1. Introduction 1

The demand for food is expected to increase in the next few years and the need for a more sustainable livestock sector can no longer be ignored. Worldwide, livestock is responsible for 16.5% of all anthropogenic GHG emissions, mainly in the form of methane (CH

4), carbon dioxide (CO

2), nitrous oxide (N

2O), and ammonia (NH

3), coming from fodder cultivation, enteric fermentation, manure management, and nitrogen deposition and application [

2,

3]. Livestock activities require an extensive amount of land, both for accommodating animals and for fodder cultivation. This generally translates to deforestation, leading to emissions of the carbon previously stored in biomass and in soil. Furthermore, the livestock sector is a great cause of waste and the pollution of water, which is contaminated by animal excreta, antibiotics and hormones, fertilizers and pesticides used in forage production, and runoff from pasture [

4]. Water quality degradation, eutrophication, and hypoxia in surface water bodies are mainly due to the nitrogen and phosphorous input coming from livestock manure management and fertilizers [

5].

In 2020, the Italian livestock sector produced 271,051 thousand tonnes of ammonia and 19,760 thousand tonnes of CO

2eq, 68% of which (13,535 thousand tonnes) was related to cattle enteric fermentation and cattle manure management. The national animal production value (in current value) accounted for 15.5 billion EUR [

6]. The Emilia-Romagna region is responsible for 10.4% of Italian livestock-related GHG emissions (2059 thousand tonnes) [

7], and its economy heavily relies on the Parmigiano Reggiano industry.

Since the MacSharry Reform in 1992, the European Common Agricultural Policy has evolved to ensure food security through more sustainable agricultural practices [

8]. Eco-schemes (ES) and Agriculture Environmental Schemes (AES) have been introduced as new policy tools with the post 2020 CAP reform to align the CAP objectives to the European Green Deal targets: reaching climate neutrality by 2050 and halving fertilizer application and nutrient loss by 2030 [

9]. Despite the introduction of these new mechanisms, the latest strategies proposed by the European Commission in response to the recent global food insecurity issues caused by the war in Ukraine are likely to have a negative environmental effect. Suffice it to mention the exemption from the greening obligations and permission to cultivate on fallow land that falls within the Ecological Focus Areas (EFAs) [

10].

In recent decades, the European Union has also developed a carbon pricing system to reduce GHG emissions and mitigate climate change. The two main carbon pricing mechanisms implemented so far are the Emissions Trading Systems (ETS) and carbon taxes. The ETS was set up in 2005 (Directive 2003/87/EC) as a cap-and-trade approach for activities, which are required to have allowances equivalent to their emissions. However, agricultural activities are not yet included in these carbon pricing mechanisms [

11]. Policy makers have been reluctant to include them, partly because of a lack of political will, and partly because of the difficulty of measuring emissions and emission reductions at the farm level [

12].

Carbon taxes, on the other hand, directly set a price on carbon emissions, with the aim of incentivising activities to reduce their emissions. Finland was the first EU country to apply a carbon tax in 1990. Carbon taxes are not compulsory for Member States, and the amount applied can vary widely: from more than 100 EUR/tCO

2eq in the northern countries, to less than 1 EUR in Poland and Ukraine [

13].

In Italy, a carbon tax was introduced in 1999 (L 448/1998) on the consumption in energy plants of coal, petroleum, and coke, with a tax rate initially fixed at 1000 £/t of product (around 0.52 EUR/t), but it was in force only for that year. Since 1999, the reintroduction of the carbon tax in Italy has been discussed but not reimplemented [

14].

In 14 July 2021, the Commission published the “Ready for 55%” package, setting out the Green New Deal [

15]. It includes the revision of the ETS Directive and introduces the Carbon Border Adjustment Mechanism (CBAM) to prevent carbon leakage and encourage a global move towards net zero carbon emissions, in line with the Paris Agreement. The CBAM regulation was approved by the Council in March 2022 [

16].

Applying measures to decrease the GHG emissions of the agricultural sector could significantly reduce the ecological footprint of agriculture, but could also negatively affect farm competitiveness and incomes [

17]. This negative effect could, however, be mitigated if farmers, operating in the same context, could engage in the exchange of production factors to reduce the inefficiencies of single farms.

The aim of this research is to assess, ex-ante, how farmers could react to the opportunity to apply to eco-schemes to make up for potential revenue losses, in an environment where they can reduce their inefficiency by exchanging production factors such as land and pollution quotas. The effect of an increasing carbon taxes (20, 50, 100, and 150 EUR/tCO2eq) is evaluated to simulate farmers’ responses in terms of changing production plans and resource allocation.

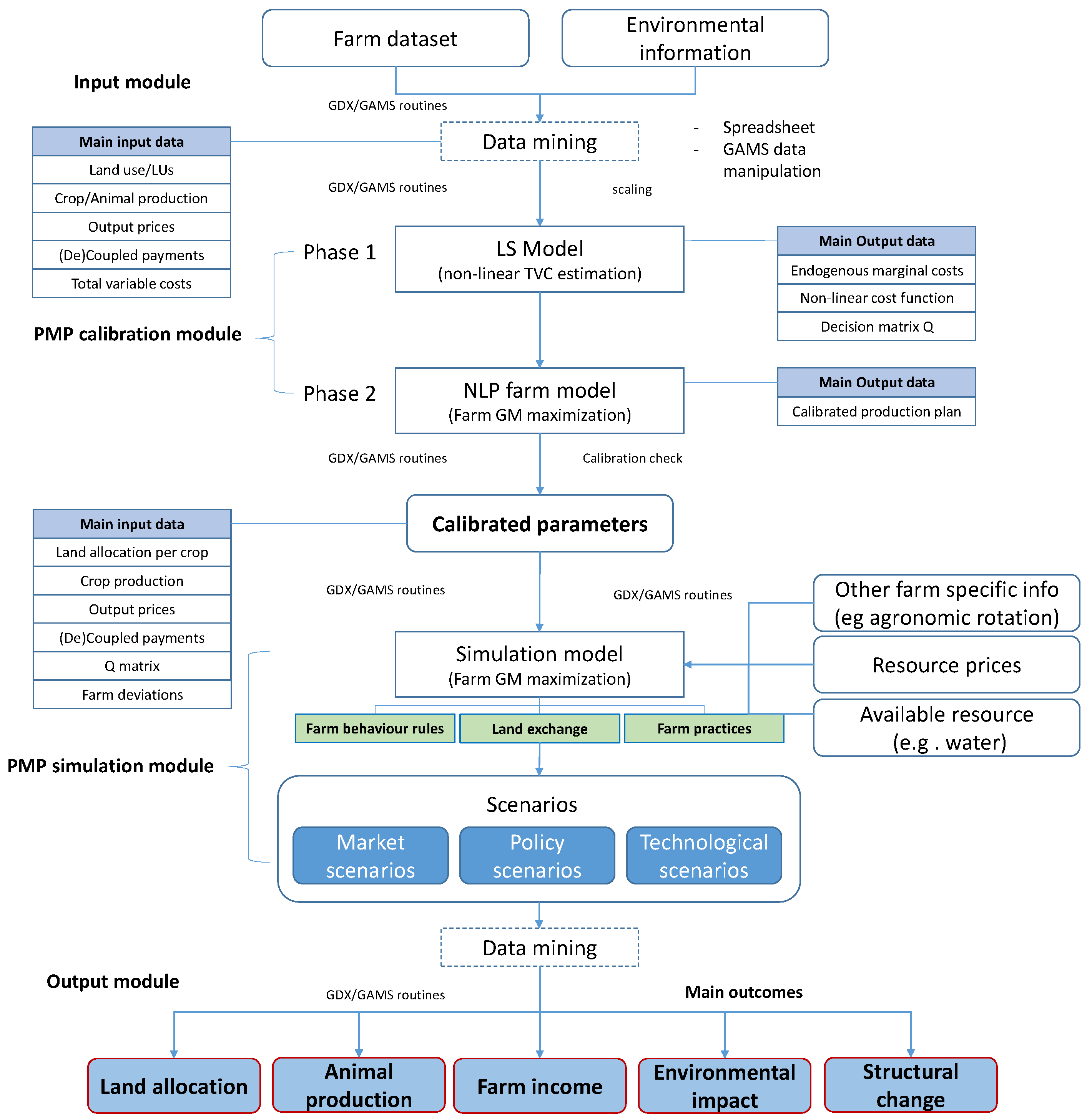

To reproduce a complex environment at the farm scale, in which farmers can interact with each other while maximizing their farms’ utility function, a Dairy Farm Agent-Based Model (AGRISP), based on Positive Mathematical Programming (PMP), is developed and applied. ABMs make it possible to evaluate agricultural policies and farmers’ level of acceptance by simulating interactions between farmers and, at the same time, taking subregional territorial specificity and farm heterogeneity into account. PMP methodology makes it possible to add social and cultural perspectives to economic drivers [

18,

19].

The integration of an ABM and the PMP approach into AGRISP (Agricultural Regional Integrated Simulation Package) make it possible to optimize every farm cost function in the sample, taking into account individual farmers’ behaviour and characteristics, starting from the observed optimal situation to simulate structural changes, such as changes in farm dimensions or a possible abandonment of farm activity. The model can estimate this choice by simulating exchanges of resources, as well as the introduction of new activities and changes into agricultural management practices. The aggregation of the regional results can also provide useful and solid insight into the general trend of the agricultural sector at the national and international level.

The paper is organized as follows.

Section 2 presents the characteristics of the Agent-Based model developed through a Positive Mathematical Programming approach, the sample data used for the simulation, and the policy scenarios.

Section 3 presents the obtained results, while

Section 4 and

Section 5 conclude and suggest paths for future research.

3. Results

The impact of different renting strategies, shown in

Table 5, explains the structural variation due to the introduction of a rule imposing the full utilisation of the available land. The total number of farms decreases from 35,459 in “s_cal” to 33,498 (−5.5%) in “s_land”, with a bigger impact on non-dairy farms (−5.9%) than dairy farms (−2.0%). Considering the farm holders’ age for the whole sample, the number of farms decreases by −7.6% in the age range of 41–65, by 5.8% in the range of ≤40, and by 3.2% in the range of ≥65.

The ”s_land” scenario, used as baseline for the “s_nitrogen” and increasing emissions taxation scenarios, depicts how some farmers opt for structural adaptation strategies to find new forms of economic efficiency, whereas other farmers decide to leave the sector when pushed to fully use their land endowment.

Figure 3 depicts the effect of environmental measures on the baseline scenario. The decrease in the number of farms is very limited in absolute numbers: it is more evident for non-dairy farms, with minus 502 farms, while in the dairy sector, only 98 farms decide to abandon their activities when a higher CO

2 tax (“s_em150”) is introduced.

Considering the farm holders’ age (

Table 6), dairy farms decrease in the range of 41–64, while non-dairy farms decrease in the range of ≥65. The introduction of the Nitrate Directive (“s_nitrogen”) has no influence on the number of farms.

Figure 4 shows the impact of policy scenarios on farm gross margins (GM), aggregated at the regional level (

Table A1). The GM decreases slightly in the scenario “s_nitrogen”, but this reduction is substantial and increases along with a tax increase (from −4.3% with a tax of 20 EUR/tCO

2eq, up to −24.7% in “s_em150”).

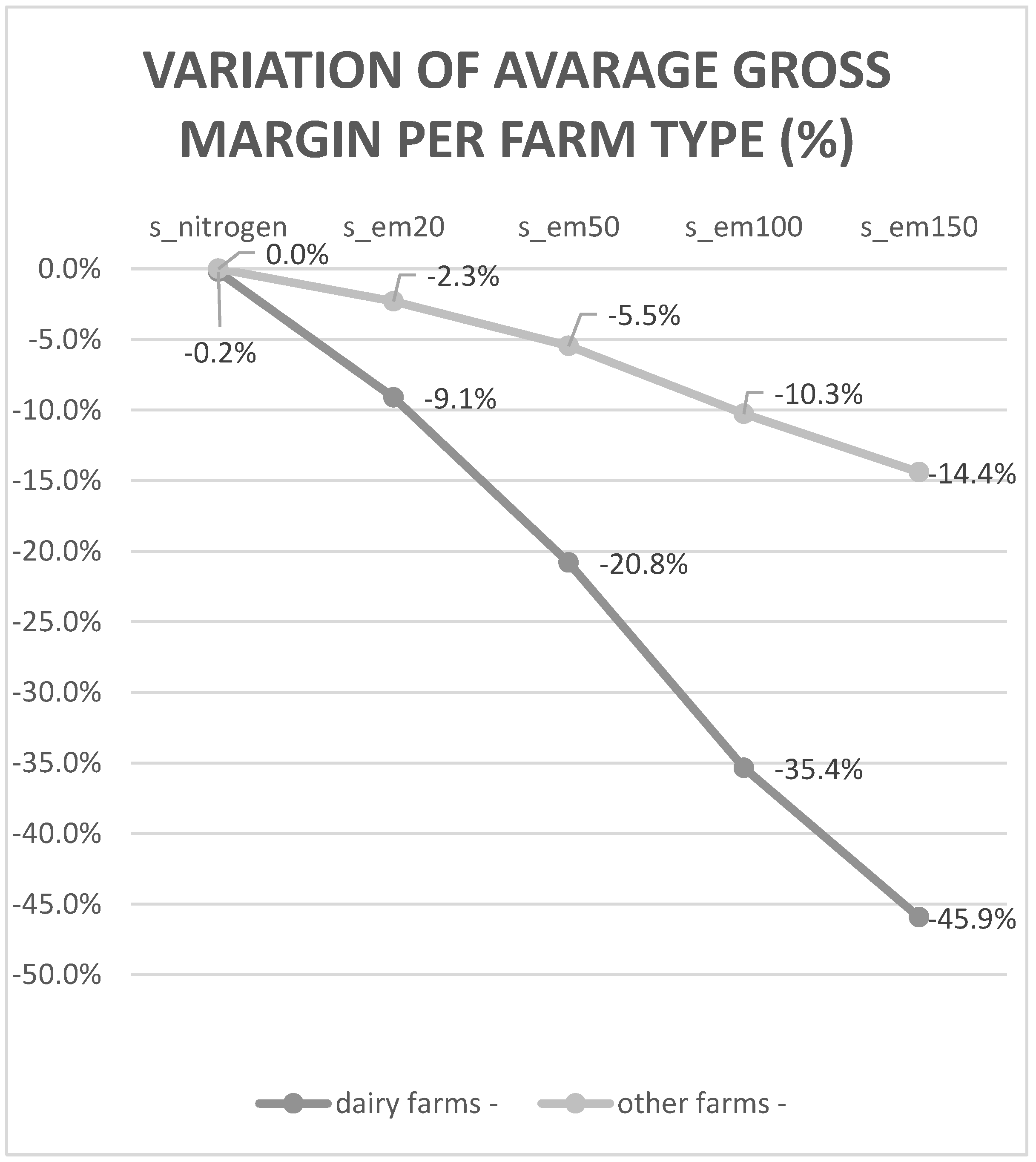

Looking at the farms’ technical orientations (

Figure 5), the average gross margins of dairy farms are more affected by both the spreading constraints and the carbon taxes compared to the gross margins of non-dairy farms (

Table A2). The “s_nitrogen” scenario only affects dairy farms, with a reduction of −0.2% in the farms’ gross margins, while the carbon tax scenarios have an economic impact on all farms, but with a stronger effect on dairy farms (−45.9% against −14.4% of non-dairy farms).

Considering the economic impact of the different measures on farm income by farm holders’ age, livestock holdings are those that show the greatest reduction in farm GM due to the introduction of CO

2 taxation (

Table A3 and

Table A4). Taxation also heavily impacts older farmers, for whom the state pension does not seem to contribute to the further existence of these farms.

The introduction of CO

2 taxation also has a significant effect on farm production organisation by modifying land use (

Table 7 and

Table 8). The “s_nitrogen” scenario, while not affecting the number of farms, modifies this production organisation by reducing the area allocated to silage for cows outside the Parmigiano Reggiano PDO (Protected Designation of Origin) area. On the other hand, the scenarios of rising taxation push farms towards a more extensive cultivation of crops with less environmental impact. In fact, the most heavily penalised crops are maize and industrial crops (tomato, potato, and beetroot), which are reduced by 65.4% and 56.7%, respectively. These crops would be replaced by fodder crops (alfa-alfa, forage maize, and other forages, +17.7%), protein crops, and oilseeds (+6.6%) and set-aside (+21.7%).

The increase in fodder crops (alfalfa, fodder maize, and other fodder crops) is due to non-dairy farms selling these products on the market, while dairy farms use them as cow feed. Meadows and pastures decrease for dairy farms in the “s_em50” scenario, then increase again. The meadows and pastures of non-dairy farms decrease progressively as the tax increases (

Table 9). It must be highlighted that, in AGRISP, dairy farms do not buy fodder from other dairy farms, as they only use fodder produced on their farm. On the other hand, other farms sell fodder on the market at the current FADN price. The increase in grazing meadows is justified by the farmers’ strategy of moving towards crops that emit less CO

2 in a strategy of progressive extensification.

All the policy scenarios introduced show a decrease in the number of dairy cows (

Figure 6,

Table A5). This decrease is due to the introduction of nitrogen pollution quotas in “s_nitrogen”, and to the introduction of CO

2 taxes that impact the GHG emissions associated with milk production.

Along with a reduction in the number of dairy cows (

Figure 7,

Table A6), the nitrogen emissions coming from manure, expressed in tonnes of N, are also reduced. The emission estimation takes into account the nitrogen produced by dairy cows and breeding cows.

Considering carbon emissions, the application of a nitrogen scenario generates a reduction of −1.2% in CO

2 emissions (

Figure 8). The most impacted products are dairy milk (−1.8%) and industrial crops (−3.8%). Emissions related to protein crops and oilseeds increase by 2.6%. The CO

2 tax scenarios also generate overall reductions in CO

2 emissions of, respectively, −9.4%, −21.7%, −35.7%, and −44.6%. Decreases occurred for dairy products, maize, industrial crops, cereals, and meadows and pastures. Forages and protein/oilseeds emissions increase (

Table A7 and

Table A8).

Finally, the model assesses water consumption (

Figure 9). The shift of allocation plans towards less carbon-emitting activities described above leads to an increase in the total water consumption, since these crops require more water. The biggest increase (+10.5%) is found in scenario “s_em150”, mainly due to an increase in the water footprint of fodder crops (

Table A9 and

Table A10).

4. Discussion

This article presented an Agent-Based bio-economic farm model with the aim of assessing the structural, production, environmental, and economic impact of an increasing tax on climate change gas emissions related to milk production under the current CAP payment system. The analysis was performed by linking the properties of PMP to agent-based modelling and by using the FADN farm dataset for the Emilia-Romagna region (Italy). The elements that characterise the ABM are:

the development of one model for each farm belonging to the sample, regardless of the farm type, including dairy farms;

the calibration performed on the observed production data;

the possibility for farms to exchange technologies and activities;

the possibility for farmers to exchange fixed factors, such as land;

the inclusion of behavioural constraints that regulate the strategy of each farm holder.

The model did not simulate the soil–plant interaction. The data on water consumption were taken from the FADN, and the C and N balances of various types of crops were not included in the calculation. The yields calculated in the FADN were used to build the substitution matrix and the agricultural practices were not considered in detail.

The variable cost per crop, needed to build the Q matrix, was, in this work, estimated through a generalised least square approach. Even though these costs are available in the Italian FADN, we decided to opt for this methodological approach to compare the results with real data and define a method adoptable for other European regions where variable costs are not reported.

In context of the current CAP, the Dairy Farm Agent-Based Model AGRISP made it possible to simulate and assess the impact of environmental policy scenarios for a heterogeneous farm population according to the farm type, structure, and age of the farmers. Six policy scenarios from Pillar I were designed to optimize the nitrogen distribution on the soil and the reduction in CO2. Measures of Pillar II were not included in this work.

Yet, the model only considered the dairy cow compartment, without considering the impact of other livestock, especially pig and poultry production, that still have a substantial impact on GHGs. The assumption that dairy cow livestock is closely linked to the available land, using the fodder crops produced on a farm, is consistent with usual farm practice, according to which, all fodder production obtained on the farmland is addressed to feed livestock and with the rules imposed by the Parmigiano Reggiano PDO Code of Specification [

62]. The Code of Specification states that at least 50% of the dry matter of the fodder used must be produced on the farmland, and at least 75% of the dry matter of the fodder must be produced within the Parmigiano Reggiano cheese production area. The strict linkage between the feed requirement and farmland allows for the imposition of an implicit structural limit on the animal production capacity at the farm level and the merging of land cultivation and livestock in one single farmer’s optimisation strategy. In other words, for dairy farms, the hypothesis is to maximise the value of the milk production intended for a transformation from fodder to milk. In this context, the dairy farm is pushed to first employ all the fodder produced in-farm until the economic equilibrium condition is fulfilled: the marginal cost of milk production, represented by the fodder (and feed) marginal cost, is equal to the marginal revenue (milk price). It is worth noting that concentrates and off-farm hay procurement were not missing in the model, but they were included as a component of the milk production cost. Therefore, one of the main characteristics of the livestock PMP approach in AGRISP was the absence of the fodder consumption function based on technical coefficients, which was replaced by the cost function.

The results can be interpreted according to the specific environmental, structural, economic, and social policy lever considered. These aspects are all interlinked, as farms change their production orientation and structure, significantly affecting the overall farm income. Despite a decrease in the number of LSUs, the increase in the land allocation of reused crops (forages and meadows and pastures) was due to the enforced agronomic constraint of equality between the total production of forage (including alfa-alfa, soja, and protein crops, plus some industrial crops such as sugar beet and tomatoes) and the total production of cereal (wheat, maize, barley, and sorghum).

The nitrogen scenario did not seem to have a big impact on any of the indicators analysed, however, the model proved to be suitable to simulate further restrictions that could be introduced into the regulation, given the persistence of the nitrogen issue.

The repercussion of CO2 taxation on farms’ structures and rural regions, revealed through the use of agent-based models, was significant. If output prices were assumed to remain unvaried, the introduction of a CO2 tax would have a greater impact on the most polluting processes, intensive crops, and dairy cows, and the more intensive farms that would then opt for new production strategies to become more environmentally sustainable. Increased environmental sustainability can be achieved by reducing soil pressure thanks to the presence of fewer animals per hectare, the use of more sustainable fodder, and the possibility of redistributing nitrate quotas to non-livestock farms.

It is interesting to note that, with the current CAP (2023–2030), the impact of greening measures on land is also low, as it was in the previous programming period [

63]. However, an increase in fodder production, as it is a less intensive crop, triggers indirect positive effects on the environment and a consequent improvement in the environmental indicators covered by the Rural Development Plan (RDP), monitoring, namely: Farmland Bird index, High nature value farming, and the Soil organic matter in arable land [

64]. The introduction of an increasing tax on CO

2 emissions would further ameliorate this positive effect. However, the possibility of exchanging land favours the most efficient farms, which increase their size to the detriment of inefficient farms, with consequent economic and social impacts.

This finding was a specific and valuable output of the Agent-Based Model, which considered the social characteristics of the farm holders, assuming their age as an indicator of the social renewal of the agricultural population. The age of farm holders is an important element in the definition of regional and national strategies aiming to increase the number of young farmers or to discourage farm abandonment [

65,

66]. In the case of Emilia-Romagna, the analysis showed how young farmers managing dairy farms are more resilient compared to other farm types, but a more closely tailored policy could reduce these drop-out rates further.

AGRISP, used in this work, represents a further advancement in agent-based modelling for agricultural policy analyses. Research attention is currently focused on developing this category of model, which is particularly well suited to representing farm strategies given their spatial production context and the possibility of interactions between farms [

67]. Within the Agrimodel Cluster (

https://agrimodels-cluster.eu/ (accessed on 14 June 2023) funded by Horizon2020, three projects are dedicated to assessing and developing ABMs for agricultural policy analyses: AGRICORE, BestMap, and MindStep. The model presented in this paper, delivered under the AGRICORE project, differs from the other models, as it uses PMP to estimate the cost functions per farm, allowing for the exchange of technologies, as well as other factors, between agents. The model can also be considered as “generalised”, in the sense that it considers all the sampled farms regardless of their specialisation. Moreover, AGRISP does not make use of information exogenous to the farm, except for the price of the production factor exchanged, in this case, land. Finally, AGRISP is particularly well suited to simulating different agricultural and environmental policy instruments involving different forms of direct payments and subsidies. It is particularly appropriate for ex ante analyses aimed at evaluating the congruence of RDP with Farm to Fork and Green Deal objectives.

5. Conclusions

Simulating the state of the application of the nitrate directive and the introduction of a CO2 tax in the agricultural sector to decrease GHG emissions and promote mitigation actions represents a helpful exercise for developing effective environmental policy measures at the farm level. The results of the simulations are meaningful for policy, in as much as the model can represent the farm heterogeneity characterizing the agricultural sector under investigation. The economic models usually adopted for assessing agricultural policy in the EU neglect the potential interactions among farms in exchanging limited resources, such as land, and simulate farm behaviour by aggregating information rather than using individual data. Aggregating FADN data by region or farm type simplifies the implementation of the mathematical programming methodology but loses essential information on the farming system (e.g., production plan) and farmer behaviour. AGRISP, as an agent- and micro-based model, exploits the farm data included in FADN, providing policymakers with clear, consistent, and understandable information on farmers’ responses to new policy measures. Given the lack of variable costs per agricultural activity in the FADN database, AGRISP estimates this economic information by farm and agricultural activity in a two-step PMP approach.

This research work contributes to enriching the set of economic mathematical models adopted to evaluate the agri-environmental policies in the EU by proposing an agent-based model capable of recovering information on the exact order of choice of each farmer and simulating farm behaviour, thanks to the constraints imposing interactions among farms and behavioural rules that mainly define the social features in the simulation phase. This model is distinguished from the other agent-based models aimed at assessing agri-environmental policies by the fact that:

the two-step PMP approach estimates the economic complementarity and substitution relationships characterizing each agricultural activity;

each farm can activate alternative agricultural activities according to the self-selection information embedded in the farm cost function;

new agricultural activities and technologies can be accommodated in the model as options for the current production plan.

Our results showed that dairy farms are more sensitive to taxes on carbon emissions than other farms, both in terms of activity withdrawals and gross margin reduction. The climate mitigation strategy promoted by an increasing CO2 tax would lead farmers to reduce their livestock and substitute more energy-intensive crops, such as maize and processed tomato, with cereals and fodder crops. Other studies on the greening of the CAP have confirmed that a more environmentally friendly CAP would depress internal animal production, increasing the dependency on non-EU markets. The experience of the introduction of green taxes in the EU indicates the need to gradually increase the tax level to allow for agents to adapt to this new policy mechanism. From a short-term perspective, as suggested by our model, a high tax on CO2 emissions would worsen the viability in rural areas and the trade balance for milk. Further development of this research work could contemplate the integration of AGRISP with other complementary models, the introduction of other forms of production factor exchanges between agents, and the repayment of tax revenues in form of incentives for more sustainable agricultural practices to adjust the environmental–economical trade-off.