1. Introduction

The Kingdom of Saudi Arabia (KSA) is the largest country in the Arabian Peninsula and is the 13th largest in the world. As of 2015, the Kingdom had a population of approximately 31,540,000—the highest among the Gulf Cooperation Council (GCC) countries [

1,

2]. Located between the Persian Gulf and the Red Sea, Saudi Arabia is also one of the largest arid countries without any permanent rivers or lakes. While the global average renewable water resource per capita per year is 6000 m

3, Saudi Arabia has only 84.8 m

3/(capita∙a) [

3]. In spite of the water scarcity, Saudi Arabia has the third highest water consumption per capita at 250 L/(capita∙d) [

3]. This is only behind the United States and Canada. The country’s water demand is expected to increase by 56% by 2035. Meanwhile, at the current rate of water withdrawal, ground water aquifers are expected to provide potable water only for the next 10–30 years [

4].

To augment the fresh water resources, Saudi Arabia relies on seawater desalination, particularly to meet the municipal and industrial water demands. In 2010, 58% of the country’s total water demand was met through non-renewable ground water resources, 33.5% by surface water and renewable ground water, 6% by desalinated water and 2.2% by waste water reuse [

5]. In 2014, desalinated water is estimated to have met 60% of KSA’s municipal water demand [

6]. By the end of 2015, Saudi Arabia accounted for 15% of the global installed desalination capacity [

5]. With the diminishing of fresh water resources, seawater desalination is expected to play a pivotal role in meeting Saudi Arabia’s future water demands. However, desalination is an energy intensive process compared to traditional water treatment methods. Saudi Arabia is reported to use 25% of the domestic oil and gas production in desalination plants and the share is expected to increase to 50% by 2030 [

7]. A report by General Electric (GE) suggests that Saudi Arabia requires 300,000 barrels of oil per day for the desalination plants on the country’s Eastern and Western coasts [

8].

Saudi Arabia has 1/5th of the world’s proven oil reserves and is the largest producer and exporter of petroleum products [

9]. In addition, KSA is the 9th largest exporter of natural gas [

9]. Saudi Arabia’s economy is based on oil revenues and during the time period 2010–2013, oil revenues contributed up to 91% of the country’s national income [

10]. This is reflected in the recent low oil prices and the resulting slower growth of the Saudi economy. Al Bassam [

10] explains that although the government has had plans to diversify the economy and decouple economic growth from oil, there has in fact been an increase in dependence on oil revenues over the last few years. In addition to the low oil prices, growing concern is the share of local fossil fuel reserves, driven by increasing income and population, being used to meet the country’s energy demand. According to the King Abdullah City for Atomic and Renewable Energy (KACARE) [

11], the country’s demand for fossil fuels is expected to grow from 3.8 million barrels of oil equivalent in 2010 to 8.3 million barrels of oil equivalent in 2028. Moser et al. [

12] suggests that at the current rate of consumption, Saudi Arabia could become an oil importer by 2030. By 2015, Saudi Arabia’s power plants capacities were almost equally separated into oil-based thermal power plants and gas-based power plants [

13].

Economic reforms have been discussed in the past but it is only recently that reforms have been discussed with haste. A report in the Guardian [

14] suggests that swift actions were triggered by the 100 billion € deficit the Saudi government incurred in 2015. Consequently, in April 2016, King Salman bin Abdulaziz presented details of the Saudi vision 2030 plan and heralded a Saudi future without oil [

14]. A key component of the new vision is the growth of Saudi Arabia’s renewable energy sector for both power and water desalination. It is planned to have 9.5 GW of renewable capacity by 2023, as an initial stage to meet the country’s increasing energy demands [

15]. According to a recent article [

16], the Saudi Energy Minister has discussed the Kingdom’s visions to push installed renewable energy (RE) capacities higher to 10 GW by 2023.

In spite of the country’s wealth of solar and wind resources, Saudi Arabia had only 83 MW of renewable power plants, all solar photovoltaic installations, by early 2015 [

13].

Figure 1 presents the total installed capacities, by the beginning of 2015, in Saudi Arabia and illustrates the almost complete reliance on oil and gas in the current power sector [

13]. The country lies within the sunbelt region of the world and the average population weighted global horizontal irradiation is estimated to be 2158 kWh/(m

2∙a) [

17,

18]. According to Yamada [

19], the potential for solar energy in Saudi Arabia is finally being acknowledged with the Saudi government referring to solar energy as ‘yellow oil’. The recent bids for 300 MW of solar PV in Saudi Arabia is set to end with an electricity production cost as low as 1.78 USD cents/kWh—the lowest bid to date [

20]. With 7 out of the 8 bids placed for the 300 MW installation being less than 3 USD cents/kWh, the new threshold for large scale projects in the MENA region is being discussed to be as little as 3 USD cents/kWh [

21]. Further to these developments, the Saudi Public Investment Fund together with the SoftBank Vision Fund, has confirmed the construction of a 3 GW solar and storage project in 2018 [

22]. This would enable to meet one-third of Saudi Arabia’s renewable energy capacity of 9.5 GW by 2023.

Table 1 illustrates the energy consumption of the most prevalent desalination technologies in Saudi Arabia [

23]. In the past, Saudi Arabia has relied on thermal desalination technologies. However, due to the lower energy consumption and improvement in technology, reverse osmosis is expected to dominate the Saudi market in the future [

5].

In Caldera et al. [

24], it was shown that the global water demand of 2030 can be met by seawater reverse osmosis (SWRO) plants powered by 100% hybrid renewable energy power plants at a cost level competitive with that of fossil powered SWRO plants today. This system eliminates the reliance of SWRO desalination plants on non-renewable fossil fuels and concerns about greenhouse gas emissions. Meanwhile, reflecting the Saudi government’s vision of high renewable energy capacities, there is recent literature that discusses the 100% renewable energy transition of different countries and regions [

25,

26,

27,

28,

29,

30,

31,

32], as well as detailed visualization of respective electricity systems [

33].

In this paper, motivated by the growing demand for seawater desalination in Saudi Arabia and transition towards 100% renewable energy power systems, we pose the following research question: What are the impacts on Saudi Arabia’s electricity and water production costs when the seawater desalination demand is integrated into the country’s 100% renewable energy (RE)-based power sector? The energy transition pathway, for Saudi Arabia, from the current fossil-based power system to a 100% RE-based system is first found. Then, the seawater desalination demand is integrated into the power system, to understand the impacts on the cost of the power and water sectors. The excess heat present in the energy system is utilized for the thermal desalination plants during the transition

In addition, the transition accounts for the non-energetic industrial gas demand of Saudi Arabia. During the transition, the non-energy demand for natural gas by the Saudi industry is increasingly met through synthetic natural gas production (SNG). Power to gas plants (PtG) are used to produce SNG from renewable electricity generation [

34,

35] and integrated into the power system. During the production of the SNG, there may be excess heat produced that can contribute to the operation of thermal desalination plants.

Thus, the results will present an optimal transition path for Saudi Arabia to manage the country’s future electricity, water and gas demands through a 100% RE system.

3. Results

The following two scenarios are simulated by the model:

1. Non-integrated scenario

In this scenario, the model determines the optimal transition pathway for Saudi Arabia’s power sector, discussed in

Section 2.3, and the power plant capacities required for seawater desalination demand, discussed in

Section 2.4. The gas sector is integrated with the power sector throughout from 2015 to 2050. Thus, the sum of the power plant capacities required for the three sectors present the total power capacities required to meet KSA’s power, water and gas demands in the energy transition.

2. Integrated scenario

In this scenario, the seawater desalination demand and the gas demand are integrated into Saudi Arabia’s power sector, throughout the transition from the fossil-based power system in 2015 up to a 100% renewable energy-based system in 2050. The desalination plants, integrated into the power system, will allow for the optimal use of the hourly energy produced by the renewable energy power plants. The excess energy produced by the renewable energy power plants can be stored as desalinated water and, at times of low energy production, the stored water can be used. Thus, the desalination plants offer additional flexibility to the energy system.

The model determines the power capacities required for the integrated scenario and the two scenarios are compared to understand the impacts of the integrated desalination plants. The integration of the gas sector with the power sector in both scenarios, enables to identify the integration benefits, if any, of the desalination plants only.

In the following sections, the technical and financial results of the energy transition for the integrated scenario are presented. The financial results are ultimately compared with that of the non-integrated scenario to learn the impacts of integrated seawater desalination plants.

3.1. Integrated Scenario—Power Sector

Figure 7a presents the installed capacities of the different types of power plants required for the energy transition from 2015 up to 2050. The colors from top to bottom in the legend are shown from bottom to top in the figure. In 2015, the total power capacity was 66.4 GW, out of which 32.9 GW were internal combustion engines and 33 GW were gas turbines. The model is restricted from installing more fossil fuels thermal power plants after 2015 and can only install renewable technologies to meet the growing electricity demand. However, power-to-gas-based gas turbines are not restricted. Internal combustion generators are eliminated from the system by 2040 after exceeding their technical lifetime. Thermal power plants running on natural gas are also eliminated from the system by 2040. Power-to-gas-based electrolyser and methanation plants are used to produce synthetic natural gas (SNG) that is then used as fuel for existing open cycle gas turbines (OCGT) or combine cycle gas turbines (CCGT). The total capacity of all plants required by 2050 is about 600 GW. PV single-axis tracking accounts for 377 GW and wind power plants account for 83 GW of the 600 GW required by 2050.

Figure 7b presents the electricity production of the different power plant categories. After 2030, electricity production from wind power plants remain constant at 217 TWh. The installed capacities of PV single-axis tracking continue to grow and start to dominate the Saudi power sector. By 2050, PV single-axis tacking contributes 922 TWh out of the total annual electricity generation of 1163 TWh, representing 79%. CSP plants for electricity generation are added from 2030 onwards but, by 2050, only account for 0.6% of the total electricity generation share. This is attributed to the higher costs of CSP for electricity generation compared to solar PV, based on the technical and financial assumptions in

Appendix A (

Table A1).

Figure 7b also illustrates the diminishing use of fossil oil and gas in the energy system. The power capacities required for the energy transition can be found in the

Appendix A (

Table A4).

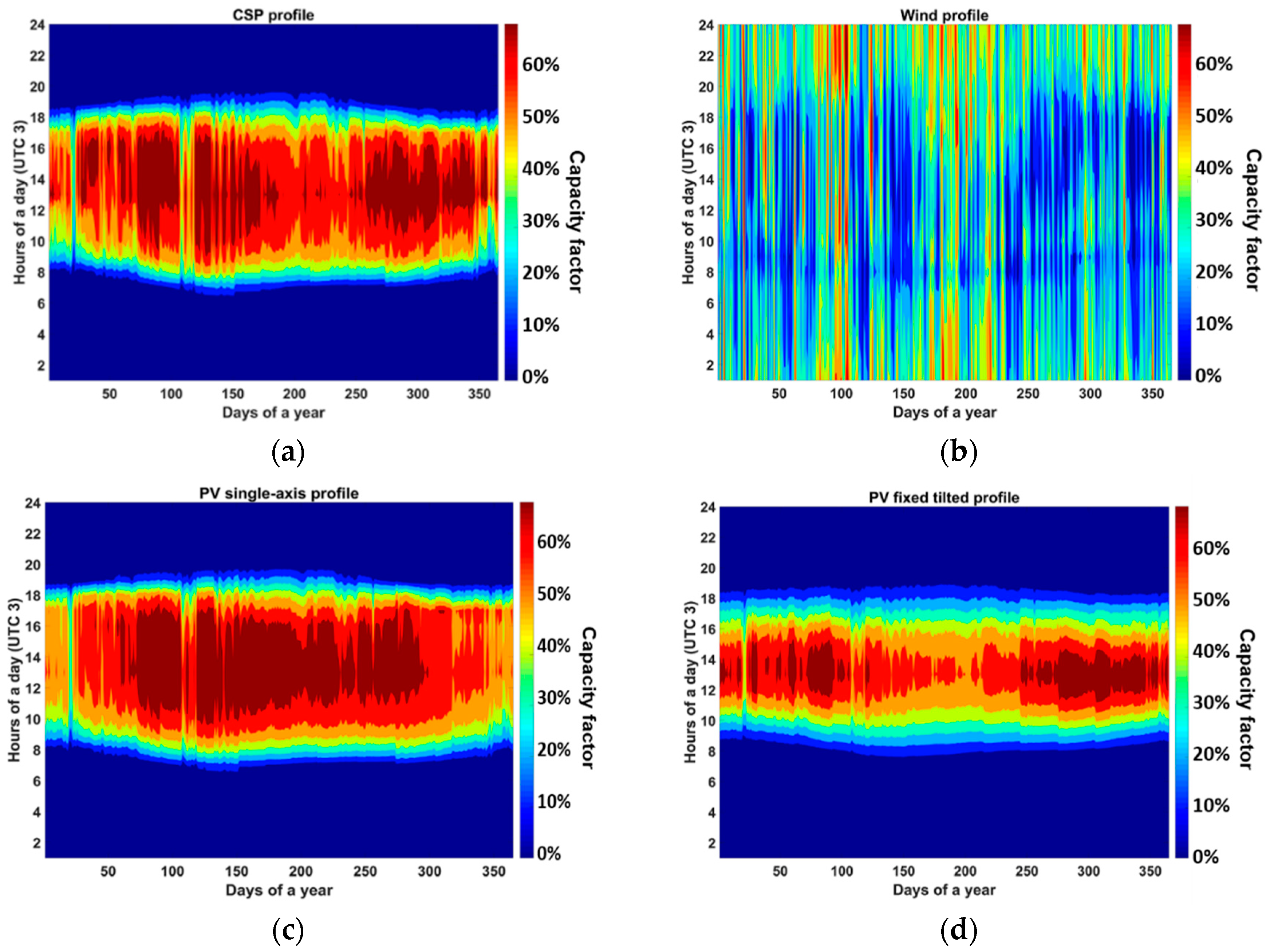

Figure 8a illustrates the full load hours (FLH) of the different power plants utilized by the model. The FLH of PV single-axis tracking, PV fixed tilted and wind onshore plants are constant at 2443, 1830 and 2618 h. The model determines the optimal FLH and the capacities of the power plants. The FLH of the internal combustion generator rapidly diminishes from 4625 to almost none by 2020. The high cost of oil renders the existing oil powered thermal power plants too expensive to run, since world market prices are taken into account to avoid subsidies for the energy system. In addition, the FLH of the OCGT reduces from 4756 FLH to zero FLH by 2030. The lower cost of the natural gas, in contrast to oil, still enables natural gas powered CCGT plants to be cost effective. However, after 2040, as shown in

Figure 7b, there is no more contribution from natural gas powered thermal plants. The remaining CCGT plants are used with SNG to store and produce electricity as required in the Saudi power system.

Figure 8b represents the additional capacities of different power plants necessary to meet the growing electricity demand and to replace the fossil-based thermal power plants that are being phased out. Initially, there are more wind power plant installations than PV power plants. However, after 2030, the installation of wind power plants cease and PV single-axis tracking start to dominate the power sector. Methanation units are added for the first time in 2035, with additional capacities added until 2050, to meet the gas demands of the energy system and industrial gas demand through SNG.

Figure 9a represents the additionally installed storage capacities for every 5 years period. The large capacity of gas storage is required in 2045, and thereafter, less additional storage is required.

Figure 9b represents the ratio of the total storage output for every time period. By 2025, electricity storage systems come into effect as it becomes a more cost effective option to balance the power system than the use of fossil powered thermal plants. By 2050, batteries provide a total output of about 413 TWh

el which accounts for about 41% of the total electricity demand and about 58% of the direct electricity supply.

The total levelised cost of electricity of the system is the sum of the levelised cost of primary electricty generation (LCOE primary), levelised cost of storage (LCOS), levelised cost of curtailment (LCOC), fuel cost and the carbondioxide emission cost (CO

2 cost).

Figure 10a represents the contribution of the different components to the total LCOE from 2015 to 2050. In 2015, the fuel cost accounts for the largest contribution due to the fuel prices of 52.50 €/MWh

th for oil and 21.8 €/MWh

th for gas. As the FLH of the fossil powered thermal plants decrease, as illustrated in

Figure 8a, the fossil fuel consumption and consequently the contribution to the LCOE decreases. The OCGT storage and CCGT storage plants in

Figure 8a refer to the gas plants utilising SNG.

The LCOC is as a result of curtailment of the excess energy produced by the renewable energy power plants. The remaining thermal power plants contribute to the CO

2 emissions cost. The batteries and gas storage contribute to the LCOS of the power system. The figure illustrates that with the transition to renewable power plants and the phasing out of the thermal powered plants, the total LCOE of the system decreases. By 2050, the LCOE is estimated to be about 41 €/MWh as opposed to 139 €/MWh in 2015.

Figure 10b separates the LCOE primary and LCOS to the individual components and presents the specific contributions towards the LCOE. The rapid drop in LCOE from 2015 to 2020 is due to the phasing out of unsubsidized expensive oil power plants. This eliminates the large fuel cost that contribute towards the LCOE cost in 2015, as shown in

Figure 10a,b. In 2020, the oil power plants are substituted by more economical solar PV and gas plants. By 2050, the largest contributors to the cost will be the PV single-axis tracking and battery plants. The contribution of wind decreases after 2030, due to no more wind plant installations and a highly competitive combination of hybrid PV-battery plants, as already found by Afanasyeva et al. for the case of Morocco [

65]. However, there is still a substantial contribution from wind to the LCOE in 2050 due to the large installed capacities of wind power plants in 2030.

Figure 10c presents the relative contribution of the different components to the LCOE. It can be seen that over time, the LCOE primary increasing accounts for the final LCOE. The relative contribution of the fossil fuel cost, and therefore also the CO

2 emission costs, disappear. From 2030 onwards, the relative contribution of the storage increases and ultimately by 2050, the LCOS and LCOE primary have almost equal contributions to the LCOE. This is also reflected in

Figure 10d.

Figure 10c presents the relative contribution of the financial components to the LCOE. In 2015, the fossil fuel costs determine the LCOE. As the fossil fuel usage diminishes, the total capex of the power system is the largest relative contributor to the LCOE. From 2040 onwards, when there is a 100% renewable energy system, the capex of the system contributes up to 75% of the LCOE. The fixed opex of the energy system components mostly account for the remainder of the LCOE.

Figure 11 illustrates the annual CO

2 emissions during the energy transition illustrated in the previous figures. The annual CO

2 emissions are reduced from about 250 Mton/a to 0 by 2040. The red line diagram represents the ratio of CO

2 emitted for every kWh of electricity produced. In 2015, this value is at about 800 g of CO

2 per kWh and drops to 0 by 2040. The CO

2 emission calculations are explained in [

65].

Figure 12 provides an overview of the gas sector after integration with the power sector.

Figure 12a shows how the levelised cost of gas (LCOG) varies over time, while the non-energetic industrial gas demand increases. The LCOG increases from 23 €/MWh

th in 2015 to 95 €/MWh

th in 2045. After 2045, the LCOG decreases and by 2050, the LCOG is 90 €/MWh

th. There is a steep increase in the LCOG from 2030 to 2035. This due to the production of SNG in 2035, as shown by

Figure 12b. By 2040, the gas utilized in the system is fully renewable SNG.

3.2. Integrated Scenario—Desalination Sector

Figure 13 illustrates the growth of the Saudi Arabian desalination sector assumed in the model. The difference between the total water demand and the installed desalination capacity is met by renewable water sources and non-renewable groundwater sources. As explained in

Section 2.4, the desalination demand increases to meet the growing total water demand and is met through SWRO and MED stand alone plants. The model optimizes the installed capacities of SWRO and MED depending on the electricity costs and availability of heat in the system.

The MSF and MED cogeneration plants are phased out based on the lifetime of the plants. By 2050, it is expected that there is a total water demand of 112 million m

3/day and SWRO plants meet 52% of the total water demand. MED stand alone provides less than 1% of the total water demand. This is due to the lower excess heat available in the system. In addition, water storage is found to vary daily after 2020.

Figure 14 illustrates the variation in water storage for the year 2030. Thus, the water storage acts a daily or seasonal storage optimizing the operation of the desalination plants. With the increase in SWRO desalination capacity there is an increase in water storage capacity.

Figure 15a presents the capex breakdown of the desalination plant capacities installed for the 5 year intervals. The contribution of water transportation increases as the installed desalination capacities increase. By 2050, the transportation infrastructure is the largest contributor to the capex. The total capex required for the period from 2015 up to 2050 for the desalination sector is 1125 b€.

Figure 15b presents the variation in the annual fixed opex of the desalination capacities. With the increase in desalination capacities, the fixed opex increases. The fixed opex excludes the electricity consumption of the desalination plants and water transportation infrastructure.

Figure 15c represents the variation in the annual variable opex. The annual variable opex accounts for both the gas and electricity consumption of the desalination plants. In 2015, due to the electricity produced by the cogeneration plants, there is no resulting electricity costs—the variable cost is finally the gas cost. The increase in the electricity cost maybe explained by the considerable increase in installed SWRO capacities with time and the variation in energy efficiency of the plants. There is only a minimal gas cost for existing cogeneration plants. SWRO and MED stand-alone plants utilize electrical energy and heat from the energy system as required.

Finally,

Figure 15d illustrates the contribution of the different aspects of the desalination system to the final LCOW for every time period. The LCOW of the final system decreases from 3.29 €/m

3 in 2015, assuming non subsidized oil and gas prices, to 0.66 €/m

3 in 2050. The costs reduction is mainly due to the elimination of gas consumption and decrease in electricity costs, but also in an increase in the efficiency of RO and MED desalination plants in the decades to come.

Table 10 shows the energy consumption of the different desalination technologies during the transition. The total electricity consumption of the SWRO plants increase due to the high installed capacities. The MSF and MED cogeneration plants only produce water up to 2030 and then are decommissioned due to end of lifetime. The MED stand alone plants continue to produce water but at lower volumes than in 2015. This is because of the low availability of heat in the energy system.

Table A4, in the

Appendix, summarises the key power capacities determined for the energy transition pathway for KSA from 2015 to 2050.

3.3. Comparison of the Integrated and Non-Integrated Scenarios

As discussed in

Section 3, the model was run for a non-integrated scenario where the power capacities to meet the electricity demand and the desalinated water sector are found separately. To compare the integrated and non-integrated scenarios, the annual levelised cost for both scenarios from 2020 to 2050 was found. This is represented in

Figure 16a. The annual levelised cost for the non-integrated scenario is higher than that for the integrated scenario. It is found that the approximate percentage benefit of the integrated scenario is between 1% and 3%, as a consequence of increased flexibility to the integrated energy system.

Figure 16b illustrates the curtailment of electricity for the two scenarios, for the time period from 2015 to 2050. The bars represent the value of the energy curtailed and the dashed lines represent the ratio of the curtailed energy to the total generated electricity. It can be seen that there is more curtailed energy in the integrated scenario. However, the ratio of the curtailed energy to the total electricity generated is lower in the integrated scenario. This can be attributed to the increased flexibility provided by the desalination plants and therefore better utilization of the hourly produced renewable energy, hence the integrated energy system can be run in a more efficient way than the separated systems.

It has to be mentioned that in the integrated scenario, for the total time period of 2015 to 2050, the power-to-gas (PtG) electrolyser capacity is reduced by 1%, compared to the separated scenario. For the integrated scenario, the PtG electrolyser capacity was estimated to be 73.6 GWe, respectively. For the non-integrated scenario, the corresponding values was estimated to be 75.4 GWe.

4. Discussion

The results show how the integration of seawater desalination with power and gas sectors contribute to the least cost transition path to achieving a 100% renewable energy sector in Saudi Arabia before the proposed year 2050.

Figure 7b illustrates that this milestone is feasible for Saudi Arabia by 2040. By 2040, PV single-axis tracking and wind power plants will dominate the Saudi power sector with 243 GW of the former and 83 GW of the latter. However, by 2050, due to the steeper decrease in the PV single-axis tracking and battery capex than the wind onshore plants, as presented in

Figure 4c, it is more economical to have PV single-axis tracking as the dominant energy source in the power sector of Saudi Arabia. By 2050, about 377 GW of PV single-axis tracking are required while the capacities of wind power plants remain at 83 GW. Thus, there are no further installations in wind power plants after 2030. This result documents the outstanding impact of low cost solar PV supported by low cost battery storage that lead to a solar PV electricity generation share of 79%, which is significantly higher than the average of about 40% found in the global average assumptions for the year 2030 [

25], but also higher than the 48% solar PV share for the MENA region [

66]. However, comparable results had been found already earlier for the case of Israel [

30], where the solar PV share had be found for cost optimized systems to about 90% of the total electricity supply. It has to be noted that Israel has less good wind conditions as in Saudi Arabia, and [

30] was done for assumptions about the year 2030. Breyer et al. [

41] discuss the significant role of solar photovoltaics, estimated to have an electricity generation share of 69% by 2050, in the global energy transition. The low cost for solar PV and battery storage can be explained by the standard experience curves in

Figure 4 [

67,

68,

69].

With the phasing out of fossil fueled thermal power plants, battery storage comes into play by 2025. By this time period, about 22% of the energy generation share is accounted for by fossil fueled thermal power plants. As the electricity demand increases and the share of renewables in the system increases, the battery storage required continues to increase. By 2050, batteries provide a total output of about 329 TWhel accounting for approximately 40% of the total electricity demand. For a 100% RE scenario by 2040, the required battery storage output is 203 TWhel accounting for approximately 32% of the total electricity demand. Between, 2025 and 2050, the battery full charge cycles required are between 300 and 330 cycles a year, indicating the almost daily usage of the battery capacity.

PtG plants come into effect in 2035 with 12 GW

el of input capacity and increases to 73 GW

el by 2050. Similarly, the FLH of the PtG plants increase from about 4313 h in 2035 to 4900 h by 2050. However, the gas storage output contributes about 2.3% towards the total electricity demand by 2050, significantly less than the 40% of batteries. The PtG plants also produce the SNG required to meet the industrial gas demand, as highlighted in

Figure 12a.

The LCOE of the energy system is dominated by the high fuel cost in 2015. However, with the phasing out of the fossil powered thermal plants and the decreased consumption of fossil fuel, the LCOE of the energy system reduces from 139 €/MWhel in 2015 to 43 €/MWhel in 2040 and further to 41 €/MWhel in 2050.

Figure 10c illustrates that by 2020 onwards, the dominating contributor to the LCOE is the LCOE

primary. With the increase in storage capacities, both the LCOE

primary and LCOS are the largest contributors to the system LCOE.

Figure 9d further shows that by 2050, the largest contributors are PV single-axis tracking and battery storage. However, by 2040, there is still a significant contribution by the existing wind power plants to the LCOE. This is in spite of the fact that new installations of wind power plants cease after 2030, due to the arising competitiveness of hybrid PV-battery plants.

Figure 13 presents the increasing desalination demand in the Kingdom of Saudi Arabia and the desalination capacities installed to meet the total water demand. The difference between the total water demand and desalination capacity is to be met through renewable water resources and some non-renewable ground water resources. SWRO and MED stand alone desalination plant capacities are optimized to meet the increasing desalination demand. The heat demand of the MED stand alone plants are met through the energy system. The existing MSF cogeneration and stand alone plants are phased out by 2035. After 2015, MSF stand alone plants are not allowed in the model due to the high thermal energy consumption. Similarly, MSF and MED cogeneration plants are not modelled due to the need for fossil powered gas plants. In an integrated scenario, the desalination capacities are used to better utilize the hourly renewable energy production of the power system.

Figure 15 presents the variation in the average LCOW from 3.3 €/m

3 in 2015 to 0.66 €/m

3 in 2050.

The reduction in the LCOE of the system, contributes to the rapid decrease of the LCOW. The electricity costs for the desalination sector includes the energy consumption for water production at the desalination plant and transportation of water (vertical and horizontal transportation) to the demand site. By 2050, the transportation costs is the highest contributor to the LCOW followed by the desalination costs. Due to the low availability of heat losses in the system, there is a dominance of SWRO desalination plants which utilize no thermal energy.

To understand the impacts of integrating the desalination and power sectors in KSA, the LUT energy systems model was used to analyse both an integrated and non-integrated scenario. Thus, for the non-integrated scenario, the same desalination capacities are required, but they are not used to increase the flexibility of the power system.

Figure 16a illustrates that the annualized levelised cost of the non-integrated scenario is higher than that of the integrated scenario for all time periods from 2020 to 2050. In fact, it is found that between 2040 and 2050, this reduction is between 1% and 3%, representing an annual cost decrease between 0.5 and 1.6 bn€. The lower cost is attributed to the reduced amounts of electricity storage, in the form of power-to-gas, required in the integrated scenario.

Figure 16b highlights the lower curtailed energy ratio in the integrated scenario and the better utilization of the hourly renewable energy production.

Therefore, the above work presents a pathway for Saudi Arabia to transition to a 100% renewable energy power sector and shows that the integration of the country’s power and desalination sectors provides the least cost solution for both sectors.

It may be argued that the current electricity production costs in Saudi Arabia are lower than what this research presents for 2015. However, the artificially low fossil fuel prices in Saudi Arabia are a result of the high subsidies which, according to Al-Iriani et al. [

70], account for 10% of the country’s GDP. As the energy consumption increases, the economic price the country has to pay increases. This is due to the heavily subsidized fuel prices that result in economic losses in the form of opportunity costs, since the export value of fuel would be much higher than the subsidized domestic consumption. With the decrease in oil prices and resulting revenue, as well as concerns about availability of fossil fuel resources to meet the country’s growing energy demand, Saudi Arabia has started the transition to less or no subsidies. Thus, our work offers a solution for Saudi Arabia to meet its growing energy demands through renewable energy, without hindering the future economic growth of the country. In addition, as demonstrated in this work, KSA can meet its own industrial gas demands by exploiting the country’s wealth of solar and wind resources.

This research also addresses how Saudi Arabia can meet the country’s growing water demand through the use of 100% renewable energy powered SWRO desalination plants. The average LCOW of KSA is found to be 0.66 €/m

3 by 2050. This includes the cost for water desalination, water transportation to the demand site and water storage. Fthenakis et al. [

71] estimated the current LCOW of a 190,000 m

3/day SWRO plant, located in Al-Khajfi, on the east coast of KSA, powered by fixed-tilted PV to be 0.70 €/m

3. Current water production costs of fossil powered SWRO plants in KSA lie between 0.65 €/m

3–1.90 €/m

3 [

36]. However, this excludes the cost of transporting the desalinated water to the demand site and water storage.

There is a fast growing number of publications on 100% renewable energy-based energy systems [

72], which helps to overcome the past concern that such systems would be neither technically feasible nor economically viable. This research on the case of Saudi Arabia is another confirmation of the high competitiveness of 100% RE systems. Recently Clack et al. [

73] claimed that fossil-CCS and nuclear should be part of an energy system solution, which attracted stark criticism by Jacobson et al. [

74]. One of the motivations for the critique was the fact that no single one of the about 60 existing articles on 100% RE systems had been mentioned in [

73]. This reveals an imbalanced literature basement of the authors. Recent publications of IPCC researchers [

75,

76] also emphasize the substantial shares of renewable energy, and in particular on solar PV. Breyer et al. [

41], recently presented an energy transition scenario for the world structured in 145 regions and simulated in full hourly resolution for the period 2015 to 2050 in 5 years steps. The research showed that 100% RE in the power system is possible, for lower global averaged cost than for the energy system of the year 2015. The energy transition has been further investigated by Ram et al. [

77] who show that the transition also implies zero greenhouse gas emissions and a drastic increase in jobs in the power sector.

5. Conclusions

There is growing interest in the energy transition towards a 100% renewable energy-based power system in many countries and regions. Meanwhile, as the global renewable freshwater resource diminishes, seawater reverse osmosis desalination is expected to play a key role in securing future water supplies.

Saudi Arabia is the world’s largest producer of crude oil and the 11th largest consumer. Economic growth of the country is tied closely to oil prices. To secure the country’s economy, the government recently heralded a future without oil. The new vision calls for increase in renewable energy capacities and at least 9 GW of installed RE capacity by 2023. Saudi Arabia is also the largest producer of desalinated water in the world and desalination will remain vital to the country’s future water supply.

The purpose of this research is to analyse the impact of integrating the large desalination demand into the country‘s 100% RE-based power system by 2050. The power sector is integrated with the non-energy industrial gas sector of Saudi Arabia. Thus, RE is used to produce SNG to satiate the industrial gas demands. The increasing desalination demand is met through SWRO and MED stand alone plants.

It is found that the integration of the power, gas sector and the desalinated water sector, allows for a reduction of 1–3% of the levelised annual costs, in comparison to the non-integrated scenario. The LCOE and LCOW for Saudi Arabia by 2050, in the integrated scenario, is estimated to be 41 €/MWh and 0.66 €/m3, respectively. By 2050, PV single-axis tracking dominates the power sector in Saudi Arabia with about 79% of total generated electricity due to the further reduction in capex of solar PV and supporting battery technology over wind power plants. In addition, SWRO plants produce most of the desalinated water required. MED stand alone plants contribute when there is sufficient heat available in the energy system. In future research, it is planned to integrate the heat sector into the model. This may lead to more free heat in the energy system resulting in an increase in the MED capacities installed. In the presence of cheap heat source, MED is favourable to SWRO due to its lower electricity consumption.

Thus, the results present a least cost transition path for Saudi Arabia to meet the country’s future electricity and water demands through a 100% RE system.

However, there are gaps in the research methodology and data for Saudi Arabia that could be summarised as below:

Better understanding of the potential for geothermal and CSP heat use for MED desalination in Saudi Arabia.

No well-defined learning curve for SWRO desalination plants: This makes it difficult to project the future SWRO costs.

By filling in the gaps in our research, we can further refine our results and provide the optimal transition pathway for Saudi Arabia to finally start the country’s future without oil. By capitalising on the country’s excellent solar and wind resources through the implementation of renewable energy, Saudi Arabia can indeed meet the country’s future electricity, water and gas demands in a lucrative manner.