Abstract

This paper aims to model the covariance of financial assets using neutrosophic fuzzy numbers. Two main concepts are discussed and used, namely the neutrosophic covariance of the financial assets and the independent neutrosophic portfolios. In terms of methodology, a three-step approach is proposed with the purpose of identifying the independent neutrosophic portfolio return, the independent neutrosophic portfolio risk and the structure of the independent neutrosophic portfolio. For this purpose, neutrosophic fuzzy theory is chosen for this type of approach as it allows a proper modeling of the financial performance indicators by taking into account the probabilities of their achievement. This action is possible even in the situation in which linguistic variables are used for better characterizing the values of the recorded data. Numerical examples are provided in each stage of the methodology description for a better understanding of the proposed approach. The results of the study can be used to substantiate the decisions made by the capital market investors.

1. Introduction

The study of the dependence between the financial assets’ KPIs is an important research topic for experts in the financial field because, depending on the evolution of these dependencies, investors can base their decisions on the capital market with the stated aim of securing maximum returns. The dependence between financial assets was studied over time with the help of statistical covariance through the calculation relationship . The research carried out led to the conclusion that if , then the financial performance indicators, namely the financial asset returns are independent of each other. If the covariance is positive, then the financial performance indicators evolve in the same direction, either increasing or decreasing. If the covariance is negative, then the financial performance indicator of one asset evolves in an upward direction, and for the other asset it evolves in a downward direction.

The modern theory of the financial asset portfolio has evolved quite rapidly, this evolution being determined by the lack of information on the capital market. Markowitz’s frontier [1], with the famous formulas for financial asset risk and return, but also with the link between financial asset portfolio return and risk, was the first decisive step in improving the existing information framework in substantiating capital market decisions.

Portfolio selection has become one of the main topics in the research literature, and the approaches used for addressing portfolio selection problem have been various, both in terms of indicators and methods. Chow [2] argued that besides the acknowledged importance of the benchmarks in the decision process, the investors can also use a utility function which comprises the variance of the absolute returns. As a result, the author proposes a function based on return, variance and tracking error which can help in finding the appropriate solutions for the investors [2].

Another work featuring the use of risk and return in portfolio selection was conducted by Shenoy and Shenoy [3]. The authors presented how the subjective judgements of the experts can be included in a Bayesian network which will provide insights related to expected return, return variance and value-at-risk [3]. Mansour et al. [4] considered the introduction of the subjectivity of human thought into the proposed model, along with the creation of some satisfaction function. The methods used rely on fuzzy set theory, while the numerical applications are conducted on the Tunisian stock market. Additionally, the authors mentioned that the model is suitable for large data situations [4].

Xue et al. [5] decided to bring a new approach to the portfolio selection problem by considering the existence of different conflicting risk attitudes rather than a singular risk attitude. Mental accounting is used to address this issue by building a mental accounting for each goal an investor has. The proposed model includes personal preference and real market restrictions [5].

A mixed-integer linear programming formulation was used by Fernandez-Navarro et al. [6] for obtaining more competitive portfolio weights when the objectives of the investors are expressed in different units. By comparing the approach with others from the field, the authors state that the performance obtained is very competitive in most cases [6].

Neural networks were employed by Yu and Chang [7] to develop a model in which the macroeconomic factors were incorporated into the investments strategies. Testing the model on three datasets, the authors concluded that the proposed approach outperforms three alternative benchmarks considered in their work [7].

An entropy-based approach was used by Mercurio et al. [8] in their work, and the results were compared with a mean-variance portfolio optimization approach. Based on the results, the authors state the superiority of the proposed approach over the considered benchmark in most of the cases [8].

Even newly developed theories such as grey systems theory have been used in addressing the portfolio selection problem. Considering a grey incidence analysis, Skrinjaric and Sego [9] evaluated the performance of 55 stocks in the Croatian capital market, suggesting that the proposed approach can be useful as guidance for the investment decision makers, while Nowak et al. [10] proposed a grey portfolio analysis method based on the predictive models.

Nevertheless, with the rise of fuzzy neutrosophic theory, some works have featured the inclusion of this theory in the approaches proposed to solve the portfolio selection problem, featuring the optimization of the portfolios [11], modeling the performance of the indicators of the financial assets [12] or risk minimization [13]. Recently, Chaudhury and Islam [14] used a multi-objective asset portfolio selection model in which the transaction cost was incorporated, proving the superiority of the proposed approach when compared to the method of aggregation used for objective functions.

Veeramani et al. [15] used neutrosophic theory combined with a DEMATEL (Decision Making Trial and Evaluation Laboratory) approach for evaluating the financial ratio performance in the case of the NASDAQ Exchange. The authors compared their proposed approach with both classical DEMATEL and fuzzy DEMATEL, showing that the neutrosophic DEMATEL approach provided more degrees of freedom to represent the uncertainty and indeterminacy regarding the used information.

Various papers have focused on portfolio optimization for particular industries, such as the automotive [16,17], high-tech [18], shipping [19], oil and gas [20,21], and pharmaceutical [22] industries, as well as emerging markets [23] and even cryptocurrencies [24]. Some other papers have taken into account some particularities of the investors (such as the low financial sustainability of the investors [25]) or new economic and social situations (such as the occurrence of the COVID-19 pandemic [26,27]).

The research carried out so far allows for determining the covariance between two financial assets, without being able to be modeled with the help of the symmetry of the neutrosophic fuzzy numbers. In that case, the investors do not have complete specific information about the probability of the achievement/non-achievement/uncertainty of the determined statistical indicator. Regarding the portfolios of financial assets, the existing performance indicators that are established for neutrosophic portfolios do not allow the identification of a reference portfolio, called in this research paper an independent portfolio. The independent portfolio used in the specialized literature for the evaluation of financial assets, namely for measuring the expected return of financial assets, or for the measurement of other performance indicators, is useful in substantiating the decisions of investors on the capital market [12,13,28].

The neutrosophic covariance was determined starting from the neutrosophic financial return specific to each financial asset, as well as from their specific level sets. Regarding the covariance between two portfolios, the neutrosophic independent portfolio was identified starting from the definition of classical independent portfolios. The classical independent portfolios represent the category of portfolios for which the covariance with respect to the base portfolio is equal to zero. In addition, for the identification of the independent portfolio, three stages described in this research paper were completed, namely: the identification of the portfolios that delimit the area of profitability on the frontier of the optimal portfolio, the writing of random portfolios on the frontier of the optimal portfolio according to these portfolios and the determination of the independent portfolio KPIs.

The current research work has an innovative character as it lays the scientific foundations of two concepts, namely: the concept of neutrosophic covariance of financial assets, as well as that of independent neutrosophic portfolios. Neutrosophic fuzzy theory has been chosen for this type of approach as it allows a proper modeling of the financial performance indicators by taking into account the probabilities of their achievement. This action is possible even in the situation in which linguistic variables are used for better characterizing the values of the recorded data. In addition, for this new scientific concept of independent neutrosophic portfolios, the financial performance indicators modeled with the help of neutrosophic fuzzy triangular numbers were determined, respectively: the neutrosophic return of the independent portfolio, the neutrosophic risk of the independent portfolio and the structure of the independent portfolio. These three determined financial performance indicators also provide this research paper with a strongly innovative content. Additionally, to the best of our knowledge, the approach of the portfolio through the use of neutrosophic fuzzy theory and considering the property of zero covariance is novel in the field, as none of the works found in the scientific literature discuss this approach.

The remainder of this paper is organized as follows: Section 2 provides the prerequisites for the proposed approach. Section 3 presents the identification of the neutrosophic covariance between financial performance indicators. Section 4 is dedicated to the specific neutrosophic covariance between portfolios of financial assets, focusing on: the identification of the neutrosophic portfolios with minimum risk and of the portfolio located at the intersection of the tangent driven by the origin of the axes; the determination of the optimal neutrosophic portfolio’s structure, according to the neutrosophic portfolio’s structure; and the determination of the covariance between two neutrosophic portfolios. Section 4 ends by determining the independent neutrosophic portfolio’s return and risk. The paper ends with concluding remarks and references.

2. Pre-Requisites

Markowitz’s frontier [1] remains famous for its famous formulas that describe financial asset risk and return and the proportionality link between financial assets’ portfolio return and risk. Regarding these categories, in the present paper, those related to financial asset optimal portfolios that contain one or more financial assets with a predetermined level for portfolio return and those for which the portfolio risk tends to minimum have been added. Appendix A contains the notations used in the paper.

Without referring to the shortcomings underlying the assumptions that define the financial assets’ optimal portfolios, the capital market is currently laying the foundations for a new category of portfolios, namely financial assets’ neutrosophic portfolios.

Financial asset neutrosophic portfolios were defined in a previous study [11] as those categories of financial asset portfolios that meet two basic conditions, namely:

- containing in their structure financial assets denoted by which have as performance indicators: the neutrosophic return , the neutrosophic risk and the neutrosophic covariance that characterizes the intensity of the links between the neutrosophic returns of two financial assets ;

- allowing the calculation of the neutrosophic portfolio return and the neutrosophic portfolio risk as fundamental variables that define any neutrosophic portfolio .

This category of optimal neutrosophic portfolios offers additional information in substantiating the capital market decisions, as they contain a category of additional information regarding the return/degree of achievement for the performance indicators of the financial asset portfolios. As a result, the new information that accompanies the financial performance indicators refers to:

- , which represents the degree/probability of achieving a financial performance indicator that characterizes financial assets or financial asset portfolios. In general, the degree/probability of achieving a financial performance indicator is presented in the form of a coefficient attributed to the existing reasoning and information on the capital market.

- , which represents the degree/probability of non-achievement of a financial performance indicator characteristic of financial assets and portfolios. It is also presented in the form of a coefficient attributed to reasoning and existing information on the capital market. The reasons behind the failure to achieve a financial performance indicator are diverse and can be found in the value of the coefficient assigned for .

- , which represents the degree/probability of uncertainty of a financial performance indicator that also characterizes financial assets and financial asset portfolios. The degree/probability of uncertainty is a type of gray area of financial performance indicators. It is allocated in the form of a coefficient based on professional judgment and existing information on the capital market.

Moreover, the modeling of financial performance indicators, whether they are performance indicators that characterize financial assets or performance indicators that characterize financial asset portfolios, takes place with the help of neutrosophic triangular fuzzy numbers, allowing both the clustering of data series as well as obtaining information divided according to the interests of investors. In addition to this category of valuable information regarding financial asset neutrosophic portfolios, the foundations have also been laid for financial asset optimal neutrosophic portfolios for which two performance indicators have been determined, namely the portfolio structure: and the portfolio risk , determined using the following formulas:

This research paper aims to study, in continuation of the findings previously presented, the intensity of the links between the financial assets’ KPIs, starting from the financial neutrosophic return of financial assets , as well as from the level sets of the financial neutrosophic return to determine the neutrosophic covariance as a statistical indicator characterizing the dependence between the neutrosophic financial returns specific to financial assets . Additionally, this research paper aims to study the intensity of the links between two neutrosophic portfolios, namely the basic neutrosophic portfolio as well as the reference neutrosophic portfolio , with the help of the statistical covariance , by following three research steps:

- Step 1: On the function graph , which as will be demonstrated in this paper is a hyperbola, the portfolios of minimum risk and minimum return will be identified, as well as the portfolio located at the tangent point of the line that passes through the origin of the coordinate system (XOY) and intersects the upper branch of the hyperbola ;

- Step 2: Development of a base neutrosophic portfolio , depending on the portfolios and , which delimit the area of efficient portfolios on the parabola graph;

- Step 3: Determining the performance indicators for the independent neutrosophic portfolio : the return the risk and the portfolio structure .

3. The Neutrosophic Covariance between Financial Performance Indicators

The neutrosophic covariance between financial performance indicators measures the intensity of the links between the financial performance indicators specific to the respective financial assets and the links between the financial returns modeled with the help of the symmetry of the neutrosophic fuzzy numbers. Three situations can be encountered, namely:

- , which indicates that the neutrosophic return of the financial asset is independent of the neutrosophic return of the financial asset ;

- If , then the financial neutrosophic returns of the two assets are dependent—either both are increasing or both are decreasing;

- If , the financial returns of the two financial assets evolve in the opposite direction—if one increases, the other decreases, and vice versa.

Definition 1.

Let there be two neutrosophic triangular fuzzy numbers specific to the financial return of two financial assets of the form:

Their specific level sets are of the form for any , where:

- For the level set of the neutrosophic number :

- For the level set of the neutrosophic number :

The neutrosophic covariance that characterizes the intensity of the links between specific neutrosophic financial returns and is given by the relationship:

For a weighting function of the form f(α) = 2α, then the neutrosophic covariance between the two neutrosophic fuzzy numbers is written as follows:

Proposition 1.

The neutrosophic covariance of two neutrosophic triangular fuzzy numbers specific to financial assets can be determined with the relation:

Demonstration: We demonstrated in previous research [12,13] that the covariance expression is established with the relation:

The level sets were established of the form: , and from the previous research papers [12,13] the average values of the neutrosophic triangular fuzzy numbers can be found, with the help of which the financial asset return is modeled:

By substituting this into the covariance expression, equation (11) is obtained (the detailed transformations are presented in Appendix B).

Example 1.

Let there be two financial assetsto which are specific two triangular neutrosophic numbers for the financial asset return, of the form:

for values of ;

for values of ;

To determine the it is required to establish the covariance between the two financial assets:

Solution: The average return will be determined using the calculation formulas:

So, it will be obtained that:

The calculation formula will be used to determine the covariance value:

By replacing in the formula, it will be obtained that:

Conclusion: The covariance between the two financial performance indicators is positive and quite low, registering a value of 5.55% with a probability of achievement of 60%, a probability of non-achievement of 20% and a probability of uncertainty of 20%. This signifies the fact that both asset returns will either slightly increase or slightly decrease.

4. The Specific Neutrosophic Covariance between Portfolios of Financial Assets

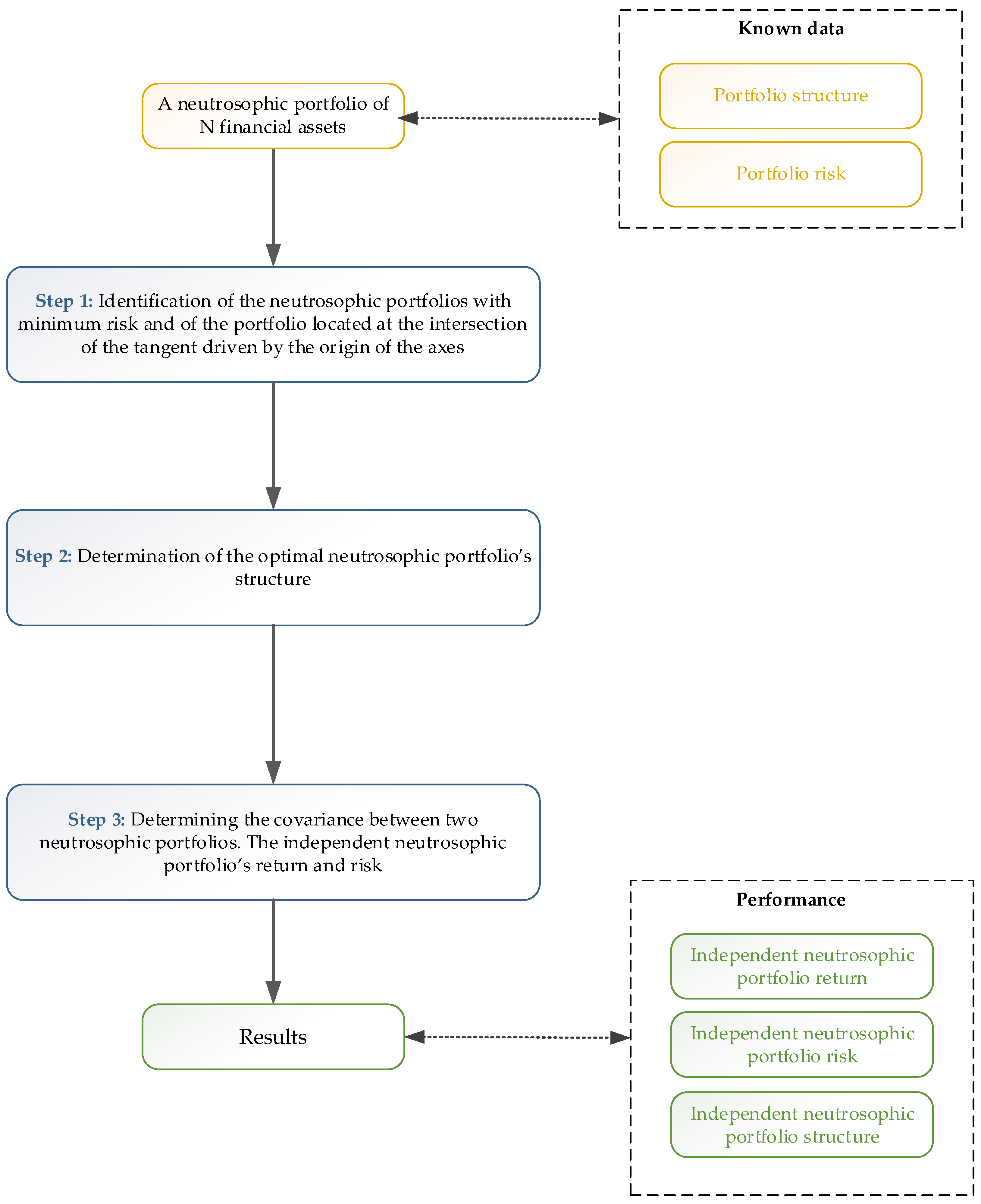

The intensity of the links between two neutrosophic portfolios, namely the basic neutrosophic portfolio and the reference neutrosophic portfolio , when the covariance between two portfolios of financial assets, , is zero, can be determined using the steps presented in Figure 1 and described below:

Figure 1.

The steps needed in the proposed approach.

- Step 1: Identification of the neutrosophic portfolios with minimum risk and of the portfolio located at the intersection of the tangent driven by the origin of the axes—during this step, the identification of the graph of the function that describes the neutrosophic optimal portfolio risk for two portfolios, namely the minimum risk portfolio , as well as the portfolio located at the intersection of the line through the origin of the coordinate system ⟨XOY⟩ and the upper branch of the hyperbola , takes place.

- Step 2: Determination of the optimal neutrosophic portfolio’s structure, according to the neutrosophic portfolio’s structure—in this step, the development of the basic neutrosophic portfolio in relationship with the portfolios and is studied.

- Step 3: Determining the covariance between two neutrosophic portfolios. The independent neutrosophic portfolio’s return and risk—during this step, the evaluation of the performance indicators of the independent neutrosophic portfolio , namely of the return , the risk and the portfolio structure , is performed.

4.1. Identification of the Neutrosophic Portfolios with Minimum Risk and of the Portfolio Located at the Intersection of the Tangent Driven by the Origin of the Axes

Theorem 1.

Letbe an optimum neutrosophic portfolio of N financial assets for which are known the following:

- The portfolio structure , determined by the formula:

- The portfolio risk , determined by the formula:

Such an optimal neutrosophic portfolio has the risk graph determined by the function in the form of a hyperbola and admits the neutrosophic portfolio of minimum risk and minimum return, as well as the neutrosophic portfolio located at the tangent point of the line passing through the origin of the coordinate system (XOY) and intersecting the upper branch of the hyperbola. The portfolios and are characterized by the following performance indicators:

and

Proof.

The algorithm for identifying the neutrosophic portfolios

and follows the procedural steps established in the classical financial asset portfolio literature. Thus, for the identification of the neutrosophic portfolios and , one can start from the portfolio risk equation obtained for the optimal neutrosophic portfolios [11], namely for those portfolio categories that have a fixed return at a certain level and for which the portfolio risk tends to minimum . The financial assets that form the portfolio have performance indicators modeled using neutrosophic triangular fuzzy numbers, so that for this asset category, the average neutrosophic financial return is determined , along with the financial risk related to the asset as well as the covariance measured as the intensity of the links between two financial assets . Under these conditions, the risk equation of the optimal neutrosophic portfolio has the following form:

with:

In the risk equation of the above portfolio, a series of transformations can be performed, as presented in Appendix C, and the optimal neutrosophic portfolio structure becomes:

In conclusion, it can be stated that the neutrosophic portfolio located at the point of tangency to the upper branch of the hyperbola of the line passing through the origin is characterized by the following KPIs:

Example 2.

Let be three financial assets to which three triangular neutrosophic numbers for the financial assets return are specified, having the form of:

for ;

for ;

for ;

The average neutrosophic return for the three financial assets is known:

The risk of each financial asset that enters the portfolio structure is also known, having the form of:

The parameters , and are determined according to the calculation methodology presented in [11].

To solve this problem, one needs to establish:

- (a)

- The portfolio return, the portfolio risk and portfolio structure ;

- (b)

- The neutrosophic portfolio return, the neutrosophic portfolio risk and the neutrosophic portfolio structure .

Solution:

- (a)

- The portfolio return is determined using the formula:

For the portfolio risk , the following calculation formula is used:

By performing the calculations, the following result is obtained:

For the portfolio structure , the formula is:

This results in:

- (b)

- The neutrosophic portfolio return is determined by using the formula:

The neutrosophic portfolio risk is determined as:

For the neutrosophic portfolio structure the following formula is used:

4.2. Determination of the Optimal Neutrosophic Portfolio’s Structure, According to the Neutrosophic Portfolio’s Structure

Theorem 2.

Let be an optimum neutrosophic portfolio which satisfies the optimization conditions:and. It is considered that the optimum neutrosophic portfolio can have a structure depending on the existing portfolios on the capital market, noted with and , and its structure is established by the calculation formula:

Proof .

Please consider Appendix D. □

Example 3.

Let us consider the portfolio presented in Example 1, consisting of the three financial assets mentioned as follows:

for ;

for ;

for ;

Knowing that the portfolio structures and are of the following form:

We also know the values for: , and . The following are required:

- (a)

- The optimal neutrosophic portfolio structure , depending on and , knowing that ;

- (b)

- The portfolio risk.

Solution:

- (a)

- The optimal neutrosophic portfolio structure is established based on the relation provided in Theorem 2:

By replacing the values in the formula, it is obtained that:

Interpretation: To ensure the neutrosophic portfolio structure depending on the portfolios and , the investors must: reduce the value of investments in the neutrosophic asset increase the value of investments in the neutrosophic asset ; and reduce the value of investments in the neutrosophic asset .

- (b)

- In order to establish the portfolio risk, the average portfolio return is determined, according to the new structure obtained above. The result is as follows:

Under these conditions, the portfolio risk depending on and , is:

Thus, it is obtained that:

Interpretation: The neutrosophic portfolio risk with the structure depending on and is only 0.33%, a result that validates the model obtained for the neutrosophic portfolio, as a low neutrosophic return corresponds to a low risk. In conclusion, the portfolio with the structure depending on and has the following performance indicators:

4.3. Determining the Covariance between Two Neutrosophic Portfolios. The Independent Neutrosophic Portfolio’s Return and Risk

Theorem 3.

Let be an optimum neutrosophic portfolio that satisfies the optimization conditions: and which is considered to have an independent portfolio for which .

The covariance between the two independent neutrosophic portfolios will be determined with the calculation formula:

The independent portfolio has the following KPIs:

Proof.

Please consider the transformations in Appendix E. □

Example 4.

Let be the optimal neutrosophic portfolio presented in Example 2, consisting of the three financial assets:

for ;

for ;

for ;

For the above portfolio, the average neutrosophic return is known , as well as the parameters , and , which have been determined in Example 2 [11]. The requirement is to establish the performance indicators of the independent portfolio as follows:

- (a)

- the independent neutrosophic portfolio return ;

- (b)

- the independent neutrosophic portfolio risk ;

- (c)

- the structure of the independent portfolio .

Solution:

- (a)

- To determine the independent neutrosophic portfolio return, the formula from Theorem 3 is used, according to which:

This results in:

Thus, the independent neutrosophic portfolio return is .

- (b)

- The independent neutrosophic portfolio risk can be determined according to the formula:

- (c)

- The structure of the independent neutrosophic portfolio is determined with the calculation formula provided in Theorem 3, as follows:

From Example 2 [14], it is known that:

Thus, it is obtained that:

Interpretation: Investors, in order to achieve the independent portfolio will have to invest in the asset , respectively, to divest in the asset and to invest in the asset .

5. Conclusions

Independent portfolios represent a continuation in the research field of optimal neutrosophic portfolios, with the role of identifying a portfolio for which there is a reference portfolio on the capital market so that the covariance between these two portfolios is zero.

The theoretical contribution of this research lays the foundations of a new theoretical concept, that of neutrosophic independent portfolios, defined as that category of portfolios consisting of N financial assets that admit the existence of another portfolio on the market for which the covariance between these two portfolios is equal to zero. Both portfolios, the base portfolio and the independent portfolio, are modeled using neutrosophic triangular fuzzy numbers, and the information for substantiating investment decisions on the capital market is supplemented with information on the probability of achieving/non-achieving/uncertainty of the investment strategies. In order to substantiate the independent neutrosophic portfolios, three steps need to be completed: the first step consists of identifying the two neutrosophic portfolios—named in the literature as two fundamental portfolios—that delimit the efficiency frontier of investment on the capital market; the second step consists of creating a random portfolio on the capital market according to these two fundamental portfolios located in the efficiency zone; and the third step consists of substantiating the performance indicators of the neutrosophic independent portfolios regarding the structure, return and risk modeled using neutrosophic triangular fuzzy numbers.

As for the practical contribution and limitations of the present research paper, we can mention that the steps for substantiating the independent neutrosophic portfolios have been tested and validated by four practical examples based on synthetic data. The first example focuses on the covariance between two financial assets. The second one is dedicated to the structure, return and risk of the two fundamental portfolios that delimit the portfolio efficiency frontier, while the third practical example aims to write an independent neutrosophic portfolio on the capital market according to these two fundamental portfolios. The paper also contains a practical example of neutrosophic performance indicators: the structure, return and risk of neutrosophic independent portfolios modeled using neutrosophic triangular fuzzy numbers. The limitations of this research include the complexity of the calculations necessary for the practical application of the model. Further work could focus on a multi-objective approach to financial portfolio selection when considering the existence of independent neutrosophic portfolios.

Author Contributions

Conceptualization, M.-I.B. and I.-A.B.; Data curation, C.D.; Formal analysis, M.-I.B. and I.-A.B.; Investigation, M.-I.B., I.-A.B. and C.D.; Methodology, M.-I.B. and I.-A.B.; Supervision, M.-I.B.; Validation, I.-A.B.; Visualization, C.D.; Writing—original draft, M.-I.B. and I.-A.B.; Writing—review and editing, C.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Description of the Symbols Used in the Paper

| Symbol | Name/Description |

| Covariance between two financial assets’ returns | |

| The financial asset return for an asset | |

| Represents the degree/probability of non-achievement of a financial performance indicator characteristic of financial assets and portfolios. It is presented in the form of a coefficient attributed to reasoning and existing information on the capital market. | |

| The degree/probability of achieving a financial performance indicator that characterizes financial assets or financial asset portfolios. In general, it is presented in the form of a coefficient attributed to the existing reasoning and information on the capital market. | |

| Represents the degree/probability of uncertainty of a financial performance indicator that also characterizes financial assets and financial asset portfolios. The degree/probability of uncertainty is a type of gray area of financial performance indicators. It is allocated in the form of a coefficient based on professional judgment and existing information on the capital market. | |

| Lagrange parameters | |

| The neutrosophic covariance that characterizes the intensity of the links between the neutrosophic returns of two financial assets | |

| The neutrosophic return | |

| The neutrosophic portfolio | |

| The reference neutrosophic portfolio | |

| The neutrosophic portfolio return | |

| The minimum risk portfolio | |

| The portfolio located at the intersection of the line through the origin of the coordinate system ⟨XOY⟩ and the upper branch of the hyperbola | |

| The portfolio structure | |

| The predetermined level for portfolio return | |

| The neutrosophic risk | |

| The neutrosophic portfolio risk |

Appendix B. Basic Transformations for Determining the Covariance by Substituting Equations (13) and (14) in (12)

This equation can be rewritten as:

Appendix C. The Determination of the Optimal Portfolio Structure

We will start from the risk equation of the optimal neutrosophic portfolio that has the following form:

with:

In the risk equation of the above portfolio, the common factor can be subtracted and the following result is obtained:

It is also known that:

Under these conditions, the above relationship can be rewritten as follows:

Moreover, Equation (26) can be rewritten as follows:

By performing the mathematical operations in the above expression, it is obtained that:

In (29), by dividing both terms by the following expression is obtained:

The above Equation (30), is the equation of a hyperbola for which one aims to identify the point of intersection with the axis (OX). Thus, in the above equation, when y = 0, we can obtain:

By solving this, it is obtained that:

and:

To determine the portfolio return for which the risk is , the value obtained for is replaced in the equation of portfolio risk, obtaining that:

By performing the calculations, it can be observed that:

The quadratic equation with the unknown to be solved is of the following form:

By determining the solutions of the quadratic equation formed, it is obtained that:

The solutions of the above equation can be rewritten as follows:

The final solution of the portfolio return located at the top of the hyperbola that thus corresponds to a minimum risk is:

For the optimal neutrosophic portfolio formed at the top of the hyperbola, the problem of determining its structure arises. Under these conditions, the formula of the portfolio structure is used, producing the following result:

In this formula, the value obtained for is replaced, which leads to:

After performing the calculations in the above expression, it is obtained that:

The final solution for the portfolio structure is in the form of:

In conclusion, the neutrosophic portfolio has the minimum neutrosophic risk, neutrosophic return and portfolio structure, having the form of:

Next, the neutrosophic portfolio is identified, which from a geometric point of view is at the intersection between the tangent drawn by the origin of the coordinate axes (XOY) and the upper branch of the hyperbola. For this, one can start from the equation of the hyperbola represented by the risk of the optimal portfolios as follows:

From the above equation, is determined, and it is obtained that:

Multiplying by it is obtained that:

After performing the calculations in the above Formula (A29), the results are as follows:

By rearranging the terms in the above equation, it is found that:

From Equation (A31), it is obtained that:

By rearranging the terms, it is found that:

From here, one can determine the first and second derivatives of in relation to , and it is obtained that:

The second derivative becomes:

The calculations for the first order derivative and the calculations for the second order derivative show that:

These calculations show that although there is a proportionality relationship between the portfolio return and the portfolio risk the return is decreasing. To identify the portfolio located as mentioned above on the upper branch of the optimal portfolio hyperbola, the equation of the line passing through the tangent point is used, according to the formula:

The condition that the equation of the above line passes through the origin of the coordinate system (XOY) is imposed, which means that and , leading to:

Knowing that by replacing it in the second equation of the above system, it is obtained that:

By performing the calculations, it is found that:

The above radical equation is solved by squaring, obtaining that:

By rearranging the terms of the above equation, it is found that:

The risk value of the analyzed portfolio has the following form:

For the optimal neutrosophic portfolio , the portfolio return is determined by replacing the value obtained for in the equation of :

By inserting the replacements into the above formula, it is obtained that:

After performing the calculations in the above formula, it is found that:

To determine the structure of the optimal neutrosophic portfolio, in the formula of the optimal portfolio structure, the value obtained for is included:

By substituting the formula for in the above formula, it is obtained that:

Under these conditions, the optimal neutrosophic portfolio structure becomes:

Appendix D. Proof for Theorem 2

To determine the structure of a neutrosophic portfolio depending on the portfolio structures and one can start from the matrix form of the equations system that describes an optimal neutrosophic portfolio given by [11]:

The following notations are used in the above equations system: the variance-covariance matrix:; the portfolio structure column vector: ; the portfolio return column vector and the portfolio unit column vector: .

With the above notations, the equations matrix system for the financial assets optimal neutrosophic portfolio becomes:

In the above equation system, to simplify the calculations, the following notations are used:

Thus, it is obtained that:

From the first equation of the matrix system produced after using the notations, one finds that:

The first term in the above equation is multiplied by , while the second term is multiplied by , obtaining the form of the portfolio structure according to the neutrosophic portfolios and as follows:

From previous considerations, it is known that the expressions for determining the neutrosophic portfolios structures and are: and , and under these conditions the expression of the portfolio structure will be of the form:

Under these conditions, the neutrosophic portfolio structure equation contains the Lagrange parameters and , which have to be determined as a function of λ in order to obtain the final form of the portfolio structure . From [11], it is known that the equation system with Lagrange parameters for optimizing the neutrosophic portfolio has the form:

In the second equation of the neutrosophic portfolio, the following notations are used:

resulting in:

Under these circumstances, it follows that:

From the above equations system, the calculation formulas for the Lagrange parameters and , respectively, are as follows:

By substituting the Lagrange parameters mentioned above into the first equation of the equation system, it is found that:

By performing the calculations, it is obtained that:

Knowing that ; ; , the final expression for λ is computed:

After performing the above calculations, it is obtained that:

Thus, for the Lagrange multiplier λ, the calculation expression is obtained:

By rearranging the terms, it is obtained that:

In order to determine the final formula of the neutrosophic portfolio depending on the two portfolios and , the values obtained for , and (λ) will be successively replaced in the expression , resulting in:

By rearranging the terms of the above expression, the final form of the portfolio depending on the two portfolios and is obtained:

Appendix E. Proof for Theorem 3

Let and be two optimal neutrosophic portfolios. According to Theorem 3, these two portfolios are independent if . These two portfolios and are written depending on and , using the equation provided by Theorem 2.

Therefore:

The covariance between these two portfolios can be written in matrix form as follows:

while the covariance between these two portfolios can be written as follows:

By replacing the structure of these two portfolios and , it is obtained that:

resulting in:

From [11], it is known that:

The relation of the covariance becomes:

Substituting in the covariance formula, it is obtained that:

Considering the above formulas for , by rearranging the terms in the covariance formula, it is found that:

From the proof of Theorem 2, it is known that , so one will have:

In these conditions, it is found that:

By rearranging the terms in the above formula, it is obtained that:

From Theorem 1, it is known that , and by replacing it in the above formula, it is obtained that:

Similarly, for :

The expressions obtained for and for are replaced in the formula of , obtaining that:

By rearranging the terms, the final form for the covariance formula is obtained, as follows:

The condition for the independent portfolios, that , is considered, resulting in:

In the above equation, the main unknown variable is , which can be determined as follows:

Knowing that , one gets:

By performing the mathematical operations in the above formula, it is obtained that:

The above formula represents the calculation relation of the independent neutrosophic portfolio return , in which the neutrosophic portfolio is of reference, while its independent portfolio is characterized by the fact that there are no connections between the two portfolios, i.e., . For the independent optimal neutrosophic portfolio , its risk and its structure are of interest. In order to determine the independent neutrosophic portfolio risk , the following calculation formula is used:

Finally, the independent neutrosophic portfolio risk is obtained, having the following form:

For the independent neutrosophic portfolio structure, the following calculation formula is used:

As a result, the structure of the independent neutrosophic portfolio is given by:

References

- Markowitz, H. Portfolio selection. J. Financ. 1952, 7, 77. [Google Scholar] [CrossRef]

- Chow, G. Portfolio selection based on return, risk, and relative performance. Financ. Anal. J. 1995, 51, 54–60. [Google Scholar] [CrossRef]

- Shenoy, C.; Shenoy, P.P. Bayesian network models of portfolio risk and return. In Computational Finance; The MIT Press: Cambridge, MA, USA, 2000; pp. 87–106. ISBN 978-0-262-01178-5. [Google Scholar]

- Mansour, N.; Cherif, M.S.; Abdelfattah, W. Multi-objective imprecise programming for financial portfolio selection with fuzzy returns. Expert Syst. Appl. 2019, 138, 112810. [Google Scholar] [CrossRef]

- Xue, L.; Di, H.; Zhao, X.; Zhang, Z. Uncertain portfolio selection with mental accounts and realistic constraints. J. Comput. Appl. Math. 2019, 346, 42–52. [Google Scholar] [CrossRef]

- Fernández-Navarro, F.; Martínez-Nieto, L.; Carbonero-Ruz, M.; Montero-Romero, T. Mean squared variance portfolio: A mixed-integer linear programming formulation. Mathematics 2021, 9, 223. [Google Scholar] [CrossRef]

- Yu, J.; Chang, K.-C. Neural network predictive modeling on dynamic portfolio management—A simulation-based portfolio optimization approach. J. Risk Financial Manag. 2020, 13, 285. [Google Scholar] [CrossRef]

- Mercurio, P.J.; Wu, Y.; Xie, H. An entropy-based approach to portfolio optimization. Entropy 2020, 22, 332. [Google Scholar] [CrossRef]

- Škrinjarić, T.; Šego, B. Using grey incidence analysis approach in portfolio selection. Int. J. Financial Stud. 2018, 7, 1. [Google Scholar] [CrossRef]

- Nowak, M.; Mierzwiak, R.; Wojciechowski, H.; Delcea, C. Grey portfolio analysis method. Grey Syst. Theory Appl. 2020. Ahead of Print. [Google Scholar] [CrossRef]

- Boloș, M.-I.; Bradea, I.-A.; Delcea, C. Optimization of financial asset neutrosophic portfolios. Mathematics 2021, 9, 1162. [Google Scholar] [CrossRef]

- Bolos, M.-I.; Bradea, I.-A.; Delcea, C. Modeling the Performance Indicators of Financial Assets with Neutrosophic Fuzzy Numbers. Symmetry 2019, 11, 1021. [Google Scholar] [CrossRef]

- Boloș, M.-I.; Bradea, I.-A.; Delcea, C. Neutrosophic portfolios of financial assets. Minimizing the risk of neutrosophic portfolios. Mathematics 2019, 7, 1046. [Google Scholar] [CrossRef]

- Chaudhury, R.; Islam, S. Multi-objective mathematical model for asset portfolio selection using neutrosophic goal programming technique. Neutrosophic Sets Syst. 2022, 50, 356–371. [Google Scholar]

- Veeramani, C.; Venugopal, R.; Edalatpanah, S.A. Neutrosophic DEMATEL approach for financial ratio performance evaluation of the NASDAQ exchange. Neutrosophic Sets Syst. 2022, 51, 766–782. [Google Scholar]

- Aliu, F.; Pavelkova, D.; Dehning, B. Portfolio risk-return analysis: The case of the automotive industry in the Czech Republic. J. Int. Stud. 2017, 10, 72–83. [Google Scholar] [CrossRef]

- Alfieri, A.; Castiglione, C.; Pastore, E. A multi-objective tabu search algorithm for product portfolio selection: A case study in the automotive industry. Comput. Ind. Eng. 2020, 142, 106382. [Google Scholar] [CrossRef]

- Borodin, A.; Tvaronavičienė, M.; Vygodchikova, I.; Panaedova, G.; Kulikov, A. Optimization of the structure of the investment portfolio of high-tech companies based on the minimax criterion. Energies 2021, 14, 4647. [Google Scholar] [CrossRef]

- Mohanty, S.K.; Aadland, R.; Westgaard, S.; Frydenberg, S.; Lillienskiold, H.; Kristensen, C. Modelling stock returns and risk management in the shipping industry. J. Risk Financial Manag. 2021, 14, 171. [Google Scholar] [CrossRef]

- Sefair, J.A.; Méndez, C.Y.; Babat, O.; Medaglia, A.L.; Zuluaga, L.F. Linear solution schemes for mean-semivariance project portfolio selection problems: An application in the oil and gas industry. Omega 2017, 68, 39–48. [Google Scholar] [CrossRef]

- Sepehri, M. Strategic selection and empowerment of supplier portfolios case: Oil and gas industries in Iran. Procedia-Soc. Behav. Sci. 2013, 74, 51–60. [Google Scholar] [CrossRef]

- Ghazanfar Ahari, S.; Ghaffari-Nasab, N.; Makui, A.; Ghodsypour, S.H. A portfolio selection using fuzzy analytic hierarchy process: A case study of Iranian pharmaceutical industry. Int. J. Ind. Eng. Comput. 2011, 2, 225–236. [Google Scholar] [CrossRef]

- Canela, M.Á.; Collazo, E.P. Portfolio selection with skewness in emerging market industries. Emerg. Mark. Rev. 2007, 8, 230–250. [Google Scholar] [CrossRef]

- Jiménez, I.; Mora-Valencia, A.; Ñíguez, T.-M.; Perote, J. Portfolio risk assessment under dynamic (equi)correlation and semi-nonparametric estimation: An application to cryptocurrencies. Mathematics 2020, 8, 2110. [Google Scholar] [CrossRef]

- Li, Z.; Li, X.; Hui, Y.; Wong, W.-K. Maslow portfolio selection for individuals with low financial sustainability. Sustainability 2018, 10, 1128. [Google Scholar] [CrossRef]

- Tsaur, R.-C.; Chiu, C.-L.; Huang, Y.-Y. Fuzzy portfolio selection in COVID-19 spreading period using fuzzy goal programming model. Mathematics 2021, 9, 835. [Google Scholar] [CrossRef]

- Yoshino, N.; Taghizadeh-Hesary, F.; Otsuka, M. COVID-19 and optimal portfolio selection for investment in sustainable development goals. Financ. Res. Lett. 2021, 38, 101695. [Google Scholar] [CrossRef]

- Islam, S.; Ray, P. Multi-objective portfolio selection model with diversification by neutrosophic optimization technique. Neutrosophic Sets Syst. 2018, 21, 74–83. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).