational goal of such enterprises must entail: the use of renewable natural resources; practice of non-chemical fertilization (mainly manure and compost); adoption of clean technologies; recovering natural soil quality and fertility; stocking of indigenous species and productivity enhancement—thereby enhancing ecosystem goods and services (provisioning, regulation, support, and cultural ecosystem services). The input, production and output of these ventures demand special attention and conformity to renewability and biodegradability guidelines.

The “green” microcredit mechanism has strengthened the process of sustainability at the local community level by adding an “environmental bottom line”. Yunus [

49] claims that microcredit has already proved itself in contributing to social and economic bottom lines, and that with the introduction of the “green” microcredit approach by the BEGCB partnership initiative, the environmental bottom line has also been fulfilled. This “green” micro-entrepreneurship strategy offers a powerful tool for implementing local-level action and solutions to counter climate change and environmental degradation.

One potential difficulty with the findings of this study is the extent to which the results of the green microloan strategy can be replicated in the absence of external financial aid i.e., if the investment portfolio lacks direct technical assistance to microenterprises or CBOs from donors or development partners. Regarding the ecologically modernized character of these enterprises, further exploration and examination of operational and institutional dimensions of community-based “green” micro-entrepreneurship can answer whether such real-world cases constitute successful examples of the ecological modernization of microenterprises.