1. Introduction

Cotton is one of the most important agricultural products in the world, and China is the world’s largest cotton importer and consumer and the second largest cotton producer [

1]. Its domestic cotton demand and supply have a significant impact on the world market. Twenty-four of the 35 provinces of China grow cotton, with nearly 300 million people involved in cotton production [

2]. Traditionally, cotton production in China was concentrated in the six provinces in the central and northern plains. In the past decade, cotton production had shifted to the Xinjiang province in the west, which has become the largest cotton producer in China [

3]. Cotton production is important to economic growth in Xinjian. In 2020, China’s total cotton lint (deseed) output was 5.91 million tons, of which Xinjiang’s total cotton lint (deseed) output was 5.161 million tons, accounting for 87.33% of the country’s total output [

4]. From 1995 to 2019, the cotton production in Xinjiang increased from 935,000 tons to 5,111,000 tons, with an average annual growth of 174,000 tons. Simultaneously, Xinjiang’s average cotton yield increased from 1.26 tons/ha to 2.05 tons/ha, and the per unit cotton yield in Xinjiang is 0.23 tons/ha higher than the national average yield in 2018 [

5]. In summary, Xinjiang cotton and other major cotton-producing areas in China (Hebei Province, Shandong Province, Hubei Province, Anhui Province, Jiangxi Province, Hunan Province) have obvious production advantages in production, planting area, and yields.

David Ricardo’s “Theory of Comparative Advantage” believes that international trade arises from the difference in the opportunity cost of producing the product between countries, “Factor Endowment Theory” believes that international trade is generated because of the difference in factor endowment between countries, and “New Trade Theory” explains the origin of international trade from the perspective of economies of scale. The “new trade theory” explains the origin of international trade from the perspective of economies of scale [

6,

7,

8,

9,

10,

11].

Studies have been conducted to measure and evaluate the comparative advantage of crop regions, mainly from the selection and evaluation of evaluation indicators [

12,

13,

14]. The evaluation indicators of the comparative advantages of crop areas can be generally divided into cost–benefit, comparative performance indicators, the domestic resource cost method, and the regional average cost method [

15]. First of all, area and yield are the basic indicators for evaluating the comparative advantages of crop areas. Sown area and yield per unit area are applied in the study of the comparative advantage of maize, wheat, soybean, cotton, and peanut [

16,

17]. Second, some of the existing studies have added factors such as cost, return, and profit in evaluating the comparative advantages of regions [

18]. Indicators such as production cost, land cost, land output ratio, output value, and net profit per unit have been used to reflect factors such as crop production costs, returns, and profits to comprehensively analyze the comparative advantage of crop industry development [

19,

20,

21]. Third, the number of imports and exports, as well as the opportunity cost of labor and land, have also been introduced into the evaluation indexes by a small number of existing studies, mostly concerning the international competitiveness of products [

22,

23,

24,

25,

26,

27,

28]. The methods for studying the comparative advantages of crop areas mainly include the integrated comparative advantage index method, the gray system assessment method, the engineering cost method, the equilibrium analysis method, the cost comparison method, and the price comparison method. The comprehensive comparative advantage index usually consists of scale, efficiency, and effectiveness comparative advantage indices, and is widely used in the study of the comparative advantages of food, which has both simplicity and science [

29,

30]. The domestic resource cost method, location entropy index method, correlation growth rate method, and data envelopment analysis method have also been applied in the study of comparative advantage [

31].

This study involves the regional comparative advantage of cotton production and is based on the concept of comparative advantage in international trade theory and the analysis of cotton in Xinjiang in the region of a comprehensive comparison of relevant indicators, reflecting whether the production of cotton in Xinjiang has a comparative advantage, and it measures the size of the comparative advantage. Another purpose of this study is to provide a perspective on the determinants of agricultural output value by using regional data collected in Xinjiang. For this cross-sectional data, multilinear regression models are the most suitable approach [

31]. Multicollinearity is one of the serious problems when using multiple linear regression at the macro level. This problem arises because of the high correlation between the independent variables, which leads to weak estimates [

32].

Fisher [

32] was the first researcher who found the seriousness of the multicollinearity problem and its effect on the results of the regression analysis. Hoerl and Kennard [

33] added a positive value to the information matrix, which named the biased parameter and the ridge regression method. Montgomery and Peck [

34] proved that the ridge trace depends on the path of the estimated curves versus several constant values between 0 and 1.

Wu et al., Hassan, et al., and Lee [

35,

36,

37] found various reasons for the gross domestic product (

GDP) to change and the economy to grow by using a large amount of theoretical and empirical research. Hasan et al. [

37] found the factors of population, imports of goods and services, agricultural value-added, manufacturing value-added, and labor force have a positive impact on Bangladesh’s

GDP through the comparison of stepwise and ridge regression models.

The overall objective of this study is to evaluate the comparative advantage of cotton production in Xinjiang province and the impact on the agricultural output value. Comparative advantage indexes, correlation analysis, and ridge regression techniques are used to build a plausible regression model. More specifically, the study (1) evaluate the comparative advantage of Xinjiang cotton production from 2005 to 2018, (2) analyze the correlation test between the independent and dependent variables using correlation analysis and multiple regression methods and determine the presence of multicollinearity between the variables with the inflation factor (VIF), and (3) analyze the magnitude of the factors influencing cotton production on agricultural output in Xinjiang using the ridge regression method to eliminate the multicollinearity between variables.

4. Conclusions and Discussion

4.1. Conclusions

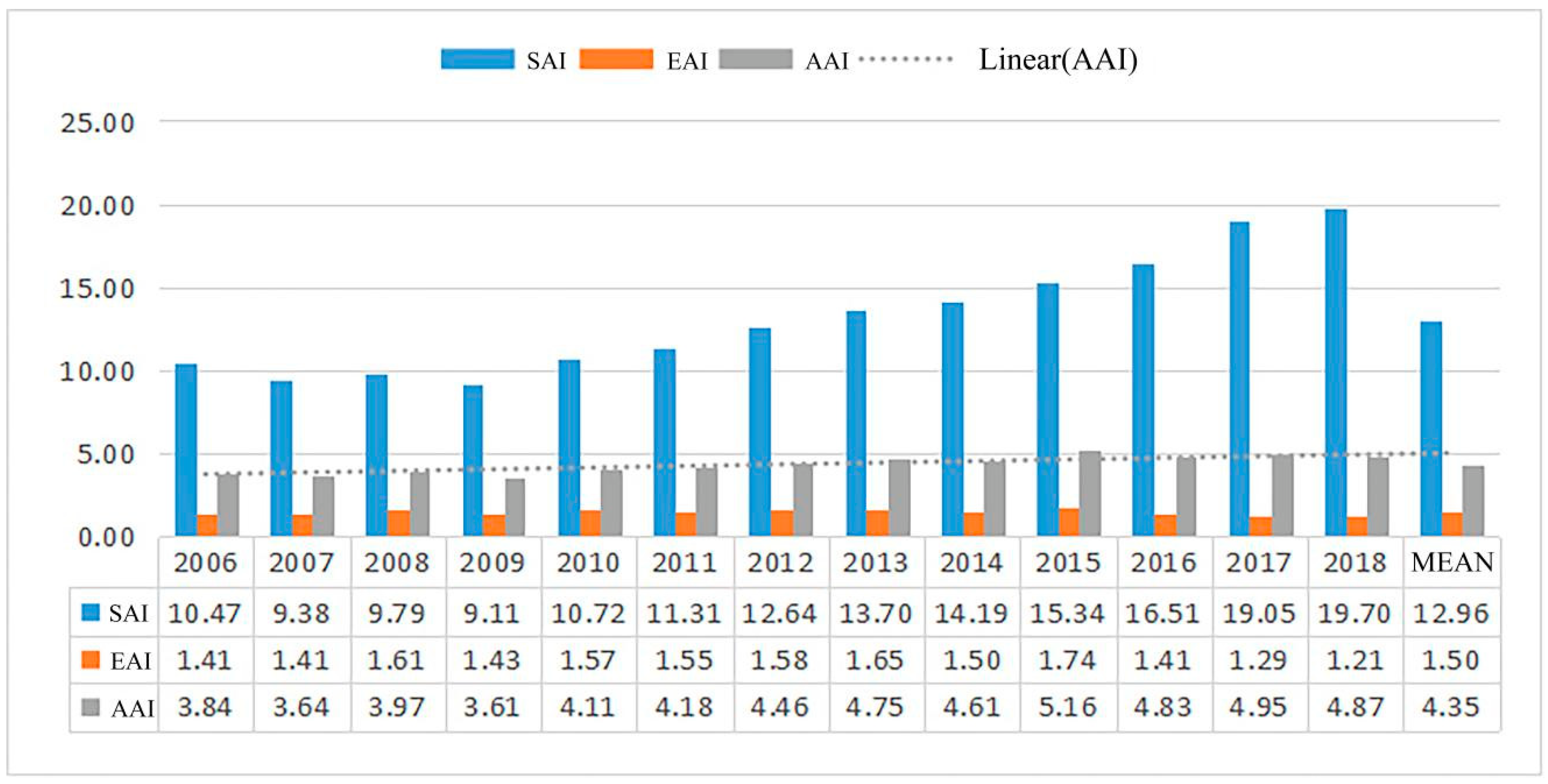

Cotton production in Xinjiang makes a significant contribution to the Chinese and world cotton markets. It ranks first in China in terms of planted area, total production, and average yield. Three different indices were calculated in this study, the efficiency advantage index (EAI), scale advantage index (SAI), and aggregate advantage index (AAI), to evaluate the comparative advantage of cotton production in Xinjiang. Second, this study applied correlation, multiple linear regression, and ridge regression to analyze the effect of cotton production in Xinjiang and its impact on agricultural output.

(1) The comparative advantage of cotton production in Xinjiang is obvious. By calculating the efficiency advantage index (EAI), scale advantage index (SAI), and comprehensive advantage index (AAI) of cotton production in Xinjiang from 2005 to 2018, the results show that cotton production in Xinjiang has obvious comparative advantages. The average values of SAI, EAI, and AAI are 12.96, 1.50, and 4.35, respectively, indicating that cotton production in Xinjiang has a high planting scale advantage and yield advantage.

(2) The results of the analysis of the factors affecting the agricultural output value of cotton production in Xinjiang show that agricultural output value and cotton production have a high correlation. Ridge regression analysis shows that total cotton production, financial support for agricultural expenditure, total agricultural machinery power, and fertilizer use have significant positive effects on agricultural output value in Xinjiang. Cotton planting area, average cotton yield, and the proportion of affected area, on the other hand, had a negative effect on the agricultural output value.

4.2. Discussion

(1) The scale advantage of cotton production in Xinjiang is very obvious, mainly because of the large cotton sowing area in Xinjiang, which reached 375.996 million mu in 2021, accounting for 82.76% of the national planting area [

57], and the full mechanization of cotton production in Xinjiang from sowing to harvesting, which further promotes the scale of cotton production. This result is important for policymakers, who should develop a more optimal scale of cotton cultivation in Xinjiang to ensure that the sustainable development of cotton production is coordinated with the environmental carrying capacity.

(2) The comparative advantage of cotton efficiency in Xinjiang shows a trend of a slow growth rate; as the overall level of cotton yield in Xinjiang is high, its marginal yield increase space becomes smaller, and the future single increase relies on variety improvement and technology improvement.

(3) Fertilizer application has an obvious positive effect on the agricultural output value; considering that agricultural production in Xinjiang is constrained by resources and the environment, the use of fertilizer needs to be gradually reduced in the future, while the area affected by disasters has a negative effect on agricultural output value, and agricultural infrastructure construction needs to be strengthened to improve the disaster resistance of agricultural production.

4.3. Policy Recommendations

Under the influence of multiple factors, for Xinjiang cotton production to maintain a sustained high yield, there is a need to overcome difficulties in the cotton production faced in recent years along with emphasizing the need to enhance planting scale and per unit yield. Due to the impact of international cotton prices and costs, the total production of cotton in Xinjiang is high, but the quality of cotton is poor, resulting in the international competitiveness of cotton not being strong. In view of this, for the establishment of a new concept of high-quality sustainable development of the cotton industry, and adjusting the cotton security strategy, it is recommended that the following four aspects reshape the economy of the cotton industry in Xinjiang, consolidating and enhancing the comparative advantage of cotton production, to ensure the security of cotton production.

4.3.1. Reasonable Planning of the Layout of the Cotton Industry

Based on in-depth investigation and research, the overall planning of the cotton industry in Xinjiang requires a scientific layout, the establishment of several high-yielding, stable production fields, and a high-quality cotton production base; under the premise of safeguarding the security of the national cotton industry, the appropriate adjustment of cotton planting area, according to local conditions. It also, requires a reasonable development of agricultural resources and the reshaping of agricultural enterprises throughout Xinjiang, so that Xinjiang’s agricultural structure changes from single to diversified entity [

58]. The optimization and integration of the cotton industry chain in Xinjiang requires the promotion of cotton seed breeding; planting, acquisition, and processing as well as cotton spinning by placing them under one industrialized management system, and the formation of a complete cotton industry chain for achieving economies of scale and competitive edge both locally and internationally.

4.3.2. Building Cotton Seed Monitoring and Quality Standard System

Establishing and improving seed-quality monitoring while setting up special seed management departments to ensure that seed inspection works perfectly. It also requires to improve the technical level of seed-quality testing standards, mainly to ensure the purity and varietal integrity of seeds while promoting the application of DNA molecular marker technology and protein gel electrophoresis technology. Similarly, there is a need to pay attention to crop seed DNA and protein testing, and establishing the corresponding seed database; improving the quality of management personnel, and regularly organizing relevant management personnel to participate in training and assessment to enhance the level of seed management. [

59]. By building a standardized system for cotton production, implementing standardized primary processing and improving cotton quality standards and cotton seed monitoring system, we can solve the problem of mixed heterogeneous fibers in Xinjiang cotton from the source and improve the core competitiveness of Xinjiang cotton. Another aspect relates to guiding cotton farmers to participate in cotton quality production process and raising their awareness on quality production and safety through training by cooperatives and agricultural technology companies.

4.3.3. Reducing the Cost of Cotton Production

Sustainable production of cotton requires establishing a long-term mechanism to develop machine-picked cotton and providing subsidy like being applied to the current food standards, thus encouraging cotton farmers to produce better lint and seed cotton through subsidized inputs [

60]. Developing preferential support policies in finance, credit, insurance, taxation, and comprehensive subsidies for agricultural production materials to vigorously support cotton production in Xinjiang are also needed to reduce production costs. At the same time, with the railway department to maintain timely communication and coordination, from October of each year to February of the following year, the peak period of cotton in Xinjiang, increasing the number of empty wagons in Xinjiang for special cotton transport to achieve efficient docking of cotton production and consumption can be pivotal for development of cotton economy.

4.3.4. Construction of Cotton Risk-Protection System

Natural climatic conditions in Xinjiang are harsh and natural disasters are frequent, directly causing losses in cotton production and reduced income for cotton farmers. Therefore, a comprehensive agricultural insurance mechanism for cotton production was established to guarantee the sustainable development of the cotton industry in Xinjiang [

61]. At the same time, the dramatic price fluctuations of cotton also seriously restrict the development of the cotton industry in Xinjiang. Combined with the current implementation of the “insurance + futures” pilot work in Xinjiang cotton, the future of the cotton industry in Xinjiang in response to natural risks and market risks, the establishment of early warning mechanisms to protect cotton farmers’ income is the key to the sustainable, healthy, and stable development of the cotton industry in Xinjiang [

62], relying on cooperative finance, withdrawing catastrophe risk funds, and adopting mutual assistance of farmers to cope with production risks.

4.4. Limitations of the Study and Future Research

Recommendations for future research include, first, that additional data encompassing a larger region and covering multiple years would enhance the representativeness of the findings. Second, the study would include more variables to analyze the impact on agricultural output value (cost, policy, modern technology, etc.). Third, future research should include an in-depth analysis of the influence of cotton production in Xinjiang on China and the world cotton market. Nonetheless, despite the foregoing recommendations for future research, the present analysis is a solid contribution to the impact of cotton production on the agricultural output value in Xinjiang, China.