Abstract

Most of the irrigated agricultural regions in Europe are supplied by surface irrigation networks managed by local water authorities (WAs). Under such conditions, WAs are not able to fully monitor water usage and farmers have an information advantage vis-a-vis the WA. This results in the water authority suffering ‘pricing failure’ if it decides to apply an incentive pricing strategy (tariffs proportional to the alleged water uses). Indeed, farmers could exploit their information advantage by behaving in an opportunistic manner, withdrawing more water than declared, and ultimately paying less than they should. This situation could also undermine the efficacy and the efficiency of the WA incentive pricing strategies. This paper analyses incentive water pricing schemes under asymmetric information by the means of a Principal-Agent model. The Agency problem between the WA and farmers is addressed by introducing a monitoring strategy that would enable the WA to detect farms action. In doing so, we compare incentive strategies with flat rate water pricing and investigate under what conditions the WA might provide/not provide incentive water pricing in the absence of water metering.

1. Introduction

In the European Union (EU) agricultural context, the European water framework directive (WFD, 2000/60CE) calls upon European water authorities (WA) to be interested in the use of economic tools to rationalize water allocations for irrigated agriculture [1,2,3]. The most challenging governance renewal issues at the WA level concern monitoring water use and designing appropriate pricing mechanisms. This situation results in a growing need to improve WAs’ capability to manage additional information with the main purpose of maximizing the social benefits derived from water use. In this respect, the European Commission’s (EC) recommends that monitoring should be maintained and/or improved, particularly when water is supplied through surface irrigation networks [4].

With respect to this concern, many scholars agree that the use of economic instruments, especially water pricing, is a useful strategy to condition the demand for water [5]. Water pricing is often regarded as the main tool to achieve an improved level of water resource valorization and is considered as a necessary policy instrument for the improvement of the efficiency of water use for irrigation [6,7,8].

Therefore, when designing pricing strategies for irrigated agriculture, the focus will be on how pricing instruments can incentivize the implementation of more efficient water use and allocate supply costs on the basis of actual use. The attention is on the adaptation of current price levels to better reflect the “true costs” of agricultural water use, as it is required in most modern water legislation [9].

Yet, the effectiveness of the policy that enables local WA to allocate costs among users and to control water usage, in accordance with the WFD principles, changes considerably depending on several factors. Lack of metering is the main constraint. Metering of individual water use is costly and difficult, since it requires a hydraulic device to measure the flow at the head of each farm. Moreover, the costs associated with monitoring water flows are prohibitive unless water is pressurized and meters can be installed [6]. This condition hinders the ability to monitor the volumes actually used and to implement volumetric pricing as a way of allocating costs and ensuring efficient water use [10,11,12,13,14]. This is a challenge especially for the agricultural sector given that water for irrigation is mostly delivered through surface irrigation networks the world over [9].

The absence of water metering is a typical condition that WAs experience when supplying water through surface irrigation networks, to heterogeneous population of farmers. Lack of water metering and information asymmetry between WA and farmers limit the possibility to implement incentive water pricing mechanisms. These problems might explain the fact that, in the absence of water metering WAs apply flat rates, tariffs that farmers pay regardless of whether or not they are irrigating [12,15,16]. In this respect, some evidence has been reported for Poland, Portugal, Bulgaria, Cyprus, France, Greece, Spain, Italy and Egypt [9,17].

The application of flat rates by WAs hinders the achievement of the European policy goals on water issues. Indeed, present European water regulations are increasing. In addition, the WFD sets out principles for the use of water resources and for protecting the environment and delegates practical implementation to Member States and WAs [18,19]. Most of the European WAs have a long standing tradition of autonomy and self-regulation, which, in principle, makes them well-equipped to manage water supplies. However, these mechanisms may be inconsistent with EU legislation. For instance, by applying flat rates, WAs basically violate two fundamental WFD principles: the Incentive Pricing Principle (IPP), as flat rates do not create any incentives to avoid the misuse of water resources, and the Polluter Pays Principle (PPP), as users pay the same tariff whenever they are contributing to undermine the status of water bodies. This common condition characterizes most of the European water authorities that provide both reclamation services and water for irrigation. The application of a tariff proportional to water uses that incorporates environmental costs would allow WA to respect both of these principles as this pricing criteria, in theory, tie supply costs to water usage that incentivize rational water use. Thus, the application of incentive pricing mechanisms would allow WAs to comply with the WFD principles, but its applicability relies on the assumption that the WA is able to monitor uses.

The effectiveness of incentive pricing in conditioning both water uses and the distribution of costs among users, depends on farms’ readiness to accept water tariffs and comply with proposed rules [20,21]. Uncertainty with respect to the effect of tariffs is attributable to the existence of information asymmetries, that is, the impossibility of fully recognizing the manner in which individual users exploit water resources. Information asymmetries can be overcome if WAs possess technologies and tools that make the necessary information about farmers available. On the other hand the implementation of technologies is conditioned by the enforcement capacity of the regulator (monitoring and sanctioning). The enforcement capacity of the water authority is, in turn, conditioned by its organizational arrangements. For instance, common institutional arrangements, acting in the interest of water users, tend to substantially reduce the costs of implementing water pricing, such as monitoring and enforcement costs [11,22]. However, in most circumstances transaction costs may be prohibitively high, preventing from adopting incentive tariffs and/or limiting its effectiveness. Thus, the level and the quality of transaction costs condition whether or not to adopt incentive tariffs, the ways incentive tariffs could be implemented, the relevant effectiveness in terms of impact on water uses as well as on the allocation of supply costs within the community of users.

Usually, high levels of information asymmetry are more likely to occur for surface irrigation networks serving a very large number of farmers [9,21]. Under such circumstances, the lack of knowledge on the part of the regulator with respect to water uses in the presence of a heterogeneous population of farmers involves, implicitly, the two typical problems of asymmetric information: adverse selection and moral hazard. Adverse selection is due to the non-observability of farm types, whereas moral hazard relates to the non-observability of farm actions [10]. In this paper, attention is focused on the non-observability of farm actions.

As a result of the non observability of farm actions, some farmers may behave opportunistically without complying with the uses negotiated with the WA, and ultimately to the detriment of the entire community of users. This is a common problem in the sphere of irrigated agriculture, which is why the EU highlights the importance of finding the appropriate tools and incentive mechanisms to reduce the negative effects of moral hazard in agriculture generally, and in irrigated agriculture more specifically [4].

There is a broad body of literature that address the issue of asymmetric information through the application of principal-agent theory in agriculture [13,23,24,25,26] and a series of papers exist that address the issue of moral hazard [27,28,29,30,31,32]. Nevertheless, only a few studies directly address the moral hazard problem inherent in irrigated agriculture. Smith and Tsur [12] and Zilberman [33] were the first authors to tackle this issue. The former authors proved that a tariff linked to outputs (i.e., indicating that tariffs depend on the yield achieved with irrigation) could reach conditions of first best, assuming zero transaction costs. Thus, the practicability of this tariff design rests on the regulator’s ability to check for output levels. Zilberman [33] developed an optimal water pricing, allocation, and conveyance system over space to capture different upstream and downstream incentives, which positively influence the level of compliance. All of these instruments differ in the identification of indirect signals, improving the quality of information flows which contribute to influence the level of compliance within the irrigation network. That is, for a given organizational arrangement of the irrigation network the level of compliance is favored by an increasing quality of information flows.

The main objective of this paper is to provide an incentive water pricing strategy in the absence of water metering by considering the presence of moral hazard and transaction costs. Additionally, the incentive pricing strategy is compared with the flat rate model and an empirical example is provided to provide an assessment of expected impacts.

The paper is organised in 4 sections. Section 2 is divided into 6 subsections where the first one provides a brief background and literature; the second subsection describes the model setting; subsection three describes the flat rate water pricing scenario; subsection four provides the incentive water pricing scenario by considering the case of full compliance and perfect detection; and subsection five describe and analyze the presence of moral hazard problem. The last subsection evaluates flat rate and incentive tariff strategies. Section 3 describes an empirical example and involves two subsections: the case study and model parameterization are described in the first one and the results achieved are described in the second one. Section 4 provides a discussion, conclusions and possible extensions of the model.

2. Materials and Methods

2.1. Background Literature

In the case of a surface irrigation network, the water provider usually applies flat rates, especially when there are no limitations to the availability of water resources and differences in water uses cannot be, or are too costly to be, assessed. This condition calls for the imposition of flat rates by the water provider, even if the level of use varies. With flat rates, users are taken to have similar access and are charged equally across farms and land [21], i.e., the tariff is the same per hectare of land for all farms. Indeed, the regions supplied by surface irrigation network are usually very large and comprise huge extensive farms irrigating only a small quota of the cultivated agricultural land or specialized small fruit and vegetable farms irrigating most of the cultivated land. As a result, farmers benefit differently from the water supplied by the WA and pay tariffs as a part of total overall water supply costs which are, however, proportional to the total agricultural farmland and not to the irrigated farmland. Moreover, flat rates do not usually incorporate the environmental costs generated by irrigation activities, which threaten the status of water resources, especially due to nutrient leaching. Under such conditions, missing to link tariffs to water use and disregarding the total costs generated by the use of water resources, the water provider cannot expect that tariffs provide incentives to farmers to rationalize the use of water for irrigation. Tariffs play just the role of recovering supply costs.

A typical agency problem surrounding the use of water resources in agriculture arises when the WA decides to apply incentive tariff schemes for the water supplied through surface irrigation networks. In this case, farmers may own private information on water use which is unknown to the WA (e.g., water use profitability) and they may take opportunistic actions totally or partially undetected by the WA (e.g., a different amounts of water withdrawn compared to that agreed or assigned to the farm). These actions lead to increasing the WA’s water supply and the management costs [32].

In particular, when a certain amount of irrigation water is assigned or self-reported by the farmer, the WA often faces difficulties in verifying whether farmers are complying with the amount reported. Under such condition, monitoring is costly and not fully effective. To avoid non-compliance, the WA might apply a sanction to farmers [27]. Thereby, farmers actions remain solely the choice of the farmer, but depending on incentives to take the action. These incentives against cheating not only depend on the sanction, but also on the efficacy of monitoring in detecting their action. In this respect, different technology options may be available. Direct monitoring by WA operators may be very costly, while the use of information technologies could be much cheaper and hence help to discourage cheating and free riding due to information asymmetries.

If the WA monitoring capacity is perfect (the WA is in a position to perfectly detect who is complying or not with the agreed amount of water at zero cost) the incentive mechanism is fully efficient and non-compliance is avoided with no sanction. If this is not the case, the WA needs to design an incentive water pricing scheme, including a monitoring and sanctioning strategy, to boost compliance [34]. The optimal monitoring strategy depends on the cost needed to enforce such mechanisms and on the effect on water use efficiency.

Given this context, the model below simulates the behavior of a WA the aim of which is to maximize the social benefit incentivizing rational water use. It is considered that the water authority is acting on behalf of a group of farmers: it seeks to maximize total farmer profits minus the costs of water provisions (including environmental costs); it also shares costs among users according to water use and may provide sanctions for non-compliant farmers. To incentivize rational water use the WA may apply incentive tariffs linked to some observable characteristics correlated to water use.

In order to analyze these contract design issues, we developed a methodology based on the Principal-Agent Theory [35,36], taking into account potential instrument design based on the asymmetric information literature. Specifically, the analytical approach developed in this study makes it possible to estimate the costs faced by the WA in setting up different pricing mechanisms in those circumstances where water is not metered.

2.2. Model Setting and Flat Rate Pricing Schemes

The sequence of decisions for the flat rate scenario works as follows: (1) During the irrigation season farmers take decisions regarding how much to irrigate; (2) At the end of the irrigating season the regulator recovers supply costs by imposing a flat rate. In this framework, farmers’ decisions with respect to water uses is independent of the cost faced by the water regulator to supply the service; on the contrary, the supply cost and hence the tariff depends on water uses. This occurs because farmers sign for water uses ex ante, while decisions on pricing are taken by the regulator ex post, at the end of the irrigation season, and depend on what farmers have subscribed to ex ante.

Consider that farm type when has a cultivated area with different crop water requirements. Without loss of generality we assume that each farm has a land area equal to 1. Supplying the water to the farm is costly for the WA and the farmer, as a result of irrigation receives a profit of . A quadratic production function is assumed for input factors concurring in generating the farms profit with regard to a cultivated crop. The water supply cost function represents total water costs for delivering the water to the farm for irrigating each crop of farm type The character indicates the share of irrigated area of the farm type . From now on, we will consider the share of irrigated area as a proxy for water use, while farm profits and regulator supply costs are assumed to be a function of the share of irrigated area and are assumed to be increasing and concave in with and .

Under such a condition, a rational farmer will choose to irrigate a share of area that will allow him to maximize his profit:

The irrigated share is the decisional variable and is the percentage of total cultivated area of the farm. Thus, the profit function is a per hectare profit function. Then, the optimal level of the farm’s irrigated share is the level for which marginal profits equal zero: . Let us call this level .

Ex post, the regulator must recover supply costs by imposing water tariffs to farmers. It is also assumed that the WA does not face any enforcement and monitoring costs, nor other transaction costs. Moreover, the WA, by assumption, is not in a position to monitor the farms’ water use and consequently to allocate supply costs among farmers based on actual uses.

Under such condition, the per hectare tariff paid by farmers will be:

where is the tariff paid by each farmer and the superscript FR indicate flat rate The farmer pays the water tariffs based on the overall water supply costs and there is no link between farms’ water consumption and the tariff paid to the regulator.

2.3. The Incentive Pricing Scenario

The absence of water metering does not prevent the WA from implementing indirect incentive tariffs. The WA could regulate water uses by connecting tariffs to the share of irrigated land. The effectiveness of the strategy may depend on the WA’s ability to monitor farmers action. The quality of monitoring and the relevant costs affect the practicality of the incentive tariffs.

The sequence of decisions for the incentive pricing scenario works as follows: (1) Before the irrigating season the regulator sets the pricing level per hectare of irrigated farmland and the farmer informs the regulator of the area he intends to irrigate; (2) during the irrigating season the regulator monitors the agricultural region served by the water supply network to check whether or not farmers are complying with their initial proposals; (3) at the end of the irrigating season farmers pay the agreed tariff to the regulator plus a sanction if it determined that they were not compliant during the irrigating season. Under such a hypothesis, farmers’ decisions on land use are conditioned by the tariff the regulator sets to recover supply costs. The implementation of incentive water pricing by the regulator would generate transaction costs, . The transaction costs are assumed to be the costs needed to implement the new incentive pricing criteria and to monitor water users.

In the following sub-sections, we set up a principal-agent model in which the goal of the regulator is to maximize the social benefit. Specifically, in the first subsection we disregard the moral hazard problem and we deal only with presence of transaction costs under the assumption of full information and discuss the equilibrium solution obtained. Then, we relax this assumption by introducing the conditions that favor the occurrence of moral hazard and the instruments that might be used to avoid such a risk, and discuss again the new equilibrium solution.

2.4. Incentive Pricing with Full Compliance and Perfect Detection

In this section we analyze the contract offered to the farmer that combines the irrigated share and the water tariff , assuming the WA fully observes the farm’s action. In such a situation, the WA’s problem is to recover water supply costs.

s.t.

The maximization of social benefit makes it possible to maximize the aggregate profit (i.e., the WA’s and farm’s profit) and involves the farm’s profit , the WA’s water supply costs and transaction costs linear on tariff . The objective function is subject to a cost recovery constraint (CR), indicating that the water tariffs must cover at least the water supply costs and the transaction costs generated by implementing incentive water pricing.

Given the transaction costs generated by the water tariff, it can be supposed that the CR constraint is always binding in optimum. Rearranging Equation (4) we are able to determine the level of the tariff , which is in function of the irrigated share and transaction costs.

Substituting in the objective function Equations (5):

And taking the derivative with respect to , the First Order Condition (FOC) yields the following optimal solution:

By solving Equation (6), where the farm’s marginal profits equal marginal costs Weighted by the level of transaction costs , we determine the optimal share of irrigated land which we can therefore replace in Equation (5) to determine water tariff .

The result of Equation (6) implies that when transaction costs are high the optimal irrigated share decreases and the tariff increases. The optimal level of reaches its maximum when , in the absence of transaction costs, and the marginal benefit equals the marginal social cost of water.

2.5. Incentive Pricing with Effective Detection

In the absence of water metering, under the incentive pricing scenario the farmers’ decisions may either to participate and comply with the agreed rules or to participating and cheat, e.g., irrigating higher irrigated shares than those allowed by the contract. Compliance implies a disutility for the farmer. This disutility is equal to the difference between the maximum profit that the farmer would obtain in the absence of incentive pricing and the profit the farmer would obtain by irrigating the share of irrigated area declared at the beginning of the irrigation season, . If the farmer chooses not to comply with his statement, his disutility would be equal to zero.

With the purpose of discouraging false reporting, the regulator monitors farm actions. If the regulator deems that there are no problems, the farmer will pay to the regulator the agreed tariff Otherwise, the farmer is obliged to pay a sanction, , in addition to the tariff. Assuming that the farmer is risk neutral, sanctions can be considered the utility that the farmer obtains when complying with the rules.

In this assumption it is considered that monitoring costs are involved in transaction costs and no explicit costs from monitoring. The monitoring strategy introduced by the WA to detect farmers’ actions in the absence of water metering is not perfect. That is, the WA might fail to detect farmers’ behavior . Without loss of generality, we introduce a discrete probability setting, where: is the probability that the farmer is found to comply with his statement when he is actually complying and is the probability that farmer is found to be non-compliant with his statement when he is actually not complying. Likewise, and are the probabilities of failing to capture the right signal. The incentive strategy is a viable strategy when dominates , otherwise the prerequisite to implement an incentive pricing strategy fails. That is, the range of possible values for is and for , .

In addition, the sanction applied by the regulator to dis-incentivize non-compliance is assumed to contribute to increasing transaction costs. With such a hypothesis, the following problem includes a sanction item in the objective function and an incentive compatibility constraint (IC) besides the CR constraint discussed above.

s.t:

where and represent probabilities of detection, indicates the farm profits in function of irrigated share, indicates the tariff and represents sanction. The IC guarantees a utility for compliance which is higher than the utility of being non-compliant. The left hand side of the newly introduced IC is the reduced form of . Likewise, the right hand side is the reduced form of . The reason behind this constraint is that in order to make sure the farmer complies with the rules, the benefit obtained by the farmer when he observes the rules must be greater than the benefit obtained by the farmer when he does not observe the rules. The IC can be further rearranged highlighting that to incentivize compliance, the utility the farmer obtains by complying with rules, , must be higher than the relevant disutility, . It is worth noting here that the utility that the farmer obtains by complying with rules is influenced by the fact that the farmer has some probability of being detected as non-compliant.

Overall, differences in utilities are conditioned by the WA’s monitoring capacity (probability to correctly detect farmers’ behavior) and by the magnitude of the losses experienced when complying with rules.

When the IC constraint holds with strict equality it is possible to estimate the level of the sanction:

The level of the sanction is obtained by the difference between the profit obtained with no restriction on irrigated land use and the profit obtained with restriction on irrigated land use divided by the difference between the probability that compliance is detected when the farmer is compliant and the probability that the farmer is detected compliant when he is non-compliant .

We obtain the following solution by substituting in the objective function determined from Equation (9) and determined from Equation (4) when both constraints are satisfied with strict equality and taking the FOC with respect to :

The equilibrium reached in Equation (10) (see Appendix A) is contingent of probabilities of detection and transaction costs. The variation of its components influence the optimal level of the irrigated share, the level of tariff and the level of the sanction, contributing in conditioning the magnitude of the social benefit.

By increasing the accuracy of monitoring (probability to correctly detect farmers’ actions), farms’ irrigated share decreases, the tariff decreases and the sanction needed to discourage non-compliance decreases.

Given the transaction cost levels, the maximum impact on a farm’s irrigated share is obtained when and , that is, when monitoring is perfect. The farmer is complying with the rules of the contract and the WA’s capacity to determine that farmers are complying with the rules is maximized. Under such a hypothesis, the equilibrium solution is subject to the level of transaction costs. The higher the level of the lower the irrigated share.

On the contrary, when then . That is, the equilibrium solution regresses to the flat rate case as the incentive mechanism has no effect on irrigated land use.

Finally, for and there are infinite intermediate solutions between the above-discussed probability scenario limits.

With reference to transaction costs, with increasing transaction cost levels the tariff level is increased from Equation (4) and, as a result, increases the marginal profit level in Equation (10) and decreases the share of irrigated area. The farmer might be wishing to decrease the irrigated share to pay less. Under such conditions, the cheating option may become more attractive and the moral hazard problem is more likely to prevail. As a reaction, the WA increases the sanction to discourage non-compliance. In addition, the value of the sanction is also influenced by the accuracy of the instruments adopted by the WA to monitor uses and increases with the reduction of the accuracy level.

2.6. Evaluating Strategies under the Two Pricing Schemes

As discussed above, the WA might face additional transaction costs and suffer some inefficiency due to imperfect monitoring to implement an incentive pricing strategy in the absence of water metering.

Because of this, the WA might decide to keep the flat rate tariff if the social benefits generated by the implementation of such pricing regimes are higher than the social benefits brought about by the implementation of the incentive pricing schemes:

where and stand respectively for the social benefit under the flat rate pricing scenario and the social benefit under the incentive pricing scenario. For the flat rate scenario, transaction costs are assumed to equal zero.

As stated previously, the prerequisite to implementing an incentive tariff is that the probability of detecting farmers as compliant when they are actually complying, must dominate the probability of detecting farmers as compliant when they are actually not complying. Such a prerequisite of dominance is a necessary condition to implement an incentive tariff, but is not a sufficient condition to justify the transition from the flat rate regime to the incentive pricing regime. The transition is favored for high levels of supply costs recovered by pricing water, for high degrees of accuracy of the instruments adopted by the WA to monitor water usage and for low levels of transaction costs faced by the WA with the implementation of the incentive pricing scheme.

Another aspect motivating the transition from the flat rate regime to the incentive pricing regime is the presence of a heterogeneous population of farmers. Unlike the flat rate, incentive pricing enables the WA to allocate supply costs among users on the basis of actual uses. This effect might positively impact overall social benefits and make it possible to tie supply costs to the benefits generated by the provision of water to irrigation.

3. Empirical Example

3.1. Case Study and Model Parameterisation

In order to assess the introduced pricing mechanisms we discuss the results obtained from Çukas, a region of Albania where the irrigation network is served by open canals. This area was selected because it comprises the most intensively irrigated agricultural area in the country. The cultivated area is approximately 5630 ha out of which 4405 ha are cultivated. The main crops are: winter wheat, maize, alfalfa, vegetables, beans, greenhouse vegetables, and grapes. The average farm size is quite small (1.4 ha) compared with the average of EU countries and farms comprise mixed cultivated crops with diverse water requirements that are served from open canals. In the past (before 2016) water management was under Water User Associations (WUAs) and the establishment of WUAs was in accordance with Law No. 9860 of 2008, later amended and supplemented by Law No. 8518 of 1999 regulating irrigation and drainage. In 2017 the management decisions were delegated to the municipalities. Nonetheless, the municipalities can also delegate the management and tariff collections to the WUA.

Tariff setting is now carried out according to the new Law No. 24/2017 for the administration of irrigation and drainage whereas Article 20 regulates water tariffs for supplying the water to farmers. The municipality sets a tariff level for each farmer based on farmers’ irrigation water requests. For surface irrigation networks, the water tariffs are estimated based on the irrigated area and disregarding the irrigated crop. The water tariffs include all water supply costs to deliver water to the farm and are approved by the municipality council. Tariffs are set under a flat rate system with the sole purpose of recovering water supply costs. The tariff is hence uncorrelated to the amount of water consumed. The WA estimates only the irrigated hectares and disregards the cultivated crops in the area. The water tariffs are usually determined ex ante by allowing the WA to estimate the overall irrigated area as farmers pay and sign for irrigated hectare. There are usually cases where a farmer has not paid in advance but irrigates during the irrigation season [14]. Accordingly, recovery of supply costs do not reach the expected level. In addition, the WA, based on Legislation No. 24/2017 for the administration of irrigation and drainage, has no clear strategy of monitoring water users; the regulator only monitors and provides evidence for the overall amount of water used during the entire year.

In addition, as Albania’s intention is to join the EU, water policies must conform to the EU’s legislation and strategies. In line with the EU’s strategies, there is a need for determining new water pricing policies that ensure the sustainability and the efficiency of water use.

In this regard we have developed incentive water pricing strategy under monitoring conditions because of its potential implementation in the region, and, possibly, in other irrigation networks with similar characteristics. The reason for underlying pricing schemes with asymmetric information is because the irrigation region is highly characterized by information asymmetries as well the impossibility of implementing a direct volumetric pricing due to unmetered irrigation water use. Moreover, the flat rate water pricing approach implemented in the region does not provide any incentives to farmers for rational water use.

According to the mechanism introduced above, in this example we assess the per hectare social benefit generated in an agricultural region served by surface irrigation networks under the flat rate pricing scheme. Then, we compare the current situation with incentive pricing schemes under different assumptions with the aim of identifying the condition under which the introduction of incentive pricing schemes might be viable.

To introduce this illustrative case, we have used the profit and cost function obtained in [14]. In this application, we have assumed two levels of water supply costs. First, water supply costs are the same as in the reference case (0.06 €/m3). Then, water supply costs are assumed to increase ten times with respect to the reference value (0.6 €/m3). This scenario is introduced with the twofold purpose of emphasizing the possible effects generated by the implementation of incentive pricing schemes and to include other potential costs not actually accounted for WAs in Albania, such as the environmental costs caused by the decay of the status of water resources as a result of irrigation.

The farm’s profit functions is estimated based on the difference of the profit obtained for each irrigated crop and the profit obtained for non irrigated crops with respect to the share of irrigated area. A quadratic concave profit function is used for a given farm type. The farm’s profit function is calculated as a farm’s revenue from cultivation minus expenses for seed or plants, fertilizer, pesticides, and tilling, while costs such as labor are not subtracted. The water supply costs are determined based on crop water consumption and unit water cost with respect to each farm type; in this way we estimate the cost of water for each crop, which allows us to determine the total water supply cost for overall irrigated area with regard to the type. The estimated water supply costs include payment to water masters to clean and maintain the secondary canals, as well as the management and distribution of water to tertiary canals to facilitate withdrawal by farmers [14].

3.2. Results

The assessment of two water pricing policies is illustrated by Figure 1, Figure 2, Figure 3, Figure 4, Figure 5 and Figure 6.

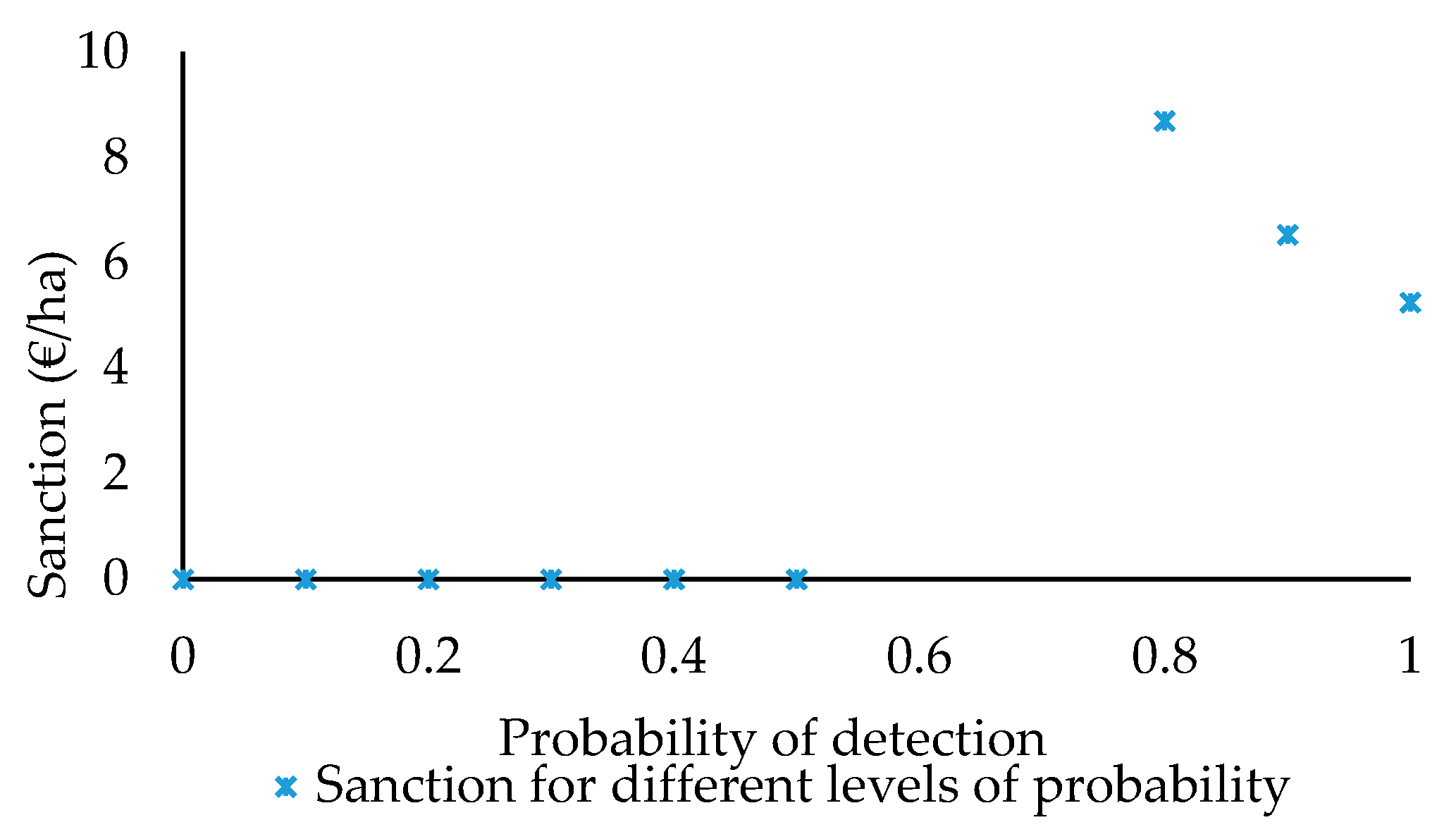

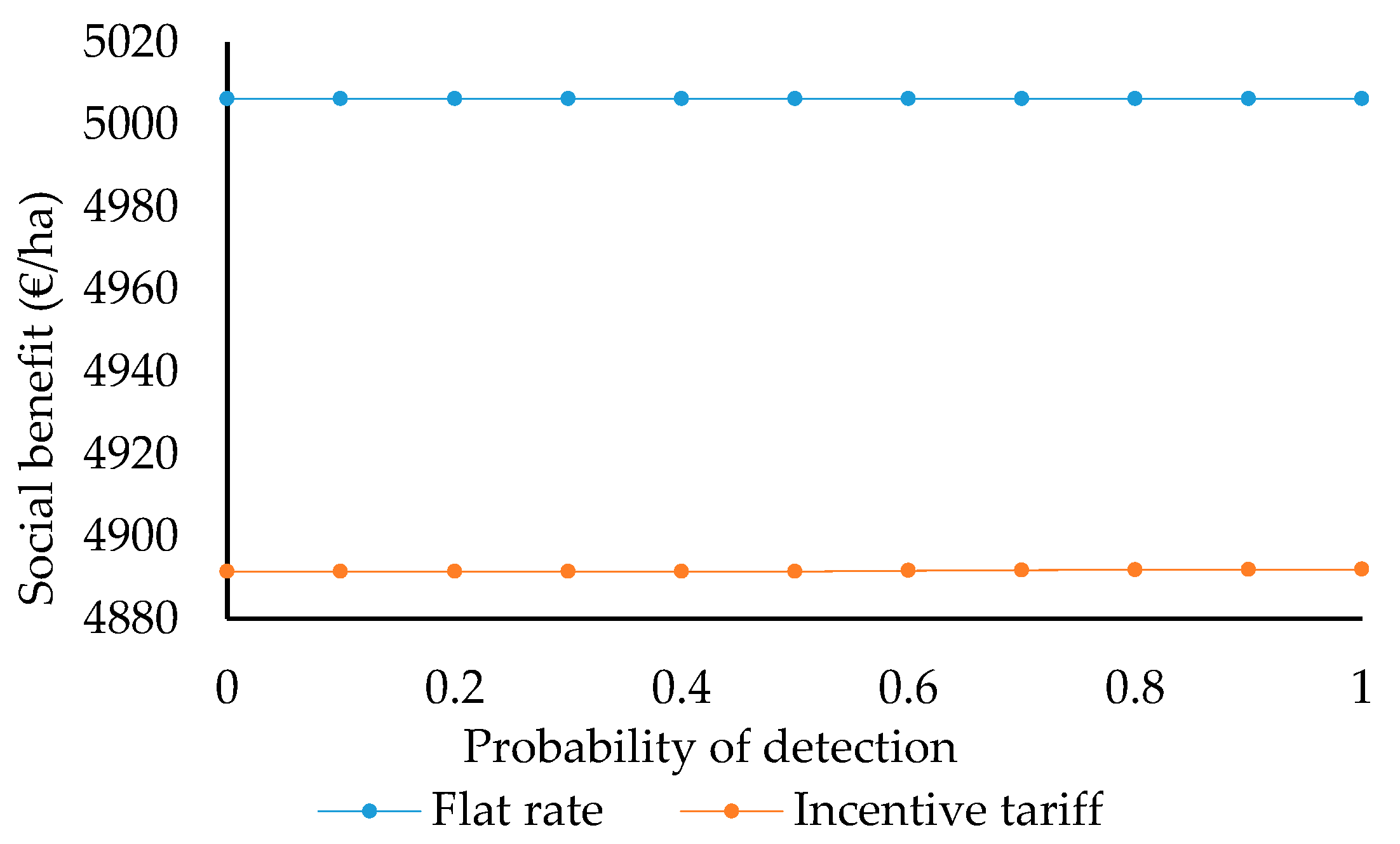

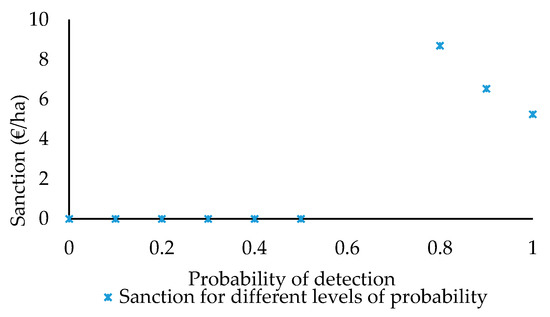

Figure 1.

Sanctions in function of detection probabilities.

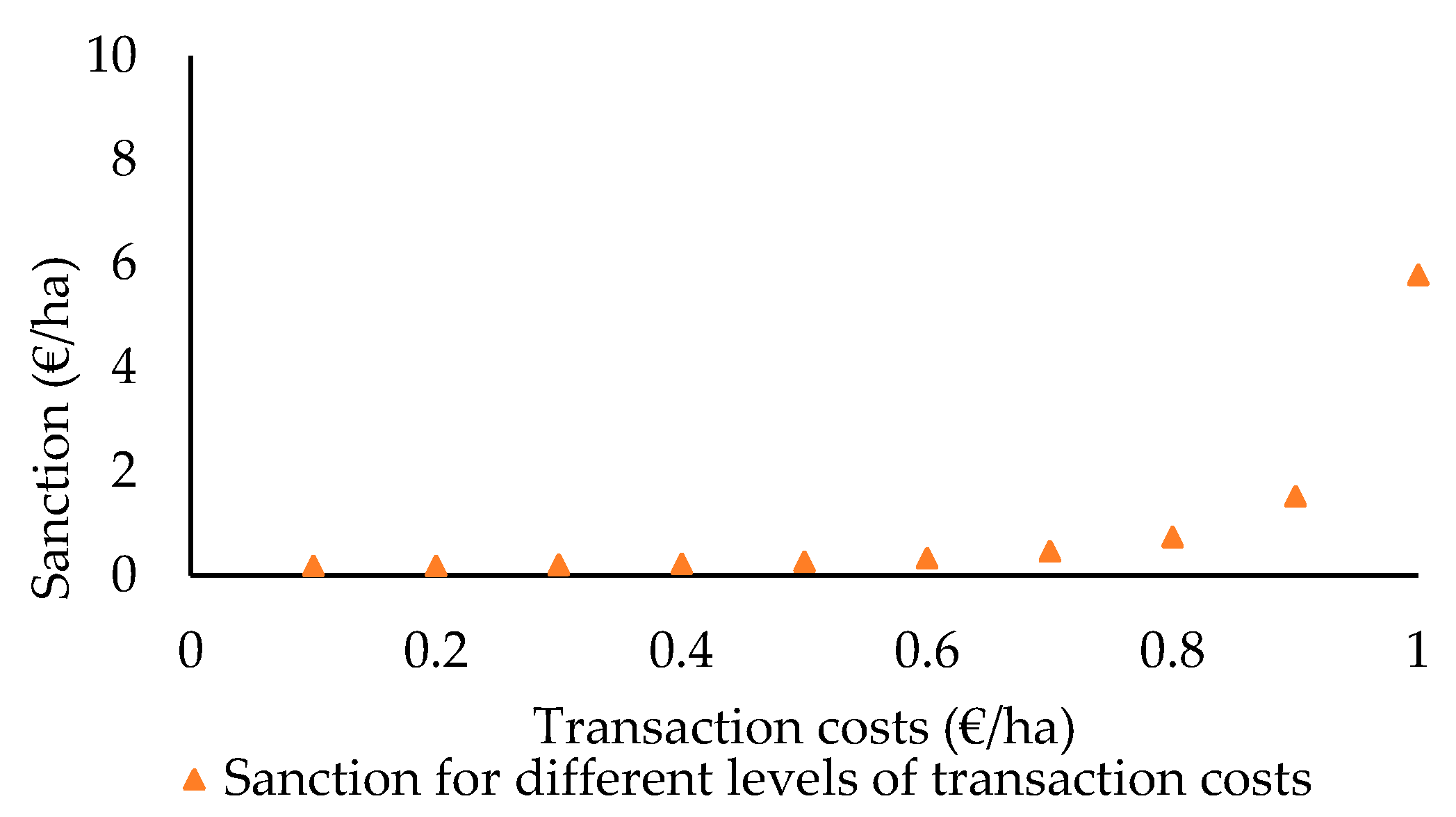

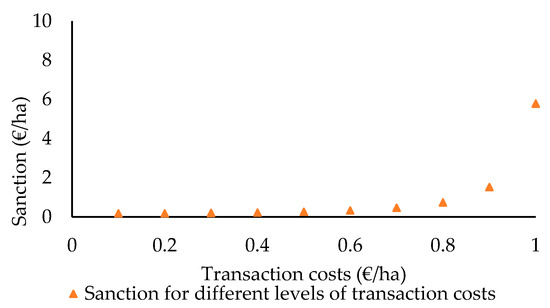

Figure 2.

Sanctions in function of transaction costs.

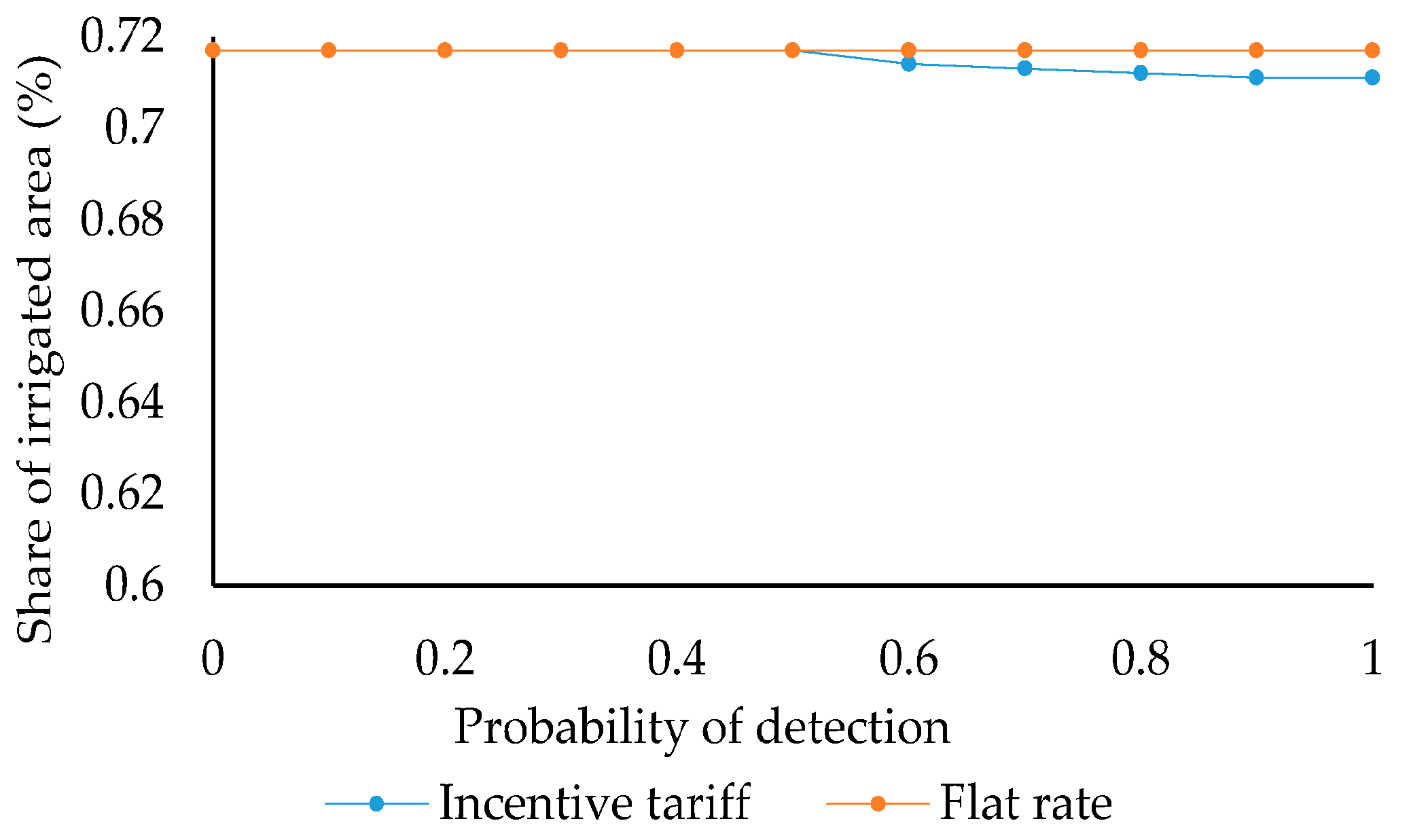

Figure 3.

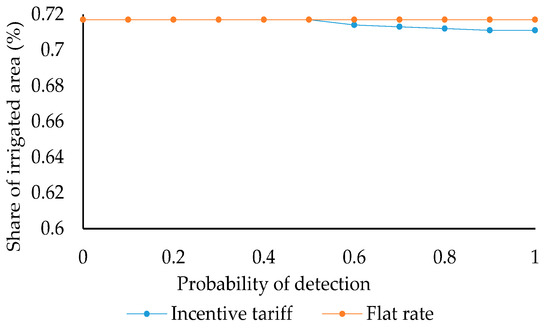

The variation of irrigated share for water cost at 0.06 €/m3 and transaction costs 0.5 €/ha.

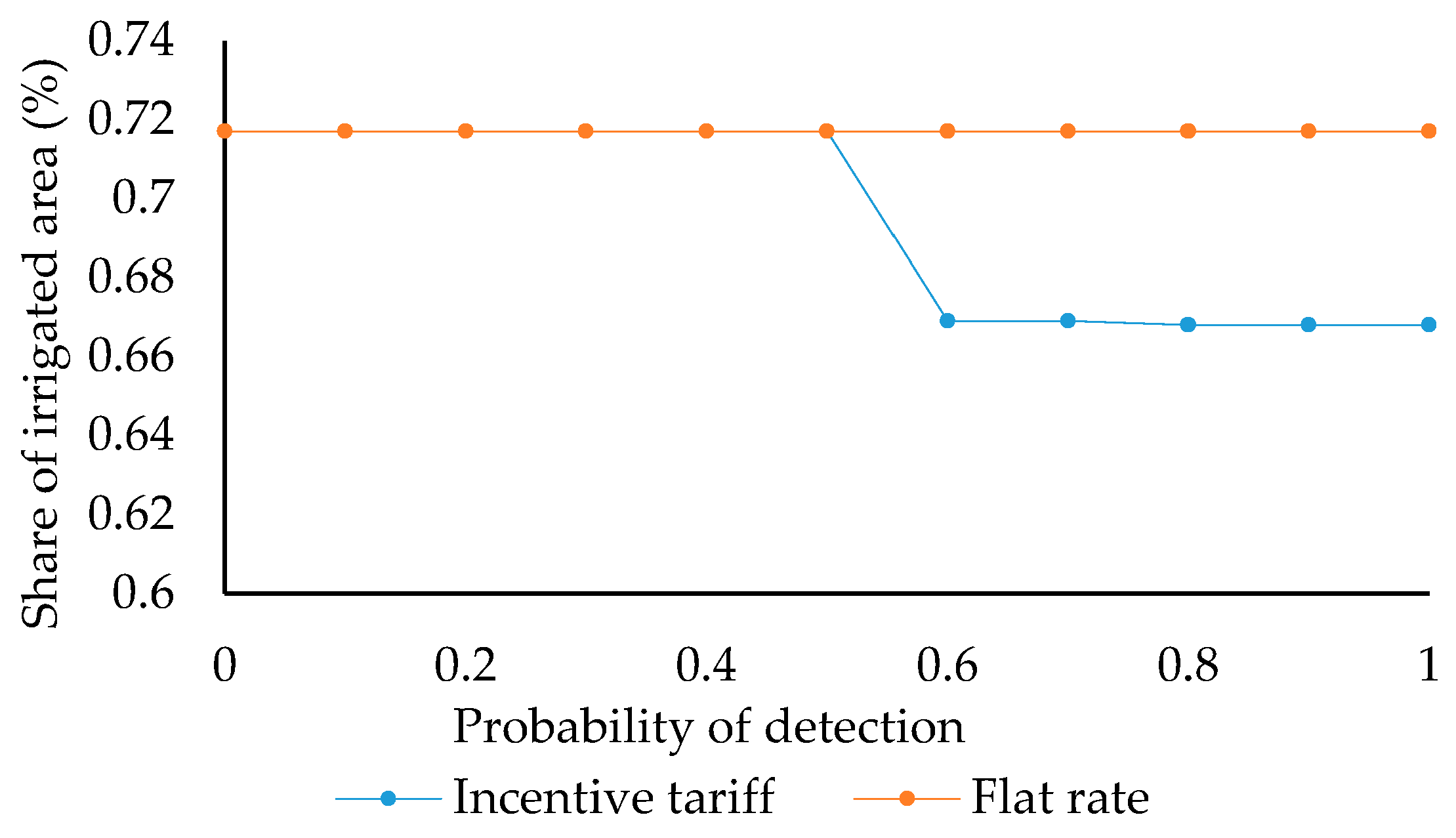

Figure 4.

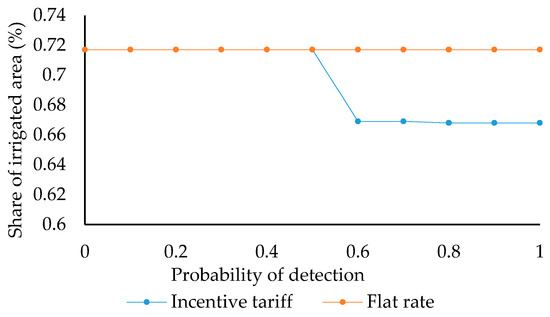

The variation of irrigated share for water cost at 0.6 €/m3 and transaction costs 0.005 €/ha.

Figure 5.

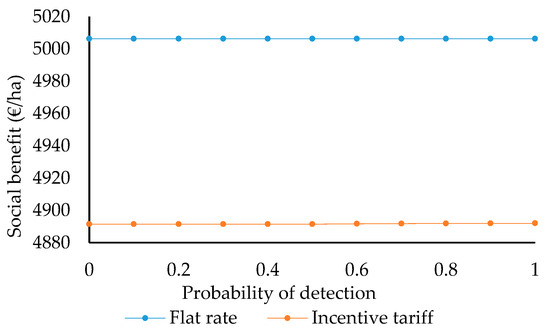

Social benefit under two pricing options for water cost at 0.06 €/m3 and transaction costs at 0.5 €/ha.

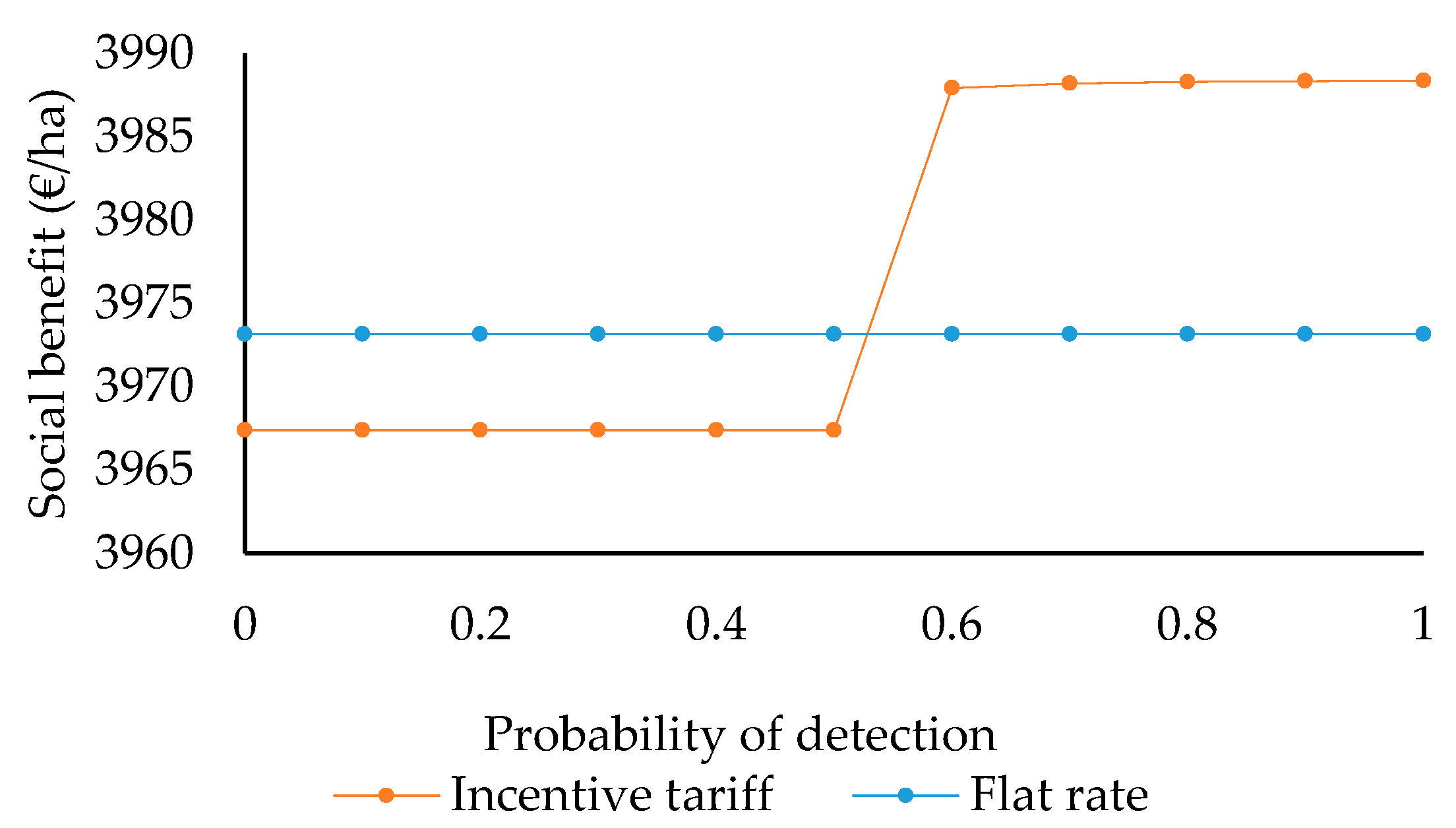

Figure 6.

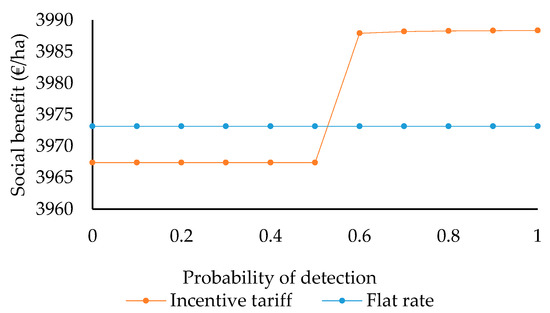

Social benefit under two pricing options for water cost at 0.6 €/m3 and transaction costs at 0.005 €/ha.

Figure 1 and Figure 2 illustrates how the level of sanctions varies with probability of detection and transaction costs (i.e., in figures, for the simplicity of representing the effects of probabilities, the variation of and are considered as increasing or decreasing with the same scale and sanctions values are estimated only for low level of water costs). The solution accounts for different levels of monitoring probability and transaction costs. The monitoring costs are assumed to be a parameter in the objective function, which do not influence in the analytical way the solution of the problem, but would effect in the efficiency of incentive water pricing scheme.

Both figures show that the value of the sanction decreases when the probability of detection increases and increases with increasing transaction costs. This occurs because by increasing these two parameters the irrigated share decreases. As expected, for low irrigated shares the value of sanctions increase from Equation (10). In addition, when the necessary condition set above is violated (i.e., the rage of possible values for is and for , ), monitoring probability does not impact on sanctions.

Figure 3 illustrates the variation of the share of irrigated area under two water pricing scenarios and different levels of water supply costs and transaction costs. With flat rate water pricing, the probability of detecting farms’ action do not influence farms’ irrigated share as farmers are not constrained in terms of water use. Under incentive tariffs, in Figure 3 when water supply costs are taken low (0.06 €/m3) and transaction costs high (0.5 €/ha) it is observed that above threshold level, set by the prerequisite condition, with increasing detection probabilities farmers start decreasing the irrigated share. Comparing this result with Figure 4 in which water supply costs are taken high (0.6 €/m3) and transaction costs are low (0.005 €/ha) the effect of the probability of detection on the irrigated share is the same but for higher water supply costs, at some interval of probabilities of detection, farmer trend to decrease the irrigated share in a larger size. This outcome is achieved because of high water supply costs. If the farmer continues to keep a higher irrigated share his net profit decreases and he will not be better off. In addition, in Figure 4 above the threshold level of monitoring probabilities the blue line becomes flat. This effect occurs because of sanction effect. For higher water costs, its effect on the farm’s net profit becomes stronger and the farmer prefers compliance instead increasing the irrigated share with the possibility of being sanctioned.

In Figure 5 we illustrate the variation of social benefit under incentive tariffs and flat rates. In addition, the observed level of social benefits is achieved under water supply costs and transaction costs as in Figure 3. The share of irrigated area for water cost 0.06 €/m3 and transaction costs 0.5 €/ha and the presence of transaction costs are assumed only under incentive water pricing.

Figure 5 shows that for low water supply costs and high transaction costs the incentive water pricing strategy is not preferred by the WA because the social benefits under this pricing instrument are lower than in flat rates, even the detection probabilities are increasing. Under this situation, transaction costs decrease the expected social benefits and the WA would impose a flat rate strategy. The numerical example also proves that the curve of social benefit seems to be flat for both pricing strategies. Under a flat rate the line is flat because probabilities have no effect on irrigated shares and tariffs, and eventually do not effect social benefits. Despite the high level of probability of detection, under incentive tariffs for low water costs, farmer decreases the irrigated share in a small size (in decimals),which have little effect on sanction and only a very small effect on the social benefit. In addition, from the observed outcome of social benefits, for higher levels of transaction costs the implementation of incentive tariffs is not justified.

The comparability of two pricing instruments becomes more evident in Figure 6 when the water supply costs are higher and transaction costs are low. This example considers the water supply costs that are similar to those of European countries where the unitary cost of water is higher compared to reference cases [37].

For flat rate water pricing the same effect is observed as in Figure 5. For incentive water tariffs, the social benefit varies with the level of probability of detection. Below the threshold level of monitoring probabilities, the WA face water supply costs and transaction costs that achieve lower levels of social benefits compared with the flat rate. When the monitoring probability exceeds the threshold level its impact on improving social benefits becomes evident. As the probability of detecting a farm’s action increases, the social benefit increases and under a certain level of monitoring probability the social benefit with regard to incentive tariffs becomes much greater than in the flat rate case. The efficacy of incentive water tariffs increases and results in greater social benefits.

In addition, the numerical example shows that when the level of water costs and transaction costs are preclusive, the efficacy of incentive mechanisms is limited. The numerical example illustrates that only above a certain threshold level of monitoring probabilities (with respect to water supply costs and transaction costs) do the incentive tariffs perform better than the flat rate in terms of social benefits.

4. Discussion and Conclusions

The paper analyses a model of a non-linear water pricing scheme and examines the implications of moral hazard problems while designing water pricing strategies for irrigated agriculture. The focus of the paper was to develop an incentive water pricing instrument that would influence farm behavior towards a more efficient use of water. The model is designed as a social welfare maximizing problem that includes the maximization of farm benefits and costs to regulators.

In recent decades, many scholars have analyzed the problem of moral hazard in agriculture by using principal-agent theory [27,28,29,30,31,32]. The authors have given attention to developing models in order to overcome the problem of moral hazard in agri-environmental policies. With regard to irrigated agriculture [12] provide a pricing strategy by applying a revelation mechanism with a focus on analyzing the implications of adverse selection and moral hazard.

With regard to the above-reference literature, to our knowledge, the model has not yet been applied in an empirically tractable form in the field of irrigated agriculture. Our model seeks to provide a pricing scheme through a monitoring strategy that would dis-incentivize farms from cheating and guarantee a higher benefit when complying with agreement entered into with WAs.

The implementation of incentive water tariffs results from the need to share supply costs among users according to water use and dis-incentivizing farmers from water misuse, in contrast with the flat rate where farmers benefit from payments that are set equally among farmers. The use of flat rate water pricing in irrigation regions is justified because it is easier to implement despite the fact that this instrument allows for significant water wastage and large economic costs. Moreover, current tariffs do not reflect the true cost of water, as tariffs are used to recover maintenance costs and not capital and environmental costs. As a result, tariffs are low and any variation in the pricing criteria would not contribute to generating appreciable benefits, especially considering the low elasticity characterizing the demand for irrigation water.

The application of the PPP might cause increases in the tariff level due to the need to recover the environmental costs generated by upstream pressures on water resources caused by agricultural activities. Downstream pressures on water resources from agricultural activities (i.e., nutrient leaching), could be tackled through the application of additional instruments (i.e., imposition of restrictions on fertilizer use and/or higher fertilizer prices). In any case, the application of the PPP determines higher tariffs. Consequently, with flat rates the disparity would increase among farmers using more water than they pay for and farmers using less water than they pay for. The application of the IPP makes it possible to solve this discrepancy, and also contributes to reducing pressures on water resources.

By referring to our methodological approach, the application of the PPP might result in an increase in the tariff level for both the flat rate and the incentive tariff scenarios. Any increase in the tariff level goes hand in hand with an increase in the benefits obtained with the transition to incentive pricing schemes. However, the application of the PPP, in addition to the IPP, could contribute to the generation of higher transaction costs (also in the form of information rents) which could, in turn, offset the additional benefits brought about by tariff improvements. The net balance is a numerical issue depending on the individual case.

Our results indicate that when the water supply costs are low and transaction costs are high incentive water pricing is less preferable than flat rate pricing. The efficacy of the incentive water pricing strategy increases with increasing water supply costs and decreasing transaction costs. In addition, the monitoring strategy, to be effective, requires that the probability of detecting the actions of the farmer be high in order to maximize social benefits. On the other hand, if the WA establishes low monitoring measures there is benefit loss as farmers may undertake costly actions.

With regard to the case study, if the water supply costs are too low and transaction costs high, as assumed, the incentive tariffs do not justify their implementation in terms of social benefits because the presence of transaction costs negatively impact on the efficiency of incentive water pricing and makes it less efficient than flat rate pricing. However, this scenario should be further investigated to estimate the actual transaction costs involved in applying incentive tariffs in the region. It is worth noting that this region has the most intensive agricultural production in Albania and analyzing the actual irrigation water pricing problems and suggestion new water pricing policies might be in its advantage for the time being or for the future. In light of the fact that water supply costs may increase, the second scenario may be applied (i.e., 0.6 €/m3) which implies that the gain in social benefits from incentive tariffs will be significantly increased.

In addition, if no other outside options exist (i.e., pricing water volumetrically or introducing other strategies that allow for sustainable irrigated agriculture) monitoring strategies should be considered as an effective measure in the irrigation projects where its characteristics make it possible to apply this instrument.

In this regard, the model can be proposed for application in other areas where irrigation networks are via open canals and water delivered to farms is unmetered (e.g., in Austria, Belgium, Spain, Italy or Greece). Furthermore, the model allows for financial sustainability. The WA at least recovers the water supply costs and imposes a strategy according to which farmers manage water resources in a manner that is consistent with water conservation efforts and discourages misleading incentives (irrigating higher irrigated share than agree ex ante).

The model has several limitations; the main one is that it counts for a single period. In the multi period case the water authority would have the opportunity to receive information about the farm’s past behavior as such behavior may persist in upcoming periods and alter tariffs and irrigated shares accordingly. This would increase the efficiency of the monitoring activity and impact on the WA’s revenue and the farm’s benefit. This also enables the WA to improve its ability to target its verification efforts in the future [27].

Furthermore, our model is based on several simplified assumptions, among which the fact that it does not account for the effects of monitoring efforts on cost and effectiveness. However, the model can be extended and developed in several ways, one of which might be to analyze a case in which monitoring costs are a function of monitoring frequency (commonly applied in agri-environmental schemes) or extending the model by introducing the problem of adverse selection which could further hinder the possibility of discriminating tariffs among farmers. This development is beyond the scope of this paper and might be an interesting topic for future research.

Acknowledgments

We would like to thank the anonymous reviewers for their valuable comments and suggestions, and David Cuming for English language editing.

Author Contributions

The paper constitutes a collective effort of the three authors. Alban Lika and Francesco Galioto designed the research, selected the case study and performed the experiments. Davide Viaggi contributed to writing and improvements of the model and provided extensive editing to all parts of the paper. All authors have read and approved the final manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

References

- Bar-Shira, Z.; Finkelshtain, I.; Simhon, A. Block-rate versus uniform water pricing in agriculture: An empirical analysis. Am. J. Agric. Econ. 2006, 88, 986–999. [Google Scholar] [CrossRef]

- Frija, A.; Wossink, A.; Buysse, J.; Speelman, S.; Huylenbroeck, G. Irrigation pricing policies and its impact on agricultural inputs demand in Tunisia: A DEA-based methodology. J. Environ. Manag. 2011, 92, 2019–2118. [Google Scholar] [CrossRef] [PubMed]

- Zhou, Q.; Wu, F.; Zhang, Q. Is irrigation water price an effective leverage for water management? An empirical study in the middle reaches of the Heihe River basin. Phys. Chem. Earth Parts A/B/C 2015, 89, 25–32. [Google Scholar] [CrossRef]

- European Commission. Report on the Progress in Implementation of the Water Framework Directive—Programmes of Measures; European Commission: Brussels, Belgium, 2015. [Google Scholar]

- Ohab-Yazdi, S.; Ahmadi, A. Design and evaluation of irrigation water pricing policies for enhanced water use efficiency. J. Water Resour. Plan. Manag. 2015, 142, 5001–5011. [Google Scholar] [CrossRef]

- Molle, F. Water scarcity, prices and quotas: A review of evidences on irrigation volumetric pricing. Irrig. Drain. Syst. 2009, 23, 43–58. [Google Scholar] [CrossRef]

- Speelman, S.; Buysse, J.; Farolfi, S.; Frija, A.; D’Haesa, M.; D’Haesa, L. Estimating the impacts of water pricing on smallholder irrigators in North West Province, South Africa. Agric. Water Manag. 2009, 96, 1560–1566. [Google Scholar] [CrossRef]

- Giannoccaro, G.; Prosperi, M.; Zanni, G. Assessing the impact of alternative water pricing schemes on income distribution. J. Agric. Econ. 2010, 61, 527–544. [Google Scholar] [CrossRef]

- ARCADIS. The Role of Water Pricing and Water Allocation in Agriculture in Delivering Sustainable Water Use in Europe—Final Report; Arcadis: Brussels, Belgium, 2012. [Google Scholar]

- Viaggi, D.; Raggi, M.; Bartolini, F.; Gallerani, V. Are simple pricing mechanisms enough? Designing contracts for irrigation water under asymmetric information in an area of Northern Italy. Agric. Water Manag. 2010, 97, 1326–1332. [Google Scholar] [CrossRef]

- Johansson, R.C.; Tsur, Y.; Roe, L.T.; Doukkali, R.; Dinar, A. Pricing irrigation water: A review of theory and practice. Water Policy 2002, 4, 173–199. [Google Scholar] [CrossRef]

- Smith, R.B.W.; Tsur, Y. Asymmetric information and pricing natural resource: Understanding the case of unmetered water. Land Econ. 1997, 97, 1326–1332. [Google Scholar] [CrossRef]

- Galioto, F.; Raggi, M.; Viaggi, D. Pricing policies in managing water resources in agriculture: An application of contract theory to unmetered water. Water 2013, 5, 1502–1516. [Google Scholar] [CrossRef]

- Lika, A.; Galioto, F.; Scardigno, A.; Zdruli, P.; Viaggi, D. Pricing unmetered irrigation water under asymmetric information and full cost recovery. Water 2016, 8, 596. [Google Scholar] [CrossRef]

- Tsur, Y.; Dinar, A. The relative efficiency of alternative methods for pricing irrigation water and their implementation. World Bank Econ. Rev. 1997, 11, 243–262. [Google Scholar] [CrossRef]

- Fragoso, M.S. R.; Marques, A.F.C. Alternative irrigation water pricing policies: An econometric mathematical programming model. New Medit Mediterr. J. Econ. Agric. Environ. 2015, 14, 42–49. [Google Scholar]

- Ester, K.W.; Liu, Y. Cost Recovery and Water Pricing for Irrigation and Drainage Projects; World Bank, Agriculture and Rural Development: Washington, DC, USA, 2005. [Google Scholar]

- European Commission. Communication from the Commission (COM(2012)673): A Blueprint to Safeguard Europe’s Water Resources; European Commission: Brussels, Belgium, 2016. [Google Scholar]

- European Commission. Report from the commission to the council and the European parliament. In Second Follow-Up Report to the Communication on Water Scarcity and Droughts in the European Union COM (2007) Final; European Commission: Brussels, Belgium, 2012. [Google Scholar]

- Bos, M.G.; Walters, W. Water charges and irrigation efficiencies. Irrig. Drain. Syst. 1990, 4, 267–278. [Google Scholar] [CrossRef]

- Molle, F.; Berkoff, J. Water pricing in irrigation: Mapping the debate in the light of experience. In Irrigation Water Pricing. The Gap between Theory and Practice; Molle, F., Berkoff, J., Eds.; Biddles Books Ltd.: King’s Lynn, UK, 2007; pp. 21–93. [Google Scholar]

- Esteban, E.; Albiac, J. Water Nonpoint Pollution Problems in Europe; GWF Discussion Paper 1224; Global Water Forum: Canberra, Australia, 2012. [Google Scholar]

- Moxey, A.; White, B.; Ozanne, A. Efficient contract design for agri-environmental policy. J. Agric. Econ. 1999, 49, 187–202. [Google Scholar]

- White, B. Designing voluntary agri-environmental policy with hidden information and hidden action. J. Agric. Econ. 2002, 53, 353–360. [Google Scholar]

- White, B.; Hankey, N. Should we pay for ecosystem service outputs, inputs or both? Environ. Resour. Econ. 2016, 63, 765–787. [Google Scholar] [CrossRef]

- Galioto, F.; Raggi, M.; Viaggi, D. Incentive pricing for irrigation water with asymmetric information. In Economics of Water Management in Agriculture; Bournaris, T., Berbel, J., Manos, B., Viaggi, D., Eds.; CRS Press: Boca Ratorn, FL, USA, 2015; pp. 168–188. [Google Scholar]

- Hart, R.; Latacz-Lohmann, L. Combating moral hazard in agri-environmental schemes: A multiple-agent approach. Eur. Rev. Agric. Econ. 2005, 32, 75–91. [Google Scholar] [CrossRef]

- Choe, C.; Fraser, I. A note on imperfect monitoring of agri-environmental policy. J. Agric. Econ. 1988, 49, 250–258. [Google Scholar] [CrossRef]

- Ozanne, A.; Hogan, T.; Colman, D. Moral hazard, risk aversion and compliance monitoring in agri-environmental policy. Eur. Rev. Agric. Econ. 2001, 28, 329–347. [Google Scholar] [CrossRef]

- Millock, K.; Xabadia, A.; Zilberman, D. Policy for the adoption of new environmental monitoring technologies to manage stock externalities. J. Environ. Econ. Manag. 2012, 64, 102–116. [Google Scholar] [CrossRef]

- Fraser, R. Moral hazard and risk management in agri-environmental policy. J. Agric. Econ. 2002, 53, 475–487. [Google Scholar] [CrossRef]

- Fraser, R. Presidential address to cheat or not to cheat: Moral hazard and agri-environmental policy. J. Agric. Econ. 2013, 64, 527–536. [Google Scholar] [CrossRef]

- Zilberman, D. Incentives and economics in water resource management. In Proceedings of the Second Toulouse Conference on Environment and Resource Economics, Toulouse, France, 14–16 May 1997. [Google Scholar]

- Rothkopf, A.; Pibernik, R. Maverick buying: Eliminate, participate, leverage? Int. J. Prod. Econ. 2016, 179, 77–89. [Google Scholar] [CrossRef]

- Bolton, P.; Dewatripont, M. Contract Theory; The MIT Press: Cambridge, MA, USA; London, UK, 2005; pp. 12–169. ISBN 0-262-02576-0. [Google Scholar]

- Laffont, J.J.; Martimort, D. The Theory of Incentives. The Principal-Agent Model; Princeton University Press: Princeton, NJ, USA, 2002; pp. 145–185. ISBN 0-691-09183-8. [Google Scholar]

- Giannakis, E.; Bruggenan, A.; Djuma, H.; Kozyra, J.; Hammer, H. Water pricing and irrigation across Europe: Opportunities and constraints for adopting irrigation scheduling decision supply systems. Water Sci. Technol. Water Supply 2016, 16, 245–252. [Google Scholar] [CrossRef]

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).