Exploring the Upgrading of Chinese Automotive Manufacturing Industry in the Global Value Chain: An Empirical Study Based on Panel Data

Abstract

:1. Introduction

2. Literature Review and Hypotheses

2.1. Core of Industrial Upgrading in Global Value Chain

2.2. Internal Technological Innovation Capability and Industrial Upgrading

2.3. External Linkages and Industrial Upgrading

2.4. Debate about the Influences of Internal Technological Innovation Capability and External Linkage on Upgrading

2.5. Upgrading the Chinese Automotive Manufacturing Industry in Different Regions

3. Research Design

3.1. Variable Selection

3.1.1. Industrial Upgrading Effect

3.1.2. Internal Technological Innovation Capability

3.1.3. External-Linkage Effect

3.2. Data Collection

| Variables | Source of Data | |

|---|---|---|

| Independent variables | Ratio of R&D expense of automobile industry to revenue (a1) | Zhonghong Industry Database [69] |

| Output value of new products (a2) | Zhonghong Industry Database [69] | |

| Ratio of automobile parts investment to total investment in the auto industry (b1) | Zhonghong Industry Database [69] | |

| Location quotient (b2) | Zhonghong Industry Database [69], China Statistical Yearbooks [70] | |

| Dependent variables | Overall labour productivity of the automobile industry (y1) | China Automotive Industry Yearbooks [71] |

| Ratio of the total business income of the automobile manufacturing industry of different regions of China to the total business income of the twelve largest automobile manufacturing enterprises in the world (y2) | China Automotive Industry Yearbooks [71], www.fortunechina.com [72] |

3.3. Data Analysis

3.3.1. Multiple Regression Analysis of the Panel Data

3.3.2. Cluster Analysis of the Panel Data

4. Results and Discussions

4.1. Results of the Regression Analysis and Discussions

| Variables | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| Constant | 4.20 × 10−11 | 2.34 × 10−32 | 20.64 × 10−43 * |

| (1.79 × 10−9) | (1.14 × 10−55) | (2.23 × 10−23) | |

| Internal technological innovation capability () | 0.217423 *** | 0.423562 ** | |

| (3.719894) | (4.156323) | ||

| External linkage effect () | 0.197047 * | 2.472564 ** | |

| (2.370632) | (2.512144) | ||

| R2 | 0.856047 | 0.833441 | 0.843251 |

| Modified R2 | 0.833734 | 0.812863 | 0.827342 |

| F | 38.36590 | 33.74523 | 35.63453 |

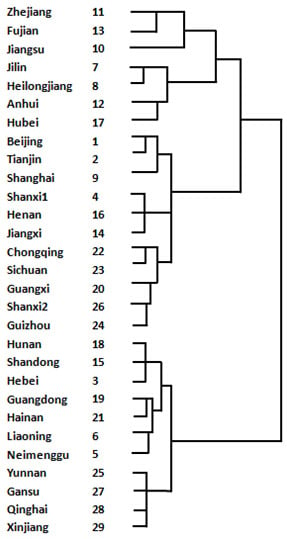

4.2. Results of the Cluster Analysis and Discussions

| Level of development of ITIC | Provinces |

|---|---|

| Provinces with high development of ITIC | Jiangsu, Shanghai, Guangdong, Anhui, Hubei, and Chongqing |

| Provinces with medium-level development of ITIC | Jilin, Beijing, Heilongjiang, Henan, Jiangxi, Fujian, and Zhejiang |

| Provinces with low development of ITIC | Liaoning, Tianjing, Shandong, Hebei, Sichuan, Shanxi2, Shanxi1, Hunan, Neimenggu, Hainan, Guangxi, Guizhou, Yunnan, Gansu, Qinghai, and Xinjiang |

| Level of development of EL | Provinces |

|---|---|

| Provinces with highest development of EL | Jilin, Heilongjiang, Anhui, Hubei |

| Provinces with high development of EL | Zhejiang, Fujian, Jiangsu |

| Provinces with general development of EL | Beijing, Tianjing, Shanghai, Shanxi1, Henan, Jiangxi, Chongqing, Sichuan, Guangxi, Shanxi2, Guizhou |

| Provinces with low development of EL | Hunan, Shandong, Hebei, Guangdong, Hainan, Liaoning, Neimenggu, Yunnan, Gansu, Qinghai, Xinjiang |

5. Conclusions

5.1. Theoretical Contributions

5.2. Managerial Implications

5.3. Limitations and Future Research

Acknowledgments

Author Contributions

Supplementary Materials

Conflicts of Interest

References

- China’s Statistical Yearbook; China Statistics Press: Beijing, China, 2011.

- Gereffi, G. International trade and industrial upgrading in the apparel commodity chain. J. Int. Econ. 1999, 48, 37–70. [Google Scholar] [CrossRef]

- Ding, Z.; Wu, Y. Choice of upgrading path of Chinese car industry and suggestions-based on global value chain. Soc. Sci. J. 2009, 1, 104–107. [Google Scholar]

- Xue, S.P. The issue of Chinese automobile parts small and medium-sized enterprises embedded in global value chain and suggestions. Econ. Res. Guide 2009, 8, 28–29. [Google Scholar]

- Yang, D.H. Analysis on the development model of Chinese automobile industry-from global value chain perspective. Int. Econ. Cooper. 2010, 2, 20–24. [Google Scholar]

- Liu, Y.; Ma, W. Micro mechanism of automobile industrial upgrading in China based on SEM-take Jiangxi Province as an example. East China Econ. Manag. 2012, 8, 66–70. [Google Scholar]

- Humphrey, J.; Schmitz, H. How does insertion in global value chains affect upgrading in industrial clusters. Reg. Stud. 2002, 36, 1017–1027. [Google Scholar] [CrossRef]

- Ernst, D.; Kim, L. Global production networks, knowledge diffusion, and local capability formation a conceptual framework. In Proceedings of the Nelson & Winter Conference, Aalborg, Denmark, 12–15 June 2001.

- Ernst, D. How Sustainable are Benefits from Global Production Networks? Malaysia’s Upgrading Prospects in the Electronics Industry; Working Paper [No. 58] of East-West Center Economics Series; East-West Center: Honolulu, HI, USA, 2003. [Google Scholar]

- Avdasheva, A.; Budanov, I.; Golikova, V.; Yakovlev, A. Upgrading Russian Enterprises from the Value Chain Perspective: The Case Study of Tube & Pipe and Furniture Sectors. Available online: http://discovery.ucl.ac.uk/17511/ (accessed on 18 May 2015).

- Yang, Y. The Taiwanese Notebook Computer Production Network in China: Implication for Upgrading of the Chinese Electronics Industry. Working Paper of Personal Computing Industry Center. Available online: http://escholarship.org/uc/item/82h77681#page-2 (accessed on 18 May 2015).

- Humphrey, J. Upgradingg in Global Value Chain. Working Paper No. 28 for International Labor Office. Available online: http://www.ilo.int/wcmsp5/groups/public/---dgreports/---integration/documents/publication/wcms_079105.pdf (accessed on 18 May 2015).

- Gereffi, G.; Humphrey, J.; Sturgeon, T. The governance of global value chains. Rev. Int. Polit. Econ. 2005, 12, 78–104. [Google Scholar] [CrossRef]

- Giuliani, E.; Pietrobelli, C.; Rabellotti, R. Upgrading in global value chains: Lessons from Latin American clusters. World Dev. 2005, 33, 549–573. [Google Scholar] [CrossRef]

- Lopez, R.V. Is it possible to upgrade in global value chains? A comparison between industrial policy in Mexico and the Asian experience. Revista de Globalización, Competitividad & Gobernabilidad 2012, 6, 119–130. [Google Scholar]

- Gereffi, G.; Tam, T. Industrial upgrading through organizational chains: Dynamics of rent, learning, and mobility in the global economy. In Proceedings of the 93rd Annual Meeting of the American Sociological Association, San Francisco, CA, USA, 21–25 August 1998.

- Kaplinsky, R.; Morris, M. A Handbook for Value Chain Research. Working Paper of IDRC. Available online: http://www.prism.uct.ac.za/papers/vchnov01.pdf (accessed on 18 May 2015).

- Tokatli, N.; Eldener, Y.B. Upgrading in the Global Clothing Industry: The Transformation of Boyner Holding. Compet. Change 2004, 8, 173–193. [Google Scholar] [CrossRef]

- Humphrey, J.; Schmitz, H. Governance and Upgrading: Linking Industrial Cluster and Global Value Chain Research; Working Paper 120 of IDS; Institute of Development Studies: Brighton, UK, 2000. [Google Scholar]

- Poon, T.S.C. Beyond the global production networks: A case of further upgrading of Taiwan’s information technology industry. Int. J. Technol. Glob. 2004, 1, 130–144. [Google Scholar] [CrossRef]

- Abernathy, W.J.; Clark, K.B. Innovation: Mapping the winds of creative destruction. Rese. Policy 1985, 4, 3–22. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar]

- Felin, T.; Hesterly, W.S. The knowledge-based view, nested heterogeneity, and new value creation: Philosophical considerations on the locus of knowledge. Acad. Manag. Rev. 2007, 32, 195–218. [Google Scholar] [CrossRef]

- Cockburn, I.M.; Henderson, R.M. Absorptive capacity, coauthoring behavior, and the organization of research in drug discovery. J. Ind. Econ. 1998, 46, 157–182. [Google Scholar] [CrossRef]

- DeCarolis, D.M.; Deeds, D.L. The impact of stocks and flows of organizational knowledge on firm performance: An empirical investigation of the biotechnology industry. Strat. Manag. J. 1999, 20, 953–968. [Google Scholar] [CrossRef]

- Deeds, D.L. The role of R&D intensity, technical development and absorptive capacity in creating entrepreneurial wealth in high technology start-ups. J. Eng. Technol. Manag. 2001, 18, 29–47. [Google Scholar] [CrossRef]

- Coombs, J.E.; Bierly, P.E. Measuring technological capability and performance. R&D Manag. 2006, 36, 421–438. [Google Scholar] [CrossRef]

- Stuart, T.E. Interorganizational alliances and the performance of firms: A study of growth and innovation rates in a high-technology industry. Strat. Manag. J. 2000, 21, 791–811. [Google Scholar] [CrossRef]

- Zong, G.; Ma, N. Study on the evaluation of industrial enterprises’ competitiveness based on DEA method. Quant. Techn. Econ. 2002, 12, 92–95. [Google Scholar]

- Gong, S. Industrial upgrading, position in global value chain and enterprise competitiveness. North. Econ. 2009, 10, 67–68. [Google Scholar]

- Liu, Y.; Ma, W.; Liu, D. Study on macro mechanism of automobile industrial upgrading in China. Sci. Technol. Manag. Res. 2012, 13, 135–139. [Google Scholar]

- Kishimoto, C. Clustering and upgrading in global value chains: The Taiwanese personal computer industry. In Local Enterprises in the Global Economy: Issues of Governance and Upgrading; Schmitz, H., Ed.; Edward Elgar Publishing: Northampton, MA, USA, 2004. [Google Scholar]

- Saxenian, A.; Hsu, J.Y. The Silicon Valley–Hsinchu connection: Technical communities and industrial upgrading. Ind. Corp. Change 2010, 10, 893–920. [Google Scholar] [CrossRef]

- Krugman, P. Increasing returns and economic geography. J. Polit. Econ. 1991, 99, 483–499. [Google Scholar] [CrossRef]

- Best, M.H. The New Competitive Advantage: The Renewal of American Industry; Oxford University Press: New York, NY, USA, 2001. [Google Scholar]

- Wallsten, S.J. An empirical test of geographic knowledge spillovers using geographic information systems and firm-level data. Reg. Sci. Urban Econ. 2001, 31, 571–599. [Google Scholar] [CrossRef]

- Asheim, B.T.; Isaksen, A. Regional innovation systems: The integration of local ‘sticky’ and global ‘ubiquitous’ knowledge. J. Technol. Transfer 2002, 7, 77–86. [Google Scholar] [CrossRef]

- McEvily, B.; Zaheer, A. Bridging ties: A source of firm heterogeneity in competitive capabilities. Strat. Manag. J. 1999, 20, 1133–1156. [Google Scholar] [CrossRef]

- Zhou, Y. A research of upgrading of automobile industry in China on the base of global value chain. Automobile Sci. Technol. 2006, 6, 7–10. [Google Scholar]

- Langlois, R.N.; Robertson, P.L. Networks and innovation in a modular system: Lessons from the microcomputer and stereo component industries. Res. Policy 1992, 21, 297–313. [Google Scholar] [CrossRef]

- Sturgeon, T.J. What Really Goes on in Silicon Valley? Spatial Clustering and Dispersal in Modular Production Networks. J. Econ. Geogr. 2003, 3, 199–225. [Google Scholar] [CrossRef]

- Liang, J. Study on industrial upgrading in developing countries-a global value chain framework. Tianjing Soc. Sci. 2007, 4, 86–92. [Google Scholar]

- He, W.; Chen, S.H. Game analysis of determinants of stability of semiconductor modular production networks. Sustainability 2014, 6, 4772–4794. [Google Scholar] [CrossRef]

- Mao, Y.; Wu, Y. Study on enterprise upgrading path and analysis model. J. Sun Yat-Sen Univ. 2009, 1, 178–186. [Google Scholar]

- Gereffi, G.; Korzeniewicz, M. Commodity Chains and Global Capitalism; Praeger: Westport, CT, USA, 1994. [Google Scholar]

- Kaplinsky, R.; Readman, J. Integrating SMEs in Global Value Chains: Towards Partnership for Development. In Proceedings of the United Nations Conference on Trade and Development, Vienna, Austria, 10–12 August 2001.

- Bair, J. Global capitalism and commodity chains: Looking back and going forward. Compet. Change 2005, 9, 153–180. [Google Scholar] [CrossRef]

- Madalena, F. Global value chains and technological upgrading in peripheral regions: The footwear industry in North Portugal. In Proceedings of the Regional Studies Association International Conference, Aalborg University, Aalborg, Denmark, 28–31 May 2005.

- Lorentzen, J.; Barnes, J. Learning, upgrading, and innovation in the South African automotive industry. Eur. J. Dev. Res. 2004, 16, 465–498. [Google Scholar] [CrossRef]

- Hotopp, U.; Radosevic, S.; Bishop, K. Trade and industrial upgrading in countries of Central and Eastern Europe: Patterns of scale- and scope-based learning. Emerg. Mark. Finance Trade 2005, 41, 20–37. [Google Scholar]

- Lin, J.Y.; Wang, Y. China’s Integration with the World Development as a Process of Learning and Industrial Upgrading; Working Paper [No. 4799] of Policy Research; World Bank: Washington, DC, USA, 2008. [Google Scholar]

- Richado, D. On the Principles of Political Economy and Taxation; The Commercial Press: Beijing, China, 1976. [Google Scholar]

- Richardson, H.W. Elements of Regional Economics; Penguin Books: Harmondsworth, USA, 1969. [Google Scholar]

- Wu, Y. Study on comparative advantages and absolute advantages. Cooper. Econ. Sci. Technol. 2008, 4, 12–18. [Google Scholar]

- Li, X.J.; Pang, L. Empirical study on regional differences of automotive industrial effect. Commerc. Res. 2009, 8, 23–27. [Google Scholar]

- Pang, L.; Li, X. Empirical study on regional differences of Chinese automotive industry competitiveness. J. Appl. Stat. Manag. 2011, 6, 46–52. [Google Scholar]

- Gong, S. Influence on Performance by the Impetus of Upgrading: An Analysis of Enterprises in Global Value Chains. Ph.D. Thesis, Jinan University, Jinan, China, 2007. [Google Scholar]

- Wang, Z.; Chen, G. Empirical analysis of interactive development between manufacturing sub-sectors and logistics industry: Based on gray correlational model. J. Shanghai Univ. Finance Econ. 2010, 12, 65–74. [Google Scholar]

- Yu, Y. Research on Competitive Power for Automobile Components and Parts Industry in China. Ph.D. Thesis, Jilin University, Jilin, China, 2008. [Google Scholar]

- Sheng, Y.; Wang, S.; Qiu, K. An empirical study of manufacturing technology transformation modes. Stud. Sci. Sci. 2011, 29, 692–698. [Google Scholar]

- Xiao, J.; Li, B.; Dong, W. Research on technical innovation influence to Jilin information technology manufacture industry and competitiveness. Inf. Sci. 2012, 30, 287–292. [Google Scholar]

- Wang, J.; Zhang, G. Organizational modularity and its measurement-an analytical framework based on loosely coupled system. J. Xidian Univ. 2008, 18, 1–10. [Google Scholar]

- Yan, B. Theory and Empirical Study of Chinese Automobile Industrial Cluster. Ph.D. Thesis, Shanghai Jiao Tong University, Shanghai, China, 2008. [Google Scholar]

- Wu, S. Empirical study on high-tech industrial clustering in Guangdong province. Spec. Zone Econ. 2010, 1, 34–36. [Google Scholar]

- Cui, Y.; Zang, X. Comparison with industry agglomeration and its participating in new international division of labor: Taking typical industries, agglomerate districts, Dongguan and Shaoxing, as an example. J. Int. Trade 2010, 4, 58–63. [Google Scholar]

- Zhang, L.; Lin, S. Research on the correlation between innovation agglomeration and industrial agglomeration. Stud. Sci. Sci. 2010, 4, 635–640. [Google Scholar]

- Illeris, S.; Sjoholt, P. The Nordic countries: High quality service in a low density environment. Progr. Plan. 1995, 43, 205–221. [Google Scholar] [CrossRef]

- Vera, B.; Zane, Z. The potential of cluster development and the role of cluster support policies in Latvia. Econ. Ann. 2011, 56, 35–67. [Google Scholar] [CrossRef]

- Zhonghong Industry Database. Available online: http://edu1.macrochina.com.cn (accessed on 18 May 2015).

- China Statistical Yearbooks; China Statistics Press: Beijing, China, 2001–2009.

- China Automotive Industry Yearbooks; China Automotive Industry Association Press: Beijing, China, 2001–2009.

- Fortune China. Available online: www.fortunechina.com (accessed on 18 May 2015).

- Tao, F.; Guo, J.W.; Yang, S.X. Technical efficiency of Chinese power generation and its deternimants in the period of electric-system transition. China Ind. Econ. 2008, 1, 68–76. [Google Scholar]

- Jiang, J.F.; Luo, Q.L. Resolving unfair distribution of income through transforming the mode of economic development. Finance Trade Econ. 2012, 9, 22–32. [Google Scholar]

- Bonzo, D.C.; Hrmosilla, A.Y. Clustering panel data via perturbed adaptive simulated annealing and genetic algorithms. Adv. Complex Syst. 2002, 4, 339–360. [Google Scholar] [CrossRef]

- Zheng, B.Y. The clustering analysis of multivariable panel data and its application. Appl. Stat. Manag. 2008, 27, 265–270. [Google Scholar]

- Sturgeon, T.J. Modular production networks: A new American model of industrial organization. Ind. Corp. Change 2002, 11, 451–496. [Google Scholar] [CrossRef]

- Cao, L.; Wang, H.; Chen, S. Dualism of modular production network and its implication on China’s enterprise. China Ind. Econ. 2008, 10, 33–42. [Google Scholar]

- Liu, K. Research on the Mechanism and Upgrading Path of Industrial Cluster. Ph.D. Thesis, Tianjing University, Tianjing, China, 2007. [Google Scholar]

- Zhang, J.; Zhang, S.; Liu, Z. Multi technology spillover effect, innovation impetus of local firms and path selection of industrial upgrading-based on the forms of Chinese local industrial clusters. Nankai Econ. Stud. 2007, 3, 34–43. [Google Scholar]

- Mardia, K.V.; Kent, J.T.; Bibby, J.M. Multivariate Analysis; Academic Press: London, UK, 1980. [Google Scholar]

- Agostino, M.; Giunta, A.; Nugent, J.; Scalera, D.; Trivieri, F. The importance of being a capable supplier: Italian industrial firms in global value chain. Int. Small Bus. J. 2014. [Google Scholar] [CrossRef]

- Bacchiocchi, E.; Florio, M.; Giunta, A. Internationalization and industrial districts: Evidence from the Italian automotive supply chain. Int. Rev. Appl. Econ. 2014, 28, 1–21. [Google Scholar] [CrossRef]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lu, F.; He, W.; Cheng, Y.; Chen, S.; Ning, L.; Mei, X. Exploring the Upgrading of Chinese Automotive Manufacturing Industry in the Global Value Chain: An Empirical Study Based on Panel Data. Sustainability 2015, 7, 6189-6211. https://doi.org/10.3390/su7056189

Lu F, He W, Cheng Y, Chen S, Ning L, Mei X. Exploring the Upgrading of Chinese Automotive Manufacturing Industry in the Global Value Chain: An Empirical Study Based on Panel Data. Sustainability. 2015; 7(5):6189-6211. https://doi.org/10.3390/su7056189

Chicago/Turabian StyleLu, Fucai, Wei He, Yang Cheng, Sihua Chen, Liang Ning, and Xiaoan Mei. 2015. "Exploring the Upgrading of Chinese Automotive Manufacturing Industry in the Global Value Chain: An Empirical Study Based on Panel Data" Sustainability 7, no. 5: 6189-6211. https://doi.org/10.3390/su7056189

APA StyleLu, F., He, W., Cheng, Y., Chen, S., Ning, L., & Mei, X. (2015). Exploring the Upgrading of Chinese Automotive Manufacturing Industry in the Global Value Chain: An Empirical Study Based on Panel Data. Sustainability, 7(5), 6189-6211. https://doi.org/10.3390/su7056189