Technology Upgrade Assessment for Open-Pit Mines through Mine Plan Optimization and Discrete Event Simulation

Abstract

:1. Introduction

2. Advances in Stochastic Open-Pit Mine Planning

3. Methodology

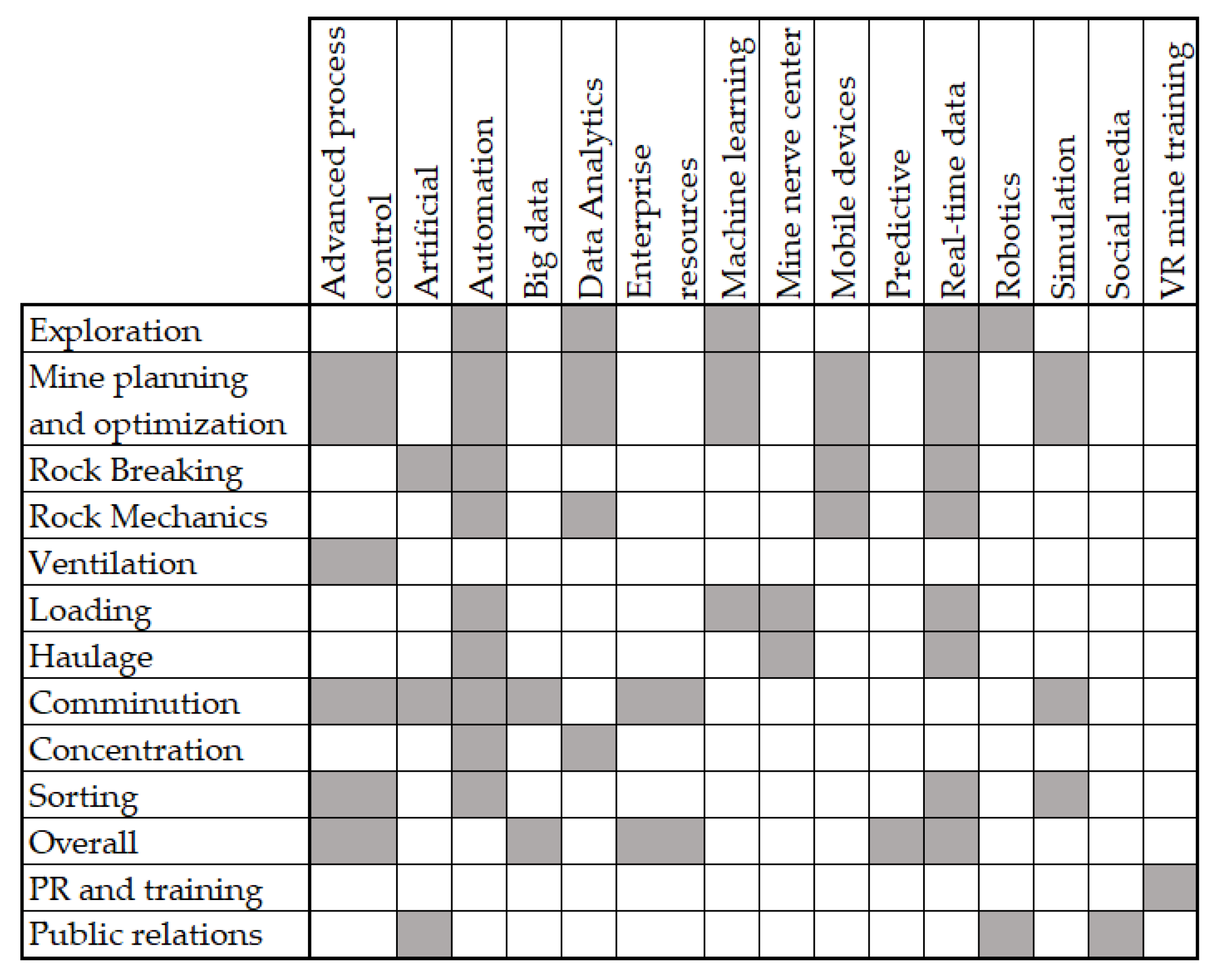

3.1. Determining Technology

3.2. Engineering of Operational Modes

3.3. Long-Term Validation (Mine Planning)

3.4. Parameter Adjustments

3.5. Medium-Term Validation (Metallurgical Plant)

3.6. Final Analysis

3.7. Framework

3.7.1. Algorithm

3.7.2. Discrete Event Simulations (DES)

4. Sample Calculations

4.1. Case Study

4.1.1. Gold Deposit

4.1.2. Ore Sorting

4.2. Application of MTAP

4.2.1. Determining Technology

4.2.2. Engineering of Operational Modes

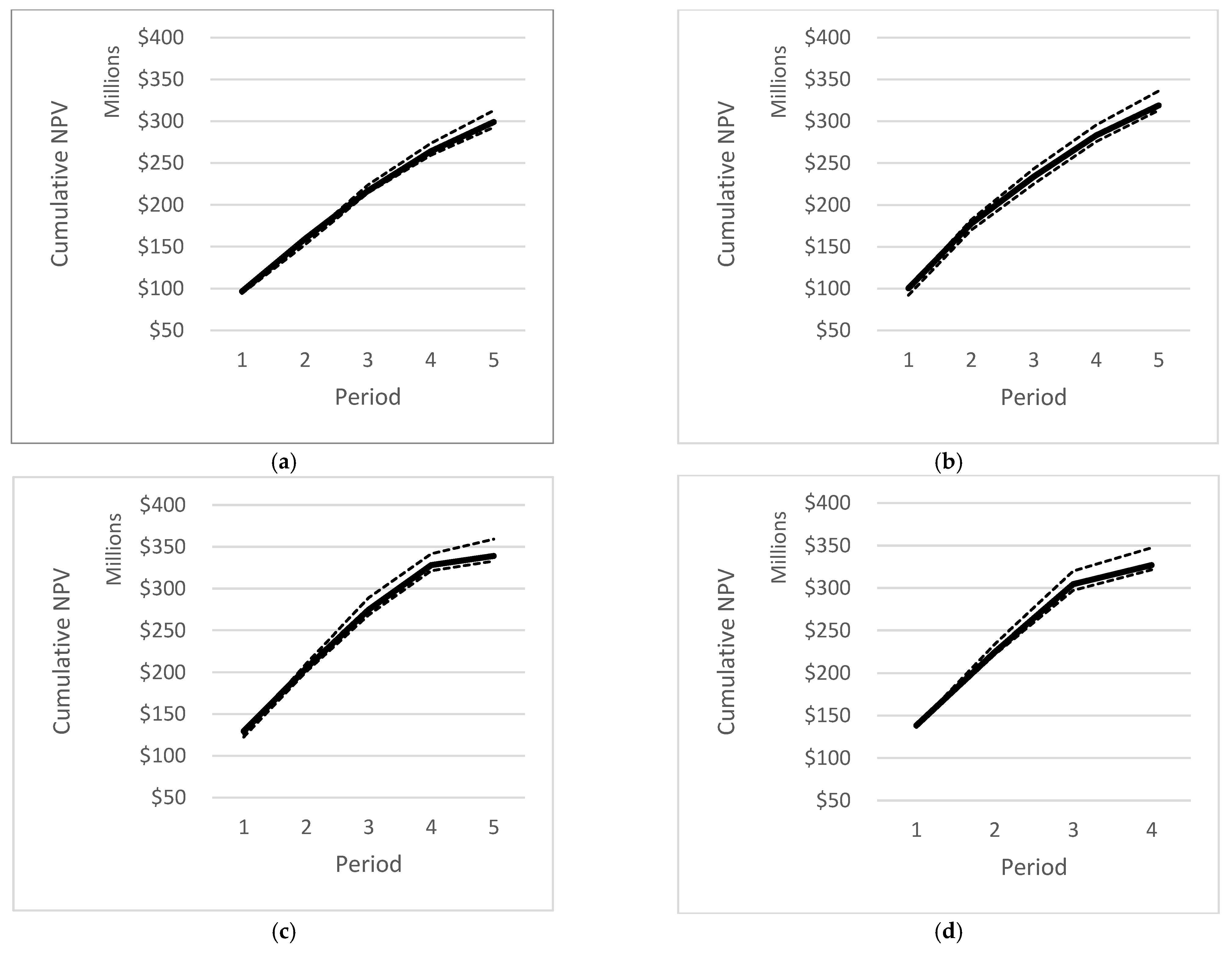

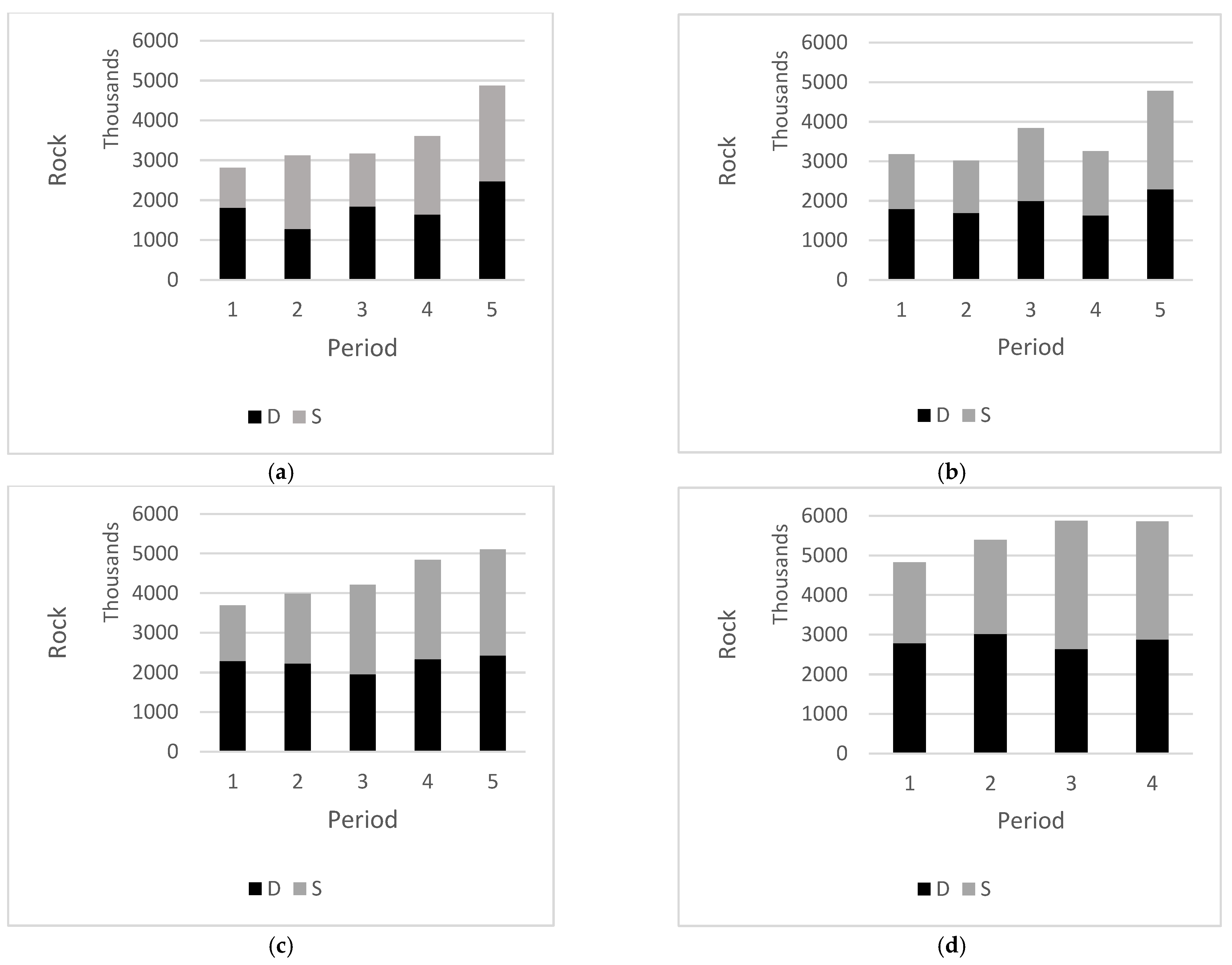

4.2.3. Long-Term Validation

4.2.4. Parameter Adjustments

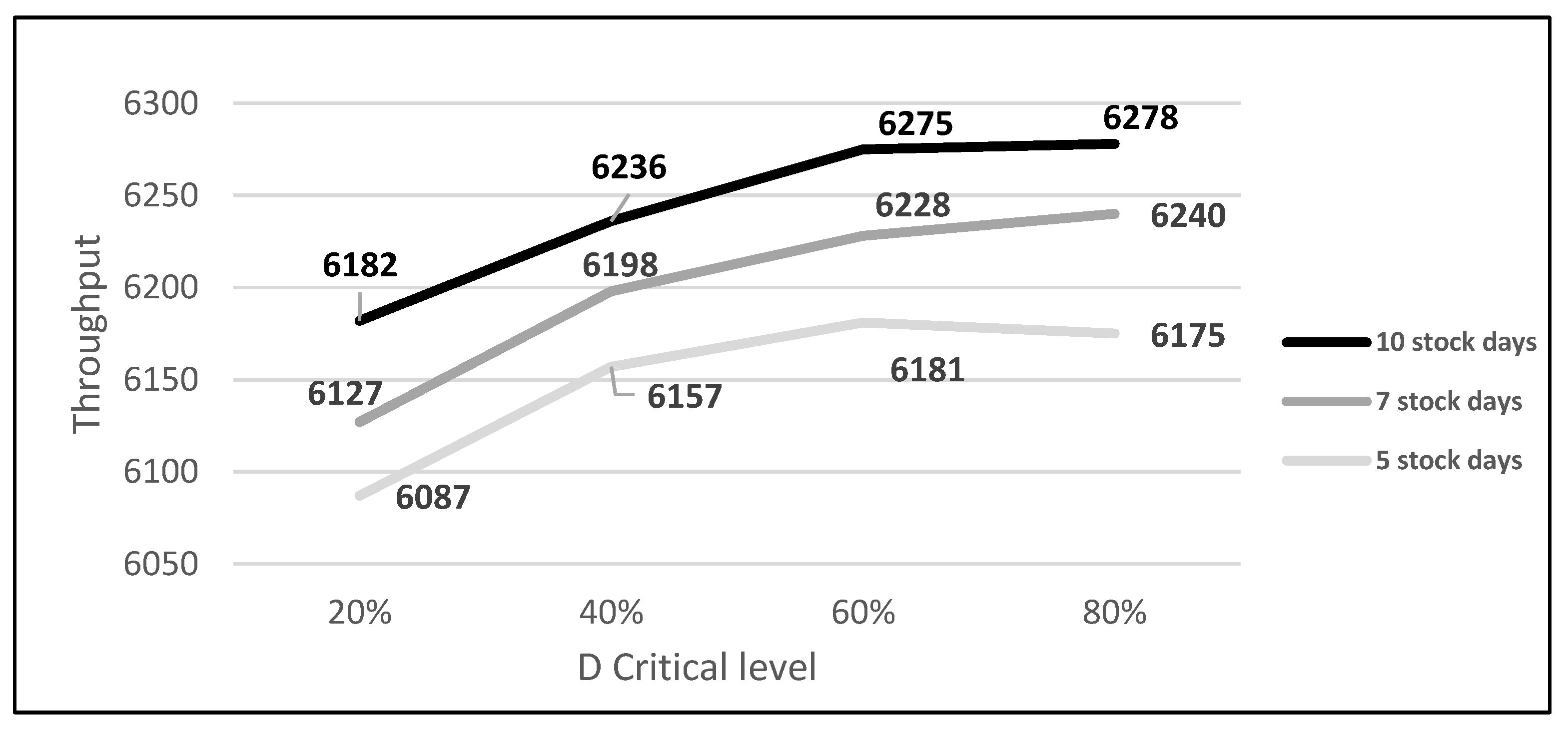

4.2.5. Medium-Term Validation

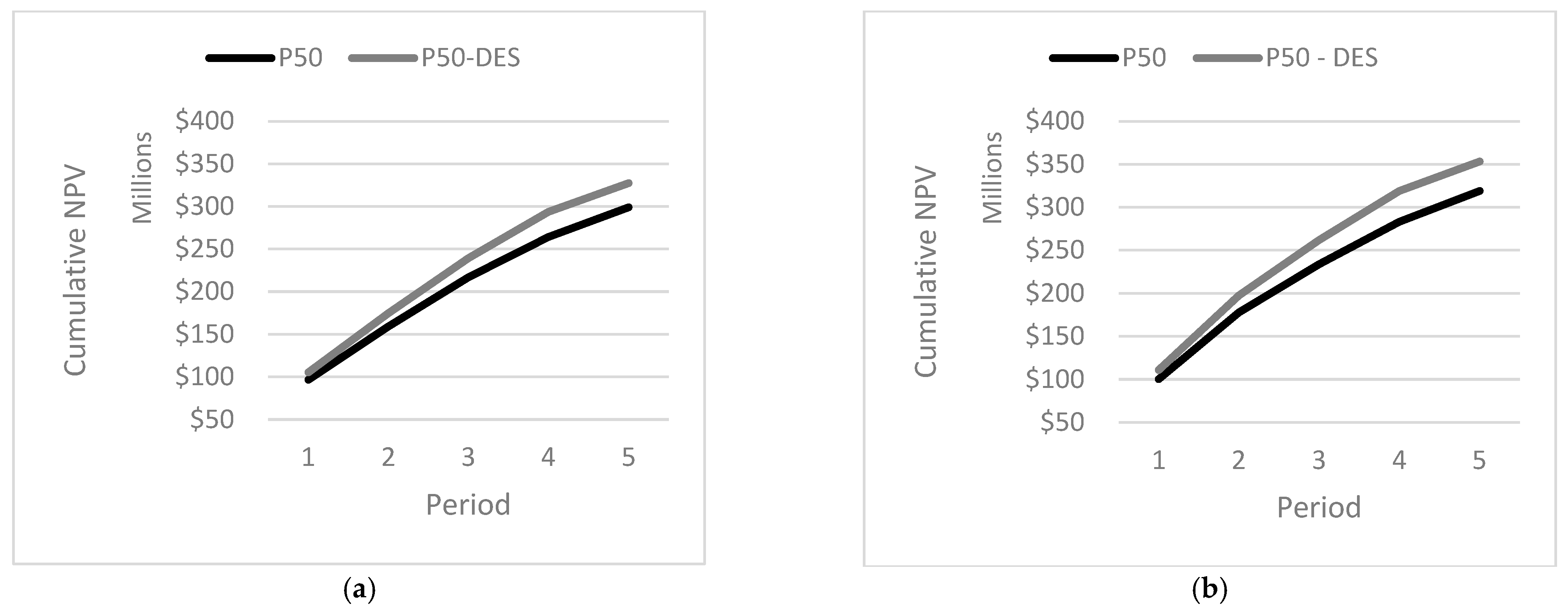

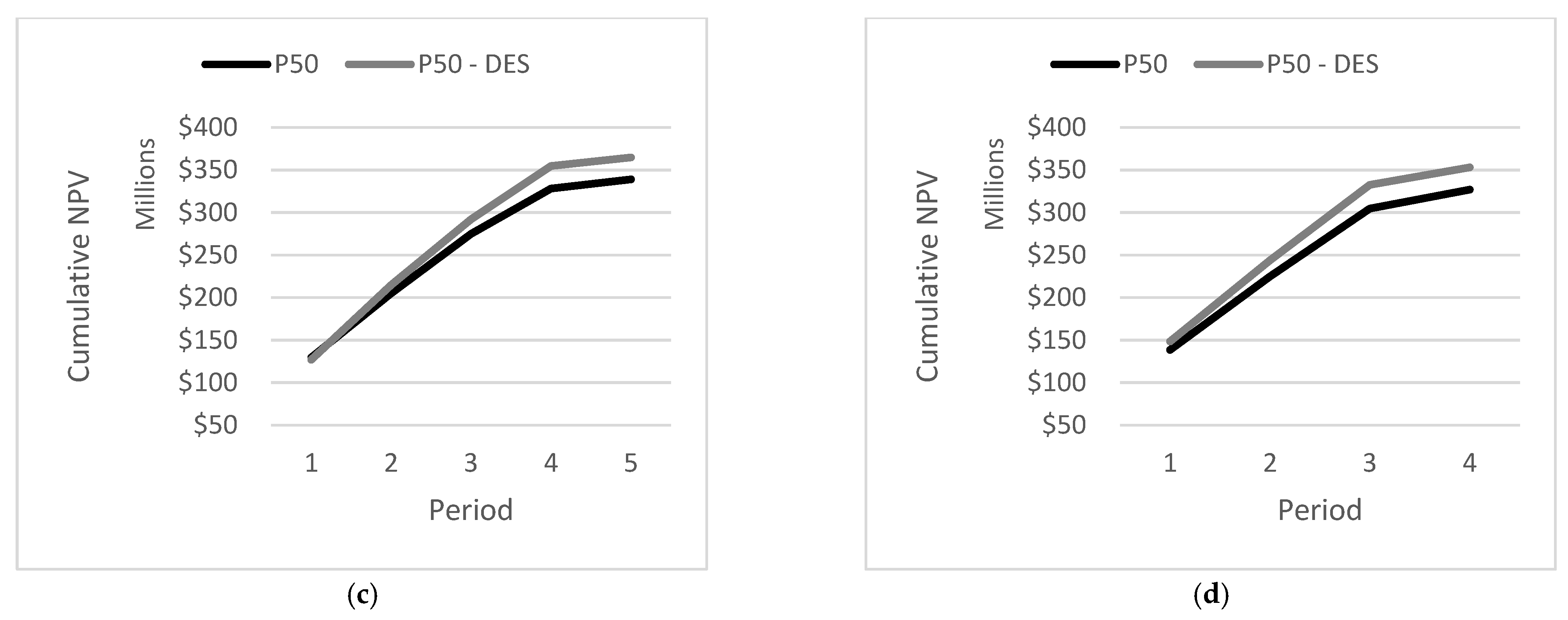

4.2.6. Final Analysis

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Barnewold, L.; Lottermoser, B. Identification of digital technologies and digitalization trends in the mining industry. Int. J. Min. Sci. Technol. 2020, 30, 747–757. [Google Scholar] [CrossRef]

- Qiuping, W.; Shunbing, Z.; Chunquan, D. Study on key technologies of Internet of Things perceiving mine. Procedia Eng. 2011, 26, 2326–2333. [Google Scholar] [CrossRef]

- Yinghua, Z.; Guanghua, F.; Zhigang, Z.; Zhian, H.; Hongchen, L.; Jixing, Y. Discussion on Application of IOT Technology in Coal Mine Safety Supervision. Procedia Eng. 2012, 43, 233–237. [Google Scholar] [CrossRef]

- Sun, E.; Zhang, X.; Zhongxue, L. The internet of things (IOT) and cloud computing (CC) based tailings dam monitoring and pre-alarm system in mines. Saf. Sci. 2012, 50, 811–815. [Google Scholar] [CrossRef]

- Mehrabi, A.; Mehrshad, N.; Massinaei, M. Machine vision-based monitoring of an industrial flotation cell in an iron flotation plant. Int. J. Miner. 2014, 133, 60–66. [Google Scholar] [CrossRef]

- Jahedsaravani, A.; Marhaban, M.; Massinaei, M. Prediction of the metallurgical performances of a batch flotation system by image analysis and neural networks. Miner. Eng. 2014, 69, 137–145. [Google Scholar] [CrossRef]

- Jahedsaravani, A.; Massinaei, M.; Marhaban, M. Development of a machine vision system for real-time monitoring and control of batch flotation process. Int. J. Miner. 2017, 167, 16–26. [Google Scholar] [CrossRef]

- Singh, V.; Rao, S. Application of image processing and radial basis neural network techniques for ore sorting and ore classification. Miner. Eng. 2005, 18, 1412–1420. [Google Scholar] [CrossRef]

- Cao, B.; Xie, Y.; Gui, W.; Wei, L.; Yang, C. Integrated prediction model of bauxite concentrate grade based on distributed machine vision. Miner. Eng. 2013, 53, 31–38. [Google Scholar] [CrossRef]

- Sun, T.; Li, H.; Wu, K.; Chen, F.; Zhu, Z.; Hu, Z. Data-Driven Predictive Modelling of Mineral Prospectivity Using Machine Learning and Deep Learning Methods: A Case Study from Southern Jiangxi Province, China. Minerals 2020, 10, 102. [Google Scholar] [CrossRef]

- Zaki, M.; Chen, S.; Zhang, J.; Feng, F.; Khoreshok, A.; Mahdy, M.; Salim, K. A Novel Approach for Resource Estimation of Highly Skewed Gold Using Machine Learning Algorithms. Minerals 2022, 12, 900. [Google Scholar] [CrossRef]

- Kaplan, U.; Dagasan, Y.; Topal, E. Mineral grade estimation using gradient boosting regression trees. Int. J. Min. Reclam. Environ. 2021, 35, 728–742. [Google Scholar] [CrossRef]

- Beretta, F.; Rodrigues, A.; Peroni, R.; Costa, J. Automated lithological classification using UAV and machine learning on an open cast mine. Appl. Earth Sci. 2019, 128, 79–88. [Google Scholar] [CrossRef]

- Khandelwal, M.; Monjezi, M. Prediction of Backbreak in Open-Pit Blasting Operations Using the Machine Learning Method. Rock Mech. Rock Eng. 2013, 46, 389–396. [Google Scholar] [CrossRef]

- Willingham, D.; Marchant, R. Predictive Maintenance Using Simulation and Machine Learning. In Proceedings of the 13th AusIMM Mill Operators, Perth, Australia, 10–12 October 2016. [Google Scholar]

- Molaei, F.; Rahimi, E.; Siavoshi, H.; Ghaychi, S.; Tenorio, V. A Comprehensive Review on Internet of Things (IoT) and its Implications in the Mining Industry. Am. J. Appl. Sci. 2020, 13, 499–515. [Google Scholar] [CrossRef]

- Skyttner, L. General Systems Theory—Ideas & Applications; World Scientific Publishing Co. Pte. Ltd.: Singapore, 2001; pp. 45–101. [Google Scholar]

- Jacobs, J.; Webber-Youngman, R.C.W. A technology map to facilitate the process of mine modernization throughout the mining cycle. J. S. Afr. 2017, 117, 637–648. [Google Scholar] [CrossRef]

- Dimitrakopoulos, R. Stochastic Optimization for Strategic Mine Planning: A Decade of Developments. J. Min. Sci. 2011, 47, 138–150. [Google Scholar] [CrossRef]

- Carvalho, J.; Dimitrakopoulos, R. Integrating Production Planning with Truck-Dispatching Decisions through Reinforcement Learning While Managing Uncertainty. Minerals 2021, 11, 587. [Google Scholar] [CrossRef]

- Wilson, R.; Mercier, P.; Patarachao, B.; Navarra, A. Partial Least Squares Regression of Oil Sands Processing Variables within Discrete Event Simulation Digital Twin. Minerals. 2021, 11, 689. [Google Scholar] [CrossRef]

- Peña-Graf, F.; Ordenes, J.; Wilson, R.; Navarra, A. Discrete Event Simulation for Machine-Learning Enabled Mine Production Control with Application to Gold Processing. Metals 2022, 12, 225. [Google Scholar] [CrossRef]

- Navarra, A.; Waters, K. Concentrator utilization under geological uncertainty. Can. Metall. Q. 2016, 55, 470–478. [Google Scholar] [CrossRef]

- Montiel, L.; Dimitrakopoulos, R. Optimizing mining complexes with multiple processing and transportation alternatives: An uncertainty-based approach. Eur. J. Oper. Res. 2015, 247, 166–178. [Google Scholar] [CrossRef]

- Lamghari, A.; Dimitrakopoulos, R.; Senécal, R. A metaheuristic approach for optimizing mineral value chains under uncertainty. Optim. Eng. 2022, 23, 1139–1164. [Google Scholar] [CrossRef]

- Goodfellow, R.; Dimitrakopoulos, R. Global optimization of open pit mining complexes with uncertainty. Appl. Soft. Comput. 2016, 40, 292–304. [Google Scholar] [CrossRef]

- Montiel, L.; Dimitrakopoulos, R.; Kawahata, K. Globally optimising open-pit and underground mining operations under geological uncertainty. Min. Techol. 2016, 125, 2–14. [Google Scholar] [CrossRef]

- Goodfellow, R.; Dimitrakopoulos, R. Simultaneous stochastic optimization of mining complexes and mineral value chain. Math. Geosci. 2017, 49, 341–360. [Google Scholar] [CrossRef] [PubMed]

- Montiel, L.; Dimitrakopoulos, R. Simultaneous stochastic optimization of production scheduling at Twin Creeks mining complex. Nevada Min. Eng. 2018, 70, 48–56. [Google Scholar] [CrossRef]

- Del Castillo, M.; Dimitrakopoulos, R. Dynamically optimizing the strategic plan of mining complexes under supply uncertainty. Resour. Policy 2019, 40, 83–93. [Google Scholar] [CrossRef]

- Levinson, Z.; Dimitrakopoulos, R. Simultaneous stochastic optimization of an open-pit gold mining complex with waste management. Int. J. Min. Reclam. Environ. 2020, 34, 415–429. [Google Scholar] [CrossRef]

- LaRoche-Boisvert, M.; Dimitrakopoulos, R. An Application of Simultaneous Stochastic Optimization at a Large Open-Pit Gold Mining Complex under Supply Uncertainty. Minerals 2021, 11, 172. [Google Scholar] [CrossRef]

- Dimitrakopoulos, R.; Lamghari, A. Simultaneous stochastic optimization of mining complexes—Mineral value chains: An overview of concepts, examples and comparisons. Int. J. Min. Reclam. Environ. 2022, 36, 443–460. [Google Scholar] [CrossRef]

- Randolph, M. Current Trends in Mining. In SME Mining Engineering Handbook, 3rd ed.; Darling, P., Ed.; Society for Mining, Metallurgy, and Exploration, Inc.: Englewood, CO, USA, 2011. [Google Scholar]

- Paravarzar, S.; Emery, X.; Madani, N. Comparing sequential Gaussian and turning bands algorithms for cosimulating grades in multi-element desposits. C. R. Geosci. 2015, 347, 84–93. [Google Scholar] [CrossRef]

- Nelis, G.; Morales, N.; Widzyk-Capehart, E. Comparison of different approaches to strategic open-pit mine planning under geological uncertainty. In Proceedings of the 27th International Symposium on Mine Planning and Equipment Selection—MPES 2018; Widzyk-Capehard, E., Hekmat, A., Singhal, R., Eds.; Springer: Cham, Switzerland, 2019; pp. 95–105. [Google Scholar]

- Ramazan, S.; Dimitrakopoulos, R. Traditional and new MIP models for production scheduling with in-situ grade variability. Int. J. Surf. Min. Reclam. Environ. 2004, 18, 85–98. [Google Scholar] [CrossRef]

- Dimitrakopoulos, R.; Ramazan, S. Stochastic integer programming for optimizing long term production schedules of open pit mines: Methods, application and value of stochastic solutions. Trans. Inst. Min. Metall. A Min. Technol. 2008, 117, 155–160. [Google Scholar]

- Lamghari, A.; Dimitrakopoulos, R. A diversified Tabu Search approach for the open-pit mine production scheduling problem with metal uncertainty. Eur. J. Oper. Res. 2012, 222, 642–652. [Google Scholar] [CrossRef]

- Kan, A. Long-term production scheduling of open pit mines using particle swarm and bat algorithms under grade uncertainty. J. South Afr. Inst. Min. Metall. 2018, 118, 361–368. [Google Scholar] [CrossRef]

- Quelopana, A.; Ordenes, J.; Araya, R.; Navarra, A. Geometallurgical Detailing of Plant Operation within Open-Pit Strategic Mine Planning. Processes 2023, 11, 381. [Google Scholar] [CrossRef]

- Navarra, A.; Rafiei, A.; Waters, K. A system approach to mineral processing based on mathematical programming. Can. Metall. Q. 2017, 56, 35–44. [Google Scholar] [CrossRef]

- Navarra, A.; Menzies, A.; Jordens, A.; Waters, K. Strategic evaluation of concentrator operational modes under geological uncertainty. Int. J. Miner. 2017, 164, 45–55. [Google Scholar] [CrossRef]

- Wilson, R.; Toro, N.; Naranjo, O.; Emery, X.; Navarra, A. Integration of geostatistical modeling inro discrete event simulation for development of tailings dam retreatment applications. Miner. Eng. 2021, 164, 106814. [Google Scholar] [CrossRef]

- Wilson, R.; Mercier, P.; Navarra, A. Integrated Artificial Neural Network and Discrete Event Simulation Framework for Regional Development of Refractory Gold Systems. Mining 2022, 2, 8. [Google Scholar] [CrossRef]

- Ordenes, J.; Toro, N.; Quelopana, A.; Navarra, A. Data-Driven Dynamic Simulations of Gold Extraction Which Incorporate Head Grade Distribution Statistics. Metals 2022, 12, 1372. [Google Scholar] [CrossRef]

- Lamghari, A.; Dimitrakopoulos, R.; Ferland, J. A variable neighborhood descend algorithm for an open-pit mine production scheduling problem with metal uncertainty. J. Oper. Res. Soc. 2014, 65, 1305–1314. [Google Scholar] [CrossRef]

- Dantzig, G.; Wolfe, P. Decomposition Principle for Linear Programs. Oper. Res. 1960, 8, 101–111. [Google Scholar] [CrossRef]

- Saldaña, M.; Toro, N.; Castillo, J.; Hernandez, P.; Navarra, A. Optimization of the heap leaching process through changes in modes of operation and discrete event simulation. Minerals 2019, 9, 421. [Google Scholar] [CrossRef]

- Hartwig, F. Episodic concentration of gold to ore grade through Earth’s history. Earth Sci. Rev. 2018, 180, 148–158. [Google Scholar]

- Sillitoe, R. Some thoughts on gold-rich porphyry copper deposits. Miner. Depos. 1979, 14, 161–174. [Google Scholar] [CrossRef]

- Sillitoe, R. Style of low-grade gold mineralization in volcano-plutonic areas: Nevada Bur. Mines Geology 1983, 36, 52–68. [Google Scholar]

- Sillitoe, R. Gold-rich porphyry copper deposits: Geological model and exploration implications. Geological Association of Canada Special Paper. Miner. Depos. Model. 1993, 40, 465–478. [Google Scholar]

- Cox, D.; Singer, D. Distribution of gold in porphyry copper deposits. In U.S. Geological Survey Open-File Report; US Geological Survey: Reston, VA, USA, 1988; pp. 88–146. [Google Scholar]

- Vila, T.; Sillitoe, R. Gold-rich porphyry systems in the Maricunga belt, northern Chile. Econ. Geol. 1991, 86, 1238–1260. [Google Scholar] [CrossRef]

- Sillitoe, R. Gold Metallogeny of Chile an Introduction. Econ. Geol. 1991, 86, 1187–1205. [Google Scholar] [CrossRef]

- Sillitoe, R.; Tolman, J.; Van Kerkvoort, G. Geology of the Caspiche Porphyry Gold-Copper Deposit, Maricunga Belt, Northern Chile. Econ. Geol. 2013, 108, 585–604. [Google Scholar] [CrossRef]

- Bearman, R.; Bowman, D.; Dunne, R. Decision support for ore sorting and preconcentration in gold applications. Miner. Process. Extr. Metall. 2020, 129, 12–23. [Google Scholar] [CrossRef]

- Luo, X.; He, K.; Zhang, Y.; He, P.; Zhang, Y. A review of intelligent ore sorting technology and equipment development. Int. J. Miner. Metall. Mater. 2022, 29, 1647–1655. [Google Scholar] [CrossRef]

| Sensor Detection Principle | Passive (P) or Active (A) | Body (B) or Surface (S) |

|---|---|---|

| X-ray Fluorescence | A | S |

| Raman Spectroscopy | A | S |

| Laser Induced Fluorescence | A | S |

| Laser Induced Breakdown Spectroscopy | A | S |

| Near Infrared Spectroscopy | A | S |

| Nuclear Magnetic Resonance | A | B |

| Microwave Heating + Infrared Detection | A | B |

| X-ray Diffraction | P | S |

| X-ray Transmission | P | B |

| Optical/Color/UV | P | S |

| Electromagnetic | P | B |

| Radiometric | P | B |

| Option | Sensor Detection Principle | Rejection | Efficiency |

|---|---|---|---|

| XRF | X-ray Fluorescence | 18% | 98% |

| NIR | Near Infrared Spectroscopy | 36% | 96% |

| OPT | Optical | 50% | 90% |

| Parameters | Values |

|---|---|

| Block weight (tonne) | 15,375 |

| Number of blocks | 4536 |

| Block dimension (m) | 25 × 25 × 10 |

| Block density (tonne/m3) | 2.46 |

| Number of periods | 5 |

| Length of periods (year) | 1 |

| Discount rate (%) | 8 |

| Metal Price Au (USD/oz) | 1185 |

| Mining cost (USD/tonne) | 3.48 |

| Mining capacity (tonne/period) 1 | 6,000,000 |

| Processing availability (hperiod) | 8280 |

| Rock types | Diorite porphyry (D) |

| Silicified intrusive breccia (S) | |

| Processing cost (USD/tonne) | 3.85 |

| Recovery Au (%) | 0.83 |

| Operational Mode A 2 | |

| Processing rate (tonne/h) | 284 |

| Percentage rock D | 80 |

| Percentage rock S | 20 |

| Operational Mode B 2 | |

| Processing rate (tonne/h) | 256 |

| Percentage rock D | 40 |

| Percentage rock S | 60 |

| Parameters | 5 Days | 7 Days | 10 Days |

|---|---|---|---|

| Length of periods (year) | 1 | ||

| Production campaigns (day) | 29 | ||

| Shutdowns (day) | 1 | ||

| Ore types | Diorite porphyry (D) Silicified intrusive breccia (S) | ||

| Target ore stock level (tonne) | 34,080 | 47,712 | 68,160 |

| Critical diorite level 1 | 20%/40%/60%/80% | ||

| Operational Mode A 2 | |||

| Processing rate (tonnes/day) | 6816 | ||

| Ore D | 5452 | ||

| Ore S | 1364 | ||

| Operational Mode A Contingency 2 | |||

| Processing rate/ore S (tonnes/day) | 4430 | ||

| Operational Mode B 2 | |||

| Processing rate (tonnes/h) | 6144 | ||

| Ore D | 2458 | ||

| Ore S | 3686 | ||

| Operational Mode B Contingency 2 | |||

| Processing rate/ore D (tonnes/day) | 3994 | ||

| Option | Ore Processed (Tonnes) | Metal Recovery (%) |

|---|---|---|

| No Sort | 11,130,541 | 83 |

| XRF | 11,081,596 | 81 |

| NIR | 10,287,053 | 80 |

| OPT | 8,134,845 | 75 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Quelopana, A.; Órdenes, J.; Wilson, R.; Navarra, A. Technology Upgrade Assessment for Open-Pit Mines through Mine Plan Optimization and Discrete Event Simulation. Minerals 2023, 13, 642. https://doi.org/10.3390/min13050642

Quelopana A, Órdenes J, Wilson R, Navarra A. Technology Upgrade Assessment for Open-Pit Mines through Mine Plan Optimization and Discrete Event Simulation. Minerals. 2023; 13(5):642. https://doi.org/10.3390/min13050642

Chicago/Turabian StyleQuelopana, Aldo, Javier Órdenes, Ryan Wilson, and Alessandro Navarra. 2023. "Technology Upgrade Assessment for Open-Pit Mines through Mine Plan Optimization and Discrete Event Simulation" Minerals 13, no. 5: 642. https://doi.org/10.3390/min13050642