Dispatch Strategies for the Utilisation of Battery Storage Systems in Smart Grid Optimised Buildings

Abstract

1. Introduction

| Technologies | Application(s) in Buildings and/or the Grid | Comments/Conclusions |

|---|---|---|

| Batteries | Peak-shaving [32] | Residential Battery energy storage systems can reduce peak electricity loads by >40%. |

| Time-of-Use (ToU) Energy management [33] | Medium-scale batteries can reduce the electricity bills of consumers through ToU energy management. They are economically beneficial for medium-scale buildings if there is an important difference between the max. and the min. electricity prices. | |

| Balancing Services, RES Integration, Customer Energy Management [34,35] | Batteries can provide several services, including balancing services, such as voltage support, black start and load following, as well as customer energy management (power quality/reliability). RES Integration can be achieved through time-shifting and capacity firming. | |

| Optimisation of energy dispatch schedule in a PV/storage system [36] | Batteries are important for providing peak-shaving and load shifting. The cost-effectiveness of the system depends on the electricity rates and battery technology used (lithium-ion, lead acid, etc.) | |

| Hydrogen Storage | Self-sufficient energy buildings and cost minimisation [37] | There is an increasing interest in combined battery and hydrogen storage. Domestic hydrogen storage can render a building self-sufficient for an annual premium of 52% when compared to buying electricity from the grid by 2030. It can also lead to annualised cost reductions of 72–80% for the supply of heat and electricity when compared to Li-ion batteries. |

| Integration of RES and balancing of the grid [38] | Electrochemical and mechanical storage are not sufficient to balance the grid; therefore, hydrogen is expected to play a major role in the energy transition. Evaluating hydrogen is very challenging while a detailed techno-economic assessment is required on a case-to-case basis. | |

| Thermal mass | Energy flexible buildings [39] | Using the building’s thermal mass as thermal storage through preheating, precooling and night ventilation can lead to a maximum of 3.2% savings for heating and 8.5% for cooling. |

| HVAC | Fast DR [40] | Turning off part of the HVAC is an efficient way for buildings to respond quickly to notifications issued by the Smart Grid, provide fast DR and achieve considerable power reduction (39%). |

| Peak-shaving [41] | An HVAC energy management system can minimise cooling loads by altering thermostat settings, leading to a reduction in the daily peak loads by 25.5% in domestic buildings. | |

| Hybrid System | Meeting loads, minimisation of costs and emissions [42] | Considering several energy systems (wind turbines, PVs, hydrogen storage, batteries), many optimal combinations include high levels of solar and wind power. As high costs are associated with hydrogen storage, priority is given to batteries. |

| CHP | Emissions reductions [43] | CHP can reduce emissions (CO2, NOx, CH4) as well as the carbon equivalent in commercial buildings. |

| Primary Energy Savings [44] | CHP can lead to the reduction in electricity and gas consumption by 56% and 43%, respectively. Results are considered to be dependent on climate conditions and building types. |

2. Methodology

2.1. Building Specifications

2.1.1. Design and Structure

- Building envelope. This characteristic refers to the thermal transmittance of the envelope elements and their airtightness. The first category meets the building regulations as described in Part L [46] while Best Practice is more energy-efficient with lower envelope U-values, along with less external infiltration. Concerning the airtightness, crack templates are used to calculate the external infiltration that takes place due to surface cracks or by general fabric porosity, as explained in [47]. The envelope determines the interior climate conditions and consequently the additional heating and cooling demand required. The envelope parameters are presented in Table 3;

- Thermal mass. Lightweight buildings are assumed to include metallic cladding with plastering while heavyweight buildings consist of brickwork, concrete and plastering at their respective external walls. Thermal mass is responsible for a time delay in the heat exchange (thermal lag) between the building interior and the outside environment, depending on the properties of the building materials used [48];

- Window-to-Wall ratio. For this category, 30% and 80% glazed buildings are considered. Glazing is considered to be one of the weakest control points in the thermal performance of buildings as heating losses and solar gain take place through the windows [49].

2.1.2. HVAC Configuration and Building Loads

2.1.3. Building Simulations

2.2. Real-Time Electricity Pricing Data

2.3. Battery Storage Model

2.3.1. Control Algorithm Strategies

2.3.2. Operational Strategy E7: Exports Allowed with Retail Revenues

2.3.3. Operational Strategy E5: Exports Allowed Only on Working Days

2.3.4. Operational Strategy E0: No Exports Allowed

2.4. Economics and Cost–Benefit Analysis (CBA)

3. Results

3.1. Breakdown Electricity Consumption

3.2. Battery Storage

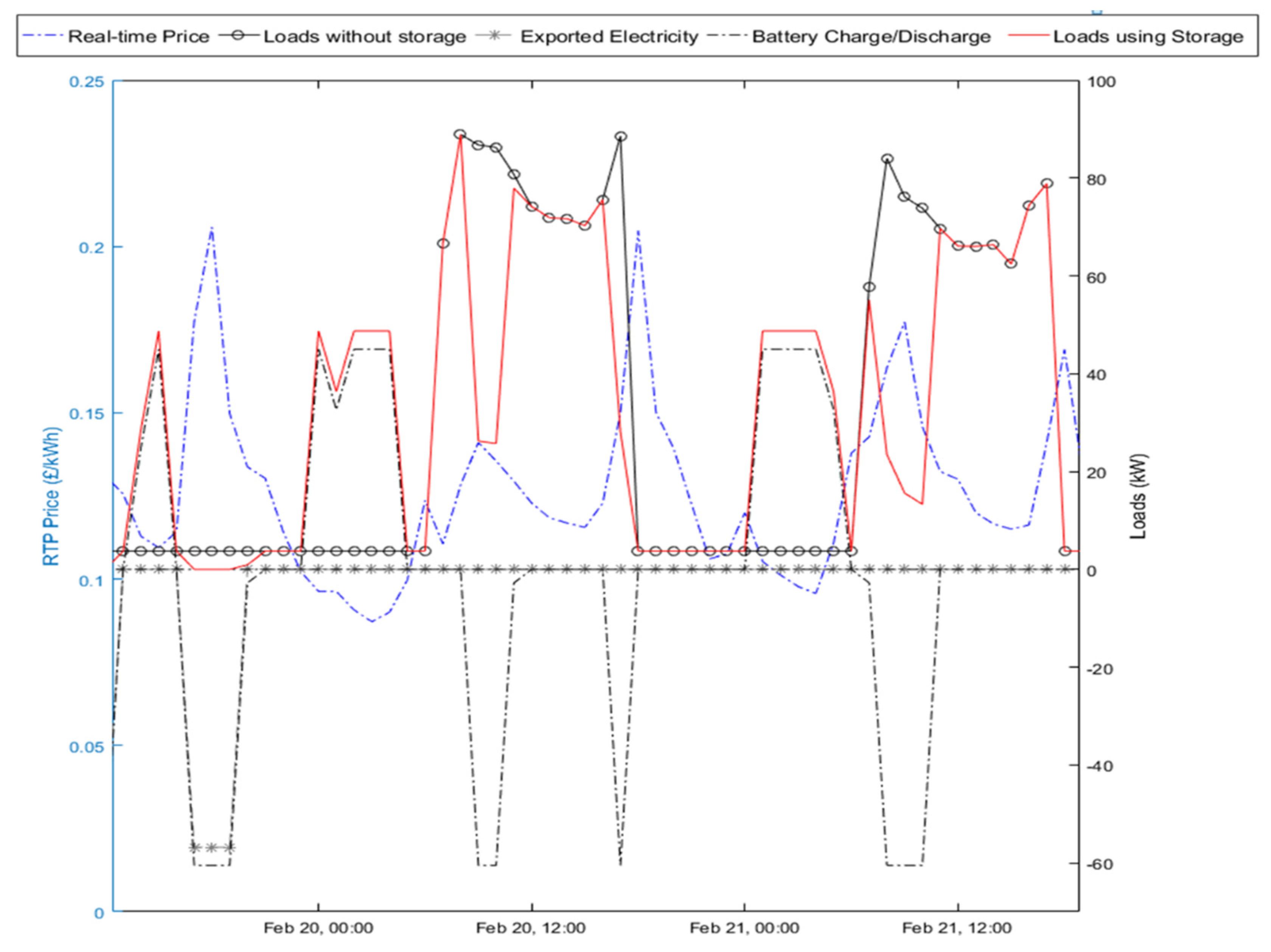

3.2.1. Exports Allowed with Retail Revenues (E7)

3.2.2. Exports Allowed on Working Days with Retail Revenues (E5)

3.2.3. No Exports (E0)

3.3. Cost–Benefit Analysis

3.3.1. CBA for a 10-Year Period

3.3.2. CBA for a 20-Year Period

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- D’Agostino, D.; Cuniberti, B.; Bertoldi, P. Energy consumption and efficiency technology measures in European non-residential buildings. Energy Build. 2017, 153, 72–86. [Google Scholar] [CrossRef]

- Warwicker, B.; Cash, D. The building services relationship to the national grid. In Proceedings of the CIBSE ASHRAE Technical Symposium, London, UK, 18–19 April 2012. [Google Scholar]

- Anderson, B.; Torriti, J. Explaining shifts in UK electricity demand using time use data from 1974 to 2014. Energy Policy 2018, 123, 544–557. [Google Scholar] [CrossRef]

- Das, P.; Mathur, J.; Bhakar, R.; Kanudia, A. Implications of short-term renewable energy resource intermittency in long-term power system planning. Energy Strat. Rev. 2018, 22, 1–15. [Google Scholar] [CrossRef]

- Sehar, F.; Pipattanasomporn, M.; Rahman, S. An energy management model to study energy and peak power savings from PV and storage in demand responsive buildings. Appl. Energy 2016, 173, 406–417. [Google Scholar] [CrossRef]

- Palensky, P.; Dietrich, D. Demand side management: Demand response, intelligent energy systems, and smart loads. IEEE Trans. Ind. Inform. 2011, 7, 381–388. [Google Scholar] [CrossRef]

- Brandt, T.; Feuerriegel, S.; Neumann, D. Modeling interferences in information systems design for cyberphysical systems: Insights from a smart grid application. Eur. J. Inf. Syst. 2018, 27, 207–220. [Google Scholar] [CrossRef]

- Valogianni, K.; Ketter, W. Effective demand response for smart grids: Evidence from a real-world pilot. Decis. Support Syst. 2016, 91, 48–66. [Google Scholar] [CrossRef]

- Alimohammadisagvand, B. Influence of Demand Response Actions on Thermal Comfort and Electricity Cost for Residential House. Ph.D. Thesis, Aalto University, Espoo, Finland, 2018. [Google Scholar]

- Alimohammadisagvand, B.; Jokisalo, J.; Siren, K. The potential of predictive control in minimizing the electricity cost in a heat-pump heat residential house. In Proceedings of the 3rd IBPSA-England Conference BSO 2016, Great North Museum, Newcastle, UK, 12–14 September 2016. [Google Scholar]

- Hemmati, M.; Mirzaei, M.A.; Abapour, M.; Zare, K.; Mohammadi-Ivatloo, B.; Mehrjerdi, H.; Marzband, M. Economic-environmental analysis of combined heat and power-based reconfigurable microgrid integrated with multiple energy storage and demand response program. Sustain. Cities Soc. 2021, 69, 102790. [Google Scholar] [CrossRef]

- Korkas, C.D.; Baldi, S.; Michailidis, I.; Kosmatopoulos, E.B. Occupancy-based demand response and thermal comfort optimization in microgrids with renewable energy sources and energy storage. Appl. Energy 2016, 163, 93–104. [Google Scholar] [CrossRef]

- Gholinejad, H.R.; Loni, A.; Adabi, J.; Marzband, M. A hierarchical energy management system for multiple home energy hubs in neighborhood grids. J. Build. Eng. 2020, 28, 101028. [Google Scholar] [CrossRef]

- Kiliccote, S.; Piette, M.A.; Ghatikar, G.; Hafemeister, D.; Kammen, D.; Levi, B.G.; Schwartz, P. Smart buildings and demand response. AIP Conf. Proc. 2011, 1401, 328–338. [Google Scholar] [CrossRef]

- Derakhshan, G.; Shayanfar, H.A.; Kazemi, A. The optimization of demand response programs in smart grids. Energy Policy 2016, 94, 295–306. [Google Scholar] [CrossRef]

- Lee, Y.M.; Horesh, R.; Liberti, L. Optimal HVAC control as demand response with on-site energy storage and generation system. Energy Procedia 2015, 78, 2106–2111. [Google Scholar] [CrossRef]

- Lorenzi, G.; Silva, C.A.S. Comparing demand response and battery storage to optimize self-consumption in PV systems. Appl. Energy 2016, 180, 524–535. [Google Scholar] [CrossRef]

- Lawrence Berkeley National Laboratory. Introduction to Commercial Building Control Strategies and Techniques for Demand Response. 2007. Available online: https://buildings.lbl.gov/publications/introduction-commercial-building (accessed on 18 March 2021).

- Winfield, M.; Shokrzadeh, S.; Jones, A. Energy policy regime change and advanced energy storage: A comparative analysis. Energy Policy 2018, 115, 572–583. [Google Scholar] [CrossRef]

- National Grid ESO. Balancing Services. 2021. Available online: https://www.nationalgrideso.com/balancing-services/list-all-balancing-services (accessed on 10 March 2021).

- Heris, M.-N.; Mirzaei, M.A.; Asadi, S.; Mohammadi-Ivatloo, B.; Zare, K.; Jebelli, H.; Marzband, M. Evaluation of hydrogen storage technology in risk-constrained stochastic scheduling of multi-carrier energy systems considering power, gas and heating network constraints. Int. J. Hydrogen Energy 2020, 45, 30129–30141. [Google Scholar] [CrossRef]

- Nazari-Heris, M.; Mohammadi-Ivatloo, B.; Asadi, S. Optimal operation of multi-carrier energy networks with gas, power, heating, and water energy sources considering different energy storage technologies. J. Energy Storage 2020, 31, 101574. [Google Scholar] [CrossRef]

- Mirzaei, M.A.; Nazari-Heris, M.; Zare, K.; Mohammadi-Ivatloo, B.; Marzband, M.; Asadi, S.; Anvari-Moghaddam, A. Evaluating the impact of multi-carrier energy storage systems in optimal operation of integrated electricity, gas and district heating networks. Appl. Therm. Eng. 2020, 176, 115413. [Google Scholar] [CrossRef]

- Bulut, M.B.; Odlare, M.; Stigson, P.; Wallin, F.; Vassileva, I. Buildings in the future energy system—Perspectives of the Swedish energy and buildings sectors on current energy challenges. Energy Build. 2015, 107, 254–263. [Google Scholar] [CrossRef]

- Bulut, M.B.; Wallin, F. Buildings as components of smart grids—Perspectives of different stakeholders. Energy Procedia 2014, 61, 1630–1633. [Google Scholar] [CrossRef][Green Version]

- Agarwal, Y.; Weng, T.; Gupta, R.K. Understanding the role of buildings in a smart microgrid. In Proceedings of the 2011 Design, Automation & Test in Europe, Grenoble, France, 14–18 March 2011. [Google Scholar]

- Niu, J.; Tian, Z.; Lu, Y.; Zhao, H. Flexible dispatch of a building energy system using building thermal storage and battery energy storage. Appl. Energy 2019, 243, 274–287. [Google Scholar] [CrossRef]

- Georgakarakos, A.D.; Mayfield, M.; Hathway, E.A. Battery storage systems in smart grid optimised buildings. Energy Procedia 2018, 151, 23–30. [Google Scholar] [CrossRef]

- Gissey, G.C.; Dodds, P.; Radcliffe, J. Market and regulatory barriers to electrical energy storage innovation. Renew. Sustain. Energy Rev. 2018, 82, 781–790. [Google Scholar] [CrossRef]

- Forrester, S.P.; Zaman, A.; Mathieu, J.; Johnson, J. Policy and market barriers to energy storage providing multiple services. Electr. J. 2017, 30, 50–56. [Google Scholar] [CrossRef]

- Zame, K.K.; Brehm, C.A.; Nitica, A.T.; Richard, C.L.; Schweitzer III, G.D. Smart grid and energy storage: Policy recommendations. Renew. Sustain. Energy Rev. 2018, 82, 1646–1654. [Google Scholar] [CrossRef]

- Leadbetter, J.; Swan, L. Battery storage system for residential electricity peak demand shaving. Energy Build. 2012, 55, 685–692. [Google Scholar] [CrossRef]

- Graditi, G.; Ippolito, M.; Telaretti, E.; Zizzo, G. Technical and economical assessment of distributed electrochemical storages for load shifting applications: An Italian case study. Renew. Sustain. Energy Rev. 2016, 57, 515–523. [Google Scholar] [CrossRef]

- Palizban, O.; Kauhaniemi, K. Energy storage systems in modern grids—Matrix of technologies and applications. J. Energy Storage 2016, 6, 248–259. [Google Scholar] [CrossRef]

- Gür, T.M. Review of electrical energy storage technologies, materials and systems: Challenges and prospects for large-scale grid storage. Energy Environ. Sci. 2018, 11, 2696–2767. [Google Scholar] [CrossRef]

- Parra, D.; Gillott, M.; Norman, S.A.; Walker, G.S. Optimum community energy storage system for PV energy time-shift. Appl. Energy 2015, 137, 576–587. [Google Scholar] [CrossRef]

- Knosala, K.; Kotzur, L.; Röben, F.T.; Stenzel, P.; Blum, L.; Robinius, M.; Stolten, D. Hybrid hydrogen home storage for decentralized energy autonomy. Int. J. Hydrogen Energy 2021, 46, 21748–21763. [Google Scholar] [CrossRef]

- Elberry, A.M.; Thakur, J.; Santasalo-Aarnio, A.; Larmi, M. Large-scale compressed hydrogen storage as part of renewable electricity storage systems. Int. J. Hydrogen Energy 2021, 46, 15671–15690. [Google Scholar] [CrossRef]

- Ramos, J.S.; Moreno, M.P.; Delgado, M.G.; Domínguez, S.Á.; Cabeza, L.F. Potential of energy flexible buildings: Evaluation of DSM strategies using building thermal mass. Energy Build. 2019, 203, 109442. [Google Scholar] [CrossRef]

- Wang, S.; Gao, D.-C.; Tang, R.; Xiao, F. Cooling supply-based HVAC system control for fast demand response of buildings to urgent requests of smart grids. Energy Procedia 2016, 103, 34–39. [Google Scholar] [CrossRef]

- Perez, K.X.; Baldea, M.; Edgar, T.F. Integrated HVAC management and optimal scheduling of smart appliances for community peak load reduction. Energy Build. 2016, 123, 34–40. [Google Scholar] [CrossRef]

- Dufo-López, R.; Agustín, J.L.B. Multi-objective design of PV–wind–diesel–hydrogen–battery systems. Renew. Energy 2008, 33, 2559–2572. [Google Scholar] [CrossRef]

- Mago, P.J.; Smith, A.D. Evaluation of the potential emissions reductions from the use of CHP systems in different commercial buildings. Build. Environ. 2012, 53, 74–82. [Google Scholar] [CrossRef]

- Jung, Y.; Kim, J.; Lee, H. Multi-criteria evaluation of medium-sized residential building with micro-CHP system in South Korea. Energy Build. 2019, 193, 201–215. [Google Scholar] [CrossRef]

- Georgakarakos, A.D.; Mayfield, M.; Buckman, A.H.; Jubb, S.A.; Wootton, C. What are smart grid optimised buildings? In Proceedings of the Living and Sustainability: An Environmental Critique of Design and Building Practices, Locally and Globally, London, UK, 9–10 February 2017. [Google Scholar]

- HM Government. The Building Regulations 2010: Conservation of Fuel and Power (L1A). 2016. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/540326/BR_PDF_AD__L1A__2013_with_2016_amendments.pdf (accessed on 5 March 2021).

- International Energy Agency. Numerical Data for Air Infiltration & Natural Ventilation Calculations. 1998. Available online: https://www.aivc.org/sites/default/files/members_area/medias/pdf/Technotes/TN44%20NUMERICAL%20DATA%20FOR%20AIR%20INFILTRATION.PDF (accessed on 10 February 2021).

- Florides, G.; Tassou, S.; Kalogirou, S.; Wrobel, L. Measures used to lower building energy consumption and their cost effectiveness. Appl. Energy 2002, 73, 299–328. [Google Scholar] [CrossRef]

- Pacheco-Torres, R.; Ordóñez, J.; Martínez, G. Energy efficient design of building: A review. Renew. Sustain. Energy Rev. 2012, 16, 3559–3573. [Google Scholar] [CrossRef]

- CIBSE. Environmental Design: CIBSE Guide A, 8th ed.; The Lavenham Press: Suffolk, UK, 2015. [Google Scholar]

- Kamel, E.; Memari, A.M. Review of BIM’s application in energy simulation: Tools, issues, and solutions. Autom. Constr. 2018, 97, 164–180. [Google Scholar] [CrossRef]

- Boyano, A.; Hernandez, P.; Wolf, O. Energy demands and potential savings in European office buildings: Case studies based on EnergyPlus simulations. Energy Build. 2013, 65, 19–28. [Google Scholar] [CrossRef]

- DesignBuilder. Calculation Options. 2019. Available online: https://designbuilder.co.uk//helpv5.4/#Calculation_Options.htm%3FTocPath%3DBuilding%2520Models%7CModel%2520Options%7CSimulation%2520Calculation%2520Options%7C_____2 (accessed on 5 January 2021).

- Nord Pool. Nord Pool Spot Annual Report 2018. 2018. Available online: http://www.nordpoolspot.com/globalassets/download-center/annual-report/annual-report_nord-pool-spot_2013.pdf (accessed on 15 December 2020).

- Nord Pool. Historical Market Data. 2019. Available online: https://www.nordpoolgroup.com/historical-market-data/ (accessed on 20 November 2020).

- Ofgem. Breakdown of an Electricity Bill. 2018. Available online: https://www.ofgem.gov.uk/data-portal/breakdown-electricity-bill (accessed on 12 December 2020).

- HM Government. Fuel and Power (VAT Notice 701/19). 2016. Available online: https://www.gov.uk/guidance/vat-on-fuel-and-power-notice-70119 (accessed on 11 November 2020).

- Ofgem. Energy Companies’ Consolidated Segmental Statements. 2018. Available online: https://www.ofgem.gov.uk/system/files/docs/2018/08/css_-_energy_companies_consolidated_segmental_statements_css_-_2018.pdf (accessed on 25 November 2020).

- Dufo-López, R.; Bernal-Agustín, J.L. Techno-economic analysis of grid-connected battery storage. Energy Convers. Manag. 2015, 91, 394–404. [Google Scholar] [CrossRef]

- Connolly, D.; Lund, H.; Finn, P.; Mathiesen, B.; Leahy, M. Practical operation strategies for pumped hydroelectric energy storage (PHES) utilising electricity price arbitrage. Energy Policy 2011, 39, 4189–4196. [Google Scholar] [CrossRef]

- Staffell, I.; Rustomji, M. Maximising the value of electricity storage. J. Energy Storage 2016, 8, 212–225. [Google Scholar] [CrossRef]

- Barbour, E.; Wilson, G.; Hall, P.; Radcliffe, J.; Wilson, I. Can negative electricity prices encourage inefficient electrical energy storage devices? Int. J. Environ. Stud. 2014, 71, 1–15. [Google Scholar] [CrossRef]

- TESVOLT. The Lithium Storage System for Business and Industry. 2016. Available online: http://www.solfex.co.uk/uploads/downloads/TESVOLT_ENG_Li_Datasheet_Version_2016_06.pdf (accessed on 3 November 2020).

- Tesla. Tesla Powerpack. 2020. Available online: https://www.tesla.com/en_GB/powerpack (accessed on 8 October 2020).

- Pimm, A.J.; Cockerill, T.T.; Taylor, P.G.; Bastiaans, J. The value of electricity storage to large enterprises: A case study on Lancaster University. Energy 2017, 128, 378–393. [Google Scholar] [CrossRef]

- Yang, L.; Ribberink, H. Investigation of the potential to improve DC fast charging station economics by integrating photovoltaic power generation and/or local battery energy storage system. Energy 2019, 167, 246–259. [Google Scholar] [CrossRef]

- Dufo-López, R. Optimisation of size and control of grid-connected storage under real time electricity pricing conditions. Appl. Energy 2015, 140, 395–408. [Google Scholar] [CrossRef]

- Dehghani-Sanij, A.; Tharumalingam, E.; Dusseault, M.; Fraser, R. Study of energy storage systems and environmental challenges of batteries. Renew. Sustain. Energy Rev. 2019, 104, 192–208. [Google Scholar] [CrossRef]

| Case | Thermal Mass | Insulation | Glazing |

|---|---|---|---|

| HwB30 | Heavyweight | Best Practice | 30% |

| HwL30 | Heavyweight | Part L | 30% |

| LwB30 | Lightweight | Best Practice | 30% |

| LwP30 | Lightweight | Part L | 30% |

| HwB80 | Heavyweight | Best Practice | 80% |

| HwL80 | Heavyweight | Part L | 80% |

| LwB80 | Lightweight | Best Practice | 80% |

| LwL80 | Lightweight | Lightweight | 80% |

| Parameter (Units) | Part L Compliant | Best Practice |

|---|---|---|

| Floor dimensions | 25 m × 25 m (6 m × 6 m for Zone 2) | |

| Floor area (Zone 1) | 2356 m2 | |

| Floor area (Zone 2) | 144 m2 | |

| Volume | 8750 m3 | |

| Flat roof U-value (W/m2K) | 0.25 | 0.18 |

| External wall U-value (W/m2K) | 0.35 | 0.26 |

| Ground floor U-value (W/m2K) | 0.25 | 0.22 |

| Internal floor U-value (W/m2K) | 2.93 | 2.93 |

| Internal partition (W/m2K) | 1.64 | 1.64 |

| Windows glazing U-value (W/m2K) | 2.2 (30% glazed) 1.3 (80% glazed) | 1.6 (30% glazed) 0.8 (80% glazed) |

| Windows g-value (%) | 38 | 38 |

| Windows lighting penetration (%) | 53 | 53 |

| Window shading | No shading | |

| Airtightness | Poor | Medium |

| Building’s Orientation | South–North | |

| Shape | Rectangular | |

| Model Variable | Unit |

|---|---|

| annual_energy_cost | Annual cost of electricity purchases (GBP/year) |

| annual_net_cost | Annual electricity net cost (GBP/year) |

| annual_OM_cost | Annual Operation and Maintenance cost for the BSS (GBP/year) |

| annual_revenues | Annual revenues from electricity exports (GBP/year) |

| battery_cost | Capital cost of the battery including cabling and other hardware (GBP) |

| bottleneck | Capacity to operate the battery based on conditions (kW) |

| converter_cost | Capital cost of the bi-directional converter (GBP) |

| energy_demand | The building’s hourly electricity demand without storage (kWh) |

| energy_from_the_grid | Total amount of hourly electricity purchased by the grid (kWh) |

| energy_shifted | Hourly building loads shifted due to the utilisation of the battery (kWh) |

| exported_energy | Net annual amount of electricity exported back to the grid (kWh/year) |

| financial_reward | Financial reward required to provide the service (arbitrage) (GBP/kWh) |

| inflation_rate | Annual inflation rate |

| interest_rate | Annual interest rate |

| LCOE_with_storage | Levelised cost of electricity with storage for the study period (GBP/kWh) |

| LCOE_without_storage | Levelised cost of electricity without storage for the study period (GBP/kWh) |

| maxHourIndex | Period of maximum electricity price (index) |

| maxHourPowerLimit | Power limit below which discharging is not allowed (kW) |

| maxHourPrice | Electricity price for the maxHourIndex period (GBP/kWh) |

| maxRangeIndex | Latest period during which the battery can discharge (index) |

| minHourIndex | Period of minimum electricity price (index) |

| minHourPowerLimit | Power limit above which charging is not allowed (kW) |

| minHourPrice | Electricity price for the minHourIndex period (GBP/kWh) |

| minRangeIndex | Earliest period during which the battery can charge (index) |

| nbattch | Charging efficiency |

| nbattd | Discharging efficiency |

| ninverter | Inverter efficiency |

| nrectifier | Rectifier efficiency |

| NPC_with_storage | Net Present Cost using storage for the study period (GBP) |

| NPC_without_storage | Net Present Cost without using storage for the study period (GBP) |

| OM_cost | Total Operation and Maintenance BSS costs for the study period (GBP) |

| replacement_costj | Cost of the replacement of BSS component j of the system (GBP) |

| RTP_retail | Calculated hourly retail electricity price (GBP/kWh) |

| Activity | Operational Strategy | ||

|---|---|---|---|

| E7 | E5 | E0 | |

| Battery is allowed to discharge to meet building loads on working days | ✓ | ✓ | ✓ |

| Exports can take place on working days | ✓ | ✓ | ✕ |

| Exports can take place on non-working days | ✓ | ✕ | ✕ |

| Charging takes place when electricity prices are cheap and building loads insignificant | ✓ | ✓ | ✓ |

| Discharging takes place when electricity prices are expensive and building loads significant | ✓ | ✓ | ✓ |

| Parameter | Value | Comments |

|---|---|---|

| Battery cost | GBP 390/kWh | Based on [65,66] |

| Bidirectional converter cost | GBP 170/kW | Based on [65,66] |

| O&M cost | GBP 100 per annum | Based on [67,68] |

| Battery lifecycle | 5000 cycles at DOD 90% (4500 full equivalent cycles) | Based on [63] |

| Estimated battery lifetime | 10.5 years (E7) 19.5 years (E5, E0) | E7: 1 cycle per day for working days 2 cycles per day for NWDs. E5 and E0: 1 cycle per day for working days only. |

| Estimated converter lifetime | 10 years (E7, E5, E0) | Based on [42] |

| Inflation rate | 2% | Based on [42,59,67] Efficiencies are assumed to be constant |

| Interest rate | 5% | |

| Charging efficiency | 97% | |

| Discharging efficiency | 97% | |

| Inverter efficiency | 96% | |

| Rectifier efficiency | 96% | |

| Roundtrip efficiency | 86.7% |

| Battery Size (kWh) | Initial Rectifier and Inverter Rated Power (kW/−kW) | Final Rectifier and Inverter Rated Power (kW/−kW) |

|---|---|---|

| 40 | 15/−20 | 15/−20 |

| 60 | 20/−30 | 20/−30 |

| 80 | 25/−35 | 25/−35 |

| 100 | 35/−45 | 35/−45 |

| 120 | 40/−55 | 40/−55 |

| 140 | 45/−65 | 45/−65 |

| 160 * | 55/−75 | 45/−65 |

| 180 * | 60/−80 | 45/−65 |

| 200 * | 65/−90 | 45/−65 |

| 220 * | 70/−100 | 45/−65 |

| BSS Specs | Electricity Consumption (kWh/m2) | Electricity Net Cost (GBP/m2) | Electricity Shifted (% of Peak Loads) | Exports (kWh/m2) | ||||

|---|---|---|---|---|---|---|---|---|

| HwL30 | HwB80 | HwL30 | HwB80 | HwL30 | HwB80 | HwL30 | HwB80 | |

| No BSS | 64.45 | 52.57 | 8.68 | 7.01 | N/A | N/A | N/A | N/A |

| 40 kWh | 67.65 | 55.77 | 8.30 | 6.63 | 7.68 | 9.34 | 2.23 | 2.23 |

| 60 kWh | 69.52 | 57.64 | 8.12 | 6.44 | 10.86 | 13.22 | 3.62 | 3.63 |

| 80 kWh | 71.27 | 59.46 | 7.95 | 6.28 | 14.11 | 17.00 | 4.91 | 4.99 |

| 100 kWh | 73.94 | 62.47 | 7.75 | 6.08 | 16.16 | 18.74 | 7.08 | 7.50 |

| 120 kWh | 76.55 | 65.39 | 7.57 | 5.90 | 17.97 | 20.24 | 9.21 | 9.93 |

| 140 kWh | 79.35 | 68.53 | 7.38 | 5.71 | 19.40 | 21.22 | 11.54 | 12.60 |

| 160 kWh | 80.75 | 70.02 | 7.29 | 5.62 | 22.54 | 24.81 | 12.53 | 13.68 |

| 180 kWh | 82.11 | 71.38 | 7.21 | 5.54 | 25.67 | 28.59 | 13.48 | 14.64 |

| 200 kWh | 83.83 | 73.34 | 7.13 | 5.47 | 27.82 | 30.59 | 14.82 | 16.23 |

| 220 kWh | 85.71 | 75.56 | 7.06 | 5.40 | 29.46 | 31.76 | 16.34 | 18.08 |

| Building | Operational Strategy | Levelised Cost of Electricity (GBP/kWh) with Storage | Levelised Cost of Electricity (GBP/kWh) without Storage | |

|---|---|---|---|---|

| 120 kWh (40 kW/−60 kW) | 240 kWh (80 kW/−60 kW) | No BSS | ||

| HwL30 | E7 | 0.1190 | 0.1235 | 0.1152 |

| E5 | 0.1288 | 0.1381 | ||

| E0 | 0.1320 | 0.1456 | ||

| HwB80 | E7 | 0.1174 | 0.1215 | 0.1141 |

| E5 | 0.1290 | 0.1382 | ||

| E0 | 0.1348 | 0.1522 | ||

| Operational Strategy | Replacements Needed | Parameter * | Building and BSS Combination | |||

|---|---|---|---|---|---|---|

| HwL30 | HwB80 | |||||

| BSS 120 kWh | BSS 240 kWh | BSS 120 kWh | BSS 240 kWh | |||

| E7 | 1 converter 1 battery | NPC | 383,573 | 441,222 | 321,118 | 379,217 |

| LCOE | 0.1040 | 0.1080 | 0.1026 | 0.1062 | ||

| Fin. motive | 0.1228 | 0.1251 | 0.1328 | 0.1377 | ||

| E5 | 1 converter | NPC | 366,094 | 398,424 | 303,639 | 336,419 |

| LCOE | 0.1112 | 0.1181 | 0.1111 | 0.1177 | ||

| Fin. motive | 0.0931 | 0.0844 | 0.1013 | 0.0937 | ||

| E0 | 1 converter | NPC | 367,304 | 401,484 | 305,265 | 340,920 |

| LCOE | 0.1140 | 0.1246 | 0.1161 | 0.1297 | ||

| Fin. motive | 0.0832 | 0.0758 | 0.0840 | 0.0811 | ||

| No storage | N/A | NPC | 324,602 | 262,076 | ||

| LCOE | 0.1007 | 0.0997 | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Georgakarakos, A.D.; Vand, B.; Hathway, E.A.; Mayfield, M. Dispatch Strategies for the Utilisation of Battery Storage Systems in Smart Grid Optimised Buildings. Buildings 2021, 11, 433. https://doi.org/10.3390/buildings11100433

Georgakarakos AD, Vand B, Hathway EA, Mayfield M. Dispatch Strategies for the Utilisation of Battery Storage Systems in Smart Grid Optimised Buildings. Buildings. 2021; 11(10):433. https://doi.org/10.3390/buildings11100433

Chicago/Turabian StyleGeorgakarakos, Andreas D., Behrang Vand, Elizabeth Abigail Hathway, and Martin Mayfield. 2021. "Dispatch Strategies for the Utilisation of Battery Storage Systems in Smart Grid Optimised Buildings" Buildings 11, no. 10: 433. https://doi.org/10.3390/buildings11100433

APA StyleGeorgakarakos, A. D., Vand, B., Hathway, E. A., & Mayfield, M. (2021). Dispatch Strategies for the Utilisation of Battery Storage Systems in Smart Grid Optimised Buildings. Buildings, 11(10), 433. https://doi.org/10.3390/buildings11100433