The Influence of Collusive Information Dissemination on Bidder’s Collusive Willingness in Urban Construction Projects

Abstract

:1. Introduction

2. Literature Review

2.1. Collusive Bidding in Urban Construction Projects

2.2. Influencing Factors of Collusive Bidding

2.3. Collusive Networks in Bidding

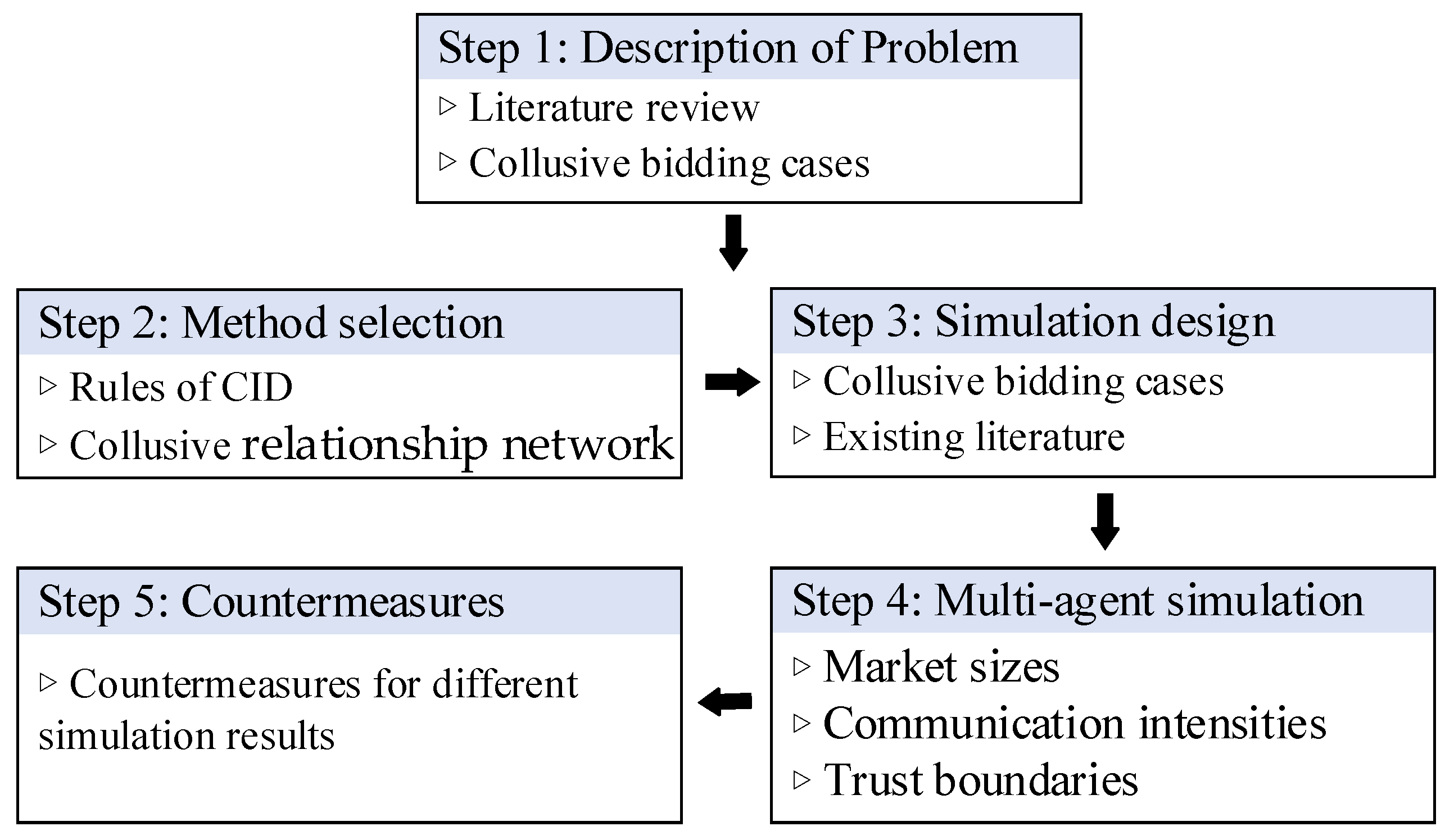

3. Methodology

3.1. Simulation Rules Setting

3.2. Simulation Scenario Setting

3.3. Simulation Parameter Setting

3.4. Multi-Agent Simulation Technology

4. Results and Discussion

4.1. Influence of CID on BCW under Different Market Sizes

4.2. The Evolution of the Influence of CID on BCW under Trust Boundary and No Trust Boundary

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Owusu, E.K.; Chan, A.P.C.; Wang, T. Tackling corruption in urban infrastructure procurement: Dynamic evaluation of the critical constructs and the anti-corruption measures. Cities 2021, 119, 103379. [Google Scholar] [CrossRef]

- Textor, C. Urbanization in China 1980–2021. Available online: https://www.statista.com/statistics/270162/urbanization-in-china/ (accessed on 28 February 2022).

- Wang, X.; Long, W.; Sang, M.; Yang, Y. Towards Sustainable Urbanization: Exploring the Influence Paths of the Urban Environment on Bidders’ Collusive Willingness. Land 2022, 11, 280. [Google Scholar] [CrossRef]

- Chen, J.; Hua, C.; Liu, C. Considerations for better construction and demolition waste management: Identifying the decision behaviors of contractors and government departments through a game theory decision-making model. J. Clean. Prod. 2019, 212, 190–199. [Google Scholar] [CrossRef]

- Owusu, E.K.; Chan, A.P.C.; Yang, J.; Pärn, E. Towards corruption-free cities: Measuring the effectiveness of anti-corruption measures in infrastructure project procurement and management in Hong Kong. Cities 2020, 96, 102435. [Google Scholar] [CrossRef]

- Carlo, M.; Marie, O. Network similarity and collusion. Soc. Netw. 2018, 55, 21–30. [Google Scholar] [CrossRef]

- Wang, X.; Ye, K.; Chen, M.; Yao, Z. A Conceptual Framework for the Inclusion of Exogenous Factors into Collusive Bidding Price Decisions. J. Manag. Eng. 2021, 37, 04021071. [Google Scholar] [CrossRef]

- Chotibhongs, R.; Arditi, D. Analysis of collusive bidding behaviour. Constr. Manag. Econ. 2012, 30, 221–231. [Google Scholar] [CrossRef]

- Lo, W.; Krizek, R.; Hadavi, A. Effects of high prequalification requirements. Constr. Manag. Econ. 1999, 17, 603–612. [Google Scholar] [CrossRef]

- Ray, R.S.; Hornibrook, J.; Skitmore, M.; Zarkada-Fraser, A. Ethics in tendering: A survey of Australian opinion and practice. Constr. Manag. Econ. 1999, 17, 139–153. [Google Scholar] [CrossRef] [Green Version]

- Ken, H.; Robert, P.; Guofu, T. Bidding rings and the winner’s curse. RAND J. Econ. 2008, 39, 1018–1041. [Google Scholar]

- Oke, A.; Aigbavboa, C.; Mangena, Z. Prevention of Collusion for Innovative Construction. Procedia Eng. 2017, 196, 491–497. [Google Scholar] [CrossRef]

- Wang, X.; Arditi, D.; Ye, K. Coupling Effects of Economic, Industrial, and Geographical (EIG) Factors on Collusive Bidding Decisions. J. Constr. Eng. Manag. 2022, 148, 04022042. [Google Scholar] [CrossRef]

- Price, M.K. Using the spatial distribution of bidders to detect collusion in the marketplace: Evidence timber auctions. J. Reg. Sci. 2008, 48, 399–417. [Google Scholar] [CrossRef]

- Zhu, J.; Wang, B.; Li, L.; Wang, J.; Bedon, C. Bidder Network Community Division and Collusion Suspicion Analysis in Chinese Construction Projects. Adv. Civ. Eng. 2020, 2020, 1–14. [Google Scholar] [CrossRef]

- Reeves-Latour, M.; Morselli, C. Bid-rigging networks and state-corporate crime in the construction industry. Soc. Netw. 2017, 51, 158–170. [Google Scholar] [CrossRef]

- PORTER, R.H. Collusion in Industrial Economics: A Comment. J. Ind. Compet. Trade 2005, 5, 231–234. [Google Scholar] [CrossRef]

- Wang, X.; Liu, R.; Ye, K.; Tekka, R.S. Modelling the cost of collusion in the construction industry: A case of China. In Proceedings of the 36th Annual ARCOM Conference, Leeds, UK, 7–8 September 2020; pp. 115–124. [Google Scholar]

- Albano, G.L.; Buccirossi, P.; Spagnolo, G.; Zanza, M. Preventing Collusion in Procurement: A Primer. In Handbook of Procurement; Dimitri, N., Piga, G., Spagnolo, G., Eds.; Cambridge University Press: New York, NY, USA, 2006; pp. 347–380. [Google Scholar]

- Dorée, A.G. Collusion in the Dutch construction industry: An industrial organization perspective. Build. Res. Inf. 2004, 32, 146–156. [Google Scholar] [CrossRef]

- Goel, R.K.; Nelson, M.A. Measures of corruption and determinants of US corruption. Econ. Gov. 2011, 12, 155–176. [Google Scholar] [CrossRef]

- Hosseini, M.R.; Martek, I.; Banihashemi, S.; Chan, A.P.C.; Darko, A.; Tahmasebi, M. Distinguishing Characteristics of Corruption Risks in Iranian Construction Projects: A Weighted Correlation Network Analysis. Sci. Eng. Ethics 2020, 26, 205–231. [Google Scholar] [CrossRef]

- Le, Y.; Shan, M.; Chan, A.P.C.; Hu, Y. Investigating the Causal Relationships between Causes of and Vulnerabilities to Corruption in the Chinese Public Construction Sector. J. Constr. Eng. Manag. 2014, 140, 05014007. [Google Scholar] [CrossRef]

- Zhang, B.; Le, Y.; Xia, B.; Skitmore, M. Causes of Business-to-Government Corruption in the Tendering Process in China. J. Manag. Eng. 2017, 33, 05016022. [Google Scholar] [CrossRef] [Green Version]

- Bowen, P.A.; Edwards, P.J.; Cattell, K. Corruption in the South African construction industry: A thematic analysis of verbatim comments from survey participants. Constr. Manag. Econ. 2012, 30, 885–901. [Google Scholar] [CrossRef]

- Brown, J.; Loosemore, M. Behavioural factors influencing corrupt action in the Australian construction industry. Eng. Constr. Archit. Manag. 2015, 22, 372–389. [Google Scholar] [CrossRef]

- Padhi, S.S.; Mohapatra, P.K.J. Detection of collusion in government procurement auctions. J. Purch. Supply Manag. 2011, 17, 207–221. [Google Scholar] [CrossRef]

- Tabish, S.Z.S.; Jha, K.N. The impact of anti-corruption strategies on corruption free performance in public construction projects. Constr. Manag. Econ. 2012, 30, 21–35. [Google Scholar] [CrossRef]

- Roux, C.; Thöni, C. Collusion among many firms: The disciplinary power of targeted punishment. J. Econ. Behav. Organ. 2015, 116, 83–93. [Google Scholar] [CrossRef]

- Wang, X.; Ye, K.; Arditi, D. Embodied cost of collusive bidding: Evidence from China’s construction industry. J. Constr. Eng. Manag. 2021, 147, 04021037. [Google Scholar] [CrossRef]

- Ballesteros-Pérez, P.; Skitmore, M.; Das, R.; del Campo-Hitschfeld, M.L. Quick Abnormal-Bid-Detection Method for Construction Contract Auctions. J. Constr. Eng. Manag. 2015, 141, 04015010. [Google Scholar] [CrossRef] [Green Version]

- Shan, M.; Le, Y.; Yiu, K.T.W.; Chan, A.P.C.; Hu, Y. Investigating the Underlying Factors of Corruption in the Public Construction Sector: Evidence from China. Sci. Eng. Ethics 2017, 23, 1643–1666. [Google Scholar] [CrossRef]

- Sichombo, B.; Muya, M.; Shakantu, W.; Kaliba, C. The need for technical auditing in the Zambian construction industry. Int. J. Proj. Manag. 2009, 27, 821–832. [Google Scholar] [CrossRef]

- Uytse, S.V. Artificial Intelligence and Collusion: A Literature Overview. In Robotics, AI and the Future of Law; Corrales, M., Fenwick, M., Forgó, M., Eds.; Springer: Singapore, 2018. [Google Scholar] [CrossRef]

- Besfamille, M. Collusion in Local Public Works. Int. Econ. Rev. 2004, 45, 1193–1219. [Google Scholar] [CrossRef]

- Tabish, S.Z.S.; Jha, K.N. Analyses and evaluation of irregularities in public procurement in India. Constr. Manag. Econ. 2011, 29, 261–274. [Google Scholar] [CrossRef]

- Vee, C.; Skitmore, C. Professional ethics in the construction industry. Eng. Constr. Archit. Manag. 2003, 10, 117–127. [Google Scholar] [CrossRef] [Green Version]

- Chotibhongs, R.; Arditi, D. Detection of Collusive Behavior. J. Constr. Eng. Manag. 2012, 138, 1251–1258. [Google Scholar] [CrossRef]

- Shan, M.; Le, Y.; Yiu, K.T.W.; Chan, A.P.C.; Hu, Y.; Zhou, Y. Assessing Collusion Risks in Managing Construction Projects Using Artificial Neural Network. Technol. Econ. Dev. Econ. 2018, 24, 2003–2025. [Google Scholar] [CrossRef]

- Signor, R.; Love, P.E.D.; Belarmino, A.T.N.; Alfred Olatunji, O. Detection of Collusive Tenders in Infrastructure Projects: Learning from Operation Car Wash. J. Constr. Eng. Manag. 2020, 146, 05019015. [Google Scholar] [CrossRef]

- Owusu, E.K.; Chan, A.P.C.; Hosseini, M.R. Impacts of anti-corruption barriers on the efficacy of anti-corruption measures in infrastructure projects: Implications for sustainable development. J. Clean. Prod. 2020, 246, 119078. [Google Scholar] [CrossRef]

- Zarkada-Fraser, A. A Classification of Factors Influencing Participating in Collusive Tendering Agreements. J. Bus. Ethics 2000, 23, 269–282. [Google Scholar] [CrossRef]

- Shi, H.B.; Li, X.W.; Xu, H.J. Game Analysis on Collusion Tender in the Construction Projects Bidding. Appl. Mech. Mater. 2013, 357–360, 2414–2419. [Google Scholar] [CrossRef]

- Baranes, E.; Mirabel, F.; Poudou, J.C. Collusion Sustainability with Multimarket Contacts: Revisiting HHI Tests. Theor. Econ. Lett. 2012, 2, 307–315. [Google Scholar] [CrossRef] [Green Version]

- Bolotova, Y.; Connor, J.M.; Miller, D.J. The impact of collusion on price behavior: Empirical results from two recent cases. Int. J. Ind. Organ. 2008, 26, 1290–1307. [Google Scholar] [CrossRef] [Green Version]

- Stigler, G.J. A Theory of Oligopoly. J. Polit. Econ. 1964, 72, 44–61. [Google Scholar] [CrossRef]

- Ratshisusu, H. Limiting collusion in the construction industry: A review of the bid-rigging settlement in South Africa. J. Econ. Financ. Sci. Spec. Issue 2014, 7, 587–606. [Google Scholar] [CrossRef]

- Harrington, J.E. Penalties and the deterrence of unlawful collusion. Econ. Lett. 2014, 124, 33–36. [Google Scholar] [CrossRef] [Green Version]

- Zarkada-Fraser, A.; Skitmore, M. Decisions with moral content: Collusion. Constr. Manag. Econ. 2000, 18, 101–111. [Google Scholar] [CrossRef] [Green Version]

- Morselli, C. Inside Criminal Networks; Springer: Berlin/Heidelberg, Germany, 2009; Volume 8. [Google Scholar]

- Van de Bunt, H. Walls of secrecy and silence: The Madoff case and cartels in the construction industry. Criminology & Public Policy 2010, 9, 435–453. [Google Scholar] [CrossRef]

- Xiao, L.; Ye, K.; Zhou, J.; Ye, X.; Tekka, R.S. A Social Network-Based Examination on Bid Riggers’ Relationships in the Construction Industry: A Case Study of China. Buildings 2021, 11, 363. [Google Scholar] [CrossRef]

- Guillaume, D.; David, N.; Frederic, A.; Gérard, W. Mixing beliefs among interacting agents. Adv. Complex Syst. 2000, 3, 87–98. [Google Scholar] [CrossRef]

- SPC. (The Supreme People’s Court of The People’s Republic of China). n.d. China Judgments Online. Available online: https://wenshu.court.gov.cn/ (accessed on 1 September 2021).

- Huang, C.; Hu, B.; Jiang, G.; Yang, R. Modeling of agent-based complex network under cyber-violence. Phys. A Stat. Mech. Its Appl. 2016, 458, 399–411. [Google Scholar] [CrossRef]

- Deffuant, G.; Amblard, F.; Weisbuch, G. How Can Extremism Prevail? a Study Based on the Relative Agreement Interaction Model. J. Artif. Soc. Soc. Simul. 2002, 5, 1. [Google Scholar] [CrossRef]

- Yan, Y. Computing Research on Investor Trust and Behavioral Decision-Making in the Online Lending Organization; Huazhong University of Science: Wuhan, China, 2018. [Google Scholar]

- Ishida, T.; Hattori, H.; Nakajima, Y. Multiagent Simulation; Springer: Berlin/Heidelberg, Germany, 2012. [Google Scholar]

- Bousquet, F.; Page, C.L. Multi-agent simulations and ecosystem management: A review. J. Ecol. Model. 2011, 176, 313–332. [Google Scholar] [CrossRef]

- Anderson, E.J.; Cau, T.D.H. Implicit collusion and individual market power in electricity markets. Eur. J. Oper. Res. 2011, 211, 403–414. [Google Scholar] [CrossRef]

| Parameter | Definition | Value or Range |

|---|---|---|

| N | number of the enterprise | (200, 500, 1000) |

| SW | type of network | - |

| TB | trust boundary | Yes/No |

| X | collusion information interaction value | N(0, 1) |

| u | uncertainty value | U(0, 0.5) |

| μ | bidders’ communication intensity | 0.2, 0.3, 0.4, 0.5, 0.6 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, X.; Ye, K.; Zhuang, T.; Liu, R. The Influence of Collusive Information Dissemination on Bidder’s Collusive Willingness in Urban Construction Projects. Land 2022, 11, 643. https://doi.org/10.3390/land11050643

Wang X, Ye K, Zhuang T, Liu R. The Influence of Collusive Information Dissemination on Bidder’s Collusive Willingness in Urban Construction Projects. Land. 2022; 11(5):643. https://doi.org/10.3390/land11050643

Chicago/Turabian StyleWang, Xiaowei, Kunhui Ye, Taozhi Zhuang, and Rui Liu. 2022. "The Influence of Collusive Information Dissemination on Bidder’s Collusive Willingness in Urban Construction Projects" Land 11, no. 5: 643. https://doi.org/10.3390/land11050643

APA StyleWang, X., Ye, K., Zhuang, T., & Liu, R. (2022). The Influence of Collusive Information Dissemination on Bidder’s Collusive Willingness in Urban Construction Projects. Land, 11(5), 643. https://doi.org/10.3390/land11050643