A Holistic Approach to Define Important Digital Skills for the Digital Society

Abstract

1. Introduction

2. Literature Review

- Cryptocurrency as a tool for risk management;

- Decentralization of crypto transactions using blockchain and fintech;

- Regulatory and digital framework of cryptocurrencies;

- Market efficiency of cryptocurrencies;

- Pricing efficiency of cryptocurrencies;

- Price clustering and liquidity in crypto transactions;

- Cryptocurrency as an investment asset;

- Portfolio diversification using cryptocurrency;

- Trading volume, return, and volatility of cryptocurrencies;

- The role of information in the volatility of cryptocurrency prices.

3. DigComp and Digital Skills in the Use of Cryptocurrencies

3.1. General Information

3.2. DigComp’s Axes for the Use of Cryptocurrencies

3.2.1. Information and Communication Technology (ICT)

3.2.2. Communication Skills

3.2.3. Digital Cultural Understanding

3.3. Usefulness of DigComp for the Use of Cryptocurrencies

3.3.1. Skills Assessment

3.3.2. Education and Training

3.3.3. Technical Understanding

3.3.4. Professional Use

| Competence | Examples in the Use of Cryptocurrencies |

|---|---|

| Information and data knowledge | Evaluation of the reliability, transparency, and validity of transactions by using cryptocurrencies. |

| Communication and collaboration | Improving communication with bots on e-commerce sites that accept this kind of payment and collaboration between all the users of the network to prevent possible frauds. |

| Digital content creation | Participating in the creation of digital content to make cryptocurrencies easier to be used by senior citizens. |

| Security | Securing the use of cryptocurrencies on e-commerce sites and reducing the risk of e-wallet hacking. |

| Problem solving | Solving any problem related to cryptocurrency transaction in everyday transactions, such as more direct and efficient communication with banking institutes, digital security certificate providers, etc. |

4. Hypotheses

4.1. The Concept of Security

4.2. The Concept of Problem Solving

4.3. The Concept of Information and Data Knowledge

5. Methodology

6. Results

6.1. Descriptive Analysis and Results

6.2. Technical Analysis and SEM Results

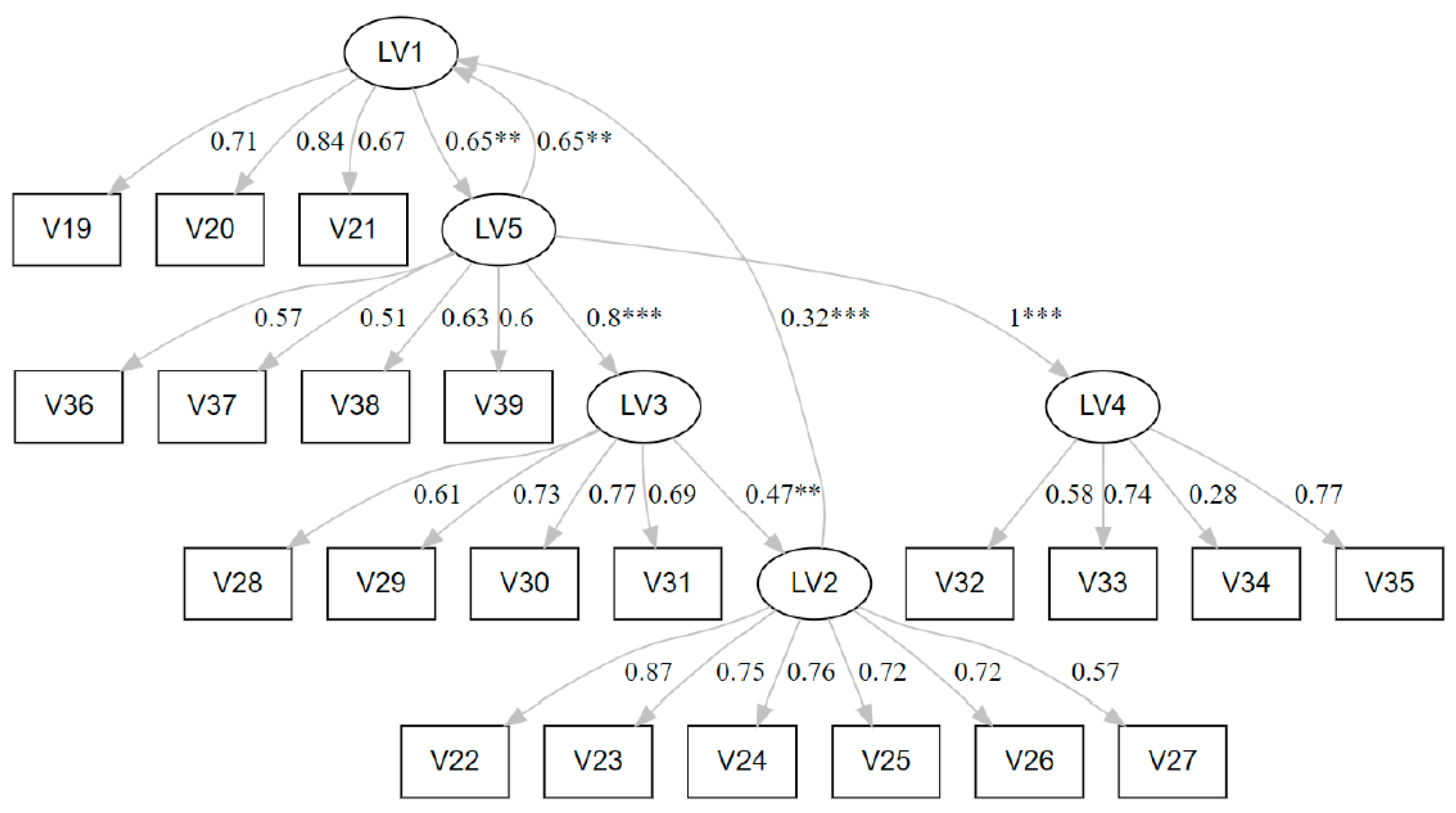

- LV1: Information and data knowledge;

- LV2: Communication and collaboration;

- LV3: Digital content creation;

- LV4: Security;

- LV5: Problem resolution.

- Define the theoretical constructs: identify the latent variables that represent the theoretical constructs. These are unobserved variables that cannot be directly measured but can be inferred from observed indicators.

- Select indicators: determine the observed indicators or measurements for each latent variable. These are observable variables that provide information about the underlying construct.

- Specify measurement models: specify how the observed indicators relate to their corresponding latent variables through measurement models. This involves assigning factor loadings that indicate the strength of the relationship between each indicator and its corresponding latent variable.

- Connect latent variables: define structural models by specifying relationships between different latent variables in the model. This involves identifying paths or connections between the latent variables and assigning regression coefficients to indicate their strength and direction.

- Assess model fit: evaluate how well the CSEM model fits the data using various fit indices, such as chi-square, the Comparative Fit Index (CFI), Root Mean Square Error of Approximation (RMSEA), etc.

- Refine and modify: if necessary, refine the model by modifying paths, adding or removing indicators or adjusting factor loadings based on statistical indices and theoretical considerations.

- Estimate parameters: use statistical software specifically designed for CSEM (e.g., Mplus v.8.3 and Lavaan v. 0.6-12 in R) to estimate parameters in the model based on maximum likelihood estimation or other appropriate methods.

- Interpret results: examine estimates of factor loadings and regression coefficients to understand how each indicator contributes to its respective construct and how different constructs relate to each other within the model.

- LV5: Problem resolution;

- LV2: Communication and collaboration;

- LV1: Information and data knowledge;

- LV3: Digital content creation;

- LV4: Security.

7. Discussion

- They will be able to use digital currency management software more effectively.

- They will be able to more easily identify the risks, threats, and fraud that will be presented online.

- They will evaluate any form of information as valid or fake, wherever it comes from.

- They will be able to solve problems encountered in digital currency management applications, such as e-wallets, through communication.

- They will contribute to optimal communication through the use of terminology between experts (computer application technicians, economists, and other professionals).

- They will participate in the better dissemination of essential information on the use of digital currencies, making them active citizens.

- Citizens will be able to understand and deal with risks by making the tools and software of banking institutions more effective.

- In the event of a cyber-attack by unknown persons, citizens will be able to effectively protect themselves by reducing the risk of destabilizing the system of digital currency transactions.

- The state will reduce losses from any cyber-attack as citizens will be significantly informed about not responding to messages that compromise cybersecurity.

- The state will be able to extend all its traditional financial activities more effectively to digital systems as citizens will be adequately educated and knowledgeable, thus increasing the degree of efficiency and effectiveness of the public tax collection system.

8. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ziomek, A. Developing Digital Skills in Economy 4.0. J. Hum. Soc. Sci. 2021, 20, 143–160. [Google Scholar] [CrossRef]

- Huang, Q. Ethereum: Introduction, Expectation, and Implementation. Highlightes Sci. Eng. Technol. 2023, 41, 175–182. [Google Scholar] [CrossRef]

- Dorn, D.; Levell, P. Trade and Inequality in Europe and the US. 2021. Available online: https://docs.iza.org/dp14914.pdf (accessed on 30 June 2024).

- Benson, V.; Adamyk, B.; Chinnaswamy, A.; Adamyk, O. Harmonising Cryptocurrency Regulation in Europe: Opportunities for Preventing Illicit Transactions. Eur. J. Law Econ. 2024, 57, 37–61. [Google Scholar] [CrossRef]

- European Crypto-Assets Regulation (MiCA)|EUR-Lex. Available online: https://eur-lex.europa.eu/EN/legal-content/summary/european-crypto-assets-regulation-mica.html (accessed on 30 June 2024).

- Baecker, D.; Elsholz, U.; Locher, M.; Thomas, M. (Eds.) Einleitung: Post-digitales Management. In Post-Digitales Management; Springer Fachmedien Wiesbaden: Wiesbaden, Germany, 2023; pp. 1–19. ISBN 978-3-658-40706-3. [Google Scholar]

- Lupač, P. Beyond the Digital Divide: Contextualizing the Information Society; Emerald Publishing Limited: Leeds, UK, 2018; ISBN 978-1-78756-548-7. [Google Scholar]

- Song, H.; Wei, Y.; Qu, Z.; Wang, W. Unveiling Decentralization: A Comprehensive Review of Technologies, Comparison, Challenges in Bitcoin, Ethereum, and Solana Blockchain. arXiv 2024, arXiv:2404.04841. [Google Scholar]

- Lekshmi, R.S.; Jawaharrani, K.; Vijayakanthan, S.; Nirmala, G.; Dheenadayalan, K.; Vasantha, S. Digital Assets for Digital Natives: Exploring Familiarity and Preference for Cryptocurrency among Millennials and Gen Z. J. Autonom. Intell. 2023, 7. [Google Scholar] [CrossRef]

- Raţiu, A.; Maniu, I.; Pop, E.-L. EntreComp Framework: A Bibliometric Review and Research Trends. Sustainability 2023, 15, 1285. [Google Scholar] [CrossRef]

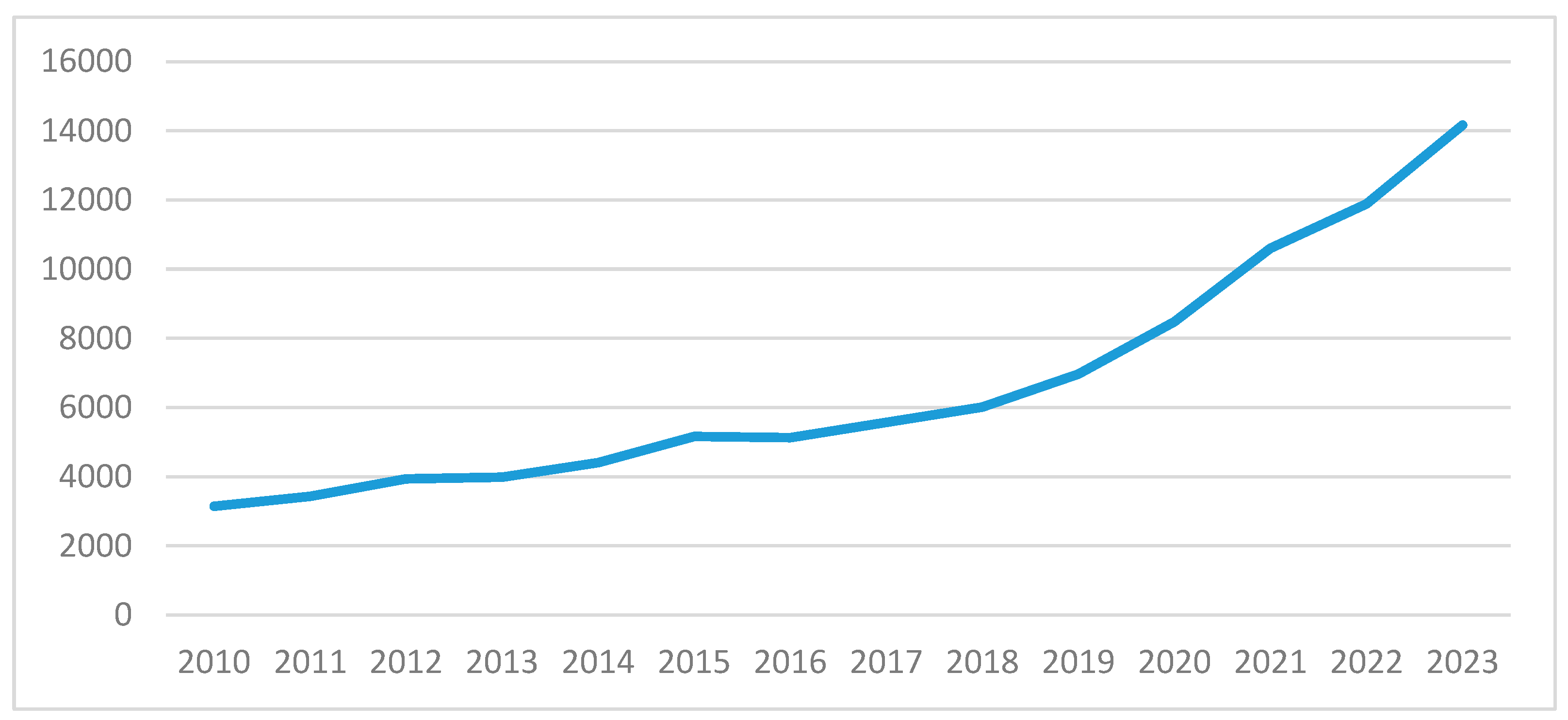

- ScienceDirect/Digital Skills. Available online: https://www.sciencedirect.com/search?qs=Digital%20Skills (accessed on 14 January 2024).

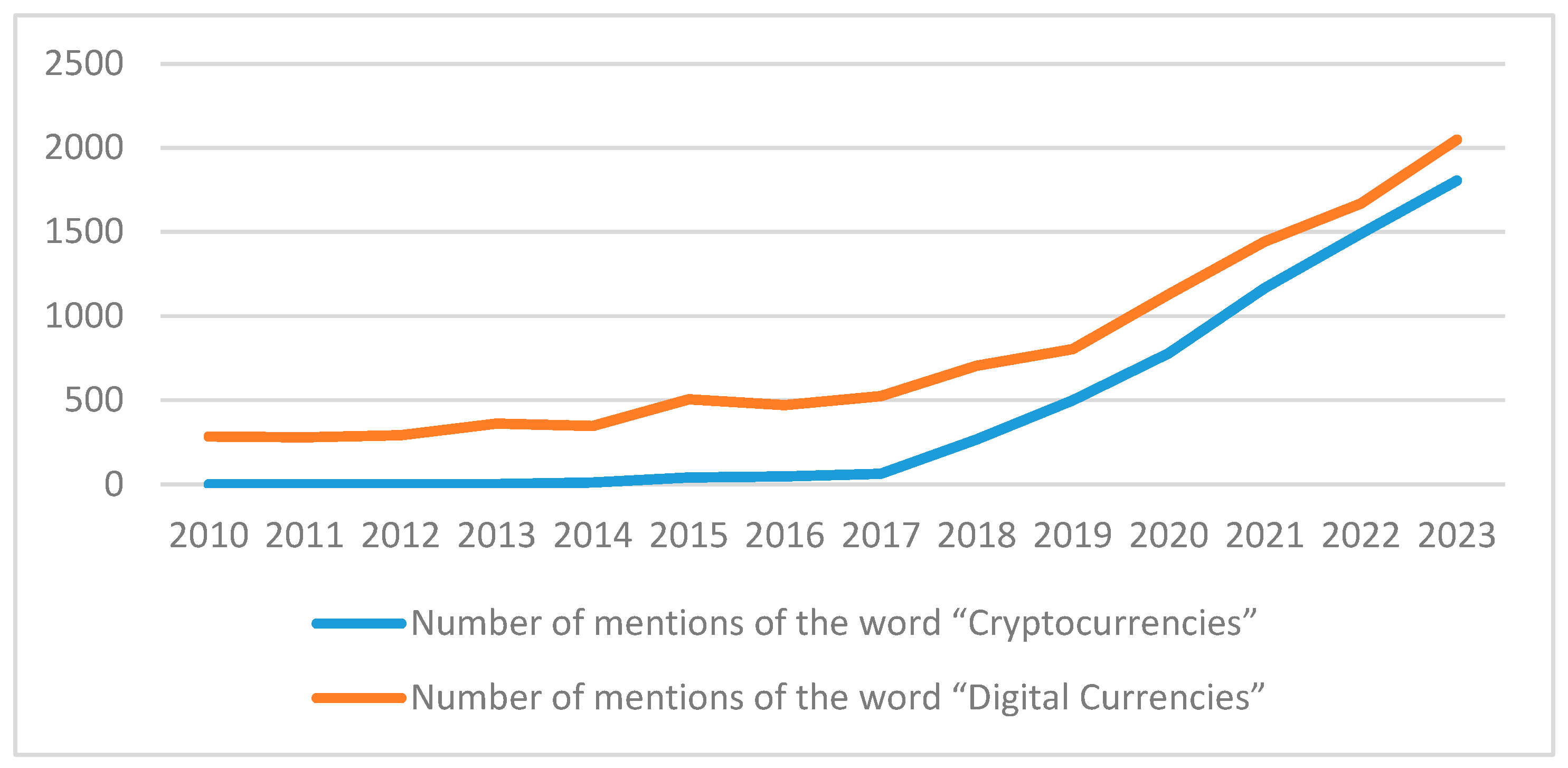

- ScienceDirect/Cryptocurrencies. Available online: https://www.sciencedirect.com/search?qs=Cryptocurrencies (accessed on 14 January 2024).

- ScienceDirect/Digital Currencies. Available online: https://www.sciencedirect.com/search?qs=Digital%20Currencies (accessed on 14 January 2024).

- Andal, V.; Aniruddh, G. A Study on Perception of Millennials on Fintech and Cryptocurrency. J. Risk Financ. Manag. 2023, 5, 7153. [Google Scholar] [CrossRef]

- Venkatachalam, N.; Kannusamy, R. Digital Skills Recruitment Challenges in Small Enterprises: The Role of Blockchain. Small Enterp. Res. 2023, 30, 301–317. [Google Scholar] [CrossRef]

- Miah, M.T.; Erdei-Gally, S.; Dancs, A.; Fekete-Farkas, M. A Systematic Review of Industry 4.0 Technology on Workforce Employability and Skills: Driving Success Factors and Challenges in South Asia. Economies 2024, 12, 35. [Google Scholar] [CrossRef]

- Colás-Bravo, P.; Conde-Jiménez, J.; Reyes-de-Cózar, S. Sustainability and Digital Teaching Competence in Higher Education. Sustainability 2021, 13, 12354. [Google Scholar] [CrossRef]

- Zhang, J.; Cai, K.; Wen, J. A Survey of Deep Learning Applications in Cryptocurrency. iScience 2024, 27, 108509. [Google Scholar] [CrossRef]

- Yoo, S. How to Design Cryptocurrency Value and How to Secure Its Sustainability in the Market. J. Risk Financ. Manag. 2021, 14, 210. [Google Scholar] [CrossRef]

- Fadeyi, O.; Krejcar, O.; Maresova, P.; Kuca, K.; Brida, P.; Selamat, A. Opinions on Sustainability of Smart Cities in the Context of Energy Challenges Posed by Cryptocurrency Mining. Sustainability 2019, 12, 169. [Google Scholar] [CrossRef]

- Rijanto, A. Co-Movements between an Asian Technology Stock Index and Cryptocurrencies during the COVID-19 Pandemic: A Bi-Wavelet Approach. Economies 2023, 11, 232. [Google Scholar] [CrossRef]

- Náñez Alonso, S.L.; Jorge-Vázquez, J.; Echarte Fernández, M.Á.; Reier Forradellas, R.F. Cryptocurrency Mining from an Economic and Environmental Perspective. Analysis of the Most and Least Sustainable Countries. Energies 2021, 14, 4254. [Google Scholar] [CrossRef]

- Kumari, V.; Bala, P.K.; Chakraborty, S. An Empirical Study of User Adoption of Cryptocurrency Using Blockchain Technology: Analysing Role of Success Factors like Technology Awareness and Financial Literacy. J. Theor. Appl. Electron. Commerce Res. 2023, 18, 1580–1600. [Google Scholar] [CrossRef]

- Pattnaik, D.; Hassan, M.K.; Dsouza, A.; Tiwari, A.; Devji, S. Ex-Post Facto Analysis of Cryptocurrency Literature over a Decade Using Bibliometric Technique. Technol. Forecast. Soc. Chang. 2023, 189, 122339. [Google Scholar] [CrossRef]

- Ozili, P.K. Central Bank Digital Currency Can Lead to the Collapse of Cryptocurrency. SSRN J. 2021. [Google Scholar] [CrossRef]

- Yeong, Y.-C.; Kalid, K.S.; Savita, K.S.; Ahmad, M.N.; Zaffar, M. Sustainable Cryptocurrency Adoption Assessment among IT Enthusiasts and Cryptocurrency Social Communities. Sustain. Energy Technol. Assess. 2022, 52, 102085. [Google Scholar] [CrossRef]

- Mostova, A.; Taranenko, I. Digital transformation of business and society: The role of digital skills. East. Eur. Econ. Bus. Manag. 2023. [Google Scholar] [CrossRef]

- Digital Future Society Measuring the Margins: A Global Framework for Digital Inclusion. Available online: https://digitalfuturesociety.com/app/uploads/2019/12/201219_Report-7_A_global_framework_for_digital_inclusion-2.pdf (accessed on 30 June 2024).

- Haq, I.U.; Ferreira, P.; Quintino, D.D.; Huynh, N.; Samantreeporn, S. Economic Policy Uncertainty, Energy and Sustainable Cryptocurrencies: Investigating Dynamic Connectedness during the COVID-19 Pandemic. Economies 2023, 11, 76. [Google Scholar] [CrossRef]

- Auer, R.; Tercero-Lucas, D. Distrust or Speculation? The Socioeconomic Drivers of U.S. Cryptocurrency Investments. J. Financ. Stab. 2022, 62, 101066. [Google Scholar] [CrossRef]

- Kumar Kulbhaskar, A.; Subramaniam, S. Breaking News Headlines: Impact on Trading Activity in the Cryptocurrency Market. Econo. Model. 2023, 126, 106397. [Google Scholar] [CrossRef]

- DigComp—European Commission. Available online: https://joint-research-centre.ec.europa.eu/digcomp_en (accessed on 16 January 2024).

- Różewski, P.; Kieruzel, M.; Lipczyński, T.; Prys, M. Framework of Visual Literacy Competences for Engineering Education Discussed in the Scope of DigComp Framework with Examples from Educational R&D Projects. Procedia Comput. Sci. 2021, 192, 4441–4447. [Google Scholar] [CrossRef]

- Zhao, Y.; Sánchez Gómez, M.C.; Pinto Llorente, A.M.; Zhao, L. Digital Competence in Higher Education: Students’ Perception and Personal Factors. Sustainability 2021, 13, 12184. [Google Scholar] [CrossRef]

- Prendes-Espinosa, P.; Solano-Fernández, I.M.; García-Tudela, P.A. EmDigital to Promote Digital Entrepreneurship: The Relation with Open Innovation. J. Open Innov. Technol. Market Complex. 2021, 7, 63. [Google Scholar] [CrossRef]

- Ulfert-Blank, A.-S.; Schmidt, I. Assessing Digital Self-Efficacy: Review and Scale Development. Comput. Educ. 2022, 191, 104626. [Google Scholar] [CrossRef]

- Zeehan, F.; Alias, R.A.; Tasir, Z. Mapping the Attribute of Digital Competency Framework for Educators. Int. J. Psychosoc. Rehabil. 2020, 24, 2361–2371. [Google Scholar]

- Jiménez-Hernández, D.; González-Calatayud, V.; Torres-Soto, A.; Martínez Mayoral, A.; Morales, J. Digital Competence of Future Secondary School Teachers: Differences According to Gender, Age, and Branch of Knowledge. Sustainability 2020, 12, 9473. [Google Scholar] [CrossRef]

- Pérez-Escoda, A.; Fernández-Villavicencio, N.G. Digital Competence in Use: From DigComp 1 to DigComp 2. In Proceedings of the Fourth International Conference on Technological Ecosystems for Enhancing Multiculturality, Salamanca, Spain, 2–4 November 2016; ACM: Salamanca, Spain, 2016; pp. 619–624. [Google Scholar]

- Sebastián-López, M.; De Miguel González, R. Mobile Learning for Sustainable Development and Environmental Teacher Education. Sustainability 2020, 12, 9757. [Google Scholar] [CrossRef]

- European Commission. Joint Research Centre. DigComp 2.1: The Digital Competence Framework for Citizens with Eight Proficiency Levels and Examples of Use; Publications Office: Luxembourg, 2017. [Google Scholar]

- Vuorikari, R. DigComp Helping Shape the Education Ecosystem in Europe. In Shaping the Digital Transformation of the Education Ecosystem in Europe; Väljataga, T., Laanpere, M., Eds.; Communications in Computer and Information Science; Springer International Publishing: Cham, Switzerland, 2022; Volume 1639, pp. 137–143. ISBN 978-3-031-20517-0. [Google Scholar]

- Mora, H.; Morales-Morales, M.R.; Pujol-López, F.A.; Mollá-Sirvent, R. Social Cryptocurrencies as Model for Enhancing Sustainable Development. Kybernetes 2021, 50, 2883–2916. [Google Scholar] [CrossRef]

- Bhatnagar, M.; Taneja, S.; Rupeika-Apoga, R. Demystifying the Effect of the News (Shocks) on Crypto Market Volatility. J. Risk Financ. Manag. 2023, 16, 136. [Google Scholar] [CrossRef]

- Gupta, M.; Taneja, S.; Sharma, V.; Singh, A.; Rupeika-Apoga, R.; Jangir, K. Does Previous Experience with the Unified Payments Interface (UPI) Affect the Usage of Central Bank Digital Currency (CBDC)? J. Risk Financ. Manag. 2023, 16, 286. [Google Scholar] [CrossRef]

- Shin, D.; Rice, J. Cryptocurrency: A Panacea for Economic Growth and Sustainability? A Critical Review of Crypto Innovation. Telemat. Inform. 2022, 71, 101830. [Google Scholar] [CrossRef]

- Van Laar, E.; Van Deursen, A.J.A.M.; Van Dijk, J.A.G.M.; De Haan, J. The Relation between 21st-Century Skills and Digital Skills: A Systematic Literature Review. Comput. Hum. Behav. 2017, 72, 577–588. [Google Scholar] [CrossRef]

- Baah-Acheamfuor, K.; Qutieshat, A.; Yangailo, T. Critical Review: Measures of Digital Competency Related to Employability. Econ. Aziend. Online 2023, 14, 379–391. [Google Scholar] [CrossRef]

- Grosseck, G.; Bran, R.A.; Țîru, L.G. Digital Assessment: A Survey of Romanian Higher Education Teachers’ Practices and Needs. Educ. Sci. 2023, 14, 32. [Google Scholar] [CrossRef]

- Guenther, P.; Guenther, M.; Ringle, C.M.; Zaefarian, G.; Cartwright, S. Improving PLS-SEM Use for Business Marketing Research. Ind. Mark. Manag. 2023, 111, 127–142. [Google Scholar] [CrossRef]

- Haputhanthrige, V.; Asghar, I.; Saleem, S.; Shamim, S. The Impact of a Skill-Driven Model on Scrum Teams in Software Projects: A Catalyst for Digital Transformation. Systems 2024, 12, 149. [Google Scholar] [CrossRef]

- Almohammad, D.; Durrah, O.; Ahmed, F. Deciphering the Motives, Barriers and Integration of Syrian Refugee Entrepreneurs into Turkish Society: A SEM Approach. Digit. Policy Regul. Gov. 2021, 23, 59–76. [Google Scholar] [CrossRef]

- Kim, Tae Ho; Shin, Yea Cheol; Im, Sam-Jin; Park, Jun-Tae An Empirical Study of Influence Relationship on Traffic Culture Index(TCI) Utilizing PLS-SEM(Structural Equation Modeling). J. Korean Soc. Saf. 2013, 28, 78–83. [CrossRef]

- Rosak-Szyrocka, J.; Tiwari, S. Structural Equation Modeling (SEM) to Test Sustainable Development in University 4.0 in the Ultra-Smart Society Era. Sustainability 2023, 15, 16167. [Google Scholar] [CrossRef]

- Braßler, M. Students’ Digital Competence Development in the Production of Open Educational Resources in Education for Sustainable Development. Sustainability 2024, 16, 1674. [Google Scholar] [CrossRef]

- Sinakou, E.; Donche, V.; Boeve-de Pauw, J.; Van Petegem, P. Designing Powerful Learning Environments in Education for Sustainable Development: A Conceptual Framework. Sustainability 2019, 11, 5994. [Google Scholar] [CrossRef]

- Sá, M.J.; Santos, A.I.; Serpa, S.; Miguel Ferreira, C. Digitainability—Digital Competences Post-COVID-19 for a Sustainable Society. Sustainability 2021, 13, 9564. [Google Scholar] [CrossRef]

- Cirillo, V.; Fanti, L.; Mina, A.; Ricci, A. The Adoption of Digital Technologies: Investment, Skills, Work Organisation. Struct. Chang. Econ. Dyn. 2023, 66, 89–105. [Google Scholar] [CrossRef]

- Allmann, K.; Blank, G. Rethinking Digital Skills in the Era of Compulsory Computing: Methods, Measurement, Policy and Theory. Inf. Commun.Soc. 2021, 24, 633–648. [Google Scholar] [CrossRef]

- Shakina, E.; Parshakov, P.; Alsufiev, A. Rethinking the Corporate Digital Divide: The Complementarity of Technologies and the Demand for Digital Skills. Technol. Forecast. Soc. Chang. 2021, 162, 120405. [Google Scholar] [CrossRef]

- Lang, V.; Šorgo, A. Views of Students, Parents, and Teachers on Smartphones and Tablets in the Development of 21st-Century Skills as a Prerequisite for a Sustainable Future. Sustainability 2024, 16, 3004. [Google Scholar] [CrossRef]

| User Model Versus Baseline Model | ||

|---|---|---|

| Comparative Fit Index (CFI) | 0.705 | 0.705 |

| Tucker–Lewis Index (TLI) | 0.661 | 0.661 |

| Robust Comparative Fit Index (CFI) | 0.708 | |

| Robust Tucker–Lewis Index (TLI) | 0.665 | |

| Root Mean Square Error of Approximation: | ||

| RMSEA | 0.143 | 0.136 |

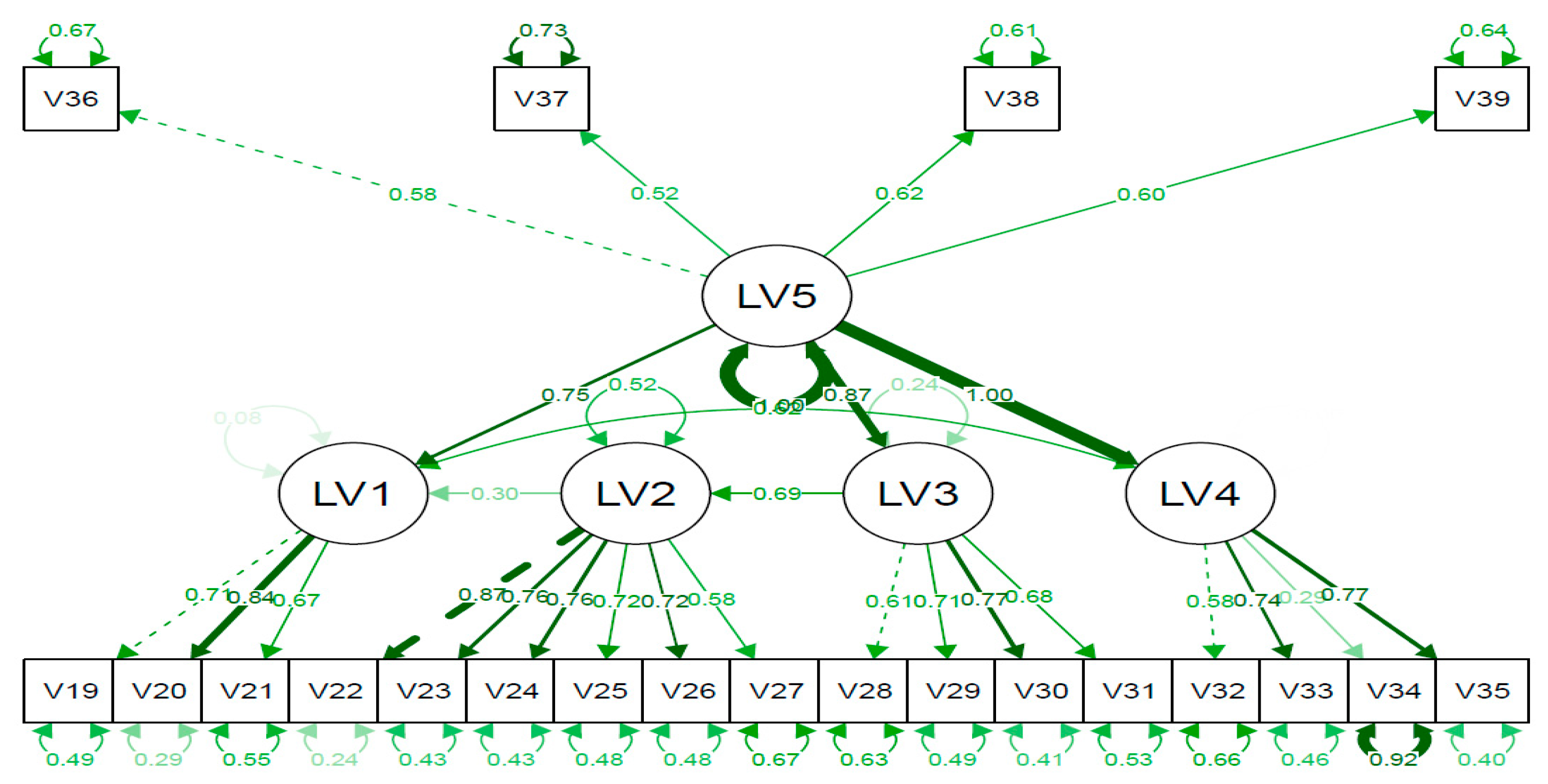

| Regressions | ||||

|---|---|---|---|---|

| Estimate | Std.Err | z-Value | p(>|z|) | |

| LV1~LV2 | 0.237 | 0.065 | 3.618 | 0.000 |

| LV1~LV5 | 0.738 | 0.262 | 2.814 | 0.005 |

| LV2~LV3 | 0.573 | 0.218 | 2.621 | 0.009 |

| LV3~LV5 | 0.982 | 0.207 | 4.741 | 0.000 |

| LV4~LV5 | 1.191 | 0.142 | 8.373 | 0.000 |

| LV5~LV1 | 0.576 | 0.204 | 2.817 | 0.005 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zervas, I.; Stiakakis, E.; Athanasiadis, I.; Tsekouropoulos, G. A Holistic Approach to Define Important Digital Skills for the Digital Society. Societies 2024, 14, 127. https://doi.org/10.3390/soc14070127

Zervas I, Stiakakis E, Athanasiadis I, Tsekouropoulos G. A Holistic Approach to Define Important Digital Skills for the Digital Society. Societies. 2024; 14(7):127. https://doi.org/10.3390/soc14070127

Chicago/Turabian StyleZervas, Ioannis, Emmanouil Stiakakis, Ioannis Athanasiadis, and Georgios Tsekouropoulos. 2024. "A Holistic Approach to Define Important Digital Skills for the Digital Society" Societies 14, no. 7: 127. https://doi.org/10.3390/soc14070127

APA StyleZervas, I., Stiakakis, E., Athanasiadis, I., & Tsekouropoulos, G. (2024). A Holistic Approach to Define Important Digital Skills for the Digital Society. Societies, 14(7), 127. https://doi.org/10.3390/soc14070127