An Analysis of Professional Perceptions of Criteria Contributing to Sustainable Housing Affordability

Abstract

:1. Introduction

2. Defining and Conceptualising Housing Affordability

Affordability…jumbles together in a single term a number of disparate issues: the distribution of housing prices, the distribution of housing quality, the distribution of income, the ability of households to borrow, public policies affecting housing markets, conditions affecting the supply of new refurbished housing, and the choices that people make about how much housing to consume relative to other goods. This mixture of issues raises difficulties in interpreting even basic facts about housing affordability.(pp. 191–192)

Affordability is concerned with securing some given standard of housing (or different standard) at a price or a rent which does not impose, in the eye of some third party (usually the government) an unreasonable burden on household incomes. A number of judgments and assumptions are made in putting the concept into practice, and, in broad terms, affordability is assessed by the ratio of a chosen definition of housing costs to a selected measure of household income in some given period.(p. 9)

…affordability cannot be divorced from housing deprivation and housing standards. If a household is achieving “affordability”, but only by virtue of living in overcrowded conditions, with insecure tenure or in unsafe or inaccessible locations, is that real affordability?

3. Methods

3.1. Literature Review and Exploratory Interviews

3.2. Questionnaire-Based Survey

3.3. Statistical Tests Used for Questionnaire Data Analysis

| Data Type | Parametric vs. non-Parametric | No of Groups | Appropriate Test | ||

|---|---|---|---|---|---|

|  |  Non-parametric test required  | Comparing differences between 2 groups |  | Mann Whitney U test |

| Comparing differences between 3+ groups |  | Kruskal-Wallis H test | ||

| |||||

- Central tendency tests—to determine average ratings of criteria importance;

- Kolmogorov-Smirnov test—to identify whether the data are normally distributed. The test was conducted on the data and each variable produced a significance value of p < 0.05, meaning that further statistical analysis to understand differences between variables had to be non-parametric;

- Mann-Whitney U test—to identify if any significant differences exist between two groups’ opinion on criteria importance;

- Kruskal Wallis test—to identify if any significant differences exist between three or more groups’ opinion on criteria importance. The Mann-Whitney U test was subsequently used as a post hoc analysis on significant results.

- Does opinion on criteria importance differ depending on the region of the UK in which the expert is based (e.g., South East)?

- Does opinion on criteria importance differ depending on the respondent’s involvement in particular sector of housing industry (e.g., housing association)?

4. Results

| Criteria | Sustainable Housing Affordability Criteria | Where Criteria Derived from (Literature References, Interviews) |

|---|---|---|

| C1 | House prices in relation to income | [17,56] and local authority interviews |

| C2 | Rental costs in relation to income | [17,56] and local authority interviews |

| C3 | Interest rates and mortgage availability | [57,58] and local authority interviews |

| C4 | Availability of rented accommodation (private and social) | [59,60,61,62] |

| C5 | Availability of low cost home ownership products | [59,60,61,62] |

| C6 | Availability of market value home ownership products | [60,61,62,63] |

| C7 | Safety (crime) | [18,60,61,64] |

| C8 | Access to employment | [18,60,61,64] |

| C9 | Access to public transport | [49,56,60,61,64] |

| C10 | Access to good quality schools | [18,56,60,64,65,66] |

| C11 | Access to shopping facilities | [60,64,65,66] |

| C12 | Access to health services | [56,60,64,66] |

| C13 | Access to early years child care | [60,64] |

| C14 | Access to leisure facilities | [60,64] |

| C15 | Access to open green public space | [56,59,60,61,64,66] |

| C16 | Low presence of environmental problems | [56,59,60,61] |

| C17 | Quality of housing | [35,36,37,40,41,59,61,67] and local authority interviews |

| C18 | Energy efficiency of housing | [42,59,61,68] and local authority interviews |

| C19 | Waste management | [59,60,61] |

| C20 | Deprivation in area | [64,69] |

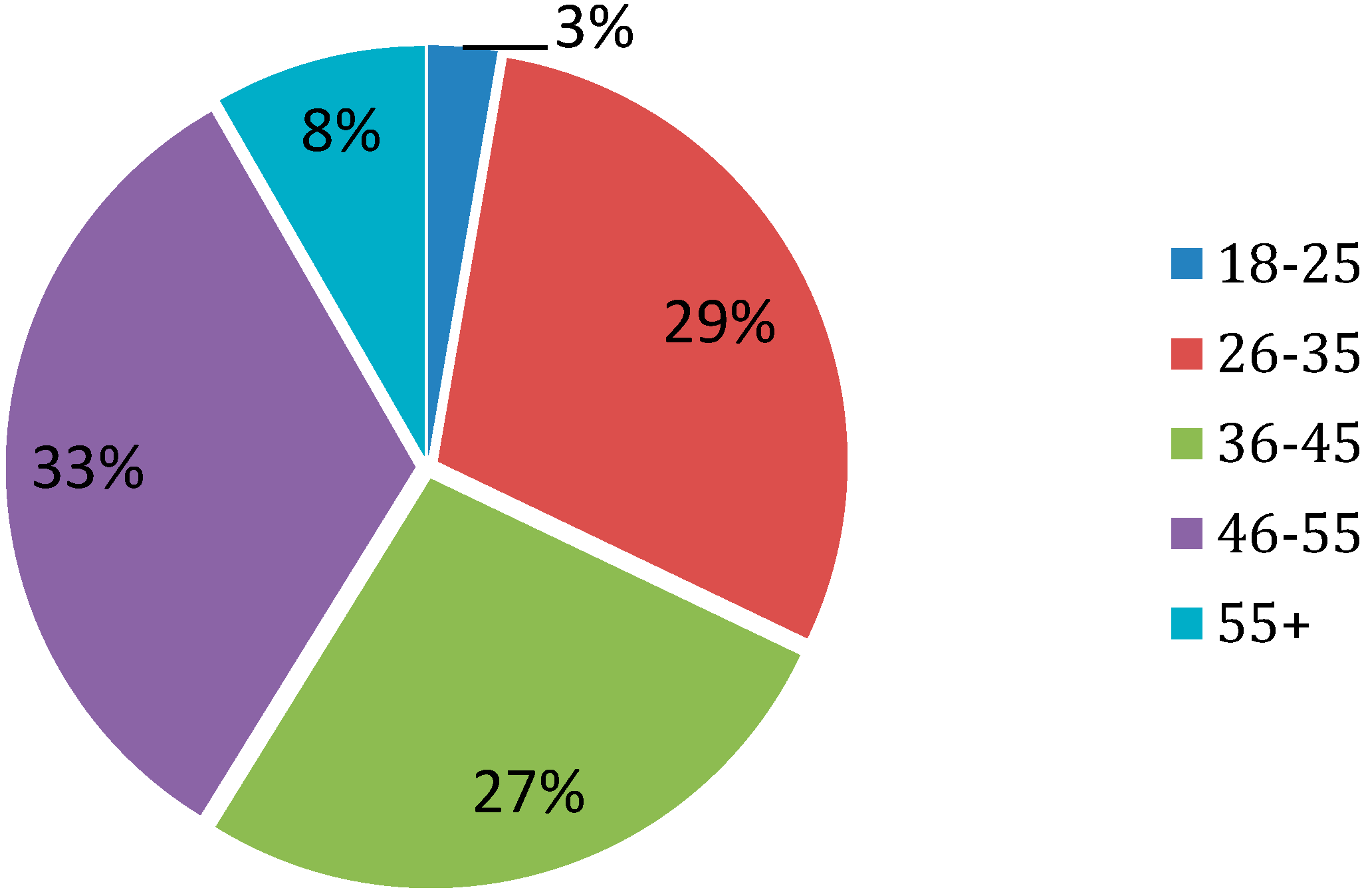

4.1. Participation in Questionnaire-Based Survey

4.2. Importance of Sustainable Housing Affordability Criteria in the View of Housing Stakeholders

4.3. Professional Perceptions Depending on the UK Geographical Region and Sector of Housing Industry

| Groups Compared | Research Question |

|---|---|

| UK region of housing industry | Does opinion on criteria importance differ depending on the region of the UK in which the expert is based? |

| Sector of housing industry | Does opinion on criteria importance differ depending on the respondent’s involvement in a particular sector of the housing industry? |

4.3.1. UK Region of Housing Industry

- C4 “availability of rented accommodation” (H(10) = 18.799, p = 0.043) at p < 0.05;

- C13 “access to early years child care” (H(10) = 19.506, p = 0.034)at p < 0.05.

- Number of comparisons required: 11(11 – 1)/2 = 55

- Bonferroni adjustment: 0.05/55 = 0.0009 (new alpha level)

4.3.2. Sector of Housing Industry

| Sustainable housing affordability criteria | Ranking of criteria | Average level of criteria importance by sector (with standard deviation in brackets) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| HA | LA-P | LA-HS | UR | HD | PAHC | GO | |||

| C1 | House prices in relation to income | 1 | 8.6 | 8.8 | 8.9 | 8 | 7.4 | 9.4 | 7.3 |

| (1.76) | (1.68) | (1.21) | (1.6) | (2.47) | (1.17) | (0.58) | |||

| C2 | Rental costs in relation to income | 1 | 8.8 | 8.6 | 8.8 | 8.5 | 6.9 | 9.3 | 7.3 |

| (1.25) | (1.56) | (1.19) | (1.69) | (2.50) | (1.06) | (0.58) | |||

| C3 | Interest rates and mortgage availability | 3 | 8.1 | 7.8 | 8.2 | 7.3 | 7.6 | 8.5 | 7 |

| (1.64) | (1.83) | (1.42) | (1.98) | (2.71) | (1.24) | (0) | |||

| C4 | Availability of rented accommodation (private and social) | 3 | 8.3 | 7.6 | 8.3 | 7.5 | 6.7 | 7.8 | 8.7 |

| (1.7) | (1.6) | (1.41) | (0.93) | (2.61) | (1.8) | (0.58) | |||

| C17 | Quality of housing | 5 | 8 | 7.4 | 7.9 | 8 | 6.4 | 6.5 | 7.3 |

| (1.7) | (1.88) | (1.71) | (1.31) | (2.68) | (1.45) | (1.53) | |||

| C8 | Access to employment | 6 | 8 | 7.2 | 7.4 | 7.9 | 7.3 | 6.5 | 7.7 |

| (1.59) | (1.78) | (1.77) | (1.25) | (2.43) | (1.88) | (3.22) | |||

| C18 | Energy efficiency of housing | 7 | 7.6 | 7 | 7.4 | 7.6 | 6.5 | 5.9 | 6.7 |

| (1.95) | (2.11) | (1.78) | (1.77) | (3.09) | (2.19) | (0.58) | |||

| C5 | Availability of low cost home ownership products | 8 | 6.8 | 6.9 | 7 | 6.8 | 6.9 | 7.4 | 7.3 |

| (2.03) | (1.99) | (1.81) | (1.58) | (2.47) | (2.11) | (2.08) | |||

| C10 | Access to good quality schools | 9 | 7.7 | 6.8 | 6.8 | 8.1 | 6.8 | 6 | 7.3 |

| (1.81) | (2.07) | (1.79) | (1.55) | (2.45) | (1.60) | (2.08) | |||

| C9 | Access to public transport | 10 | 7.5 | 6.9 | 6.6 | 6.8 | 6.3 | 6.1 | 6.7 |

| (1.81) | (1.97) | (1.76) | (2.38) | (2.38) | (2.02) | (2.31) | |||

| C12 | Access to health services | 11 | 7.1 | 6.7 | 6.4 | 7.6 | 5.4 | 5.3 | 7 |

| (1.86) | (1.92) | (1.86) | (1.69) | (2.28) | (1.91) | (2) | |||

| C6 | Availability of market value home ownership products | 12 | 6.7 | 6.4 | 6.5 | 6 | 6 | 7.6 | 7 |

| (1.76) | (2.19) | (1.84) | (1.41) | (2.17) | (1.31) | (2) | |||

| C13 | Access to early years child care | 13 | 7 | 6.5 | 6.1 | 7.6 | 5.8 | 5.3 | 6.3 |

| (1.97) | (1.85) | (1.8) | (1.92) | (2.3) | (1.83) | (2.08) | |||

| C11 | Access to shopping facilities | 14 | 6.9 | 6.5 | 6 | 7.4 | 5.1 | 5.3 | 6.3 |

| (2.02) | (1.85) | (1.72) | (1.92) | (2.5) | (2.02) | (1.53) | |||

| C7 | Safety (crime) | 15 | 6.9 | 5.6 | 6.1 | 7 | 5.5 | 5 | 6.7 |

| (2.16) | (2.19) | (1.92) | (1.6) | (3.06) | (2.13) | (2.31) | |||

| C16 | Low presence of environmental problems | 15 | 6.5 | 5.8 | 6.1 | 7.3 | 5.7 | 5.1 | 7 |

| (2.11) | (2.07) | (1.89) | (1.49) | (2.19) | (1.93) | (1.93) | |||

| C20 | Deprivation in area | 15 | 6.9 | 5.3 | 6.3 | 5.6 | 6 | 5.8 | 6.3 |

| (1.97) | (2.3) | (2.01) | (2.33) | (2.13) | (1.75) | (1.16) | |||

| C15 | Access to open green public space | 18 | 6.1 | 6.3 | 5.8 | 7.1 | 5.3 | 5.2 | 6 |

| (2.16) | (1.99) | (1.99) | (1.89) | (2.31) | (1.95) | (1.73) | |||

| C19 | Waste management | 19 | 6.2 | 5.6 | 5.8 | 6.5 | 5.6 | 5.3 | 6.3 |

| (2.49) | (2.34) | (2.04) | (2.45) | (2.94) | (2.53) | (2.52) | |||

| C14 | Access to leisure facilities | 20 | 5.7 | 6 | 5.2 | 7.5 | 4.9 | 5.1 | 5.7 |

| (2.04) | (1.97) | (1.95) | (1.85) | (2.31) | (1.93) | (1.53) | |||

| Criterion | Kruskal-Wallis Test Result |

|---|---|

| C1: House prices in relation to income | H(6) = 21.821, p = 0.001 (p < 0.01) |

| C2: Rental costs in relation to income | H(6) = 17.114, p = 0.009 (p < 0.01) |

| C4: Availability of rented accommodation | H(6) = 18.502, p = 0.005 (p < 0.01) |

| C7: Safety | H(6) = 14.510, p = 0.024 (p < 0.05) |

| C8: Access to employment | H(6) = 15.032, p = 0.020 (p < 0.05) |

| C9: Access to public transport services | H(6) = 13.190, p = 0.040 (p < 0.05) |

| C10: Access to good quality schools | H(6) = 15.950, p = 0.014 (p < 0.05) |

| C11: Access to shopping facilities | H(6) = 21.263, p = 0.002 (p < 0.01) |

| C12: Access to health services | H(6) = 16.806, p = 0.010 (p < 0.05) |

| C13: Access to early years child care | H(6) = 17.184, p = 0.009 (p < 0.01) |

| C14: Access to leisure facilities | H(6) = 19.929, p = 0.003 (p < 0.01) |

| C17: Quality of housing | H(6) = 17.028, p = 0.009 (p < 0.01) |

| C20: Deprivation in area | H(6) = 19.209, p = 0.004 (p < 0.01) |

| Sector of Housing Industry | Criterion | Mann-Whitney Result | Rank of Criterion |

|---|---|---|---|

| Local authority housing gave higher rankings than local authority planning | C4: availability of rented accommodation | U = 5054, Z = −3.310, p = 0.001 (p < 0.0024) | 4 |

| Housing associations gave higher rankings than local authority housing | C11: access to shopping facilities | U = 2278, Z = −3.126, p = 0.002 (p < 0.0024) | 14 |

| Local authority planning gave higher rankings than local authority housing | C14: access to leisure facilities | U = 5098, Z = −3.195, p = 0.001 (p < 0.0024) | 20 |

| Housing associations gave higher rankings than local authority planning | C20: deprivation in area | U = 1074, Z = −3.751, p = 0.000 (p < 0.0024) | 15–17 |

| Local authority housing gave higher rankings than local authority planning | C20: deprivation in area | U = 5026, Z = −3.333, p = 0.001 (p < 0.0024) | 15–17 |

5. Discussion

6. Conclusions

Author Contributions

Conflicts of Interests

References

- Whitehead, C. From need to affordability: An analysis of UK housing objectives. Urban. Stud. 1991, 28, 871–887. [Google Scholar] [CrossRef]

- Bramley, G. Affordability, poverty and housing need: Triangulating measures and standards. J. Hous. Built Environ. 2012, 27, 133–151. [Google Scholar] [CrossRef]

- Chen, J.; Hao, Q.; Stephens, M. Assessing housing affordability in post-reform China: A case study of Shanghai. Hous. Stud. 2010, 25, 877–901. [Google Scholar] [CrossRef]

- Crook, A.D.H.; Monk, S.; Rowley, S.; Whitehead, C.M.E. Planning gain and the supply of new affordable housing in England—Understanding the numbers. Town Plan. Rev. 2006, 77, 353–373. [Google Scholar] [CrossRef]

- Gurran, N.; Phibbs, P. Housing supply and urban planning reform: The recent Australian experience 2003–2012. Int. J. Hous. Policy 2013, 13, 381–407. [Google Scholar] [CrossRef]

- Haffner, M.; Boumeester, H. Housing affordability in the Netherlands: The impact of rent and energy costs. J. Hous. Built Environ. 2014, 25, 799–820. [Google Scholar]

- Moore, E.; Skaburskis, A. Canadaʼs increasing housing affordability burdens. Hous. Stud. 2004, 19, 395–413. [Google Scholar] [CrossRef]

- Mulliner, E.; Maliene, V. Austerity and reform to affordable housing policy. J. Hous. Built Environ. 2013, 28, 397–407. [Google Scholar] [CrossRef]

- Norris, M.; Shiels, P. Housing affordability in the republic of Ireland: Is planning part of the problem or part of the solution? Hous. Stud. 2007, 22, 45–62. [Google Scholar] [CrossRef]

- Yates, J. Australiaʼs housing affordability crisis. Aust. Econ. Rev. 2008, 41, 200–214. [Google Scholar] [CrossRef]

- Gan, Q.; Hill, R.J. Measuring housing affordability: Looking beyond the median. J. Hous. Econ. 2009, 18, 115–125. [Google Scholar] [CrossRef]

- Hulchanski, J.D. Discrimination in Ontarioʼs Rental Housing Market: The Role of Minimum Income Criteria; Ontario Human Rights Commission: Toronto, ON, Canada, 1994. [Google Scholar]

- Stone, M.E. What is housing affordability? The case for the residual income approach. Hous. Policy Debate 2006, 17, 151–184. [Google Scholar] [CrossRef]

- Gabriel, M.; Jacobs, K.; Arthurson, K.; Burke, T.; Yates, J. Conceptualising and Measuring the Housing Affordability Problem, National Research Venture 3: Housing Affordability for Lower Income Australians; Australian Housing and Urban Research Institute: Melbourne, Australia, 2005. [Google Scholar]

- Kutty, N.K. A New Measure of Housing Affordability: Estimates and Analytical Results. Hous. Policy Debate 2005, 16, 113–142. [Google Scholar] [CrossRef]

- Lux, M. The quasi-normative approach to housing affordability: The case of the Czech Republic. Urban Stud. 2007, 44, 1109–1124. [Google Scholar] [CrossRef]

- Whitehead, C.; Monk, S.; Clarke, A.; Holmans, A.; Markkanen, S. Measuring Housing Affordability: A Review of Data Sources; Cambridge Centre for Housing and Planning Research: Cambridge, UK, 2009. [Google Scholar]

- Fisher, L.M.; Pollakowski, H.O.; Zabel, J. Amenity-based housing affordability indexes. Real Estate Econ. 2009, 37, 705–746. [Google Scholar] [CrossRef]

- Bramley, G. An affordability crisis in British housing: Dimensions, causes and policy impact. Hous. Stud. 1994, 9, 103–124. [Google Scholar] [CrossRef]

- Stone, M.E. Housing Affordability: One-Third of a Nation Shelter Poor. In Right to Housing: Foundation for a New Social Agenda; Bratt, R., Stone, M.E., Hartman, C.A., Eds.; Temple University Press: Philadelphia, PA, USA, 2005; pp. 38–60. [Google Scholar]

- Hulchanski, J.D. The concept of housing affordability: Six contemporary uses of the housing expenditure-to-income ratio. Hous. Stud. 1995, 10, 471–491. [Google Scholar] [CrossRef]

- MacLennan, D.; Williams, R. Affordable Housing in Britain and America; Joseph Rowntree Foundation: England, UK, 1990. [Google Scholar]

- Linneman, P.; Megbolugbe, I.F. Housing Affordability: Myth or Reality? Urban. Stud. 1992, 29, 369–392. [Google Scholar] [CrossRef]

- Malpass, P.; Murie, A. Housing Policy and Practice; Macmillan Press Ltd.: London, UK, 1990. [Google Scholar]

- Ndubueze, O. Measuring Housing Affordability: A composite approach. In Proceedings of the ENHR 2007 International Conference Sustainable Urban Areas, Rotterdam, The Netherlands, 25–28 June 2007.

- Quigley, J.M.; Raphael, S. Is Housing Unaffordable? Why Isn’t It More Affordable? J. Econ. Perspect. 2004, 18, 191–214. [Google Scholar] [CrossRef]

- Bramley, G. Access, affordability and housing need. In Proceedings of the ESRC Housing Studies Conference, University of Surrey, Bristol, SAUS, University of Bristol, September 1990.

- Stone, M.E. Shelter Poverty: New Ideas on Housing Affordability; Temple University Press: Philadelphia, PA, USA, 1993. [Google Scholar]

- Hancock, K.E. Can pay? Won’t Pay? or Economic Principles of “affordability”. Urban. Stud. 1993, 30, 127–145. [Google Scholar] [CrossRef]

- Chaplin, R.; Martin, S.; Yang, J.H.; Whitehead, C. Affordability: Definitions, Measures and Implications for Lenders; University of Cambridge, Department of Land Economy: Cambridge, UK, 1994. [Google Scholar]

- Freeman, A.; Chaplin, R.; Whitehead, C. Rental Affordability: A Review of International Literature. Discussion Paper No. 88; Department of Land Economy, Cambridge University: Cambridge, UK, 1997. [Google Scholar]

- Field, C.G. Building consensus for affordable housing. Hous. Policy Debate 1997, 8, 801–832. [Google Scholar] [CrossRef]

- Brownill, S.; Sharp, C.; Jones, C.; Merrett, S. Housing London; Joseph Rowntree Foundation: England, UK, 1990. [Google Scholar]

- Burke, T. Measuring Housing Affordability; Australian Housing and Urban Research Institute Swinburne-Monash Research Centre: Sydney, Australia, 2004. [Google Scholar]

- Bogdon, A.S.; Can, A. Indicators of local housing affordability: Comparative and spatial approaches. Real Estate Econ. 1997, 25, 43–80. [Google Scholar] [CrossRef]

- Belsky, E.S.; Goodman, J.; Drew, R. Measuring the Nation’s Rental Housing Affordability Problems; Harvard University, Joint Center for Housing Studies: Cambridge, UK, 2005. [Google Scholar]

- Rowley, S.; Ong, R. Housing Affordability, Housing Stress and Household Wellbeing in Australia Final Report No. 192; Australian Housing and Urban Research Institute: Melbourne, Australia, 2012. [Google Scholar]

- Thalmann, P. “House poor” or simply “poor”? J. Hous. Econ. 2003, 12, 291–317. [Google Scholar] [CrossRef]

- Malpass, P. Housing Tenure and Affordability: The British Disease. In The New Housing Shortage: Housing Affordability in Europe and the USA; Hallett, G., Ed.; Routledge: London, UK, 1993; pp. 87–88. [Google Scholar]

- Stone, M.E.; Burke, T.; Ralston, L. The Residual Income Approach to Housing Affordability: The Theory and the Practice Positioning Paper No. 139; Australian Housing and Urban Research Institute: Melbourne, Australia, 2011. [Google Scholar]

- Leishman, C.; Rowley, S. Affordable housing. In The Sage Handbook of Housing; Clapham, D.F., Clarke, A.V., Gibb, K., Eds.; Sage: London, UK, 2012. [Google Scholar]

- Australian Conservation Foundation and Victorian Council of Social Service (ACF & VCOSS). Housing Affordability: More than Rents and Mortgages. 2008. Available online: http://www.vcoss.org.au/documents/VCOSS%20docs/Housing/REP_ACF_VCOSS%20Housing%20Affordability%20October%202008%20.PDF (accessed on 20 October 2014).

- Seelig, T.; Phibbs, P. Beyond the Normative: Low Income Private Rentersʼ Perspectives of Housing Affordability and Need for Housing Assistance. Urban. Policy Res. 2006, 24, 53–66. [Google Scholar] [CrossRef]

- Jones, C.; Watkins, C.; Watkins, D. Measuring local affordability: Variations between housing market areas. Int. J. Hous. Markets Anal. 2011, 4, 341–356. [Google Scholar] [CrossRef]

- Nepal, B.; Tanton, R.; Harding, A. Measuring housing stress: How much do definitions matter? Urban. Policy Res. 2010, 28, 211–224. [Google Scholar] [CrossRef]

- Haffner, M.; Heylen, K. User costs and housing expenses towards a more comprehensive approach to affordability. Hous. Stud. 2011, 26, 593–614. [Google Scholar] [CrossRef]

- McCord, M.; McGreal, S.; Berry, J.; Haran, M.; Davis, P. The implications of mortgage finance on housing market affordability. Int. J. Hous. Markets Anal. 2011, 4, 394–417. [Google Scholar] [CrossRef]

- Center for Transit-Oriented Development and Center for Neighborhood Technology (CTOD & CNT). The Affordability Index: A New Tool for Measuring the True Affordability of a Housing Choice; Urban Markets Initiative, The Brookings Institution: Washington, DC, USA, 2006. [Google Scholar]

- MacKillop, F. Sustainable as a basis of affordable? Understanding the affordability “crisis” in Australian housing. Aust. Plan. 2013, 50, 2–12. [Google Scholar] [CrossRef]

- Prochorskaite, A.; Maliene, V. Health, well-being and sustainable housing. Int. J. Strat. Prop. Manag. 2013, 17, 44–57. [Google Scholar] [CrossRef]

- Winston, N. Sustainable communities? A comparative perspective on urban housing in the European Union. Eur. Plan. Stud. 2014, 22, 1384–1406. [Google Scholar] [CrossRef]

- Wood, G.; Smith, S.J.; Ong, R.; Cigdem, M. The Edges of Home Ownership Final Report No. 216; Australian Housing and Urban Research Institute: Melbourne, Australia, 2013. [Google Scholar]

- Mulliner, E.; Maliene, V. Criteria for Sustainable Housing Affordability. In Proceedings of the 8th International Conference on Environmental Engineering, Vilnius, Lithuania, 19–20 May 2011; pp. 966–973.

- Office of the Deputy Prime Minister. The Egan Review: Skills for Sustainable Communities; RIBA Enterprise: London, UK, 2004. [Google Scholar]

- Pallant, J. SPSS Survival Manual, 2nd ed.; Open University Press: Buckingham, UK, 2005. [Google Scholar]

- Communities and Local Government. Strategic Housing Market. Assessments: Practice Guidance Version 2; The Stationary Office: London, UK, 2007.

- National Housing and Planning Advice Unit. Housing Affordability: A Fuller. Picture; National Housing and Planning Advice Unit: Fareham, UK, 2010.

- Shelter. ROOF Affordability Index 2006; Shelter: London, UK, 2006. [Google Scholar]

- Maliene, V.; Malys, N. High-quality housing—A key issue in delivering sustainable communities. Build. Environ. 2009, 44, 426–430. [Google Scholar] [CrossRef]

- Office of the Deputy Prime Minister. Sustainable Communities: Homes for All; The Stationary Office: London, UK, 2005. [Google Scholar]

- Winston, N. Regeneration for Sustainable Communities? Barriers to Implementing Sustainable Housing in Urban Areas. Sustain. Dev. 2010, 18, 319–330. [Google Scholar] [CrossRef]

- Yates, J.; Milligan, V.; Berry, M.; Burke, T.; Gabriel, M.; Phibbs, P.; Pinnegar, S.; Randolph, B. Housing Affordability: A 21st Century Problem, National Research Venture 3: Housing affordability for lower income Australians Final Report No. 105; Australian Housing and Urban Research Institute: Melbourne, Australia, 2013. [Google Scholar]

- Robinson, M.; Scobie, G.M.; Hallinan, B. Affordability of Housing: Concepts, Measurement and Evidence Working Paper No. 06/03; New Zealand Treasury: Wellington, New Zealand, 2006. [Google Scholar]

- Office of the Deputy Prime Minister. Sustainable Communities: People, Places and Prosperity; The Stationery Office: London, UK, 2005. [Google Scholar]

- Samuels, I. What Home Buyers Want: Attitudes and Decision Making Among Consumers; Commission for Architecture and the Built Environment: London, UK, 2005. [Google Scholar]

- Zhu, X.; Liu, S.; Yeow, M.C.A. GIS-Based Multi-Criteria Analysis Approach to Accessibility Analysis for Housing Development in Singapore. In Proceedings of the SSC 2005 Spatial Intelligence, Innovation and Praxis: The National Biennial Conference of the Spatial Sciences Institute, Spatial Sciences Institute, Melbourne, Australia, 12 September 2005.

- Communities and Local Government. Delivering Affordable Housing; Communities and Local Government: London, UK, 2006.

- Pullen, S.; Arman, M.; Zillante, G.; Zuo, J.; Chileshe, N.; Wilson, L. Developing an assessment framework for affordable and sustainable housing. Australas. J. Constr. Econ. Build. 2010, 10, 48–64. [Google Scholar] [CrossRef]

- Prime Ministerʼs Strategy Unit and Office of the Deputy Prime Ministe. Improving the Prospects of People Living in Areas of Multiple Deprivation in England; Cabinet Office: London, UK, 2005. [Google Scholar]

- Clapham, D.; Mackie, P.; Orford, S.; Thomas, I.; Buckley, K. The housing pathways of young people in the UK. Environ. Plan. A 2014, 46, 2016–2031. [Google Scholar] [CrossRef]

- Pittini, A. Housing affordability in the EU: Current situation and recent trends. Cecodhas Hous. Eur. Obs. Res. Brief. 2012, 5, 6. [Google Scholar]

- Thomsen, J. Reflections on the opportunities of urban planning to promote non-vehicular transportation in a sustainable settlement in Norway. Urban. Des. Int. 2011, 16, 162–170. [Google Scholar] [CrossRef]

- Communities and Local Government. National Planning Policy Framework; Communities and Local Government: London, UK, 2012.

- McDonald, S.; Malys, N.; Maliene, V. Urban regeneration for sustainable communities: A case study. Technol. Econ. Dev. Econ. 2009, 15, 49–59. [Google Scholar] [CrossRef]

- Ryan, T.P. Nonparametric Methods, in Sample Size Determination and Power; John Wiley & Sons Inc: Hoboken, NJ, USA, 2013. [Google Scholar]

- Campello, M.; Graham, J.R.; Harvey, C.R. The real effects of financial constraints: Evidence from a financial crisis. J. Financ. Econ. 2010, 97, 470–487. [Google Scholar] [CrossRef]

© 2014 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mulliner, E.; Maliene, V. An Analysis of Professional Perceptions of Criteria Contributing to Sustainable Housing Affordability. Sustainability 2015, 7, 248-270. https://doi.org/10.3390/su7010248

Mulliner E, Maliene V. An Analysis of Professional Perceptions of Criteria Contributing to Sustainable Housing Affordability. Sustainability. 2015; 7(1):248-270. https://doi.org/10.3390/su7010248

Chicago/Turabian StyleMulliner, Emma, and Vida Maliene. 2015. "An Analysis of Professional Perceptions of Criteria Contributing to Sustainable Housing Affordability" Sustainability 7, no. 1: 248-270. https://doi.org/10.3390/su7010248

APA StyleMulliner, E., & Maliene, V. (2015). An Analysis of Professional Perceptions of Criteria Contributing to Sustainable Housing Affordability. Sustainability, 7(1), 248-270. https://doi.org/10.3390/su7010248