1. Introduction

It is now widely recognized that fundamental shifts are required in the way energy and means of mobility are provided and used. The notion of “socio-technical transitions” is increasingly being used to describe fundamental shifts in socio-technical systems like, for example, the energy or the mobility system. The term “sustainability transitions” refers to the assumption that such changes can to some extent be intentionally steered towards particular goals—

i.e., that there is scope to govern such transitions [

1]. Some off-springs of transition theory like the governance approach of Transition Management (TM) particularly fuel such expectations and aim to provide conceptual tools for the understanding and shaping of such transitions [

2]. These approaches are rooted in a systems perspective and in a quasi-evolutionary understanding of economic processes. Transition concepts have also been found useful in transport geography (see, e.g., [

3,

4,

5]), though a greater integration with behavioral and political science [

4] or practice theory approaches [

6] has been recommended.

As some critics argue, transition theory does not put sufficient emphasis on the role that powerful actors can actually play in changing the course of such change processes [

7,

8]—partly because of a focus on change processes “from below” (niches) and partly due to its foundation in a systems perspective. Crucial questions for anybody striving for a more sustainable society are: to what extent are transitions shaped by powerful incumbent actors? What power resources are available to exert such strategic influence? It is this complex interplay of interests, discursive agency and systemic change that we want to explore with regard to a particular interplay of key industry and governmental actors. Such actor constellations often reflect the particularity of a certain region which may, for example, also be dominated in political terms by key industries. We need to acknowledge such spatial particularities in order to understand the dynamics of socio-technical change and therefore to apply an explicitly geographical perspective on this process [

9,

10].

Mobility has been identified as one of the key fields in which a sustainability transition must happen rapidly in order to limit climate change and resource depletion. This urgency is rarely questioned. What such a sustainable mobility system will look like, however, is highly contested. For many years, most people would have thought of highly efficient cars. Today, this vision is increasingly questioned. Car-sharing initiatives prove that mobility does not necessarily require individual ownership of vehicles [

11]. Public transport systems, together with cycling and walking, are increasingly freed from the image of being for underprivileged groups only [

5]. Visions of sustainable mobility can thus be grouped into two categories: Those which maintain a central place for individual ownership of vehicles and those which do not.

The car industry of course has a key stake in this debate. Although it has so far shown a remarkable capacity to withstand transition pressures and retain its dominant position and business models (see [

12]), an image of incumbent regime actors who are just defending the status quo, while niche actors and new market entrants attempt to introduce change, is misplaced. The interests of actors in this sector are far from clear-cut and simple. For example, every household or company which through car sharing, public transport or the like delays or avoids the purchase of a new car reduces sales, turnover and profit for the car industry. It would hence be rational for industry actors to fiercely oppose such trends. However, these trends may prevail in the long-term meaning that all actors in the industry may eventually have to adapt. In light of this reality, incumbent firms may attempt to shape and redefine transitions in a way which allows them to retain a central market position. To hedge against the risk of not being prepared, it is thus also rational for such actors to get involved in experiments relating to these emerging alternatives to the classical business case of the industry.

Alongside the relevant industry, public policy is also burdened with uncertainty and ambivalence. What are motivations and possibilities for elected politicians to initiate and support experiments with elements of a sustainable mobility system? How do they frame the challenges facing the mobility system and possible solutions? How do they organize their relations with incumbent players in the existing mobility system? A specific arena in which both groups of actors are involved and forced to negotiate their understandings of sustainable mobility are “model regions for electric mobility”. We examine one of the nine German model regions for e-mobility to identify the dynamics of this very specific interplay between industry and politics which frame and institutionalize research and development for a sustainable mobility future.

The Stuttgart region in Southwest Germany is traditionally perceived as the home base of the (German) car industry, with the headquarters and main production sites of car manufacturers like Daimler and Porsche as well as key suppliers like Bosch. In light of this, we expect to clearly see in this region how actors from a key industry of national importance are able to react to expectations of change (e.g., towards more sustainable systems of mobility) without having to compromise on profits derived from their traditional business model (despite it being widely perceived as unsustainable). By examining well-funded and nominally “transitional” activities in a region in which a car-orientation is entrenched in a particularly wicked way, we seek to better understand the factors and dynamics at play in actually inhibiting regional contributions to a more fundamental transition of the mobility system. In the Stuttgart region, e-mobility experiments have been supported by the national ministry for transportation until the end of 2011 in order to develop the respective markets. In 2012, the region was selected by the same ministry (BMVI) to become one of four “showcase regions” for electric mobility. In the following years, around 40 projects were developed under the label “LivingLab BWe mobil” by more than 100 partners with significant funding (40 Mio. Euro by BMVI were complemented with 15 Mio by the state of Baden-Württemberg and the city region) [

13]. Between 2006 and 2015, BMVI has spent 850 Mio. Euro on demonstration activities around electric mobility, mostly in nine “model regions” and “showcase regions” spread across Germany. (Deutsches Institut für Urbanistik: “Elektromobilität in Kommunen –Ein Stimmungsbild”; Berlin, 2015). Focusing particularly on agency in such a “transition arena”, our key questions are: How do the key actors in this arena frame the challenge of sustainable mobility? How do different parts of the industry relate to each other? What role is attributed to public policy? What role is attributed to the industry?

In the following

Section 2, we describe our conceptual starting points: a space-sensitive application of the Multi-Level Perspective (MLP) on the socio-technical system of mobility. Deviating from many classical applications of this framework, however, we put much emphasis on (discursive) agency. In

Section 3, we introduce our explorative case study: Activities to develop the Stuttgart Region into a “model region for sustainable mobility” by fostering applied research on and a roll-out of e-mobility infrastructure. After presenting our empirical material in

Section 4, we draw some conceptual conclusions in

Section 5.

2. Conceptualizing Incumbents’ Reactions to Regime Challenges

Durable changes in any complex mobility system necessarily involve a multi-layered and multi-stakeholder process. The socio-technical transition approach provides us with a viable set of assumptions and heuristic devices to analyze actors’ constellations and potential dynamics such as typical patterns of change in mobility regimes [

14,

15,

16]. A large part of the transition literature operates with the so-called Multi-Level Perspective (MLP) which distinguishes socio-technical niches, regimes and landscape primarily as three levels of structuration. Combined with a quasi-evolutionary heuristic, these levels help us to sort out various interdependencies that shape the dynamics of socio-technical transformation processes.

The mobility regime is such a case in point. For over a century, it has been characterized by the individual car powered by an internal combustion engine (ICE) and thus has rightly been considered as a clear case of a stabilized regime [

3,

4,

17,

18]. Electric propulsion has been available since the early days of automobility, and a shift away from ICE dominance has been discussed for decades, though the prospects of this occurring have rather seemed to diminish over time [

12,

14,

19,

20,

21,

22,

23]. Recently, however, more and more analysts of the mobility sector in Europe and the US have identified signs of significant destabilization in the regime of individual ownership of ICE powered vehicles [

3,

24]. An increasing variety of alternatives to individual car

ownership and a policy-driven shift to

e-mobility are two important trends that are widely discussed.

Emphasis in transition studies is often put on how regime structures can be challenged through the development of promising socio-technical niches which may accumulate and build up sufficient momentum to finally overthrow the entrenched regimes. Following a preoccupation with niches and more recently also with “cracks” in the entrenched regimes, pathways of transitions are often modeled rather optimistically. While transition study approaches help us understand the inertia of highly stabilized and interdependent systems, the potential of incumbent regime actors to strategically react to and effectively attenuate challenges to their superior position—such as changed societal expectations, novel technologies or regulatory policies—often tends to be downplayed (see [

25,

26,

27,

28] for recent exceptions). However, even repeated reminders to consider more closely the role of power imbalances and politics [

7,

8,

29] have not yet led to much explicit analysis of the leeway that powerful incumbent actors can use to mitigate potentially transformative challenges. Smith and Kern [

30], for example, showed in their study of the Dutch Energy transition in 2009, how incumbent actors were able to capture and re-define a process of institutional reform that originally aimed to support “systemic” sustainability transitions in the energy domain of the Netherlands. However, the politico-economic concept of “capture” [

31], while frequently used by transition scholars, has rarely been defined and operationalized in the literature on socio-technical transitions.

While the term “incumbent actor” is used ubiquitously throughout the transition literature to signify the dominant actors within the existing regime, little effort is usually made to specify what kind of agency is to be expected from incumbents. Being a constitutive part of the regime and by definition benefiting from the regime’s constellation, incumbent actors are assumed to strategically enact their interest, which is to keep the regime stable and fend off radical innovations which would fundamentally change regime structures and power relations. However, as is acknowledged in many real world situations, incumbent actors may also be interested in the adaptation of the regime to emerging challenges in order to avoid a complete break-down. Then even the strategic support of particular niche-activities can be part of an incumbent’s strategy.

Further, we should not expect the same framing of an incumbent’s self-interest to prevail homogenously throughout an entire enterprise. Particularly in multi-national companies, which operate in many different national markets and are exposed to diverse regulatory and normative framework conditions, we can expect a significant internal cultural diversity within heterogeneous teams (comprising of sales managers, product developers etc.) leading to inconsistent strategies across diverse parts of the enterprise. It can also be considered a very rational choice to develop a “pluralistic” response to perceived risks of regime change. Although enterprises in key industries will often try to perpetuate a once successful business model as long as possible, including massive lobbying for political support, they may at the same time invest significant resources in research and development activity around alternative technical configurations. In this context, the participation in potentially transformative joint niche activities with external partners can be considered necessary for hedging against the risk of a complete break-down of revenues. Additionally, such activities may be seen as instrumental in attracting young employees to the enterprise, who love to get involved in cutting edge research and development.

The notion of co-evolution between technology and social elements of regimes is a fundamental component of transition theory. Moreover, the expectations of actors in different societal spheres are also unlikely to develop completely independently from each other. We have to expect, for example, that governmental actors—particularly after being in an influential position for many years—will develop an understanding of the future and possible regulation of key industries that is aligned with the perspectives held in the industry itself. Although the idea that governments could manage the transformation of socio-technical regimes from an external position has been challenged by key texts of the transition literature from the beginning (

cf. [

32]), this simplification and optimistic outlook reappears again and again. Governments, just as multi-national companies, should not be treated as monolithic blocks with a consistent strategy of regime change, but as aggregates of multiple actors with different and internally ambivalent views and strategies.

To summarize, we consider that to properly assess the transformative potential of regime dynamics it is very important to disaggregate the various strategies of actors both within key industries and within governments. Furthermore, we need to understand and appreciate the ways in which these actors interact with each other. Most importantly, they will try to support each other in order to increase the chances of stabilizing in the long-term the core features of the incumbent regime.

When local transition initiatives, which often interplay with non-local discourses, are examined thoroughly, the crucial importance of discursive dynamics comes to the fore. In line with, e.g., Kern [

33], it can be assumed that shifts in dominant ideas, discursive strategies and underlying perceptions as well as processes of discourse institutionalization are key determinants of systemic transitions in a socio-technical regime such as the mobility regime. Along with this emphasis on discursive dynamics we also want to pay particular attention to actors’ agency in such dynamics. As far as data allow, we aim to apply the perspective of “argumentative discourse analysis (ADA)”, which was developed by Maarten Hajer [

34,

35,

36] and is frequently used in interpretive policy analysis [

37,

38]. It particularly highlights agency in the form of building discourse coalitions and in a struggle about discourse structuration and institutionalization, e.g., in policy formation and is therefore recommended by many authors as a framework that is complementary to the more structural concepts of the multi-level perspective [

39,

40].

Hajer builds his approach around three key concepts: (a) discourses; (b) story-lines; and (c) discourse coalitions.

Discourse is defined as: “

a specific ensemble of ideas, concepts, and categorizations that is produced, reproduced, and transformed in a particular set of practices and through which meaning is given to physical and social realities” [

34].

Story-lines are narrative constructs which are reproduced on a frequent basis and through which the elements of different discourses are bound together. They are condensed statements which summarize a narrative used by actors as a “short hand” in discussions. Actors engaged in a certain political struggle (e.g., about environmental policy) try to achieve dominance or hegemony in that discursive space. In doing so, they form

discourse coalitions,

i.e., groups of actors that—for various reasons—are attracted to a specific (set of) story-lines. “Story-lines are here seen as the discursive cement that keeps a discourse-coalition together” [

34].

The political struggle is modeled here as an “argumentative game” in which everybody aims at domination. Hajer distinguishes two processes through which a discourse can become dominant: (1) A discourse can begin to dominate the way in which a social entity (e.g., policy area, enterprise, society as a whole) conceptualizes the world, e.g., by making things appear “traditional”, “natural” or “normal”. He calls this the condition of “discourse structuration”. (2) A discourse can also become manifest in specific institutional arrangements and organizational practices such as monitoring arrangements, planning procedures, etc. This is what he calls the condition of “discourse institutionalization”.

Our analysis is mainly based on document analyses complemented by 14 expert interviews, which were conducted between June and September 2011 with large car manufacturers, suppliers, political actors, innovative niche producers, associations and research organizations, which all participate in the promotion of e-mobility in the Stuttgart Region. According to the framework outlined above, the transcribed interviews have been analyzed with particular focus on the different logics and problem framings applied by the interviewed actors.

3. Stuttgart “Model Region” for Sustainable Mobility

During the last few years, German politicians of all persuasions have committed themselves to realizing a transition to a more sustainable transportation system, particularly in cities. As home to the headquarters and major production sites of several global players in car manufacturing (Daimler and Porsche) and component supply companies (Bosch, Siemens and many others), the Stuttgart region was chosen to become a model region for sustainable mobility systems. While there are different approaches to green mobility, the electrification of cars is particularly compatible with the interests of the car industry. In 2012, there were 43 million cars in Germany, of which only 7100 were all-electric. However, in 2009, Chancellor Merkel set a goal to bring one million electric cars onto the streets by the year 2020. In 2013, a tax exemption for owners of electric cars was prolonged for ten more years. Moreover, 1.5 billion Euros have been dedicated to research for electric mobility [

41,

42,

43]. The state government of Baden-Württemberg provides significant financial support to the regional initiative to make Stuttgart a model of sustainable mobility. In 2009, the federal government of Germany also allocated 115 million for research and pilot projects on electro mobility in the Stuttgart region alone. Transition pathways towards sustainable mobility taking shape in this region can thus be assumed to have a major impact on the direction of the overall German mobility transition. In the following, we sketch out the corner stones of this regional initiative.

3.1. Particularities of the Region

The Stuttgart region is one of the most innovative and economically dynamic regions in Germany and belongs to the most important European Metropolitan Areas. Since the beginning of significant economic development around 1860, the Stuttgart Region has been famous for vehicle manufacturing and has managed to retain the automotive sector as the most important economic driver in the region until today. Important automotive enterprises such as Daimler AG or Porsche AG have their roots, headquarters and significant production capacities located here. Audi produces just around the corner in Neckarsulm. Important suppliers like Bosch, Siemens AG, Voith,

etc. have settled around the car producers and jointly form a dense network of projects and partnerships. Under these circumstances it is not surprising that the Stuttgart Region ranks amongst the most economically powerful regions in Europe. Approximately 2.7 million inhabitants (about 3% of the German population) produce goods and services amounting to over 100 billion Euro per annum. The per capita productivity of the region is about 25% higher than the national average [

44] (p. 47).

The Stuttgart region is characterized by a high level of commuting between and within the regional industrial sub-centers (see

Figure 1). The car manufacturers Daimler, Porsche and Audi, and some large suppliers such as Bosch make for a very particular, multi-centered landscape of employment distribution in the region. More than 64% of all work-related mobility in the “automotive region” is car-based. Of all instances of personal mobility in the region, 46% involve an individual car, resulting in 15.3 billion car-km annually [

45]. In the metropolitan area of Berlin, for a contrast, only 31% of journeys are covered with individual cars. The car ownership rate is also particularly high in the Stuttgart Region (631 cars per 1000 inhabitants [

46]). This is nearly double the motorization rate in Berlin, the metropolitan area with the lowest figure (324 cars/1000 inhabitants; [

47]). The economic importance of the automotive industry in the region is also reflected in the local infrastructure (high density of highways, comparatively little public transport) and in values and habits of the regional population.

3.2. Actors and Their Framings of Sustainable Mobility Initiatives in the Region

Before we can empirically study the most influential framings of sustainable mobility and particularly of the roles that are attributed to different stakeholders in the industry and public policy, we need to gain an overview of influential actors and select those key actors whose framings and positioning we intend to analyze. Based on an analysis of publically available documents (minutes, press releases, conference contributions, publications), the actors most frequently mentioned in debates about e-mobility initiatives in the Stuttgart Region were categorized into four sectors of society and attributed assumed levels of political influence, command over financial resources, and regional interconnectedness. This mapping exercise produced the following list of actors most relevant to the e-mobility initiatives in the Stuttgart Region (

Table 1):

From each of these organizations, a high-ranking representative with particular insight into the e-mobility initiatives was interviewed during the summer of 2011. The lack of civil society actors such as NGOs in this picture reflects the fact that the topic has been defined merely as a technical and economic issue and critical voices are rarely heard. Some observers speculate that the capacities of many potentially critical citizens have long been preoccupied with the conflict around the large and extremely controversial project of transforming the Stuttgart central station into an underground hub called “Stuttgart 21”.

The major initiatives to foster a transition to e-mobility that originated in the Stuttgart Region can be clearly divided into commercial initiatives on the one hand and political initiatives on the other.

Initiatives driven by commercial actors (in 2011) included:

Several collaborative projects between commercial actors from different sectors that are aimed at developing new technologies and business models for sustainable mobility in the region, e.g., a joint venture of EnBW, the commercial energy provider of southern Germany with ELMOTO, a start-up producer of electric bikes aimed to bring 600 E-Bikes into experimental application in the Stuttgart Region, in 2011 and 2012.

A joint venture for research and development of batteries for e-vehicles (“Limotive”) initiated by the companies Bosch and Samsung.

The development of electric traction engines for e-vehicles in a joint venture between Daimler and Bosch (“EM-motive GmbH“).

The innovative car-sharing concept car2go was implemented in the Stuttgart region from 2012. In October 2013, 380 electric cars (model: Smart) were in operation, fuelled at 177 stations (run by EnBW).

We observed the development of these industry initiatives during the years 2012–2013. One change was particularly notable:

In all recent follow-up initiatives in the field of Research and Development (R&D), there are no longer any small- or medium-sized enterprise (SME) partners. Even the start-up ELMOTO which was previously involved is no longer part of the R & D-activities (confirmed in interview). We do not have enough data to explain this as either a shift in discourse, in factual R & D requirements or in statutory requirements for funding of the model region activities. We assume, however, that the involvement of SMEs was a (soft, political) requirement for funding in the initial phase. But the regional chambers of commerce IHK and WRS, who continually promote the involvement of SMEs in the E-mobility Model Region [

45], have apparently not been successful in the long run.

In addition to industry-driven initiatives, there are also policy-driven ones at a regional and state level, including the following:

The former CDU-led (conservative) state government initiated a regional and state level program for sustainable mobility, which has been taken up and developed further by the new green party-led state government of Winfried Kretschmann.

The regional parliament initiated a “model region for sustainable mobility” and mobilized 7.5 million for projects that concentrated on intermodal and flexible mobility solutions. Since 2009, the “model region for electric mobility” has been funded by the national ministry for Transport (BMVBS), and now replaces the former model region for sustainable mobility.

The agency e-Mobil BW was founded in 2010 as a platform for bringing together all relevant actors in the sector of e-mobility at state level. Its annual budget of 2 million is funded by the state of Baden-Württemberg (e-mobil BW 2013). The agency coordinates: (a) the “Leading Edge Cluster Initiative Electric Mobility South-West” (collaborative R&D worth 80 million, funded half by the national ministry of research and the regional industry); and (b) the “LivingLab BW

emobil Showcase”,

i.e., application-oriented, systemic research into, and experimentation with, sustainable mobility systems, funded by the national government (45 million), the state of Baden-Württemberg (15 million) and the regional authorities [

48].

To summarize these policy initiatives: Efforts to make Stuttgart a Model for sustainable mobility have been substantial. First initiatives were supported by or even initiated from within governments and parliaments at regional and state level. A key turning point was the selection of the Stuttgart Region as one of eight model regions, which led to it receiving 115 million for research and pilot projects on electro mobility in 2009 when the German government spent 500 million from its economic stimulus package on the promotion of electric vehicles [

49].

With the creation of the agency “e-mobil BW” in 2010, a new institutional basis was built for the coordination of all activities regarding sustainable mobility under the title of “e-mobility”. It was established with the explicit purpose to serve as a platform for bringing together local actors on issues of electric mobility and thereby facilitating and catalyzing industrial development and research on issues crucial for this new technology [

50]. Created in 2010 by the conservative state government, the agency has been funded since 2011 by the Green-led government. In autumn 2013, the cabinet even committed itself to funding the agency for five more years while postponing an evaluation that was originally foreseen as a precondition for such a sustained engagement till the year 2018. At this occasion, the state minister for finance and economy, Nils Schmid, said: “

The state government will help to make the car-state Baden-Württemberg become a pioneer region for sustainable mobility” [

51]. However, according to a self-description of the agency, it clearly focuses on e-mobility and fuel cell technology. The agency was key to the acquisition of public money from the federal level for the e-mobility research cluster and the “LivingLab BWe mobil”, which are both e-mobility related R&D efforts co-funded by the regional industry with federal and state level governments [

51]. This orientation towards industry-led R&D was supported by the choice of the agency’s director: Franz Loogen—who for 20 years had occupied leading positions at Daimler AG—was appointed head of the agency. Naturally, he views the local industry as being well-equipped for the shift towards “new mobility”: “

The technology for a new and networked electric mobility is made up of three basic technologies: the electrical engineering, communication technology and vehicle technology. In each of these three industry sectors you will find the important players that now have to switch to new products of new forms of mobility within a new symbiosis. Only through collaboration of the three technological fields is new mobility created” [

52].

In line with the political will articulated by the regional chambers of commerce IHK and WRS, the agency also claims to push for an “integration” of small and medium suppliers in the process of innovation. To our knowledge, however, this declared ambition has not resulted in significant efforts from the side of the agency e-mobil BW or of the big players to actively support smaller companies. In clear contrast to smaller companies, the big three (Daimler, Bosch and EnBW) were all very present with their e-mobility initiatives at public events, fairs and in the media during 2012–2013. What we have no clear evidence for, but assume, is that these influential actors may also monopolize further initiatives to attract public research funding into the region and that the agency e-mobil BW may be instrumental in this.

Over time, as the amount of money involved increased, the focus of some political initiatives shifted away from a broader interest in “sustainable mobility”—which included efforts to improve whole mobility systems (car-sharing, increase inter-modal connectivity with public transport, etc.)—to the improvement of electric vehicles and the development of the required infrastructure. Sustainable mobility was increasingly equated with e-mobility. E-mobility research that is focused on the electrification of vehicles within an individual-car-ownership paradigm is geared towards improving business opportunities for all three actors which dominate the region’s e-mobility initiatives: If electric vehicles are purchased in addition to conventional cars, Daimler can expect increased sales; With its electronic equipment, Bosch may expect to supply a larger share of the value of such vehicles; and by operating the charging infrastructure, EnBW can increase electricity sales.

3.3. Who will Bring about E-Mobility? The Positioning of Industry, Consumers and Public Policy

An important dimension in shaping a more sustainable transport system is the interplay of commercial activities and public policy. Of particular importance in our case is a specific form of research funding and the establishment of an agency to foster the transition towards sustainable mobility. In this regard, it is crucial how politicians, who support such initiatives, perceive their own role.

When asked by a researcher, “Who do you think are the most important actors for a transition to e-mobility?”, a spokesman for the social democrats (governing party in the state parliament) pointed towards the car manufacturers: “

First of all, the car manufacturers

are the most important actors. The most important thing is that they produce cars that can compete with conventional cars in terms of range and costs” [

53].

The president of the Stuttgart regional parliament characterizes the situation in a similar way: “

As politicians we cannot invent the car anew. The industry has to lead here. It has to do the research and to find out which one is the right path” [

54]. It is seen as particularly “natural” in the region of Stuttgart that the (automotive) industry should play a leading role in technological development:

“This region owes its prosperity to the automobile. If there had not been smart people in this region who said: ‘this is how it has to function’, and who made these developments, then it would not be like this today. And so today those enterprises and smart, young people have to develop similar innovative ideas and products, so we can keep our prosperity in the future” [

53]. This parliamentarian even narrows down the task of “managing” a “technological transition” to three companies within the broader Stuttgart Region: “

I have great trust that Daimler and Porsche will manage the technological transition. They build the best cars in the world—together with Audi. The question is what will happen with those who today produce exhaust pipes or pistons. Will they be able to switch their production?” [

53].

Both by emphasizing their trust in the decisions taken within the industry and by reducing the governance of “technological transitions” to a matter of good engineering, these politicians naturally downplay the role of public policy in technological development. When explicitly asked about the influence of politically negotiated framework conditions on the transition to e-mobility, a member of the state parliament, and spokesperson for the social democrats on traffic and mobility stated: “

Of course: if we have to set legal framework conditions, the politicians will do this. But in the case of electro mobility I do not see any need for new legal frameworks at the moment. This may come later. Politics doesn’t create the legal framework a priori, it has to come afterwards” [

53]. Once again, the specific car-orientation of the regional economy is used as an argument for a very modest approach to political regulation. Asked about possible impacts of higher emissions standards or environmental zones in cities, the same politician responded as follows: “

Of course one has to enact emission directives, but one must not forget that our wealth is built upon the combustion engine. It can be done very gradually but it would be absurd to do this from one day to the other…” [

53].

So these politicians from state and regional level, social democrats who are particularly familiar with the Stuttgart e-mobility model region, stress in unison that agency with regard to e-mobility will be reserved for the regional industries. Before we turn to the self-positioning of the industry, we first need to differentiate the position of politicians: There are politicians who disagree with the pro-industry positioning presented above. The vice president of the green party club in the state parliament, for example, sees a need for action from diverse actors in order to achieve sustainable mobility in due time. Trust in the industry is much less pronounced here: “

I believe, that if we would leave the market uninfluenced, the transition would take much longer. It could be too late for climate protection by then. I have had discussions with parts of the industry who ask us not to impose the e-motor. From my understanding we do not impose anything: markets, government and civil society give incentives and set the framework conditions. But I see great skepticism within parts of the industry that leads to resistance” [

55].

How do representatives of the respective industries describe their own responsibility and the role of public policy? A member of the Daimler research department, when asked the same question about agency in the transition to e-mobility, actually pointed in yet another direction: “

I think society

plays the most important role. Nobody produces something that nobody wants to have … companies can certainly contribute to sustainable mobility, but a company naturally has an incentive to produce something with which it can earn money in the free market economy. So when the customer wishes for climate-friendly and emission-free vehicles, every company will move.” [

56]. Describing the car manufacturer as merely responding to customer demand, however, also draws the unfavorable picture of industry having a passive or highly reactive position with regard to sustainable mobility. On other occasions, Dieter Zetsche, CEO of Daimler AG, at least acknowledges the role of supportive framework conditions: “

Electric vehicles—with higher costs—still have less utility than vehicles with combustion engines. … There are many possible non-financial incentives for increasing the appeal of electric vehicles—such as free parking places in the inner city or dedicated traffic lanes for electric vehicles. The framework conditions in Germany are currently not ideal.” [

57]. Mr. Zetsche asserts that there is not much leeway for his own company to do more within the context of the given market conditions. As such, he openly calls on the German Government to spend more public money on the creation of a market for e-mobility: “

If a government says that, out of national interest, we want to play a leading role in this field, then the framework conditions must be set in a way that this can also evolve. And that cannot occur without buyers’ premiums.” [

57]. Thus, we can discern contradicting statements with regard to the necessity and desirability of a political manipulation of framework conditions for markets in the mobility sector. Some of these statements may be strategic rhetoric.

A representative of Bosch, the biggest automotive supplier in the region, also has a contrasting view about the industry’s role within the transition towards a system of electric mobility. She clearly considers the car manufacturers to be the most important actors within the transition, however, she also stresses the role of politicians in the creation of a new mobility system: “

Politics always interferes. There is no such thing as an undistorted market. Just take the taxes for Diesel. This is all intervention. Without specific measures, electric mobility will never be implemented. ... If a politician leans back and says: ‘it’s all up to the companies’, he already takes decisions against electro mobility, because with this he keeps promoting his previous measures that were favoring combustion engines.” [

58].

This position makes complete sense when considering the different interests of Bosch as a large supplier of car components. This company had a huge and unexpected success with a motor for electric bicycles. That may explain why representatives make the point more strongly that choices made by the industry itself can make a difference. However, apparently, this view is not openly supported by many industrial actors.

Concluding our findings regarding car manufacturers, who highlighted the role of customers, regarding supply companies, who pointed mainly to governments, and regarding politicians, who partly downplay their own role and emphasize their trust in the industry (see

Figure 2), we can draw the following picture:

Interestingly, the only example of somebody who considers that the actor group to which he himself belongs can influence a potential transition towards e-mobility is the green parliamentarian. However, even if this political ambition was shared by the whole green party as the leading partner of the governing state coalition, the capacity of this position to achieve a substantial impact seems to be relatively small. In this context, we once again quote Dieter Zetsche, CEO of Daimler. When asked how he gets along with the new (green) premier of the state Baden-Württemberg, he reveals: “

For both sides, it has taken a certain period of adaptation. But today Winfried Kretschmann would probably not repeat so definitively his statement that ‘fewer cars are better than more cars’. We work quite constructively together.” [

57].

4. Discussion

What we see in our interviews and in many public statements is a car industry which is very outspoken about its contribution to “revolutionizing the mobility system” and a transition towards more sustainable mobility systems. At the same time, this industry manages to shape the terms of discourse in a discursive arena (innovation in mobility) which is defined regionally (the Stuttgart model region). This discursive agency is evident from the re-framing of sustainable mobility as e-mobility based on individual cars and the dominant business model for these. It is also seen in the fact that some incumbent actors successfully neglect a pro-active role in shaping the transition, while at the same time they have to a large extent de-facto control over the institutionalization of the model region initiative (e.g., having a gate-keeper position concerning R&D projects). Obviously, both transport and economic policies in the Stuttgart Region are heavily dominated by the view that the automotive industry and the combustion engine are the backbone of economic prosperity. The unspoken fear is that the region will suffer an economic downturn and a decline in jobs if it pushes towards a different mobility regime. The resulting “regime level alliance” between policy makers and incumbent firms [

25] is a key ingredient of resistance to more fundamental change processes. As long as incumbent actors manage to keep up this imperative, any “transitional activities” will stay aligned with their interests.

Of course, such statements by the car industry may reflect their genuinely held self-image., However, they might also represent strategic and interest-driven communication, for example, communication that aims to align particular actors—such as politicians with access to crucial resources—with particular networks or to promote certain views and projects. The differences between (a) the positions of the car manufacturer Daimler and the key supplier of car electronics Bosch and (b) between the green party representative and the other politicians interviewed can be well explained by divergent commercial interests and basic normative positions. Interestingly, several politicians are most explicit in ruling out any political intervention that would force the regional car industry to do something they do not themselves want to do. Even if this extreme position is not shared by the green politician, there are no signs of any political intervention that is not in favor of the main incumbent actors of the car industry. The only slightly more moderate position—that political interventions are only legitimate if they are unproblematic for the large employers of the region—seems to be absolutely dominant given that no contradictory statement was found.

Although many interviewees equated sustainable mobility with e-mobility and although this perspective ran systematically through public statements of “e-mobil BW”, this is not a view which is universally shared by all relevant actors. Even the openly car-enthusiast state minister of finance, Schmid, expressed in 2013 his ambition “

to make the car-state Baden-Württemberg become a pioneer region for sustainable mobility”—not e-mobility! However, again, such nuances have no practical effect because the large industrial players, together with e-mobil BW, are influential enough to make sure that by far the largest share of the public money mobilized for R&D activities is devoted to projects which mainly strengthen their competitive position on the market (see also [

12]).

Acknowledging the limitations of our data-set, we see strong indications of a highly stabilized discourse coalition. The basic story-line of this coalition is: Our regional car industry is the backbone of our wealth, meaning that nobody dares to challenge it. Participating in this coalition are not only the main car manufacturers and the suppliers closely intertwined with them, but also politicians at regional, state and federal level. In effect, this political support may shield the industry from possible political interventions, e.g., by ruling out activities towards sustainable mobility that are not aligned with their interest in selling large quantities of high value cars.

The situation in Bavaria (BMW) and in Niedersachsen (VW) seems to be quite similar to the one in Baden-Württemberg, which may partly explain why the Federal Government also frequently intervenes at EU level in favor of the German manufacturers of relatively big, high value cars e.g., blocking strict CO

2 reduction targets for manufacturers’ car portfolios in 2013 [

41,

59]. A donation of 690,000 Euro that the governing party CDU received from the owners of BMW just a few days after this intervention in Brussels was much debated in Germany in October 2013 and used to explain the motivation of politicians to intervene on behalf of the car industries’ interests.

In the terms of transition studies, the regional and state level parliamentarians and governments—due to their participation in the discourse coalition—seem to be an essential part of the regionally entrenched car regime. Even when promoting a fundamental “revolution” towards sustainable mobility, they actually continue to stabilize the regime as long as they do not challenge the traditional business model of the industry. At least in Stuttgart, a strong taboo seems to prevent this from happening.

5. Conclusions

The case of the “e-mobility model region” activities in Stuttgart exemplifies ways in which incumbent actors, with support of governments and parliaments at regional, state and national level, are able to align a nominally “transformative” project with their short and medium term commercial interests. We assume that the possibility for and success of such strategies has long been underrated in the literature on transitions pathways [

32,

60]. Similar developments have been observed, for example, in the case of the Energie Transitie in the Netherlands [

61], and such a capture of transition processes by incumbents may well be the norm rather than the exception. Our case, we believe, has provided plenty of illustrations of how important it is to trace the discursive influence of key incumbents on any attempted sustainability transition—such as the proposed shift towards sustainable mobility.

While all actors rhetorically affiliate themselves with a broad vision of “sustainable mobility” which would most likely have to transgress the individually-owned-vehicles paradigm, some incumbent actors succeeded in shrinking the range of activities that are actually funded by the national program in the region to a program of R&D for the electrification of otherwise conventional cars. Seen through the lens of Hajer’s Argumentative Discourse Analysis, this can be interpreted as a discursive shift that has been much supported by an identifiable discourse coalition benefitting from tampering political interventions. Both discursive shifts: (a) the equation of sustainable mobility with a rather narrow research agenda for electrifying cars; and (b) the limitation of political interventions to those that support the competitive position of the regional car industry, can be interpreted as incidences of discourse structuration in the sense that alternatives are not even considered debatable. The establishment of an agency e-mobil BW that is clearly instrumental in aligning the activities with the interests of a few key industrial actors can be considered a case of discourse institutionalization (see p. 5).

The strong position of the automotive industry, accounting for roughly 20% of local jobs, also coalesces with a culture that highly values economic security and excellence in engineering. Together, this seems to result in a kind of discursive lock-in with the incumbent socio-technical regime. As long as this constellation is unchanged, it will either hinder any attempt at systemic regime transition by capturing it and reframing it according to the interests of the large incumbent actors, or will at best work for a more gradual and incremental reconfiguration of the mobility regime around individualized transport solutions with the main incumbents still in a dominant position.

This brings us back to the question of under what conditions a proclaimed political will to transform an existing regime (here towards sustainable mobility) can result in truly systemic socio-technical transitions. More precisely, we ask about the power base required for a sustainability transition to be discursively backed up. What Smith and Kern ([

30], p. 95) described with regard to the “Energie Transitie” in the Netherlands, can be equally said about the mobility transition in the Stuttgart region: The power base and pressure for a sustainability transition is currently not sufficiently strong to effectively counter the strategies of incumbent actors and to bring about substantial change.

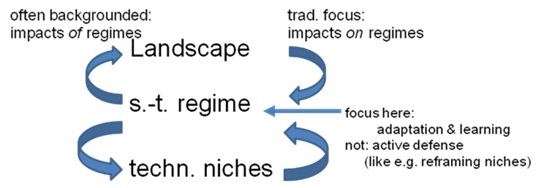

This emphasis on the agency of incumbent actors should, in our view, be reflected in a modified application of the multi-level perspective: MLP studies traditionally focus on how regimes are challenged,

i.e., on “impacts

on regimes” as opposed to “impacts

of regimes” [

60,

62]. The focus traditionally tends to be on how socio-technical regimes

adapt to challenges from niches and landscapes, which is often positively framed as “learning” (see right hand side of

Figure 3 below). Due to the axiomatic assumption that with regard to socio-technical regimes complex system dynamics dominate over individual actors’ agency, the possibility of regime actors to (strategically) influence niches and broader publics has so far been backgrounded by many transition studies. In contrast, we suggest shedding more light on reverse impacts,

i.e., “impacts

of regimes” on niche activities and potentially also on landscape developments (see left hand side of

Figure 3 below). Comparable case studies should be conducted in other regions where car manufacturing is also perceived to be an irreplaceable backbone of the regional economy, such as Bavaria (BMW) and Niedersachsen (VW) in Germany, but also others abroad. This would make it possible to further substantiate the findings of this first explorative study.

We assume that such processes of capture of niche developments are often and easily overlooked, not least due to a widespread assumption of rather clear-cut regime boundaries with niche developments challenging the regime from “below” and landscape pressures (translated into policies) challenging the regime from “above”. In fact, regime actors such as the car industry also sit at the policy table (visibly or invisibly) and they are at the same time niche actors experimenting with alternative mobility solutions. Comprehensively analyzing the dynamics of fundamental transformations of the transport system or other regimes requires more sensibility to those intrinsic connections and interdependencies between niches, regimes and landscapes than current transition studies suggest. Narrowly delineated “regime transitions”, triggered by a combination of landscape pressures and emerging niches, will most probably not result in the fundamental system change that is often promised and needed. Such a type of change seems to require much more pervasive changes to our political and economic system, such as political pressure on both, governments and the management of large businesses, as it may, for example, result from an increased political awareness among citizens.