Abstract

Financing frameworks for Public–Private Partnerships (PPPs) are lacking in developing countries. This study aims to develop a financing framework for adoption for water and sanitation PPP infrastructure projects in Zimbabwe. Using data covering a 25-year period from 1996 to 2021, Tobit econometric models are applied to the secondary data collected from both international and domestic sources. The results of this study confirm that capital market variables, bank market development, and economic affluence drive the financing of water and sanitation Public–Private Partnership infrastructure projects in Zimbabwe. It was also established that both public and private sources of finance are instrumental in financing water and sanitation PPP projects. The results inform our eventual framework model, which integrates the Public–Private Partnership (PPP) models, sources of finance for water and sanitation PPPs, and the drivers of water and sanitation PPP finance. This study recommends the application of the developed framework in the water and sanitation Public–Private Partnership infrastructure financing policy of developing countries so as to capitalise on the strengths, resources, and networks of the respective stakeholders in the PPPs.

1. Introduction

After decades of economic turmoil and political turbulence, the deterioration of infrastructure in Zimbabwe is evident [1]. Fiscal misalignment, corruption, and the haphazardness with which the land redistribution programme was executed piloted the deepest peace-time economic contraction the country has ever seen [2,3]. Western governments, responding to human rights abuses and the disregard for the rule of law, imposed political and economic sanctions [4]. Consequentially, the country failed to service its debts, and payment arrears accumulated with International Development Partners (IDPs) and bilateral creditors. Zimbabwe’s debt overhang currently stands at over USD 17.7 billion, and this is making it difficult for the country to obtain long-term infrastructure financing [5]. The result has been the depletion of the productive capacity of existing infrastructure facilities, including those under the water and sanitation sector.

In Zimbabwe, water and sanitation services provision is unreliable [6]. Securing capital investment has not been easy for the country, resulting in a sustained deterioration in the quality of operations. Frequently, sewage networks experience disruptive blockages, and the scarceness of wastewater treatment chemicals results in unprocessed sewage being disposed of in freshwater bodies that supply Zimbabwe’s urban populace [7]. Water treatment plants are malfunctioning fundamentally because the machinery has long outlived its productive life. Water and sanitation sector challenges are further compounded by the structural bottlenecks in the generation and distribution of electricity [8]. Water and sewage systems require a dependable electricity supply, without which they cannot be efficiently operated. Often, maintenance of water and sanitation plants is deferred, and the lack of financing for plant expansion and rehabilitation has made the delivery of water services sporadic, thus creating a constant threat to public health [9].

Dependable infrastructure is an indispensable component of the Sustainable Development Goals (SDGs). If Zimbabwe is to score high on water and sanitation SDG targets, the country must transition to innovative ways of financing infrastructure. Others support the view that Public–Private Partnerships (PPP), if well structured, can remedy financing bottlenecks in the water and sanitation infrastructure sector [10]. PPPs can crowd in private sector experience, operational efficiencies, and, most importantly, the needed capital for water and sanitation infrastructure development. The government of Zimbabwe is conscious of this. Under its Agenda for Sustainable Socio-Economic Transformation (Zim-ASSET) and the Transitional Stabilisation Programme (TSP), the government has opened the water and sanitation sector to private sector investments [11]. However, compared to China, where the demand for water and sanitation PPP transactions continues to strengthen, the uptake of PPP ventures is currently very low [12]. Several factors explain the positive trend in the number of infrastructure PPPs that have reached financial closure in China. The Chinese government has shifted from a centrally planned economic system, where water supply was viewed as an indispensable task for the government to satisfy the elementary public needs, with urban water and sanitation services being provided by the state free of charge [13,14]. Foreign investors are permitted to pursue a competitive bidding process for urban water infrastructure contracts. Market-oriented reforms, which entail the liberalisation of water tariffs if a project finance structure has a foreign component in it, were instituted [13,14]. Through the reforms, international investors received attractive risk-adjusted net returns from Chinese water and sanitation infrastructure projects. Moreover, besides the tariff reforms, instead of relying solely on foreign banks for financing, China encouraged domestic banks to invest in water and sanitation PPPs [14].

In contrast to PPP market developments in China, ref. [15] reports that since 1994, notwithstanding the socio-economic importance of water for sustainable development and the infrastructure inadequacy in Zimbabwe, there has not been any mega water or sanitation sector PPP transaction that has successfully been executed. Where water and sanitation PPPs have been implemented, projects have stalled [16]. The Matabeleland Zambezi Water Project (MZWP), whose conception was in 1912 during the colonial era, is a classic example of one such project. Although several factors can be cited for the delays, according to [16], the key constraint is inadequate finance. Given this background, the objectives of the paper are twofold:

- This paper seeks to identify the key drivers of water and sanitation PPP financing in Zimbabwe; and

- To propose a framework to better inform the future financing of water and sanitation PPPs in Zimbabwe.

In [17], the authors noted that infrastructure development, in part, is constrained by a lack of comprehensive frameworks to guide policy formulation. In the same vein, we have found that studies that seek to cover the information gap in Zimbabwe are scant. The weaknesses of earlier empirical studies are that the methodology has been primarily qualitative [18] or applied a broad categorisation of infrastructure sectors [18,19]. As such, while addressing the two main objectives stated above, the current study pursues a quantitative research approach that recognises the different risk and return profiles of the water and sanitation infrastructure sector. This study seeks to complement the Government of Zimbabwe’s commitment to address infrastructure bottlenecks in the water and sanitation sector by developing a framework for infrastructure financing, which requires engagements with the private sector.

Government, in the greater interest of society, provides public goods. The authors in [20] noted that in Europe, public financing of water and sanitation infrastructure is institutionalised at the continental level through the European Union (EU) Cohesion Funds. Infrastructure development in central and eastern European countries have benefited immensely from the EU Cohesion Funds [20]. Equality and sustainable access to water and sanitation services are achievable subject to public investment [21]. Taxes and tariffs revenue can finance water and sanitation infrastructure either in competition or in collaboration with private investors. With proper administrative capacity, taxation and tariffs can be a stable source of viability gap finance in water and sanitation PPPs [22]. The size of the tax base is a fundamental determinant of the amount of revenue that can mobilised. The informal structure of the economy, as well as profit-shifting activities by multinational companies predominantly through transfer pricing manipulation, has eroded the tax base in Zimbabwe [23]; hence, there is a need to integrate other innovative sources to finance PPPs.

Official development finance (ODF) consists of various forms of international developmental financial flows that aim mainly towards emerging and developing countries [24]. The key components of ODF are official development assistance (ODA), other official flows (OOFs), other transactions from development finance institutions (DFIs), and contributions towards peace-keeping operations, among other forms of financial flows [24]. Official development assistance (ODA) refers to financial flows issued from publicly controlled bilateral or multilateral development agencies [25]. ODF loans and grants are issued either on concessional or non-concessional terms [26]. Concessional loans have favourable loan-servicing structures that suit the particular socio-economic conditions of the recipient country [27]. For most developing countries, ODF still constitutes a small proportion of water infrastructure finance. In [28], the author stated that ODF for water and sanitation is increasing at slower rates compared to the health and education sectors. Regardless, given the water and sanitation infrastructure financing gap, ODA has been noted to be insufficient to address the scope of investment requirements, as many donor countries have failed to reach the 0.7% of gross domestic product (GDP) aid target [29].

Foreign direct investment in infrastructure (FDII) is important in providing financial resources, know-how, and technology for water and sanitation infrastructure development [30,31]. The privatisation policies of the 1990s immensely promoted FDII. Private FDII investments have taken many forms that vary depending on the level of investment risk [32]. Investment structures such as joint ventures and divestitures have been used in FDII. With greenfield infrastructure projects, for instance, a foreign enterprise can jointly finance, construct, and operate a water and sanitation facility [33]. Ownership of the facility can either remain joint or can transfer to either the private or public enterprise at the end of the contract. With a divesture structure, foreign companies purchase an equity stake in a state-owned (SOE) enterprise through an asset sale, privatisation, or public offering [34]. The Government of Zimbabwe views FDII as important to meet the SDG targets. Accordingly, the Zimbabwe Investment Development Agency (ZIDA) bill was promulgated in 2019 to outline the safeguards and opportunities available to international investors. The ZIDA bill is complemented by the National Development Strategy 1 (NDS 1), a blueprint directing economic decisions between 2021 and 2025.

Optimising bank sources of finance reduces financial pressure on governments seeking to develop infrastructure facilities. Banks, as financial intermediaries, provide loanable funds [35,36]. This functionality that banks provide under project finance structures is very important and complex at the same time. Banks can issue securities to mobilise loanable resources. With developments in financial engineering, banks can underwrite infrastructure loans with the intention of selling the entire asset or a part of it on the bank loan secondary market [37]. The global financial crisis of 2007 and the Euro-zone sovereign crisis, as well as the regulatory changes that followed, have not made bank lending to PPP infrastructure projects any easier [38]. The policy-induced changes in the way banks conduct business impact negatively on the large-scale construction industry that relies on long-term loans to bring projects to financial and operational completion. Ref. [39] noted that the size of commercial banks in Africa is small. This is compounded by the lack of meaningful domestic savings in developing economies.

Listed infrastructure companies raise equity capital to finance investments in PPP projects through issuing shares. Shares are perpetuities that confer ownership to the holders and are ideal for long-term investments. In emerging markets, public equity markets are dominated by infrastructure companies [40]. Their participation is traced back to the era of privatisation policies [41]. Like infrastructure companies, infrastructure funds are active in the PPP market. In [42], the author highlighted that infrastructure funds invest heavily in PPP/PFI projects; hence, they are an attractive source of project finance. The funds are largely popular in Australia, having been promoted through the partnership that Macquarie Group entered with state-controlled entities [43]. Financing PPP through the stock market requires the market to be developed to a stage where it is feasible to mobilise the huge amounts required to develop economy-transforming infrastructure projects. Stock market crashes typified by the global financial meltdown of 2007 can potentially result in massive capital losses to investors in PPP projects [36].

The universe of bonds is very wide [44]. Nonetheless, project bonds are an instrument of choice for PPP financing. The SPV can issue project bonds to a catchment of investors to whom commitment is made to periodically make coupon payments and to reimburse the capital when the bond matures or according to a predetermined amortisation schedule [45]. Obligations to bondholders are settled exclusively from the cash flows generated by the project without the possibility of recourse from other cash flow sources. The financial performance of the underlying project is integral to debt servicing. The SPV can issue bonds denominated in domestic currency, with a preference for holding the security being given to domestic institutional and retail investors. Such bonds are defined as domestic instruments. Domestic bonds are ideal when financing is being sought for small-scale projects whose geographical concentration is well defined and with a large constituent of raw materials being locally sourced. Financing large-scale infrastructure projects using domestic bonds is challenging for most developing countries. Bond markets are underdeveloped and, as such, they cannot supply the requisite financial resources [46,47]. Contra to domestic bonds are foreign project bonds, an instrument of choice for large-scale capital-intensive projects. Foreign bonds are issued in foreign markets in the currency of the placement market. Bonds have been used to finance public infrastructure in Zimbabwe, with the medium of issue being private placement [19]. However, the use of infrastructure bonds is constrained by the absence of a developed bond market.

In most developing countries, using count data models, ref. [48] confirmed that PPP financing is driven by the nature of the economic environment. The same study further postulated that indebted governments have a higher likelihood of signing PPP contracts. The indebtedness of the government of Zimbabwe has substantially curtailed international capital inflows; hence, there is a policy inclination towards private investment for water and sanitation infrastructure development. In [49], the author further confirmed that inflation, import cover, market size, and purchasing power drive PPP investments in developing countries. The study used a blend of count models and OLS estimation. However plausible the findings are, they cannot be superimposed to the Zimbabwean scenario in view of the socio-economic transformation that the country underwent over the recent past. Ref. [50], combining count data models and Tobit regression, concluded that the level of inflation is negatively related to PPP financing. This finding is congruent with economic theory that emphasises the corrosive effect of high inflation on return on investment. Nonetheless, the study is premised on the supposition that, in developing countries, the impact of macro-economic factors is symmetric across infrastructure sectors, which is not the case. In the current study, the examination is specific to the water and sanitation sector.

Financial market access is a pre-requisite for infrastructure project companies to borrow long-term. In [51], the authors established that, in PPP energy markets, the extent of financial market advancement significantly impacts financing. Nonetheless, and relative to the bank loan market, the capital market predominantly drives PPP energy investment. Extending the analysis in [51] to Zimbabwe’s infrastructure sectors and comparing the results adds value to discussions on PPP financing in emerging and developing countries. Contra to [51,52], it was empirically identified that the bank loan market is the main driver relative to the capital market. This finding suggests that the bank market is central to intermediating PPP infrastructure investments in developing countries.

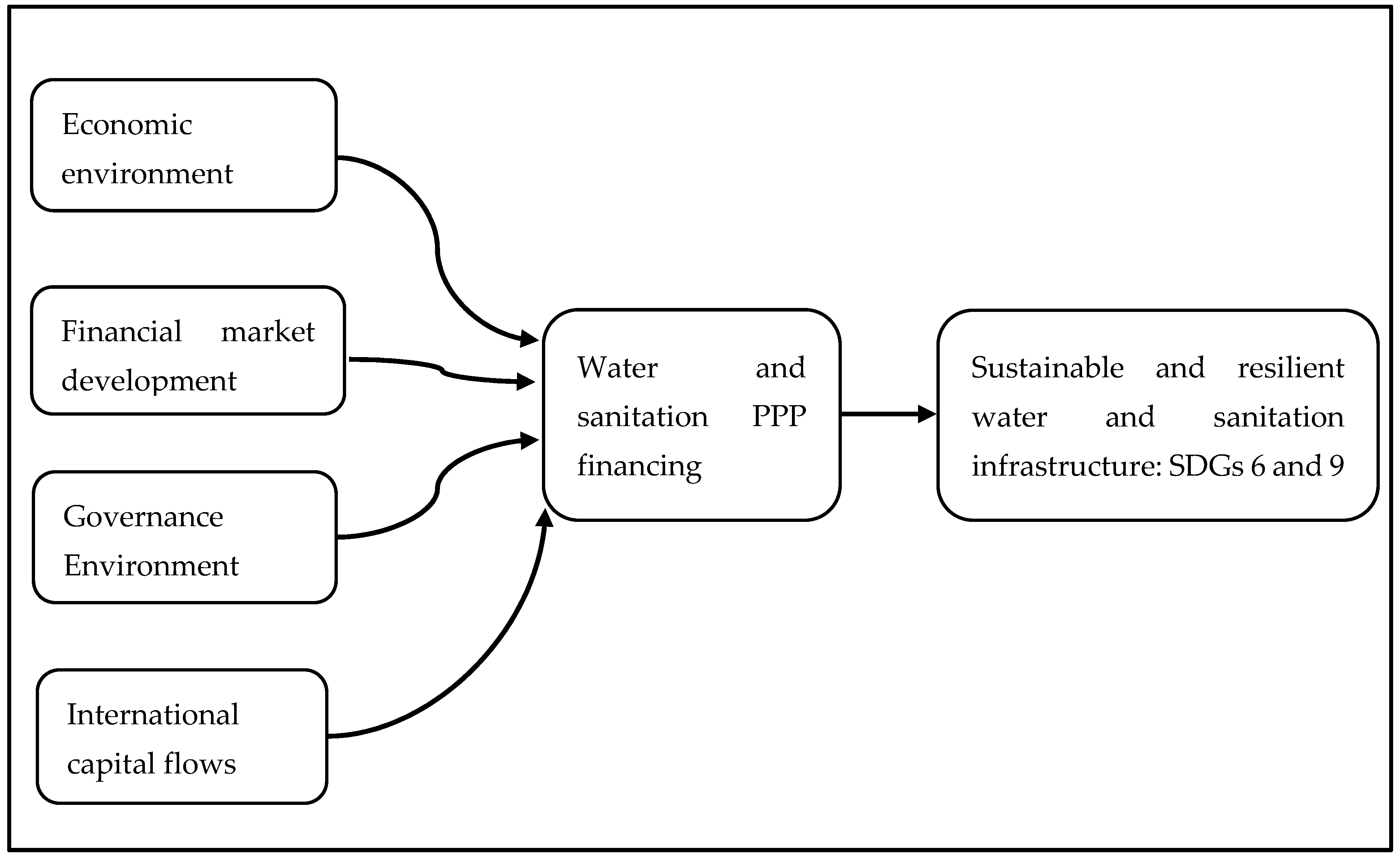

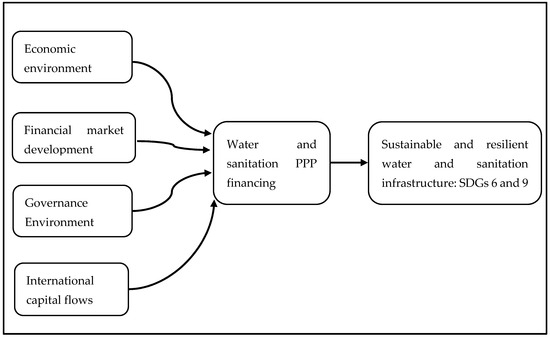

Other than economic and financial development variables, the governance environment influences the sustainable financing of water and sanitation PPPs. Either collectively or individually, the governance elements of the rule of law and the control of corruption, among others, exert influence on PPP finance. However, researchers at times report contrasting results about the relationship between the element of the governance environment and the financing of PPP infrastructure projects. For instance, contrary to [53,54], it was reported that, in selected developing countries, the more corrupt the economic environment is, the higher the level of PPP infrastructure investments. The studies used a count data model and pooled OLS, respectively. The researchers argued that, at times, project sponsors cannot entirely circumvent corruption. Similarly, the authors in [55] counter-intuitively reported the finding that a higher likelihood of political instability results in increased PPP infrastructure investments. This is contrary to [56], who postulated an inverse relationship between infrastructure investment and political instability. Using Tobit regression analysis, ref. [55] argued that citizen demand for better services expressed through political uprising may compel public authorities to use PPPs to increase investments in infrastructure. Conceptually, the relationship between determinants of PPP investment, elements of the economic environment, financial market development, the governance environment, and water and sanitation PPP financing is presented in Figure 1. The authors in [17] are among the few that have attempted to create a framework for public infrastructure financing in Zimbabwe. Their study provided a decision tool that can assist public authorities regarding whether a project is implemented or not. However instrumental the framework is, it is not sector-specific. Risk–return profiles are different across the infrastructure sector. The current study is water-and-sanitation-specific.

Figure 1.

Conceptual framework.

2. Materials and Methods

In line with [50,57], this study used secondary data for its empirical analysis. Data on PPP investment were obtained from the World Bank’s Private Participation in Infrastructure database (PPI). Even though the PPI databank provides good reporting of internationally published PPP projects, according to [48], the data bank falls short regarding the reporting of small projects that involve domestic sponsors. As such, the domestic databases of the Central Statistics Office (CSO) Zimbabwe and the Reserve Bank of Zimbabwe (RBZ) data bank were used to supplement the World Bank’s databases. The sample frame was from 1996 to 2021. The choice of time frame was rationalised on the basis that, in Zimbabwe, being an infant PPP market, it was in the late 1990s that the pioneering PPP contract was signed. The sample frame provided 25 data points that the researchers considered reasonable, given that this is a single-country analysis. In sync with [52,58], the dependent variable (PPPUSD) was the investment value of PPPs that reached financial closure. Table 1 summarises the explanatory variables.

Table 1.

Explanatory variables.

The objective of this analysis is to present a proposed framework for financing water and sanitation PPP projects in Zimbabwe. Achieving the objective requires, firstly, the identification of finance sources for PPP projects, and secondly, the empirical determination of the variables that drive PPP financing in Zimbabwe. To achieve the latter, and since the dependent variable (PPPUSD) is a non-negative and continuous variable, the Tobit regression model was used [55,58]. Moreso, the Tobit regression model accounts for censoring in the dependent variable that can potentially create biases if Ordinary Least Squares (OLS) were to be used. Parameters were estimated using the maximum likelihood estimation. The dependent variable was judged to be left-censored, being characterised by a clustering pattern around zero. Zimbabwe’s PPP market is in its formative stages, and for this reason, over the sample period, some years had recorded zero PPPs that were finalised. The literature confirms governance variables to be highly correlated [67,68]. To manage the adverse consequences of multicollinearity and the loss of explanatory power, the six governance variables (control of corruption, CC; regulatory quality, RQ; rule of law, RL; voice and accountability, VA; political stability, PS; and government effectiveness, GE) were examined separately, and hence, seven models were estimated.

where is the natural logarithm of the USD investment value differenced once. and are the natural logarithm of the one period lag of GDP per capita and inflation differenced once, whereas represents a one period lag of the ratio of international reserves to imports differenced once. , , , and are the financial market measures of stock market capitalisation to GDP, domestic bank credit to private sector, the ratio of bank credit to bank deposits, and non-performing loans, respectively. The metrics are in the first difference. , , , , , and represent the first difference of the percentile ranking of the governance variables, namely, the control of corruption, regulatory quality, rule of law, voice and accountability, political stability, and government effectiveness, respectively. is the error term.

3. Results and Discussion of Findings

Multicollinearity was controlled by estimating the models using variables with a variance inflation factor (VIF) under 10 [62]. Unit root testing was performed using the augmented Dickey–Fuller test [69]. The VIF and ADF diagnostic test results are reported below, in Table 2 and Table 3, respectively. As recommended by [69,70,71], to control for heteroskedasticity, robust standard errors were used.

Table 2.

Variance inflation factor analysis.

Table 3.

ADF unit root test.

Seven models were estimated, and the results are summarised in Table 4. A mixed influence of GDP per capita on PPP financing was reported across the models. Models 1, 2, and 6 confirmed that GDP per capita, at the 10% and 5% levels of significance, impact water and sanitation PPP investment. Contrary to [50,58], the relationship between GDP per capita and PPP financing in Zimbabwe was negative. The inverse variation between GDP per capita and water and sanitation PPPs, consistent across the seven models, can be explained by the World Bank’s observation that low-income economies have a greater need to invest in infrastructure, including through PPP, to transform economies and enhance the standards of living. As countries prosper, the demand for PPP declines since public finances can adequately finance water infrastructure. Nevertheless, models 3, 4, 5, and 7 reported that GDP per capita does not significantly influence the financing of water PPPs in Zimbabwe. China is the main source of infrastructure finance in Zimbabwe, and primarily, investments are rationalised on political solidarity rather than economic metrics.

Table 4.

Tobit regression estimates.

The ratio of international reserves to imports (IRIMP) does not influence water and sanitation PPPs. Ref. [72] argues that the level of import cover is an important determinant of infrastructure investments on the observation that developing economies characterised by low import cover are prone to currency crashes. In Zimbabwe, IRIMP has largely been low [73]. The authors in [74] asserted that the closure of water and sanitation PPPs is explained by the prevalence of the stable rate of inflation in China. However, despite high inflation volatility [20], the bearing of inflation on water and sanitation infrastructure financing is insignificant. Perhaps, the finding can be explained by the fact that precious minerals have been used to guarantee returns for investors. On the other hand, we determined that the relationship between FDI and PPP financing was negative and significant. The negative relationship implies that, subject to dwindling international capital inflows, the government of Zimbabwe values PPPs for water infrastructure development. In fact, in [75], the authors stated that it is only when public finances are under pressure that the Government of Zimbabwe seeks to attract private partners.

The ratio of stock market capitalisation positively related to water and sanitation finance, and the relationship is significant at 1%. Earlier, ref. [51] confirmed that PPP investments are mainly driven by capital market development. Characteristically, infrastructure investments are long-term in nature and thus require liquid markets for financing. Other than the capital market, bank market development influences water and sanitation PPP financing. The ratio of bank credit to bank deposits (BCD) significantly influences PPP financing at 1%. This finding is synchronous with [35,64], who in their studies established that commercial banks with large balance sheets are better positioned to finance infrastructure projects. The ratio of domestic bank credit to private sector (DBC) significantly influences water PPP finance. During the early construction phases, refs. [35,52] reiterated the centrality of commercial bank loans as a source of debt finance.

Non-performing loans (NPL) significantly and negatively bear on financing PPP investment. This finding supports the proposition that the propensity to avail project finance is high for institutions with high asset quality [35]. According to [76], since 2015, the proportion of non-performing loans in the banking sector has been improving. Contrary to [18,55,56,65,75,77], who reiterated the importance of governance indicators in project finance, the current study concludes that, in Zimbabwe, the governance environment has an insignificant bearing on PPP financing. Perhaps the observation can be explained by the fact that the Chinese, with little regard for institutional quality, are the main sponsors of water and sanitation PPPs in Zimbabwe.

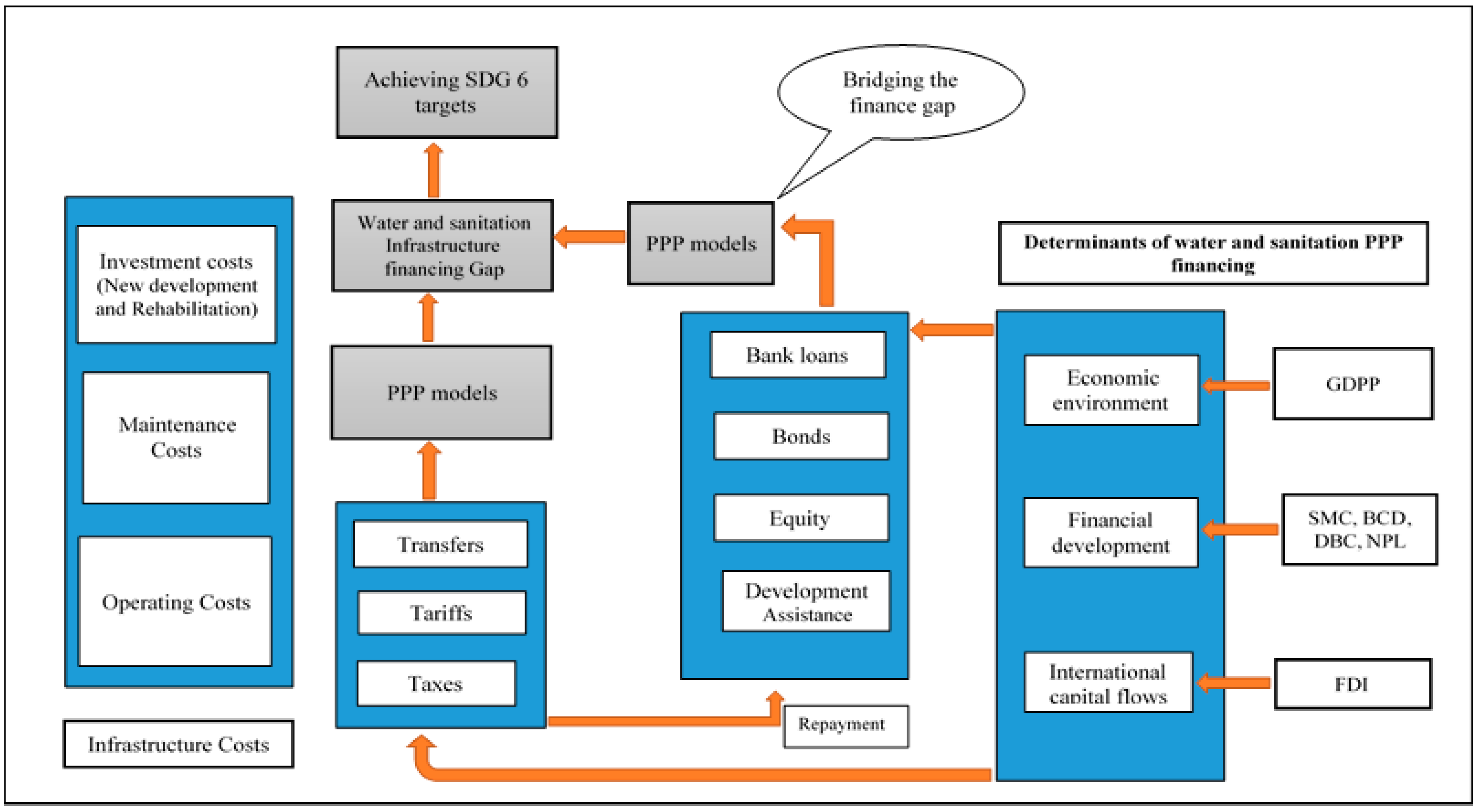

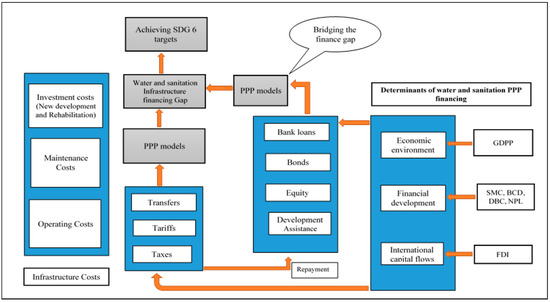

4. Framework for Financing Water and Sanitation PPPs

Figure 2 summarises the framework for financing water and sanitation infrastructure PPPs in Zimbabwe. The provision of water and sanitation can be conceptualised as constituting of three cost components, namely, capital investment, maintenance, and operating costs [78]. Capital investment is expenditure on hardware and software on water and sanitation infrastructure systems. Expenditure on upgrading or expanding water and sanitation services to additional consumers is classified as capital in nature. Software capital expenditure includes the costs of assessment studies that precede the water and sanitation project implementation along with any other costs for capacity building. Once construction is completed, a phase comes in the lifecycle of the project when the infrastructure asset becomes operational. Ref. [79] noted that even though operating expenditure receives limited attention in the water and infrastructure financing discourse, over the life-time of the asset, operating expenditures are substantial. Moreover, in some developing countries, despite international support for building infrastructure assets, domestic resources cannot suffice to operate the asset. Operating costs are recurrent and include expenditure on labour and materials needed to keep water and sanitation systems functional. Operating costs are expected to constitute a significant share of infrastructure costs if sustainable development targets on water are to be achieved [80]. Over time, some components of the water and sanitation systems may stop working and would thus require maintenance. The authors in [81] reiterated that the water and sanitation finance plan in Zimbabwe, for the decade ahead, must prioritise maintenance expenditures. Approximately 50% of the treated water produced in Zimbabwe cannot be accounted for due to network distribution losses. Inadequate expenditure on maintenance, besides reducing the useful life of investment assets, increases asset replacement costs by 60% [80]. To meet SDG target 6.1, it is estimated to cost developing countries between 1.1% and 1.4% of GDP.

Figure 2.

Framework model for financing water and sanitation infrastructure in Zimbabwe.

The water and sanitation financing gap in Zimbabwe is huge. For instance, according to the greater Harare master plan, the city requires, between 2021 and 2030, USD 1.4 billion to finance water and sanitation infrastructure. When investment requirements for other cities such as Gweru, Bulawayo, and Mutare are factored in, the investment need is even higher. The need for capital investments has come during a phase of severe economic underperformance. Given the acceptance of PPPs for infrastructure development in Zimbabwe, Figure 2 shows that private and public sources complement to finance PPPs [82]. Commercial bank loans can be used to channel capital, operational, and maintenance resources for water and sanitation PPP projects. Zimbabwe has 19 functional banking institutions, which, given a conducive environment, can be a rich source of loanable funds. Bank sources can be supplemented with bonds. On average, bonds offer long maturity and, hence, the suitability to finance infrastructure. The types of bonds that can be issued may include sovereign bonds, corporate bonds, diaspora bonds, and project bonds, among other bond classes. Furthermore, domestic and international equity markets can be used to mobilise finance. The equity market is an attractive source for long-term investments since there is no specific deadline for capital repayment. Moreso, equity investors are often interested in holding a stake in PPPs for a longer period to maximise both the capital gains and the holding period return. Harnessing the sources of financing is dependent on the economic, financial development, and international capital flow variables econometrically confirmed as significant determinants. PPP financing policy in Zimbabwe should target these variables to enhance investment inflows into the water and sanitation sector.

5. Conclusions

This study sought to identify the drivers of water and sanitation PPP financing so as to later develop a financing framework for water and sanitation PPPs in Zimbabwe. This follows the observation by [17] that even in developed OECD countries, there are no readily available comprehensive frameworks for financing public infrastructure, as respective countries embrace their own practices that guide water and sanitation infrastructure financing. Our study concludes that water and sanitation financing frameworks, in line with SDG 17, must integrate both state and non-state sources of finance to sustainably bridge the water and sanitation financing gap in Zimbabwe. The Government of Zimbabwe is implored to seek to optimise internal public revenue sources of taxes, tariffs, and transfers that can be channelled towards financing its PPP projects. Collectively and independently, public sources of PPP financing provide viability gap funding, which is critical to enhancing the risk profile of water and sanitation infrastructure projects. This study concludes that the level of financial market development is key to attracting private investors. As such, enhancing private sources of PPP finance requires that economic policies in Zimbabwe stimulate both capital market and bank market development [61], as it has been proven that developed financial markets are efficient in intermediating infrastructure investments. Similar to the work by [79], we propose that developing countries such as Zimbabwe should move away from the traditional PPP model and consider a Multi-Stakeholder Partnerships (MSPs) approach, which extends responsibilities, power, and interest to other key stakeholders such as non-governmental organisations (NGOs), communities, and private investors so as to promote inclusivity in water and sanitation infrastructure projects while simultaneously tapping into additional resources and networks.

Other than contributing to the scant literature on financing frameworks for water and sanitation PPPs in Zimbabwe, this study is a basis for future research that can apply an extended methodology such as count models or binary models to build the framework, as this could generate different outcomes from studies that apply the censored regression technique such as ours.

Author Contributions

Conceptualisation, J.M. and P.L.M.; methodology, J.M. and P.L.M.; formal analysis, J.M. and P.L.M.; writing—original draft preparation, J.M.; review and editing, P.L.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding. The APC was paid by the University of South Africa (UNISA).

Data Availability Statement

Data used in the study were sourced from the following publicly accessible repositories: World Bank PPI database, Reserve Bank of Zimbabwe, and Central Statistics Office Zimbabwe.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Bandauko, E.; Bobo, T.; Mandisvika, G. Towards Smart Urban Transportation System in Harare, Zimbabwe. In Intelligent Transportation and Planning: Breakthroughs in Research and Practice; IGI Global Publishing: Hershey, PA, USA, 2018; pp. 962–978. [Google Scholar] [CrossRef]

- Drabo, D. From Land Reform to Hyperinflation: The Zimbabwean Experience of 1997–2008. 2018. Available online: https://econpapers.repec.org/paper/haljournl/hal-02141818.htm (accessed on 20 August 2020).

- Adeleke, F. Illicit financial flows and inequality in Africa: How to reverse the tide in Zimbabwe. S. Afr. J. Int. Aff. 2019, 26, 367–393. [Google Scholar] [CrossRef]

- Marevesa, T. The government of national unity and national healing in Zimbabwe. In National Healing, Integration and Reconciliation in Zimbabwe, 1st ed.; Routledge: London, UK, 2019; pp. 55–68. [Google Scholar] [CrossRef]

- Saungweme, T.; Odhiambo, N.M. Government debt, government debt service and economic growth nexus in Zambia: A multivariate analysis. Cogent Econ. Finance 2019, 7, 1–17. [Google Scholar] [CrossRef]

- Nhapi, I. Challenges for water supply and sanitation in developing countries: Case studies from Zimbabwe. In Understanding and Managing Urban Water in Transition; Springer: Dordrecht, The Netherlands, 2015; pp. 91–119. [Google Scholar] [CrossRef]

- Tendaupenyu, P.; Magadza, C.H.D.; Murwira, A. Changes in landuse/landcover patterns and human population growth in the Lake Chivero catchment, Zimbabwe. Geocarto Int. 2016, 32, 797–811. [Google Scholar] [CrossRef]

- Homerai, F.; Mayo, A.W.; Hoko, Z. Sustainability of Chiredzi town water supply and wastewater management in Zimbabwe. Afr. J. Environ. Sci. Technol. 2019, 13, 22–35. [Google Scholar] [CrossRef]

- Cole, A.; Mudhuviwa, S.; Maja, T.; Cronin, A. Lessons Learnt from financing WASH rehabilitation works in small towns in Zimbabwe. Dev. Pract. 2021, 31, 533–547. [Google Scholar] [CrossRef]

- Fall, M.; Marin, P.; Locussol, A.; Verspyck, R. Reforming Urban Water Utilities in Western and Central Africa: Experiences with Public-Private Partnerships Case Studies. 2009. Available online: https://documents1.worldbank.org/curated/en/356151468236368922/pdf/487300NWP0v10B1P131PPPWestAfrica1v1.pdf (accessed on 28 March 2021).

- Ministry of Finance and Economic Development. 2019 National Budget Statement. Harare, Zimbabwe. 2019. Available online: http://www.zimtreasury.gov.zw/?page_id=731 (accessed on 25 September 2022).

- Zhao, Z.J.; Su, G.; Li, D. The rise of public-private partnerships in China. J. Chin. Gov. 2018, 3, 158–176. [Google Scholar] [CrossRef]

- Wu, X.; House, R.S.; Peri, R. Public-private partnerships (PPPs) in water and sanitation in India: Lessons from China. Water Policy 2016, 18, 153–176. [Google Scholar] [CrossRef]

- Qian, N.; House, S.; Wu, A.M.; Wu, X. Public–private partnerships in the water sector in China: A comparative analysis. Int. J. Water Resour. Dev. 2019, 36, 631–650. [Google Scholar] [CrossRef]

- Private Participation in Infrastructure Database. Available online: https://ppi.worldbank.org/en/ppi (accessed on 10 May 2023).

- Chilunjika, A. Public Private Partnerships (PPPs), road tolling and highway infrastructure investment in Zimbabwe. Int. J. Res. Bus. Soc. Sci. 2023, 12, 575–584. [Google Scholar] [CrossRef]

- Henn, L.; Sloan, K.; Charles, M.B.; Douglas, N. An appraisal framework for evaluating financing approaches for public infrastructure. Public Money Manag. 2016, 36, 273–280. [Google Scholar] [CrossRef]

- Tshehla, M.F.; Mukudu, E. Addressing Constraints for Effective Project Finance for Infrastructure Projects in Emerging Economies—The Case of Zimbabwe. J. Constr. Bus. Manag. 2020, 4, 48–59. [Google Scholar] [CrossRef]

- Kapesa, T.; Mugano, G.; Fourie, H. A framework for financing public economic infrastructure in Zimbabwe. S. Afr. J. Account. Audit. Res. 2021, 23, 65–76. [Google Scholar] [CrossRef]

- Frone, S.; Frone, D.F. Issues of efficiency for public-private partnerships in the water sector. Stud. Sci. Res. Econ. Ed. 2018, 27, 75–85. [Google Scholar] [CrossRef][Green Version]

- World Bank. Reducing Inequalities in Water Supply, Sanitation, and Hygiene in the Era of the Sustainable Development Goals: Synthesis Report of the WASH Poverty Diagnostic initiative; World Bank Group: Washington, DC, USA, 2017; Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/27831/w17075.pdf?sequence=5&isallowed=y (accessed on 19 May 2020).

- Möykkynen, H.; Pantelias, A. Viability gap funding for promoting private infrastructure investment in Africa: Views from stakeholders. J. Econ. Policy Reform 2020, 24, 253–269. [Google Scholar] [CrossRef]

- Sebele-Mpofu, F.Y.; Mashiri, E.; Korera, P. Transfer Pricing Audit Challenges and Dispute Resolution Effectiveness in Developing Countries with Specific Focus on Zimbabwe. Account. Econ. Law A Conviv. 2021, 11, 1–47. [Google Scholar] [CrossRef]

- Miyamoto, K.; Chiofalo, E. Official Development Finance for Infrastructure: With a Special Focus on Multilateral Development Banks; OECD Development Co-operation Working Papers, No. 30; OECD Publishing: Paris, France, 2016. [Google Scholar] [CrossRef]

- Patel, P.; Dahab, M.; Tanabe, M.; Murphy, A.; Ettema, L.; Guy, S.; Roberts, B. Tracking official development assistance for reproductive health in conflict-affected countries: 2002–2011. BJOG Int. J. Obstet. Gynaecol. 2016, 123, 1693–1704. [Google Scholar] [CrossRef]

- Kolker, J.E.; Trémolet, S.; Winpenny, J.; Cardone, R. Financing Options for the 2030 Water Agenda. 2016. Available online: https://hdl.handle.net/10986/25495 (accessed on 19 May 2021).

- Kitano, N.; Harada, Y. Estimating China’s Foreign Aid 2001–2013. J. Int. Dev. 2015, 28, 1050–1074. [Google Scholar] [CrossRef]

- Alaerts, G.J. Financing for water—Water for financing: A global review of policy and practice. Sustainability 2019, 11, 821. [Google Scholar] [CrossRef]

- Yaya, S.; Udenigwe, O.; Yeboah, H. Development aid and access to water and sanitation in sub-Saharan Africa. In Better Spending for Localizing Global Sustainable Development Goals; Routledge: London, UK, 2019; pp. 167–185. [Google Scholar] [CrossRef]

- Osano, H.M.; Koine, P.W. Role of foreign direct investment on technology transfer and economic growth in Kenya: A case of the energy sector. J. Innov. Entrep. 2016, 5, 31. [Google Scholar] [CrossRef]

- Ghebrihiwet, N.; Motchenkova, E. Relationship between FDI, foreign ownership restrictions, and technology transfer in the resources sector: A derivation approach. Resour. Policy 2017, 52, 320–326. [Google Scholar] [CrossRef]

- Kirkpatrick, C.; Parker, D.; Zhang, Y.-F. An empirical analysis of state and private-sector provision of water services in Africa. World Bank Econ. Rev. 2006, 20, 143–163. [Google Scholar] [CrossRef]

- Nag, T.; Kettunen, J.; Sorsa, K. Exploring Private Participation in Indian Water Sector: Issues and Options. Sustainable Engagement in the Indian and Finnish Business, no. 119. Available online: http://julkaisut.turkuamk.fi/isbn9789522167040.pdf (accessed on 20 May 2021).

- Jackline, A. Public water and waste management in Uganda: The legal framework, obstacles and challenges. KAS Afr. Law Study Libr.-Libr. Afr. d’Etudes Juridiques 2020, 7, 642–652. [Google Scholar] [CrossRef]

- Rao, V. An Empirical Analysis of the Factors that Influence Infrastructure Project Financing by Banks in Select Asian Economies. ADBI No 554. 2018. Available online: https://www.adb.org/sites/default/files/publication/445881/ewp-554-project-financing-infrastructure-ppp-projects.pdf (accessed on 11 August 2021).

- Linh, N.N.; Wan, X.; Thuy, H.T. Financing a PPP Project: Sources and Financial Instruments—Case Study from China. Int. J. Bus. Manag. 2018, 13, p240. [Google Scholar] [CrossRef]

- Lu, Z.; Peña-Mora, F.; Wang, S.Q.; Liu, T.; Wu, D. Assessment framework for financing public–private partnership infrastructure projects through asset-backed securitization. J. Manag. Eng. 2019, 35, 04019027. [Google Scholar] [CrossRef]

- Vassallo, J.M.; Rangel, T.; de los Ángeles Baeza, M.; Bueno, P.C. The Europe 2020 Project Bond Initiative: An alternative to finance infrastructure in Europe. Technol. Econ. Dev. Econ. 2015, 24, 229–252. [Google Scholar] [CrossRef]

- WB (World Bank). Zimbabwe’s Infrastructure a Continental Perspective. 2011. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/27258/647390WP0P12420e0country0report0Web.pdf?sequence=1&isAllowed=y (accessed on 2 February 2021).

- Srivastava, V. Project finance bank loans and PPP funding in India: A risk management perspective. J. Bank. Regul. 2017, 18, 14–27. [Google Scholar] [CrossRef]

- Inderst, G. Infrastructure Investment, Private Finance, and Institutional Investors: Asia from a Global Perspective; ADBI Working Paper 555; Asian Development Bank Institute: Tokyo, Japan, 2016. [Google Scholar] [CrossRef]

- OECD (Organisation for Economic Cooperation and Development). Infrastructure Financing Instruments and Incentives. 2015. Available online: https://www.oecd.org/finance/private-pensions/Infrastructure-Financing-Instruments-and-Incentives.pdf (accessed on 15 October 2022).

- Lara-Galera, A.; Technical University of Madrid; Sánchez-Soliño, A.; Gómez-Linacero, M. Analysis of infrastructure funds as an alternative tool for the financing of public-private partnerships. J. Constr. 2017, 16, 403–411. [Google Scholar] [CrossRef]

- Oji, C.K. Bonds: A Viable Alternative for Financing Africa’s Development. 2015. Available online: https://africaportal.org/publication/bonds-a-viable-alternative-for-financing-africas-development/ (accessed on 20 June 2023).

- Vecchi, V.; Casalini, F.; Cusumano, N.; Leone, V.M. Private Investments for Infrastructure. In Public Private Partnerships; Palgrave Macmillan: Cham, Switzerland, 2021. [Google Scholar] [CrossRef]

- Musah, A.; Badu-Acquah, B.; Adjei, E. Factors that influence bond markets development in Ghana. J. Perspekt. Pembiayaan Dan Pembang. Drh. 2019, 6, 461–476. [Google Scholar] [CrossRef]

- Hyun, S.; Park, D.; Tian, G. Determinants of Public–Private Partnerships in Infrastructure in Asia: Implications for Capital Market Development; Asian Development Bank Economics Working Paper Series, 552; Asian Development Bank Institute: Tokyo, Japan, 2018. [Google Scholar] [CrossRef]

- Jensen, O.; Blanc-Brude, F. The Handshake: Why Do Governments and Firms Sign Private Sector Participation Deals? Evidence from the Water and Sanitation Sector in Developing Countries. World Bank Policy Research Working Paper, (3937). 2006. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=923244#:~:text=Jensen%2C%20Olivia%20and,com/abstract%3D923244 (accessed on 15 August 2022).

- IMF (International Monetary Fund). Determinants of Public-Private Partnerships in Infrastructure. 2006. Available online: https://www.elibrary.imf.org/view/journals/001/2006/099/001.2006.issue-099-en.xml (accessed on 20 October 2022).

- Sharma, C. Determinants of PPP in infrastructure in developing economies. Transform. Gov. People Process. Policy 2012, 6, 149–166. [Google Scholar] [CrossRef]

- Ba, L.; Gasmi, F.; Noumba, P. Is the Level of Financial Sector Development a Key Determinant of Private Investment in the Power Sector? World Bank Policy Research Working Paper, (5373); Asian Development Bank Institute: Tokyo, Japan, 2010; Available online: https://ssrn.com/abstract=1647517 (accessed on 8 September 2022).

- Ba, L.; Um, P.N.; Gasmi, F. The relationship between financial development and private investment commitments in energy projects. J. Econ. Dev. 2017, 42, 17–40. [Google Scholar] [CrossRef]

- Jensen, O.; Blanc-Brude, F. The Institutional Determinants of Private Sector Participation in the Water and Sanitation Sector in Developing Countries. In Proceedings of the 4th Conference on Applied Infrastructure Research, Berlin, Germany, 8 October 2005; Available online: https://www.researchgate.net/publication/228775879_The_Institutional_Determinants_of_Private_Sector_Participation_in_the_Water_and_Sanitation_Sector_in_Developing_Countries (accessed on 23 August 2022).

- Banerjee, S.G.; Oetzel, J.M.; Ranganathan, R. Private provision of infrastructure in emerging markets: Do institutions matter? Dev. Policy Rev. 2006, 24, 175–202. [Google Scholar] [CrossRef]

- Fleta-Asín, J.; Muñoz, F. Renewable energy public–private partnerships in developing countries: Determinants of private investment. Sustain. Dev. 2021, 29, 653–670. [Google Scholar] [CrossRef]

- Taguchi, H.; Sunouchi, Y. The role of institutions in private participation in infrastructure in low-and middle-income countries: Greenfield versus brownfield projects. Econ. Bull. 2019, 39, 2027–2039. Available online: http://www.accessecon.com/Pubs/EB/2019/Volume39/EB-19-V39-I3-P190.pdf (accessed on 20 August 2022).

- Panayides, P.M.; Parola, F.; Lam, J.S.L. The effect of institutional factors on public–private partnership success in ports. Transp. Res. Part A Policy Pract. 2015, 71, 110–127. [Google Scholar] [CrossRef]

- Pan, D.; Chen, H.; Zhou, G.; Kong, F. Determinants of public-private partnership adoption in solid waste management in rural China. Int. J. Environ. Res. Public Health 2020, 17, 5350. [Google Scholar] [CrossRef]

- Kumar, N. Determinants of Public Private Partnerships in Infrastructure: A Study of Developing Countries. J. Commer. Account. Res. 2019, 8, 79–85. [Google Scholar]

- Kasri, R.A.; Wibowo, F.A. Determinants of Public Private Partnerships in Infrastructure provision: Evidence from Muslim developing countries. J. Econ. Coop. Dev. 2015, 36, 1–34. [Google Scholar]

- Marozva, G.; Makoni, P.L. Foreign direct investment, infrastructure development and economic growth in African economies, Acta Universitatis Danubius. Œconomica 2018, 14, 90–102. [Google Scholar]

- Chikaza, Z.; Simatele, M. Private financing for infrastructural development: A search for determinants in public–private partnerships in SSA. Acta Universitatis Danubius. Œconomica 2021, 17, 170–188. [Google Scholar]

- Telang, V.; Prakash, S. Financing of public private partnerships in India (sources, problems and challenges). Res. Front. 2015, 3, 49–62. [Google Scholar]

- Kamau, P. Commercial Banks and Economic Infrastructure PPP Projects in Kenya: Experience and Prospects. KBA Centre for Research on Financial Markets and Policy Working Papers Series WPS/01, 16. 2016. Available online: https://www.kba.co.ke/wp-content/uploads/2022/05/Working-Paper-WPS-01-16.pdf (accessed on 11 August 2021).

- Banerjee, S.G.; Rondinelli, D.A.; Koo, J. Decentralisation’s Impact on Private Participation in Infrastructure in Developing Countries; Working Paper; University of North Carolina: Chapel Hill, NC, USA, 2003. [Google Scholar]

- Sahni, H.; Nsiah, C.; Fayissa, B. Institutional quality, infrastructure, and economic growth in Africa. J. Afr. Dev. 2021, 22, 7–37. [Google Scholar] [CrossRef]

- Nxumalo, I.S. International Capital Inflows in Emerging Markets: The Role of Institutions. Master’s Dissertation, University of South Africa, Cape Town, South Africa, 2020. Available online: https://uir.unisa.ac.za/bitstream/handle/10500/26992/dissertation_nxumalo_is.pdf (accessed on 8 September 2022).

- Nxumalo, I.S.; Makoni, P.L. Analysis of International Capital Inflows and Institutional Quality in Emerging Markets. Economies 2021, 9, 179. [Google Scholar] [CrossRef]

- Brooks, C. Introductory Econometrics for Finance; Cambridge University: Cambridge, UK, 2008. [Google Scholar]

- Mundonde, J.; Makoni, P.L. Public private partnerships and water and sanitation infrastructure development in Zimbabwe: What determines financing? Environ. Syst. Res. 2023, 12, 14. [Google Scholar] [CrossRef]

- Wooldridge, J.M. A computationally simple heteroskedasticity and serial correlation robust standard error for the linear regression model. Econ. Lett. 1989, 31, 239–243. [Google Scholar] [CrossRef]

- Nakatani, R. Structural vulnerability and resilience to currency crisis: Foreign currency debt versus export. North Am. J. Econ. Finance 2017, 42, 132–143. [Google Scholar] [CrossRef]

- Kavila, W.; Le Roux, P. Inflation dynamics in a dollarised economy: The case of Zimbabwe. South. Afr. Bus. Rev. 2019, 20, 94–117. [Google Scholar] [CrossRef] [PubMed]

- Chan, A.P.C.; Lam, P.T.I.; Wen, Y.; Ameyaw, E.E.; Wang, S.; Ke, Y. Cross-sectional analysis of critical risk factors for PPP water projects in China. J. Infrastruct. Syst. 2015, 21, 401–403. [Google Scholar] [CrossRef]

- Maposa, L.; Munanga, Y. Public-private partnerships development finance model in Zimbabwe infrastructure projects. Open Access Libr. J. 2021, 8, 1–24. [Google Scholar] [CrossRef]

- RBZ (Reserve Bank of Zimbabwe). Monetary Policy Statement. 2020. Available online: https://www.rbz.co.zw/index.php/monetary-policy/monetary-policy-statements (accessed on 18 November 2022).

- Chitongo, L. Public private partnerships and housing provision in Zimbabwe: The case of Runyararo South West housing scheme (Mbudzi) Masvingo. Eur. J. Res. Soc. Sci. 2017, 5, 17–29. Available online: https://www.idpublications.org/wp-content/uploads/2017/06/Abstract-PUBLIC-PRIVATE-PARTNERSHIPS-AND-HOUSING-PROVISION.pdf (accessed on 30 August 2022).

- Goksu, A.; Trémolet, S.; Kolker, J.E. Easing the Transition to Commercial Financing for Sustainable Water and Sanitation. 2017. Available online: https://www.oecd.org/water/Background-Document-OECD-GIZ-Conference-Easing-the-Transition.pdf (accessed on 4 April 2023).

- Mendis, K.; Thayaparan, M.; Kaluarachchi, Y.; Ingirige, B. Effective Stakeholder Management for Inclusive Post-Flood Management: Sri Lanka as a Case Study. Water 2024, 16, 1429. [Google Scholar] [CrossRef]

- Rozenberg, J.; Fay, M. (Eds.) Beyond the Gap: How Countries Can Afford the Infrastructure They Need while Protecting the Planet; World Bank Publications: Chicago, IL, USA, 2019; Available online: http://documents.worldbank.org/curated/en/189471550755819133/Beyond-the-Gap-How-Countries-Can-Afford-the-Infrastructure-They-Need-while-Protecting-the-Planet (accessed on 18 November 2022).

- AfDB (African Development Bank). Zimbabwe Infrastructure Report. 2019. Available online: https://www.afdb.org/fileadmin/uploads/afdb/Documents/Project-and-Operations/Zimbabwe_Infrastructure_Report_2019_-_AfDB.pdf (accessed on 28 February 2023).

- Humphreys, E.; van der Kerk, A.; Fonseca, C. Public finance for water infrastructure development and its practical challenges for small towns. Water Policy 2018, 20, 100–111. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).