Abstract

As the net effect of agglomeration on entrepreneurship depends on the trade-off between positive and negative effects, urban agglomeration can either promote or discourage entrepreneurial activity in theory. However, there is an unexpected shortage of empirical confirmations on this potential cause-and-effect relationship. Our study strives to fill this empirical gap by providing credible evidence whether agglomeration, measured by the urban density or population, increases the probability of individuals being self-employed. Based on the China Labor-Force Dynamic Survey of 2012, 2014, and 2016, we find that big cities fail to facilitate individuals to start or run their own businesses. Further analyses illustrate that the entrepreneurs in large cities can be easily tempted by a wider range of salaried opportunities and are generally exposed to high fixed costs and intense competition. In contrast, entrepreneurship in large cities is of high reward. These results serve as direct evidence of the co-existence of agglomeration diseconomies and economies. This also suggests the direction of government policy in large cities, which is to alleviate, as much as possible, the negative impact on entrepreneurs.

1. Introduction

Entrepreneurship, the essence of which is creative destruction [1], does not only create employment and promote productivity, but also fundamentally affects cities’ future evolution. A prominent phenomenon in China’s entrepreneurial boom is the uneven geographical distribution of entrepreneurial activity. Beijing, Shanghai, Shenzhen, or other densely populated cities are often considered “pioneer cities of innovation and entrepreneurship in China” or “best cities of entrepreneurship in China”. This is widely supported by the “China City Entrepreneurship Index” released by Renmin University of China (https://news.ruc.edu.cn/archives/126019, accessed on 14 December 2022) and the “Best Startup Cities in China” list issued by China’s leading startup community (CYZONE) (https://www.cyzone.cn/article/132069.html, accessed on 14 December 2022). Given the highly spatial concentration of entrepreneurial activities, agglomeration economies are commonly considered as a starting point to understanding the generation and development of entrepreneurship [2,3,4]. Traditionally, cities with a large population or a high density have been regarded as “incubators” or “nurseries” for entrepreneurs [5,6]. Glaeser et al. (2010) also affirm that entrepreneurs in densely populated urban regions have the advantages of ready access to agglomerated local inputs, skills, ideas, and markets, among others.

However, there is a surprising lack of rigorous empirical evidence to test this assumed cause–effect relationship between urban agglomeration and entrepreneurship. There are a limited number of studies [7,8] that both used urban population size or density as their main variable of concern in the estimation of the effect of agglomeration on entrepreneurship and addressed endogeneity concerns. We consider that this absence of empirical verifications is due to the following issues. First, most researchers rarely question the positive effect of urban agglomeration. In previous empirical studies on the sources of entrepreneurship, while agglomeration has been covered, it has often been treated as a control variable [9,10,11]. Second, although these studies confirm that big/dense cities are friendlier to entrepreneurs, the causal relationship between these two variables remains questionable. The endogeneity problem has no easy treatment [12], as the main sources of endogeneity are sorting and potential omitting variables. We discuss these issues in more detail in the literature review section.

This paper, therefore, aims to provide a quantitative assessment on whether agglomeration, measured by urban density or population, increases the probability of individuals becoming entrepreneurs. With regard to entrepreneurship, there is no agreed measurement. We take respondents who claim they are self-employed as entrepreneurs, which is believed to be the most commonly used measurement of entrepreneurship [10]. Our study contributes to the literature in two important ways. First, it is one of the first quantitative attempts to establish the causal relationship between urban agglomeration and entrepreneurship. We use agglomeration, measured by urban density or population, as our focal variable and tackle the potential endogeneity problem by using a restricted subsample and two-stage least squares (TSLS) regressions. Our findings support the existence of agglomeration diseconomies and even suggest that the cost of agglomeration has surpassed its benefit in terms of entrepreneurship in China. Second, this paper identifies the source of our counter-intuitive finding, that is, why large cities fail to boost the possibility of being self-employed. Although previous studies have begun questioning the long-held positive effect of urban population size or density on entrepreneurship, there is still a shortage of evidence-based explorations in this area [7,13]. For an emerging market economy like China, which is in the process of institutional transformation and rapid urbanization, how to build and optimize urban entrepreneurial ecosystems is undoubtedly an issue worthy of attention in current research. The purpose of this paper is to explore the above-mentioned uneven geographical distribution of entrepreneurial activities from a relatively new perspective of urban agglomeration [14,15,16].

2. Literature Review and Research Proposition

This section reviews the theoretical and empirical research on the relationship between urban agglomeration and entrepreneurship. Since it is a core topic in economic geography, there is a rich body of literature dedicated to agglomeration economies [3,5,12,14,17]. While it has long been established that the spatial concentration of firms and workers increases productivity, theoretically, the benefits of agglomeration accumulate faster initially, but eventually, costs prevail as population and density increase in cities [18,19]. Therefore, we next theoretically approach the effects of agglomeration on entrepreneurship from the benefit-cost perspective.

First proposed by Duranton and Puga (2004), agglomeration economies, or the benefits of agglomeration, are wildly widely recognized to stem from three sources: sharing, learning, and matching. Sharing means that the increased local outcomes of spatial concentration lie primarily in sharing indivisible facilities, input suppliers, industrial specialization, and risks, while learning suggests that the improvements in the local productivity of spatial agglomeration come largely from the generation, diffusion, and accumulation of knowledge. These two sources of agglomeration also motivate entrepreneurship, as the sharing and learning effects in large cities are accelerators for entrepreneurs [20,21,22]. However, the matching mechanism of agglomeration economies may not serve the same function when it comes to entrepreneurship. Specifically, the boost in local performance from urban agglomeration mainly lies in the improvement of either the quality or quantity of the matches between firms and workers. On one hand, this helps entrepreneurs find employees and partners easily and efficiently, thus encouraging entrepreneurial activity; on the other hand, a higher matching effect in large cities also implies it is easier to find a satisfactory job, meaning individuals tend to become salaried-job employees rather than risk-taking employers.

In addition to this matching effect, there are other often mentioned costs of agglomeration, such as high land/house prices or intense competition, which are expected to negatively affect entrepreneurship [23]. The high land/house price costs are commonly believed to have a direct negative impact on entrepreneurship. Induced by agglomeration, high land/house prices suggest office or store rent required is likely higher for entrepreneurs in larger cities. Moreover, high land/house prices also mean entrepreneurs need to offer high salaries to enable their employees to afford rent. As for the intense competition, while some scholars argue that it makes entrepreneurship more efficient [7,14], others believe that excessive competition can discourage entrepreneurs [7]. Other costs, such as congestion, pollution, and crime, do not directly affect the profits or costs of entrepreneurial activity, and are thus not further discussed in this paper.

Apart from the theoretical uncertainty, empirical studies on the impact of urban agglomeration on entrepreneurship are lacking. There are limited empirical papers devoted to this specific topic [7,8] and their findings are inconsistent. Specifically, considering Italian college graduates’ work possibilities as entrepreneurs after graduation, Di Addario and Vuri (2010) found that young college graduates were discouraged from starting their entrepreneurial activity in the most densely populated provinces. However, Sato et al. (2012) found that a U-shaped relationship existed between population density and observed entrepreneurship in Japanese prefectures, and the impact of population density on observed entrepreneurship was positive in both small and large cities, while the impact was smaller (or even negative) in medium-sized cities. While there are empirical studies on entrepreneurship that include urban agglomeration as control variables, these studies do not generally discuss the endogeneity of agglomeration and arrive at varied findings [10,11,24]. Similarly, there are empirical-based studies that focus on the industrial structure within agglomerations to explore the impact of specialization and diversification on entrepreneurship [25,26]. We do not further discuss these two branches of literature here because their topic is beyond the scope of this paper.

There are, in fact, two critical challenges in empirically answering the question of whether urban agglomeration increases the probability of an individual becoming an entrepreneur. They are also the main endogeneity sources. The first challenge refers to addressing the sorting or self-selection effect [7,14,27,28]. Specifically, both risk-taking entrepreneurs and risk-averse employees prefer to relocate to large cities because of the greater availability of both entrepreneurial and employment opportunities there. This re-location influences both the population size and level of entrepreneurship of a city, thus leading to biased estimates of the impact of agglomeration on entrepreneurship. Moreover, it is difficult to determine whether this is an overestimate or underestimate. However, this self-selection or sorting effect may not introduce a heavy bias. According to Michelacci and Silva (2007) [29], entrepreneurship can be regarded as a local factor, given that entrepreneurs tend to start their business in the regions they were born.

The second challenge regards missing variables [7,30,31]. To some degree, it is impossible for any study to rule out the possibility of missing variables. Attributes such as the cultural atmosphere of entrepreneurship are likely to influence both the urban population and its entrepreneurship level but are difficult to fully capture. This can lead to biased and inconsistent estimates of urban agglomeration, and ultimately to the failure to establish the causal link between agglomeration and entrepreneurship. It is also worth noting that, while both studies deal with endogeneity using instrumental variables, neither pays special attention to the issue of self-selection.

Taken together, we make our research proposition as follows. It is difficult to conclude whether urban agglomeration promotes or discourages entrepreneurship, as the net effect of agglomeration on entrepreneurship depends on the trade-off between positive and negative influences. Notably, there is a good chance that agglomeration poses a disadvantage for entrepreneurship, with the potential disadvantages or agglomeration diseconomies being mainly embodied in alternative salaried opportunities, high land/house prices, and intense competition. Therefore, there is an urgent need for more empirical evidence to test this potential cause-and-effect relationship, while paying attention to endogeneity issues.

3. Data and Estimation Strategies

3.1. Data

Our main data source is the China Labor-Force Dynamic Survey (CLDS), which is a nation-wide database updated by Sun Yat-sen University every two years. The CLDS provides a representative image of China’s workforce population and we focus on its 2012, 2014, and 2016 waves. Our sample consists of 11,551 working individuals (self-employer and employees), with a self-employment rate of about 17.98% (Table 1). The self-employment rate indicates that our data source is reliable, as it is consistent with the results of a sample survey of 1% of China’s population. According to Wu et al. (2014) [32], which is based on the 2005 China’s population sample survey (1/5 of a random subsample), the self-employment rate of the urban population was 13.1% in 2005. Generally, the self-employment rate is expected to remain stable and the rapid growth in 2014 mirrors the initiation of a policy on “mass entrepreneurship and innovation”.

Table 1.

Distribution of the sample between the self-employed and employees.

Although there is no agreed measurement of entrepreneurship, self-employment is considered the most natural individual measure of entrepreneurship [10,33,34]. Hence, we start constructing the core explained variable Entrep, which is a dummy variable taking the value of 1 if the respondents state they are self-employed. Moreover, as a robust check, we also employ Active_Entrep, which is also a dummy variable taking the value of 1 if the respondents state that he or she was motivated to start a business based on taking advantage of a good business opportunity. The individuals who are self-employed as nannies or in odd jobs are dropped from the sample, as they are not really engaged in entrepreneurial activities. For further analysis, we also collect other information at the individual level (see Table 2).

Table 2.

Variable definitions and summary statistics.

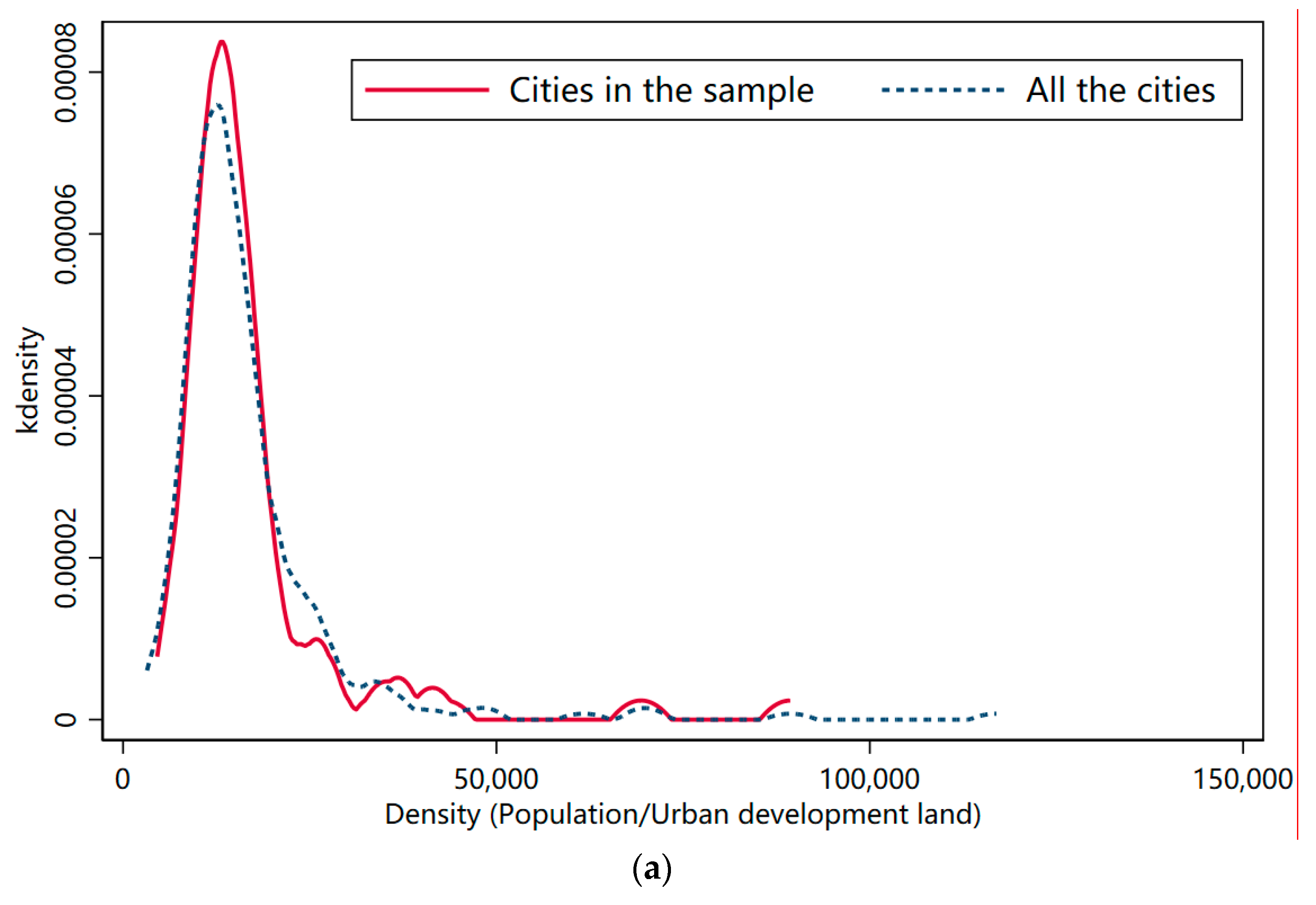

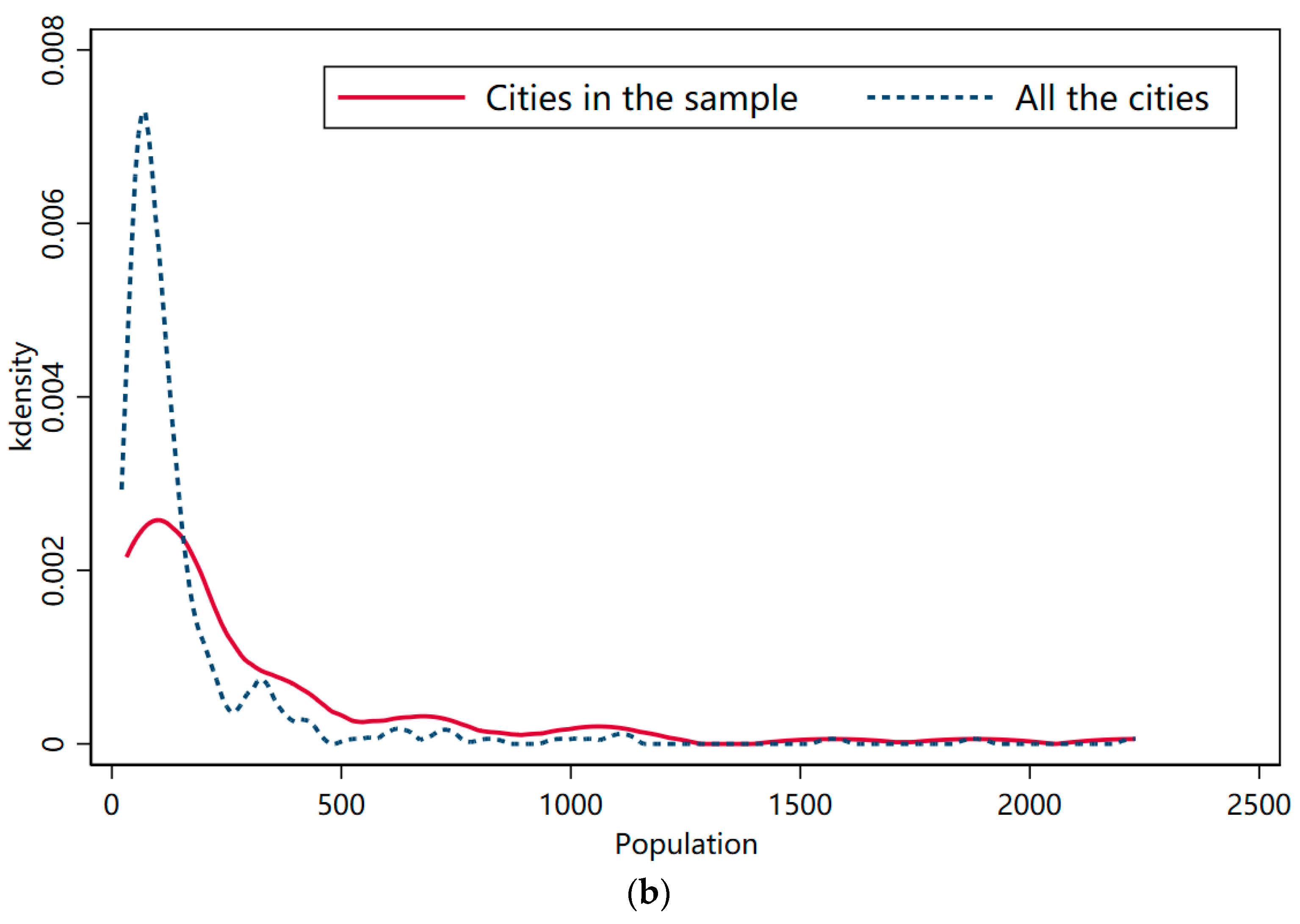

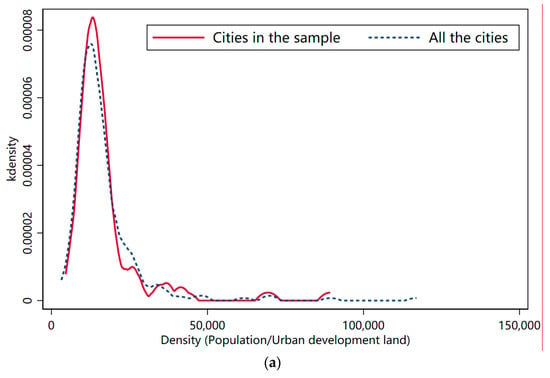

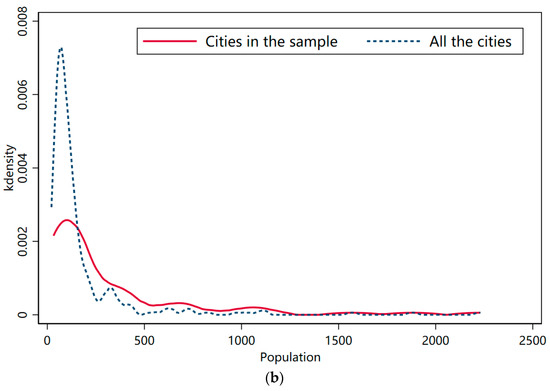

Our core explanatory variable—urban agglomeration—is a proxy of urban density or population. The three CLDS waves considered in this study cover a total of 78 cities, providing a good national representation. A piece of supporting evidence is that the density and population distribution in our sample of 78 cities is similar to that of the national cities (Figure 1a,b). To be specific, the cities in our sample not only share a similar trend of density with all cities, but also have a wide population range, from 0.32 million (Yunfu) to 22.30 million (Shanghai). Moreover, these population-related data are all gathered from the 2010 Population Census of the People’s Republic of China to ensure that the permanent population is considered. We also collect other city-level data from the China City Statistical Yearbook for the following analysis (Table 2).

Figure 1.

Kernel density estimate of urban density (a) and population (b).

3.2. Estimation

To investigate whether urban agglomeration increases the probability of individuals being self-employed, we run the following logit regression:

where, as previously discussed, Entrep is a dummy variable indicating whether the respondent works as a self-employed entrepreneur, Density and Population are two continuous proxies for urban agglomeration, and and are vectors of control variables at individual and city levels (i signifies different individuals, and j stands for different cities), respectively. Specifically, includes respondents’ age (Age), gender (Male), years of schooling (Edu_year), marital status (Married), income (Income), possessing a local hukou or not (Local_hukou), and being a party member or not (Party), while includes the area of constructed land (Land_area), GDP per capita (GDP_pop), city’s average level of education (Coll_pop), share of government expenditure in GDP (Gov_gdp), share of tertiary sector output to GDP (Ter_gdp), and number of internet users per capita (Internet_pop). These control variables were primarily sourced from entrepreneurship and urban agglomeration studies [7,8,10,12,35,36]. We also include industry, province, and year fixed effects in the specification.

Although we focus on the three waves of the CLDS survey, we still employ a (pooled) cross-sectional strategy rather than panel regression. The main reason lies in the fact that a panel-based identification requires variation in the entrepreneurial status of individuals between 2012 and 2016 for weighing the impact of agglomeration on entrepreneurship. However, the entrepreneurs who have entered and exited the market are only around 200 during the study period (2012–2014). Therefore, our individual-level variables, including the core explained variables, cover three years (2012, 2014, and 2016), while all city-level variables and the core explaining variables are only for 2010. The definition and statistical information for all variables are outlined in Table 2.

To address the two empirical challenges mentioned above, we adopt two approaches. Our solution for the self-selection issue is to identify a subsample of only respondents that have not moved across counties since the age of 14. In this way, we rule out the risk-taking entrepreneurs and risk-averse employees who prefer to relocate among cities to some extent. Regarding potential missing variables, apart from adding region and year dummy variables, we use a TSLS regression with an historical instrumental variable, that is, density or population in 1953, the data coming from the first census conducted in China.

Since the groundbreaking work of Ciccone and Hall (1996) [37], historical instrumental variables have become common practice in the study of agglomeration economies. This instrument can satisfy both the relevance and exogenous requirements. As for relevance, the population in 1953 shaped today’s population. As shown in Table 3, the Kleibergen-Paap rk Wald F (KP F) statistic confirms the relevance of our instrument. As for exogeneity, the spatial pattern of China’s population has changed dramatically in response to various broadly population-oriented projects, such as the well-known Shangshan Hsia-hsiang and The Third Front programs [38,39]. At the same time, entrepreneurship has also been deeply transformed by three decades of planned economy. Hence, the 1953 population should have no direct effect on current entrepreneurship.

Table 3.

Baseline identifications under different approaches.

4. Empirical Evidence

4.1. Baseline Results of Urban Agglomeration on Entrepreneurship

Table 3 reports the logit specification results of urban agglomeration on entrepreneurship for different proxy variables and econometric approaches. Columns (1)–(3) use the proxy variable Density, while columns (4)–(6) use Population as a proxy. Each column group uses the maximum likelihood estimate (MLE), sorting, and instrumental variable (IV) strategies, respectively. MLE is the most commonly used estimation strategy in logistic regression. Sorting refers to our adoption of subsamples that have not moved across counties since the age of 14 to tackle the potential sorting problem. IV implies estimation using TSLS with the 1953 density or population as IVs to address the missing variable concern. Moreover, in the IV specification, the KP F statistic of columns (3) and (6) is close to 10, which is above the 15% maximal IV size (8.96) in the Stock–Yogo weak instrument test. This confirms the relevance of our instrumental variables.

Turning to our focal variable, the odds ratios for both Density and Population are below 1; that is, all else being equal, the higher the population density or the larger the population, the less chance individuals have of becoming self-employed. This finding is robust to three different strategies and the odds ratios are of roughly the same magnitude. In other words, big cities fail to incentivize individuals to start or run their own business, and our concerns about self-selection and omitted variables do not make a significant difference. The magnitude and significance of Density and Population are the same. As this is an inevitable result when considering Land area as a control variable, we only employ Density as the proxy for urban agglomeration in the following.

The results of the other controls are in line with expectations. At the individual level, male, married, and higher income individuals are more likely to be entrepreneurs, while individuals with high education, who hold a local residence, and are party members are less likely to engage in an entrepreneurial venture. This is consistent with Cejudo García et al. (2020) [40]. At the city level, the roles of these variables are rather mixed. In general, government intervention is harmful to individual entrepreneurship, while the average education level in the city does not affect whether an individual chooses to be self-employed.

Someone may argue that self-employment is not an appropriate measure for entrepreneurship, for many people are pushed into self-employment. In order to tackle this potential issue, we select the self-employed entrepreneur who claims that their motivation is to take advantage of a good business opportunity, as explained variables (Table 4). According to Table 4, all else being equal, the odds ratios for Density or Population are again below 1. In other words, for active self-employed entrepreneurs, big cities still play a negative role.

Table 4.

Robust check with active entrepreneur.

4.2. Potential Explanations for the Negative Impact of Agglomeration

As shown above, the probability of becoming an entrepreneur decreases as urban density increases. This result is robust for controlling for a wide range of individual- and city-level features and after correcting for the two potential endogenous sources of agglomeration. Here, we explore the potential explanations for our counter-intuitive finding from three aspects. Additionally, as the endogeneity problem is largely insensitive according to the benchmark regressions, in the follow-up specifications, we do not specifically target endogeneity to avoid MLE non-convergence. This is always the case, especially when the sample size is small. The sample size is reduced in many of the specifications in this section.

4.2.1. Matching Effect

It is believed that an increase in density or population can increase the probability of finding a match and improves the quality of matches. This translates into easier access to a satisfying job in dense or large cities; as a result, individuals tend to be wage-earning employees rather than risk-taking employers.

To verify this reasoning, we first divide our sample into high and low groups based on the availability of employment opportunities to check whether the magnitude and significance of Density differ. Next, we replace the explained variables with the job satisfaction to examine differences in match quality. Particularly, the availability of employment opportunities is measured by the total number of workers in the 2008 Industrial Census, while job satisfaction (ranging from 1 to 5 for strongly dissatisfied to strongly satisfied, respectively) is derived from the CLDS questionnaire.

We find that the coefficient on Density is significantly lower than 1 in column (1) but insignificant in column (2) of Table 5. This implies that the negative effect of agglomeration is stronger in cities with a higher availability of employment opportunities. Meanwhile, according to column (3), higher urban density is indeed associated with higher job satisfaction among employees. However, the increase in density has no significant effect on employer job satisfaction, based on column (4). This reflects the high quality of matches in large cities, where employees are more likely to find desirable jobs. In short, the negative effect of density can be explained by the fact that the densest markets are better at matching quantity with quality, thus creating a trade-off for entrepreneurship.

Table 5.

Agglomeration economies and entrepreneurship: testing matching effect.

4.2.2. High House Price

As a non-tradable resource, land and housing prices are bound to increase with density, which can impose a high fixed cost on entrepreneurs and raise entrepreneurship entry barriers. Hence, it is generally agreed that high land/housing costs are a strong discouragement to entrepreneurship. Additionally, a side-effect of the high land/prices is that entrepreneurs typically have to pay high salaries to make house rent affordable for their employees. This may make the cost of labor additionally hinder entrepreneurship.

To explore whether this is the case, we split the sample into two high-low groups based on average house prices and salary in the city (Table 6). The coefficient on Density with high house prices is significantly below 1 but does not show significance for the subsample of low house prices. This empirically confirms the discouraging effect of house prices on entrepreneurship. In terms of salary, although the coefficient on Density with low labor cost is greater than 1, it is insignificant. In fact, none of the coefficients on density are significant when grouped by salary (columns (3) and (4)). In other words, the dampening effect of labor costs is not verified. Overall, high housing prices in big cities tend to discourage individuals from entrepreneurship.

Table 6.

Agglomeration and entrepreneurship: testing the effect of house price and salary.

4.2.3. Intense Competition

As for competition, it is widely accepted that there exists higher competition in larger markets. This is also confirmed by our empirical examination in column (1) of Table 7. Taking the employer’s personal perception of intense business competition in the past year (Fierce, ranges 1 to 5 for free of competition to fierce competition, respectively) as the explanatory variable, an ordered logistic regression shows that the higher the density, the more intense perceived competition is.

Table 7.

Agglomeration economies and entrepreneurship: testing the effect of competition.

More importantly, fierce competition may invariably increase the difficulty of starting a business, which in turn discourages over-thinking entrepreneurs. Hence, we measure the degree of competition using the density of firms from the 2008 Industrial Census and divide the sample into high and low competition groups. As shown in Table 7, the subsample with a high competition degree has a regression coefficient on density significantly below 1 (column (2)), while the coefficient is insignificant for a low competition degree (column (3)). Therefore, the fierce competition in big cities does, as expected, drive individuals away from becoming employers.

4.3. Reward for Entrepreneurs in Large Cities

Based on Section 4.1 and Section 4.2, we can conclude that large cities fail to encourage individuals to start or run their own businesses because entrepreneurs in large cities can easily be tempted by a wider range of salaried opportunities and face high fixed costs and intense competition. However, these findings can easily be translated into misleading policy, that is, limiting or restricting individuals from engaging in entrepreneurship in large cities. In fact, if a firm or entrepreneur can survive high housing prices and fierce competition in large cities, they can expect to reap significant rewards. In this sense, it is worth encouraging entrepreneurship in big cities.

To find out whether this is true, we respectively take the gross profit of firms, number of employees, and operational income of entrepreneurs as dependent variables and observe the coefficients on density. Table 8 confirms that, as urban density increases, firms and entrepreneurs indeed perform better. This can serve as a friendly reminder that the firms and entrepreneurs surviving in large cities are productive and do receive rewards.

Table 8.

Rewards for entrepreneurs in large cities.

5. Discussion

Theoretically, it is difficult to draw conclusions on whether urban agglomeration promotes or hinders entrepreneurship. Based on our empirical examination, we find that, all else being equal, the higher the population density or the larger the population, the less chance individuals have of becoming self-employed. This baseline result is in line with Di Addario and Vuri (2010), who found that young Italian university graduates were reluctant to start their entrepreneurial activities in the most densely populated provinces. A U-shaped relationship was found in Japanese prefectures [8], but it could not be confirmed in our study (the square items of population and density are not statistically significant).

As for the reasons why large cities fail to encourage individuals to start their own businesses, we empirically find that entrepreneurs in large cities can easily be tempted by a wider range of salaried opportunities. This is against the suggestion of van Oort and Bosma (2013), who argue that the matching effect in large cities can help entrepreneurs find employees and partners easily and efficiently, thus encouraging the development of startups. Our findings lend more support to the idea that this matching effect makes it easier for individuals to find a satisfying job, which makes individuals tend to be employees with salaried jobs rather than risk-taking employers. Moreover, we find that entrepreneurs in large cities face intense competition. This is consistent with the Di Addario and Vuri (2010) argument about excessive competition.

Moreover, incredible rewards can be expected if a firm or entrepreneur can survive high housing prices and fierce competition in large cities. We do find firms in large cities are more likely to make better profits and hire more employees, and entrepreneurs can earn higher incomes. This may explain why big cities have traditionally been seen as pioneering cities for entrepreneurship [41,42,43].

6. Conclusions

Cities with large or dense populations have traditionally been treated as entrepreneurial “incubators” or “nurseries” [44,45]. However, there is a surprising lack of rigorous empirical evidence to test this assumed cause–effect relationship between agglomeration economies and entrepreneurship. Based on the 2012, 2014, and 2016 CLDS waves, this paper tries to fill this empirical gap using credible specifications. We find that large cities fail to boost individuals to start or run their own businesses, and this primary finding is robust in correcting the two potential endogeneity sources of agglomeration. Further analyses illustrate that entrepreneurs in large cities can be easily tempted by a wider range of salaried opportunities and are largely exposed to high fixed costs and intense competition. Additional examinations find that firms in larger cities yield better profits and hire more employees, and entrepreneurs are more likely to have higher incomes.

These findings lead to critical implications for boosting entrepreneurship. First, our baseline finding is a timely reminder that the cost of agglomeration has even outweighed its benefit in terms of entrepreneurship in China. It can be further deduced that China’s cities may be experiencing deviations from their optimal sizes. The most prominent agglomeration diseconomy is excessive housing prices, which pose a serious obstacle to entrepreneurship.

Second, our findings should not simply be reduced to the idea that we should limit or restrict individuals from engaging in entrepreneurship in large cities. Although a high density is a strong discouragement for individuals becoming entrepreneurs, the survivors in large cities can always expect significant rewards. According to our empirical examination, firms in large cities are more likely to make better profits and hire more employees, and entrepreneurs can earn higher incomes. The key message we aim to deliver is that entrepreneurs in large cities suffer from many disadvantages and mitigating these vulnerabilities is a top priority.

Third, targeted government policies to mitigate agglomeration diseconomies can focus on the following aspects. As entrepreneurs in large cities can be easily tempted by a wider range of salaried opportunities and are largely exposed to high fixed costs and intense competition, policymakers in large cities could at least nurture the culture of self-employment, reduce taxes for entrepreneurs, and encourage legitimate competition.

Author Contributions

Conceptualization, W.L., B.S., S.H. and X.J.; Data curation, X.J.; Formal analysis, W.L.; Funding acquisition, W.L., B.S. and S.H.; Supervision, B.S.; Validation, S.H.; Writing—original draft, W.L.; Writing—review & editing, B.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by National Natural Science Foundation of China grant number 41901184, 42071210, Fundamental Research Funds for the Central Universities grant number 2022ECNU-XWK-XK001, Humanities and Social Science Youth Foundation of Ministry of Education of China grant number 22YJC790037, and Philosophy and Social Science Annual Project Youth Foundation of Henan Province of China grant number 2022CJJ130.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Schumpeter, J. The Theory of Economic Development; Harvard University Press: Cambridge, MA, USA, 1934. [Google Scholar]

- Capello, R. Entrepreneurship and Spatial Externalities: Theory and Measurement. Ann. Reg. Sci. 2002, 36, 387–402. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Rosenthal, S.S.; Strange, W.C. Urban Economics and Entrepreneurship. J. Urban Econ. 2010, 67, 1–14. [Google Scholar] [CrossRef]

- Rosenthal, S.S.; Strange, W.C. Small Establishments/big Effects: Agglomeration, Industrial Organization and Entrepreneurship. In Agglomeration Economics; Glaeser, E.L., Ed.; University of Chicago Press: Chicago, IL, USA, 2010; pp. 277–302. [Google Scholar]

- Duranton, G.; Puga, D. Micro-Foundations of Urban Agglomeration Economies. In Handbook of Regional and Urban Economics; Henderson, J.V., Thisse, J.F., Eds.; Elsevier: Amsterdam, The Netherlands, 2004; Volume 4, pp. 2063–2117. [Google Scholar]

- Hoover, E.M.; Vernon, R. Anatomy of a Metropolis: The Changing Distribution of People and Jobs within the New York Metropolitan Region; Harvard University Press: Cambridge MA, USA, 2013. [Google Scholar]

- Di Addario, S.; Vuri, D. Entrepreneurship and Market Size. The Case of Young College Graduates in Italy. Labour Econ. 2010, 17, 848–858. [Google Scholar] [CrossRef]

- Sato, Y.; Tabuchi, T.; Yamamoto, K. Market Size and Entrepreneurship. J. Econ. Geogr. 2012, 12, 1139–1166. [Google Scholar] [CrossRef]

- Reynolds, P.D.; Miller, B.; Maki, W.R. Explaining Regional Variation in Business Births and Deaths: U.S. 1976–1988. Small Bus. Econ. 1995, 7, 389–407. [Google Scholar] [CrossRef]

- Glaeser, E.L. Entrepreneurship and the City. In Entrepreneurship and Openness; Edward Elgar Publishing: Cheltenham, UK, 2009. [Google Scholar]

- Zheng, S.; Du, R. How Does Urban Agglomeration Integration Promote Entrepreneurship in China? Evidence from Regional Human Capital Spillovers and Market Integration. Cities 2020, 97, 102529. [Google Scholar] [CrossRef]

- Combes, P.P.; Gobillon, L. The Empirics of Agglomeration Economies. In Handbook of Regional and Urban Economics; Henderson, J.V., Thisse, J.F., Eds.; Elsevier: Amsterdam, The Netherlands, 2015; Volume 5, pp. 247–348. [Google Scholar]

- Nocke, V. A Gap for Me: Entrepreneurs and Entry. J. Eur. Econ. Assoc. 2006, 4, 929–956. [Google Scholar] [CrossRef]

- Duranton, G.; Puga, D. The Economics of Urban Density. J. Econ. Perspect. 2020, 34, 3–26. [Google Scholar] [CrossRef]

- Barkham, R.J. Entrepreneurial Characteristics and the Size of the New Firm: A Model and an Econometric Test. Small Bus. Econ. 1994, 6, 117–125. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Fritsch, M. The Geography of Firm Births in Germany. Reg. Stud. 1994, 28, 359–365. [Google Scholar] [CrossRef]

- Combes, P.P.; Duranton, G.; Gobillon, L.; Puga, D. The Productivity Advantages of Large Cities: Distinguishing Agglomeration from Firm Selection. Econometrica 2012, 80, 2543–2594. [Google Scholar] [CrossRef]

- Rauch, J.E. Productivity Gains from Geographic Concentration of Human Capital: Evidence from the Cities. J. Urban Econ. 1993, 34, 380–400. [Google Scholar] [CrossRef]

- Henderson, J.V. The Sizes and Types of Cities. Am. Econ. Rev. 1974, 64, 640–656. [Google Scholar]

- van Oort, F.G.; Bosma, N.S. Agglomeration Economies, Inventors and Entrepreneurs as Engines of European Regional Economic Development. Ann. Reg. Sci. 2013, 51, 213–244. [Google Scholar] [CrossRef]

- Qian, H.; Zhao, C. Space-Time Analysis of High Technology Entrepreneurship: A Comparison of California and New England. Appl. Geogr. 2018, 95, 111–119. [Google Scholar] [CrossRef]

- Buenstorf, G.; Klepper, S. Why Does Entry Cluster Geographically? Evidence from the US Tire Industry. J. Urban Econ. 2010, 68, 103–114. [Google Scholar] [CrossRef]

- Combes, P.-P.; Duranton, G.; Gobillon, L. The Costs of Agglomeration: House and Land Prices in French Cities. Rev. Econ. Stud. 2018, 86, 1556–1589. [Google Scholar] [CrossRef]

- Sun, B.; Zhu, P.; Li, W. Cultural Diversity and New Firm Formation in China. Reg. Stud. 2019, 53, 1371–1384. [Google Scholar] [CrossRef]

- van Oort, F.G.; Stam, E. Agglomeration Economies and Entrepreneurship in the ICT Industry. ERIM Report Series Reference No: ERS-2006-016-ORG. 2006, pp. 1–24. Available online: https://ssrn.com/abstract=902745 (accessed on 15 November 2022).

- Capozza, C.; Salomone, S.; Somma, E. Local Industrial Structure, Agglomeration Economies and the Creation of Innovative Start-Ups: Evidence from the Italian Case. Entrep. Reg. Dev. 2018, 30, 749–775. [Google Scholar] [CrossRef]

- Andersson, M.; Lööf, H. Agglomeration and Productivity: Evidence from Firm-Level Data. Ann. Reg. Sci. 2011, 46, 601–620. [Google Scholar] [CrossRef]

- Forslid, R.; Okubo, T. Spatial Sorting with Heterogeneous Firms and Heterogeneous Sectors. Reg. Sci. Urban Econ. 2014, 46, 42–56. [Google Scholar] [CrossRef]

- Michelacci, C.; Silva, O. Why so Many Local Entrepreneurs? Rev. Econ. Stat. 2007, 89, 615–633. [Google Scholar] [CrossRef]

- Zheng, L.; Zhao, Z. What Drives Spatial Clusters of Entrepreneurship in China? Evidence from Economic Census Data. China Econ. Rev. 2017, 46, 229–248. [Google Scholar] [CrossRef]

- Catalini, C. Microgeography and the Direction of Inventive Activity. Manag. Sci. 2018, 64, 4348–4364. [Google Scholar] [CrossRef]

- Wu, X.Y.; Wang, M.; Li, L.X. Did High Housing Price Discourage Entrepreneurship in China. Econ. Res. J. 2014, 9, 121–134. (In Chinese) [Google Scholar]

- Harding, J.P.; Rosenthal, S.S. Homeownership, Housing Capital Gains and Self-Employment. J. Urban Econ. 2017, 99, 120–135. [Google Scholar] [CrossRef]

- Blanchflower, D.G. Self-Employment in OECD Countries. Labour Econ. 2000, 7, 471–505. [Google Scholar] [CrossRef]

- Barkham, R. Regional Variations in Entrepreneurship: Some Evidence from the United Kingdom: Regional Variations in Entrepreneurship. Entrep. Reg. Dev. 1992, 4, 225–244. [Google Scholar] [CrossRef]

- Qin, N.; Kong, D. Human Capital and Entrepreneurship. J. Hum. Cap. 2021, 15, 513–553. [Google Scholar] [CrossRef]

- Ciccone, A.; Hall, R.E. Productivity and the Density of Economic Activity; Nber Working Paper, No: 4313; American Economic Association: Nashville, TN, USA, 1993. [Google Scholar]

- Bernstein, T.P. Up to the Mountains and Down to the Villages: The Transfer of Youth from Urban to Rural China; Yale University Press: New York, NY, USA, 1977. [Google Scholar]

- Naughton, B. The Third Front: Defence Industrialization in the Chinese Interior. China Q. 1988, 115, 351–386. [Google Scholar] [CrossRef]

- Cejudo García, E.; Cañete Pérez, J.A.; Navarro Valverde, F.; Ruiz Moya, N. Entrepreneurs and Territorial Diversity: Success and Failure in Andalusia 2007–2015. Land 2020, 9, 262. [Google Scholar] [CrossRef]

- Acs, Z.J.; Glaeser, E.L.; Litan, R.E.; Fleming, L.; Goetz, S.J.; Kerr, W.; Klepper, S.; Rosenthal, S.S.; Sorenson, O.; Strange, W.C. Entrepreneurship and Urban Success: Toward a Policy Consensus. 2008. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1092493 (accessed on 15 November 2022).

- Bosma, N.; Sternberg, R. Entrepreneurship as an Urban Event? Empirical Evidence from European Cities. Reg. Stud. 2014, 48, 1016–1033. [Google Scholar] [CrossRef]

- Florida, R.; Adler, P.; Mellander, C. The City as Innovation Machine. Reg. Stud. 2017, 51, 86–96. [Google Scholar] [CrossRef]

- Duranton, G.; Puga, D. Nursery Cities: Urban Diversity, Process Innovation, and the Life Cycle of Products. Am. Econ. Rev. 2001, 91, 1454–1477. [Google Scholar] [CrossRef]

- Fan, D.; Su, Y.; Huang, X. Nursery City Innovation: A CELL Framework. Public Adm. Rev. 2022, 82, 764–770. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).