Challenges of Commercial Aquaponics in Europe: Beyond the Hype

Abstract

:1. Introduction

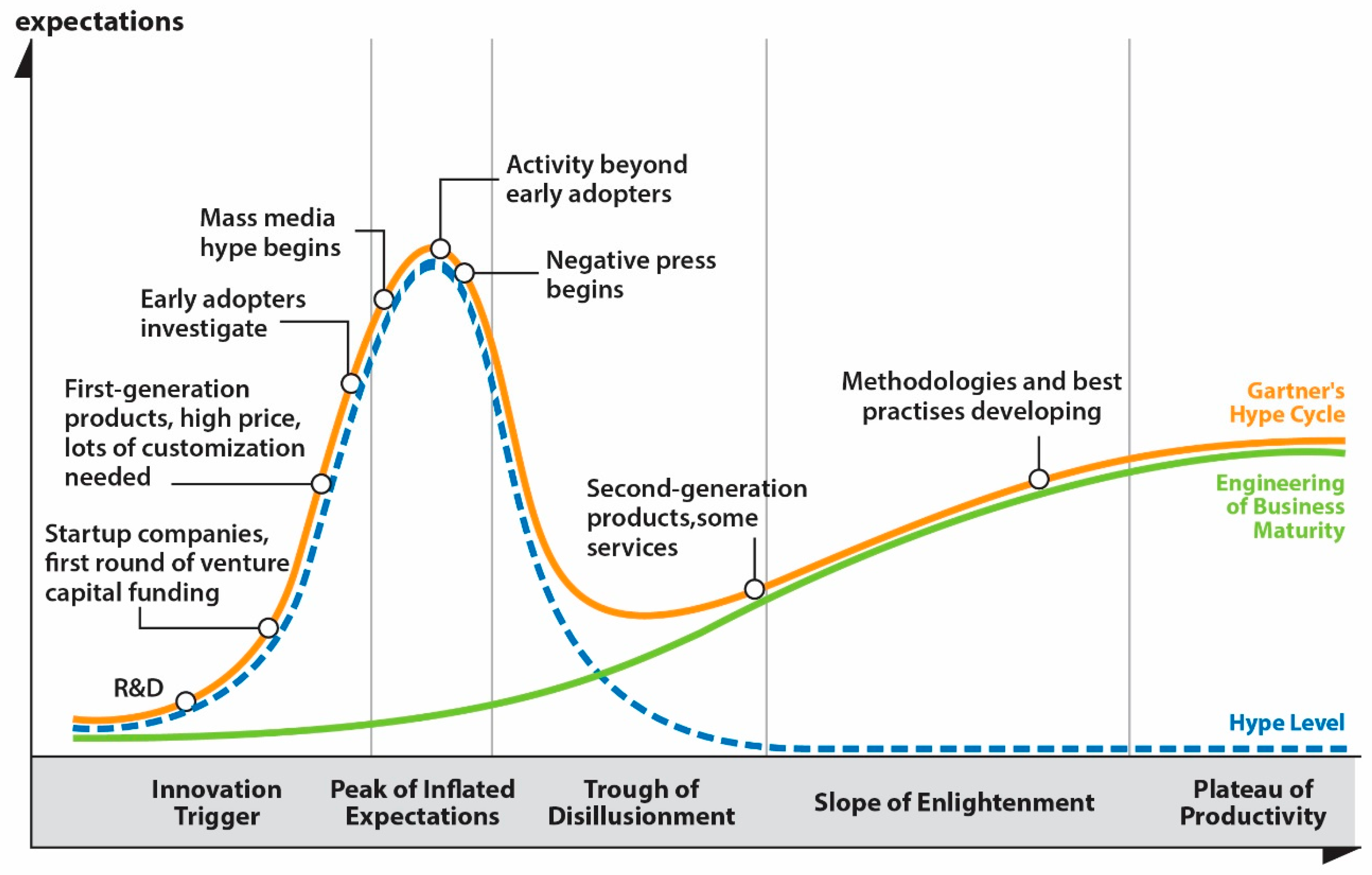

1.1. Adopting Commercial Aquaponics: Mere Hype or Hype Cycle?

1.2. Purpose of Our Study

2. Materials and Methods

3. Results and Discussion

3.1. Demographics, Background, and Organisation

3.2. Type of Funding and Revenues

3.3. Initial Drivers and Intentions

3.4. “Inflated” Perceptions and Optimism for the Future

3.5. Challenges Encountered

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Lewis, W.M.; Yopp, J.H.; Schramm, H.L., Jr.; Brandenburg, A.M. Use of hydroponics to maintain quality of recirculated water in a fish culture system. Trans. Am. Fish. Soc. 1978, 107, 92–99. [Google Scholar] [CrossRef] [Green Version]

- Naegel, L.C.A. Combined production of fish and plants in recirculating water. Aquaculture 1977, 10, 17–24. [Google Scholar] [CrossRef]

- Love, D.C.; Fry, J.P.; Li, X.; Hill, E.S.; Genello, L.; Semmens, K.; Thompson, R.E. Commercial aquaponics production and profitability: Findings from an international survey. Aquaculture 2015, 435, 67–74. [Google Scholar] [CrossRef] [Green Version]

- Buehler, D.; Junge, R. Global Trends and current status of Commercial Urban Rooftop Farming. Sustainability 2016, 8, 1108. [Google Scholar] [CrossRef] [Green Version]

- Bailey, D.S.; Rakocy, J.E.; Cole, W.M.; Shultz, K.A. Economic analysis of a commercial-scale aquaponic system for the production of tilapia and lettuce. In Proceedings of the Fourth International Symposium on Tilapia in Aquaculture, Orlando, FL, USA, 9–12 November 1997; Fitzsimmons, K., Ed.; Northeast Regional Agricultural Engineering Service: Ithaca, NY, USA, 1997. [Google Scholar]

- Rakocy, J.E.; Bailey, D.S.; Cole, W.M.; Shultz, C.A. Evaluation of an aquaponic system for the production of red tilapia and leaf lettuce. In Proceedings of the Fourth International Symposium on Tilapia in Aquaculture, Orlando, FL, USA, 9–12 November 1997; Northeast Regional Agricultural Engineering Service: Ithaca, NY, USA, 1997. [Google Scholar]

- Savidov, N.; Brooks, A. Evaluation and Development of Aquaponics Production and Product Market Capabilities in Alberta. Crop Diversification Centre South; Food and Rural Development: Alberta, AB, Canada, 2004; Available online: http://wptest.backyardmagazines.com/wp-content/uploads/2009/08/Evaluation-and-Development-of-Aquaponics-Production-and-Product-Market-Capabilities-in-Alberta.pdf (accessed on 8 September 2018).

- IndustryArc. Aquaponics Market by Equipment (Grow Lights, Pumps, Valves, Greenhouse, Water heaters, Aeration Systems); Components (Rearing Tanks, Settling Basins, Sump, Biofilter, Hydroponics). Available online: https://www.slideshare.net/rajesh193k/aquaponics-market-size-and-forecast-2018 (accessed on 24 March 2018).

- Graber, A.; Junge-Berberovic, R. Aquaponic Systems: Nutrient recycling from fish wastewater by vegetable production. Desalination 2009, 246, 147–156. [Google Scholar] [CrossRef]

- Junge, R.; Wilhelm, S.; Hofstetter, U. Aquaponic in classrooms as a tool to promote system thinking. In Collection of Papers, Proceedings of the Conference VIVUS: Transmission of Innovations, Knowledge and Practical Experience into Everyday Practice, Strahinj, Slovenia, 14–15 November 2014; Maček Jerala, M., Maček, M.A., Eds.; Biotehniški center Naklo: Strahinj, Slovenia, 2014; pp. 234–244. ISBN 978-961-93564-4-9. [Google Scholar]

- Villarroel, M.; Junge, R.; Komives, T.; König, B.; Plaza, I.; Bittsánszky, A.; Joly, A. Survey of Aquaponics in Europe. Water 2016, 8, 468. [Google Scholar] [CrossRef] [Green Version]

- Thorarinsdottir, R.I. Aquaponics Guidelines. Available online: http://skemman.is/en/stream/get/1946/23343/52997/1/Guidelines_Aquaponics_20151112.pdf (accessed on 8 September 2018).

- COST FA1305. EU Aquaponics Hub. Available online: https://euaquaponicshub.com (accessed on 8 September 2018).

- Van Woensel, L.; Archer, G. Ten technologies which could change our lives. Sci. Foresight UnitEur. Parliam. Res. Serv. 2015, 10, 610145. [Google Scholar]

- Engle, C.R. Economics of Aquaponics. SRAC Publication—Southern Regional Aquaculture Center. No. 5006. 2015. Available online: https://srac.tamu.edu/serveFactSheet/282 (accessed on 8 September 2018).

- Villarroel. Map. Aquaponics Map (COST FA1305). 2018. Available online: https://www.google.com/maps/d/u/0/viewer?ll=35.35294037658608%2C0.45745135072172616&z=4&mid=1bjUUbCtUfE_BCgaAf7AbmxyCpT0 (accessed on 8 September 2018).

- ACAC. Association of Commercial Aquaponics Companies. 2018. Available online: https://euaquaponicshub.wordpress.com/association-of-commercial-aquaponics-companies-acac/ (accessed on 8 September 2018).

- Steinert, M.; Leifer, L. Scrutinizing Gartner’s Hype Cycle Approach. Paper Presented at the Technology Management for Global Economic Growth (PICMET). Available online: https://ieeexplore.ieee.org/document/5603442 (accessed on 8 September 2018).

- Linden, A.; Fenn, J. Understanding Gartner’s Hype Cycles, Strategic Analysis Report N° R-20-1971; Gartner, Inc: Stamford, CA, USA, 2003. [Google Scholar]

- Junge, R.; König, B.; Villarroel, M.; Komives, T.; Jijakli, M.H. Strategic Points in Aquaponics. Water 2017, 9, 182. [Google Scholar] [CrossRef] [Green Version]

- Google Trends. Search for Aquaponics. 2019. Available online: https://trends.google.com/trends/explore?date=all&geo=US&q=aquaponics (accessed on 7 August 2019).

- Turnšek, M.; Morgenstern, R.; Schröter, I.; Mergenthaler, M.; Hüttel, S.; Leyer, M. Commercial Aquaponics: A Long Road Ahead. In Aquaponics Food Production Systems; Springer: Cham, Switzerland, 2019; pp. 453–485. [Google Scholar]

- Joly, A. Aquaponics in France: From Dream to Reality. In Proceedings of the Conference presentation: Aquaponics Biz., Murcia, Spain, 19 April 2017; Available online: https://euaquaponicshub.com/hub/wp-content/uploads/2016/05/Aquaponics-in-France-From-dream-to-reality.pdf (accessed on 8 September 2018).

- United Nations Geoscheme for Europe. Available online: https://www.worldatlas.com/articles/the-four-european-regions-as-defined-by-the-united-nations-geoscheme-for-europe.html (accessed on 8 September 2018).

- König, B.; Janker, J.; Reinhardt, T.; Villarroel, M.; Junge, R. Analysis of Aquaponics as an emerging technological innovation system. J. Clean. Prod. 2018, 180, 232–243. [Google Scholar] [CrossRef] [Green Version]

- Goddek, S.; Delaide, B.; Mankasingh, U.; Ragnarsdottir, K.; Jijakli, H.; Thorarinsdottir, R. Challenges of Sustainable and Commercial Aquaponics. Sustainability 2015, 7, 4199–4224. [Google Scholar] [CrossRef] [Green Version]

- Adler, P.R.; Harper, J.K.; Wade, E.M.; Takeda, F.; Summerfelt, S.T. Economic analysis of an aquaponic system for the integrated production of rainbow trout and plants. Int. J. Recirc. Aquac. 2000, 1, 15–34. [Google Scholar] [CrossRef] [Green Version]

- Bosma, R.H.; Lacambra, L.; Landstra, Y.; Perini, C.; Poulie, J.; Schwaner, M.J.; Yin, Y. The financial feasibility of producing fish and vegetables through aquaponics. Aquac. Eng. 2017, 78, 146–154. [Google Scholar] [CrossRef]

- Tokunaga, K.; Tamaru, C.; Ako, H.; Leung, P. Economics of Small-scale Commercial Aquaponics in Hawaii. J. World Aquac. Soc. 2015, 46, 20–32. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations; Simon and Schuster: New York, NY, USA, 2003. [Google Scholar]

- Hoevenaars, K.; Junge, R.; Bardocz, T.; Leskovec, M. EU policies: New opportunities for aquaponics. Ecocycles 2018, 4, 10–15. [Google Scholar] [CrossRef]

- Joly, A.; Junge, R.; Bardocz, T. Aquaponics business in Europe: Some legal obstacles and solutions. Ecocycles 2015, 1, 3–5. [Google Scholar] [CrossRef]

- Tamin, M.; Harun, A.; Estim, A.; Saufie, S.; Obong, S. Consumer Acceptance towards Aquaponic Products. IOSR J. Bus. Manag. 2015, 17, 49–64. [Google Scholar] [CrossRef]

- Zugravu, G.A.; Rahoveanu, T.M.M.; Rahoveanu, T.A.; Khalel, S.M.; Ibrahim, R.A.M. The perception of aquaponics products in Romania. In Proceedings of the International Conference “Risk in Contemporary Economy”, Faculty of Economics and Business Administration, Galati, Romania, 8 December 2016; pp. 1–6. Available online: http://www.rce.feaa.ugal.ro/images/stories/RCE2016/ZugravuTurekTurekKhalelIbrahim.pdf (accessed on 3 December 2016).

- Specht, K.; Weith, T.; Swoboda, K.; Siebert, R. Socially acceptable urban agriculture businesses. Agron. Sustain. Dev. 2016, 36, 17. [Google Scholar] [CrossRef] [Green Version]

- Miličič, V.; Thorarinsdottir, R.I.; Dos Santos, M.; Hančič, M.T. Commercial Aquaponics Approaching the European Market: To Consumers’ Perceptions of Aquaponics Products in Europe. Water 2017, 9, 80. [Google Scholar] [CrossRef] [Green Version]

| Characteristic | European Study (N 1 = 60) | French Study (N = 43) |

|---|---|---|

| % | % | |

| Country-European Regions 2 | ||

| Eastern Europe | 7 | 0 |

| Northern Europe | 12 | 0 |

| Southern Europe | 30 | 0 |

| Western Europe | 26 | 100 |

| Not specified | 25 | 0 |

| Gender | ||

| Male | 63 | 77 |

| Female | 13 | 23 |

| Not specified | 27 | 0 |

| Age (years) | ||

| 23–30 | 32 | 37 |

| 31–50 | 40 | 51 |

| 50–65 | 13 | 12 |

| Not specified | 22 | 0 |

| Year when the respondents first started considering aquaponics | ||

| 1990–2000 | 7 | 9 |

| 2001–2010 | 17 | 19 |

| 2011–2017 | 78 | 70 |

| Education | ||

| Graduate degree or above | 60 | 67 |

| Vocational college diploma | 5 | 16 |

| High school or lower | 5 | 7 |

| Other or not specified | 30 | 9 |

| Background in terms of field of education and/or experience | ||

| Aquaculture | 15 | 26 |

| Natural sciences /technology other than aquaculture | 13 | 14 |

| Social sciences and business | 7 | 30 |

| Other | 17 | 30 |

| Not specified | 22 | 0 |

| How many people (even part time) have been involved in your project/idea, including yourself? 3 | ||

| 1 | 3 | 53 |

| 2–3 | 28 | 26 |

| 4–8 | 23 | 21 |

| 9–75 | 22 | 0 |

| Other or not specified | 23 | 0 |

| Sources of Funding and Revenues | European Study | European Study (Universities Excluded) | French Study | |||

|---|---|---|---|---|---|---|

| N 1 | % 2 | N 1 | % 2 | N 1 | % 2 | |

| National public grants | 16 | 27 | 8 | 11 | 1 | 2 |

| International public grants | 8 | 13 | 6 | 8 | 1 | 2 |

| Private investment | 25 | 42 | 18 | 24 | 14 | 33 |

| Food products sales | 15 | 25 | 12 | 16 | 4 | 9 |

| Sales or design of aquaponic systems | 20 | 33 | 16 | 21 | 9 | 21 |

| Courses, visits, consulting | 16 | 27 | 13 | 17 | 5 | 12 |

| Other or none | 3 | 5 | 2 | 3 | 29 | 67 |

| Aspect | European Study | French Study | ||

|---|---|---|---|---|

| n | % 3 | n | % 3 | |

| Why did you choose aquaponics over other available techniques? (several answers possible): | ||||

| More sustainable and/or environmentally friendly in terms of saving resources | 41 | 68 | 32 | 74 |

| Having a higher economic potential | 13 | 22 | 23 | 53 |

| Having better social applications (e.g., applicable to working with disabled, unemployed, marginalised people) | 16 | 27 | 9 | 21 |

| Having better community applications (e.g., creating community farms) | 14 | 23 | / 2 | |

| Allowing healthier products | 27 | 45 | 121 | 29 |

| Allowing fresher products | 24 | 40 | 121 | 29 |

| Allowing more local production | 32 | 53 | 121 | 29 |

| More modern and applying contemporary technologies | 25 | 42 | / 2 | |

| More fun | 11 | 18 | / 2 | |

| Other | 9 | 15 | 1 | 2 |

| What was the objective of your planned project at the start (several answers possible)? | ||||

| Commercial production of fish and vegetables | 30 | 50 | 34 | 79 |

| Systems design and set-up, consulting business demonstration | 34 | 57 | 3 | 7 |

| Pedagogic or demonstration goals, consulting | 27 | 45 | 12 | 28 |

| Social/community enterprise | 14 | 23 | 1 | 2 |

| Some family consumption | 10 | 17 | 8 | 19 |

| Personal development and/or socialising with others | 14 | 23 | 3 | 7 |

| Other | 4 | 7 | / 2 | / 2 |

| Not specified | 6 | 10 | 2 | 5 |

| At the time you started planning your aquaponics project, what were your intentions? | ||||

| Project without an income from the aquaponics (other funding source) | 8 | 13 | 8 | 19 |

| Project providing some income from aquaponics | 19 | 32 | 20 | 47 |

| Project providing entire (or main) income from aquaponics | 22 | 37 | 15 | 35 |

| Other | 5 | 8 | 0 | 0 |

| Not specified | 6 | 10 | 0 | 0 |

| Attitudes | 1 | 2 | 3 | 4 | 5 | Average Answer (Weighed Mean) | Std. Deviation |

|---|---|---|---|---|---|---|---|

| “Inflatedness” of Perception of the Current State of Aquaponics | (in % of All Answers) | ||||||

| Lower cultivation costs in aquaponics with substantially higher yields equals more net returns. | 13 | 11 | 17 | 32 | 23 | 3.4 | 1.3 |

| Aquaponic produce grows in half the time of conventional means. | 21 | 15 | 23 | 19 | 15 | 2.9 | 1.4 |

| Aquaponics has all the great points of traditional gardening, without all the back-breaking toil necessary to bring in a great harvest. | 13 | 19 | 23 | 17 | 28 | 3.3 | 1.4 |

| Optimism for the future of aquaponics | |||||||

| Aquaponics has a key role to play in food provision and tackling global challenges such as food security. | 2 | 11 | 13 | 23 | 47 | 4.1 | 1.1 |

| Aquaponics will develop competitive commercial systems delivering cost effective food production. | 2 | 11 | 30 | 26 | 23 | 3.6 | 1.4 |

| Aquaponics is the answer of the future to water scarcity. | 4 | 13 | 30 | 11 | 34 | 3.6 | 1.3 |

| Aquaponic farms will prove to be economically sustainable in the future. | 0 | 0 | 26 | 19 | 49 | 4.3 | 0.9 |

| Aspect | European Study (N = 60) | French Study (N = 43) | ||

|---|---|---|---|---|

| n | % | n | % | |

| Status of the project | ||||

| The aquaponics project was planned but never started | 7 | 12 | 15 | 35 |

| The aquaponics project has been or is currently being planned and is on hold, or under study | 7 | 12 | 15 | 35 |

| The aquaponic facility/farm is under construction | 4 | 7 | 4 | 9 |

| You are involved in an aquaponics activity without having to create revenue (such as research) | 19 | 32 | 0 | 0 |

| You are involved in an aquaponics activity which creates a revenue | 14 | 23 | 9 | 21 |

| You have started an aquaponics project but abandoned it later | 4 | 7 | 0 | 0 |

| Other or not specified | 5 | 8 | 0 | 0 |

| If abandoned: To what degree did you abandon your aquaponics project (only one answer)? | ||||

| Continue with the project, but without aquaponics | 1 | 2 | 2 | 5 |

| Continue with aquaponics but without an economic goal | 3 | 5 | 1 | 2 |

| Abandoned it all: project and aquaponics | 7 | 12 | 11 | 26 |

| If abandoned: Could you please share with us a few words on why you have abandoned your aquaponics project/idea? | ||||

| European sample: | ||||

| We have set up a 400 m2 commercial system. Have been selling fresh cut herbs for two seasons. Found it was not economically viable due to too high labour costs and too high plant disease risks. | ||||

| Mostly lack of funds—no access to courses/conferences, no-one in local area practicing to learn from/no response from them. | ||||

| Lack of finance and time. | ||||

| Not feasible. | ||||

| At the time aquaponics did not attract investors, due to high risk investment. | ||||

| No proper space, high initial costs, high maintenance. | ||||

| Moving house, kids. | ||||

| French sample (comments of the interviewer): | ||||

| The partner was unemployed, the project was difficult to launch; the partner went back to a normal job | ||||

| Planned to do it with a farmer, but he retreated and she stopped | ||||

| Couple broke up and both stopped | ||||

| Too many obstacles: regulations, finance … he went for family production only | ||||

| Too many obstacles, he changed for insect farming | ||||

| Project Obstacle | Frequency of Mentions |

|---|---|

| Energy source | 5 |

| Water source | 4 |

| Season/climate | 9 |

| Investment costs | 33 |

| Unexpected regulation | 21 |

| Competition on market prices | 10 |

| Lack of skilled labour | 11 |

| Cost of labour | 5 |

| Other | 8 |

| Areas of Support Needed | European Study (N = 60) | French Study (N = 43) |

|---|---|---|

| Frequency of Mentions | ||

| Technical advice | 11 | - |

| Administrative assistance | 8 | - |

| Consulting on investments | 8 | - |

| Financing for either investment or running costs | 23 | 43 |

| Finding the right location | 13 | 15 |

| Time to really do it | 13 | 6 |

| Gaining experience | 9 | 29 |

| Enlarging my team | 9 | 16 |

| Marketing | 8 | - |

| Growing to reach the economy of scale | 17 | 8 |

| Other | 3 | - |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Turnsek, M.; Joly, A.; Thorarinsdottir, R.; Junge, R. Challenges of Commercial Aquaponics in Europe: Beyond the Hype. Water 2020, 12, 306. https://doi.org/10.3390/w12010306

Turnsek M, Joly A, Thorarinsdottir R, Junge R. Challenges of Commercial Aquaponics in Europe: Beyond the Hype. Water. 2020; 12(1):306. https://doi.org/10.3390/w12010306

Chicago/Turabian StyleTurnsek, Maja, Agnes Joly, Ragnheidur Thorarinsdottir, and Ranka Junge. 2020. "Challenges of Commercial Aquaponics in Europe: Beyond the Hype" Water 12, no. 1: 306. https://doi.org/10.3390/w12010306

APA StyleTurnsek, M., Joly, A., Thorarinsdottir, R., & Junge, R. (2020). Challenges of Commercial Aquaponics in Europe: Beyond the Hype. Water, 12(1), 306. https://doi.org/10.3390/w12010306