4.1. Spatial Spillover Effect of Housing Jeonse Prices

To analyze the spatial spillover of jeonse prices, we performed the ADF unit root test to identify the stability of the time series data. The ADF test was performed using the jeonse price index and the rate of change in the jeonse price (jeonse price change rate) compared to the previous month. Consequently, we found that a unit root exists in the jeonse price index, but the jeonse price change rate was statistically significant within the 5% significance level, indicating the lack of a unit root (see

Table 1). Therefore, a time series analysis was performed based on the jeonse price change rate in which there was no unit root of the raw data. Further, using the actual change data is advantageous as it can easily explain the analysis results.

Table 2 presents the descriptive statistics of jeonse price. The region with the largest increase in jeonse price during the research period was Gangnam (Seoul), which exhibited an average monthly increase of about 0.35%. The location with the next highest upward trend was Goyang, which is located in the Gyeongeui region, with an average monthly increase of 0.304%. Eunpyeong in the Northwest region exhibited the largest increase (maximum) in jeonse price, with a monthly average of about 3.7%, while Gangnam had the largest drop (minimum), with a monthly average of 3.65% in December 2008.

Following this, we conducted a correlation analysis to examine the changes in jeonse price between regions. The price between regions was found to have a higher correlation within the same region, implying that the spillover effect could be higher in regions with similar housing market characteristics. In addition, the correlation between cities in the Northwest region was found to be higher than that of the Gyeongeui region, and the correlation with other cities in the Gangnam area was found to be lower than that of the Northwest and Gyeongeui regions. However, the difference was not significant. Accordingly, it can be inferred that the price spillover effect of the jeonse market within the Seoul area is noticeable, and the influence of the Gangnam jeonse market appears over a relatively wide spatial range (see

Table 3).

Additionally, we examined the relationship of jeonse price changes between cities through the correlation analysis. The price change in Goyang indicates a high correlation with neighboring cities such as Paju and Mapo. Moreover, Mapo shows a high correlation with Goyang, Seodaemun, and Gangnam, while Gimpo and Paju exhibit a relatively low correlation. Eunpyeong shows a relatively high correlation with Gimpo, Mapo, and Goyang, but a relatively low correlation with Paju. Seodaemun has a high correlation with Mapo, Goyang, and Eunpyeong, but a low correlation with Paju and Gimpo. In the case of Gimpo, jeonse price has the highest correlation with Goyang, followed by Eunpyeong, while Paju has the highest correlation with Goyang. Lastly, Mapo and Goyang were the cities with high correlation with Gangnam, and other cities show a slightly lower correlation than Mapo and Goyang (see

Table 4).

A correlation analysis merely identifies the relationship between two regions, and it has limited scope in examining whether this relationship causes the price change. Although it is possible to infer a relationship between two regions through correlation analysis, it is not possible to identify a causal relationship such as whether a price change in one region has an effect or can cause a price change in another region. Since the Granger causality analysis can explain the causes that affect the variation of one variable, it can compensate for the shortcomings of the correlation analysis results. However, since the judgment of inter-variable influences was limited with the results of solely the Granger causal analysis, a VAR was constructed to examine the influences by region. To establish an analysis model, the long-term balance relationship and the appropriate time lag were tested.

The test result reveals that the appropriate lag length was 1, indicating that there was no long-term balance relationship. Therefore, we identified the regions that cause price changes between regions through the Granger causality analysis;

Table 5 presents the results of this analysis. On the one hand, the results reveal that jeonse price in the Gangnam area, the core housing market in Korea, is a strong Granger cause of the changes in jeonse prices in Mapo, Eunpyeong, and Seodaemun in the Northwest region. Moreover, jeonse prices in Goyang, Paju, and Gimpo, which are in the Gyeongeui region, were found to be a strong Granger cause of changes in jeonse prices in Gangnam, which is geographically distant. On the other hand, we found that there was no significant Granger causality in other regions regarding the price changes in Gangnam. However, Mapo, which has a relatively high jeonse price because it is located close to the center of Seoul, was the cause of the changes in jeonse price in Gangnam after the 2nd period (Lag 2). These results indicate that the change in jeonse price in Mapo was affected by the price in Gangnam and vice-versa.

Similar to the previous correlation results, the results of the Granger causality analysis reveal that jeonse prices in neighboring cities may have a positive (+) relationship. In other words, Gangnam, which is considered to be the core housing market in Korea, has a significant effect on the jeonse price changes in other housing submarkets (cities) within the same region, and also exerts a considerable influence on the jeonse market in geographically distant outskirts.

Next,

Table 6 presents the results of the Granger causality analysis of jeonse prices in the Northwest and Gyeongeui regions’ cities, excluding Gangnam. First, Goyang exhibited a mutual Granger causality with Mapo. Second, the change in jeonse price in Eunpyeong was the Granger cause of the jeonse price change in Goyang from the outset, and Gimpo and Paju showed a Granger causality with Goyang from the outset as well. This result indicates that there was a statistically significant Granger causal relationship for jeonse price in most cities in the Northwest and Gyeongeui regions and in their neighboring cities. However, we found that cities in the Gyeongeui region did not show a significant Granger causality with the jeonse prices of cities in the Northwest region, suggesting that the cities in Seoul maintain a subordinate relationship with those in neighboring Gyeonggi-do.

Based on the VAR, we performed the impulse response analysis and variance decomposition analysis. The results of the impulse response analysis reveal that the spillover effect affecting the jeonse price varied for each region and individual city. Specifically, the jeonse price of Mapo was most affected by Mapo itself, and the effect lasted for more than 10 months. Further, Mapo was found to have a short-term effect on price changes in the neighboring cities of Eunpyeong, Seodaemun and Goyang, but had a relatively weak or negative effect on Paju, which is at a distance. Eunpyeong and Seodaemun exhibited a spillover effect with adjacent cities such as Mapo. This indicated that the cities in the Northwest region had a large spillover effect and a differential effect on the neighboring cities in the Gyeongeui region depending on the geographical distance (see

Figure 3).

Moreover, individual cities in the Gyeongeui region exhibited their own significant influence on the change in jeonse prices, but the period of this influence was approximately 30% shorter than that of the Northwest region. In addition, unlike the Northwest region, the effect of jeonse price spillover in the cities in the Gyeongeui region was closely related to the cities in the Northwest region, and the price spillover between cities in the Gyeongeui region was relatively low. In the case of Paju, we found that the relationship with other regions was the weakest, which appears to be due to the limitation of the spatial constraint in that Paju is located in the far northwestern part of Korea and has a border to its north, which is not the case for the other cities (See

Figure 1 and

Figure 4).

The results can be summarized as follows: In the jeonse market, the price spillover between cities in the Northwest region (Seoul) was large, which in turn had a sizeable influence on the neighboring Gyeongeui region (Gyeonggi-do). However, the price spillover in the Gyeongeui region was more closely related to the Northwest region (Seoul) rather than being significant within the region. This suggests that Seoul leads the jeonse market, and that cities in the neighboring Gyeonggi-do may experience notable price changes due to the changes in jeonse prices in Seoul.

On examining the results of the variance decomposition analysis, which can confirm the contribution of other cities to the change in jeonse price, we found that in the Northwest region, the price changes in individual cities contributed the most to their own price changes. In particular, Mapo in the Northwest region had the highest influence (over 80%) on its own jeonse prices and greatly influenced the jeonse price changes in other cities in the Northwest region. Furthermore, in other cities, their own price changes were found to be an important factor regarding the changes in their own jeonse markets, but the effect was found to be lower than that of Mapo. These results reveal that the highest-priced city (primary city) drove the spillover, causing price changes in other cities (See

Figure 5).

In the Gyeongeui region, the influence of Mapo, which has the highest average jeonse price, was found to be higher than that of other cities in the Northwest region. This served to indicate that the price spillover effect from the highest-priced city in the adjacent area may be quite strong. In addition, we found that the change in the jeonse price of Goyang, the highest-priced city in the Gyeongeui region, had the greatest effect on the jeonse market of cities within the same region. This indicated that the primary city in an adjacent region and within the same region has a significant influence on the market price changes of neighboring cities, and the higher the primary city’s average price level, the greater the spillover effect (See

Figure 6).

4.2. Spatial Spillover Effect of Housing Sales Price

Like jeonse price, the stability of the time series data was verified using the sales price index and the sales price change rate through the ADF unit root test. In this regard, we found that a unit root exists in the sales price index, so we used the sales price change rate data to investigate the spatial spillover effect of sales price (See

Table 7).

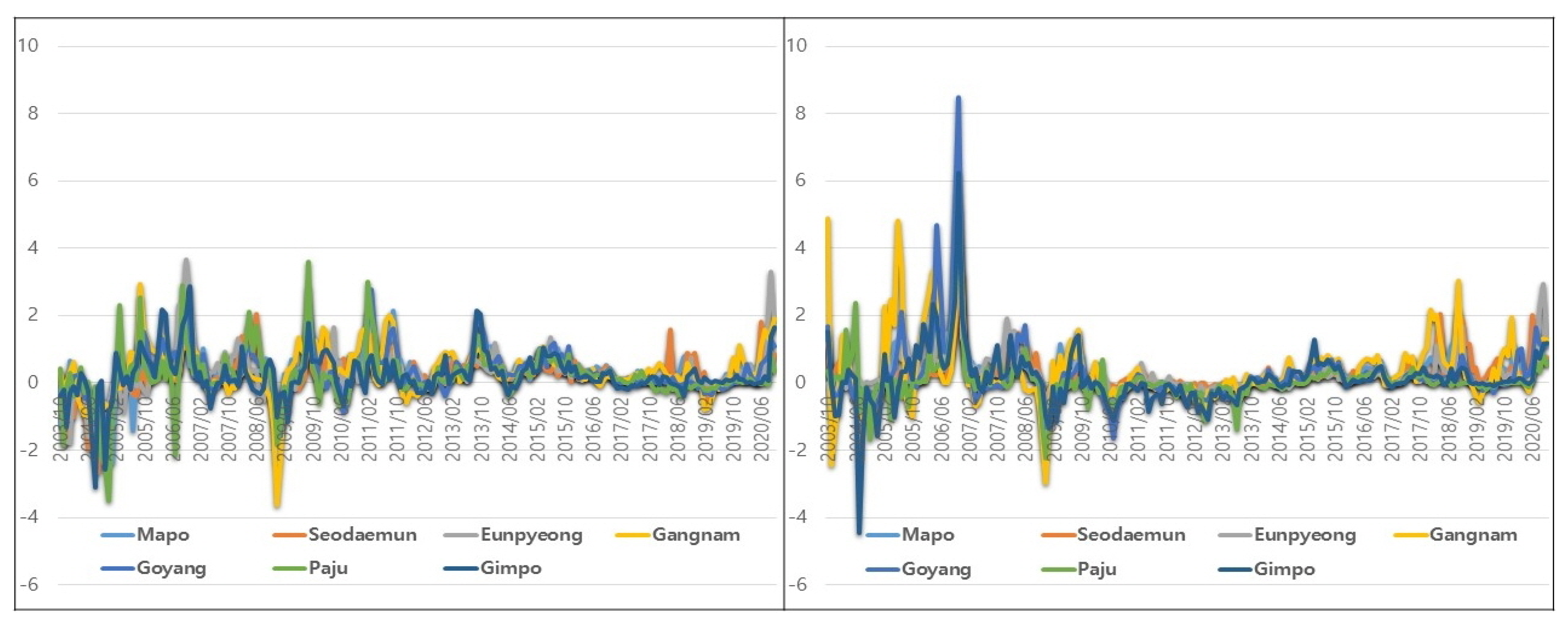

The descriptive statistics of the time series data reveal that the housing sales price in Gangnam (Seoul) recorded the steepest drop of −2.97% in December 2008, and other cities in Gyeonggi-do and Seoul recorded the largest decline during this period as well. The prices in Goyang in the Gyeongeui region (Gyeonggi-do) increased by 0.21% per month, which was the highest in the region, and rose by 8.5%, which was the largest increase, in November 2006. The largest decline occurred in July 2010, recording a −1.65% drop. When the rate of increase in sales price in Goyang was at the highest, the prices in the Northwest and Gyeongeui regions rose significantly as well, but they did not reach the rate of increase recorded in Goyang. In Mapo and Eunpyeong (Northwest region), the period with the steepest drop in sales prices was December 2008, which was during the Korean financial crisis, and the period with the largest increase was November 2006 (See

Table 8).

Table 9 presents the relationship of sales price changes between regions through correlation analysis. We found that the correlation between inter-regional sales price change rates was higher within the same region. This implies that the spillover effect may be higher in regions with similar housing market characteristics. In addition, the correlation effect between cities within the Gyeongeui region was found to be higher than that of the Northwest region, but the difference was not very significant. These results confirmed that the correlation between Gangnam and other regions was lower than the correlation between the Northwest and Gyeongeui regions.

According to the correlation among individual cities, Eunpyeong (Northwest region) and Goyang (Gyeongeui region) had the highest correlation. Although Eunpyeong and Goyang are associated with Seoul and Gyeonggi-do, respectively, the price correlation was found to be high as they are immediately adjacent. In the case of Mapo, it maintained a high correlation with cities within the same region, such as Eunpyeong and Seodaemun. In addition, Mapo had the highest price correlation with Gangnam. This could indicate that Mapo has certain characteristics such that various patterns of spillover occur between high-priced areas (Gangnam) and lower-priced areas (Eunpyeong, Seodaemun) within the same region. The price spillover between the rest of the cities exhibited a pattern similar to the result of the jeonse price correlation (see

Table 10).

The Granger causality analysis was conducted to examine the causal relationship among the sales prices in Gangnam, Gyeongeui region, and the Northwest region.

Table 11 presents the results, which indicate that Gangnam was the Granger cause of sales price changes in most cities. Interestingly, the price change in Gangnam shows a significant causal relationship to Paju, which is about 40 km away. This indicates that sales price in Gangnam had a significant impact on the housing market in the Seoul metropolitan area as a whole.

Table 12 presents the results of the Granger causality analysis on the sales price changes in the cities of the Northwest and Gyeongeui regions, excluding Gangnam. We found that the sales price changes in Mapo, Eunpyeong, and Seodaemun in the Northwest region have a mutual Granger causal relationship, for the most part. In particular, Mapo, the highest-priced city in the Northwest region, was identified as a strong Granger cause of change in the sales price of cities in the same region. Additionally, Goyang, the highest-priced city in Gyeongeui region, was found to be a strong Granger cause of sales price change in cities in the same region. This indicates that the primary city can lead the price spillover effect in the housing sales market as well as in the housing jeonse market.

Regarding inter-regional influence, the cities in the Gyeongeui region were greatly impacted by price changes in the adjacent Northwest region, exhibiting a stronger causal relationship to price changes in geographically adjacent regions. Specifically, it was confirmed that the changes in sales price in Mapo affected the changes in sales prices in cities in the same region. Further, the change in sales price in the Northwest region affected the change in sales price in Goyang, which in turn affected changes in sales prices in cities in the same region. This indicates that there is a unilinear (unidirectional) spillover effect among cities and regions depending on the sales price.

The results of the impulse response analysis that was performed to check the impact of change in sales price by city indicated that the spillover between cities’ sales prices exhibited a different pattern from that of the jeonse price. In the Northwest region, the change in sales price in Mapo had a significant effect over the long-term for more than 10 months, but the price impact of cities other than Mapo was relatively shorter (see

Figure 7).

According to the previous result, the change in the jeonse price was greatly affected by Goyang in the Gyeongeui region, however, Goyang exerted relatively little influence on the change in sales prices. Moreover, the influence of Eunpyeong in the Northwest region was relatively significant (see

Figure 8).

The results of the variance decomposition analysis indicate that the influence of individual cities, especially the primary city, was more pronounced than that of jeonse price regarding the change in sales price. The contributions of Eunpyeong and Seodaemun to the change in the sales price in Mapo in the Northwest region were very low, amounting to less than 2%, and the contributions of cities in the Gyeongeui region were also very low, amounting to less than 1%. Moreover, the contributions of cities to the change in their own sales prices, excluding Mapo, decreased, while the contribution of the primary city (Mapo) to changes in the sales prices in all cities gradually increased.

This indicates that the change in jeonse price has a mutual interaction between neighboring cities, but the sales price is transferred in one direction. In other words, price spillover in the city with the highest sale price (Mapo) affects the neighboring cities (Eunpyeong, Seodaemun), and this effect goes on to affect Goyang, the primary city of the Gyeongeui region that is subordinate to the Northwest region. Further, this effect, in turn, affects other cities in the Gyeongeui region as well. However, the opposite price effect was found to be negligible, indicating that the unilateral spillover of the sales price is very strong compared to that of the jeonse price (see

Figure 9 and

Figure 10).