Models of Subsidies for Water and Sanitation Services for Vulnerable People in South American Countries: Lessons for Brazil

Abstract

1. Introduction

2. Access to WSS in South America

2.1. Access to WSS

2.1.1. Argentina

2.1.2. Bolivia

2.1.3. Brazil

2.1.4. Chile

2.1.5. Colombia

2.1.6. Paraguay

2.1.7. Peru

2.1.8. Uruguay

2.2. Subsidy Model, Tariff Structure and Coverage by Country

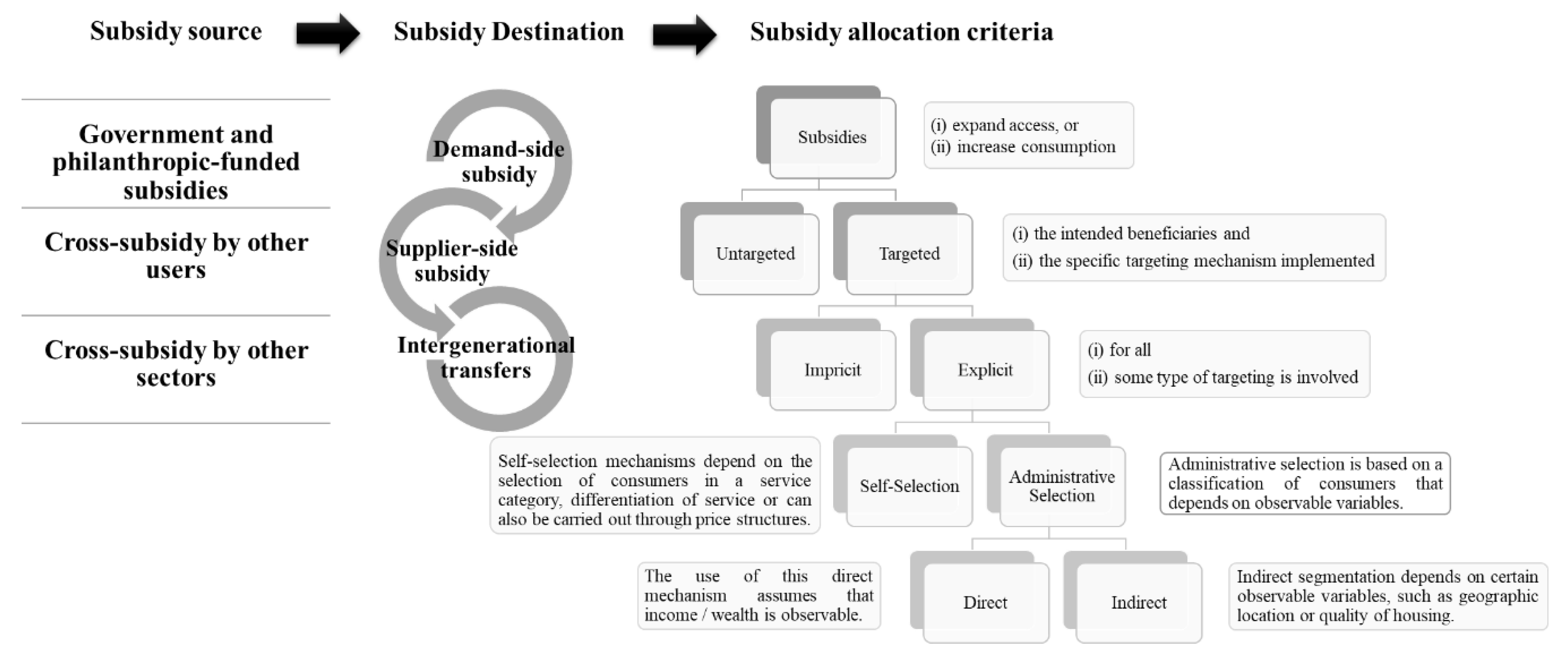

3. Categorization of Subsidy Models for WSS Tariffs

3.1. Overview

3.2. Categorization

3.3. Discussion

4. The Case of Brazil: Proposal for Improvement

4.1. Households without Access to WSS

4.2. Tariff Subsidies for WSS

4.3. Proposal for Improving the Tariff Subsidy Policy in Brazil

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Marques, R.C. Regulation of Water and Wastewater Services. An International Comparison; IWA Publishing: London, UK, 2010. [Google Scholar]

- Ménard, C. Meso-institutions: The variety of regulatory arrangements in the water sector. Util. Policy 2017, 49, 6–19. [Google Scholar] [CrossRef]

- Bel, G. Public versus private water delivery, remunicipalization and water tariffs. Util. Policy 2020, 62, 100982. [Google Scholar] [CrossRef]

- Bardasi, E.; Wodon, Q. Who pays the most for water? Alternative providers and service costs in Niger. Econ. Bull. 2008, 9, 1–10. [Google Scholar]

- Kayaga, S.; Franceys, R. Costs of urban utility water connections: Excessive burden to the poor. Util. Policy 2007, 15, 270–277. [Google Scholar] [CrossRef]

- Whittington, D.; Nauges, C.; Fuente, D.; Wu, X. A diagnostic tool for estimating the incidence of subsidies delivered by water utilities in low- and medium-income countries, with illustrative simulations. Util. Policy 2015, 34, 70–81. [Google Scholar] [CrossRef]

- Halpern, J.; Gómez-Lobo, A.; Foster, V. Designing Direct Subsidies for Water and Sanitation Services Panama—A Case Study; Policy Research; World Bank: Washington, DC, USA, 2000.

- Halpern, J.; Walker, I.; Ordoñez, F.; Serrano, P. Pricing, Subsidies, and the Poor: Demand for Improved Water Services in Central America; World Bank: Washington, DC, USA, 1999.

- De Hacienda, M. Evaluación de Impacto del Subsidio al Pago del Consumo de Agua Potable y Servicio de Alcantarillado y Tratamiento de Aguas Servidas; Ministerio de Hacienda: Santiago, Chile, 2017. Available online: https://www.dipres.gob.cl/597/articles-163133_informe_final.pdf (accessed on 25 May 2020).

- Komives, K.; Foster, V.; Halpern, J.; Wodon, Q.; Abdullah, R. Water, Electricity, and the Poor: Who Benefits from Utility Subsidies? World Bank: Washington, DC, USA, 2005.

- Komives, K.; Halpern, J.; Foster, V.; Wodon, Q.; Abdullah, R. The Distributional Incidence of Residential Water and Electricity Subsidies; World Bank: Washington, DC, USA, 2006.

- Komives, K.; Halpern, J.; Foster, V.; Wodon, Q.; Abdullah, R. Utility Subsidies as Social Transfers: An Empirical Evaluation of Targeting Performance. Dev. Policy Rev. 2007, 25, 659–679. [Google Scholar] [CrossRef]

- Ying, Y.; Skilling, H.; Banerjee, S.; Wodon, Q.; Foster, V. Cost Recovery, Equity, and Efficiency in Water Tariffs: Evidence from African Utilities; World Bank: Washington, DC, USA, 2010.

- Foster, V. Toward a Social Policy for Argentina’s Infrastructure Sectors: Evaluating the Past and Exploring the Future; World Bank: Washington, DC, USA, 2004.

- Barde, J.A.; Lehmann, P. Distributional effects of water tariff reforms e an empirical study for Lima, Peru. Water Resour. Econ. 2014, 6, 30–57. [Google Scholar] [CrossRef]

- Fuente, D.; Gatua, J.G.; Ikiara, M.; Kabubo-Mariara, J.; Mwaura, M.; Whittington, D. Water and sanitation service delivery, pricing, and the poor: An empirical estimate of subsidy incidence in Nairobi, Kenya. Water Resour. Res. 2016, 52, 4845–4862. [Google Scholar] [CrossRef]

- Foster, V.; Araujo, C. Does Infrastructure Reform Work for the Poor? A Case Study from Guatemala; World Bank: Washington, DC, USA, 2004.

- Angel-Urdinola, D.F.; Wodon, Q. Do utility subsidies reach the poor? Framework and evidence for Cape Verde, Sao Tome, and Rwanda. Econ. Bull. 2007, 9, 1–7. [Google Scholar]

- MIOPyV. Plan Nacional de Agua Potable y Saneamiento: Cobertura Universal Y Sostenibilidad de Los Servicios; Ministerio del Interior, Obras Públicas y Vivienda: Buenos Aires, Argentina, 2017.

- Mercadier, A.C.; Brenner, F.S. Tariff (un)sustainability in contexts of price (in)stability: The case of the Buenos Aires water and sanitation concession. Util. Policy 2020, 63, 101005. [Google Scholar] [CrossRef]

- MMAyA. Marco de Gestion Social y Evaluacion Social: Proyecto de Abastecimiento de Agua y Alcantarillado en Areas Periurbanas y Peqeñas Localidades; Ministerio de Medio Ambiente y Agua: La Paz, Bolivia, 2018.

- MMAyA. Informe de Avances Hacia el Cumplimiento del Derecho Humano al Agua y al Saneamiento en Bolivia; Ministerio de Medio Ambiente y Agua: La Paz, Bolivia, 2017.

- Del Saz-Salazar, S.; González-Gómez, F.; Guardiola, J. Willingness to pay to improve urban water supply: The case of Sucre, Bolivia. Water Policy 2015, 17, 112–125. [Google Scholar] [CrossRef]

- MDR. 24º Diagnóstico dos Serviços de Água e Esgotos; Ministério do Desenvolvimento Regional: Brasília, Brazil, 2019.

- SISS. Informe de Gestión del Sector Sanitario; Superintendencia de Servicios Sanitararios: Santiago, Chile, 2018.

- Molinos-Senante, M. Urban water management. In Water Policy in Chile; Donoso, G., Ed.; Springer International Publishing: Cham, Switzerland, 2018; pp. 131–150. [Google Scholar]

- Donoso, G. Water Policy in Chile; Springer International Publishing: Cham, Switzerland, 2018. [Google Scholar]

- Molinos-Senante, M.; Donoso, G. Water scarcity and affordability in urban water pricing: A case study of Chile. Util. Policy 2016, 43, 107–116. [Google Scholar] [CrossRef]

- Contreras, D.; Gómez-Lobo, A.; Palma, I. Revisiting the distributional impacts of water subsidy policy in Chile: A historical analysis from 1998–2015. Water Policy 2018, 20, 1208–1226. [Google Scholar] [CrossRef]

- DNP. Plan Nacional de Desarrollo; Departamento Nacional de Planeación: Bogota, Colombia, 2015.

- CGR. Gestión y Resultados del Sector de Agua Potable y Saneamiento Básico con Enfasis en los Recursos del Sistema General de Participaciones 1994–2017; Controladoría General de la República: Bogotá, Colombia, 2018.

- Li, F.; Wang, W.; Ramírez, L.H.G. The determinants of two-dimensional service quality in the drinking water sector—Evidence from Colombia. Water Policy 2016, 18, 983–997. [Google Scholar] [CrossRef]

- MAVDT. Costos y Tarifas Municipios Menores y Zonas Rurales; Ministério de Ambiente Vivendas e Desenvolvimento Territorial: Bogotá, Colombia, 2005.

- MVCT. Plan Director Agua y Saneamiento Básico: Visión Estratégica 2018–2030; Ministerio de Vivienda, Ciudad y Territorio: Bogotá, Colombia, 2018.

- DGEEC. Encuesta de Indicadores Múltiples por Conglomerados; Dirección General de Estadísticas Encuestas y Censos: Asuncion, Paraguay, 2016.

- ERSSAN. Comité de Administración: Informe de Gestión 2017; Ente Regulador de Servicios Sanitarios: Asuncion, Paraguay, 2017.

- MOPC. Plan Nacional de Agua Potable y Saneamiento; Ministerio de Obras Públicas y Comunicaciones: Asuncion, Paraguay, 2018.

- INEI. Perú: Formas de Acceso Al Agua y Saneamiento Básico; Instituto Nacional de Estadística e Informática: Lima, Peru, 2019.

- SUNASS. Planos Estratificados de Lima Metropolitana para Aplicar o Sistema de Subsídios Cruzados na Estrutura Tarifária da SEDAPAL S.A; Superintendência Nacional de Serviços de Saneamento—Resolução do Conselho de Administração Nº 021-2017-SUNASS-CD; Superintendência Nacional de Serviços de Saneamento: Lima, Peru, 2017.

- Ioris, A.A.R. Water scarcity and the exclusionary city: The struggle for water justice in Lima, Peru. Water Int. 2016, 41, 125–139. [Google Scholar] [CrossRef]

- Eagin, B.; Graham, J.P. A study of water and sanitation access trends in Peru: Where do inequities persist? J. Water Sanit. Hyg. Dev. 2014, 4, 499–508. [Google Scholar] [CrossRef][Green Version]

- Ferro, G. América Latina y el Caribe Hacia los Objetivos de Desarrollo Sostenible en Agua y Saneamiento; Reformas Recientes de las Políticas Sectoriales; CEPAL-AECID-UN: Santiago, Chile, 2017.

- MVOTMA. Plan Nacional de Aguas; Ministerio de Vivienda, Ordenamiento Territorial y Medio Ambiente: Montevideo, Uruguay, 2017.

- MIDES. Reporte Uruguay 2017; Ministerio de Desarrollo Social: Montevideo, Uruguay, 2017.

- MVOTMA. Plan Nacional de Saneamiento; Ministerio de Vivienda, Ordenamiento Territorial y Medio Ambiente: Montevideo, Uruguay, 2019.

- URSEA. Régimen Tarifario; Unidad Reguladora de Servicios de Energía y Agua: Montevideo, Uruguay, 2019; Available online: https://www.gub.uy/unidad-reguladora-servicios-energia-agua/politicas-y-gestion/regimen-tarifario-0 (accessed on 4 February 2020).

- ADERASA. Las Tarifas de Agua Potable y Alcantarillado en América Latina; Asociación de Entes Reguladores de Agua Potable y Saneamiento de las Américas: Asuncion, Paraguay, 2005. [Google Scholar]

- MCidades. Proposta de Programas e Ações Estratégicas no Âmbito do Estudo Sobre Modelo de Subsídio às Famílias de Baixa Renda Aplicável aos Serviços de Abastecimento de Água e Esgotamento Sanitário; Ministério das Cidades: Brasília, Brazil, 2018.

- Marques, R.D.C. Regulação de Serviços Públicos; Edições Sílabo: Lisbon, Portugal, 2005. [Google Scholar]

- Andres, L.A.; Thibert, M.; Lombana Cordoba, C.; Danilenko, A.; Joseph, G.; Borja-Vega, C. Doing More with Less: Smarter Subsidies for Water Supply and Sanitation; World Bank: Washington, DC, USA, 2019.

- Cook, J.; Fuente, D.; Matichich, M.; Whittington, D. A Global Assessment of Nontariff Customer Assistance Programs in Water Supply and Sanitation. In Development Studies in Regional Science; Chen, Z., Bowen, W., Whittington, D., Eds.; Springer: Singapore, 2020; pp. 315–371. [Google Scholar]

- Cook, J.; Fuente, D.; Whittington, D. Choosing Among Pro-Poor Policy Options in the Delivery of Municipal Water Services. Water Econ. Policy 2020, 1950013, 1–21. [Google Scholar] [CrossRef]

- IBGE. Censo Demográfico; Instituto Brasileiro de Geografia e Estatística: Rio de Janeiro, Brazil, 2010.

- Guimaraes, E.; Malheiros, T.; Marques, R.C. Inclusive governance: New concept of water supply and sanitation services in social vulnerability areas. Util. Policy 2016, 43, 124–129. [Google Scholar] [CrossRef]

- Guimarães, E.F. Modelo Inclusivo para a Universalização do Saneamento Básico em Áreas de Vulnerabilidade Social. Ph.D. Thesis, Universidade de São Paulo, São Paulo, Brazil, 2015. [Google Scholar]

- Queiroz, V.C.; De Carvalho, R.C.; Heller, L. New Approaches to Monitor Inequalities in Access to Water and Sanitation: The SDGs in Latin America and the Caribbean. Water 2020, 12, 931. [Google Scholar] [CrossRef]

- Marques, R.C.; Pinto, F.S.; Miranda, J. Redrafting Water Governance: Guiding the way to improve the status quo. Util. Policy 2016, 43, 1–3. [Google Scholar] [CrossRef]

- Evans, B.; Alexander, I.; Brocklehurst, C.; Kariuki, M.; Komives, K.; Rosenthal, S.; Tremolet, S.; Triche, T. New Designs for Water and Sanitation Transactions: Making Private Sector Participation Work for the Poor; World Bank Water and Sanitation Program and PPIAF: Washington, DC, USA, 2004.

- Dar, O.A.; Khan, M.S. Millennium development goals and the water target: Details, definitions and debate. Trop. Med. Int. Health 2011, 16, 540–544. [Google Scholar] [CrossRef] [PubMed]

- United Nations (UN). The Human Right to Water and Sanitation Media Brief. 2011. Available online: http://www.un.org/waterforlifedecade/pdf/human_right_to_water_and_sanitation_media_brief.pdf (accessed on 23 August 2019).

- Lyra, D.H.S. Subsídios às Tarifas dos Serviços Públicos de Abastecimento de Água e Esgotamento Sanitário para Municípios sem Capacidade de Pagamento Compatível com a Autossustentação Econômico-Financeira: Concretização de Direitos Fundamentais; IDP: Brasília, Brazil, 2015. [Google Scholar]

- UNESCO. The United Nations World Water Development Report 2015: Water for a Sustainable World; UNESCO: Paris, France, 2015. Available online: http://unesdoc.unesco.org/images/0023/002318/231823E.pdf (accessed on 20 August 2019).

- Galvão Junior, A.C. Regulação e Universalização dos Serviços de Água e Esgoto: Estudo do Nordeste Brasileiro; USP: São Paulo, Brazil, 2008. [Google Scholar]

- Fuente, D. The design and evaluation of water tariffs: A systematic review. Util. Policy 2019, 61, 100975. [Google Scholar] [CrossRef]

- Galvão Júnior, A.C.; Monteiro, M.A.P.; Costa, S.A.B.; Cossenzo, C.S.; Oliveira Júnior, L.A.; Silva, A.C.; Sobrinho, G.B.; Freire, B.V. Tarifa Social nas Companhias Estadual de Saneamento Básico e o Papel da Regulação; ABAR: Brasília, Brazil, 2018. [Google Scholar]

| Country | Regulation | Tariff Structure | Cross Subsidies | Indirect Subsidies | Direct Subsidies | Subsidy Targeting Scheme | Population 2018 Word Bank | GDP per Capita 2018 (US$) Word Bank | Water Access Coverage | Sanitation Access Coverage |

|---|---|---|---|---|---|---|---|---|---|---|

| Argentina | Yes | Fixed and variable | Yes | Yes | Partial | By zone, quality of housing, and year of construction | 44,494,502 | 11,684 | 84.4% | 58.4% |

| Bolivia | Yes | Fixed and variable with IBT | Yes | Yes | No | By geographical area | 11,353,142 | 3549 | 85.6% | 59.2% |

| Brazil | Yes | Minimum consumption and IBT | Yes | Yes | No | By social conditions and geographical area | 209,469,333 | 8921 | 83.6% | 53% |

| Chile | Yes | Fixed and variable | No | Yes | Yes | For family income | 18,729,160 | 15,923 | 100% | 96.8% |

| Colombia | Yes | Fixed and variable | Yes | Yes | Partial | By geographical area and based on housing quality | 49,648,685 | 6668 | 91.4% | 69% |

| Paraguay | Yes | Fixed and variable with IBT | Yes | Yes | No | Type of housing | 6,956,071 | 5822 | 95.3% | 80.3% |

| Peru | Yes | Fixed and variable with IBT | Yes | Yes | No | By geographical area | 31,989,256 | 6941 | 90.7% | 74.7% |

| Uruguay | Yes | Fixed and variable with Minimum consumption and IBT | Yes | Yes | No | By social conditions and geographical area | 3,449,299 | 17,278 | 99.8% | 99.5% |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Narzetti, D.A.; Marques, R.C. Models of Subsidies for Water and Sanitation Services for Vulnerable People in South American Countries: Lessons for Brazil. Water 2020, 12, 1976. https://doi.org/10.3390/w12071976

Narzetti DA, Marques RC. Models of Subsidies for Water and Sanitation Services for Vulnerable People in South American Countries: Lessons for Brazil. Water. 2020; 12(7):1976. https://doi.org/10.3390/w12071976

Chicago/Turabian StyleNarzetti, Daniel Antonio, and Rui Cunha Marques. 2020. "Models of Subsidies for Water and Sanitation Services for Vulnerable People in South American Countries: Lessons for Brazil" Water 12, no. 7: 1976. https://doi.org/10.3390/w12071976

APA StyleNarzetti, D. A., & Marques, R. C. (2020). Models of Subsidies for Water and Sanitation Services for Vulnerable People in South American Countries: Lessons for Brazil. Water, 12(7), 1976. https://doi.org/10.3390/w12071976