Does the Level of Financial Cognition Affect the Income of Rural Households? Based on the Moderating Effect of the Digital Financial Inclusion Index

Abstract

:1. Introduction

2. Research Design

2.1. Research Hypothesis

2.2. Data and Model Specification

2.2.1. Data

2.2.2. Basic Regression Model

2.2.3. Unconditional Quantile Regression (UQR) Model

2.3. Variables

2.3.1. Measurement of the Explained Variables

2.3.2. Measurement of the Independent Variables

2.3.3. Control Variables and Other Variables

2.3.4. Descriptive Statistics

3. Empirical Analysis

3.1. Regression Analysis

3.1.1. Ordinary Least Squares (OLS) Regression Analysis

3.1.2. Unconditional Quantile Regression (UQR) Analysis

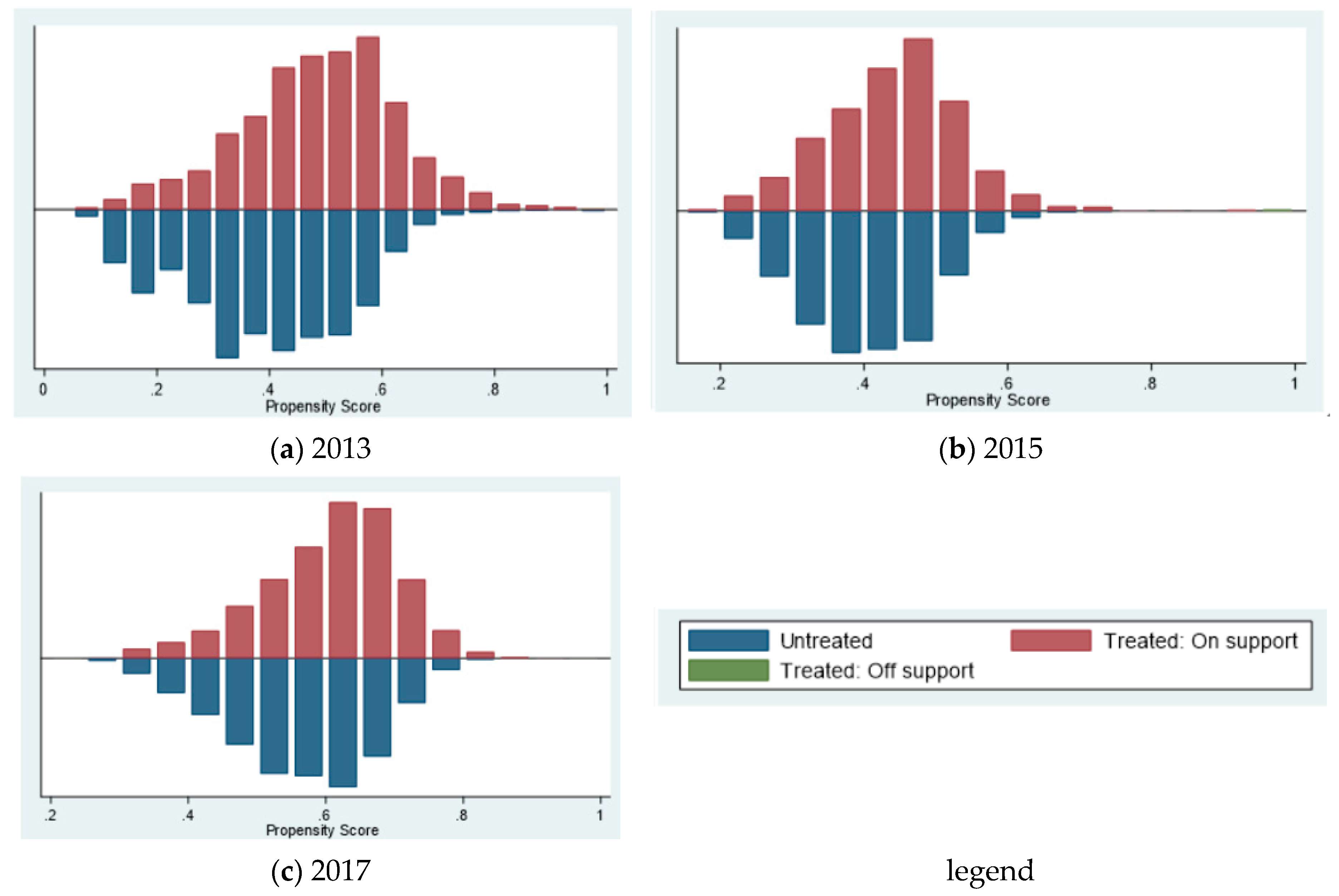

3.2. Robustness Test

4. Further Analysis

4.1. Mechanism Analysis

4.2. Heterogeneity Analysis

4.2.1. Regional Heterogeneity

4.2.2. Family Asset Heterogeneity

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Categories | Questions | Option 1 1 | Option 2 | Option 3 | Option 4 | Option 5 | Option 6 | Others | |

|---|---|---|---|---|---|---|---|---|---|

| 2017 | the degree of attention to finance | h3102 2 | 3 | 2 | 1 | 4 | 1 | 0 | 0 |

| financial basic knowledge | h3103 | 2 | 1 | 0 | |||||

| h3115 | 2 | 1 | 0 | ||||||

| risk perception | h3108 | 5 | 4 | 3 | 2 | 1 | 0 | ||

| h3109 | 5 | 4 | 3 | 2 | 1 | 0 | |||

| financial market knowledge | h3110 | 4 | 3 | 2 | 1 | 0 | 0 | ||

| h3112 | 3 | 5 | 1 | 2 | 0 | 4 | 0 | ||

| h3113 | 5 | 3 | 1 | 2 | 0 | 4 | 0 | ||

| h3114 | 3 | 5 | 1 | 2 | 0 | 4 | 0 | ||

| 2015 | the degree of attention to finance | A4002a | 4 | 3 | 2 | 1 | 0 | 0 | |

| A4002b | 1 | 0 | 0 | ||||||

| financial basic knowledge | A4004a | 2 | 1 | 3 | 0 | 0 | |||

| A4005a | 3 | 2 | 1 | 0 | 0 | ||||

| risk perception | A4003 | 5 | 4 | 3 | 2 | 1 | 0 | 0 | |

| A4006a | 1 | 2 | 0 | ||||||

| financial market knowledge | A4007aa | 4 | 3 | 1 | 2 | 0 | 0 | ||

| 2013 | the degree of attention to finance | A4002a | 4 | 3 | 2 | 1 | 0 | 0 | |

| A4002b | 1 | 0 | 0 | ||||||

| financial basic knowledge | A4004a | 2 | 1 | 3 | 0 | 0 | |||

| A4005a | 3 | 2 | 1 | 0 | 0 | ||||

| risk perception | A4003 | 5 | 4 | 3 | 2 | 1 | 0 | 0 | |

| A4006a | 1 | 2 | 0 | ||||||

| financial market knowledge | A4007aa | 4 | 3 | 1 | 2 | 0 | 0 |

References

- Nam, S. Cognitive capitalism, free labor, and financial communication: A critical discourse analysis of social media IPO registration statements. Inf. Commun. Soc. 2020, 23, 420–436. [Google Scholar] [CrossRef]

- Li, T.; Liao, G. The Heterogeneous Impact of Financial Development on Green Total Factor Productivity. Front. Energy Res. 2020, 8, 29. [Google Scholar] [CrossRef] [Green Version]

- Zhong, J.; Li, T. Impact of Financial Development and Its Spatial Spillover Effect on Green Total Factor Productivity: Evidence from 30 Provinces in China. Math. Probl. Eng. 2020, 2020, 5741387. [Google Scholar] [CrossRef] [Green Version]

- Li, Z.; Wang, Y.; Huang, Z. Risk Connectedness Heterogeneity in the Cryptocurrency Markets. Front. Phys. 2020, 8, 243. [Google Scholar] [CrossRef]

- Xu, S. International comparison of green credit and its enlightenment to China. Green Financ. 2020, 2, 75–99. [Google Scholar] [CrossRef]

- Li, Z.; Dong, H.; Floros, C.; Charemis, A.; Failler, P. Re-examining Bitcoin Volatility: A CAViaR-based Approach. Emerg. Mark. Financ. Trade 2021. [Google Scholar] [CrossRef]

- Tan, Y.; Li, Z.; Liu, S.; Nazir, M.I.; Haris, M. Competitions in different banking markets and shadow banking: Evidence from China. Int. J. Emerg. Mark. 2021. [Google Scholar] [CrossRef]

- Wen, F.; Cao, J.; Liu, Z.; Wang, X. Dynamic volatility spillovers and investment strategies between the Chinese stock market and commodity markets. Int. Rev. Financ. Anal. 2021, 76, 101772. [Google Scholar] [CrossRef]

- Mouna, A.; Anis, J. Financial literacy in Tunisia: Its determinants and its implications on investment behavior. Res. Int. Bus. Financ. 2017, 39, 568–577. [Google Scholar] [CrossRef]

- Croce, A.; Ughetto, E.; Cowling, M. Investment Motivations and UK Business Angels’ Appetite for Risk Taking: The Moderating Role of Experience. Br. J. Manag. 2019, 31, 728–751. [Google Scholar] [CrossRef]

- Wickstrom, K.A.; Klyver, K.; Cheraghi-Madsen, M. Age effect on entry to entrepreneurship: Embedded in life expectancy. Small Bus. Econ. 2020, 1–20. [Google Scholar] [CrossRef]

- Lusardi, A.; Michaud, P.-C.; Mitchell, O.S. Optimal Financial Knowledge and Wealth Inequality. J. Political Econ. 2017, 125, 431–477. [Google Scholar] [CrossRef] [Green Version]

- Zhu, A.Y.F.; Yu, C.W.M.; Chou, K.L. Improving Financial Literacy in Secondary School Students: An Randomized Experiment. Youth Soc. 2021, 53, 539–562. [Google Scholar] [CrossRef]

- Evgenii, G.; Aleksandra, C. Saving behavior and financial literacy of Russian high school students: An application of a copula-based bivariate probit-regression approach. Child. Youth Serv. Rev. 2021, 127, 106122. [Google Scholar]

- Finke, M.S.; Howe, J.S.; Huston, S.J. Old Age and the Decline in Financial Literacy. Manag. Sci. 2017, 63, 213–230. [Google Scholar] [CrossRef]

- MacLeod, S.; Musich, S.; Hawkins, K.; Armstrong, D.G. The growing need for resources to help older adults manage their financial and healthcare choices. BMC Geriatr. 2017, 17, 84. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Anderson, A.; Baker, F.; Robinson, D.T. Precautionary savings, retirement planning and misperceptions of financial literacy. J. Financ. Econ. 2017, 126, 383–398. [Google Scholar] [CrossRef] [Green Version]

- Demirtas, Y.E.; Kececi, N.F. The efficiency of private pension companies using dynamic data envelopment analysis. Quant. Financ. Econ. 2020, 4, 204–219. [Google Scholar] [CrossRef]

- Toosi, N.R.; Voegeli, E.N.; Antolin, A.; Babbitt, L.G.; Brown, D.K. Do Financial Literacy Training and Clarifying Pay Calculations Reduce Abuse at Work? J. Soc. Issues 2020, 76, 681–720. [Google Scholar] [CrossRef]

- Meyll, T.; Pauls, T. The gender gap in over-indebtedness. Financ. Res. Lett. 2019, 31, 398–404. [Google Scholar] [CrossRef]

- Morshadul, H.; Thi, L.; Ariful, H. How does financial literacy impact on inclusive finance? Financ. Innov. 2021, 7, 1–23. [Google Scholar]

- Grohmann, A.; Kluehs, T.; Menkhoff, L. Does financial literacy improve financial inclusion? Cross country evidence. World Dev. 2018, 111, 84–96. [Google Scholar] [CrossRef] [Green Version]

- Naz, M.; Iftikhar, S.F.; Fatima, A. Does financial inclusiveness matter for the formal financial inflows? Evidence from Pakistan. Quant. Financ. Econ. 2020, 4, 19–35. [Google Scholar] [CrossRef]

- Coibion, O.; Gorodnichenko, Y.; Kudlyak, M.; Mondragon, J. Greater Inequality and Household Borrowing: New Evidence from Household Data. J. Eur. Econ. Assoc. 2020, 18, 2922–2971. [Google Scholar] [CrossRef]

- Szymborska, H.K. Wealth structures and income distribution of US households before and after the Great Recession. Struct. Chang. Econ. Dyn. 2019, 51, 168–185. [Google Scholar] [CrossRef]

- Larrimore, J.; Mortenson, J.; Splinter, D. Household Incomes in Tax Data Using Addresses to Move from Tax-Unit to Household Income Distributions. J. Hum. Resour. 2021, 2, 600–631. [Google Scholar] [CrossRef] [Green Version]

- Nicolini, E.A.; Palencia, F.R. Decomposing income inequality in a backward pre—Industrial economy. Econ. Hist. Rev. 2016, 69, 747–772. [Google Scholar] [CrossRef]

- Markkanen, S.; Braeckman, J.P.; Souvannaseng, P. Mapping the evolving complexity of large hydropower project finance in low and lower-middle income countries. Green Financ. 2020, 2, 151–172. [Google Scholar] [CrossRef]

- Murayama, Y. Inequality, mobility, and growth. Natl. Account. Rev. 2019, 1, 62–70. [Google Scholar] [CrossRef]

- Sukharev, O.S. Structural analysis of income and risk dynamics in models of economic growth. Quant. Financ. Econ. 2020, 4, 1–18. [Google Scholar] [CrossRef]

- Aguila, E.; Park, J.H.; Vega, A. Living Arrangements and Supplemental Income Programs for Older Adults in Mexico. Demography 2020, 57, 1345–1368. [Google Scholar] [CrossRef]

- Hickey, G.M.; Pouliot, M.; Smith-Hall, C.; Wunder, S.; Nielsen, M.R. Quantifying the economic contribution of wild food harvests to rural livelihoods: A global-comparative analysis. Food Policy 2016, 62, 122–132. [Google Scholar] [CrossRef]

- Zhang, L.; Feng, S.; Heerink, N.; Qu, F.; Kuyvenhoven, A. How do land rental markets affect household income? Evidence from rural Jiangsu, PR China. Land Use Policy 2018, 74, 151–165. [Google Scholar] [CrossRef]

- Davis, B.; Di Giuseppe, S.; Zezza, A. Are African households (not) leaving agriculture? Patterns of households’ income sources in rural Sub-Saharan Africa. Food Policy 2017, 153–174. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Takada, S.; Morikawa, S.; Idei, R.; Kato, H. Impacts of improvements in rural roads on household income through the enhancement of market accessibility in rural areas of Cambodia. Transportation 2021, 1–25. [Google Scholar] [CrossRef]

- Aryo, S.G.; Jeffrey, D.; Qing, L.; Nigar, N.; Firman, W. Tobacco or not tobacco: Predicting farming households’ income in Indonesia. Tob. Control 2021, 30, 320–327. [Google Scholar]

- McNelis, P.D.; Yoshino, N. Household Income Dynamics in A Lower-Income Small Open Economy: A Comparison of Banking and Crowdfunding Regimes. Singap. Econ. Rev. 2018, 63, 147–166. [Google Scholar] [CrossRef]

- Abdullah, A.N.M.; Stacey, N.; Garnett, S.T.; Myers, B. Economic dependence on mangrove forest resources for livelihoods in the Sundarbans, Bangladesh. For. Policy Econ. 2016, 64, 15–24. [Google Scholar] [CrossRef]

- Angelsen, A.; Jagger, P.; Babigumira, R.; Belcher, B.; Hogarth, N.J.; Bauch, S.; Boerner, J.; Smith-Hall, C.; Wunder, S. Environmental Income and Rural Livelihoods: A Global-Comparative Analysis. World Dev. 2014, 64, S12–S28. [Google Scholar] [CrossRef] [Green Version]

- Chen, S.; Luo, E.-g.; Alita, L.; Han, X. Impacts of formal credit on rural household income: Evidence from deprived areas in western China. J. Integr. Agric. 2021, 20, 927–942. [Google Scholar] [CrossRef]

- Arouri, M.; Ben Youssef, A.; Nguyen, C. Does urbanization reduce rural poverty? Evidence from Vietnam. Econ. Model. 2017, 60, 253–270. [Google Scholar] [CrossRef] [Green Version]

- Igwe, P.A.; Rahman, M.; Odunukan, K.; Ochinanwata, N.; Egbo, O.P.; Ochinanwata, C. Drivers of diversification and pluriactivity among smallholder farmers-evidence from Nigeria. Green Financ. 2020, 2, 263–283. [Google Scholar] [CrossRef]

- Peng, G.; Liu, F.; Lu, W.; Liao, K.; Tang, C.; Zhu, L. A spatial-temporal analysis of financial literacy in United States of America. Financ. Res. Lett. 2018, 26, 56–62. [Google Scholar] [CrossRef]

- Carpena, F.; Cole, S.; Shapiro, J.; Zia, B. The ABCs of Financial Education: Experimental Evidence on Attitudes, Behavior, and Cognitive Biases. Manag. Sci. 2019, 65, 346–369. [Google Scholar] [CrossRef] [Green Version]

- OECD INFE. Measuring Financial Literacy: Core Questionnaire in Measuring Financial Literacy: Questionnaire and Guidance Notes for Conducting an Internationally Comparable Survey of Financial Literacy; OECD: Paris, France, 2020. [Google Scholar]

- Song, X.; Guo, H. Influence Factors of the Urban-rural Residents’ Income Gap: A Restudy with the Digital Inclusive Finance. In Proceedings of the 2017 4th International Conference on Business, Economics and Management, Qingdao, China, 16–17 November 2017; p. 7. [Google Scholar]

- Li, Z.; Chen, L.; Dong, H. What are bitcoin market reactions to its-related events? Int. Rev. Econ. Financ. 2021, 73, 1–10. [Google Scholar] [CrossRef]

- Jiang, Y.; Tian, G.; Wu, Y.; Mo, B. Impacts of geopolitical risks and economic policy uncertainty on Chinese tourism-listed company stock. Int. J. Financ. Econ. 2020. [Google Scholar] [CrossRef]

- Gan, L.; Yin, Z.; Tan, J. Report on the Development of Household Finance in Rural China (2014); Springer: Singapore, 2016. [Google Scholar]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Zhiyun, C. Measuring China’s Digital Financial Inclusion: Index Compilation and Spatial Characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar]

- Koenker, R.; Bassett, G. Regression Quantiles. Econometrica 1978, 46, 33–50. [Google Scholar] [CrossRef]

- Firpo, S.; Fortin, N.M.; Lemieux, T. Unconditional Quantile Regressions. Econometrica 2009, 77, 953–973. [Google Scholar] [CrossRef] [Green Version]

- Sayinzoga, A.; Bulte, E.H.; Lensink, R. Financial Literacy and Financial Behaviour: Experimental Evidence from Rural Rwanda. Econ. J. 2016, 126, 1571–1599. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

| the Degree of Attention to Finance | Financial Basic Knowledge | Risk Perception | Financial Market Knowledge | |

|---|---|---|---|---|

| 2013 | (A4002a): 0–10 1 | (A4004a): 0–3 | (A4003): 0–5 | (A4007aa): 0–4 |

| (A4002b): 0–1 | (A4005a): 0–3 | (A4006a): 0–2 | ||

| 2015 | (A4002a): 0–10 | (A4004a): 0–3 | (A4003): 0–5 | (A4007aa): 0–4 |

| (A4002b): 0–1 | (A4005a): 0–3 | (A4006a): 0–2 | ||

| 2017 | (H3102): 0–10 | (H3103): 0–2 | (H3108): 0–5 | (H3110): 0–4 |

| (H3112): 0–5 | ||||

| (H3115): 0–2 | (H3109): 0–5 | (H3113): 0–5 | ||

| (H3114): 0–5 |

| Control Variables | Indicators | Calculation Method |

|---|---|---|

| age | Age of householder | Survey year year of birth |

| sex | Gender of householder | Male: 1; Female: 0 |

| marriage | Marital status of householder | With a spouse (married, living together): 1; Without a spouse (unmarried, separated, divorced, widowed): 0 |

| health | Health of householder | Excellent: 5; Very good: 4; Good: 3; Fair: 2; Bad: 1 |

| education | Education years of householder | Never been to school: 0; Elementary school: 6; Junior high school: 9; High school/ Technical secondary school/ Vocational high school: 12; Junior college/ Vocational college: 15; Bachelor’s degree: 16; Master’s degree: 19; Doctor’s degree: 22 |

| asset | Total family assets (thousand yuan) | Financial assets: personal social security account balances, deposits, cash, stocks, funds, bonds, derivatives, non-RMB assets, gold, other financial assets, loans Non-financial assets: agricultural assets, industrial and commercial assets, housing assets, shop assets, land assets, vehicle assets, and other non-financial assets |

| Variable | Year | Obs 1 | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| Income(k) | 2013 | 7046 | 35.4274 | 66.5792 | −1000 | 3000 |

| 2015 | 7046 | 41.3964 | 114.1691 | −800 | 5000 | |

| 2017 | 7046 | 750.6099 | 381.4633 | 178.87 | 3321.51 | |

| f | 2013 | 7046 | 27.5281 | 18.3008 | 0 | 96.4286 |

| 2015 | 7046 | 26.8482 | 19.9213 | 0 | 91.4286 | |

| 2017 | 7046 | 18.1178 | 10.7688 | 0 | 75.3708 | |

| asset(k) | 2013 | 7046 | 274.4948 | 504.8637 | 0 | 11,300 |

| 2015 | 7046 | 313.1871 | 690.9248 | 0 | 20,000 | |

| 2017 | 7046 | 341.4470 | 951.4082 | 0 | 56,200 | |

| age | 2013 | 7046 | 54.0739 | 26.3863 | 5 | 115 |

| 2015 | 7046 | 55.7839 | 12.3071 | 3 | 96 | |

| 2017 | 7046 | 56.9604 | 12.1754 | 4 | 97 | |

| sex | 2013 | 7046 | 0.8926 | 0.3097 | 0 | 1 |

| 2015 | 7046 | 0.8808 | 0.3241 | 0 | 1 | |

| 2017 | 7046 | 0.8884 | 0.3148 | 0 | 1 | |

| education | 2013 | 7046 | 6.9837 | 3.4387 | 0 | 16 |

| 2015 | 7046 | 6.9664 | 3.4519 | 0 | 16 | |

| 2017 | 7046 | 6.9493 | 3.4826 | 0 | 16 | |

| health | 2013 | 7046 | 2.1746 | 1.3058 | 0 | 5 |

| 2015 | 7041 | 3.1287 | 1.0068 | 0 | 5 | |

| 2017 | 7043 | 3.1090 | 1.0440 | 1 | 5 | |

| marriage | 2013 | 7046 | 0.9008 | 0.2990 | 0 | 1 |

| 2015 | 7046 | 0.9008 | 0.2990 | 0 | 1 | |

| 2017 | 7046 | 0.8846 | 0.3195 | 0 | 1 | |

| index | 2013 | 7046 | 154.0691 | 21.6499 | 118.01 | 215.62 |

| 2015 | 7046 | 218.2908 | 18.9576 | 193.29 | 276.38 | |

| 2017 | 7046 | 270.5729 | 20.0758 | 240.20 | 329.94 |

| (1) 2013 | (2) 2015 | (3) 2017 | |

|---|---|---|---|

| Income | Income | Income | |

| β | 0.168 *** (2.59) 1 | 0.203 * (1.77) | 0.929 ** (2.34) |

| α | 10.65 ** (2.21) | 3.153 (0.41) | 1141.1 *** (3.93) |

| Control variables | yes | yes | yes |

| Regional fixed effects | yes | yes | yes |

| N | 7046 | 7046 | 7046 |

| R-sq | 0.087 | 0.212 | 0.226 |

| (1) 2013 | (2) 2015 | (3) 2017 | |

|---|---|---|---|

| UQR10th β | 0.0197 ** (2.09) 1 | 0.0369 *** (3.49) | 0.400 (1.59) |

| UQR30th β | 0.0763 *** (5.26) | 0.0815 *** (5.60) | 1.267 *** (4.12) |

| UQR50th β | 0.0927 *** (3.54) | 0.170 *** (6.92) | 1.847 *** (3.47) |

| UQR70th β | 0.186 *** (4.50) | 0.263 *** (6.53) | 1.583 ** (2.46) |

| UQR90th β | 0.562 *** (5.81) | 0.478 *** (4.68) | 1.213 (1.29) |

| Control variables | yes | yes | yes |

| Regional fixed effects | yes | yes | yes |

| N | 7046 | 7046 | 7046 |

| Matching Method | 2013 ATT Difference | 2015 ATT Difference | 2017 ATT Difference |

|---|---|---|---|

| One-to-one | 5.09972472 (1.96) 1 | 5.52958823 (1.96) | 32.7634009 (2.61) |

| K = 4 Nearest neighbors matching | 4.39147759 (2.17) | 7.1373086 (2.66) | 37.0123294 (3.50) |

| Radius matching | 3.60359892 (2.05) | 8.50397007 (3.37) | 40.7273265 (4.26) |

| Kernel matching | 3.75708599 (2.14) | 8.35412397 (3.31) | 40.6649744 (4.25) |

| Variable | Year | Unmatched | Mean | %Reduced |Bias| | t-Test | V(T)/ V(C) | |||

|---|---|---|---|---|---|---|---|---|---|

| Matched | Treated | Untreated | %Bias | t | p > t | ||||

| asset | 2013 | U | 349.74 | 216.7 | 26.1 | 11.06 | 0.000 | 1.78 *1 | |

| M | 343.36 | 333.1 | 2 | 92.3 | 0.71 | 0.475 | 0.75 * | ||

| 2015 | U | 389.5 | 258.34 | 18.2 | 7.89 | 0.000 | 3.43 * | ||

| M | 364.34 | 343.84 | 2.8 | 84.4 | 1.25 | 0.211 | 1.03 | ||

| 2017 | U | 384.33 | 280.39 | 11.3 | 4.52 | 0.000 | 2.28 * | ||

| M | 370.93 | 364.98 | 0.6 | 94.3 | 0.38 | 0.703 | 0.72 * | ||

| age | 2013 | U | 50.882 | 56.033 | −43 | −17.80 | 0.000 | 0.83 * | |

| M | 50.883 | 50.461 | 3.5 | 91.8 | 1.40 | 0.162 | 0.88 * | ||

| 2015 | U | 53.728 | 57.259 | −29.1 | −12.01 | 0.000 | 0.94 | ||

| M | 53.718 | 53.296 | 3.5 | 88 | 1.33 | 0.182 | 0.94 | ||

| 2017 | U | 55.349 | 59.269 | −32.5 | −13.47 | 0.000 | 0.91 * | ||

| M | 55.336 | 54.894 | 3.7 | 88.7 | 1.64 | 0.101 | 0.85 * | ||

| sex | 2013 | U | 0.91898 | 0.87227 | 15.3 | 6.29 | 0.000 | . | |

| M | 0.91893 | 0.91762 | 0.4 | 97.2 | 0.19 | 0.852 | . | ||

| 2015 | U | 0.89573 | 0.87032 | 7.9 | 3.25 | 0.001 | . | ||

| M | 0.8959 | 0.89929 | −1.1 | 86.7 | −0.43 | 0.668 | . | ||

| 2017 | U | 0.90883 | 0.85916 | 15.6 | 6.53 | 0.000 | . | ||

| M | 0.90903 | 0.90806 | 0.3 | 98.1 | 0.15 | 0.879 | . | ||

| education | 2013 | U | 7.9922 | 6.209 | 54.1 | 22.32 | 0.000 | 0.76 * | |

| M | 7.9895 | 7.9448 | 1.4 | 97.5 | 0.58 | 0.563 | 1.04 | ||

| 2015 | U | 7.5142 | 6.573 | 27.6 | 11.39 | 0.000 | 0.92 * | ||

| M | 7.5137 | 7.4368 | 2.3 | 91.8 | 0.91 | 0.365 | 1.10 * | ||

| 2017 | U | 7.3929 | 6.3134 | 31.2 | 12.95 | 0.000 | 0.88 * | ||

| M | 7.3943 | 7.2698 | 3.6 | 88.5 | 1.69 | 0.091 | 1 | ||

| health | 2013 | U | 2.2826 | 2.0916 | 14.6 | 6.10 | 0.000 | 1.12 * | |

| M | 2.2811 | 2.2403 | 3.1 | 78.6 | 1.17 | 0.244 | 0.92 * | ||

| 2015 | U | 3.2129 | 3.0678 | 14.5 | 5.99 | 0.000 | 0.93 * | ||

| M | 3.2126 | 3.2635 | −5.1 | 65 | −1.98 | 0.048 | 0.98 | ||

| 2017 | U | 3.2009 | 2.9776 | 21.5 | 8.88 | 0.000 | 0.96 | ||

| M | 3.201 | 3.1969 | 0.4 | 98.2 | 0.18 | 0.856 | 1 | ||

| marriage | 2013 | U | 0.93303 | 0.87604 | 19.5 | 7.97 | 0.000 | . | |

| M | 0.93298 | 0.93789 | −1.7 | 91.4 | −0.78 | 0.435 | . | ||

| 2015 | U | 0.91605 | 0.89038 | 8.7 | 3.56 | 0.000 | . | ||

| M | 0.9159 | 0.90709 | 3 | 65.6 | 1.19 | 0.233 | . | ||

| 2017 | U | 3476.4 | 3582.6 | −5.3 | −2.16 | 0.031 | 1.16 * | ||

| M | 3476.7 | 3506.7 | −1.5 | 71.8 | −0.67 | 0.503 | 1.13 * | ||

| (1) | (2) | ||

|---|---|---|---|

| Income | Income | ||

| −5.259 ***(−11.17) 1 | c_ | 1.374 ***(9.84) | |

| 5.522 ***(77.13) | c_ | 4.774 ***(113.97) | |

| 0.0310 ***(11.59) | c_ | 0.0310 ***(11.59) | |

| α | −880.3 ***(−66.53) | c_α | 270.0 ***(120.01) |

| N | 21,138 | N | 21,138 |

| R-sq | 0.391 | R-sq | 0.391 |

| (1) Low_GDP | (2) Middle_GDP | (3) High_GDP | ||

|---|---|---|---|---|

| Income | Income | Income | ||

| 2013 | β | −0.017(−0.15) 1 | 0.360 **(1.99) | 0.218 ***(3.34) |

| α | 23.80 **(2.19) | 1.471(0.14) | 3.127(0.52) | |

| Control variables | yes | yes | yes | |

| N | 2097 | 1194 | 3755 | |

| R-sq | 0.11 | 0.077 | 0.055 | |

| 2015 | β | 0.117(1.44) | 0.378(1.35) | 0.251 ***(2.62) |

| α | 3.583(0.41) | 13.06(1.09) | 9.339(0.5) | |

| Control variables | yes | yes | yes | |

| N | 2311 | 2311 | 2419 | |

| R-sq | 0.198 | 0.079 | 0.359 | |

| 2017 | β | 0.278(0.37) | 0.726(0.97) | 1.048 *(1.8) |

| α | 1096.0 ***(17.7) | 1058.9 ***(17.86) | 989.1 ***(18.6) | |

| Control variables | yes | yes | yes | |

| N | 2376 | 2137 | 2530 | |

| R-sq | 0.206 | 0.172 | 0.215 | |

| (1) Low Assets | (2) Lower Middle Assets | (3) Upper Middle Asset | (4) High Assets | ||

|---|---|---|---|---|---|

| Income | Income | Income | Income | ||

| 2013 | β | 0.0162 (0.34) 1 | 0.0636 (1.31) | 0.125 ** (2.25) | 0.394 ** (2.48) |

| α | 23.40 *** (5.73) | 23.53 *** (4.27) | 7.9 (1.08) | 12.67 (0.61) | |

| Control variables | yes | yes | yes | yes | |

| Regional control effect | yes | yes | yes | yes | |

| N | 1761 | 1762 | 1762 | 1761 | |

| R-sq | 0.057 | 0.038 | 0.046 | 0.032 | |

| 2015 | β | 0.096 * (1.86) | 0.0513 (1.1) | 0.199 *** (3.43) | 1.044 ** (2.16) |

| α | 20.83 *** (3.38) | 27.85 *** (4.23) | 12.83 (1.64) | −33.62 (−0.67) | |

| Control variables | yes | yes | yes | Yes | |

| Regional control effect | yes | yes | yes | Yes | |

| N | 1759 | 1760 | 1761 | 1761 | |

| R-sq | 0.082 | 0.071 | 0.061 | 0.026 | |

| 2017 | β | −0.328 (−0.47) | 0.394 (0.49) | 0.353 (0.46) | 1.038 (1.18) |

| α | 1223.4 ** (2.37) | 353.2 (0.62) | 2025.4 *** (3.4) | 351.7 (0.58) | |

| Control variables | yes | yes | yes | yes | |

| Regional control effect | yes | yes | yes | yes | |

| N | 1760 | 1760 | 1762 | 1761 | |

| R-sq | 0.338 | 0.227 | 0.173 | 0.16 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zou, F.; Li, T.; Zhou, F. Does the Level of Financial Cognition Affect the Income of Rural Households? Based on the Moderating Effect of the Digital Financial Inclusion Index. Agronomy 2021, 11, 1813. https://doi.org/10.3390/agronomy11091813

Zou F, Li T, Zhou F. Does the Level of Financial Cognition Affect the Income of Rural Households? Based on the Moderating Effect of the Digital Financial Inclusion Index. Agronomy. 2021; 11(9):1813. https://doi.org/10.3390/agronomy11091813

Chicago/Turabian StyleZou, Fanqi, Tinghui Li, and Feite Zhou. 2021. "Does the Level of Financial Cognition Affect the Income of Rural Households? Based on the Moderating Effect of the Digital Financial Inclusion Index" Agronomy 11, no. 9: 1813. https://doi.org/10.3390/agronomy11091813

APA StyleZou, F., Li, T., & Zhou, F. (2021). Does the Level of Financial Cognition Affect the Income of Rural Households? Based on the Moderating Effect of the Digital Financial Inclusion Index. Agronomy, 11(9), 1813. https://doi.org/10.3390/agronomy11091813