Chinese Residents’ Willingness to Buy Housing: An Evaluation in Nanyang City, Henan Province, China Based on the Extension Cloud Model

Abstract

:1. Introduction

2. Methodology

2.1. Evaluation Index System of Chinese Residents’ Willingness to Buy Housing

2.1.1. PVT-Based Analysis of Influencing Factors

2.1.2. Classification of Evaluation Grades

2.2. Proposed Evaluation Model

2.2.1. Calculation of Weights Based on C-OWA

2.2.2. Evaluation Model Based on ECM

- (1)

- Design of the questionnaire:

- (2)

- Distribution and recovery of questionnaires:

- (3)

- Reliability analysis of questionnaire survey results

- (4)

- Calculation of the evaluation data:

- (1)

- Generating a normal random number ;

- (2)

- Generating a normal random number ;

- (3)

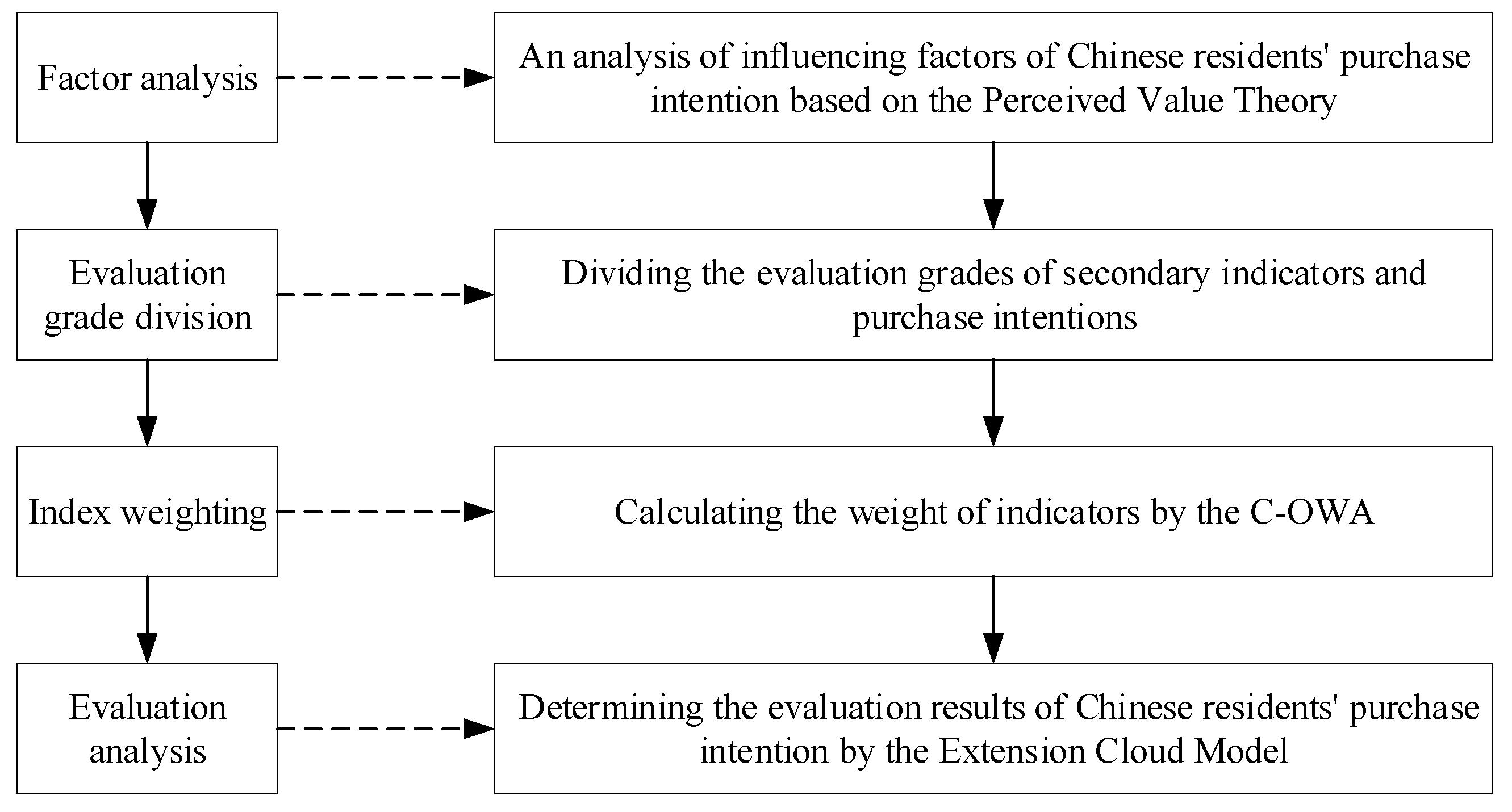

2.3. Flowchart of the Proposed Model

3. Case Study

3.1. Study Area and Data Sources

3.2. Calculation of Index Weight

3.3. Determination of the Evaluation Grade

- (1)

- Creation of the selling point of the project location.

- (2)

- Reasonable pricing and reduction in extra costs for consumers to buy housing.

- (3)

- Strict implementation of the supervision system of pre-sale funds to enhance the reputation of developers.

4. Discussion

4.1. Effect of Different Evaluation Index Systems on the Evaluation Results

4.2. Dynamic Analysis of Residents’ Purchase Intention

4.3. Influence of Different Research Methods on Evaluation Results

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Secondary Indexes | Weight Calculation Information | Index Score |

|---|---|---|

| 0.7876 | 0.7490 | |

| 0.7354 | 0.7422 | |

| 0.7227 | 0.7648 | |

| 0.8533 | 0.8090 | |

| 0.7021 | 0.7422 | |

| 0.7838 | 0.8648 | |

| 0.7872 | 0.7574 | |

| 0.8142 | 0.8231 | |

| 0.8881 | 0.7688 | |

| 0.7319 | 0.8711 | |

| 0.7282 | 0.7273 | |

| 0.7269 | 0.7949 | |

| 0.8312 | 0.9057 | |

| 0.7384 | 0.7426 | |

| 0.7605 | 0.8712 | |

| 0.8279 | 0.7760 | |

| 0.8015 | 0.8331 |

| Index | (1) | (2) | (3) | (4) | (5) | (87) | (89) | (90) | (91) | (92) | Average Score | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 30 | 35 | 20 | 25 | 40 | 45 | 35 | 25 | 20 | 20 | 27.5442 | ||

| 20 | 15 | 25 | 35 | 20 | 15 | 35 | 30 | 25 | 20 | 22.8496 | ||

| 45 | 50 | 45 | 40 | 55 | 60 | 65 | 75 | 70 | 55 | 58.7422 | ||

| 25 | 35 | 40 | 25 | 20 | 30 | 45 | 50 | 20 | 25 | 30.4081 | ||

| 45 | 25 | 15 | 10 | 10 | 15 | 10 | 15 | 5 | 25 | 18.2530 | ||

| 50 | 70 | 60 | 65 | 55 | 65 | 75 | 60 | 75 | 60 | 66.5728 | ||

| 25 | 35 | 40 | 30 | 20 | 40 | 45 | 35 | 50 | 50 | 40.2721 | ||

| 60 | 55 | 65 | 70 | 45 | 45 | 50 | 60 | 65 | 45 | 61.4391 | ||

| 90 | 85 | 95 | 90 | 90 | 95 | 95 | 95 | 80 | 90 | 92.4368 | ||

| 25 | 30 | 30 | 35 | 40 | 35 | 30 | 25 | 15 | 20 | 30.4081 | ||

| 60 | 50 | 45 | 50 | 55 | 75 | 60 | 60 | 50 | 45 | 63.4224 | ||

| 40 | 35 | 50 | 45 | 45 | 30 | 45 | 35 | 45 | 40 | 37.5465 | ||

| 75 | 70 | 60 | 65 | 50 | 70 | 60 | 65 | 75 | 80 | 73.6444 | ||

| 70 | 75 | 80 | 85 | 60 | 60 | 55 | 50 | 60 | 75 | 68.6181 | ||

| 45 | 50 | 75 | 40 | 60 | 70 | 45 | 60 | 55 | 65 | 61.4344 | ||

| 35 | 30 | 25 | 40 | 40 | 35 | 45 | 50 | 55 | 40 | 42.5823 | ||

| 55 | 65 | 60 | 45 | 60 | 60 | 45 | 65 | 55 | 45 | 61.4344 |

| Index | Local Weight | Comprehensive Weight | ||

|---|---|---|---|---|

| Weight | Ranking | Weight | Ranking | |

| 0.336 | 2 | - | - | |

| 0.361 | 1 | - | - | |

| 0.302 | 3 | - | - | |

| 0.097 | 4 | 0.033 | 10 | |

| 0.161 | 3 | 0.054 | 8 | |

| 0.269 | 2 | 0.090 | 6 | |

| 0.091 | 5 | 0.030 | 12 | |

| 0.070 | 6 | 0.024 | 15 | |

| 0.312 | 1 | 0.105 | 3 | |

| 0.078 | 5 | 0.028 | 14 | |

| 0.262 | 2 | 0.095 | 4 | |

| 0.257 | 3 | 0.093 | 5 | |

| 0.090 | 4 | 0.033 | 11 | |

| 0.313 | 1 | 0.113 | 2 | |

| 0.067 | 5 | 0.020 | 16 | |

| 0.454 | 1 | 0.137 | 1 | |

| 0.099 | 4 | 0.030 | 13 | |

| 0.202 | 2 | 0.061 | 7 | |

| 0.008 | 6 | 0.002 | 17 | |

| 0.170 | 3 | 0.051 | 9 | |

| Resident | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

| 6.5 | 5 | 7 | 4.5 | 5 | 6.5 | 6 | 7.5 | 5.5 | 6 | |

| 4.5 | 7.5 | 4.5 | 5 | 4.5 | 5 | 4.5 | 5 | 4.5 | 6.5 | |

| 5.5 | 6.5 | 6 | 5.5 | 5 | 5.5 | 6 | 4.5 | 7.5 | 5 | |

| Resident | (11) | (12) | (13) | (14) | (15) | (79) | (80) | (81) | (82) | |

| 7 | 5 | 5.5 | 6.5 | 6 | 4.5 | 5 | 7.5 | 6.5 | ||

| 6 | 6.5 | 6 | 5 | 4.5 | 7 | 6.5 | 4.5 | 6 | ||

| 5.5 | 5.5 | 4.5 | 4.5 | 6.5 | 5 | 5.5 | 8 | 7 | ||

| Resident | (83) | (84) | (85) | (86) | (87) | (88) | (89) | (90) | (91) | (92) |

| 8 | 6.5 | 7.5 | 6 | 4.5 | 8 | 6.5 | 7.5 | 7 | 7.5 | |

| 6 | 4.5 | 5 | 6.5 | 6 | 4.5 | 5 | 6.5 | 7.5 | 5 | |

| 6.5 | 5 | 6.5 | 5.5 | 4.5 | 5 | 6.5 | 4.5 | 7 | 7.5 |

| Re-Order | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| 8.5 | 8.5 | 8 | 8 | 8 | 8 | 8 | 8 | ||

| 9 | 9 | 9 | 9 | 9 | 9 | 8.5 | 8.5 | ||

| 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | ||

| Re-order | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 |

| 0.054 | 0.064 | 0.073 | 0.079 | 0.083 | 0.083 | 0.079 | 0.073 | 0.064 | |

| 6 | 6 | 6 | 6 | 6 | 6 | 6 | 5.5 | 5.5 | |

| 6.5 | 6.5 | 6.5 | 6 | 6 | 6 | 6 | 6 | 6 | |

| 5.5 | 5.5 | 5.5 | 5.5 | 5.5 | 5.5 | 5.5 | 5.5 | 5.5 | |

| Re-order | 85 | 86 | 87 | 88 | 89 | 90 | 91 | 92 | |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| 4 | 3.5 | 3.5 | 3.5 | 3.5 | 3.5 | 3.5 | 3.5 | ||

| 4 | 4 | 4 | 3.5 | 3.5 | 3.5 | 3.5 | 3.5 | ||

| 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 |

| Index | Index | ||||||

|---|---|---|---|---|---|---|---|

| 27.5442 | 9.547 | 0.105 | 30.4081 | 6.763 | 0.088 | ||

| 22.8496 | 6.316 | 0.085 | 63.4224 | 18.315 | 0.145 | ||

| 58.7422 | 15.878 | 0.135 | 37.5465 | 5.764 | 0.081 | ||

| 30.4081 | 12.731 | 0.121 | 73.6444 | 14.451 | 0.129 | ||

| 18.2530 | 15.288 | 0.132 | 68.6181 | 15.514 | 0.133 | ||

| 66.5728 | 8.746 | 0.100 | 61.4344 | 18.147 | 0.144 | ||

| 40.2721 | 12.764 | 0.121 | 42.5823 | 10.260 | 0.108 | ||

| 61.4391 | 13.627 | 0.125 | 61.4344 | 11.605 | 0.115 | ||

| 92.4368 | 3.263 | 0.061 | - | - | - | - |

| Index | Ⅰ | II | III | Ⅳ | V | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| 0.847 | 0.028 | 0.136 | 0.004 | 0.017 | 0.001 | 0 | 0 | 0 | 0 | |

| 0.988 | 0.053 | 0.012 | 0.001 | 0 | 0 | 0 | 0 | 0 | 0 | |

| 0.002 | 0 | 0.250 | 0.023 | 0.748 | 0.067 | 0 | 0 | 0 | 0 | |

| 0.163 | 0.005 | 0.837 | 0.025 | 0 | 0 | 0 | 0 | 0 | 0 | |

| 0.996 | 0.024 | 0.004 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| 0 | 0 | 0.014 | 0.001 | 0.832 | 0.087 | 0.154 | 0.016 | 0 | 0 | |

| 0 | 0 | 0.797 | 0.022 | 0.203 | 0.006 | 0 | 0.000 | 0 | 0 | |

| 0 | 0 | 0.101 | 0.010 | 0.845 | 0.080 | 0.054 | 0.005 | 0 | 0 | |

| 0 | 0 | 0 | 0 | 0 | 0 | 0.046 | 0.004 | 0.954 | 0.089 | |

| 0.001 | 0 | 0.841 | 0.028 | 0.058 | 0.002 | 0 | 0 | 0 | 0 | |

| 0 | 0 | 0 | 0 | 0.842 | 0.095 | 0.158 | 0.018 | 0 | 0 | |

| 0.109 | 0.002 | 0.764 | 0.015 | 0.127 | 0.003 | 0 | 0 | 0 | 0 | |

| 0 | 0 | 0. | 0 | 0.719 | 0.099 | 0.261 | 0.036 | 0.020 | 0.003 | |

| 0 | 0 | 0.119 | 0.004 | 0.739 | 0.022 | 0.142 | 0.004 | 0 | 0 | |

| 0 | 0 | 0.175 | 0.011 | 0.682 | 0.042 | 0.143 | 0.009 | 0 | 0 | |

| 0.160 | 0 | 0.804 | 0.002 | 0.036 | 0.000 | 0 | 0 | 0 | 0 | |

| 0 | 0 | 0.153 | 0.008 | 0.815 | 0.042 | 0.042 | 0.002 | 0 | 0 | |

| Index | April 2021 | July 2021 | January 2022 | June 2022 | ||||

|---|---|---|---|---|---|---|---|---|

| Weight | Ranking | Weight | Ranking | Weight | Ranking | Weight | Ranking | |

| 0.336 | 2 | 0.296 | 2 | 0.220 | 3 | 0.269 | 2 | |

| 0.361 | 1 | 0.274 | 3 | 0.268 | 2 | 0.240 | 3 | |

| 0.302 | 3 | 0.430 | 1 | 0.510 | 1 | 0.490 | 1 | |

| 0.033 | 10 | 0.039 | 14 | 0.028 | 16 | 0.027 | 14 | |

| 0.054 | 8 | 0.077 | 5 | 0.040 | 13 | 0.066 | 8 | |

| 0.090 | 6 | 0.054 | 9 | 0.032 | 15 | 0.054 | 11 | |

| 0.030 | 12 | 0.010 | 17 | 0.040 | 10 | 0.027 | 15 | |

| 0.024 | 15 | 0.048 | 10 | 0.040 | 11 | 0.074 | 7 | |

| 0.105 | 3 | 0.068 | 6 | 0.040 | 12 | 0.021 | 17 | |

| 0.028 | 14 | 0.047 | 11 | 0.072 | 6 | 0.024 | 16 | |

| 0.095 | 4 | 0.031 | 15 | 0.071 | 7 | 0.052 | 12 | |

| 0.093 | 5 | 0.068 | 7 | 0.027 | 17 | 0.056 | 10 | |

| 0.033 | 11 | 0.045 | 12 | 0.036 | 14 | 0.045 | 13 | |

| 0.113 | 2 | 0.083 | 4 | 0.062 | 8 | 0.063 | 9 | |

| 0.020 | 16 | 0.030 | 16 | 0.084 | 3 | 0.077 | 4 | |

| 0.137 | 1 | 0.092 | 2 | 0.051 | 9 | 0.075 | 6 | |

| 0.030 | 13 | 0.041 | 13 | 0.079 | 5 | 0.079 | 3 | |

| 0.061 | 7 | 0.122 | 1 | 0.124 | 1 | 0.097 | 1 | |

| 0.002 | 17 | 0.088 | 3 | 0.080 | 4 | 0.075 | 5 | |

| 0.051 | 9 | 0.057 | 8 | 0.092 | 2 | 0.087 | 2 | |

| Index | C-OWA | AHP | Entropy Weight | |||

|---|---|---|---|---|---|---|

| Weight | Ranking | Weight | Ranking | Weight | Ranking | |

| 0.336 | 2 | 0.324 | 3 | 0.260 | 3 | |

| 0.361 | 1 | 0.328 | 2 | 0.302 | 2 | |

| 0.302 | 3 | 0.348 | 1 | 0.438 | 1 | |

| 0.033 | 10 | 0.073 | 5 | 0.015 | 17 | |

| 0.054 | 8 | 0.058 | 11 | 0.029 | 13 | |

| 0.090 | 6 | 0.076 | 4 | 0.077 | 7 | |

| 0.030 | 12 | 0.037 | 14 | 0.081 | 4 | |

| 0.024 | 15 | 0.014 | 17 | 0.015 | 16 | |

| 0.105 | 3 | 0.066 | 8 | 0.043 | 11 | |

| 0.028 | 14 | 0.050 | 12 | 0.083 | 3 | |

| 0.095 | 4 | 0.078 | 3 | 0.048 | 10 | |

| 0.093 | 5 | 0.068 | 6 | 0.074 | 8 | |

| 0.033 | 11 | 0.066 | 9 | 0.060 | 9 | |

| 0.113 | 2 | 0.066 | 10 | 0.037 | 12 | |

| 0.020 | 16 | 0.028 | 16 | 0.079 | 5 | |

| 0.137 | 1 | 0.095 | 1 | 0.125 | 1 | |

| 0.030 | 13 | 0.041 | 13 | 0.102 | 2 | |

| 0.061 | 7 | 0.086 | 2 | 0.026 | 14 | |

| 0.002 | 17 | 0.031 | 15 | 0.079 | 6 | |

| 0.051 | 9 | 0.067 | 7 | 0.026 | 15 | |

References

- Chen, Y.; Cai, Y.; Zheng, C. Efficiency of Chinese Real Estate Market Based on Complexity-Entropy Binary Causal Plane Method. Complexity 2020, 2020, 2791352. [Google Scholar] [CrossRef] [Green Version]

- D’Lima, W.; Lopez, L.A.; Pradhan, A. COVID-19 and housing market effects: Evidence from US shutdown orders. Real Estate Econ. 2022, 50, 303–339. [Google Scholar] [CrossRef]

- French, N. Property valuation in the UK: Material uncertainty and COVID-19. J. Prop. Investig. Financ. 2020, 38, 463–470. [Google Scholar] [CrossRef]

- Tang, Y.; Hong, K.; Zou, Y.; Zhang, Y. Impact of Emotional Perceived Value on the Uncertain Evolution of the Housing Bubble. Mathematics 2021, 9, 1543. [Google Scholar] [CrossRef]

- Gabrieli, T.; Piibeam, K.; Wang, T.Y. Estimation of bubble dynamics in the Chinese real estate market: A State space model. Int. Econ. Econ. Policy 2018, 15, 483–499. [Google Scholar] [CrossRef] [Green Version]

- Wen, L.; Hao, Q. Consumer investment preferences and the Chinese real estate market. Int. J. Hous. Mark. Anal. 2013, 6, 231–243. [Google Scholar] [CrossRef]

- Kadir, Z.A.; Mohammad, R.; Othman, N.; Amrin, A.; Muhtazaruddin, M.N.; Abu-Bakar, S.H.; Muhammad-Sukki, F. Risk Management Framework for Handling and Storage of Cargo at Major Ports in Malaysia towards Port Sustainability. Sustainability 2020, 12, 516. [Google Scholar] [CrossRef] [Green Version]

- Li, S.; Sun, Q.; Liu, S. Risk assessment for supply chain based on Cloud model. J. Intell. Fuzzy Syst. 2021, 41, 3523–3540. [Google Scholar] [CrossRef]

- Wu, Q.; Zheng, Z.; Li, W.B. Can Housing Assets Affect the Chinese Residents’ Willingness to Pay for Green Housing? Front. Psychol. 2022, 12, 782035. [Google Scholar] [CrossRef] [PubMed]

- Wu, N.; Zhao, S.C. Impact of Transportation Convenience, Housing Affordability, Location, and Schooling in Residence Choice Decisions. J. Urban Plan. Dev. 2015, 141, 05014028. [Google Scholar] [CrossRef]

- Hentschke, C.D.; Echeveste, M.E.S.; Formoso, C.T.; Ribeiro, J.L.D. Method for capturing demands for housing customisation: Balancing value for customers and operations costs. J. Hous. Built Environ. 2022, 37, 311–337. [Google Scholar] [CrossRef]

- Gan, Q.; Hill, R.J. Measuring housing affordability: Looking beyond the median. J. Hous. Econ. 2009, 18, 115–125. [Google Scholar] [CrossRef] [Green Version]

- Kuang, W.D.; Li, X.W. Does China face a housing affordability issue? Evidence from 35 cities in China. Int. J. Hous. Mark. Anal. 2012, 5, 272–288. [Google Scholar] [CrossRef]

- Tsai, I.C. Housing affordability, self-occupancy housing demand and housing price dynamics. Habitat Int. 2013, 40, 73–81. [Google Scholar] [CrossRef]

- Song, Y.; Guo, S.; Zhang, M. Assessing customers’ perceived value of the anti-haze cosmetics under haze pollution. Sci. Total Environ. 2019, 685, 753–762. [Google Scholar] [CrossRef] [PubMed]

- Luo, B.; Li, L.; Sun, Y. Understanding the Influence of Consumers’ Perceived Value on Energy-Saving Products Purchase Intention. Front. Psychol. 2022, 12, 640376. [Google Scholar] [CrossRef] [PubMed]

- Yuan, C.; Wang, S.; Yu, X. The impact of food traceability system on consumer perceived value and purchase intention in China. Ind. Manag. Data Syst. 2020, 120, 810–824. [Google Scholar] [CrossRef]

- Chen, P.Y. Effects of the entropy weight on TOPSIS. Expert Syst. Appl. 2021, 168, 114186. [Google Scholar] [CrossRef]

- Fattahi, R.; Khalilzadeh, M. Risk evaluation using a novel hybrid method based on FMEA, extended MULTIMOORA, and AHP methods under fuzzy environment. Saf. Sci. 2018, 102, 290–300. [Google Scholar] [CrossRef]

- Zhang, Q.; Li, P.; Lyu, Q.; Ren, X.; He, S. Groundwater contamination risk assessment using a modified DRATICL model and pollution loading: A case study in the Guanzhong Basin of China. Chemosphere 2022, 291, 132695. [Google Scholar] [CrossRef] [PubMed]

- Kishor, A.; Singh, A.K.; Sonam, S.; Pal, N.R. A New Family of OWA Operators Featuring Constant Orness. IEEE Trans. Fuzzy Syst. 2020, 28, 2263–2269. [Google Scholar] [CrossRef]

- Jia, L. Monitoring and Analysis of Ultra-wide and Deep Foundation Pit Deformation in Complex Environment. In Proceedings of the 5th International Conference on Energy Materials and Environment Engineering (ICEMEE), Kuala Lumpur, Malaysia, 12–14 April 2019. [Google Scholar]

- Xing, C.; Yao, L.H.; Wang, Y.D.; Hu, Z.J. Suitability Evaluation of the Lining Form Based on Combination Weighting-Set Pair Analysis. Appl. Sci. 2022, 12, 4896. [Google Scholar] [CrossRef]

- Chen, J.-F.; Hsieh, H.-N.; Do, Q.H. Evaluating teaching performance based on fuzzy AHP and comprehensive evaluation approach. Appl. Soft Comput. 2015, 28, 100–108. [Google Scholar] [CrossRef]

- Wei, G.; Lei, F.; Lin, R.; Wang, R.; Wei, Y.; Wu, J.; Wei, C. Algorithms for probabilistic uncertain linguistic multiple attribute group decision making based on the GRA and CRITIC method: Application to location planning of electric vehicle charging stations. Econ. Res. Ekon. Istraz. 2020, 33, 828–846. [Google Scholar] [CrossRef] [Green Version]

- Dong, J.; Wang, D.X.; Liu, D.R.; Ainiwaer, P.; Nie, L.P. Operation Health Assessment of Power Market Based on Improved Matter-Element Extension Cloud Model. Sustainability 2019, 11, 5470. [Google Scholar] [CrossRef] [Green Version]

- Zou, Y.; Zhang, Y.; Ma, Z. Emergency Situation Safety Evaluation of Marine Ship Collision Accident Based on Extension Cloud Model. J. Mar. Sci. Eng. 2021, 9, 1370. [Google Scholar] [CrossRef]

- Hu, W.; Cheng, F. Evaluation on Green Carbon Expressway based on Game Theory and Extension Cloud Model. In Proceedings of the International Symposium on Mechanical and Electronical Systems and Control Engineering, Shanghai, China, 23–24 June 2018; pp. 70–78. [Google Scholar]

- Guo, Q.; Amin, S.; Hao, Q.; Haas, O. Resilience assessment of safety system at subway construction sites applying analytic network process and extension cloud models. Reliab. Eng. Syst. Saf. 2020, 201, 106956. [Google Scholar] [CrossRef]

- Jiang, B.; Ren, B.; Su, M.; Wang, B.; Li, X.; Yu, G.; Wei, T.; Han, Y. A New Quantitative Method for Risk Assessment of Coal Floor Water Inrush Based on PSR Theory and Extension Cloud Model. Geofluids 2021, 2021, 5520351. [Google Scholar] [CrossRef]

- Zhang, X.M.; Liu, W.F. Application of Analytic Hierarchy Process in Buying Houses. In Proceedings of the International Conference on Management of Technology, Taiyuan, China, 27–28 February 2008; pp. 681–686. [Google Scholar]

- Hu, H.; Geertman, S.; Hooimeijer, P. Personal values that drive the choice for green apartments in Nanjing China: The limited role of environmental values. J. Hous. Built Environ. 2016, 31, 659–675. [Google Scholar] [CrossRef]

- Li, G.L.; Zhang, J.P. Reason And Disadvantage of The Short-Lived Residential House In China. In Proceedings of the 1st International Conference on Energy and Environmental Protection (ICEEP 2012), Hohhot, China, 23–24 June 2012; pp. 2775–2779. [Google Scholar]

- Ma, C.; Liu, Z.B.; Cao, Z.G.; Song, W.; Zhang, J.; Zeng, W.L. Cost-sensitive deep forest for price prediction. Pattern Recognit. 2020, 107, 107499. [Google Scholar] [CrossRef]

- Brzezicka, J.; Laszek, J.; Olszewski, K. An analysis of the relationships between domestic real estate markets—A systemic approach. Real Estate Manag. Valuat. 2019, 27, 79–91. [Google Scholar] [CrossRef] [Green Version]

- Falzon, J.; Lanzon, D. Comparing alternative house price indices: Evidence from asking prices in Malta. Int. J. Hous. Mark. Anal. 2013, 6, 98–135. [Google Scholar] [CrossRef]

- Deng, W.B.; Su, T.; Zhang, Y.M.; Tan, C.L. Factors Affecting Consumers’ Online Choice Intention: A Study Based on Bayesian Network. Front. Psychol. 2021, 12, 4764. [Google Scholar] [CrossRef] [PubMed]

- Liang, A.R.D.; Lee, C.L.; Tung, W. The role of sunk costs in online consumer decision-making. Electron. Commer. Res. Appl. 2014, 13, 56–68. [Google Scholar] [CrossRef]

- Qiu, S.Z.; Wu, L.; Yang, Y.J.; Zeng, G.J. Offering the right incentive at the right time: Leveraging customer mental accounting to promote prepaid service. Ann. Tour. Res. 2022, 93, 103367. [Google Scholar] [CrossRef]

- Rosner, Y.; Amitay, Z.; Perlman, A. Consumer’s attitude, socio-demographic variables and willingness to purchase green housing in Israel. Environ. Dev. Sustain. 2022, 24, 5295–5316. [Google Scholar] [CrossRef]

- Fu, Y.M.; Tse, D.K.; Zhou, N. Housing choice behavior of urban workers in China’s transition to a housing market. J. Urban Econ. 2000, 47, 61–87. [Google Scholar] [CrossRef]

- de Wit, E.R.; van der Klaauw, B. Asymmetric information and list-price reductions in the housing market. Reg. Sci. Urban Econ. 2013, 43, 507–520. [Google Scholar] [CrossRef] [Green Version]

- Gordon, B.L.; Winkler, D.T. The Effect of Listing Price Changes on the Selling Price of Single-Family Residential Homes. J. Real Estate Financ. Econ. 2017, 55, 185–215. [Google Scholar] [CrossRef]

- Sivitanides, P.S. Macroeconomic drivers of London house prices. J. Prop. Investig. Financ. 2018, 36, 539–551. [Google Scholar] [CrossRef]

- Zhang, X.N.; Qu, M.; Jin, Z.D. Exploring the Determinants of Migrant Workers ‘ Willingness to Buy Houses in Cities: A Case Study in Xi’an, China. Sustainability 2018, 10, 62. [Google Scholar] [CrossRef] [Green Version]

- Kraft, H.; Munk, C. Optimal Housing, Consumption, and Investment Decisions over the Life Cycle. Manag. Sci. 2011, 57, 1025–1041. [Google Scholar] [CrossRef] [Green Version]

- Rendon, J.M.; Rendon, R.G. Procurement fraud in the US Department of Defense Implications for contracting processes and internal controls. Manag. Audit. J. 2016, 31, 748–767. [Google Scholar] [CrossRef]

- von Bieberstein, F.; Schiller, J. Contract design and insurance fraud: An experimental investigation. Rev. Manag. Sci. 2018, 12, 711–736. [Google Scholar] [CrossRef] [Green Version]

- Adzis, A.A.; Lim, H.E.; Yeok, S.G.; Saha, A. Malaysian residential mortgage loan default: A micro-level analysis. Rev. Behav. Financ. 2021, 13, 663–681. [Google Scholar] [CrossRef]

- Dajcman, S. Demand for residential mortgage loans and house prices in the euro area. Econ. Sociol. 2020, 13, 40–51. [Google Scholar] [CrossRef] [PubMed]

- Dinh, M.T.H.; Mullineux, A.W.; Muriu, P. Macroeconomic factors influencing UK household loan losses. J. Financ. Regul. Compliance 2012, 20, 385–401. [Google Scholar] [CrossRef]

- Sanchez, J.D. Evaluating the sensibility of adjustable rate loan annuities to fluctuations of interest rates. Empirical application in Spanish mortgage market 2009–2013. Investig. Eur. Dir. Y Econ. Empresa 2015, 21, 148–157. [Google Scholar] [CrossRef] [Green Version]

- Sobieraj, J.; Metelski, D. Private Renting vs. Mortgage Home Buying: Case of British Housing Market-A Bayesian Network and Directed Acyclic Graphs Approach. Buildings 2022, 12, 189. [Google Scholar] [CrossRef]

- Cronin, J.J.; Brady, M.K.; Hult, G.T.M. Assessing the effects of quality, value, and customer satisfaction on consumer behavioral intentions in service environments. J. Retail. 2000, 76, 193–218. [Google Scholar] [CrossRef]

- Nasibov, E.; Kandemir-Cavas, C. OWA-based linkage method in hierarchical clustering: Application on phylogenetic trees. Expert Syst. Appl. 2011, 38, 12684–12690. [Google Scholar] [CrossRef]

- Li, X.; Zhang, L.; Zhang, R.; Yang, M.; Li, H. A semi-quantitative methodology for risk assessment of university chemical laboratory. J. Loss Prev. Process Ind. 2021, 72, 104553. [Google Scholar] [CrossRef]

- Xu, Z. A C-OWA operator-based approach to decision making with interval fuzzy preference relation. Int. J. Intell. Syst. 2006, 21, 1289–1298. [Google Scholar] [CrossRef]

- Mokarram, M.; Shafie-khah, M.; Aghaei, J. Risk-based multi-criteria decision analysis of gas power plants placement in semi-arid regions. Energy Rep. 2021, 7, 3362–3372. [Google Scholar] [CrossRef]

- Jobe, J.B.; Mingay, D.J. Cognition and survey measurement—History and overview. Appl. Cogn. Psychol. 1991, 5, 175–192. [Google Scholar] [CrossRef]

- Weir, K.R.; Ailabouni, N.J.; Schneider, C.R.; Hilmer, S.N.; Reeve, E. Considerations for systematic reviews of quantitative surveys: Learnings from a systematic review of the Patients’ Attitudes Towards Deprescribing questionnaire. Res. Soc. Adm. Pharm. 2022, 18, 2345–2349. [Google Scholar] [CrossRef]

- Bernardi, R.A. Validating research results when cronbachs-alpha is below. 70—A methodological procedure. Educ. Psychol. Meas. 1994, 54, 766–775. [Google Scholar] [CrossRef]

- Renigier-Bilozor, M.; Zrobek, S.; Walacik, M.; Janowski, A. Hybridization of valuation procedures as a medicine supporting the real estate market and sustainable land use development during the covid-19 pandemic and afterwards. Land Use Policy 2020, 99, 105070. [Google Scholar] [CrossRef]

- Trojanek, R.; Gluszak, M.; Hebdzynski, M.; Tanaś, J. The COVID-19 Pandemic, Airbnb and Housing Market Dynamics in Warsaw. Crit. Hous. Anal. 2021, 8, 72–84. [Google Scholar] [CrossRef]

- Laplante, P.A.; Neill, C.J. Modeling uncertainty in software engineering using rough sets. Innov. Syst. Softw. Eng. 2005, 1, 71–78. [Google Scholar] [CrossRef]

- Li, Z.Y.; Chen, C.H.; Yu, S.P.; Wu, B.; Hao, L.J.; Wang, J.; Wu, Y.C. Safety evaluation of spent fuel road transportation based on weighted nearest neighbor method. Ann. Nucl. Energy 2019, 127, 412–418. [Google Scholar] [CrossRef]

- Lin, S.S.; Shen, S.L.; Zhou, A.; Xu, Y.S. Risk assessment and management of excavation system based on fuzzy set theory and machine learning methods. Autom. Constr. 2021, 122, 103490. [Google Scholar] [CrossRef]

- Xu, Q.Y.; Wang, N. A survey on ship collision risk evaluation. Promet-Traffic Transp. 2014, 26, 475–486. [Google Scholar] [CrossRef]

| Primary Index | Secondary Index | References |

|---|---|---|

| Perceived benefits: | Traffic convenience: | [10,11] |

| Perfection of supporting facilities: | [9,10,31] | |

| Beautiful living environment: | [11,32] | |

| Rationality of apartment design: | [4,10,31] | |

| Good construction quality: | [9,10,33] | |

| Credibility of developers: | [10,33] | |

| Purchase costs: | Affordability of house price: | [12,13,14] |

| Unreasonable house price: | [31,33,34,35] | |

| Price-performance ratio: | [10,36] | |

| Time cost: | [4,37,38,39] | |

| Additional economic cost: | [4,40] | |

| Perceived risks: | Price reduction: | [41,42,43,44] |

| Change in regional planning: | [41] | |

| Unsatisfactory housing quality: | [33,45,46] | |

| Possibility of being left unfinished: | [2,45] | |

| Contract fraud: | [47,48] | |

| Decline in loan interest rate: | [49,50,51,52,53] |

| Grade | First Choice? | Possibility of Recommendation | Select the Same If You Choose It Again? |

|---|---|---|---|

| I | Yes | Very strong | Very firm |

| II | Yes | Between very intense and intense | Between very firm and firm |

| III | Vacillating | Strong | Firm |

| IV | No | Between strong and not strong | Between firmness and no regret |

| V | No | Not strong | With regret |

| Importance Score | Qualitative Description |

|---|---|

| 1 | This index is extremely important. |

| 3 | This index is very important. |

| 5 | This index is important. |

| 7 | This index is not important. |

| 9 | This index is extremely unimportant. |

| Evaluation Grade | I | II | III | IV | V |

|---|---|---|---|---|---|

| [0, 1.5) | [1.5, 2.5) | [2.5, 3.5) | [3.5, 4.5) | [4.5, +∞) |

| Primary Index | |||

|---|---|---|---|

| Absolute weight | 4.487 | 4.822 | 4.034 |

| Final weight | 0.336 | 0.361 | 0.302 |

| Deleted Indexes | Evaluation Results | Deleted Indexes | Evaluation Results | ||

|---|---|---|---|---|---|

| None | 2.8974 | III | , | 2.8532 | III |

| 2.9862 | III | , | 2.9515 | III | |

| 2.8417 | III | , | 3.2714 | III | |

| 2.7944 | III | , , | 2.9589 | III | |

| 2.9930 | III | , , | 2.8317 | III | |

| , | 3.0314 | III | , , | 2.8400 | III |

| , | 2.8843 | III | , , | 2.4574 | II |

| , | 3.0199 | III | , , , | 2.3460 | II |

| Time Point | Evaluation Results | |

|---|---|---|

| April 2021 | 2.8974 | III |

| July 2021 | 5.7302 | V |

| January 2022 | 6.2390 | V |

| June 2022 | 5.3956 | V |

| Kendall Correlation Coefficient | C-OWA | AHP | Entropy Weight |

|---|---|---|---|

| C-OWA | 1.000 | 0.698 | 0.672 |

| AHP | 0.784 | 1.000 | 0.642 |

| Entropy weight | 0.504 | 0.64 | 1.000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Feng, Y.; Wahab, M.A.; Azmi, N.A.B.; Yan, H.; Wu, H. Chinese Residents’ Willingness to Buy Housing: An Evaluation in Nanyang City, Henan Province, China Based on the Extension Cloud Model. Buildings 2022, 12, 1695. https://doi.org/10.3390/buildings12101695

Feng Y, Wahab MA, Azmi NAB, Yan H, Wu H. Chinese Residents’ Willingness to Buy Housing: An Evaluation in Nanyang City, Henan Province, China Based on the Extension Cloud Model. Buildings. 2022; 12(10):1695. https://doi.org/10.3390/buildings12101695

Chicago/Turabian StyleFeng, Yuan, Maszuwita Abdul Wahab, Nurul Afiqah Binti Azmi, Hong Yan, and Han Wu. 2022. "Chinese Residents’ Willingness to Buy Housing: An Evaluation in Nanyang City, Henan Province, China Based on the Extension Cloud Model" Buildings 12, no. 10: 1695. https://doi.org/10.3390/buildings12101695

APA StyleFeng, Y., Wahab, M. A., Azmi, N. A. B., Yan, H., & Wu, H. (2022). Chinese Residents’ Willingness to Buy Housing: An Evaluation in Nanyang City, Henan Province, China Based on the Extension Cloud Model. Buildings, 12(10), 1695. https://doi.org/10.3390/buildings12101695