The Impact of Climate Change on China and Brazil’s Soybean Trade

Abstract

1. Introduction

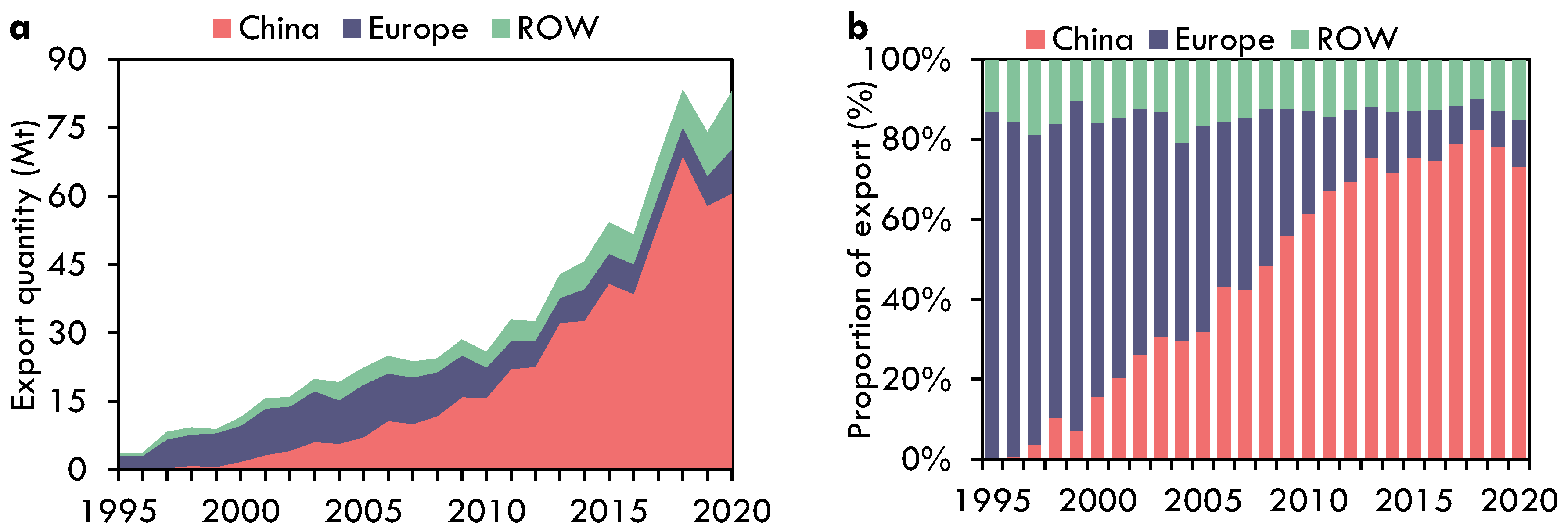

2. Historical Evolution and Future Projections of Soybean Demand in China and Supply in Brazil

2.1. China’s Demand and Import

2.2. Brazil’s Production and Export

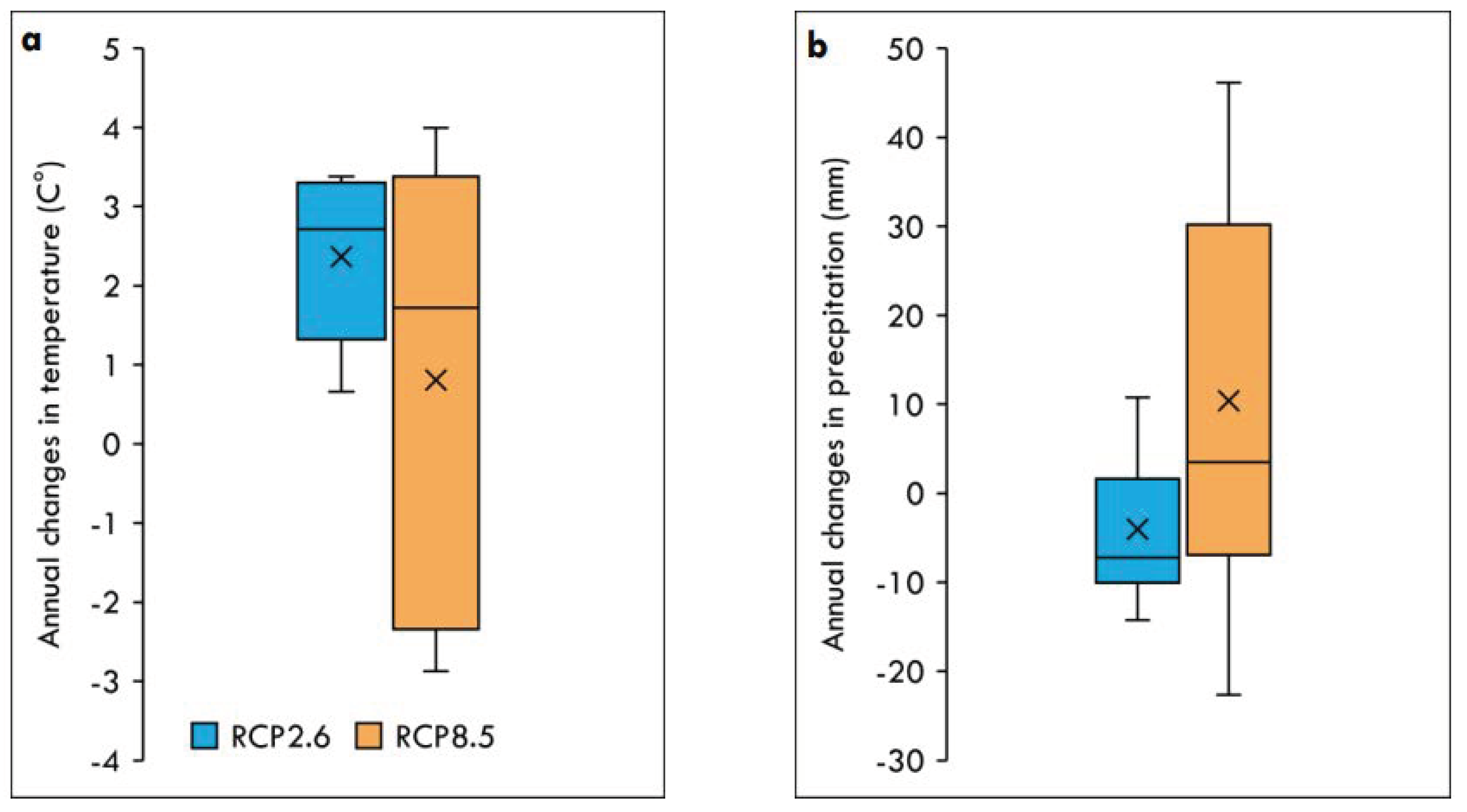

3. Climate Change and Changes in Biophysical Yields of Soybean in Brazil

3.1. Climate Change Shocks for Biophysical Yields of Soybean in Brazil

3.2. Incorporating Brazil Soybean Biophysical Yield Shocks into Economic Models

4. Methods and Data

4.1. Economic Modeling Methods for Simulating the Impact of Climate Change on China and Brazil’s Soybean Trade

4.2. Baseline Scenario

4.3. Climate Change Scenario

5. Results and Discussion

5.1. Climate Change Impacts on Soybean Production in Brazil and Implications for China’s Food Security

5.2. Comparison of Brazil’s Soybean Harvested Area and China’s Virtual Land Imports from Brazil

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Aggregation | Original Sectors |

|---|---|

| Rice | Paddy rice; Processed rice |

| Wheat | Wheat |

| Maize | Maize |

| Other grains | Other cereal grains n.e.c |

| Vegfru | Vegetables, fruit, nuts |

| Soybean | Soybean |

| Other oilseeds | Other Oilseeds |

| Sugar | Sugar cane, sugar beet, Sugar |

| Plant-based fibers | Plant-based fibers |

| Other crops | Crops n.e.c. |

| Cattle | Bovine cattle, sheep and goats, horses; Bovine meat products |

| Pork and Chicken | Pork and chicken; Pork and chicken meat products n.e.c. |

| Milk | Raw milk; Dairy products |

| Wool | Wool, silk-worm cocoons |

| Vegetable oils | Vegetable oils and fats |

| Beverage and Tobacco | Beverages and tobacco products |

| Processed food products | Processed food products |

| Fishing | Fishing |

| Extraction | Forestry; Fishing; Coal, Oil; Gas; Minerals; Mineral products; Ferrous metals; Metals; Metal products |

| Light Manufacturing | Textiles; Wearing apparel; Leather products; Wood products; Paper products, publishing; Petroleum, coal products; Chemical, rubber, plastic products; Motor vehicles and parts; Transport equipment; Manufactures |

| Heavy Manufacturing | Electronic equipment; Machinery, and equipment n.e.c. |

| Utilities and Construction | Electricity; Gas manufacture distribution; Water; Construction |

| Transport and Communication | Trade; Transport others; Water transport; Air transport; Communication |

| Services | Financial services; Insurance; Business services; Recreational and other services; Public Administration, Defense, Education, Health; Dwellings |

| Aggregation | Original Regions |

|---|---|

| Australia New Zealand | Australia; New Zealand; Rest of Oceania |

| China | China |

| Southeast Asia | Brunei Darussalam; Cambodia; Indonesia; Japan, Lao PDR; Malaysia; Philippines; Singapore; Thailand; Viet Nam; Rest of Southeast Asia |

| Canada | Canada |

| USA | United States of America |

| Mexico | Mexico |

| Argentina | Argentina |

| Brazil | Brazil |

| European Union | Austria; Belgium; Cyprus; Czech Republic; Denmark; Estonia; Finland; France; Germany; Greece; Hungary; Ireland; Italy; Latvia; Lithuania; Luxembourg; Malta; Netherlands; Poland; Portugal; Slovakia; Slovenia; Spain; Sweden; United Kingdom; Bulgaria; |

| Russia | Russian Federation |

| Africa | Benin; Botswana; Burkina Faso; Cameroon; Côte d’Ivoire; Egypt; Ethiopia; Ghana; Guinea; Kenya; Madagascar; Malawi; Mauritius; Morocco; Mozambique; Namibia; Nigeria; Rest of Central Africa; Rest of Eastern Africa; Rest of North Africa; Rest of South African Customs Union; Rest of Western Africa; Rwanda; Senegal; South Africa; South Central Africa; Tanzania, the United Republic of; Togo; Tunisia; Uganda; Zambia; Zimbabwe |

| Rest of the world | Albania; Armenia; Azerbaijan; Bahrain; Bangladesh; Belarus; Bolivia; Chile; Colombia; Costa Rica; Croatia; Dominican Republic P; Ecuador; El Salvador; Georgia; Guatemala; Honduras; Hong Kong; India; Iran, the Islamic Republic of; Israel; Jamaica; Jordan; Kazakhstan; Korea, Republic of; Kuwait; Kyrgyzstan; Mongolia; Nepal; Nicaragua; Norway; Oman; Pakistan; Panama; Paraguay; Peru; Puerto Rico; Qatar; Rest of Caribbean; Rest of Central America; Rest of East Asia; Rest of Eastern Europe; Rest of Europe; Rest of European Free Trade Association; Rest of Former Soviet Union; Rest of North America; Rest of South America; Rest of South Asia; Rest of the World; Rest of Western Asia; Romania; Saudi Arabia; Sri Lanka; Switzerland; Taiwan; Trinidad and Tobago P; Turkey; Ukraine; United Arab Emirates; Uruguay; Venezuela |

References

- NBSC (National Bureau of Statistics of China). China Statistical Yearbook; China Statistics Press: Beijing, China, 2020. (In Chinese) [Google Scholar]

- Huang, J.K.; Yang, G.L. Understanding recent challenges and new food policy in China. Glob. Food Secur. 2017, 12, 119–126. [Google Scholar] [CrossRef]

- Ali, T.; Huang, J.; Wang, J.; Xie, W. Global footprints of water and land resources through China’s food trade. Glob. Food Secur. 2017, 12, 139–145. [Google Scholar] [CrossRef]

- Oliveira Gustavo de, L.T.; Schneider, M. The politics of flexing soybeans: China, Brazil and global agroindustrial restructuring. J. Peasant Stud. 2016, 43, 167–194. [Google Scholar] [CrossRef]

- Zilli, M.; Scarabello, M.; Soterroni, A.C.; Valin, H.; Mosnier, A.; Leclere, D.; Havlik, P.; Kraxner, F.; Lopes, M.A.; Ramos, F.M. The impact of climate change on Brazil’s agriculture. Sci. Total Environ. 2020, 740, 139384. [Google Scholar]

- Hofmann, G.S.; Cardoso, M.F.; Alves, R.J.; Weber, E.J.; Barbosa, A.A.; de Toledo, P.M.; Pontual, F.B.; Salles, L.D.O.; Hasenack, H.; Cordeiro, J.L.; et al. The Brazilian Cerrado is becoming hotter and drier. Global Chang. Biol. 2021, 27, 4060–4073. [Google Scholar]

- Maciel, E.A.; Oliveira-Filho, A.T.; Sobral-Souza, T.S.; Marimon, B.S.; Cupertino-Eisenlohr, M.A.; José-Silva, L.; Eisenlohr, P.V. Climate change forecasts suggest that the conservation area network in the Cerrado-Amazon transition zone needs to be expanded. Acta Oecol. 2021, 112, 103764. [Google Scholar] [CrossRef]

- Marengo, J.A.; Jimenez, J.C.; Espinoza, J.C.; Cunha, A.P.; Aragão, L.E. Increased climate pressure on the agricultural frontier in the Eastern Amazonia–Cerrado transition zone. Sci. Rep. 2022, 12, 1–10. [Google Scholar] [CrossRef] [PubMed]

- FAO; FAOSTAT. 2022. Available online: http://www.fao.org/faostat/en/#data (accessed on 19 March 2022).

- ISI-MIP (The Inter-Sectoral Impact Model Intercomparison Project). 2022. Available online: https://www.isimip.org/outcomes/ (accessed on 20 March 2022).

- CMIP5. Coupled Model Intercomparison Project Phase 5. 2022. Available online: https://pcmdi.llnl.gov/mips/cmip5/ (accessed on 19 March 2022).

- Gale, F.; Valdes, C.; Ash, M. Interdependence of China, United States, and Brazil in Soybean Trade; US Department of Agriculture’s Economic Research Service (ERS) Report: New York, NY, USA, 2019; pp. 1–48.

- Huang, J.K.; Wei, W.; Cui, Q.; Xie, W. The prospects for China’s food security and imports: Will China starve the world via imports? J. Integr. Agri. 2017, 16, 2933–2944. [Google Scholar] [CrossRef]

- CAAS (Chinese Academy of Agricultural Sciences). China Agricultural Outlook (2020–2029); China Agricultural Science and Technology Press: Beijing, China, 2020. (In Chinese) [Google Scholar]

- USDA (the United States Department of Agriculture). International Long-Term Projections to 2029. 2020. Available online: https://www.ers.usda.gov/data-products/international-baseline-data/ (accessed on 15 March 2022).

- OECD/FAO. OECD-FAO Agricultural Outlook 2020–2029; FAO: Italy; OECD Publishing: Paris, France, 2020; Available online: https://doi.org/10.1787/1112c23b-en (accessed on 26 March 2022).

- Soybean and Corn Advisor. Brazil Ministry—Soy Production to Expand 32.9% over next Decade. 2020. Available online: http://www.soybeansandcorn.com/news/Aug1_19-Brazil-Ministry-Soy-Production-to-Expand-32_9-Over-Next-Decade (accessed on 1 August 2022).

- MAPA (Ministério da Agricultura, Pecuária e Abastecimento). PROJEÇÕES DO AGRONEGÓCIO Brasil 2019/20 a 2029/30 Projeções de Longo Prazo; Ministério da Agricultura, Pecuária e Abastecimento Secretaria de Política Agrícola, Brazil: Brasilia, Brazil, 2020.

- Roson, R.; Van der Mensbrugghe, D. Climate change and economic growth: Impacts and interactions. Int. J. Sust. Econ. 2012, 4, 270–285. [Google Scholar] [CrossRef]

- Robinson, S.; van Meijl, H.; Valin, H.; Willenbockel, D. Comparing supply-side specifications in models of global agriculture and the food system. Agri. Econ. 2014, 45, 21–35. [Google Scholar] [CrossRef]

- Nelson, G.C.; Valin, H.; Sands, R.D.; Havlík, P.; Ahammad, H.; Deryng, D.; Elliott, J.; Fujimori, S.; Hasegawa, T.; Heyhoe, E.; et al. Climate change effects on agriculture: Economic responses to biophysical shocks. Proc. Natl Acad. Sci. USA 2014, 111, 3274–3279. [Google Scholar] [CrossRef] [PubMed]

- Liu, J.; Hertel, T.W.; Lammers, R.B.; Prusevich, A.; Baldos, U.L.C.; Grogan, D.S.; Frolking, S. Achieving sustainable irrigation water withdrawals: Global impacts on food security and land use. Environ. Res. Lett. 2017, 12, 104009. [Google Scholar] [CrossRef]

- Xie, W.; Xiong, W.; Pan, J.; Ali, T.; Cui, Q.; Guan, D.; Meng, J.; Mueller, N.D.; Lin, E.; Davis, S.J. Decreases in global beer supply due to extreme drought and heat. Nat. Plants 2018, 4, 964–973. [Google Scholar] [CrossRef] [PubMed]

- Diffenbaugh, N.S.; Field, C.B.; Appel, E.A.; Azevedo, I.L.; Baldocchi, D.D.; Burke, M.; Burney, J.A.; Ciais, P.; Davis, S.J.; Fiore, A.M.; et al. The COVID-19 lockdowns: A window into the Earth System. Nat. Rev. Earth Environ. 2020, 1, 470–481. [Google Scholar] [CrossRef]

- Barrera, E.L.; Hertel, T. Global food waste across the income spectrum: Implications for food prices, production and resource use. Food Policy 2021, 98, 101874. [Google Scholar] [CrossRef]

- Horridge, M. SplitCom (Victoria University, Melbourne). 2005. Available online: http://www.copsmodels.com/splitcom.html (accessed on 23 March 2022).

- UN Comtrade. The United Nations Comtrade Database. 2005. Available online: https://comtrade.un.org/data/ (accessed on 11 March 2022).

- Hertel, T.W. (Ed.) Global Trade Analysis: Modeling and Applications; Cambridge University Press: New York, NY, USA, 1997. [Google Scholar]

- Walmsley, T.L.; Dimaranan, B.V.; McDougall, B. A baseline scenario for the dynamic GTAP model. In Dynamic Modeling and Applications for Global Economic Analysis; Cambridge University Press: Cambridge, UK, 2006; pp. 136–157. [Google Scholar]

- Iglesias, A.; Garrote, L.; Quiroga, S.; Moneo, M. A regional comparison of the effects of climate change on agricultural crops in Europe. Clim. Chang. 2012, 112, 29–46. [Google Scholar] [CrossRef]

- Palatnik, R.R.; Roson, R. Climate change and agriculture in computable general equilibrium models: Alternative modeling strategies and data needs. Clim. Chang. 2012, 112, 1085–1100. [Google Scholar] [CrossRef]

- Feng, L.; Wang, H.; Ma, X.; Peng, H.; Shan, J. Modeling the current land suitability and future dynamics of global soybean cultivation under climate change scenarios. Field Crop. Res. 2021, 263, 108069. [Google Scholar] [CrossRef]

- Xie, W.; Huang, J.; Wang, J.; Cui, Q.; Robertson, R.; Chen, K. Climate change impacts on China’s agriculture: The responses from market and trade. China Econ. Rev. 2020, 62, 101256. [Google Scholar] [CrossRef]

- Mosnier, A.; Obersteiner, M.; Havlík, P.; Schmid, E.; Khabarov, N.; Westphal, M.; Albrecht, F. Global food markets, trade and the cost of climate change adaptation. Food Secur. 2014, 6, 29–44. [Google Scholar] [CrossRef]

- Barr, K.J.; Babcock, B.A.; Carriquiry, M.A.; Nassar, A.M.; Harfuch, L. Agricultural Land Elasticities in the United States and Brazil. Appl. Econ. Perspect. Policy 2011, 33, 449–462. [Google Scholar] [CrossRef]

- Hausman, C. Biofuels and land use change: Sugarcane and soybean acreage response in Brazil. Environ. Resour. Econ. 2012, 51, 163–187. [Google Scholar] [CrossRef]

- Richards, P.; Taheripour, F.; Arima, E.; Tyner, W.E. Tariffs on American soybeans and their impact on land use change and greenhouse gas emissions in South America. Choices 2020, 35, 1–8. [Google Scholar]

- Fader, M.; Gerten, D.; Thammer, M.; Heinke, J.; Lotze-Campen, H.; Lucht, W.; Cramer, W. Internal and external green-blue agricultural water footprints of nations, and related water and land savings through trade. Hydrol. Earth Syst. Sci. 2011, 15, 1641–1660. [Google Scholar] [CrossRef]

- Qiang, W.; Liu, A.; Cheng, S.; Kastner, T.; Xie, G. Agricultural trade and virtual land use: The case of China’s crop trade. Land Use Policy 2013, 33, 141–150. [Google Scholar] [CrossRef]

- Bruckner, M.; Fischer, G.; Tramberend, S.; Giljum, S. Measuring telecouplings in the global land system: A review and comparative evaluation of land footprint accounting methods. Ecolog. Econ. 2015, 114, 11–21. [Google Scholar] [CrossRef]

- MacDonald, G.K.; Brauman, K.A.; Sun, S.; Carlson, K.M.; Cassidy, E.S.; Gerber, J.S.; West, P.C. Rethinking agricultural trade relationships in an era of globalization. BioScience 2015, 65, 275–289. [Google Scholar] [CrossRef]

- van Vliet, J. Direct and indirect loss of natural area from urban expansion. Nat. Sustain. 2019, 2, 755–763. [Google Scholar] [CrossRef]

| RCP2.6 | RCP8.5 | |

|---|---|---|

| Minimum | −16.05 | −17.66 |

| 25th percentile | −6.76 | −11.95 |

| Median | −3.03 | −7.94 |

| 75th percentile | 1.13 | −0.34 |

| Maximum | 16.39 | 39.29 |

| Mean | −1.51 | −2.47 |

| Indicator | Baseline Quantity (Mt) | Climate change Impacts | |||

|---|---|---|---|---|---|

| Scenarios | Percentage | Quantity (Mt) | |||

| Brazil | Production | 147.5 | RCP8.5 | −13.06 * (−1.7) ** | −19.26 (−2.507) |

| RCP2.6 | −11.78 (−1.04) | −17.373 (−1.534) | |||

| Total export | 85.4 | RCP8.5 | −15.25 (−1.91) | −13.028 (−1.632) | |

| RCP2.6 | −13.7 (−1.16) | −11.704 (−0.991) | |||

| China | Total import | 107.6 | RCP8.5 | −9.244 (−1.131) | −9.942 (−1.217) |

| RCP2.6 | −8.282 (−0.689) | −8.908 (−0.741) | |||

| Import from Brazil | 69.9 | RCP8.5 | −14.22 (−1.74) | −9.942 (−1.217) | |

| RCP2.6 | −12.74 (−1.06) | −8.908 (−0.741) | |||

| Total domestic supply | 119.1 | RCP8.5 | −8.352 (−1.022) | −9.947 (−1.217) | |

| RCP2.6 | −7.482 (−0.623) | −8.912 (−0.741) | |||

| Soybean price (%) | - | RCP8.5 | 0.24 (0.03) | - | |

| RCP2.6 | 0.21 (0.02) | - | |||

| Welfare (billion US$) | - | RCP8.5 | - | −4.53 (−0.579) | |

| RCP2.6 | - | −4.077 (−0.352) | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ali, T.; Zhou, B.; Cleary, D.; Xie, W. The Impact of Climate Change on China and Brazil’s Soybean Trade. Land 2022, 11, 2286. https://doi.org/10.3390/land11122286

Ali T, Zhou B, Cleary D, Xie W. The Impact of Climate Change on China and Brazil’s Soybean Trade. Land. 2022; 11(12):2286. https://doi.org/10.3390/land11122286

Chicago/Turabian StyleAli, Tariq, Bo Zhou, David Cleary, and Wei Xie. 2022. "The Impact of Climate Change on China and Brazil’s Soybean Trade" Land 11, no. 12: 2286. https://doi.org/10.3390/land11122286

APA StyleAli, T., Zhou, B., Cleary, D., & Xie, W. (2022). The Impact of Climate Change on China and Brazil’s Soybean Trade. Land, 11(12), 2286. https://doi.org/10.3390/land11122286