Exploring the Spatial Discrete Heterogeneity of Housing Prices in Beijing, China, Based on Regionally Geographically Weighted Regression Affected by Education

Abstract

1. Introduction

2. Data Sources and Methods

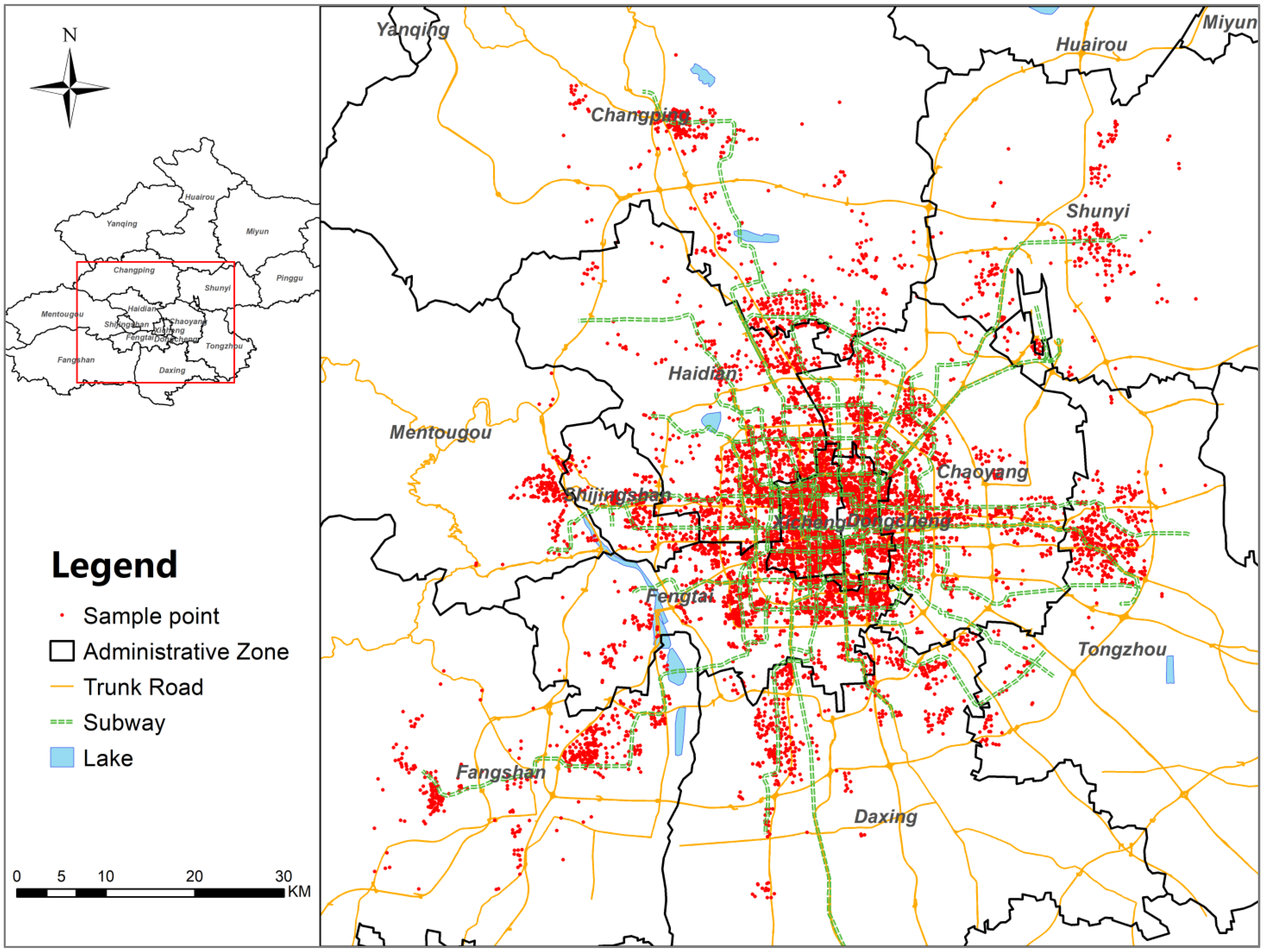

2.1. Study Area and Data

2.1.1. Housing Hedonic Price Data

2.1.2. Location POI and Base Map Data

2.1.3. Middle and Primary School Data

2.2. Research Methodology

2.2.1. Geographically Weighted Regression (GWR)

2.2.2. Regionally and Geographically Weighted Regression (RGWR)

2.2.3. Regionally Geographically Weighted Regression Affected by Education (E-RGWR)

2.2.4. Model Evaluation of Performance

2.3. Data Preprocessing

2.3.1. Coordinates (Latitude and Longitude)

2.3.2. Structure Covariates

2.3.3. Temporal Covariates

2.3.4. Neighborhood Covariate

2.3.5. School Quality

2.4. Analytical Framework Design and Implementation

| Algorithm 1: Pseudo-code describing the E-RGWR model. |

| Algorithm: E-RGWR |

| INPUT: explanatory variables X spatial coordinates dependent variable Y |

| PROCESS |

| Find the optimal spatial bandwidth |

| For do |

| construct the spatial kernel weight between and |

| calculate the AICc value |

| obtain the optimal spatial bandwidth |

| end for |

| Establish a regional factor affected by education between and |

| Construct the spatial kernel weight affected by regional education between and |

| Calculate the fitted value E-Ry |

| Calculate R2, R2adj, MSE, and RMSE |

2.5. Parameter Setting

3. Results

3.1. Model Performance Comparison

3.1.1. Comparison of Model Results

3.1.2. Comparison of Model Fitting Effects

3.2. Analysis of Variables Related to House Prices

4. Discussion

4.1. Model Performance in Exploring Spatial Heterogeneity

4.2. Spatial Discrete Heterogeneity of Commercial Housing Prices in Beijing

4.3. Policy Impact Analysis

4.4. Extended Significance of the Model

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Chai, Z.; Yang, Y.; Zhao, Y.; Fu, Y.; Hao, L. Exploring the Effects of Contextual Factors on Residential Land Prices Using an Extended Geographically and Temporally Weighted Regression Model. Land 2021, 10, 1148. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, Y.; Wu, S.; Du, Z. House Price Valuation Model Based on Geographically Neural Network Weighted Regression: The Case Study of Shenzhen, China. ISPRS Int. J. Geo-Inf. 2022, 11, 450. [Google Scholar] [CrossRef]

- Garang, Z.; Wu, C.; Li, G.; Zhuo, Y.; Xu, Z. Spatio-Temporal Non-Stationarity and Its Influencing Factors of Commercial Land Price: A Case Study of Hangzhou, China. Land 2021, 10, 317. [Google Scholar] [CrossRef]

- Laborde, D.; Martin, W.; Swinnen, J.; Vos, R. COVID-19 risks to global food security. Science 2020, 369, 500–502. [Google Scholar] [CrossRef]

- International Moetary Fund. Available online: https://www.imf.org/en/Home (accessed on 1 April 2022).

- Miyazaki, K.; Bowman, K.; Sekiya, T.; Takigawa, M.; Neu, J.L.; Sudo, K.; Eskes, H. Global tropospheric ozone responses to reduced NO x emissions linked to the COVID-19 worldwide lockdowns. Sci. Adv. 2021, 7, f7460. [Google Scholar] [CrossRef]

- Chossière, G.P.; Xu, H.; Dixit, Y.; Isaacs, S.; Eastham, S.; Allroggen, F.; Speth, R.; Barrett, S. Air pollution impacts of COVID-19--related containment measures. Sci. Adv. 2021, 7, e1178. [Google Scholar] [CrossRef]

- Livingston, G.; Huntley, J.; Sommerlad, A.; Ames, D.; Ballard, C.; Banerjee, S.; Brayne, C.; Burns, A.; Cohen-Mansfield, J.; Cooper, C.; et al. Dementia prevention, intervention, and care: 2020 report of the Lancet Commission. Lancet 2020, 396, 413–446. [Google Scholar] [CrossRef]

- Dunsky, R.M.; Follain, J.R.; Giertz, S.H. Pricing Credit Risk for Mortgages: Credit Risk Spreads and Heterogeneity across Housing Markets. Real Estate Econ. 2021, 49, 997–1032. [Google Scholar] [CrossRef]

- Stockhammer, E.; Bengtsson, E. Financial effects in historic consumption and investment functions. Int. Rev. Appl. Econ. 2020, 34, 304–326. [Google Scholar] [CrossRef]

- Qu, Y.; Jiang, G.; Li, Z.; Shang, R.; Zhou, D. Understanding the multidimensional morphological characteristics of urban idle land: Stage, subject, and spatial heterogeneity. Cities 2020, 97, 102492. [Google Scholar] [CrossRef]

- Cabras, I.; Sohns, F.; Canduela, J.; Toms, S. Public houses and house prices in Great Britain: A panel analysis. Eur. Plan. Stud. 2020, 29, 163–180. [Google Scholar] [CrossRef]

- Lancaster, K.J. A New Approach to Consumer Theory. J. Political Econ. 1966, 74, 132–157. [Google Scholar] [CrossRef]

- Rosen, S. Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition. J. Politi-Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Páez, A.; Long, F.; Farber, S. Moving Window Approaches for Hedonic Price Estimation: An Empirical Comparison of Modelling Techniques. Urban Stud. 2008, 45, 1565–1581. [Google Scholar] [CrossRef]

- Shen, Y.; Karimi, K. The economic value of streets: Mix-scale spatio-functional interaction and housing price patterns. Appl. Geogr. 2017, 79, 187–202. [Google Scholar] [CrossRef]

- Mok, H.M.; Chan, P.P.; Cho, Y. A hedonic price model for private properties in Hong Kong. J. Real Estate Financ. Econ. 1995, 10, 37–48. [Google Scholar] [CrossRef]

- Glumac, B.; Herrera-Gomez, M.; Licheron, J. A hedonic urban land price index. Land Use Policy 2019, 81, 802–812. [Google Scholar] [CrossRef]

- Duan, J.; Tian, G.; Yang, L.; Zhou, T. Addressing the macroeconomic and hedonic determinants of housing prices in Beijing Metropolitan Area, China. Habitat Int. 2021, 113, 102374. [Google Scholar] [CrossRef]

- Huang, Z.; Chen, R.; Xu, D.; Zhou, W. Spatial and hedonic analysis of housing prices in Shanghai. Habitat Int. 2017, 67, 69–78. [Google Scholar] [CrossRef]

- Stewart Fotheringham, A.; Charlton, M.; Brunsdon, C. The geography of parameter space: An investigation of spatial non-stationarity. Int. J. Geogr. Inf. Syst. 1996, 10, 605–627. [Google Scholar] [CrossRef]

- Brunsdon, C.; Fotheringham, S.; Charlton, M. Geographically weighted regression. J. R. Stat. Soc. Ser. D 1998, 47, 431–443. [Google Scholar] [CrossRef]

- Brunsdon, C.; Fotheringham, A.S.; Charlton, M.E. Geographically Weighted Regression: A Method for Exploring Spatial Nonstationarity. Geogr. Anal. 1996, 28, 281–298. [Google Scholar] [CrossRef]

- Tobler, W.R. A Computer Movie Simulating Urban Growth in the Detroit Region. Econ. Geogr. 1970, 46, 234–240. [Google Scholar] [CrossRef]

- Liu, J.; Yang, Y.; Xu, S.; Zhao, Y.; Wang, Y.; Zhang, F. A Geographically Temporal Weighted Regression Approach with Travel Distance for House Price Estimation. Entropy 2016, 18, 303. [Google Scholar] [CrossRef]

- Liu, J.; Zhao, Y.; Yang, Y.; Xu, S.; Zhang, F.; Zhang, X.; Shi, L.; Qiu, A. A Mixed Geographically and Temporally Weighted Regression: Exploring Spatial-Temporal Variations from Global and Local Perspectives. Entropy 2017, 19, 53. [Google Scholar] [CrossRef]

- Wu, C.; Ren, F.; Hu, W.; Du, Q. Multiscale geographically and temporally weighted regression: Exploring the spatiotemporal determinants of housing prices. Int. J. Geogr. Inf. Sci. 2019, 33, 489–511. [Google Scholar] [CrossRef]

- Yao, J.; Fotheringham, A.S. Local Spatiotemporal Modeling of House Prices: A Mixed Model Approach. Prof. Geogr. 2015, 68, 189–201. [Google Scholar] [CrossRef]

- Yu, D.; Wei, Y.D.; Wu, C. Modeling Spatial Dimensions of Housing Prices in Milwaukee, WI. Environ. Plan. B Plan. Des. 2007, 34, 1085–1102. [Google Scholar] [CrossRef]

- Bitter, C.; Mulligan, G.F.; Dall’Erba, S. Incorporating spatial variation in housing attribute prices: A comparison of geographically weighted regression and the spatial expansion method. J. Geogr. Syst. 2007, 9, 7–27. [Google Scholar] [CrossRef]

- Li, H.; Wei, Y.D. Spatial inequality of housing value changes since the financial crisis. Appl. Geogr. 2020, 115, 102141. [Google Scholar] [CrossRef]

- Li, X.; Kao, C. Spatial Analysis and Modeling of the Housing Value Changes in the U.S. during the COVID-19 Pandemic. J. Risk Financ. Manag. 2022, 15, 139. [Google Scholar] [CrossRef]

- Anselin, L. Thirty years of spatial econometrics. Pap. Reg. Sci. 2010, 89, 3–25. [Google Scholar] [CrossRef]

- Qin, W.Z. The Basic Theoretics and Application Research on Geographically Weighted Regression. Ph.D. Thesis, Tongji University, Shanghai, China, 2007. [Google Scholar]

- Wang, Z.; Zhao, Y.; Zhang, F. Simulating the Spatial Heterogeneity of Housing Prices in Wuhan, China, by Regionally Geographically Weighted Regression. ISPRS Int. J. Geo-Inf. 2022, 11, 129. [Google Scholar] [CrossRef]

- Weir, R. Using geographically weighted regression to explore neighborhood-level predictors of domestic abuse in the UK. Trans. GIS 2019, 23, 1232–1250. [Google Scholar] [CrossRef]

- Baborska-Narozny, M.; Stevenson, F.; Chatterton, P. Temperature in housing: Stratification and contextual factors. Proc. Inst. Civ. Eng.-Eng. Sustain. 2016, 169, 125–137. [Google Scholar] [CrossRef]

- Weimer, D.L.; Wolkoff, M.J. School Performance and Housing Values: Using Non-Contiguous District and Incorporation Boundaries to Identify School Effects. Natl. Tax J. 2001, 54, 231–253. [Google Scholar] [CrossRef]

- Bates, L.K. Does neighborhood really matter? Comparing historically defined neighborhood boundaries with housing submarkets. J. Plan. Educ. Res. 2006, 26, 5–17. [Google Scholar] [CrossRef]

- Hu, W.; Zheng, S.; Wang, R. The capitalization of school quality in home value: A matching regression approach with housing price-rent comparison. China Econ. Q. 2014, 13, 1195–1214. [Google Scholar]

- Feng, H.; Lu, M. School quality and housing prices: Empirical evidence from a natural experiment in Shanghai, China. J. Hous. Econ. 2013, 22, 291–307. [Google Scholar] [CrossRef]

- Ha, W.; Wu, H.B.; Yu, R. A new research on the capitalization of school quality in housing prices: An empirical study based on repeated cross-sectional data in Beijing. Educ. Econ. 2015, 5, 3–10. [Google Scholar]

- Huang, B.; He, X.; Xu, L.; Zhu, Y. Elite school designation and housing prices-quasi-experimental evidence from Beijing, China✰. J. Hous. Econ. 2020, 50, 101730. [Google Scholar] [CrossRef]

- Beijing Municipal Education Commission. Available online: http://jw.beijing.gov.cn/xxgk/shujufab/#huadong (accessed on 22 April 2022).

- Lin, G.; Long, Z.; Wu, M. A spatial analysis of regional economic convergence in China: 1978–2002. China Econ. Q.-Beijing 2005, 4, 67. [Google Scholar]

- Fotheringham, A.S.; Charlton, M.; Brunsdon, C. Measuring spatial variations in relationships with geographically weighted regression. In Recent Developments in Spatial Analysis; Springer: Berlin/Heidelberg, Germany, 1997; pp. 60–82. [Google Scholar]

- Feng, H.; Lu, M. selecting school via buying houses-an enmpirical evidence and policy implication of the impact of education on housing price. J. World Econ. 2010, 1, 89–104. [Google Scholar]

- Bi, B.; Zhang, X. “Attending Nearby Schools” in Central Beijing: Influencing Factors and the Policy Distortion. Int. Rev. Spat. Plan. Sustain. Dev. 2016, 4, 31–48. [Google Scholar] [CrossRef][Green Version]

- Wan, B.; Yang, T. Configuration in the Development of Urban School District: A Case Study of Beijing, China; Atlantis Press: Paris, France, 2020; pp. 421–430. [Google Scholar]

- Zheng, S.; Sun, W.; Wang, R. Land supply and capitalization of public goods in housing prices: Evidence from Beijing. J. Reg. Sci. 2013, 54, 550–568. [Google Scholar] [CrossRef]

- Zheng, S.; Kahn, M.E. Land and residential property markets in a booming economy: New evidence from Beijing. J. Urban Econ. 2008, 63, 743–757. [Google Scholar] [CrossRef]

- Zhang, L.; Yi, Y. Quantile house price indices in Beijing. Reg. Sci. Urban Econ. 2017, 63, 85–96. [Google Scholar] [CrossRef]

- Li, Y.; Xiang, Z.; Xiong, T. The Behavioral Mechanism and Forecasting of Beijing Housing Prices from a Multiscale Perspective. Discret. Dyn. Nat. Soc. 2020, 2020, 1–13. [Google Scholar] [CrossRef]

- Yang, H.; Fu, M.; Wang, L.; Tang, F. Mixed Land Use Evaluation and Its Impact on Housing Prices in Beijing Based on Multi-Source Big Data. Land 2021, 10, 1103. [Google Scholar] [CrossRef]

- Liu, Z.; Ye, J.; Ren, G.; Feng, S. The Effect of School Quality on House Prices: Evidence from Shanghai, China. Land 2022, 11, 1894. [Google Scholar] [CrossRef]

| Abbreviation | Description | Minimum | Mean | Maximum |

|---|---|---|---|---|

| LnPrice | Price of the house | −0.8144 | 1.9288 | 3.3426 |

| Administrative Regionalization | ||||

| RC | Corresponding administrative regionalization code | - | - | - |

| Structural Covariates | ||||

| LNFAR | Log of the FAR | −1.2040 | 0.5498 | 2.2148 |

| LNGR | Log of the green ratio | −2.9957 | 3.3834 | 4.3820 |

| LNPF | Log of the property fees | −4.6052 | 0.1729 | 2.8904 |

| Temporal Covariates | ||||

| NA | Normalized building age | 0 | 76.3704 | 97 |

| Neighborhood Covariates | ||||

| LNS | Log of the distance to the nearest subway station | 1.7918 | 6.4872 | 9.2023 |

| LNH | Log of the distance to the nearest hospital | 1.0986 | 5.5976 | 8.2074 |

| LNP | Log of the distance to the nearest park | 1.6094 | 6.3703 | 8.5624 |

| LNM | Log of the distance to the nearest market | 0.6931 | 6.2340 | 9.0388 |

| LNPS | Log of the distance to the nearest primary school | 2.4849 | 6.2265 | 8.3687 |

| LNMS | Log of the distance to the nearest middle school | 2.0794 | 5.9527 | 8.4849 |

| Model p-Value | LNPF | LNFAR | LNGR | NA | LNS | LNH | LNP | LNM | LNPS | LNMS |

|---|---|---|---|---|---|---|---|---|---|---|

| GWR (Fixed) | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| RGWR(Fixed) | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| E-RGWR(Fixed) | 0.000 *** | 0.000 *** | 0.000 *** | 0.086 * | 0.000 *** | 0.009 ** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| GWR(Adaptive) | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| RGWR(Adaptive) | 0.000 *** | 0.000 *** | 0.000 *** | 0.052 * | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| E-RGWR(Adaptive) | 0.000 *** | 0.000 *** | 0.000 *** | 0.062 * | 0.000 *** | 0.006 ** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| Models | Bandwidth/Nth | R2 | R2adj | MSE | RMSE | AICc |

|---|---|---|---|---|---|---|

| GWR (fixed) | 10,012.4 | 0.7789 | 0.7785 | 0.0695 | 0.2637 | 1775 |

| RGWR (fixed) | 10,012.4 | 0.8371 | 0.8368 | 0.0512 | 0.2263 | −212.5276 |

| E-RGWR (fixed) | 10,012.4 | 0.8644 | 0.8642 | 0.0426 | 0.2065 | −1322.3 |

| GWR (adaptive) | 900 | 0.7848 | 0.7844 | 0.0677 | 0.2601 | 966.0492 |

| RGWR (adaptive) | 900 | 0.8325 | 0.8322 | 0.0527 | 0.2295 | −895.3239 |

| E-RGWR (adaptive) | 900 | 0.8406 | 0.8403 | 0.0501 | 0.2239 | −1315.7 |

| E-RGWR (fixed)/GWR (fixed) Improvement | -- | 10.98% | 11.01% | 38.71% | 21.69% | |

| RGWR (fixed)/GWR (fixed) Improvement | -- | 7.47% | 7.49% | 26.33% | 14.18% | |

| E-RGWR (adaptive)/GWR (adaptive) Improvement | -- | 7.11% | 7.13% | 26.00% | 13.92% | |

| RGWR (adaptive)/GWR (adaptive) Improvement | -- | 6.08% | 6.09% | 22.16% | 13.92% | - |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Z.; Zhang, F.; Zhao, Y. Exploring the Spatial Discrete Heterogeneity of Housing Prices in Beijing, China, Based on Regionally Geographically Weighted Regression Affected by Education. Land 2023, 12, 167. https://doi.org/10.3390/land12010167

Wang Z, Zhang F, Zhao Y. Exploring the Spatial Discrete Heterogeneity of Housing Prices in Beijing, China, Based on Regionally Geographically Weighted Regression Affected by Education. Land. 2023; 12(1):167. https://doi.org/10.3390/land12010167

Chicago/Turabian StyleWang, Zengzheng, Fuhao Zhang, and Yangyang Zhao. 2023. "Exploring the Spatial Discrete Heterogeneity of Housing Prices in Beijing, China, Based on Regionally Geographically Weighted Regression Affected by Education" Land 12, no. 1: 167. https://doi.org/10.3390/land12010167

APA StyleWang, Z., Zhang, F., & Zhao, Y. (2023). Exploring the Spatial Discrete Heterogeneity of Housing Prices in Beijing, China, Based on Regionally Geographically Weighted Regression Affected by Education. Land, 12(1), 167. https://doi.org/10.3390/land12010167